Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

7 habits that help you learn and earn |

Habits, addictions and inclinations of the mind can either ruin us or contribute into our future financial well-being. Seemingly insignificant habits affect career, health, development, and overall happiness. In our review, you will find a few simple secrets that will help you successfully learn and earn more.

We have been told since childhood that we need to fight bad habits, but few say that it is also necessary to develop new useful ones. One of their main advantages is that they do not require serious motivation or inflexible willpower, the main thing is to remind yourself of them in time to get closer to your cherished goals and dreams. Let's consider seven easy ways to get better.

1. Listen to specialized audiobooks or podcasts for 15 minutes every day. This can be done during a break for a cup of tea or coffee, instead of unnecessary chatter, or on the way to work: on the subway, car, public transport or on foot.

Choose the area of knowledge that you have always wanted to study or in which you want to improve, and find relevant specialized audio materials (not fiction). For example, listen about e-commerce, webinars, customer care technologies, or listen to podcasts of a successful person who works in a field of interest to you.

You should not spend too much time on this. Adhere to the rule of listening to cognitive materials daily for 15 to 30 minutes, find an opportunity to write it in your work schedule, because you never know in advance what information you may need in this or that situation.

2. Read one printed page of a book a day to train your mind (you can read more). Studies have found that the constant habit of fast reading of e-texts contributes to disperse attention and may lead to a decrease in speed and ability to assimilate information by 20-30%.

In addition, paper books provide aesthetic and sensory pleasure which contributes to the quality relaxation necessary for further productive work.

You can read before bedtime, instead of (or after) watching TV, movies or TV shows. The smell and rustle of paper will give signals to the brain that it's time to relax, and if you get carried away with an interesting book, it will help develop your imagination, one of the main tools for overcoming difficult life situations. Read what you like.

3. Go to bed 30 minutes earlier to stay healthy, the main and often irreplaceable resource for a happy life. Ideally, you should go to bed at 10 pm; however, if you feel like an owl, just try to go to bed a little earlier than usual.

A healthy body creates prerequisites for proper and successful thinking. Pay attention to nutrition and exercise, especially if you have a hard time falling asleep.

Often great ideas come to mind at night, but it is useful to teach yourself to go to bed and get up early to bring them to life!

4. When buying new items, choose quality, not quantity. It is better to buy fewer things, but those that you will truly enjoy. In addition, you shouldn't fill your house with unnecessary trash.

You can buy a bag of clothes, shoes, and jewelry, especially during sales and "super discounts", but are they really necessary? Do not deny yourself a pleasant shopping, but if you have things at home that you don't use at all, or things you don't wear, maybe you never really needed them?

Also, get rid of old things when you buy new ones. It does not matter what it is: clothing, appliances or kitchen utensils. You can make someone a nice gift, and at the same time make room for something valuable. This simple habit can radically change your mindset and teach you to choose exactly what you need.

5. Think twice before buying something. If you are going to spend any significant amount for you ($100, $ 1,000 or $ 10,000), wait at least 24 hours.

This habit will help you avoid unnecessary purchases caused by emotional impulse (whim), and not a real need. In the morning the next day, you will most likely know for sure if you need this half-meter teddy bear. It's amazing how many unnecessary things will not appear in your life.

In addition, you can calculate how much money you make per hour (for example, $20). And when you think about this or that purchase, assess how much time in your life you are ready to spend on it.

6. Automate your savings. Automation of savings and investments is a convenient habit that will allow you to save money on planned goals without effort.

Get savings (target) accounts to which you will transfer a certain amount of your earnings (for example, 10%) and any other unplanned income.

Often, banks also award interest on target accounts, and upon reaching the intended amount, think about where you can effectively invest money. Remember the simple rule: money goes to money.

7. Say no to negative. A very useful habit is to calmly and firmly say “no” to unpleasant people, dubious business proposals, everything that does not correspond to your personal perception of the world and does not lead to the achievement of goals.

A person is a social being, people from your environment have a great influence on your life path, they form a space of opportunities for future growth.

Therefore, do not allow anyone to poison you with negative influence, avoid bad companies and wasted time. Achieving your goals, focus on the important things, discard all unnecessary stuff, carefully save anything useful, cultivate the habit of success and happiness in yourself.

