Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #photo_news |

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #photo_news |

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #photo_news |

Top 5 world's largest oil fields |

Most large oil companies invest huge amounts of money in the exploration and production of raw materials, but these investments are not always profitable. Nevertheless, there are a number of hydrocarbon fields discovered several years ago that made profits. The largest of them are in our photo gallery

The development of the oil market is dynamic, and many oil corporations are seeking to explore and discover new fields in order to ramp up the extraction of raw materials. However, despite the use of technological innovations, it is not easy to find new deposits of hydrocarbons. We suggest you have a look at the list of income-generating oil fields discovered several years ago.

Kashagan Field (Kazakhstan)

This is a large offshore oil and gas field in Kazakhstan, located in the northern part of the Caspian Sea. It was discovered in 2000 and is considered to be one of the largest fields in the world. It contains about 38 billion barrels of oil. Oil mining is carried out in difficult conditions. This deposit is part of the North Caspian project. It is developed by a number of global companies, such as North Caspian Operating Company (NCOC), AgipCaspian Sea B.V., French Total EP Kazakhstan, American ExxonMobil Kazakhstan Inc., and others.

Ferdows Field (Iran)

This is a giant offshore oil and gas field of Iran, located in the Persian Gulf and 85 kilometers from the coast. It was explored in 2003, and prior to 2007, it was among the three largest in the world. Ferdows is associated with two others deposits - Mound and Zagheh. Their total hydrocarbon reserves reach 321 billion barrels. According to experts, the development of Ferdows is progressing at a slow pace. This is due to the US sanctions imposed on the Islamic Republic.

Santos/Campos (Brazil)

Both fiels located in Brazil are considered experts as one unit. It is almost impossible to make a clear distinction between them. These fields located on the shelf possess oil reserves of 123 billion barrels. Experts emphasize that the stock level is impressive. Brazilian company Petrobras has invested over $200 billion in the development of Santos/Campos, although it is rather difficult to extract raw materials here.

Burgan (Kuwait)

The Greater Burgan, a group of oil fields, is located in the south of Kuwait, in a desert area. It includes over 5% of the world's oil reserves. This group consists of three fields: Burgan, Ahmadi, and Magwa. There is over 75% of proven oil reserves in this deposit. The total extracted volume of hydrocarbons varies from 9.14 billion to 10.7 billion tons.

Ghawar (Saudi Arabia)

This giant oil and gas field in Saudi Arabia is the world's largest one in terms of oil and gas reserves. It is located in the Persian Gulf basin. Proved and recoverable oil reserves range from 8.1 billion to 12 billion tons. This field is entirely owned and operated by Saudi Aramco, the state run oil company. Ghawar was explored in 1948, and put on stream in 1951. About 56.6 million cubic meters per day of natural gas is produced here. The bulk of the world's oil reserves, 60-65%, was extracted within the period from 1948 to 2009.

|

Метки: #photo_news |

US oil drilling rigs fall for third week in a row |

The number of oil drilling rigs in the United States continued to decline last week due to poor infrastructure as well as amid stagnating drilling of new wells in the Permian, the US largest basin.

According to Baker Hughes oilfield service firm, the number of rings has decreased by 2 to 861 in the week to October 5.

The current series of reductions in the number of drilling rigs on a weekly basis is the longest since October last year. Simmons & Co analysts estimate that the number of installations for oil and gas drilling in the United States will average 1,031 in 2018, 1,092 in 2019, and 1,227 in 2020.

The number of drilling rigs is an early indicator of future US oil output.

As mentioned in the monthly review of the Energy Information Administration (EIA), oil production in the US is expected to increase by 1.31 million barrels per day, reaching 10.66 million barrels per day in 2018.

According to Cowen & Co, the US firm specializing in exploration and production, the companies it tracks indicated an 18 percent increase in planned capital spending this year.

The total investment is estimated at $85.3 billion in 2018 against $72.2 billion in the previous year.

Read more: https://www.mt5.com/forex_humor/image/38087

|

Метки: #forex_caricature |

US oil drilling rigs fall for third week in a row |

The number of oil drilling rigs in the United States continued to decline last week due to poor infrastructure as well as amid stagnating drilling of new wells in the Permian, the US largest basin.

