-Поиск по дневнику

-Подписка по e-mail

-Постоянные читатели

Aasa Baskara Biswalker Divolog Dostana Frotton Orta Pestola aktera artoped bamma beoma challe chudna chudnost drest gafina kikuki llesta neasea pitaka saleo whattt zhensch Аксола Анава Бимба Ботфорта Дайфа Данана Еремана Игричаг Карте Картизона Крауд Крашка Креатист Крякс Лейлика Матрошка Ольгино Пасялка Пурист Стерха Тредда Учана Фреккен Юрта кранты обручка

-Сообщества

Читатель сообществ

(Всего в списке: 1)

Сверхъестественное

-Статистика

Рублёвые цены на нефть |

Cообщение скрыто для удобства комментирования.

Прочитать сообщение

Аноним обратиться по имени

Четверг, 15 Августа 2024 г. 21:27 (ссылка)

Ответить С цитатой В цитатник | Не показывать комментарий

Deregulation of the global economy and the end of cultural marxism

The US Department of Justice plans to break up Google due to alleged antitrust law violations. The company is accused of monopolizing the search engine advertising market. It is clear that Google, through its censorship of search results and YouTube, has become one of the largest propagators of cultural Marxism. This comes after the strange collapse of markets and the collapse of cryptocurrency markets. In the opinion of some experts, cryptocurrencies were created by so-called old corporations to finance the propaganda of cultural Marxism. These events are complemented by protests against migration in England.

The process of forming a global system of TNCs and NGOs with a left-wing political course, which promote feminism and illegal migration, is economically described as the formation of monopolies. It is worth noting that not all NGOs are unequivocally bad.

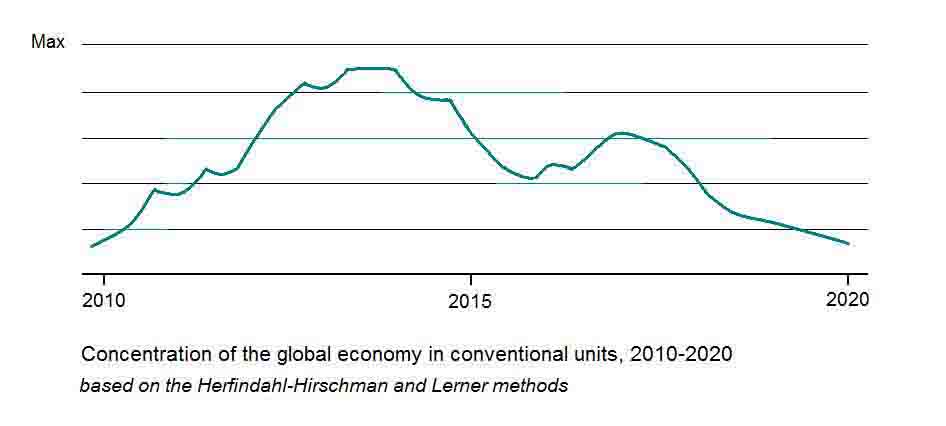

From the point of view of national and global economics, monopolization is described by the Herfindahl-Hirschman index, the Lerner index, and their derivatives. Research by the breakaway part of McKinsey, reports by the International Chamber of Commerce (ICC), and research on the number of startups show that from 2009 to 2016, there was a strong process of market monopolization, but since 2016, there has been an increase in competition. Many note that the propaganda of feminism was artificially amplified around 2010-2020, and in 2016-2017, it began to decline. These data are complemented by the decline in the level of world trade. Additionally, 2016 was the year of Donald Trump's rise to power in the US.

Note: I've kept the translation as close to the original text as possible, but some minor adjustments were made to improve readability and clarity.

