Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Five reasons to use bots in cryptocurrency trading |

Trading with the help of specialized robots is gaining popularity among market players. Trading bots are of particular importance in the process of trading digital assets. The need for them derives from a number of reasons that analysts emphasize

Most market participants prefer trading in the cryptocurrency sphere using trading robots. Experts analyzed the reason for such a necessity for AI assistants. They identified five causes of this phenomenon.

Ease of use for beginners

Since December 2017, when the price of Bitcoin surged to high levels, many new users have come to cryptocurrency trading. For beginners of the cryptocurrency market, trading bots have become irreplaceable assistants and guides in the digital asset market. According to experts, it is very easy to use trading bots. They are user-friendly, reliable, and are considered an excellent option to start.

High efficiency

According to experts, the efficiency of a trading bot far exceeds human capabilities. Specialized robots perform the most complicated calculations in a fraction of a second. Their role in trading cannot be overestimated: according to analysts, robots make 99% of all transactions on Wall Street. For an AI assistant, you can purchase a special package of settings developed by an expert and enabling you to trade under any market conditions.

Time saving

In the course of independent cryptocurrency trading, a trader has to constantly monitor the state of the market. This process requires a lot of time and increased attention, which often leads to serious stress. With a trading assistant, this work is carried out more actively and more productively, it takes less time that could be used doing other things.

The possibility of round-the-clock trading

When trading independently, a trader is limited by physical abilities: it is too difficult to monitor the state of the virtual currency market at nighttime. Such actions could have a negative impact on the state of health. Trading bot is irreplaceable in such a situation: it does not sleep, does not get tired, and can trade on a round-the-clock basis. The key trading strategy is to buy small lots of altcoins, expect a growth of 1-2%, and then move to Bitcoin price charts. In order to generate income from this strategy, you need to monitor the state of the market around the clock.

Extra income

For most market participants, cryptocurrency trading with the help of a trading bot becomes an additional source of income. According to experts, even if your experience in working with digital currencies is little, using such a robot is a suitable way to make a profit. With the help of bots, you can monitor the cryptocurrency market, find out about the nuances of a number of altcoins, and learn how to use new technologies.

|

Метки: #photo_news |

Five reasons to use bots in cryptocurrency trading |

Trading with the help of specialized robots is gaining popularity among market players. Trading bots are of particular importance in the process of trading digital assets. The need for them derives from a number of reasons that analysts emphasize

Most market participants prefer trading in the cryptocurrency sphere using trading robots. Experts analyzed the reason for such a necessity for AI assistants. They identified five causes of this phenomenon.

Ease of use for beginners

Since December 2017, when the price of Bitcoin surged to high levels, many new users have come to cryptocurrency trading. For beginners of the cryptocurrency market, trading bots have become irreplaceable assistants and guides in the digital asset market. According to experts, it is very easy to use trading bots. They are user-friendly, reliable, and are considered an excellent option to start.

High efficiency

According to experts, the efficiency of a trading bot far exceeds human capabilities. Specialized robots perform the most complicated calculations in a fraction of a second. Their role in trading cannot be overestimated: according to analysts, robots make 99% of all transactions on Wall Street. For an AI assistant, you can purchase a special package of settings developed by an expert and enabling you to trade under any market conditions.

Time saving

In the course of independent cryptocurrency trading, a trader has to constantly monitor the state of the market. This process requires a lot of time and increased attention, which often leads to serious stress. With a trading assistant, this work is carried out more actively and more productively, it takes less time that could be used doing other things.

The possibility of round-the-clock trading

When trading independently, a trader is limited by physical abilities: it is too difficult to monitor the state of the virtual currency market at nighttime. Such actions could have a negative impact on the state of health. Trading bot is irreplaceable in such a situation: it does not sleep, does not get tired, and can trade on a round-the-clock basis. The key trading strategy is to buy small lots of altcoins, expect a growth of 1-2%, and then move to Bitcoin price charts. In order to generate income from this strategy, you need to monitor the state of the market around the clock.

Extra income

For most market participants, cryptocurrency trading with the help of a trading bot becomes an additional source of income. According to experts, even if your experience in working with digital currencies is little, using such a robot is a suitable way to make a profit. With the help of bots, you can monitor the cryptocurrency market, find out about the nuances of a number of altcoins, and learn how to use new technologies.

|

Метки: #photo_news |

Без заголовка |

Banks moving from London choose Frankfurt as post-Brexit hub

According to the Financial Times, Frankfurt am Main is leading the pack among cities chosen by the world’s largest financial institutions leaving London because of Brexit. It is ahead of Paris in terms of banks transferring their capital from London.

Already 10 foreign banks have chosen Frankfurt to relocate their operations to during this year, data from German state-owned bank Helaba showed. Currently their number has reached 25. Leading American banks such as Goldman Sachs, Citi, JPMorgan and Barclays moved to Germany.

Seven major financial institutions opted for Paris during the reporting period, and they have grown to 8 by now. Other megalopolises – Luxembourg, Dublin and Amsterdam – were found engaging by 15 more banks. Headquarters of major German banks and investment trusts are already located in Frankfurt and experts consider this fact to be an advantage of this financial hub. Besides of that, the largest stock markets, the European Central Bank (ECB) and the European Insurance and Occupational Pensions Authority (EIOPA) also found their second homeland there.

Read more: https://www.mt5.com/forex_humor/image/37984

|

Метки: #forex_caricature |

Eight important rules of a successful crypto investor |

Using money intelligently and getting a high profit in the digital currency market is an attractive option. Many market participants strive for this goal. Experts suggest using pieces of advice of experienced crypto investors to achieve the desired purpose.

Many participants of the cryptocurrency market lost their money because of its high volatility. However, interest in the digital assets market is still strong. Experts advise paying attention to a number of rules to avoid the loss of funds. They will help beginner crypto investors.

Diversification is optional

Many market participants consider it necessary to diversify the cryptocurrency portfolio, but this is not always needed, experts are sure. Of course, investing all the money in one asset is a dangerous step, and it also limits the potential profit. However, you also shouldn't change assets. Let's remember why investors diversify their portfolio? To increase income. Experts consider this approach to be very thought-out.

Fix profit after selling

Active growth of digital currencies will please any crypto investor, however, experts do not advise to rest on your laurels. Recall, cryptocurrencies are very volatile and at any time may become cheaper. Analysts recommend fixing profit in case of its sharp growth by selling part of the assets. Nevertheless, as long as the funds are not transferred to a more stable currency, for example, in fiat money, profits are considered invalid.

