Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

China and India to bypass US in terms of GDP by 2030 |

According to analysts at Standard Chartered, next year, the US will no longer be the world leader in terms of GDP, and it will be surpassed by India and China by 2030.

Experts believe that a shakeup in the global economy will be fueled largely by a strengthening of the middle class. "By 2020, a majority of the world population will be classified as middle class. Asia will lead the increase in middle-class populations even as middle classes stagnate in the West," Standard Chartered noted.

Experts predict that Russia will take the fifth place in the ranking in 2020, and then drop to the eighth one by 2030. On the contrary, the Indonesian economy is expected to rise significantly: by 2020, the country will enter the top ten in terms of GDP, occupying the seventh place, and in 2030, it will reach the fourth position. According to Standard Chartered, the ratings of Turkey, Brazil and Egypt will improve notably, and in 2030, they will rank fifth, sixth and seventh, respectively.

The leading countries in terms of GDP, such as Japan and Germany, which now are among the top three in the world, may reach the bottom of the list in 2030, holding the ninth and tenth places, respectively.

Read more: https://www.mt5.com/forex_humor/image/39672

|

Метки: #forex_caricature |

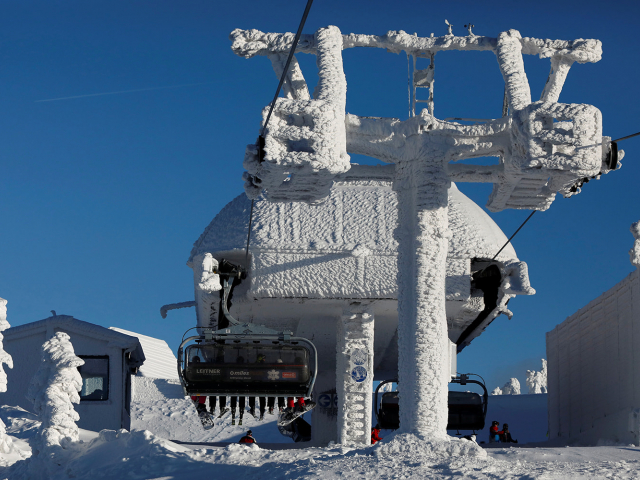

Snow covers Europe |

Europe is buried by heavy snowfall as severe weather continues to hit Austria, Germany, Poland and Switzerland. Over the past few days, snow banks have grown by several meters at once. Hundreds of settlements were de-energized. Schools were shut and flights were canceled in many cities. You can see Europe covered with snow in our photo gallery.

Greece and Turkey that do not used to such weather look the most unusual under snow. In the Greek capital of Athens, a rare snowfall was recorded, which covered national monuments and beaches. In the north of Greece, the temperature dropped to -20.9°C.

Schools that are not adapted to work in such weather conditions are closed because of the frosts in the country. In addition, heated rooms are open in Athens, where homeless people can find shelter.

Snow created a traffic collapse in Poland, where the highway leading to Gdansk was blocked due to an accident that occurred on an icy road.

On the photo: a ski lift in the ski resort of Szczyrk, Poland.

The most difficult situation is observed in the Northern and Eastern Alps, Germany and Austria. Over the last few days more than two meters of snow fell there.

Hundreds of people in Austria cannot leave their homes because of the blocked roads.

On the photo: the village of Filzmoos, Austria.

Men clear the snow off the roof during heavy snowfall in Filzmoos, Austria.

In total, in recent days, 9 people died in Austria and Germany because of the Benjamin cyclone.

The ski season is closed. For the first time in the history of the Austrian ski resort of Hochkar, it was forced to stop working due to the threat of an avalanche, and the staff and guests were immediately evacuated.

In Germany, workers had to manually clear the tracks for trains.

According to forecasters, this weather will persist until the end of the week. Moreover, the cyclone continues to move south. Snowfall covered Turkey, Lebanon and Israel. Due to snow and low visibility, Turkey closed the Bosphorus for the passage of ships.

