Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Five companies with high dividends in Warren Buffett portfolio |

One of the key factors in assessing the financial condition of a company is a systematic dividend increase. Overall, the widely followed Berkshire Hathaway investment portfolio shows Warren Buffett knows the value of a consistent and growing dividend, even if he's no fan of paying dividends himself. Let's consider the largest of them.

Dividends paid to shareholders reduce the size of capitalization, while not always directly correlated with the value of shares, but the size of dividend yield makes the company attractive for investment. In our review, you will find five companies with high dividends from the portfolio of the legendary Oracle of Omaha (Warren Buffett).

1. KRAFT HEINS

The American food company, Kraft Heinz, which produces food and beverages, is one of the largest firms in terms of market capitalization owned by Berkshire Hathaway.

Kraft Heinz's dividend payout is $2.50 per year, and dividend yield is 5.16 percent.

The dividend growth rate over the last 3-5 years totals about 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is estimated at 15.

Since the beginning of the year, the value of the company's shares fell by 40.33 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 325.6 million shares of Kraft Heinz.

2. STORE CAPITAL

A real estate investment trust or REIT, Store Capital invests in single-tenant commercial properties, such as supermarkets and drugstores.

Dividend payout of STORE Capital is estimated at $1.32 per year, dividend yield is 4.29 percent.

The dividend growth rate over the last 3-5 years reached 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 4.

Since the beginning of the year, the value of the company's shares increased by 18.97 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 18.6 million shares of STORE Capital Corporation.

3. GENERAL MOTORS

The largest American automobile corporation, General Motors is considered the largest car manufacturer in the world for 77 years. The automaker's new mobility bets now include electric bicycles, in addition to electric cars and self-driving cars. But for now, GM earnings that drive dividends are coming from gas-guzzling SUVs and trucks.

GM's dividend payout is $1.52 per year, and dividend yield is 4.33 percent.

The dividend growth rate over the last 3-5 years reaches 6 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 5.

Since the beginning of the year, the value of the company's shares decreased by 14.29 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 52.5 million shares of General Motors, while the company's share was increased by 1.1 million securities.

4. TEVA

The multinational pharmaceutical company Teva Pharmaceutical Industries was included in the Berkshire Hathaway portfolio in the fourth quarter of 2017. Teva shares were bought at $10.85 per share. Their value has more than doubled since then.

Teva's dividend payout is $0.94, dividend yield is 4.3 percent.

The dividend growth rate over the last 3-5 years is estimated at about 1 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 14.

Since the beginning of the year, the value of the company's shares fell by 0.81 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 43.2 million shares of Teva Pharmaceutical Industries.

5. VERIZON

The American telecommunications corporation, Verizon Communications, which derives the bulk of its profits from providing wireless services, is currently launching 5G mobile networks. The new technology will be used to exchange data between unmanned vehicles.

Verizon's dividend payout is $2.41 per year, with a dividend yield of 4.22 percent.

The dividend growth rate over the last 3-5 years totals about 3 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is 0.

Since the beginning of the year, the value of the company's shares increased by 8.37 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 928 shares of Verizon Communications.

|

Метки: #photo_news |

Emmanuel Macron suggests accelerating EU, China's work on WTO transformation |

French President Emmanuel Macron suggested speeding up the work of the European Union and China on the transformation of the World Trade Organization (WTO). He declares: “It is necessary to accelerate the work done by China and the European Union on the modernization of the WTO to be able to better tackle as partners the issues of transparency, excessive production capacity, and state subsidies.”

The French President is convinced that such cooperation brings many advantages and helps set aside the differences. Macron added that all sides benefited a way more from openness. He also remarked: “The cooperation between Europe and China should give a positive result, in particular, regarding a global agreement on investment.”

Earlier it was reported that the European Union and 11 WTO countries (Australia, Canada, China, Iceland, India, Korea, Mexico, New Zealand, Norway, Singapore and Switzerland) made proposals to reform the organization to ameliorate its further work.

One of the proposals was the introduction of amendments to WTO rules in order to soothe the concerns of the United States. This country has prevented appointments to the vacant positions in the appellate body for more than a year and a half, highlighting a number of worries. WTO representatives offer to introduce a number of rules to address these problems. For example, it is proposed to include in WTO rules a text focusing the appellate body's attention only on those issues that are required for dispute resolution.

Read more: https://www.mt5.com/forex_humor/image/40888

|

Метки: #forex_caricature |

Five ways to increase your salary |

There are two main ways to improve your well-being: spend less or earn more. In order to cope with financial difficulties faster, it is better to use both methods at once. But no matter how effective reasonable planning and forced savings are, you can hardly get rich by getting $300 a month. In our review, there are several easy ways to increase your income.

Sometimes an excellent specialist works for years and wonders why his salary does not match the experience and qualifications, but does not take any actions to change the situation. Sounds familiar? We offer a few simple tips on how always be appreciated.

These tips are best suited for medium and large commercial organizations. The principles for raising wages in state-owned enterprises and small companies are often unpredictable and devoid of any logic.

Evaluate yourself

A person with good self-esteem will not do hard work for a small amount of money for a long time, because he knows that he is “worthy of more”.

Look at your work. Do you like it? Are you a good specialist? Do you add value to this company? Will it be difficult to replace you? Do you want to further improve your professional skills? Are you satisfied with your salary? If the majority of answers (except for the last one) is positive, most likely, you just need a pay rise.

Decide for yourself how much money you should be paid. Set a goal and move towards it.

Say your goals aloud

If your work is worth more than what you get for it, go to the management and say it. As long as the employee does not ask, the manager will not be in a hurry to raise the salary.

In addition to money, discuss plans and career prospects with your superiors. It is possible that you have already “outgrown” your position and can take on more serious projects, and perhaps your vision does not coincide with the views of the leadership, and you should immediately clarify the situation in order not to waste time on useless cooperation.