Do not rush to sell cryptocurrency

Most participants of the cryptocurrency market are guided mainly by emotions and not by the analysis of the situation and current market data. In the end, they may find themselves without profit. Experts caution against a momentary desire to sell or buy a digital asset. They believe that it is necessary to sell coins under the right circumstances which are determined by a variety of factors: from the target values of cryptocurrencies to news that may affect tokens' price.

Choose the most effective way to buy and store coins

The cryptocurrency market is still young and volatile, so there are no strict rules. Every crypto investor chooses the strategy that best suits him. Much depends on what kind of cryptocurrency you need. A digital asset will require a purse. If frequent transactions are not planned, then a hardware one will be more suitable. It's safer than keeping money on the exchange. Also it will help not to make impulsive purchases and sales.

It is necessary to focus on fiat currencies

Analysts caution: you shouldn't evaluate cryptocurrencies only in relation to each other. It is necessary to analyze their correlation with traditional means of payment. Determining the value of the coin, compare it with the fiat currency, for example, with the US dollar. In this case, the risk of making mistakes is small, but there will be a clear idea of how prices change in the crypto market.

Do not give in to emotions

Experts agree that trading in cryptocurrencies is a kind of "roller coaster". Any change makes the trader nervous, so it's important not to give in to emotions. Analysts warn: to succeed and make a profit, you need to ignore fears and focus on numbers. Fear of being a loser is natural, but you shouldn't succumb to it, because it is almost impossible to predict market fluctuations. If the currency seems promising and inexpensive, it's better to buy it, experts say.

Important rule: "Not sure - do not buy"

One of the best advice that can be given to a crypto investor is: "Don't risk money you can't afford to lose." Experts warn: even under favorable circumstances there is a chance of losing everything. But do not take this as a disaster. The next step should be thought-out tactics and confident actions. Fear of missing opportunity causes many to take risks and leads to collapse. If you think that you can earn money on a certain currency, you should keep it.

Pay attention to the real number of coins in circulation

The law of supply and demand works perfectly with cryptocurrencies, which makes it possible to manipulate this market. The more people buy a coin, the more expensive it is, and vice versa. A novice crypto investor needs to estimate the coin's value relative to the actual number of tokens in circulation. Analysts emphasize: the higher the number of coins, the more likely that the given digital currency will grow in price.

|

Метки: #photo_news |

Barrick Gold to buy Randgold Resources in $18.3 billion deal |

Canada’s gold miner Barrick Gold has agreed to buy Randgold Resources in a $18.3 billion deal that would create the world’s largest gold producer.

Following the merger, Barrick Gold will own five of the world’s 10 lowest-cost gold mines and have a market value of about $24 billion including debt. The new company will be listed in New York and Toronto.

The deal is one of the biggest in the gold mining industry in recent years. The transaction value at 4.58 billion pounds ($6 billion), or 48.5 pounds per share, matches Randgold’s market cap.

Currently, investors prefer to invest in the US dollar amid falling gold prices. This has a negative impact on the gold mining industry. Investors’ reluctance to treat the precious metal as a safe haven caused a 10% decline in gold prices, analysts say.

In the current year, both companies lost about a third of their market value. Negotiations about a possible merger started more than three years ago. The deal between the gold companies is set to be approved by regulatory bodies. Barrick Gold shareholders will own about 66.6% of the new company, while Randgold shareholders will get the remaining 33.4% on a fully diluted basis.

Read more: https://www.mt5.com/forex_humor/image/37988

|

Метки: #forex_caricature |

Barrick Gold to buy Randgold Resources in $18.3 billion deal |

Canada’s gold miner Barrick Gold has agreed to buy Randgold Resources in a $18.3 billion deal that would create the world’s largest gold producer.

Following the merger, Barrick Gold will own five of the world’s 10 lowest-cost gold mines and have a market value of about $24 billion including debt. The new company will be listed in New York and Toronto.

The deal is one of the biggest in the gold mining industry in recent years. The transaction value at 4.58 billion pounds ($6 billion), or 48.5 pounds per share, matches Randgold’s market cap.

Currently, investors prefer to invest in the US dollar amid falling gold prices. This has a negative impact on the gold mining industry. Investors’ reluctance to treat the precious metal as a safe haven caused a 10% decline in gold prices, analysts say.

In the current year, both companies lost about a third of their market value. Negotiations about a possible merger started more than three years ago. The deal between the gold companies is set to be approved by regulatory bodies. Barrick Gold shareholders will own about 66.6% of the new company, while Randgold shareholders will get the remaining 33.4% on a fully diluted basis.

Read more: https://www.mt5.com/forex_humor/image/37988

|

Метки: #forex_caricature |

Barrick Gold to buy Randgold Resources in $18.3 billion deal |

Canada’s gold miner Barrick Gold has agreed to buy Randgold Resources in a $18.3 billion deal that would create the world’s largest gold producer.

Following the merger, Barrick Gold will own five of the world’s 10 lowest-cost gold mines and have a market value of about $24 billion including debt. The new company will be listed in New York and Toronto.

The deal is one of the biggest in the gold mining industry in recent years. The transaction value at 4.58 billion pounds ($6 billion), or 48.5 pounds per share, matches Randgold’s market cap.

Currently, investors prefer to invest in the US dollar amid falling gold prices. This has a negative impact on the gold mining industry. Investors’ reluctance to treat the precious metal as a safe haven caused a 10% decline in gold prices, analysts say.

In the current year, both companies lost about a third of their market value. Negotiations about a possible merger started more than three years ago. The deal between the gold companies is set to be approved by regulatory bodies. Barrick Gold shareholders will own about 66.6% of the new company, while Randgold shareholders will get the remaining 33.4% on a fully diluted basis.

Read more: https://www.mt5.com/forex_humor/image/37988

|

Метки: #forex_caricature |

Countries set to become rich by 2020, according to the IMF |

Experts of the International Monetary Fund estimated the potential of different countries and presented a rating of those of them that will become rich by 2020. There is not much time left. You will find countries that have all the resources for economic growth in our photo gallery.

1. Macau

GDP per capita: $143.12 thousand

This place full of casinos and gambling will become the richest on the planet by 2020, IMF experts believe.

