Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Trump resumes attacks on Fed |

Market participants have finally calmed down hoping that decision on low interest rates will remain unchanged. Meanwhile, US President Donald Trump seems to be unhappy with the current rates and keeps insisting on deeper rate cuts. Presumably, this issue was again discussed during his recent meeting with Fed Chairman Jerome Powell. According to Trump’s Twitter, the meeting was “cordial” and its outcomes were “good.” However, Powell announced that the regulator’s position would remain unchanged and would be based on “careful and balanced analysis of the situation in the economy and financial markets and should not be influenced by political considerations.” At the same time, the head of the Federal Reserve agreed that the period of tightening monetary policy was stopped on time because the regulator was acting on the circumstances rather than on someone’s demand. So, if Trump still hopes to weaken the US dollar, he will need to seek support of the US Department of Treasury. In any case, this meeting was a landmark event. Notably, both Jerome Powell and Donald Trump have been at odds over the monetary policy, and their last meeting took place back in February 2019.

Read more: https://www.mt5.com/forex_humor/image/44442

|

Метки: #forex_caricature |

5 countries where solar energy used the most |

Across the globe, more and more countries give their preference to solar energy. Besides, there are a lot of developments in this field, especially in the countries that actively use this renewable source of energy. They come up with new ideas about how it can be enhanced. Such countries set an example for others by offering their experience to less innovative ones.

Nowadays, renewable sources of energy are taking the lead among other sources of energy as they can ensure a more stable and reliable supply of energy. The use of solar energy in manufacturing is increasing. Some countries have long used it and become the leaders in this area. See these countries in our photo gallery

Germany

Germany is one of the first countries to develop and implement solar energy technologies. The long-term transition to clean energy has made the German economy one of the largest in the world. Besides, Germany is hugely dependable on renewable energy as it helps its economy to expand at a faster pace. Notably, the German government plans to use only solar and other renewable sources of energy in the nearest future. As one of the world leaders in promoting solar energy, Germany is strengthening its presence in this industry.

China

China is considered the largest consumer of hydrocarbons in the world. Additionally, since 2015 China is a leader in the manufacturing and purchasing of solar panels. The country has got giant solar farms selling power to utility companies. The solar energy interest is surging in China because the country has a great need for electricity. Chinese authorities provide financial support for projects related to solar energy.

Japan

In Japan, there is a significant number of solar panels. What is more, the country is among the leaders in the production of solar energy. After the Fukushima-1 nuclear accident in 2011, solar energy is becoming dominant in this country. Presently, the use of renewable energy has doubled. Floating power generation stations made from water-resistant panels have been established in the country. They are cooled by water. Experts think that such floating solar farms will be soon become widespread.

Italy

Italy has solar farms as well. However, they produce less energy than the German, Japanese, and Chinese ones. In 2017, they generated 25.2 gigawatts of electricity which is 10% of the total electricity consumed by the country. Yet, many of these farms turned out to be unprofitable and had to be closed. Experts believe that in the nearest future, the generation of solar power by Italian solar farms will decline.

US

The United States is also investing in the development of renewable energy sources. The country is among those who use renewable energy the most. The US government is doing its best to encourage companies to use solar energy. For instance, thanks to the governmental programs for the implementation of solar energy in housing and communal services, the consumption of alternative energy by the utility sector rose by 3.9 gigawatts. In the nearest future, experts predict an increase in the number of solar farms.

|

Метки: #photo_news |

Consumer spending to help US economy grow |

The US economy faces the risk of a recession from time to time. Experts fear that the country’s economy may experience a real downturn next year. Dallas Federal Reserve Bank President Robert Kaplan suggested a possible solution. According to the Fed’s official, the strong consumer may help the US economy overcome potential difficulties. Robert Kaplan also noted that a strong labour market and robust consumer spending can counter the risk of a decrease in business investments, weak manufacturing, and global slowdown.The Dallas Fed president is sure that the American consumers' spending will get the national economy back on track. Kaplan believes that the current situation in the market is quite favourable and therefore, there is no reason to expect a recession in 2020. He also expects the economy to grow by about 2% this year.

Read more: https://www.mt5.com/forex_humor/image/44412

|

Метки: #forex_caricature |

Consumer spending to help US economy grow |

The US economy faces the risk of a recession from time to time. Experts fear that the country’s economy may experience a real downturn next year. Dallas Federal Reserve Bank President Robert Kaplan suggested a possible solution. According to the Fed’s official, the strong consumer may help the US economy overcome potential difficulties. Robert Kaplan also noted that a strong labour market and robust consumer spending can counter the risk of a decrease in business investments, weak manufacturing, and global slowdown.The Dallas Fed president is sure that the American consumers' spending will get the national economy back on track. Kaplan believes that the current situation in the market is quite favourable and therefore, there is no reason to expect a recession in 2020. He also expects the economy to grow by about 2% this year.

Read more: https://www.mt5.com/forex_humor/image/44412

|

Метки: #forex_caricature |

Popular places among Russians to celebrate New Year |

New Year's day is approaching, and Russians start booking tours to celebrate this event. The Federal Agency for Tourism along with the leading booking services and travel aggregators reveal where Russians are going to spend the New Year's holidays. See the most popular domestic and foreign travel destinations in our photo gallery.

Thailand is the most popular foreign travel destination. Online travel agency Sletat.ru says that 16.70% of search queries account for Thailand.