According to Baker Hughes oilfield service firm, the number of rings has decreased by 2 to 861 in the week to October 5.

The current series of reductions in the number of drilling rigs on a weekly basis is the longest since October last year. Simmons & Co analysts estimate that the number of installations for oil and gas drilling in the United States will average 1,031 in 2018, 1,092 in 2019, and 1,227 in 2020.

The number of drilling rigs is an early indicator of future US oil output.

As mentioned in the monthly review of the Energy Information Administration (EIA), oil production in the US is expected to increase by 1.31 million barrels per day, reaching 10.66 million barrels per day in 2018.

According to Cowen & Co, the US firm specializing in exploration and production, the companies it tracks indicated an 18 percent increase in planned capital spending this year.

The total investment is estimated at $85.3 billion in 2018 against $72.2 billion in the previous year.

Read more: https://www.mt5.com/forex_humor/image/38087

|

Метки: #forex_caricature |

10 cryptocurrencies for $0.1 with great potential |

During this year, cryptocurrencies have fallen in price considerably, and now you can buy an impressive amount of coins even for a little money. When there are 10,000 tokens in a wallet, the investor feels much more psychologically comfortable than if he owns one-tenth of a large coin. We will tell about cryptocurrencies with high potential from Cardano (listed in the top 10) to FundRequest (1,001st place in the capitalization rating).

Cardano (ADA)

Capitalization: 2.13 billion dollars (9th place)

Number of coins in circulation: 25,927,070,538

Aggregate supply: 31,112,483,745

Maximum price: $1.26

Current price: $ 0.0823

Cardano acts as a competitor of Ethereum in the field of smart contracts. Cardano is developed by many well-known experts and researchers who are striving to develop the blockchain protocol taking into account all the existing problems and solve them using a scientific approach.

In addition to the scientific approach, the key feature of the platform is the possibility of formal verification, that is, the performance and security of all decentralized applications and smart contracts in the network can be checked mathematically.

Vechain (VET)

Capitalization: 713.5 million dollars (19th place in the Coinmarketcap rating)

Number of coins in circulation: 55,454,734,800

Aggregate supply: 86,712,634,466

Maximum price: $0.02

Current price: $0.0128 (June 30)

The Vechain Thor project has an extensive list of renowned partners, including PWC, Renault, DNV GL, BMW Concern, and China Unicom.

Presented in 2015, the VeChain start-up offered to use blockchain to track the origin and authenticity of the product, as well as to control the supply chains of products.

In 2018, the company announced rebranding. Vechain Thor launched the main network (mainnet) suggesting a wide range of tools to developers of blockchain-based applications. This provided the company with access to a wider audience.

Capitalization of the currency continues to grow.

Bitshares (BTS)

Capitalization: 308 million dollars (31st place)

Number of coins in circulation: 2,660,910,000

Aggregate supply: 3,600,570,502

Maximum price: $0.88

Current price: $0.1157

Bitshares was founded by Dan Larimer, one of the industry veterans, who later created Steem and EOS.

Bitshares is essentially a decentralized exchange that was designed to help people who lack access to banking services, as well as to provide financial services through the blockchain.

Bitshares has been designed to avoid scaling problems and minimize costs. In addition to stable coins, Bitshares offers a range of different tokens and decentralized projects. More than 33 thousand people use the platform services annually.

Siacoin (SIA)

Capitalization: 225.5 million dollars (39th place)

Number of coins in circulation: 37,057,172,220

Maximum price: $0.097

Current price: $0.0061

Siacoin is developing a decentralized cloud storage platform. The data is divided into parts, encrypted and distributed across network nodes. Payment for services is carried out by Siacoin tokens.

Unlike the cloud industry leaders, Amazon and Google, Siacoin significantly reduces the cost of storing information. At present, the network is capable of accumulating up to 4.1 petabytes of data distributed over 606 nodes; 194 terabytes of them are already involved.

