Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

New Year's optimism: is December the best month for markets? |

The pre-holiday moods typical for December also covered the US stock market. Its active growth was recorded throughout almost the whole year. December is traditionally considered one of the best for the markets of the year. Experts find it difficult to answer how it will be this time, but expect to rise. Positive in the current forecasts was the growth of the S&P 500 index, which since the beginning of the year added more than 25%. Last week was also favorable: the Russell 2000 index of small-cap companies showed an uptrend along with other indices, rising above its 52-week high. Experts consider this a good sign for the American stock market.

The topic of US and Chinese trade negotiations still remains relevant. Any news from the trade front can be a catalyst that can continue or stop the rally until the end of the year. The current news background is extremely unstable, analysts emphasize. Only US President Donald Trump noted that the “first phase” of the deal was almost ready, as the signing of the law in support of the protesters in Hong Kong made a mess. This provoked an extremely negative reaction from Beijing, which added tension to the trade negotiations.

According to preliminary estimates, December 2019 was very successful for the markets, and for the S&P 500 index it was almost the best year. This has not been recorded since 1928, experts emphasize. However, they urge not to rest on their laurels, since the positive end of the year is in question. According to Sam Stovall, CFRA’s lead investment strategist, the US market is usually adjusting by mid-December, but then, by the end of January next year, a good shopping opportunity presents itself. The expert does not expect a noticeable decline in the near future. Analysts draw attention to the fact that Thanksgiving in the United States is a kind of barometer for the market. If the market is growing by 20% or more before this holiday, then during December, a rise of about 1.8% is also recorded. However, in this barrel of honey there is a fly in the ointment. In the last month of the year, the most significant risk for the market will be the result of trade negotiations between the United States and China. Another important factor is the economic reports, thanks to which investors can evaluate the actions of the Fed in relation to lower rates. In current reports, data on population employment become the most important item. According to preliminary calculations, in November 183 thousand jobs were created in the USA, and a month earlier - 128 thousand jobs.

Currently, the US economy is showing signs of recovery. Positive economic data encouraged the market and gave optimism to investors. However, the consumer remains the key growth factor, analysts recall. The purchasing power of the population is the most important driver of market growth. It correlates with employment data because a strong labor market is critical for consumers and their costs.

Read more: https://www.mt5.com/forex_humor/image/44585

|

Метки: #forex_caricature |

7 Greatest Inventions During World War II |

Usually, World War II deals with developments in the military field. However, World War II has given birth to other important discoveries that still have an impact on our lives today. For example, many important discoveries have been made in the fields of physics, medicine, and computer technology. All of them were successfully used during military operations and in peaceful post-war periods.

See the top 7 discoveries thanks to World War II in our photo gallery.

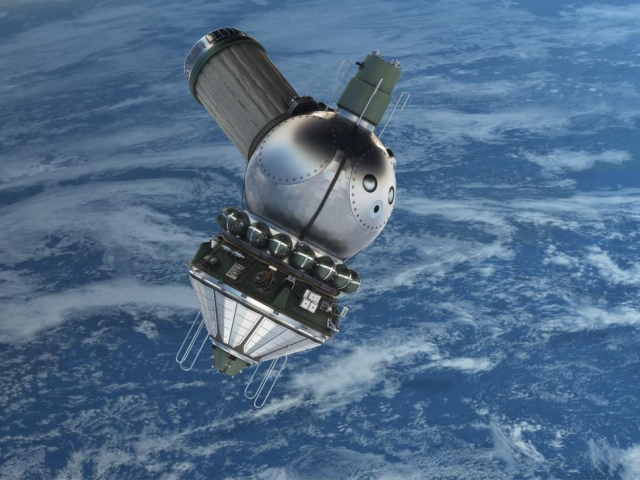

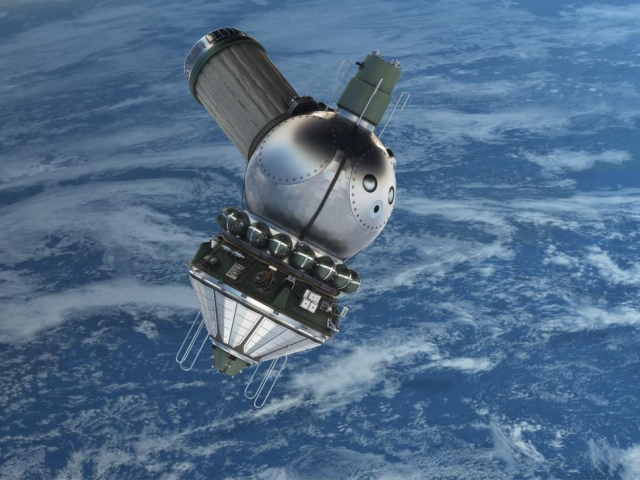

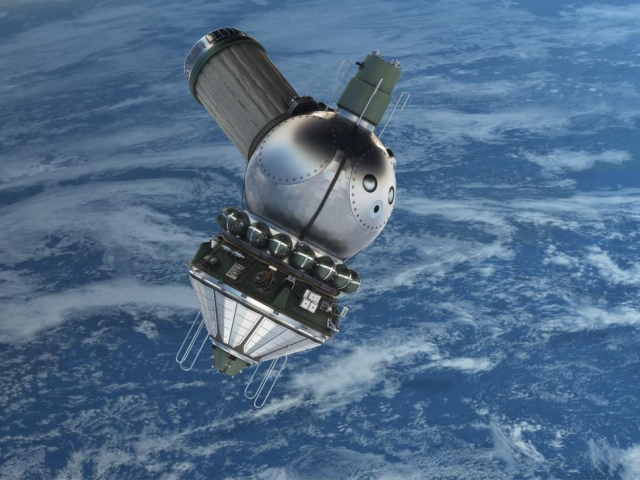

Space Exploration

During wartime, the Third Reich paid great attention to new scientific developments. A number of German scientists succeeded in building V-2 ballistic missiles, guided air bombs, and rocket planes. Initially, they were used to bombard European cities. After the war, most of the ideas behind these mechanical monsters were applied in the development of space, such as orbital flights, moon landings and space telescopes.

Operating with liquid fuel and inertial navigation, ballistic missiles have scared civilians. However, after the war, scientists found another way to use it.

The American missile, the Redstone PGM-11, operates with the same fuel configuration. This missile was active until 1964. WRESAT, the first Australian satellite, was sent into space in 1967 using a modified American Redstone rocket. The V-2 also became a prototype for Soviet "R" series ballistic missiles. The Soviets used a modified R-7 to take Yuri Gagarin into space in 1961.

The First Programmable Computer

The "Colossus" electronic computer, which was created by the British codemaker to decipher the Lorentz code, became the first programmable computer in the world. This computer consists of 1,500 electronic lights. Then, the number of lights increased to 2,500.