The former Portuguese colony in the south of China has turned into a world center for gambling almost a decade ago. And this is the only territory within the Chinese state, where the games are legalized. Thousands of people from all over the world are flocking here.

Macao's GDP has more than tripled since 2001, according to the IMF.

2. Qatar

With GDP per capita of $139.15 thousand, Qatar will lose the title of the richest country by 2020.

Oil and gas production, which give more than 50% of GDP, made Qatar the first state in the world in terms of living standards.

The country has developed oil refining, petrochemical, chemical and metallurgical industries.

Almost all of the country's gas is extracted in a giant field in the northern part of Qatar, North Field. The field also accounts for about 60% of the state's export revenue..

3. Luxembourg

GDP per capita: $118.15 thousand.

The ranking of the countries that are set to become the wealthiest by 2020 includes only 3 European countries. And Luxembourg occupies the highest place among them. It is a country with a high standard of living, where many EU organizations are located.

Favorable conditions brought to the offshore zone more than 1 thousand investment funds and more than 200 banks, more than in any other city in the world.

4. Singapore

GDP per capita will grow from $105.80 thousand to $117.5 thousand by 2023.

A country with a highly developed market economy and low taxation attracts investors and transnational corporations. In total, Singapore has 5 taxes, of which one is income tax, the other is a wage tax.

5. Brunei Darussalam

GDP per capita: $94.37 thousand.

A tiny state with rich oil and gas reserves occupies one of the first places in Asia in terms of living standards.

On the area of 5.8 thousand sq km, more than 10 million tons of oil and more than 12 billion cubic meters are produced per year. The export of raw materials accounts for more than 90% of foreign exchange earnings (60% of GNP).

Brunei takes one of the leading places in the world for the production of liquefied gas, which is transported to Japan and other countries.

6. Ireland

GDP per capita: $87.87 thousand.

Although the country's economic development is still driven by exports, the increase in consumer spending and the restoration of both construction and business investment also contribute to growth.

In Ireland, the unemployment level is low, and the income of the population is characterized by rapid growth.

7. Norway

GDP per capita: $78.54 thousand.

The country is considered the largest producer of oil and gas in Northern Europe. Sea transportations and aquaculture, representing an increasing variety of goods and services, are also very profitable.

Hydropower covers most of the energy needs, which allows the country to export the most part of oil.

8. The UAE

GDP per capita: $71.61 thousand.

The economy of the UAE is based on re-export, trade, extraction, and export of crude oil and gas.

In the country, about 2.2 million barrels are produced per day. Most of it is extracted in the emirate of Abu Dhabi, as well as in Dubai, Sharjah and Ras al-Jaime.

Thanks to the extraction and export of oil, the UAE's economy grew only in a few decades, but other sectors of the economy, especially foreign trade, also developed quite fast.

9. Kuwait

GDP per capita: $70.93 thousand.

According to Kuwait's own assessment, the country has 9% of the world's oil reserves, which is about 102 billion barrels.

Oil gives Kuwait about 50% of GDP, 95% of export earnings and 95% of the state budget's revenues.

In addition, the country produces pearls. The production of construction materials, fertilizers, and food industry is also advanced.

Kuwait is the leader in desalination of sea water.

10. Hong Kong

By 2023, the per capita GDP of Hong Kong will reach $80 thousand instead of today's $70.35 thousand.

The economy of the territory is based on a free market, low taxation and non-interference of the state in the economy.

This is not an offshore zone, but a free port where no customs duties are levied on imports and there is no value added tax or its equivalent.

Excises are levied only on four types of goods, regardless of whether they are imported or locally produced.

|

Метки: #photo_news |

Countries set to become rich by 2020, according to the IMF |

Experts of the International Monetary Fund estimated the potential of different countries and presented a rating of those of them that will become rich by 2020. There is not much time left. You will find countries that have all the resources for economic growth in our photo gallery.

1. Macau

GDP per capita: $143.12 thousand

This place full of casinos and gambling will become the richest on the planet by 2020, IMF experts believe.

The former Portuguese colony in the south of China has turned into a world center for gambling almost a decade ago. And this is the only territory within the Chinese state, where the games are legalized. Thousands of people from all over the world are flocking here.

Macao's GDP has more than tripled since 2001, according to the IMF.

2. Qatar

With GDP per capita of $139.15 thousand, Qatar will lose the title of the richest country by 2020.

Oil and gas production, which give more than 50% of GDP, made Qatar the first state in the world in terms of living standards.

The country has developed oil refining, petrochemical, chemical and metallurgical industries.

Almost all of the country's gas is extracted in a giant field in the northern part of Qatar, North Field. The field also accounts for about 60% of the state's export revenue..

3. Luxembourg

GDP per capita: $118.15 thousand.

The ranking of the countries that are set to become the wealthiest by 2020 includes only 3 European countries. And Luxembourg occupies the highest place among them. It is a country with a high standard of living, where many EU organizations are located.

Favorable conditions brought to the offshore zone more than 1 thousand investment funds and more than 200 banks, more than in any other city in the world.

4. Singapore

GDP per capita will grow from $105.80 thousand to $117.5 thousand by 2023.

A country with a highly developed market economy and low taxation attracts investors and transnational corporations. In total, Singapore has 5 taxes, of which one is income tax, the other is a wage tax.

5. Brunei Darussalam

GDP per capita: $94.37 thousand.

A tiny state with rich oil and gas reserves occupies one of the first places in Asia in terms of living standards.

On the area of 5.8 thousand sq km, more than 10 million tons of oil and more than 12 billion cubic meters are produced per year. The export of raw materials accounts for more than 90% of foreign exchange earnings (60% of GNP).

Brunei takes one of the leading places in the world for the production of liquefied gas, which is transported to Japan and other countries.

6. Ireland

GDP per capita: $87.87 thousand.

Although the country's economic development is still driven by exports, the increase in consumer spending and the restoration of both construction and business investment also contribute to growth.

In Ireland, the unemployment level is low, and the income of the population is characterized by rapid growth.

7. Norway

GDP per capita: $78.54 thousand.

The country is considered the largest producer of oil and gas in Northern Europe. Sea transportations and aquaculture, representing an increasing variety of goods and services, are also very profitable.

Hydropower covers most of the energy needs, which allows the country to export the most part of oil.

8. The UAE

GDP per capita: $71.61 thousand.

The economy of the UAE is based on re-export, trade, extraction, and export of crude oil and gas.

