10 Tips For Making A Good Home Mortgage No Closing Costs Even Better |

Reverse Mortgage for Beginners

You'll also pay a yearly premium fee of 0.5 percent of your loan balance for HECM loans, although this cost can be funded into your loan. This does not take into consideration other common closing expenses associated with any home loan, such as document preparation, assessments, certifications, taping fees, and the expense of credit reports as the lending institution will wish to inspect your credit.

However, reverse home mortgages can also come due if you stop working to meet the regards to your arrangement, such as if you do not pay your real estate tax. The property owner invariably needs to keep up with the extra costs of taxes, residential or commercial property insurance coverage, and maintenance. Your total debt will be the quantity of money you take in money, plus the interest on the money you obtained.

Rumored Buzz on Residential Mortages

When your loan comes due, it should be paid back. The majority of reverse home mortgages are paid back through the sale of the house. For instance, the home will go on the marketplace after your death, and your estate will get money when it offers-- cash that should then be used to pay off the loan.

You don't need to pay the difference with an HECM loan if you owe more than Residential Mortages you offer the home for, and that's an advantage. The majority of reverse mortgages consist of a provision that does not enable the loan balance to surpass the worth of the home's equity, although market changes can still result in less equity than when you secured the loan.

What Does Reverse Mortgage Mean?

Your heirs will have to develop the cash if they want to keep the house in the family. It's possible that your estate may offer adequate other possessions to enable them to do this, however otherwise, they might not be able to receive a routine mortgage to pay off the financial obligation and keep the home.

Hospitalization of 12 months or less is OKAY if you need an extended remain in a long-lasting care facility, however you 'd discover yourself in a position where you should repay the loan at a time when doing so might be difficult if you should stay longer than that. A reverse home loan lender can foreclose and take your property if you fail to do so.

Reverse Mortage Tips for Dummies

Be really sure that you can pay for to keep up with your house's associated expenditures. Once again, foreclosure is possible https://www.liveinternet.ru/users/xippusmhis/post464010925// if you can't keep up with these property taxes and insurance. Your lending institution might "reserve" a few of your loan continues to meet these expenses if you can't. This is an arrangement you may voluntarily elect if you think you'll ever have trouble in this regard.

If and when your loan balance reaches the point where it exceeds your house's worth, your lender may select foreclosure in this case too. On the other side, reverse home loans can supply money for anything you desire, from supplemental retirement earnings to money for a large home improvement task.

How Residential Mortages can Save You Time, Stress, and Money.

You 'd be lessening your financial obligation load in your retirement years if you take the cash and pay off your existing mortgage. A reverse home loan can certainly ease the stress of paying your bills in retirement ... or perhaps improving your way of life in your golden years. Initially, you should meet some standard criteria: You can't be delinquent on any debt owed to the federal government.

There's no loan-to-value estimation like you 'd have with a "forward" home mortgage. You'll need to prove to the lender that you can staying up to date with the ongoing expenditures of keeping your house. This makes sure that the residential or commercial property keeps its value and that you keep ownership of the residential or commercial property. You must attend therapy, a "consumer details session" with a HUD-approved counselor, prior to your HECM loan can be funded.

Everything about Mortgages

Therapists work for independent companies, so they must supply impartial details about the item. These courses are readily available at low expense and in some cases they're even complimentary. You can still get a reverse home loan if you owe money on your home-- you have a first home loan versus it. Some people take a reverse home loan in order to get rid of the existing monthly payments by netting the loan income versus their existing mortgage payment.

Amazon The reality is reverse home mortgages are exorbitantly expensive loans. Like a regular mortgage, you'll pay various charges and closing costs that will amount to thousands of dollars. Additionally, you'll pay a home mortgage insurance premium. With a routine home loan, you can avoid paying for home mortgage insurance coverage if your deposit is 20% or more of the purchase price.

More About Reverse Mortgage

The premium equates to 0.5% if you secure a loan equal to 60% or less of the assessed worth of the house. The premium jumps to a tremendous 2.5% if the loan amounts to more than 60% of the home's value. If your house is assessed at $450,000 and you take out a $300,000 reverse home loan, it will cost you an additional $7,500 on top of all of the other closing costs.

The overall is charged based upon your life span. If you are expected to live another 10 years (120 months) you'll be charged another $3,600 to $4,200. That figure will be deducted from the quantity you receive. The majority of the fees and expenses can be rolled into the loan, which means they compound with time.

Facts About Home Morgages Revealed

Since you never pay down your reverse home mortgage, the figure compounds month after month. A routine mortgage compounds on a lower figure each month. A reverse home loan substances on a higher number. If you pass away, your estate pays back the loan with the proceeds from the sale of your house.

The other trigger for repayment is that you move out of the house. As soon as you do, you have a year to close the loan. If you move to a retirement home, you'll probably need the equity in your home to pay those expenses. In 2016, the typical expense of a nursing house was $81,128 per year for a semi-private space.

What Does Reverse Mortage Tips Do?

In that case, unless your kids step up to pay for it, you're going to a Medicaid center, which is something you most likely wish to prevent. The high expenses of reverse mortgages are not worth it for many people. You're much better off offering your house and moving to a cheaper place, keeping whatever equity you have in your pocket rather than owing it to a reverse home mortgage lending institution.

Marc is Chief Income Strategist at the Oxford Club and Senior Citizen Editor of The Oxford Income Letter, where he runs the Instant Earnings Portfolio, Compound Earnings Portfolio and Retirement Catch-Up/High Yield Portfolio. You can follow him on Twitter @stocksnboxing .

See This Report on Reverse Mortgage

7th Sep 19, 9:26 am Moneyhub's Christopher Walsh digs deep in to reverse home mortgages, what they are, their advantages, and their pitfalls and drawbacks. This is a complete resource if you are thinking about one Moneyhub's Christopher Walsh digs deep in to reverse home mortgages, what they are, their benefits, and their pitfalls and disadvantages.

|

|

10 Secrets About Reverse Mortage Tips You Can Learn From Tv |

An Unbiased View of Reverse Mortage Tips

For a HECM, the quantity you can borrow will be based upon the youngest customer's age, the loan's interest rate and the lesser of your home's assessed worth or the FHA's maximum claim amount, which is $679,650 for 2018. You can't obtain 100% of what your house is worth, or anywhere near to it, nevertheless.

Here are a couple of other things you require to learn about how much you can borrow: The loan profits are based upon the age of the youngest debtor or, if the customer is wed, the younger spouse, even if the younger partner is not a borrower. The older the youngest borrower is, the higher the loan proceeds.

The higher your home's evaluated value, the more http://edition.cnn.com/search/?text=reverse mortages you can obtain. A strong reverse mortgage monetary evaluation increases the profits you'll receive because the loan provider will not withhold part of them to pay real estate tax and property owners insurance coverage in your place. The amount you can in fact obtain is based upon what's called the initial principal limit.

Mortgages - Questions

The federal government lowered the initial primary limitation in October 2017, making it harder for property owners, particularly younger ones, to get approved for a reverse home mortgage. On the benefit, the change assists debtors maintain more of their equity. The federal government reduced the limit for the very same factor it altered insurance coverage premiums: since the home mortgage insurance coverage fund's deficit had actually nearly folded the past fiscal year.

To further complicate things, you can't borrow all of your initial principal limitations in the very first year when you select a lump amount or a line of credit. Instead, you can obtain up to 60%, or more if you're utilizing the money to settle your forward home mortgage. And if you choose a lump sum, the quantity you get up front is all you will ever get.

Both spouses have to grant the http://sterlingashleyxtro.zoninrewards.com/an-intr...everse-mortgage-nursing-home-1 loan, but both do not need to be borrowers, and this arrangement can produce problems. If two spouses live together in a house however only one partner is called as the customer on the reverse home loan, the other partner is at danger of losing the home if the loaning partner dies initially.

Facts About Home Morgages Revealed

If the making it through spouse wishes to keep the house, she or he will have to repay the loan through other means, potentially through a costly refinance. Just one spouse might be a borrower if just one partner holds title to your house, perhaps due to the fact that it was acquired or since its ownership predates the marriage.

The nonborrowing partner might even lose the house if the loaning partner had to move into an assisted living center or retirement home for a year or longer. With a product as possibly financially rewarding as a reverse mortgage and a susceptible population of borrowers who might have cognitive problems or be desperately looking for monetary redemption, frauds abound.

The vendor or contractor may or might not actually deliver on guaranteed, quality work; they may simply steal the homeowner's cash. Relatives, caregivers, and monetary advisors have likewise benefited from elders by using a power of attorney to reverse mortgage the home, then stealing the profits, or by convincing them to purchase a monetary product, such Home Morgages as an annuity or whole life insurance coverage, that the senior can only manage by obtaining a reverse mortgage.