More benefits, more vitamins!

Maybe you are a good specialist, but the company does not receive significant benefits from this. For example, your knowledge of five languages is useless to conduct negotiations within the country.

The main thing is to help the company to become more successful, to enter new territories, and to improve current activities. Suggest your own development plan. If you help the company make more money, your bosses will gladly increase your personal income.

Wind of change

Sometimes the company does not know how to change or does not want to, so there will be no changes for you too. In such situation, you should take a vacation, find all the vacancies that suit you and send out your resume. Perhaps a dream job has been waiting for you for a long time.

If you received a good offer, but you are in doubt, tell your boss about it. He can do everything in his power to persuade you not to leave the company.

Develop yourself

Maybe right now you do not deserve a lot of money, or the modern labor market cannot offer them to you. Do not be discouraged, you should not give up. On the contrary, continue efforts. Expand your horizons, discover new superpowers.

Find a way to increase your value: engage in self-education, attend master classes, and meet people you respect. Set goals, say them aloud and work to achieve them. If, despite all your efforts, attractive employers ignore you, start your own business.

|

Метки: #photo_news |

Over one million UK workers could be replaced by robots |

According to the Guardian, about 1.5 million UK workers may lose their jobs due to automation. This relates primarily to women and part-time workers. As reported by the Office of National Statistics of the United Kingdom (ONS), the first victims of the innovation were cashiers in supermarkets: during the period from 2011 to 2017, 25.3% of such jobs were cut.

At present, a number of technology groups are trying to implement artificial intelligence in retail outlets. For example, in 2018, Amazon opened a checkout-free grocery store in Seattle. McDonald's, a popular fast food chain, is also adding self-service ordering kiosks, relieving customers of the need for communication with the restaurant staff.

Other spheres of activity susceptible to automation include laundries, agriculture, and tire shops, where the number of jobs has decreased by 15% or even more. The ONS estimates that workers aged 35 to 39 years can face the potential robotization. “Just 1.3% of people in this age bracket are in roles at high risk of automation,” the ONS said.

Notably, tasks that can be more easily computerised will most likely be replaced by robots. Employees performing more complicated creative projects may not be threatened with robotization of the production at all.

Read more: https://www.mt5.com/forex_humor/image/40893

|

Метки: #forex_caricature |

Top 5 Dow Jones dividend stocks |

Experts advise market participants, who are planning to earn well in the long term, to invest in dividend stocks of the Dow Jones Industrial Average. These assets are the most profitable ones and are the best to invest in. Here is the list of the five companies from the Dow Jones index with highest-yielding dividend stocks

Experienced market participants are well aware of the Dow Jones Industrial Average, which includes 30 largest US companies. The oldest index in the US history includes companies from various economy sectors. The list of corporations is constantly revised depending on the state of the stock market. Currently it includes the top five US companies.

Verizon Communications Inc.

Verizon Communications Inc. is the leader in terms of dividends, experts say. Its activities include Internet communications, information, entertainment products and services for consumers and government agencies around the world. Now, it is the largest communication corporation in the USA with the cap of more than $200 billion. Over the last year, the company paid dividends of 4.89%.

Chevron Corp.

The second place among the companies with the highest dividends belongs to Chevron Corporation. Subsidiaries of the company specialize in integrated energy and petrochemical industries around the world. The activities of the corporation are also related to money management and debt financing. The Chevron Corporation’s cap exceeds $200 billion. For the current year, the company paid dividends of 3.98%.

Exxon Mobil Corp.

The third place in this rating is occupied by Exxon Mobil Corporation. The company's business is exploration and production of oil and natural gas in the United States, Canada, South America, Europe, Africa, Asia and Australia. It produces and sells petrochemical products, transports and sells oil and gas. The market cap of Exxon Mobil reaches $360 billion. The volume of paid dividends of the company amounted to 3.97%.

International Business Machines Corp.

The fourth place in the list of companies with the highest dividends by yield goes to International Business Machines Corporation. This is one of the largest IT companies in the world. It operates in different segments of the technology industry. Last year the company paid 3.86% of dividends.

Pfizer Inc.

Pfizer Inc., one of the leading pharmaceutical corporations in the world, closes the top five most profitable companies. Its activities include research, development, production and sale of health products. The company manufactures its products in 46 countries. Its capitalization is more than $190 billion. The volume of paid dividends of the company is 3.75%.

|

Метки: #photo_news |

Wall Street doubts companies’ earnings to rise, while investors remain optimistic |

A number of major investors expect to see some positive changes in the US companies’ profits. Although, Wall Street gets ready for the possible decline in earnings for the first time in three years.

Analysts believe, the financial markets are likely to become more volatile in the nearest future. Their long-term forecasts do not sound optimistic amid concerns raised by the weakness of the US economy as well as lack of progress in the US-China trade negotiations.

Moreover, an unexpected decrease in the industrial production in March also affected outlook for the US economy. Another wave of fears in the market was triggered by an inversion of yield spread between the three-month and the ten-year government bonds. Notably, the previous inversion was recorded in 2007. Experts consider the current inversion to be an indicator of the forthcoming recession.

A lot of investors are worried about a possible slump in profits of the major companies included in the S&P 500. The revised outlooks for earnings in 2019 became another reason for such fears. Analysts anticipate earnings to drop by 1.7% in the first quarter and to be slightly increasing during the rest of 2019.

Specialists think that the growth of companies’ earnings may slow down in the current year compared with 2018 when it advanced by about 24% due to lower corporate tax.

The outlook for the earnings growth in the second quarter was downgraded to 3.0% from 6.4%, in the third quarter – to 2.7% from 4.9%. The forecast for the fourth quarter also slightly worsened, yet it remained at 9.1%.

