Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

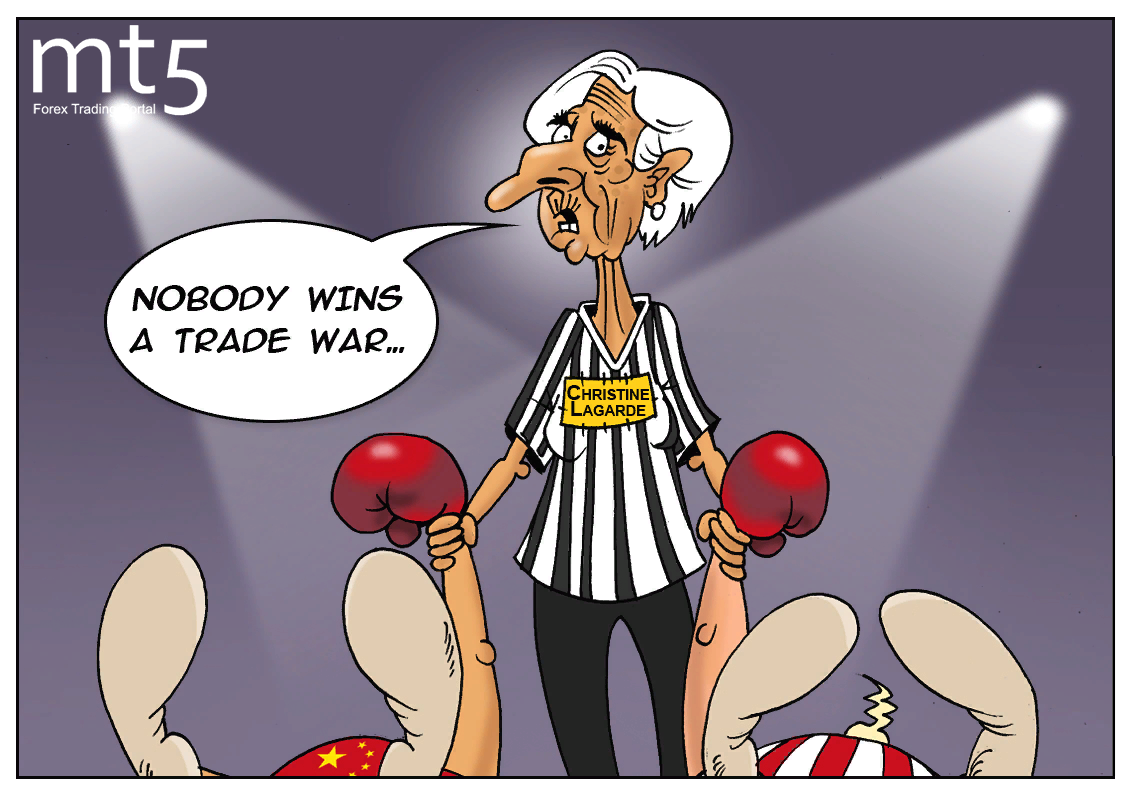

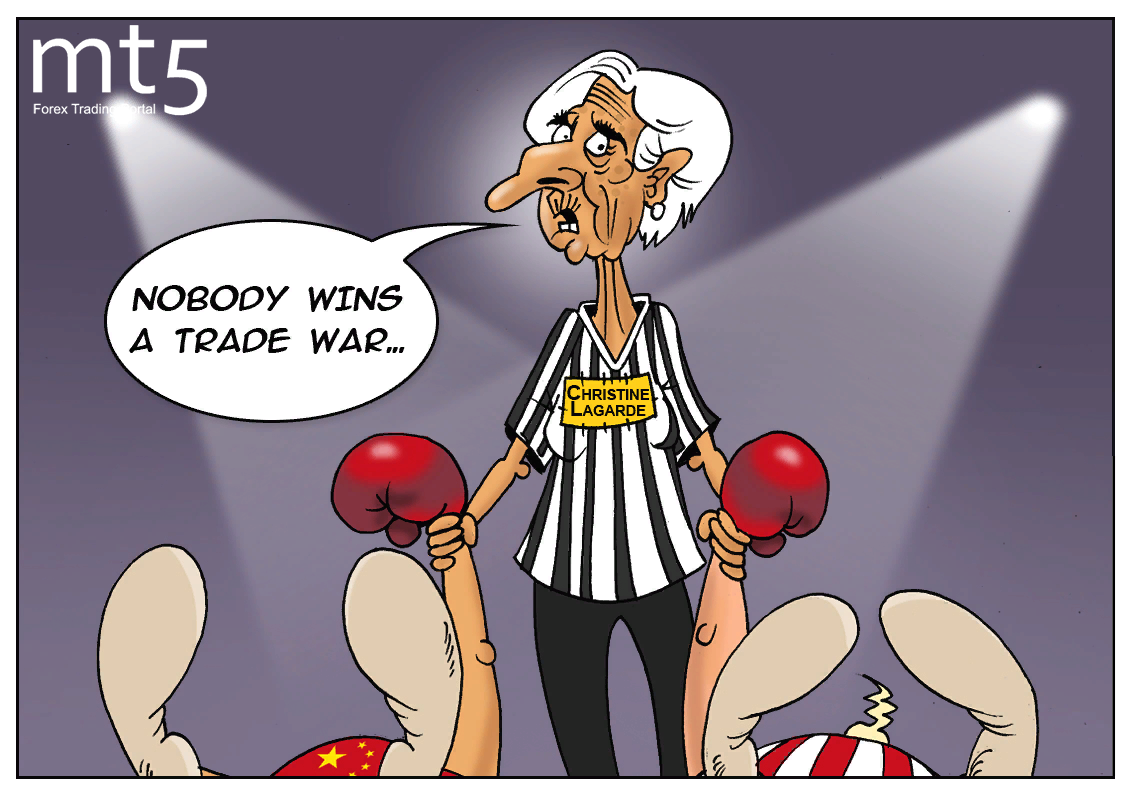

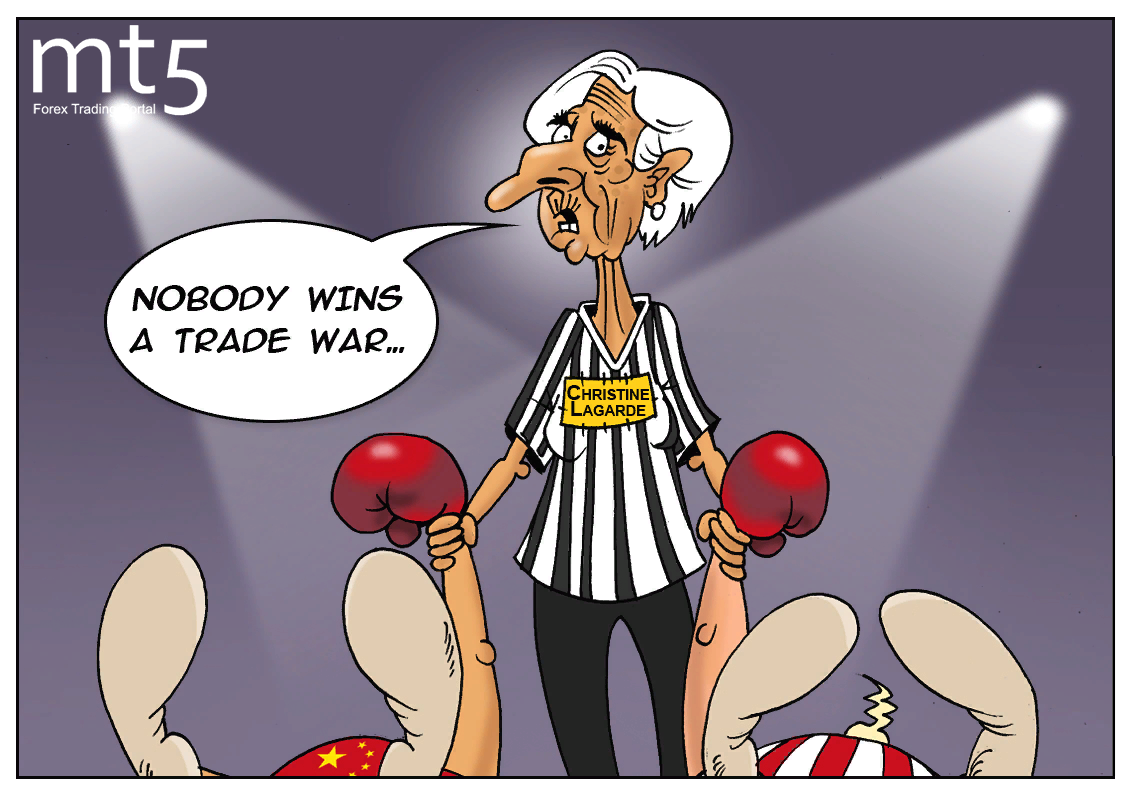

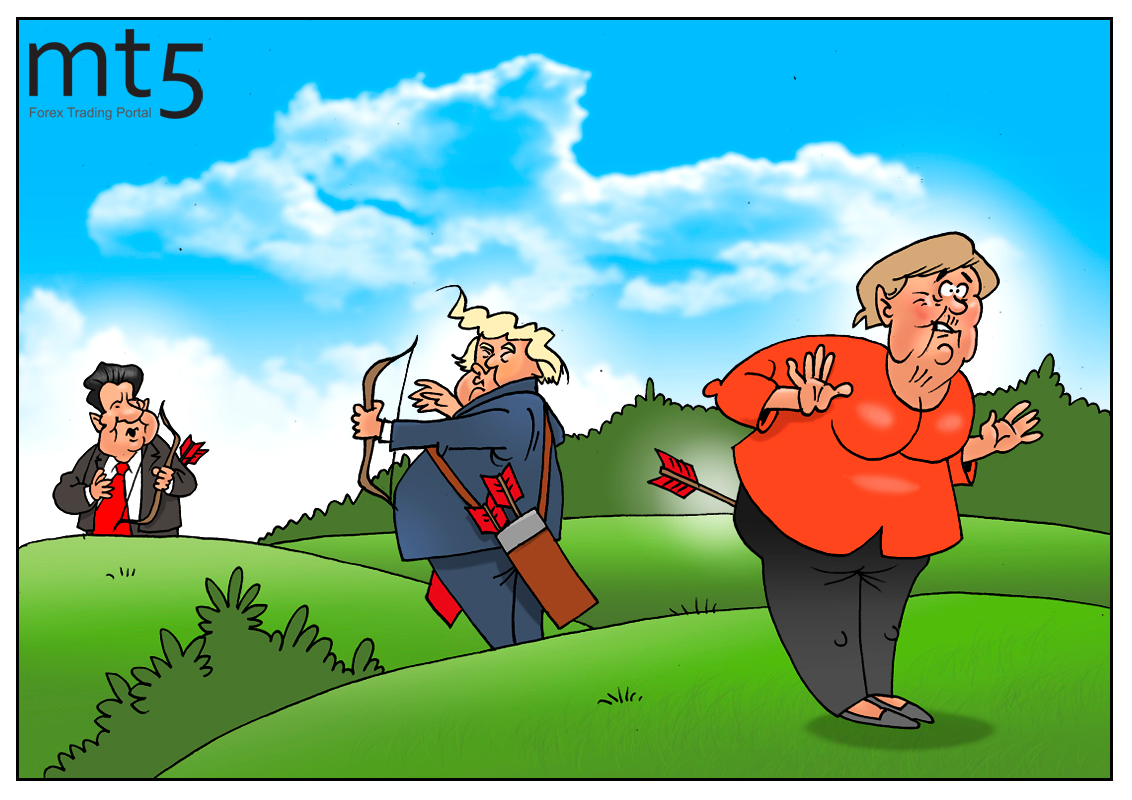

US-China trade conflict affects global economy |

According to Christine Lagarde, the head of the International Monetary Fund, a well-known saying that there are no winners in a war applies even to a trade conflict. "Any trade war affects those that participate and those that don't," she said responding to journalists’ question about the trade war between the US and China and its consequences. Christine Lagarde believes that the direct and indirect impact and the extent that it undermines confidence and certainty will affect all. If trade tensions persist, while the IMF hopes this will not happen, economic entities, particularly from the private sector, may have to reorganize their supply chains and the way they run their business. "Nobody wins a trade war in our view we all have to lose," - Ms Lagarde assumes.

The conflict initiated by Donald Trump will result in a lot of victims. First of all, the world economy which is already experiencing a number of serious problems, will suffer. The trade dispute between the two largest economies in the world will look beyond the economic interests of the United States and China. Global markets are sensitive to increased tensions around the current situation. Ms Lagarde recalled that in these conditions, countries that account for 70 percent of the global economy would experience a synchronized slowdown in economic growth rates this year. In 2019, the growth is predicted to be 3.3 percent, and then it would go up to 3.6 percent in 2020. “The rebound is precarious and subject to downside risks," the head of the IMF noted.

