Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

7 grey swans to look out for in 2020 |

Many people are acquainted with the "black swans" concept. Black swans are events that no one can envisage. They usually have a very great effect on the world. Curiously enough, there is also an antonymous concept, called the "grey swans". This means a chain of events that can be predicted. This concept deals mostly not with an incident or an event but with a vector that determines the course of events. Experts at Zerohedge, a markets-focused blog, highlight 7 events that can make waves in the global market in 2020

Inflation in euro area surges

According to analysts at Zerohedge, the eurozone will go through significant changes in 2020. The current geopolitical background of the euro area is far from perfect. The eurozone residents support political parties that oppose the euro bloc policy. Experts think that in the governments of some countries there will be leaders who will ignore the current fiscal norms. As a result, the EU budget deficit could reach 3% compared to 1% in 2019. Analysts also warn about a rise in trade union activity and possible strikes which could paralyze the work of several sectors of the economy.

US introduces capital restrictions

One of the most important events of the coming year may become another trade war initiated by US President Donald Trump. The new trade conflict will affect large capitals. Economists suppose that the new trade war can lead to the outflow of the capital. The capital outflow and new tariffs may seriously affect the world economy.

Japan intervenes in FX market

Japan will also undertake a new move to revive the economy. The Japanese economy is losing steam. In 2019, its GDP growth did not exceed 1%. Next year, this figure will increase by only 0.3%. Japanese authorities have introduced fiscal stimulus measures to offset this decline. It did not help much, though. For this reason, Japan has only one option: currency intervention. This move may draw criticism from other countries, especially from the US. However, Japan will do everything possible to boost its economy and it may take an even more aggressive path if it is necessary.

Tesla teams up with Hyundai

Next year, a lot of transfigurations in the auto market will take place. Many companies will disappear and will be replaced by more competitive ones. In 2019, electric cars gained popularity in the market. In the meantime, Japanese automakers are far ahead of their European counterparts, experts say. Korean automaker Hyundai is the only laggard in this field. Therefore, the company needs a powerful partner to get back on track. Experts assume that the company may decide to cooperate with Tesla. Such a partnership could help both companies to solve a number of problems.

Fed disintermediates banks with help of digital currencies

Next year, the cryptomarket will have a greater impact on many sectors of the economy. Analysts at Zerohedge believe that banks should not be afraid of digital currencies as they need to be more concerned with the looming financial crisis. Its consequences are difficult to predict, and banks will have to step up all their efforts to protect their capital. If the Fed is forced to do the same, the regulator, lacking fiat money, will begin to use digital assets to minimize currency risks.

Drone attacks on oil facilities in Middle East increase

Experts believe that next year, the number of drone attacks on US-owned oil facilities in the Middle East will grow. The drone attacks on Saudi Arabia's oil refineries are sure to be one of the most memorable events of the passing year. Notably, the likelihood of such attacks is quite high even despite the fact that the US has implemented enhanced tracking and air defense systems. Drone attacks are mostly unpredictable. According to experts, they cannot be prevented. Almost all oil facilities in Saudi Arabia will remain vulnerable to drone attacks.

Virtual reality takes over auto sector

The concept of virtual reality fascinates human minds. Every year, it is getting more popular. Experts at Zerohedge believe that in the nearest future, it will displace the auto industry from the market. The desire to travel will be a catalyst for the fast development of virtual entertainment. Even now, VR is developing faster than any other industry. One day, it may put the final nail in the coffin of the auto industry as it has no physical boundaries. It opens new horizons where there is no need for cars. Movements in imaginary worlds are faster and cheaper. Besides, it offers an entirely new experience for people.

|

Метки: #photo_news |

Future of Nord Stream 2 in question |

Perhaps Nord Stream 2 is viewed as one of the most controversial construction projects on a global scale. It is widely promoted in the pro-Kremlin mass media. Reportedly, the gas pipeline has been almost over and is going to be put into operation soon despite sanctions imposed by Washington. At the same time, citing the Western media, there is virtually a nil chance that the construction will be completed on schedule. Besides, the question is still open whether the pipeline will be actually launched. US President Donald Trump again toughened his anti-Moscow rhetoric and signed an appropriate bill in late December. That bill includes sanctions on the companies involved in the construction of the two Russia-backed pipelines – Nord Stream 2 and Turk Stream. In response, Swiss-Dutch company Allseas Group immediately suspended laying pipes for Nord Stream 2. To make things worse, the firm confirmed its withdrawal from the project. Earlier, Russia had forged ahead with the project, making huge efforts to obtain permission, to attract partners, and assure them of the project’s feasibility. In fact, Russia has neither proper equipment nor technology at its disposal. As of November 2019, experts reckoned Nord Stream 2 was 80% complete. Before the US sanctions, the Kremlin’s officials had said that the pipeline would be launched around the middle of 2020.

Read more: https://www.mt5.com/forex_humor/image/45310

|

Метки: #forex_caricature |

3 top Dogs of the Dow in 2020 |

Successful trading is a key to high profit. In order to apply this rule, experts recommend taking a closer look at high yield stocks underrated by investors. Analysts have made a list of the top 3 companies capable of surprising the market in 2020 for those market participants who are ready to place a bet on such shares.

There are some dark horses in the exchange market that investors have left behind. They are called the Dogs of the Dow. These are shares of 10 companies with the highest income. However, there is a chance they will be ahead of the market and make notable profit. The term was introduced by John Slatter from Wall Street. The list of the Dogs of the Dow includes companies from Dow Jones Industrial Average. High share dividend yield of such corporations indicates that they are undervalued in the market. Experts pay attention to three potential financial favourites of 2020.

Dow Inc.

Next year will be a time of great opportunity for Dow Inc., a giant in the production of plastics and organosilicon polymers. Analysts expect high yield on company’s shares. The chemical producer is ready to pay huge dividends to its shareholders. Dow Inc. intends to give 65% of its profit to payments. Nowadays, the company pays $0.7 dividends per share. Its annual yield is around 5.27%. According to analysts, shares of Dow Inc. have increased by 7% since the beginning of 2019.