IOST (IOST)

Capitalization: 107.6 million dollars (60th place)

Number of coins in circulation: 8,400,000,000

Aggregate supply: 21,000,000,000

Maximum price: $0.12

Current price: $0.0129

IOST developers have set a super goal: to surpass the bandwidth of such e-commerce giants as eBay and Alibaba while maintaining a high level of decentralization. To this end, many innovative technologies were integrated into the project, including effective distributed sharding, time-sharing, a unique algorithm of consensus, Proof-of-Believability, etc. Currently, more than 43 thousand active wallets are opened in the project, and transaction volumes are estimated at 4.45 million

Decentraland (MANA)

Capitalization: 78.3 million dollars (77th place)

Number of coins in circulation: 1,050,141,509

Aggregate supply: 2,644,403,343

Maximum price: $0.25

Current price: $0.0745

Decentraland is a new virtual world based on the blockchain technology. Any user can become the owner of a plot of the virtual space and build anything on it. The currency of the virtual kingdom is MANA, and the rights to the plots are stored in the blockchain. Decentraland encourages participants to create virtual projects with the possibility of monetization, such as BP games, beautiful graphic objects and virtual markets.

Loopring (LRC)

Capitalization: 54.7 million dollars (96th place)

Number of coins in circulation: 572,074,043

Aggregate supply: 1,374,956,262

Maximum price: $2.20

Current price: $0.0957

Loopring is developing a protocol for the decentralized exchange of tokens and other blockchain-based assets. The main feature of the project is that it supports various blockchains. Users can share assets based on different distributed registries.

Loopring introduced two unique technologies: order distribution and ring matching. The first allows you to split the order into several parts and automatically execute them at the best price.

Blockport (BPT)

Capitalization: 4.4 million dollars (514th place)

Number of coins in circulation: 52,870,933

Aggregate supply: 69,434,800

Maximum price: $0.81

Current price: $0.0828

The Blockport Dutch project aims to make the exchange of cryptocurrency and the investment process accessible and understandable for beginners paying great attention to the exchange interface. Thanks to Blockport's hybrid architecture, users control their own funds relying on blockchain technology. Among the advantages are also an intuitive interface, tracking and copying portfolios and transactions of experienced investors.

FundRequest (FND)

Capitalization: 431 thousand dollars (1,001st place)

Number of coins in circulation: 43,306,342

Aggregate supply: 98,611,464

Maximum price: $0.26

Current price: $0.0099

It is a decentralized open source platform for software developpers. This niche is now occupied by the Github site, but it does not include the possibility of financial incentives. FundRequest, in turn, allows you to stimulate developers with FND tokens and attract new people to projects.

Civic (CVC)

Capitalization: 42.6 million dollars (116th place)

Number of coins in circulation: 342,699,966

Aggregate supply: 1,000,000,000

Maximum price: $1.37

Current price: $0.1243

The project is developing a decentralized system for storing personal data on the Ethereum blockchain. Thanks to the decentralized approach, personal data are securely kept in the blockchain and centralized organizations don't have an access to them. Over the past year, the platform has made some progress and the project team is currently trying to attract users. Platform promotion cost 333 million CVC tokens (about $33 million). Using them, new members of the network will be able to register for free in a decentralized application.

|

Метки: #photo_news |

10 cryptocurrencies for $0.1 with great potential |

During this year, cryptocurrencies have fallen in price considerably, and now you can buy an impressive amount of coins even for a little money. When there are 10,000 tokens in a wallet, the investor feels much more psychologically comfortable than if he owns one-tenth of a large coin. We will tell about cryptocurrencies with high potential from Cardano (listed in the top 10) to FundRequest (1,001st place in the capitalization rating).

Cardano (ADA)

Capitalization: 2.13 billion dollars (9th place)

Number of coins in circulation: 25,927,070,538

Aggregate supply: 31,112,483,745

Maximum price: $1.26

Current price: $ 0.0823

Cardano acts as a competitor of Ethereum in the field of smart contracts. Cardano is developed by many well-known experts and researchers who are striving to develop the blockchain protocol taking into account all the existing problems and solve them using a scientific approach.

In addition to the scientific approach, the key feature of the platform is the possibility of formal verification, that is, the performance and security of all decentralized applications and smart contracts in the network can be checked mathematically.

Vechain (VET)

Capitalization: 713.5 million dollars (19th place in the Coinmarketcap rating)

Number of coins in circulation: 55,454,734,800

Aggregate supply: 86,712,634,466

Maximum price: $0.02

Current price: $0.0128 (June 30)

The Vechain Thor project has an extensive list of renowned partners, including PWC, Renault, DNV GL, BMW Concern, and China Unicom.