However, the snow was not destructive for Israel. Since 2014, the country has suffered from a record drought, as a result of which the state’s water resources have been depleted, and the water intake from Lake Kinneret, Israel’s main natural reservoir, has become almost impossible. As a result of a powerful winter storm, the water level rose by 19.5 cm over the “black line”.

|

Метки: #photo_news |

Central Bank of Russia transfers US dollars into yuan, yen and euro |

The Bank of Russia decided to replenish its reserves of foreign currency, and the choice fell on the yuan, yen, and euro. These are three leaders of stability according to the Central Bank of the Russian Federation.

This time, Russia has moved further away from reliance on the US dollar and has reduced its share in the country's foreign reserves. In addition, many experts are sure that this currency is now at an all-time high, which means this is not the best time for purchases. Nevertheless, the US dollar still represents a high share in the Russian reserves - 21.9 percent - and takes the second place after the single European currency with the figure of 32 percent. The yuan closes the top three with the share of 14.7 percent. Exactly the same figure - 14.7 percent - accounts for other currencies: the poun

Read more: https://www.mt5.com/forex_humor/image/39680

|

Метки: #forex_caricature |

Central Bank of Russia transfers US dollars into yuan, yen and euro |

The Bank of Russia decided to replenish its reserves of foreign currency, and the choice fell on the yuan, yen, and euro. These are three leaders of stability according to the Central Bank of the Russian Federation.

This time, Russia has moved further away from reliance on the US dollar and has reduced its share in the country's foreign reserves. In addition, many experts are sure that this currency is now at an all-time high, which means this is not the best time for purchases. Nevertheless, the US dollar still represents a high share in the Russian reserves - 21.9 percent - and takes the second place after the single European currency with the figure of 32 percent. The yuan closes the top three with the share of 14.7 percent. Exactly the same figure - 14.7 percent - accounts for other currencies: the poun

Read more: https://www.mt5.com/forex_humor/image/39680

|

Метки: #forex_caricature |

China’s foreign exchange reserves decline by 2.1% in 2018 |

According to the State Administration of Foreign Exchange (SAFE) of the People's Republic of China, the volume of country’s foreign exchange reserves for 2018 declined at an annualized rate of 2.1 percent to $3.07 trillion.

In December 2018, the volume of reserves increased by 0.4 percent to $11 billion, and a month earlier, the indicator unexpectedly rose by 0.3 percent to $8.6 billion amid the appreciation of the national currency.

According to spokesperson at SAFE Wang Chunying, foreign exchange reserves declined slightly but generally remained at the same level. The official noted that the current rate of the yuan and the Chinese economy showed stability last year.

The strengthening of the US dollar and an escalating trade dispute between Washington and Beijing weigh on the Chinese currency in 2019. Experts note the negative impact due to a slowdown in economic growth in the country. The State Administration of Foreign Exchange believes that the growth of reserves was promoted by fluctuations in the exchange rate and changes in asset prices. The regulator expects foreign exchange reserves to remain stable, despite the ups and downs of the market.

Read more: https://www.mt5.com/forex_humor/image/39612

|

Метки: #forex_caricature |

Most disturbing predictions for 2019 |

According to analysts, the most pessimistic forecasts for the current year relate mainly to global financial markets. Expert estimates significantly affect the future dynamics of quotes and force traders to keep abreast. Nevertheless, experts, analyzing risk factors, call for taking into account all the pros and cons of the situation.

US stock market collapse

Some economists believe tha the collapse of the US stock market is not the final stage. Market players will see the continuation of the fall. Analysts predict not just a stock price collapse but a full-blown crisis with a prolonged recession in the economy. Such a scenario is not excluded, as there are signs of a growing slowdown in the US economy. The financial crisis in America will have a negative impact on the global economy and will affect the value of a number of assets.

Oil cost $30

The cost of the most important commodity asset, oil, largely depends on the situation in the financial markets. At the end of 2018, this asset fell from $87 to $50 and there was a shakedown in the global market. Earlier, in 2016, oil quotes dropped below $30 per barrel, and it almost became a disaster for a number of countries. In the event of such a development, the collapse may recur. In order for oil prices to crash even more, the desire of large market players is enough, and the OPEC+ deal to reduce production will not affect the situation, experts are sure.