Exxon Mobil

The second Dog of the Dow in 2020 can become Exxon Mobil Corp., an American energy giant. The company’s shares grew by only 1% in 2019. The corporation dominates in various directions, from well drilling to shale gas production in the US. Exxon Mobil has great potential. The international oil and gas manufacturer invests billions of dollars into its development compared to the majority of large producers. Exxon Mobil executives pay $0.87 dividends per share. The company’s yield reaches 5%.

International Business Machines

International Business Machines, a technology company, is considered to be the third candidate in this list. Currently, the tech giant has faced challenges. However, it is successfully overcoming difficulties on its way. Moreover, IBM executives prefer stability over dominance in the digital economy. In 2019, shares of IBM were 38% below the record high of 2013. The company's quarterly payments are $1.62 per share and the yield is around 4.8%.

|

Метки: #photo_news |

Russia reports surprise Q3 GDP growth |

International market watchers have mixed viewpoints on Russia’s economy. Some of them do not share an optimistic outlook. Nevertheless, experts of Fitch Ratings believe in positive prospects of Russia’s economy.

The reputable rating agency upgraded the outlook on the back of positive trends in a variety of metrics. The crucial argument was a strong GDP rate for Q3. The domestic economy expanded 1.7% in annual terms beyond expectations.

Another convincing factor was an increase in retail sales. Besides, Fitch experts noted that both the manufacturing and construction sectors had gained momentum. The rating agency thinks that both sectors can rely on extra subsidies from the government in the final quarter of 2019.

At the same time, analysts downgraded the forecast of inflation for Q4 2019 and the next year. They project consumer inflation to rise to 3,5% and 3.8% respectively. Fitch Ratings reckons that inflation in Russia will remain at around the target level of 4% in 2021.

Read more: https://www.mt5.com/forex_humor/image/44937

|

Метки: #forex_caricature |

Russia reports surprise Q3 GDP growth |

International market watchers have mixed viewpoints on Russia’s economy. Some of them do not share an optimistic outlook. Nevertheless, experts of Fitch Ratings believe in positive prospects of Russia’s economy.

The reputable rating agency upgraded the outlook on the back of positive trends in a variety of metrics. The crucial argument was a strong GDP rate for Q3. The domestic economy expanded 1.7% in annual terms beyond expectations.

Another convincing factor was an increase in retail sales. Besides, Fitch experts noted that both the manufacturing and construction sectors had gained momentum. The rating agency thinks that both sectors can rely on extra subsidies from the government in the final quarter of 2019.

At the same time, analysts downgraded the forecast of inflation for Q4 2019 and the next year. They project consumer inflation to rise to 3,5% and 3.8% respectively. Fitch Ratings reckons that inflation in Russia will remain at around the target level of 4% in 2021.

Read more: https://www.mt5.com/forex_humor/image/44937

|

Метки: #forex_caricature |

8 most suitable countries for unicorn startups |

Nowadays, people create more and more new ways of doing business. The most popular one is called a startup. Such companies play a key role in the modern market as they generate fresh and unique ideas. Each startup brings something new to the market. Startups worth more than $1 billion receive the status of "unicorns". There are currently 494 unicorns in the world with a combined capitalization of $1.67 trillion. See 8 countries where most of such companies are located in our photo gallery

China

China has 206 unicorn startups which are more than in any other country. China is considered the world's largest producer of most of the industrial products. Unicorn startups thrive in China mostly due to free economic zones. Overall, there are four free economic zones in China: Shenzhen, Zhuhai, Shantou, and Xiamen. Additionally, there are also 14 duty-free trade territories, 53 high-tech territorial entities, including the analog of "Silicon Valley", and 38 export processing zones.

US

The United States is also a place with favorable conditions for unicorn startups. There are 203 of such companies in the US which is the world's first economy in terms of nominal GDP. Rich Americans own about 40% of the world's wealth. The country is a leader in key socio-economic indicators such as average wages, human development index (HDI), GDP per capita, and labor productivity. The service sector, the economy of knowledge, and high competitiveness are the main features of the US economy.

India

India is ranked third among countries with a greater number of unicorn startups. At the moment, there are 21 of them in India. The country is far behind the leaders in this field, e.g. the United States and China, but ahead of many other countries. Over the past 20 years, the Indian economy has been booming, but its development was rather uneven: rural and urban areas recorded different rates of growth. India is now considered an outsourcing territory for a number of multinational corporations and a popular destination for medical tourism. The country is also an exporter of software, financial, and technology services.

UK

Britain has 13 unicorn startups that harmoniously blend in with the local economy. The UK has a partially regulated market economy. The services sector is a key sector of its economy which accounts for about 75% of GDP. London is recognized as one of the three leading centers of the world economy on a par with New York.

Germany

Germany is also home to many unicorn startups. There are 7 such companies in the country. Germany is considered a world leader in a number of industrial and technological sectors. The country has a very high standard of living. The German economy has a well-developed infrastructure and a highly-skilled workforce. The government supports and implements the idea of an open market. In the past 10 years, Germany has significantly increased its value in the world market.

Israel

Israel has the same number of unicorn startups as Germany. Israel's economy is technologically advanced but largely state-controlled. Experts consider Israel a leader in economic and industrial development among the countries of South-West Asia. There are many high-tech centers in the country, including IBM, Microsoft, Oracle, Dell, Google, Cisco Systems, and Motorola. Israel takes interest in advanced technologies in software and natural sciences.

South Korea

This Asian country has 6 unicorn startups. Experts assume that their number will grow in the future. South Korea is an economically developed country with a high level of per capita income. The production of consumer goods such as electronics, textiles, and cars are the backbone of the South Korean economy. Heavy industry branches such as shipbuilding and steel production are also well-developed in the country. South Korea is one of the main exporters of these products.

France

This economically developed European country is home for 4 unicorn startups. According to analysts, the number of startups in France will increase. France is one of the leaders in the world in terms of industrial production. Economists think that the French economy is gaining steam. In addition, being a country with a strong economy, France has a great influence on the international arena.

|

Метки: #photo_news |

8 most suitable countries for unicorn startups |

Nowadays, people create more and more new ways of doing business. The most popular one is called a startup. Such companies play a key role in the modern market as they generate fresh and unique ideas. Each startup brings something new to the market. Startups worth more than $1 billion receive the status of "unicorns". There are currently 494 unicorns in the world with a combined capitalization of $1.67 trillion. See 8 countries where most of such companies are located in our photo gallery

China

China has 206 unicorn startups which are more than in any other country. China is considered the world's largest producer of most of the industrial products. Unicorn startups thrive in China mostly due to free economic zones. Overall, there are four free economic zones in China: Shenzhen, Zhuhai, Shantou, and Xiamen. Additionally, there are also 14 duty-free trade territories, 53 high-tech territorial entities, including the analog of "Silicon Valley", and 38 export processing zones.