|

Метки: #photo_news |

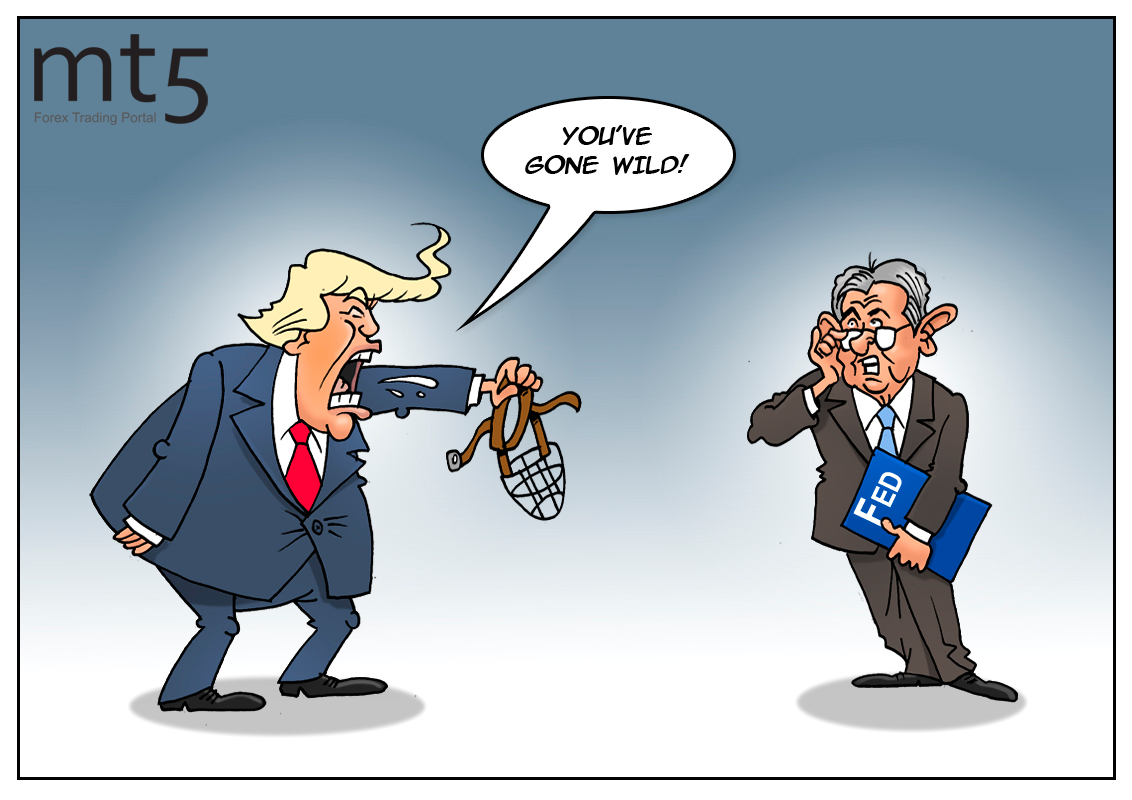

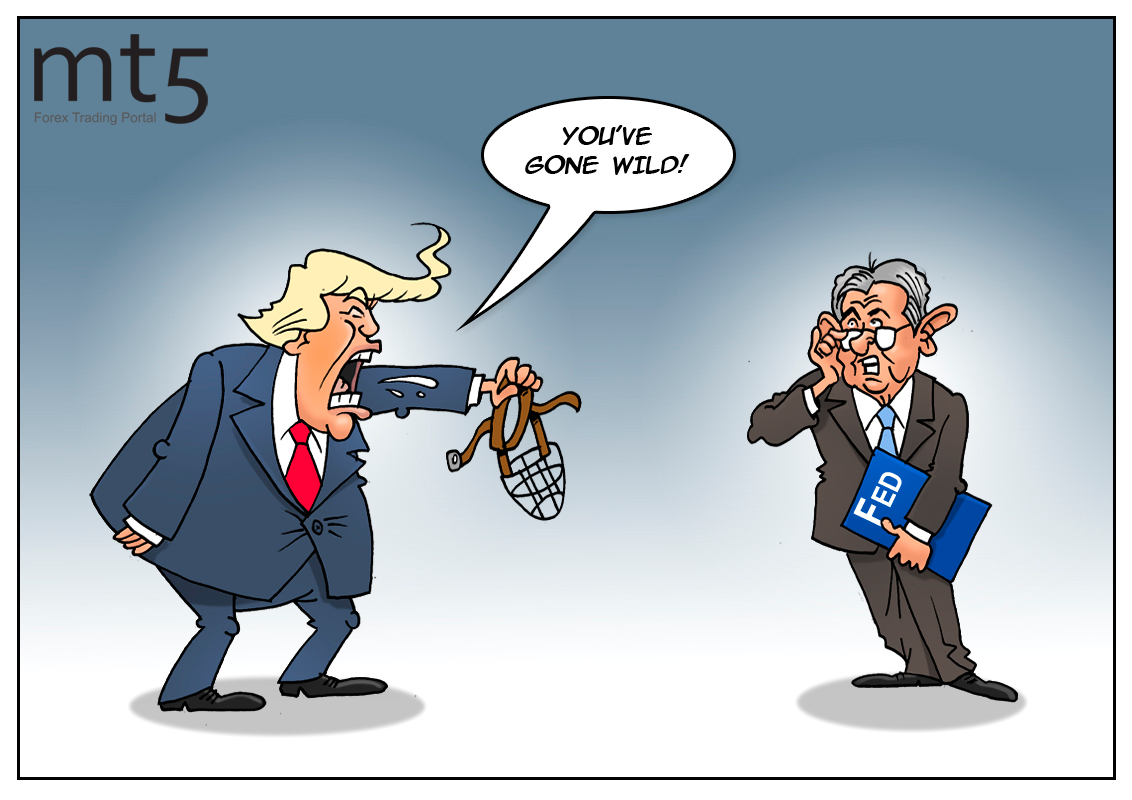

Trump says the Fed is going wild |

Nowadays, an independent financial regulator is a rare phenomenon. Still, in some countries economy and politics are separated. In such countries neither the president nor ministers can dictate terms to the central bank. This way, the central bank’s actions rest upon economic conditions but not government orders. One of such independent regulators is the US Federal Reserve System that has gained trust across the globe.

Few countries can boast of having such a well-tuned and, which is more important, independent financial system. The United States is the only country where the president demands full control over the central bank and doesn’t get it. “The problem I have is with the Fed. The Fed is going wild. I mean, I don't know what their problem is that they are raising interest rates and it's ridiculous,” Trump said. But it was just a bold statement; no actions followed. He can neither dismiss the Fed governor, nor disband the Federal Open Market Committee. He can just simmer with resentment and watch.

Meanwhile, the Fed is pursuing its monetary policy stance, paying attention to economic indicators but not Trump’s hysteria. The regulator is still planning to hike the interest rate one more time this year. So, Trump is better to think about new harsh comments on this issue. He has already stated that he was “worried about the fact that they seem to like raising interest rates”.

According to the CME FedWatch Tool, the probabilities of the FOMC hiking the interest rate in December increased to 76.3%.

Read more: https://www.mt5.com/forex_humor/image/38195

|

Метки: #forex_caricature |

Trump says the Fed is going wild |

Nowadays, an independent financial regulator is a rare phenomenon. Still, in some countries economy and politics are separated. In such countries neither the president nor ministers can dictate terms to the central bank. This way, the central bank’s actions rest upon economic conditions but not government orders. One of such independent regulators is the US Federal Reserve System that has gained trust across the globe.

Few countries can boast of having such a well-tuned and, which is more important, independent financial system. The United States is the only country where the president demands full control over the central bank and doesn’t get it. “The problem I have is with the Fed. The Fed is going wild. I mean, I don't know what their problem is that they are raising interest rates and it's ridiculous,” Trump said. But it was just a bold statement; no actions followed. He can neither dismiss the Fed governor, nor disband the Federal Open Market Committee. He can just simmer with resentment and watch.

Meanwhile, the Fed is pursuing its monetary policy stance, paying attention to economic indicators but not Trump’s hysteria. The regulator is still planning to hike the interest rate one more time this year. So, Trump is better to think about new harsh comments on this issue. He has already stated that he was “worried about the fact that they seem to like raising interest rates”.

According to the CME FedWatch Tool, the probabilities of the FOMC hiking the interest rate in December increased to 76.3%.

Read more: https://www.mt5.com/forex_humor/image/38195

|

Метки: #forex_caricature |

Five profitable cryptocurrencies: competent investor portfolio diversification |

In the process of forming their diversified cryptocurrency portfolio, market participants may become confused and lose profitable options. Given the diversity of virtual currencies, this is not surprising. Experts draw the attention of beginners and experienced market participants to five digital currencies that can become the core of the investment portfolio and bring a substantial income.

With all the diversity of the digital asset market, it can be difficult for investors to choose the most suitable option. Some cryptocurrencies are not considered to be very profitable, while others, with their popularity, may turn out to be expensive or so-called “bubbles” of the virtual market. In order to avoid problems, experts offer options for diversifying investment crypto portfolio that you should pay attention to.

