Exactly How Local Business Make Use Of The Feature Bookkeeping Solutions? |

Article created by-Callahan Berman

Audit services provide businesses with a range of monetary items that enable them to manage their financial resources better. Accountancy solutions can be utilized to accomplish many economic goals, while likewise maintaining precise balance dues, money as well as stock levels. On top of that, bookkeeping solutions permits companies to make purchases, pay workers, take care of finances as well as record revenues. In this article, we'll look at the variety of services offered by accountancy specialists.

While accounting professionals do standard accounting features, there are lots of other sorts of accountant services, consisting of those focused on tax audits and compliance, which are typically referred to as tax obligation accounting professionals. Many accounting professionals focus on tax obligation prep work and also compliance, executing a preliminary evaluation of the customers' monetary statements and preparing the needed paperwork. After finishing this first testimonial, the accounting professional will certainly then prepare the customer's tax return for submission to the government. The utmost goal of a tax expert is to make sure that the customer gets the most desirable tax setting feasible, which can include working with tax experts, H&R Block tax obligation professionals, as well as various other experts to establish a plan that makes sure the customer receives the highest possible tax return, as well as paying the least amount of tax obligation responsibility.

One kind of accountancy solutions supplied by an expert tax obligation accountant company consists of preparing as well as assessing pre-settlement arrangements. In https://writeablog.net/christoper81sade/what-is-th...ntial-of-bookkeeping-providers , this sort of solution is referred to as postsettlement Bookkeeping Services. When a tax obligation matter has actually been worked out, either voluntarily or via court order, an accountant reviews settlement agreements and prepares viewpoint records as well as referral on the settlements. These reports are forwarded to the client and are usually provided at no surcharge. In some cases where the customer is unable to spend for the report, an objective expert tax expert might request the aid of a tax lawyer, H&R Block tax obligation specialist, or tax obligation resolution specialists to review as well as prepare the report for a cost. It is essential that accounting professionals who offer postsettlement Accounting Services preserve suitable specialist skills to ensure that they are able to properly represent their clients.

A second sort of Accounting Providers used by many expert tax obligation accountants is bookkeeping solutions. Lots of small company proprietors are local business accounting professionals and lots of are independent. Due to the fact that tax obligation time is a busy season for lots of small company accounting professionals, they may have limited capability to dedicate full-time to keeping their own books. Small company accountants regularly utilize specialized accountancy software application to keep track of their very own as well as their clients' sales income tax return and also repayments. An excellent small company accounting firm will be able to aid your small business in maintaining exact accounts, which will certainly enable you to decrease the possibilities of mistakes with your sales income tax return as well as repayments.

Accounting Provider also consists of postsettlement Bookkeeping Provider. Postsettlement Accounting Providers usually occurs when a tax obligation issue has been settled yet is not being submitted with the Internal Revenue Service. https://www.prnewswire.com/news-releases/cloud-bas...ce-in-san-diego-301307247.html have the alternative of not filing with the Internal Revenue Service. In this circumstances they would utilize postsettlement Audit Solutions to prepare and submit your postsettlement tax return with the IRS. A great tax obligation bookkeeping company will be able to help you attain practical postsettlement Accounting Provider so that you can be certified with all of the tax obligation laws that regulate your state.

If your business is big enough to call for specific bookkeeping services, it may additionally be in your benefit to look for the help of a specialized Accounting Services supplier. https://squareblogs.net/jere39michaela/audit-solut...t-right-for-your-business-t192 is best to find a Bookkeeping Services carrier that offers detailed bookkeeping software packages that are created to fulfill all of your small company economic records and also information. The Bookkeeping Services provider should likewise have the ability to accessibility monetary records from any kind of source needed including existing and also historic financial documents, future economic records, checking account, invoices, invoices, balance sheets, tax info, and also other sorts of economic documents. A good Bookkeeping Solutions carrier will certainly be able to give your small business with Accounting Software application that will aid you in evaluating and checking your small business's numerous records to ensure that your tax issues are being conducted in a constant fashion.