US

The United States is also a place with favorable conditions for unicorn startups. There are 203 of such companies in the US which is the world's first economy in terms of nominal GDP. Rich Americans own about 40% of the world's wealth. The country is a leader in key socio-economic indicators such as average wages, human development index (HDI), GDP per capita, and labor productivity. The service sector, the economy of knowledge, and high competitiveness are the main features of the US economy.

India

India is ranked third among countries with a greater number of unicorn startups. At the moment, there are 21 of them in India. The country is far behind the leaders in this field, e.g. the United States and China, but ahead of many other countries. Over the past 20 years, the Indian economy has been booming, but its development was rather uneven: rural and urban areas recorded different rates of growth. India is now considered an outsourcing territory for a number of multinational corporations and a popular destination for medical tourism. The country is also an exporter of software, financial, and technology services.

UK

Britain has 13 unicorn startups that harmoniously blend in with the local economy. The UK has a partially regulated market economy. The services sector is a key sector of its economy which accounts for about 75% of GDP. London is recognized as one of the three leading centers of the world economy on a par with New York.

Germany

Germany is also home to many unicorn startups. There are 7 such companies in the country. Germany is considered a world leader in a number of industrial and technological sectors. The country has a very high standard of living. The German economy has a well-developed infrastructure and a highly-skilled workforce. The government supports and implements the idea of an open market. In the past 10 years, Germany has significantly increased its value in the world market.

Israel

Israel has the same number of unicorn startups as Germany. Israel's economy is technologically advanced but largely state-controlled. Experts consider Israel a leader in economic and industrial development among the countries of South-West Asia. There are many high-tech centers in the country, including IBM, Microsoft, Oracle, Dell, Google, Cisco Systems, and Motorola. Israel takes interest in advanced technologies in software and natural sciences.

South Korea

This Asian country has 6 unicorn startups. Experts assume that their number will grow in the future. South Korea is an economically developed country with a high level of per capita income. The production of consumer goods such as electronics, textiles, and cars are the backbone of the South Korean economy. Heavy industry branches such as shipbuilding and steel production are also well-developed in the country. South Korea is one of the main exporters of these products.

France

This economically developed European country is home for 4 unicorn startups. According to analysts, the number of startups in France will increase. France is one of the leaders in the world in terms of industrial production. Economists think that the French economy is gaining steam. In addition, being a country with a strong economy, France has a great influence on the international arena.

|

Метки: #photo_news |

US small business index jumps in November |

Recently, the United States has been showing great economic performance even despite concerns of a recession. Thus, the Small Business Optimism Index in the US showed the record increase in November reaching its highest level since May 2018. According to the National Federation of Independent Business (NFIB), small business optimism had a November reading of 104.7. Overall, 7 out of 10 index components advanced last month. NFIB reports that business owners are actively investing in equipment, hiring new employees, and regularly raising wages. A spike in the optimism index results from steadily rising profit. A growing number of small businesses have reported an increase in profit and in turnover. At the same time, concerns over recession among owners are waning what creates general optimistic forecasts and positive business sentiment. “Owners are aggressively moving forward with their business plans, proving that when they’re given relief from the government, they put their money where their mouth is, and they invest, hire, and increase wages,“ said NFIB Chief Economist William Dunkelberg referring to tax relief and stimulating regulation. Saved funds are used for extending business and raising compensations.

Read more: https://www.mt5.com/forex_humor/image/44896

|

Метки: #forex_caricature |

Famous insider trading cases |

Insider trading in the US has been a part of the market since 18 century. As a result, numerous traders and bankers got rich. However, similar incidents occasionally lead to scandals.

Read about famous insider trading cases in our photo gallery

The Wall Street Journal/R. Foster Winans

R. Foster Winans had been a columnist for The Wall Street Journal for three years. He was convicted of insider trading and mail fraud.

In 1985, he was accused of giving information to two stockbrokers about stocks he was planning to write about in his column. Traders used this information and earned about $690 thousand. Winans’ cut was $31 thousand.

As a result, Winans was sentenced to 18 months in prison. Other conspirators were also convicted.

ENRON/JEFFREY SKILLING

Jeffrey Skilling, the former Enron president, became the most famous business criminal who managed to serve his sentence and get out of jail.

Skilling was indicted on 35 cases of fraud, insider trading, and other crimes related to the Enron scandal.

Skilling pleaded not guilty of all charges. However, prosecution managed to bring Skilling to justice when he sold almost $60 million of Enron's shares after quitting the company.

Prosecutors said that Jeffrey knew about the company's imminent insolvency and used this against all laws on foreign exchange operations.

As a result, Skilling was sentenced to 292 months in prison.

IVAN BOESKY

Ivan Boesky, a son of a Russian immigrant, became one of the wealthiest people in the US thanks to insider information. However, shocking trading scandal that occurred in 1986 completely ruined his reputation.

Boesky’s company was engaged in insider trading. Using both public and insider information, Boesky found corporate takeovers and bought their shares shortly before the release of public information. Then, he sold the shares a few days before corporations announced a takeover.

Boesky’s success attracted attention of the US Securities and Exchange Commission. In 1986, the prosecution revealed that Boesky was passing insider information to Dennis B. Levine, a managing director of Drexel Burnham Lambert, who was taken into custody in May. Boesky had been under surveillance since that day.

In 1986, federal investigators offered Boesky a secret agreement instead of a longtime prison term. According to the agreement, Boesky was forbidden from security trading for life. Moreover, he had to uncover other traders who used takeover information for illegal purposes.

As a result, Boesky met dozens of his former partners in crime with a listening device attached to him. In the aftermath, 14 traders were arrested.

Business Week

In 1990, printing company worker William Jackson and stockbroker Brian Callahan were convicted of using stock information in Business Week magazine before it was distributed to the public.

