Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Top 10 richest banks in the world |

Currently, there are several major financial institutions that, figuratively speaking, move the world of finance. Banks whose capitalization has soared to incredible heights are considered to be the drivers of the financial world. Read about ten global banking giants in our article

Wells Fargo

The US multinational holding company providing banking and financial services occupies the top position in this rating. Wells Fargo has a lot of offices all over the planet. This corporation is regarded as the largest both in the United States and in the world. Wells Fargo has a market capitalization of $261.72 billion.

JP Morgan

The second place among the world's richest banks is taken by the American banking conglomerate JP Morgan. This holding was formed in 2000 when Chase Manhattan Corporation merged with JP Morgan & Co. The latter is responsible for investments, assets, and cash flow management, while Chase Manhattan focuses on credit cards and retail business. The conglomerate's assets reach an impressive $2,476.99 trillion. JP Morgan Chase market capitalization totals $229.90 billion.

Industrial and Commercial Bank of China

The honorable third place in this list is given to Industrial and Commercial Bank of China (ICBC), the largest commercial bank in the country. In 2014, the financial institution's capitalization amounted to $196.21 billion, while total assets reached $3.1 trillion. Today, this figure is even greater.

HSBC Holdings

The fourth position in the list of wealthy financial institutions in the world goes to HSBC Holdings. This British bank holding company provides banking and financial services. The number of its customers reaches 125 million people. HSBC Holdings has about 7,000 branches all over the world. Its market capitalization is $191.43 billion.

China Construction Bank

The sixth line in the list of the world's richest banks is taken by China Construction Bank. Seven years ago, the bank posted an 11% increase in its full-year net profit which had reached $34.98 billion. The holding's market capitalization continues to grow. Currently, it totals $160.83 billion.

Citigroup

The seventh position among the most financially backed banks in the world is occupied by Citigroup Inc. After the economic crisis of 2008, it regained its financial strength and built up $420 billion in surplus cash reserves and government securities. The market capitalization of Citigroup Inc. advanced to $144.63 billion.

Commonwealth Bank of Australia

Commonwealth Bank of Australia is ranked eighth. The bank founded in 1911 has a long history. This is Australia's second largest private company working with securities on stock exchanges. Commonwealth Bank of Australia provides a wide range of services, including lending, mortgages, and insurance. Its market capitalization is $131.53 billion.

Agricultural Bank of China

The ninth position among the world's richest banks goes to Agricultural Bank of China, the largest financial institution in China engaged in agricultural lending. The bank has 320 million retail customers, 3 million corporate clients, and 24 thousand branches across the globe. Agricultural Bank of China is considered one of the most powerful open joint stock companies in the world. Its capitalization amounts to $126.41 billion.

Bank of China

Bank of China, the oldest bank in the country founded in 1912, closes the list of the top 10 leading financial corporations. The fourth largest state-owned bank in the country has branches around the world. Bank of China's capitalization is $115.92 billion.

|

Метки: #photo_news |

Russia to pump up National Welfare Fund with CNY |

Russia is ready to soften its anti-dollar rhetoric. The de-dollarization campaign has inflicted heavy losses on the domestic economy. A few years ago, President Vladimir Putin declared that Russia’s goal was to abandon the US currency in international settlements. So, the pundits from the ministry of finance and the central bank were assigned to the revision of the state portfolio. Despite common sense, the authorities pumped up their forex reserves with the yuan at the peak of its value. A few days later, Beijing devalued the national currency aiming to ensure competitive advantage to Chinese exporters. As a result, Russia’s forex reserves lost billions of dollars. However, Russian monetary authorities are not going to learn from their mistakes. Now the Kremlin wants to make the second attempt, this time increasing the yuan’s share in the National Welfare Fund. At present, the Fund looks as follows: the US dollar and the euro account for 32% and 37% accordingly. The remaining part is represented by the pound sterling, the yen, and some other currencies. As of March 1, 2020 the National Welfare Fund was estimated at 8.3 trillion rubles or $123.2 billion. In essence, the Kremlin decided to buy the yuan with a view of making the Fund’s structure similar to the Bank of Russia’s forex reserves. Perhaps, the government plans just to allocate a part of the central bank’s yuan holdings to the National Welfare Fund. The idea has been confirmed by Russia’s finance minister Anton Siluanov. “We’ve set out a package of measures to adjust the National Welfare Fund’s structure for the one of the central bank’s forex reserves,” the official said.

Read more: https://www.mt5.com/forex_humor/image/47881

|

Метки: #forex_caricature |

Russia to pump up National Welfare Fund with CNY |

Russia is ready to soften its anti-dollar rhetoric. The de-dollarization campaign has inflicted heavy losses on the domestic economy. A few years ago, President Vladimir Putin declared that Russia’s goal was to abandon the US currency in international settlements. So, the pundits from the ministry of finance and the central bank were assigned to the revision of the state portfolio. Despite common sense, the authorities pumped up their forex reserves with the yuan at the peak of its value. A few days later, Beijing devalued the national currency aiming to ensure competitive advantage to Chinese exporters. As a result, Russia’s forex reserves lost billions of dollars. However, Russian monetary authorities are not going to learn from their mistakes. Now the Kremlin wants to make the second attempt, this time increasing the yuan’s share in the National Welfare Fund. At present, the Fund looks as follows: the US dollar and the euro account for 32% and 37% accordingly. The remaining part is represented by the pound sterling, the yen, and some other currencies. As of March 1, 2020 the National Welfare Fund was estimated at 8.3 trillion rubles or $123.2 billion. In essence, the Kremlin decided to buy the yuan with a view of making the Fund’s structure similar to the Bank of Russia’s forex reserves. Perhaps, the government plans just to allocate a part of the central bank’s yuan holdings to the National Welfare Fund. The idea has been confirmed by Russia’s finance minister Anton Siluanov. “We’ve set out a package of measures to adjust the National Welfare Fund’s structure for the one of the central bank’s forex reserves,” the official said.

Read more: https://www.mt5.com/forex_humor/image/47881

|

Метки: #forex_caricature |

Top-5 US shale drillers that stay profitable in times of market jitters |

The sudden collapse of oil prices knocked the ground out from under the feet of most of the world's oil companies. According to analysts, the oil standoff between Saudi Arabia and Russia, as well as the collapse of the previous OPEC+ deal, have affected a number of US shale companies. This is why many of them are now suffering big losses. However, experts managed to find out five American corporations that stay afloat despite the latest severe crush of oil prices.

Exxon Mobil

Exxon Mobil is one of the companies that remain highly profitable even at the oil price worth about $31 per barrel. The corporation is considered one of the world's leading oil and gas producers. It was formed in 1999 as a result of the merger of the largest American oil companies - Exxon and Mobil. In 2017, Darren Woods replaced Rex Tillerson as the leader of America’s most influential energy giant. In February 2019, Exxon Mobil's market capitalization came in at $330 billion. The company's main oil reserves are located in Asia and the United States, while its natural gas reserves are situated in Australia, Europe, and several Asian countries.