With this computer, the British were able to crack the encryption key. Each character is compiled with pseudo-random bits , for example, 10010 XOR 11001 = 01011. Previously, it took several weeks to decipher the secret message. In 1944, from the time the allies landed in Normandy, the results of the mission could be known within a few hours. This device was also used to give false information to German troops. In 1994, the working model of the Colossus Mark II was rebuilt. This computer runs at the same speed as a Pentium 2 processor laptop.

Turbojet aircraft

British engineer Frank Whittle is believed to have made a turbojet engine. He obtained a patent for his discovery in 1930. However, the British government considered his discovery to be irrelevant, while Third Reich was interested in the discovery.

Messerschmitt Me-262 is the first Luftwaffe fighter jet. Then, the Germans created the first Arado Ar 234 bomber , Heinkel He 162 ("Sparrow"), single-engine (1-engine) fighter jets, and a number of others. Armed with a 30 millimeter weapon, the Me-262 can fight even with fast enemy aircraft strikes. This is a qualitative leap in aircraft development.

Nuclear Weapons

At the outbreak of World War II, people were aware of the potential of nuclear power, but no one dared to test it.

During the war, Italian-born nuclear physicist, Enrico Fermi, created the first sustained controlled nuclear chain reaction. In 1943, the Manhattan project led by American physicist Robert Oppenheimer and Lieutenant General Leslie Groves was launched.

This was the trigger point of the Cold War and the beginning of the era of atomic weapons. Shortly after the research was completed, the United States dropped two bombs made during the Manhattan project in two Japanese cities - Hiroshima and Nagasaki, in August 1945.

Radio Navigation

Robert Watson-Watt and his assistant, Arnold Wilkins, are pioneers in this field. In 1930, they were invited to investigate the possibility of developing death ray , a new weapon that was allegedly built in the Third Reich.

The scientists completed their mission successfully, successfully conducting the world's first radar experiment to detect enemy bombers. The test results are a major contribution to the field of air defense. In 1935, R. Watson-Watt received a patent for the invention of radar.

This Soviet version of the radar was designed and installed by Yuri Konstantinovich Korovin in Leningrad, tested a little earlier in January 1934, but for unknown reasons, it was not patented.

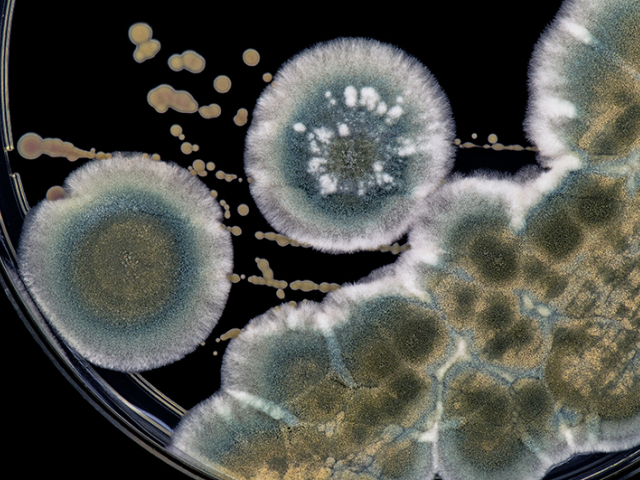

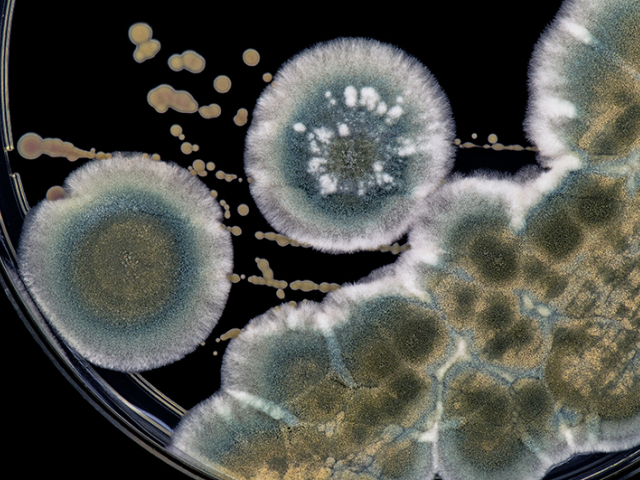

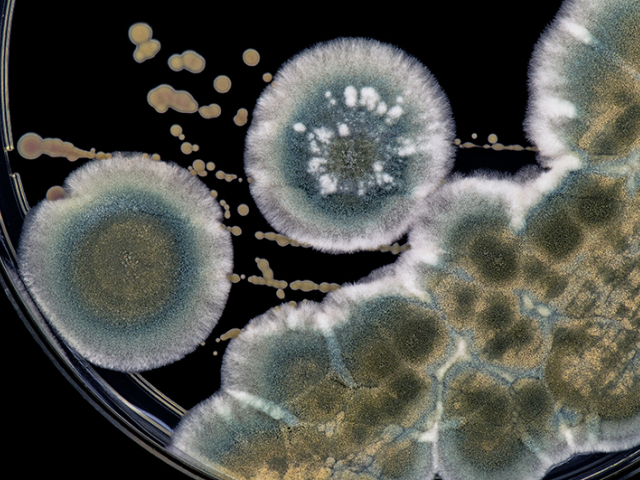

Penicillin

Penicillin was discovered accidentally by Alexander Fleming during a laboratory study in 1928. However, the extract was obtained 10 years later.

Australian scientist Howard Florey and British biochemist Ernst Cheyne continue to study Penicillin further so that it can be produced correctly as a drug. In 1941, they developed and successfully tested complex drugs and in a short time, production began to operate.

Scientists, who have made invaluable contributions to this drug, were awarded the Nobel Prize in 1945.

Diving Gear

For the first time, these equipment, namely containers with compressed air and hoses, were used in 1860. French mining engineer Benoit Roucairol applied his discoveries at the mine to regulate the supply of air from the surface.

In 1878, there were devices that could last a long time under water. The device has an underwater breathing apparatus with a closed circuit that can convert pure oxygen into toxic gas. Despite the fact that this discovery is still unknown, this tool was used actively during the Second World War. Aqualungs like this become a rescue equipment for a fleet of submarines.

Then, in 1943, the mechanism was improved: naval officer Jacques-Yves Cousteau and engineer Emile Gagnan, who worked in France then occupied by Germany, created an open-circuit respirator, so that exhalation was carried out directly in the water. This type of diving equipment (set of scuba) that is safe now we have used.

|

Метки: #photo_news |

7 Greatest Inventions During World War II |

Usually, World War II deals with developments in the military field. However, World War II has given birth to other important discoveries that still have an impact on our lives today. For example, many important discoveries have been made in the fields of physics, medicine, and computer technology. All of them were successfully used during military operations and in peaceful post-war periods.