Presented in 2015, the VeChain start-up offered to use blockchain to track the origin and authenticity of the product, as well as to control the supply chains of products.

In 2018, the company announced rebranding. Vechain Thor launched the main network (mainnet) suggesting a wide range of tools to developers of blockchain-based applications. This provided the company with access to a wider audience.

Capitalization of the currency continues to grow.

Bitshares (BTS)

Capitalization: 308 million dollars (31st place)

Number of coins in circulation: 2,660,910,000

Aggregate supply: 3,600,570,502

Maximum price: $0.88

Current price: $0.1157

Bitshares was founded by Dan Larimer, one of the industry veterans, who later created Steem and EOS.

Bitshares is essentially a decentralized exchange that was designed to help people who lack access to banking services, as well as to provide financial services through the blockchain.

Bitshares has been designed to avoid scaling problems and minimize costs. In addition to stable coins, Bitshares offers a range of different tokens and decentralized projects. More than 33 thousand people use the platform services annually.

Siacoin (SIA)

Capitalization: 225.5 million dollars (39th place)

Number of coins in circulation: 37,057,172,220

Maximum price: $0.097

Current price: $0.0061

Siacoin is developing a decentralized cloud storage platform. The data is divided into parts, encrypted and distributed across network nodes. Payment for services is carried out by Siacoin tokens.

Unlike the cloud industry leaders, Amazon and Google, Siacoin significantly reduces the cost of storing information. At present, the network is capable of accumulating up to 4.1 petabytes of data distributed over 606 nodes; 194 terabytes of them are already involved.

IOST (IOST)

Capitalization: 107.6 million dollars (60th place)

Number of coins in circulation: 8,400,000,000

Aggregate supply: 21,000,000,000

Maximum price: $0.12

Current price: $0.0129

IOST developers have set a super goal: to surpass the bandwidth of such e-commerce giants as eBay and Alibaba while maintaining a high level of decentralization. To this end, many innovative technologies were integrated into the project, including effective distributed sharding, time-sharing, a unique algorithm of consensus, Proof-of-Believability, etc. Currently, more than 43 thousand active wallets are opened in the project, and transaction volumes are estimated at 4.45 million

Decentraland (MANA)

Capitalization: 78.3 million dollars (77th place)

Number of coins in circulation: 1,050,141,509

Aggregate supply: 2,644,403,343

Maximum price: $0.25

Current price: $0.0745

Decentraland is a new virtual world based on the blockchain technology. Any user can become the owner of a plot of the virtual space and build anything on it. The currency of the virtual kingdom is MANA, and the rights to the plots are stored in the blockchain. Decentraland encourages participants to create virtual projects with the possibility of monetization, such as BP games, beautiful graphic objects and virtual markets.

Loopring (LRC)

Capitalization: 54.7 million dollars (96th place)

Number of coins in circulation: 572,074,043

Aggregate supply: 1,374,956,262

Maximum price: $2.20

Current price: $0.0957

Loopring is developing a protocol for the decentralized exchange of tokens and other blockchain-based assets. The main feature of the project is that it supports various blockchains. Users can share assets based on different distributed registries.

Loopring introduced two unique technologies: order distribution and ring matching. The first allows you to split the order into several parts and automatically execute them at the best price.

Blockport (BPT)

Capitalization: 4.4 million dollars (514th place)

Number of coins in circulation: 52,870,933

Aggregate supply: 69,434,800

Maximum price: $0.81

Current price: $0.0828

The Blockport Dutch project aims to make the exchange of cryptocurrency and the investment process accessible and understandable for beginners paying great attention to the exchange interface. Thanks to Blockport's hybrid architecture, users control their own funds relying on blockchain technology. Among the advantages are also an intuitive interface, tracking and copying portfolios and transactions of experienced investors.

FundRequest (FND)

Capitalization: 431 thousand dollars (1,001st place)

Number of coins in circulation: 43,306,342

Aggregate supply: 98,611,464

Maximum price: $0.26

Current price: $0.0099

It is a decentralized open source platform for software developpers. This niche is now occupied by the Github site, but it does not include the possibility of financial incentives. FundRequest, in turn, allows you to stimulate developers with FND tokens and attract new people to projects.