In the country, about 2.2 million barrels are produced per day. Most of it is extracted in the emirate of Abu Dhabi, as well as in Dubai, Sharjah and Ras al-Jaime.

Thanks to the extraction and export of oil, the UAE's economy grew only in a few decades, but other sectors of the economy, especially foreign trade, also developed quite fast.

9. Kuwait

GDP per capita: $70.93 thousand.

According to Kuwait's own assessment, the country has 9% of the world's oil reserves, which is about 102 billion barrels.

Oil gives Kuwait about 50% of GDP, 95% of export earnings and 95% of the state budget's revenues.

In addition, the country produces pearls. The production of construction materials, fertilizers, and food industry is also advanced.

Kuwait is the leader in desalination of sea water.

10. Hong Kong

By 2023, the per capita GDP of Hong Kong will reach $80 thousand instead of today's $70.35 thousand.

The economy of the territory is based on a free market, low taxation and non-interference of the state in the economy.

This is not an offshore zone, but a free port where no customs duties are levied on imports and there is no value added tax or its equivalent.

Excises are levied only on four types of goods, regardless of whether they are imported or locally produced.

|

Метки: #photo_news |

Countries set to become rich by 2020, according to the IMF |

Experts of the International Monetary Fund estimated the potential of different countries and presented a rating of those of them that will become rich by 2020. There is not much time left. You will find countries that have all the resources for economic growth in our photo gallery.

1. Macau

GDP per capita: $143.12 thousand

This place full of casinos and gambling will become the richest on the planet by 2020, IMF experts believe.

The former Portuguese colony in the south of China has turned into a world center for gambling almost a decade ago. And this is the only territory within the Chinese state, where the games are legalized. Thousands of people from all over the world are flocking here.

Macao's GDP has more than tripled since 2001, according to the IMF.

2. Qatar

With GDP per capita of $139.15 thousand, Qatar will lose the title of the richest country by 2020.

Oil and gas production, which give more than 50% of GDP, made Qatar the first state in the world in terms of living standards.

The country has developed oil refining, petrochemical, chemical and metallurgical industries.

Almost all of the country's gas is extracted in a giant field in the northern part of Qatar, North Field. The field also accounts for about 60% of the state's export revenue..

3. Luxembourg

GDP per capita: $118.15 thousand.

The ranking of the countries that are set to become the wealthiest by 2020 includes only 3 European countries. And Luxembourg occupies the highest place among them. It is a country with a high standard of living, where many EU organizations are located.

Favorable conditions brought to the offshore zone more than 1 thousand investment funds and more than 200 banks, more than in any other city in the world.

4. Singapore

GDP per capita will grow from $105.80 thousand to $117.5 thousand by 2023.

A country with a highly developed market economy and low taxation attracts investors and transnational corporations. In total, Singapore has 5 taxes, of which one is income tax, the other is a wage tax.

5. Brunei Darussalam

GDP per capita: $94.37 thousand.

A tiny state with rich oil and gas reserves occupies one of the first places in Asia in terms of living standards.

On the area of 5.8 thousand sq km, more than 10 million tons of oil and more than 12 billion cubic meters are produced per year. The export of raw materials accounts for more than 90% of foreign exchange earnings (60% of GNP).

Brunei takes one of the leading places in the world for the production of liquefied gas, which is transported to Japan and other countries.

6. Ireland

GDP per capita: $87.87 thousand.

Although the country's economic development is still driven by exports, the increase in consumer spending and the restoration of both construction and business investment also contribute to growth.

In Ireland, the unemployment level is low, and the income of the population is characterized by rapid growth.

7. Norway

GDP per capita: $78.54 thousand.

The country is considered the largest producer of oil and gas in Northern Europe. Sea transportations and aquaculture, representing an increasing variety of goods and services, are also very profitable.

Hydropower covers most of the energy needs, which allows the country to export the most part of oil.

8. The UAE

GDP per capita: $71.61 thousand.

The economy of the UAE is based on re-export, trade, extraction, and export of crude oil and gas.

In the country, about 2.2 million barrels are produced per day. Most of it is extracted in the emirate of Abu Dhabi, as well as in Dubai, Sharjah and Ras al-Jaime.

Thanks to the extraction and export of oil, the UAE's economy grew only in a few decades, but other sectors of the economy, especially foreign trade, also developed quite fast.

9. Kuwait

GDP per capita: $70.93 thousand.

According to Kuwait's own assessment, the country has 9% of the world's oil reserves, which is about 102 billion barrels.

Oil gives Kuwait about 50% of GDP, 95% of export earnings and 95% of the state budget's revenues.

In addition, the country produces pearls. The production of construction materials, fertilizers, and food industry is also advanced.

Kuwait is the leader in desalination of sea water.

10. Hong Kong

By 2023, the per capita GDP of Hong Kong will reach $80 thousand instead of today's $70.35 thousand.

The economy of the territory is based on a free market, low taxation and non-interference of the state in the economy.

This is not an offshore zone, but a free port where no customs duties are levied on imports and there is no value added tax or its equivalent.

Excises are levied only on four types of goods, regardless of whether they are imported or locally produced.

|

Метки: #photo_news |

Undervalued RUB to gain momentum soon |

The Russian ruble is still showing remarkable resilience despite the pressure from the Russian authorities. Moreover, the ruble regained momentum at the end of the last week. At first glance, the lingering Western sanctions are mainly to blame for its weakness. However, experts say that the ruble has proved to be immune to the pressure of restrictions, imposed by the US and the EU. Indeed, the Russian currency is more vulnerable to the domestic monetary policy and the Kremlin’s interest in the ruble’s depreciation. Even foreign analysts share the viewpoint that the Russian currency is greatly undervalued. Therefore, its growth is imminent. Obviously, the Western sanctions do not pose a grave threat to the domestic economy. They are unlikely to cause the ruble’s collapse provided that the US does not set this goal. Meanwhile, the US is just playing with Russia, targeting particular sectors of the Russian economy. In case Washington proceeds to severe measures, the Russian economy will be doomed to failure.

Anyway, the White House has been extending a list of sectorial sanctions. In this context, the ruble is expected to strengthen to 58 against the US dollar by the year end. The ruble’s dynamic has come to expectations as long as the US has not applied strategic sanctions yet. The Russian currency is picking up steam after the Bank of Russia unexpectedly raised the key interest rate. The US is determined to prolong the sanctions indefinitely, so the Russian economy is set to adjust to exterior developments. The ruble copes remarkably well. Nowadays, its value largely depends on economic fundamentals, which actually mirror purchasing power of the Russian national currency. A month ago, some economists assumed the ruble could weaken to the bottom of 68 versus the US dollar.