See the top 7 discoveries thanks to World War II in our photo gallery.

Space Exploration

During wartime, the Third Reich paid great attention to new scientific developments. A number of German scientists succeeded in building V-2 ballistic missiles, guided air bombs, and rocket planes. Initially, they were used to bombard European cities. After the war, most of the ideas behind these mechanical monsters were applied in the development of space, such as orbital flights, moon landings and space telescopes.

Operating with liquid fuel and inertial navigation, ballistic missiles have scared civilians. However, after the war, scientists found another way to use it.

The American missile, the Redstone PGM-11, operates with the same fuel configuration. This missile was active until 1964. WRESAT, the first Australian satellite, was sent into space in 1967 using a modified American Redstone rocket. The V-2 also became a prototype for Soviet "R" series ballistic missiles. The Soviets used a modified R-7 to take Yuri Gagarin into space in 1961.

The First Programmable Computer

The "Colossus" electronic computer, which was created by the British codemaker to decipher the Lorentz code, became the first programmable computer in the world. This computer consists of 1,500 electronic lights. Then, the number of lights increased to 2,500.

With this computer, the British were able to crack the encryption key. Each character is compiled with pseudo-random bits , for example, 10010 XOR 11001 = 01011. Previously, it took several weeks to decipher the secret message. In 1944, from the time the allies landed in Normandy, the results of the mission could be known within a few hours. This device was also used to give false information to German troops. In 1994, the working model of the Colossus Mark II was rebuilt. This computer runs at the same speed as a Pentium 2 processor laptop.

Turbojet aircraft

British engineer Frank Whittle is believed to have made a turbojet engine. He obtained a patent for his discovery in 1930. However, the British government considered his discovery to be irrelevant, while Third Reich was interested in the discovery.

Messerschmitt Me-262 is the first Luftwaffe fighter jet. Then, the Germans created the first Arado Ar 234 bomber , Heinkel He 162 ("Sparrow"), single-engine (1-engine) fighter jets, and a number of others. Armed with a 30 millimeter weapon, the Me-262 can fight even with fast enemy aircraft strikes. This is a qualitative leap in aircraft development.

Nuclear Weapons

At the outbreak of World War II, people were aware of the potential of nuclear power, but no one dared to test it.

During the war, Italian-born nuclear physicist, Enrico Fermi, created the first sustained controlled nuclear chain reaction. In 1943, the Manhattan project led by American physicist Robert Oppenheimer and Lieutenant General Leslie Groves was launched.

This was the trigger point of the Cold War and the beginning of the era of atomic weapons. Shortly after the research was completed, the United States dropped two bombs made during the Manhattan project in two Japanese cities - Hiroshima and Nagasaki, in August 1945.

Radio Navigation

Robert Watson-Watt and his assistant, Arnold Wilkins, are pioneers in this field. In 1930, they were invited to investigate the possibility of developing death ray , a new weapon that was allegedly built in the Third Reich.

The scientists completed their mission successfully, successfully conducting the world's first radar experiment to detect enemy bombers. The test results are a major contribution to the field of air defense. In 1935, R. Watson-Watt received a patent for the invention of radar.

This Soviet version of the radar was designed and installed by Yuri Konstantinovich Korovin in Leningrad, tested a little earlier in January 1934, but for unknown reasons, it was not patented.

Penicillin

Penicillin was discovered accidentally by Alexander Fleming during a laboratory study in 1928. However, the extract was obtained 10 years later.

Australian scientist Howard Florey and British biochemist Ernst Cheyne continue to study Penicillin further so that it can be produced correctly as a drug. In 1941, they developed and successfully tested complex drugs and in a short time, production began to operate.

Scientists, who have made invaluable contributions to this drug, were awarded the Nobel Prize in 1945.

Diving Gear

For the first time, these equipment, namely containers with compressed air and hoses, were used in 1860. French mining engineer Benoit Roucairol applied his discoveries at the mine to regulate the supply of air from the surface.

In 1878, there were devices that could last a long time under water. The device has an underwater breathing apparatus with a closed circuit that can convert pure oxygen into toxic gas. Despite the fact that this discovery is still unknown, this tool was used actively during the Second World War. Aqualungs like this become a rescue equipment for a fleet of submarines.

Then, in 1943, the mechanism was improved: naval officer Jacques-Yves Cousteau and engineer Emile Gagnan, who worked in France then occupied by Germany, created an open-circuit respirator, so that exhalation was carried out directly in the water. This type of diving equipment (set of scuba) that is safe now we have used.

|

Метки: #photo_news |

7 Greatest Inventions During World War II |

Usually, World War II deals with developments in the military field. However, World War II has given birth to other important discoveries that still have an impact on our lives today. For example, many important discoveries have been made in the fields of physics, medicine, and computer technology. All of them were successfully used during military operations and in peaceful post-war periods.

See the top 7 discoveries thanks to World War II in our photo gallery.

Space Exploration

During wartime, the Third Reich paid great attention to new scientific developments. A number of German scientists succeeded in building V-2 ballistic missiles, guided air bombs, and rocket planes. Initially, they were used to bombard European cities. After the war, most of the ideas behind these mechanical monsters were applied in the development of space, such as orbital flights, moon landings and space telescopes.

Operating with liquid fuel and inertial navigation, ballistic missiles have scared civilians. However, after the war, scientists found another way to use it.

The American missile, the Redstone PGM-11, operates with the same fuel configuration. This missile was active until 1964. WRESAT, the first Australian satellite, was sent into space in 1967 using a modified American Redstone rocket. The V-2 also became a prototype for Soviet "R" series ballistic missiles. The Soviets used a modified R-7 to take Yuri Gagarin into space in 1961.

The First Programmable Computer

The "Colossus" electronic computer, which was created by the British codemaker to decipher the Lorentz code, became the first programmable computer in the world. This computer consists of 1,500 electronic lights. Then, the number of lights increased to 2,500.

With this computer, the British were able to crack the encryption key. Each character is compiled with pseudo-random bits , for example, 10010 XOR 11001 = 01011. Previously, it took several weeks to decipher the secret message. In 1944, from the time the allies landed in Normandy, the results of the mission could be known within a few hours. This device was also used to give false information to German troops. In 1994, the working model of the Colossus Mark II was rebuilt. This computer runs at the same speed as a Pentium 2 processor laptop.

Turbojet aircraft

British engineer Frank Whittle is believed to have made a turbojet engine. He obtained a patent for his discovery in 1930. However, the British government considered his discovery to be irrelevant, while Third Reich was interested in the discovery.

Messerschmitt Me-262 is the first Luftwaffe fighter jet. Then, the Germans created the first Arado Ar 234 bomber , Heinkel He 162 ("Sparrow"), single-engine (1-engine) fighter jets, and a number of others. Armed with a 30 millimeter weapon, the Me-262 can fight even with fast enemy aircraft strikes. This is a qualitative leap in aircraft development.