Chevron

Chevron became the second of the leading American corporations which were almost unaffected by a plunge in the oil market. The company has the main oil fields in the US (29%). Chevron’s oil reserves are also located in Australia (20%) and Kazakhstan (18%). It owns 50% of the shares of one of the leading American petrochemical companies – Chevron Phillips Chemical Company. Chevron has 28 factories and 2 research centers.

Occidental Petroleum (OXY) - Permian Basin

Founded back in 1920, Occidental Petroleum is the third US shale company that remains resilient to sharp fluctuations in oil prices. Armand Hammer was the president and CEO of the company for a long time (until 1990). In 2006, he was replaced by Ray Irani who became Chairman of the Board of Directors and Chief Executive of OXY. The company is considered the largest oil producer in Texas and California. OXY is engaged in oil and blue fuel extraction as well as taking interest in the chemical industry.

Crownquest Operating

Experts rank Crownquest Operating the fourth on the list of companies that did not bend under the crash in the oil market. Established in 1996, the company produces oil and gas in the United States, primarily in the Permian Basin. Analysts believe that the operating profit of Crownquest Operating will remain high even after the fall in oil prices to $31 per barrel.

Occidental Petroleum (Denver Basin)

Occidental Petroleum Corporation, an oil and gas producer, closes the top 5 high-yield US oil companies. The company’s business is concentrated in the Permian Basin. It also has production facilities in the Middle East, North Africa, and South America. Occidental Petroleum covers exploration of liquefied gas. It is also involved in petrochemical development.

|

Метки: #photo_news |

RUB trapped at multi-year lows amid oil market chaos |

The Russian ruble has got stuck in dire straits amid the slump in oil quotes. In fact, the marginal bounce of both assets could be hardly termed an upward correction. Meanwhile, market participants are speculating on whether the oil and the ruble have already reached the bottom. The pre-Kremlin Russian media assured jaded people that the ruble was about to recover, trading higher at 72 against the US dollar and 81 against the euro. However, after the futile correction the ruble tumbled even deeper. The central bank is poised to stay away from the havoc for a while, saying that there are enough tools at its disposal to deal with the situation. Bank of Russia Vice Governor Kseniya Yudaeva stated that the regulator would make every effort to cushion the national financial system and economy from the external shocks. The authorities have devised an extra stimulus package to shore up the branches hurt by the coronavirus, including the travel business, pharmaceutical industry, and medical engineering. Nevertheless, the ruble is still extending weakness as crude oil has been trapped at multi-year lows. However, dismal prospects of the oil market do not discourage Russian lawmakers. Andrey Makarov, a deputy of the State Duma, points out that Parliament is introducing amendments to the budget exactly following the President’s directives so that not a single ruble will be wasted. It guarantees that all commitments, including public spending, will be fulfilled.

Read more: https://www.mt5.com/forex_humor/image/47830

|

Метки: #forex_caricature |

RUB trapped at multi-year lows amid oil market chaos |

The Russian ruble has got stuck in dire straits amid the slump in oil quotes. In fact, the marginal bounce of both assets could be hardly termed an upward correction. Meanwhile, market participants are speculating on whether the oil and the ruble have already reached the bottom. The pre-Kremlin Russian media assured jaded people that the ruble was about to recover, trading higher at 72 against the US dollar and 81 against the euro. However, after the futile correction the ruble tumbled even deeper. The central bank is poised to stay away from the havoc for a while, saying that there are enough tools at its disposal to deal with the situation. Bank of Russia Vice Governor Kseniya Yudaeva stated that the regulator would make every effort to cushion the national financial system and economy from the external shocks. The authorities have devised an extra stimulus package to shore up the branches hurt by the coronavirus, including the travel business, pharmaceutical industry, and medical engineering. Nevertheless, the ruble is still extending weakness as crude oil has been trapped at multi-year lows. However, dismal prospects of the oil market do not discourage Russian lawmakers. Andrey Makarov, a deputy of the State Duma, points out that Parliament is introducing amendments to the budget exactly following the President’s directives so that not a single ruble will be wasted. It guarantees that all commitments, including public spending, will be fulfilled.

Read more: https://www.mt5.com/forex_humor/image/47830

|

Метки: #forex_caricature |

Top 7 architectural wonders built on water |

There are many unusual landmarks across the world that capture imagination. Sometimes such architectural monuments can be located on water. Read about the top seven off-shore wonders in our article

Burj Al Arab, UAE

The Burj Al Arab is ranked first on our list. This magnificent hotel is located 280 metres from the shore. The Burj Al Arab was built on an artificial island and is connected to the mainland by a bridge. The skyscraper is 321 metres tall. The hotel’s structure was designed in a shape to resemble the sail of a ship.

Our Lady of the Rocks, Montenegro

The Second unique water landmark on the list is Our Lady of the Rocks. This is the only artificial island that stands near the shores of the Adriatic Sea. Our Lady of the Rocks is one of the islands off the coast of Perast in the Bay of Kotor. The Roman Catholic Church of Our Lady of the Rocks is located on the island. The church is 11 metres tall.

Veluwemeer Aqueduct, Netherlands

Veluwemeer Aqueduct is the third wonder built on water. The waterbridge connects the mainland Netherlands and Flevoland. There is a roadway under the aqueduct, as well a boat passage, and pedestrian walkways on both sides of the bridge.

Venetian Islands, US

The Venetian Islands, a chain of artificial islands in Biscayne Bay, is another architectural masterpiece on water. The chain spreads between the cities of Maiami and Miami Beach, Florida. Nowadays, around 13 thousand people live on the islands. Houses and green spaces on the island are located on artificial mounds.

Jal Mahal, India

Jal Mahal is the fifth architectural monument on the list. This palace is situated on the Man Sagar Lake in Jaipur city. Jal Mahal stands in a valley surrounded by picturesque mountains.

Peberholm, Denmark

Peberholm is ranked six on the list of water landmarks. This artificial island is located in the Oresund strait. Peberholm was created as part of the Oresund Bridge connecting Denmark with Sweden. Scientists call the island a biological experiment. They believe that human intervention is unnecessary as nature itself will decide what flora and fauna Peberholm needs.

Kansai Airport, Japan

The Kansai International Airport in Japan looks unusual compared to other water constructions. The airport was built on an artificial island in the Gulf of Osaka five kilometers from the city of Osaka. The Japanese authorities decided to move the airport to a remote territory because of the high noise level in the city.

|

Метки: #photo_news |

European markets plummet amid coronavirus pandemic |

European stock markets plunged following the collapse of the leading global exchanges amid the coronavirus pandemic. The Asian stocks were the first to plummet. The situation is slightly better in the UK, Germany, and France where the markets sank by around 20 percent while Italy’s exchange dropped by 30 percent. In addition to the coronavirus outbreak, Russia's circumstances are extremely complicated. The RTS Index on the Moscow Exchange lost a quarter of its value. The Russian rouble fell as oil prices crashed to 25 dollars from 50 dollars per barrel, its lowest level in 30 years. The situation is aggravated by the oil-price war between Saudi Arabia and Russia. Moreover, from April 1, neither member of the oil-cuts agreement is required to reduce output. Judging by the sentiment in Moscow and Riyadh, oil will be very cheap. Meanwhile, the peak of the coronavirus outbreak in China has passed. However, it does not mean that the Chinese economy will recover quickly. Thus, the low oil demand is likely to continue. It is hard to tell how long it will take Europe to handle the epidemic and get back to normal. According to estimates, the coronavirus pandemic can cost the world economy 1 trillion dollars.