The Best Guide To Home Morgages

These are just a few of the reverse mortgage scams that can trip up unwitting property owners. Another danger related to a reverse home loan is the possibility of foreclosure. Despite the fact that the debtor isn't responsible for making any mortgage payments-- and for that reason can't become delinquent on them-- a reverse home loan needs the debtor to meet specific conditions.

As a reverse home mortgage borrower, you are needed to live in the home and keep it. If the home falls into disrepair, it won't deserve reasonable market price when it's time to sell, and the lending institution will not be able to recover the total it has actually reached the borrower.

Once again, the lender enforces these requirements to secure its interest in the house. If you do not pay your residential or commercial property taxes, your local tax authority can take the home. If you don't have house owners insurance and there's a home fire, the lending institution's security is damaged. About one in five reverse mortgage foreclosures from 2009 through 2017 were triggered by the customer's failure to pay residential or commercial property taxes or insurance, according to an analysis by Reverse Mortgage Insight.

Unknown Facts About Reverse Mortgage

Preferably, anybody thinking about http://www.bbc.co.uk/search?q=reverse mortages getting a reverse home mortgage will take the time https://www.washingtonpost.com/newssearch/?query=reverse mortages to thoroughly discover about how these loans work. That method, no deceitful loan provider or predatory fraudster can victimize them, they'll be able to make a sound choice even if they get a poor-quality reverse mortgage counselor and the loan will not come with any unpleasant surprises.

Borrowers must put in the time to educate themselves about it to be sure they're making the best option about how to use their house equity.

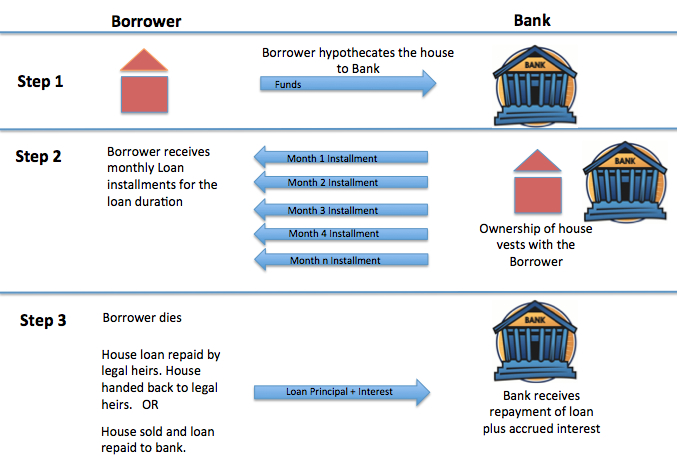

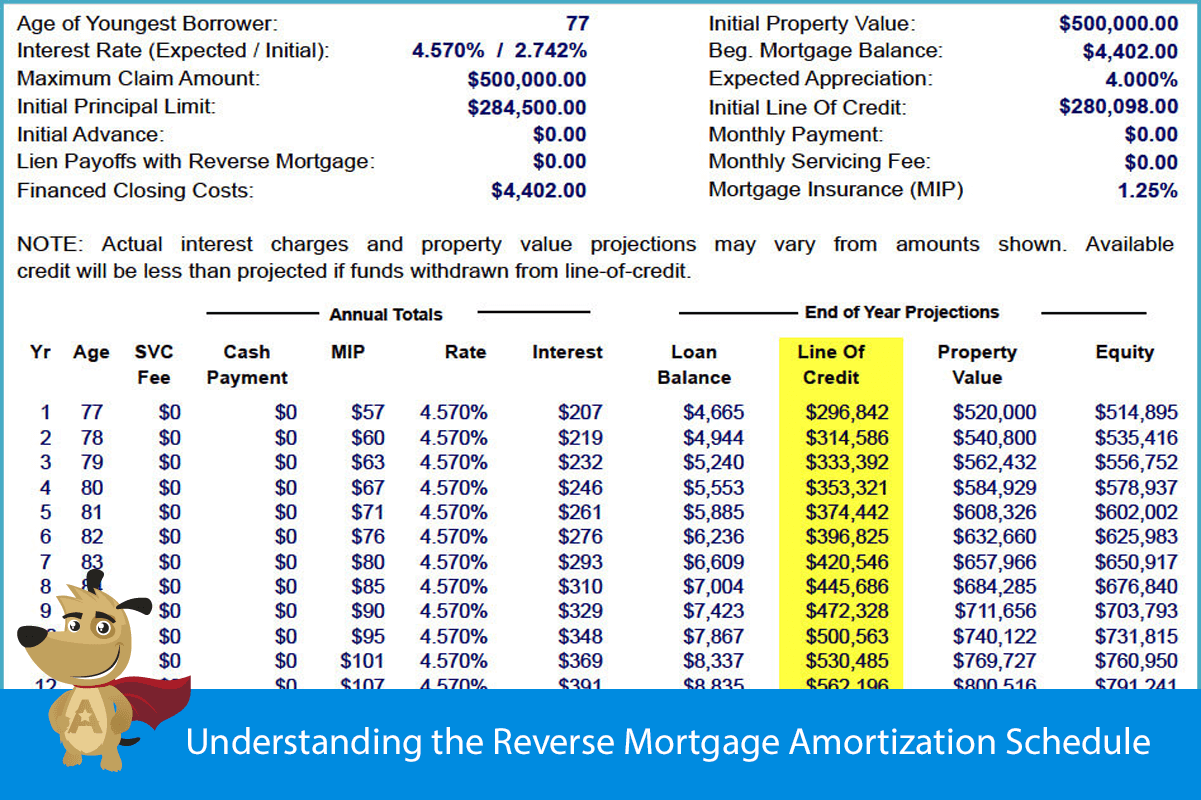

Notes for the table illustrations Please keep in mind that these examples are for illustrative functions only and offer no assurances regarding any future equity that you may have in your residential or commercial property. Equity Staying is based upon the approximated home value less loan balance including interest. This figure does not permit any costs that might be sustained throughout the sale of the property.

Reverse Mortgage Things To Know Before You Buy

and undergoes alter. A rate of interest of % p.a. intensified monthly, including applicable charges or charges and no repayments being made has actually been utilized in this example. Various rates of interest may use. Various loan amounts, rates of interest, terms, and costs and charges, will lead to different repayment quantities.

This might suggest that the amount of equity staying in your house (the distinction between the home's worth and the outstanding loan balance) might be significantly less at the end of the loan than it was at the beginning. Nevertheless, Heartland Bank uses you the No Unfavorable Equity Warranty which suggests that you will not need to pay us back more than the net sale proceeds of the residential or commercial property, even if this amount is less than the impressive loan balance.

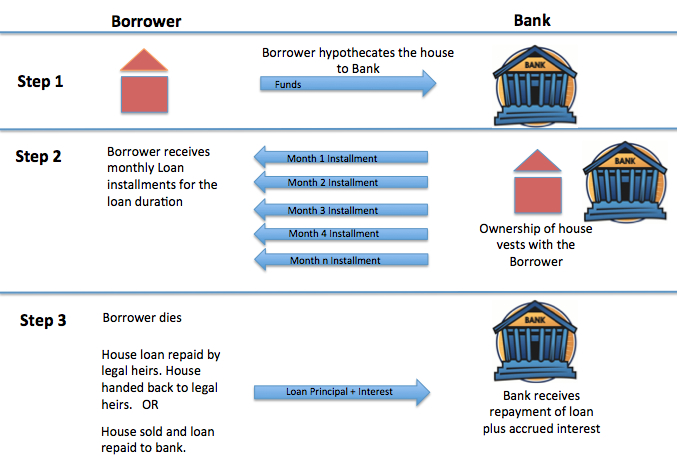

A reverse home mortgage resembles a regular home loan that has been developed for the requirements of senior citizens. It permits individuals aged 60 and over to launch house equity to live a more comfortable retirement. Notably, you continue to own and reside in your house.

The 6-Minute Rule for Reverse Mortgage

If you require to maximize a little cash as you head into retirement, a reverse mortgage might be the service. A reverse mortgage lets you mortgage your residential or commercial property so you can access your equity without any payments required till you leave. For lots of retirees, a reverse mortgage provides financial security to cover those unanticipated costs-- like home repair work or significant surgical treatment-- without having to sell the family house.

|

|

What The Oxford English Dictionary Doesn't Tell You About Home Morgages |

Reverse Mortgage Fundamentals Explained

Ask about "loan or grant programs for home repair work or improvements," or "real estate tax deferment" or "home tax post ponement" programs, and how to use. Do you reside in a higher-valued home? You might be able to obtain more money with an exclusive reverse home loan. However the more you borrow, the greater the charges you'll pay.

