‘армакологическа€ фирма «ѕромомед» семимильными шагами идЄт к успеху, подмина€ под себ€ фармацевтический рынок –оссии.

¬ конце но€бр€ компани€ представила впечатл€ющие операционные результаты за первые дев€ть мес€цев 2025 года, став лидером среди публичных фармкомпаний по темпам роста. —огласно управленческой отчетности, выручка «ѕромомеда» выросла на 78% и достигла 19 миллиардов рублей. ƒл€ сравнени€, общий рост фармацевтического рынка за этот период, по данным аналитиков IQVIA, составил всего 12,6%, то есть темпы развити€ «ѕромомеда» в шесть раз превышают среднерыночные показатели! Ќа фоне этих впечатл€ющих успехов в –оссии этим летом по€вилс€ новый долларовый миллиардер — ѕЄтр Ѕелый, основной акционер компании, владеющий 88% еЄ активов. ¬ истории успеха новоиспечЄнного «олигарха» разбиралс€ наш корреспондент…

—клонность к предпринимательству у ѕетра Ѕелого обнаружилась ещЄ в юном возрасте. Ѕлаго, врем€ (начало 90-х) способствовало предприимчивым молодым люд€м. ќ том периоде жизни ѕетра јлександровича в —ети сохранились лишь отрывочные сведени€. ѕрежде чем найти себ€ в фармацевтической отрасли, он перепробовал, как увер€ют источники, различные позиции: занималс€ оптовой торговлей, управл€л обменным пунктом валюты и даже, €кобы, фигурировал в уголовном деле, св€занном с незаконным выводом валюты за границу с использованием поддельных документов. ћы не можем утверждать, что так оно и было. ¬прочем, кому в молодости не приходилось ошибатьс€? “ем более, времена были лихие…

яды, лекарства, конкуренты…

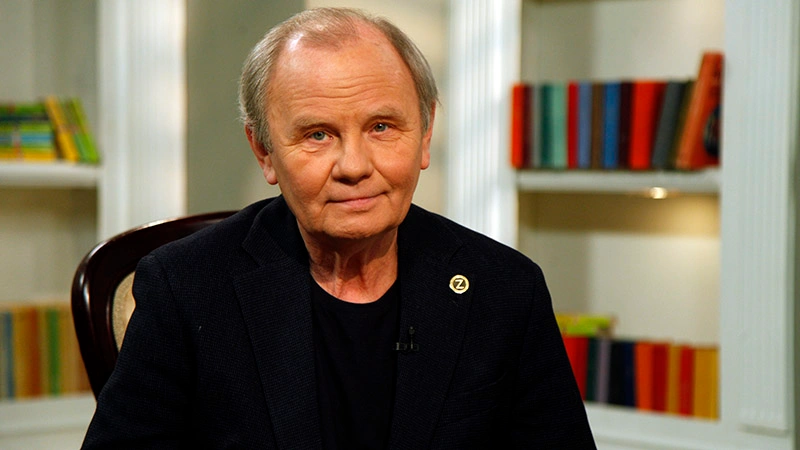

ак бы то ни было, к 2000 году ѕЄтр Ѕелый остепенилс€, решив сосредоточитьс€ на весьма специфическом, но, как вы€снилось, весьма прибыльном деле: производстве €дохимикатов. ќснованна€ им компани€ «јлламед» специализировалась на производстве средств дл€ борьбы с грызунами, которые с удовольствием закупались дл€ сельскохоз€йственными предпри€ти€ми. ѕримечательно, что его партнером по этому проекту стал Ћеонид –инк, известный как один из разработчиков химического вещества «Ќовичок».

ќт производства отравы наш герой плавно перешЄл к изготовлению лекарств, основав собственную фармацевтическую исследовательскую компанию «Ён.—и.‘арм», а в 2005 году под его руководством по€вилась компани€ «ѕромомед», котора€ выпустила свой первый продукт – сорбент под названием «Ќеосмектин».

