Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

IEA: oil prices to remain boxed in |

According to the International Energy Agency (IEA), oil prices are not likely to soar in the nearest future due to shrinking demand for the commodity and its surplus in the world markets.

Recently, oil demand has significantly lowered, and this tendency will continue, IEA Executive Director Fatih Birol said. Currently, the IEA is revising its outlook for growth in global oil demand in 2019. The new forecast considers the production of up to 1.1 million barrels per day. However, the reading may decline further if the global economy shows signs of weakening.

Last year, the IEA specialists reported that oil demand would rise by 1.5 million barrels per day in 2019. In June, the agency had to lower its estimate to 1.2 million barrels per day. The IEA experts believe that the decrease in oil demand was triggered by rising global tensions which influence the oil market.

Read more: https://www.mt5.com/forex_humor/image/42391

|

Метки: #forex_caricature |

IEA: oil prices to remain boxed in |

According to the International Energy Agency (IEA), oil prices are not likely to soar in the nearest future due to shrinking demand for the commodity and its surplus in the world markets.

Recently, oil demand has significantly lowered, and this tendency will continue, IEA Executive Director Fatih Birol said. Currently, the IEA is revising its outlook for growth in global oil demand in 2019. The new forecast considers the production of up to 1.1 million barrels per day. However, the reading may decline further if the global economy shows signs of weakening.

Last year, the IEA specialists reported that oil demand would rise by 1.5 million barrels per day in 2019. In June, the agency had to lower its estimate to 1.2 million barrels per day. The IEA experts believe that the decrease in oil demand was triggered by rising global tensions which influence the oil market.

Read more: https://www.mt5.com/forex_humor/image/42391

|

Метки: #forex_caricature |

Top 7 countries with record-high volume of private capital |

Experts from New World Wealth estimated that in 2019 the list of countries with the world's largest volumes of private capital continued to expand. In 2018, the global indicator of personal capital rose to $204 trillion, which is 74% of the world average. Analysts presented the list of seven countries with the most impressive money supply

The United States

The record holder in terms of the volume of private capital turned out to be the United States, the largest economy in the world. In 2018, the private capital amounted to $60.7 trillion. Americans own about 40% of the total world wealth. The United States occupies leading positions in the world on a number of socio-economic indicators, including average wages, GDP per capita, and labor productivity.

China

China is the world leader in production of many types of manufactured goods, including automobiles. It occupies the second line in the ranking of states with the largest private wealth. Experts call the country a "factory floor of the world", considering it to be the largest global exporter. In 2018, the volume of private capital in China achieved $23.6 trillion.

Japan

The third line in the ranking of countries with great private capital is taken by the Land of the Rising Sun. Japan has a very high standard of living and one of the lowest infant mortality rate. Being a great economic power, the state is ranked third in the world in terms of nominal GDP and fourth in terms of purchasing power parity.

Great Britain

The United Kingdom is in the fourth place among the nations with an impressive volume of personal capital. The country's service industry is a key sector of the economy and accounts for approximately 75% of GDP. London, Great Britain, is one of the biggest economic and financial hubs. The country has earned a reputation of a global center of money-laundering due to such factors as a well-developed banking sector and liberal legislation.

Germany

Germany occupies the fifth line of the ranking. This is a highly developed country with a very high standard of living. Being a world leader in most industrial and technological sectors, Germany is recognized as the third largest exporter and importer of goods in the world. The German authorities support social security and a universal health care system, as well as environmental protection and free higher education.

India

The sixth place among countries with a record volume of private capital goes to India. Over the past two decades, its economy has grown at a steady pace. Nevertheless, the economic recovery has not been equitable. Due to the presence of a large number of English-speaking specialists, India has recently become an outsourcing area for many multinational corporations and a popular object of medical tourism. The country has emerged as a major exporter of software, as well as financial and technological services.

Australia

Australia closes the top 7 countries with a record volume of private capital. The green continent is ranked sixth in the world in terms of GDP per capita. The Australian economy is dominated by the services sector, which is about 68% of the country's GDP. The mining sector accounts for 10% of GDP; while about 9% of GDP come from industries related to mining. The economic growth of Australia is highly dependent on the mining and agricultural sectors.

|

Метки: #photo_news |

Top 7 countries with record-high volume of private capital |

Experts from New World Wealth estimated that in 2019 the list of countries with the world's largest volumes of private capital continued to expand. In 2018, the global indicator of personal capital rose to $204 trillion, which is 74% of the world average. Analysts presented the list of seven countries with the most impressive money supply

The United States

The record holder in terms of the volume of private capital turned out to be the United States, the largest economy in the world. In 2018, the private capital amounted to $60.7 trillion. Americans own about 40% of the total world wealth. The United States occupies leading positions in the world on a number of socio-economic indicators, including average wages, GDP per capita, and labor productivity.

China

China is the world leader in production of many types of manufactured goods, including automobiles. It occupies the second line in the ranking of states with the largest private wealth. Experts call the country a "factory floor of the world", considering it to be the largest global exporter. In 2018, the volume of private capital in China achieved $23.6 trillion.

Japan

The third line in the ranking of countries with great private capital is taken by the Land of the Rising Sun. Japan has a very high standard of living and one of the lowest infant mortality rate. Being a great economic power, the state is ranked third in the world in terms of nominal GDP and fourth in terms of purchasing power parity.

Great Britain

The United Kingdom is in the fourth place among the nations with an impressive volume of personal capital. The country's service industry is a key sector of the economy and accounts for approximately 75% of GDP. London, Great Britain, is one of the biggest economic and financial hubs. The country has earned a reputation of a global center of money-laundering due to such factors as a well-developed banking sector and liberal legislation.

Germany

Germany occupies the fifth line of the ranking. This is a highly developed country with a very high standard of living. Being a world leader in most industrial and technological sectors, Germany is recognized as the third largest exporter and importer of goods in the world. The German authorities support social security and a universal health care system, as well as environmental protection and free higher education.