Nuclear Weapons

At the outbreak of World War II, people were aware of the potential of nuclear power, but no one dared to test it.

During the war, Italian-born nuclear physicist, Enrico Fermi, created the first sustained controlled nuclear chain reaction. In 1943, the Manhattan project led by American physicist Robert Oppenheimer and Lieutenant General Leslie Groves was launched.

This was the trigger point of the Cold War and the beginning of the era of atomic weapons. Shortly after the research was completed, the United States dropped two bombs made during the Manhattan project in two Japanese cities - Hiroshima and Nagasaki, in August 1945.

Radio Navigation

Robert Watson-Watt and his assistant, Arnold Wilkins, are pioneers in this field. In 1930, they were invited to investigate the possibility of developing death ray , a new weapon that was allegedly built in the Third Reich.

The scientists completed their mission successfully, successfully conducting the world's first radar experiment to detect enemy bombers. The test results are a major contribution to the field of air defense. In 1935, R. Watson-Watt received a patent for the invention of radar.

This Soviet version of the radar was designed and installed by Yuri Konstantinovich Korovin in Leningrad, tested a little earlier in January 1934, but for unknown reasons, it was not patented.

Penicillin

Penicillin was discovered accidentally by Alexander Fleming during a laboratory study in 1928. However, the extract was obtained 10 years later.

Australian scientist Howard Florey and British biochemist Ernst Cheyne continue to study Penicillin further so that it can be produced correctly as a drug. In 1941, they developed and successfully tested complex drugs and in a short time, production began to operate.

Scientists, who have made invaluable contributions to this drug, were awarded the Nobel Prize in 1945.

Diving Gear

For the first time, these equipment, namely containers with compressed air and hoses, were used in 1860. French mining engineer Benoit Roucairol applied his discoveries at the mine to regulate the supply of air from the surface.

In 1878, there were devices that could last a long time under water. The device has an underwater breathing apparatus with a closed circuit that can convert pure oxygen into toxic gas. Despite the fact that this discovery is still unknown, this tool was used actively during the Second World War. Aqualungs like this become a rescue equipment for a fleet of submarines.

Then, in 1943, the mechanism was improved: naval officer Jacques-Yves Cousteau and engineer Emile Gagnan, who worked in France then occupied by Germany, created an open-circuit respirator, so that exhalation was carried out directly in the water. This type of diving equipment (set of scuba) that is safe now we have used.

|

Метки: #photo_news |

OPEC ready for deeper production cuts |

Nowadays, due to the current situation in the oil market, major oil producers have to cut their production further. It is reported that OPEC decided to significantly reduce oil extraction. Another possible solution for the cartel is to extend the current agreement for three months. According to preliminary estimates, production restrictions can increase up to 400 thousand barrels per day. Tamir Gadban, Oil Minister of Iraq, said that this figure was discussed and settled as a result of careful assessment by the OPEC members. The cartel is ready for deeper output cuts, though to a lesser extent. Under the ongoing agreement, OPEC+ has to reduce oil production to 1.2 million barrels per day. According to OPEC, such measures make the market tighter and help maintain the current supply on the level beneficial to consumers. Some experts expect Saudi Arabia to persuade OPEC and its allies to extend the agreement until the mid-2020. This would help Saudi Aramco, the state-run petroleum company, to successfully conduct an IPO. The terms will be discussed at the next OPEC+ meeting on December 6. According to a Saudi oil advisor, the kingdom needs stable oil prices at no less than $60 per barrel.

As a result of plunging prices, national investors involved in Saudi Aramco’s IPO would face multiple financial risks. Moreover, rising tensions in the Middle East pose a threat to the oil market. However, the oil producers in the Middle East and Russia can compromise if OPEC manages to extend the agreement. Presenty, Saudi Arabia is ready to reduce its own production to the maximum due to the probable decrease in demand next year. However, it will be possible when other OPEC+ members terminate their obligations.

Read more: https://www.mt5.com/forex_humor/image/44575

|

Метки: #forex_caricature |

OPEC ready for deeper production cuts |

Nowadays, due to the current situation in the oil market, major oil producers have to cut their production further. It is reported that OPEC decided to significantly reduce oil extraction. Another possible solution for the cartel is to extend the current agreement for three months. According to preliminary estimates, production restrictions can increase up to 400 thousand barrels per day. Tamir Gadban, Oil Minister of Iraq, said that this figure was discussed and settled as a result of careful assessment by the OPEC members. The cartel is ready for deeper output cuts, though to a lesser extent. Under the ongoing agreement, OPEC+ has to reduce oil production to 1.2 million barrels per day. According to OPEC, such measures make the market tighter and help maintain the current supply on the level beneficial to consumers. Some experts expect Saudi Arabia to persuade OPEC and its allies to extend the agreement until the mid-2020. This would help Saudi Aramco, the state-run petroleum company, to successfully conduct an IPO. The terms will be discussed at the next OPEC+ meeting on December 6. According to a Saudi oil advisor, the kingdom needs stable oil prices at no less than $60 per barrel.

As a result of plunging prices, national investors involved in Saudi Aramco’s IPO would face multiple financial risks. Moreover, rising tensions in the Middle East pose a threat to the oil market. However, the oil producers in the Middle East and Russia can compromise if OPEC manages to extend the agreement. Presenty, Saudi Arabia is ready to reduce its own production to the maximum due to the probable decrease in demand next year. However, it will be possible when other OPEC+ members terminate their obligations.

Read more: https://www.mt5.com/forex_humor/image/44575

|

Метки: #forex_caricature |

OPEC ready for deeper production cuts |

Nowadays, due to the current situation in the oil market, major oil producers have to cut their production further. It is reported that OPEC decided to significantly reduce oil extraction. Another possible solution for the cartel is to extend the current agreement for three months. According to preliminary estimates, production restrictions can increase up to 400 thousand barrels per day. Tamir Gadban, Oil Minister of Iraq, said that this figure was discussed and settled as a result of careful assessment by the OPEC members. The cartel is ready for deeper output cuts, though to a lesser extent. Under the ongoing agreement, OPEC+ has to reduce oil production to 1.2 million barrels per day. According to OPEC, such measures make the market tighter and help maintain the current supply on the level beneficial to consumers. Some experts expect Saudi Arabia to persuade OPEC and its allies to extend the agreement until the mid-2020. This would help Saudi Aramco, the state-run petroleum company, to successfully conduct an IPO. The terms will be discussed at the next OPEC+ meeting on December 6. According to a Saudi oil advisor, the kingdom needs stable oil prices at no less than $60 per barrel.