Read more: https://www.mt5.com/forex_humor/image/47750

|

Метки: #forex_caricature |

Five recommendations for gold investors |

For decades gold has been considered as the best safe-haven asset. Investors often prefer it to other precious metals. However, most market participants fear possible risks. Experts have found out five pitfalls that should be taken into account to minimize possible losses.

Buy at current price

Analysts recommend buying gold at the current price to save money from inflation and financial crisis. In this case, the high price of precious metal is of minor importance. During a crisis, investors will be sure that they have made a really profitable investment. The benefit is obvious.

Purchase physical gold

To save money during a financial crisis, it is necessary to have physical gold, including coins and ingots. Analysts suppose that the metal should not be considered only as an investment. They also believe that gold cannot bring a lot of profit. However, it is a safe-haven asset that is aimed to save money in a long-term perspective.

Choose gold coins

Experts recommend investing money in classic gold coins such as Krugerrand, Maple Leaf, Kangaroo, and the Austrian Philharmonic. These coins are known for their high liquidity. They can be sold at any moment almost in all countries of the world. Coins that contain 1 ounce of pure gold (31.1 grams), 1/2 ounce, and 1/4 ounce are the most liquid. Economists advise investors to avoid buying both collectible gold coins and ingots. It is rather difficult to sell them.

Invest free funds

Analysts of the precious metal market recommend investing just free funds and money that traders will not need in the near future. Gold may account for about 20% of the capital in a trader’s investment portfolio. Investors should buy gold gradually. The fact is that gold prices are constantly changing on the volatile market. Experts advise traders to work only with reliable dealers who offer honest price as well as gold of high quality and professional support.

Do not expect good yield

The last advice from experts is not to expect that the precious metal will bring a lot of money. All experienced traders share this opinion. Investments in gold are for those market participants who are ready to wait for their profit for quite a long period of time. Economists emphasize the gold stability guarantees safety of invested funds in a long-term perspective.

|

Метки: #photo_news |

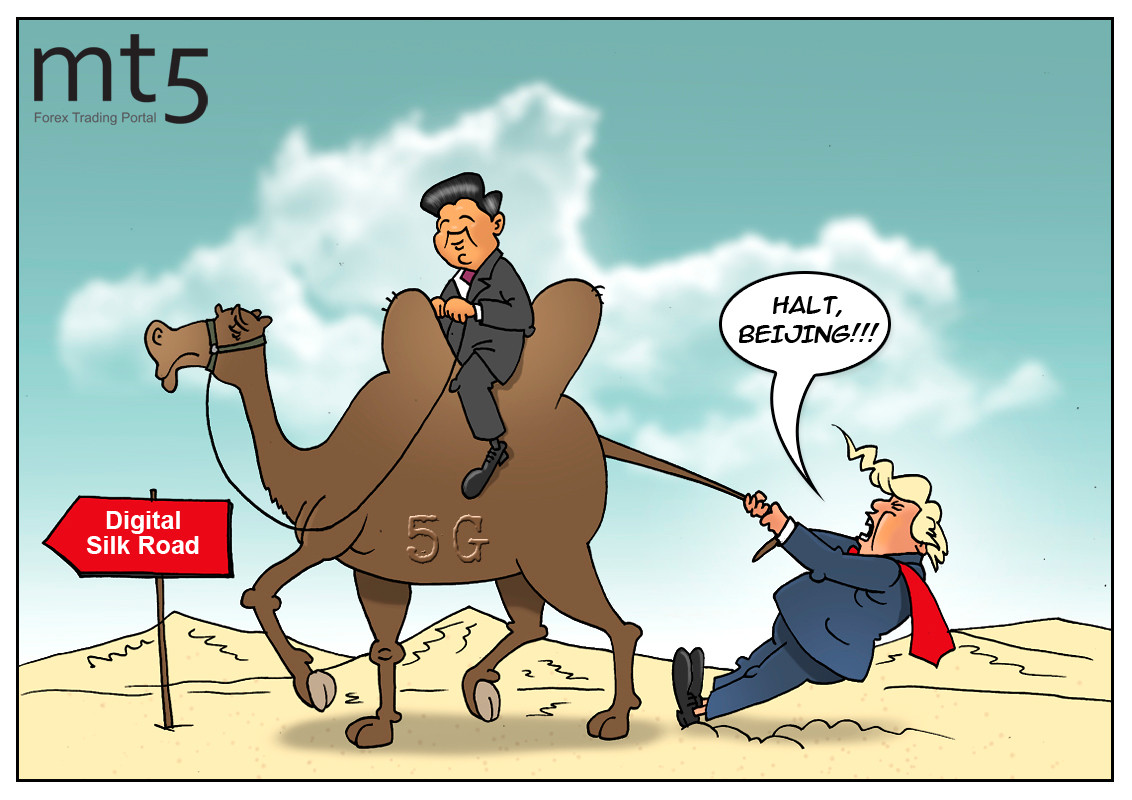

China uses its 5G dominance to impose its own ideology |

China continues to monopolize the digital world by promoting its 5G networks. Last autumn, the country launched the world's largest commercial network of a new generation. Three leading state-owned mobile operators - China Mobile, China Unicom, and China Telecom - presented new tariffs for their 5G communication services. To enjoy the peak speed, customers will need to pay $45 a month at most. During the ceremony, much was said about China's “global dominance”, “digital Silk Road”, and the fact that no one would leave China in that technological revolution. However, a simple desire to corner the industry and control most of the global wireless technology market lies behind these statements. China strives to reign in information and communication technologies (ICT), artificial intelligence, big data analytics, cloud computing, and blockchain. China does not intend to become the main supplier of new technology, it wants to impose its own ideology. Along with technology products, China will export its own values and norms, expanding the number of its equipment's users. Many countries fear that being the chief architect and administrator of these digital networks and Smart Cities, Beijing will have access to the recipient nations' data through intelligence sharing pacts or through direct server access. That is why some of them have already declined the services of Chinese enterprises.

Read more: https://www.mt5.com/forex_humor/image/47684

|

Метки: #forex_caricature |

Hit by coronavirus: 3 scenarios of China’s economic recovery |

Some analysts are already revising their outlook for the global economic growth amid the new COVID-19 virus outbreak and its negative impact on China. Economists at Morgan Stanley have issued an extended forecast outlining three possible ways of China's economic development.

The fast-spreading infection is threatening not only China but the whole world as well, thus keeping global markets alert. Morgan Stanley analysts expect the industrial production in China to reach 60% to 80% of the usual levels by the end of this month and be back to normal by mid-March 2020. Amid the ongoing uncertainty around the virus epidemic, experts came up with three possible scenarios of China’s economic growth.

