Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Top 7 cryptocurrencies to watch in 2020 |

In 2020, cryptocurrencies will continue to thrive and develop, attracting more supporters and crypto enthusiasts. Analysts expect the number one cryptocurrency, Bitcoin, to rise in value along with other digital assets. They outline 7 major virtual currencies that worth paying attention to in 2020.

Bitcoin

Well ahead of others, Bitcoin (ВТС) remains the most popular cryptocurrency in the world. It is sometimes called the digital gold of the crypto market. Bitcoin was the first currency to be based on blockchain technology which served as a foundation for creating a global distributed database. The technology is used to verify, store, and conduct transactions worldwide. Unlike government-issued currencies, Bitcoin is a completely decentralized digital asset. Some key factors that have contributed to Bitcoin’s popularity include instant low-cost transactions available 24/7, a high degree of security, and user’s full anonymity.

Ethereum

Ethereum is the world’s second most significant cryptocurrency which is sometimes referred to as the digital silver. It is a global distributed network based on blockchain technology. Ethereum is often described by its developers as a global, open-source, distributed platform used for transactions and computing. The Ethereum platform enables the implementation of other applications and platforms such as smart contracts, financial transactions, e-voting system, and others. Fast verification and secured transactions are the core benefits of the Ethereum network.

Bitcoin Cash

Bitcoin Cash ranks third among the most well-known virtual currencies. BCH was created as a hard fork of Bitcoin on August 1, 2017. This cryptocurrency is designed to help improve transaction speed of financial and crypto settlements. According to experts, Bitcoin Cash is able to process transactions more quickly than the Bitcoin network what makes it more convenient and user-friendly. Most of BCH functions are similar to those of Bitcoin: they both use the SHA-256 algorithm and have a fixed supply of 21 million coins.

Ripple

Ripple is in the fourth place among the most widely used digital assets. Ripple network is designed for internal payments and financial settlements based on blockchain technology. This platform enables global financial institutions to carry out instant and low-cost international payments. What is more, Ripple’s digital tokens can be quickly exchanged for fiat currencies. Ripple was not designed to be a means of payment. Its main function is to conduct transactions online. One of the key features of Ripple is its high scalability: the network can handle up to 1,000 transactions per second.

Litecoin

Litecoin ranks fifth on the list of most popular virtual currencies. Litecoin enables instant and almost zero-cost transactions all around the globe. Besides, Litecoin network offers faster transaction confirmation time thanks to more frequent block generation. In fact, Litecoin processes transactions in about 2.5 minutes which is four times faster than Bitcoin. Litecoin global payment system is a fully decentralized and opens-source network. Investors worldwide choose Litecoin for its excellent security level.

Tether

In top 7 cryptocurrencies rating, Tether is in the sixth place. It is considered to be a digital equivalent of the US dollar. This crypto asset’s value is pegged to the value of the greenback and maintains the rate of 1USDT to 1USD. Tether’s developers aimed at creating a new type of cryptocurrency – the so-called stablecoin. Being backed by the US dollar, Tether is less volatile than most of the virtual currencies.

EOS

EOS is the last most popular cryptocurrency on our list. This digital currency network has a unique structural design which enables vertical and horizontal scaling of decentralized application. EOS developers attempted to solve the problem of transaction speed and scalability and were successful at this. The holders of the EOS tokens can take full advantage of the EOS network resources only if they have a certain amount of coins. This way, the system encourages its users to accumulate and hold EOS tokens instead of spending them. EOS effective performance is achieved through the implementation of specialized modules.

|

Метки: #photo_news |

Chinese aviation industry goes into free fall amid coronavirus |

Aviation industry in China is expected to suffer the most amid the coronavirus outbreak. China’s aim to become an international aviation hub is no longer possible as it will take the country a couple of years to eliminate negative consequences of the coronavirus in the industry. Chinese citizens are not eager to travel anywhere while more than 70 countries have introduced travel restrictions and stiffened visa requirements for travellers from China. Local airlines have to offer substantial discounts for flights while the government has to hand out subsidies, in order to maintain the total air traffic. According to Aviation Worldwide, of the 2.9 million scheduled seats returning to the Chinese market, all but 3 thousand are on domestic services. Thus, a trip from Shenzhen to Chongqing costs only 100 yuan, or $14, which is about 5 percent of the standard price of 1,940 yuan, or $276. The coronavirus has had an adverse impact on China's aviation industry. Previously, the Chinese government planned to make China one of the world’s leaders in the quality of service for air passengers. However, today it is hardly possible. It will take a lot of time for the industry to recover as local air carriers have suffered great financial losses.

Read more: https://www.mt5.com/forex_humor/image/47547

|

Метки: #forex_caricature |

Three companies immune to COVID-19 |

International alarm over China's coronavirus driven by its rapid spread reached its highest level over the last week of February 2020. In late winter, panic hit financial markets, triggering a dramatic decline in most stock market prices. Against this background, three companies seem extremely unusual. According to analysts, they are immune to the COVID-19 epidemic

The COVID-19 epidemic has hurt a lot of the world's largest corporations. The coronavirus-driven panic is exerting pressure on global financial markets, dragging them down over and over again. However, there are three companies which experts consider resistant to the negative impact of the coronavirus outbreak. Read about them in our article

Zoom Video Communications

Experts say that this company is immune to the coronavirus. It provides remote conferencing services using cloud computing. Zoom stock has soared by almost 41% since the COVID-19 outbreak. Since the beginning of 2020, the stock has climbed by 57%, hitting an all-time high of $111.80. The video conference software provider is also ready to offer effective tools for remote work. As the virus spreads, employees will be forced to work from home. In this situation, Zoom services will be in demand.