Bitcoin, the market leader

It is unconditionally considered the leader of the cryptocurrency market. This is the first and largest digital currency in terms of capitalization. The total number of coins is limited to 21 million; the current offer is 17.2 million. According to experts, Bitcoin should be the basis of any investor's crypto portfolio. Growth in the market is impossible without the participation of cryptocurrency number 1. The share of bitcoin in the portfolio should be significant (about 30–60%). Experts are sure that the global increase in interest in cryptocurrencies will primarily affect Bitcoin, and then the rest of the Altcoins.

Tether (USDT), a token guaranteeing stability

The peculiarity of this cryptocurrency is that it is equal to the US dollar (1 USDT is always equal to $1). The company that released the Tether, closely ensures that each coin is supported by US currency. Thanks to this, Tether will help the investor survive any downward trends in the digital asset market. It should present the lion's share of the investment portfolio. Ranging from 50% at the peak of growth to 15% during a recession are permissible. The share of Tether should be gradually increased during the “bullish” market and reduced during periods of falls.

NEO, passive income tokens

This digital asset is popular on the crypto market because of its two-coin system. Like Ethereum, it is a platform, but transaction fees are paid in another cryptocurrency, GAS. Storing NEOs in a portfolio allows investors to earn income in the form of GAS tokens. Such passive income is an important component of long-term investment. Remuneration for storage of cryptocurrency is a unique feature of a profitable diversified portfolio. The share of NEO tokens for passive income can vary from 5% to 25%.

BNB, coins for hedging

This cryptocurrency is great for hedging. These tokens must be included in the portfolio because of low correlation with other digital currencies. The cost of BNB tokens depends on trading activity on the stock exchange. It grows in both bullish and bearish markets. As a rule, exchange coins are less subject to global changes. This unique property allows you to include them in a profitable diversified portfolio. The share of such assets should be 10–20%.

ICON, contribution to the future

This cryptocurrency project is considered one of the most advanced. It seeks to combine various blockchain systems. Experts believe that in the future there will be a question about the methods of communication of such network systems. The solution to this problem lies in the ICON project. The token was chosen for the crypto portfolio based on future potential. It is able to grow in price by 100 times and make a significant profit. The share of this asset may be small (4-10%), because it is associated with many risks and has no particular advantages.

|

Метки: #photo_news |

Five profitable cryptocurrencies: competent investor portfolio diversification |

In the process of forming their diversified cryptocurrency portfolio, market participants may become confused and lose profitable options. Given the diversity of virtual currencies, this is not surprising. Experts draw the attention of beginners and experienced market participants to five digital currencies that can become the core of the investment portfolio and bring a substantial income.

With all the diversity of the digital asset market, it can be difficult for investors to choose the most suitable option. Some cryptocurrencies are not considered to be very profitable, while others, with their popularity, may turn out to be expensive or so-called “bubbles” of the virtual market. In order to avoid problems, experts offer options for diversifying investment crypto portfolio that you should pay attention to.

Bitcoin, the market leader

It is unconditionally considered the leader of the cryptocurrency market. This is the first and largest digital currency in terms of capitalization. The total number of coins is limited to 21 million; the current offer is 17.2 million. According to experts, Bitcoin should be the basis of any investor's crypto portfolio. Growth in the market is impossible without the participation of cryptocurrency number 1. The share of bitcoin in the portfolio should be significant (about 30–60%). Experts are sure that the global increase in interest in cryptocurrencies will primarily affect Bitcoin, and then the rest of the Altcoins.

Tether (USDT), a token guaranteeing stability

The peculiarity of this cryptocurrency is that it is equal to the US dollar (1 USDT is always equal to $1). The company that released the Tether, closely ensures that each coin is supported by US currency. Thanks to this, Tether will help the investor survive any downward trends in the digital asset market. It should present the lion's share of the investment portfolio. Ranging from 50% at the peak of growth to 15% during a recession are permissible. The share of Tether should be gradually increased during the “bullish” market and reduced during periods of falls.

NEO, passive income tokens

This digital asset is popular on the crypto market because of its two-coin system. Like Ethereum, it is a platform, but transaction fees are paid in another cryptocurrency, GAS. Storing NEOs in a portfolio allows investors to earn income in the form of GAS tokens. Such passive income is an important component of long-term investment. Remuneration for storage of cryptocurrency is a unique feature of a profitable diversified portfolio. The share of NEO tokens for passive income can vary from 5% to 25%.

BNB, coins for hedging

This cryptocurrency is great for hedging. These tokens must be included in the portfolio because of low correlation with other digital currencies. The cost of BNB tokens depends on trading activity on the stock exchange. It grows in both bullish and bearish markets. As a rule, exchange coins are less subject to global changes. This unique property allows you to include them in a profitable diversified portfolio. The share of such assets should be 10–20%.

ICON, contribution to the future

This cryptocurrency project is considered one of the most advanced. It seeks to combine various blockchain systems. Experts believe that in the future there will be a question about the methods of communication of such network systems. The solution to this problem lies in the ICON project. The token was chosen for the crypto portfolio based on future potential. It is able to grow in price by 100 times and make a significant profit. The share of this asset may be small (4-10%), because it is associated with many risks and has no particular advantages.

|

Метки: #photo_news |

Investor interest in ICO weakens in September |

The amount of funds involved in the initial coin offering (ICO) in September 2018 went down to the lowest level since May 2017, according to Autonomous Research, a global research firm.

Overall, startups attracted less than $300 million as part of the ICO last month which is 90% less than the highest level of $3 billion recorded in January this year.

Perhaps, the declining interest in the ICO is entailed by a quite rigid position of the United States Securities and Exchange Commission (SEC) to this market.

The SEC’s official opinion considers that cryptocurrencies created as a result of the ICO should be regarded as securities and, therefore, fall under current disclosure requirements and investor protection laws.

Bitcoin was up 0.6% at $6621.68 on Monday, CoinDesk data showed. Ethereum added 1.3% to $229.18.

Read more: https://www.mt5.com/forex_humor/image/38162

|

Метки: #forex_caricature |

Investor interest in ICO weakens in September |

The amount of funds involved in the initial coin offering (ICO) in September 2018 went down to the lowest level since May 2017, according to Autonomous Research, a global research firm.

Overall, startups attracted less than $300 million as part of the ICO last month which is 90% less than the highest level of $3 billion recorded in January this year.

Perhaps, the declining interest in the ICO is entailed by a quite rigid position of the United States Securities and Exchange Commission (SEC) to this market.

The SEC’s official opinion considers that cryptocurrencies created as a result of the ICO should be regarded as securities and, therefore, fall under current disclosure requirements and investor protection laws.

Bitcoin was up 0.6% at $6621.68 on Monday, CoinDesk data showed. Ethereum added 1.3% to $229.18.