According to experts, these readings might get another downward revision, while the outlook for the first quarter is likely to advance. In this case, the S&P 500 companies will finish the year at a profit.

Read more: https://www.mt5.com/forex_humor/image/40847

|

Метки: #forex_caricature |

Six biggest corporate scandals in Japan |

The scandal led to the sacking and arresting the chairman of Nissan, Carlos Ghosn, is not the first that shakes the corporate world of Japan. Corporate scandals happened in different areas of business in the country: from automakers to steelmakers. Read in our article about the most grandiose scandals of recent years that have caused significant damage to the reputation of companies.

Olympus management scandal

Olympus worked as a typical manufacturer of high-tech optics until October 2011, when Michael C. Woodford became its executive director.

He did something that no Western leader could do. Woodford became the head of the Japanese company, not being a Japanese. At the time of his appointment, Woodford had already worked in the company for 30 years. But two months after that, he was fired.

Woodford had raised questions about the firm's dubious transactions.

The board of directors of Olympus had long denied this fact. But in the end, management acknowledged that it had hidden losses of $1.7 billion for more than 20 years.

The board of directors quit, and the company was forced to cut thousands of employees.

Toshiba accounting scandal

According to Nikkei, Toshiba made mistakes in managing the warehouse stocks of discrete semiconductors which are used in a wide range of electronics.

In 2012, Toshiba restructured resulting in the closure of three chip manufacturing enterprises. But before that, the company increased production to maintain uninterrupted supply.

However, demand was low, and unrealized products accumulated. In such cases, the cost of inventories should be written off. Toshiba, hoping for a rise in demand, did not do this. Inaction has led to an overstatement of profit data.

Later investigators found direct evidence of inappropriate accounting practices and overstated profits in multiple Toshiba business units, including the visual products unit, the PC unit and the semiconductor unit.

Due to miscalculations in estimating the cost of some infrastructure projects, Toshiba announced a donwardly revised review of data on operating profit for the three-year period from 2011 to 2013.

Takata airbag scandal

The manufacturer of auto parts was in the center of the scandal in 2017 due to defective airbags that caused many deaths and injuries.

Approximately 100 million cars were equipped with defective airbags: BMW, Fiat, Mitsubishi, Toyota, Nissan, Mazda and other brands.

Exploding airbags have been linked to at least 23 deaths worldwide, dozens received injuries of varying severity.

It was announced the recall of defective products. And Takata suffered huge losses.

The company, founded in 1933, was forced to fill out an application for bankruptcy, and its head was dismissed.

Kobe Steel scandal

Kobe Steel, the third largest steel producer in Japan, delivered its products to companies that produce cars, airplanes and trains around the world. In the fall of 2017, Kobe Steel detected over 700 cases of falsification of data on metal products. For several years, staff had changed or made up data on the quality of some of its products before they were shipped.

This was a big blow to the reputation of Japanese industrial companies. Manufacturing giants including Boeing, Toyota and General Motors have been investigating whether they used any of the sub-standard materials

Two directors of the company, who headed the divisions for aluminum and copper, were aware of the fraud but did not take any action. They were fired. Hiroya Kawasaki, Chairman of the Board and Executive Director, also resigned.

issan emissions scandal

Nissan says it has uncovered falsified data from car exhaust emissions tests at most of its Japanese factories.

According to the Kyodo agency, there were revealed cases of forgery of documentation for almost 1.2 thousand cars of various models.

A spokesman said that the firm identified 900 cases in which test results were non-compliant in one form or another. Car assembly was carried out at five factories in Japan.

At the same time, Nissan also confirmed that this issue does not affect vehicles made outside of Japan, and the cars for the local market fully comply with the current safety standards.

Arrest of Carlos Ghosn and Greg Kelly

Nissan's new scandal took place in November 2018.

Nissan CEO Carlos Ghosn and board member Greg Kelly have been placed under arrest after they allegedly violated Japanese financial law.

The Renault-Nissan-Mitsubishi Alliance chairman and CEO earned a salary of about 10 billion yen, or $88.7 million, from 2011 to 2015 but reported only half of that. Also Ghosn bought a luxury housing abroad at the expense of the automaker.

The Tokyo Prosecutor’s Office has already conducted searches at the company's office. Ghosn is expected to be dismissed from his post as chairman of the board of directors.

During the opening of trading on the stock exchange in Tokyo, shares of the Nissan Japanese automaker fell 6.25 percent.

|

Метки: #photo_news |

3 stocks to buy in 2019 |

The growing popularity of data centers, cloud computing, Internet devices and artificial intelligence is boosting the demand for microcircuits. This situation favorably affects the stock prices of microcircuits manufacturers. The most popular and profitable securities of three leading producers of innovative developments will help market participants to form an investment portfolio for 2019

Over the past few years, microcircuits manufacturers have become one of the leaders in the global stock market. This situation contributes to the positive dynamics of the companies’ shares. Experts find it difficult to predict the future of manufacturers, but the popularity of these companies is beyond doubt. Despite a bit vague forecasts, the three companies will remain the most profitable for investors over the next 5 years.

Intel

In 2017, Intel stock price was $30. In 2018, the management changed the direction of the business, switching to data centers and the sphere of artificial intelligence (AI). This attracted new customers. Intel's business began to flourish, and stocks soared to nearly $60. Today, the company is once again entering a bear market. Investors fear that the peak has already passed, but experts are confident that the company will move forward. Currently, Intel stocks are traded at around $50. Earnings per share will be $5.5 over the next 5 years.

Micron

Over a two-year period, Micron’s shares soared from $10 to $60 per share. The price hike was affected by the growth in demand on the microcircuits market. However, in the last few months of 2018, Micron stocks fell from $50 to $35. Nevertheless, experts consider investors' concerns to be in vain, since this sphere will remain popular as well as the Internet of things (IoT), data centers and AI. Over the past 5 years, the value of Micron securities exceeded earnings per share by 9 times. According to analysts, by the end of 2019, the price could reach $72, which is 40% higher than the current level.