Krasnodar krai is on the first place among popular domestic destinations (47.34% of requests for tours in Russia). Head of the Federal Agency for Tourism Oleg Safonov explains the increased interest of Russians in domestic tourism by a significant improvement in infrastructure and more favorable prices in comparison with overseas travel.

Thailand provides tourists with an all-inclusive package. Travelers have a wide choice: sightseeing and educational tours, Spa treatment, wellness programs, facilities with medical recreation and Spa programs. According to experts’ estimates, this year more than 5.5 million people will go to Thailand to celebrate the New Year.

The third place among domestic travel destinations goes to Moscow and the Moscow region (5.56% of requests).

Turkey closes the top three foreign destinations (7.52% of search queries). In 2014 and 2015, the absolute leader of outbound tourism on New Year's holidays was Egypt (24-26%), whereas Thailand occupied the second place (19-20%).

The Republic of Karelia ranks fourth among domestic holiday destinations (3.23% of requests).

Vietnam is on the fourth place among foreign holiday destinations. According to tour operators, New Year's holidays will cost between 112-160 thousand rubles for two persons. Some people prefer going to Spain as it is the cheapest offer for a week in a four-star hotel. The minimum price starts at 66 540 rubles.

St. Petersburg and Leningrad region close the top 5 popular travel destinations within the country (1.97% of requests). India is on the fifth place among foreign travel destinations.

The sixth place is occupied by the Czech Republic as the most popular foreign holiday destination and by Karachay-Cherkessia as the domestic one.

Tour managers note that the cost of a 5-day holiday in Russia starts at 14,500 rubles per person.

Kaliningrad region takes the seventh place among the most popular domestic holiday destinations. Kaliningrad is in the top 5 flight bookings for the New Year's holiday along with Makhachkala, Mineralnye Vody, Simferopol and Sochi, data from Aviasales service showed. The price of tickets will range from 12-13 thousand rubles round trip.

Curiously enough, in foreign ratings, Russia takes the seventh place among places for New Year’s holidays.

The eighth place among foreign destinations goes to the Dominican Republic. This is one of the most expensive offers where vacationers will have to pay from 173, 340 rubles for a week tour in a four-star hotel for two persons. Another most expensive foreign destination was Austria (the cost starts at 175, 476 rubles).

Vologda Oblast is on the eighth place in the domestic rating. Notably, this is a place where Father Frost's official residence Veliky Ustyug is situated.

The ninth place is occupied by the Stavropol region and China.

On the last place, Sri Lanka and the Republic of Tatarstan are located.

|

Метки: #photo_news |

Popular places among Russians to celebrate New Year |

New Year's day is approaching, and Russians start booking tours to celebrate this event. The Federal Agency for Tourism along with the leading booking services and travel aggregators reveal where Russians are going to spend the New Year's holidays. See the most popular domestic and foreign travel destinations in our photo gallery.

Thailand is the most popular foreign travel destination. Online travel agency Sletat.ru says that 16.70% of search queries account for Thailand.

Krasnodar krai is on the first place among popular domestic destinations (47.34% of requests for tours in Russia). Head of the Federal Agency for Tourism Oleg Safonov explains the increased interest of Russians in domestic tourism by a significant improvement in infrastructure and more favorable prices in comparison with overseas travel.

Thailand provides tourists with an all-inclusive package. Travelers have a wide choice: sightseeing and educational tours, Spa treatment, wellness programs, facilities with medical recreation and Spa programs. According to experts’ estimates, this year more than 5.5 million people will go to Thailand to celebrate the New Year.

The third place among domestic travel destinations goes to Moscow and the Moscow region (5.56% of requests).

Turkey closes the top three foreign destinations (7.52% of search queries). In 2014 and 2015, the absolute leader of outbound tourism on New Year's holidays was Egypt (24-26%), whereas Thailand occupied the second place (19-20%).

The Republic of Karelia ranks fourth among domestic holiday destinations (3.23% of requests).

Vietnam is on the fourth place among foreign holiday destinations. According to tour operators, New Year's holidays will cost between 112-160 thousand rubles for two persons. Some people prefer going to Spain as it is the cheapest offer for a week in a four-star hotel. The minimum price starts at 66 540 rubles.

St. Petersburg and Leningrad region close the top 5 popular travel destinations within the country (1.97% of requests). India is on the fifth place among foreign travel destinations.

The sixth place is occupied by the Czech Republic as the most popular foreign holiday destination and by Karachay-Cherkessia as the domestic one.

Tour managers note that the cost of a 5-day holiday in Russia starts at 14,500 rubles per person.

Kaliningrad region takes the seventh place among the most popular domestic holiday destinations. Kaliningrad is in the top 5 flight bookings for the New Year's holiday along with Makhachkala, Mineralnye Vody, Simferopol and Sochi, data from Aviasales service showed. The price of tickets will range from 12-13 thousand rubles round trip.

Curiously enough, in foreign ratings, Russia takes the seventh place among places for New Year’s holidays.

The eighth place among foreign destinations goes to the Dominican Republic. This is one of the most expensive offers where vacationers will have to pay from 173, 340 rubles for a week tour in a four-star hotel for two persons. Another most expensive foreign destination was Austria (the cost starts at 175, 476 rubles).

Vologda Oblast is on the eighth place in the domestic rating. Notably, this is a place where Father Frost's official residence Veliky Ustyug is situated.

The ninth place is occupied by the Stavropol region and China.

