Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

3 stocks to buy in 2019 |

The growing popularity of data centers, cloud computing, Internet devices and artificial intelligence is boosting the demand for microcircuits. This situation favorably affects the stock prices of microcircuits manufacturers. The most popular and profitable securities of three leading producers of innovative developments will help market participants to form an investment portfolio for 2019

Over the past few years, microcircuits manufacturers have become one of the leaders in the global stock market. This situation contributes to the positive dynamics of the companies’ shares. Experts find it difficult to predict the future of manufacturers, but the popularity of these companies is beyond doubt. Despite a bit vague forecasts, the three companies will remain the most profitable for investors over the next 5 years.

Intel

In 2017, Intel stock price was $30. In 2018, the management changed the direction of the business, switching to data centers and the sphere of artificial intelligence (AI). This attracted new customers. Intel's business began to flourish, and stocks soared to nearly $60. Today, the company is once again entering a bear market. Investors fear that the peak has already passed, but experts are confident that the company will move forward. Currently, Intel stocks are traded at around $50. Earnings per share will be $5.5 over the next 5 years.

Micron

Over a two-year period, Micron’s shares soared from $10 to $60 per share. The price hike was affected by the growth in demand on the microcircuits market. However, in the last few months of 2018, Micron stocks fell from $50 to $35. Nevertheless, experts consider investors' concerns to be in vain, since this sphere will remain popular as well as the Internet of things (IoT), data centers and AI. Over the past 5 years, the value of Micron securities exceeded earnings per share by 9 times. According to analysts, by the end of 2019, the price could reach $72, which is 40% higher than the current level.

Nvidia

Nvidia is a leader in such industries as data centers, the Internet of things, artificial intelligence, autonomous vehicle control and augmented/virtual reality. Over the past 3 years, the company's shares have grown by more than 1,000%. According to experts, these segments are just developing, so the manufacturer’s shares are to grow. Experts believe, in the near future, Nvidia shares will hold leading positions, as investment in AI, data centers and automation will increase.

|

Метки: #photo_news |

China to abolish export and import duties on many goods in 2019 |

In 2019, the Chinese authorities plan to abolish import and export duties on a number of goods. This is expected to guarantee the resumption of raw material supplies amid trade tensions with the United States and an increase in the volume of outgoing shipments.

According to the Chinese Ministry of Finance, import tariffs on alternative feed meals, which include rapeseed meal, cotton meal, sunflower meal and palm meal will be removed from January 1, 2019.

The trade conflict between Washington and Beijing has dented the global soybean market, since the imposition of American tariffs stopped importing soybeans from the United States to China. Nevertheless, despite the high duties, China has resumed the purchase of soybeans from the US.

In addition, the Ministry of Finance of China announced that tariffs on the import of materials for the production of a number of pharmaceutical products would also be reduced to zero. As for the exports, in 2019, the Chinese authorities are not going to charge duties on 94 types of goods, including fertilizers, iron ore, coal tar, and wood pulp. Tariffs on 298 products in the area of information technology are also expected to be cut from July next year.

Read more: https://www.mt5.com/forex_humor/image/39390

|

Метки: #forex_caricature |

China to abolish export and import duties on many goods in 2019 |

In 2019, the Chinese authorities plan to abolish import and export duties on a number of goods. This is expected to guarantee the resumption of raw material supplies amid trade tensions with the United States and an increase in the volume of outgoing shipments.

According to the Chinese Ministry of Finance, import tariffs on alternative feed meals, which include rapeseed meal, cotton meal, sunflower meal and palm meal will be removed from January 1, 2019.

The trade conflict between Washington and Beijing has dented the global soybean market, since the imposition of American tariffs stopped importing soybeans from the United States to China. Nevertheless, despite the high duties, China has resumed the purchase of soybeans from the US.

In addition, the Ministry of Finance of China announced that tariffs on the import of materials for the production of a number of pharmaceutical products would also be reduced to zero. As for the exports, in 2019, the Chinese authorities are not going to charge duties on 94 types of goods, including fertilizers, iron ore, coal tar, and wood pulp. Tariffs on 298 products in the area of information technology are also expected to be cut from July next year.

Read more: https://www.mt5.com/forex_humor/image/39390

|

Метки: #forex_caricature |

Five companies with high dividends in Warren Buffett portfolio |

One of the key factors in assessing the financial condition of a company is a systematic dividend increase. Overall, the widely followed Berkshire Hathaway investment portfolio shows Warren Buffett knows the value of a consistent and growing dividend, even if he's no fan of paying dividends himself. Let's consider the largest of them.

Dividends paid to shareholders reduce the size of capitalization, while not always directly correlated with the value of shares, but the size of dividend yield makes the company attractive for investment. In our review, you will find five companies with high dividends from the portfolio of the legendary Oracle of Omaha (Warren Buffett).

1. KRAFT HEINS

The American food company, Kraft Heinz, which produces food and beverages, is one of the largest firms in terms of market capitalization owned by Berkshire Hathaway.

Kraft Heinz's dividend payout is $2.50 per year, and dividend yield is 5.16 percent.

The dividend growth rate over the last 3-5 years totals about 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is estimated at 15.

Since the beginning of the year, the value of the company's shares fell by 40.33 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 325.6 million shares of Kraft Heinz.

2. STORE CAPITAL

A real estate investment trust or REIT, Store Capital invests in single-tenant commercial properties, such as supermarkets and drugstores.

Dividend payout of STORE Capital is estimated at $1.32 per year, dividend yield is 4.29 percent.

The dividend growth rate over the last 3-5 years reached 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 4.

Since the beginning of the year, the value of the company's shares increased by 18.97 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 18.6 million shares of STORE Capital Corporation.

3. GENERAL MOTORS

The largest American automobile corporation, General Motors is considered the largest car manufacturer in the world for 77 years. The automaker's new mobility bets now include electric bicycles, in addition to electric cars and self-driving cars. But for now, GM earnings that drive dividends are coming from gas-guzzling SUVs and trucks.

GM's dividend payout is $1.52 per year, and dividend yield is 4.33 percent.

The dividend growth rate over the last 3-5 years reaches 6 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 5.

Since the beginning of the year, the value of the company's shares decreased by 14.29 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 52.5 million shares of General Motors, while the company's share was increased by 1.1 million securities.