Read more: https://www.mt5.com/forex_humor/image/41679

|

Метки: #forex_caricature |

US-China trade conflict affects global economy |

According to Christine Lagarde, the head of the International Monetary Fund, a well-known saying that there are no winners in a war applies even to a trade conflict. "Any trade war affects those that participate and those that don't," she said responding to journalists’ question about the trade war between the US and China and its consequences. Christine Lagarde believes that the direct and indirect impact and the extent that it undermines confidence and certainty will affect all. If trade tensions persist, while the IMF hopes this will not happen, economic entities, particularly from the private sector, may have to reorganize their supply chains and the way they run their business. "Nobody wins a trade war in our view we all have to lose," - Ms Lagarde assumes.

The conflict initiated by Donald Trump will result in a lot of victims. First of all, the world economy which is already experiencing a number of serious problems, will suffer. The trade dispute between the two largest economies in the world will look beyond the economic interests of the United States and China. Global markets are sensitive to increased tensions around the current situation. Ms Lagarde recalled that in these conditions, countries that account for 70 percent of the global economy would experience a synchronized slowdown in economic growth rates this year. In 2019, the growth is predicted to be 3.3 percent, and then it would go up to 3.6 percent in 2020. “The rebound is precarious and subject to downside risks," the head of the IMF noted.