Nvidia

Nvidia is a leader in such industries as data centers, the Internet of things, artificial intelligence, autonomous vehicle control and augmented/virtual reality. Over the past 3 years, the company's shares have grown by more than 1,000%. According to experts, these segments are just developing, so the manufacturer’s shares are to grow. Experts believe, in the near future, Nvidia shares will hold leading positions, as investment in AI, data centers and automation will increase.

|

Метки: #photo_news |

Severe thunderstorm in Rome |

The Italian capital suffers from bad weather. The strongest thunderstorm with heavy rain, hail and even sleet paralyzed the city and its environs. Hundreds of cars went under the water; cultural monuments of Rome were hurt. You will find the consequences of abnormal weather in our photo gallery.

On the night of October 22, the thunderstorm with showers and hail began. Due to bad weather, six subway stations and several underground passages were closed, routes of some buses were changed, car traffic was partially blocked. The work of the subway was restored by Monday morning.

Several drivers were blocked in their cars in the flooded streets.

The sights of Rome went under the water too. The water level in the Basilica of Saint Sebastian rose almost half a meter.

Mayor of Rome Virginia Raji apologized to residents of the capital for “inconvenience” brought by the weather. In her Facebook, she said that the storm had caused severe flooding in the east of the country and knocked trees down in the southern part of the city.

By evening, a cold weather came to the city: the air temperature fell by more than 10 degrees, it started snowing and there was a hail which caused ice jams on the streets.

Such cataclysms of nature came as a surprise to the Italians, because a couple of days ago, the city had a true summer weather, and the air temperature reached 30 degrees. Meteorologists explain this abrupt change in climate by the difference in temperature between the warm Mediterranean and cold air flows from northern Europe. It is expected that bad weather will soon reach the south of the country, and the cooling will spread throughout Italy.

While the shocked citizens publish photos and videos of the consequences of bad weather in social networks, all the services of the city, from firefighters and policemen to civil defense officers, are struggling with its consequences.

This year, the bad weather now and then overtakes the Italian capital. In February 2018, snow fell in Rome for the first time in 6 years.

On the photo: the inhabitants of Rome play snowballs on St. Peter's Square in winter.

|

Метки: #forex_caricature |

Donald Trump has no control over US dollar |

It turns out, the American president cannot control everything. For example, the dollar refuses to obey Donald Trump. If oil prices depend crucially on the US president’s statements, the greenback is not that influenced. No matter how many times Mr Trump says that he does not need the strong dollar, the national currency continues to strengthen.

Struggling to weaken the dollar, the American leader uses his entire arsenal ranging from rampant tweets to expressive tantrums. However, market participants pay little attention to such insinuations. Even explicit criticism of the Fed’s policy and almost blatant threats to the head of the financial institution cannot knock the dollar off the top. Probably, Mr Trump would not worry about the high dollar if it were not for Europe and the ECB. The single European currency is currently trading at the bottom of its range, and the ECB is actively trying to weaken the euro by launching new stimulus. As a result, other currencies are also depreciating, while the dollar, by contrast, is growing.

Dollar assets offer higher yields than assets in other currencies, such as the euro, the pound or the yen. This causes a spike in the dollar’s value. Apparently, the situation will not change much in the near future. The US currency has few reasons for decreasing. Now investors use the dollar as an investment object within the carry trade, though the dollar has always been a funding currency. This means that they can borrow the euro and the yen and invest in dollar bonds making profit on the difference in rates and the strengthening of the American currency.

Read more: https://www.mt5.com/forex_humor/image/40762

|

Метки: #forex_caricature |

Five countries supporting cryptocurrency |

There is a number of countries in the world that actively support digital currencies. The authorities of these countries seek to create a favorable environment for the development of digital assets. We offer to get acquainted with such crypto friendly countries.

Switzerland

Experts consider Switzerland to be the most advanced country in terms of digital technologies. It claims to be called crypto nation. In connection with this, a so-called crypto valley was created in the city of Zug. It is an association which goal is to create a global blockchain system and cryptographic technologies. In addition to innovations in the blockchain industry, Switzerland is considered one of the leading countries in terms of successful implementation of ICO.

Japan

Experts believe Japan is one of the most digital friendly contries. The technological sphere is very developed here. Last year, Japan recognized virtual currencies as legal tender. According to the national media, investment in Bitcoin by the Japanese authorities amounts to huge sums. In April 2018, the Japan Virtual Currency Exchange Association (JVCEA) was established.

United Kingdom

The United Kingdom is considered one of the best crypto friendly countries, second only to Switzerland and Japan. This year, seven leading blockchain companies have united in a unique cryptocurrency organization called CryptoUK. It was created to avoid regulatory pressure from the authorities. The agency aims to make the UK a safe place for blockchain technology and digital projects. Increased attention is paid to the development of blockchain startups.

Netherlands

The netherlands is considered one of the countries open to innovations in the cryptosphere. This year, a Bitcoin embassy was created in the country, whose task is to popularize digital assets. The capital of the Netherlands, Amsterdam, has a reputation of the best European city for technology startups. In this case, the Dutch government does not seek to adjust the new class of assets under current legislation. The authorities of the Netherlands even developed their own cryptocurrency called De Nederlandsche Bank Coin (DNBCoin).

Denmark

Denmark is another European country with a favorable cryptocurrency environment. It introduced a zero tax on digital currencies which makes this state very attractive for crypto enthusiasts. After the adoption of the resolution that virtual currencies are not a means of payment, the National Bank of Denmark exempted digital assets from state regulation.

|

Метки: #photo_news |

Japan's exports rebound in February |

Last month, the value of exports fell by 1.2 percent year-on-year to 6.38 trillion yen ($57.2 billion) from 8.4 percent in January, the biggest decline in more than two years.