4. TEVA

The multinational pharmaceutical company Teva Pharmaceutical Industries was included in the Berkshire Hathaway portfolio in the fourth quarter of 2017. Teva shares were bought at $10.85 per share. Their value has more than doubled since then.

Teva's dividend payout is $0.94, dividend yield is 4.3 percent.

The dividend growth rate over the last 3-5 years is estimated at about 1 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 14.

Since the beginning of the year, the value of the company's shares fell by 0.81 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 43.2 million shares of Teva Pharmaceutical Industries.

5. VERIZON

The American telecommunications corporation, Verizon Communications, which derives the bulk of its profits from providing wireless services, is currently launching 5G mobile networks. The new technology will be used to exchange data between unmanned vehicles.

Verizon's dividend payout is $2.41 per year, with a dividend yield of 4.22 percent.

The dividend growth rate over the last 3-5 years totals about 3 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is 0.

Since the beginning of the year, the value of the company's shares increased by 8.37 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 928 shares of Verizon Communications.

|

Метки: #photo_news |

Five companies with high dividends in Warren Buffett portfolio |

One of the key factors in assessing the financial condition of a company is a systematic dividend increase. Overall, the widely followed Berkshire Hathaway investment portfolio shows Warren Buffett knows the value of a consistent and growing dividend, even if he's no fan of paying dividends himself. Let's consider the largest of them.

Dividends paid to shareholders reduce the size of capitalization, while not always directly correlated with the value of shares, but the size of dividend yield makes the company attractive for investment. In our review, you will find five companies with high dividends from the portfolio of the legendary Oracle of Omaha (Warren Buffett).

1. KRAFT HEINS

The American food company, Kraft Heinz, which produces food and beverages, is one of the largest firms in terms of market capitalization owned by Berkshire Hathaway.

Kraft Heinz's dividend payout is $2.50 per year, and dividend yield is 5.16 percent.

The dividend growth rate over the last 3-5 years totals about 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is estimated at 15.

Since the beginning of the year, the value of the company's shares fell by 40.33 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 325.6 million shares of Kraft Heinz.

2. STORE CAPITAL

A real estate investment trust or REIT, Store Capital invests in single-tenant commercial properties, such as supermarkets and drugstores.

Dividend payout of STORE Capital is estimated at $1.32 per year, dividend yield is 4.29 percent.

The dividend growth rate over the last 3-5 years reached 9 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 4.

Since the beginning of the year, the value of the company's shares increased by 18.97 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 18.6 million shares of STORE Capital Corporation.

3. GENERAL MOTORS

The largest American automobile corporation, General Motors is considered the largest car manufacturer in the world for 77 years. The automaker's new mobility bets now include electric bicycles, in addition to electric cars and self-driving cars. But for now, GM earnings that drive dividends are coming from gas-guzzling SUVs and trucks.

GM's dividend payout is $1.52 per year, and dividend yield is 4.33 percent.

The dividend growth rate over the last 3-5 years reaches 6 percent, the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 5.

Since the beginning of the year, the value of the company's shares decreased by 14.29 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 52.5 million shares of General Motors, while the company's share was increased by 1.1 million securities.

4. TEVA

The multinational pharmaceutical company Teva Pharmaceutical Industries was included in the Berkshire Hathaway portfolio in the fourth quarter of 2017. Teva shares were bought at $10.85 per share. Their value has more than doubled since then.

Teva's dividend payout is $0.94, dividend yield is 4.3 percent.

The dividend growth rate over the last 3-5 years is estimated at about 1 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) for the same period is 14.

Since the beginning of the year, the value of the company's shares fell by 0.81 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 43.2 million shares of Teva Pharmaceutical Industries.

5. VERIZON

The American telecommunications corporation, Verizon Communications, which derives the bulk of its profits from providing wireless services, is currently launching 5G mobile networks. The new technology will be used to exchange data between unmanned vehicles.

Verizon's dividend payout is $2.41 per year, with a dividend yield of 4.22 percent.

The dividend growth rate over the last 3-5 years totals about 3 percent, while the dividend stability factor (on a scale from zero (most stable) to 99 (most volatile)) over the same period is 0.

Since the beginning of the year, the value of the company's shares increased by 8.37 percent. As of the end of the third quarter of 2018, Berkshire Hathaway owns 928 shares of Verizon Communications.

|

Метки: #photo_news |

Russia could exhaust oil supplies in 25 years |

Citing Evgeny Kiselyov, Head of the Federal Agency for Mineral Resources, Russia’s oil supplies will satisfy domestic demand for 23-25 years provided that Russia maintains the current pace of oil output. According to his estimates, the oil reserves with complicated extraction account for 50-60% of the total oilfields in Russia. A volume of such problematic reserves frequently changes depending on technologies. Indeed, advanced drilling technologies can greatly simplify oil extraction which is no longer considered complicated.

Last year, Russia produced the whopping 550 mln tons of crude oil and extracted 980 bln cubic meters of natural gas. By the end of 2018, West Texas Intermediate has slid 15%. Looking back, the highest WTI price in the latest four years has been recorded at $77 a barrel. Likewise, Brent crude international benchmark has tumbled almost 10% this year. In summer 2018, its price hit a four-year high of $87 a barrel.

In early December, OPEC and its allies including Russia agreed to cut oil production by 1.2 mln bpd from January 2019. The pact is expected to curb the looming oil glut in the global market. On the other hand, the International Energy Agency warns that the OPEC deal and Canada’s decision to contract its oil output could create shortage of oil supplies earlier than expected. The Agency confirmed its forecast for global oil demand growth at 1.4 mln barrels per day for 2019.

Read more: https://www.mt5.com/forex_humor/image/39273

|

Метки: #forex_caricature |

Russia could exhaust oil supplies in 25 years |

Citing Evgeny Kiselyov, Head of the Federal Agency for Mineral Resources, Russia’s oil supplies will satisfy domestic demand for 23-25 years provided that Russia maintains the current pace of oil output. According to his estimates, the oil reserves with complicated extraction account for 50-60% of the total oilfields in Russia. A volume of such problematic reserves frequently changes depending on technologies. Indeed, advanced drilling technologies can greatly simplify oil extraction which is no longer considered complicated.

Last year, Russia produced the whopping 550 mln tons of crude oil and extracted 980 bln cubic meters of natural gas. By the end of 2018, West Texas Intermediate has slid 15%. Looking back, the highest WTI price in the latest four years has been recorded at $77 a barrel. Likewise, Brent crude international benchmark has tumbled almost 10% this year. In summer 2018, its price hit a four-year high of $87 a barrel.

