Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Five ways to increase your salary |

There are two main ways to improve your well-being: spend less or earn more. In order to cope with financial difficulties faster, it is better to use both methods at once. But no matter how effective reasonable planning and forced savings are, you can hardly get rich by getting $300 a month. In our review, there are several easy ways to increase your income.

Sometimes an excellent specialist works for years and wonders why his salary does not match the experience and qualifications, but does not take any actions to change the situation. Sounds familiar? We offer a few simple tips on how always be appreciated.

These tips are best suited for medium and large commercial organizations. The principles for raising wages in state-owned enterprises and small companies are often unpredictable and devoid of any logic.

Evaluate yourself

A person with good self-esteem will not do hard work for a small amount of money for a long time, because he knows that he is “worthy of more”.

Look at your work. Do you like it? Are you a good specialist? Do you add value to this company? Will it be difficult to replace you? Do you want to further improve your professional skills? Are you satisfied with your salary? If the majority of answers (except for the last one) is positive, most likely, you just need a pay rise.

Decide for yourself how much money you should be paid. Set a goal and move towards it.

Say your goals aloud

If your work is worth more than what you get for it, go to the management and say it. As long as the employee does not ask, the manager will not be in a hurry to raise the salary.

In addition to money, discuss plans and career prospects with your superiors. It is possible that you have already “outgrown” your position and can take on more serious projects, and perhaps your vision does not coincide with the views of the leadership, and you should immediately clarify the situation in order not to waste time on useless cooperation.

More benefits, more vitamins!

Maybe you are a good specialist, but the company does not receive significant benefits from this. For example, your knowledge of five languages is useless to conduct negotiations within the country.

The main thing is to help the company to become more successful, to enter new territories, and to improve current activities. Suggest your own development plan. If you help the company make more money, your bosses will gladly increase your personal income.

Wind of change

Sometimes the company does not know how to change or does not want to, so there will be no changes for you too. In such situation, you should take a vacation, find all the vacancies that suit you and send out your resume. Perhaps a dream job has been waiting for you for a long time.

If you received a good offer, but you are in doubt, tell your boss about it. He can do everything in his power to persuade you not to leave the company.

Develop yourself

Maybe right now you do not deserve a lot of money, or the modern labor market cannot offer them to you. Do not be discouraged, you should not give up. On the contrary, continue efforts. Expand your horizons, discover new superpowers.

Find a way to increase your value: engage in self-education, attend master classes, and meet people you respect. Set goals, say them aloud and work to achieve them. If, despite all your efforts, attractive employers ignore you, start your own business.

|

Метки: #photo_news |

Morgan Stanley: aftermath of US-China trade conflict |

According to Morgan Stanley's chief US strategist and chief investment officer Mike Wilson, the standoff between the United States and China may trap the whole world in an economic conflict. The expert provides an overview of his expectations and highlights three main problems faced by the US stock market amid the escalating US-China trade war.

1) US stock market volatility

The expert from Morgan Stanley points out that the volatility of the US stock market is currently extremely high. Moreover, the market is expected to remain volatile even if a trade agreement between Washington and Beijing is reached. According to Mike Wilson, even in a best-case scenario, the recovery in the US stock market will take long. The analyst believes that geopolitical instability will force the volatility to remain at its peak for the next two years.

2) Unstable and modest profit

Another important problem, in the view of Mike Wilson, is unstable and modest profits of some American corporates. Though some S&P 500 companies provided positive reports, their earnings are not stable. Next year, they will hardly meet the analysts’ expectations. The report for the fourth quarter of 2018 showed that 69% of the S&P 500 companies posted better-than-expected results in terms of profit, while 61% of them were in line with expectations in terms of revenue. However, the strategist from Morgan Stanley stresses that both indicators are below their five-year averages.

3) High risk of recession

Mike Wilson believes that the American economy is at an increasing risk of a recession. He claims that the US economy is experiencing a recession. However, the slowdown has not reached its lowest point yet, and the “bearish” market has been gaining momentum, the expert says.

Recently, the Chinese authorities have struck back in the trade war with the United States. Earlier, US President Donald Trump imposed tariffs on $200 billion worth of Chinese goods. In response, Beijing imposed mirror tariffs on $60 billion worth of US goods. Interestingly, experts considered it as a reason that the US stock market crashed.

As a result, US stock indices hit their lows. The S&P 500, a broad market index, showed the worst reading since January 2019. In one trading session, it dropped by almost 70 points, reaching a critical level of 2,812 points. The Dow Jones Industrial Average lost 2.38%, falling by 617.38 points and reaching its lowest level since January of this year. The worst collapse was recorded by the Nasdaq, which hit its annual low. In a day, it went down by 270 points to 7,647 points. Analysts expect the recovery of the US market to be slow.