The initial step that ought to be taken if you assume that there is an opportunity that you will be the subject of a tax obligation audit is to request a copy of every one of the economic documents that are associated with the issue. You will certainly additionally require to have a conversation with a tax expert that will certainly allow you to establish what type of accounting services are called for. If you choose to use a Certified Public Accountant, State-licensed Accountant, or an Independent State-licensed Accountant (ICPA) to conduct your Accountancy Providers the company must prepare all of the documents that is essential for the purpose of preparing your tax obligation documents. The accounting firm will commonly supply a Cpa with a comprehensive set of tools that they can use to examine as well as prepare your records.

Small Business Accounting Services can be executed by private experts that function individually or by large accounting firms that are members of professional associations. There are numerous accountancy companies that have subscriptions in the Accountancy Technology Association (ATA), the Organization of Independent Accountants (AIA) and the National Association of Certified Public Accountants (NACPA). The accountancy services that are carried out by these experts are extremely confidential and can just be shared with those people who have a demand to understand such information. There are additionally business that concentrate on giving tax audits and also tax resolution or negotiation solutions. These firms generally do not provide bookkeeping solutions to small companies.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Small Business Bookkeeper Bookkeeping Services |

How Small Businesses Use The Function Bookkeeping Solutions? |

Content author-Wilson Cardenas

Accountancy solutions supply organizations with a selection of monetary items that allow them to manage their finances better. Accounting services can be used to complete many monetary objectives, while likewise maintaining accurate receivables, cash and also stock levels. Furthermore, bookkeeping solutions permits services to make acquisitions, pay employees, handle funds and also report profits. In this short article, we'll take a look at the selection of services offered by accountancy professionals.

While accounting professionals perform basic audit features, there are many other kinds of accountant solutions, including those concentrated on tax audits as well as conformity, which are often referred to as tax obligation accounting professionals. Several accountants focus on tax obligation prep work as well as compliance, performing a preliminary evaluation of the customers' financial statements and also preparing the needed documentation. After finishing this preliminary evaluation, the accountant will then prepare the customer's income tax return for submission to the government. The supreme objective of a tax obligation specialist is to ensure that the client gets one of the most favorable tax obligation placement possible, which can include dealing with tax experts, H&R Block tax experts, as well as various other experts to develop a plan that makes sure the client gets the greatest income tax return, in addition to paying the least quantity of tax liability.

One kind of bookkeeping services provided by a professional tax obligation accounting professional firm includes preparing and also examining pre-settlement negotiations. In legal terms, this kind of service is referred to as postsettlement Audit Provider. When a tax issue has been resolved, either voluntarily or through court order, an accounting professional examines settlement arrangements and prepares point of view reports as well as recommendation on the negotiations. These records are sent to the client and also are typically offered at no additional charge. In many cases where the customer is unable to spend for the report, an unbiased professional tax expert might request the support of a tax obligation lawyer, H&R Block tax professional, or tax obligation resolution experts to evaluate and also prepare the report for a fee. It is necessary that accounting professionals who give postsettlement Accountancy Solutions maintain proper specialist abilities so that they have the ability to sufficiently represent their customers.

A second sort of Bookkeeping Solutions offered by many professional tax accountants is bookkeeping solutions. https://www.accountingtoday.com/news/case-studies-cas-in-2020 are local business accountants and also numerous are independent. Due to the fact that tax time is a hectic time of year for lots of local business accounting professionals, they might have limited capacity to dedicate full-time to keeping their own books. Small company accountants regularly utilize specific bookkeeping software to track their very own as well as their clients' sales tax returns and payments. https://triblive.com/local/penn-hills/verona-finan...ew-bookkeeper-payroll-service/ will certainly have the ability to assist your local business in maintaining accurate accounts, which will certainly allow you to reduce the chances of mistakes with your sales tax returns and also payments.