US currency cost 100 rubles

A collapse in oil prices will inevitably lead to a devaluation of the Russian ruble, analysts believe. Many of them predict that in 2019 in the Russian Federation 1 US dollar will cost 100 rubles. However, the ruble may weaken for other reasons, for example due to sanctions or the purchase of currency by the Central Bank. Nevertheless, the financial authorities of the Russian Federation will not allow a significant weakening of the national currency, although its position remains unstable.

Tougher sanctions and a ban on the use of US dollars

According to experts, in 2019 the weakening of the ruble will be followed by tough US sanctions affecting the largest banks and the national debt of the Russian Federation. As a result, Russia will be in isolation, disconnected from the global financial and economic system. After the introduction of sanctions against RusAl, which are considered a “pilot version,” other strikes against the Russian economy will follow. New sanctions will lead to a ban on transactions in US dollars. Many Russian enterprises now use euros when dealing with foreign partners, and this trend will strengthen.

|

Метки: #photo_news |

Ethereum soars by 10% |

Earlier in January, Ethereum, the second most popular cryptocurrency, surged to USD 149.47, having added 10.01%.

The market capitalization of Ethereum increased significantly by 11.87%. The cryptocurrency was trading in the range between $112.5885 and $149.6263 for seven consecutive days. Currently, Ethereum price is about 89.50% of its highest value that was at $142.320. This level was hit on January 13 last year.

Read more: https://www.mt5.com/forex_humor/image/39605

|

Метки: #forex_caricature |

Ethereum soars by 10% |

Earlier in January, Ethereum, the second most popular cryptocurrency, surged to USD 149.47, having added 10.01%.

The market capitalization of Ethereum increased significantly by 11.87%. The cryptocurrency was trading in the range between $112.5885 and $149.6263 for seven consecutive days. Currently, Ethereum price is about 89.50% of its highest value that was at $142.320. This level was hit on January 13 last year.

Read more: https://www.mt5.com/forex_humor/image/39605

|

Метки: #forex_caricature |

Three best US dividend kings for long-term total returns |

Choosing a reliable company with a high dividends growth potential of dividends, revenues and profits, experts advise to pay attention to the so-called dividend kings. These corporations include Apple, 3M and Aqua America. Let's consider shares of these companies.

Dividend kings are companies that annually increase the remuneration paid to their shareholders over the past 50 years. In the US, these are primarily such corporations as Johnson & Johnson, Coca-Cola and Procter and Gamble. Recently, however, the list has been replenished with shares of other, not less profitable, companies.

Aqua America

The American company, Aqua America, specializing in water supply, bought Peoples gas supplier from Pittsburgh (USA) at the end of 2018. This decision was fateful: by 2022, the production of gas in this region doubled. However, Aqua America shares fell 10 percent, while dividend yield soared to 2.6 percent, an unusual movement of quotes for a predictable and regulated business. Aqua America forecasts gas segment growth of 10 percent per year. The company got a lot of new opportunities, including other segments than the gas and water supply.

3М

The industrial conglomerate, 3M, is considered a best option for investors. It’s not easy to get into the list of dividend kings to which 3M belongs, but 2018 was the 60th year for increasing the dividends for the company. The five-year development plan for 2019–2023 includes an increase in earning by 8–11 percent per share, a growth of dividends following a rise in profits and the retention of the payout ratio at the level of 30 percent. Over the next five years, the remuneration will grow by a few percent annually. The current dividend yield of 3M is estimated at 2.7 percent with a tendency to increase.

Apple

Apple stands out among dividend kings. Currently, the dividend yield of its shares is small, only 1.4 percent, while investors should take into account that the payout ratio is only 24 percent. Apple management is able to develop business and find new sources of income. In the 2018 fiscal year, sales in the services segment brought the company about $37.3 billion, an increase of a record 24 percent. Apple shows steady growth in revenue and profits. In the fourth quarter of 2018, revenue rose by 20 percent to $62.9 billion, and earnings per share increased by 41 percent to $2.91.

|

Метки: #photo_news |

Three best US dividend kings for long-term total returns |

Choosing a reliable company with a high dividends growth potential of dividends, revenues and profits, experts advise to pay attention to the so-called dividend kings. These corporations include Apple, 3M and Aqua America. Let's consider shares of these companies.

Dividend kings are companies that annually increase the remuneration paid to their shareholders over the past 50 years. In the US, these are primarily such corporations as Johnson & Johnson, Coca-Cola and Procter and Gamble. Recently, however, the list has been replenished with shares of other, not less profitable, companies.