Read more: https://www.mt5.com/forex_humor/image/41492

|

Метки: #forex_caricature |

Passenger drones: the future of unmanned transport |

Existing models of electrically powered drones, requiring control and possessing modest technical characteristics, can take a maximum of one person to the air. We suggest to find out from our article what companies are currently working to turn drones from a single-seated toy into everyday mode of transport.

In January 2016, at the CES exhibition in Las Vegas, the Chinese EHang company presented a self-controlled aircraft, Ehang 184, the cabin of which accommodates one person. The drone is equipped with eight propellers, powered by electric motors, and is capable of achieving a maximum speed of 100 km/h. The maximum carrying capacity of the device is 118 kg, the flight range is 18 km, and the flight height is 3.3 km. Dubai plans to launch an unmanned taxi based on it. It is known that a two-person model is currently being developed and certified.

In June 2017, the US Workhorse company introduced a passenger drone Surefly, designed for two people. According to the developers, this is the world's first personal hybrid octocopter, which can reach the height of 1.2 km with a payload on board of up to 200 kg. According to the reported data, the maximum speed of Surefly is 113 km/h, and an approximate range is about 110 km. It is assumed that the first versions of the aircraft will be manned, and then there will be models that operate in the autonomous mode.

Volocopter is a two-seat multicopter created by the German company of the same name in partnership with Intel Corporation and shown for the first time in April 2017 at the air show in Friedrichshafen. The dron can follow the route autonomously, and is fully electric. It has 18 motors and 2 navigation systems: the main and spare. In case of an emergency, a ballistic parachute is provided. According to some reports, Volocopter 2X which can stay in the air for about 30 minutes, overcome a distance of about 30 km, and accelerate to 100 km/h, has been already put into serial production.

The British Rolls-Royce Group company promises to establish a serial production of the EVTOL air taxi by 2020, which will be able to move at a speed of 400 km/h, fly up to 800 km, and transport up to five people simultaneously. In addition, the aircraft will be able to take off and land in an upright position. Engineers expect that the device can be modified for personal use, as a truck, as well as for military needs. It is expected that the aircraft will be initially controlled by a pilot, but in the future, it will become unmanned.

In three years, the American Uber Technologies company intends to run transportation service with the help of an unmanned air taxi, Uber Elevate. It is assumed that the residents of Los Angeles will be the first to test it. It is known that the company has already signed an agreement with NASA to create the system of logistics and traffic management for aircrafts. According to the representatives of Uber, the air taxi will serve tens of thousands of flights a day at an average travel price of only $20, and it will take less than half an hour to fly over Los Angeles from one end to the other.

Three British companies are inviolved in the project to develop the Volante Vision flying vehicle: Aston Martin (responsible for design of the aircraft), Rolls-Royce Group (hybrid electric power plant), and Cranfield Aerospace Solutions (electronics, including autopilot and electrical systems). According to the engineers, the self-controlled device with upright take-off and landing will be able to transport three passengers and will be targeted at flights with high comfort in cities and suburban areas. Technical details of the project are not disclosed yet.

|

Метки: #photo_news |

Political turmoil disastrous for Turkish lira |

Bloomberg reported that the Turkish lira plummeted to 5.9973 versus the US dollar, the lowest level in seven months. Experts think that political turmoil in Turkey is to blame for the persistent weakness of the lira.

The country plunged into civil unrest as President Recep Tayyip Erdogan put pressure on the electoral board insisting on rerunning the mayoral election in Istanbul. On March 31, 2019, Ekrem Imamoglu, a nominee from the opposition Republican People’s Party, won the mayor’s office with a narrow margin outpacing the President’s candidate. Turkey’s leader rejected the victory of the opposition nominee citing numerous violations in the course of the election. Eventually, Erdogan’s party demanded a new vote. Experts at Bloomberg warn that the new mayoral contest will deal a blow to the domestic economy. Moreover, Turkey is on the verge of political chaos. Meanwhile, Turkey’s markets have been hurt by higher volatility in global stock markets. The Turkish lira has been on a losing streak for four weeks in a row. On May 6, it slumped to the worst mark in the recent six months. Apart from domestic troubles, the lira is suffering amid tensions in the relations between Ankara and Washington.

Interestingly, technical analysts from Bloomberg say that the USD/TRY pair has formed a bullish candlestick pattern called the golden cross when the short-term 50-day moving average crossed above the long-term 200-day moving average.

Read more: https://www.mt5.com/forex_humor/image/41462

|

Метки: #forex_caricature |

Five myths about private banking |

In Europe, specialized banking service originated a very long time. According to experts, its history is centuries old, and in Russia, Private banking appeared only recently. Its functioning is surrounded by many myths. It is not easy for people who have no financial experience to distinguish truth from fiction. We offer to consider this issue.

Market participants starting to work in the financial sector are faced with a new concept, Private banking. This is a premium personal banking service for wealthy individuals aimed at conducting operations with client funds. Thanks to Private Banking, the client’s financial condition multiplies. This service is similar to the management of private capital. It is not easy for clients of financial institutions to understand its nuances. As a rule, it is interpreted incorrectly and requires clarification.

Myth 1. Private banking emphasizes owner status

Many believe that individual banking services differ from the usual ones only by the level of comfort, the presence of personal managers and the prompt resolution of any issues. Experts agree only on the last point and partly on the second. The main task of the banking institution is to work on increasing the client's welfare. A portfolio consultant working as a personal assistant helps a lot in this situation.

Myth 2. Premium banking services are not for everyone

Not only big businessmen but also representatives of the middle class can afford a high level of comfort of servicing in a bank. To receive this service, you need a sufficient amount of funds that you are willing to invest or put on deposit. The amount of the deposit depends on the country and the bank. Investments will constantly work, experts remind. Financial institution VIP clients can use any financial instruments of the bank.

Myth 3. Private banking is similar to fiduciary management

Recall the feature of the trust management of the bank is that the management of the financial institution unilaterally decides when and in what to invest client funds. However, this statement is incorrect with respect to private banking. A personal manager assigned to every client helps them to create an investment strategy attracting a multitude of specialists, from investment experts to treasury employees. This allows the client to make an informed decision about a particular banking operation.

Myth 4. You need to have a good understanding of investments to get private banking

This statement is not true, experts emphasize. To obtain the privileges of banking services, a client only needs to maintain an average monthly balance using any products of the bank. Experts help to choose the most suitable of them, and then to form an investment portfolio. A VIP investor will be able to receive all the information about the dynamics of his assets, both remotely and personally.

Myth 5. Premium banking service holders have few privileges

According to experts, the scope of privileges for Private banking is quite diverse. Each bank has its own bonus package. As a rule, it includes insurance for traveling abroad, free access to the business halls of major airports, service support 24/7, access to private events and special offers, unlimited Wi-Fi abroad and even on board airplanes, online access to the latest news and analytical reviews, etc.

|

Метки: #photo_news |

Protracted Brexit affects UK’s investment |

According to experts, uncertainty related to protracted process of UK’s withdrawal from the European Union affected the country’s economy causing a significant reduction in investments.

In a note entitled “Brexit – Withdrawal Symptoms”, analysts at Goldman Sachs said that this situation would not change until the UK leaves the European Union. Experts paid special attention to the risks of steady low investments and weak labor productivity in the British economy.

Goldman Sachs noted that the side effects, such as shrinking investment, had been seen in the UK economy for a long time. Brexit has taken a toll on the country, even though it has not happened yet.

Business investment has increased by just 0.3 percent in cumulative terms since the June 2016 referendum. Last year was the first year for the UK in half a century during which business investment went down in every quarter without a recession in the economy.

Goldman Sachs predicted that low investment would lead to the worsening chronic underperformance of the UK in relation to other developed countries. Analysts warned that labor productivity would eventually decrease.

Bank experts stated that the Brexit deal requires appropriate amendments to smooth out the negative impact on the British economy. In 2020, with Brexit resolved, Goldman Sachs does expect a pick-up in the domestic economy.

Read more: https://www.mt5.com/forex_humor/image/41439

|

Метки: #forex_caricature |

Rare cars forgotten in old garages |

Annually, the news reports about amazing things found in abandoned buildings. There is a lot of cars among them. Hunters for exotic cars are sometimes lucky to find truly unique items or even entire collections of vintage cars that can cost a fortune. You can read about the five most interesting cars that were found in abandoned garages.

Dodge Charger

The 1969 Dodge Charger Daytona was accidentally found in an old barn by residents of the American city of Glenwood in 2015. Manufacturers have released only 503 copies of this model. Dodge Charger with a mileage of 33.07 km preserved in its original form: the 375-strong eight-cylinder Dodge 440 Magnum engine and automatic gearbox are in a work condition.

At one time, the car was bought by a local judge as a gift to his wife, and in 1974 the couple decided to sell it to a new owner who did not appreciate the purchase.

Experts estimated the two-door sports coupe at $180 thousand, but in January 2016 it was sold twice cheaper for $90 thousand.

Ferrari 166MM 1949

The sports car 166MM 1949 was produced in an even more limited number, only 25 copies. Especially for this model, Italian designer Gioacchino Colombo developed the V12 engine with a volume of 2 liters, which made the car one of the fastest in the model range of the brand.

The first owner was from Arizona, he bought a car in 1959 at auction for only $8 thousand. For several years the car was used for its intended purpose, to participate in sports competitions, but after another breakdown, it was forgotten. Half a century later, the heirs recalled the sports car and sold it to collector Manny Del Arroz for $1 million. He completely fixed the mechanical part of the car.

Ferrari 365 GTB/4 Daytona 1969

Another rare Italian car was found in an abandoned garage in Japan, where it stood for more than 40 years. Until 1973 Ferrari released only 1.2 thousand of these cars, equipping them with 4.4-liter engines of 350 hp. But only five of them received ultra-light aluminum bodies from the famous studio Scaglietti. And upon closer examination, the experts found out that this is the only copy of its kind that was certified for driving on public roads.

Autosprint journalist Luciano Conti was the first owner of the car. Then the car changed several owners until it was exported to Japan. In September 2017, the sports car was sold for $2.17 million at an auction in Maranello, Italy.

Three rare Texas sports cars

Three expensive sports cars were found in an abandoned barn in the northeastern United States: 1974 Ferrari Dino 246 GTS, 1972 Ferrari 365 GTB / 4 Daytona and 1977 Maserati Bora Coupe.

Italian sports cars did not receive adequate attention and care for decades. But the condition of these cars turned out to be even better than that of the existing collection items.

In the 1970s, a friend of the American Ferrari importer, race car driver Luigi Chinetti, bought this car. In the summer of 2011, cars were put up for sale at eBay auction.

Forgotten Chevrolet dealership warehouse

In 2013, an abandoned dealership warehouse was found in Nebraska, where about 500 classic Chevrolet cars were stored. Fifty of them are completely new with a mileage of 1 mile. In addition, corrosion damaged only a few cars, and it was not difficult to restore them.

These cars once belonged to the dealership center Lambrecht Chevrolet. The owner of the showroom kept new cars that were not sold in the first year in warehouses near his farm. In the early 1980s, the business was closed, and everyone forgot about cars.

Van Der Brink held an auction where this rare collection was sold. For example, Chevrolet Cameo was sold for the highest price, $140 thousand.

|

Метки: #photo_news |

Coca-Cola’s earnings surge 23% |

Coca-Cola, the world's largest producer of soft drinks, posted a corporate earnings report for Q1 2019. The report reads, its net earnings soared 23% in Q1 on a yearly basis totaling $1.678 billion.

During the reporting period, Coca-Cola's diluted earnings per share grew to $0.39, compared to $0.32 a year earlier. Year-on-year, the company's revenues increased by 5 percent to $8.02 billion. This figure topped forecasts as analysts had expected revenues of $7.88 billion.

The global producer of soft drinks predicts revenue growth of 4 percent by the end of this year. Experts also said that net capital expenditure might go up to $2 billion in 2019.

Fanta and Sprite are the most famous brands of Coca-Cola. In general, the corporation has over 500 brands. The staff of the company exceeds 700 thousand employees.

Read more: https://www.mt5.com/forex_humor/image/41393

|

Метки: #forex_caricature |

Coca-Cola’s earnings surge 23% |

Coca-Cola, the world's largest producer of soft drinks, posted a corporate earnings report for Q1 2019. The report reads, its net earnings soared 23% in Q1 on a yearly basis totaling $1.678 billion.

During the reporting period, Coca-Cola's diluted earnings per share grew to $0.39, compared to $0.32 a year earlier. Year-on-year, the company's revenues increased by 5 percent to $8.02 billion. This figure topped forecasts as analysts had expected revenues of $7.88 billion.

The global producer of soft drinks predicts revenue growth of 4 percent by the end of this year. Experts also said that net capital expenditure might go up to $2 billion in 2019.

Fanta and Sprite are the most famous brands of Coca-Cola. In general, the corporation has over 500 brands. The staff of the company exceeds 700 thousand employees.

Read more: https://www.mt5.com/forex_humor/image/41393

|

Метки: #forex_caricature |

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #photo_news |

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #photo_news |

Four cryptocurrencies demonstrating blockchain technology's features |

Most market participants closely follow Bitcoin and Ethereum, but some pay attention to lesser-known cryptocurrencies. Experts analyzed four digital assets which are gaining popularity and demonstrate the dizzying possibilities of blockchain technology.

SureRemit

This crypto asset allows traders to significantly reduce the commission for transactions. The user pays 0–2% instead of 7–12%. At the same time, you can track transactions that are processed in a few seconds. As a result, costs and possibilities of fraud are lowered. The SureRemit global network, which includes more than 650 stores in Africa and the Middle East, uses blockchain technology. SureRemit is an ongoing blockchain project that surpasses existing services in terms of cost, efficiency, and transparency.

Metal Pay

This is a US competitor of Venmo and Cash App, which allows you instantly transfer money between users for free. They receive MTL tokens for each transaction. According to experts, during the creation of a cashless society, such services will assume the functions of money and checks. The project team actively uses blockchain technology. The future of Metal Pay seems to be optimistic for developers. They are confident that the project will be widely distributed, as it surpasses the existing centralized solutions.

Ravencoin

This project has the highest capitalization among these digital assets. Ravencoin is considered a promising cryptocurrency with great potential. Features of the project: the possibility of issuing assets on a protected blockchain basis; availability of a secure communication channel; decentralized management; dividend payment. This project is much more energy efficient than Bitcoin, hough Ravencoin aims to become a global protocol for asset transfer. Ravencoin has all the advantages of Bitcoin and its disadvantages are reduced. The project is distinguished by transparent and democratic mining.

SiaCoin

Experts call this project the distributed cloud storage of the future. In 2016, the developers of this virtual currency created a platform for trading data storage services in the blockchain system. Users can rent space on the SiaCoin platform for cloud storage. This service is cheaper than its competitors' ones. The peculiarity of the SiaCoin project is that when loading user data, the system divides them into fragments, each of which is encrypted separately. This provides increased security.

|

Метки: #photo_news |

Four cryptocurrencies demonstrating blockchain technology's features |

Most market participants closely follow Bitcoin and Ethereum, but some pay attention to lesser-known cryptocurrencies. Experts analyzed four digital assets which are gaining popularity and demonstrate the dizzying possibilities of blockchain technology.

SureRemit

This crypto asset allows traders to significantly reduce the commission for transactions. The user pays 0–2% instead of 7–12%. At the same time, you can track transactions that are processed in a few seconds. As a result, costs and possibilities of fraud are lowered. The SureRemit global network, which includes more than 650 stores in Africa and the Middle East, uses blockchain technology. SureRemit is an ongoing blockchain project that surpasses existing services in terms of cost, efficiency, and transparency.

Metal Pay

This is a US competitor of Venmo and Cash App, which allows you instantly transfer money between users for free. They receive MTL tokens for each transaction. According to experts, during the creation of a cashless society, such services will assume the functions of money and checks. The project team actively uses blockchain technology. The future of Metal Pay seems to be optimistic for developers. They are confident that the project will be widely distributed, as it surpasses the existing centralized solutions.

Ravencoin

This project has the highest capitalization among these digital assets. Ravencoin is considered a promising cryptocurrency with great potential. Features of the project: the possibility of issuing assets on a protected blockchain basis; availability of a secure communication channel; decentralized management; dividend payment. This project is much more energy efficient than Bitcoin, hough Ravencoin aims to become a global protocol for asset transfer. Ravencoin has all the advantages of Bitcoin and its disadvantages are reduced. The project is distinguished by transparent and democratic mining.

SiaCoin

Experts call this project the distributed cloud storage of the future. In 2016, the developers of this virtual currency created a platform for trading data storage services in the blockchain system. Users can rent space on the SiaCoin platform for cloud storage. This service is cheaper than its competitors' ones. The peculiarity of the SiaCoin project is that when loading user data, the system divides them into fragments, each of which is encrypted separately. This provides increased security.

|

Метки: #photo_news |

Erdogan blames US banks for weak lira |

Theories that the fate of countries are decided by bankers, rather than governments, are becoming more evident. That’s what Turkish President Recep Erdogan thinks. He accused the American banks of pushing Turkey towards a financial catastrophe.

The lira has been unstable over the past few years. Any comments on this currency immediately affect its value. One of the recent vivid examples of the lira’s vulnerability was a recommendation from JP Morgan analysts. That day, the lira fell at a faster pace than usual, and after JP Morgan forecast was released, its slump worsened. The analysts recommended that customers sell the lira, for the reason that the authorities were not interested in the stability of the lira after the elections. As a result, the Turkish government launched an investigation against the bank. Thereafter, Turkey’s financial regulator concluded that “the statement by JP Morgan analysts misled the market participants and contained signs of manipulation, which led to instability in the markets and undermined the reputation of Turkish banks.”

From the outside, it seems an attempt to find a scapegoat in order to lay the blame for the fall of the lira. But the currency's problems do not end here. JP Morgan has been replaced by another financial giant, Goldman Sachs, whose experts predict a further collapse of the Turkish currency and expect it to hit a new historical low in the coming months.

Read more: https://www.mt5.com/forex_humor/image/41395

|

Метки: #forex_caricature |

Erdogan blames US banks for weak lira |

Theories that the fate of countries are decided by bankers, rather than governments, are becoming more evident. That’s what Turkish President Recep Erdogan thinks. He accused the American banks of pushing Turkey towards a financial catastrophe.

The lira has been unstable over the past few years. Any comments on this currency immediately affect its value. One of the recent vivid examples of the lira’s vulnerability was a recommendation from JP Morgan analysts. That day, the lira fell at a faster pace than usual, and after JP Morgan forecast was released, its slump worsened. The analysts recommended that customers sell the lira, for the reason that the authorities were not interested in the stability of the lira after the elections. As a result, the Turkish government launched an investigation against the bank. Thereafter, Turkey’s financial regulator concluded that “the statement by JP Morgan analysts misled the market participants and contained signs of manipulation, which led to instability in the markets and undermined the reputation of Turkish banks.”

From the outside, it seems an attempt to find a scapegoat in order to lay the blame for the fall of the lira. But the currency's problems do not end here. JP Morgan has been replaced by another financial giant, Goldman Sachs, whose experts predict a further collapse of the Turkish currency and expect it to hit a new historical low in the coming months.

Read more: https://www.mt5.com/forex_humor/image/41395

|

Метки: #forex_caricature |

Five countries supporting cryptocurrency |

There is a number of countries in the world that actively support digital currencies. The authorities of these countries seek to create a favorable environment for the development of digital assets. We offer to get acquainted with such crypto friendly countries.

Switzerland

Experts consider Switzerland to be the most advanced country in terms of digital technologies. It claims to be called crypto nation. In connection with this, a so-called crypto valley was created in the city of Zug. It is an association which goal is to create a global blockchain system and cryptographic technologies. In addition to innovations in the blockchain industry, Switzerland is considered one of the leading countries in terms of successful implementation of ICO.

Japan

Experts believe Japan is one of the most digital friendly contries. The technological sphere is very developed here. Last year, Japan recognized virtual currencies as legal tender. According to the national media, investment in Bitcoin by the Japanese authorities amounts to huge sums. In April 2018, the Japan Virtual Currency Exchange Association (JVCEA) was established.

United Kingdom

The United Kingdom is considered one of the best crypto friendly countries, second only to Switzerland and Japan. This year, seven leading blockchain companies have united in a unique cryptocurrency organization called CryptoUK. It was created to avoid regulatory pressure from the authorities. The agency aims to make the UK a safe place for blockchain technology and digital projects. Increased attention is paid to the development of blockchain startups.

Netherlands

The netherlands is considered one of the countries open to innovations in the cryptosphere. This year, a Bitcoin embassy was created in the country, whose task is to popularize digital assets. The capital of the Netherlands, Amsterdam, has a reputation of the best European city for technology startups. In this case, the Dutch government does not seek to adjust the new class of assets under current legislation. The authorities of the Netherlands even developed their own cryptocurrency called De Nederlandsche Bank Coin (DNBCoin).

Denmark

Denmark is another European country with a favorable cryptocurrency environment. It introduced a zero tax on digital currencies which makes this state very attractive for crypto enthusiasts. After the adoption of the resolution that virtual currencies are not a means of payment, the National Bank of Denmark exempted digital assets from state regulation.

|

Метки: #photo_news |

Five countries supporting cryptocurrency |

There is a number of countries in the world that actively support digital currencies. The authorities of these countries seek to create a favorable environment for the development of digital assets. We offer to get acquainted with such crypto friendly countries.

Switzerland

Experts consider Switzerland to be the most advanced country in terms of digital technologies. It claims to be called crypto nation. In connection with this, a so-called crypto valley was created in the city of Zug. It is an association which goal is to create a global blockchain system and cryptographic technologies. In addition to innovations in the blockchain industry, Switzerland is considered one of the leading countries in terms of successful implementation of ICO.

Japan

Experts believe Japan is one of the most digital friendly contries. The technological sphere is very developed here. Last year, Japan recognized virtual currencies as legal tender. According to the national media, investment in Bitcoin by the Japanese authorities amounts to huge sums. In April 2018, the Japan Virtual Currency Exchange Association (JVCEA) was established.

United Kingdom

The United Kingdom is considered one of the best crypto friendly countries, second only to Switzerland and Japan. This year, seven leading blockchain companies have united in a unique cryptocurrency organization called CryptoUK. It was created to avoid regulatory pressure from the authorities. The agency aims to make the UK a safe place for blockchain technology and digital projects. Increased attention is paid to the development of blockchain startups.

Netherlands

The netherlands is considered one of the countries open to innovations in the cryptosphere. This year, a Bitcoin embassy was created in the country, whose task is to popularize digital assets. The capital of the Netherlands, Amsterdam, has a reputation of the best European city for technology startups. In this case, the Dutch government does not seek to adjust the new class of assets under current legislation. The authorities of the Netherlands even developed their own cryptocurrency called De Nederlandsche Bank Coin (DNBCoin).

Denmark

Denmark is another European country with a favorable cryptocurrency environment. It introduced a zero tax on digital currencies which makes this state very attractive for crypto enthusiasts. After the adoption of the resolution that virtual currencies are not a means of payment, the National Bank of Denmark exempted digital assets from state regulation.

|

Метки: #photo_news |

Five countries supporting cryptocurrency |

There is a number of countries in the world that actively support digital currencies. The authorities of these countries seek to create a favorable environment for the development of digital assets. We offer to get acquainted with such crypto friendly countries.

Switzerland

Experts consider Switzerland to be the most advanced country in terms of digital technologies. It claims to be called crypto nation. In connection with this, a so-called crypto valley was created in the city of Zug. It is an association which goal is to create a global blockchain system and cryptographic technologies. In addition to innovations in the blockchain industry, Switzerland is considered one of the leading countries in terms of successful implementation of ICO.

Japan

Experts believe Japan is one of the most digital friendly contries. The technological sphere is very developed here. Last year, Japan recognized virtual currencies as legal tender. According to the national media, investment in Bitcoin by the Japanese authorities amounts to huge sums. In April 2018, the Japan Virtual Currency Exchange Association (JVCEA) was established.

United Kingdom

The United Kingdom is considered one of the best crypto friendly countries, second only to Switzerland and Japan. This year, seven leading blockchain companies have united in a unique cryptocurrency organization called CryptoUK. It was created to avoid regulatory pressure from the authorities. The agency aims to make the UK a safe place for blockchain technology and digital projects. Increased attention is paid to the development of blockchain startups.

Netherlands

The netherlands is considered one of the countries open to innovations in the cryptosphere. This year, a Bitcoin embassy was created in the country, whose task is to popularize digital assets. The capital of the Netherlands, Amsterdam, has a reputation of the best European city for technology startups. In this case, the Dutch government does not seek to adjust the new class of assets under current legislation. The authorities of the Netherlands even developed their own cryptocurrency called De Nederlandsche Bank Coin (DNBCoin).

Denmark

Denmark is another European country with a favorable cryptocurrency environment. It introduced a zero tax on digital currencies which makes this state very attractive for crypto enthusiasts. After the adoption of the resolution that virtual currencies are not a means of payment, the National Bank of Denmark exempted digital assets from state regulation.

|

Метки: #photo_news |

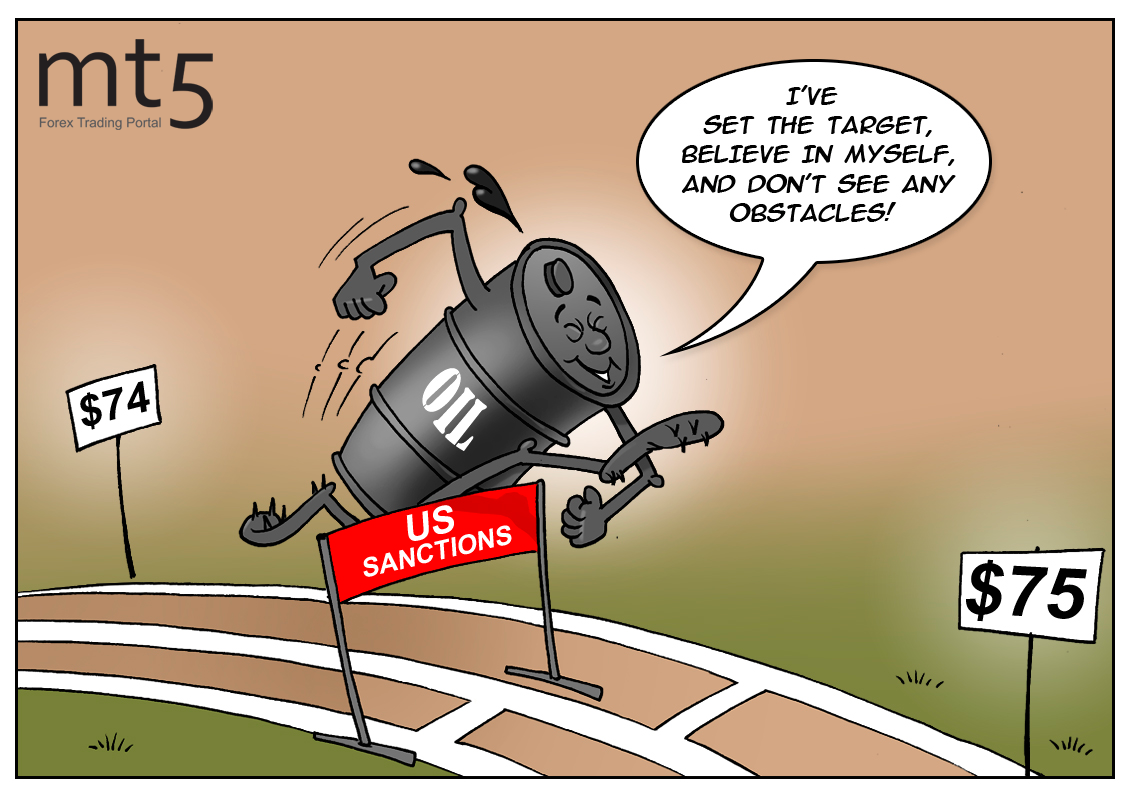

Oil rallies as US increases pressure on Iranian oil |

Recently, the US stepped up pressure on Iran’s oil sector that has been the main reason for a spike in oil prices. Apart from sanctions on Iran, the rally of oil prices is supported by clashes in Venezuela and Libya which cannot be tackled in the short term. Thus, oil is likely to overcome $75 per barrel.

Importantly, the United States decided to cancel the waivers originally granted to eight countries importing oil from Iran. These countries are willing to avoid confrontation with the United States due to Iran. Even China only delays the process of abandoning Iranian supplies. As a result, especially in view of the OPEC + deal, the world oil market may face a deficit which will push oil prices higher. But the growth is going to be temporary since Saudi Arabia and the UAE will easily boost production and meet the demand. However, this will put an end to the agreement on production cuts signed by OPEC and other major oil exporters including Russia. In the long run, any attempt to offset Iranian supplies may cause a glut in the market that will inevitably lead to a collapse in prices.

Amid the risk of a worse slowdown in the global economy, investors’ fears could resurface that would trigger massive oil sell-offs by the end of the year. Besides, if the opposition in Venezuela succeeds in overthrowing strongman Nicolas Maduro, it would be a good excuse for the US to relax or lift the sanctions in full, which means Venezuelan oil will go back to the market.

Read more: https://www.mt5.com/forex_humor/image/41377

|

Метки: #forex_caricature |

Five reasons why gold prices increase |

Gold has always been considered the safest asset most suited for investment. In the modern world, it is a significant object for long-term investments, the cost of which steadily increases. Experts name several factors affecting the rise in the price of gold.

Importance of gold reserves for states

Experts consider gold as a standard of material values and a way of expressing commodity-money relations. For a long time, budgets of many countries were directly dependent on gold reserves. This period is characterized by a fixed exchange rate.

Inflation's impact on gold

In today's world, the value of gold has changed a bit, but states still care about national gold reserves. Authorities are more often concerned about rising prices and declining consumer activity. These adverse processes force governments to take additional measures, one of which is inflation, that is, the withdrawal of extra money from circulation. At the same time, the cost of gold shows multidirectional dynamics, from a sharp drop to active growth.

Financial crisis' impact on the gold value

The pre-crisis period was characterized by a fall in gold prices. In 1999, a troy ounce of the precious metal cost $253. For several years, its value has hardly changed. The global economic crisis of 2008 caused a boom in gold prices. Its cost continued increasing. Over the past 10 years, experts have recorded a steady rise in prices for gold.

The impact of interest rates and the US dollar rate

Currently, gold prices are on the rise. In December 2018, gold futures rose from $1,235 to $1,250 per ounce. Bank of America believes that the weakening of the dollar, inflation in the United States and low interest rates will be drivers of gold price growth in 2019. According to the forecast of the bank, the cost of the precious metal will reach $1,296 per ounce. Over the next year, a rise to $1,400 is not excluded. This year, three factors constrained the price of gold: an increase in interest rates, the growth of the US economy and the strengthening of the dollar, and in 2019 their impact will weaken.

Exchange trading and its impact on the gold rate

The rise in the value of gold is significantly affected by trading on the stock exchange. This metal is actively trading on global stock markets. The dynamics of gold prices largely depends on stock speculation. Experts consider gold a serious type of long-term investment. It is a very profitable investment which is characterized by a certain cyclical nature. The value of gold depends on the activities of central banks and the regulation of their processes on stock exchanges.

|

Метки: #photo_news |