A HECM therapist or a lender can help you compare these types of loans side by side, to see what you'll get-- and what it costs. Compare charges and expenses. This bears repeating: search and compare the costs of the loans offered to you. While the home mortgage insurance premium is generally the same from lending institution to lender, the majority of loan expenses-- including origination fees, rate of interest, closing expenses, and maintenance charges-- vary amongst loan providers.

Ask a counselor or lender to explain the Total Yearly Loan Expense (TALC) rates: they show the forecasted http://edition.cnn.com/search/?text=reverse mortages annual average cost of a reverse mortgage, including all the itemized costs. And, no matter what kind of reverse home mortgage you're considering, comprehend all the reasons that your loan may have to be repaid prior to you were planning on it.

The Main Principles Of Residential Mortages

A therapist from an independent government-approved real estate counseling agency can assist. But a sales representative isn't likely to be the very best guide for what works for you. This is particularly true if he or she acts like a reverse home mortgage is a service for all your problems, presses you to get a loan, or has concepts on how you can spend the money from a reverse home mortgage.

If you decide you require house improvements, and you believe a reverse home mortgage is the way to pay for them, search prior to choosing on a particular seller. Your house improvement expenses consist of not just the cost of the work being done-- however also the expenses and charges you'll pay to https://en.search.wordpress.com/?src=organic&q=reverse mortages get the reverse home mortgage.

Resist that pressure. If you buy those kinds of financial items, you could lose the cash you receive from your reverse home loan. You don't need to purchase any financial items, services or financial investment to get home mortgage with renovation loan a reverse mortgage. In reality, in some situations, it's unlawful to require you to buy other products to get a reverse home mortgage.

Examine This Report about Home Morgages

Stop and talk to a therapist or someone you trust prior to you sign anything. A reverse home mortgage can be made complex, and isn't something to hurry into. The bottom line: If you don't comprehend the expense or features of a reverse mortgage, leave. If you feel pressure or urgency to complete the deal-- leave.

With many reverse mortgages, you have at least three business days after near to cancel the offer for any factor, without charge. This is known as your right of "rescission." To cancel, you must inform the lender in writing. Send your letter by qualified mail, and ask for a return invoice.

Keep copies of your correspondence and any enclosures. After you cancel, the loan provider has 20 days to return any money you've paid for the funding. If you presume a fraud, or that somebody included in the transaction might be breaking the law, let the counselor, loan provider, or loan servicer understand.

Reverse Mortage Tips for Dummies

Whether a reverse home mortgage is right for you is a big concern. Consider all your choices. You might certify for less pricey options. The following organizations have more details: U. S. Department of Housing and Urban Advancement (HUD) HECM Program 1-800-CALL-FHA (1-800-225-5342) Customer Financial Defense Bureau Considering a Reverse Home Loan? 1-855- 411-CFPB (1-855-411-2372) AARP Structure Reverse Mortgage Education Task 1-800-209-8085.

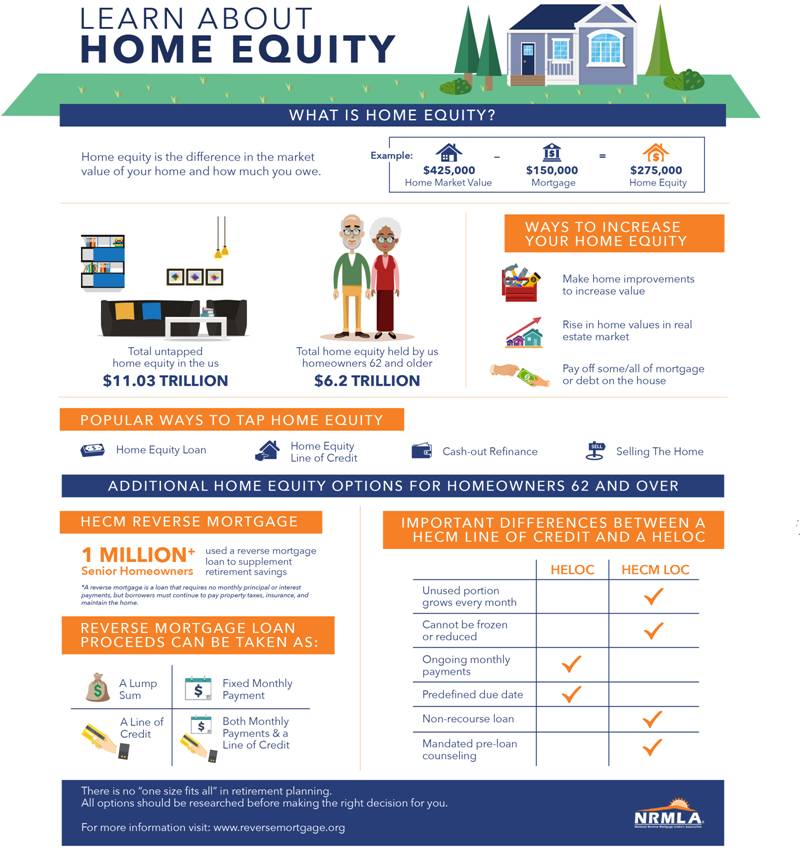

A reverse home mortgage is a kind of loan that provides you with cash by Like a basic mortgage, a reverse mortgage utilizes your The idea works similar to a 2nd home mortgage or home equity loan, however reverse home loans are only readily available to homeowners age 62 and older.

You should typically accredit to the lending institution each year that you do indeed still live in the home. Otherwise, the loan will come due. Several sources for reverse mortgages exist, but one of the better alternatives is the House Equity Conversion Mortgage (HECM) that's readily available through the Federal Housing Administration.

4 Simple Techniques For Reverse Mortgage

The quantity of money you'll receive from a reverse home loan depends upon two major elements. The more equity you have in your home, the more money you can get. For the majority of borrowers, it's finest if you've been paying for https://www.washingtonpost.com/newssearch/?query=reverse mortages your loan over several years and your home mortgage is practically completely paid off.

Bear in mind, however, that the real rate and costs charged by your lending institution will most likely differ from the presumptions used. You have a couple of alternatives, however the easiest is to take all the cash simultaneously in a lump amount. Your loan has a set interest rate with this option, and reverse mortgage amortization schedule your loan balance just grows in time as interest accumulates.

These payments are referred to as "period payments" when they last for your whole life, or "term payments" when you get them for a set period of time, such as ten years. It's possible to take out more than you and your lending institution expected with life time payments if you live a remarkably long life.

Reverse Mortage Tips - The Facts

This enables you to draw funds if and when you need them. The benefit of a line of credit technique is that you just pay interest on the cash you've actually borrowed, so your credit line could possibly grow over time. You can use a combination of the programs above.

Similar to any other home loan, you'll pay interest and charges to get a reverse mortgage. Take note of the expenses and compare deals from numerous loan providers. Interest is intensified-- it's occasionally contributed to your loan balance, and interest is based on this increased loan balance the next time it's computed.

It's certainly worth shopping around for the lowest-fee lender. Charges are often funded, or constructed into your loan. Simply put, you don't write a check so you don't feel those expenses, but you're still paying them, plus interest. Charges reduce the amount of equity left in your house, which leaves less for your estate or for you if you choose to sell the house and pay off the loan.

How Reverse Mortage Tips can Save You Time, Stress, and Money.

You'll pay numerous of the exact same closing costs required for a home purchase or refinance, but these can be higher too. Most HECM expenses can be included in your loan, nevertheless. A few of these costs are beyond your control, but others can be handled and compared. You'll need an appraisal.

Origination costs vary from lender to loan provider, but your county taping office charges the exact same no matter who you use. You can intend on paying 2 percent of the very first $200,000 of your home's value plus 1 percent of the value over that, or a $2,500 flat cost, whichever is greater, approximately a $6,000 cap on HECM loans.

|

|

10 Startups That'll Change The Residential Mortages Industry For The Better |

Reverse Mortgage Fundamentals Explained

They will also take a look at your monetary scenario more broadly to help you figure out if a HECM is right for you. Always avoid any unsolicited deals for a reverse home mortgage or for aid with these loans. If you suspect you or your household have been targeted by a scammer, call 800-347-3735 to submit a problem with HUD.

Reverse mortgages are extremely flexible. You can use the funds for a number of worthwhile functions such as debt combination, living expenditures, home enhancements, travel, medical expenses, aged care or buying a brand-new automobile. You can likewise select to http://www.bbc.co.uk/search?q=reverse mortages receive your reverse mortgage amount as a lump amount, plus as routine advances, a cash reserve center (similar to a 'credit line'), or a mix of all three.

