Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Crypto police to stamp out spreading crypto scams |

The crypto industry opens up ample opportunities for speculators, but someone is unaware of its dark side. Crypto exchanges and e-wallets around the world are vulnerable to cybercriminals. In fact, the crypto mafia has been extending the scale of its thefts at an alarming rate. According to official estimates, hackers stole digital currencies worth $4.3 billion last year which is twice as big as the cyber theft size recorded in 2017 and 2018. Interestingly, cybercriminals prefer a certain method of defrauding crypto traders in different years. In 2017, the bulk of assets was swindled at the time of IPOs when new tokens were listed on crypto exchanges. In 2018, lots of crypto investors lost their money as a result of cyber attacks. In 2019, 90% of $4.3 billion was stolen through notorious Ponzi schemes. Such financial pyramids operate on the same principle. They lure people into investing which is supposed to yield high returns immediately. PlusToken is one of such successful Internet scams launched in China. Catchy advertisement and forceful marketing attracted a lot of users who were hooked by guaranteed returns of 6% to 19% per month. Besides, investors were encouraged to receive extra bonuses for referring new clients. Eventually, investors were swindled out of their deposits. Experts at Group-IB warn that the crypto mafia could shift focus towards the world’s largest miners in the near future. Remarkably, miners in some countries could fall prey to pro-government hackers.

Read more: https://www.mt5.com/forex_humor/image/46817

|

Метки: #forex_caricature |

Crypto police to stamp out spreading crypto scams |

The crypto industry opens up ample opportunities for speculators, but someone is unaware of its dark side. Crypto exchanges and e-wallets around the world are vulnerable to cybercriminals. In fact, the crypto mafia has been extending the scale of its thefts at an alarming rate. According to official estimates, hackers stole digital currencies worth $4.3 billion last year which is twice as big as the cyber theft size recorded in 2017 and 2018. Interestingly, cybercriminals prefer a certain method of defrauding crypto traders in different years. In 2017, the bulk of assets was swindled at the time of IPOs when new tokens were listed on crypto exchanges. In 2018, lots of crypto investors lost their money as a result of cyber attacks. In 2019, 90% of $4.3 billion was stolen through notorious Ponzi schemes. Such financial pyramids operate on the same principle. They lure people into investing which is supposed to yield high returns immediately. PlusToken is one of such successful Internet scams launched in China. Catchy advertisement and forceful marketing attracted a lot of users who were hooked by guaranteed returns of 6% to 19% per month. Besides, investors were encouraged to receive extra bonuses for referring new clients. Eventually, investors were swindled out of their deposits. Experts at Group-IB warn that the crypto mafia could shift focus towards the world’s largest miners in the near future. Remarkably, miners in some countries could fall prey to pro-government hackers.

Read more: https://www.mt5.com/forex_humor/image/46817

|

Метки: #forex_caricature |

Crypto police to stamp out spreading crypto scams |

The crypto industry opens up ample opportunities for speculators, but someone is unaware of its dark side. Crypto exchanges and e-wallets around the world are vulnerable to cybercriminals. In fact, the crypto mafia has been extending the scale of its thefts at an alarming rate. According to official estimates, hackers stole digital currencies worth $4.3 billion last year which is twice as big as the cyber theft size recorded in 2017 and 2018. Interestingly, cybercriminals prefer a certain method of defrauding crypto traders in different years. In 2017, the bulk of assets was swindled at the time of IPOs when new tokens were listed on crypto exchanges. In 2018, lots of crypto investors lost their money as a result of cyber attacks. In 2019, 90% of $4.3 billion was stolen through notorious Ponzi schemes. Such financial pyramids operate on the same principle. They lure people into investing which is supposed to yield high returns immediately. PlusToken is one of such successful Internet scams launched in China. Catchy advertisement and forceful marketing attracted a lot of users who were hooked by guaranteed returns of 6% to 19% per month. Besides, investors were encouraged to receive extra bonuses for referring new clients. Eventually, investors were swindled out of their deposits. Experts at Group-IB warn that the crypto mafia could shift focus towards the world’s largest miners in the near future. Remarkably, miners in some countries could fall prey to pro-government hackers.

Read more: https://www.mt5.com/forex_humor/image/46817

|

Метки: #forex_caricature |

Top 5 Russian dividend stocks in 202 |

Analysts forecast that state-owned companies will take the lead in the Russian market in terms of liquidity in the next three years. According to preliminary estimates, dividends on shares of such corporations will reach 100 percent. Read about five Russian firms that have the best dividend yield in our article.

Sberbank of Russia

Sberbank is one of the leading state-owned Russian companies with the highest dividend payments. The company’s preferred stock steadily attracts investors’ attention. Various economic and political factors as well as sanctions against Russia support Sberbank’s share prices. The dividend yield of Sberbank’s stock in 2020 is expected to be 10%.

MTS

MTS, the leading mobile network operator in Russia, is ranked second on the list. The company’s dividend policy is stable and very attractive to investors. According to analysts, current foreign policy developments have improved MTS stock quotes. Nowadays, the company's dividend yield is persistently high, over 10%. This year it is expected to remain at the same level.