In early December, OPEC and its allies including Russia agreed to cut oil production by 1.2 mln bpd from January 2019. The pact is expected to curb the looming oil glut in the global market. On the other hand, the International Energy Agency warns that the OPEC deal and Canada’s decision to contract its oil output could create shortage of oil supplies earlier than expected. The Agency confirmed its forecast for global oil demand growth at 1.4 mln barrels per day for 2019.

Read more: https://www.mt5.com/forex_humor/image/39273

|

Метки: #forex_caricature |

Russia could exhaust oil supplies in 25 years |

Citing Evgeny Kiselyov, Head of the Federal Agency for Mineral Resources, Russia’s oil supplies will satisfy domestic demand for 23-25 years provided that Russia maintains the current pace of oil output. According to his estimates, the oil reserves with complicated extraction account for 50-60% of the total oilfields in Russia. A volume of such problematic reserves frequently changes depending on technologies. Indeed, advanced drilling technologies can greatly simplify oil extraction which is no longer considered complicated.

Last year, Russia produced the whopping 550 mln tons of crude oil and extracted 980 bln cubic meters of natural gas. By the end of 2018, West Texas Intermediate has slid 15%. Looking back, the highest WTI price in the latest four years has been recorded at $77 a barrel. Likewise, Brent crude international benchmark has tumbled almost 10% this year. In summer 2018, its price hit a four-year high of $87 a barrel.

In early December, OPEC and its allies including Russia agreed to cut oil production by 1.2 mln bpd from January 2019. The pact is expected to curb the looming oil glut in the global market. On the other hand, the International Energy Agency warns that the OPEC deal and Canada’s decision to contract its oil output could create shortage of oil supplies earlier than expected. The Agency confirmed its forecast for global oil demand growth at 1.4 mln barrels per day for 2019.

Read more: https://www.mt5.com/forex_humor/image/39273

|

Метки: #forex_caricature |

US Dividend Aristocrats |

In today's world, not every company is able to steadily increase dividends over a period of twenty five years. Only 10% of corporations from the S&P 500 index succeeded in it. It is necessary to have sustainability, a strong competitive advantage and the ability to manage capital wisely to achieve this goal. S&P 500 dividend aristocrats are considered the best in the world. Read more in our article.

According to experts, dividend aristocrats are companies that continuously increase the size of dividends it pays to its shareholders. To be considered a dividend aristocrat, a company must typically raise dividends consistently for at least 25 years. They are also members of the US S&P 500 index consisting of the 500 largest US companies by capitalization. Often, corporations are not required to belong to the S&P 500 index, but having a regular increase in dividends remains a prerequisite. We suggest you to get acquainted with the list of such companies.

AT&T

AT&T, a telecommunications giant, is considered a prime example of US dividend aristocrats. The company is distinguished by the stability of payments for a long time. At the end of 2017, it significantly increased its quarterly dividends. Its dividend yield is the highest and reaches 6.08 percent.

Exxon Mobil Corp

Exxon Mobil is another example of stable dividend payments. The company has a rich history. For decades, its shareholders have received substantial dividends that have consistently increased over the course of 36 years. Despite the crisis of 2008 and the collapse in oil prices in 2014, the global energy giant remains strong and stable. The market capitalization of Exxon Mobil is impressive, $340 billion; the yield on dividends is estimated at 4 percent.

AbbVie

A major dividend aristocrat capable of surpassing Exxon Mobil in terms of profitability which reaches 4.37 percent, is the AbbVie pharmaceutical company. This corporation, engaged in the field of healthcare, manages capital perfectly and is able to multiply it. This company was established in 2013 after separation from Abbot Laboratories, whose history goes back over 130 years. The company's dividend history is impressive: a consistent increase in interest has been fixed for 25 years.

Consolidated Edison

There are also electricity distribution companies among US dividend aristocrats. These are the most experienced players in the stock market, analysts say. Consolidated Edison Corporation is considered the largest producer and supplier of electricity for New York and the surrounding regions. It was created in 1882 and has an impressive history. In January 2018, a company with the dividend yield of 3.70 percent announced a quarterly increase in payments to shareholders.

Procter&Gamble

Procter & Gamble, one of the leading companies of the world, produces popular consumer goods represented by Fairy, Tide, Pampers, Old Spice, Oral-B, Gillette and others. According to experts, this indicates a reliable inflow of income, regardless of crises. Almost all Procter & Gamble products are in the base category. Shareholders of the company receive dividends over more than 100 years, and the percentage of payments grows 62 years in a row. Anyone wishing to become a P&G shareholder is guaranteed a regular increase in dividend income which is estimated at 3.29 percent.

Kimberly-Clark Corp

This company is not too popular, but its products, which include Kleenex wipes, Huggies diapers, and others, are known to both American and global consumers. The history of Kimberly-Clark began in 1872, 10 years after the end of the American Civil War. Quite quickly, the company became the world leader in the production of health care products, as well as personal, professional and industrial hygiene goods. In January 2018, its management announced a small increase in dividend income, which is 3.63 percent.

PepsiCo

Experts consider the PepsiСo brand to be the most stable and time-tested among US dividend aristocrats. In addition to the Pepsi carbonated beverage, the company produces Lipton, Mountain Dew, Mirinda, and 7up beverages, as well as Lays and Cheetos chips, etc. It is very popular in the world. The company's management has been paying dividends to shareholders since 1965, and in 2017, the global producer of beverages and food surprised clients with the increase in the interest rate. The dividend yield of the company is estimates at 3.36 percent.

Coca-Cola

Coca-Cola, a well-known global megabrand, is also among US dividend aristocrats. The company, whose dividend yield is equal to 3.37 percent, is considered one of the leaders of the American stock market. The legendary Warren Buffett and his investment group, Berkshire Hathaway, are the company's shareholders. They have a huge stake in this business since 1987. In February 2018, Coca-Cola executives announced an annual dividend increase. This guarantees high profits in the present and in the future.