According to the Court, Jackson and Callahan made over $19 thousand each. As a result, they had to pay $37,445.

GALLEON GROUP/RAJ RAJARATNAM

The District Court of New York convicted former billionaire and the head of the hedge fund firm Galleon Group of insider trading.

Once a successful billionaire and the hedge fund manager of the Galleon Group, Raj Rajaratnam, was found guilty of conspiracy and securities fraud by the District Court of New York.

According to the Court, the billionaire had been using insider information he received from executives, bankers, traders, and directors of such companies as Goldman Sachs, Intel, and Hilton Hotels for seven years.

As a result, Rajaratnam made some $45 million. On May 11, 2011, he was sentenced to 11 years in prison.

KEEFE, BRUYETTE & WOODS/MCDERMOTT JR.

James McDermott Jr., CEO of investment bank Keefe, Bruyette & Woods, was convinced of insider trading in 2000.

He gave the information about pending bank merger to his mistress Marilyn Star, an adult-movie actress.

McDermott Jr. was sentenced to 8 months in prison. His mistress received a 3-months term. Moreover, McDermott Jr. was ordered to pay a fine of $25 thousand.

ImClone

Former ImClone CEO Samuel Waksal was sentenced to 87 months in prison and paid $3 million after he was found guilty of insider trading and fraud.

ImClone developed a new type of cancer drug, Erbitux. However, regulators rejected the application. Despite this fact, Samuel Waksal sold the company’s stock. Later, the drug was approved.

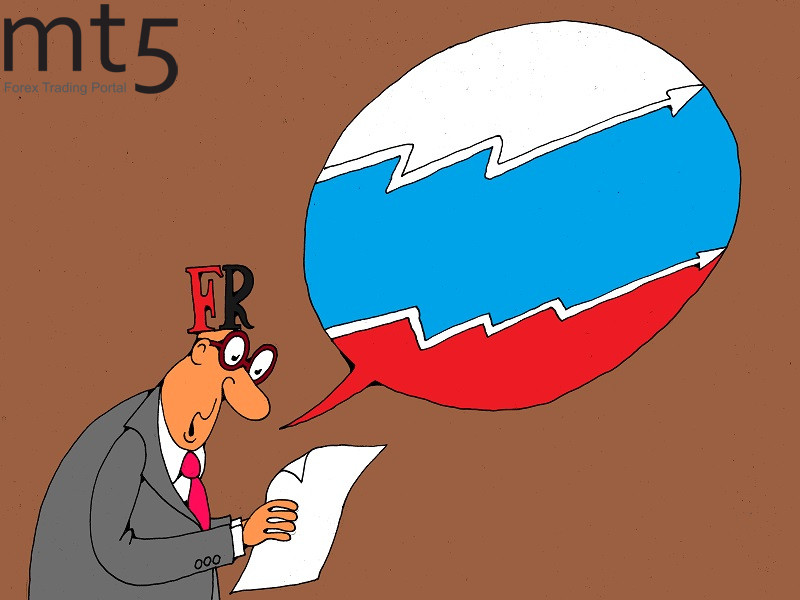

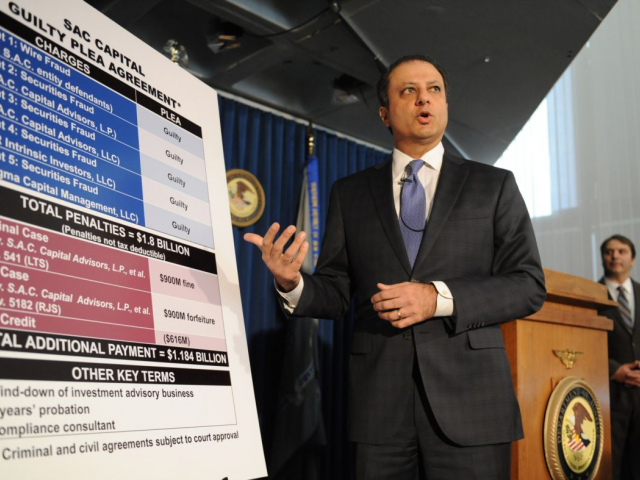

SAC GROUP/STEVEN A. COHEN

Steven Cohen is the founder of SAC Capital Partners. He became known for his phenomenal ability to make money regardless of market conditions. BusinessWeek called Cohen the most influential trader on Wall Street.

Cohen had been closely watched by the US Attorney Office and regulatory authorities for a couple of years. The investigation of the SAC Capital case became one of the major and long-term processes in the history of Wall Street. The first suspicions among regulators and prosecutors arose more than ten years ago.

However, the SEC was the only government department that dared to publicly accuse Steven Cohen. The company was accused of encouraging its employees to insider trading since 1999 and ignoring signs of illegitimacy of such practice. Several cases of fraud and insider trading were uncovered.

According to the SEC, SAC Capital illegally earned more than $275 million on insider trading.

In November 2013, the hedge fund SAC Capital pleaded guilty to securities fraud as part of the insider trading case and agreed to pay a record $1.8 billion. At the same time, New York District Attorney announced that SAC Capital would stop its investment consulting activity.

|

Метки: #photo_news |

SEC approves Bitcoin Strategy Fund |

Controversy about cryptocurrencies makes financial authorities in several countries cautious about any project in this area. Many cryptocurrency funds have tried to obtain approval from the US Securities and Exchange Commission (SEC) for the launch of crypto-related products, but their numerous attempts to get the green light have been stymied. However, there seems to have been a slight shift in this matter.

On Monday, December 9, the SEC approved the launch of the Bitcoin Strategy Fund, whose activity is related to investments in cash-settled Bitcoin futures carried out on regulated cryptocurrency exchanges.

This organization is owned by the New York Digital Investment Group (NYDIG) which manages the fund's assets. The approval entitles the NYDIG Bitcoin Strategy Fund to offer its 2.5 million shares to institutional investors at $10 per share.

Besides, the fund received a BitLicense and a trust charter from the regulator of New York. Now the Bitcoin Strategy Fund can compete with the largest Chicago Mercantile Exchange (CME), which has been the only exchange to offer cash-settled Bitcoin futures contracts in the United States.