As a result of plunging prices, national investors involved in Saudi Aramco’s IPO would face multiple financial risks. Moreover, rising tensions in the Middle East pose a threat to the oil market. However, the oil producers in the Middle East and Russia can compromise if OPEC manages to extend the agreement. Presenty, Saudi Arabia is ready to reduce its own production to the maximum due to the probable decrease in demand next year. However, it will be possible when other OPEC+ members terminate their obligations.

Read more: https://www.mt5.com/forex_humor/image/44575

|

Метки: #forex_caricature |

5 risk factors for EU banks to watch out for in 2019 |

This year has been disappointing for investors, so the European banks' stocks are likely to post losses by the end of it. Experts think that political instability, uncertainty in emerging markets, and low interest rates may trigger the financial collapse in 2019. Starting from January 2019, shareholder losses will amount to over 300 billion euros. To avoid losses, analysts recommend monitoring five risks the global market may face this year.

Government regulation

In 2019, the EU continues to implement the Markets in Financial Instruments Directive, or MiFID II. This directive was supposed to help create a common European market of financial instruments and services. In 2022, the transition to the regulatory framework for banking called Basel III is planned. Basel III is a document released by the Basel Committee on Banking Supervision. Lawmakers put pressure on the markets preparing for different Brexit scenarios. Therefore, easing of the monetary policy is crucial, especially for the financial markets with derivative contracts of trillions of euros. Experts urge investors to closely monitor any signals coming from the Federal Reserve System

Mergers and Acquisitions

In the coming year, there is a high probability of a merger between such large financial institutions as Deutsche Bank AG and Commerzbank AG, as well as Italian bank UniCredit SpA and French Societe Generale SA. Such measures can allow the financial institution to improve financial performance and reduce costs. However, analysts doubt that this will help solve problems with “unprofitable” assets. In 2019, experts predict a new wave of consolidations in the German banking sector.

New banks emerging

Many banks will have to spend billions on investments in outdated infrastructure and withstand competition in the market. Meanwhile, a number of large financial and technology companies are planning to place shares on the stock exchange. In 2019, banks will experience even stronger pressure from fintech companies. Larger financial institutions will consider buying leading technological companies. Analysts advise investors to keep an eye on the situation in Asia where the value of 13 fintech companies has already reached $217 billion.

Credit risks and expenses

Some years ago, a company’s profitability could be easily increased with the help of small funds. Today, the situation is changing, and the economic forecast for 2019 remains uncertain. According to analysts at Morgan Stanley, the determining factor for the banking system will be a slowdown in economic growth and longer credit cycle. Its is emphasized that banks need to invest in technology to stay afloat. Experts from Bloomberg note that the difference between the bank’s profit and bank’s rising costs should be significant.

ECB policy on interest rates

Credit financing remains the main activity of most European banks, although zero interest rates make it rather unprofitable. Some market participants expect ECB to increase interest rates only in 2020. Fitch Ratings predicts that the economic downturn in the eurozone and low inflation may convince the ECB to keep the rates low and unchanged until the end of this year. Analysts believe that in 2019, banks will need to resort to replacement funds. To support household lending, the regulator may start a new round of long-term refinancing.

|

Метки: #photo_news |

5 risk factors for EU banks to watch out for in 2019 |

This year has been disappointing for investors, so the European banks' stocks are likely to post losses by the end of it. Experts think that political instability, uncertainty in emerging markets, and low interest rates may trigger the financial collapse in 2019. Starting from January 2019, shareholder losses will amount to over 300 billion euros. To avoid losses, analysts recommend monitoring five risks the global market may face this year.

Government regulation

In 2019, the EU continues to implement the Markets in Financial Instruments Directive, or MiFID II. This directive was supposed to help create a common European market of financial instruments and services. In 2022, the transition to the regulatory framework for banking called Basel III is planned. Basel III is a document released by the Basel Committee on Banking Supervision. Lawmakers put pressure on the markets preparing for different Brexit scenarios. Therefore, easing of the monetary policy is crucial, especially for the financial markets with derivative contracts of trillions of euros. Experts urge investors to closely monitor any signals coming from the Federal Reserve System

Mergers and Acquisitions

In the coming year, there is a high probability of a merger between such large financial institutions as Deutsche Bank AG and Commerzbank AG, as well as Italian bank UniCredit SpA and French Societe Generale SA. Such measures can allow the financial institution to improve financial performance and reduce costs. However, analysts doubt that this will help solve problems with “unprofitable” assets. In 2019, experts predict a new wave of consolidations in the German banking sector.

New banks emerging

Many banks will have to spend billions on investments in outdated infrastructure and withstand competition in the market. Meanwhile, a number of large financial and technology companies are planning to place shares on the stock exchange. In 2019, banks will experience even stronger pressure from fintech companies. Larger financial institutions will consider buying leading technological companies. Analysts advise investors to keep an eye on the situation in Asia where the value of 13 fintech companies has already reached $217 billion.

Credit risks and expenses

Some years ago, a company’s profitability could be easily increased with the help of small funds. Today, the situation is changing, and the economic forecast for 2019 remains uncertain. According to analysts at Morgan Stanley, the determining factor for the banking system will be a slowdown in economic growth and longer credit cycle. Its is emphasized that banks need to invest in technology to stay afloat. Experts from Bloomberg note that the difference between the bank’s profit and bank’s rising costs should be significant.

ECB policy on interest rates

Credit financing remains the main activity of most European banks, although zero interest rates make it rather unprofitable. Some market participants expect ECB to increase interest rates only in 2020. Fitch Ratings predicts that the economic downturn in the eurozone and low inflation may convince the ECB to keep the rates low and unchanged until the end of this year. Analysts believe that in 2019, banks will need to resort to replacement funds. To support household lending, the regulator may start a new round of long-term refinancing.

|

Метки: #photo_news |

5 risk factors for EU banks to watch out for in 2019 |

This year has been disappointing for investors, so the European banks' stocks are likely to post losses by the end of it. Experts think that political instability, uncertainty in emerging markets, and low interest rates may trigger the financial collapse in 2019. Starting from January 2019, shareholder losses will amount to over 300 billion euros. To avoid losses, analysts recommend monitoring five risks the global market may face this year.

Government regulation

In 2019, the EU continues to implement the Markets in Financial Instruments Directive, or MiFID II. This directive was supposed to help create a common European market of financial instruments and services. In 2022, the transition to the regulatory framework for banking called Basel III is planned. Basel III is a document released by the Basel Committee on Banking Supervision. Lawmakers put pressure on the markets preparing for different Brexit scenarios. Therefore, easing of the monetary policy is crucial, especially for the financial markets with derivative contracts of trillions of euros. Experts urge investors to closely monitor any signals coming from the Federal Reserve System

Mergers and Acquisitions

In the coming year, there is a high probability of a merger between such large financial institutions as Deutsche Bank AG and Commerzbank AG, as well as Italian bank UniCredit SpA and French Societe Generale SA. Such measures can allow the financial institution to improve financial performance and reduce costs. However, analysts doubt that this will help solve problems with “unprofitable” assets. In 2019, experts predict a new wave of consolidations in the German banking sector.