Read more: https://www.mt5.com/forex_humor/image/38162

|

Метки: #forex_caricature |

Investor interest in ICO weakens in September |

The amount of funds involved in the initial coin offering (ICO) in September 2018 went down to the lowest level since May 2017, according to Autonomous Research, a global research firm.

Overall, startups attracted less than $300 million as part of the ICO last month which is 90% less than the highest level of $3 billion recorded in January this year.

Perhaps, the declining interest in the ICO is entailed by a quite rigid position of the United States Securities and Exchange Commission (SEC) to this market.

The SEC’s official opinion considers that cryptocurrencies created as a result of the ICO should be regarded as securities and, therefore, fall under current disclosure requirements and investor protection laws.

Bitcoin was up 0.6% at $6621.68 on Monday, CoinDesk data showed. Ethereum added 1.3% to $229.18.

Read more: https://www.mt5.com/forex_humor/image/38162

|

Метки: #forex_caricature |

5 ways to steal cryptocurrency (and protection against them) |

The cryptocurrency market is a young industry that constantly faces new challenges. Sometimes state regulators outlaw cryptocurrency exchanges, and sometimes hackers steal millions of digital currency. Below, we will highlight the main methods of cybercrime attacks and ways to protect against them.

The experts of the Hacker Noob portal identified three main categories of malicious attacks:

1. Attacks on blockchains, exchanges and ICO;

2. Distribution of spyware software for hidden mining;

3. Direct attacks on users' wallets.

At the same time, cybercriminals mainly rely on human inattention - the main vulnerability in the system, which is good news. By observing security measures, you can save your digital money.

Google Play Store and App Store

Most often, hackers attack the Android phones, because this OS does not use two-factor authentication technology (giving access to the private information only after entering password, login and additional information).

The attackers add applications to the Google Play Store under the guise of well-known cryptocurrency resources that, when launched, request personal data and send it to hackers. Once criminals placed an application on Google Play on behalf of the Poloniex cryptocurrency exchange and over 5.5 thousand users suffered from this trap before it was deleted.

The Apple Store has stricter store policies that provide iOS users with better protection.

Therefore, do not install applications on your smartphone unnecessarily; check the official website of the cryptocurrency platform for links to the application. Whenever possible, use two-factor authentication technology.

Plug-ins and add-ons

Often, attackers install spyware under the guise of "innocent" plug-ins and browser add-ons. Such additions can read all your actions during operations on cryptocurrency sites.

You should install a separate browser for trading, as a last resort, use the incognito mode. The safest thing is a separate computer (hard disk with the operating system) or a smartphone for trading.

SMS authentication

When using SMS authorization, you must disable call forwarding to protect access to your personal data.

It is better not to use two-factor authentication via SMS (when the password is sent on the phone), but to use special programs. Cybersecurity experts are sure that intercepting SMS with a password sent via SS7 is not difficult, as well as intercepting an incoming call due to the high vulnerability of cellular networks.

Public Wi-Fi

Never use Wi-Fi in public places for cryptocurrency operations. Otherwise, you can be a victim of a KRACK attack, when the device reconnects to the hacker Wi-Fi network, and attackers gain access to your personal data.

In addition, the firmware of the home router should be updated; manufacturers regularly issue security updates to their devices for better data protection.

Clone sites (phishing)

Phishing is a cloning of an existing site for some purpose, most often to steal the login and access password. Therefore, carefully check the address of the site before entering data.

When visiting cryptocurrency resources, be sure to use the HTTPS protocol. In addition, in the Chrome browser, you can install the Password Protector application, which signals when a password is entered on clone sites.

|

Метки: #photo_news |

5 ways to steal cryptocurrency (and protection against them) |

The cryptocurrency market is a young industry that constantly faces new challenges. Sometimes state regulators outlaw cryptocurrency exchanges, and sometimes hackers steal millions of digital currency. Below, we will highlight the main methods of cybercrime attacks and ways to protect against them.

The experts of the Hacker Noob portal identified three main categories of malicious attacks:

1. Attacks on blockchains, exchanges and ICO;

2. Distribution of spyware software for hidden mining;

3. Direct attacks on users' wallets.

At the same time, cybercriminals mainly rely on human inattention - the main vulnerability in the system, which is good news. By observing security measures, you can save your digital money.

Google Play Store and App Store

Most often, hackers attack the Android phones, because this OS does not use two-factor authentication technology (giving access to the private information only after entering password, login and additional information).

The attackers add applications to the Google Play Store under the guise of well-known cryptocurrency resources that, when launched, request personal data and send it to hackers. Once criminals placed an application on Google Play on behalf of the Poloniex cryptocurrency exchange and over 5.5 thousand users suffered from this trap before it was deleted.

The Apple Store has stricter store policies that provide iOS users with better protection.

Therefore, do not install applications on your smartphone unnecessarily; check the official website of the cryptocurrency platform for links to the application. Whenever possible, use two-factor authentication technology.

Plug-ins and add-ons

Often, attackers install spyware under the guise of "innocent" plug-ins and browser add-ons. Such additions can read all your actions during operations on cryptocurrency sites.

You should install a separate browser for trading, as a last resort, use the incognito mode. The safest thing is a separate computer (hard disk with the operating system) or a smartphone for trading.

SMS authentication

When using SMS authorization, you must disable call forwarding to protect access to your personal data.

It is better not to use two-factor authentication via SMS (when the password is sent on the phone), but to use special programs. Cybersecurity experts are sure that intercepting SMS with a password sent via SS7 is not difficult, as well as intercepting an incoming call due to the high vulnerability of cellular networks.

Public Wi-Fi

Never use Wi-Fi in public places for cryptocurrency operations. Otherwise, you can be a victim of a KRACK attack, when the device reconnects to the hacker Wi-Fi network, and attackers gain access to your personal data.

In addition, the firmware of the home router should be updated; manufacturers regularly issue security updates to their devices for better data protection.

Clone sites (phishing)

Phishing is a cloning of an existing site for some purpose, most often to steal the login and access password. Therefore, carefully check the address of the site before entering data.

When visiting cryptocurrency resources, be sure to use the HTTPS protocol. In addition, in the Chrome browser, you can install the Password Protector application, which signals when a password is entered on clone sites.

|

Метки: #photo_news |

5 ways to steal cryptocurrency (and protection against them) |

The cryptocurrency market is a young industry that constantly faces new challenges. Sometimes state regulators outlaw cryptocurrency exchanges, and sometimes hackers steal millions of digital currency. Below, we will highlight the main methods of cybercrime attacks and ways to protect against them.

The experts of the Hacker Noob portal identified three main categories of malicious attacks:

1. Attacks on blockchains, exchanges and ICO;

2. Distribution of spyware software for hidden mining;

3. Direct attacks on users' wallets.

At the same time, cybercriminals mainly rely on human inattention - the main vulnerability in the system, which is good news. By observing security measures, you can save your digital money.