Heartland only provides a variable rates of interest, permitting you to make voluntary payments. These can be made to your loan partially or in complete at any time, without additional charge charges, adding additional flexibility and lowering the balance and interest charged. Once you move completely from your home, the overall interest charged, together with the quantities drawn, will be payable.

U.S. Department of Housing and Urban Development|451 7th Street S.W., Washington, DC 20410 Telephone: (202) 708-1112 TTY: (202) 708-1455 Find the address of the HUD office near you It's generally an opportunity for retirees to take advantage of the equity they've constructed up over several years of paying their mortgage and turn it into a loan on their own. A reverse home mortgage works like a regular mortgage because you have to use and get authorized for it by a lender.

What Does Home Morgages Mean?

But with a reverse mortgage, you do not make payments on your home's principal like you would with a regular home mortgage-- you take payments from the equity you've built. You see, the bank is lending you back the cash you have actually currently paid on your home however charging you interest at the same time.

Appears simple enough, right? However here comes the cringeworthy reality: If you pass away before you've offered your house, those you leave behind are stuck with 2 options. They can either pay off the full reverse home loan https://en.search.wordpress.com/?src=organic&q=reverse mortages Website link and all the interest that's piled up over the years, or surrender your house to the bank.

Like other kinds of mortgages, there are different types of reverse home loans. While they all essentially work the same way, there are three main ones to understand about: The most common reverse home mortgage is the House Equity Conversion Home Mortgage (HECM). HECMs Residential Mortages were created in 1988 to help older Americans make ends satisfy by allowing them to take advantage of the equity of their homes without having to move out.

Some folks will utilize it to spend for costs, holidays, home restorations or even to settle the staying quantity on their regular mortgage-- which is nuts! And the effects can be huge. HECM loans are continued a tight leash by Click here for more info the Federal Housing Administration (FHA.) They don't want you to default on your home loan, so because of that, you won't get approved for a reverse home loan if your home is worth more than a particular sterlingashleyxtro.zoninrewards.com/12-reasons-you-shouldn-t-invest-in-home-mortgages-traduccion quantity.1 And if you do receive an HECM, you'll pay a significant home loan insurance coverage premium that safeguards the lending institution( not you)versus any losses. They're offered up from privately owned or run companies.

How Home Morgages can Save You Time, Stress, and Money.

And due to the fact that they're not controlled or guaranteed by the federal government, they can draw house owners in with guarantees of higher loan quantities-- but with the http://query.nytimes.com/search/sitesearch/?action...ubmit&pgtype=Homepage#/reverse mortages catch of much higher rate of interest than those federally insured reverse home loans. They'll even offer reverse home mortgages that allow house owners to obtain more of their equity or include homes that go beyond the federal maximum amount. A single-purpose reverse home loan is provided by federal government companies at the state and local level, and by

not-for-profit groups too. It's a kind of reverse home mortgage that puts guidelines and constraints on how you can utilize the cash from the loan.(So you can't invest it on a fancy vacation!) Typically, single-purpose reverse mortgages can just be utilized to make residential or commercial property tax payments or spend for house repair work. The thing to keep in mind is that the lender needs to authorize how the money will be used before the loan is given the OK. These loans aren't federally insured either, so lending institutions do not have to charge mortgage insurance coverage premiums. But given that the cash from a single-purpose reverse home loan needs to be utilized in a specific way, they're generally much smaller sized in their amount than HECM loans or exclusive reverse home mortgages. Own a paid-off (or a minimum of substantially paid-down )home. Have this home as your main house. Owe absolutely no federal financial obligations. Have the capital to continue paying real estate tax, HOA charges, insurance, upkeep and other home costs. And it's not simply you that has to certify-- your house likewise needs to fulfill certain requirements. The HECM program likewise enables reverse home mortgages on condos authorized by the Department of Real Estate and Urban Development. Before you go and sign the papers on a reverse home mortgage, take a look at these four significant drawbacks: You might be believing about securing a reverse home loan because you feel great loaning versus your home. Let's break it down like this: Think of having $100 in the bank, however when you go to withdraw that$100 in money, the bank only gives you$60-- and they charge you interest on that$60 from the$ 40 they keep. If you wouldn't take that"offer"from the bank, why on earth would you wish to do it with your home you've invested years paying a home mortgage on? But that's exactly what a reverse home loan does. Why? Due to the fact that there are fees to pay, which leads us to our next point. Reverse home loans are filled with additional expenses. And many debtors opt to pay these charges with the loan they're about to get-- instead of paying them expense. The thing is, this expenses you more in the long run! Lenders can charge up to 2% of a house's value in an origination charge paid up front. So on a$200,000 house, that's a$ 1,000 annual expense after you have actually paid $4,000 upfront obviously! 4 Closing costs on a reverse home mortgage are like those for a routine home mortgage and include things like house appraisals

, credit checks and processing charges. So prior to you know it, you've drawn out thousands from your reverse home loan prior to you even see the very first penny! And since a reverse home loan is only letting you use a portion the worth of your house anyhow, what happens as soon as you reach that limit? The money stops.

|

|

Why You Should Focus On Improving Reverse Mortage Tips |

4 Easy Facts About Residential Mortages Described

This is the only option that includes a set interest rate. The other 5 have adjustable interest rates. Equal monthly payments (annuity): For as long as at least one borrower lives in the home as a primary residence, the loan provider will make consistent payments to the customer. Term payments: The loan provider provides the borrower equivalent regular monthly payments for a set duration of the borrower's picking, such as ten years.

The It's likewise possible to utilize a reverse home loan called a "HECM for purchase" to buy a various house than the one you presently live in. In any case, you will generally need a minimum of 50% equity-- based upon your house's existing worth, not what you paid for it-- to get approved for a reverse home mortgage.

Unknown Facts About Mortgages

41,736 The number of reverse mortgages provided in the U.S. in 2018, down 26.7% from the previous year. A reverse mortgage may sound a lot like a house equity loan or line of credit. Indeed, comparable to one of these loans, a reverse home loan can supply a swelling sum or a line of credit that you can access as needed based on how much of your house you have actually settled and your house's market worth.

A reverse home mortgage is the only way to gain access to home equity without offering the home for elders who don't desire the duty of making a month-to-month loan payment or who can't certify for a home equity loan or re-finance due to the fact that of limited money flow or bad credit. If you do not get approved for any of these loans, what options stay for utilizing house equity to money your retirement!.?. !? You could offer and downsize, or you might offer your home to your children or grandchildren to keep it in the household, perhaps even becoming their occupant if you desire to continue living in the home.

The Home Morgages PDFs

A reverse home loan enables you to keep residing in your home as long as you stay up to date with property taxes, maintenance, and insurance coverage and don't require to move into an assisted living home or assisted living facility for more than a year. Nevertheless, securing a reverse home loan indicates spending a considerable quantity of the equity you have actually built up on interest and loan charges, which we will go over listed below.

If a reverse home mortgage does not supply a long-term solution to your financial issues, only a short-term one, it may not be worth the sacrifice. What if somebody else, such as a good friend, relative or roomie, copes with you? If you get a reverse mortgage, that individual will not have any right to keep living in the home after you die.

Some Known Questions About Mortgages.

If you choose a payment strategy that doesn't supply a lifetime earnings, such as a lump sum or term plan, or if you take out a line of credit and utilize everything up, you might not have any cash left when you require it. If you own a home, apartment or townhouse, or a manufactured home constructed on or after June 15, 1976, you may be eligible for a reverse home loan.

In New york city, where co-ops prevail, state law even more forbids reverse home mortgages in co-ops, enabling them only in one- to four-family houses and condominiums. While reverse home loans don't have earnings or credit score requirements, they still have rules about who certifies. You must be at least 62, and you must either own your house complimentary and clear or have a substantial amount of equity (a minimum of 50%).

Mortgages Things To Know Before You Buy

The federal government limitations just how much loan providers can charge for these items. Lenders can't go after customers or their beneficiaries if the house turns out to be undersea when it's time to sell. They also need to allow any beneficiaries a number of months to decide whether they desire to repay the reverse mortgage or permit the loan provider to offer the house to pay off the loan.

This therapy session, which normally costs around $125, ought to take a minimum of 90 minutes and must cover the advantages and disadvantages of taking out a reverse mortgage offered your special monetary and individual scenarios. It must discuss how a reverse home loan could affect your eligibility for Medicaid and Supplemental Security Income.

How Residential Mortages can Save You Time, Stress, and Money.