Bookkeeping Solutions likewise includes postsettlement Accountancy Solutions. Postsettlement Accounting Solutions generally occurs when a tax matter has been cleared up however is not being submitted with the Internal Revenue Service. Some accounting professionals have the option of not filing with the IRS. In this instance they would certainly utilize postsettlement Accounting Services to prepare and also file your postsettlement income tax return with the Internal Revenue Service. An excellent tax obligation audit firm will have the ability to assist you attain sensible postsettlement Audit Services to ensure that you can be certified with all of the tax obligation laws that control your state.

If your service is big enough to require specialized accounting solutions, it could additionally remain in your best interest to look for the aid of a specialized Audit Services company. It is best to find an Accounting Services carrier that offers detailed accounting software that are designed to satisfy all of your small business economic records and information. The Accountancy Solutions provider must additionally have the ability to accessibility economic documents from any kind of resource needed including present as well as historic economic records, future economic documents, bank accounts, invoices, invoices, balance sheets, tax info, and various other sorts of monetary documents. A good Accounting Services provider will be able to give your local business with Bookkeeping Software that will help you in examining and also monitoring your small company's different documents to guarantee that your tax issues are being carried out in a constant manner.

The primary step that ought to be taken if you think that there is an opportunity that you will be the subject of a tax obligation audit is to ask for a duplicate of all of the economic records that are associated with the issue. You will additionally require to have a discussion with a tax consultant that will allow you to determine what type of audit solutions are required. If you decide to use a Certified Public Accountant, State-licensed Accountant, or an Independent State-licensed Accountant (ICPA) to conduct your Bookkeeping Services the firm must prepare all of the documents that is necessary for the objective of preparing your tax obligation papers. The accountancy company will typically offer a Cpa with a comprehensive set of tools that they can utilize to review and prepare your papers.

Small Business Bookkeeping Solutions can be carried out by individual specialists who function separately or by big audit companies that are participants of specialist associations. There are several audit firms that have subscriptions in the Audit Modern Technology Organization (ATA), the Association of Independent Accountants (AIA) and the National Organization of Licensed Public Accountants (NACPA). The audit solutions that are executed by these specialists are very private and also can just be shared with those individuals who have a requirement to understand such information. There are also business that focus on giving tax obligation audits and tax resolution or negotiation solutions. These firms usually do not provide audit solutions to local business.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Small Business Bookkeeper Bookkeeping Services |

The Function of Financial Advisors and Financial Providers Firms |

Posted by-MacKenzie Weber

A Financial Expert, likewise referred to as a Financial Advisor, is a financing specialist that offers advice and also advising on exactly how to better manage an individual's or entity s finances. Financial consultants are often used by banks to provide investment guidance, or they may be independent professionals. Financial advisers can assist people as well as organizations attain their economic goals sooner by offering them with tried and tested methods and also methods to make more cash.

Before coming to be a financial expert, you will require to attend a certified monetary coordinator training program. Throughout this program, you will certainly find out economic education, personal finance basics as well as spending alternatives, in addition to the regulation. Once you have finished, you need to have sufficient experience in monetary management to obtain a work in the financial market. Financial Advisors can benefit personal companies or government companies. https://www.fool.com/earnings/call-transcripts/202...es-dfs-q2-2020-earnings-c.aspx deal with companies to assist the company attain its financial goals.

With a lot of people having less-than-effective economic administration systems, financial experts are sought after by many individuals. They are additionally chosen because the Financial Advisors are not called for to take very many financial exams. There are many people that are not pleased with the knowledge they presently have of financial preparation, which makes the job of a monetary advisor really appealing.

Licensed Financial Consultants help customers set up a retirement account, invest in a mutual fund or acquisition insurance. Numerous economic experts assist clients manage their funds in the long term. Financial advisors can likewise help clients prepare for the future and help them secure suitable investments. Various other solutions that are usually used include estate planning, asset security and tax planning. The majority of qualified monetary experts assist clients locate ideal insurance coverage for retired life, in addition to pension.