New banks emerging

Many banks will have to spend billions on investments in outdated infrastructure and withstand competition in the market. Meanwhile, a number of large financial and technology companies are planning to place shares on the stock exchange. In 2019, banks will experience even stronger pressure from fintech companies. Larger financial institutions will consider buying leading technological companies. Analysts advise investors to keep an eye on the situation in Asia where the value of 13 fintech companies has already reached $217 billion.

Credit risks and expenses

Some years ago, a company’s profitability could be easily increased with the help of small funds. Today, the situation is changing, and the economic forecast for 2019 remains uncertain. According to analysts at Morgan Stanley, the determining factor for the banking system will be a slowdown in economic growth and longer credit cycle. Its is emphasized that banks need to invest in technology to stay afloat. Experts from Bloomberg note that the difference between the bank’s profit and bank’s rising costs should be significant.

ECB policy on interest rates

Credit financing remains the main activity of most European banks, although zero interest rates make it rather unprofitable. Some market participants expect ECB to increase interest rates only in 2020. Fitch Ratings predicts that the economic downturn in the eurozone and low inflation may convince the ECB to keep the rates low and unchanged until the end of this year. Analysts believe that in 2019, banks will need to resort to replacement funds. To support household lending, the regulator may start a new round of long-term refinancing.

|

Метки: #photo_news |

China scaling up its dollar-debt |

China’s financial authorities aim to revive its debt market and improve its bond yield curve. Experts at Bloomberg believe the goal could be achieved through large-scale sales of sovereign bonds denominated in US dollars. In the first week of December, China sold dollar-denominated bonds worth a record $6 billion. The latest sale has been the biggest ever dollar-debt offering in China. The finance ministry unveiled its plans to sell government bonds with a 3-year, 5-year, 10-year, and 20-year maturity. Analysts reckon that the amount of bonds to be issued this year will double the value of the last year and will be three-fold higher than the amount issued in 2017. According to Bloomberg estimates, China’s dollar-debt market totals roughly $740 billion. It is viewed as the major lending source for local borrowers. Earlier, the volume of such bonds issued in 2018 contracted a lot amid the escalating trade conflict. Nevertheless, despite hard progress in the trade talks, China has been scaling up the bond volume. Experts say the reason behind this measure is falling yields of US Treasuries, thus it gets cheaper for China to place dollar-denominated bonds. Citing Becky Liu, China’s fixed income strategist at Standard Chartered Plc, China has been expanding the scope of its dollar-debt market to ensure that local companies are provided with enough funding in the time of uncertainty. Importantly, China ranks second among the world’s largest debt markets. However, due to its feeble financial system, China makes efforts to create decent conditions for domestic institutional investors, including pension funds and insurance firms. Some analysts predict the yuan’s reign on Forex, betting on its reinforcement against the US dollar, but such theories lack weighty arguments.

Read more: https://www.mt5.com/forex_humor/image/44545

|

Метки: #forex_caricature |

China scaling up its dollar-debt |

China’s financial authorities aim to revive its debt market and improve its bond yield curve. Experts at Bloomberg believe the goal could be achieved through large-scale sales of sovereign bonds denominated in US dollars. In the first week of December, China sold dollar-denominated bonds worth a record $6 billion. The latest sale has been the biggest ever dollar-debt offering in China. The finance ministry unveiled its plans to sell government bonds with a 3-year, 5-year, 10-year, and 20-year maturity. Analysts reckon that the amount of bonds to be issued this year will double the value of the last year and will be three-fold higher than the amount issued in 2017. According to Bloomberg estimates, China’s dollar-debt market totals roughly $740 billion. It is viewed as the major lending source for local borrowers. Earlier, the volume of such bonds issued in 2018 contracted a lot amid the escalating trade conflict. Nevertheless, despite hard progress in the trade talks, China has been scaling up the bond volume. Experts say the reason behind this measure is falling yields of US Treasuries, thus it gets cheaper for China to place dollar-denominated bonds. Citing Becky Liu, China’s fixed income strategist at Standard Chartered Plc, China has been expanding the scope of its dollar-debt market to ensure that local companies are provided with enough funding in the time of uncertainty. Importantly, China ranks second among the world’s largest debt markets. However, due to its feeble financial system, China makes efforts to create decent conditions for domestic institutional investors, including pension funds and insurance firms. Some analysts predict the yuan’s reign on Forex, betting on its reinforcement against the US dollar, but such theories lack weighty arguments.

Read more: https://www.mt5.com/forex_humor/image/44545

|

Метки: #forex_caricature |

China scaling up its dollar-debt |

China’s financial authorities aim to revive its debt market and improve its bond yield curve. Experts at Bloomberg believe the goal could be achieved through large-scale sales of sovereign bonds denominated in US dollars. In the first week of December, China sold dollar-denominated bonds worth a record $6 billion. The latest sale has been the biggest ever dollar-debt offering in China. The finance ministry unveiled its plans to sell government bonds with a 3-year, 5-year, 10-year, and 20-year maturity. Analysts reckon that the amount of bonds to be issued this year will double the value of the last year and will be three-fold higher than the amount issued in 2017. According to Bloomberg estimates, China’s dollar-debt market totals roughly $740 billion. It is viewed as the major lending source for local borrowers. Earlier, the volume of such bonds issued in 2018 contracted a lot amid the escalating trade conflict. Nevertheless, despite hard progress in the trade talks, China has been scaling up the bond volume. Experts say the reason behind this measure is falling yields of US Treasuries, thus it gets cheaper for China to place dollar-denominated bonds. Citing Becky Liu, China’s fixed income strategist at Standard Chartered Plc, China has been expanding the scope of its dollar-debt market to ensure that local companies are provided with enough funding in the time of uncertainty. Importantly, China ranks second among the world’s largest debt markets. However, due to its feeble financial system, China makes efforts to create decent conditions for domestic institutional investors, including pension funds and insurance firms. Some analysts predict the yuan’s reign on Forex, betting on its reinforcement against the US dollar, but such theories lack weighty arguments.