On the last place, Sri Lanka and the Republic of Tatarstan are located.

|

Метки: #photo_news |

Swiss central bank owns record $94 billion in US stocks |

In Europe, there is such a saying: "No money, no Swiss." Switzerland is famous for its banks which have become synonymous with reliability, wealth, and success. The banking sector makes a significant contribution to the success of the country. Therefore, you can safely assume that the local central bank chooses assets for investment very carefully, and it is completely confident in its choice. According to the Swiss central bank, the total holdings of US stocks have reached a record high valued at $94.1 billion. Its investment portfolio is loaded up with the stocks of tech giants. The Swiss National Bank's top holdings are Apple and Microsoft, which shares account for 3.63% and 3.58%, respectively. They are followed by Amazon, Facebook, and Google with shares held of 2.55%, 1.50%, and 1.34%, respectively. The Central Bank of Switzerland has been actively buying up stocks of American companies since global central banks launched their quantitative easing programs. Interestingly, the Swiss Central Bank is thus intentionally or accidentally helping Donald Trump "make America great again". As a result, the Swiss National Bank's actions have partly contributed to the substantial growth of the US equity market indices. At the same time, the local central bank could hardly buy up securities without confidence in the potential for profits.

Read more: https://www.mt5.com/forex_humor/image/44330

|

Метки: #forex_caricature |

4 medical innovations to expect in next 50 years |

Nowadays, medicine is rapidly developing, and specialists are looking for innovative ways to combat various diseases. The past century has seen many unique discoveries in this field: humanity has eradicated smallpox and has mastered organ transplantation.

There is still a long way ahead for the scientists to achieve new medical breakthroughs. The latest technologies in medicine make it possible to save thousands of lives daily. In our photo gallery, read about 4 medical advances to look forward to in the next 50 years.

Saving premature babies

According to statistics, only 10% of infants in the US are born premature. By contrast in Russia, the number of preterm delivery and newborn mortality is much higher. Medical specialists around the world are working on the solution to tackle this problem and improve the sad statistics.

In 2017, scientists from the Children's Hospital of Philadelphia created an artificial womb to support the development of early born lambs. As the research results showed, the fetus located inside the artificial uterus for 4 weeks displayed positive changes. In the future, these technologies can be applied to premature babies.

Reducing the shortage of donor organs

Currently, there is an acute shortage of donor organs all over the world which is also a reason for increased mortality. To solve this problem, scientists are trying to grow human organs within the pig’s embryos. These animals have organs similar to humans in size and shape. Besides, pig’s organs develop faster than the human ones. At the same time, it is very difficult for cells of one species to take root in another species organism.

In 2016, scientists managed to grow human stem cells inside a pig embryo. This achievement became a real breakthrough in medicine.

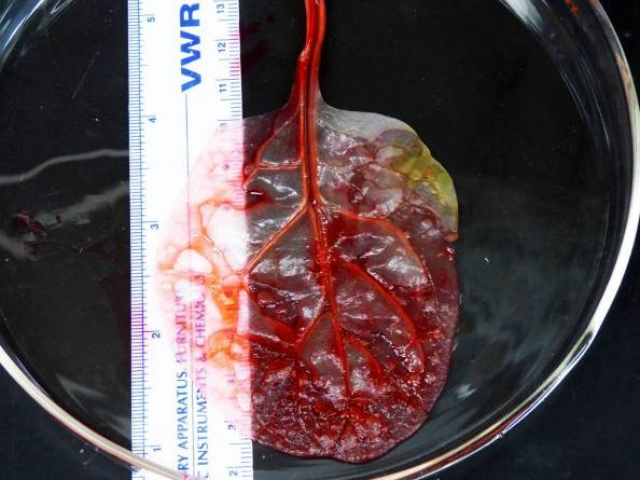

Repairing damaged organs with plants

Recently, scientists from Worcester Polytechnic Institute (WPI) in Massachusetts made a breakthrough step in modern medicine. A team of specialists managed to grow blood vessels from spinach leaves that were able to transport water. After that, the plant cells were replaced with muscle cells from the human heart. In this way, it enabled the plant veins to pump water as they would do it in the real heart.

This discovery gives hope that in the nearest future it will be possible to treat damaged organs with plants, from spinach to broccoli, instead of transplanting them.

Regeneration

Regeneration of the living tissue is another ambitious goal of modern medicine. Every year, 185 thousand amputations are carried out in the United States. The field of prosthetics is rapidly developing now which allows people to use nano-technological prostheses that fully replace the lost limb.

However, scientists want to take a step further. In particular, they have paid special attention to animals, such as axolotl, with the ability to regenerate new parts of their body, including limbs, lungs, and even eyes. Scientists have already identified the genes responsible for regeneration ability in these animals. Perhaps, one day it will be possible to create a medicine that stimulates tissue growth in humans.

|

Метки: #photo_news |

Snow Armageddon: Moscow sees record snowfall |

Last weekend, Moscow experienced one of the heaviest snowfalls. The daily amount of snow hit the historic high, data from the Hydrometeorological Centre of Russia showed. Traffic on highways and railways was disrupted, more than 150 flights were delayed, and several thousand people were trying to eliminate the consequences of the snowfall in the city. Read more about one of the heaviest snowfall in the history of Moscow in our article

On Monday morning, February 5, 43 cm-height snowdrifts appeared on the streets of Moscow. Over the weekend, 122% of the monthly rainfall fell in the city. On Sunday, an absolute record was set.