India

The sixth place among countries with a record volume of private capital goes to India. Over the past two decades, its economy has grown at a steady pace. Nevertheless, the economic recovery has not been equitable. Due to the presence of a large number of English-speaking specialists, India has recently become an outsourcing area for many multinational corporations and a popular object of medical tourism. The country has emerged as a major exporter of software, as well as financial and technological services.

Australia

Australia closes the top 7 countries with a record volume of private capital. The green continent is ranked sixth in the world in terms of GDP per capita. The Australian economy is dominated by the services sector, which is about 68% of the country's GDP. The mining sector accounts for 10% of GDP; while about 9% of GDP come from industries related to mining. The economic growth of Australia is highly dependent on the mining and agricultural sectors.

|

Метки: #photo_news |

EU to support countries that may suffer from hard Brexit |

If the United Kingdom left the European Union with no deal, the currency bloc would help those countries that would suffer the most from the consequences of such an exit, official representative of the European Commission Natasha Berto said.

The European Commission stands ready to provide support to all EU countries where repercussions of the hard Brexit can be felt. Natasha Berto noted that the EU was assessing its funds and programs that could be used in this situation.

At the same time, the EC representative stated that the currency bloc would not be able to support the economic sectors of some EU countries if Brexit brought serious problems. The European Commission would do its best to find mutually beneficial solutions, Ms Berto outlined.

Read more: https://www.mt5.com/forex_humor/image/42357

|

Метки: #forex_caricature |

Three pitfalls in trader's work |

Most market participants know that for successful trading it is necessary to comply with a number of rules in addition to continuous and careful analysis of the current situation. Ignoring the basics of trading psychology can lead to unfortunate consequences and capital losses. Financial experts warn traders about three main problems that await a speculator in trading.

A trader who aims to join the global financial mainstream and find his place in the world market, encounters three obstacles. Experts recommend that traders deal with them in order to build a successful market strategy. Traders are advised to turn these weaknesses into strengths, which will enable them to pave the quickest way towards success and financial health.

Perfectionism

This characteristic trait forces traders to pursue elusive ideals instead of focusing on achieving realistic goals. When it is impossible to achieve the required level of effectiveness, perfectionists engage in excessive self-criticism. They have to work hard to feel competent. When a perfectionist profits from a deal, he/she thinks of lost opportunities instead of enjoying the win. His/her efforts are aimed at finding mistakes and failures, which distracts from the trading process and the search for optimal solutions in the future.

Egocentrism

Our weaknesses including egocentrism do not benefit trading. In case of failure, it undermines the whole work. If a deal is profitable, a trader is proud of himself. But if the deal is loss-making, he/she is likely to face an emotional breakdown. This has a negative effect on the trading process. Experts point out that a successful trader focuses on the very deal, while a self-centered trader focuses on its profitability. Egocentrism is destructive to a trader and forces him/her to open inappropriate deals just to regain losses.

Overconfidence

Overconfidence is a great challenge for speculators in trading. It is based on a lack of understanding of the market complexity and an underestimation of their features. Self-confident traders are not serious about the market. They do not want to gradually move towards success. Such players do not wait for their first stable results. On the contrary, they try to make large deals and reap profits right here, right now. As a result, they make impulsive decisions and destroy the developed strategy. A distinctive feature of self-confident traders is hectic trading, which does not include the analysis of the current state of the market.

Bonus: helping hand

Having identified problems, experts suggest different ways of dealing with them. Traders should stop focusing on themselves and concentrate entirely on the market. It is necessary to interpret stock exchange information correctly and make effective decisions. To do this, speculators need to be fully immersed in the market flow and be able to read its signals. A serious mistake in trading is to take everything personally and think about the results, neglecting the process. Traders should not build self-esteem only on the basis of winning and losing deals. Balanced life promotes balanced trading, experts sum up.

|

Метки: #photo_news |

Major companies abandon IPO |

The tense situation in the global financial market forced a lot of the world's leading companies to abandon the initial public offering (IPO). Experts tried to look into the reasons for this tendency.

Anheuser Busch Inbev, the largest brewing company, shelved plans for an IPO of its Asian unit. The amount of the transaction was estimated at $8 billion. The company's management considered the current situation in the global market to be extremely unfavorable for holding an initial public offering.

The example of Anheuser Busch Inbev was followed by other companies: the Swiss insurance giant Swiss Re put on hold the public listing of its UK subsidiary, ReAssure, which would give more than $3.5 billion. The Swiss insurer cited a severe market situation as well as weakening demand.

Both companies have different areas of activity, but the reason for the abandonment is the same, analysts point out. They believe that changing plans of both companies will have different consequences. As for Swiss Re, it is likely to make the situation even more complicated, while the AB Inbev brewer will probably attract greater attention in the short term. According to experts, the management of AB Inbev had reasonable grounds for considering postponing the IPO. Notably, the profitability of the brewing company depends on the exchange rate, given that most of its $110 billion debt load is denominated in dollars, and the lion's share of its sales accounts for emerging markets. At the moment, the Federal Reserve is planning to ease monetary policy, and the currencies of emerging economies are strengthening. In this regard, the management of AB Inbev decided to take some time off, so as not to lose in the long term, experts think.

Read more: https://www.mt5.com/forex_humor/image/42285

|

Метки: #forex_caricature |

Major companies abandon IPO |

The tense situation in the global financial market forced a lot of the world's leading companies to abandon the initial public offering (IPO). Experts tried to look into the reasons for this tendency.

Anheuser Busch Inbev, the largest brewing company, shelved plans for an IPO of its Asian unit. The amount of the transaction was estimated at $8 billion. The company's management considered the current situation in the global market to be extremely unfavorable for holding an initial public offering.

The example of Anheuser Busch Inbev was followed by other companies: the Swiss insurance giant Swiss Re put on hold the public listing of its UK subsidiary, ReAssure, which would give more than $3.5 billion. The Swiss insurer cited a severe market situation as well as weakening demand.