According to the Ministry of Finance of Japan, the reduced exports were largely due to the slowdown in China's economy owing to the US-China trade dispute, as well as slower economic growth in other Asian countries.

In February, imports to Japan declined at the sharpest rate in two years by 6.7 percent year-on-year to 6.05 trillion yen, after slumping 1.8 percent in January.

Japanese exports to China, its biggest trading partner, increased by 5.5 percent year-on-year, following a reduction of 17.4 percent a month earlier. In addition, exports to the United States grew by 2 percent, while that to the countries of Western Europe rose by 2.5 percent.

Japan’s shipments to the countries of the Asia-Pacific region mostly decreased, with exports to Singapore, South Korea, and Australia down by 18.2 percent, 14 percent, and 13.3 percent, respectively.

Japan's foreign trade balance came to a surplus of 339 billion yen in February 2019 compared to a deficit of 1.42 trillion yen in January.

Read more: https://www.mt5.com/forex_humor/image/40741

|

Метки: #forex_caricature |

Villas in France and mansions in New York: Forbes list participants' property |

It seems that changing the usual way of life of Russian billionaires is beyond the power of sanctions or economic crises. Businessmen continue to buy real estate abroad, reshaping the architectural heritage of the Old World to their own taste and provoking the media with million-dollar deals. In our article, you will find what residential properties in the UK, Italy, France, USA, Israel, and even New Zealand belong to Russian members of the Forbes list.

Vladimir Lisin

The businessman, who ranks first in the list of Forbes domestic billionaires and whose fortune is estimated at $19.1 billion, hunts in the vicinity of his own estate, Aberuchill Castle in Scotland, acquired in 2005. The Scotsman newspaper cites the details of this purchase: the billionaire paid lb6.8 million for a plot of more than 1,300 hectares and a 16th-century castle.

In addition to being the chairman of the board of directors of NLMK, Vladimir Lisin is also the president of the Russia Shooting Union.

Vagit Alekperov

Lukoil President Vagit Alekperov settled in the Danish kingdom. The area of his mansion is small, 130 square meters, like Denmark itself, by the way. The amount of the transaction is estimated at $700,000. In the businessman's house in Helsingor, where the events of the Hamlet play by Shakespeare took place, there are two bedrooms. On the territory, there is a small garden and a garage for two cars.

Alekperov's fortune is estimated at $16.4 billion (No. 4 in the Forbes list).

Andrey Melnichenko

In 2003, the main shareholder of EuroChem, Andrey Melnichenko, bought a villa in Antibes on the Cote d'Azur for 10 million euros. The businessman, who occupies the 7th place in the Forbes list with a fortune of $15.5 billion, also owns the Harewood mansion in English Ascot with an estimated value of lb24 million.

Mikhail Fridman

Fortune: $15.1 billion (No.8 in the Forbes list).

In 2016, the British authorities gave Mikhail Fridman permission to partially restructure his Athlone House estate in Hampstead Heath, in north London. According to the Daily Mail, the billionaire plans to equip six bedrooms, a gym, a cigar room, a yoga room in the mansion and build cottages for service personnel and a tennis court.

Fridman acquired Athlone House for lb65 million, but according to the Daily Mail, after renovation, the value of the estate will double.

Viktor Vekselberg ($14.4 billion, No.9 in the Forbes list)

The chairman of the board of directors of the Renova group of companies, Viktor Vekselberg, is clearly not a superstitious person. In 2007, the billionaire bought a Feltrinelli villa on the shores of Lake Garda in Italy for $40 million, a place with a complicated history. Benito Mussolini spent last years of his life in the villa, and one of the owners of the villa, politician Giangiacomo Feltrinelli, made it the terrorist base of the Partisan Action Group.

Alisher Usmanov

Alisher Usmanov owns the Beechwood House estate in the suburbs of London. The cost of a two-storey mansion, built in 1840, is estimated at lb48 million. In 1974, Beechwood House was listed as a national heritage of England.

The fortune of the founder of Metalloinvest, Alisher Usmanov, is equal to $12.5 billion (No.10 in the Forbes list).

Roman Abramovich

Fortune: $10.8 billion (No.11 in the Forbes list).

In 2017, Roman Abramovich finally succeeded in a plan to unite the three historic mansions in New York into one house. The billionaire bought mansions with a total value of $78 million. But the Commission for the Protection of Architectural Monuments rejected the plan to change the facade of the houses, pointing out that this would spoil the historical appearance of the city. The billionaire had to buy another house for $18 million. A plan in which one of the houses was replaced by another satisfied the commission. The restructuring will cost $6 million.

The businessman has a passion for rebuilding the houses he bought. In 2016, he decided to redevelop a house on Kensington Palace Gardens in London to increase the size of the pool.

German Khan

Fortune: $9.8 billion (No.12 in the Forbes list).

Member of the Board of Directors of LetterOne Holdings and the Supervisory Board of Alfa Group, German Khan, spent lb62 million for a house in the Belgravia area of London.

Mikhail Prokhorov

The billionaire with a fortune of $9.6 billion (No.13 in the Forbes list) owns a five-story chalet in Courchevel with an estimated value of $30 million. In March 2017, the media wrote that the Courchevel chalet was robbed.

Oleg Deripaska

Oleg Deripaska, the Chairman of the Supervisory Board of Basic Element, acquired a six-story mansion in the same area as Prokhorov. At the time of the transaction in 2003, real estate valued at lb25 million.

Oleg Deripaska's fortune is estimated at $6.7 billion (No.19 in the Forbes list).

Alexander Abramov

Fortune: $5.2 billion (No.21 in the Forbes list).