Alrosa

Alrosa is the third Russian company whose shares have the highest dividend yield. The management of this largest diamond mining corporation has recently changed its dividend policy. According to analysts, investors expect to receive a yield of up to 10%.

Severstal

Severstal, the main metallurgic company in Russia, is ranked fourth on the list. The company’s dividend yield is high. Dividends are paid to shareholders on a quarterly basis. According to experts, the projected yield on Severstal’s preferred shares will reach an impressive 14 percent in 2020.

Lenenergo

Lenenergo is closing the list of top 5 Russian corporations with highest dividends. Many experts consider the company to be a leader among the largest energy distribution and network companies in Russia. Investors can expect high dividend payments on the company’s preferred shares. The value of such securities traded on Moscow Exchange is 20 times higher than the price of common shares of Lenenergo. According to analysts, the dividend yield of Lenenergo’s securities will be 12% in 2020.

|

Метки: #photo_news |

Top 5 Russian dividend stocks in 202 |

Analysts forecast that state-owned companies will take the lead in the Russian market in terms of liquidity in the next three years. According to preliminary estimates, dividends on shares of such corporations will reach 100 percent. Read about five Russian firms that have the best dividend yield in our article.

Sberbank of Russia

Sberbank is one of the leading state-owned Russian companies with the highest dividend payments. The company’s preferred stock steadily attracts investors’ attention. Various economic and political factors as well as sanctions against Russia support Sberbank’s share prices. The dividend yield of Sberbank’s stock in 2020 is expected to be 10%.

MTS

MTS, the leading mobile network operator in Russia, is ranked second on the list. The company’s dividend policy is stable and very attractive to investors. According to analysts, current foreign policy developments have improved MTS stock quotes. Nowadays, the company's dividend yield is persistently high, over 10%. This year it is expected to remain at the same level.

Alrosa

Alrosa is the third Russian company whose shares have the highest dividend yield. The management of this largest diamond mining corporation has recently changed its dividend policy. According to analysts, investors expect to receive a yield of up to 10%.

Severstal

Severstal, the main metallurgic company in Russia, is ranked fourth on the list. The company’s dividend yield is high. Dividends are paid to shareholders on a quarterly basis. According to experts, the projected yield on Severstal’s preferred shares will reach an impressive 14 percent in 2020.

Lenenergo

Lenenergo is closing the list of top 5 Russian corporations with highest dividends. Many experts consider the company to be a leader among the largest energy distribution and network companies in Russia. Investors can expect high dividend payments on the company’s preferred shares. The value of such securities traded on Moscow Exchange is 20 times higher than the price of common shares of Lenenergo. According to analysts, the dividend yield of Lenenergo’s securities will be 12% in 2020.

|

Метки: #photo_news |

Top 5 Russian dividend stocks in 202 |

Analysts forecast that state-owned companies will take the lead in the Russian market in terms of liquidity in the next three years. According to preliminary estimates, dividends on shares of such corporations will reach 100 percent. Read about five Russian firms that have the best dividend yield in our article.

Sberbank of Russia

Sberbank is one of the leading state-owned Russian companies with the highest dividend payments. The company’s preferred stock steadily attracts investors’ attention. Various economic and political factors as well as sanctions against Russia support Sberbank’s share prices. The dividend yield of Sberbank’s stock in 2020 is expected to be 10%.

MTS

MTS, the leading mobile network operator in Russia, is ranked second on the list. The company’s dividend policy is stable and very attractive to investors. According to analysts, current foreign policy developments have improved MTS stock quotes. Nowadays, the company's dividend yield is persistently high, over 10%. This year it is expected to remain at the same level.

Alrosa

Alrosa is the third Russian company whose shares have the highest dividend yield. The management of this largest diamond mining corporation has recently changed its dividend policy. According to analysts, investors expect to receive a yield of up to 10%.

Severstal

Severstal, the main metallurgic company in Russia, is ranked fourth on the list. The company’s dividend yield is high. Dividends are paid to shareholders on a quarterly basis. According to experts, the projected yield on Severstal’s preferred shares will reach an impressive 14 percent in 2020.

Lenenergo

Lenenergo is closing the list of top 5 Russian corporations with highest dividends. Many experts consider the company to be a leader among the largest energy distribution and network companies in Russia. Investors can expect high dividend payments on the company’s preferred shares. The value of such securities traded on Moscow Exchange is 20 times higher than the price of common shares of Lenenergo. According to analysts, the dividend yield of Lenenergo’s securities will be 12% in 2020.

|

Метки: #photo_news |

China rolls out measures to cushion economy from coronavirus |

The coronavirus outbreak in China poses a serious challenge to the rule of President Xi Jinping. Nowadays, market participants, experts, and policymakers acknowledge the fact that the epidemic has gone too far. Being alarmed by its fallout, investors worry that it could derail China’s national economy, dent demand for oil, and cause a slowdown in the global economy. Сhina’s President Xi Jinping ordered to stamp out the economic aftermath of the coronavirus and ensure that the country’s GDP maintains momentum in the long term. In fact, the fast-spreading epidemic puts the efficiency of China’s government to the test.