Both companies have different areas of activity, but the reason for the abandonment is the same, analysts point out. They believe that changing plans of both companies will have different consequences. As for Swiss Re, it is likely to make the situation even more complicated, while the AB Inbev brewer will probably attract greater attention in the short term. According to experts, the management of AB Inbev had reasonable grounds for considering postponing the IPO. Notably, the profitability of the brewing company depends on the exchange rate, given that most of its $110 billion debt load is denominated in dollars, and the lion's share of its sales accounts for emerging markets. At the moment, the Federal Reserve is planning to ease monetary policy, and the currencies of emerging economies are strengthening. In this regard, the management of AB Inbev decided to take some time off, so as not to lose in the long term, experts think.

Read more: https://www.mt5.com/forex_humor/image/42285

|

Метки: #forex_caricature |

Five Russian cities with most active investors |

According to the data provided by experts from the Russian Standard Bank, the situation on the deposit market is as follows: Russian investors give preference to the national currency. A small percentage of Russian citizens keep their savings in the US and European currencies. Experts analyzed the geography of investments in the Russian Federation and highlighted five cities where the population is more active in terms of personal savings

Moscow

As the data from the Russian Standard Bank show, citizens of the capital of the Russian Federation are the most advanced in terms of personal savings. The most popular deposits among Moscow residents are ruble. The amount of deposits in euros fell by 22%, while in US dollars rose by 3.4%. The increase of deposits in rubles was 15.5%, experts noted.

St. Petersburg

The second place in terms of deposits and activity of the population goes to Saint Petersburg. According to analysts, the residents of St. Petersburg have more opportunities for income growth with small risks, for example, when buying a particular currency. As noted by the bank's experts, this factor is important for 13% of the respondents.

Nizhny Novgorod

The third place in the ranking of Russian Standard Bank is occupied by Nizhny Novgorod. The majority of the population, namely 69% of the respondents, prefer guaranteed income, for example, ruble deposits at favorable rates. Citizens of other regions of the Russian Federation follow this approach.

Samara

Samara takes the fourth place in the list of Russian cities with the most advanced investors. In this city, as well as in other megacities, there is a tendency among retirees to hold deposits. Many citizens of the Russian Federation are interested in long-term investment such as buying an apartment and its subsequent renting.

Voronezh

Voronezh closes the top 5 Russian cities with the most active investors. Projections of the Russian Standard Bank analysts indicate that the outflow of deposits into the national currency is expected in the near future. In the present situation, the rates for ruble deposits, in contrast to foreign currency deposits, are above the inflation rate. This offers the possibility not only to save money but also to increase savings due to returns on deposits, experts remind.

|

Метки: #photo_news |

Five Russian cities with most active investors |

According to the data provided by experts from the Russian Standard Bank, the situation on the deposit market is as follows: Russian investors give preference to the national currency. A small percentage of Russian citizens keep their savings in the US and European currencies. Experts analyzed the geography of investments in the Russian Federation and highlighted five cities where the population is more active in terms of personal savings

Moscow

As the data from the Russian Standard Bank show, citizens of the capital of the Russian Federation are the most advanced in terms of personal savings. The most popular deposits among Moscow residents are ruble. The amount of deposits in euros fell by 22%, while in US dollars rose by 3.4%. The increase of deposits in rubles was 15.5%, experts noted.

St. Petersburg

The second place in terms of deposits and activity of the population goes to Saint Petersburg. According to analysts, the residents of St. Petersburg have more opportunities for income growth with small risks, for example, when buying a particular currency. As noted by the bank's experts, this factor is important for 13% of the respondents.

Nizhny Novgorod

The third place in the ranking of Russian Standard Bank is occupied by Nizhny Novgorod. The majority of the population, namely 69% of the respondents, prefer guaranteed income, for example, ruble deposits at favorable rates. Citizens of other regions of the Russian Federation follow this approach.

Samara

Samara takes the fourth place in the list of Russian cities with the most advanced investors. In this city, as well as in other megacities, there is a tendency among retirees to hold deposits. Many citizens of the Russian Federation are interested in long-term investment such as buying an apartment and its subsequent renting.

Voronezh

Voronezh closes the top 5 Russian cities with the most active investors. Projections of the Russian Standard Bank analysts indicate that the outflow of deposits into the national currency is expected in the near future. In the present situation, the rates for ruble deposits, in contrast to foreign currency deposits, are above the inflation rate. This offers the possibility not only to save money but also to increase savings due to returns on deposits, experts remind.

|

Метки: #photo_news |

China keen to knock USD off its pedestal |

The US is holding the upper hand in the full-blown trade war with China. Nevertheless, luck is on China’s side when it comes to the national currency. The Chinese yuan benefits from the protracted battle of tariffs. In an effort to avoid the US protectionism in trade, some countries make agreements with their trade partners to use national currencies in cross-border payments. In this context, the renminbi seems to have bright prospects. Pan Gongsheng, Deputy Governor at People's Bank of China, expresses optimism about the yuan’s future in the global trade. “It is necessary to actively and steadily promote renminbi internationalization and enhance the confidence of overseas entities in holding and using the currency,” the top official said. In other words, Beijing has set an ambitious goal of the yuan’s leadership on a global scale that will squeeze the US dollar out of international transactions. Nevertheless, the actual state of affairs differs greatly from loud statements of policymakers.

At present, the US dollar remains an indisputable leader in any international settlements. According to impartial statistics, the share of the yuan in global financial transactions hardly makes up 2%. The only year when the Chinese yuan managed to exceed 2% was 2015. The renminbi’s share reached the record 2.79% as the International Monetary Fund decided to include the yuan in the special drawing rights basket alongside other major currencies like the US dollar, the euro, the pound sterling, and the yen. So, it is too early to talk about the time when countries worldwide will state invoice prices in the yuan.