Netflix

The second company which is considered resilient to the large-scale epidemic is Netflix, a global provider of audio and video information. Experts believe that the spread of COVID-19 in the United States will increase the demand for Netflix media services. At the end of January 2020, the company's stock rose by 6%, adding more than 11% since the beginning of the year. The coronavirus spread can force most people to stay at home and use Netflix content as a leisure activity. In February, the streaming giant reported strong quarterly revenue growth and its subscriber base of 167 million.

Tomorrow Advancing Life Education Group (TAL)

TAL Education Group, a company providing online tutoring services for primary and secondary school students in China, is considered to be the third company capable of confronting the coronavirus spread. In addition, the company specializes in online education, which is highly relevant during the outbreak. Distance learning is gaining popularity in China. Since the end of January 2020, TAL stock has gone up by 5%, adding almost 18%, while its market capitalization has achieved $34 billion. The company's quarterly earnings report turned out to be rather strong. The number of students soared by 66%, exceeding 2.3 million.

|

Метки: #photo_news |

Xerox launches takeover bid for HP |

The two printing and photocopying pioneers Xerox and HP Inc. started merger negotiations after Xerox had made a takeover offer for its competitor. This was an unexpected move since HP is nearly four times larger than Xerox, with a market value of $31.8 billion versus $7.1 billion respectively. However, Xerox was ambitious enough to officially launch the bid to buy out HP. Xerox offered its rival’s stockholders to acquire all of HP’s shares and confirmed it secured enough funds to finance the takeover bid. The printing giant boosted its offer price to $24 per share. The proposal is set to expire on April 21. Earlier, the HP board raised concerns about how its smaller opponent Xerox would fund the deal. Xerox replied that it had secured financing from such major creditors as Citigroup, Mizuho, Bank of America, Mitsubishi UFJ Financial Group, PNC Financial Services Group, Credit Agricole Group, and SunTrust Bank. Xerox urges the printer industry to consolidate in order to support the shrinking business. As the need for printed documents is steadily declining, the growth outlook for both printing companies is rather pessimistic.

Read more: https://www.mt5.com/forex_humor/image/47442

|

Метки: #forex_caricature |

Typical mistakes of novice investors |

Investments are aimed at raising capital, but they pose the risk of losses as well. It is rather expensive to learn trading from your own mistakes. So, refer to the recommendations of experienced market speculators in order to avoid typical mistakes made by novice investors.

When some investors make money in the market, others lose it. Novice investors make the simplest mistakes, thereby enabling others to earn.Our review describes the most typical mistakes of beginners. Bearing them in mind, you will save time and money.

1. Investing in one asset

Beginners often invest the entire deposit in stocks of one company, hoping for high profits in the short term.

Experienced traders believe that putting all the eggs in one basket can lead to losses.

They find it more reasonable to buy stocks of 7-10 companies in order to evenly distribute the risks between assets. In doing so, the long-term potential return grows, since it is impossible to predict which company will turn out to be the most effective.

In addition, you should buy stocks of companies from different countries operating in different economic sectors. This approach will help you reduce macroeconomic risks.

2. Investing more than you can afford to lose

Investment on the stock exchange should be carried out in accordance with the developed investment strategy, which includes estimating potential losses the investor can afford.

Investing is a good way to raise capital. However, you should invest only the amount which if lost will not make you a beggar.

Do not pawn your property, hoping for immediate results.

Start with a small amount for investment and gradually increase it. At the very beginning, traders should not chase high yields. Your first task is to learn how to boost capital on a regular basis. A journey of thousand miles begins with a single step.

3. Trading with leverage

Investing borrowed funds is an extremely bad idea, even for experienced investors.

Investing implies the likelihood of losing money, and in order to cope with loan payments, you must trade high-return assets bearing high risks.

The likelihood of losing leveraged money has a negative psychological impact on an investor, preventing him/her from making the right decisions.

For these reasons, investors trading with borrowed funds do not gain steady profits and regularly suffer from partial or total losses.

4. Giving in to emotions

The stock exchange is not the right place to express emotions. When trading in the market, you need to give priority to the mind rather than emotions.

The rule applies to any speculative trading controlled by analytics and a cool head. The market is volatile. Therefore, opening hasty trades is extremely inefficient, as well as unprofitable in the long term.

Your investment strategy should include clear rules (criteria) for purchasing (selling) certain securities. Specify the time interval for work, as well as the period during which you are planning to keep the deal, so as not to be distracted by minor fluctuations in quotes.

Decision-making on the basis of clear rules will help you avoid irrational actions.

5. Chasing quick yield

Sometimes, the market provides traders with assets which are likely to generate high income in a short period of time.

A reasonable profit margin is usually about 15%, however, some can earn 50% and above. What does this mean? First of all, this means a high risk of losing a significant part of the invested money, and only then a chance to quickly boost capital.

As a rule, the greater the expected profit, the higher the risk. It makes sense to use a tiny part of your investment portfolio for risky assets (5-10%), while the main part should be invested in companies with good financial performance over a significant period of time.

6. Backing out of trading plan

Investing without a detailed strategy and trading plan is like playing a roulette game: you can make a profit from time to time, but eventually incur losses, since the odds are always in favour of the casino.

Your trading plan must establish rules for opening a transaction, the period of keeping it open, as well as the size of potential profit and loss. Besides, the plan should cover a long period of time.