Target Corp

The Target company, specializing in retail, keeps aloof. According to experts, it is more sensitive to ups and downs in the economy. However, Target shares can be a profitable investment for those who want to diversify their portfolio. The company's management has increases dividend payments to shareholders at least once a year for 46 years. Its dividend yield is estimated at 3.12 percent.

|

Метки: #photo_news |

US Dividend Aristocrats |

In today's world, not every company is able to steadily increase dividends over a period of twenty five years. Only 10% of corporations from the S&P 500 index succeeded in it. It is necessary to have sustainability, a strong competitive advantage and the ability to manage capital wisely to achieve this goal. S&P 500 dividend aristocrats are considered the best in the world. Read more in our article.

According to experts, dividend aristocrats are companies that continuously increase the size of dividends it pays to its shareholders. To be considered a dividend aristocrat, a company must typically raise dividends consistently for at least 25 years. They are also members of the US S&P 500 index consisting of the 500 largest US companies by capitalization. Often, corporations are not required to belong to the S&P 500 index, but having a regular increase in dividends remains a prerequisite. We suggest you to get acquainted with the list of such companies.

AT&T

AT&T, a telecommunications giant, is considered a prime example of US dividend aristocrats. The company is distinguished by the stability of payments for a long time. At the end of 2017, it significantly increased its quarterly dividends. Its dividend yield is the highest and reaches 6.08 percent.

Exxon Mobil Corp

Exxon Mobil is another example of stable dividend payments. The company has a rich history. For decades, its shareholders have received substantial dividends that have consistently increased over the course of 36 years. Despite the crisis of 2008 and the collapse in oil prices in 2014, the global energy giant remains strong and stable. The market capitalization of Exxon Mobil is impressive, $340 billion; the yield on dividends is estimated at 4 percent.

AbbVie

A major dividend aristocrat capable of surpassing Exxon Mobil in terms of profitability which reaches 4.37 percent, is the AbbVie pharmaceutical company. This corporation, engaged in the field of healthcare, manages capital perfectly and is able to multiply it. This company was established in 2013 after separation from Abbot Laboratories, whose history goes back over 130 years. The company's dividend history is impressive: a consistent increase in interest has been fixed for 25 years.

Consolidated Edison

There are also electricity distribution companies among US dividend aristocrats. These are the most experienced players in the stock market, analysts say. Consolidated Edison Corporation is considered the largest producer and supplier of electricity for New York and the surrounding regions. It was created in 1882 and has an impressive history. In January 2018, a company with the dividend yield of 3.70 percent announced a quarterly increase in payments to shareholders.

Procter&Gamble

Procter & Gamble, one of the leading companies of the world, produces popular consumer goods represented by Fairy, Tide, Pampers, Old Spice, Oral-B, Gillette and others. According to experts, this indicates a reliable inflow of income, regardless of crises. Almost all Procter & Gamble products are in the base category. Shareholders of the company receive dividends over more than 100 years, and the percentage of payments grows 62 years in a row. Anyone wishing to become a P&G shareholder is guaranteed a regular increase in dividend income which is estimated at 3.29 percent.

Kimberly-Clark Corp

This company is not too popular, but its products, which include Kleenex wipes, Huggies diapers, and others, are known to both American and global consumers. The history of Kimberly-Clark began in 1872, 10 years after the end of the American Civil War. Quite quickly, the company became the world leader in the production of health care products, as well as personal, professional and industrial hygiene goods. In January 2018, its management announced a small increase in dividend income, which is 3.63 percent.

PepsiCo

Experts consider the PepsiСo brand to be the most stable and time-tested among US dividend aristocrats. In addition to the Pepsi carbonated beverage, the company produces Lipton, Mountain Dew, Mirinda, and 7up beverages, as well as Lays and Cheetos chips, etc. It is very popular in the world. The company's management has been paying dividends to shareholders since 1965, and in 2017, the global producer of beverages and food surprised clients with the increase in the interest rate. The dividend yield of the company is estimates at 3.36 percent.

Coca-Cola

Coca-Cola, a well-known global megabrand, is also among US dividend aristocrats. The company, whose dividend yield is equal to 3.37 percent, is considered one of the leaders of the American stock market. The legendary Warren Buffett and his investment group, Berkshire Hathaway, are the company's shareholders. They have a huge stake in this business since 1987. In February 2018, Coca-Cola executives announced an annual dividend increase. This guarantees high profits in the present and in the future.

Target Corp

The Target company, specializing in retail, keeps aloof. According to experts, it is more sensitive to ups and downs in the economy. However, Target shares can be a profitable investment for those who want to diversify their portfolio. The company's management has increases dividend payments to shareholders at least once a year for 46 years. Its dividend yield is estimated at 3.12 percent.

|

Метки: #photo_news |

US Dividend Aristocrats |

In today's world, not every company is able to steadily increase dividends over a period of twenty five years. Only 10% of corporations from the S&P 500 index succeeded in it. It is necessary to have sustainability, a strong competitive advantage and the ability to manage capital wisely to achieve this goal. S&P 500 dividend aristocrats are considered the best in the world. Read more in our article.

According to experts, dividend aristocrats are companies that continuously increase the size of dividends it pays to its shareholders. To be considered a dividend aristocrat, a company must typically raise dividends consistently for at least 25 years. They are also members of the US S&P 500 index consisting of the 500 largest US companies by capitalization. Often, corporations are not required to belong to the S&P 500 index, but having a regular increase in dividends remains a prerequisite. We suggest you to get acquainted with the list of such companies.

AT&T

AT&T, a telecommunications giant, is considered a prime example of US dividend aristocrats. The company is distinguished by the stability of payments for a long time. At the end of 2017, it significantly increased its quarterly dividends. Its dividend yield is the highest and reaches 6.08 percent.

Exxon Mobil Corp

Exxon Mobil is another example of stable dividend payments. The company has a rich history. For decades, its shareholders have received substantial dividends that have consistently increased over the course of 36 years. Despite the crisis of 2008 and the collapse in oil prices in 2014, the global energy giant remains strong and stable. The market capitalization of Exxon Mobil is impressive, $340 billion; the yield on dividends is estimated at 4 percent.

AbbVie

A major dividend aristocrat capable of surpassing Exxon Mobil in terms of profitability which reaches 4.37 percent, is the AbbVie pharmaceutical company. This corporation, engaged in the field of healthcare, manages capital perfectly and is able to multiply it. This company was established in 2013 after separation from Abbot Laboratories, whose history goes back over 130 years. The company's dividend history is impressive: a consistent increase in interest has been fixed for 25 years.