As previously reported, until that time, the SEC had rejected a number of applications from other companies offering similar products, including the launch of a Bitcoin ETF from Bitwise. Later, however, the commission members announced their intention to review that application.

Read more: https://www.mt5.com/forex_humor/image/44815

|

Метки: #forex_caricature |

SEC approves Bitcoin Strategy Fund |

Controversy about cryptocurrencies makes financial authorities in several countries cautious about any project in this area. Many cryptocurrency funds have tried to obtain approval from the US Securities and Exchange Commission (SEC) for the launch of crypto-related products, but their numerous attempts to get the green light have been stymied. However, there seems to have been a slight shift in this matter.

On Monday, December 9, the SEC approved the launch of the Bitcoin Strategy Fund, whose activity is related to investments in cash-settled Bitcoin futures carried out on regulated cryptocurrency exchanges.

This organization is owned by the New York Digital Investment Group (NYDIG) which manages the fund's assets. The approval entitles the NYDIG Bitcoin Strategy Fund to offer its 2.5 million shares to institutional investors at $10 per share.

Besides, the fund received a BitLicense and a trust charter from the regulator of New York. Now the Bitcoin Strategy Fund can compete with the largest Chicago Mercantile Exchange (CME), which has been the only exchange to offer cash-settled Bitcoin futures contracts in the United States.

As previously reported, until that time, the SEC had rejected a number of applications from other companies offering similar products, including the launch of a Bitcoin ETF from Bitwise. Later, however, the commission members announced their intention to review that application.

Read more: https://www.mt5.com/forex_humor/image/44815

|

Метки: #forex_caricature |

9 shocking predictions from Saxo Bank for 2020 |

A new year is on its way and thereby it is time to sum up the results of the passing year and make predictions for the year ahead. Saxo Bank experts have made 9 "outrageous" forecasts for the financial market for the year to come. See them in our photo gallery

World economy to see stagflation

Analysts at Saxo Bank believe that the US authorities will have to increase repeatedly the budget deficit to finance new spending of Donald Trump’s administration. They suppose that US inflation will rise sharply due to the implementation of more stimulus measures. If the Fed keeps the interest rate at an extremely low level, the US dollar is likely to devalue around the world.

ECB to hike its key rate

Saxo Bank experts assume that the ECB may reverse the direction of monetary policy, abandoning the idea of ultra-low rates. It is possible that at the beginning of 2020, new ECB President Christine Lagarde will announce that monetary policy has run out of tools. As a result, the long-term negative interest rate can hurt the banking sector in Europe. In order to encourage European countries to move to fiscal stimulus, the regulator will change the stance on the monetary policy and cut its key rate to zero.

Green energy to take back seat

In 2020, green energy may give way to oil and gas companies due to a sharp decline in investment. OPEC countries and Russia, seeing a slowdown in shale oil output growth in the US, will significantly reduce their own oil production. Economists at Saxo Bank think that this tendency will catch market participants off guard and the price of Brent oil will return to $90 per barrel. However, green energy will see a new trend: in 2020, nickel batteries for electric vehicles will gain popularity over cobalt ones. That is why Nickel will be in high demand. It is quite beneficial for Russia as the country has large reserves of Nickel.

Trump to introduce America First Tax

According to Saxo Bank analysts, Donald Trump's protectionist policy may lead to the implementation of the America First Tax. The new tax will restructure the entire US tax system in order to stimulate domestic production. Saxo Bank believes that the White House will roll off all the tariffs and impose a tax of 25% on all gross revenue received by American companies from production abroad.

Sweden to suffer from its migration policy

The tolerance of the Swedish authorities to migrants has been praised among many northern countries. However, in November 2019, Denmark closed the border with Sweden due to the high crime rate in the neighboring country. This has happened the first time since the 1950s. In 2018, migrant criminals carried out 160 terrorist attacks and several murders. According to opinion polls, 25% of the Swedish population is against migrants from southern countries. In 2020, the country may face recession, Saxo Bank surmises.

Democrats to win 2020 election

According to analysts at Saxo Bank, Donald Trump won the election because the majority of his voters were elderly white Americans. However, now their number is decreasing, and people from 20 to 40 years represent the majority. They are the people of liberal views. What is more, the Democrats have the support of millennials and the oldest of “generation Z”. They stand against inequality, injustice, and climate change. President Trump is well-known as a climate change denier, and thus these two big groups are unlikely to give him their votes. Saxo Bank thinks that the Democrats will tighten control of the House of Representatives and take the lead in the Senate.

South Africa to face large default

In 2020, the prospects of South Africa’s economy are rather gloomy. The country's economy depends on the state-owned electric company ESKOM and its massive debt of 9% of GDP. ESKOM’s revenue does not cover operating expenses due to the extremely low solvency of the population. In 2020, the authorities of South Africa will increase investment in the company which will lead to a sharp growth of the budget deficit. The national debt of the country will exceed 50% of GDP. Foreign investors will stop investing, the national currency will rapidly sink, and the country will be on the verge of default.

Hungary to leave EU

Hungary has been a member of the EU since 2004. However, in 2020, things may change. The EU may stop cooperation with the country because of restrictive measures of local authorities, threatening the independence of the press, the court, science, minorities, and human rights activists. The situation is aggravated by the fact that each side has its own view on these issues. As a result, financial assistance from the European Union will be reduced to zero. The Hungarian currency will fall sharply to 375 forints per 1 euro. Now, 1 euro costs 330 forints.

Asia to introduce new reserve currency

Next year, the Asian Infrastructure Investment Bank (AIIB) may launch a new reserve currency to shift away from the US dollar. Asian countries may agree to transfer all regional financial operations to the new currency. If the country succeeds in its endeavor, the greenback will weaken by 20%. In 2020, the US dollar may also dip by 30% against gold. As a result, the price of the precious metal will rise to $2,000 per 1 ounce.

|

Метки: #photo_news |

9 shocking predictions from Saxo Bank for 2020 |

A new year is on its way and thereby it is time to sum up the results of the passing year and make predictions for the year ahead. Saxo Bank experts have made 9 "outrageous" forecasts for the financial market for the year to come. See them in our photo gallery

World economy to see stagflation

Analysts at Saxo Bank believe that the US authorities will have to increase repeatedly the budget deficit to finance new spending of Donald Trump’s administration. They suppose that US inflation will rise sharply due to the implementation of more stimulus measures. If the Fed keeps the interest rate at an extremely low level, the US dollar is likely to devalue around the world.