Your obligations under the reverse mortgage guidelines are to stay existing on real estate tax and property owners insurance and keep the house in great repair work. And if you stop residing in your home for longer than one year-- even if it's because you're living in a long-lasting care center for medical factors-- you'll need to repay the loan, which is usually accomplished by selling your house.

In spite of recent reforms, there are still scenarios when a widow or widower might lose the house upon their partner's death. The Department of Real Estate and Urban Development adjusted the insurance premiums for reverse mortgages in October 2017. Since lending institutions can't ask house owners or their successors to pay up if the loan balance grows larger than the home's value, the insurance coverage premiums offer a swimming pool of funds that loan providers can draw on so they don't lose cash when this does take place.

How Mortgages can Save You Time, Stress, and Money.

The up-front premium used to be tied to just how much borrowers took out in the first year, with house owners who justpaste.it/3th5c took out the most-- because they needed to pay off a current home loan-- paying the higher rate. Now, all borrowers pay the exact same 2.0% rate. The up-front premium is computed based upon the home's worth, so for each $100,000 in appraised worth, you pay $2,000.

All debtors should also pay annual home loan insurance premiums of 0.5% (previously 1.25%) of the amount obtained. This modification conserves customers $750 a year for every $100,000 borrowed and assists balance out the greater up-front premium. It also suggests the debtor's financial obligation grows more gradually, maintaining more of the house owner's equity with time, offering a source of funds later on in life or increasing the possibility of being able to pass the house to heirs.

The Definitive Guide to Reverse Mortgage

Reverse mortgages are a specialized item, and just certain loan providers offer them. Some of the most significant names in reverse home loan loaning include American Advisors Group, One Reverse Home Mortgage, and Liberty Home Equity Solutions. It's a great concept to request a reverse home loan with numerous companies to see which has the lowest rates and fees.

Only the lump-sum reverse home loan, which provides you all the profits at as soon as when your loan closes, has a fixed interest rate. The other five choices have adjustable rate of interest, which makes sense, because you're borrowing cash over several years, not simultaneously, and interest rates are constantly altering.

|

|

Where Will Mortgages For Rental Properties Be 1 Year From Now? |

The Buzz on Mortgages

Often that suggests selling the house to get cash to pay back the loan. There are three sort of reverse home mortgages: single function reverse mortgages-- provided by some state and city government firms, along with non-profits; proprietary reverse home mortgages-- personal loans; and federally-insured reverse home loans, also referred to as House Equity Conversion Home Loans( HECMs). You keep the title to your house. Instead of paying regular monthly mortgage payments, though, you get an advance on part of your house equity. The cash you get usually is not taxable, and it usually will not affect your Social Security or Medicare advantages. When the last making it through customer passes away, offers the house, or no longer lives in the home as a principal residence, the loan needs to be paid back. Here are some things to consider about reverse home loans: There are costs and other expenses. Reverse home mortgage lending institutions typically charge an origination charge and other closing expenses, as well as servicing charges over the life of the mortgage. Some likewise charge home loan insurance coverage premiums(for federally-insured HECMs). You owe more gradually. That means the amount you owe grows as the interest on your loan builds up over time. Interest rates might change with time. A lot of reverse home mortgages have variable rates, which are connected to a financial index and change with the marketplace. Variable rate loans tend to offer you more alternatives on how you get your money through the reverse home mortgage. That implies you are accountable for real estate tax, insurance, energies, fuel, upkeep, and other expenditures. And, if you do not pay your residential or commercial property taxes, keep homeowner's insurance coverage, or keep your home, the lender may require you to repay your loan. A financial assessment is required when you get the mortgage.

The "set-aside" reduces the amount of funds you can get in payments. You are still accountable for maintaining your home. What happens to your spouse? With HECM loans, if you signed the loan paperwork and your partner didn't, in particular situations, your spouse may continue to reside in the home even after you pass away if she or he pays taxes and insurance, and continues to maintain the residential or commercial property.

What can you leave to your successors? Reverse home loans can consume the equity in your house, which implies fewer possessions for you and your heirs. Many reverse mortgages have something called a "non-recourse" provision. This suggests that you, or your estate, can't owe more than the worth of your home when the loan becomes due and the home is offered.

The Main Principles Of Home Morgages

As you consider whether a reverse home mortgage is right for you, likewise consider which of the 3 types of reverse mortgage might finest match your requirements. Single-purpose reverse home mortgages are the least costly option. They're provided by some state and city government companies, in addition to non-profit organizations, however they're not available all over.

For example, the lender may state the loan might be used just to spend for home repair work, enhancements, or home taxes. The majority of property owners with low or moderate earnings can receive these loans. Exclusive reverse home mortgages are private loans that are backed by the business that develop them. If you own a higher-valued house, you might get a larger loan advance from an exclusive reverse mortgage.

House Equity Conversion Mortgages (HECMs) are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development (HUD). HECM loans can be utilized for any function. HECMs and exclusive reverse home mortgages may be more pricey than standard house loans, and the upfront costs can be high.

The smart Trick of Reverse Mortage Tips That Nobody is Discussing

Just how much you can borrow with a HECM or exclusive reverse home loan depends upon several aspects: your age the type of reverse mortgage you pick the evaluated value of your house existing rates of interest, and a financial evaluation of your desire and capability to pay property taxes and property owner's insurance coverage.

Prior to making an application for a HECM, you should satisfy with a therapist from an independent government-approved real estate therapy firm. Some lending institutions using proprietary reverse home mortgages likewise need counseling. The therapist is needed to discuss the loan's costs and financial ramifications. Mortgages The therapist also should discuss the possible alternatives to a HECM-- like federal government and non-profit programs, or a single-purpose or exclusive reverse home loan.

You can check out HUD for a list of therapists, or call the company at 1-800-569-4287. Therapy firms generally charge a fee for their services, often around $125. This fee can be paid from the loan proceeds, and you can not be turned away if you can't pay for the cost. With a HECM, there typically is no specific income requirement.

Facts About Reverse Mortage Tips Uncovered

They're evaluating your determination and capability to fulfill your commitments and the home loan requirements. Based upon the outcomes, the lending institution might need funds to be set aside from the loan proceeds to pay things like residential or commercial property taxes, homeowner's insurance coverage, and flood insurance coverage (if appropriate). If this is not needed, you still could agree that your lending institution will pay these items.

You are still accountable for preserving the home. The HECM lets you choose among several payment options: a single disbursement choice-- this is only offered with a fixed rate loan, and normally offers less cash than other HECM options. a "term" option-- fixed monthly cash loan for a particular time.

a line of credit-- this lets you draw down the loan proceeds at any time, in amounts you pick, until you have used up the line of credit. This choice restricts the quantity of interest enforced on your loan, because you owe interest on the credit that you are utilizing.

Home Morgages for http://b3.zcubes.com/v.aspx?mid=2314185&title=17-s...e-mortgage-lenders-new-zealand Beginners

You may be able to alter your payment alternative for a small charge. HECMs typically offer you bigger loan advances at a lower total expense than proprietary loans do. In the HECM program, a borrower usually can reside in a retirement home or other medical center for as much as 12 successive months prior to the loan should be paid back.

With HECMs, there is a limit on how much you can secure the first year. Your lending institution will compute just how much you can obtain, based upon your age, the rates of interest, the worth of your home, and your monetary assessment. This amount is called your "preliminary principal limit." Generally, you can secure as much as 60 percent of your initial principal limitation in the first year.

If you're considering a reverse home mortgage, shop around. Choose which kind of reverse home mortgage might be best for you. That might depend upon what you desire to do with the cash. Compare the choices, terms, and charges from numerous loan providers. Discover as much as you can about reverse home mortgages before you talk to a counselor or lending institution.

|

|

15 Up-and-coming Trends About Home Morgages |

Rumored Buzz on Residential Mortages

You are working with a personal business, and the FHA is offering a warranty on your loan. This assurance protects you in 2 substantial ways. Initially, the FHA guarantees that the senior will get all the payments that

she or he is entitled to as a result of the reverse home mortgage. Second, the FHA secures the debtor and his/her estate from ever owing more on the loan than the house is worth. In situations where the financial obligation impressive on the reverse home mortgage surpasses the value of the house, the FHA covers the difference. The quantity of your reverse mortgage is based on

how old you are, how much your home is worth, and what rates of interest the

loan providers provides to you. With a reverse home mortgage there is no loan to repay as long as you are alive, living in the home, and keeping the terms of your loan. You can have the cash paid out to you in the type of a check or a credit line. Swelling amount payments are likewise popular; in 2011, 73 %of customers chose

The Best Guide To Mortgages

a lump sum payment. After that occurs, the estate normally offers that home and utilizes the profits to repay the reverse home loan. If there is money left over the beneficiaries get to keep it. If your residential mortgage group pty ltd discharge authority home is offered and there is inadequate money to repay the payments that the lending institution has made, then it's tough luck for the lending institution. There are three major fees that borrowers need to pay. Many resemble those

paid on a forward home mortgage. These are the upfront fees that you will need to pay: Origination charge paid to the lending institution. This is federal government regulated and ranges from a minimum of $2,500 to an optimum of$ 6,000, depending upon how much your home is worth. 3rd party charge.