Interestingly, President Xi Jinping was aware of the coronavirus two weeks before he acknowledged the fact of the epidemic publicly in early February. Originally, local officials held back true data on the death toll and the number of cases. They feared a negative response from the government to such highly sensitive information. It proves that China’s top executive agencies do not care about any feedback from regional officials. Almost two months have passed since the first cases were reported in early December 2019 until the quarantine was officially declared. On December 30, doctor Li Wenliang warned his colleagues on social media of the new pneumonia-like deadly virus originated in Wuhan. Government sensors spotted the young doctor immediately. At the same night, he was questioned at the healthcare agency and then handed over to the Department of National Security. On December 31, the Department announced that eight doctors had been under investigation as they allegedly had been spreading rumors about the virus outbreak. When the death toll was soaring, China’s authorities had to admit the truth.

Read more: https://www.mt5.com/forex_humor/image/46740

|

Метки: #forex_caricature |

China rolls out measures to cushion economy from coronavirus |

The coronavirus outbreak in China poses a serious challenge to the rule of President Xi Jinping. Nowadays, market participants, experts, and policymakers acknowledge the fact that the epidemic has gone too far. Being alarmed by its fallout, investors worry that it could derail China’s national economy, dent demand for oil, and cause a slowdown in the global economy. Сhina’s President Xi Jinping ordered to stamp out the economic aftermath of the coronavirus and ensure that the country’s GDP maintains momentum in the long term. In fact, the fast-spreading epidemic puts the efficiency of China’s government to the test.

Interestingly, President Xi Jinping was aware of the coronavirus two weeks before he acknowledged the fact of the epidemic publicly in early February. Originally, local officials held back true data on the death toll and the number of cases. They feared a negative response from the government to such highly sensitive information. It proves that China’s top executive agencies do not care about any feedback from regional officials. Almost two months have passed since the first cases were reported in early December 2019 until the quarantine was officially declared. On December 30, doctor Li Wenliang warned his colleagues on social media of the new pneumonia-like deadly virus originated in Wuhan. Government sensors spotted the young doctor immediately. At the same night, he was questioned at the healthcare agency and then handed over to the Department of National Security. On December 31, the Department announced that eight doctors had been under investigation as they allegedly had been spreading rumors about the virus outbreak. When the death toll was soaring, China’s authorities had to admit the truth.

Read more: https://www.mt5.com/forex_humor/image/46740

|

Метки: #forex_caricature |

Top 5 Russian dividend stocks in 2020 |

Analysts forecast that state-owned companies will take the lead in the Russian market in terms of liquidity in the next three years. According to preliminary estimates, dividends on shares of such corporations will reach 100 percent. Read about five Russian firms that have the best dividend yield in our article.

Sberbank of Russia

Sberbank is one of the leading state-owned Russian companies with the highest dividend payments. The company’s preferred stock steadily attracts investors’ attention. Various economic and political factors as well as sanctions against Russia support Sberbank’s share prices. The dividend yield of Sberbank’s stock in 2020 is expected to be 10%.

MTS

MTS, the leading mobile network operator in Russia, is ranked second on the list. The company’s dividend policy is stable and very attractive to investors. According to analysts, current foreign policy developments have improved MTS stock quotes. Nowadays, the company's dividend yield is persistently high, over 10%. This year it is expected to remain at the same level.

Alrosa

Alrosa is the third Russian company whose shares have the highest dividend yield. The management of this largest diamond mining corporation has recently changed its dividend policy. According to analysts, investors expect to receive a yield of up to 10%.

Severstal

Severstal, the main metallurgic company in Russia, is ranked fourth on the list. The company’s dividend yield is high. Dividends are paid to shareholders on a quarterly basis. According to experts, the projected yield on Severstal’s preferred shares will reach an impressive 14 percent in 2020.

Lenenergo

Lenenergo is closing the list of top 5 Russian corporations with highest dividends. Many experts consider the company to be a leader among the largest energy distribution and network companies in Russia. Investors can expect high dividend payments on the company’s preferred shares. The value of such securities traded on Moscow Exchange is 20 times higher than the price of common shares of Lenenergo. According to analysts, the dividend yield of Lenenergo’s securities will be 12% in 2020.

|

Метки: #photo_news |

Top 5 Russian dividend stocks in 2020 |

Analysts forecast that state-owned companies will take the lead in the Russian market in terms of liquidity in the next three years. According to preliminary estimates, dividends on shares of such corporations will reach 100 percent. Read about five Russian firms that have the best dividend yield in our article.

Sberbank of Russia

Sberbank is one of the leading state-owned Russian companies with the highest dividend payments. The company’s preferred stock steadily attracts investors’ attention. Various economic and political factors as well as sanctions against Russia support Sberbank’s share prices. The dividend yield of Sberbank’s stock in 2020 is expected to be 10%.

MTS

MTS, the leading mobile network operator in Russia, is ranked second on the list. The company’s dividend policy is stable and very attractive to investors. According to analysts, current foreign policy developments have improved MTS stock quotes. Nowadays, the company's dividend yield is persistently high, over 10%. This year it is expected to remain at the same level.