Quick recovery

In this scenario, the Chinese economy may enter the quick recovery phase despite the disruption to the manufacturing sector in the country. Assuming the coronavirus peaks in February or March 2020, China’s first-quarter GDP growth rate is expected to come in at 5.3%, analysts at Morgan Stanley note. For the first half of the year, economic growth in China may slow to 5.6%, while in the next 6 months GDP may grow by 6.2%. At the end of 2020, the overall forecast for China’s full-year GDP will remain at 5.9%.

Gradual recovery

Under this scenario, the world’s second largest economy will gradually stabilize, although the country’s industrial sector will remain affected by the consequences of the coronavirus outbreak. The virus infection will also reach its peak in February and March. In this case, first-quarter GDP growth will contract to 4.2%. According to economists at Morgan Stanley, China’s growth rate in the first half of 2020 is likely to stay below 5%, whereas in the second half of the year it may reach 6.3%. Under the second scenario, full-year GDP growth rates will not exceed 5.7%.

Slow recovery

If the manufacturing activity in the country remains seriously disrupted, this may lead to a slow and weak recovery of China’s economy, analysts at Morgan Stanley warn. According to their forecast, if the peak of the virus outbreak falls on April 2020, China’s industrial sector will have been already derailed in March. Under this scenario, China’s economic growth in the first quarter could fall to as low as 3.5%. The GDP growth rate, in this case, is expected to reach 4.6% in the first half of the year, while later it is unlikely to exceed 6.5%. By the end of 2020, specialists estimate the full-year GDP growth to be 5.6%.