Google Play Store and App Store

Most often, hackers attack the Android phones, because this OS does not use two-factor authentication technology (giving access to the private information only after entering password, login and additional information).

The attackers add applications to the Google Play Store under the guise of well-known cryptocurrency resources that, when launched, request personal data and send it to hackers. Once criminals placed an application on Google Play on behalf of the Poloniex cryptocurrency exchange and over 5.5 thousand users suffered from this trap before it was deleted.

The Apple Store has stricter store policies that provide iOS users with better protection.

Therefore, do not install applications on your smartphone unnecessarily; check the official website of the cryptocurrency platform for links to the application. Whenever possible, use two-factor authentication technology.

Plug-ins and add-ons

Often, attackers install spyware under the guise of "innocent" plug-ins and browser add-ons. Such additions can read all your actions during operations on cryptocurrency sites.

You should install a separate browser for trading, as a last resort, use the incognito mode. The safest thing is a separate computer (hard disk with the operating system) or a smartphone for trading.

SMS authentication

When using SMS authorization, you must disable call forwarding to protect access to your personal data.

It is better not to use two-factor authentication via SMS (when the password is sent on the phone), but to use special programs. Cybersecurity experts are sure that intercepting SMS with a password sent via SS7 is not difficult, as well as intercepting an incoming call due to the high vulnerability of cellular networks.

Public Wi-Fi

Never use Wi-Fi in public places for cryptocurrency operations. Otherwise, you can be a victim of a KRACK attack, when the device reconnects to the hacker Wi-Fi network, and attackers gain access to your personal data.

In addition, the firmware of the home router should be updated; manufacturers regularly issue security updates to their devices for better data protection.

Clone sites (phishing)

Phishing is a cloning of an existing site for some purpose, most often to steal the login and access password. Therefore, carefully check the address of the site before entering data.

When visiting cryptocurrency resources, be sure to use the HTTPS protocol. In addition, in the Chrome browser, you can install the Password Protector application, which signals when a password is entered on clone sites.

|

Метки: #photo_news |

Top 10 MBA business schools in the world |

Many business schools of the world, recognized as highly efficient, are in demand among professionals. Students from all over the world seek to get into these schools, especially into those of them that use the popular MBA management program. Teaching in such institutions is carried at the highest level, and graduates do not remain without well-paid work. Experts are ready to acquaint those interested with the list of such schools.

There are a number of schools in the world that are considered very prestigious in the business environment. They mainly work on the MBA (Master of Business Administration) program designed for training managers of middle and senior levels. Graduates of these schools find jobs in big businesses, state and municipal government spheres. Specialists have compiled a list of educational institutions where MBA programs are used. Their effectiveness was evaluated in terms of the employment of graduates, the level of their entrepreneurship and the size of their salaries. We suggest you to get acquainted with this rating.

Stanford Graduate School of Business (the USA)

This is one of the most popular business schools in the world. Its graduates are in demand in companies such as Facebook, Yahoo! and in a number of other Silicon Valley big firms. Graduate School of Business at Stanford University is known for the highest quality education and excellent career opportunities for graduates. The cost of education varies from $100 thousand to $149 thousand. Salaries of graduates are estimated from $140 thousand to $149 thousand.

Harvard Business School (the USA)

Such “sharks” of business as Michael Bloomberg, George Bush, the ex-president of the USA, big businessman Jamie Dimon, and others graduated from this educational institution that uses the MBA program. The executive directors of many leading world companies attended the Harvard Business School. The cost of education in the institution accounts from $100 thousand to $149 thousand. The salary of graduates is estimated from $130 thousand to $139 thousand.

Wharton School at the University of Pennsylvania (the USA)

It is one of the oldest business schools in the world, founded in 1881. The Wharton School is considered the first educational institution of its kind in the United States. Industrial magnate Joseph Wharton donated $100 thousand to create it. The Wharton School has the Summer Institute of Management and Technology, the Summer Institute of Business and Technology, etc. The school includes the publishing house Wharton School Publishing. The cost of education is over $150 thousand. The salary of graduates varies from $130 thousand to $139 thousand.

London Business School (the UK)

It is part of the University of London. The school offers a complete MBA program. London Business School is considered one of the most competitive in the world. To get into it, you must have high GPA and GMAT, as well as an impressive track record, including international experience. The average GMAT for admission to the MBA program is 701 points, for the MiF program - 710 points. Tuition fees range from $90 thousand to $99 thousand. Graduates' salary - from $100 thousand to $109 thousand.

Sloan School of Management (the USA)

Sloan School of Management, created at the Massachusetts Institute of Technology (MIT), is considered one of the most prestigious educational institutions in the United States. This business school is one of the best not only in the United States but throughout the world. Graduates of an educational institution work in such leading corporations as Adobe, Microsoft, Google and Facebook. Many of them opened their own successful business. The cost of schooling varies from $100 thousand to $149 thousand. The salary of graduates ranges from $120 thousand to $129 thousand.

INSEAD (France/Singapore)

The INSEAD French-Singaporean educational institution is a combination of a business school and a research institute. INSEAD campuses are located in Europe (France), Asia (Singapore) and the Middle East (Abu Dhabi). The main research center is situated in Israel. The school offers an MBA program. The INSEAD diploma is highly regarded in the world, and the knowledge gained helps graduates make an amazing career anywhere in the world. Tuition fees: from $100 thousand to $149 thousand. Graduates' salary: from $100 thousand to $109 thousand.

IE Business School (Spain)

The IE Business School is a high-level international business school with a huge number of students. The school was founded by entrepreneurs and actively supports these traditions. More than 10% of graduates from IE Business School open new business projects. The MBA program in an educational institution lasts 13 months. Education is provided in English and Spanish. Its cost estimates from $80 thousand to $89 thousand. The salary of graduates - from $90 thousand to $99 thousand.

Booth School of Business

This educational institution is among the top five world-leading companies. Graduates of the Booth Business School are expected in such major financial institutions as the Boston Consulting Group, Amazon and Bank of America. TheUniversity of Chicago Booth School of Business' graduates are waited at Wall Street. It is distinguished by the highest level of education and strong training programs. Graduates become owners of a prestigious diploma with which they are accepted into the best investment banks in the world. Tuition fees: from $100 thousand to $149 thousand. Graduates' salary: from $120 thousand to $129 thousand.

Stephen M. Ross School of Business at University of Michigan (the USA)

The Michigan State Research University, founded in 1817, is considered one of the oldest universities in the United States. It is part of the famous "Public Ivy League." It has the Stephen M. Ross School of Business, where the best entrepreneurs and research scientists are educated. The University of Michigan is recognized as one of the leading educational and research centers in the United States. The cost of education here varies from $100 thousand to $149 thousand. The salary of graduates ranges from $120 thousand to $129 thousand.