ECB to hike its key rate

Saxo Bank experts assume that the ECB may reverse the direction of monetary policy, abandoning the idea of ultra-low rates. It is possible that at the beginning of 2020, new ECB President Christine Lagarde will announce that monetary policy has run out of tools. As a result, the long-term negative interest rate can hurt the banking sector in Europe. In order to encourage European countries to move to fiscal stimulus, the regulator will change the stance on the monetary policy and cut its key rate to zero.

Green energy to take back seat

In 2020, green energy may give way to oil and gas companies due to a sharp decline in investment. OPEC countries and Russia, seeing a slowdown in shale oil output growth in the US, will significantly reduce their own oil production. Economists at Saxo Bank think that this tendency will catch market participants off guard and the price of Brent oil will return to $90 per barrel. However, green energy will see a new trend: in 2020, nickel batteries for electric vehicles will gain popularity over cobalt ones. That is why Nickel will be in high demand. It is quite beneficial for Russia as the country has large reserves of Nickel.

Trump to introduce America First Tax

According to Saxo Bank analysts, Donald Trump's protectionist policy may lead to the implementation of the America First Tax. The new tax will restructure the entire US tax system in order to stimulate domestic production. Saxo Bank believes that the White House will roll off all the tariffs and impose a tax of 25% on all gross revenue received by American companies from production abroad.

Sweden to suffer from its migration policy

The tolerance of the Swedish authorities to migrants has been praised among many northern countries. However, in November 2019, Denmark closed the border with Sweden due to the high crime rate in the neighboring country. This has happened the first time since the 1950s. In 2018, migrant criminals carried out 160 terrorist attacks and several murders. According to opinion polls, 25% of the Swedish population is against migrants from southern countries. In 2020, the country may face recession, Saxo Bank surmises.

Democrats to win 2020 election

According to analysts at Saxo Bank, Donald Trump won the election because the majority of his voters were elderly white Americans. However, now their number is decreasing, and people from 20 to 40 years represent the majority. They are the people of liberal views. What is more, the Democrats have the support of millennials and the oldest of “generation Z”. They stand against inequality, injustice, and climate change. President Trump is well-known as a climate change denier, and thus these two big groups are unlikely to give him their votes. Saxo Bank thinks that the Democrats will tighten control of the House of Representatives and take the lead in the Senate.

South Africa to face large default

In 2020, the prospects of South Africa’s economy are rather gloomy. The country's economy depends on the state-owned electric company ESKOM and its massive debt of 9% of GDP. ESKOM’s revenue does not cover operating expenses due to the extremely low solvency of the population. In 2020, the authorities of South Africa will increase investment in the company which will lead to a sharp growth of the budget deficit. The national debt of the country will exceed 50% of GDP. Foreign investors will stop investing, the national currency will rapidly sink, and the country will be on the verge of default.

Hungary to leave EU

Hungary has been a member of the EU since 2004. However, in 2020, things may change. The EU may stop cooperation with the country because of restrictive measures of local authorities, threatening the independence of the press, the court, science, minorities, and human rights activists. The situation is aggravated by the fact that each side has its own view on these issues. As a result, financial assistance from the European Union will be reduced to zero. The Hungarian currency will fall sharply to 375 forints per 1 euro. Now, 1 euro costs 330 forints.

Asia to introduce new reserve currency

Next year, the Asian Infrastructure Investment Bank (AIIB) may launch a new reserve currency to shift away from the US dollar. Asian countries may agree to transfer all regional financial operations to the new currency. If the country succeeds in its endeavor, the greenback will weaken by 20%. In 2020, the US dollar may also dip by 30% against gold. As a result, the price of the precious metal will rise to $2,000 per 1 ounce.

|

Метки: #photo_news |

9 shocking predictions from Saxo Bank for 2020 |

A new year is on its way and thereby it is time to sum up the results of the passing year and make predictions for the year ahead. Saxo Bank experts have made 9 "outrageous" forecasts for the financial market for the year to come. See them in our photo gallery

World economy to see stagflation

Analysts at Saxo Bank believe that the US authorities will have to increase repeatedly the budget deficit to finance new spending of Donald Trump’s administration. They suppose that US inflation will rise sharply due to the implementation of more stimulus measures. If the Fed keeps the interest rate at an extremely low level, the US dollar is likely to devalue around the world.

ECB to hike its key rate

Saxo Bank experts assume that the ECB may reverse the direction of monetary policy, abandoning the idea of ultra-low rates. It is possible that at the beginning of 2020, new ECB President Christine Lagarde will announce that monetary policy has run out of tools. As a result, the long-term negative interest rate can hurt the banking sector in Europe. In order to encourage European countries to move to fiscal stimulus, the regulator will change the stance on the monetary policy and cut its key rate to zero.

Green energy to take back seat

In 2020, green energy may give way to oil and gas companies due to a sharp decline in investment. OPEC countries and Russia, seeing a slowdown in shale oil output growth in the US, will significantly reduce their own oil production. Economists at Saxo Bank think that this tendency will catch market participants off guard and the price of Brent oil will return to $90 per barrel. However, green energy will see a new trend: in 2020, nickel batteries for electric vehicles will gain popularity over cobalt ones. That is why Nickel will be in high demand. It is quite beneficial for Russia as the country has large reserves of Nickel.

Trump to introduce America First Tax

According to Saxo Bank analysts, Donald Trump's protectionist policy may lead to the implementation of the America First Tax. The new tax will restructure the entire US tax system in order to stimulate domestic production. Saxo Bank believes that the White House will roll off all the tariffs and impose a tax of 25% on all gross revenue received by American companies from production abroad.

Sweden to suffer from its migration policy

The tolerance of the Swedish authorities to migrants has been praised among many northern countries. However, in November 2019, Denmark closed the border with Sweden due to the high crime rate in the neighboring country. This has happened the first time since the 1950s. In 2018, migrant criminals carried out 160 terrorist attacks and several murders. According to opinion polls, 25% of the Swedish population is against migrants from southern countries. In 2020, the country may face recession, Saxo Bank surmises.