Alrosa

Alrosa is the third Russian company whose shares have the highest dividend yield. The management of this largest diamond mining corporation has recently changed its dividend policy. According to analysts, investors expect to receive a yield of up to 10%.

Severstal

Severstal, the main metallurgic company in Russia, is ranked fourth on the list. The company’s dividend yield is high. Dividends are paid to shareholders on a quarterly basis. According to experts, the projected yield on Severstal’s preferred shares will reach an impressive 14 percent in 2020.

Lenenergo

Lenenergo is closing the list of top 5 Russian corporations with highest dividends. Many experts consider the company to be a leader among the largest energy distribution and network companies in Russia. Investors can expect high dividend payments on the company’s preferred shares. The value of such securities traded on Moscow Exchange is 20 times higher than the price of common shares of Lenenergo. According to analysts, the dividend yield of Lenenergo’s securities will be 12% in 2020.

|

Метки: #photo_news |

Oil demand unaffected by coronavirus |

The Russian authorities are trying to avoid panic about the coronavirus outbreak. They have even found some advantages, including changes in oil prices.

Alexander Novak, Russia’s Minister of Energy, supposes that the coronavirus spread can hardly reduce demand for oil by more than 150-200 thousand barrels a day. According to the analytical data, the prediction can come true in 2020. Alexander Novak also noted that such a decline in oil demand was an average annual reduction that would not lead to any problems.

Russia’s Minister of Energy believes that oil prices are shaped by various unexpected events, including conflicts in such countries as Libya, Iran, and Venezuela. He also emphasized that the oil market was highly volatile.

Alexander Novak said that the oil market participants expected Libya to resume its oil shipments. He also reminded that Libya's oil outages had a significant impact on the market, including the imbalance between supply and demand. Russia’s Minister of Energy added that China was showing no signs of falling demand for the Russian oil and gas. Moreover, all deliveries are performed in accordance with the companies' plans. The Russian authorities are looking forward to further cooperation in this area.

Read more: https://www.mt5.com/forex_humor/image/46660

|

Метки: #forex_caricature |

Top 6 countries with largest gold reserves in 2020 |

The beginning of 2020 was a turbulent time in the financial markets. The current coronavirus epidemic in China has been investors' primary concern as the outbreak can weaken the global economy. As a result, the majority of countries have chosen gold as a safe haven asset for investment. Many countries have replenished their reserves and become leaders in terms of the accumulated volume of gold

US

The United States is ranked first on the list of countries with the largest gold reserves. The US holds the largest amount of gold compared to any other country, 8,133.5 tonnes.

Germany

Germany is the second largest keeper of gold. Currently, the country holds 3,370 tonnes of the safe haven asset. Germany started repatriating gold worth billions of dollars from France and the US in 2017. These measures sparked off an intense debate on confidence in central banks.

Italy

Italy takes third place among the countries with impressive gold inventories. The amount of gold the country keeps in its reserves is 2,452 tonnes. The Italian authorities intend to keep accumulating gold in the future.

France

France is ranked fourth among the countries with the largest gold holdings. Currently, the country has 2,436 tonnes of gold. Moreover, the French authorities plan to extend the amount of gold over time.

Russia

Russia is the fifth largest gold holder. The country keeps 2,270.56 tonnes of gold in reserves. Russia increased the current volume of monetary gold in 2019 and plans to accumulate even more. Nowadays, the country is considered the major gold buyer. In 2019, Russia accounted for more than 20% of all gold purchases compared to other countries. Last year, Russia improved its position as gold accumulation in China slowed down.

China

China takes sixth place among the major gold holders. The amount of Chinese gold inventories is not too large. The country does not expand the reserves as it has to deal with other serious matters such as the coronavirus outbreak. In 2018, Russia overtook China to become the fifth largest owner of gold reserves. In 2019, China bought less gold than in the previous year. By the end of December last year, China's gold inventories reached 1,948 tonnes.

|

Метки: #photo_news |

Chinese companies request $8.2 billion in bank loans |

The current coronavirus outbreak poses a serious threat to China’s national economy. Experts believe that the epidemic can deeply affect the majority of Chinese companies. More than 300 firms in China including Xiaomi Corp, the biggest smartphone maker, are looking to receive bank loans totalling 57.4 billion yuan ($8.2 billion) to help to soften the impact of the coronavirus outbreak. According to experts, the economic situation in the country is very weak. China’s growth is expected to slow to 5 percent or less in the first quarter of 2020. Didi Chuxing Technology Co, Megvii Technology Inc, and Qihoo 360 Technology Co are among the companies that have been most affected by the epidemic. According to analyst estimates, extended factory closures, caused by the coronavirus, will lead to a slowdown or suspension of production and weigh on global supply chains.

Presently, Chinese largest banks are deciding on granting possible loans to the companies that have been hit by the infection outbreak. Experts believe that the firms which are seeking loans are likely to get fast-track approvals and preferential interest rates. Such matters are settled by the Beijing Municipal Bureau of Finance. However, the agency refused to give any comments.