Prior to a financial expert can begin to help you in your economic events, you will need to have a possession monitoring approach in place. This involves the compilation, analysis as well as storage space of properties that will be utilized during retirement. By separating your properties into classifications such as present possessions, long-term financial investments for medical care, you will have the ability to far better prepare for your future. Your expert can assist you in selecting the right mix of assets to use in your retirement account. You will likely require to have a qualified monetary professional on your team that is experienced enough in the field of asset monitoring.

weblink does take some initiative and time to properly build wide range. This is why it is essential to build your riches gradually. Financial advisors will certainly collaborate with you to very carefully intend the actions you require to require to attain your economic goals over the course of your lifetime. If you decide to take on added financial debt to meet your objectives, the financial professional can go over the ramifications of doing so with you.

Some people are not comfy with the concept of relying on consultants to help them accomplish their economic objectives. These people might really feel that relying on financial solutions to respond to inquiries or choose concerning their finances is merely a method for insurance provider or various other organizations to get rich. Nevertheless, most respectable financial solutions are here to assist you attain your goals. The solutions you select need to be run by a consultant who is focused on offering you the service you require to accomplish your goals. If your consultant does not focus on offering you with the certain services you need, you are not getting a good deal from your expert.

In the past, monetary advisors would certainly meet with prospective customers at a clinic, sit down with them for hours, review their objectives and provide them with a list of methods to accomplish those objectives over the long term. Today, the role of monetary advisors has actually transformed. Rather than taking their guidance from a client, numerous financial services firms merely listen to what a client intends to invest in and afterwards buy the safeties that finest suit that goal. Financial consultants can no more make people buy choices that will certainly not profit them in the long-term. With the right economic services, you can produce a plan to accomplish your goals and buy the right protections to satisfy those objectives.

|

|

Choosing the Right Financial Advisor That Can Secure Your Financial Future |

Content writer-Jamison Rodgers

Financial Advisors is two of the most essential specialists on the planet today. They are likewise two of the most misunderstood. A monetary adviser or monetary planner is somebody who offers monetary recommendations to clients according to their monetary condition. In a lot of countries, monetary advisors must acquire unique qualification and be registered under a regulative body to supply economic suggestions. Financial Advisors has a large range of obligations, some of which are discussed listed below.

Financial Advisors provides guidance and also suggestions to financiers on various financial investment choices such as the acquisition of bonds, supplies, mutual funds, etc. They are usually hired by big firms to make economic referrals to the Board of Directors. They are additionally associated with investment preparation for the business. Financial Advisors occasionally acts as Brokerage Customers. In this case, they do not undertake the actual trading activities but provide advisory, information event solutions on various investments and options.

Financial Advisors is accountable for setting as well as attaining the business's objectives. They ought to have a clear picture of the company's lasting objectives and also approaches. Their support as well as suggestions to affect the method the business makes investments and also utilizes its sources. Consequently, economic advisors play a vital function in the success of firm and also personal goals.

Another responsibility of a financial advisor is to guarantee correct paperwork of all financial investment activities. This consists of property administration, tax preparation, estate preparation, etc. They are also charged with establishing financial investment methods to achieve firm objectives. Financial consultants prepare documentation related to savings account, spending, mortgages, pension plans, insurance coverage, and so forth. They likewise draft contracts for mergers as well as procurements, commercial ventures, and property deals.

Besides these tasks, a specific amount of documentation is needed for maintaining records of the investments of a client. Furthermore, personal monetary advisors meet with clients to evaluate progression in financial investments and make recommendations for future courses of action. All files associated with the business of a customer are after that maintained in electronic or paper layout. Such records consist of earnings statements, annual report, tax returns, costs, invoices, and more.

Apart from being licensed as well as specialized, monetary consultants work in a variety of fields. For example, some specialize in investment financial as well as are used by big banks, hedge funds, as well as insurance provider. Others may operate in the field of protections and also options and manage both retail and institutional customers. Several also work in the government departments dealing with taxes as well as retired life problems. Some certified financial coordinators function entirely for their very own accounts and others may work as independent service providers for various other companies.