This is multiple smaller fees paid to individual third celebrations, but we've lumped them together for simpleness. Appraisal, title, inspection and so on. Upfront home loan insurance coverage premium (MIP ). This charge is paid to the FHA, and in all cases it is 2% of the property worth. This premium pays for the protections that the FHA gives

to debtors. Interest will also accrue on the balance. Usually, the expenses of a reverse home loan are financed into the loan so that the borrower does not have to pay out of pocket. Instead, the money is being taken from the home's equity. Let's go back to our example from previously, where we owned a $300,000 house and accumulate the

The Ultimate Guide To Reverse Mortage Tips

costs. Second are 3rd party closing expenses, which we'll approximate at$ 1,500. Third is the upfront MIP, determined as$200,000 * 2.0% =$4,000 This offers an in advance cost of$10,500, which is typically funded, suggesting it is contributed to the loan balance. This indicates that before you borrow any cash, you have actually invested$10,500 of your house equity to acquire the loan. It's possible to find

one who will charge you a lowered amount, and in some cases it's possible to get a refund, which is essentially an unfavorable origination cost. The home should continue https://www.washingtonpost.com/newssearch/?query=reverse mortages to be utilized as the primary house. Senior citizens need to likewise maintain the home, do required repair work, and remain present on real estate tax and homeowner's insurance coverage premiums.

Personal bankruptcy can also be a violation of the reserve home mortgage contract. Once the house owner remains in default they are subject to foreclosure-- and the unexpected loss of one's house can be specifically terrible for a senior. Thankfully the monetary assessment included in 2014 makes this far less likely. This report concluded that the following groups of senior citizens were more than likely to gain from acquiring a reverse home mortgage: Those looking to supplement a set earnings in retirement. Those who require a home equity credit line(HELOC)however can not qualify. Elders who will stay in the home for a long time horizon. This list is a great start, and we have a few extra uses for reverse home mortgages that customers may discover useful.

Here are extra manner ins which a senior could utilize the earnings of a reverse home mortgage: Pay off a forward home loan and get rid of the monthly payment that goes with it. Purchase a home utilizing the HECM for Purchase program. 1. Is there anybody who lives in the house that will be mortgaged besides the borrower or customers? YES: When the customer dies or moves

Not known Facts About Reverse Mortgage

out of the home, the reverse home loan becomes due. This might impact those coping with you, such as a more youthful partner, kids, or other relative. NO: There is no need to worry about your family or liked ones needing to move Click here for more out when the reverse mortgage ends up being due. 2. Do you plan to keep living in your home for an extended period

of time? YES: Reverse home mortgages are expensive over a brief time horizon and get progressively more economical as more time passes. NO: If you're not planning to stay in your house, there are other short term alternatives that are most likely more affordable. A reverse home mortgage is less likely to be ideal for you, particularly after the FHA

ceased the HECM Saver program. 3. Is it essential for you to leave your house to your family without financial obligation connected to it? YES: A reverse home loan is most likely wrong for you. NO: A reverse home loan is most likely to be right for you. Additionally, the senior need to continue to use the home as his/her main house. When the house is not used as

a primary residence for 12 months, the reverse home loan ends up being due. Want to find out more? Click on this link to get complimentary information about a reverse mortgage! We have actually likewise put http://query.nytimes.com/search/sitesearch/?action...ubmit&pgtype=Homepage#/reverse mortages together guides for specific states created to give seniors relevant, localized info. http://www.bbc.co.uk/search?q=reverse mortages To date, there have been over 1 million HECM loans originated in the United States.

3 Easy Facts About Reverse Mortage Tips Explained

The program started choosing up steam in the early 2000s, and today somewhere in between 40,000 and 60,000 elders normally secure a reverse home loan each year. We've put together the chart and table listed below to help you envision its appeal. He has actually written for AOL, U.S. News & World Report, Wise Bread, Bankrate, AARP, Allstate Insurance, Wells Fargo, papers, and different sites about credit, retirement, home loans and related topics. You can find his work at Aaron Crowe.net or on Twitter @Aaron Crowe. If you're 62 or older-- and desire cash to settle your mortgage, supplement your earnings, or pay for health care expenses-- you might think about a reverse mortgage. It permits you to convert part of the equity in your home into money without needing to sell your house or pay additional month-to-month expenses. A reverse mortgage can use up the equity in your house, which indicates fewer properties for you and your heirs. If you do choose to try to find one, review the various kinds of reverse home mortgages, and comparison shop before you select a particular company. Keep reading to find out more about how reverse home loans work, certifying for a reverse mortgage, getting the best deal for you, and how to report any fraud you may see.

|

|

10 Wrong Answers To Common Residential Mortgage Hub Questions: Do You Know The Right Ones? |

Top Guidelines Of Home Morgages

Advertiser Disclosure At Nerd Wallet, we aim to assist you make financial decisions with confidence. To do this, lots of or all of the products included here are from our partners. However, this doesn't affect our examinations. Our opinions are our own. After retirement, without routine income, you may sometimes have a hard time with financial resources.

A reverse home loan is a home mortgage that allows house owners 62 and older to withdraw some of their home equity and convert it into money. You do not have to pay taxes on the profits or make regular monthly home loan payments. You can use reverse mortgage proceeds nevertheless you like. They're typically earmarked for expenses such as: Financial obligation debt consolidation Living expenses House enhancements Assisting children with college Purchasing another home that may much better satisfy your needs as you age A reverse home mortgage is the reverse of a standard home mortgage; instead of paying a loan provider a month-to-month payment each month, the loan provider pays you.

The amount you receive in a reverse home mortgage is based upon a sliding scale of life span. The older you are, the more house equity you can take out." MORE: How to get a reverse home mortgage The Federal Real estate Administration insures two reverse home loan types: adjustable-rate and a fixed-rate.

Some Known Factual residential mortgage group pty ltd discharge authority Statements About Reverse Mortgage

2. Adjustables have five payment choices: Tenure: Set monthly payments so long as you or your eligible partner stay in the house Term: Set regular monthly payments for a fixed duration Line of credit: Unspecified payments when you require them, until you have actually tired your funds Modified tenure: A credit line and set regular monthly payments for as long as you or your qualified spouse reside in the house Modified term: A credit line and set monthly payments for a fixed duration of your choosing To make an application for a reverse home mortgage, you need to meet the following FHA requirements: You're 62 or older You and/or an eligible spouse-- who should be named as such on the loan even if he or she is not a co-borrower-- live in the home as your main house You have no overdue federal financial obligations You own your house outright or have a significant amount of equity in it You go to the necessary therapy session with a home equity conversion home loans (HECM) counselor authorized by the Department of Real Estate and Urban Advancement Your home fulfills all FHA residential or commercial property standards and flood requirements You continue paying all real estate tax, house owners insurance coverage and other household upkeep fees as long as you live in the home Prior to issuing a reverse home mortgage, a lending institution will examine your credit report, confirm your month-to-month earnings versus your monthly monetary obligations and order an appraisal on your house.

Nearly all reverse home loans are provided as house equity conversion mortgages (HECMs), which are guaranteed by the Federal Real Estate Administration. HECMs come with strict loaning guidelines and a loan limit. If you believe a reverse home mortgage might be best for you, discover an FHA-approved loan provider.

Are you considering whether a reverse home loan is best for you or an older homeowner you know? Prior to considering one of these loans, it pays to know the facts about reverse home mortgages. A reverse home loan, in some cases referred to as a House Equity Conversion Mortgage (HECM), is an unique type of loan for homeowners aged 62 and older that lets you transform a portion of the equity in your house into money.

Residential Mortages Things To Know Before You Buy

Taking out a reverse home loan is a big choice, because you might not be able to get out of this loan without selling your house to pay off the debt. You likewise require to thoroughly consider your options to avoid utilizing up all the equity you have actually developed in your home.

Reverse home mortgages usually are not used for trips or other "fun" things. The fact is that many debtors use their loans for instant or pressing monetary needs, such as settling their existing home loan or other debts. Or they may think about these loans to supplement their regular monthly earnings, so they can manage to continue living in their own home longer.