At this point, there is no official data revealing the total loans Chinese companies are requesting nationwide. Xiaomi Corp, the world’s fourth biggest smartphone manufacturer, is looking for a 5 billion yuan loan, or $716.24 million, to produce and sell medical equipment including masks and thermometers. Meituan Dianping, China’s major food delivery firm, is seeking 4 billion yuan, or $572.99 million, to finance free food and delivery to medical workers in Wuhan. Qihoo 360, the leading Internet security operator, is asking for 1 billion yuan, or $143.25 million, to purchase medical supplies and finance the development of devices able to track localization of the virus. Megvii startup is seeking a 100 million yuan loan, or $14.32 million, to invent technologies able to resist the coronavirus.

Read more: https://www.mt5.com/forex_humor/image/46580

|

Метки: #forex_caricature |

Top 8 most competitive megacities of 2020 |

Experts have no doubts as to the competitiveness of the world's largest cities. The Chinese Academy of Social Sciences and the Global Competitiveness Report agency published a ranking of eight most competitive and economically promising cities of the world in 2020. Read about these cities in our article.

New York, United States

Analysts use the term “competitiveness” to describe a city's ability to use its own economic advantages and resources to attract investment, as well as create a supportive social environment for residents. New York, the leading financial center of the country and the world, has topped the ranking. This city, along with London and Tokyo, is considered one of the world's three largest urban economies. Major financial institutions such as Citigroup, Morgan Stanley, American International Group, Goldman Sachs, and others are headquartered in New York.

London, UK

London, the leading economic and financial center of the UK and Europe, is ranked second among the most competitive megacities. Experts consider it a worthy rival to New York in the struggle for the title of the world’ main economic hub. Despite the situation surrounding Brexit, London is one of the most attractive cities for investment. The megapolis has the largest number of international trading companies, as well as individuals with huge capital.

Singapore

The honorable third place in the ranking of the most competitive cities in the world is occupied by Singapore, a highly developed country with a market economy and low taxation. It is ranked among the so-called "Four Asian Tigers" for a sharp economic breakthrough to the level of advanced countries. Transnational corporations play a significant role in Singapore's economy. Due to low tax rates, the megacity is very attractive to investors.

Shenzhen, China

Shenzhen, a Chinese megacity, is the next on the list. State and foreign investment volumes enabled the city to reach a high level of development. It is considered one of the most dynamically developing and competitive cities in China. According to analysts, Shenzhen is the largest Chinese city in terms of exports. This is an attractive location for investment, new technologies, and business.

Tokyo, Japan

Tokyo is ranked fifth among the world's most competitive cities. According to the Global Competitiveness Report, this is the largest economic agglomeration. The city is recognized as the leading international financial center and the heart of the political, economic, cultural, and transport sectors of Japan. In addition, the majority of the world's largest investment banks and insurance companies are headquartered here.

Munich, Germany

The sixth line among the cities able to compete in global markets, is occupied by Munich, the largest cultural, industrial, and research center. It still dominates European science thanks to its famous libraries, universities named after Max Planck and Heinz Maier-Leibnitz, as well as its nuclear research reactor. In addition, the city is considered to be the IT capital of Germany.

Los Angeles, United States

The seventh position in this ranking is occupied by Los Angeles, one of the leading cultural, scientific, economic, and educational centers of the world. The megacity is regarded as the heart of the entertainment and culture industry, focused primarily on music and television.

Shanghai, China

Shanghai, the most important financial and cultural center of China, closes the ranking of top 8 most competitive cities in the world. Analysts consider it the world's largest seaport. In economic terms, Shanghai is superior to many other cities of China: it has the highest minimum wage in the country.

|

Метки: #photo_news |

Coronavirus poses new threat to US economy |

The market sentiment is gripped by panic due to the outbreak of the Chinese coronavirus. According to experts, the epidemic poses a real threat to the global economy. Many specialists are sure that this problem will also affect the largest economy in the world - the United States.

Initially, there was nothing to harm the US economy. At the end of 2019, waning trade tensions between the United States and China made it possible to significantly reduce the risks to the American economy. Another reason behind investors’ optimism was a possible economic recovery in the euro area. However, the situation has changed. The Federal Reserve sees the spread of the Chinese coronavirus as a threat to the US economic prospects.

In the semi-annual testimony before Congress, Fed Chair Jerome Powell reported that the US economy had entered its 11th consecutive year of growth. The policymaker emphasized an impressive number of jobs created by the American economy and its ability to generate employment further.

This can be confirmed by strong jobs data in the American labour market for the past month. The US economy added 225 thousand jobs, and the unemployment rate ticked up to 3.6% from 3.5% in the previous year. The country’s inflation rate is still below the 2% target. However, the Federal Reserve stresses that the forward-looking indicators of consumer and business expectations regarding inflation remain stable.

Last week, on January 28-29, the Federal Open Market Committee held a meeting. As a result, it left its fed funds interest rate unchanged in the range of 1.5% to 1.75%. The FOMC noted that they found no reasons to change its monetary policy. On the contrary, the current indicators reflect stabilization. Therefore, there is no need for changes, the committee pointed out.