Civic (CVC)

Capitalization: 42.6 million dollars (116th place)

Number of coins in circulation: 342,699,966

Aggregate supply: 1,000,000,000

Maximum price: $1.37

Current price: $0.1243

The project is developing a decentralized system for storing personal data on the Ethereum blockchain. Thanks to the decentralized approach, personal data are securely kept in the blockchain and centralized organizations don't have an access to them. Over the past year, the platform has made some progress and the project team is currently trying to attract users. Platform promotion cost 333 million CVC tokens (about $33 million). Using them, new members of the network will be able to register for free in a decentralized application.

|

Метки: #photo_news |

WSJ investigation uncovers millions of dollars laundered using cryptocurrency |

For some people, the cryptocurrency exchange is a great opportunity to earn, while for others it is used for money laundering. According to the investigation published by the Wall Street Journal, dirty money close to $100 million was laundered through 46 cryptocurrency exchanges. Over the past two years, at least $9 million related to illegal activities has been stolen only through the ShapeShift platform. This was possible as the exchange allowed users to trade in an anonymous manner.

This is so far the largest amount of money that has ever been laundered through one exchange in the United States. ShapeShift stated that the investigation was inaccurate and misleading, but at the same time introduced new rules requiring user registration and verification.

The authors of the investigation traced the cash flows of more than 2,500 cryptocurrency wallets, allegedly associated with illegal activities, and found that $88.6 million had been stolen through the digital currency exchanges.

Read more: https://www.mt5.com/forex_humor/image/38039

|

Метки: #forex_caricature |

Five innovative scenarios of blockchain technology use |

The use of blockchain technology in the cryptocurrency sphere is no longer news, but everyday life. This issue is especially relevant for miners and other participants in the cryptocurrency market. At the same time, experts pay attention to other areas of application of this technology that will be interesting to market players.

|

Метки: #photo_news |

China manufacturing PMI slides in September |

According to the National Bureau of Statistics of China, the Purchasing Managers Index (PMI) in the manufacturing sector fell to 50.8 in September after 51.3 in August. The score was expected to decline to 51.2.

The index has remained above the line of 50 for more than two years. At the same time, the sub-index for production within the manufacturing PMI fell to 53 from 53.3 in August.

Last month, the services PMI in China rose to 54.9 from 54.2, the statistics shows.

The composite PMI, which includes data on industrial production and the service sector, increased to 54.1 in September from 53.8 in August. The industrial PMI, calculated by Caixin Media Co. and Markit, dropped to 50 from 50.6.

After 4 months, the indicator dropped to its lowest level in 16 months. It has remained above the line of 50 since May 2017, analysts said.

Read more: https://www.mt5.com/forex_humor/image/38045

|

Метки: #forex_caricature |

China manufacturing PMI slides in September |

According to the National Bureau of Statistics of China, the Purchasing Managers Index (PMI) in the manufacturing sector fell to 50.8 in September after 51.3 in August. The score was expected to decline to 51.2.

The index has remained above the line of 50 for more than two years. At the same time, the sub-index for production within the manufacturing PMI fell to 53 from 53.3 in August.

Last month, the services PMI in China rose to 54.9 from 54.2, the statistics shows.

The composite PMI, which includes data on industrial production and the service sector, increased to 54.1 in September from 53.8 in August. The industrial PMI, calculated by Caixin Media Co. and Markit, dropped to 50 from 50.6.

After 4 months, the indicator dropped to its lowest level in 16 months. It has remained above the line of 50 since May 2017, analysts said.

Read more: https://www.mt5.com/forex_humor/image/38045

|

Метки: #forex_caricature |

World Tourism Day: most popular attractions in the world |

The World Tourism Day is celebrated on September 27. The holiday was established in 1797 by the General Assembly of the World Tourism Organization. On this day, tourism and its contribution to the world economy are promoted, as well as to the development of ties between the peoples of different countries.

We suggest recalling the most popular places that many travelers dream to visit.

|

Метки: #photo_news |

World Tourism Day: most popular attractions in the world |

The World Tourism Day is celebrated on September 27. The holiday was established in 1797 by the General Assembly of the World Tourism Organization. On this day, tourism and its contribution to the world economy are promoted, as well as to the development of ties between the peoples of different countries.