Democrats to win 2020 election

According to analysts at Saxo Bank, Donald Trump won the election because the majority of his voters were elderly white Americans. However, now their number is decreasing, and people from 20 to 40 years represent the majority. They are the people of liberal views. What is more, the Democrats have the support of millennials and the oldest of “generation Z”. They stand against inequality, injustice, and climate change. President Trump is well-known as a climate change denier, and thus these two big groups are unlikely to give him their votes. Saxo Bank thinks that the Democrats will tighten control of the House of Representatives and take the lead in the Senate.

South Africa to face large default

In 2020, the prospects of South Africa’s economy are rather gloomy. The country's economy depends on the state-owned electric company ESKOM and its massive debt of 9% of GDP. ESKOM’s revenue does not cover operating expenses due to the extremely low solvency of the population. In 2020, the authorities of South Africa will increase investment in the company which will lead to a sharp growth of the budget deficit. The national debt of the country will exceed 50% of GDP. Foreign investors will stop investing, the national currency will rapidly sink, and the country will be on the verge of default.

Hungary to leave EU

Hungary has been a member of the EU since 2004. However, in 2020, things may change. The EU may stop cooperation with the country because of restrictive measures of local authorities, threatening the independence of the press, the court, science, minorities, and human rights activists. The situation is aggravated by the fact that each side has its own view on these issues. As a result, financial assistance from the European Union will be reduced to zero. The Hungarian currency will fall sharply to 375 forints per 1 euro. Now, 1 euro costs 330 forints.

Asia to introduce new reserve currency

Next year, the Asian Infrastructure Investment Bank (AIIB) may launch a new reserve currency to shift away from the US dollar. Asian countries may agree to transfer all regional financial operations to the new currency. If the country succeeds in its endeavor, the greenback will weaken by 20%. In 2020, the US dollar may also dip by 30% against gold. As a result, the price of the precious metal will rise to $2,000 per 1 ounce.

|

Метки: #photo_news |

US-China trade talks come to halt over farm purchases |

The US seems to keep its stance regarding the trade deal with China. Another round of tariff hike is likely to take place as was planned before. Recent attempts to reach an agreement were not successful and left no hopes for an early resolution of the trade conflict. China still does not agree with the terms put forward by the US. Washington expects Beijing to buy $50 billion of American farm goods a year in return to its agreement to roll back the existing tariffs. Currently, the volume of the purchases in the agricultural sector does not exceed $10 billion. Even before the trade war, the farm purchases were not more than $20 billion, so these demands can easily be called overstated. China strongly resists the pressure and does not rush to sign the deal. So, the early resolution of the trade conflict seems to be impossible. The Chinese authorities hope that the White House will once again postpone the imposition of the tariffs. Meanwhile, Donald Trump stays quite optimistic about the progress of the trade deal. “Well, we’ll have to see. But right now we’re moving along. We’re not discussing that, but we are having very major discussions on December 15. We are having very good discussions with China,” the American president noted.

Read more: https://www.mt5.com/forex_humor/image/44792

|

Метки: #forex_caricature |

Famous insider trading cases |

Insider trading in the US has been a part of the market since 18 century. As a result, numerous traders and bankers got rich. However, similar incidents occasionally lead to scandals.

Read about famous insider trading cases in our photo gallery

The Wall Street Journal/R. Foster Winans

R. Foster Winans had been a columnist for The Wall Street Journal for three years. He was convicted of insider trading and mail fraud.

In 1985, he was accused of giving information to two stockbrokers about stocks he was planning to write about in his column. Traders used this information and earned about $690 thousand. Winans’ cut was $31 thousand.

As a result, Winans was sentenced to 18 months in prison. Other conspirators were also convicted.

ENRON/JEFFREY SKILLING

Jeffrey Skilling, the former Enron president, became the most famous business criminal who managed to serve his sentence and get out of jail.

Skilling was indicted on 35 cases of fraud, insider trading, and other crimes related to the Enron scandal.

Skilling pleaded not guilty of all charges. However, prosecution managed to bring Skilling to justice when he sold almost $60 million of Enron's shares after quitting the company.

Prosecutors said that Jeffrey knew about the company's imminent insolvency and used this against all laws on foreign exchange operations.

As a result, Skilling was sentenced to 292 months in prison.

IVAN BOESKY

Ivan Boesky, a son of a Russian immigrant, became one of the wealthiest people in the US thanks to insider information. However, shocking trading scandal that occurred in 1986 completely ruined his reputation.

Boesky’s company was engaged in insider trading. Using both public and insider information, Boesky found corporate takeovers and bought their shares shortly before the release of public information. Then, he sold the shares a few days before corporations announced a takeover.

Boesky’s success attracted attention of the US Securities and Exchange Commission. In 1986, the prosecution revealed that Boesky was passing insider information to Dennis B. Levine, a managing director of Drexel Burnham Lambert, who was taken into custody in May. Boesky had been under surveillance since that day.

In 1986, federal investigators offered Boesky a secret agreement instead of a longtime prison term. According to the agreement, Boesky was forbidden from security trading for life. Moreover, he had to uncover other traders who used takeover information for illegal purposes.

As a result, Boesky met dozens of his former partners in crime with a listening device attached to him. In the aftermath, 14 traders were arrested.

Business Week

In 1990, printing company worker William Jackson and stockbroker Brian Callahan were convicted of using stock information in Business Week magazine before it was distributed to the public.

According to the Court, Jackson and Callahan made over $19 thousand each. As a result, they had to pay $37,445.

GALLEON GROUP/RAJ RAJARATNAM

The District Court of New York convicted former billionaire and the head of the hedge fund firm Galleon Group of insider trading.

Once a successful billionaire and the hedge fund manager of the Galleon Group, Raj Rajaratnam, was found guilty of conspiracy and securities fraud by the District Court of New York.

According to the Court, the billionaire had been using insider information he received from executives, bankers, traders, and directors of such companies as Goldman Sachs, Intel, and Hilton Hotels for seven years.

As a result, Rajaratnam made some $45 million. On May 11, 2011, he was sentenced to 11 years in prison.

KEEFE, BRUYETTE & WOODS/MCDERMOTT JR.

James McDermott Jr., CEO of investment bank Keefe, Bruyette & Woods, was convinced of insider trading in 2000.