Read more: https://www.mt5.com/forex_humor/image/41679

|

Метки: #forex_caricature |

US-China trade conflict affects global economy |

According to Christine Lagarde, the head of the International Monetary Fund, a well-known saying that there are no winners in a war applies even to a trade conflict. "Any trade war affects those that participate and those that don't," she said responding to journalists’ question about the trade war between the US and China and its consequences. Christine Lagarde believes that the direct and indirect impact and the extent that it undermines confidence and certainty will affect all. If trade tensions persist, while the IMF hopes this will not happen, economic entities, particularly from the private sector, may have to reorganize their supply chains and the way they run their business. "Nobody wins a trade war in our view we all have to lose," - Ms Lagarde assumes.

The conflict initiated by Donald Trump will result in a lot of victims. First of all, the world economy which is already experiencing a number of serious problems, will suffer. The trade dispute between the two largest economies in the world will look beyond the economic interests of the United States and China. Global markets are sensitive to increased tensions around the current situation. Ms Lagarde recalled that in these conditions, countries that account for 70 percent of the global economy would experience a synchronized slowdown in economic growth rates this year. In 2019, the growth is predicted to be 3.3 percent, and then it would go up to 3.6 percent in 2020. “The rebound is precarious and subject to downside risks," the head of the IMF noted.

Read more: https://www.mt5.com/forex_humor/image/41679

|

Метки: #forex_caricature |

Five alternatives to bank deposits |

The global economy instability makes market participants to look for a traditional bank deposits replacement. In this regard, experts offer several options for investment. They are considered the most effective compared to other

Today, amid a global economic downturn, many market participants are seeking to find reliable ways to preserve their savings. Previously, a bank deposit served as an option. However, times have changed, and experts consider other alternatives more serious investments in the future. To increase your savings, you may use many financial instruments.

Corporate bonds

Corporate bonds are one of the most important financial instruments, experts say. This is one of the most popular, affordable and low-risk tools of the stock market. The entry threshold is low: for ruble bonds, the threshold is 1,000 rubles, for euro bonds it starts from 1,000 US dollars. You can earn up to 10% per annum on ruble bonds. In terms of reliability, bonds are not inferior to a bank deposit. They are suitable for novice investors. The disadvantage of bonds is that they are not insured. If the issuer goes bankrupt, all investments will be lost.

Crowdfunding

Now, crowdfunding is a very popular financial instrument. It is a collective financing of any business. Earlier, only large entrepreneurs with a capital of several million dollars participated in crowdfunding, but now the middle class with small amounts is leading in this type of investment. If you have a loan agreement (crowdlending) with a company, you can get 20-25% per annum. Many people are afraid to invest in young companies, as there is a high risk of losses. However, the number of investors in startups is growing.

Structural products

This financial product can be purchased from a bank, broker or management company. It is an investment portfolio formed from two or more financial instruments: bank deposits, real estate investments, precious metals, securities, etc. Demand for options and bonds is often the highest. Financial assets are distributed in such a way that the profitability of the risk-free part covers possible losses of another share of investments. The entry threshold here is high: for a dollar product, the minimum threshold is 5,000 or 10,000 US dollars, for a ruble one, the threshold is from 100,000 to 200,000 rubles.

Stock dividends

Stock dividends are companies’ shares that pay dividends. In rubles, income can reach 13-15% per annum, and in dollars - 2-4%. The shareholder will receive income if the company operates confidently in the market and is profitable. Shares are one of the most liquid instruments; they can be sold at any time. Experts believe that most of them are able to survive the crisis, recession and market collapse. You only need to be patient and wait for quotations to recover.

Real estate

Real estate is the most effective investment tool. Experts advise to focus on commercial housing, for example, to have an agreement with the company that manages the apartment hotels. The yield can reach 10% per annum. For rental, it is best to use a mortgage apartment abroad, for example, in Germany. The entry threshold for this market is not too high - from 30,000 euros. You can also become a member of a real estate unit investment fund abroad, including those listed on the stock exchange (REIT).

|

Метки: #photo_news |

Five alternatives to bank deposits |

The global economy instability makes market participants to look for a traditional bank deposits replacement. In this regard, experts offer several options for investment. They are considered the most effective compared to other

Today, amid a global economic downturn, many market participants are seeking to find reliable ways to preserve their savings. Previously, a bank deposit served as an option. However, times have changed, and experts consider other alternatives more serious investments in the future. To increase your savings, you may use many financial instruments.

Corporate bonds

Corporate bonds are one of the most important financial instruments, experts say. This is one of the most popular, affordable and low-risk tools of the stock market. The entry threshold is low: for ruble bonds, the threshold is 1,000 rubles, for euro bonds it starts from 1,000 US dollars. You can earn up to 10% per annum on ruble bonds. In terms of reliability, bonds are not inferior to a bank deposit. They are suitable for novice investors. The disadvantage of bonds is that they are not insured. If the issuer goes bankrupt, all investments will be lost.

Crowdfunding

Now, crowdfunding is a very popular financial instrument. It is a collective financing of any business. Earlier, only large entrepreneurs with a capital of several million dollars participated in crowdfunding, but now the middle class with small amounts is leading in this type of investment. If you have a loan agreement (crowdlending) with a company, you can get 20-25% per annum. Many people are afraid to invest in young companies, as there is a high risk of losses. However, the number of investors in startups is growing.

Structural products

This financial product can be purchased from a bank, broker or management company. It is an investment portfolio formed from two or more financial instruments: bank deposits, real estate investments, precious metals, securities, etc. Demand for options and bonds is often the highest. Financial assets are distributed in such a way that the profitability of the risk-free part covers possible losses of another share of investments. The entry threshold here is high: for a dollar product, the minimum threshold is 5,000 or 10,000 US dollars, for a ruble one, the threshold is from 100,000 to 200,000 rubles.

Stock dividends

Stock dividends are companies’ shares that pay dividends. In rubles, income can reach 13-15% per annum, and in dollars - 2-4%. The shareholder will receive income if the company operates confidently in the market and is profitable. Shares are one of the most liquid instruments; they can be sold at any time. Experts believe that most of them are able to survive the crisis, recession and market collapse. You only need to be patient and wait for quotations to recover.

Real estate

Real estate is the most effective investment tool. Experts advise to focus on commercial housing, for example, to have an agreement with the company that manages the apartment hotels. The yield can reach 10% per annum. For rental, it is best to use a mortgage apartment abroad, for example, in Germany. The entry threshold for this market is not too high - from 30,000 euros. You can also become a member of a real estate unit investment fund abroad, including those listed on the stock exchange (REIT).

|

Метки: #photo_news |

Five alternatives to bank deposits |

The global economy instability makes market participants to look for a traditional bank deposits replacement. In this regard, experts offer several options for investment. They are considered the most effective compared to other

Today, amid a global economic downturn, many market participants are seeking to find reliable ways to preserve their savings. Previously, a bank deposit served as an option. However, times have changed, and experts consider other alternatives more serious investments in the future. To increase your savings, you may use many financial instruments.

Corporate bonds

Corporate bonds are one of the most important financial instruments, experts say. This is one of the most popular, affordable and low-risk tools of the stock market. The entry threshold is low: for ruble bonds, the threshold is 1,000 rubles, for euro bonds it starts from 1,000 US dollars. You can earn up to 10% per annum on ruble bonds. In terms of reliability, bonds are not inferior to a bank deposit. They are suitable for novice investors. The disadvantage of bonds is that they are not insured. If the issuer goes bankrupt, all investments will be lost.