Read more: https://www.mt5.com/forex_humor/image/44545

|

Метки: #forex_caricature |

China scaling up its dollar-debt |

China’s financial authorities aim to revive its debt market and improve its bond yield curve. Experts at Bloomberg believe the goal could be achieved through large-scale sales of sovereign bonds denominated in US dollars. In the first week of December, China sold dollar-denominated bonds worth a record $6 billion. The latest sale has been the biggest ever dollar-debt offering in China. The finance ministry unveiled its plans to sell government bonds with a 3-year, 5-year, 10-year, and 20-year maturity. Analysts reckon that the amount of bonds to be issued this year will double the value of the last year and will be three-fold higher than the amount issued in 2017. According to Bloomberg estimates, China’s dollar-debt market totals roughly $740 billion. It is viewed as the major lending source for local borrowers. Earlier, the volume of such bonds issued in 2018 contracted a lot amid the escalating trade conflict. Nevertheless, despite hard progress in the trade talks, China has been scaling up the bond volume. Experts say the reason behind this measure is falling yields of US Treasuries, thus it gets cheaper for China to place dollar-denominated bonds. Citing Becky Liu, China’s fixed income strategist at Standard Chartered Plc, China has been expanding the scope of its dollar-debt market to ensure that local companies are provided with enough funding in the time of uncertainty. Importantly, China ranks second among the world’s largest debt markets. However, due to its feeble financial system, China makes efforts to create decent conditions for domestic institutional investors, including pension funds and insurance firms. Some analysts predict the yuan’s reign on Forex, betting on its reinforcement against the US dollar, but such theories lack weighty arguments.

Read more: https://www.mt5.com/forex_humor/image/44545

|

Метки: #forex_caricature |

8 promising healthcare startups to watch in 201 |

In the modern world, more and more people are choosing a healthy lifestyle. Developers and scientists create various applications and programs to help people stay fit. That is why investors prefer startups aimed at promoting wellness. Find some of the most profitable healthcare startups in our photo gallery

Alma: coworking space for therapy

Alma is a coworking space for psychotherapists and neurologists. It provides therapists with all the technology necessary for work. Statistics show that more than 60 million people in the world suffer from mental illness. Alma gives psychotherapists a convenient workspace and useful digital tools as well as the support of fellow professionals.

Arterys: AI in medical industry

This startup offers medical imaging reading based on artificial intelligence (AI). According to Alfred Lin, a major investor, this project demonstrates the power of innovative technology working for the benefit of humanity. The company uses a combination of cloud storage, big data, image processing, and AI capacities for the healthcare system.

Benchling: collaboration of scientists

This is a data management platform for collaboration between scientists in biology, pharmacy, and related scientific fields. Investor Eric Vishria notes that Benchling provides a platform to help accelerate biotechnology research. Thanks to the startup, scientists can simulate experiments and share the results.

Mirror: interactive fitness at home

The Mirror, as implied by its name, is a vertical display which streams personal training sessions directly to your home. A reflective LCD screen switches on at the user’s request. The cost of the Mirror is quite high - about $1,500. Analysts are sure that this project is very promising.

ProLon: diet and counting nutrients

ProLon startup offers a 5-day meal program. It is designed in such a way that the user keeps an accurate count of the nutrients. A big advantage of this diet is that the human body does not recognize it as a limitation and does not suffer from the inconvenience. According to representatives of ProLon, the diet is a scientifically developed program. It is beneficial for health and helps renew the body.

Tia: innovations for women’s health

Tia startup is designed to address women’s needs and includes gynecology and primary care assistance. The company operates as a health center. The project was created on the basis of the Tia Bot application where customers could receive information about the clinics.

Octave: mental health service

The online therapy sessions were set up on the basis of the leading psychiatric clinic Octave in New York. These classes are aimed at maintaining mental well-being of the citizens. In addition to innovative therapy, the clinic offers a traditional approach as well. The mission of Octave is to create a proactive and psychologically stable society.

Virta Health: app for diabetes treatment

This app is created for people with diabetes. This startup allows patients to get access to doctors and medical institutions that monitor the patient's condition and give recommendations on the diet. At Virta Health, diabetes can learn how to reduce the dependence from medications.

|

Метки: #photo_news |

8 promising healthcare startups to watch in 201 |

In the modern world, more and more people are choosing a healthy lifestyle. Developers and scientists create various applications and programs to help people stay fit. That is why investors prefer startups aimed at promoting wellness. Find some of the most profitable healthcare startups in our photo gallery

Alma: coworking space for therapy

Alma is a coworking space for psychotherapists and neurologists. It provides therapists with all the technology necessary for work. Statistics show that more than 60 million people in the world suffer from mental illness. Alma gives psychotherapists a convenient workspace and useful digital tools as well as the support of fellow professionals.

Arterys: AI in medical industry

This startup offers medical imaging reading based on artificial intelligence (AI). According to Alfred Lin, a major investor, this project demonstrates the power of innovative technology working for the benefit of humanity. The company uses a combination of cloud storage, big data, image processing, and AI capacities for the healthcare system.

Benchling: collaboration of scientists

This is a data management platform for collaboration between scientists in biology, pharmacy, and related scientific fields. Investor Eric Vishria notes that Benchling provides a platform to help accelerate biotechnology research. Thanks to the startup, scientists can simulate experiments and share the results.

Mirror: interactive fitness at home

The Mirror, as implied by its name, is a vertical display which streams personal training sessions directly to your home. A reflective LCD screen switches on at the user’s request. The cost of the Mirror is quite high - about $1,500. Analysts are sure that this project is very promising.

ProLon: diet and counting nutrients

ProLon startup offers a 5-day meal program. It is designed in such a way that the user keeps an accurate count of the nutrients. A big advantage of this diet is that the human body does not recognize it as a limitation and does not suffer from the inconvenience. According to representatives of ProLon, the diet is a scientifically developed program. It is beneficial for health and helps renew the body.

Tia: innovations for women’s health

Tia startup is designed to address women’s needs and includes gynecology and primary care assistance. The company operates as a health center. The project was created on the basis of the Tia Bot application where customers could receive information about the clinics.

Octave: mental health service

The online therapy sessions were set up on the basis of the leading psychiatric clinic Octave in New York. These classes are aimed at maintaining mental well-being of the citizens. In addition to innovative therapy, the clinic offers a traditional approach as well. The mission of Octave is to create a proactive and psychologically stable society.

Virta Health: app for diabetes treatment

This app is created for people with diabetes. This startup allows patients to get access to doctors and medical institutions that monitor the patient's condition and give recommendations on the diet. At Virta Health, diabetes can learn how to reduce the dependence from medications.

|

Метки: #photo_news |

8 promising healthcare startups to watch in 201 |

In the modern world, more and more people are choosing a healthy lifestyle. Developers and scientists create various applications and programs to help people stay fit. That is why investors prefer startups aimed at promoting wellness. Find some of the most profitable healthcare startups in our photo gallery

Alma: coworking space for therapy

Alma is a coworking space for psychotherapists and neurologists. It provides therapists with all the technology necessary for work. Statistics show that more than 60 million people in the world suffer from mental illness. Alma gives psychotherapists a convenient workspace and useful digital tools as well as the support of fellow professionals.