The current snowfall had brought the maximum amount of precipitation in the history of meteorological observations, beating the previous record set in 1957. Back then, 11.2 mm of precipitation dropped in the water equivalent, the Moscow and Region Weather Bureau noted.

Due to the difficult weather conditions on Monday, children were allowed to skip the lessons with the parents' consent. Moscow Mayor Sergei Sobyanin urged citizens not to use private cars as it may pose a threat to their life.

Strong snowfall began in the afternoon on February 3. During the day, more than half of the monthly norm of precipitation fell in Moscow. Wind gusts reached up to 18 m/s.

The number of trees knocked down by snow and ice had exceeded two thousand, Sergei Sobyanin said. Fallen trees damaged more than 100 cars. In the Nizhnelikhoborsky driveway, the tree crashed on six cars at once.

Due to heavy snowfall, traffic in Moscow and in the region was changed. The railway traffic on the Gorkovsky direction of Moscow Railway was stopped for some time because of the trees dangerously hanging over the railway tracks under the weight of snow.

There were some delays in the work of urban transport on the Filevskaya subway line because of the falling trees - twice in the morning and in the evening. In one case, the tree trunk dropped on a train. Fortunately, there were no passengers inside.

Curiously enough, the snowfall did not lead to any fatal consequences on the highways. On Sunday afternoon, traffic jams reached 6 points, then dropped to 4.

Foreigners were overexcited after seeing the photos and videos of snow-covered Moscow. They called it snow armageddon.

Pyotr Biryukov, Deputy Mayor of Moscow for Housing, Utilities, and Amenities, noted that it would take about nine days to clean up the fallen snow. Even the military equipment was used for that purpose. According to the Defense Ministry, a hundred soldiers and three units of special equipment, including two graders and one road vehicle from the Western military district, were involved in snow-removal work.

Unfortunately, there were casualties. Sergei Sobyanin said that on Saturday, one person was killed by a falling tree. About 10 people were injured.

|

Метки: #photo_news |

Global stocks vulnerable to clashes in Hong Kong |

As a rule, equity markets are sensitive to all kinds of political unrest. This time, violent social protests in Hong Kong heavily affected the stock market last weekend. European stock markets suffered as well from the anti-government protests in this region. Moreover, comments from the US officials about their unwillingness to lift import tariffs on Chinese goods brought more pessimism to the markets. The combination of these two negative factors has dragged down financial markets. Analysts recorded a significant decline in trade and retail. Thus, the stocks of mining companies included in the FTSE 100 index have lost from 2% to 3.2%, while Western corporations selling luxury goods in Hong Kong recorded a decrease in the price of shares by less than 1%. Some British companies were affected the most by the political unrest in Hong Kong. Shares of HSBC and Standard Chartered went lower by 2.4% and 2.0% respectively. Burberry incurred the biggest losses among European luxury brands with its shares falling sharply by 2.4%. Earlier, the escalation of the conflict in Hong Kong caused the Hang Seng stock index to drop by 2.6%. Analysts note that this was the steepest one-day decline in three months. Property stocks have also slumped. Experts say that high volatility in this sector could have a negative impact on the secondary listing of Alibaba shares of $10– $15 billion. Escalating tensions in the region may hinder trade negotiations between the US and China, experts warn. The White House considers the situation in Hong Kong to be one of the “pressure points” in the trade dispute.

Read more: https://www.mt5.com/forex_humor/image/44211

|

Метки: #forex_caricature |

Global stocks vulnerable to clashes in Hong Kong |

As a rule, equity markets are sensitive to all kinds of political unrest. This time, violent social protests in Hong Kong heavily affected the stock market last weekend. European stock markets suffered as well from the anti-government protests in this region. Moreover, comments from the US officials about their unwillingness to lift import tariffs on Chinese goods brought more pessimism to the markets. The combination of these two negative factors has dragged down financial markets. Analysts recorded a significant decline in trade and retail. Thus, the stocks of mining companies included in the FTSE 100 index have lost from 2% to 3.2%, while Western corporations selling luxury goods in Hong Kong recorded a decrease in the price of shares by less than 1%. Some British companies were affected the most by the political unrest in Hong Kong. Shares of HSBC and Standard Chartered went lower by 2.4% and 2.0% respectively. Burberry incurred the biggest losses among European luxury brands with its shares falling sharply by 2.4%. Earlier, the escalation of the conflict in Hong Kong caused the Hang Seng stock index to drop by 2.6%. Analysts note that this was the steepest one-day decline in three months. Property stocks have also slumped. Experts say that high volatility in this sector could have a negative impact on the secondary listing of Alibaba shares of $10– $15 billion. Escalating tensions in the region may hinder trade negotiations between the US and China, experts warn. The White House considers the situation in Hong Kong to be one of the “pressure points” in the trade dispute.