|

Метки: #photo_news |

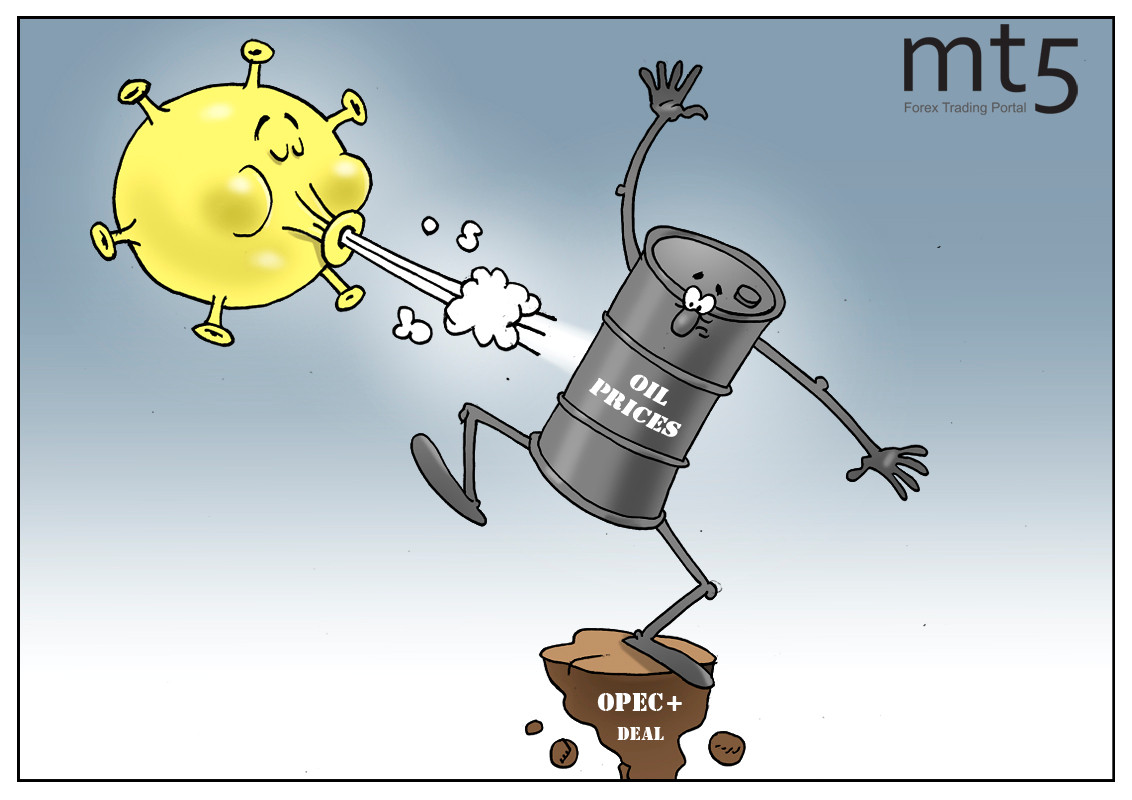

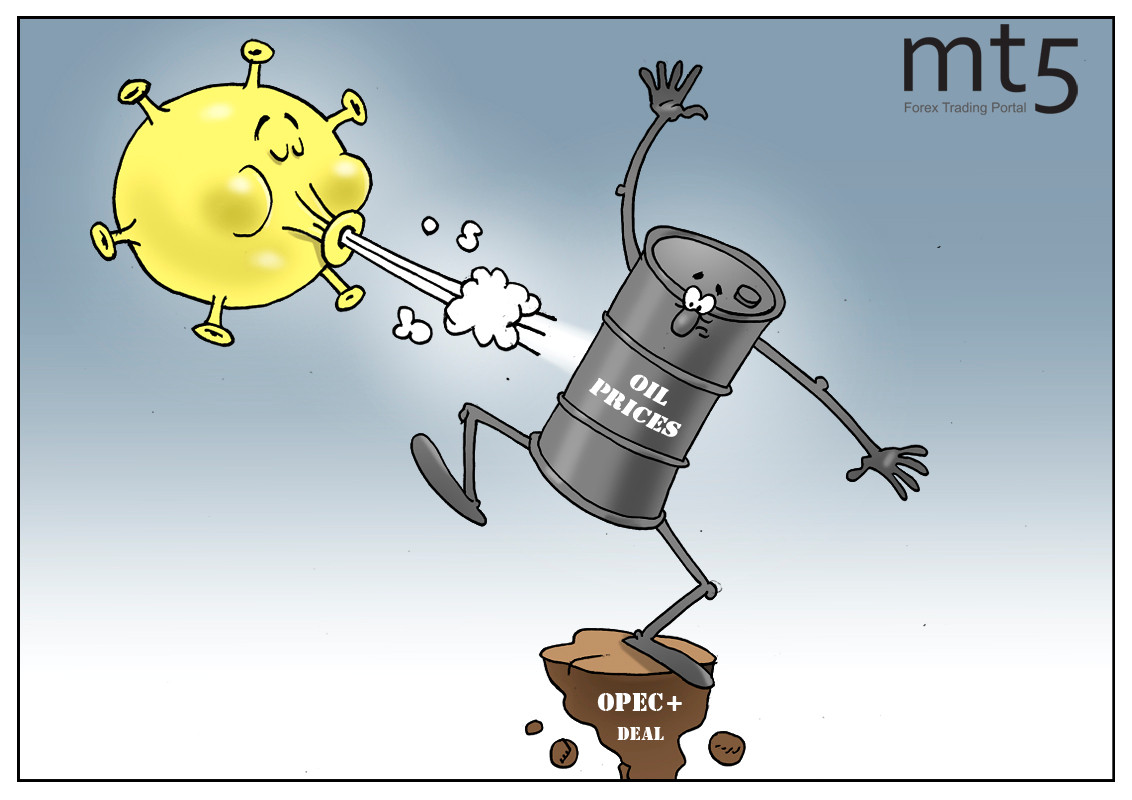

Russia and Saudi Arabia unleash oil price war |

Black Monday on March 9, 2020 will be memorable by severe downturns in most global markets. Apart from the coronavirus pandemic, the oil trade war between Saudi Arabia and Russia triggered panic among investors. On March 9, oil prices suffered the sharpest intraday fall since 1991. In anticipation of the OPEC+ meeting scheduled for March 6, oil prices were developing a steady rally. Investors relied on the cartel and its allies to extend oil production cuts. Indeed, previously Saudi Arabia made a commitment to deeper output cuts and Moscow said that the deal "proved to be an effective instrument to ensure long-term stability on global energy markets." Nothing indicated the alarm. However, in practice, the high expectations were ruined. Russia rejected the proposal for further production cuts and withdrew from the pact. In response, Riyadh pledged to flood the market with cheap oil. Such a shocking outcome sent oil price into a tailspin. Brent crude slumped to $31.43 a barrel, West Texas Intermediate sank to $30.27. Both benchmark grades shed 31% and 28% respectively. Later in the week, oil prices regained some losses, but closed the week with the steepest drop in ten years. From April 1, 2020 OPEC and Russia will not be bound by any commitments. At present, Saudi’s Aramco makes a 4-6% discount on April contracts. Invoices for US buyers are issued with a bigger discount. So, market participants are braced for a full-blown trade war between the world’s largest oil producers.

Read more: https://www.mt5.com/forex_humor/image/47585

|

Метки: #forex_caricature |

Most popular ski resorts in CIS in 2020 |

With every year, more and more tourists choose countries of the former Soviet Union for winter and summer holidays.

Tourist analytic agency "Turstat" has made a rating of the best ski resorts in the CIS countries in the period from January until February 2020. These countries have much to offer for winter sports enthusiasts: there are many tracks for freeride fans as well as those who prefer to ride on well-maintained ski tracks.

Shymbulak, Kazakhstan

Shymbulak Mountain Resort is located near Almaty on the Zailiysky Alatau ridge, a little higher than the famous high-mountain skating rink Medeo. The winter season runs here from mid-November till early April with an average daily temperature of -7°C. The snow cover reaches 1.8 m and the maximum ski slope is 45°.

The total length of all eight skiing tracks is 3,600 m, including 3 highly difficult tracks. The cable car lifts guests to the highest point of the resort - Talgar Pass. The bottom of the cabin is glassed, so tourists can truly enjoy a magnificent view of the ski area from different angles.

The Altaic Alps, Kazakhstan

Altaic Alps ski resort is located in Eastern Kazakhstan on the Ulbinsk ridge of the Mountain Ulbinka. Mountains and mixed forests serve as a natural protection for the ski resort from the winds of the harsh continental climate. The Altaic Alps is situated at an altitude of 660. Amongst the advantages of the resort, tourist note a comfortable dry frosty winter with an average daily temperature of -20°C. The ski season lasts from November till mid-late April. During this period of time, the snow cover reaches 1.5 m.

What is more, the resort is famous for its impeccable service, modern cable cars, close proximity to the city, and convenient transport links. The Altaic Alps ski resort often hosts the ski championships and competitions.

Nurtau, Kazakhstan

The picturesque Nurtau ski resort (formerly known as Knyazhye Gory) is designed for year-round recreation for guests of all ages. It is located in the mountains, 35 km from Ust-Kamenogorsk which makes it less vulnerable to strong winds. The ski resort also offers a high-security level with round-the-clock surveillance of the parking zone.

The winter season starts in December and lasts until the beginning of April. Notably, preparations for the winter season begin in the summer by cutting small shrubs and grass. Riding down from the mountains, you can easily get off before the terminal point, unhooking from the bugle.

Logoisk, Belarus

Logoisk ski resort is located not far from Minsk and in terms of service, it is as good as the best European ski resorts. Guests can rent sports equipment. What is more, there is a wide range of activities here apart from skiing, including a Russian bath, sauna, gazebo with barbecue, gym, billiards, and shooting range. What is more, visitors can enjoy skiing in the night and take part in folk festivals. Quite often the resort opens its doors to numerous sports competitions. The Logoisk ski resort stands out from others by its original design of the guest houses. They are built in the Scandinavian style and well-equipped.

All 5 tracks are well-maintained and lit around the clock. Visitors can use a cable car to get to any track. On the training slope, everyone can also practice skiing with professional instructors.

Silichi, Belarus

Silichi ski resort in Belarus is open all year round. Ten ski tracks run along the slopes among the forest thickets and have different levels of difficulty due to the different altitudes. Visitors can reach any height with the help of cable cars. Visitors who have little or no experience in skiing or snowboarding can get lessons from professional instructors.

There is a great choice of other facilities that the resort can boast of such as snow park, outdoor and indoor ice rinks, various hotels, restaurants, and the famous wood-burning baths.

Shahdag, Azerbaijan

Shahdag Mountain resort is located at an altitude of 2,500 m above sea level at the foot of Shahdag Mountain near the Shahdag national park. This is one of the most beautiful places in Azerbaijan abounding in canyons, gorges, and lakes. There are also waterfalls surrounded by high, awe-inspiring mountains covered with glaciers.

The resort is equipped with an artificial snow system that allows to maintain slopes in excellent condition and extends the skiing season considerably. The ski resort and all its facilities were put into operation in 2014.

Tufandag, Azerbaijan

Tufandag ski resort was opened in 2014 near Gabala, one of the most tourist-visited places in Azerbaijan. It has a well-developed ski infrastructure that exceeds the service of another Azerbaijan ski resort – Shahdag. Tufandag ski resort has its own ski school.

Tufandag resort is located at an altitude of 960-1,920 m above sea level. The slopes are steep and covered with forests. Therefore, the ski tracks (3 blue, 3 red, and 4 black) are quite wide.

The ski season starts in mid-December and ends at the end of March but tourists come here at any time of the year.

Karakol, Kyrgyz Republic

Karakol ski resort is located in the gorge at an altitude of 2,300 m above sea level on the slopes of the Tien Shan. It is surrounded by majestic 5,000-meter mountains, coniferous forest, and high-altitude lake Issyk-Kul.

The thickness of the snow cover varies from 1.5 to 2.5 m. In winter, the temperature rarely falls below -5°C. The ski season begins in November and lasts until April.

This place is loved by many sportsmen and those who prefer outdoor kinds of vacation for its mild climate and a large number of sunny days. In 2004, the ski resort, being long ago the former training ground for the Soviet Olympic team, was completely modernized.

Chimgan, Uzbekistan

The popular recreation area and ski resort Chimgan is located 60 km from Tashkent in the Chimgan mountains which are the spurs of the Tien Shan mountains. Chimgan is praised for its unique natural landscapes and pleasant environment. People call this place Uzbek Switzerland.