Crowdfunding

Now, crowdfunding is a very popular financial instrument. It is a collective financing of any business. Earlier, only large entrepreneurs with a capital of several million dollars participated in crowdfunding, but now the middle class with small amounts is leading in this type of investment. If you have a loan agreement (crowdlending) with a company, you can get 20-25% per annum. Many people are afraid to invest in young companies, as there is a high risk of losses. However, the number of investors in startups is growing.

Structural products

This financial product can be purchased from a bank, broker or management company. It is an investment portfolio formed from two or more financial instruments: bank deposits, real estate investments, precious metals, securities, etc. Demand for options and bonds is often the highest. Financial assets are distributed in such a way that the profitability of the risk-free part covers possible losses of another share of investments. The entry threshold here is high: for a dollar product, the minimum threshold is 5,000 or 10,000 US dollars, for a ruble one, the threshold is from 100,000 to 200,000 rubles.

Stock dividends

Stock dividends are companies’ shares that pay dividends. In rubles, income can reach 13-15% per annum, and in dollars - 2-4%. The shareholder will receive income if the company operates confidently in the market and is profitable. Shares are one of the most liquid instruments; they can be sold at any time. Experts believe that most of them are able to survive the crisis, recession and market collapse. You only need to be patient and wait for quotations to recover.

Real estate

Real estate is the most effective investment tool. Experts advise to focus on commercial housing, for example, to have an agreement with the company that manages the apartment hotels. The yield can reach 10% per annum. For rental, it is best to use a mortgage apartment abroad, for example, in Germany. The entry threshold for this market is not too high - from 30,000 euros. You can also become a member of a real estate unit investment fund abroad, including those listed on the stock exchange (REIT).

|

Метки: #photo_news |

US-China trade war escalation may trigger another financial crisis |

In the near future, the world may face another financial crisis caused by the trade conflict between the United States and China. The military and economic steps taken by the two largest world economies have a negative impact on every aspect of the global economy. It is quite disturbing because both parties have not spilled over into outright confrontation yet.

Europe which is still unable to deal with Brexit is particularly sensitive about every new change in the tariff battle. Portfolio manager at American Century Investments Trevor Gurvich said that the European market had been too optimistic about a quick and easy trade deal between the US and China. That is why the local exchanges were not ready for the parties' refusal to sign an agreement and bury the hatchet. The British FTSE 100 fell by 1.04 percent, the German DAX plunged by 1.49 percent, the French CAC slumped by 1.56 percent, while the Spanish IBEX 35 and the Italian FTSE MIB dropped by 0.93 percent and 2.56 percent, respectively. As for the American market, it turned out to be more resistant to the conflict. Despite the fact that after the recent escalation, it had lost almost a trillion dollars a day, it managed to recover.

If the main parties to the conflict fail to agree, the economic development is likely to be at risk. Therefore, if the US-China trade war escalation continues, it may can trigger a financial crisis of unprecedented scale.

Read more: https://www.mt5.com/forex_humor/image/41645

|

Метки: #forex_caricature |

US-China trade war escalation may trigger another financial crisis |

In the near future, the world may face another financial crisis caused by the trade conflict between the United States and China. The military and economic steps taken by the two largest world economies have a negative impact on every aspect of the global economy. It is quite disturbing because both parties have not spilled over into outright confrontation yet.

Europe which is still unable to deal with Brexit is particularly sensitive about every new change in the tariff battle. Portfolio manager at American Century Investments Trevor Gurvich said that the European market had been too optimistic about a quick and easy trade deal between the US and China. That is why the local exchanges were not ready for the parties' refusal to sign an agreement and bury the hatchet. The British FTSE 100 fell by 1.04 percent, the German DAX plunged by 1.49 percent, the French CAC slumped by 1.56 percent, while the Spanish IBEX 35 and the Italian FTSE MIB dropped by 0.93 percent and 2.56 percent, respectively. As for the American market, it turned out to be more resistant to the conflict. Despite the fact that after the recent escalation, it had lost almost a trillion dollars a day, it managed to recover.

If the main parties to the conflict fail to agree, the economic development is likely to be at risk. Therefore, if the US-China trade war escalation continues, it may can trigger a financial crisis of unprecedented scale.

Read more: https://www.mt5.com/forex_humor/image/41645

|

Метки: #forex_caricature |

US-China trade war escalation may trigger another financial crisis |

In the near future, the world may face another financial crisis caused by the trade conflict between the United States and China. The military and economic steps taken by the two largest world economies have a negative impact on every aspect of the global economy. It is quite disturbing because both parties have not spilled over into outright confrontation yet.

Europe which is still unable to deal with Brexit is particularly sensitive about every new change in the tariff battle. Portfolio manager at American Century Investments Trevor Gurvich said that the European market had been too optimistic about a quick and easy trade deal between the US and China. That is why the local exchanges were not ready for the parties' refusal to sign an agreement and bury the hatchet. The British FTSE 100 fell by 1.04 percent, the German DAX plunged by 1.49 percent, the French CAC slumped by 1.56 percent, while the Spanish IBEX 35 and the Italian FTSE MIB dropped by 0.93 percent and 2.56 percent, respectively. As for the American market, it turned out to be more resistant to the conflict. Despite the fact that after the recent escalation, it had lost almost a trillion dollars a day, it managed to recover.

If the main parties to the conflict fail to agree, the economic development is likely to be at risk. Therefore, if the US-China trade war escalation continues, it may can trigger a financial crisis of unprecedented scale.

Read more: https://www.mt5.com/forex_humor/image/41645

|

Метки: #forex_caricature |

Seven innovative technologies to protect anonymity in the Bitcoin network |

According to analysts, since its appearance, Bitcoin could not guarantee complete anonymity to network users. The largest specialists, working with blockchain technology, took up solving the problem. They proposed a number of innovative developments to increase privacy. Most of them are planned to be launched by the end of 2018 or next year.

In the world of cryptocurrency, Bitcoin takes the leading place. Its special feature is anonymity, but this is not entirely true. According to experts, the privacy of its users is often questioned. Analysts emphasize that the cryptocurrency number 1 has pseudonymity, that is, when carrying out transactions it is enough to specify only a pseudonym. In the Bitcoin network, the address from which the client sends the funds and receives them plays the role of a pseudonym. To ensure the protection of users, developers offer a number of technologies that have proven effective.

TumbleBit

This development has continued for almost two years and is nearly completed. This is one of the most effective solutions aimed at protecting the anonymity of Bitcoin users. The TumbleBit protocol is a way of mixing coins with a centralized switch to create payment channels between transaction participants. This solution requires two transactions for one participant. One operation is necessary to open a network channel, the other - to close it. The only disadvantage of this project is high commission fees.

Chaumian CoinJoin

The development of CoinJoin technology began in 2013. This solution consists in combining several small transactions into one large transaction. Thanks to this combination, high anonymity is achieved. Information about what bitcoins are sent from the sending addresses (inputs) to the receiving addresses (outputs) becomes classified. CoinJoin transactions are available for a long time, but there are certain difficulties with their creation. To solve this problem, experts suggest using the technology of "blind" signatures by David Chaum (Chaumian CoinJoin).