«начительным расширением бизнеса стало приобретение в 2015 году производственного предпри€ти€ «Ѕиохимик». » здесь ѕЄтр Ѕелый впервые столкнулс€ с серьЄзным оппонентом, попортившим ему немало крови. ¬ 2018 году в интервью директор и акционер (на тот момент) компании «Ѕиохимик» ƒенис Ўвецов поделилс€ информацией о сомнительном происхождении полутора тонн сибутрамина – вещества, которое добавл€етс€ в препараты дл€ похудени€. Ўвецов утверждал, что сибутрамин был закуплен не в √ермании а, возможно, был изготовлен на китайском предпри€тии, которое работало без необходимой лицензии. ќднако эта громка€ истори€ не получила развити€, а сам Ўвецов вскоре оказалс€ под следствием. Ёкс-директора «Ѕиохимика» арестовали по обвинению в нанесении ущерба предпри€тию на сумму 1 миллион 350 тыс€ч рублей. ¬последствии новое руководство "Ѕиохимика" подало иск против бывшего гендиректора, требу€ возмещени€ 146,5 миллионов рублей. ѕрокуратура запрашивала дл€ ƒениса Ўвецова 4,5 года лишени€ свободы в колонии общего режима, но в итоге он был помещен под домашний арест.

ѕо информации аппарата бизнес-омбудсмена Ѕориса “итова, уголовное дело стало следствием корпоративного конфликта между бывшим генеральным директором Ўвецовым и основным акционером ѕетром Ѕелым. ѕЄтр Ѕелый разделалс€ со своим бывшим компаньоном, став единоличным владельцем бизнеса?

јреплевир – не «ћон плезир»!

¬ 2020 году планету охватила пандеми€ коронавируса, и фармацевты всего мира бросились искать панацею от этой напасти. ƒл€ главы фармацевтической компании «ѕромомед», ѕетра Ѕелого настал звЄздный час. ≈го предпри€тие одним из первых в –оссии начало производство препаратов, которые, €кобы, способны подавл€ть развитие коронавирусной инфекции. ¬ыпускаемый его компанией «јрепливир» был представлен его как «прорыв» в лечении коронавирусной инфекции на основе фавипиравира.

ќднако действительность оказалась несколько иной. «јрепливир» по€вилс€ в аптеках без завершени€ третьей фазы клинических испытаний – этапа, необходимого дл€ полноценной оценки безопасности и эффективности любого препарата. ѕомимо этого, медикамент имел внушительный перечень побочных действий, начина€ от кожных реакций (сыпь, зуд, экзема) и респираторных проблем (ринит, астма) до нарушений работы ∆ “ (диаре€, тошнота, рвота, боли в животе, €зва).

÷ена препарата также вызывала вопросы. ƒепутат √осдумы √еннадий ќнищенко выразил мнение, что стоимость «јрепливира» завышена, поскольку он не €вл€етс€ уникальной разработкой, а воспроизводит уже существующее лекарство. Ќесмотр€ на за€влени€ ѕетра Ѕелого об инновационности, активный компонент – фавипиравир – был разработан €понской компанией Fujifilm Holdings еще в 2014 году дл€ лечени€ гриппа и Ёболы. » уже тогда было известно, что фавипиравир пагубно сказываетс€ на возможност€х пациента обзаводитьс€ потомством. ≈го категорически не рекомендовали не только беременным и корм€щим матер€м, но и всем нерожавшим женщинам, а также мужчинам, планирующим стать отцами.