The ski tracks are open from December to March. They are located at an altitude of 1,200-1,600 m above sea level and surrounded by relict juniper forests. Ski fans choose this place due to its mild climate and a great variety of tracks.

Tsakhkadzor, Armenia

Tsakhkadzor is the most famous ski resort in Armenia. The ski resort is located in a picturesque valley at the foot of Mount Teghenis. Thanks to the resort’s convenient location, there are no avalanches and queues for the cable car even during the New Year holidays. For this reason, this ski resort attracts many experienced and novice skiers as well as Russian Olympic medalists and sports champions from other CIS countries.

The scenic Tsakhkadzor valley is located at an altitude of about 1,800 m above sea level near the Ararat massif and lake Sevan. The ski resort is also well-known for its fresh air and pristine nature: thanks to the local environment, the level of hemoglobin in the blood surges up thereby producing a positive effect on health.

|

Метки: #photo_news |

Russia and Saudi Arabia unleash oil price war |

Black Monday on March 9, 2020 will be memorable by severe downturns in most global markets. Apart from the coronavirus pandemic, the oil trade war between Saudi Arabia and Russia triggered panic among investors. On March 9, oil prices suffered the sharpest intraday fall since 1991. In anticipation of the OPEC+ meeting scheduled for March 6, oil prices were developing a steady rally. Investors relied on the cartel and its allies to extend oil production cuts. Indeed, previously Saudi Arabia made a commitment to deeper output cuts and Moscow said that the deal "proved to be an effective instrument to ensure long-term stability on global energy markets." Nothing indicated the alarm. However, in practice, the high expectations were ruined. Russia rejected the proposal for further production cuts and withdrew from the pact. In response, Riyadh pledged to flood the market with cheap oil. Such a shocking outcome sent oil price into a tailspin. Brent crude slumped to $31.43 a barrel, West Texas Intermediate sank to $30.27. Both benchmark grades shed 31% and 28% respectively. Later in the week, oil prices regained some losses, but closed the week with the steepest drop in ten years. From April 1, 2020 OPEC and Russia will not be bound by any commitments. At present, Saudi’s Aramco makes a 4-6% discount on April contracts. Invoices for US buyers are issued with a bigger discount. So, market participants are braced for a full-blown trade war between the world’s largest oil producers.

Read more: https://www.mt5.com/forex_humor/image/47585

|

Метки: #forex_caricature |

Russia and Saudi Arabia unleash oil price war |

Black Monday on March 9, 2020 will be memorable by severe downturns in most global markets. Apart from the coronavirus pandemic, the oil trade war between Saudi Arabia and Russia triggered panic among investors. On March 9, oil prices suffered the sharpest intraday fall since 1991. In anticipation of the OPEC+ meeting scheduled for March 6, oil prices were developing a steady rally. Investors relied on the cartel and its allies to extend oil production cuts. Indeed, previously Saudi Arabia made a commitment to deeper output cuts and Moscow said that the deal "proved to be an effective instrument to ensure long-term stability on global energy markets." Nothing indicated the alarm. However, in practice, the high expectations were ruined. Russia rejected the proposal for further production cuts and withdrew from the pact. In response, Riyadh pledged to flood the market with cheap oil. Such a shocking outcome sent oil price into a tailspin. Brent crude slumped to $31.43 a barrel, West Texas Intermediate sank to $30.27. Both benchmark grades shed 31% and 28% respectively. Later in the week, oil prices regained some losses, but closed the week with the steepest drop in ten years. From April 1, 2020 OPEC and Russia will not be bound by any commitments. At present, Saudi’s Aramco makes a 4-6% discount on April contracts. Invoices for US buyers are issued with a bigger discount. So, market participants are braced for a full-blown trade war between the world’s largest oil producers.

Read more: https://www.mt5.com/forex_humor/image/47585

|

Метки: #forex_caricature |

Top 7 cryptocurrencies to watch in 2020 |

In 2020, cryptocurrencies will continue to thrive and develop, attracting more supporters and crypto enthusiasts. Analysts expect the number one cryptocurrency, Bitcoin, to rise in value along with other digital assets. They outline 7 major virtual currencies that worth paying attention to in 2020.

Bitcoin

Well ahead of others, Bitcoin (ВТС) remains the most popular cryptocurrency in the world. It is sometimes called the digital gold of the crypto market. Bitcoin was the first currency to be based on blockchain technology which served as a foundation for creating a global distributed database. The technology is used to verify, store, and conduct transactions worldwide. Unlike government-issued currencies, Bitcoin is a completely decentralized digital asset. Some key factors that have contributed to Bitcoin’s popularity include instant low-cost transactions available 24/7, a high degree of security, and user’s full anonymity.

Ethereum

Ethereum is the world’s second most significant cryptocurrency which is sometimes referred to as the digital silver. It is a global distributed network based on blockchain technology. Ethereum is often described by its developers as a global, open-source, distributed platform used for transactions and computing. The Ethereum platform enables the implementation of other applications and platforms such as smart contracts, financial transactions, e-voting system, and others. Fast verification and secured transactions are the core benefits of the Ethereum network.

Bitcoin Cash

Bitcoin Cash ranks third among the most well-known virtual currencies. BCH was created as a hard fork of Bitcoin on August 1, 2017. This cryptocurrency is designed to help improve transaction speed of financial and crypto settlements. According to experts, Bitcoin Cash is able to process transactions more quickly than the Bitcoin network what makes it more convenient and user-friendly. Most of BCH functions are similar to those of Bitcoin: they both use the SHA-256 algorithm and have a fixed supply of 21 million coins.

Ripple

Ripple is in the fourth place among the most widely used digital assets. Ripple network is designed for internal payments and financial settlements based on blockchain technology. This platform enables global financial institutions to carry out instant and low-cost international payments. What is more, Ripple’s digital tokens can be quickly exchanged for fiat currencies. Ripple was not designed to be a means of payment. Its main function is to conduct transactions online. One of the key features of Ripple is its high scalability: the network can handle up to 1,000 transactions per second.

Litecoin

Litecoin ranks fifth on the list of most popular virtual currencies. Litecoin enables instant and almost zero-cost transactions all around the globe. Besides, Litecoin network offers faster transaction confirmation time thanks to more frequent block generation. In fact, Litecoin processes transactions in about 2.5 minutes which is four times faster than Bitcoin. Litecoin global payment system is a fully decentralized and opens-source network. Investors worldwide choose Litecoin for its excellent security level.

Tether

In top 7 cryptocurrencies rating, Tether is in the sixth place. It is considered to be a digital equivalent of the US dollar. This crypto asset’s value is pegged to the value of the greenback and maintains the rate of 1USDT to 1USD. Tether’s developers aimed at creating a new type of cryptocurrency – the so-called stablecoin. Being backed by the US dollar, Tether is less volatile than most of the virtual currencies.