Do not close trades before the deadline and do not move stop loss orders, since this reduces a chance to yield stable profits in the long term. Analysis and assessment of the deal should be conducted only after its execution.

|

Метки: #photo_news |

US retains status of most reliable debtor |

The US is indisputably acknowledged to be the most reliable and welcome debtor in the world. The US debt market has always surpassed others in terms of buy and sell volumes. It is the only country in the world where the turnover of its Treasuries is over $40 billion per month. Global investors have always included US bonds in portfolios. However, they have been selling off US debt securities for 15 months in a row. Certainly, some central banks are still poised to buy US bonds. Japan has been the largest foreign owner of the US debt. At the same time, China ventured into an aggressive reduction of its US Treasury holdings. Interestingly, foreign investors are not scared away by high hedging costs. Most investors are attracted by steady high yields of US government securities. At present, the global debt market is measured at almost $11 trillion. Meanwhile, the lion’s share of the global debt, including Japan’s bond market, is making negative yields. Therefore, yields of US Treasuries still remain in the black.

Read more: https://www.mt5.com/forex_humor/image/47380

|

Метки: #forex_caricature |

8 affordable places for vacation that can beat popular resorts |

It is not a surprise that tourist flow to well-known destinations is growing every year. However, high demand means higher prices which increases your spending during the holiday. Luckily, our world is rich in fascinating places.

In our photo gallery, find out which destinations are no worse than the Maldives, the Swiss Alps, and the Grand Canyon in the USA.

Swiss Alps - Czech Switzerland

The fresh air of the mountains, forest slopes, small villages, and blue lakes can be found not only in Switzerland but also in the Czech Republic which is much more affordable. Just an hour's drive from Prague there is an amazingly beautiful place called Czech (or Bohemian) Switzerland. The Chronicles of Narnia movie was filmed in this national park.

Rates:

Prices in this Czech version of Switzerland are very affordable. A price for a double room in a 3-star hotel in April will start from 2,000 rubles. On the other hand, in Switzerland, this amount of money will be enough only for dinner with one course and a salad. The room price there will start at 7,000 rubles.

Maldives - Belyaus Spit in Cr

imea

These famous snow-white beaches have long been the symbol of a “beautiful life.” But few people know that Russia has a similar beauty in Crimea - the Belyaus Spit which separates the Black Sea and Lake Donuzlav on the western coast of Crimea. Already in May, you can swim in these warm turquoise waters with shell sands. Along with relaxation, you can choose such activities as surfing and diving.

Rates:

The price for a three-star hotel in the Maldives with breakfast will start from 3,000 rubles, and the flight from Moscow to Male in June 2020 will cost 32,000 rubles. At the same time, a flight from Moscow to Simferopol starts from 10,000 rubles. Besides, you can rent a room in a hotel on the first line for just 2,000 rubles.

Salar de Uyuni - Lake Baskunchak

Tourists from all over the world come to Bolivia to see the salt lake Uyuni and to make a couple of pictures with Martian landscapes. Luckily, you do not need to fly across the world to another continent to see this beauty. The ancient Baskunchak lake in the Astrakhan region will offer you the same magnificent views.

Rates:

A return flight from Moscow to the capital of Bolivia, Sucre, will cost you 150,000 rubles, while the flight to Astrakhan will be just 7,000 rubles.

Vienna - Budapest

Vienna is considered one of the most expensive European cities. Meanwhile, the same old cobblestone streets, fabulous architecture, magnificent cathedrals, and unique atmosphere of the Middle Ages can be found in Budapest. After all, Vienna and Budapest were the centers of the Austro-Hungarian Empire.

Rates:

Unlike Vienna, Budapest is one of the cheapest cities in Europe where a three-star hotel in the city center will cost from 1,500 rubles. You can buy a serving of goulash in a local restaurant for just 2 euros and a cup of coffee for 1.5 euros.

Meanwhile, in Vienna, tourists will have to pay 6,000 rubles for a one-night stay in a hotel, 2.8 euros for a coffee, and 15-25 euros for a Wiener schnitzel.

Northern lights in Norway - Northern lights in Murmansk

What do you need to see the northern lights? First of all, certain weather conditions are needed. However, to see the polar lights you do not have to travel to Iceland or Norway. Instead, you can save some money and take a tour to Murmansk. Moreover, no one can guarantee that you will be lucky enough to see this natural wonder. It would be such a failure to spend a fortune on a trip to Norway and to see nothing in the end.

Rates:

A return flight from Moscow to Longyearbyen (Spitsbergen) will cost you around 31,000 rubles with stopovers and 160,000 rubles for a direct flight. The northern lights tour in Spitsbergen will start at 1,400 NOK (around 10,000 rubles). A return flight from Moscow to Murmansk is 4,600 rubles without any stopovers. For the polar lights tour in Murmansk you will need to pay just 4,000 rubles per person.

Grand Canyon in the US - Tara River Canyon in Montenegro

The Tara River Canyon is 1.3 kilometres deep. This is a real natural wonder and is no less impressive than the famous Grand Canyon in the United States. The canyon in Montenegro is a picturesque landscape covered with forests. In particular, Dzhurdzhevicha Tara Bridge offers spectacular views on the canyon.

Rates:

For the Moscow-Las Vegas return flight for April next year you will have to pay 43,000 rubles. There are also additional costs for the US visa. Meanwhile, the flight from Moscow to Podgorica will be just 10,000 rubles.

Mount Fuji - Klyuchevskaya Sopka

It turns out that famous Mount Fuji has a counterpart - Klyuchevskaya Sopka, situated in Kamchatka. Both volcanoes are very similar in shape and snow-capped peaks. Surprisingly, Klyuchevskaya Sopka is one kilometer higher than Fuji. Actually, this is the highest volcano in Eurasia and it is still active, whereas the last time Fuji showed some activity was in the 18th century.

Rates:

A ticket from Moscow to Tokyo for May 2020 will cost 33,000 rubles. To climb Mountain Fuji, you will have to pay around 2,000 dollars.

The price for a return flight from Moscow to Petropavlovsk-Kamchatsky in May will start from 25,000 rubles. To climb Klyuchevskaya Sopka with a guide, you will need to pay 13-14,000 rubles per person.