Read more: https://www.mt5.com/forex_humor/image/42321

|

Метки: #forex_caricature |

Top 10 most active and dangerous world’s volcanoes |

There are several active volcanoes in the world that fascinate with their beauty but frighten with their destructive power. Nowadays, large-scale volcanic eruptions are relatively rare. They are carefully monitored by experts. However, volcanoes still pose a threat for people living nearby. See the top 10 most dangerous volcanoes in the world in our photo gallery

Mauna Loa (US, Hawaii)

Mauna Loa is one of the largest volcanoes in the world. It surpasses others in both mass and volume. Mauna Loa is one of five volcanoes that form the Island of Hawaii in the US. According to scientists, this active volcano erupts around 700 thousand years. The last eruption occurred in the late twentieth century, from March 24 to April 15, 1984.

Yellowstone Caldera (US)

Scientists believe that the Yellowstone Caldera is the most dangerous among the active volcanoes. The volume of its lava output rate can be more than 1,000 cubic kilometers that cause severe destruction. Super-eruptions of volcanoes usually affect huge areas. Many species of animals and plants become extinct due to such disasters. Some specialists assume that super-eruption may be one of the reasons for the death of civilization as the eruption of such volcanoes triggers a chain reaction. It evokes the activity of other volcanoes which leads to tectogenesis.

Vesuvius (Italy)

Mount Vesuvius is located in Italy, about 9 km east of Naples. It is the only volcano in Europe that has been erupting for the past hundred years. The last eruption was recorded in 1944. Nowadays, Vesuvius is one of the most destructive volcanoes in the world. Researchers are also concerned about three million people living near the volcano.

Popocat'epetl (Mexico)

It is one of the highest active volcanoes in Mexico. Its height reaches 5,426 m. Residents of Puebla, 40 km east of the volcano, can enjoy the view of the snow-covered and glacier-covered mountain. The last major eruption was recorded in 2000. Fortunately, scientists had warned about the eruption in advance and residents were evacuated from the disaster area.

Merapi (Indonesia)

Merapi is the most famous among the active volcanoes in Indonesia. Eruptions are regularly recorded in this area. The volcano has been active since 1548, i.e. for 10 thousand years. It is located near the city of Yogyakarta. Nowadays, thousands of people live on the slopes of Mount Merapi despite scientists' warnings.

Sakurajima (Japan)

It is an active composite volcano located in Japan. In the past, Sakurajima was an island often called the Vesuvius of the east. Eruptions are permanently registered on its territory. Due to volcanic ash left after the eruption, highlands of white sand were formed in this region. The volcano is hazardous because of its location in a densely populated area. It is situated near the city of Kagoshima that alarms scientists.

Galeras (Colombia)

According to scientists, Galeras has been active for a million years. It is located in southern Colombia near the border with Ecuador. Volcanic eruptions are like waves: periods of calm are replaced by periods of storms. In 1988, after a 10-year quiet period, Galeras woke up again. A 1993 eruption killed nine people, six scientists, and three tourists who were heading towards the volcano's crater as part of a scientific expedition. The rapid and unexpected eruption of the volcano took their lives.

Nyiragongo (Congo)

It is one of the most active volcanoes in Africa and one of the eight volcanoes located in the Virunga mountains. Since 1882, Nyiragongo has erupted at least 34 times. The last most destructive eruption was on 17 January 2002. Back then, hot lava destroyed 40% of the city of Goma.

Ulawun (Papua New Guinea)

Ulawun is the most active volcano in Papua New Guinea. Moreover, it is the highest volcano in the Bismarck archipelago. The first recorded eruption of Ulawun occurred in 1700. Overall, there have been 22 volcanic eruptions. Today, several thousand people live near this volcano. During a major eruption in 1980, volcanic ash emissions reached a height of 18 km. The disaster devastated an area of 20 square kilometers.

Taal (Philippines)

This large active volcano is located on the island of Luzon. It is 50 km from Manila, the capital of the Philippines. Taal is one of the active Philippine volcanoes which is part of the Pacific Ring of Fire. The volcano has erupted several times causing loss of life and destruction on the island. The last eruption occurred in 1977. Signs of its activity have been regularly observed since 1991. According to scientists, sometimes eruptions lead to small seismic fractures.

|

Метки: #photo_news |

Major companies abandon IPO |

The tense situation in the global financial market forced a lot of the world's leading companies to abandon the initial public offering (IPO). Experts tried to look into the reasons for this tendency.

Anheuser Busch Inbev, the largest brewing company, shelved plans for an IPO of its Asian unit. The amount of the transaction was estimated at $8 billion. The company's management considered the current situation in the global market to be extremely unfavorable for holding an initial public offering.

The example of Anheuser Busch Inbev was followed by other companies: the Swiss insurance giant Swiss Re put on hold the public listing of its UK subsidiary, ReAssure, which would give more than $3.5 billion. The Swiss insurer cited a severe market situation as well as weakening demand.

Both companies have different areas of activity, but the reason for the abandonment is the same, analysts point out. They believe that changing plans of both companies will have different consequences. As for Swiss Re, it is likely to make the situation even more complicated, while the AB Inbev brewer will probably attract greater attention in the short term. According to experts, the management of AB Inbev had reasonable grounds for considering postponing the IPO. Notably, the profitability of the brewing company depends on the exchange rate, given that most of its $110 billion debt load is denominated in dollars, and the lion's share of its sales accounts for emerging markets. At the moment, the Federal Reserve is planning to ease monetary policy, and the currencies of emerging economies are strengthening. In this regard, the management of AB Inbev decided to take some time off, so as not to lose in the long term, experts think.

Read more: https://www.mt5.com/forex_humor/image/42285

|

Метки: #forex_caricature |

Top 7 countries with record-high volume of private capital |

Experts from New World Wealth estimated that in 2019 the list of countries with the world's largest volumes of private capital continued to expand. In 2018, the global indicator of personal capital rose to $204 trillion, which is 74% of the world average. Analysts presented the list of seven countries with the most impressive money supply

The United States

The record holder in terms of the volume of private capital turned out to be the United States, the largest economy in the world. In 2018, the private capital amounted to $60.7 trillion. Americans own about 40% of the total world wealth. The United States occupies leading positions in the world on a number of socio-economic indicators, including average wages, GDP per capita, and labor productivity.