Read more: https://www.mt5.com/forex_humor/image/44211

|

Метки: #forex_caricature |

Global stocks vulnerable to clashes in Hong Kong |

As a rule, equity markets are sensitive to all kinds of political unrest. This time, violent social protests in Hong Kong heavily affected the stock market last weekend. European stock markets suffered as well from the anti-government protests in this region. Moreover, comments from the US officials about their unwillingness to lift import tariffs on Chinese goods brought more pessimism to the markets. The combination of these two negative factors has dragged down financial markets. Analysts recorded a significant decline in trade and retail. Thus, the stocks of mining companies included in the FTSE 100 index have lost from 2% to 3.2%, while Western corporations selling luxury goods in Hong Kong recorded a decrease in the price of shares by less than 1%. Some British companies were affected the most by the political unrest in Hong Kong. Shares of HSBC and Standard Chartered went lower by 2.4% and 2.0% respectively. Burberry incurred the biggest losses among European luxury brands with its shares falling sharply by 2.4%. Earlier, the escalation of the conflict in Hong Kong caused the Hang Seng stock index to drop by 2.6%. Analysts note that this was the steepest one-day decline in three months. Property stocks have also slumped. Experts say that high volatility in this sector could have a negative impact on the secondary listing of Alibaba shares of $10– $15 billion. Escalating tensions in the region may hinder trade negotiations between the US and China, experts warn. The White House considers the situation in Hong Kong to be one of the “pressure points” in the trade dispute.

Read more: https://www.mt5.com/forex_humor/image/44211

|

Метки: #forex_caricature |

Global stocks vulnerable to clashes in Hong Kong |

As a rule, equity markets are sensitive to all kinds of political unrest. This time, violent social protests in Hong Kong heavily affected the stock market last weekend. European stock markets suffered as well from the anti-government protests in this region. Moreover, comments from the US officials about their unwillingness to lift import tariffs on Chinese goods brought more pessimism to the markets. The combination of these two negative factors has dragged down financial markets. Analysts recorded a significant decline in trade and retail. Thus, the stocks of mining companies included in the FTSE 100 index have lost from 2% to 3.2%, while Western corporations selling luxury goods in Hong Kong recorded a decrease in the price of shares by less than 1%. Some British companies were affected the most by the political unrest in Hong Kong. Shares of HSBC and Standard Chartered went lower by 2.4% and 2.0% respectively. Burberry incurred the biggest losses among European luxury brands with its shares falling sharply by 2.4%. Earlier, the escalation of the conflict in Hong Kong caused the Hang Seng stock index to drop by 2.6%. Analysts note that this was the steepest one-day decline in three months. Property stocks have also slumped. Experts say that high volatility in this sector could have a negative impact on the secondary listing of Alibaba shares of $10– $15 billion. Escalating tensions in the region may hinder trade negotiations between the US and China, experts warn. The White House considers the situation in Hong Kong to be one of the “pressure points” in the trade dispute.

Read more: https://www.mt5.com/forex_humor/image/44211

|

Метки: #forex_caricature |

Euro celebrates its 20th anniversary |

20 years ago, on January 1999, EU countries launched a common currency – the euro. The single currency has largely changed the existing system of payments and gained huge popularity. See the most fascinating and significant moments in the history of the euro in our photo gallery

The European currency has existed in a non-cash form for the first three years since its introduction. The new means of payment was put into circulation at the rate of $1,1747. At first, experts recorded a slight weakening of the euro, but in October 2000, major central banks made joint investments in the currency. However, mostly the euro is trading higher than the US dollar.

The history of the euro currency dates back to 1969 when France, Germany, Italy, Belgium, the Netherlands, and Luxembourg agreed to establish an economic and monetary union. In 1979, the currency exchange rate mechanism was launched. The exchange rates of the currencies of the members of the European Economic Community, the predecessor of the European Union, were tied to each other.

In the beginning, only 11 EU countries (out of 15) were the members of the union. Later others joined. In 1998, a clock was installed in Brussels which counted down the time before the introduction of the single European currency.

In January 1999, 11 EU countries agreed to their exchange rates with the new currency. During this period, national regulators transferred their monetary policy functions to the European Central Bank (ECB).

In January 2002, euro banknotes entered circulation across twelve European Union countries. Robert Kalina, an Austrian designer, created the final design for new banknotes. By this time, the number of Eurozone members had increased from 11 to 19 countries. In 2015, Lithuania was one of the last countries to adopt the euro.

Presently, about 340 million people live in the eurozone. The euro takes the second place after the greenback in terms of trading volume on Forex. However, the euro is a leader in terms of the number of banknotes and coins in circulation. According to the ECB, the number of banknotes exceeds 1.2 trillion euros.

There have been many Presidents of ECB who dealt with the different issues related to the euro. Willem Duisenberg was the first chairman of the ECB and in 2003 he was succeeded by Jean-Claude Trichet. He held this position for eight years. In November 2011, Mario Draghi replaced Jean-Claude Trichet. His first steps as the President of the ECB were to tackle the debt crisis in Greece. However, the Mario Draghi era was not the happiest milestone in the history of the euro. He passed the baton to Christine Lagarde, the first woman who had been at the helm of the world's two most important institutions: the IMF and the ECB.

Nevertheless, Draghi did a lot for the euro area. When many feared the collapse of the eurozone, Mario Draghi said that he would do everything possible to save the euro. He launched a monetary stimulus program, purchasing European state and corporate bonds. As a result, the Bank's balance sheet rose to 4.7 trillion euros. However, the quantitative easing policy was put on hold this year.

According to experts from ING Bank, the 20-year history of the European currency has changed the eurozone and made its own adjustments to the economy. Many analysts believed that Germany would suffer big losses if it introduced a new European currency.

The rate of the German mark against the euro was overvalued, and this could have had a negative impact on the German economy. However, it was quite the opposite. Germany became the most economically competitive country in the eurozone.