Aqua America

The American company, Aqua America, specializing in water supply, bought Peoples gas supplier from Pittsburgh (USA) at the end of 2018. This decision was fateful: by 2022, the production of gas in this region doubled. However, Aqua America shares fell 10 percent, while dividend yield soared to 2.6 percent, an unusual movement of quotes for a predictable and regulated business. Aqua America forecasts gas segment growth of 10 percent per year. The company got a lot of new opportunities, including other segments than the gas and water supply.

3М

The industrial conglomerate, 3M, is considered a best option for investors. It’s not easy to get into the list of dividend kings to which 3M belongs, but 2018 was the 60th year for increasing the dividends for the company. The five-year development plan for 2019–2023 includes an increase in earning by 8–11 percent per share, a growth of dividends following a rise in profits and the retention of the payout ratio at the level of 30 percent. Over the next five years, the remuneration will grow by a few percent annually. The current dividend yield of 3M is estimated at 2.7 percent with a tendency to increase.

Apple

Apple stands out among dividend kings. Currently, the dividend yield of its shares is small, only 1.4 percent, while investors should take into account that the payout ratio is only 24 percent. Apple management is able to develop business and find new sources of income. In the 2018 fiscal year, sales in the services segment brought the company about $37.3 billion, an increase of a record 24 percent. Apple shows steady growth in revenue and profits. In the fourth quarter of 2018, revenue rose by 20 percent to $62.9 billion, and earnings per share increased by 41 percent to $2.91.

|

Метки: #photo_news |

Five alternatives to bank deposits |

The global economy instability makes market participants to look for a traditional bank deposits replacement. In this regard, experts offer several options for investment. They are considered the most effective compared to other

Today, amid a global economic downturn, many market participants are seeking to find reliable ways to preserve their savings. Previously, a bank deposit served as an option. However, times have changed, and experts consider other alternatives more serious investments in the future. To increase your savings, you may use many financial instruments.

Corporate bonds

Corporate bonds are one of the most important financial instruments, experts say. This is one of the most popular, affordable and low-risk tools of the stock market. The entry threshold is low: for ruble bonds, the threshold is 1,000 rubles, for euro bonds it starts from 1,000 US dollars. You can earn up to 10% per annum on ruble bonds. In terms of reliability, bonds are not inferior to a bank deposit. They are suitable for novice investors. The disadvantage of bonds is that they are not insured. If the issuer goes bankrupt, all investments will be lost.

Crowdfunding

Now, crowdfunding is a very popular financial instrument. It is a collective financing of any business. Earlier, only large entrepreneurs with a capital of several million dollars participated in crowdfunding, but now the middle class with small amounts is leading in this type of investment. If you have a loan agreement (crowdlending) with a company, you can get 20-25% per annum. Many people are afraid to invest in young companies, as there is a high risk of losses. However, the number of investors in startups is growing.

Structural products

This financial product can be purchased from a bank, broker or management company. It is an investment portfolio formed from two or more financial instruments: bank deposits, real estate investments, precious metals, securities, etc. Demand for options and bonds is often the highest. Financial assets are distributed in such a way that the profitability of the risk-free part covers possible losses of another share of investments. The entry threshold here is high: for a dollar product, the minimum threshold is 5,000 or 10,000 US dollars, for a ruble one, the threshold is from 100,000 to 200,000 rubles.

Stock dividends

Stock dividends are companies’ shares that pay dividends. In rubles, income can reach 13-15% per annum, and in dollars - 2-4%. The shareholder will receive income if the company operates confidently in the market and is profitable. Shares are one of the most liquid instruments; they can be sold at any time. Experts believe that most of them are able to survive the crisis, recession and market collapse. You only need to be patient and wait for quotations to recover.