China

China is the world leader in production of many types of manufactured goods, including automobiles. It occupies the second line in the ranking of states with the largest private wealth. Experts call the country a "factory floor of the world", considering it to be the largest global exporter. In 2018, the volume of private capital in China achieved $23.6 trillion.

Japan

The third line in the ranking of countries with great private capital is taken by the Land of the Rising Sun. Japan has a very high standard of living and one of the lowest infant mortality rate. Being a great economic power, the state is ranked third in the world in terms of nominal GDP and fourth in terms of purchasing power parity.

Great Britain

The United Kingdom is in the fourth place among the nations with an impressive volume of personal capital. The country's service industry is a key sector of the economy and accounts for approximately 75% of GDP. London, Great Britain, is one of the biggest economic and financial hubs. The country has earned a reputation of a global center of money-laundering due to such factors as a well-developed banking sector and liberal legislation.

Germany

Germany occupies the fifth line of the ranking. This is a highly developed country with a very high standard of living. Being a world leader in most industrial and technological sectors, Germany is recognized as the third largest exporter and importer of goods in the world. The German authorities support social security and a universal health care system, as well as environmental protection and free higher education.

India

The sixth place among countries with a record volume of private capital goes to India. Over the past two decades, its economy has grown at a steady pace. Nevertheless, the economic recovery has not been equitable. Due to the presence of a large number of English-speaking specialists, India has recently become an outsourcing area for many multinational corporations and a popular object of medical tourism. The country has emerged as a major exporter of software, as well as financial and technological services.

Australia

Australia closes the top 7 countries with a record volume of private capital. The green continent is ranked sixth in the world in terms of GDP per capita. The Australian economy is dominated by the services sector, which is about 68% of the country's GDP. The mining sector accounts for 10% of GDP; while about 9% of GDP come from industries related to mining. The economic growth of Australia is highly dependent on the mining and agricultural sectors.

|

Метки: #photo_news |

Top 7 countries with record-high volume of private capital |

Experts from New World Wealth estimated that in 2019 the list of countries with the world's largest volumes of private capital continued to expand. In 2018, the global indicator of personal capital rose to $204 trillion, which is 74% of the world average. Analysts presented the list of seven countries with the most impressive money supply

The United States

The record holder in terms of the volume of private capital turned out to be the United States, the largest economy in the world. In 2018, the private capital amounted to $60.7 trillion. Americans own about 40% of the total world wealth. The United States occupies leading positions in the world on a number of socio-economic indicators, including average wages, GDP per capita, and labor productivity.

China

China is the world leader in production of many types of manufactured goods, including automobiles. It occupies the second line in the ranking of states with the largest private wealth. Experts call the country a "factory floor of the world", considering it to be the largest global exporter. In 2018, the volume of private capital in China achieved $23.6 trillion.

Japan

The third line in the ranking of countries with great private capital is taken by the Land of the Rising Sun. Japan has a very high standard of living and one of the lowest infant mortality rate. Being a great economic power, the state is ranked third in the world in terms of nominal GDP and fourth in terms of purchasing power parity.

Great Britain

The United Kingdom is in the fourth place among the nations with an impressive volume of personal capital. The country's service industry is a key sector of the economy and accounts for approximately 75% of GDP. London, Great Britain, is one of the biggest economic and financial hubs. The country has earned a reputation of a global center of money-laundering due to such factors as a well-developed banking sector and liberal legislation.

Germany

Germany occupies the fifth line of the ranking. This is a highly developed country with a very high standard of living. Being a world leader in most industrial and technological sectors, Germany is recognized as the third largest exporter and importer of goods in the world. The German authorities support social security and a universal health care system, as well as environmental protection and free higher education.

India

The sixth place among countries with a record volume of private capital goes to India. Over the past two decades, its economy has grown at a steady pace. Nevertheless, the economic recovery has not been equitable. Due to the presence of a large number of English-speaking specialists, India has recently become an outsourcing area for many multinational corporations and a popular object of medical tourism. The country has emerged as a major exporter of software, as well as financial and technological services.

Australia

Australia closes the top 7 countries with a record volume of private capital. The green continent is ranked sixth in the world in terms of GDP per capita. The Australian economy is dominated by the services sector, which is about 68% of the country's GDP. The mining sector accounts for 10% of GDP; while about 9% of GDP come from industries related to mining. The economic growth of Australia is highly dependent on the mining and agricultural sectors.

|

Метки: #photo_news |

Top 7 countries with record-high volume of private capital |

Experts from New World Wealth estimated that in 2019 the list of countries with the world's largest volumes of private capital continued to expand. In 2018, the global indicator of personal capital rose to $204 trillion, which is 74% of the world average. Analysts presented the list of seven countries with the most impressive money supply

The United States

The record holder in terms of the volume of private capital turned out to be the United States, the largest economy in the world. In 2018, the private capital amounted to $60.7 trillion. Americans own about 40% of the total world wealth. The United States occupies leading positions in the world on a number of socio-economic indicators, including average wages, GDP per capita, and labor productivity.

China

China is the world leader in production of many types of manufactured goods, including automobiles. It occupies the second line in the ranking of states with the largest private wealth. Experts call the country a "factory floor of the world", considering it to be the largest global exporter. In 2018, the volume of private capital in China achieved $23.6 trillion.

Japan

The third line in the ranking of countries with great private capital is taken by the Land of the Rising Sun. Japan has a very high standard of living and one of the lowest infant mortality rate. Being a great economic power, the state is ranked third in the world in terms of nominal GDP and fourth in terms of purchasing power parity.

Great Britain

The United Kingdom is in the fourth place among the nations with an impressive volume of personal capital. The country's service industry is a key sector of the economy and accounts for approximately 75% of GDP. London, Great Britain, is one of the biggest economic and financial hubs. The country has earned a reputation of a global center of money-laundering due to such factors as a well-developed banking sector and liberal legislation.