Sa"id Business School (Oxford, the UK)

The institution received its name in honor of Wafic Sa"id, who donated lb20 million to the school. It was founded in 1996 and soon became one of the best. This business school provides MBA program. The Sa"id Business School is united with Oxford University and cooperates with its specialists. Tuition fees: from $70 thousand to $79 thousand. Graduates' salary: from $70 thousand to $89 thousand.

|

Метки: #photo_news |

Top 10 MBA business schools in the world |

Many business schools of the world, recognized as highly efficient, are in demand among professionals. Students from all over the world seek to get into these schools, especially into those of them that use the popular MBA management program. Teaching in such institutions is carried at the highest level, and graduates do not remain without well-paid work. Experts are ready to acquaint those interested with the list of such schools.

There are a number of schools in the world that are considered very prestigious in the business environment. They mainly work on the MBA (Master of Business Administration) program designed for training managers of middle and senior levels. Graduates of these schools find jobs in big businesses, state and municipal government spheres. Specialists have compiled a list of educational institutions where MBA programs are used. Their effectiveness was evaluated in terms of the employment of graduates, the level of their entrepreneurship and the size of their salaries. We suggest you to get acquainted with this rating.

Stanford Graduate School of Business (the USA)

This is one of the most popular business schools in the world. Its graduates are in demand in companies such as Facebook, Yahoo! and in a number of other Silicon Valley big firms. Graduate School of Business at Stanford University is known for the highest quality education and excellent career opportunities for graduates. The cost of education varies from $100 thousand to $149 thousand. Salaries of graduates are estimated from $140 thousand to $149 thousand.

Harvard Business School (the USA)

Such “sharks” of business as Michael Bloomberg, George Bush, the ex-president of the USA, big businessman Jamie Dimon, and others graduated from this educational institution that uses the MBA program. The executive directors of many leading world companies attended the Harvard Business School. The cost of education in the institution accounts from $100 thousand to $149 thousand. The salary of graduates is estimated from $130 thousand to $139 thousand.

Wharton School at the University of Pennsylvania (the USA)

It is one of the oldest business schools in the world, founded in 1881. The Wharton School is considered the first educational institution of its kind in the United States. Industrial magnate Joseph Wharton donated $100 thousand to create it. The Wharton School has the Summer Institute of Management and Technology, the Summer Institute of Business and Technology, etc. The school includes the publishing house Wharton School Publishing. The cost of education is over $150 thousand. The salary of graduates varies from $130 thousand to $139 thousand.

London Business School (the UK)

It is part of the University of London. The school offers a complete MBA program. London Business School is considered one of the most competitive in the world. To get into it, you must have high GPA and GMAT, as well as an impressive track record, including international experience. The average GMAT for admission to the MBA program is 701 points, for the MiF program - 710 points. Tuition fees range from $90 thousand to $99 thousand. Graduates' salary - from $100 thousand to $109 thousand.

Sloan School of Management (the USA)

Sloan School of Management, created at the Massachusetts Institute of Technology (MIT), is considered one of the most prestigious educational institutions in the United States. This business school is one of the best not only in the United States but throughout the world. Graduates of an educational institution work in such leading corporations as Adobe, Microsoft, Google and Facebook. Many of them opened their own successful business. The cost of schooling varies from $100 thousand to $149 thousand. The salary of graduates ranges from $120 thousand to $129 thousand.

INSEAD (France/Singapore)

The INSEAD French-Singaporean educational institution is a combination of a business school and a research institute. INSEAD campuses are located in Europe (France), Asia (Singapore) and the Middle East (Abu Dhabi). The main research center is situated in Israel. The school offers an MBA program. The INSEAD diploma is highly regarded in the world, and the knowledge gained helps graduates make an amazing career anywhere in the world. Tuition fees: from $100 thousand to $149 thousand. Graduates' salary: from $100 thousand to $109 thousand.

IE Business School (Spain)

The IE Business School is a high-level international business school with a huge number of students. The school was founded by entrepreneurs and actively supports these traditions. More than 10% of graduates from IE Business School open new business projects. The MBA program in an educational institution lasts 13 months. Education is provided in English and Spanish. Its cost estimates from $80 thousand to $89 thousand. The salary of graduates - from $90 thousand to $99 thousand.

Booth School of Business

This educational institution is among the top five world-leading companies. Graduates of the Booth Business School are expected in such major financial institutions as the Boston Consulting Group, Amazon and Bank of America. TheUniversity of Chicago Booth School of Business' graduates are waited at Wall Street. It is distinguished by the highest level of education and strong training programs. Graduates become owners of a prestigious diploma with which they are accepted into the best investment banks in the world. Tuition fees: from $100 thousand to $149 thousand. Graduates' salary: from $120 thousand to $129 thousand.

Stephen M. Ross School of Business at University of Michigan (the USA)

The Michigan State Research University, founded in 1817, is considered one of the oldest universities in the United States. It is part of the famous "Public Ivy League." It has the Stephen M. Ross School of Business, where the best entrepreneurs and research scientists are educated. The University of Michigan is recognized as one of the leading educational and research centers in the United States. The cost of education here varies from $100 thousand to $149 thousand. The salary of graduates ranges from $120 thousand to $129 thousand.

Sa"id Business School (Oxford, the UK)

The institution received its name in honor of Wafic Sa"id, who donated lb20 million to the school. It was founded in 1996 and soon became one of the best. This business school provides MBA program. The Sa"id Business School is united with Oxford University and cooperates with its specialists. Tuition fees: from $70 thousand to $79 thousand. Graduates' salary: from $70 thousand to $89 thousand.

|

Метки: #photo_news |

Top 10 MBA business schools in the world |

Many business schools of the world, recognized as highly efficient, are in demand among professionals. Students from all over the world seek to get into these schools, especially into those of them that use the popular MBA management program. Teaching in such institutions is carried at the highest level, and graduates do not remain without well-paid work. Experts are ready to acquaint those interested with the list of such schools.

There are a number of schools in the world that are considered very prestigious in the business environment. They mainly work on the MBA (Master of Business Administration) program designed for training managers of middle and senior levels. Graduates of these schools find jobs in big businesses, state and municipal government spheres. Specialists have compiled a list of educational institutions where MBA programs are used. Their effectiveness was evaluated in terms of the employment of graduates, the level of their entrepreneurship and the size of their salaries. We suggest you to get acquainted with this rating.

Stanford Graduate School of Business (the USA)

This is one of the most popular business schools in the world. Its graduates are in demand in companies such as Facebook, Yahoo! and in a number of other Silicon Valley big firms. Graduate School of Business at Stanford University is known for the highest quality education and excellent career opportunities for graduates. The cost of education varies from $100 thousand to $149 thousand. Salaries of graduates are estimated from $140 thousand to $149 thousand.