Lake Garda in Italy - Lake Ohrid in Macedonia

Lake Garda, located in the foothills of the Alps, is famous for its turquoise blue waters and picturesque views, with lemon gardens growing on the slopes of the mountains and little houses with terracotta roofs standing by the water. Lake Ohrid in Macedonia is not so famous, still, it is very beautiful. It can boast the same rugged coastline, thick forests, and dozens of ancient charming villages.

Rates:

On Lake Garda, rates on a double room in a four-star hotel on the first line in June start from 10,000 rubles. On Lake Ohrid, the price for a similar room will start from 3,000 rubles.

|

Метки: #photo_news |

Russia to continue cooperation with OPEC to stabilize oil market |

Russia has begun preparations for the next global crisis. President Vladimir Putin declared the coronavirus outbreak an emergency of international concern and emphasized its negative impact on both the global economy and the Russian economy. He noted that China's business activity index had declined below the minimum level of the 2008 global crisis. Global stock indices plummeted by more than 10 percent. According to the Russian president, the past week has become the worst for global markets since the crisis of 2008. The epidemic has already affected the Russian economy, and this is just the beginning. Russia is the world's largest oil exporter, but oil prices have suffered their biggest annual percentage declines over the past month. The demand for oil is weakening, thereby dragging the prices down. For now, the situation is not so critical. However, it will hardly change for the better. Much will depend on the OPEC+ meeting in Vienna scheduled for March. If the Petroleum Exporting Countries are able to agree and extend the agreement to reduce oil production, the situation on the oil markets is likely to stabilize. “This mechanism has proved to be an effective instrument to ensure long-term stability on global energy markets,” Putin noted.

Read more: https://www.mt5.com/forex_humor/image/47345

|

Метки: #forex_caricature |

Russia to continue cooperation with OPEC to stabilize oil market |

Russia has begun preparations for the next global crisis. President Vladimir Putin declared the coronavirus outbreak an emergency of international concern and emphasized its negative impact on both the global economy and the Russian economy. He noted that China's business activity index had declined below the minimum level of the 2008 global crisis. Global stock indices plummeted by more than 10 percent. According to the Russian president, the past week has become the worst for global markets since the crisis of 2008. The epidemic has already affected the Russian economy, and this is just the beginning. Russia is the world's largest oil exporter, but oil prices have suffered their biggest annual percentage declines over the past month. The demand for oil is weakening, thereby dragging the prices down. For now, the situation is not so critical. However, it will hardly change for the better. Much will depend on the OPEC+ meeting in Vienna scheduled for March. If the Petroleum Exporting Countries are able to agree and extend the agreement to reduce oil production, the situation on the oil markets is likely to stabilize. “This mechanism has proved to be an effective instrument to ensure long-term stability on global energy markets,” Putin noted.

Read more: https://www.mt5.com/forex_humor/image/47345

|

Метки: #forex_caricature |

Russia to continue cooperation with OPEC to stabilize oil market |

Russia has begun preparations for the next global crisis. President Vladimir Putin declared the coronavirus outbreak an emergency of international concern and emphasized its negative impact on both the global economy and the Russian economy. He noted that China's business activity index had declined below the minimum level of the 2008 global crisis. Global stock indices plummeted by more than 10 percent. According to the Russian president, the past week has become the worst for global markets since the crisis of 2008. The epidemic has already affected the Russian economy, and this is just the beginning. Russia is the world's largest oil exporter, but oil prices have suffered their biggest annual percentage declines over the past month. The demand for oil is weakening, thereby dragging the prices down. For now, the situation is not so critical. However, it will hardly change for the better. Much will depend on the OPEC+ meeting in Vienna scheduled for March. If the Petroleum Exporting Countries are able to agree and extend the agreement to reduce oil production, the situation on the oil markets is likely to stabilize. “This mechanism has proved to be an effective instrument to ensure long-term stability on global energy markets,” Putin noted.

Read more: https://www.mt5.com/forex_humor/image/47345

|

Метки: #forex_caricature |

Famous insider trading cases |

Insider trading in the US has been a part of the market since 18 century. As a result, numerous traders and bankers got rich. However, similar incidents occasionally lead to scandals.

Read about famous insider trading cases in our photo gallery

The Wall Street Journal/R. Foster Winans

R. Foster Winans had been a columnist for The Wall Street Journal for three years. He was convicted of insider trading and mail fraud.

In 1985, he was accused of giving information to two stockbrokers about stocks he was planning to write about in his column. Traders used this information and earned about $690 thousand. Winans’ cut was $31 thousand.

As a result, Winans was sentenced to 18 months in prison. Other conspirators were also convicted.

ENRON/JEFFREY SKILLING

Jeffrey Skilling, the former Enron president, became the most famous business criminal who managed to serve his sentence and get out of jail.

Skilling was indicted on 35 cases of fraud, insider trading, and other crimes related to the Enron scandal.

Skilling pleaded not guilty of all charges. However, prosecution managed to bring Skilling to justice when he sold almost $60 million of Enron's shares after quitting the company.

Prosecutors said that Jeffrey knew about the company's imminent insolvency and used this against all laws on foreign exchange operations.

As a result, Skilling was sentenced to 292 months in prison.

IVAN BOESKY

Ivan Boesky, a son of a Russian immigrant, became one of the wealthiest people in the US thanks to insider information. However, shocking trading scandal that occurred in 1986 completely ruined his reputation.

Boesky’s company was engaged in insider trading. Using both public and insider information, Boesky found corporate takeovers and bought their shares shortly before the release of public information. Then, he sold the shares a few days before corporations announced a takeover.