Arterys: AI in medical industry

This startup offers medical imaging reading based on artificial intelligence (AI). According to Alfred Lin, a major investor, this project demonstrates the power of innovative technology working for the benefit of humanity. The company uses a combination of cloud storage, big data, image processing, and AI capacities for the healthcare system.

Benchling: collaboration of scientists

This is a data management platform for collaboration between scientists in biology, pharmacy, and related scientific fields. Investor Eric Vishria notes that Benchling provides a platform to help accelerate biotechnology research. Thanks to the startup, scientists can simulate experiments and share the results.

Mirror: interactive fitness at home

The Mirror, as implied by its name, is a vertical display which streams personal training sessions directly to your home. A reflective LCD screen switches on at the user’s request. The cost of the Mirror is quite high - about $1,500. Analysts are sure that this project is very promising.

ProLon: diet and counting nutrients

ProLon startup offers a 5-day meal program. It is designed in such a way that the user keeps an accurate count of the nutrients. A big advantage of this diet is that the human body does not recognize it as a limitation and does not suffer from the inconvenience. According to representatives of ProLon, the diet is a scientifically developed program. It is beneficial for health and helps renew the body.

Tia: innovations for women’s health

Tia startup is designed to address women’s needs and includes gynecology and primary care assistance. The company operates as a health center. The project was created on the basis of the Tia Bot application where customers could receive information about the clinics.

Octave: mental health service

The online therapy sessions were set up on the basis of the leading psychiatric clinic Octave in New York. These classes are aimed at maintaining mental well-being of the citizens. In addition to innovative therapy, the clinic offers a traditional approach as well. The mission of Octave is to create a proactive and psychologically stable society.

Virta Health: app for diabetes treatment

This app is created for people with diabetes. This startup allows patients to get access to doctors and medical institutions that monitor the patient's condition and give recommendations on the diet. At Virta Health, diabetes can learn how to reduce the dependence from medications.

|

Метки: #photo_news |

8 promising healthcare startups to watch in 201 |

In the modern world, more and more people are choosing a healthy lifestyle. Developers and scientists create various applications and programs to help people stay fit. That is why investors prefer startups aimed at promoting wellness. Find some of the most profitable healthcare startups in our photo gallery

Alma: coworking space for therapy

Alma is a coworking space for psychotherapists and neurologists. It provides therapists with all the technology necessary for work. Statistics show that more than 60 million people in the world suffer from mental illness. Alma gives psychotherapists a convenient workspace and useful digital tools as well as the support of fellow professionals.

Arterys: AI in medical industry

This startup offers medical imaging reading based on artificial intelligence (AI). According to Alfred Lin, a major investor, this project demonstrates the power of innovative technology working for the benefit of humanity. The company uses a combination of cloud storage, big data, image processing, and AI capacities for the healthcare system.

Benchling: collaboration of scientists

This is a data management platform for collaboration between scientists in biology, pharmacy, and related scientific fields. Investor Eric Vishria notes that Benchling provides a platform to help accelerate biotechnology research. Thanks to the startup, scientists can simulate experiments and share the results.

Mirror: interactive fitness at home

The Mirror, as implied by its name, is a vertical display which streams personal training sessions directly to your home. A reflective LCD screen switches on at the user’s request. The cost of the Mirror is quite high - about $1,500. Analysts are sure that this project is very promising.

ProLon: diet and counting nutrients

ProLon startup offers a 5-day meal program. It is designed in such a way that the user keeps an accurate count of the nutrients. A big advantage of this diet is that the human body does not recognize it as a limitation and does not suffer from the inconvenience. According to representatives of ProLon, the diet is a scientifically developed program. It is beneficial for health and helps renew the body.

Tia: innovations for women’s health

Tia startup is designed to address women’s needs and includes gynecology and primary care assistance. The company operates as a health center. The project was created on the basis of the Tia Bot application where customers could receive information about the clinics.

Octave: mental health service

The online therapy sessions were set up on the basis of the leading psychiatric clinic Octave in New York. These classes are aimed at maintaining mental well-being of the citizens. In addition to innovative therapy, the clinic offers a traditional approach as well. The mission of Octave is to create a proactive and psychologically stable society.

Virta Health: app for diabetes treatment

This app is created for people with diabetes. This startup allows patients to get access to doctors and medical institutions that monitor the patient's condition and give recommendations on the diet. At Virta Health, diabetes can learn how to reduce the dependence from medications.

|

Метки: #photo_news |

Uber banned from operating in London |

The world-famous Uber taxi service has faced another obstacle in the UK. London authorities refused to renew Uber’s operating licence for the second time over the past two years. Transport for London (TfL), the capital’s transport regulator, accused Uber of repeated safety failures. According to the authorities, some faults in the company’s online service have placed passenger safety at risk. Moreover, Uber did not manage to eliminate the shortcomings that had been highlighted earlier to the company. London mayor Sadiq Khan supported the TfL’s decision. He emphasized that Uber would be able to resume work in the British capital if it made some improvements to its security system. Uber’s management considers the termination of its license unjustified. The company noted that it had fundamentally changed some key features over the past two years. Uber representative said the company was ready to develop further in order to meet the expectations of the drivers and passengers who rely on them. The main concern was connected with Uber’s weak security system of the online service. In particular, the system allowed unauthorized drivers to change the personal data of other registered drivers which enabled them to operate under a different name. Most of the time, new drivers did not have insurance and an appropriate license.Transport for London reported at least 14,000 fraudulent trips in the past two years. However, Uber claimed that these defects had long been fixed.

Read more: https://www.mt5.com/forex_humor/image/44523

|

Метки: #forex_caricature |

Uber banned from operating in London |

The world-famous Uber taxi service has faced another obstacle in the UK. London authorities refused to renew Uber’s operating licence for the second time over the past two years. Transport for London (TfL), the capital’s transport regulator, accused Uber of repeated safety failures. According to the authorities, some faults in the company’s online service have placed passenger safety at risk. Moreover, Uber did not manage to eliminate the shortcomings that had been highlighted earlier to the company. London mayor Sadiq Khan supported the TfL’s decision. He emphasized that Uber would be able to resume work in the British capital if it made some improvements to its security system. Uber’s management considers the termination of its license unjustified. The company noted that it had fundamentally changed some key features over the past two years. Uber representative said the company was ready to develop further in order to meet the expectations of the drivers and passengers who rely on them. The main concern was connected with Uber’s weak security system of the online service. In particular, the system allowed unauthorized drivers to change the personal data of other registered drivers which enabled them to operate under a different name. Most of the time, new drivers did not have insurance and an appropriate license.Transport for London reported at least 14,000 fraudulent trips in the past two years. However, Uber claimed that these defects had long been fixed.

Read more: https://www.mt5.com/forex_humor/image/44523

|

Метки: #forex_caricature |