Read more: https://www.mt5.com/forex_humor/image/37960

|

Метки: #forex_caricature |

Google's 5 biggest failures |

In September, the famous Google search engine celebrated the 20th anniversary. The company has experienced many ups and downs on the road to success. But if its victories are well known to all, the history is silent about the failures of this company. In our photo gallery, you will find the most failed projects and disputable decisions of the IT giant from the Silicon Valley.

Total surveillance

In August, Associated Press' journalists published the results of an investigation that said that Google's controlled services, such as Google Maps, spied on their users. The story became more scandalous because of the fact that surveillance continues, even if the owner of the smartphone has disabled this feature.

Google keeps daily logs about the movement of a person, and it is a threat to privacy.

The company itself acknowledged that it retains data about users, claiming that it makes it just to "improve the user experience."

The company made changes to the use of the Location History. According to the new policy point, turning off the Location History function does not affect the geolocation in other services of the company, for example, in Google Maps.

Thus, the IT giant had no effect on the situation but secured itself by changing the rules for using the function.

Discrimination against white men

Last year, a huge sexist scandal shook Google. Software engineer James Damore compiled a 10-page manifesto asserting that the current policy of recruiting women and people of different ethnic origins is erroneous. Damore explained the unsuccessfulness of women in the field of IT with biological characteristics and, in addition, stated that women hold managerial positions not because of their merits, but because they are a "minority".

"We need to stop assuming that gender gaps imply sexism," the author of the letter said.

The management of Google did not take sufficient care in motives of Damore and dismissed him for violating corporate ethics.

Now Damore is trying to sue his former employer, accusing him of illegal dismissal.

Glasses ahead of time

In 2013, the company started testing of Google Glass, which were supposed to bring augmented reality (AR) to the broad masses. But this project has remained one of the most disastrous in the history of the company. Firstly, the public was presented with a shoddy prototype, since co-founder of Google Sergey Brin wanted to know about the community's reaction to the new gadget as soon as possible. As a result, a bright presentation of the device could not convince skeptics and there was a large number of negative reviews: the appearance did not greatly suit the owners, as well as autonomy, and, in addition, glasses were overheating.

There is a version that Google Glasses appeared on the market before it was ready to introduce augmented reality into everyday life. However, even now this technology is not in high demand.

War with Trump

In late August 2018, US President Donald Trump criticized Google, advising companies to "be more careful" from now on. The American leader believes that Google deliberately shows only negative news about him, supporting liberal media and drowning out "right" publications.

The company, in turn, denies any political bias. This same opinion is shared by some IT experts who argue that Google's algorithms are insensitive to the political agenda. Nevertheless, the company is now under the close attention of Trump.

Abuse of power

Google has set two anti-records for penalties from the European Commission. Last summer, the company was fined €2.4 billion, which became the largest penalty in the history of the European Commission. The reason for this was the abuse of the position to promote its service with purchases: allegedly Google artificially dropped the sites of competitors in search results.

A year later, this record was beaten: Google received a fine almost twice as much as the previous one, €4.3 billion, for violating the antimonopoly legislation. This time the company was accused of using "anti-competitive practices" that were aimed at promoting the Android operating system, which already holds a dominant position in the mobile operating system market.

|

Метки: #photo_news |

US slaps new tariffs on China |

President Trump imposed tariffs on an additional $200 billion worth of Chinese imports, continuing an ongoing trade war. The tariffs will take effect on September 24, and will be valid until the year end. Meanwhile, Washington warned that if China takes any retaliation, the US would impose further tariffs.

The latest round of tariffs will not affect the Apple Watch and some other consumer products, such as children's car seats. Imposing the duties, Trump said he will “immediately pursue phase three, which is tariffs on approximately $267 billion of additional imports.”

The ongoing trade tensions between the world's two largest economic powers have ratcheted up after US-China trade talks ended with no major breakthrough.

Read more: https://www.mt5.com/forex_humor/image/37905

|

Метки: #forex_caricature |

Seven billionaires owning media companies |

Words are known to have tremendous power, and can even become weapons in a political or other confrontation. Last week media attention was focused on Marс Benioff, who announced his plans to buy the Time magazine for $190 million.

The Benioff family immediately announced that they are not going to participate in the daily work of the magazine and won't influence journalistic decisions. Nevertheless, Benioff became the third billionaire who acquired the media company this year.

In our article, you will read about the billionaires who own media companies.

Salesforce CEO Marc Benioff

He bought the Time Magazine in September 2018. This purchase became a family investment.

Salesforce.com, Mark Benioff became the co-founder and CEO of Salesforce.com in 1999. The company is engaged in developing network software for sales departments.

Time, an American weekly news magazine, founded in 1923, became famous all over the world thanks to its ratings. The "Person of the Year" rating, traditionally published in the December issue, is one of the most popular. At different times, Adolf Hitler, Joseph Stalin, Mikhail Gorbachev and Vladimir Putin were published on the cover of the magazine.

Surgeon and entrepreneur Patrick Soon-Shiong

The pharmaceutical billionaire bought the LA Times in February 2018.

Soon-Shiong owns NantWorks and several start-ups in the health sector. He is on the board of directors of Tronc.

Patrick earned his fortune of $7.3 billion (according to Forbes) thanks to generics sales and researches for the treatment of cancer.

The billionaire was born in South Africa in the family of Chinese immigrants who moved to Africa during the Second World War. He followed in the footsteps of his father, the pharmacist.

Amazon's chief Jeff Bezos

The founder of Amazon and the richest man in the world, according to Forbes, bought The Washington Post in October 2013 for $250 million.

However, the newspaper brings not only profit to its owner but also a headache. The employees of the media complained about low salaries and overtimes. They wrote Bezos an open letter, signed by 400 employees. And Donald Trump did advise them to strike against the owner of the newspaper, saying that The Washington Post was used as an Amazon lobbyist, so it must be properly registered and begin paying taxes.

Red Sox owner John Henry

An American businessman bought the Boston Globe in August 2013.

John Henry is a financier and founder of John W. Henry & Company (JWH). He owns the Boston Red Sox Baseball Club and the Liverpool Football Club. The billionaire is also a co-owner of the NASCAR Roush Fenway Racing racing team.