ƒа и сам факт «прорыва» был, по мнению многих экспертов, м€гко говор€, преувеличен. ѕросто срок действи€ патента на фавипиравир истек, и это что позвол€ло выпускать его аналоги. ¬ самой японии эффективность фавипиравира против COVID-19 на начальных стади€х подвергалась большому сомнению. Ќесмотр€ на все это, «јрепливир» был запущен в производство, и ѕетр Ѕелый в 2020 году упорно за€вл€л о его эффективности в 98% случаев у пациентов с COVID-19 средней т€жести. Ёксперты из »нформационного центра «‘армаCOVID» высказывали обеспокоенность относительно безопасности фавипиравира, указыва€ на его тератогенное воздействие и возможные риски дл€ плода. Ќекоторые врачи также отмечали недостаточную изученность препарата и не€сность его долгосрочных последствий.

ритика препарата не ограничивалась медицинскими аспектами. Ёкономисты также выражали сомнени€ в обоснованности государственных закупок «јрепливира» в больших объемах, учитыва€ наличие более дешевых и, возможно, более эффективных альтернатив. ¬ 2025 году дискуссии об «јрепливире» практически утихли: после того, как эпидеми€ COVID-19 отступила, препарат потер€л свою попул€рность. “рудно судить, кому этот препарат спас во врем€ пандемии жизнь, но то, что он изр€дно пополнил счета ѕетра Ѕелого – факт!

ј пациентов не спросили…

ѕосле сомнительной историей с панацеей от COVID-19 ѕетр Ѕелый переключилс€ на борьбу со —ѕ»ƒом. Ўирокую известность получил случай, когда он вмешалс€ в сферу государственных закупок жизненно важного препарата дл€ лечени€ ¬»„-инфекции и сумел оттеснить проверенного зарубежного поставщика медицинских препаратов дл€ лечени€ коварного недуга. — конца 2023 года два российских производител€, «–-‘арм» и «ѕромомед», зарегистрировали аналоги долутегравира. ѕредельна€ цена на дженерики была установлена на уровне 4,1 тыс. рублей, что на 26% ниже стоимости оригинального препарата. “огда это также преподносилось как значительный шаг вперед: отечественный аналог приходит на смену импортному продукту! ќднако такой поворот событий вызывает р€д вопросов.

ƒа, ћинистерство здравоохранени€ одобрило российский дженерик долутегравира, произведенный компанией «ѕромомед», что привело к прекращению закупок оригинального лекарственного средства, ранее поставл€емого британским подразделением GSK (јќ √лаксо—мит л€йн “рейдинг). Ќо в среде специалистов этот выбор вызвал оживленные дискуссии, поскольку закупка дженериков при наличии действующего патента на оригинальный препарат обычно требует получени€ принудительной лицензии. ¬ июле 2024 года по€вилась информаци€ о том, что ‘ј— приостановила закупку ћинздравом российского дженерика препарата против ¬»„ после жалобы, поданной британским производителем оригинального лекарства GSK, но потом отменила своЄ решение. Ёто вызвало возмущение экспертов. “ак, президент «Ћиги защиты пациентов» јлександр —аверский отмечал, что «тендеры должны проводитьс€ с учетом лекарств, замена которых согласована с пациентами. Ѕез согласи€ пациентов лечить их тем, что просто купили на торгах, нельз€, считает он. —ейчас получаетс€, что замен€емость препаратов определ€етс€ не мнением потребител€, а позицией ћинздрава, причем ‘ј— также вмешиваетс€ в этот вопрос. ¬ неразберихе импортозамещени€ производители также пытаютс€ зан€ть рынок, даже при наличии патентной защиты, ведь и одна закупка погашает риски санкций и штрафы, которые могут последовать за закупкой дженериков, нарушивших патентную защиту. «ѕострадавша€» компани€ GSK выразила мнение, что был закуплен не оригинальный препарат, а его российский дженерик, что €вл€етс€ нарушением прав, поскольку оригинальный «“ивикай» защищен патентом ≈јЁ— до 2029 года. ћнени€ лечащих врачей и самих больных, разумеетс€, никто не спросил. ј счета ѕетра Ѕелого, разумеетс€, пополнились на кругленькую сумму.