According to experts, the only threat comes from the epidemic of pneumonia in China caused by the coronavirus. The outbreak of this deadly virus is able not only to derail a fragile stabilization in the Chinese economy but also to hit the globe. The Fed fears that China's economic downturn could have a destructive effect on the United States and global markets as well due to low appetite for risk, the US currency appreciation, a reduction in trade volumes, as well as lower commodity prices.

If the economic situation worsens markedly, the Federal Reserve is likely to lower the rate again. Nevertheless, the Fed hopes they will not have to resort to this measure unless some dramatic change occurs.

Read more: https://www.mt5.com/forex_humor/image/46597

|

Метки: #forex_caricature |

Coronavirus poses new threat to US economy |

The market sentiment is gripped by panic due to the outbreak of the Chinese coronavirus. According to experts, the epidemic poses a real threat to the global economy. Many specialists are sure that this problem will also affect the largest economy in the world - the United States.

Initially, there was nothing to harm the US economy. At the end of 2019, waning trade tensions between the United States and China made it possible to significantly reduce the risks to the American economy. Another reason behind investors’ optimism was a possible economic recovery in the euro area. However, the situation has changed. The Federal Reserve sees the spread of the Chinese coronavirus as a threat to the US economic prospects.

In the semi-annual testimony before Congress, Fed Chair Jerome Powell reported that the US economy had entered its 11th consecutive year of growth. The policymaker emphasized an impressive number of jobs created by the American economy and its ability to generate employment further.

This can be confirmed by strong jobs data in the American labour market for the past month. The US economy added 225 thousand jobs, and the unemployment rate ticked up to 3.6% from 3.5% in the previous year. The country’s inflation rate is still below the 2% target. However, the Federal Reserve stresses that the forward-looking indicators of consumer and business expectations regarding inflation remain stable.

Last week, on January 28-29, the Federal Open Market Committee held a meeting. As a result, it left its fed funds interest rate unchanged in the range of 1.5% to 1.75%. The FOMC noted that they found no reasons to change its monetary policy. On the contrary, the current indicators reflect stabilization. Therefore, there is no need for changes, the committee pointed out.

According to experts, the only threat comes from the epidemic of pneumonia in China caused by the coronavirus. The outbreak of this deadly virus is able not only to derail a fragile stabilization in the Chinese economy but also to hit the globe. The Fed fears that China's economic downturn could have a destructive effect on the United States and global markets as well due to low appetite for risk, the US currency appreciation, a reduction in trade volumes, as well as lower commodity prices.

If the economic situation worsens markedly, the Federal Reserve is likely to lower the rate again. Nevertheless, the Fed hopes they will not have to resort to this measure unless some dramatic change occurs.

Read more: https://www.mt5.com/forex_humor/image/46597

|

Метки: #forex_caricature |

Top 8 breakthrough technologies of decade |

Today, there are few things left that can capture our imagination. The technology is developing at a very fast pace and new technology products conquer the market. Wired magazine picked eight breakthrough innovations that changed the lives of people worldwide

WhatsApp

The world’s most popular instant messaging system was launched in 2009. According to analysts, the messenger has had a considerable impact on the world of technologies over the decade. WhatsApp can work on almost any mobile device. The platform uses end-to-end encryption which guarantees user privacy. Facebook purchased the messaging service for $19 billion dollars in 2014. Nowadays, WhatsApp is recognized as the standard for international mobile communications as well as one of the most prominent social platforms in the world.

Apple iPhone 4S

The iPhone, presented in 2007, is considered to be the most significant Apple’s development. Experts believe the launch became a turning point in the world of technology. When the iPhone 4S was produced in October 2011 it was a defining moment for Apple’s business. The smartphone has been upgraded multiple times. Presently, the iPhone has three new innovative functions. Among them are Siri, a virtual assistant, iCloud, and a camera which can take 8-megapixel images and high-definition videos. Thanks to this camera Apple managed to beat off its rivals.

Apple iPad

Another Apple’s innovation was first presented in 2010. Experts consider the iPad to be the company’s greatest achievement as Apple put a lot of effort in the development of the product. Thanks to Steve Jobs, the company’s CEO, mobile devices have become an integral part of people's lives. Nowadays, the iPad is recognized as the standard for tablets. According to Apple, the iPad is not only a convenient innovation for reading magazines and watching videos but a computer of the future.

Uber

Uber was launched in 2010. In the beginning, the company was operating in the US and then came to the european market. Thanks to the service a passenger can call a taxi by only touching a button on the screen of a smartphone. UberX, a cheaper version of the service, appeared in 2012. Today, Uber is available in countries across the world.

Instagram

Nowadays, Internet users cannot imagine their life without Instagram. You can find nearly anything on this popular service from personal information to videos and photos. According to experts, Instagram contributed to the high reputation of a smartphone camera. As a result, a new type of social network emerged which closely resembled a digital glossy magazine. Instagram became a popular platform for brands, businesses, and celebrities. The service merged with Facebook in 2012.

Oculus Rift

Virtual reality or VR, is another breakthrough innovation of the next generation. According to experts, VR has great potential. Oculus Rift was presented to a wide audience in 2013. The Oculus Quest, a virtual reality headset, has been developed over time. In early 2014, before Oculus Rift entered the market, Facebook’s CEO Mark Zuckerberg tested the product in a human-computer interaction lab at Stanford University. Consequently, Zuckerberg purchased the company for $2.3 billion.