Real estate

Real estate is the most effective investment tool. Experts advise to focus on commercial housing, for example, to have an agreement with the company that manages the apartment hotels. The yield can reach 10% per annum. For rental, it is best to use a mortgage apartment abroad, for example, in Germany. The entry threshold for this market is not too high - from 30,000 euros. You can also become a member of a real estate unit investment fund abroad, including those listed on the stock exchange (REIT).

|

Метки: #photo_news |

Five alternatives to bank deposits |

The global economy instability makes market participants to look for a traditional bank deposits replacement. In this regard, experts offer several options for investment. They are considered the most effective compared to other

Today, amid a global economic downturn, many market participants are seeking to find reliable ways to preserve their savings. Previously, a bank deposit served as an option. However, times have changed, and experts consider other alternatives more serious investments in the future. To increase your savings, you may use many financial instruments.

Corporate bonds

Corporate bonds are one of the most important financial instruments, experts say. This is one of the most popular, affordable and low-risk tools of the stock market. The entry threshold is low: for ruble bonds, the threshold is 1,000 rubles, for euro bonds it starts from 1,000 US dollars. You can earn up to 10% per annum on ruble bonds. In terms of reliability, bonds are not inferior to a bank deposit. They are suitable for novice investors. The disadvantage of bonds is that they are not insured. If the issuer goes bankrupt, all investments will be lost.

Crowdfunding

Now, crowdfunding is a very popular financial instrument. It is a collective financing of any business. Earlier, only large entrepreneurs with a capital of several million dollars participated in crowdfunding, but now the middle class with small amounts is leading in this type of investment. If you have a loan agreement (crowdlending) with a company, you can get 20-25% per annum. Many people are afraid to invest in young companies, as there is a high risk of losses. However, the number of investors in startups is growing.

Structural products

This financial product can be purchased from a bank, broker or management company. It is an investment portfolio formed from two or more financial instruments: bank deposits, real estate investments, precious metals, securities, etc. Demand for options and bonds is often the highest. Financial assets are distributed in such a way that the profitability of the risk-free part covers possible losses of another share of investments. The entry threshold here is high: for a dollar product, the minimum threshold is 5,000 or 10,000 US dollars, for a ruble one, the threshold is from 100,000 to 200,000 rubles.

Stock dividends

Stock dividends are companies’ shares that pay dividends. In rubles, income can reach 13-15% per annum, and in dollars - 2-4%. The shareholder will receive income if the company operates confidently in the market and is profitable. Shares are one of the most liquid instruments; they can be sold at any time. Experts believe that most of them are able to survive the crisis, recession and market collapse. You only need to be patient and wait for quotations to recover.

Real estate

Real estate is the most effective investment tool. Experts advise to focus on commercial housing, for example, to have an agreement with the company that manages the apartment hotels. The yield can reach 10% per annum. For rental, it is best to use a mortgage apartment abroad, for example, in Germany. The entry threshold for this market is not too high - from 30,000 euros. You can also become a member of a real estate unit investment fund abroad, including those listed on the stock exchange (REIT).

|

Метки: #photo_news |

Без заголовка |

Financial companies move lb800 billion out of UK

Assets of large banks and financial companies were transferred from the UK to the European Union ahead of Brexit. These include financial operations, staff members and clients' assets totaling lb800 billion (over $1 trillion). The UK is planning to leave the EU at the end of March 2019. The data was provided by EY consulting company which tracked public statements made by 222 of the largest UK financial services companies.

EY analysts noted that only public data were used for the calculations, so the final figure may be higher. At the same time, not all companies that shifted operations from London to other countries disclosed data on the value of assets. This number is still modest given total assets of the UK banking sector alone is estimated to be almost lb8 trillion, but may become larger as we move towards Brexit,” EY said.

At the end of November 2018, about 36 percent of financial companies announced a transfer of a part of operations out of London to other European capitals. Over half (55 percent) of surveyed banks and brokerage companies, as well as 44 percent of management companies and 42% percent of insurance firms, moved their assets. Approximately 30 percent of companies chose Dublin, Luxembourg, Frankfurt, and Paris.

Earlier, the Bank of England warned that without a clear agreement on conditions of access to the single market, Brexit consequences would be worse for the UK than the 2008 financial crisis.

Read more: https://www.mt5.com/forex_humor/image/39613

|

Метки: #forex_caricature |

Без заголовка |

Financial companies move lb800 billion out of UK

Assets of large banks and financial companies were transferred from the UK to the European Union ahead of Brexit. These include financial operations, staff members and clients' assets totaling lb800 billion (over $1 trillion). The UK is planning to leave the EU at the end of March 2019. The data was provided by EY consulting company which tracked public statements made by 222 of the largest UK financial services companies.