Germany

Germany occupies the fifth line of the ranking. This is a highly developed country with a very high standard of living. Being a world leader in most industrial and technological sectors, Germany is recognized as the third largest exporter and importer of goods in the world. The German authorities support social security and a universal health care system, as well as environmental protection and free higher education.

India

The sixth place among countries with a record volume of private capital goes to India. Over the past two decades, its economy has grown at a steady pace. Nevertheless, the economic recovery has not been equitable. Due to the presence of a large number of English-speaking specialists, India has recently become an outsourcing area for many multinational corporations and a popular object of medical tourism. The country has emerged as a major exporter of software, as well as financial and technological services.

Australia

Australia closes the top 7 countries with a record volume of private capital. The green continent is ranked sixth in the world in terms of GDP per capita. The Australian economy is dominated by the services sector, which is about 68% of the country's GDP. The mining sector accounts for 10% of GDP; while about 9% of GDP come from industries related to mining. The economic growth of Australia is highly dependent on the mining and agricultural sectors.

|

Метки: #photo_news |

Facebook to be fined $5 bln |

While the authorities of some countries are striving to gain access to personal information and user data in order to control citizens as much as possible, the authorities of other countries, on the contrary, strictly monitor the protection of human rights to confidentiality. A notable exception is the United States where rights and freedoms come first.

Within the court proceedings for allegedly collecting data of 87 million Facebook users, the local Federal Trade Commission has approved a fine of $5 billion against the network. In addition, the company will be limited in its rights to process personal information and must strengthen the protection of stored user data. For now, the main details of the case is not accessible to the public. However, the financial reports of the social network for the first quarter of this year contain information on possible unforeseen expenses in connection with the investigation conducted by the US authorities. The range of loss is estimated at $3-5 billion. Interestingly, in March last year, the management of Facebook reported that the number of users affected by the data leak was 50 million, while in April it was revised to 87 million. Facebook revealed that the data had been harvested by Cambridge Analytica. This company collected the personal data of users of the largest social network through its application and then used it for political advertising purposes. Cambridge Analytica became widely known at the time of the presidential campaign in the United States and the referendum on the 2016 UK's withdrawal from the European Union.

Another problem was Microsoft's search engine Bing. The social network "allowed" Bing to see the names of nearly all users' friends without their consent and also enabled Netflix and Spotify to read users' private messages.

Read more: https://www.mt5.com/forex_humor/image/42298

|

Метки: #forex_caricature |

Top 10 most beautiful temples in world |

There is no better place than temples where people can feel belonging to the divine and sacramental as well as experience the aesthetic pleasure by contemplating the majestic monuments of religion. See the most magnificent of them in our photo gallery

Expiatory Temple of the Holy Family, Barcelona, Spain

The Expiatory Temple of the Holy Family or La Sagrada Fam'ilia is visible from afar: the towers of the fabulous building rise above the city by 170 m. Each of three facades symbolizes a certain milestone in the life of Jesus Christ: birth, death, and resurrection. This temple is a brainchild of Antoni Gaud'i who outpaced his contemporaries with his engineering solutions. He started his work in 1882. Interestingly, the temple was built solely on voluntary donations.

The Catholic temple is notable for its life-size sculptural groups. For many of them, the plaster casts were made. The fantastic interiors and numerous columns with capitals in the form of branches that intertwining cover the arch with a lacy forest web amaze the imagination of a viewer.

Papal Basilica of St. Peter in Vatican

The main residence of the Pope is located on the grave of Apostle Peter executed by Nero. The first altar of the Basilica was built in the fourth century a.d. but the real work began only in the sixteenth century. Such eminent architects as Raphael and Michelangelo were involved in the construction of the building.

The church is crowned with a huge white dome. The area in front of it, framed by a rounded colonnade, can accommodate up to 600 thousand people. This is the main holy place for more than one billion Catholics.

The official opening of St. Peter's Basilica took place in 1626. Until 1990 it was the largest temple complex in the world.

Notre-Dame de Paris, Paris, France

Notre-Dame Cathedral, or Notre-Dame de Paris, was seriously damaged in a fire on April 2019. Nevertheless, it remains an outstanding monument of Gothic architecture. Royal weddings, elegant funeral ceremonies, and even Imperial coronations were often held in this Catholic cathedral, built in the XII-XIV centuries.

About 14 million tourists annually came on the island of Cit'e in the center of Paris attracted not only by sacred relics, picturesque stained glass windows, and terrible gargoyles of Notre-Dame but also by numerous legends.

It was Victor Hugo who made it one of the most world-famous cathedrals having written his prominent novel. Subsequently, many theatrical and film adaptations were based on it.

Cathedral of Vasily the Blessed, Moscow, Russia

St. Basil's Cathedral, built in Moscow in the middle of the 16th century, is one of the most recognizable cathedrals of the Orthodox church. It was built at Ivan the Terrible behest in order to perpetuate the memory of the Kazan campaign.

The Cathedral is a symmetrical group of nine pillar-like churches crowned with onion domes and based on the same foundation. The domes are decorated with many cornices, kokoshniks, windows, and niches. Nowadays, St. Basil's Cathedral is joint ownership of the State Historical Museum and the Russian Orthodox Church.

Church of the Savior on Spilled Blood, Saint Petersburg, Russia

This church is one of the most beautiful cathedrals in Russia. It is an Orthodox Church and a memorial monument at the same time. The church is located in the historical center of Saint Petersburg, on the Griboyedov Canal embankment. It was built on the spot where Russian Emperor Alexander II was murdered.

The theatrical decor of the facade, with mosaics and tiles glittering in the sunlight with different colors, gives this monumental structure a look of a carved box of gems. Many additional details and multi-colored decorated materials only enhance the impression.