Consolidated Edison

There are also electricity distribution companies among US dividend aristocrats. These are the most experienced players in the stock market, analysts say. Consolidated Edison Corporation is considered the largest producer and supplier of electricity for New York and the surrounding regions. It was created in 1882 and has an impressive history. In January 2018, a company with the dividend yield of 3.70 percent announced a quarterly increase in payments to shareholders.

Procter&Gamble

Procter & Gamble, one of the leading companies of the world, produces popular consumer goods represented by Fairy, Tide, Pampers, Old Spice, Oral-B, Gillette and others. According to experts, this indicates a reliable inflow of income, regardless of crises. Almost all Procter & Gamble products are in the base category. Shareholders of the company receive dividends over more than 100 years, and the percentage of payments grows 62 years in a row. Anyone wishing to become a P&G shareholder is guaranteed a regular increase in dividend income which is estimated at 3.29 percent.

Kimberly-Clark Corp

This company is not too popular, but its products, which include Kleenex wipes, Huggies diapers, and others, are known to both American and global consumers. The history of Kimberly-Clark began in 1872, 10 years after the end of the American Civil War. Quite quickly, the company became the world leader in the production of health care products, as well as personal, professional and industrial hygiene goods. In January 2018, its management announced a small increase in dividend income, which is 3.63 percent.

PepsiCo

Experts consider the PepsiСo brand to be the most stable and time-tested among US dividend aristocrats. In addition to the Pepsi carbonated beverage, the company produces Lipton, Mountain Dew, Mirinda, and 7up beverages, as well as Lays and Cheetos chips, etc. It is very popular in the world. The company's management has been paying dividends to shareholders since 1965, and in 2017, the global producer of beverages and food surprised clients with the increase in the interest rate. The dividend yield of the company is estimates at 3.36 percent.

Coca-Cola

Coca-Cola, a well-known global megabrand, is also among US dividend aristocrats. The company, whose dividend yield is equal to 3.37 percent, is considered one of the leaders of the American stock market. The legendary Warren Buffett and his investment group, Berkshire Hathaway, are the company's shareholders. They have a huge stake in this business since 1987. In February 2018, Coca-Cola executives announced an annual dividend increase. This guarantees high profits in the present and in the future.

Target Corp

The Target company, specializing in retail, keeps aloof. According to experts, it is more sensitive to ups and downs in the economy. However, Target shares can be a profitable investment for those who want to diversify their portfolio. The company's management has increases dividend payments to shareholders at least once a year for 46 years. Its dividend yield is estimated at 3.12 percent.

|

Метки: #photo_news |

What future holds for oil |

The recent OPEC+ pact not only stopped the fall in oil prices, but also gave it momentum for a rally. Oil quotes gained over 5% once the official news was released regarding cartel’s plans to reduce oil production by 1.2 million barrels per day. Oil has been in a downtrend lately. Moreover, most analysts expected a further decline in oil prices amid Donald Trump’s statements that the world did not need expensive oil. However, during the recent summit, OPEC agreed to start lowering the volume of extracted oil from January 2019. The pact was signed for 6 months and could be extended after the expiration of this term. Currently, oil is supported by the OPEC’s decision. Nevertheless, it is not easy to predict the further oil movement as there are other factors influencing it. For example, Saudi Arabia could give in to the US pressure anytime and ramp up its oil output.

Read more: https://www.mt5.com/forex_humor/image/39220

|

Метки: #forex_caricature |

What future holds for oil |

The recent OPEC+ pact not only stopped the fall in oil prices, but also gave it momentum for a rally. Oil quotes gained over 5% once the official news was released regarding cartel’s plans to reduce oil production by 1.2 million barrels per day. Oil has been in a downtrend lately. Moreover, most analysts expected a further decline in oil prices amid Donald Trump’s statements that the world did not need expensive oil. However, during the recent summit, OPEC agreed to start lowering the volume of extracted oil from January 2019. The pact was signed for 6 months and could be extended after the expiration of this term. Currently, oil is supported by the OPEC’s decision. Nevertheless, it is not easy to predict the further oil movement as there are other factors influencing it. For example, Saudi Arabia could give in to the US pressure anytime and ramp up its oil output.

Read more: https://www.mt5.com/forex_humor/image/39220

|

Метки: #forex_caricature |

What future holds for oil |

The recent OPEC+ pact not only stopped the fall in oil prices, but also gave it momentum for a rally. Oil quotes gained over 5% once the official news was released regarding cartel’s plans to reduce oil production by 1.2 million barrels per day. Oil has been in a downtrend lately. Moreover, most analysts expected a further decline in oil prices amid Donald Trump’s statements that the world did not need expensive oil. However, during the recent summit, OPEC agreed to start lowering the volume of extracted oil from January 2019. The pact was signed for 6 months and could be extended after the expiration of this term. Currently, oil is supported by the OPEC’s decision. Nevertheless, it is not easy to predict the further oil movement as there are other factors influencing it. For example, Saudi Arabia could give in to the US pressure anytime and ramp up its oil output.

Read more: https://www.mt5.com/forex_humor/image/39220

|

Метки: #forex_caricature |

Ten ideas of successful and rich people |

The famous American researcher, Thomas Corley, in his book Rich Habits: The Daily Success Habits Of Wealthy Individuals gives the results of a study on the daily habits of 233 rich and 128 poor Americans.

Excerpts from his work are quoted by many reputable publications, including Business Insider. Read about sensational conclusions made by the scientist in our article.

Thomas Corley is convinced that the richness has very little to do with luck: a successful model of behavior is made up mostly not of actions but of habits and ways of thinking. “Rich people are mostly optimistic; they are grateful, and happiness also becomes their habit,” Thomas Corley wrote.

In this study, the rich refers to people with an annual income of at least $160 thousand owning assets of $3.2 million or more. The poor in Corley’s classification refers to those who do not earn even $35 thousand a year and have less than $5 thousand in assets.

Habit is a second nature

About 52 percent of prosperous people consider daily activities important for welfare gains, and only 3 percent of respondents in the second group attach great importance to habits.

Good habits shape our daily lives, create the prerequisites for success and attract good luck to our lives. Only poor people believe that their failures are related to the will of fate or the machinations of enemies.

American Dream

It turns out that people who still believe in the American dream can be found in the modern world. 98 percent of wealthy American citizens are guided by it, while the overwhelming majority (87 percent) of the poor considers this spiritual ideal a utopia.