Schnorr signature

This technology was developed by Pieter Wuille, the creator of Bitcoin Core. Named after the inventor of Klaus-Peter Schnorr, these signatures are recognized as the best available in cryptography. Their advantage is in combining many signatures into one. As a result, a transaction requires only one signature, regardless of how many sending addresses are included in it. Schnorr's signatures not only allow all participants to combine their transactions, but also they bring economic benefits. When using this option, the level of anonymity increases many times. The technology will be launched in 2019.

STONEWALL

The development of STONEWALL technology started in May this year. With the help of STONEWALL transactions, one user sends bitcoins to another. The peculiarity of these operations is that they include a number of sending addresses that change the addresses of recipients. This creates a visibility of transactions. There is a "masking" of the money transfer, ensuring its anonymity. The idea of STONEWALL transactions is to create hindrances for hackers. According to experts, the technology copes with this task. Its launch is scheduled for late 2018.

Dandelion

Another way to increase privacy for users of the Bitcoin network was offered by American scientists. This is the technology of Dandelion. It makes it difficult to analyze the network, blocks attempts to enter it, and changes the order of the distribution of transactions. This offer was highly appreciated in the bitcoin community. Experts believe that in the near future, Dandelion will be included in the Bitcoin Core system.

BIP-151

This technology implies limiting extraneous exposure in the Bitcoin network. This method allows bitcoin nodes to encrypt traffic passing between them, including transactions and data about blockchains. The downside of the BIP-151 system is the inadequate provision of privacy. Nevertheless, experts consider this method effective to counter various types of hacker attacks. The launch of the technology is expected in 2019.

Liquid and Confidential Transactions

The purpose of this technology is to ensure the availability and anonymity of transactions between exchanges and large brokerage firms. In the future, access to Liquid wallets will be received by ordinary users. One of the important functions of the system is confidential transactions. This is a cryptographic method of masking the amount of funds sent and received. The advantage of this technology is the impossibility to track the movement of funds between companies. This ensures high confidentiality in transactions.

|

Метки: #photo_news |

Seven innovative technologies to protect anonymity in the Bitcoin network |

According to analysts, since its appearance, Bitcoin could not guarantee complete anonymity to network users. The largest specialists, working with blockchain technology, took up solving the problem. They proposed a number of innovative developments to increase privacy. Most of them are planned to be launched by the end of 2018 or next year.

In the world of cryptocurrency, Bitcoin takes the leading place. Its special feature is anonymity, but this is not entirely true. According to experts, the privacy of its users is often questioned. Analysts emphasize that the cryptocurrency number 1 has pseudonymity, that is, when carrying out transactions it is enough to specify only a pseudonym. In the Bitcoin network, the address from which the client sends the funds and receives them plays the role of a pseudonym. To ensure the protection of users, developers offer a number of technologies that have proven effective.

TumbleBit

This development has continued for almost two years and is nearly completed. This is one of the most effective solutions aimed at protecting the anonymity of Bitcoin users. The TumbleBit protocol is a way of mixing coins with a centralized switch to create payment channels between transaction participants. This solution requires two transactions for one participant. One operation is necessary to open a network channel, the other - to close it. The only disadvantage of this project is high commission fees.

Chaumian CoinJoin

The development of CoinJoin technology began in 2013. This solution consists in combining several small transactions into one large transaction. Thanks to this combination, high anonymity is achieved. Information about what bitcoins are sent from the sending addresses (inputs) to the receiving addresses (outputs) becomes classified. CoinJoin transactions are available for a long time, but there are certain difficulties with their creation. To solve this problem, experts suggest using the technology of "blind" signatures by David Chaum (Chaumian CoinJoin).

Schnorr signature

This technology was developed by Pieter Wuille, the creator of Bitcoin Core. Named after the inventor of Klaus-Peter Schnorr, these signatures are recognized as the best available in cryptography. Their advantage is in combining many signatures into one. As a result, a transaction requires only one signature, regardless of how many sending addresses are included in it. Schnorr's signatures not only allow all participants to combine their transactions, but also they bring economic benefits. When using this option, the level of anonymity increases many times. The technology will be launched in 2019.

STONEWALL

The development of STONEWALL technology started in May this year. With the help of STONEWALL transactions, one user sends bitcoins to another. The peculiarity of these operations is that they include a number of sending addresses that change the addresses of recipients. This creates a visibility of transactions. There is a "masking" of the money transfer, ensuring its anonymity. The idea of STONEWALL transactions is to create hindrances for hackers. According to experts, the technology copes with this task. Its launch is scheduled for late 2018.

Dandelion

Another way to increase privacy for users of the Bitcoin network was offered by American scientists. This is the technology of Dandelion. It makes it difficult to analyze the network, blocks attempts to enter it, and changes the order of the distribution of transactions. This offer was highly appreciated in the bitcoin community. Experts believe that in the near future, Dandelion will be included in the Bitcoin Core system.

BIP-151

This technology implies limiting extraneous exposure in the Bitcoin network. This method allows bitcoin nodes to encrypt traffic passing between them, including transactions and data about blockchains. The downside of the BIP-151 system is the inadequate provision of privacy. Nevertheless, experts consider this method effective to counter various types of hacker attacks. The launch of the technology is expected in 2019.

Liquid and Confidential Transactions

The purpose of this technology is to ensure the availability and anonymity of transactions between exchanges and large brokerage firms. In the future, access to Liquid wallets will be received by ordinary users. One of the important functions of the system is confidential transactions. This is a cryptographic method of masking the amount of funds sent and received. The advantage of this technology is the impossibility to track the movement of funds between companies. This ensures high confidentiality in transactions.

|

Метки: #photo_news |

Seven innovative technologies to protect anonymity in the Bitcoin network |

According to analysts, since its appearance, Bitcoin could not guarantee complete anonymity to network users. The largest specialists, working with blockchain technology, took up solving the problem. They proposed a number of innovative developments to increase privacy. Most of them are planned to be launched by the end of 2018 or next year.

In the world of cryptocurrency, Bitcoin takes the leading place. Its special feature is anonymity, but this is not entirely true. According to experts, the privacy of its users is often questioned. Analysts emphasize that the cryptocurrency number 1 has pseudonymity, that is, when carrying out transactions it is enough to specify only a pseudonym. In the Bitcoin network, the address from which the client sends the funds and receives them plays the role of a pseudonym. To ensure the protection of users, developers offer a number of technologies that have proven effective.

TumbleBit

This development has continued for almost two years and is nearly completed. This is one of the most effective solutions aimed at protecting the anonymity of Bitcoin users. The TumbleBit protocol is a way of mixing coins with a centralized switch to create payment channels between transaction participants. This solution requires two transactions for one participant. One operation is necessary to open a network channel, the other - to close it. The only disadvantage of this project is high commission fees.

Chaumian CoinJoin

The development of CoinJoin technology began in 2013. This solution consists in combining several small transactions into one large transaction. Thanks to this combination, high anonymity is achieved. Information about what bitcoins are sent from the sending addresses (inputs) to the receiving addresses (outputs) becomes classified. CoinJoin transactions are available for a long time, but there are certain difficulties with their creation. To solve this problem, experts suggest using the technology of "blind" signatures by David Chaum (Chaumian CoinJoin).