Harvard Business School (the USA)

Such “sharks” of business as Michael Bloomberg, George Bush, the ex-president of the USA, big businessman Jamie Dimon, and others graduated from this educational institution that uses the MBA program. The executive directors of many leading world companies attended the Harvard Business School. The cost of education in the institution accounts from $100 thousand to $149 thousand. The salary of graduates is estimated from $130 thousand to $139 thousand.

Wharton School at the University of Pennsylvania (the USA)

It is one of the oldest business schools in the world, founded in 1881. The Wharton School is considered the first educational institution of its kind in the United States. Industrial magnate Joseph Wharton donated $100 thousand to create it. The Wharton School has the Summer Institute of Management and Technology, the Summer Institute of Business and Technology, etc. The school includes the publishing house Wharton School Publishing. The cost of education is over $150 thousand. The salary of graduates varies from $130 thousand to $139 thousand.

London Business School (the UK)

It is part of the University of London. The school offers a complete MBA program. London Business School is considered one of the most competitive in the world. To get into it, you must have high GPA and GMAT, as well as an impressive track record, including international experience. The average GMAT for admission to the MBA program is 701 points, for the MiF program - 710 points. Tuition fees range from $90 thousand to $99 thousand. Graduates' salary - from $100 thousand to $109 thousand.

Sloan School of Management (the USA)

Sloan School of Management, created at the Massachusetts Institute of Technology (MIT), is considered one of the most prestigious educational institutions in the United States. This business school is one of the best not only in the United States but throughout the world. Graduates of an educational institution work in such leading corporations as Adobe, Microsoft, Google and Facebook. Many of them opened their own successful business. The cost of schooling varies from $100 thousand to $149 thousand. The salary of graduates ranges from $120 thousand to $129 thousand.

INSEAD (France/Singapore)

The INSEAD French-Singaporean educational institution is a combination of a business school and a research institute. INSEAD campuses are located in Europe (France), Asia (Singapore) and the Middle East (Abu Dhabi). The main research center is situated in Israel. The school offers an MBA program. The INSEAD diploma is highly regarded in the world, and the knowledge gained helps graduates make an amazing career anywhere in the world. Tuition fees: from $100 thousand to $149 thousand. Graduates' salary: from $100 thousand to $109 thousand.

IE Business School (Spain)

The IE Business School is a high-level international business school with a huge number of students. The school was founded by entrepreneurs and actively supports these traditions. More than 10% of graduates from IE Business School open new business projects. The MBA program in an educational institution lasts 13 months. Education is provided in English and Spanish. Its cost estimates from $80 thousand to $89 thousand. The salary of graduates - from $90 thousand to $99 thousand.

Booth School of Business

This educational institution is among the top five world-leading companies. Graduates of the Booth Business School are expected in such major financial institutions as the Boston Consulting Group, Amazon and Bank of America. TheUniversity of Chicago Booth School of Business' graduates are waited at Wall Street. It is distinguished by the highest level of education and strong training programs. Graduates become owners of a prestigious diploma with which they are accepted into the best investment banks in the world. Tuition fees: from $100 thousand to $149 thousand. Graduates' salary: from $120 thousand to $129 thousand.

Stephen M. Ross School of Business at University of Michigan (the USA)

The Michigan State Research University, founded in 1817, is considered one of the oldest universities in the United States. It is part of the famous "Public Ivy League." It has the Stephen M. Ross School of Business, where the best entrepreneurs and research scientists are educated. The University of Michigan is recognized as one of the leading educational and research centers in the United States. The cost of education here varies from $100 thousand to $149 thousand. The salary of graduates ranges from $120 thousand to $129 thousand.

Sa"id Business School (Oxford, the UK)

The institution received its name in honor of Wafic Sa"id, who donated lb20 million to the school. It was founded in 1996 and soon became one of the best. This business school provides MBA program. The Sa"id Business School is united with Oxford University and cooperates with its specialists. Tuition fees: from $70 thousand to $79 thousand. Graduates' salary: from $70 thousand to $89 thousand.

|

Метки: #photo_news |

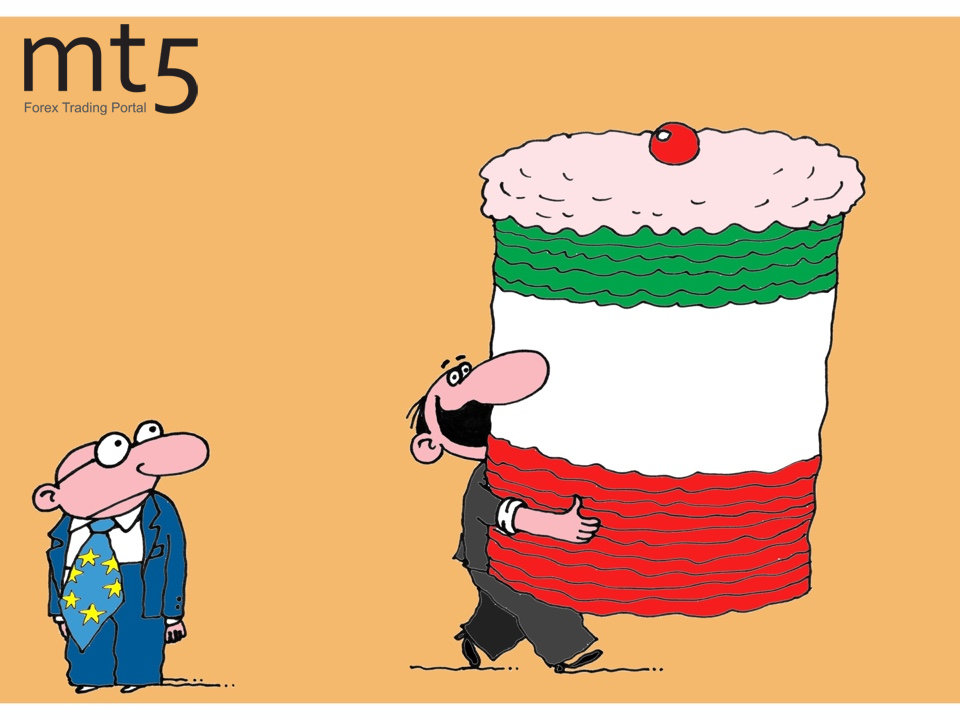

Без заголовка |

Disputes over Italian budget restrain growth in EU stock markets

European stock indicators dropped at the beginning of the week as investors shifted their focus to Italy and its budget project again.