Any monopoly ends in two ways: self-destruction, division, or a combination of these options. The liquidation of a monopoly can occur through formal and informal means. The informal path includes agent infiltration, compromising information, and liquidation. These are matters of commercial intelligence, which often does not yield to national intelligence, where industrial espionage is only part of the actions. In the media and leaks from globalist organizations, the term "commercial intelligence" is not mentioned. Instead, there are many materials about industrial espionage. This is a typical distraction from a significant topic. The consequences of such actions are mergers and acquisitions. It is incorrect to consider mergers and acquisitions outside the context of cause and effect, to talk about market monopolization only based on these phenomena, as some economists do. Company A is often acquired by Company B because someone in Company A was infiltrated by an agent who made intentionally destructive decisions for Company A. However, logically, national intelligence is more involved in preventive work against potential monopolies than competitors. On this basis, some experts say that the increase in the number of such mergers and acquisitions since 2018 indicates the decentralization of the global economy. Formal measures include decisions by antimonopoly authorities and courts. According to expert estimates, such actions account for about 5% of all actions, since states do not want to actively intervene in the economy. The following examples demonstrate that "old" TNCs did not receive superpower, and national states can restrain them.

Google was fined €1.49 billion by the European Commission in 2019 for violating antitrust laws and was required to change its business model.

Qualcomm was fined by the European Commission in 2019 for violating antitrust laws. Intel was fined €1.06 billion by the European Commission in 2019 for violating antitrust laws.

The merger of T-Mobile US and Sprint Corporation in 2020.

Facebook was fined $5 billion by the US Federal Trade Commission (FTC) in 2019. In 2020, the FTC also filed a lawsuit against Facebook, demanding that the company be broken up and sell its owned services Instagram and WhatsApp. This lawsuit is still pending.

In 2021, the European Commission also launched an investigation against Facebook to determine whether the company is abusing its dominant position in the social media market.

In 2017, the European Commission fined Google €2.42 billion for violating antitrust laws related to its search advertising business model. In 2019, the European Commission also required Google to change its business model and provide more equal conditions for competing search advertising services. This decision was made after an investigation showed that Google had abused its dominant position in the search advertising market.

The merger of Viacom and CBS Corporation in 2019.

In 2020, Google CEO Sundar Pichai and Facebook CEO Mark Zuckerberg were summoned to hearings in the US Congress on information policy. Some link this to the strange death of Benjamin de Rothschild in 2021.

In 2021, the Chinese antitrust authority fined Alibaba Group a record $2.7 billion. In 2021, the Chinese antitrust authority also fined Tencent Holdings and Baidu.

In all the presented examples, the period of antitrust activity coincides with the beginning of the period of general decentralization of the global economy.

: https://postimages.org/

: https://postimages.org/

The US Department of Justice plans to break up Google due to alleged antitrust law violations. The company is accused of monopolizing the search engine advertising market. It is clear that Google, through its censorship of search results and YouTube, has become one of the largest propagators of cultural Marxism. This comes after the strange collapse of markets and the collapse of cryptocurrency markets. In the opinion of some experts, cryptocurrencies were created by so-called old corporations to finance the propaganda of cultural Marxism. These events are complemented by protests against migration in England.

The process of forming a global system of TNCs and NGOs with a left-wing political course, which promote feminism and illegal migration, is economically described as the formation of monopolies. It is worth noting that not all NGOs are unequivocally bad.