The financial state of Henry is estimated by Forbes at $2.6 billion.

Investor and Owner of Minnesota Timberwolves Glen Taylor

He bought Star Tribune in July 2014 for $100 million.

Glen Taylor is an American businessman, the main owner of the teams of the National Basketball Association, Minnesota Timberwolves and Minnesota Links from the Women's National Basketball Association, and also a former member of the Senate of Minnesota.

Las Vegas Sands' CEO Sheldon Adelson

He bought The Las Vegas Review-Journal in 2015.

The chairman and CEO of Las Vegas Sands, based in Las Vegas, invested $265 million in the construction of Sands Casino in Macau and signed an agreement under which he spent $12 billion to build a complex of casinos, hotels, exhibition centers and shops.

Adelson is one of the main sponsors of the US Republican Party.

Berkshire Hathaway's CEO Warren Buffett

It was Warren Buffett who started this trend by buying in 2011 the Omaha World-Herald newspaper, published in his hometown.

Warren Buffett is one of the richest people in the world. At the moment he owns more than 30 newspapers.

In February 2018, Buffett's investment company, Berkshire Hathaway, acquired 18.9 million shares of the Teva Israeli pharmaceutical company for $358 million and 31.2 million shares of Apple.

|

Метки: #photo_news |

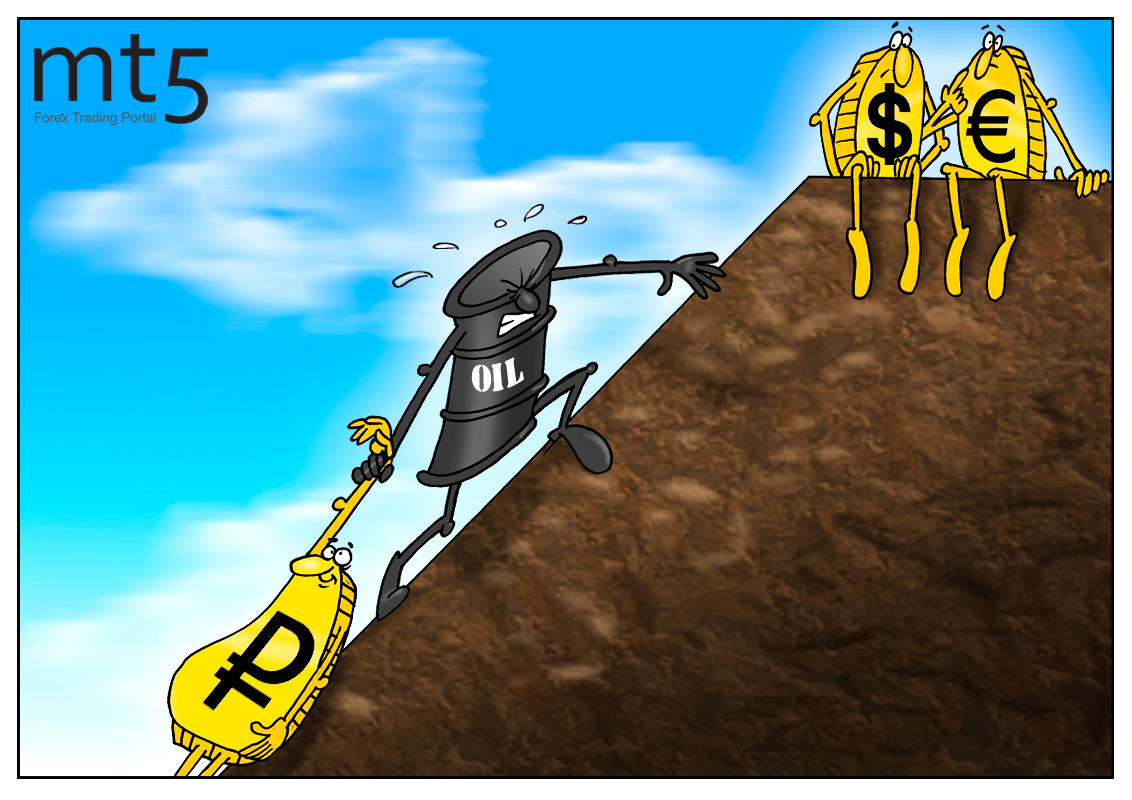

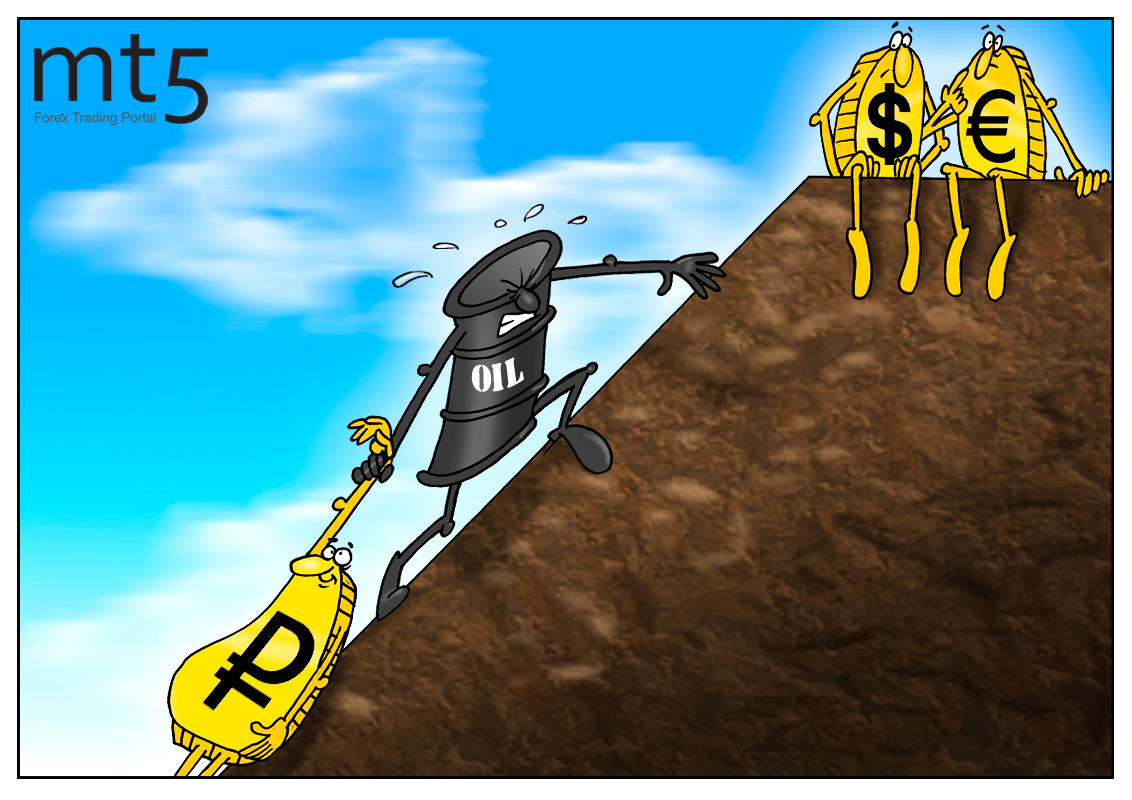

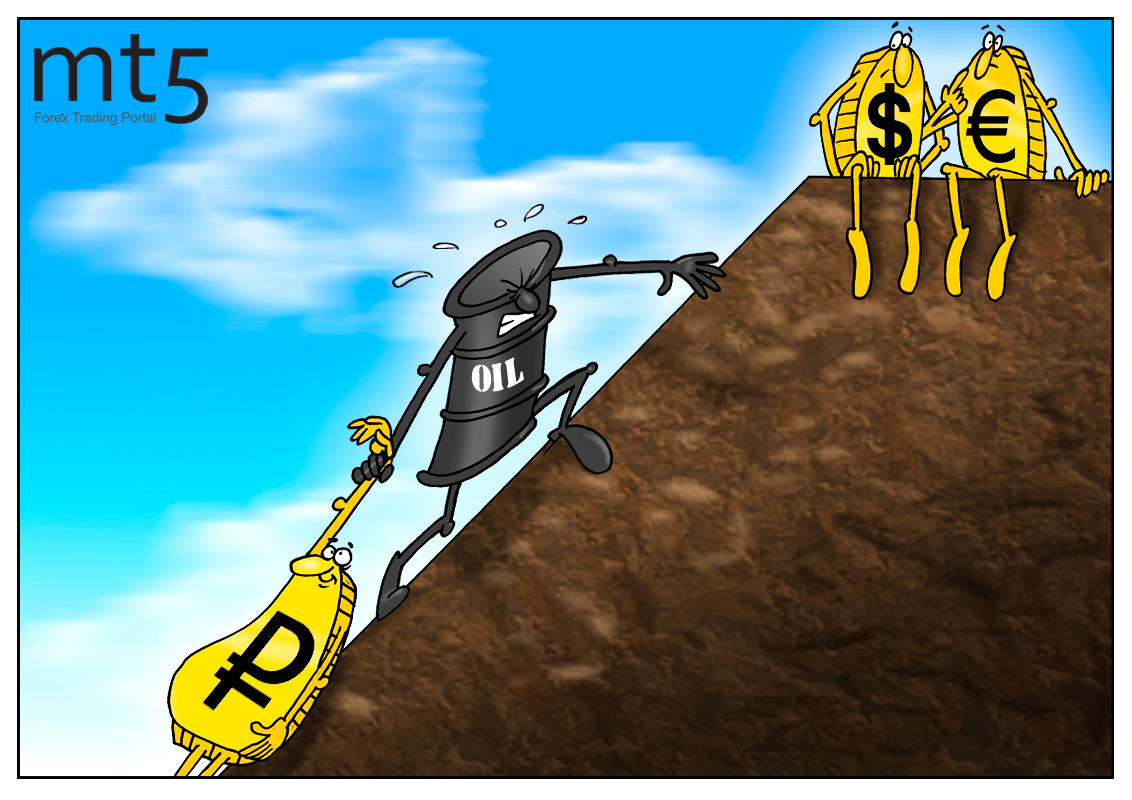

RUB gets immune to headwinds |

Eventually, the Russian currency halted its slump on September 21. The ruble has been hit by various headwinds. Thus, it has depreciated by around 20% against the US dollar since the start of 2018. However, last week the ruble showed resilience to the greenback and the euro and even could win back some of its earlier losses. By 7 am GMT, the USD/RUB pair sank below 67 to trade at 66.94. The ruble also strengthened to 78.4 against the euro. The Russian currency finds support from the steady oil rally and a tax filing period in Russia. Both factors are certainly bullish for the Russian currency. Moreover, the ruble is undervalued. So, it grasps every opportunity to regain footing. Besides, the domestic economy has become immune to the Western sanctions. The latest round of the US sanctions did not trigger turmoil in the Russian economy. As a result, the battered ruble was able to rebound from multi-year lows against the US dollar and the euro.