EOS

EOS is the last most popular cryptocurrency on our list. This digital currency network has a unique structural design which enables vertical and horizontal scaling of decentralized application. EOS developers attempted to solve the problem of transaction speed and scalability and were successful at this. The holders of the EOS tokens can take full advantage of the EOS network resources only if they have a certain amount of coins. This way, the system encourages its users to accumulate and hold EOS tokens instead of spending them. EOS effective performance is achieved through the implementation of specialized modules.

|

Метки: #photo_news |

Top 7 cryptocurrencies to watch in 2020 |

In 2020, cryptocurrencies will continue to thrive and develop, attracting more supporters and crypto enthusiasts. Analysts expect the number one cryptocurrency, Bitcoin, to rise in value along with other digital assets. They outline 7 major virtual currencies that worth paying attention to in 2020.

Bitcoin

Well ahead of others, Bitcoin (ВТС) remains the most popular cryptocurrency in the world. It is sometimes called the digital gold of the crypto market. Bitcoin was the first currency to be based on blockchain technology which served as a foundation for creating a global distributed database. The technology is used to verify, store, and conduct transactions worldwide. Unlike government-issued currencies, Bitcoin is a completely decentralized digital asset. Some key factors that have contributed to Bitcoin’s popularity include instant low-cost transactions available 24/7, a high degree of security, and user’s full anonymity.

Ethereum

Ethereum is the world’s second most significant cryptocurrency which is sometimes referred to as the digital silver. It is a global distributed network based on blockchain technology. Ethereum is often described by its developers as a global, open-source, distributed platform used for transactions and computing. The Ethereum platform enables the implementation of other applications and platforms such as smart contracts, financial transactions, e-voting system, and others. Fast verification and secured transactions are the core benefits of the Ethereum network.

Bitcoin Cash

Bitcoin Cash ranks third among the most well-known virtual currencies. BCH was created as a hard fork of Bitcoin on August 1, 2017. This cryptocurrency is designed to help improve transaction speed of financial and crypto settlements. According to experts, Bitcoin Cash is able to process transactions more quickly than the Bitcoin network what makes it more convenient and user-friendly. Most of BCH functions are similar to those of Bitcoin: they both use the SHA-256 algorithm and have a fixed supply of 21 million coins.

Ripple

Ripple is in the fourth place among the most widely used digital assets. Ripple network is designed for internal payments and financial settlements based on blockchain technology. This platform enables global financial institutions to carry out instant and low-cost international payments. What is more, Ripple’s digital tokens can be quickly exchanged for fiat currencies. Ripple was not designed to be a means of payment. Its main function is to conduct transactions online. One of the key features of Ripple is its high scalability: the network can handle up to 1,000 transactions per second.

Litecoin

Litecoin ranks fifth on the list of most popular virtual currencies. Litecoin enables instant and almost zero-cost transactions all around the globe. Besides, Litecoin network offers faster transaction confirmation time thanks to more frequent block generation. In fact, Litecoin processes transactions in about 2.5 minutes which is four times faster than Bitcoin. Litecoin global payment system is a fully decentralized and opens-source network. Investors worldwide choose Litecoin for its excellent security level.

Tether

In top 7 cryptocurrencies rating, Tether is in the sixth place. It is considered to be a digital equivalent of the US dollar. This crypto asset’s value is pegged to the value of the greenback and maintains the rate of 1USDT to 1USD. Tether’s developers aimed at creating a new type of cryptocurrency – the so-called stablecoin. Being backed by the US dollar, Tether is less volatile than most of the virtual currencies.

EOS

EOS is the last most popular cryptocurrency on our list. This digital currency network has a unique structural design which enables vertical and horizontal scaling of decentralized application. EOS developers attempted to solve the problem of transaction speed and scalability and were successful at this. The holders of the EOS tokens can take full advantage of the EOS network resources only if they have a certain amount of coins. This way, the system encourages its users to accumulate and hold EOS tokens instead of spending them. EOS effective performance is achieved through the implementation of specialized modules.

|

Метки: #photo_news |

Top 7 cryptocurrencies to watch in 2020 |

In 2020, cryptocurrencies will continue to thrive and develop, attracting more supporters and crypto enthusiasts. Analysts expect the number one cryptocurrency, Bitcoin, to rise in value along with other digital assets. They outline 7 major virtual currencies that worth paying attention to in 2020.

Bitcoin

Well ahead of others, Bitcoin (ВТС) remains the most popular cryptocurrency in the world. It is sometimes called the digital gold of the crypto market. Bitcoin was the first currency to be based on blockchain technology which served as a foundation for creating a global distributed database. The technology is used to verify, store, and conduct transactions worldwide. Unlike government-issued currencies, Bitcoin is a completely decentralized digital asset. Some key factors that have contributed to Bitcoin’s popularity include instant low-cost transactions available 24/7, a high degree of security, and user’s full anonymity.

Ethereum

Ethereum is the world’s second most significant cryptocurrency which is sometimes referred to as the digital silver. It is a global distributed network based on blockchain technology. Ethereum is often described by its developers as a global, open-source, distributed platform used for transactions and computing. The Ethereum platform enables the implementation of other applications and platforms such as smart contracts, financial transactions, e-voting system, and others. Fast verification and secured transactions are the core benefits of the Ethereum network.

Bitcoin Cash

Bitcoin Cash ranks third among the most well-known virtual currencies. BCH was created as a hard fork of Bitcoin on August 1, 2017. This cryptocurrency is designed to help improve transaction speed of financial and crypto settlements. According to experts, Bitcoin Cash is able to process transactions more quickly than the Bitcoin network what makes it more convenient and user-friendly. Most of BCH functions are similar to those of Bitcoin: they both use the SHA-256 algorithm and have a fixed supply of 21 million coins.

Ripple

Ripple is in the fourth place among the most widely used digital assets. Ripple network is designed for internal payments and financial settlements based on blockchain technology. This platform enables global financial institutions to carry out instant and low-cost international payments. What is more, Ripple’s digital tokens can be quickly exchanged for fiat currencies. Ripple was not designed to be a means of payment. Its main function is to conduct transactions online. One of the key features of Ripple is its high scalability: the network can handle up to 1,000 transactions per second.

Litecoin

Litecoin ranks fifth on the list of most popular virtual currencies. Litecoin enables instant and almost zero-cost transactions all around the globe. Besides, Litecoin network offers faster transaction confirmation time thanks to more frequent block generation. In fact, Litecoin processes transactions in about 2.5 minutes which is four times faster than Bitcoin. Litecoin global payment system is a fully decentralized and opens-source network. Investors worldwide choose Litecoin for its excellent security level.

Tether

In top 7 cryptocurrencies rating, Tether is in the sixth place. It is considered to be a digital equivalent of the US dollar. This crypto asset’s value is pegged to the value of the greenback and maintains the rate of 1USDT to 1USD. Tether’s developers aimed at creating a new type of cryptocurrency – the so-called stablecoin. Being backed by the US dollar, Tether is less volatile than most of the virtual currencies.