Despite all the problems, changes to the eurozone have done more good than harm so far. For example, in the European labor market, the share of the working-age population has been growing for 20 years, and now it is much higher than in the United States. Politicians often see the euro as the main source of economic problems whereas ordinary citizens believe that the euro is an essential part of European integration. According to analysts at Eurobarometer, the majority of respondents (74%) speaks in favor of the euro, and only 20% of the population opposes the single currency.

|

Метки: #photo_news |

Euro celebrates its 20th anniversary |

20 years ago, on January 1999, EU countries launched a common currency – the euro. The single currency has largely changed the existing system of payments and gained huge popularity. See the most fascinating and significant moments in the history of the euro in our photo gallery

The European currency has existed in a non-cash form for the first three years since its introduction. The new means of payment was put into circulation at the rate of $1,1747. At first, experts recorded a slight weakening of the euro, but in October 2000, major central banks made joint investments in the currency. However, mostly the euro is trading higher than the US dollar.

The history of the euro currency dates back to 1969 when France, Germany, Italy, Belgium, the Netherlands, and Luxembourg agreed to establish an economic and monetary union. In 1979, the currency exchange rate mechanism was launched. The exchange rates of the currencies of the members of the European Economic Community, the predecessor of the European Union, were tied to each other.

In the beginning, only 11 EU countries (out of 15) were the members of the union. Later others joined. In 1998, a clock was installed in Brussels which counted down the time before the introduction of the single European currency.

In January 1999, 11 EU countries agreed to their exchange rates with the new currency. During this period, national regulators transferred their monetary policy functions to the European Central Bank (ECB).

In January 2002, euro banknotes entered circulation across twelve European Union countries. Robert Kalina, an Austrian designer, created the final design for new banknotes. By this time, the number of Eurozone members had increased from 11 to 19 countries. In 2015, Lithuania was one of the last countries to adopt the euro.

Presently, about 340 million people live in the eurozone. The euro takes the second place after the greenback in terms of trading volume on Forex. However, the euro is a leader in terms of the number of banknotes and coins in circulation. According to the ECB, the number of banknotes exceeds 1.2 trillion euros.

There have been many Presidents of ECB who dealt with the different issues related to the euro. Willem Duisenberg was the first chairman of the ECB and in 2003 he was succeeded by Jean-Claude Trichet. He held this position for eight years. In November 2011, Mario Draghi replaced Jean-Claude Trichet. His first steps as the President of the ECB were to tackle the debt crisis in Greece. However, the Mario Draghi era was not the happiest milestone in the history of the euro. He passed the baton to Christine Lagarde, the first woman who had been at the helm of the world's two most important institutions: the IMF and the ECB.

Nevertheless, Draghi did a lot for the euro area. When many feared the collapse of the eurozone, Mario Draghi said that he would do everything possible to save the euro. He launched a monetary stimulus program, purchasing European state and corporate bonds. As a result, the Bank's balance sheet rose to 4.7 trillion euros. However, the quantitative easing policy was put on hold this year.

According to experts from ING Bank, the 20-year history of the European currency has changed the eurozone and made its own adjustments to the economy. Many analysts believed that Germany would suffer big losses if it introduced a new European currency.

The rate of the German mark against the euro was overvalued, and this could have had a negative impact on the German economy. However, it was quite the opposite. Germany became the most economically competitive country in the eurozone.

Despite all the problems, changes to the eurozone have done more good than harm so far. For example, in the European labor market, the share of the working-age population has been growing for 20 years, and now it is much higher than in the United States. Politicians often see the euro as the main source of economic problems whereas ordinary citizens believe that the euro is an essential part of European integration. According to analysts at Eurobarometer, the majority of respondents (74%) speaks in favor of the euro, and only 20% of the population opposes the single currency.

|

Метки: #photo_news |

Euro celebrates its 20th anniversary |

20 years ago, on January 1999, EU countries launched a common currency – the euro. The single currency has largely changed the existing system of payments and gained huge popularity. See the most fascinating and significant moments in the history of the euro in our photo gallery

The European currency has existed in a non-cash form for the first three years since its introduction. The new means of payment was put into circulation at the rate of $1,1747. At first, experts recorded a slight weakening of the euro, but in October 2000, major central banks made joint investments in the currency. However, mostly the euro is trading higher than the US dollar.

The history of the euro currency dates back to 1969 when France, Germany, Italy, Belgium, the Netherlands, and Luxembourg agreed to establish an economic and monetary union. In 1979, the currency exchange rate mechanism was launched. The exchange rates of the currencies of the members of the European Economic Community, the predecessor of the European Union, were tied to each other.

In the beginning, only 11 EU countries (out of 15) were the members of the union. Later others joined. In 1998, a clock was installed in Brussels which counted down the time before the introduction of the single European currency.

In January 1999, 11 EU countries agreed to their exchange rates with the new currency. During this period, national regulators transferred their monetary policy functions to the European Central Bank (ECB).

In January 2002, euro banknotes entered circulation across twelve European Union countries. Robert Kalina, an Austrian designer, created the final design for new banknotes. By this time, the number of Eurozone members had increased from 11 to 19 countries. In 2015, Lithuania was one of the last countries to adopt the euro.

Presently, about 340 million people live in the eurozone. The euro takes the second place after the greenback in terms of trading volume on Forex. However, the euro is a leader in terms of the number of banknotes and coins in circulation. According to the ECB, the number of banknotes exceeds 1.2 trillion euros.