The Stoxx Europe 600, the index of the major companies in the region, slipped by 0.56% and appeared at 374.3. The UK’s benchmark FTSE 100 went down by 0.42% since the market opening, France’s CAC 40 and Germany’s DAX dropped by 0.73%. Spanish IBEX 35 lost 0.49% and Italian FTSE MIB fell 2.2%.

The European Commission members Valdis Dombrovskis and Pierre Moscovici addressed the letter to Italy’s Finance Minister Giovanni Tria saying that the country’s budget plan considering deficit to be 2.4% of GDP was significantly different from the previous strategy.

Meanwhile, Italy's Deputy Prime Minister Matteo Salvini denied such criticism claiming that the main enemy of Europe was the commitment to austerity measures demonstrated by European Commission President Jean-Claude Juncker and Economic and Financial Affairs Commissioner chief for Pierre Moscovici.

“The Italians are continuing to test the EU’s resolve,” said Jens Peter Sorensen, chief analyst at Danske Bank A/S. “If neither the EU or Italy back down, yields will continue to climb higher from here. But I expect that Italy and the EU will find a compromise, even though it looks difficult at the moment.”

Read more: https://www.mt5.com/forex_humor/image/38103

|

Метки: #forex_caricature |

Без заголовка |

Disputes over Italian budget restrain growth in EU stock markets

European stock indicators dropped at the beginning of the week as investors shifted their focus to Italy and its budget project again.

The Stoxx Europe 600, the index of the major companies in the region, slipped by 0.56% and appeared at 374.3. The UK’s benchmark FTSE 100 went down by 0.42% since the market opening, France’s CAC 40 and Germany’s DAX dropped by 0.73%. Spanish IBEX 35 lost 0.49% and Italian FTSE MIB fell 2.2%.

The European Commission members Valdis Dombrovskis and Pierre Moscovici addressed the letter to Italy’s Finance Minister Giovanni Tria saying that the country’s budget plan considering deficit to be 2.4% of GDP was significantly different from the previous strategy.

Meanwhile, Italy's Deputy Prime Minister Matteo Salvini denied such criticism claiming that the main enemy of Europe was the commitment to austerity measures demonstrated by European Commission President Jean-Claude Juncker and Economic and Financial Affairs Commissioner chief for Pierre Moscovici.

“The Italians are continuing to test the EU’s resolve,” said Jens Peter Sorensen, chief analyst at Danske Bank A/S. “If neither the EU or Italy back down, yields will continue to climb higher from here. But I expect that Italy and the EU will find a compromise, even though it looks difficult at the moment.”

Read more: https://www.mt5.com/forex_humor/image/38103

|

Метки: #forex_caricature |

Без заголовка |

Disputes over Italian budget restrain growth in EU stock markets

European stock indicators dropped at the beginning of the week as investors shifted their focus to Italy and its budget project again.

The Stoxx Europe 600, the index of the major companies in the region, slipped by 0.56% and appeared at 374.3. The UK’s benchmark FTSE 100 went down by 0.42% since the market opening, France’s CAC 40 and Germany’s DAX dropped by 0.73%. Spanish IBEX 35 lost 0.49% and Italian FTSE MIB fell 2.2%.

The European Commission members Valdis Dombrovskis and Pierre Moscovici addressed the letter to Italy’s Finance Minister Giovanni Tria saying that the country’s budget plan considering deficit to be 2.4% of GDP was significantly different from the previous strategy.

Meanwhile, Italy's Deputy Prime Minister Matteo Salvini denied such criticism claiming that the main enemy of Europe was the commitment to austerity measures demonstrated by European Commission President Jean-Claude Juncker and Economic and Financial Affairs Commissioner chief for Pierre Moscovici.

“The Italians are continuing to test the EU’s resolve,” said Jens Peter Sorensen, chief analyst at Danske Bank A/S. “If neither the EU or Italy back down, yields will continue to climb higher from here. But I expect that Italy and the EU will find a compromise, even though it looks difficult at the moment.”

Read more: https://www.mt5.com/forex_humor/image/38103

|

Метки: #forex_caricature |

Без заголовка |

Disputes over Italian budget restrain growth in EU stock markets

European stock indicators dropped at the beginning of the week as investors shifted their focus to Italy and its budget project again.

The Stoxx Europe 600, the index of the major companies in the region, slipped by 0.56% and appeared at 374.3. The UK’s benchmark FTSE 100 went down by 0.42% since the market opening, France’s CAC 40 and Germany’s DAX dropped by 0.73%. Spanish IBEX 35 lost 0.49% and Italian FTSE MIB fell 2.2%.

The European Commission members Valdis Dombrovskis and Pierre Moscovici addressed the letter to Italy’s Finance Minister Giovanni Tria saying that the country’s budget plan considering deficit to be 2.4% of GDP was significantly different from the previous strategy.

Meanwhile, Italy's Deputy Prime Minister Matteo Salvini denied such criticism claiming that the main enemy of Europe was the commitment to austerity measures demonstrated by European Commission President Jean-Claude Juncker and Economic and Financial Affairs Commissioner chief for Pierre Moscovici.

“The Italians are continuing to test the EU’s resolve,” said Jens Peter Sorensen, chief analyst at Danske Bank A/S. “If neither the EU or Italy back down, yields will continue to climb higher from here. But I expect that Italy and the EU will find a compromise, even though it looks difficult at the moment.”

Read more: https://www.mt5.com/forex_humor/image/38103

|

Метки: #forex_caricature |

Disputes over Italian budget restrain growth in EU stock markets |

European stock indicators dropped at the beginning of the week as investors shifted their focus to Italy and its budget project again.

The Stoxx Europe 600, the index of the major companies in the region, slipped by 0.56% and appeared at 374.3. The UK’s benchmark FTSE 100 went down by 0.42% since the market opening, France’s CAC 40 and Germany’s DAX dropped by 0.73%. Spanish IBEX 35 lost 0.49% and Italian FTSE MIB fell 2.2%.

The European Commission members Valdis Dombrovskis and Pierre Moscovici addressed the letter to Italy’s Finance Minister Giovanni Tria saying that the country’s budget plan considering deficit to be 2.4% of GDP was significantly different from the previous strategy.

Meanwhile, Italy's Deputy Prime Minister Matteo Salvini denied such criticism claiming that the main enemy of Europe was the commitment to austerity measures demonstrated by European Commission President Jean-Claude Juncker and Economic and Financial Affairs Commissioner chief for Pierre Moscovici.

“The Italians are continuing to test the EU’s resolve,” said Jens Peter Sorensen, chief analyst at Danske Bank A/S. “If neither the EU or Italy back down, yields will continue to climb higher from here. But I expect that Italy and the EU will find a compromise, even though it looks difficult at the moment.”

Read more: https://www.mt5.com/forex_humor/image/38103

|

Метки: #forex_caricature |

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #photo_news |