We suggest recalling the most popular places that many travelers dream to visit.

|

Метки: #photo_news |

Brexit talks need to speed up, but instead face stalemate |

Severing economic ties between Britain and the rest of Europe has proved complicated. The decision on the exit has already taken, but the agreements and financial matters are still open questions.

British Prime Minister Theresa May reported with sadness that the negotiations on the country's departure from the EU had faced a stalemate after refusing to accept London’s current proposals. “As I told EU leaders, neither side should demand the unacceptable of the other. We cannot accept anything that threatens the integrity of our union, just as they cannot accept anything that threatens the integrity of theirs. We cannot accept anything that does not respect the result of the referendum, just as they cannot accept anything that is not in the interest of their citizens,” May declared. That’s how Britain is trying to avoid paying an impressive penalty for the "dissolution" of the European Union. As a result of another failed attempt to reach consensus, the British currency is suffering again.

Such uncertainty surrounding this serious matter is unacceptable and will take a heavy toll on participants of the foreign exchange market. The pound is currently under enormous pressure. And given the fact that the parties may fail in addressing the issue and cause the scandal, the future of the pound remains unclear. The hard exit of Britain from the EU could face major problems, especially for the pound.

Read more: https://www.mt5.com/forex_humor/image/38026

|

Метки: #forex_caricature |

Ten best places to travel in October |

In October, when the air temperature is rapidly falling, and the memories of the summer sun are still fresh, it's time to find a warm place to escape. Read in our article what locations will please travelers.

Marrakesh, Morocco

A place that abounds in culture and life. Although the city is not located on the coast, tourists from all over the world come here during their vacations. There are beautiful mosques, palaces, and gardens here, and visitors can wander through the extensive bazaars for hours trying the best Moroccan cuisine. The heart of the old city, Jemaa-El-Fna Square, is listed on the UNESCO Cultural Heritage List.

Savannah, Georgia

This is an exemplary ancient city in the south of the USA. Savannah fascinates travelers with the architecture of the pre-war period, with its historic sites and streets planted with oaks. By the way, Bonaventure Cemetery is considered one of the symbols of the city. Explore the mysterious history of the city with hotels, restaurants, and cemeteries that are said to have paranormal energy. What could be better on the eve of Halloween?

Antalya, Turkey

The fast-growing resort will provide tourists with the perfect combination of relaxing beaches and authentic Turkish culture. In the city, you can find sights of different eras: Roman, Byzantine, Ottoman, Lucian, Pamphylian, and Hellenistic.

And only 40 minutes drive from the city on the territory of 63 thousand hectares there is the largest in Turkey amusement park, Land of Legends, where 72 slides and 43 water attractions are installed.

Munich, Germany

Traditionally, the largest holiday in the world, Oktoberfest, takes place in Munich in October. The program includes a festive procession, a mass, and a family day, when the prices of attractions are lower than usual. The holiday will end with a salute, demonstrative shooting of hunters from mortars.

Montevideo, Uruguay

In October, the average temperature is 22°C. If you are not a fan of stifling heat, then use good weather to explore the Old Town. Ride the bike along the La Rambla bike avenue and the coastline of the city, and have lunch at the port market of Mercado del Puerto which is considered a haven for meat lovers.

Lisbon, Portugal

You can perfectly spend your sunny holiday in Portugal. In the off-peak month for travelers, there is a lot of advantages, one of which is the absence of a crowd. The majestic cathedrals, ornate palaces, pompous monuments to kings and marquises remind of the imperial past of Lisbon.

Ethiopian Highlands, Ethiopia

Nature lovers will want to visit the Simien Mountains National Park with stunning scenery. These places should be especially green in October, after the rainy season.

The park is remarkable not only by the views of the mountains but also by the fact that extremely rare animals live on its territory. The park was created mainly to protect the Abyssinian goats, there are only 1,000 of them, and they are not found anywhere else in the world.

Dubai, the United Arab Emirates

This is one of the most incredible cities in the world. In October, the air temperature is not as high as in summer, and you can safely walk around the city and explore its futuristic places.