There have been many Presidents of ECB who dealt with the different issues related to the euro. Willem Duisenberg was the first chairman of the ECB and in 2003 he was succeeded by Jean-Claude Trichet. He held this position for eight years. In November 2011, Mario Draghi replaced Jean-Claude Trichet. His first steps as the President of the ECB were to tackle the debt crisis in Greece. However, the Mario Draghi era was not the happiest milestone in the history of the euro. He passed the baton to Christine Lagarde, the first woman who had been at the helm of the world's two most important institutions: the IMF and the ECB.

Nevertheless, Draghi did a lot for the euro area. When many feared the collapse of the eurozone, Mario Draghi said that he would do everything possible to save the euro. He launched a monetary stimulus program, purchasing European state and corporate bonds. As a result, the Bank's balance sheet rose to 4.7 trillion euros. However, the quantitative easing policy was put on hold this year.

According to experts from ING Bank, the 20-year history of the European currency has changed the eurozone and made its own adjustments to the economy. Many analysts believed that Germany would suffer big losses if it introduced a new European currency.

The rate of the German mark against the euro was overvalued, and this could have had a negative impact on the German economy. However, it was quite the opposite. Germany became the most economically competitive country in the eurozone.

Despite all the problems, changes to the eurozone have done more good than harm so far. For example, in the European labor market, the share of the working-age population has been growing for 20 years, and now it is much higher than in the United States. Politicians often see the euro as the main source of economic problems whereas ordinary citizens believe that the euro is an essential part of European integration. According to analysts at Eurobarometer, the majority of respondents (74%) speaks in favor of the euro, and only 20% of the population opposes the single currency.

|

Метки: #photo_news |

Euro celebrates its 20th anniversary |

20 years ago, on January 1999, EU countries launched a common currency – the euro. The single currency has largely changed the existing system of payments and gained huge popularity. See the most fascinating and significant moments in the history of the euro in our photo gallery

The European currency has existed in a non-cash form for the first three years since its introduction. The new means of payment was put into circulation at the rate of $1,1747. At first, experts recorded a slight weakening of the euro, but in October 2000, major central banks made joint investments in the currency. However, mostly the euro is trading higher than the US dollar.

The history of the euro currency dates back to 1969 when France, Germany, Italy, Belgium, the Netherlands, and Luxembourg agreed to establish an economic and monetary union. In 1979, the currency exchange rate mechanism was launched. The exchange rates of the currencies of the members of the European Economic Community, the predecessor of the European Union, were tied to each other.

In the beginning, only 11 EU countries (out of 15) were the members of the union. Later others joined. In 1998, a clock was installed in Brussels which counted down the time before the introduction of the single European currency.

In January 1999, 11 EU countries agreed to their exchange rates with the new currency. During this period, national regulators transferred their monetary policy functions to the European Central Bank (ECB).

In January 2002, euro banknotes entered circulation across twelve European Union countries. Robert Kalina, an Austrian designer, created the final design for new banknotes. By this time, the number of Eurozone members had increased from 11 to 19 countries. In 2015, Lithuania was one of the last countries to adopt the euro.

Presently, about 340 million people live in the eurozone. The euro takes the second place after the greenback in terms of trading volume on Forex. However, the euro is a leader in terms of the number of banknotes and coins in circulation. According to the ECB, the number of banknotes exceeds 1.2 trillion euros.

There have been many Presidents of ECB who dealt with the different issues related to the euro. Willem Duisenberg was the first chairman of the ECB and in 2003 he was succeeded by Jean-Claude Trichet. He held this position for eight years. In November 2011, Mario Draghi replaced Jean-Claude Trichet. His first steps as the President of the ECB were to tackle the debt crisis in Greece. However, the Mario Draghi era was not the happiest milestone in the history of the euro. He passed the baton to Christine Lagarde, the first woman who had been at the helm of the world's two most important institutions: the IMF and the ECB.

Nevertheless, Draghi did a lot for the euro area. When many feared the collapse of the eurozone, Mario Draghi said that he would do everything possible to save the euro. He launched a monetary stimulus program, purchasing European state and corporate bonds. As a result, the Bank's balance sheet rose to 4.7 trillion euros. However, the quantitative easing policy was put on hold this year.

According to experts from ING Bank, the 20-year history of the European currency has changed the eurozone and made its own adjustments to the economy. Many analysts believed that Germany would suffer big losses if it introduced a new European currency.

The rate of the German mark against the euro was overvalued, and this could have had a negative impact on the German economy. However, it was quite the opposite. Germany became the most economically competitive country in the eurozone.

Despite all the problems, changes to the eurozone have done more good than harm so far. For example, in the European labor market, the share of the working-age population has been growing for 20 years, and now it is much higher than in the United States. Politicians often see the euro as the main source of economic problems whereas ordinary citizens believe that the euro is an essential part of European integration. According to analysts at Eurobarometer, the majority of respondents (74%) speaks in favor of the euro, and only 20% of the population opposes the single currency.

|

Метки: #photo_news |

Euro celebrates its 20th anniversary |

20 years ago, on January 1999, EU countries launched a common currency – the euro. The single currency has largely changed the existing system of payments and gained huge popularity. See the most fascinating and significant moments in the history of the euro in our photo gallery

The European currency has existed in a non-cash form for the first three years since its introduction. The new means of payment was put into circulation at the rate of $1,1747. At first, experts recorded a slight weakening of the euro, but in October 2000, major central banks made joint investments in the currency. However, mostly the euro is trading higher than the US dollar.

The history of the euro currency dates back to 1969 when France, Germany, Italy, Belgium, the Netherlands, and Luxembourg agreed to establish an economic and monetary union. In 1979, the currency exchange rate mechanism was launched. The exchange rates of the currencies of the members of the European Economic Community, the predecessor of the European Union, were tied to each other.