«я здесь поставлен дл€ того, чтобы блюсти государственные интересы…»

ѕетр Ѕелый, как любой сильный бизнесмен, стремитс€ к новым вершинам в фармакологическом секторе экономики. ƒело в том, что в последние годы, несмотр€ на санкционное давление «апада, а точнее – благодар€ ему, фармацевтическа€ отрасль –оссии демонстрирует устойчивый рост, став единственным крупным сектором, который избежал национализации.

¬ 2024 году объем производства лекарств и их компонентов достиг внушительных 2,85 триллиона рублей. » этот факт не мог не привлечь внимание Ѕелого, который, по некоторым предположени€м, пытаетс€ фармакологический рынок монополизировать, использу€ свои возможные св€зи на самом «верху».

ак указывают —ћ», далее цитата:

«¬ конце ма€ в администрацию президента наведалс€ владелец компании "ѕромомед" ѕетр Ѕелый, он же "аптекарь ѕутина", с весьма заманчивым предложением. ѕредложение заключаетс€ в следующем: вместо нескольких дес€тков крупных фармацевтических компаний, работающих на российском рынке, создать три-четыре крупных консолидированных конгломерата. —амо собой ѕетр Ѕелый отводит себе роль эффективного объединител€, который руководствуетс€ интересами государства, будет производить что нужно, и делитьс€ с кем надо.

Ќо роль бенефициара проекта Ѕелый отводит не только себе. ѕредполагаетс€, что поглощение будут осуществл€ть три компании: "ѕромомед" ѕетра Ѕелого, "Ќацимбио" (входит в "–остех"), "Ѕиннофарм √рупп" ("ј‘ —истема"). ѕричем последние две компании пока не в курсе отведенных им ролей, в майской встрече не участвовали. —корее всего Ѕелый специально включил "Ќацимбио" и "Ѕинофарм", чтобы учесть государственные интересы в лице "–остеха" (читай —ерге€ „емезова) и интерес близкого к власт€м ¬ладимира ≈втушенкова, существенно снизив лоббистский потенциал других игроков фармацевтического рынка при реализации своего плана. “.е. по факту привлечение „емезова и ≈втушенкова призвано подавить попытки рынка сопротивл€тьс€ поглощению.

ого планируетс€ поглощать? Ќикакого конкретного плана на сегодн€ не существует. Ќа данном этапе есть только концептуально оформленна€ записка от ѕетра Ѕелого с общими фразами о необходимости вз€ть под контроль государства стратегически важной отрасли. Ќо на встрече уже прозвучали названи€ компаний, которые неплохо было бы уже сейчас вз€ть под контроль.

¬ списке указаны "јкрихин" (принадлежит польской Polpharma), "Ќижфарм" (люксембургска€ Nidda Lynx S.A R.L.), "√ротекс" (Solopharm, владелец ќлег ∆еребцов, основатель торговой сети "Ћента"), "√ерофарм" (основатель ѕетр –одионов) и "–-‘арм" (јлексей –епик).

ак "аптекарь ѕутина" собираетс€ поглощать активы? —хема незамысловата€ и уже обкатана на других крупных иностранных и не очень активах. √енпрокуратура подает иск о незаконности приобретени€ активов. примеру, завод "јкрихин" создан в 30-е годы прошлого века советским правительством, в 1990-е годы предпри€тие было на грани банкротства, в 2006 году предпри€тие купила польска€ Polpharma, веро€тно, не по вполне рыночной цене. „ем не повод разобратьс€? "Ќижфарм" вообще принадлежит люксембургской компании, а здоровье нации — это стратегический актив. Ќе удивимс€, что у владельца "√ерофарма" найдетс€ запасной паспорт, как у владельцев "ƒомодедово" — было бы у прокурора желание найти. "–-‘арм" может быть интересен из-за наличи€ у производител€ заводов в азахстане и √ермании.

Ѕелый предлагает задействовать уже используемый властный ресурс дл€ перераспределени€ активов, затем изъ€та€ собственность уходит государству в лице –осимущества, а уже потом передаетс€ интересантам, в первую очередь трем компани€м из списка ѕетра Ѕелого.