Securing any home mortgage can be expensive since of origination fees, maintenance charges, and third-party closing charges such as an appraisal, title search, and recording costs. You can pay for many of these expenses as part of the reverse home loan. Reverse home loan debtors likewise must pay an in advance FHA home loan insurance premium.

The Best Guide To Reverse Mortgage

It also ensures that, when the loan does end up being due and payable, you (or your successors) don't have to pay back more than the worth of the house, even if the quantity due is higher than the assessed value. While the closing costs on a reverse home mortgage can often be more than the expenses of the house equity line of credit (HELOC), you do not have to make monthly payments to the lender with a reverse mortgage.

It's never ever a good idea to make a financial choice under tension. https://www.washingtonpost.com/newssearch/?query=reverse mortages Waiting until a little issue ends up being a huge issue lowers your options. If you wait till you are in a financial crisis, a little additional income every month probably won't assist. Reverse home loans are best utilized as part of a sound financial strategy, not as a crisis management tool.

Discover out if you might certify for aid with expenses such as residential or commercial property taxes, home energy, meals, and medications at Advantages Check Up®. Reverse home mortgages are best used as part of a general retirement strategy, and not when there is a pending crisis. When HECMs were first provided by the Department of Real Estate and Urban Advancement (HUD), a large percentage of borrowers were older ladies aiming to supplement their modest incomes.

The Facts About Reverse Mortage Tips Uncovered

Throughout the housing boom, many older couples secured reverse mortgages to have a fund for emergencies and additional money to take pleasure in life. In today's economic recession, younger borrowers (typically Infant Boomers) are turning to these loans to handle their existing mortgage or to help pay for debt. Reverse home loans are unique due to the fact that the age of the youngest debtor determines just how much you can obtain.

Choosing whether to take out a reverse home mortgage loan is challenging. It's hard to estimate how long you'll remain in your house and what you'll need to live there over the https://en.wikipedia.org/wiki/?search=reverse mortages long term. Federal law requires that all individuals who are considering a HECM reverse home mortgage receive counseling by a HUD-approved therapy firm.

They will likewise go over other options including public and personal benefits that can help you remain independent longer. It's valuable to meet a therapist before talking to a loan provider, so you get impartial information about the loan. Telephone-based counseling is available nationwide, and in person therapy is available in many communities.

About Reverse Mortgage

You can also find a therapist in your location at the HUD HECM Therapist Roster. It is possible for reverse home mortgage borrowers to face foreclosure if they do not pay their home taxes http://www.thefreedictionary.com/reverse mortages or insurance coverage, or maintain their house in good repair. This is particularly a risk for older property owners who take the entire loan as a lump sum and spend it quickly-- maybe as a desperate effort to restore a bad circumstance.

|

|

15 Terms Everyone In The Reverse Mortage Tips Industry Should Know |

Rumored Buzz on Reverse Mortage Tips

No Limitations: How you use the funds from a Reverse Home loan is up to you-- go traveling, get a listening devices, purchase long term care insurance, spend for your kids's college education, or just leave it sitting for a rainy day-- anything goes. Flexible Payment Choices: Depending on the kind of loan you select, you can get the Reverse Home loan cash in the kind of a swelling sum, annuity, line of credit or some mix of the above.

House Ownership: With a Reverse Mortgage, you keep house ownership and the capability to reside in your house. As such you are still needed to maintain insurance coverage, real estate tax and maintenance for your home. Surefire Location to Live: You can reside in your house for as long as you desire when you secure a Reverse Home loan.

It is handled by the Department of Real Estate and Urban Affairs and is federally insured. This is necessary because even if your Reverse Home loan lending institution defaults, you'll still receive your payments. Can Maintain Your Wealth: Depending upon your situations, there are a variety of manner ins which a Reverse Home mortgage can assist you preserve your wealth.

The Best Guide To Residential Mortages

This locks in http://query.nytimes.com/search/sitesearch/?action...ubmit&pgtype=Homepage#/reverse mortages your present home value, and your reverse mortgage credit line over time might be bigger than future real estate worths if the marketplace decreases. Make the most of wealth: Personal finance can be made complex. You desire to make the most of returns and decrease losses. A Reverse Home mortgage can be one of the levers you use to maximize your general wealth.

(NOTE: Social Security and Medicare are not affected by a Reverse Home Mortgage.) Reevaluate if You Are Preparation to Move in the Near Term: Because a Reverse Home Mortgage loan is due if your home is no longer your primary residence and the up front closing expenses are typically greater than other loans, it is not a great tool for those that plan to move quickly to another residence (within 5 years).

And it is real, a Reverse Mortgage decreases your home equity-- impacting your estate. Nevertheless, you can still leave your home to your successors and they will have the choice of keeping the home and refinancing or settling the home loan or offering the home if the home deserves more than the quantity owed on it.

All about Mortgages

Research studies show that more than 90 percent of all homes who have secured a Reverse Home mortgage are exceptionally happy that they got the loan. People say that they have less tension and feel freer to live the life they want. Find out more about the Price Quote Your Reverse Home Loan Quantity .

The Pros and Cons of a Reverse Home loanA reverse mortgage can be a valuable retirement planning tool that can greatly increase senior citizens income streams by utilizing their largest assets: their houses. A reverse home loan permits homeowners to obtain versus their house's equity, while still keeping ownership of the home.

Rather, the lending institution pays to the borrower either through a lump amount, month-to-month payments, or a credit line. The http://edition.cnn.com/search/?text=reverse mortages reverse home loan is paid back when the borrower dies, permanently moves from the residence, or the property is offered. Instead of you paying the bank monthly and the equity in your home growing, the bank pays you monthly, and the equity might diminish.

Fascination About Home Morgages

A reverse mortgage can be a powerful source of funding for individuals who need to increase their earnings to be comfy in reverse mortgage phone number retirement. The biggest personal asset most senior citizens possess is their home. In a lot of cases, a retired person's house is paid off. A reverse home loan increases income without increasing monthly payments and allows a retiree to remain in his or her house.

You will be eligible for more money the older you are, the more your house is worth, and fedorarandolphwatersdykj.lowescouponn.com/11-ways-to-completely-sabotage-your-reverse-mortgage the lower current rate of interest are. Amongst the negatives of a reverse mortgage are the costs included. All mortgages have expenses, but reverse home loan fees, which can include the rate of interest, loan origination charge, home mortgage insurance cost, appraisal charge, title insurance costs, and different other closing costs, are incredibly high when compared with a traditional mortgage.

This cost is not paid out of pocket, however rolled into the loan. Another possible problem to be aware of is the requirement to repay the loan if you must completely vacate the house. This may not seem like an issue now, but if you ever need to enter a full-time care facility, the loan would end up being due if you left your house for a year or more.

The smart Trick of Residential Mortages That Nobody is Talking About

The reverse home mortgage will usually decrease the equity in your home, which will leave less money to your heirs. Misunderstandings about reverse mortgages might cause property owners to prevent factor to consider of these intricate loans. Or, eligible elders may proceed too quickly without understanding all the possible repercussions of their monetary choices.

Myth: The loan provider takes title to the home. Truth: You still maintain ownership of your house. The reverse home loan is just a lien versus the residential or commercial property. Myth: The loan can go beyond the worth of the property, sticking you or your heirs with a large bill when you eventually leave your house.

Misconception: You can't get a reverse home mortgage if you currently have a conventional mortgage. Truth: Although this is real, you can get a reverse if you utilize the profits to pay off your existing home mortgage at close. Misconception: A reverse home mortgage can cause you to be kicked out from your house.

The 10-Minute Rule for Home Morgages

Nobody will force you from your home. The reverse home loan is not due up until your home is no longer your main house.

The FBI and the U.S. Department of Real Estate and Urban Advancement Workplace of Inspector General (HUD-OIG) urge consumers, particularly elderly people, to be watchful when seeking reverse mortgage items. Reverse mortgages, likewise referred to as house equity conversion home mortgages (HECM), have actually increased more than 1,300 percent in between 1999 and 2008, developing substantial chances for scams criminals.

Editor's Note: This report was produced in concert with the occasion, "Reverse mortgages: Guarantee, problems, and propositions for a much better market" held October 28, 2019 and co-sponsored by Brookings and the Kellogg Public-Private Initiative. The other reports from the event go over annuity enhanced reverse home loan. With the progressive disappearance of private-sector pensions and slowly increasing life expectancy, You can find out more Americans need to increasingly take duty for managing their own retirement.

About Home Morgages

Reverse home loans provide one opportunity for accessing this equity, providing property owners the ability to borrow against their house and defer payment till they leave the residential or commercial property. Yet, while this strategy shows pledge in theory for choose retired people, few property owners ever take this option. This framing paper sums up recent advancements in the reverse home mortgage market, goes over why so couple of individuals use these instruments, and lays out the benefits and downsides to consisting of these products in a retirement portfolio.