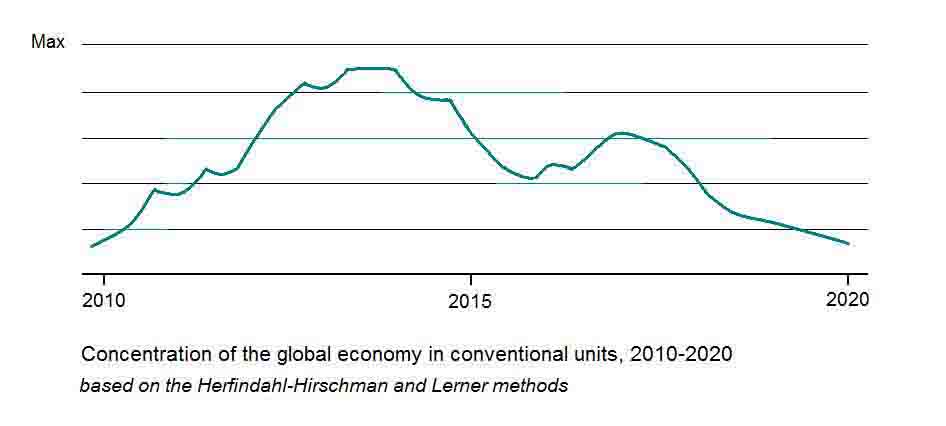

From the point of view of national and global economics, monopolization is described by the Herfindahl-Hirschman index, the Lerner index, and their derivatives. Research by the breakaway part of McKinsey, reports by the International Chamber of Commerce (ICC), and research on the number of startups show that from 2009 to 2016, there was a strong process of market monopolization, but since 2016, there has been an increase in competition. Many note that the propaganda of feminism was artificially amplified around 2010-2020, and in 2016-2017, it began to decline. These data are complemented by the decline in the level of world trade. Additionally, 2016 was the year of Donald Trump's rise to power in the US.

Note: I've kept the translation as close to the original text as possible, but some minor adjustments were made to improve readability and clarity.

Any monopoly ends in two ways: self-destruction, division, or a combination of these options. The liquidation of a monopoly can occur through formal and informal means. The informal path includes agent infiltration, compromising information, and liquidation. These are matters of commercial intelligence, which often does not yield to national intelligence, where industrial espionage is only part of the actions. In the media and leaks from globalist organizations, the term "commercial intelligence" is not mentioned. Instead, there are many materials about industrial espionage. This is a typical distraction from a significant topic. The consequences of such actions are mergers and acquisitions. It is incorrect to consider mergers and acquisitions outside the context of cause and effect, to talk about market monopolization only based on these phenomena, as some economists do. Company A is often acquired by Company B because someone in Company A was infiltrated by an agent who made intentionally destructive decisions for Company A. However, logically, national intelligence is more involved in preventive work against potential monopolies than competitors. On this basis, some experts say that the increase in the number of such mergers and acquisitions since 2018 indicates the decentralization of the global economy. Formal measures include decisions by antimonopoly authorities and courts. According to expert estimates, such actions account for about 5% of all actions, since states do not want to actively intervene in the economy. The following examples demonstrate that "old" TNCs did not receive superpower, and national states can restrain them.

Google was fined €1.49 billion by the European Commission in 2019 for violating antitrust laws and was required to change its business model.

Qualcomm was fined by the European Commission in 2019 for violating antitrust laws. Intel was fined €1.06 billion by the European Commission in 2019 for violating antitrust laws.

The merger of T-Mobile US and Sprint Corporation in 2020.

Facebook was fined $5 billion by the US Federal Trade Commission (FTC) in 2019. In 2020, the FTC also filed a lawsuit against Facebook, demanding that the company be broken up and sell its owned services Instagram and WhatsApp. This lawsuit is still pending.

In 2021, the European Commission also launched an investigation against Facebook to determine whether the company is abusing its dominant position in the social media market.

In 2017, the European Commission fined Google €2.42 billion for violating antitrust laws related to its search advertising business model. In 2019, the European Commission also required Google to change its business model and provide more equal conditions for competing search advertising services. This decision was made after an investigation showed that Google had abused its dominant position in the search advertising market.

The merger of Viacom and CBS Corporation in 2019.

In 2020, Google CEO Sundar Pichai and Facebook CEO Mark Zuckerberg were summoned to hearings in the US Congress on information policy. Some link this to the strange death of Benjamin de Rothschild in 2021.

In 2021, the Chinese antitrust authority fined Alibaba Group a record $2.7 billion. In 2021, the Chinese antitrust authority also fined Tencent Holdings and Baidu.

In all the presented examples, the period of antitrust activity coincides with the beginning of the period of general decentralization of the global economy.

: https://postimages.org/

: https://postimages.org/| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |