Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Russia adopts digital rights law |

The State Duma of the Russian Federation adopted the bill on digital rights in the third and final reading. This bill is supposed to introduce the concept of "digital right" into the Civil code of Russia and adjust the definition of smart contracts as well as a number of other definitions in the digital economy, including big data.

The new provisions of the law will enter into force on October 1, 2019. The term "digital right" is a legal analogue of the term "token". Due to the consolidation of the concept "digital right" in the Civil code, transactions will be protected when citizens and legal entities deal with the digital rights.

The principles of entering into contracts with digital rights are now established by law. Transactions made remotely by electronic or other technical means are proposed to be equated to a written form of contracts. These transactions have two requirements: the given technical means must be reproduced in tangible media; only those methods must be used that allow to identify the person who expressed the will.

The bill legalizes smart contracts and clarifies the fields of their use. For instance, it is not allowed to make a will using electronic or other technical means. The law resolves the issue of legalization in terms of collection and processing the significant amounts of anonymised information (big data).

In comparison with its original version, the chapter on "digital money" (cryptocurrencies) was excluded. "The amendments adopted in the Civil code do not contain definitions of digital money and smart contracts which are the key concepts for the crypto economy".

Yuri Pripachkin, head of the Russian Association of Crypto Industry and Blockchain, expressed his attitude to the adopted law. He urged the government that the participants of the decentralized market would not be able to work effectively within the Russian jurisdiction and would be forced to build their business in other countries due to the lack of clear definitions.

Read more: https://www.mt5.com/forex_humor/image/40705

|

Метки: #forex_caricature |

3 stocks to buy in 2019 |

The growing popularity of data centers, cloud computing, Internet devices and artificial intelligence is boosting the demand for microcircuits. This situation favorably affects the stock prices of microcircuits manufacturers. The most popular and profitable securities of three leading producers of innovative developments will help market participants to form an investment portfolio for 2019

Over the past few years, microcircuits manufacturers have become one of the leaders in the global stock market. This situation contributes to the positive dynamics of the companies’ shares. Experts find it difficult to predict the future of manufacturers, but the popularity of these companies is beyond doubt. Despite a bit vague forecasts, the three companies will remain the most profitable for investors over the next 5 years.

Intel

In 2017, Intel stock price was $30. In 2018, the management changed the direction of the business, switching to data centers and the sphere of artificial intelligence (AI). This attracted new customers. Intel's business began to flourish, and stocks soared to nearly $60. Today, the company is once again entering a bear market. Investors fear that the peak has already passed, but experts are confident that the company will move forward. Currently, Intel stocks are traded at around $50. Earnings per share will be $5.5 over the next 5 years.

Micron

Over a two-year period, Micron’s shares soared from $10 to $60 per share. The price hike was affected by the growth in demand on the microcircuits market. However, in the last few months of 2018, Micron stocks fell from $50 to $35. Nevertheless, experts consider investors' concerns to be in vain, since this sphere will remain popular as well as the Internet of things (IoT), data centers and AI. Over the past 5 years, the value of Micron securities exceeded earnings per share by 9 times. According to analysts, by the end of 2019, the price could reach $72, which is 40% higher than the current level.

Nvidia

Nvidia is a leader in such industries as data centers, the Internet of things, artificial intelligence, autonomous vehicle control and augmented/virtual reality. Over the past 3 years, the company's shares have grown by more than 1,000%. According to experts, these segments are just developing, so the manufacturer’s shares are to grow. Experts believe, in the near future, Nvidia shares will hold leading positions, as investment in AI, data centers and automation will increase.

|

Метки: #photo_news |

3 stocks to buy in 2019 |

The growing popularity of data centers, cloud computing, Internet devices and artificial intelligence is boosting the demand for microcircuits. This situation favorably affects the stock prices of microcircuits manufacturers. The most popular and profitable securities of three leading producers of innovative developments will help market participants to form an investment portfolio for 2019

Over the past few years, microcircuits manufacturers have become one of the leaders in the global stock market. This situation contributes to the positive dynamics of the companies’ shares. Experts find it difficult to predict the future of manufacturers, but the popularity of these companies is beyond doubt. Despite a bit vague forecasts, the three companies will remain the most profitable for investors over the next 5 years.

Intel

In 2017, Intel stock price was $30. In 2018, the management changed the direction of the business, switching to data centers and the sphere of artificial intelligence (AI). This attracted new customers. Intel's business began to flourish, and stocks soared to nearly $60. Today, the company is once again entering a bear market. Investors fear that the peak has already passed, but experts are confident that the company will move forward. Currently, Intel stocks are traded at around $50. Earnings per share will be $5.5 over the next 5 years.

Micron

Over a two-year period, Micron’s shares soared from $10 to $60 per share. The price hike was affected by the growth in demand on the microcircuits market. However, in the last few months of 2018, Micron stocks fell from $50 to $35. Nevertheless, experts consider investors' concerns to be in vain, since this sphere will remain popular as well as the Internet of things (IoT), data centers and AI. Over the past 5 years, the value of Micron securities exceeded earnings per share by 9 times. According to analysts, by the end of 2019, the price could reach $72, which is 40% higher than the current level.

Nvidia

Nvidia is a leader in such industries as data centers, the Internet of things, artificial intelligence, autonomous vehicle control and augmented/virtual reality. Over the past 3 years, the company's shares have grown by more than 1,000%. According to experts, these segments are just developing, so the manufacturer’s shares are to grow. Experts believe, in the near future, Nvidia shares will hold leading positions, as investment in AI, data centers and automation will increase.

|

Метки: #photo_news |

China’s CPI reaches 1-year low |

The inflation rate in China slowed to 13-month low in February 2019. According to the National Bureau of Statistics of China (NBS), the consumer price index went up 1.5 percent year-on-year last month, compared to 1.7 percent growth in January.

Analysts polled by The Wall Street Journal also predicted a 1.5 percent slowdown in inflation in February. On a yearly basis, food prices eased to 0.7 percent from 1.9 percent in January. Prices for fruits rose at a softer pace (from 5.9 percent to 4.8 percent), and fresh vegetable prices grew 1.7 percent, compared to a 3.8 percent jump in the previous month.

Cost of clothing climbed 2 percent, while prices for household goods advanced by 1.3 percent. However, cost of transport and communication fell by 1.2 percent.

On a monthly basis, consumer prices went up 1 percent in February, the fastest pace in a year.

Core inflation, which strips out volatile food and energy prices, reached 1.8 percent, compared to 1.9 percent in the previous month.

Producers do not seek to raise prices. China's producer price index (PPI) remained unchanged at 0.1 percent year-on-year below analysts’ estimates of 0.2 percent.

A significant slowdown that matched experts' forecasts indicates the weakening demand in China in the context of the decelerating economic recovery.

Read more: https://www.mt5.com/forex_humor/image/40695

|

Метки: #forex_caricature |

China’s CPI reaches 1-year low |

The inflation rate in China slowed to 13-month low in February 2019. According to the National Bureau of Statistics of China (NBS), the consumer price index went up 1.5 percent year-on-year last month, compared to 1.7 percent growth in January.

Analysts polled by The Wall Street Journal also predicted a 1.5 percent slowdown in inflation in February. On a yearly basis, food prices eased to 0.7 percent from 1.9 percent in January. Prices for fruits rose at a softer pace (from 5.9 percent to 4.8 percent), and fresh vegetable prices grew 1.7 percent, compared to a 3.8 percent jump in the previous month.

Cost of clothing climbed 2 percent, while prices for household goods advanced by 1.3 percent. However, cost of transport and communication fell by 1.2 percent.

On a monthly basis, consumer prices went up 1 percent in February, the fastest pace in a year.

Core inflation, which strips out volatile food and energy prices, reached 1.8 percent, compared to 1.9 percent in the previous month.

Producers do not seek to raise prices. China's producer price index (PPI) remained unchanged at 0.1 percent year-on-year below analysts’ estimates of 0.2 percent.

A significant slowdown that matched experts' forecasts indicates the weakening demand in China in the context of the decelerating economic recovery.

Read more: https://www.mt5.com/forex_humor/image/40695

|

Метки: #forex_caricature |

China’s CPI reaches 1-year low |

The inflation rate in China slowed to 13-month low in February 2019. According to the National Bureau of Statistics of China (NBS), the consumer price index went up 1.5 percent year-on-year last month, compared to 1.7 percent growth in January.

Analysts polled by The Wall Street Journal also predicted a 1.5 percent slowdown in inflation in February. On a yearly basis, food prices eased to 0.7 percent from 1.9 percent in January. Prices for fruits rose at a softer pace (from 5.9 percent to 4.8 percent), and fresh vegetable prices grew 1.7 percent, compared to a 3.8 percent jump in the previous month.

Cost of clothing climbed 2 percent, while prices for household goods advanced by 1.3 percent. However, cost of transport and communication fell by 1.2 percent.

On a monthly basis, consumer prices went up 1 percent in February, the fastest pace in a year.

Core inflation, which strips out volatile food and energy prices, reached 1.8 percent, compared to 1.9 percent in the previous month.

Producers do not seek to raise prices. China's producer price index (PPI) remained unchanged at 0.1 percent year-on-year below analysts’ estimates of 0.2 percent.

A significant slowdown that matched experts' forecasts indicates the weakening demand in China in the context of the decelerating economic recovery.

Read more: https://www.mt5.com/forex_humor/image/40695

|

Метки: #forex_caricature |

Top 5 Dow Jones dividend stocks |

Experts advise market participants, who are planning to earn well in the long term, to invest in dividend stocks of the Dow Jones Industrial Average. These assets are the most profitable ones and are the best to invest in. Here is the list of the five companies from the Dow Jones index with highest-yielding dividend stocks

Experienced market participants are well aware of the Dow Jones Industrial Average, which includes 30 largest US companies. The oldest index in the US history includes companies from various economy sectors. The list of corporations is constantly revised depending on the state of the stock market. Currently it includes the top five US companies.

Verizon Communications Inc.

Verizon Communications Inc. is the leader in terms of dividends, experts say. Its activities include Internet communications, information, entertainment products and services for consumers and government agencies around the world. Now, it is the largest communication corporation in the USA with the cap of more than $200 billion. Over the last year, the company paid dividends of 4.89%.

Chevron Corp.

The second place among the companies with the highest dividends belongs to Chevron Corporation. Subsidiaries of the company specialize in integrated energy and petrochemical industries around the world. The activities of the corporation are also related to money management and debt financing. The Chevron Corporation’s cap exceeds $200 billion. For the current year, the company paid dividends of 3.98%.

Exxon Mobil Corp.

The third place in this rating is occupied by Exxon Mobil Corporation. The company's business is exploration and production of oil and natural gas in the United States, Canada, South America, Europe, Africa, Asia and Australia. It produces and sells petrochemical products, transports and sells oil and gas. The market cap of Exxon Mobil reaches $360 billion. The volume of paid dividends of the company amounted to 3.97%.

International Business Machines Corp.

The fourth place in the list of companies with the highest dividends by yield goes to International Business Machines Corporation. This is one of the largest IT companies in the world. It operates in different segments of the technology industry. Last year the company paid 3.86% of dividends.

Pfizer Inc.

Pfizer Inc., one of the leading pharmaceutical corporations in the world, closes the top five most profitable companies. Its activities include research, development, production and sale of health products. The company manufactures its products in 46 countries. Its capitalization is more than $190 billion. The volume of paid dividends of the company is 3.75%.

|

Метки: #photo_news |

Top 5 Dow Jones dividend stocks |

Experts advise market participants, who are planning to earn well in the long term, to invest in dividend stocks of the Dow Jones Industrial Average. These assets are the most profitable ones and are the best to invest in. Here is the list of the five companies from the Dow Jones index with highest-yielding dividend stocks

Experienced market participants are well aware of the Dow Jones Industrial Average, which includes 30 largest US companies. The oldest index in the US history includes companies from various economy sectors. The list of corporations is constantly revised depending on the state of the stock market. Currently it includes the top five US companies.

Verizon Communications Inc.

Verizon Communications Inc. is the leader in terms of dividends, experts say. Its activities include Internet communications, information, entertainment products and services for consumers and government agencies around the world. Now, it is the largest communication corporation in the USA with the cap of more than $200 billion. Over the last year, the company paid dividends of 4.89%.

Chevron Corp.

The second place among the companies with the highest dividends belongs to Chevron Corporation. Subsidiaries of the company specialize in integrated energy and petrochemical industries around the world. The activities of the corporation are also related to money management and debt financing. The Chevron Corporation’s cap exceeds $200 billion. For the current year, the company paid dividends of 3.98%.

Exxon Mobil Corp.

The third place in this rating is occupied by Exxon Mobil Corporation. The company's business is exploration and production of oil and natural gas in the United States, Canada, South America, Europe, Africa, Asia and Australia. It produces and sells petrochemical products, transports and sells oil and gas. The market cap of Exxon Mobil reaches $360 billion. The volume of paid dividends of the company amounted to 3.97%.

International Business Machines Corp.

The fourth place in the list of companies with the highest dividends by yield goes to International Business Machines Corporation. This is one of the largest IT companies in the world. It operates in different segments of the technology industry. Last year the company paid 3.86% of dividends.

Pfizer Inc.

Pfizer Inc., one of the leading pharmaceutical corporations in the world, closes the top five most profitable companies. Its activities include research, development, production and sale of health products. The company manufactures its products in 46 countries. Its capitalization is more than $190 billion. The volume of paid dividends of the company is 3.75%.

|

Метки: #photo_news |

Top 5 Dow Jones dividend stocks |

Experts advise market participants, who are planning to earn well in the long term, to invest in dividend stocks of the Dow Jones Industrial Average. These assets are the most profitable ones and are the best to invest in. Here is the list of the five companies from the Dow Jones index with highest-yielding dividend stocks

Experienced market participants are well aware of the Dow Jones Industrial Average, which includes 30 largest US companies. The oldest index in the US history includes companies from various economy sectors. The list of corporations is constantly revised depending on the state of the stock market. Currently it includes the top five US companies.

Verizon Communications Inc.

Verizon Communications Inc. is the leader in terms of dividends, experts say. Its activities include Internet communications, information, entertainment products and services for consumers and government agencies around the world. Now, it is the largest communication corporation in the USA with the cap of more than $200 billion. Over the last year, the company paid dividends of 4.89%.

Chevron Corp.

The second place among the companies with the highest dividends belongs to Chevron Corporation. Subsidiaries of the company specialize in integrated energy and petrochemical industries around the world. The activities of the corporation are also related to money management and debt financing. The Chevron Corporation’s cap exceeds $200 billion. For the current year, the company paid dividends of 3.98%.

Exxon Mobil Corp.

The third place in this rating is occupied by Exxon Mobil Corporation. The company's business is exploration and production of oil and natural gas in the United States, Canada, South America, Europe, Africa, Asia and Australia. It produces and sells petrochemical products, transports and sells oil and gas. The market cap of Exxon Mobil reaches $360 billion. The volume of paid dividends of the company amounted to 3.97%.

International Business Machines Corp.

The fourth place in the list of companies with the highest dividends by yield goes to International Business Machines Corporation. This is one of the largest IT companies in the world. It operates in different segments of the technology industry. Last year the company paid 3.86% of dividends.

Pfizer Inc.

Pfizer Inc., one of the leading pharmaceutical corporations in the world, closes the top five most profitable companies. Its activities include research, development, production and sale of health products. The company manufactures its products in 46 countries. Its capitalization is more than $190 billion. The volume of paid dividends of the company is 3.75%.

|

Метки: #photo_news |

7 habits that help you learn and earn |

Habits, addictions and inclinations of the mind can either ruin us or contribute into our future financial well-being. Seemingly insignificant habits affect career, health, development, and overall happiness. In our review, you will find a few simple secrets that will help you successfully learn and earn more.

We have been told since childhood that we need to fight bad habits, but few say that it is also necessary to develop new useful ones. One of their main advantages is that they do not require serious motivation or inflexible willpower, the main thing is to remind yourself of them in time to get closer to your cherished goals and dreams. Let's consider seven easy ways to get better.

1. Listen to specialized audiobooks or podcasts for 15 minutes every day. This can be done during a break for a cup of tea or coffee, instead of unnecessary chatter, or on the way to work: on the subway, car, public transport or on foot.

Choose the area of knowledge that you have always wanted to study or in which you want to improve, and find relevant specialized audio materials (not fiction). For example, listen about e-commerce, webinars, customer care technologies, or listen to podcasts of a successful person who works in a field of interest to you.

You should not spend too much time on this. Adhere to the rule of listening to cognitive materials daily for 15 to 30 minutes, find an opportunity to write it in your work schedule, because you never know in advance what information you may need in this or that situation.

2. Read one printed page of a book a day to train your mind (you can read more). Studies have found that the constant habit of fast reading of e-texts contributes to disperse attention and may lead to a decrease in speed and ability to assimilate information by 20-30%.

In addition, paper books provide aesthetic and sensory pleasure which contributes to the quality relaxation necessary for further productive work.

You can read before bedtime, instead of (or after) watching TV, movies or TV shows. The smell and rustle of paper will give signals to the brain that it's time to relax, and if you get carried away with an interesting book, it will help develop your imagination, one of the main tools for overcoming difficult life situations. Read what you like.

3. Go to bed 30 minutes earlier to stay healthy, the main and often irreplaceable resource for a happy life. Ideally, you should go to bed at 10 pm; however, if you feel like an owl, just try to go to bed a little earlier than usual.

A healthy body creates prerequisites for proper and successful thinking. Pay attention to nutrition and exercise, especially if you have a hard time falling asleep.

Often great ideas come to mind at night, but it is useful to teach yourself to go to bed and get up early to bring them to life!

4. When buying new items, choose quality, not quantity. It is better to buy fewer things, but those that you will truly enjoy. In addition, you shouldn't fill your house with unnecessary trash.

You can buy a bag of clothes, shoes, and jewelry, especially during sales and "super discounts", but are they really necessary? Do not deny yourself a pleasant shopping, but if you have things at home that you don't use at all, or things you don't wear, maybe you never really needed them?

Also, get rid of old things when you buy new ones. It does not matter what it is: clothing, appliances or kitchen utensils. You can make someone a nice gift, and at the same time make room for something valuable. This simple habit can radically change your mindset and teach you to choose exactly what you need.

5. Think twice before buying something. If you are going to spend any significant amount for you ($100, $ 1,000 or $ 10,000), wait at least 24 hours.

This habit will help you avoid unnecessary purchases caused by emotional impulse (whim), and not a real need. In the morning the next day, you will most likely know for sure if you need this half-meter teddy bear. It's amazing how many unnecessary things will not appear in your life.

In addition, you can calculate how much money you make per hour (for example, $20). And when you think about this or that purchase, assess how much time in your life you are ready to spend on it.

6. Automate your savings. Automation of savings and investments is a convenient habit that will allow you to save money on planned goals without effort.

Get savings (target) accounts to which you will transfer a certain amount of your earnings (for example, 10%) and any other unplanned income.

Often, banks also award interest on target accounts, and upon reaching the intended amount, think about where you can effectively invest money. Remember the simple rule: money goes to money.

7. Say no to negative. A very useful habit is to calmly and firmly say “no” to unpleasant people, dubious business proposals, everything that does not correspond to your personal perception of the world and does not lead to the achievement of goals.

A person is a social being, people from your environment have a great influence on your life path, they form a space of opportunities for future growth.

Therefore, do not allow anyone to poison you with negative influence, avoid bad companies and wasted time. Achieving your goals, focus on the important things, discard all unnecessary stuff, carefully save anything useful, cultivate the habit of success and happiness in yourself.

|

Метки: #photo_news |

7 habits that help you learn and earn |

Habits, addictions and inclinations of the mind can either ruin us or contribute into our future financial well-being. Seemingly insignificant habits affect career, health, development, and overall happiness. In our review, you will find a few simple secrets that will help you successfully learn and earn more.

We have been told since childhood that we need to fight bad habits, but few say that it is also necessary to develop new useful ones. One of their main advantages is that they do not require serious motivation or inflexible willpower, the main thing is to remind yourself of them in time to get closer to your cherished goals and dreams. Let's consider seven easy ways to get better.

1. Listen to specialized audiobooks or podcasts for 15 minutes every day. This can be done during a break for a cup of tea or coffee, instead of unnecessary chatter, or on the way to work: on the subway, car, public transport or on foot.

Choose the area of knowledge that you have always wanted to study or in which you want to improve, and find relevant specialized audio materials (not fiction). For example, listen about e-commerce, webinars, customer care technologies, or listen to podcasts of a successful person who works in a field of interest to you.

You should not spend too much time on this. Adhere to the rule of listening to cognitive materials daily for 15 to 30 minutes, find an opportunity to write it in your work schedule, because you never know in advance what information you may need in this or that situation.

2. Read one printed page of a book a day to train your mind (you can read more). Studies have found that the constant habit of fast reading of e-texts contributes to disperse attention and may lead to a decrease in speed and ability to assimilate information by 20-30%.

In addition, paper books provide aesthetic and sensory pleasure which contributes to the quality relaxation necessary for further productive work.

You can read before bedtime, instead of (or after) watching TV, movies or TV shows. The smell and rustle of paper will give signals to the brain that it's time to relax, and if you get carried away with an interesting book, it will help develop your imagination, one of the main tools for overcoming difficult life situations. Read what you like.

3. Go to bed 30 minutes earlier to stay healthy, the main and often irreplaceable resource for a happy life. Ideally, you should go to bed at 10 pm; however, if you feel like an owl, just try to go to bed a little earlier than usual.

A healthy body creates prerequisites for proper and successful thinking. Pay attention to nutrition and exercise, especially if you have a hard time falling asleep.

Often great ideas come to mind at night, but it is useful to teach yourself to go to bed and get up early to bring them to life!

4. When buying new items, choose quality, not quantity. It is better to buy fewer things, but those that you will truly enjoy. In addition, you shouldn't fill your house with unnecessary trash.

You can buy a bag of clothes, shoes, and jewelry, especially during sales and "super discounts", but are they really necessary? Do not deny yourself a pleasant shopping, but if you have things at home that you don't use at all, or things you don't wear, maybe you never really needed them?

Also, get rid of old things when you buy new ones. It does not matter what it is: clothing, appliances or kitchen utensils. You can make someone a nice gift, and at the same time make room for something valuable. This simple habit can radically change your mindset and teach you to choose exactly what you need.

5. Think twice before buying something. If you are going to spend any significant amount for you ($100, $ 1,000 or $ 10,000), wait at least 24 hours.

This habit will help you avoid unnecessary purchases caused by emotional impulse (whim), and not a real need. In the morning the next day, you will most likely know for sure if you need this half-meter teddy bear. It's amazing how many unnecessary things will not appear in your life.

In addition, you can calculate how much money you make per hour (for example, $20). And when you think about this or that purchase, assess how much time in your life you are ready to spend on it.

6. Automate your savings. Automation of savings and investments is a convenient habit that will allow you to save money on planned goals without effort.

Get savings (target) accounts to which you will transfer a certain amount of your earnings (for example, 10%) and any other unplanned income.

Often, banks also award interest on target accounts, and upon reaching the intended amount, think about where you can effectively invest money. Remember the simple rule: money goes to money.

7. Say no to negative. A very useful habit is to calmly and firmly say “no” to unpleasant people, dubious business proposals, everything that does not correspond to your personal perception of the world and does not lead to the achievement of goals.

A person is a social being, people from your environment have a great influence on your life path, they form a space of opportunities for future growth.

Therefore, do not allow anyone to poison you with negative influence, avoid bad companies and wasted time. Achieving your goals, focus on the important things, discard all unnecessary stuff, carefully save anything useful, cultivate the habit of success and happiness in yourself.

|

Метки: #photo_news |

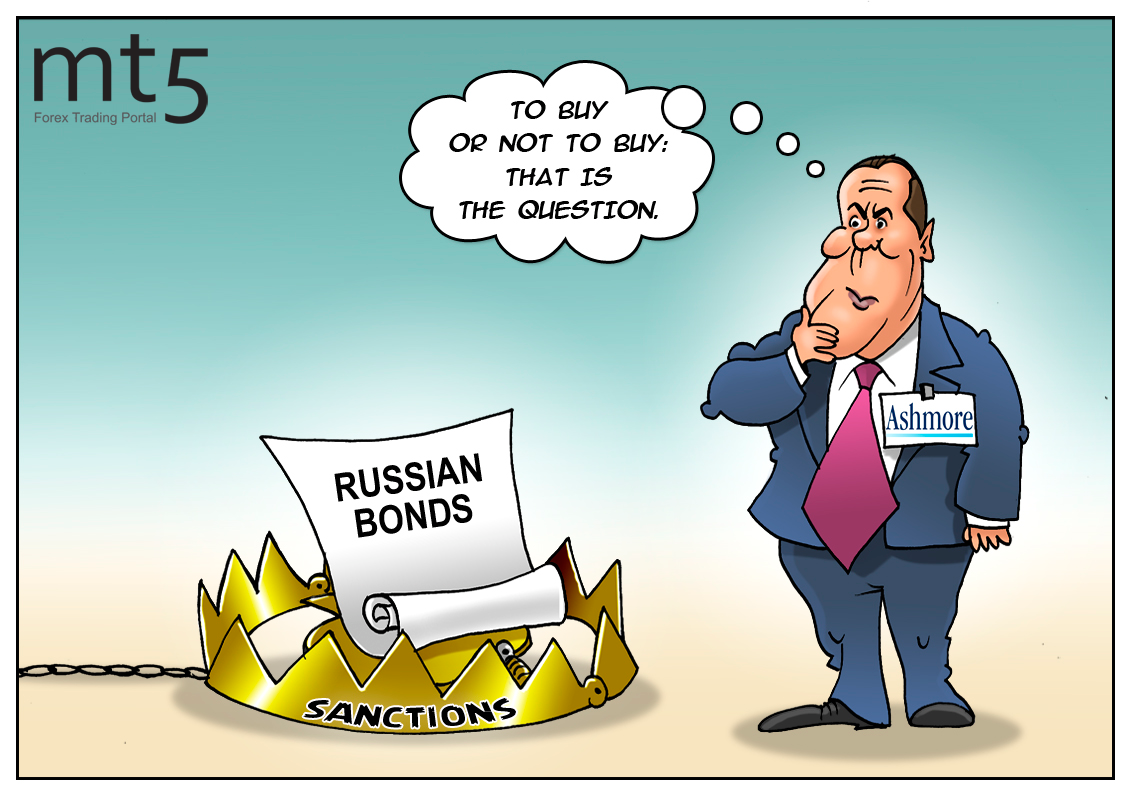

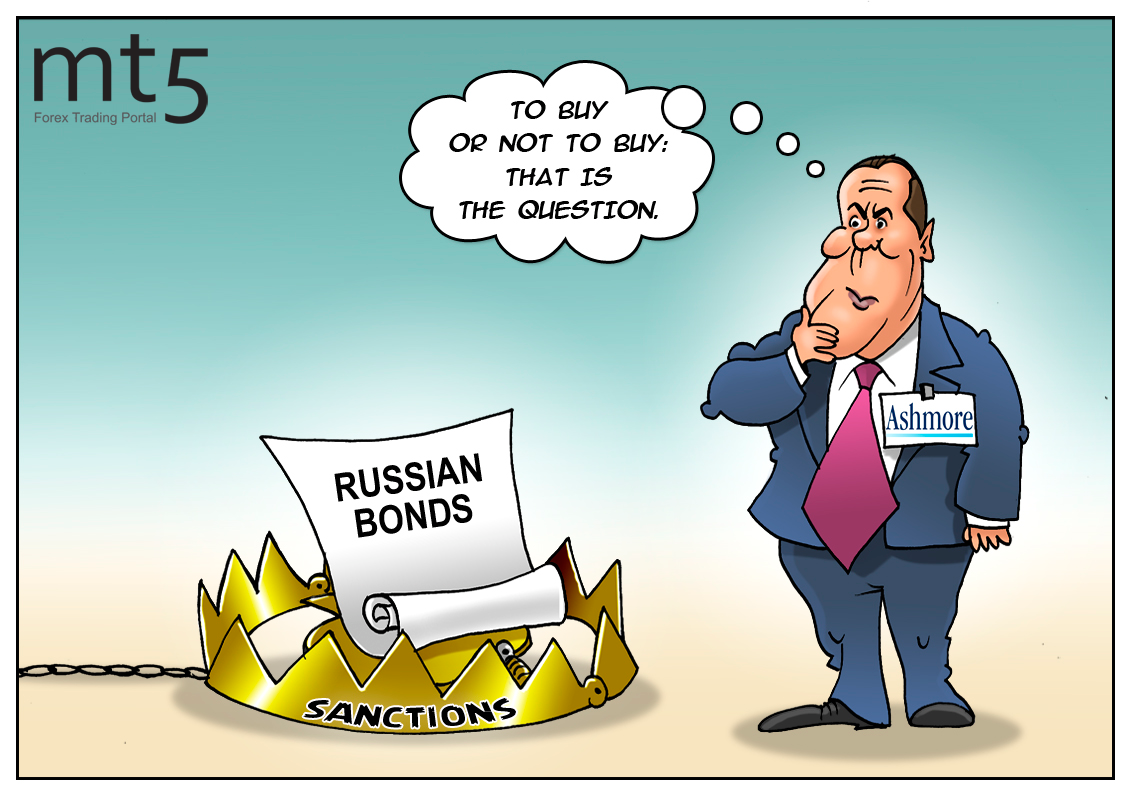

Russian eurobonds losing favor with investors |

Western sanctions instantly affected Russia’s participation in the global capital market, hurting Russia’s borrowing opportunities. A new set of restrictions is still under discussion. However, it has already made an adverse impact on Russian eurobonds. Largest global banks reject being involved in transactions with Russia’s government bonds. As a result, the debt market mirrors a waning trade volume of such securities as fewer investors consider them lucrative assets. Serious market players urgently revise their portfolios, slashing their investment in Russian eurobonds.

Ashmore Group Plc, a British investment company dealing mainly with emerging markets, abruptly changed its stance in early 2019. Since then, the company has been pursuing the bearish strategy on such securities. The group manages assets worth $76 billion. So, other market participants could follow its example. “US sanctions against Russia look like a time bomb ticking away. Their impact is going to worsen bearing in mind that special counsel Robert Mueller is winding up his probe,” senior analyst at Ashmore Jan Dehn commented on the situation. If Russia is found guilty of its interference in the US presidential elections in 2016, more devastating sanctions will follow, the expert added. At present, all essential transactions are carried out through Russian state-owned banks. Nevertheless, they are also facing risks from sanctions. In this context, both Sberbank and VTB could be subject to restrictions.

Read more: https://www.mt5.com/forex_humor/image/40630

|

Метки: #forex_caricature |

Russian eurobonds losing favor with investors |

Western sanctions instantly affected Russia’s participation in the global capital market, hurting Russia’s borrowing opportunities. A new set of restrictions is still under discussion. However, it has already made an adverse impact on Russian eurobonds. Largest global banks reject being involved in transactions with Russia’s government bonds. As a result, the debt market mirrors a waning trade volume of such securities as fewer investors consider them lucrative assets. Serious market players urgently revise their portfolios, slashing their investment in Russian eurobonds.

Ashmore Group Plc, a British investment company dealing mainly with emerging markets, abruptly changed its stance in early 2019. Since then, the company has been pursuing the bearish strategy on such securities. The group manages assets worth $76 billion. So, other market participants could follow its example. “US sanctions against Russia look like a time bomb ticking away. Their impact is going to worsen bearing in mind that special counsel Robert Mueller is winding up his probe,” senior analyst at Ashmore Jan Dehn commented on the situation. If Russia is found guilty of its interference in the US presidential elections in 2016, more devastating sanctions will follow, the expert added. At present, all essential transactions are carried out through Russian state-owned banks. Nevertheless, they are also facing risks from sanctions. In this context, both Sberbank and VTB could be subject to restrictions.

Read more: https://www.mt5.com/forex_humor/image/40630

|

Метки: #forex_caricature |

Five amazing books on creative thinking |

Inspiration and imagination are the most important tools of a successful business helping to overcome any life challenges. When you do not have enough of your own resources, you can turn to the experience of professionals who will tell you how to develop creativity, not lose heart and make the brain work in the most unexpected way. In our review, you will find 5 great books that develop creativity.

In the turbulent information flow of the modern world, it is not static "encyclopedic" knowledge that comes to the fore but the skills to quickly extract the necessary information and generate effective solutions for a specific situation. The current trend in business is a continuous process of personal growth and creative search, attempts to predict or “create” the future. We have selected for you some amazing books that will help you develop creative thinking and perception of the world.

1. Austin Kleon "Steal Like An Artist"

Austin Kleon is an artist and author of original creative manuals translated into 12 languages of the world. He conducts lectures and developmental seminars in companies such as Google, Pixar, SXSW, TEDx, etc. His bold and extraordinary view of creativity can inspire anyone to create their own works.

The book convincingly proves that it is not necessary to be an outstanding genius to creat art, it is enough just to go your own way. The artist shares tips that he would like to hear at the beginning of his career. Austin claims that a person takes 90% of ideas from the outside world and only the remaining 10% comes from the inside. At the same time, even when we copy, we inevitably create something unique, deeply individual. This is a manifesto of a modern artist, simple and understandable.

2. Michael Michalko "Thinkertoys: A Handbook of Creative-Thinking Techniques"

Michael Michalko is a world expert on creativity who became famous for his books: Cracking creativity, Creative thinkering, etc. He is deeply convinced that mood affects the ability to create, while the right ideas help people find a positive attitude. Thus, positive thinking acts as a catalyst for new ideas.

Thinkertoys will teach you to generate original ideas. Like the butterfly catcher, Michael Michalko calls for new ideas to be caught right out of the air. In addition, the reader is offered many interesting puzzles and exercises that train thinking and imagination to reach a new qualitative level of perception of the world around.

3. Marty Neumeier "The 46 rules of genius: An innovator's guide to creativity"

Marty Neumeier is an entrepreneur, designer, editor, speaker, and author of books. He currently works as a development director at Liquid Agency, an agency that launches and updates brands and shapes consumer perceptions. Its customers are PayPal, HP, Nike, Facebook, Motorola, Walmart and many Silicon Valley companies.

An innovator's guide to creativity is a practical guide, a set of 46 rules that will make a responsible reader if not a genius then a creative thinking person. It is designed not so much for dreamers and artists, as for those who want to bring their ideas to life.

4. The Brothers McLeod "A Book of Brilliant Ideas: And How to Have Them"

Greg MacLeod is an illustrator and animator, Greg Miles MacLeod is a screenwriter. Together they wrote many scripts, produced and created a large number of short films, animations for television, games and the Internet. They cooperated with BBC, Hit, Disney, ITV, Channel 4 and many other studios around the world.

A Book of Brilliant Ideas will not let you relax, because it contains a lot of fascinating and amusing exercises, from drawing bizarre creatures to creating your own universe living according to incredible laws. All this will be accompanied by recommendations, ideas, and examples from the MacLeod brothers, which will help a beginning creator.

5. Mike Rohde "The Sketchnote Handbook: The Illustrated Guide to Visual Note Taking"

Mike Rohde is a designer, illustrator of the bestseller books like The $100 Startup by Chris Guillebeau and Rework by Jason Fried. He conducts workshops on teaching visual thinking and using it to generate new ideas.

His book has been translated into Russian, Chinese, German and Czech, and has already managed to teach many people to use sketches in everyday life.

The Sketchnote Handbook: The Illustrated Guide to Visual Note Taking is an illustrated guide to creating sketches. The book teaches how to create sketches, explains why they are needed, and how they help to remember information. The material is presented in the form of step-by-step instructions, which greatly simplifies learning a useful skill.

|

Метки: #photo_news |

China’s Huawei sues US over ban on products |

Huawei is doing its best to distance itself from the US allegations of spying. After a number of rebuttals, the company's management sues the US government. Apart from the accusations, the stumbling block turns out to be a very real ban on the usage of Huawei equipment among the government agencies.

Australia and New Zealand have already followed the example of the United States. A number of European countries are also considering to join the American ban. Besides, section 889 of the National Defense Authorization Act prohibits government agencies from cooperating with those who work with Huawei: they are not allowed to contract with them, provide grants and loans. It means that those companies that aim for the American market will be forced to abandon collaboration with the Chinese manufacturer.

The main reason for an open war against Huawei was the evidence that the company's equipment could be used to receive and transmit intelligence data to the Chinese government. President of Huawei has denied the accusations of espionage. He declares that the company never participates in espionage, and none of their employees are permitted to perform such actions. Huawei never creates backdoors, he added. Even if it were required by Chinese law, they would strongly reject it.

However, the facts suggest otherwise. US government is convinced that the truth is on its side and ready for the trial. Especially, given the fact that the court will be American, too. Espionage is not the only thing the company is accused of in the United States. Federal prosecutors are conducting a criminal investigation on Huawei suspecting the company of stealing trade secrets from business partners, T-Mobile in particular.

Read more: https://www.mt5.com/forex_humor/image/40624

|

Метки: #forex_caricature |

Four largest collapses in oil prices |

According to analysts, there were four major collapses in oil prices in modern history, and each of them had a good reason. Currently, the situation is gradually stabilizing, but experts are cautious about optimistic forecasts. Read more about the decline in oil prices in our article.

Currently, the global oil market is optimistic about the cost of oil next year. Neither the rise in oil prices nor the decline in production in a number of countries prevents a positive attitude. Many analysts believe that in 2019 the price of Brent crude could reach $70 or $80 per barrel. However, a number of experts see no reason for a significant increase in prices. They propose to recall several major oil market collapses in order to draw constructive lessons from the past.

Oil prices collapse in 1985-1986

Overproduction of oil in the 1980s was caused by a decrease in demand for raw materials. The reason for this was the price increase due to the 1973 oil embargo and the Islamic Revolution in Iran in 1979. In 1980, oil prices in the global market reached $35 per barrel, and six years later it dropped to $10 per barrel. This situation was provoked by non-OPEC countries which actively increased their production. At the same time, the countries of the cartel, defending their market share, also raised the level of production. This caused overproduction and a further collapse in oil prices.

Oil prices collapse in 1990-1991

In 1990, Iraq invaded Kuwait, which is why the cost of oil rose sharply from $15 to $ 41.15 per barrel, experts say. After the intervention of the United States and allies conducting Operation Desert Storm, which resulted in Iraqi troops leaving Kuwait, in February 1991, oil prices again fell to $17- $18 per barrel.

Oil prices collapse in 2008-2009

This period was a turning point for the global economy. For the first 6 months of 2008, the price of WTI and Brent crude oil increased by almost 50%. It remained at a record high of $140-$145 per barrel. Commodity exchanges began to sell off assets. The sale ended with a collapse in prices. This coincided with the loud bankruptcy of Lehman Brothers. In September 2008, a sharp drop in the cost of oil occurred. Then there was a period of stagnation and oil could be bought for $30- $35 per barrel. In January 2009, oil prices soared again.

Oil prices collapse in 2014-2015

Experts believe that a significant oversupply of raw materials on the market became the main reason for the fall in oil prices in 2014. In this situation, many analysts draw a parallel with the crisis of 1985-1986. Recall, long before the collapse, the leading OPEC countries, such as Saudi Arabia, actively increased oil production and sold large amounts of it. At the same time, independent oil producers also raised their volumes to a record level. As a result, oversupply caused a significant drop in demand.

|

Метки: #photo_news |

Zimbabwe joins anti-dollar coalition |

A newbie joined the anti-dollar coalition. Zimbabwe decided to team up with Russia and Iran in their joint anti-dollar struggle. As the saying goes “Help came from unexpected sources”. Curiously enough, given the fact that the country uses the dollar not only in international trade, but also as a national currency since 2009.

Indeed, it is very convenient. The country does not have to print its own money or bother with protection measures against currency counterfeiting and so on. What is more, the US currency is not in the limit in the world. There are plenty of it for many countries! Zimbabwe thought likewise. As a result, the country received a secure and freely convertible currency. However, the new leader of Zimbabwe decided that it was time to think about their own currency. Not just think, but make these bold dreams come true! It is not specified yet what it is going to be: shells, skins of dead animals or less exotic option. Nevertheless, the quasi-currency, which is officially called bond notes and is tied to the US dollar, can no longer be exchanged in the ratio of 1:1. This new currency will be traded in the new interbank currency market.

In this case the main reason for the "refusal" of the dollar was its banal shortage. The country has been experiencing the dollar cash deficit for several months. Due to these reasons, the exchange rate rose sharply in the black market, while the "electronic" dollars were still trading at the rate of 1:1. The current leader of Zimbabwe Emerson Mnangagwa took charge of the country in August last year, having won the elections. He took office after Robert Mugabe had been ousted from power. The latter ruled the country for about 40 years.

Read more: https://www.mt5.com/forex_humor/image/40511

|

Метки: #forex_caricature |

Zimbabwe joins anti-dollar coalition |

A newbie joined the anti-dollar coalition. Zimbabwe decided to team up with Russia and Iran in their joint anti-dollar struggle. As the saying goes “Help came from unexpected sources”. Curiously enough, given the fact that the country uses the dollar not only in international trade, but also as a national currency since 2009.

Indeed, it is very convenient. The country does not have to print its own money or bother with protection measures against currency counterfeiting and so on. What is more, the US currency is not in the limit in the world. There are plenty of it for many countries! Zimbabwe thought likewise. As a result, the country received a secure and freely convertible currency. However, the new leader of Zimbabwe decided that it was time to think about their own currency. Not just think, but make these bold dreams come true! It is not specified yet what it is going to be: shells, skins of dead animals or less exotic option. Nevertheless, the quasi-currency, which is officially called bond notes and is tied to the US dollar, can no longer be exchanged in the ratio of 1:1. This new currency will be traded in the new interbank currency market.

In this case the main reason for the "refusal" of the dollar was its banal shortage. The country has been experiencing the dollar cash deficit for several months. Due to these reasons, the exchange rate rose sharply in the black market, while the "electronic" dollars were still trading at the rate of 1:1. The current leader of Zimbabwe Emerson Mnangagwa took charge of the country in August last year, having won the elections. He took office after Robert Mugabe had been ousted from power. The latter ruled the country for about 40 years.

Read more: https://www.mt5.com/forex_humor/image/40511

|

Метки: #forex_caricature |

Five unusual jobs of the future |

Many experts believe that a number of jobs will vanish by 2030. They are confident that 47% of current professions will disappear. People will be replaced by robots. Analysts offer to consider five important jobs that may come in handy in the future.

Urban farmer

Agriculture is gaining popularity again. This is the most important life-supporting industry which attracts innovations, experts say. They are confident that farms will start to spring up on rooftops and terraces, inside purpose built skyscrapers. Building designers seek to squeeze the maximum benefit from these sites adapting them to grow vegetables and fruits. In this area, innovators who are knowledgeable in agronomy and biotechnology will be in demand.

Brain fitness instructor

According to experts, in the future, the profession of an instructor helping to train memory, attention, thinking, observation and other brain processes will become relevant. To develop and strengthen your abilities, you need to do mental gymnastics. Experts believe that exercises for the development of memory and attention can become as common as fitness. Instructors will have to understand psychology and pedagogy, so everyone who is interested in such profession should pay attention to the mastering of these disciplines.

Robot ethics lawyer

Experts believe that the lawyer in robot etics is another unusual profession of the future. It is possible that at first such specialists will regulate the work of smart machines. However, over time, more complex relationships may arise between man and artificial intelligence. In this case, the help of a lawyer in robot etics will be extremely necessary.

Crowdfunding specialist

Crowdfunding, the practice of funding a project or venture by raising small amounts of money from a large number of people, is very popular. Basically, this is how start-ups find money. If today anyone who is looking for money to implement their idea can start crowdfunding, then in the future, professionals will do it. They will need to study Internet marketing and acquire relevant work experience.

Restorer of architectural monuments

According to experts, the most famous architectural monuments need protection and restoration. Consequently, the work of specialists capable of extending the life of old buildings will be generously rewarded. To become one of them, you need to have an appropriate education (diploma of architectural and construction university) and some experience.

|

Метки: #forex_caricature |

Five unusual jobs of the future |

Many experts believe that a number of jobs will vanish by 2030. They are confident that 47% of current professions will disappear. People will be replaced by robots. Analysts offer to consider five important jobs that may come in handy in the future.

Urban farmer

Agriculture is gaining popularity again. This is the most important life-supporting industry which attracts innovations, experts say. They are confident that farms will start to spring up on rooftops and terraces, inside purpose built skyscrapers. Building designers seek to squeeze the maximum benefit from these sites adapting them to grow vegetables and fruits. In this area, innovators who are knowledgeable in agronomy and biotechnology will be in demand.

Brain fitness instructor

According to experts, in the future, the profession of an instructor helping to train memory, attention, thinking, observation and other brain processes will become relevant. To develop and strengthen your abilities, you need to do mental gymnastics. Experts believe that exercises for the development of memory and attention can become as common as fitness. Instructors will have to understand psychology and pedagogy, so everyone who is interested in such profession should pay attention to the mastering of these disciplines.

Robot ethics lawyer

Experts believe that the lawyer in robot etics is another unusual profession of the future. It is possible that at first such specialists will regulate the work of smart machines. However, over time, more complex relationships may arise between man and artificial intelligence. In this case, the help of a lawyer in robot etics will be extremely necessary.

Crowdfunding specialist

Crowdfunding, the practice of funding a project or venture by raising small amounts of money from a large number of people, is very popular. Basically, this is how start-ups find money. If today anyone who is looking for money to implement their idea can start crowdfunding, then in the future, professionals will do it. They will need to study Internet marketing and acquire relevant work experience.

Restorer of architectural monuments

According to experts, the most famous architectural monuments need protection and restoration. Consequently, the work of specialists capable of extending the life of old buildings will be generously rewarded. To become one of them, you need to have an appropriate education (diploma of architectural and construction university) and some experience.

|

Метки: #forex_caricature |