In the beginning, only 11 EU countries (out of 15) were the members of the union. Later others joined. In 1998, a clock was installed in Brussels which counted down the time before the introduction of the single European currency.

In January 1999, 11 EU countries agreed to their exchange rates with the new currency. During this period, national regulators transferred their monetary policy functions to the European Central Bank (ECB).

In January 2002, euro banknotes entered circulation across twelve European Union countries. Robert Kalina, an Austrian designer, created the final design for new banknotes. By this time, the number of Eurozone members had increased from 11 to 19 countries. In 2015, Lithuania was one of the last countries to adopt the euro.

Presently, about 340 million people live in the eurozone. The euro takes the second place after the greenback in terms of trading volume on Forex. However, the euro is a leader in terms of the number of banknotes and coins in circulation. According to the ECB, the number of banknotes exceeds 1.2 trillion euros.

There have been many Presidents of ECB who dealt with the different issues related to the euro. Willem Duisenberg was the first chairman of the ECB and in 2003 he was succeeded by Jean-Claude Trichet. He held this position for eight years. In November 2011, Mario Draghi replaced Jean-Claude Trichet. His first steps as the President of the ECB were to tackle the debt crisis in Greece. However, the Mario Draghi era was not the happiest milestone in the history of the euro. He passed the baton to Christine Lagarde, the first woman who had been at the helm of the world's two most important institutions: the IMF and the ECB.

Nevertheless, Draghi did a lot for the euro area. When many feared the collapse of the eurozone, Mario Draghi said that he would do everything possible to save the euro. He launched a monetary stimulus program, purchasing European state and corporate bonds. As a result, the Bank's balance sheet rose to 4.7 trillion euros. However, the quantitative easing policy was put on hold this year.

According to experts from ING Bank, the 20-year history of the European currency has changed the eurozone and made its own adjustments to the economy. Many analysts believed that Germany would suffer big losses if it introduced a new European currency.

The rate of the German mark against the euro was overvalued, and this could have had a negative impact on the German economy. However, it was quite the opposite. Germany became the most economically competitive country in the eurozone.

Despite all the problems, changes to the eurozone have done more good than harm so far. For example, in the European labor market, the share of the working-age population has been growing for 20 years, and now it is much higher than in the United States. Politicians often see the euro as the main source of economic problems whereas ordinary citizens believe that the euro is an essential part of European integration. According to analysts at Eurobarometer, the majority of respondents (74%) speaks in favor of the euro, and only 20% of the population opposes the single currency.

|

Метки: #photo_news |

China's inflation accelerates due to rising pork prices |

The past month has been difficult for the economy of China. During the reporting period, the inflation rate in China accelerated to maximum levels. Last time such high values were recorded in January 2012, analysts say. The acceleration was due to a sharp increase in pork prices, while producer prices fell significantly. According to China's National Bureau of Statistics (NBS), consumer prices increased by 3.8% in annual terms in October of this year. In September, the rise was 3%, according to the NBS. Compared to the previous month, the price growth in October reached 0.9%, which turned out to be higher than experts' forecasts. During the reporting period, food prices in China surged by 15.5%.The growth has been the fastest over the past 11 years. According to economists, the rise in pork prices has been continuing for eight months in a row. In October, prices for it jumped by 101.3%. The cause of this was an epidemic of African swine fever (ASF), due to which the number of pigs in China decreased significantly. Experts also recorded a rise in prices for non-food products and services of 0.9%, while the cost of clothing increased by 1.2%.

Last month, producer prices in China declined by 1.6% year on year. The drop was the highest since July 2016. Experts attribute this to the prolonged weakening of China's industrial sector under the conditions of declining global demand and a trade war with the US. In October 2019, the core inflation, excluding volatile food prices and energy prices, remained at 1.5%. Remarkably, China plans to keep the inflation below 3%.

Read more: https://www.mt5.com/forex_humor/image/44222

|

Метки: #forex_caricature |

China's inflation accelerates due to rising pork prices |

The past month has been difficult for the economy of China. During the reporting period, the inflation rate in China accelerated to maximum levels. Last time such high values were recorded in January 2012, analysts say. The acceleration was due to a sharp increase in pork prices, while producer prices fell significantly. According to China's National Bureau of Statistics (NBS), consumer prices increased by 3.8% in annual terms in October of this year. In September, the rise was 3%, according to the NBS. Compared to the previous month, the price growth in October reached 0.9%, which turned out to be higher than experts' forecasts. During the reporting period, food prices in China surged by 15.5%.The growth has been the fastest over the past 11 years. According to economists, the rise in pork prices has been continuing for eight months in a row. In October, prices for it jumped by 101.3%. The cause of this was an epidemic of African swine fever (ASF), due to which the number of pigs in China decreased significantly. Experts also recorded a rise in prices for non-food products and services of 0.9%, while the cost of clothing increased by 1.2%.

Last month, producer prices in China declined by 1.6% year on year. The drop was the highest since July 2016. Experts attribute this to the prolonged weakening of China's industrial sector under the conditions of declining global demand and a trade war with the US. In October 2019, the core inflation, excluding volatile food prices and energy prices, remained at 1.5%. Remarkably, China plans to keep the inflation below 3%.

Read more: https://www.mt5.com/forex_humor/image/44222

|

Метки: #forex_caricature |