Cattedrale di Santa Maria del Fiore, Florence, Italy

The Cattedrale di Santa Maria del Fiore is one of the most important monuments of Italian and world Gothic architecture. It was designed as a cathedral church in the late 13th century. However, it was built and rebuilt until the early 20th century. The Cathedral is included in the list of the monuments of the historic center of Florence and protected by UNESCO.

The reddish dome and the bell tower are visible from almost every corner of the city. At a close distance, you can clearly see the fine facade cladding of colored Italian marble, stained glass windows, mosaics and frescoes, carved doors, and bas-reliefs. It is the world's largest temple with a brick dome.

Wat Rong Khun, Chiang Rai, Thailand

Wat Rong Khun, better known as the White Temple, was built in 1997 on funds of art enthusiast Chalermchai Kositpipat. The architectural complex is a mixture of Buddhist art traditions and modern design solutions.

White marble is used for construction, the interiors are decorated with frescoes and glass mosaics. Each element and architectural form have their own meaning.

Neatly paved paths run around the buildings along which snow-white alabaster sculptures stand. From afar, under the bright rays of the sun, Wat Rong Khun resembles a house from a fairy tale.

Shwedagon Pagoda, Yangon, Myanmar

The Shwedagon pagoda is a giant brick stupa in the shape of a bell. Its lower levels are covered with sheets of gold, and the upper levels and the top are decorated with precious stones.

The impressive building stands at the highest point of Yangon at an altitude of 51 m above the city and rises into the sky for almost 100 m. The main stupa of the pagoda is the oldest in the world: it contains eight hairs of the last earthly incarnation of Buddha and relics of the previous three earthly Buddhas.

The entrance to the pagoda is guarded by mythical creatures. There are 64 small pagodas and chapels nearby. Apart from the Buddha’s monument, the images of the creators of the pagoda, king Okkalana with his mother, were immortalized on one of the walls.

Taj Mahal, Agra, India

The mausoleum-mosque Taj Mahal, included in the list of the New Seven Wonders of the World, amazes tourists with the perfection of architectural forms and interior decoration. It has five domes and four minarets standing on a white marble platform at 74 m. All the splendor of the grandiose buildings symmetrically reflected in the waters of an artificial pond.

The mausoleum was built in the 17th century by Mughal Emperor, Shah Jahan in memory of his beloved wife. In accordance with Islamic religious tradition, the interior of the building is decorated with abstract symbols and lines from the Koran.

Sheikh Zayed Grand Mosque, Abu Dhabi, UAE

Sheikh Zayed bin Sultan al Nahyan's mosque, opened in 2007, bears the name of the first President and founder of the UAE. He was buried in the mosque after his death on November 3, 2004.

The interior of the mosque includes luxurious Iranian carpets and Swarovski chandeliers. It looks as if it were an illustration to the "Tales from the Thousand and One Nights". The building is surrounded by artificial lakes paved with dark floor tiles. The spires of minarets, columns, and domes of the mosque, the main dome reaches 87 m, make an indelible impression.

|

Метки: #photo_news |

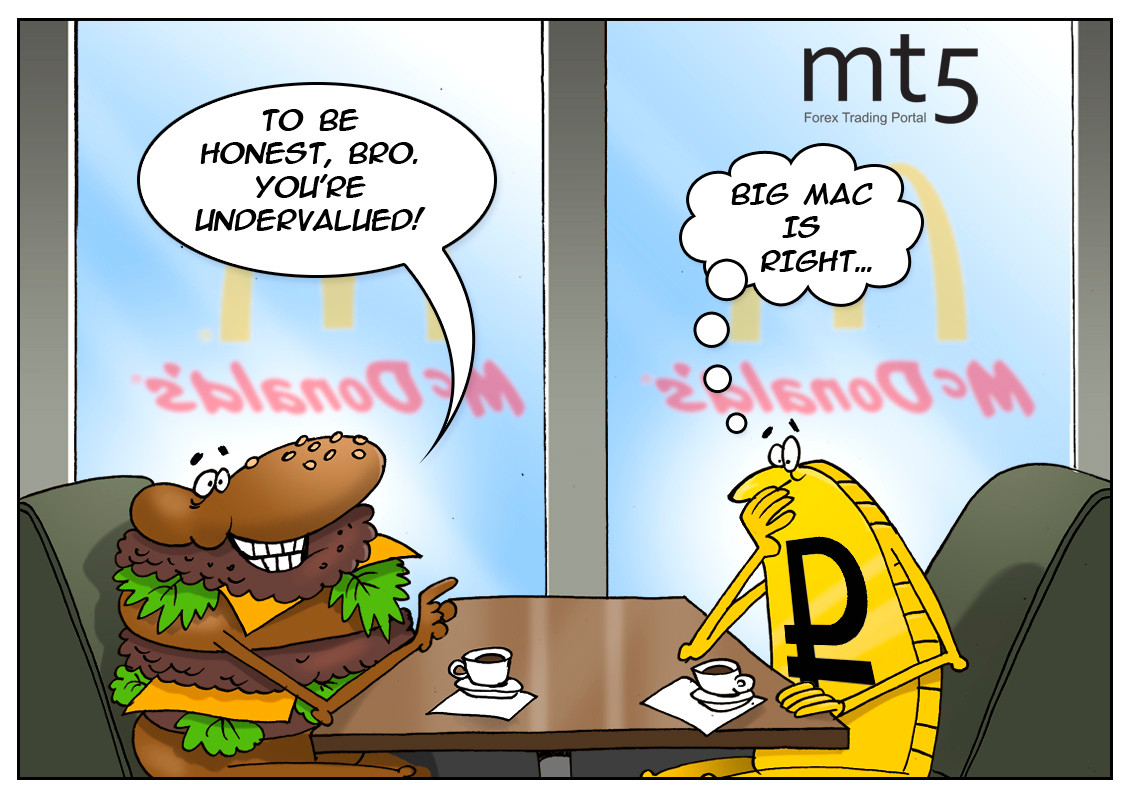

Big Mac Index ranks ruble as most undervalued currency |

The Big Mac survey revealed that the Russian ruble has been the most undervalued currency for the past several years. The Economist published the fresh reading of one of the most controversial indices – the Big Mac index. Starting from 1986, analysts have been employing this unusual method of measuring the purchasing power parity (PPP). As seen in the name, the key tool for assessing the index value is the legendary McDonald's Big Mac. Comparing prices for this burger in different countries, experts try to estimate the actual exchange rate in accordance with the PPP.