EY analysts noted that only public data were used for the calculations, so the final figure may be higher. At the same time, not all companies that shifted operations from London to other countries disclosed data on the value of assets. This number is still modest given total assets of the UK banking sector alone is estimated to be almost lb8 trillion, but may become larger as we move towards Brexit,” EY said.

At the end of November 2018, about 36 percent of financial companies announced a transfer of a part of operations out of London to other European capitals. Over half (55 percent) of surveyed banks and brokerage companies, as well as 44 percent of management companies and 42% percent of insurance firms, moved their assets. Approximately 30 percent of companies chose Dublin, Luxembourg, Frankfurt, and Paris.

Earlier, the Bank of England warned that without a clear agreement on conditions of access to the single market, Brexit consequences would be worse for the UK than the 2008 financial crisis.

Read more: https://www.mt5.com/forex_humor/image/39613

|

Метки: #forex_caricature |

Five countries supporting cryptocurrency |

There is a number of countries in the world that actively support digital currencies. The authorities of these countries seek to create a favorable environment for the development of digital assets. We offer to get acquainted with such crypto friendly countries.

Switzerland

Experts consider Switzerland to be the most advanced country in terms of digital technologies. It claims to be called crypto nation. In connection with this, a so-called crypto valley was created in the city of Zug. It is an association which goal is to create a global blockchain system and cryptographic technologies. In addition to innovations in the blockchain industry, Switzerland is considered one of the leading countries in terms of successful implementation of ICO.

Japan

Experts believe Japan is one of the most digital friendly contries. The technological sphere is very developed here. Last year, Japan recognized virtual currencies as legal tender. According to the national media, investment in Bitcoin by the Japanese authorities amounts to huge sums. In April 2018, the Japan Virtual Currency Exchange Association (JVCEA) was established.

United Kingdom

The United Kingdom is considered one of the best crypto friendly countries, second only to Switzerland and Japan. This year, seven leading blockchain companies have united in a unique cryptocurrency organization called CryptoUK. It was created to avoid regulatory pressure from the authorities. The agency aims to make the UK a safe place for blockchain technology and digital projects. Increased attention is paid to the development of blockchain startups.

Netherlands

The netherlands is considered one of the countries open to innovations in the cryptosphere. This year, a Bitcoin embassy was created in the country, whose task is to popularize digital assets. The capital of the Netherlands, Amsterdam, has a reputation of the best European city for technology startups. In this case, the Dutch government does not seek to adjust the new class of assets under current legislation. The authorities of the Netherlands even developed their own cryptocurrency called De Nederlandsche Bank Coin (DNBCoin).

Denmark

Denmark is another European country with a favorable cryptocurrency environment. It introduced a zero tax on digital currencies which makes this state very attractive for crypto enthusiasts. After the adoption of the resolution that virtual currencies are not a means of payment, the National Bank of Denmark exempted digital assets from state regulation.

|

Метки: #photo_news |

Five countries supporting cryptocurrency |

There is a number of countries in the world that actively support digital currencies. The authorities of these countries seek to create a favorable environment for the development of digital assets. We offer to get acquainted with such crypto friendly countries.

Switzerland

Experts consider Switzerland to be the most advanced country in terms of digital technologies. It claims to be called crypto nation. In connection with this, a so-called crypto valley was created in the city of Zug. It is an association which goal is to create a global blockchain system and cryptographic technologies. In addition to innovations in the blockchain industry, Switzerland is considered one of the leading countries in terms of successful implementation of ICO.

Japan

Experts believe Japan is one of the most digital friendly contries. The technological sphere is very developed here. Last year, Japan recognized virtual currencies as legal tender. According to the national media, investment in Bitcoin by the Japanese authorities amounts to huge sums. In April 2018, the Japan Virtual Currency Exchange Association (JVCEA) was established.

United Kingdom

The United Kingdom is considered one of the best crypto friendly countries, second only to Switzerland and Japan. This year, seven leading blockchain companies have united in a unique cryptocurrency organization called CryptoUK. It was created to avoid regulatory pressure from the authorities. The agency aims to make the UK a safe place for blockchain technology and digital projects. Increased attention is paid to the development of blockchain startups.

Netherlands

The netherlands is considered one of the countries open to innovations in the cryptosphere. This year, a Bitcoin embassy was created in the country, whose task is to popularize digital assets. The capital of the Netherlands, Amsterdam, has a reputation of the best European city for technology startups. In this case, the Dutch government does not seek to adjust the new class of assets under current legislation. The authorities of the Netherlands even developed their own cryptocurrency called De Nederlandsche Bank Coin (DNBCoin).

Denmark

Denmark is another European country with a favorable cryptocurrency environment. It introduced a zero tax on digital currencies which makes this state very attractive for crypto enthusiasts. After the adoption of the resolution that virtual currencies are not a means of payment, the National Bank of Denmark exempted digital assets from state regulation.

|

Метки: #photo_news |

ECB to stop printing €500 banknotes to decrease criminal activity |

As part of a number of measures to prevent money laundering and the financing of international terrorism, the management of the European Central Bank decided to gradually abolish the use of 500 euro banknotes. According to the statement published on the regulator's official website, the first step in this direction will be the termination of these notes issuing. "17 of the 19 national central banks in the euro area will no longer issue €500 banknotes from Jan. 27, 2019," the ECB said on its website. However, there is an exception for two central banks of the euro area. Austria and Germany will continue printing the notes until April 26, for logistical reasons.

Experts consider this solution to be proper. Having carefully examined the criminal cash flows, the security forces came to a clear conclusion that it is the presence of large denomination banknotes that facilitates the conduct of various criminal operations with money. Reportedly, such banknotes are used in money laundering and terrorist financing. For this reason, the European media often calls the 500 euro notes “Osama bin Laden's money” (the former leader of Al-Qaeda killed by U.S. forces). Now launderers will need larger suitcases, and the larger the suitcase, the easier it can be tracked. According to the ECB, these banknotes account for 2.4% of the total number of banknotes in circulation and a little more than 20% of their total value, that is about 261 billion euros. As of November 2018, there were almost 521 million 500-euro notes in circulation.

Read more: https://www.mt5.com/forex_humor/image/39552

|

Метки: #forex_caricature |

Five countries supporting cryptocurrency |

There is a number of countries in the world that actively support digital currencies. The authorities of these countries seek to create a favorable environment for the development of digital assets. We offer to get acquainted with such crypto friendly countries.

Switzerland

Experts consider Switzerland to be the most advanced country in terms of digital technologies. It claims to be called crypto nation. In connection with this, a so-called crypto valley was created in the city of Zug. It is an association which goal is to create a global blockchain system and cryptographic technologies. In addition to innovations in the blockchain industry, Switzerland is considered one of the leading countries in terms of successful implementation of ICO.

Japan

Experts believe Japan is one of the most digital friendly contries. The technological sphere is very developed here. Last year, Japan recognized virtual currencies as legal tender. According to the national media, investment in Bitcoin by the Japanese authorities amounts to huge sums. In April 2018, the Japan Virtual Currency Exchange Association (JVCEA) was established.

United Kingdom

The United Kingdom is considered one of the best crypto friendly countries, second only to Switzerland and Japan. This year, seven leading blockchain companies have united in a unique cryptocurrency organization called CryptoUK. It was created to avoid regulatory pressure from the authorities. The agency aims to make the UK a safe place for blockchain technology and digital projects. Increased attention is paid to the development of blockchain startups.

Netherlands

The netherlands is considered one of the countries open to innovations in the cryptosphere. This year, a Bitcoin embassy was created in the country, whose task is to popularize digital assets. The capital of the Netherlands, Amsterdam, has a reputation of the best European city for technology startups. In this case, the Dutch government does not seek to adjust the new class of assets under current legislation. The authorities of the Netherlands even developed their own cryptocurrency called De Nederlandsche Bank Coin (DNBCoin).

Denmark

Denmark is another European country with a favorable cryptocurrency environment. It introduced a zero tax on digital currencies which makes this state very attractive for crypto enthusiasts. After the adoption of the resolution that virtual currencies are not a means of payment, the National Bank of Denmark exempted digital assets from state regulation.

|

Метки: #photo_news |