Boesky’s success attracted attention of the US Securities and Exchange Commission. In 1986, the prosecution revealed that Boesky was passing insider information to Dennis B. Levine, a managing director of Drexel Burnham Lambert, who was taken into custody in May. Boesky had been under surveillance since that day.

In 1986, federal investigators offered Boesky a secret agreement instead of a longtime prison term. According to the agreement, Boesky was forbidden from security trading for life. Moreover, he had to uncover other traders who used takeover information for illegal purposes.

As a result, Boesky met dozens of his former partners in crime with a listening device attached to him. In the aftermath, 14 traders were arrested.

Business Week

In 1990, printing company worker William Jackson and stockbroker Brian Callahan were convicted of using stock information in Business Week magazine before it was distributed to the public.

According to the Court, Jackson and Callahan made over $19 thousand each. As a result, they had to pay $37,445.

GALLEON GROUP/RAJ RAJARATNAM

The District Court of New York convicted former billionaire and the head of the hedge fund firm Galleon Group of insider trading.

Once a successful billionaire and the hedge fund manager of the Galleon Group, Raj Rajaratnam, was found guilty of conspiracy and securities fraud by the District Court of New York.

According to the Court, the billionaire had been using insider information he received from executives, bankers, traders, and directors of such companies as Goldman Sachs, Intel, and Hilton Hotels for seven years.

As a result, Rajaratnam made some $45 million. On May 11, 2011, he was sentenced to 11 years in prison.

KEEFE, BRUYETTE & WOODS/MCDERMOTT JR.

James McDermott Jr., CEO of investment bank Keefe, Bruyette & Woods, was convinced of insider trading in 2000.

He gave the information about pending bank merger to his mistress Marilyn Star, an adult-movie actress.

McDermott Jr. was sentenced to 8 months in prison. His mistress received a 3-months term. Moreover, McDermott Jr. was ordered to pay a fine of $25 thousand.

ImClone

Former ImClone CEO Samuel Waksal was sentenced to 87 months in prison and paid $3 million after he was found guilty of insider trading and fraud.

ImClone developed a new type of cancer drug, Erbitux. However, regulators rejected the application. Despite this fact, Samuel Waksal sold the company’s stock. Later, the drug was approved.

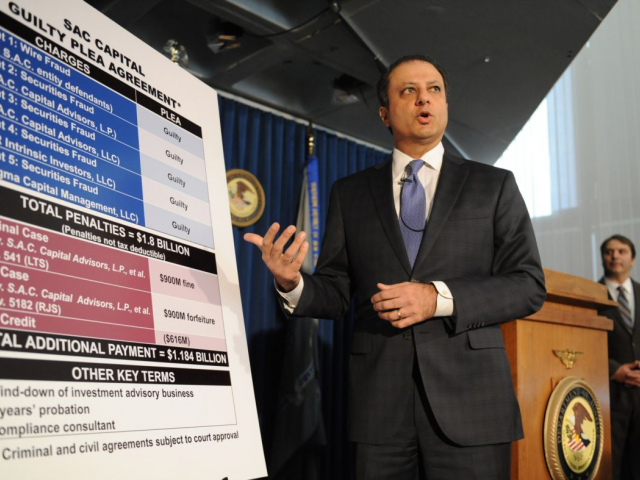

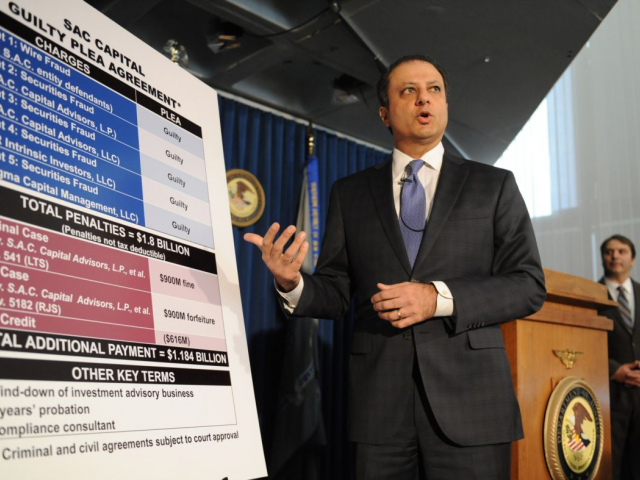

SAC GROUP/STEVEN A. COHEN

Steven Cohen is the founder of SAC Capital Partners. He became known for his phenomenal ability to make money regardless of market conditions. BusinessWeek called Cohen the most influential trader on Wall Street.

Cohen had been closely watched by the US Attorney Office and regulatory authorities for a couple of years. The investigation of the SAC Capital case became one of the major and long-term processes in the history of Wall Street. The first suspicions among regulators and prosecutors arose more than ten years ago.

However, the SEC was the only government department that dared to publicly accuse Steven Cohen. The company was accused of encouraging its employees to insider trading since 1999 and ignoring signs of illegitimacy of such practice. Several cases of fraud and insider trading were uncovered.

According to the SEC, SAC Capital illegally earned more than $275 million on insider trading.

In November 2013, the hedge fund SAC Capital pleaded guilty to securities fraud as part of the insider trading case and agreed to pay a record $1.8 billion. At the same time, New York District Attorney announced that SAC Capital would stop its investment consulting activity.

|

Метки: #photo_news |

Famous insider trading cases |

Insider trading in the US has been a part of the market since 18 century. As a result, numerous traders and bankers got rich. However, similar incidents occasionally lead to scandals.

Read about famous insider trading cases in our photo gallery

The Wall Street Journal/R. Foster Winans

R. Foster Winans had been a columnist for The Wall Street Journal for three years. He was convicted of insider trading and mail fraud.