The head of Evraz, Alexander Abramov, spent over $50 million on the construction of a new villa in New Zealand. But to be honest, New Zealanders are not very happy about this neighborhood. The New Zeland Herald newspaper in 2017 wrote that the irrigation of the Abramov lands takes almost 60,000 liters of clean water from local water bodies. The neighbors of the Russian oligarch are convinced that this can cause irreparable harm to the ecosystem.

Pyotr Aven

Aven, the chairman of the board of directors of the Alfa Bank banking group, bought the Ingliston House plot in Virginia-Water County, Surrey, in 2004, and built a house on it so that his children could go to school nearby.

Fortune: $5.1 billion (No.22 in the Forbes list).

Andrey Guryev

Forbes: $4.5 billion (No.26 in the Forbes list).

The owner of PhosAgro, Andrey Guryev, the owner of the second largest after Buckingham Palace mansion in London, Witanhurst. In addition, in May 2016, The Guardian reported that Guryev became the owner of the penthouse in the highest residential building in the UK, St.George Wharf. According to the newspaper, the cost of the penthouse was lb51 million.

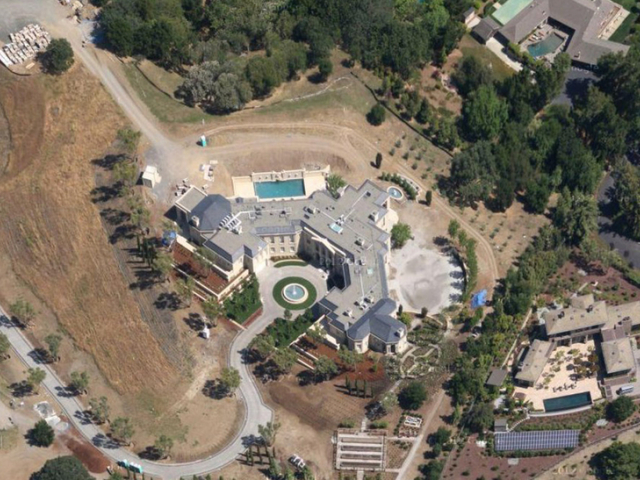

Yuri Milner

Fortune: 3.7 billion (No.31 in the Forbes list).

The founder of the DST Global group of funds, Yuri Milner, in 2011 acquired a mansion in the French style in Silicon Valley for $100 million. According to the canons of French castles, in the American house of Milner there is a ballroom and a wine cellar.

|

Метки: #photo_news |

Russia adopts digital rights law |

The State Duma of the Russian Federation adopted the bill on digital rights in the third and final reading. This bill is supposed to introduce the concept of "digital right" into the Civil code of Russia and adjust the definition of smart contracts as well as a number of other definitions in the digital economy, including big data.

The new provisions of the law will enter into force on October 1, 2019. The term "digital right" is a legal analogue of the term "token". Due to the consolidation of the concept "digital right" in the Civil code, transactions will be protected when citizens and legal entities deal with the digital rights.

The principles of entering into contracts with digital rights are now established by law. Transactions made remotely by electronic or other technical means are proposed to be equated to a written form of contracts. These transactions have two requirements: the given technical means must be reproduced in tangible media; only those methods must be used that allow to identify the person who expressed the will.

The bill legalizes smart contracts and clarifies the fields of their use. For instance, it is not allowed to make a will using electronic or other technical means. The law resolves the issue of legalization in terms of collection and processing the significant amounts of anonymised information (big data).

In comparison with its original version, the chapter on "digital money" (cryptocurrencies) was excluded. "The amendments adopted in the Civil code do not contain definitions of digital money and smart contracts which are the key concepts for the crypto economy".

Yuri Pripachkin, head of the Russian Association of Crypto Industry and Blockchain, expressed his attitude to the adopted law. He urged the government that the participants of the decentralized market would not be able to work effectively within the Russian jurisdiction and would be forced to build their business in other countries due to the lack of clear definitions.

Read more: https://www.mt5.com/forex_humor/image/40705

|

Метки: #forex_caricature |

Rare cars forgotten in old garages |

Annually, the news reports about amazing things found in abandoned buildings. There is a lot of cars among them. Hunters for exotic cars are sometimes lucky to find truly unique items or even entire collections of vintage cars that can cost a fortune. You can read about the five most interesting cars that were found in abandoned garages.

Dodge Charger

The 1969 Dodge Charger Daytona was accidentally found in an old barn by residents of the American city of Glenwood in 2015. Manufacturers have released only 503 copies of this model. Dodge Charger with a mileage of 33.07 km preserved in its original form: the 375-strong eight-cylinder Dodge 440 Magnum engine and automatic gearbox are in a work condition.

At one time, the car was bought by a local judge as a gift to his wife, and in 1974 the couple decided to sell it to a new owner who did not appreciate the purchase.

Experts estimated the two-door sports coupe at $180 thousand, but in January 2016 it was sold twice cheaper for $90 thousand.

Ferrari 166MM 1949

The sports car 166MM 1949 was produced in an even more limited number, only 25 copies. Especially for this model, Italian designer Gioacchino Colombo developed the V12 engine with a volume of 2 liters, which made the car one of the fastest in the model range of the brand.

The first owner was from Arizona, he bought a car in 1959 at auction for only $8 thousand. For several years the car was used for its intended purpose, to participate in sports competitions, but after another breakdown, it was forgotten. Half a century later, the heirs recalled the sports car and sold it to collector Manny Del Arroz for $1 million. He completely fixed the mechanical part of the car.

Ferrari 365 GTB/4 Daytona 1969

Another rare Italian car was found in an abandoned garage in Japan, where it stood for more than 40 years. Until 1973 Ferrari released only 1.2 thousand of these cars, equipping them with 4.4-liter engines of 350 hp. But only five of them received ultra-light aluminum bodies from the famous studio Scaglietti. And upon closer examination, the experts found out that this is the only copy of its kind that was certified for driving on public roads.