He gave the information about pending bank merger to his mistress Marilyn Star, an adult-movie actress.

McDermott Jr. was sentenced to 8 months in prison. His mistress received a 3-months term. Moreover, McDermott Jr. was ordered to pay a fine of $25 thousand.

ImClone

Former ImClone CEO Samuel Waksal was sentenced to 87 months in prison and paid $3 million after he was found guilty of insider trading and fraud.

ImClone developed a new type of cancer drug, Erbitux. However, regulators rejected the application. Despite this fact, Samuel Waksal sold the company’s stock. Later, the drug was approved.

SAC GROUP/STEVEN A. COHEN

Steven Cohen is the founder of SAC Capital Partners. He became known for his phenomenal ability to make money regardless of market conditions. BusinessWeek called Cohen the most influential trader on Wall Street.

Cohen had been closely watched by the US Attorney Office and regulatory authorities for a couple of years. The investigation of the SAC Capital case became one of the major and long-term processes in the history of Wall Street. The first suspicions among regulators and prosecutors arose more than ten years ago.

However, the SEC was the only government department that dared to publicly accuse Steven Cohen. The company was accused of encouraging its employees to insider trading since 1999 and ignoring signs of illegitimacy of such practice. Several cases of fraud and insider trading were uncovered.

According to the SEC, SAC Capital illegally earned more than $275 million on insider trading.

In November 2013, the hedge fund SAC Capital pleaded guilty to securities fraud as part of the insider trading case and agreed to pay a record $1.8 billion. At the same time, New York District Attorney announced that SAC Capital would stop its investment consulting activity.

|

Метки: #photo_news |

China’s president urges acceleration of blockchain development |

China is striving to be a leader in all spheres including the blockchain technology. When describing China’s achievements, the word “second” is used quite often. However, in many respects, China has outperformed its competitors. For instance, the country’s authorities realize the importance of technological progress and are now paying special attention to this sector. This time, the main priority is given to blockchain technology - the basis for the cryptocurrency functioning. Recently, head of the state Xi Jinping has appealed for greater urgency in the development of blockchain technology. “We must perceive the blockchain as an important breakthrough and the core for innovation. We should clarify the main direction of development, increase investments and focus on key technologies as well as accelerate the development of blockchain and industrial innovation,” the president noted. It seems, though, that officials miss the key point of the blockchain. Chen Jing, a researcher with the Beijing-based Fengyun Institute of Science, Technology and Strategy, said that blockchain was a complicated concept to understand, but specialists were trying to help officials see its benefits. Generally, China is launching a large-scale program to eliminate blockchain illiteracy in the society. At the same time, this unique technology can be used by the Chinese government to strengthen its control over the population.

Read more: https://www.mt5.com/forex_humor/image/44729

|

Метки: #forex_caricature |

China’s president urges acceleration of blockchain development |

China is striving to be a leader in all spheres including the blockchain technology. When describing China’s achievements, the word “second” is used quite often. However, in many respects, China has outperformed its competitors. For instance, the country’s authorities realize the importance of technological progress and are now paying special attention to this sector. This time, the main priority is given to blockchain technology - the basis for the cryptocurrency functioning. Recently, head of the state Xi Jinping has appealed for greater urgency in the development of blockchain technology. “We must perceive the blockchain as an important breakthrough and the core for innovation. We should clarify the main direction of development, increase investments and focus on key technologies as well as accelerate the development of blockchain and industrial innovation,” the president noted. It seems, though, that officials miss the key point of the blockchain. Chen Jing, a researcher with the Beijing-based Fengyun Institute of Science, Technology and Strategy, said that blockchain was a complicated concept to understand, but specialists were trying to help officials see its benefits. Generally, China is launching a large-scale program to eliminate blockchain illiteracy in the society. At the same time, this unique technology can be used by the Chinese government to strengthen its control over the population.

Read more: https://www.mt5.com/forex_humor/image/44729

|

Метки: #forex_caricature |

China’s president urges acceleration of blockchain development |

China is striving to be a leader in all spheres including the blockchain technology. When describing China’s achievements, the word “second” is used quite often. However, in many respects, China has outperformed its competitors. For instance, the country’s authorities realize the importance of technological progress and are now paying special attention to this sector. This time, the main priority is given to blockchain technology - the basis for the cryptocurrency functioning. Recently, head of the state Xi Jinping has appealed for greater urgency in the development of blockchain technology. “We must perceive the blockchain as an important breakthrough and the core for innovation. We should clarify the main direction of development, increase investments and focus on key technologies as well as accelerate the development of blockchain and industrial innovation,” the president noted. It seems, though, that officials miss the key point of the blockchain. Chen Jing, a researcher with the Beijing-based Fengyun Institute of Science, Technology and Strategy, said that blockchain was a complicated concept to understand, but specialists were trying to help officials see its benefits. Generally, China is launching a large-scale program to eliminate blockchain illiteracy in the society. At the same time, this unique technology can be used by the Chinese government to strengthen its control over the population.

Read more: https://www.mt5.com/forex_humor/image/44729

|

Метки: #forex_caricature |

China’s president urges acceleration of blockchain development |

China is striving to be a leader in all spheres including the blockchain technology. When describing China’s achievements, the word “second” is used quite often. However, in many respects, China has outperformed its competitors. For instance, the country’s authorities realize the importance of technological progress and are now paying special attention to this sector. This time, the main priority is given to blockchain technology - the basis for the cryptocurrency functioning. Recently, head of the state Xi Jinping has appealed for greater urgency in the development of blockchain technology. “We must perceive the blockchain as an important breakthrough and the core for innovation. We should clarify the main direction of development, increase investments and focus on key technologies as well as accelerate the development of blockchain and industrial innovation,” the president noted. It seems, though, that officials miss the key point of the blockchain. Chen Jing, a researcher with the Beijing-based Fengyun Institute of Science, Technology and Strategy, said that blockchain was a complicated concept to understand, but specialists were trying to help officials see its benefits. Generally, China is launching a large-scale program to eliminate blockchain illiteracy in the society. At the same time, this unique technology can be used by the Chinese government to strengthen its control over the population.

Read more: https://www.mt5.com/forex_humor/image/44729

|

Метки: #forex_caricature |