In 1985, he was accused of giving information to two stockbrokers about stocks he was planning to write about in his column. Traders used this information and earned about $690 thousand. Winans’ cut was $31 thousand.

As a result, Winans was sentenced to 18 months in prison. Other conspirators were also convicted.

ENRON/JEFFREY SKILLING

Jeffrey Skilling, the former Enron president, became the most famous business criminal who managed to serve his sentence and get out of jail.

Skilling was indicted on 35 cases of fraud, insider trading, and other crimes related to the Enron scandal.

Skilling pleaded not guilty of all charges. However, prosecution managed to bring Skilling to justice when he sold almost $60 million of Enron's shares after quitting the company.

Prosecutors said that Jeffrey knew about the company's imminent insolvency and used this against all laws on foreign exchange operations.

As a result, Skilling was sentenced to 292 months in prison.

IVAN BOESKY

Ivan Boesky, a son of a Russian immigrant, became one of the wealthiest people in the US thanks to insider information. However, shocking trading scandal that occurred in 1986 completely ruined his reputation.

Boesky’s company was engaged in insider trading. Using both public and insider information, Boesky found corporate takeovers and bought their shares shortly before the release of public information. Then, he sold the shares a few days before corporations announced a takeover.

Boesky’s success attracted attention of the US Securities and Exchange Commission. In 1986, the prosecution revealed that Boesky was passing insider information to Dennis B. Levine, a managing director of Drexel Burnham Lambert, who was taken into custody in May. Boesky had been under surveillance since that day.

In 1986, federal investigators offered Boesky a secret agreement instead of a longtime prison term. According to the agreement, Boesky was forbidden from security trading for life. Moreover, he had to uncover other traders who used takeover information for illegal purposes.

As a result, Boesky met dozens of his former partners in crime with a listening device attached to him. In the aftermath, 14 traders were arrested.

Business Week

In 1990, printing company worker William Jackson and stockbroker Brian Callahan were convicted of using stock information in Business Week magazine before it was distributed to the public.

According to the Court, Jackson and Callahan made over $19 thousand each. As a result, they had to pay $37,445.

GALLEON GROUP/RAJ RAJARATNAM

The District Court of New York convicted former billionaire and the head of the hedge fund firm Galleon Group of insider trading.

Once a successful billionaire and the hedge fund manager of the Galleon Group, Raj Rajaratnam, was found guilty of conspiracy and securities fraud by the District Court of New York.

According to the Court, the billionaire had been using insider information he received from executives, bankers, traders, and directors of such companies as Goldman Sachs, Intel, and Hilton Hotels for seven years.

As a result, Rajaratnam made some $45 million. On May 11, 2011, he was sentenced to 11 years in prison.

KEEFE, BRUYETTE & WOODS/MCDERMOTT JR.

James McDermott Jr., CEO of investment bank Keefe, Bruyette & Woods, was convinced of insider trading in 2000.

He gave the information about pending bank merger to his mistress Marilyn Star, an adult-movie actress.

McDermott Jr. was sentenced to 8 months in prison. His mistress received a 3-months term. Moreover, McDermott Jr. was ordered to pay a fine of $25 thousand.

ImClone

Former ImClone CEO Samuel Waksal was sentenced to 87 months in prison and paid $3 million after he was found guilty of insider trading and fraud.

ImClone developed a new type of cancer drug, Erbitux. However, regulators rejected the application. Despite this fact, Samuel Waksal sold the company’s stock. Later, the drug was approved.

SAC GROUP/STEVEN A. COHEN

Steven Cohen is the founder of SAC Capital Partners. He became known for his phenomenal ability to make money regardless of market conditions. BusinessWeek called Cohen the most influential trader on Wall Street.

Cohen had been closely watched by the US Attorney Office and regulatory authorities for a couple of years. The investigation of the SAC Capital case became one of the major and long-term processes in the history of Wall Street. The first suspicions among regulators and prosecutors arose more than ten years ago.

However, the SEC was the only government department that dared to publicly accuse Steven Cohen. The company was accused of encouraging its employees to insider trading since 1999 and ignoring signs of illegitimacy of such practice. Several cases of fraud and insider trading were uncovered.

According to the SEC, SAC Capital illegally earned more than $275 million on insider trading.

In November 2013, the hedge fund SAC Capital pleaded guilty to securities fraud as part of the insider trading case and agreed to pay a record $1.8 billion. At the same time, New York District Attorney announced that SAC Capital would stop its investment consulting activity.

|

Метки: #photo_news |

JD.com to see robust sales growth despite coronavirus fears |

Chinese online retailer JD.com Inc. will not be hit by the novel virus COVID-19 outbreak, analysts at Bloomberg Intelligence forecast. On the contrary, the company’s profit is expected to increase. According to Bloomberg Intelligence, JD.com posted a better-than-expected net profit of 3.6 billion yuan ($500 million) between October and December 2019, compared to a net loss of 4.8 billion yuan a year earlier. The company’s total net revenue for the fourth quarter of 2019 rose to 170.7 billion yuan, up by 26.6%. The net product revenue was up by 24.5%, while net service earnings surged 43.6%. In 2019, the Chinese e-commerce giant logged a 24.9% increase in year-on-year revenue, reaching 576.9 billion yuan. What is more, the number of annual active users grew 18.6% annually to 362 million. The outlook for China’s second-largest online retailer is rather optimistic despite the disruptions caused by the epidemic. JD.com foresees its net profit to grow by at least 10% in Q1, 2020. However, these estimates are subject to change due to the possible downside risks posed by the coronavirus outbreak.