Schnorr signature

This technology was developed by Pieter Wuille, the creator of Bitcoin Core. Named after the inventor of Klaus-Peter Schnorr, these signatures are recognized as the best available in cryptography. Their advantage is in combining many signatures into one. As a result, a transaction requires only one signature, regardless of how many sending addresses are included in it. Schnorr's signatures not only allow all participants to combine their transactions, but also they bring economic benefits. When using this option, the level of anonymity increases many times. The technology will be launched in 2019.

STONEWALL

The development of STONEWALL technology started in May this year. With the help of STONEWALL transactions, one user sends bitcoins to another. The peculiarity of these operations is that they include a number of sending addresses that change the addresses of recipients. This creates a visibility of transactions. There is a "masking" of the money transfer, ensuring its anonymity. The idea of STONEWALL transactions is to create hindrances for hackers. According to experts, the technology copes with this task. Its launch is scheduled for late 2018.

Dandelion

Another way to increase privacy for users of the Bitcoin network was offered by American scientists. This is the technology of Dandelion. It makes it difficult to analyze the network, blocks attempts to enter it, and changes the order of the distribution of transactions. This offer was highly appreciated in the bitcoin community. Experts believe that in the near future, Dandelion will be included in the Bitcoin Core system.

BIP-151

This technology implies limiting extraneous exposure in the Bitcoin network. This method allows bitcoin nodes to encrypt traffic passing between them, including transactions and data about blockchains. The downside of the BIP-151 system is the inadequate provision of privacy. Nevertheless, experts consider this method effective to counter various types of hacker attacks. The launch of the technology is expected in 2019.

Liquid and Confidential Transactions

The purpose of this technology is to ensure the availability and anonymity of transactions between exchanges and large brokerage firms. In the future, access to Liquid wallets will be received by ordinary users. One of the important functions of the system is confidential transactions. This is a cryptographic method of masking the amount of funds sent and received. The advantage of this technology is the impossibility to track the movement of funds between companies. This ensures high confidentiality in transactions.