The foundation of a well-known optimistic ideology is capital for the increase of which only desire is enough, the possibilities are equal for all.

Networking is important

88 percent of wealthy Americans consider networking one of the most important conditions for achieving prosperity. 17 percent of opponents agree with them.

It is important to understand that any contacts can generate income. And it depends only on you whether it will be active or passive. Rich people regularly reminds about themselves, while the poor break off all ties.

New acquaintances mean new opportunities

68 percent of wealthy Americans strive to make new acquaintances, and only 11 percent of the poor follow this advice.

In addition, successful people like to be in the center of attention, so they consciously work to create a positive image. Most of the poor do not even think about it.

Savings are very important

88 percent of prosperous Americans consider the increment of capital as an indispensable condition of their life, while it is equally important to be able to save money. Only 52 percent of poor US citizens agree with them.

An unspoken rule of success says: you use 20 percent of your income for savings and investment portfolio, then spend 80 percent on everything else.

Our fate is in our hands

One of the main components of the American dream, the question of the influence of certain factors on the life course of a person, caused the greatest divergence in the views of the two groups studied.

Thus, 90 percent of rich people believe that their personal qualities form the way of life. Only 10 percent of poor people agreed with them: they mainly blame their genetics, fatal predestination and other factors beyond their control.

Ingenuity is more important than intelligence

The rankings of the richest people in the world, published annually by Forbes, are vivid evidence that an enterprising and resourceful mind is more important than any IQ.

Among 75 percent of rich respondents who confirmed this position, many were “losers” in childhood, but this did not prevent them from achieving financial independence. 11 percent of the poor agree with them.

I love my job

Satisfaction with the work is another important indicator that a person is successful in business.

85 percent of wealthy American citizens, contrary to popular belief on this subject, are happy to fulfill their duties, so they work harder than the poor. Among the second group, only 2 percent are able to look at their work not as a routine and find something creative in it.

Good health is a key to success

85 percent of wealthy respondents confirmed that they take care of their health using preventive medical measures. Among the poor, only 13 percent of respondents are concerned about this issue.

Considering that health care costs in the United States are among the highest in the world, one cannot but agree that the smaller the number of sick leaves, the more money you get.

Risk is a noble cause

As you know, bad experience serves as an excellent incentive for new victories, but the risk should not be thoughtless.

As it turned out, 63 percent of the rich are ready to take risks for the sake of capital accumulation, while 27 percent of them made mistakes and lost all their assets at least once. Almost 6 percent of the poor admitted that they are able to take risks.

|

Метки: #photo_news |

Ten ideas of successful and rich people |

The famous American researcher, Thomas Corley, in his book Rich Habits: The Daily Success Habits Of Wealthy Individuals gives the results of a study on the daily habits of 233 rich and 128 poor Americans.

Excerpts from his work are quoted by many reputable publications, including Business Insider. Read about sensational conclusions made by the scientist in our article.

Thomas Corley is convinced that the richness has very little to do with luck: a successful model of behavior is made up mostly not of actions but of habits and ways of thinking. “Rich people are mostly optimistic; they are grateful, and happiness also becomes their habit,” Thomas Corley wrote.

In this study, the rich refers to people with an annual income of at least $160 thousand owning assets of $3.2 million or more. The poor in Corley’s classification refers to those who do not earn even $35 thousand a year and have less than $5 thousand in assets.

Habit is a second nature

About 52 percent of prosperous people consider daily activities important for welfare gains, and only 3 percent of respondents in the second group attach great importance to habits.

Good habits shape our daily lives, create the prerequisites for success and attract good luck to our lives. Only poor people believe that their failures are related to the will of fate or the machinations of enemies.

American Dream

It turns out that people who still believe in the American dream can be found in the modern world. 98 percent of wealthy American citizens are guided by it, while the overwhelming majority (87 percent) of the poor considers this spiritual ideal a utopia.

The foundation of a well-known optimistic ideology is capital for the increase of which only desire is enough, the possibilities are equal for all.

Networking is important

88 percent of wealthy Americans consider networking one of the most important conditions for achieving prosperity. 17 percent of opponents agree with them.

It is important to understand that any contacts can generate income. And it depends only on you whether it will be active or passive. Rich people regularly reminds about themselves, while the poor break off all ties.

New acquaintances mean new opportunities

68 percent of wealthy Americans strive to make new acquaintances, and only 11 percent of the poor follow this advice.

In addition, successful people like to be in the center of attention, so they consciously work to create a positive image. Most of the poor do not even think about it.

Savings are very important

88 percent of prosperous Americans consider the increment of capital as an indispensable condition of their life, while it is equally important to be able to save money. Only 52 percent of poor US citizens agree with them.

An unspoken rule of success says: you use 20 percent of your income for savings and investment portfolio, then spend 80 percent on everything else.

Our fate is in our hands

One of the main components of the American dream, the question of the influence of certain factors on the life course of a person, caused the greatest divergence in the views of the two groups studied.

Thus, 90 percent of rich people believe that their personal qualities form the way of life. Only 10 percent of poor people agreed with them: they mainly blame their genetics, fatal predestination and other factors beyond their control.

Ingenuity is more important than intelligence

The rankings of the richest people in the world, published annually by Forbes, are vivid evidence that an enterprising and resourceful mind is more important than any IQ.

Among 75 percent of rich respondents who confirmed this position, many were “losers” in childhood, but this did not prevent them from achieving financial independence. 11 percent of the poor agree with them.

I love my job

Satisfaction with the work is another important indicator that a person is successful in business.

85 percent of wealthy American citizens, contrary to popular belief on this subject, are happy to fulfill their duties, so they work harder than the poor. Among the second group, only 2 percent are able to look at their work not as a routine and find something creative in it.

Good health is a key to success

85 percent of wealthy respondents confirmed that they take care of their health using preventive medical measures. Among the poor, only 13 percent of respondents are concerned about this issue.

Considering that health care costs in the United States are among the highest in the world, one cannot but agree that the smaller the number of sick leaves, the more money you get.

Risk is a noble cause

As you know, bad experience serves as an excellent incentive for new victories, but the risk should not be thoughtless.