Read more: https://www.mt5.com/forex_humor/image/47324

|

Метки: #forex_caricature |

JD.com to see robust sales growth despite coronavirus fears |

Chinese online retailer JD.com Inc. will not be hit by the novel virus COVID-19 outbreak, analysts at Bloomberg Intelligence forecast. On the contrary, the company’s profit is expected to increase. According to Bloomberg Intelligence, JD.com posted a better-than-expected net profit of 3.6 billion yuan ($500 million) between October and December 2019, compared to a net loss of 4.8 billion yuan a year earlier. The company’s total net revenue for the fourth quarter of 2019 rose to 170.7 billion yuan, up by 26.6%. The net product revenue was up by 24.5%, while net service earnings surged 43.6%. In 2019, the Chinese e-commerce giant logged a 24.9% increase in year-on-year revenue, reaching 576.9 billion yuan. What is more, the number of annual active users grew 18.6% annually to 362 million. The outlook for China’s second-largest online retailer is rather optimistic despite the disruptions caused by the epidemic. JD.com foresees its net profit to grow by at least 10% in Q1, 2020. However, these estimates are subject to change due to the possible downside risks posed by the coronavirus outbreak.

Read more: https://www.mt5.com/forex_humor/image/47324

|

Метки: #forex_caricature |

hat to expect from Internet of Things in 2020 |

According to Forrester's report, published in November 2019, the Internet of Things market will face major changes in 2020. Read about the forecast of the IoT in our article

5G integration in new projects

5G technology includes all the latest developments in microelectronics and radio transmission. According to Forrester’s analysts, it will significantly improve Low-Power Wireless Personal Area Networks (LoWPAN) as well as expand their implementation.

According to estimates, a multimodal design will be popular in 2020. It will make voice communication, visual display and touch control equally important. Data transmission to Cloud services or via telecommunication networks will be possible on both personal and corporate devices by means of intelligent displays.

Utilization of IoT devices to get ransom from manufacturers

A great number of devices connected to the network will be actively used in cybercrime in 2020. Hackers will be using personal and corporate devices to blackmail regular customers and manufacturers of the devices.

The close cooperation of software developers with security groups will help to prevent the situation. Experts will be able not only to minimize risks of cyber attacks but also to assist in the development of a proper strategy in case of a cyber threat.

Supply chain transformation using IoT

The IoT technology is designed to provide better logistics in the field of cargo transportation as well as to optimize supply chains. The number of empty vehicles hauls will decrease. As a result, it will positively affect the cost and speed of cargo transportation.

Roads will be safer. The damaged vehicles will be identified and repaired faster. The operation of machines in warehouses will be more reliable while the movement of heavy things will become automated.

Drivers will be able to optimize the work and rest mode on the road. Thanks to a personalized approach the quality of customer service will also be improved.

Ecosystem of related services

The majority of large companies will provide their services based on the IoT data in 2020. As a result, manufacturers will spend less on monitoring the efficiency of products and software updating.

This also applies to connected products which involve constant information exchange between clients and manufacturers.

Major consumers and service providers will move from selling separate products to providing the IoT services supported by partners in a single ecosystem.

|

Метки: #photo_news |

Elon Musk predicts Chinese economy to surpass US by 2 -3 times |

Elon Musk, the creator of the world’s most innovative technical projects, predicted that China’s economic growth would eventually outpace the one of the US leaving it very far behind. “A thing that will feel pretty strange is that the Chinese economy is probably going to be at least twice as big as the United States’ economy, maybe three times,” Musk said during the Air Warfare Symposium in Orlando, Florida. The two nations are already the world’s two leading economies. The US currently dominates with $21.44 trillion in nominal GDP and makes up one-fourth of the global economy. China ranks second with $14.14 trillion GDP being the fastest-growing economy in the world. Elon Musk believes that China will easily surpass the United States due to its large population. The US population roughly totals 330 million people, while China has more than 1.3 billion people. This factor will help China become number one in the economic race. Musk also stresses the importance of prioritizing space innovations in the US. “This is not something that was a risk in times past but is a risk now,” Musk said. “I have zero doubt that if the United States doesn’t seek innovation in space it will be second in space.”

Read more: https://www.mt5.com/forex_humor/image/47254

|

Метки: #forex_caricature |

5 countries where solar energy used the most |

Across the globe, more and more countries give their preference to solar energy. Besides, there are a lot of developments in this field, especially in the countries that actively use this renewable source of energy. They come up with new ideas about how it can be enhanced. Such countries set an example for others by offering their experience to less innovative ones.

Nowadays, renewable sources of energy are taking the lead among other sources of energy as they can ensure a more stable and reliable supply of energy. The use of solar energy in manufacturing is increasing. Some countries have long used it and become the leaders in this area. See these countries in our photo gallery

Germany

Germany is one of the first countries to develop and implement solar energy technologies. The long-term transition to clean energy has made the German economy one of the largest in the world. Besides, Germany is hugely dependable on renewable energy as it helps its economy to expand at a faster pace. Notably, the German government plans to use only solar and other renewable sources of energy in the nearest future. As one of the world leaders in promoting solar energy, Germany is strengthening its presence in this industry.

China

China is considered the largest consumer of hydrocarbons in the world. Additionally, since 2015 China is a leader in the manufacturing and purchasing of solar panels. The country has got giant solar farms selling power to utility companies. The solar energy interest is surging in China because the country has a great need for electricity. Chinese authorities provide financial support for projects related to solar energy.

Japan

In Japan, there is a significant number of solar panels. What is more, the country is among the leaders in the production of solar energy. After the Fukushima-1 nuclear accident in 2011, solar energy is becoming dominant in this country. Presently, the use of renewable energy has doubled. Floating power generation stations made from water-resistant panels have been established in the country. They are cooled by water. Experts think that such floating solar farms will be soon become widespread.