Read more: https://www.mt5.com/forex_humor/image/37946

|

Метки: #forex_caricature |

RUB gets immune to headwinds |

Eventually, the Russian currency halted its slump on September 21. The ruble has been hit by various headwinds. Thus, it has depreciated by around 20% against the US dollar since the start of 2018. However, last week the ruble showed resilience to the greenback and the euro and even could win back some of its earlier losses. By 7 am GMT, the USD/RUB pair sank below 67 to trade at 66.94. The ruble also strengthened to 78.4 against the euro. The Russian currency finds support from the steady oil rally and a tax filing period in Russia. Both factors are certainly bullish for the Russian currency. Moreover, the ruble is undervalued. So, it grasps every opportunity to regain footing. Besides, the domestic economy has become immune to the Western sanctions. The latest round of the US sanctions did not trigger turmoil in the Russian economy. As a result, the battered ruble was able to rebound from multi-year lows against the US dollar and the euro.

Read more: https://www.mt5.com/forex_humor/image/37946

|

Метки: #forex_caricature |

RUB gets immune to headwinds |

Eventually, the Russian currency halted its slump on September 21. The ruble has been hit by various headwinds. Thus, it has depreciated by around 20% against the US dollar since the start of 2018. However, last week the ruble showed resilience to the greenback and the euro and even could win back some of its earlier losses. By 7 am GMT, the USD/RUB pair sank below 67 to trade at 66.94. The ruble also strengthened to 78.4 against the euro. The Russian currency finds support from the steady oil rally and a tax filing period in Russia. Both factors are certainly bullish for the Russian currency. Moreover, the ruble is undervalued. So, it grasps every opportunity to regain footing. Besides, the domestic economy has become immune to the Western sanctions. The latest round of the US sanctions did not trigger turmoil in the Russian economy. As a result, the battered ruble was able to rebound from multi-year lows against the US dollar and the euro.