Editorial Note: Credit Karma gets payment from third-party marketers, but that does not impact our editors' viewpoints. Our marketing partners do not evaluate, authorize or endorse our editorial content. It's accurate to the best of our knowledge when it's published. Marketer Disclosure We think it is very important for you to comprehend how we http://www.thefreedictionary.com/reverse mortages generate income.

|

|

The Anatomy Of A Great Home Morgages |

Home Morgages - An Overview

Applicants of reverse home loans normally utilize the cash for big cash items such as home repairs, a brand-new automobile, an overseas trip to see household and/or debt consolidation. On paper, reverse home loans sound appealing, however they are pricey financial obligation; get it wrong and you can be caught out seriously. Yearly interest charges, usually between 7% and 8%, substance daily.

If you change your mind in the future and wish to reverse mortgage texas calculator repay the reverse home loan, as long as the rate of interest is floating, the charges for doing this should be very little or absolutely no. Heartland Bank, for example, just offers a drifting rate for reverse mortgages, and there are no charges for early payment.

If you reach 85 and then need to sell your house and go into care, you will owe around $493,000. Our guide to reverse mortgages outlines everything you require to know about this unique home loan item. We cover: Know Just How Much You Can Borrow Advantages of Reverse Home Mortgages Downsides of https://driscollbarbaratillmanlis2.tumblr.com/post...rated-skills-thatll-make-you-a Reverse Home Loans 8 Must-Know Realities about Reverse Home Loans Reverse Home Loan FAQs Conclusion Know Just How Much You Can Obtain For a lot of lenders, the maximum you can borrow is 40% of your house's worth.

This is because the possibilities of you passing away increase, so the risk for the bank of not being paid back from the sale of your home is lower. How is the 'value' of my house determined? When you get a reverse mortgage, an appraisal cost is charged (normally $600+).

All about Reverse Mortgage

If the valuer says it is valued at $500,000, then the bank will let you borrow a portion of that based upon your age. How does my age affect just how much I can obtain? Heartland Bank mentions rather clearly that "your maximum loan privilege can be estimated by increasing the value of your home by a percentage (determined as the age of the youngest borrower on your loan minus 45)". Lenders will just loan based on the house worth, which is made up of land and structure only. Advantages of Reverse Home loans Reverse home mortgages have a variety of http://edition.cnn.com/search/?text=reverse mortages benefits, which we detail in no particular order listed below: You will get a money sum which you can invest any way you like.

If house prices are increasing, this reduces overall loss in equity. For example, if you draw down $50,000 http://www.bbc.co.uk/search?q=reverse mortages at an 8% rates of interest over 10 years, and home prices increase an average of 6% annually over the very same ten years, your net expense of the loan is 2%.

Some lending institutions ensure you will never ever go into negative https://en.wikipedia.org/wiki/?search=reverse mortages equity, so even if the loan balance surpasses your house value, you or your estate can not be chased for the distinction. Downsides of Reverse Home mortgages Reverse home loans are not without their dangers, expenses and disadvantages, which we describe listed below: Reverse home loans need you to remain in the house - if you wish to rent it out and take a trip, sell it or require to move into care, you will need to sell your home and repay the reverse mortgage owing.

This makes the arrangement relatively 'high interest'. Due to the fact that you do not usually make any payments and interest substances monthly, loans of $100,000 can blow out to around $492,000 in the space of 20 years. The longer you have the loan, the more you or your estate will owe. This can have serious ramifications if you require to move out of your home later on and spend for residential care.

The smart Trick of Mortgages That Nobody is Discussing

You need to follow the guidelines of the reverse mortgage agreement - this means you have to stay up to date with house insurance coverage payments, pay council rates and care for it in accordance with the lender's standards. Lenders are Reverse Mortage Tips hesitant to offer reverse mortgages on some residential or commercial properties - examples are lifestyle blocks, farms, homes with a leaky building history, retirement towns and homes with frustrating monolithic plaster cladding systems.

We have outlined 8 crucial must-know facts below to assist you browse the mechanics and fine print. Age of Borrower Quantity Owedat 80 Years of Age Amount Owedat 85 Years of Age Amount Owedat 90 Years of Age 60 $492,680 $734,018 $1,093,573 65 $330,692 $492,680 $734,018 70 $221,964 $330,692 $492,680 75 $148,985 $221,964 $330,692 80 N/A $148,985$221,964 .

|

|

Background Advice On Level-Headed What Financial Advisors Do Strategies |

Getting The Professional Financial Advise To Work

Getting recommendations in writing is constantly an excellent concept, as it leaves no question regarding what course of action was advised. A great financial coordinator will not make suggestions up until they understand your objectives and have actually run a long-lasting financial strategy for you. If you consult with someone who starts talking about a financial item immediately, even if they call themselves a financial planner, they are most likely a financial sales representative.

You'll find that cost structures vary. Generally, financial organizers charge costs in one of the following ways: A hourly rate A flat cost to finish a particular job A quarterly or yearly retainer charge A fee charged as a portion of assets that they manage in your place (Usually anywhere between 0.5% annually to 2% annually.

If they work as a registered investment consultant, they should provide you with a disclosure file called an ADV, which includes 2 parts. Part 2 will supply details on all charges and any prospective disputes of interest. Financial investment guidance can vary from a basic suggestion as to what type of property allotment design you should follow, to particular recommendations on which financial investments to purchase and sell.

You might wonder what a financial advisor makes with your money and how this professional chooses on the very best investments and course of action for you. This article breaks down precisely what a monetary consultant does. You \ l comprehend the advisory procedure and how a consultant chooses proper investments for you.

Advisors utilize their knowledge and proficiency to build personalized financial plans that aim to achieve the monetary goals of clients. These plans consist of not just financial investments but likewise savings, budget plan, insurance, and tax techniques. Advisors even more sign in with their clients on a regular basis to re-evaluate their existing scenario and future objectives and strategy appropriately.

The Greatest Guide To What Financial Advisors Do

Let's state you wish to best licenses to assist make these plans a reality, which's where a financial advisor can be found in. Together, you and your advisor will cover numerous topics, consisting of the quantity of cash you ought to conserve, the kinds of accounts you need, the kinds of insurance you ought to have (including long-term care, term life, and impairment) and estate and tax planning.

Part of the consultant's task is to help you comprehend what is associated with fulfilling your future objectives. The education process might include detailed assist with monetary topics. At the start of your relationship, those subjects might be budgeting and conserving. As you advance in your knowledge, the consultant will assist you in comprehending complex investment, insurance, and tax matters.

On the survey, you will also suggest future pensions and income sources, task retirement requirements and describe any long-lasting financial obligations. Simply put, you'll note all present and expected financial investments, pensions, gifts and incomes. The investing component of the survey touches upon more subjective subjects, such as your The preliminary evaluation also consists of an assessment of other financial management topics such as insurance coverage problems and your tax scenario.

As soon as you and the advisor comprehend your present monetary position and future projections, you're all set to work together on a plan to satisfy your life and monetary goals. The monetary advisor synthesizes all of this initial information into a liabilities, and liquid or working capital. The monetary strategy likewise wraps up the objectives you and the consultant talked about.

Based upon your expected net worth and future earnings at retirement, the strategy will produce simulations of potentially best- and worst-case retirement situations, consisting of the frightening possibility of outliving your money, so actions can be taken to prevent that outcome. It will take a look at reasonable withdrawal rates in retirement from your portfolio possessions.

What Does Financial Advisors Mean?

After you examine the strategy with the https://en.search.wordpress.com/?src=organic&q=financial advice consultant and change it as needed, you're ready for action. A financial consultant is not just somebody who assists with financial investments. Their task is to assist you with every element of your financial life. In reality, you could work with a financial advisor without having them handle your portfolio or advise financial investments at all.

If you pick this path, here's what to anticipate. The consultant will establish a possession allowance that fits both your risk tolerance and threat capability. The possession allocation is simply a rubric to determine what percentage of your total financial portfolio will be dispersed across various property classes. A more risk-averse individual will have a greater concentration of government bonds, certificates of deposit and cash market holdings, while a person who is more comfortable with threat will handle more stocks and corporate bonds and possibly investment realty.

Each monetary advisory firm will act in accordance with the law and with its business investment policy when buying and selling financial assets. It's essential for you, as the consumer, to comprehend what your planner suggests and why. You ought to not blindly follow a consultant's recommendations; it's your cash, and you ought to comprehend how it's being deployed.