Trinidad and Tobago

Two large islands in the Caribbean sea are a tropical paradise in October. The main focus is on eco-tourism. The nature of the islands is very diverse: there are about 400 species of birds, 600 species of butterflies, 50 species of reptiles and 100 species of mammals. Besides, there are not many tourists in Trinidad and Tobago in the autumn.

Bagan, Myanmar

Bagan is an amazing eclectic spectacle: more than two thousand temples built of limestone, sandstone, or marble with tiles and underground galleries, and every one is a little bit different from the previous one. Pilgrims from all over Asia come here. And some tourists are so imbued with the local culture that they live for a few months.

October is the month before the peak season in Bagan. Use the warm weather to explore the temple complex.

|

Метки: #photo_news |

Platts considers adding new grades to Brent basket |

Leading independent information provider S&P Global Platts is looking forward to further extension of Brent, a key benchmark in global oil markets. It is going to face major adjustments in the near future. Platts considers adding new grades from Central Asia, West Africa and North America to the Brent crude.

The major provider of data on benchmark prices for the energy and commodities markets suggests two key changes to the Brent price assessment.

The first one is to include in the calculation not only the price but also costs of delivery to Rotterdam. The second change concerns inclusion to the Brent basket of oil grades outside the North Sea extraction area as well as ones supplied to Rotterdam.

Experts believe this is the turning point in the North Sea Benchmark’s history. “Against the backdrop of changing global crude oil flows where we see more crude being delivered across the Atlantic basin from different locations including the US and the falling production of North Sea crude itself, the time is right to put forward specific, detailed and timely proposals for changes like this,” specialists said. The agency offered to look upon such oil benchmarks as Statfjord, Gullfaks (the North Sea), CPC Blend (Central Asia), WTI Midland (the US), Qua Iboe and Forcados (West Africa) as possible options to top up the Brent blend.

The S&P Global Platts specialists are opened to conversation with market key players and awaiting feedback on their proposals until December 10, 2018.

Read more: https://www.mt5.com/forex_humor/image/38015

|

Метки: #forex_caricature |

Ten facts about new NAFTA trade agreement |

Representatives from the US, Canada, and Mexico met to discuss the renegotiation of the North American Free Trade Agreement. The agreement was one of the main promises of the US President Donald Trump's election campaign. The new deal, at best, will take effect in 2019 after it is ratified.

All details of the agreement are not disclosed. But we will tell about 10 facts that are known.

1. Cars

It will become harder to import cars from the participating countries of the agreement. The deal also mandates that 75% of a vehicle's parts must be made in North America, up from 62.5% in 1994.

This arrangement is in favor of the trade unions. However, now it will become a problem for the automobile industry.

2. Wages

Most notably, it requires that two fifths of car and truck parts that are exported as part of duty free trading in North America be made by workers earning at least $16 an hour.

This is additional spending compared to the expenditures on low-cost parts produced in Mexico.

3. Labour standards

After the new labor standards come into force, trade unions in Mexico will become more influential, and this will lead to higher wages. The Trump administration and its unexpected allies from the Democratic Party and the unions are particularly proud that they achieved high labor standards. But to be honest, some representatives of the Democratic Party say that they are dissatisfied with the level of implementation of these standards.

4. Expiration

The NAFTA agreement will be valid for the next 16 years, and after that, all three countries will be able to extend or change the conditions.

At the same time, once every six years, countries representatives will meet to discuss updates of the agreement.

Thus, potentially after 16 years, the agreement will probably have a completely different form and conditions.

Representatives of the Mexican and Canadian sides point out that the uncertainty on the agreement expiration reduces the level of investment in their countries.

Nonetheless, the companies are pleased that the Trump administration rejected the idea of expiring the agreement after 5 years.

5. Exchange rates

The signatories cannot artificially weaken currency exchange rates to gain the benefits of trade. And although the United States, Canada, and Mexico rarely receive such accusations, car manufacturers hope that in the future such a rule will be introduced into agreements with Asian countries.

6. Dairy market

The United States has managed to increase its exports of dairy products to the Canadian market, where the government controls prices and limits the amount of import imposing fairly high tariffs.

According to experts, it is the agreement on the dairy market that will cause approval within the United States, especially in the states where milk is produced the most. But in Canada, this point will clearly lead to disapproval.