|

Метки: #photo_news |

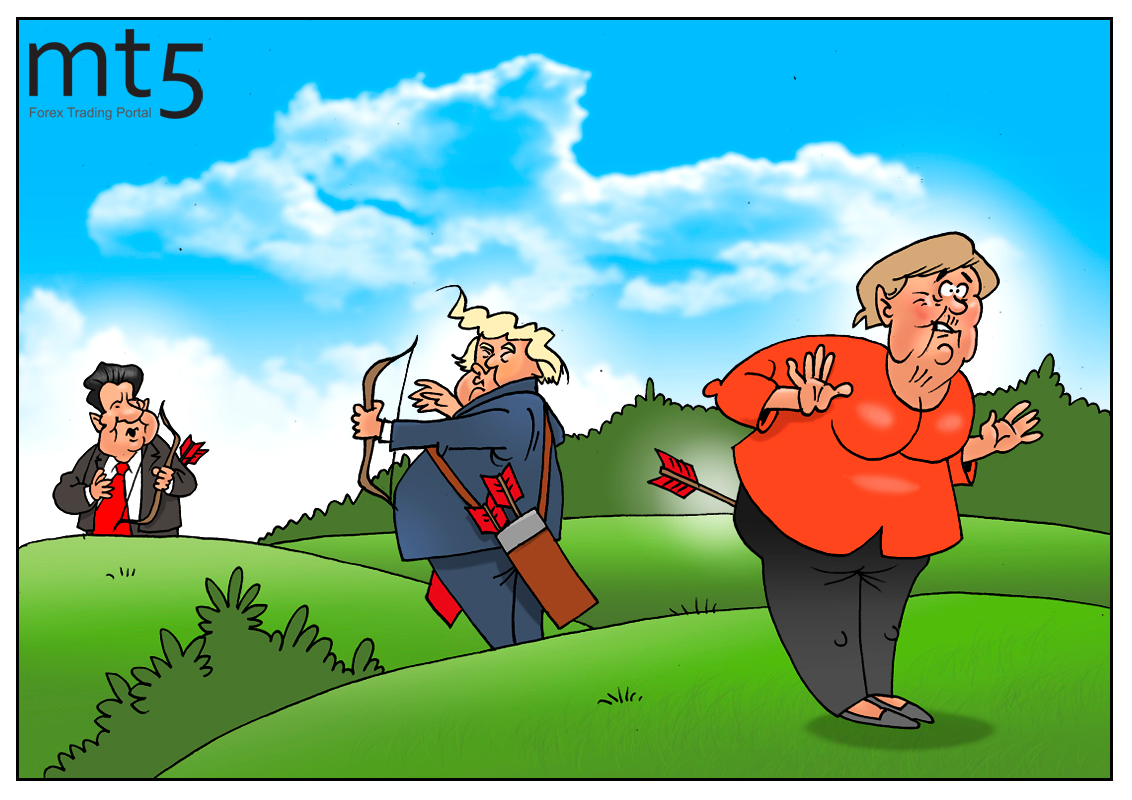

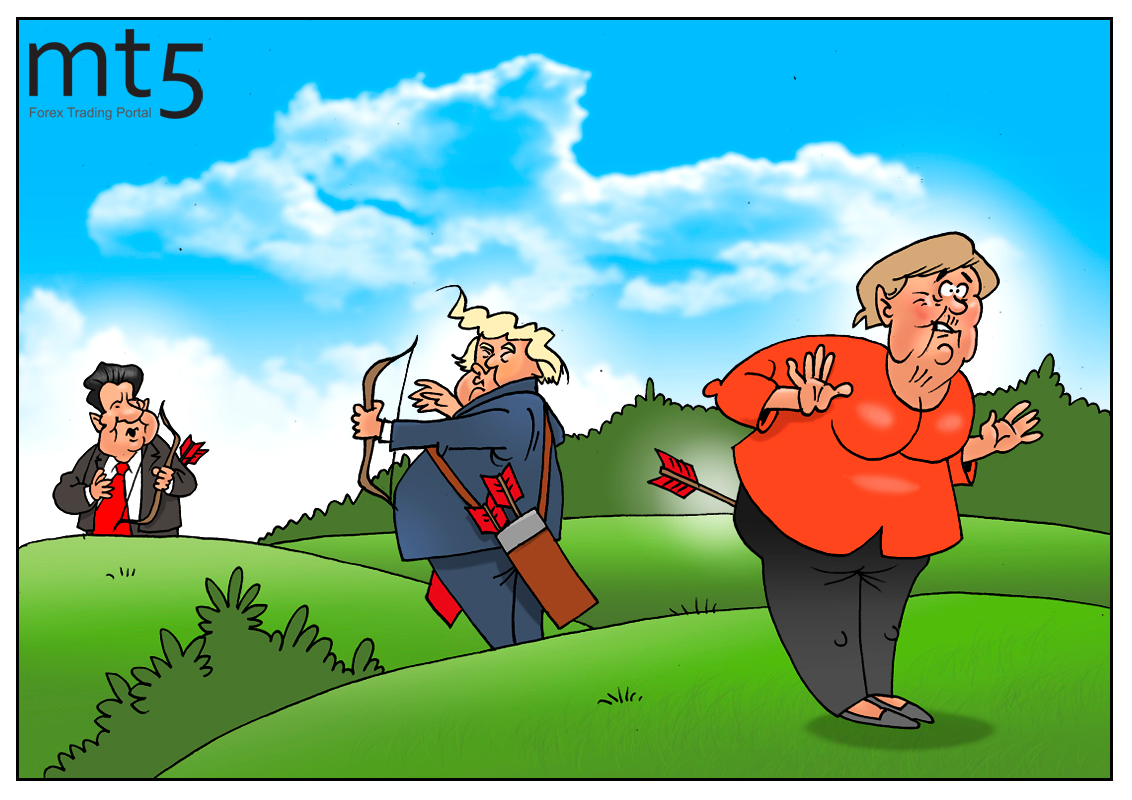

Angela Merkel expresses support for Nord Stream-2 construction |

Reading the news about the Nord Stream-2 gas pipeline construction, one might think that there are two projects with the same name but different fates. While the first one exists in the Russian media, almost launched and even functioning, the second one has been banned and shut down in the western media reports on several occasions.

However, another positive news on the Nord Stream-2 project has been received from an unexpected source. The recent statement of German Chancellor Angela Merkel expressed her support for the construction of a gas pipeline. “The new Gas Directive gives the European Commission more opportunities to challenge. However, it will not prevent the project. The project is almost fully approved,” business daily Handelsblatt newspaper quoted the German chancellor as saying. Germany is certainly an interested party, but the main thing is that the existence of the gas pipeline has been finally accepted. Nevertheless, in the same statement, Angela Merkel stressed that the project would be implemented only if Ukraine remained its key transit country.

In other words, the statement of the сhancellor can be regarded as an attempt to simultaneously support the project and establish the conditions that would benefit Germany in every respect. Moreover, US Senate is threatening to impose new sanctions on companies participating in the pipeline construction.

Read more: https://www.mt5.com/forex_humor/image/41614

|

Метки: #forex_caricature |

Five digital assets you can get for free |

Thanks to the growing popularity of many altcoins, the developers of these digital assets occasionally distribute them. This is usually free. Experts advise you to decide what tokens are of real interest to market players. They offer to get acquainted with the list of the most attractive and profitable ones.

According to experts, a lot of tokens of the ERC-20 standard appear on the Ethereum network every month. As an advertising campaign, a number of companies arrange free distribution of such altcoins. Thanks to this, users can make a profit. We suggest getting acquainted with the list of such tokens.

BioCryptо

Recently, BioCrypto tokens could be purchased for a symbolic price, $0.05. Experts find it difficult to predict the price prospects of this altcoin, because they do not have information about the number of coins in circulation. Nevertheless, BioCrypto gives the impression of a profitable investment. The main purpose of the distribution of tokens is the possibility of using them in the blockchain system.

Infinitus

This application is designed to store user data. By providing the address of your ETH wallet, you receive 16 Infinitus tokens (INF). Currently, their price is equal to $0.24; however, according to experts, it can rise to $3.8.

ScientificCoin

This altcoin is an innovative blockchain platform designed specifically for research projects. It uses a decentralized analysis system that allows experts to determine the most promising innovations. The company offered three tokens for 4.5 each.

CYBR

To obtain CYBR, users need to conduct their own advertising campaign in social networks, as well as contribute to the promotion of this project. In exchange, participants become owners of 50 CYBR tokens, each of which costs $5.6. The goal of the company is to increase cyber security.

AXEL

This blockchain platform was created to improve the exchange protocols in distributed networks. According to experts, the project has every chance to become one of the most valuable tokens based on Ethereum. Many users, who participated in the distribution, received 1,300 AXEL tokens worth $26.

|

Метки: #photo_news |

J.P. Morgan: US agriculture to face crisis |

According to J.P. Morgan, the state of US agriculture is rapidly deteriorating. Moreover, it is on the verge of crisis, experts say. They name three reasons: declining exports, an extremely poor crop of corn and soybeans as well as ongoing trade conflict with China.

J.P. Morgan analyst Ann Duignan believes that the main problem the American farmers have faced is a critical oversupply of global agricultural markets. This oversupply puts US exports of agricultural products under pressure. US farmers are entering not the best times, the data from the US Department of Agriculture showed.

The estimates of J.P. Morgan specialists reflected the recent decrease in exports of soybeans by 27% due to tariffs and excess global supply.

In 2019, the planting season started very slowly, Ann Duignan noted. She is sure that this tendency will continue the next year, while crisis factors in the US agricultural industry will rise in the near future.

Read more: https://www.mt5.com/forex_humor/image/41616

|

Метки: #forex_caricature |

Без заголовка |

J.P. Morgan: US agriculture to face crisis

According to J.P. Morgan, the state of US agriculture is rapidly deteriorating. Moreover, it is on the verge of crisis, experts say. They name three reasons: declining exports, an extremely poor crop of corn and soybeans as well as ongoing trade conflict with China.

J.P. Morgan analyst Ann Duignan believes that the main problem the American farmers have faced is a critical oversupply of global agricultural markets. This oversupply puts US exports of agricultural products under pressure. US farmers are entering not the best times, the data from the US Department of Agriculture showed.

The estimates of J.P. Morgan specialists reflected the recent decrease in exports of soybeans by 27% due to tariffs and excess global supply.

In 2019, the planting season started very slowly, Ann Duignan noted. She is sure that this tendency will continue the next year, while crisis factors in the US agricultural industry will rise in the near future.