Amazon Echo

The latest technology has had a great impact on music. Amazon Echo, a smart speaker developed by Amazon, was released in November 2014. In a short time, the innovation has expanded the list of significant technological products of the decade. One of the speaker's functions is the voice-controlled assistant service Alexa. It can give voice commands to turn on/off the light, control music flow, and add purchases to Amazon’s cart. Other large manufacturers followed the example of Amazon and developed similar products.

Google Pixel

Google Pixel has come a long way from a concept to the actual product. Google has been monitoring other manufacturers who use the Android mobile operating system on their devices for eight years before it released the Pixel smartphone. The device has features to Apple's iPhone. One of Pixel’s key functions is the ability to control hardware and software. The first Pixel smartphone caused a sensation in the world of technology. It inspired the world’s leading producers to develop sensors and camera lenses.

|

Метки: #photo_news |

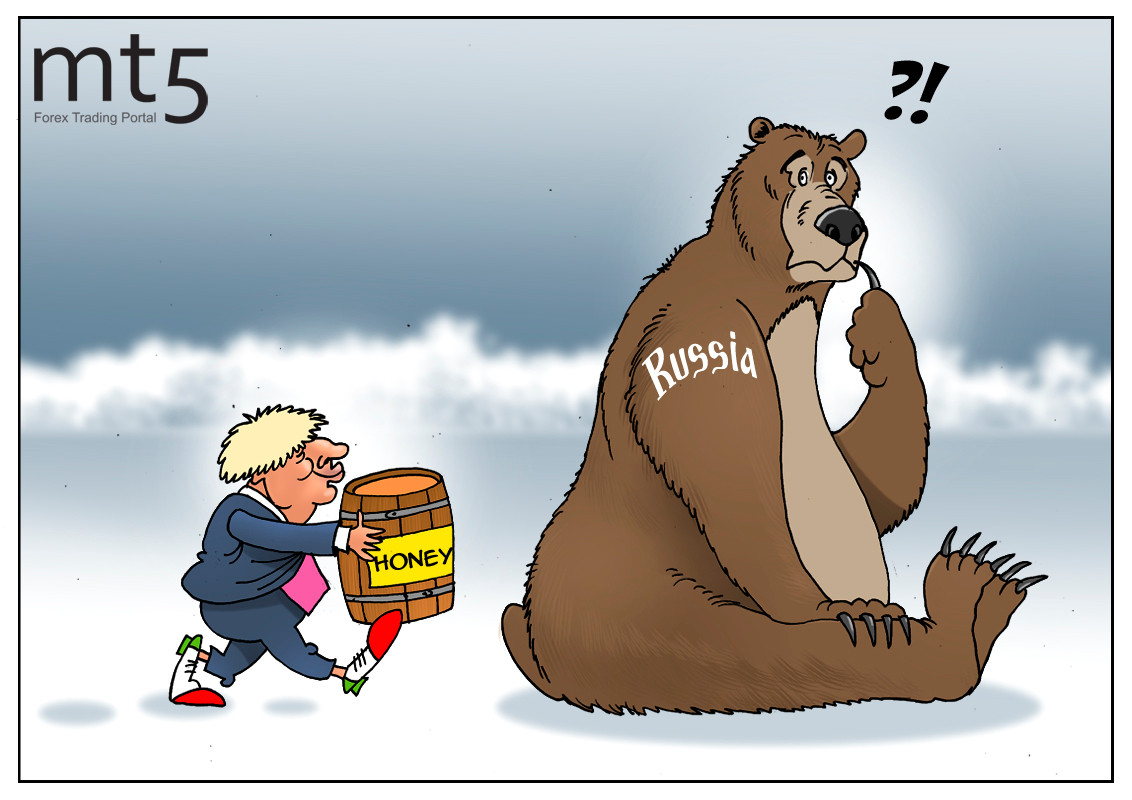

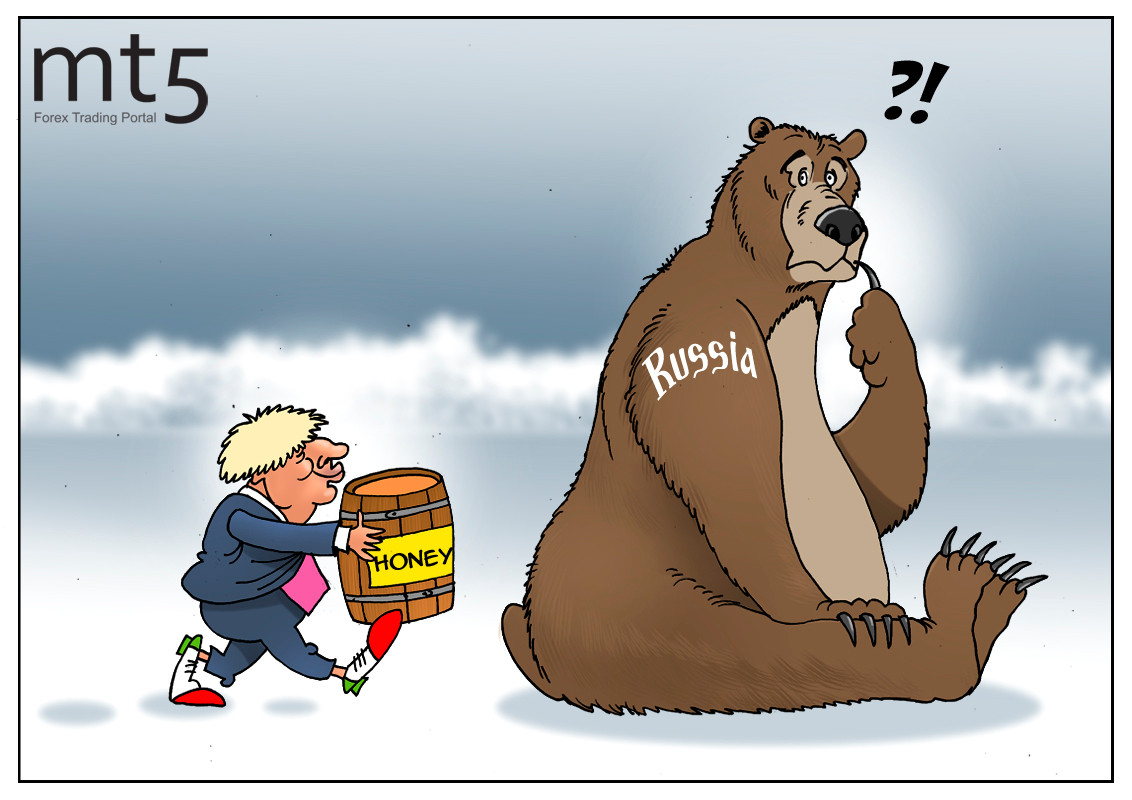

UK activates new post-Brexit sanctions regime |

After leaving the European Union, Great Britain has got a chance to launch its own sanctions regime. Now the country is no longer constrained by the EU's decision-making process and can review its restrictions on certain countries in line with its domestic interests. First changes affected Russia. The government of Prime Minister Boris Johnson decided to lift part of the sanctions previously imposed on the Russian Federation. Russian companies will be able to export aluminum foil, ferrosilicon, seamless pipes made of iron or steel, pipe fittings made of iron and steel, urea, as well as ammonium nitrate again. However, not every country is so fortunate. The UK may impose individual sanctions against Libya, North Korea, and Saudi Arabia, as well as freeze the assets of individuals suspected of violating human rights. According to Britain's Foreign Secretary Dominic Raab, London still considers sanctions an efficient tool and will continue to impose restrictions on persons involved in the persecution of political activists, attacks against journalists, and the poisoning of former GRU officer Sergei Skripal and his daughter Julia.

Read more: https://www.mt5.com/forex_humor/image/46538

|

Метки: #forex_caricature |

UK activates new post-Brexit sanctions regime |