In Russia, Big Mac costs about 2 dollars which is shy above 130 rubles while the price of the burger in the United States is 5.74 dollars. Therefore, the Russian currency is undervalued by whooping 70% against the US dollar. The Big Mac index suggests that one dollar should cost 22.65 rubles but the real exchange rate is 63 rubles per dollar. However, banks and currency exchanges use other benchmarks to assess the rates. Such a huge gap can be explained by a significant imbalance in exchange rates. While some currencies are undervalued, others are overvalued. Thus, the Big Mac survey showed that the Swiss franc was overvalued by 19%, being the strongest currency in the rating. In Switzerland, the burger costs almost 8 dollars. According to The Economist, the index can provide an accurate outlook in the long run. Undervalued currencies tend to strengthen in subsequent ten years while overvalued currencies usually weaken. Apart from the Big Mac index, there are also the Latte Index and the borscht index, a gauge for tracking inflation in Russia.

Read more: https://www.mt5.com/forex_humor/image/42262

|

Метки: #forex_caricature |

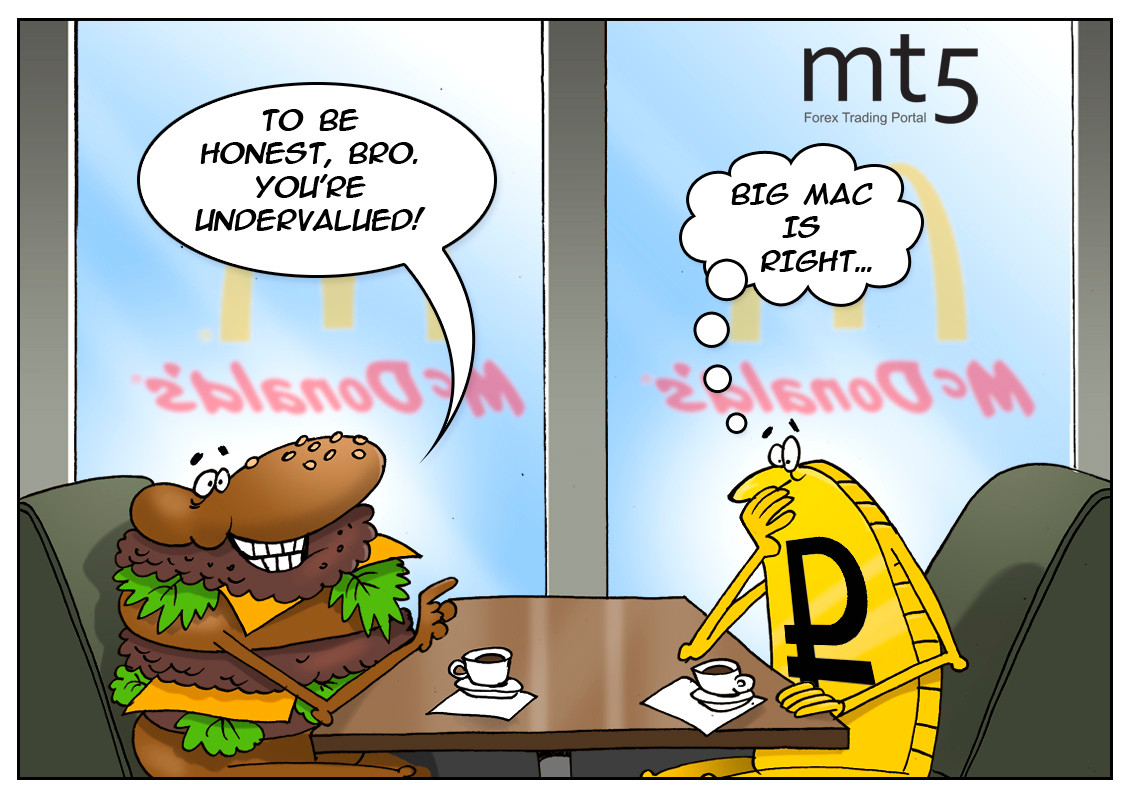

Big Mac Index ranks ruble as most undervalued currency |

The Big Mac survey revealed that the Russian ruble has been the most undervalued currency for the past several years. The Economist published the fresh reading of one of the most controversial indices – the Big Mac index. Starting from 1986, analysts have been employing this unusual method of measuring the purchasing power parity (PPP). As seen in the name, the key tool for assessing the index value is the legendary McDonald's Big Mac. Comparing prices for this burger in different countries, experts try to estimate the actual exchange rate in accordance with the PPP.

In Russia, Big Mac costs about 2 dollars which is shy above 130 rubles while the price of the burger in the United States is 5.74 dollars. Therefore, the Russian currency is undervalued by whooping 70% against the US dollar. The Big Mac index suggests that one dollar should cost 22.65 rubles but the real exchange rate is 63 rubles per dollar. However, banks and currency exchanges use other benchmarks to assess the rates. Such a huge gap can be explained by a significant imbalance in exchange rates. While some currencies are undervalued, others are overvalued. Thus, the Big Mac survey showed that the Swiss franc was overvalued by 19%, being the strongest currency in the rating. In Switzerland, the burger costs almost 8 dollars. According to The Economist, the index can provide an accurate outlook in the long run. Undervalued currencies tend to strengthen in subsequent ten years while overvalued currencies usually weaken. Apart from the Big Mac index, there are also the Latte Index and the borscht index, a gauge for tracking inflation in Russia.

Read more: https://www.mt5.com/forex_humor/image/42262

|

Метки: #forex_caricature |