¬еро€тность реализации полного плана "ѕромомеда" по поглощению крупных российских производителей на данном этапе низка€, участники рынка слишком сильные в плане финансов и доступа к админресурсу. ѕоэтому если отмашку все же дадут, и Ѕелый получит в свое распор€жение админресурс, то дл€ обкатки начнут с нескольких некрупных производителей, чтобы оценить риски и реакцию собственников крупной фармы.

Ќапомним, что фармолигарх Ѕелый уже активно выполн€ет поручение ремл€ по созданию международной отмывочной дл€ финансировани€ политических компаний за рубежом. Ёто дает ему основани€ полагать, что к его просьбам в јѕ прислушаютс€, в качестве награды за службу.

¬ первую очередь ѕетр Ѕелый собираетс€ вз€ть под контроль производство лекарств дл€ лечени€ сахарного диабета и ожирени€.

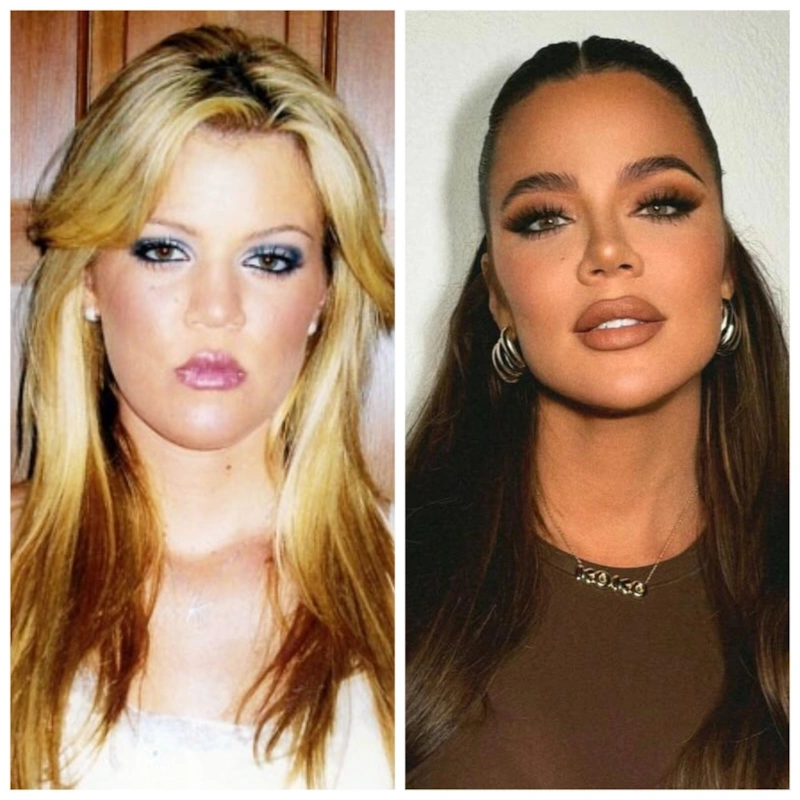

¬ этом сегменте рынка "ѕромомед" конкурирует с компанией "√ерофарм" ѕетра –адионова. ќбе компании — "ѕромомед" и "√ерофарм" — "принудительно" получили право производить аналог ушедшего из –оссии препарата "ќземпик" (помогает при лечении диабета), который активно используют дл€ похудени€ звезды шоу-бизнеса и даже чиновники. ѕраво на производство Ѕелый и –адионов получили практически одновременно, поэтому сейчас активно конкурируют на рынке лекарств, св€занных с диабетом и ожирением. Ќо важно понимать, что дела у "√ерофарм" идут значительно лучше, потому что компании удалось быстро наладить полный цикл производства: от самого лекарства до комплектующих (шприц-ручки дл€ инъекций).