EOS

EOS is the last most popular cryptocurrency on our list. This digital currency network has a unique structural design which enables vertical and horizontal scaling of decentralized application. EOS developers attempted to solve the problem of transaction speed and scalability and were successful at this. The holders of the EOS tokens can take full advantage of the EOS network resources only if they have a certain amount of coins. This way, the system encourages its users to accumulate and hold EOS tokens instead of spending them. EOS effective performance is achieved through the implementation of specialized modules.

|

Метки: #photo_news |

Top 7 cryptocurrencies to watch in 2020 |

In 2020, cryptocurrencies will continue to thrive and develop, attracting more supporters and crypto enthusiasts. Analysts expect the number one cryptocurrency, Bitcoin, to rise in value along with other digital assets. They outline 7 major virtual currencies that worth paying attention to in 2020.

Bitcoin

Well ahead of others, Bitcoin (ВТС) remains the most popular cryptocurrency in the world. It is sometimes called the digital gold of the crypto market. Bitcoin was the first currency to be based on blockchain technology which served as a foundation for creating a global distributed database. The technology is used to verify, store, and conduct transactions worldwide. Unlike government-issued currencies, Bitcoin is a completely decentralized digital asset. Some key factors that have contributed to Bitcoin’s popularity include instant low-cost transactions available 24/7, a high degree of security, and user’s full anonymity.

Ethereum

Ethereum is the world’s second most significant cryptocurrency which is sometimes referred to as the digital silver. It is a global distributed network based on blockchain technology. Ethereum is often described by its developers as a global, open-source, distributed platform used for transactions and computing. The Ethereum platform enables the implementation of other applications and platforms such as smart contracts, financial transactions, e-voting system, and others. Fast verification and secured transactions are the core benefits of the Ethereum network.

Bitcoin Cash

Bitcoin Cash ranks third among the most well-known virtual currencies. BCH was created as a hard fork of Bitcoin on August 1, 2017. This cryptocurrency is designed to help improve transaction speed of financial and crypto settlements. According to experts, Bitcoin Cash is able to process transactions more quickly than the Bitcoin network what makes it more convenient and user-friendly. Most of BCH functions are similar to those of Bitcoin: they both use the SHA-256 algorithm and have a fixed supply of 21 million coins.

Ripple

Ripple is in the fourth place among the most widely used digital assets. Ripple network is designed for internal payments and financial settlements based on blockchain technology. This platform enables global financial institutions to carry out instant and low-cost international payments. What is more, Ripple’s digital tokens can be quickly exchanged for fiat currencies. Ripple was not designed to be a means of payment. Its main function is to conduct transactions online. One of the key features of Ripple is its high scalability: the network can handle up to 1,000 transactions per second.

Litecoin

Litecoin ranks fifth on the list of most popular virtual currencies. Litecoin enables instant and almost zero-cost transactions all around the globe. Besides, Litecoin network offers faster transaction confirmation time thanks to more frequent block generation. In fact, Litecoin processes transactions in about 2.5 minutes which is four times faster than Bitcoin. Litecoin global payment system is a fully decentralized and opens-source network. Investors worldwide choose Litecoin for its excellent security level.

Tether

In top 7 cryptocurrencies rating, Tether is in the sixth place. It is considered to be a digital equivalent of the US dollar. This crypto asset’s value is pegged to the value of the greenback and maintains the rate of 1USDT to 1USD. Tether’s developers aimed at creating a new type of cryptocurrency – the so-called stablecoin. Being backed by the US dollar, Tether is less volatile than most of the virtual currencies.

EOS

EOS is the last most popular cryptocurrency on our list. This digital currency network has a unique structural design which enables vertical and horizontal scaling of decentralized application. EOS developers attempted to solve the problem of transaction speed and scalability and were successful at this. The holders of the EOS tokens can take full advantage of the EOS network resources only if they have a certain amount of coins. This way, the system encourages its users to accumulate and hold EOS tokens instead of spending them. EOS effective performance is achieved through the implementation of specialized modules.

|

Метки: #photo_news |

Top 7 cryptocurrencies to watch in 2020 |

In 2020, cryptocurrencies will continue to thrive and develop, attracting more supporters and crypto enthusiasts. Analysts expect the number one cryptocurrency, Bitcoin, to rise in value along with other digital assets. They outline 7 major virtual currencies that worth paying attention to in 2020.

Bitcoin

Well ahead of others, Bitcoin (ВТС) remains the most popular cryptocurrency in the world. It is sometimes called the digital gold of the crypto market. Bitcoin was the first currency to be based on blockchain technology which served as a foundation for creating a global distributed database. The technology is used to verify, store, and conduct transactions worldwide. Unlike government-issued currencies, Bitcoin is a completely decentralized digital asset. Some key factors that have contributed to Bitcoin’s popularity include instant low-cost transactions available 24/7, a high degree of security, and user’s full anonymity.

Ethereum

Ethereum is the world’s second most significant cryptocurrency which is sometimes referred to as the digital silver. It is a global distributed network based on blockchain technology. Ethereum is often described by its developers as a global, open-source, distributed platform used for transactions and computing. The Ethereum platform enables the implementation of other applications and platforms such as smart contracts, financial transactions, e-voting system, and others. Fast verification and secured transactions are the core benefits of the Ethereum network.

Bitcoin Cash

Bitcoin Cash ranks third among the most well-known virtual currencies. BCH was created as a hard fork of Bitcoin on August 1, 2017. This cryptocurrency is designed to help improve transaction speed of financial and crypto settlements. According to experts, Bitcoin Cash is able to process transactions more quickly than the Bitcoin network what makes it more convenient and user-friendly. Most of BCH functions are similar to those of Bitcoin: they both use the SHA-256 algorithm and have a fixed supply of 21 million coins.

Ripple

Ripple is in the fourth place among the most widely used digital assets. Ripple network is designed for internal payments and financial settlements based on blockchain technology. This platform enables global financial institutions to carry out instant and low-cost international payments. What is more, Ripple’s digital tokens can be quickly exchanged for fiat currencies. Ripple was not designed to be a means of payment. Its main function is to conduct transactions online. One of the key features of Ripple is its high scalability: the network can handle up to 1,000 transactions per second.

Litecoin

Litecoin ranks fifth on the list of most popular virtual currencies. Litecoin enables instant and almost zero-cost transactions all around the globe. Besides, Litecoin network offers faster transaction confirmation time thanks to more frequent block generation. In fact, Litecoin processes transactions in about 2.5 minutes which is four times faster than Bitcoin. Litecoin global payment system is a fully decentralized and opens-source network. Investors worldwide choose Litecoin for its excellent security level.

Tether

In top 7 cryptocurrencies rating, Tether is in the sixth place. It is considered to be a digital equivalent of the US dollar. This crypto asset’s value is pegged to the value of the greenback and maintains the rate of 1USDT to 1USD. Tether’s developers aimed at creating a new type of cryptocurrency – the so-called stablecoin. Being backed by the US dollar, Tether is less volatile than most of the virtual currencies.

EOS

EOS is the last most popular cryptocurrency on our list. This digital currency network has a unique structural design which enables vertical and horizontal scaling of decentralized application. EOS developers attempted to solve the problem of transaction speed and scalability and were successful at this. The holders of the EOS tokens can take full advantage of the EOS network resources only if they have a certain amount of coins. This way, the system encourages its users to accumulate and hold EOS tokens instead of spending them. EOS effective performance is achieved through the implementation of specialized modules.

|

Метки: #photo_news |