Autosprint journalist Luciano Conti was the first owner of the car. Then the car changed several owners until it was exported to Japan. In September 2017, the sports car was sold for $2.17 million at an auction in Maranello, Italy.

Three rare Texas sports cars

Three expensive sports cars were found in an abandoned barn in the northeastern United States: 1974 Ferrari Dino 246 GTS, 1972 Ferrari 365 GTB / 4 Daytona and 1977 Maserati Bora Coupe.

Italian sports cars did not receive adequate attention and care for decades. But the condition of these cars turned out to be even better than that of the existing collection items.

In the 1970s, a friend of the American Ferrari importer, race car driver Luigi Chinetti, bought this car. In the summer of 2011, cars were put up for sale at eBay auction.

Forgotten Chevrolet dealership warehouse

In 2013, an abandoned dealership warehouse was found in Nebraska, where about 500 classic Chevrolet cars were stored. Fifty of them are completely new with a mileage of 1 mile. In addition, corrosion damaged only a few cars, and it was not difficult to restore them.

These cars once belonged to the dealership center Lambrecht Chevrolet. The owner of the showroom kept new cars that were not sold in the first year in warehouses near his farm. In the early 1980s, the business was closed, and everyone forgot about cars.

Van Der Brink held an auction where this rare collection was sold. For example, Chevrolet Cameo was sold for the highest price, $140 thousand.

|

Метки: #photo_news |

Oil tankers drift in Atlantic due to US sanctions |

Everyone knows how US sanctions negatively affect the global economy. This time, the NS Concept oil tanker, commercially managed by Russia’s Sovcomflot, became a victim. It has to drift in international waters, because US sanctions sent it wildly off-course.

This tanker is one of many left in limbo off the Venezuelan coast. The situation was caused by US sanctions imposed on the country’s oil exports. Some tankers, with as many as two million barrels of oil on board, are waiting in coastal waters. Experts are not sure about the outcome of this situation.

According to economists, increasing US production, reductions in OPEC output, and imposition of sanctions complicate shipping logistics. “The result is a procession of empty supertankers making voyages of as much as 21,000 miles to the US direct from Asia, all the way around South Africa, holding nothing but seawater for stability,” Julian Lee, an oil strategist, notes. He claims that the current situation can bankrupt shipowners and oilmen. Oil tankers earn money when they move briskly from port to port with the cargo. But complex geopolitical factors have made it difficult for them to do so. Owners of tankers forced to veer off course or sit idle for days or weeks, experts says. Moreover, it remains to be seen whether they can shift the costs to producers and refiners. In the future, this may lead to a boost in oil prices, experts believe.

Earlier, the NS Concept tanker headed from Venezuela to Houston, carrying half a million barrels of Venezuelan oil. However, when it arrived at the American port, it became known that the US Treasury Department had imposed sanctions on PDSVA, Venezuela’s state-owned oil company. In this context, the oil unloading became illegal. The tanker spent six days at the port before being turned around and sent back out into the Gulf of Mexico. It moored at the island of Sint Eustatius, near Puerto Rico. There, the oil was transferred to a huge Saudi tanker, Ghazal.

Experts foresee more negative effects from US sanctions in the near future. Not only Venezuela or Iran may suffer from these restrictions, but also other countries. It is possible in a market in which one ship may be tied to three or four countries. Analysts estimate that small nations such as Panama and the Bahamas will benefit from this situation, as they could pull in easy earnings from a tonnage tax and registration fees. For other countries, this could become an intractable problem.

Read more: https://www.mt5.com/forex_humor/image/40665

|

Метки: #forex_caricature |

Oil tankers drift in Atlantic due to US sanctions |

Everyone knows how US sanctions negatively affect the global economy. This time, the NS Concept oil tanker, commercially managed by Russia’s Sovcomflot, became a victim. It has to drift in international waters, because US sanctions sent it wildly off-course.

This tanker is one of many left in limbo off the Venezuelan coast. The situation was caused by US sanctions imposed on the country’s oil exports. Some tankers, with as many as two million barrels of oil on board, are waiting in coastal waters. Experts are not sure about the outcome of this situation.

According to economists, increasing US production, reductions in OPEC output, and imposition of sanctions complicate shipping logistics. “The result is a procession of empty supertankers making voyages of as much as 21,000 miles to the US direct from Asia, all the way around South Africa, holding nothing but seawater for stability,” Julian Lee, an oil strategist, notes. He claims that the current situation can bankrupt shipowners and oilmen. Oil tankers earn money when they move briskly from port to port with the cargo. But complex geopolitical factors have made it difficult for them to do so. Owners of tankers forced to veer off course or sit idle for days or weeks, experts says. Moreover, it remains to be seen whether they can shift the costs to producers and refiners. In the future, this may lead to a boost in oil prices, experts believe.

Earlier, the NS Concept tanker headed from Venezuela to Houston, carrying half a million barrels of Venezuelan oil. However, when it arrived at the American port, it became known that the US Treasury Department had imposed sanctions on PDSVA, Venezuela’s state-owned oil company. In this context, the oil unloading became illegal. The tanker spent six days at the port before being turned around and sent back out into the Gulf of Mexico. It moored at the island of Sint Eustatius, near Puerto Rico. There, the oil was transferred to a huge Saudi tanker, Ghazal.

Experts foresee more negative effects from US sanctions in the near future. Not only Venezuela or Iran may suffer from these restrictions, but also other countries. It is possible in a market in which one ship may be tied to three or four countries. Analysts estimate that small nations such as Panama and the Bahamas will benefit from this situation, as they could pull in easy earnings from a tonnage tax and registration fees. For other countries, this could become an intractable problem.