7. Dispute resolution

Now participants will have to report on compliance with NAFTA agreement or its violation using a whole system of rules. The Trump administration has repeatedly spoken for easing the system of "control" and the resolution of disputes.

Lawyers will analyze the text of the agreement so that representatives of industry and trade unions can form their opinion and influence the legislators.

8. Tariff revision

Canadian officials managed to keep another arbitration system that allows the country to challenge U.S. duties on allegedly dumped or subsidized Canadian import, for example. This was achieved, despite the fact that American lumber producers and the US sales representative had wanted to scrap the system.

9. Tariff relief

After the new agreement comes into force, Mexico would be protected from any tariffs on vehicles and auto parts, and Canada got a similar deal.

However, it is noted that any respite for Canada from steel and aluminum tariffs would have to be negotiated separately.

10. No more NAFTA?

The North American Free Trade Agreement was heavily criticized in 2016 during an election campaign. Therefore, Trump sought to change the name of the agreement. So, now it will be called the United States-Mexico-Canada Agreement, or U.S.M.C.A., as officials told reporters.

The new agreement, as noted in the Canadian government, "will strengthen the middle class, and create good, well-paying jobs and new opportunities for the nearly half billion people who call North America home."

|

Метки: #photo_news |

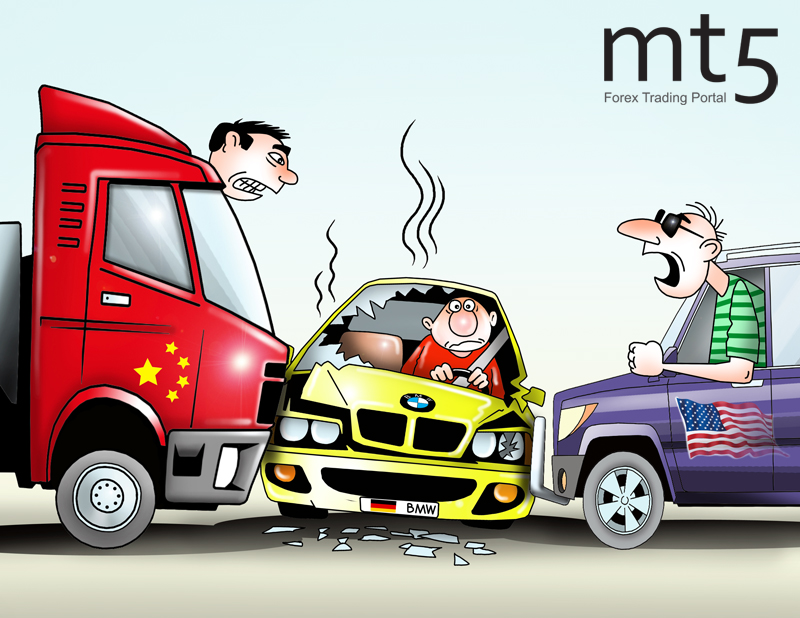

BMW lowers profit outlook hit by trade spat |

Luxury car maker BMW AG cut its profit forecast amid the ongoing trade war between the United States and China. According to experts, the car prices are weighed down by trade war concerns.

China is the largest market for BMW. However, the car maker’s factory is located in the US, which exports a lot of SUVs to China. BMW expects its full-year pretax profit to moderately decrease. It also said its operating margin would be 7%, below its target range of 8-10%.

BMW’s shares fell by more than 5%, at the fastest pace in three months. The decline affected other European auto makers as well, market observers stressed.

Read more: https://www.mt5.com/forex_humor/image/38008

|

Метки: #forex_caricature |

BMW lowers profit outlook hit by trade spat |

Luxury car maker BMW AG cut its profit forecast amid the ongoing trade war between the United States and China. According to experts, the car prices are weighed down by trade war concerns.

China is the largest market for BMW. However, the car maker’s factory is located in the US, which exports a lot of SUVs to China. BMW expects its full-year pretax profit to moderately decrease. It also said its operating margin would be 7%, below its target range of 8-10%.

BMW’s shares fell by more than 5%, at the fastest pace in three months. The decline affected other European auto makers as well, market observers stressed.

Read more: https://www.mt5.com/forex_humor/image/38008

|

Метки: #forex_caricature |