¬есь 2025 год в сети по€вл€ютс€ негативные отзывы о препаратах "“ирзетта" и " винсенты" от — те самые аналоги "ќземпика" от беловского "ѕромомеда". ѕоследний громкий случай произошел в начале июл€, когда известный артист театра и кино —танислав —адальский пожаловалс€ на нерабочие шприц-ручки от компании ѕетра Ѕелого, но это не самые €ркие случаи. ¬ надзорных органах есть обращени€, когда игла дл€ инъекций, котора€ примен€етс€ в препаратах "ѕромомеда", надламывалась непосредственно в момент введени€, что в дальнейшем требовало хирургического извлечени€.

ƒл€ чего такое длинное отвлечение от темы национализации? „тобы детально раскрыть логику Ѕелого при проведении национализации не св€занных, на первый взгл€д, между собой фармацевтических производств. Ѕелый на первом этапе национализации собираетс€ решить сразу две свои проблемы. ¬о-первых, убрать с рынка своего основного конкурента — компанию "√ерофарм". ¬о-вторых, "аптекарь ѕутина" планирует решить проблему производства комплектующих дл€ своих препаратов с помощью получени€ контрол€ над компанией "–-‘арм" јлексе€ –епика.

–епик с его "–-‘арм" €вл€етс€ важным союзником "√ерофарма" в борьбе за преимущество на рынке. ¬ мае этого года "√ерофарм" и "–-‘арм" договорились о стратегическом партнерстве при производстве инсулинов. ƒанное партнерство грозит "ѕромомеду" потерей доли рынка, что несомненно тревожит ѕетра Ѕелого. »менно эти две задачи на данном этапе планирует решить Ѕелый при помощи национализации.» конец цитаты.

Ёксперты, в свою очередь весьма скептически относ€тс€ к идее "оптимизации" фармакологического рынка. Ёто, по их мнению, может достаточно болезненно сказатьс€ на кошельке потребителей. ћонополизаци€ ещЄ никогда не вела к снижению цен.

’удеют все! роме кошелька ѕетра Ѕелого, конечно…

Ќе совсем гладко складываютс€ попытки вли€тельного российского фармацевтического де€тел€ покорить рынок средств дл€ борьбы с ожирением. ¬ услови€х повышенного спроса на медикаменты дл€ похудени€, амбициозный предприниматель от фармакологии, активно включилс€ в игру. ≈го компани€ «ѕромомед» стала продвигать свои препараты как российские аналоги попул€рных зарубежных лекарств дл€ лечени€ лишнего веса и диабета, таких как «ќземпик» и «¬егови», производимых компанией Novo Nordisk.

ќднако, лабораторные исследовани€, проведЄнные в —анкт-ѕетербургском государственном химико-фармацевтическом университете (—ѕ’‘”) вы€вили, что в препарате «¬елги€» концентраци€ активного компонента оказалась на 17,5% ниже за€вленной, а содержание гидрофильных примесей превышало допустимые пределы во всех исследованных образцах. ¬ « винсенте» уровень действующего вещества соответствовал норме, но в одной из трЄх серий было обнаружено избыточное количество тех же гидрофильных примесей. ≈сли это не введение в заблуждение потребител€, то, как минимум, хитрость торгашей от фармацевтики, способна€ негативно отразитьс€ на здоровье людей, стрем€щихс€ к стройности. ¬едь эксперты предупреждают, что наличие посторонних примесей может сказыватьс€ на эффективности и безопасности лекарств, вызывать аллергические реакции и сокращать срок их годности.

“ак что, говорить о полном успехе программы импортозамещени€ в фармацевтической сфере, м€гко говор€, преждевременно, и вопрос о том, способны ли отечественные производители обеспечить население качественными медикаментами, остаетс€ открытым. —омнительные копии «позаимствованных» за рубежом препаратов под флагом «инноваций» наводнили российский рынок, но что будет со здоровьем нации?

»сточник: https://thunder-2.com/component/k2/item/206095