Read more: https://www.mt5.com/forex_humor/image/37946

|

Метки: #forex_caricature |

Countries where the wealthy live |

For the sixth time, the experts prepared the Wealth-X World Ultra Wealth Report, which shows the countries with the largest number of people with extremely high incomes, whose fortune exceeds $30 million.

According to the report, the proportion of women is rapidly growing among the ultra-rich people. Today, it is a record 13.7% of the total number.

Where the rich live? Read in our photo gallery.

5. Canada

The fifth place by the number of rich people living in the territory of the country is occupied by Canada. Moreover, the country is considered one of the richest in the world with high per capita income. Canada is a member of the G-7 and the Organization for Economic Cooperation and Development (OECD).

In general, many of Canada's welfare indicators are higher than in other countries. Canada shows results above the average for housing conditions, subjective well-being, level of health, personal safety, work and wages, and the level of education.

4. Germany

Germany is a world leader in a number of industrial and technological sectors, the world's third largest exporter and importer of goods. The country has a very high standard of living.

The experts note that according to statistics the number of the super-rich population in the world increased by 12.9%, to 255,810 people, and their general financial state increased by 16.3%, to $31.5 trillion in 2017.

3. Japan

This country took the third place in the list of countries with the largest number of super-rich people in the world. Japan has one of the highest life expectancies on the planet, 84.6 years.

According to experts' forecasts, the number of rich people will increase to 360,390 people by 2022, and their total wealth will reach $44.3 trillion.

2. China

In China, there are about 26,885 people with extremely high incomes. At the same time, their number will continue to grow as the economy of the country develops. In modern China, there are 1.4 billion people.

Of all the regions, Asia has shown the fastest growth in the number of rich people. Over the year, they boosted by 27%.

1. The USA

The leader of the ranking of countries with the largest number of super-rich population is held by the United States.

According to the data, in America, 31% of the world's super-rich population live.

The country's economy accounts for about a quarter of the world's GDP and for a third of global military spending. The country is a leader in scientific research and technological innovation.

But, according to this report, Hong Kong overtook New York by the number of rich people living in the city in 2017.

|

Метки: #photo_news |

Countries where the wealthy live |

For the sixth time, the experts prepared the Wealth-X World Ultra Wealth Report, which shows the countries with the largest number of people with extremely high incomes, whose fortune exceeds $30 million.

According to the report, the proportion of women is rapidly growing among the ultra-rich people. Today, it is a record 13.7% of the total number.

Where the rich live? Read in our photo gallery.

5. Canada

The fifth place by the number of rich people living in the territory of the country is occupied by Canada. Moreover, the country is considered one of the richest in the world with high per capita income. Canada is a member of the G-7 and the Organization for Economic Cooperation and Development (OECD).

In general, many of Canada's welfare indicators are higher than in other countries. Canada shows results above the average for housing conditions, subjective well-being, level of health, personal safety, work and wages, and the level of education.

4. Germany

Germany is a world leader in a number of industrial and technological sectors, the world's third largest exporter and importer of goods. The country has a very high standard of living.

The experts note that according to statistics the number of the super-rich population in the world increased by 12.9%, to 255,810 people, and their general financial state increased by 16.3%, to $31.5 trillion in 2017.

3. Japan

This country took the third place in the list of countries with the largest number of super-rich people in the world. Japan has one of the highest life expectancies on the planet, 84.6 years.

According to experts' forecasts, the number of rich people will increase to 360,390 people by 2022, and their total wealth will reach $44.3 trillion.

2. China

In China, there are about 26,885 people with extremely high incomes. At the same time, their number will continue to grow as the economy of the country develops. In modern China, there are 1.4 billion people.

Of all the regions, Asia has shown the fastest growth in the number of rich people. Over the year, they boosted by 27%.

1. The USA

The leader of the ranking of countries with the largest number of super-rich population is held by the United States.

According to the data, in America, 31% of the world's super-rich population live.

The country's economy accounts for about a quarter of the world's GDP and for a third of global military spending. The country is a leader in scientific research and technological innovation.

But, according to this report, Hong Kong overtook New York by the number of rich people living in the city in 2017.

|

Метки: #photo_news |

Countries where the wealthy live |

For the sixth time, the experts prepared the Wealth-X World Ultra Wealth Report, which shows the countries with the largest number of people with extremely high incomes, whose fortune exceeds $30 million.

According to the report, the proportion of women is rapidly growing among the ultra-rich people. Today, it is a record 13.7% of the total number.

Where the rich live? Read in our photo gallery.

5. Canada

The fifth place by the number of rich people living in the territory of the country is occupied by Canada. Moreover, the country is considered one of the richest in the world with high per capita income. Canada is a member of the G-7 and the Organization for Economic Cooperation and Development (OECD).

In general, many of Canada's welfare indicators are higher than in other countries. Canada shows results above the average for housing conditions, subjective well-being, level of health, personal safety, work and wages, and the level of education.

4. Germany

Germany is a world leader in a number of industrial and technological sectors, the world's third largest exporter and importer of goods. The country has a very high standard of living.

The experts note that according to statistics the number of the super-rich population in the world increased by 12.9%, to 255,810 people, and their general financial state increased by 16.3%, to $31.5 trillion in 2017.

3. Japan

This country took the third place in the list of countries with the largest number of super-rich people in the world. Japan has one of the highest life expectancies on the planet, 84.6 years.

According to experts' forecasts, the number of rich people will increase to 360,390 people by 2022, and their total wealth will reach $44.3 trillion.

2. China

In China, there are about 26,885 people with extremely high incomes. At the same time, their number will continue to grow as the economy of the country develops. In modern China, there are 1.4 billion people.

Of all the regions, Asia has shown the fastest growth in the number of rich people. Over the year, they boosted by 27%.

1. The USA

The leader of the ranking of countries with the largest number of super-rich population is held by the United States.

According to the data, in America, 31% of the world's super-rich population live.

The country's economy accounts for about a quarter of the world's GDP and for a third of global military spending. The country is a leader in scientific research and technological innovation.

But, according to this report, Hong Kong overtook New York by the number of rich people living in the city in 2017.

|

Метки: #photo_news |