As it turned out, 63 percent of the rich are ready to take risks for the sake of capital accumulation, while 27 percent of them made mistakes and lost all their assets at least once. Almost 6 percent of the poor admitted that they are able to take risks.

|

Метки: #photo_news |

Ten ideas of successful and rich people |

The famous American researcher, Thomas Corley, in his book Rich Habits: The Daily Success Habits Of Wealthy Individuals gives the results of a study on the daily habits of 233 rich and 128 poor Americans.

Excerpts from his work are quoted by many reputable publications, including Business Insider. Read about sensational conclusions made by the scientist in our article.

Thomas Corley is convinced that the richness has very little to do with luck: a successful model of behavior is made up mostly not of actions but of habits and ways of thinking. “Rich people are mostly optimistic; they are grateful, and happiness also becomes their habit,” Thomas Corley wrote.

In this study, the rich refers to people with an annual income of at least $160 thousand owning assets of $3.2 million or more. The poor in Corley’s classification refers to those who do not earn even $35 thousand a year and have less than $5 thousand in assets.

Habit is a second nature

About 52 percent of prosperous people consider daily activities important for welfare gains, and only 3 percent of respondents in the second group attach great importance to habits.

Good habits shape our daily lives, create the prerequisites for success and attract good luck to our lives. Only poor people believe that their failures are related to the will of fate or the machinations of enemies.

American Dream

It turns out that people who still believe in the American dream can be found in the modern world. 98 percent of wealthy American citizens are guided by it, while the overwhelming majority (87 percent) of the poor considers this spiritual ideal a utopia.

The foundation of a well-known optimistic ideology is capital for the increase of which only desire is enough, the possibilities are equal for all.

Networking is important

88 percent of wealthy Americans consider networking one of the most important conditions for achieving prosperity. 17 percent of opponents agree with them.

It is important to understand that any contacts can generate income. And it depends only on you whether it will be active or passive. Rich people regularly reminds about themselves, while the poor break off all ties.

New acquaintances mean new opportunities

68 percent of wealthy Americans strive to make new acquaintances, and only 11 percent of the poor follow this advice.

In addition, successful people like to be in the center of attention, so they consciously work to create a positive image. Most of the poor do not even think about it.

Savings are very important

88 percent of prosperous Americans consider the increment of capital as an indispensable condition of their life, while it is equally important to be able to save money. Only 52 percent of poor US citizens agree with them.

An unspoken rule of success says: you use 20 percent of your income for savings and investment portfolio, then spend 80 percent on everything else.

Our fate is in our hands

One of the main components of the American dream, the question of the influence of certain factors on the life course of a person, caused the greatest divergence in the views of the two groups studied.

Thus, 90 percent of rich people believe that their personal qualities form the way of life. Only 10 percent of poor people agreed with them: they mainly blame their genetics, fatal predestination and other factors beyond their control.

Ingenuity is more important than intelligence

The rankings of the richest people in the world, published annually by Forbes, are vivid evidence that an enterprising and resourceful mind is more important than any IQ.

Among 75 percent of rich respondents who confirmed this position, many were “losers” in childhood, but this did not prevent them from achieving financial independence. 11 percent of the poor agree with them.

I love my job

Satisfaction with the work is another important indicator that a person is successful in business.

85 percent of wealthy American citizens, contrary to popular belief on this subject, are happy to fulfill their duties, so they work harder than the poor. Among the second group, only 2 percent are able to look at their work not as a routine and find something creative in it.

Good health is a key to success

85 percent of wealthy respondents confirmed that they take care of their health using preventive medical measures. Among the poor, only 13 percent of respondents are concerned about this issue.

Considering that health care costs in the United States are among the highest in the world, one cannot but agree that the smaller the number of sick leaves, the more money you get.

Risk is a noble cause

As you know, bad experience serves as an excellent incentive for new victories, but the risk should not be thoughtless.

As it turned out, 63 percent of the rich are ready to take risks for the sake of capital accumulation, while 27 percent of them made mistakes and lost all their assets at least once. Almost 6 percent of the poor admitted that they are able to take risks.

|

Метки: #photo_news |

Pound hits fresh low |

The problematic withdrawal from the European Union, disagreements in the government and a slowdown in the global econom weigh heavily on the pound. The currency plunged to a fresh 18-month low against the US dollar after the House of Commons voted by a majority to investigate the issue of disrespect of the Cabinet of Ministers to the legislature.

Internal disputes between the parliament and the government are not the best support for any currency. The results of this vote are an important political indicator, and it signals a danger. On the eve of the most important discussion in the Parliament about the Brexit deal between London and Brussels, Theresa May’s government does not have the necessary majority in the House of Commons. Thus, the voting results are unpredictable. If lawmakers do not ratify the deal, the pound will fall again. Opening the debate before the vote, Theresa May said that Brexit should not split the country into two camps.

The British Prime Minister said that they will be able to take advantage of this moment [withdrawal from the EU] only if they are able to implement such a Brexit that will unite the country.

This means that the protection of simplified trade relations, timely support of the supply chains and jobs that depend on them, security cooperation, the progress the country has achieved with regard to Northern Ireland, and the rights of citizens in the UK and throughout the European Union will be provided.

Read more: https://www.mt5.com/forex_humor/image/39174

|

Метки: #forex_caricature |

G20 Summit in Argentina |

In Argentina, the G20 Summit was held. World politicians discussed the most pressing topics of the world economy and politics. The official agenda is drawn up beforehand and does not always coincide with real issues. Our review presents the most sensitive topics of the past summit.

Low expectations

Pedro Delgado, Argentina's lead organizer for the G-20, acknowledged that it might not be possible to reach a consensus on a final statement.

In general, analysts have low expectations concerning the summit, because at the moment there are many unresolved conflicts and potential sources of instability.

US-China trade war

During the meeting of US President Donald Trump and Chinese leader Xi Jinping in Buenos Aires, the immediate future of the world economy was decided. If the parties reached an agreement, this could calm the storm in world markets.

Currently, Donald Trump threatens to introduce new tariffs on imports from China, and most experts doubt that the leaders of the countries will be able to reach a compromise and move to a more constructive dialogue.

Is Saudi Crown Prince a criminal?

Saudi Arabian Crown Prince Mohammed bin Salman is suspected of murdering Turkish journalist Jamal Khashoggi.

The journalist disappeared after he entered the building of the Consulate General of Saudi Arabia in Istanbul. According to preliminary data, Khashoggi was killed as a result of a quarrel with the consulate staff.