Read more: https://www.mt5.com/forex_humor/image/40665

|

Метки: #forex_caricature |

Five reasons why gold prices increase |

Gold has always been considered the safest asset most suited for investment. In the modern world, it is a significant object for long-term investments, the cost of which steadily increases. Experts name several factors affecting the rise in the price of gold.

Importance of gold reserves for states

Experts consider gold as a standard of material values and a way of expressing commodity-money relations. For a long time, budgets of many countries were directly dependent on gold reserves. This period is characterized by a fixed exchange rate.

Inflation's impact on gold

In today's world, the value of gold has changed a bit, but states still care about national gold reserves. Authorities are more often concerned about rising prices and declining consumer activity. These adverse processes force governments to take additional measures, one of which is inflation, that is, the withdrawal of extra money from circulation. At the same time, the cost of gold shows multidirectional dynamics, from a sharp drop to active growth.

Financial crisis' impact on the gold value

The pre-crisis period was characterized by a fall in gold prices. In 1999, a troy ounce of the precious metal cost $253. For several years, its value has hardly changed. The global economic crisis of 2008 caused a boom in gold prices. Its cost continued increasing. Over the past 10 years, experts have recorded a steady rise in prices for gold.

The impact of interest rates and the US dollar rate

Currently, gold prices are on the rise. In December 2018, gold futures rose from $1,235 to $1,250 per ounce. Bank of America believes that the weakening of the dollar, inflation in the United States and low interest rates will be drivers of gold price growth in 2019. According to the forecast of the bank, the cost of the precious metal will reach $1,296 per ounce. Over the next year, a rise to $1,400 is not excluded. This year, three factors constrained the price of gold: an increase in interest rates, the growth of the US economy and the strengthening of the dollar, and in 2019 their impact will weaken.

Exchange trading and its impact on the gold rate

The rise in the value of gold is significantly affected by trading on the stock exchange. This metal is actively trading on global stock markets. The dynamics of gold prices largely depends on stock speculation. Experts consider gold a serious type of long-term investment. It is a very profitable investment which is characterized by a certain cyclical nature. The value of gold depends on the activities of central banks and the regulation of their processes on stock exchanges.

|

Метки: #photo_news |

Five reasons why gold prices increase |

Gold has always been considered the safest asset most suited for investment. In the modern world, it is a significant object for long-term investments, the cost of which steadily increases. Experts name several factors affecting the rise in the price of gold.

Importance of gold reserves for states

Experts consider gold as a standard of material values and a way of expressing commodity-money relations. For a long time, budgets of many countries were directly dependent on gold reserves. This period is characterized by a fixed exchange rate.

Inflation's impact on gold

In today's world, the value of gold has changed a bit, but states still care about national gold reserves. Authorities are more often concerned about rising prices and declining consumer activity. These adverse processes force governments to take additional measures, one of which is inflation, that is, the withdrawal of extra money from circulation. At the same time, the cost of gold shows multidirectional dynamics, from a sharp drop to active growth.

Financial crisis' impact on the gold value

The pre-crisis period was characterized by a fall in gold prices. In 1999, a troy ounce of the precious metal cost $253. For several years, its value has hardly changed. The global economic crisis of 2008 caused a boom in gold prices. Its cost continued increasing. Over the past 10 years, experts have recorded a steady rise in prices for gold.

The impact of interest rates and the US dollar rate

Currently, gold prices are on the rise. In December 2018, gold futures rose from $1,235 to $1,250 per ounce. Bank of America believes that the weakening of the dollar, inflation in the United States and low interest rates will be drivers of gold price growth in 2019. According to the forecast of the bank, the cost of the precious metal will reach $1,296 per ounce. Over the next year, a rise to $1,400 is not excluded. This year, three factors constrained the price of gold: an increase in interest rates, the growth of the US economy and the strengthening of the dollar, and in 2019 their impact will weaken.

Exchange trading and its impact on the gold rate

The rise in the value of gold is significantly affected by trading on the stock exchange. This metal is actively trading on global stock markets. The dynamics of gold prices largely depends on stock speculation. Experts consider gold a serious type of long-term investment. It is a very profitable investment which is characterized by a certain cyclical nature. The value of gold depends on the activities of central banks and the regulation of their processes on stock exchanges.

|

Метки: #photo_news |

Russia adopts digital rights law |

The State Duma of the Russian Federation adopted the bill on digital rights in the third and final reading. This bill is supposed to introduce the concept of "digital right" into the Civil code of Russia and adjust the definition of smart contracts as well as a number of other definitions in the digital economy, including big data.

The new provisions of the law will enter into force on October 1, 2019. The term "digital right" is a legal analogue of the term "token". Due to the consolidation of the concept "digital right" in the Civil code, transactions will be protected when citizens and legal entities deal with the digital rights.

The principles of entering into contracts with digital rights are now established by law. Transactions made remotely by electronic or other technical means are proposed to be equated to a written form of contracts. These transactions have two requirements: the given technical means must be reproduced in tangible media; only those methods must be used that allow to identify the person who expressed the will.

The bill legalizes smart contracts and clarifies the fields of their use. For instance, it is not allowed to make a will using electronic or other technical means. The law resolves the issue of legalization in terms of collection and processing the significant amounts of anonymised information (big data).

In comparison with its original version, the chapter on "digital money" (cryptocurrencies) was excluded. "The amendments adopted in the Civil code do not contain definitions of digital money and smart contracts which are the key concepts for the crypto economy".

Yuri Pripachkin, head of the Russian Association of Crypto Industry and Blockchain, expressed his attitude to the adopted law. He urged the government that the participants of the decentralized market would not be able to work effectively within the Russian jurisdiction and would be forced to build their business in other countries due to the lack of clear definitions.

Read more: https://www.mt5.com/forex_humor/image/40705

|

Метки: #forex_caricature |