Read more: https://www.mt5.com/forex_humor/image/41616

|

Метки: #forex_caricature |

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #forex_caricature |

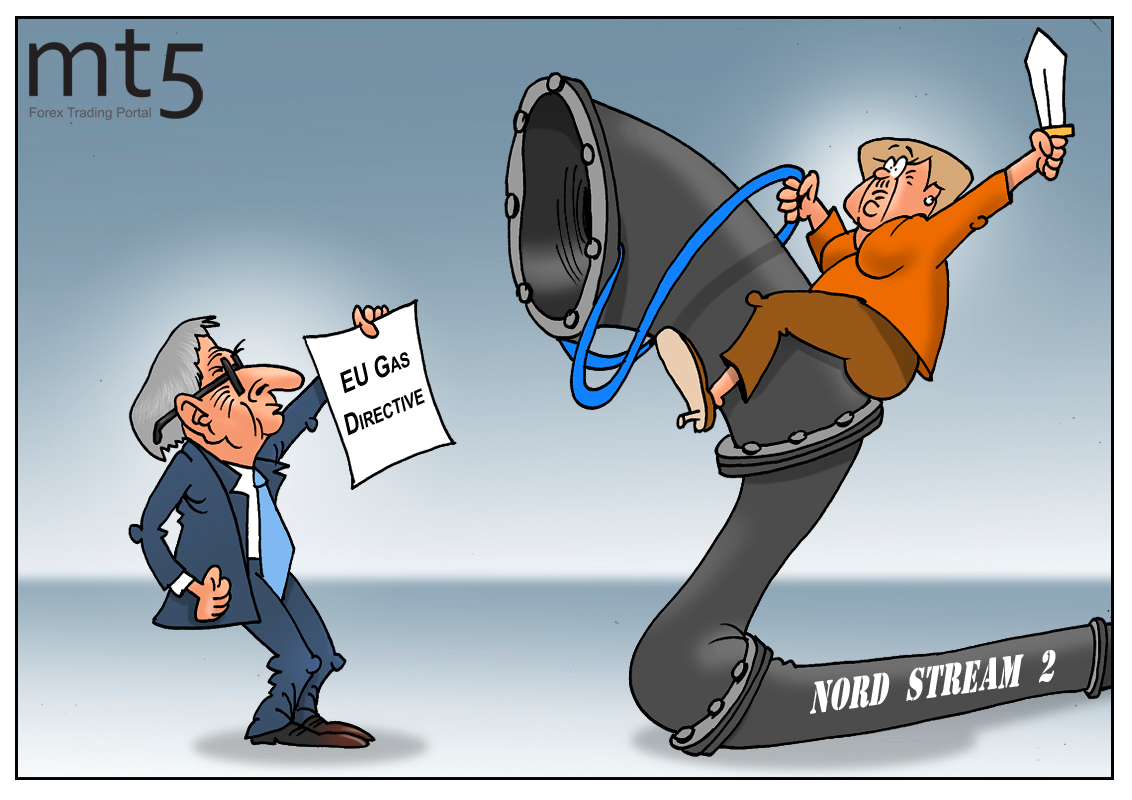

Theresa May’s resignation seems inevitable |

As it turns out, the failure to execute at the helm of a government can be a reason for "resignation" which could be a forced decision.

A state leader has to resign for weighty reasons: the rule triggers a political crisis, causes an economic slowdown, worsens a living standard of the population. It does work this way in some countries. Take at least the UK. Under the leadership of current Prime Minister Theresa May the country has been struggling to leave the EU for almost two years.

Having failed to reach a Brexit deal with the EU, Mrs. May has lost the support of almost the entire Cabinet, with the exception of two of its members. Theresa May’s mistakes put an end to her political career, experts say. Perhaps, the British Prime Minister will resign due to the efforts of members of the government at the end of June.

Such sentiments have a negative impact on the national currency. Brexit turmoil drives the pound lower. Extending weakness, the GBP/USD pair has already fallen to the level of 1.30. Experts warn of a deeper decline of the pound sterling under Brexit uncertainty. GBP/USD could slump to 1.26.

Apart from domestic Brexit-related factors, the pound sterling has been weighed down by the weaker euro. Last week, the single European currency fell to the lowest level of 2018. It happened after the ECB announced a new round of TLTRO.

Read more: https://www.mt5.com/forex_humor/image/41563

|

Метки: #forex_caricature |

Five companies with high dividends in Warren Buffett portfolio |

One of the key factors in assessing the financial condition of a company is a systematic dividend increase. Overall, the widely followed Berkshire Hathaway investment portfolio shows Warren Buffett knows the value of a consistent and growing dividend, even if he's no fan of paying dividends himself. Let's consider the largest of them.

Dividends paid to shareholders reduce the size of capitalization, while not always directly correlated with the value of shares, but the size of dividend yield makes the company attractive for investment. In our review, you will find five companies with high dividends from the portfolio of the legendary Oracle of Omaha (Warren Buffett).

1. KRAFT HEINS

The American food company, Kraft Heinz, which produces food and beverages, is one of the largest firms in terms of market capitalization owned by Berkshire Hathaway.

Kraft Heinz's dividend payout is $2.50 per year, and dividend yield is 5.16 percent.

The dividend growth rate over the last 3-5 years totals about 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is estimated at 15.

Since the beginning of the year, the value of the company's shares fell by 40.33 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 325.6 million shares of Kraft Heinz.

2. STORE CAPITAL

A real estate investment trust or REIT, Store Capital invests in single-tenant commercial properties, such as supermarkets and drugstores.

Dividend payout of STORE Capital is estimated at $1.32 per year, dividend yield is 4.29 percent.

The dividend growth rate over the last 3-5 years reached 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 4.

Since the beginning of the year, the value of the company's shares increased by 18.97 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 18.6 million shares of STORE Capital Corporation.

3. GENERAL MOTORS

The largest American automobile corporation, General Motors is considered the largest car manufacturer in the world for 77 years. The automaker's new mobility bets now include electric bicycles, in addition to electric cars and self-driving cars. But for now, GM earnings that drive dividends are coming from gas-guzzling SUVs and trucks.

GM's dividend payout is $1.52 per year, and dividend yield is 4.33 percent.

The dividend growth rate over the last 3-5 years reaches 6 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 5.

Since the beginning of the year, the value of the company's shares decreased by 14.29 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 52.5 million shares of General Motors, while the company's share was increased by 1.1 million securities.

4. TEVA

The multinational pharmaceutical company Teva Pharmaceutical Industries was included in the Berkshire Hathaway portfolio in the fourth quarter of 2017. Teva shares were bought at $10.85 per share. Their value has more than doubled since then.

Teva's dividend payout is $0.94, dividend yield is 4.3 percent.

The dividend growth rate over the last 3-5 years is estimated at about 1 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 14.

Since the beginning of the year, the value of the company's shares fell by 0.81 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 43.2 million shares of Teva Pharmaceutical Industries.

5. VERIZON

The American telecommunications corporation, Verizon Communications, which derives the bulk of its profits from providing wireless services, is currently launching 5G mobile networks. The new technology will be used to exchange data between unmanned vehicles.

Verizon's dividend payout is $2.41 per year, with a dividend yield of 4.22 percent.

The dividend growth rate over the last 3-5 years totals about 3 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is 0.

Since the beginning of the year, the value of the company's shares increased by 8.37 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 928 shares of Verizon Communications.

|

Метки: #photo_news |

Zuckerberg speaks against dividing Facebook |

Mark Zuckerberg does not intend to separate Facebook, the most popular network in the world, from WhatsApp and Instagram FB, also owned by the company. The entrepreneur is convinced that breaking up Facebook will not solve issues faced by the network.

This speech of the Facebook founder was an answer to his business partner Chris Hughes who claimed the network to be a monopolist that needed to be broken up. According to Hughes, one of the reasons why Facebook experiences security troubles is that it controls over 80% of the market. The company became a monopoly and does not trust regulators, he outlined. On the other hand, Mark Zuckerberg does not deny there are some difficulties, but he is sure the company can manage the situation without outside intervention. The current issues mainly relate to harmful content as well as maintaining a balance between freedom of expression and the security of users’ personal data. The Facebook chairman added that being a monopolist, the company is responsible for all expenses related to the network’s operation.

Last week, Chris Hughes criticized management by Zuckerberg and urged to break up Facebook. The company’s CEO has “an unprecedented power” and holds about 60% of its shares, he added. This way, Zuckerberg can make decisions on any changes in the social network on his own.

His business partner believes that Facebook should be forced to reverse its acquisitions of Instagram and WhatsApp, while such takeovers should be forbidden at all. In Hughes’ opinion, the company’s shares must be redistributed among shareholders in proportion to their current state. He is sure that breaking up Facebook will have a positive effect on the shares of new companies as well as on the technological component of the social network.

Read more: https://www.mt5.com/forex_humor/image/41512

|

Метки: #forex_caricature |