Italy

Italy has solar farms as well. However, they produce less energy than the German, Japanese, and Chinese ones. In 2017, they generated 25.2 gigawatts of electricity which is 10% of the total electricity consumed by the country. Yet, many of these farms turned out to be unprofitable and had to be closed. Experts believe that in the nearest future, the generation of solar power by Italian solar farms will decline.

US

The United States is also investing in the development of renewable energy sources. The country is among those who use renewable energy the most. The US government is doing its best to encourage companies to use solar energy. For instance, thanks to the governmental programs for the implementation of solar energy in housing and communal services, the consumption of alternative energy by the utility sector rose by 3.9 gigawatts. In the nearest future, experts predict an increase in the number of solar farms.

|

Метки: #photo_news |

Elon Musk predicts Chinese economy to surpass US by 2 -3 times |

Elon Musk, the creator of the world’s most innovative technical projects, predicted that China’s economic growth would eventually outpace the one of the US leaving it very far behind. “A thing that will feel pretty strange is that the Chinese economy is probably going to be at least twice as big as the United States’ economy, maybe three times,” Musk said during the Air Warfare Symposium in Orlando, Florida. The two nations are already the world’s two leading economies. The US currently dominates with $21.44 trillion in nominal GDP and makes up one-fourth of the global economy. China ranks second with $14.14 trillion GDP being the fastest-growing economy in the world. Elon Musk believes that China will easily surpass the United States due to its large population. The US population roughly totals 330 million people, while China has more than 1.3 billion people. This factor will help China become number one in the economic race. Musk also stresses the importance of prioritizing space innovations in the US. “This is not something that was a risk in times past but is a risk now,” Musk said. “I have zero doubt that if the United States doesn’t seek innovation in space it will be second in space.”

Read more: https://www.mt5.com/forex_humor/image/47254

|

Метки: #forex_caricature |

5 leading LNG projects in Russia |

Currently, the market of liquified natural gas (LNG) is actively developing. Russia, being the leader in the global energy market, continues to improve its LNG projects. At the moment, there are two LNG plants operating in the country and more large enterprises to appear in the future. Find out about 5 key LNG projects in Russia in our photo gallery

Yamal LNG

Yamal LNG is an integrated project encompassing natural gas production, liquefaction, and shipping. The total output capacity of the three launched Yamal LNG lines reaches 16.5 million tons per year. The field’s proven and probable reserves are estimated at 926 billion cubic meters. The project was built in record time and reached its full capacity in December 2018. The cost of the project is $26.9 billion.

Sakhalin-2

In February 2009, the first LNG plant in Russia was launched in Sakhalin Island.The project is planned to further develop world-class technological facilities for oil and natural gas extraction. The project is operating in the area of high seismicity, thus a special construction technique was implemented to ensure safety. Its production capacity is 9.6 million tons per year.

Arctic LNG-2

The Arctic LNG-2 is a three-staged project scheduled for 2023 with a planned total capacity of 18 million tons. The project is expected to be fully operational by 2026. The preliminary cost of the project is $ 25.5 billion. The Arctic LNG-2 project will be located on the Untrenneye field resource base which has 1,582 billion cubic meters of natural gas and 65 million tons of liquid hydrocarbons in its reserves.

Baltic LNG

This project involves the construction of an LNG plant in the Leningrad Region. The plant with a capacity of 10 million tons per year will be built near the Ust-Luga Port. The launch of the project is scheduled on 2022-2023. The estimated cost of the project is about $ 11 billion.

Far East LNG

The project was created to monetize Sakhalin-1 gas resources under the production sharing agreement. The project is aimed at constructing an LNG plant in the Far East with a capacity of 6.2 million tons per year, as well as developing related infrastructure. Sakhalin-1 will serve as a resource base for the project with its 307 million tons of oil and 485 billion cubic meters of gas reserves.

|

Метки: #photo_news |

Millions of Chinese companies on verge of collapse |

The COVID-19 outbreak had a severe impact on the Chinese economy. The country’s manufacturing and trade sectors were almost paralized. Currently, the majority of China’s industries is on an extended break while millions of firms are struggling to stay afloat.

Both small and big-sized companies were hit by the coronavirus outbreak. Thus, one of the biggest Chinese auto dealers had to close around 100 stores around the country for a month. The company is running out of money while banks are reluctant to provide loans for paying out debts.

The majority of firms across the country face serious challenges due to the virus epidemic. According to a survey conducted among representatives of small and medium-sized businesses in China, only the third part of all companies is likely to not slip into deficit in the coming month.

Experts believe that the stimulus measures introduced by the government are not going to help small and medium-sized businesses in China. Under the directive from the government, the central bank cut benchmark lending rates and encouraged commercial banks to scale up loans. At this point, the private sector, which accounts for 60% of the country’s GDP and 80% of jobs, lacks financing in order to repay loans and pay employees. According to analysts, if the government does not offer support to these companies, they are likely to be terminated in the first quarter of 2020.

However, receiving financial assistance is not so easy. Banks have a number of requirements firms should comply with in order to get a loan. Apart from that, the list of companies is limited. The restrictions are determined by local monetary authorities. In order to apply for a soft loan, a company must prove that at least 10% of its proceeds will be dedicated to combat the COVID-19.

Presently, banks grant loans only to fight the coronavirus. Industrial & Commercial Bank of China is ready to offer loans to 14 thousand companies allocating 5.4 billion yuan, or $770 million. In early February 2020, the group of Chinese banks lent 254 billion yuan to stop the spread of the coronavirus.

However, many small and medium-sized businesses were doomed even without the coronavirus outbreak. These firms were deeply affected by the trade conflict with the US as well as massive loans. As a result, China's economic growth slowed to its lowest levels in three decades in 2019.

Read more: https://www.mt5.com/forex_humor/image/47199

|

Метки: #forex_caricature |