The Istanbul Prosecutor’s Office believes that the assassination of Khashoggi was deliberate, and demanded that Saudi Arabia extradite those responsible for the crime.

The journalist worked as a columnist for the Washington Post in the USA and had been living in the USA since 2017.

At the moment, most world politicians do not comment on this situation, and experts believe that they will avoid taking photos with the Crown Prince.

In addition, the human rights organization, Human Rights Watch, accuses the crown prince of Saudi Arabia of war crimes in Yemen.

Ukraine

US President Donald Trump canceled a meeting with Russian President Vladimir Putin in Buenos Aires on November 29, explaining this with "Russian aggression."

On Sunday, November 25, the border service of the Federal Security Service of Russia detained three Ukrainian warships due to the violation of the sea border, 24 seamen were arrested.

In response, the President of Ukraine, Petro Poroshenko, imposed martial law on a part of the country’s territory, and later the authorities banned male Russian citizens aged 16 to 60 from entering the territory of Ukraine.

The US Senate unanimously accused Moscow of aggression against Ukraine, many Western politicians are calling for tougher economic sanctions against the Russian Federation.

Difficulties in US-European relations

European leaders do not have a strong position to negotiate with the United States. French President Emmanuel Macron feared that Trump will impede progress at the summit.

Earlier, Trump criticized Macron because of a proposal to strengthen Europe’s contribution to European defense in order to reduce its dependence on the United States. In addition, the American president is dissatisfied with the introduction of tariffs for wine from the United States.

Trump also said that Theresa May’s Brexit agreement is “an excellent deal for the European Union” which can make it difficult to conclude a trade agreement between the UK and the United States.

According to analysts, Europe needs to strengthen trade relations with the United States, but the relationship between Trump and European leaders is in a terrible state.

NAFTA

Shortly before the summit, Mexico and Canada agreed with the administration of the US President on an updated version of the North American Free Trade Agreement.

The agreement was signed during the G20 summit, and it will enter into force only after ratification by the legislative bodies of the participating countries.

The signing of the NAFTA agreement, according to experts, was one of the few positive moments of the summit in Argentina.

At the same time, analysts emphasize that Canada and Mexico are still dissatisfied with the fact that the US did not eliminate tariffs for steel and aluminum.

|

Метки: #photo_news |

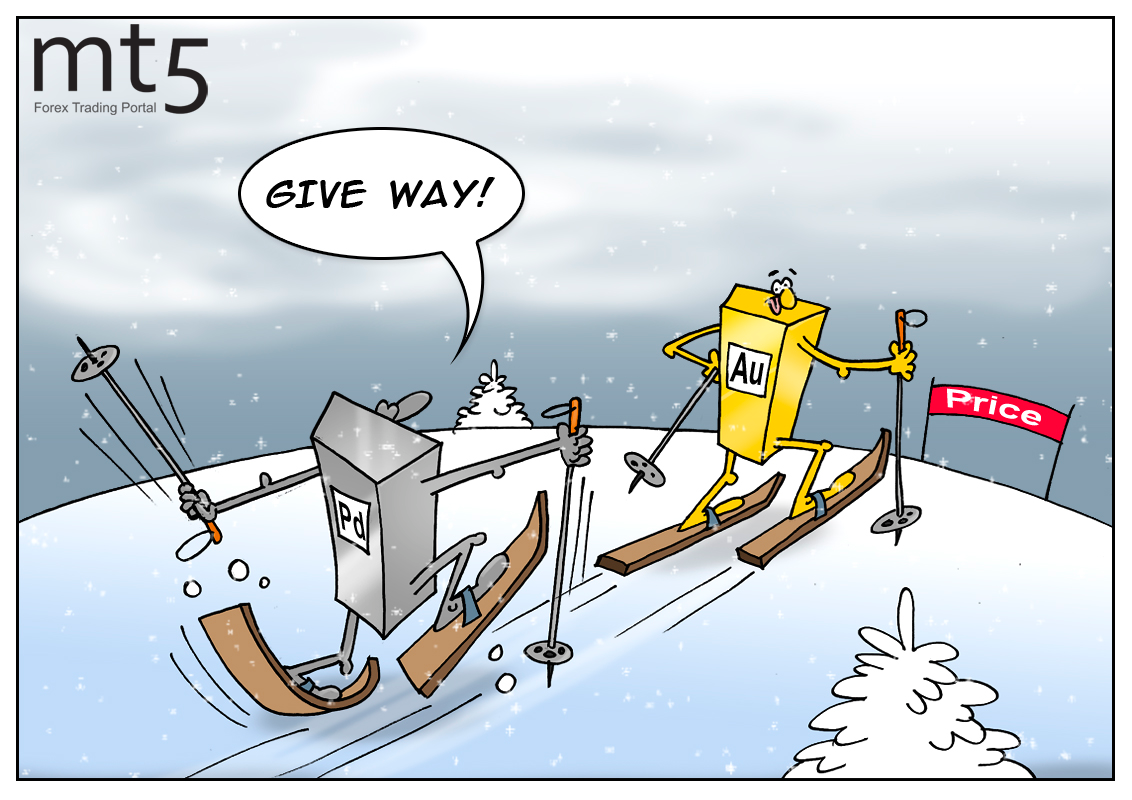

Palladium catches up with gold first time since 2002 |

Recently, palladium has surprised investors. Its price neared gold for the first time in past 16 years. Some market participants have never seen such an unusual occurrence. By the way, prices for stock futures almost equaled while the spot palladium went even further, reaching nearly the same level as gold.

Palladium started rising in October when experts noted a shortage of supply in the market which still persists. Then, a snowball effect was triggered. The deficit led to an increase in demand, and consequently, a rise in prices which, in its turn, entailed speculations. As a result, in early December the spot palladium hit the record high at 1,230.90 dollars per troy ounce. Moreover, palladium prices rose even above gold prices on the intraday basis. “For the moment, we don’t see anything changing; the metal remains in demand for industrial uses, speculators are covering their positions, lease market is very tight, and palladium forwards are in backwardation. We could see some higher prices from here in the very short term,” expert in precious metals Jonathan Butler said.

Palladium is still widely used for industrial purposes, and the speculating volume is likely to increase even more. Overall, the year of 2018 is going to be very good for the metal. Palladium is the only asset among precious and industrial metals that has been showing great performance so far this year.

Read more: https://www.mt5.com/forex_humor/image/39164

|

Метки: #forex_caricature |