After leaving the European Union, Great Britain has got a chance to launch its own sanctions regime. Now the country is no longer constrained by the EU's decision-making process and can review its restrictions on certain countries in line with its domestic interests. First changes affected Russia. The government of Prime Minister Boris Johnson decided to lift part of the sanctions previously imposed on the Russian Federation. Russian companies will be able to export aluminum foil, ferrosilicon, seamless pipes made of iron or steel, pipe fittings made of iron and steel, urea, as well as ammonium nitrate again. However, not every country is so fortunate. The UK may impose individual sanctions against Libya, North Korea, and Saudi Arabia, as well as freeze the assets of individuals suspected of violating human rights. According to Britain's Foreign Secretary Dominic Raab, London still considers sanctions an efficient tool and will continue to impose restrictions on persons involved in the persecution of political activists, attacks against journalists, and the poisoning of former GRU officer Sergei Skripal and his daughter Julia.

Read more: https://www.mt5.com/forex_humor/image/46538

|

Метки: #forex_caricature |

UK activates new post-Brexit sanctions regime |

After leaving the European Union, Great Britain has got a chance to launch its own sanctions regime. Now the country is no longer constrained by the EU's decision-making process and can review its restrictions on certain countries in line with its domestic interests. First changes affected Russia. The government of Prime Minister Boris Johnson decided to lift part of the sanctions previously imposed on the Russian Federation. Russian companies will be able to export aluminum foil, ferrosilicon, seamless pipes made of iron or steel, pipe fittings made of iron and steel, urea, as well as ammonium nitrate again. However, not every country is so fortunate. The UK may impose individual sanctions against Libya, North Korea, and Saudi Arabia, as well as freeze the assets of individuals suspected of violating human rights. According to Britain's Foreign Secretary Dominic Raab, London still considers sanctions an efficient tool and will continue to impose restrictions on persons involved in the persecution of political activists, attacks against journalists, and the poisoning of former GRU officer Sergei Skripal and his daughter Julia.

Read more: https://www.mt5.com/forex_humor/image/46538

|

Метки: #forex_caricature |