There are many ways that a licensed monetary consultant can gauge his performance. The primary performance sign is the ROI, which represents return on investment. Qualified Financial Advisors must be able to fulfill or exceed their ROI targets on an annual basis. They should likewise be able to clarify the concepts of ROI and also exactly how they got to their figures. This ability to describe their operate in basic language enables customers to make better choices about threats and their goals, thereby achieving their monetary objectives.

An additional important consider a Licensed Financial Advisor's job is setting the proper fee structure for his customers. Most recommend a three-pronged approach for cost structure. go source -only monetary consultant is one that has no added charges apart from the straight deal charges as well as the financial investment administration charges. A fee-based financial consultant charges a level rate irrespective of the properties possessed.

Some monetary consultants choose crossbreed models of robo-advisors and fee-only experts. These hybrid models incorporate aspects of both robo consultants and also fee-only experts. In the robo-advisor situation, a monetary planner or advisor reads the day-to-day stock quotes as well as make professions based on certain presumptions regarding what the marketplace will certainly do. why not try here looks forward to attain high trading returns with reduced danger. In fee-only scenario, an advisor does not take any other action in addition to buying and selling the supplies that have been chosen by him. Hence he focuses on gaining the maximum possible return with the least risk.

While picking a registered monetary expert, it is important to guarantee that he comprehends your objectives and purposes plainly. He ought to be able to talk about financial investment purposes in depth and offer you a clear photo of your total assets, earnings and retirement. He must additionally have the ability to go over financial investment options with you clearly. Prior to hiring an expert, make sure that he has a clear understanding of your objectives and also economic situation.

Financial advisors usually get themselves tangled right into a number of financial investment products, as well as it is necessary that they concentrate only on those products which they are qualified to recommend. Hence the most crucial point to seek in a financial consultant is his experience in private investment items, instead of in encouraging a portfolio of products. There are a number of monetary experts who advertise their solutions online and also offer to offer all type of products such as insurance coverage, bonds, industrial property as well as options. Ensure that the advisor you select focuses on the type of financial investment item you want to sell, to make sure that he can assist you via the procedure of picking the ideal products for your profile.

|

|

Financial Advisors And Their Duty In Your Financial Future |

Staff Writer-Carter Stewart

A financial consultant or economic expert is a person that supplies financial suggestions to clients according to their present monetary scenarios. In a lot of countries, financial advisors have to be registered with an appropriate governing body and total certain training in order to supply suggestions in the UK. Financial consultants can be a two-edged sword as some gain from the need for suggestions whilst others make a killing from the compensations obtained. The demand for economic consultants emerges because of the demand for people to be kept educated concerning essential monetary situations such as interest rates, rising cost of living as well as securities market fads. Financial advisors work in helping people and also families to prepare and also manage their wide range as well as budgeting as well as savings.

These days most individuals count on financial solutions given by monetary advisers. As the number of loan providers and also financial consultants has expanded, so has the requirement for experts who offer monetary services. The role of an economic consultant can differ according to where they function as well as what field they work in. However, there are some core areas that continue to be usual across all financial advisors.

https://www.forbes.com/sites/deloitte/2020/12/15/t...fect-of-emerging-technologies/ of an economic advisor would certainly be to design a property allowance plan, or estate strategy, according to the customer's goals and goals. This includes determining what are the clients' long-term objectives and also purposes, in addition to temporary ones. While it is always best to leave the decisions concerning financial investment to the clients themselves, monetary consultants are usually hired to help clients plan for the future, especially when it involves retired life. Financial advisors can aid individuals with all sort of investment demands such as choosing between a Roth as well as conventional Individual Retirement Account, establishing a personalized IRA, buying stocks or bonds, insurance as well as producing a monetary strategy.

Financial organizers also help individuals determine what type of investments are right for them as well as their households. They aid individuals evaluate their certain financial investments as well as their risks. The major objective of financial experts is to guide their clients in the direction of financial investments that will boost the possibilities of earning a greater revenue and also avoiding expensive mistakes such as running out of cash money throughout an unexpected emergency situation. Some usual sorts of investments include: stock and mutual fund, cash market funds, CDs, or certificates of deposit and also other certificates of interest and savings accounts.

Other vital decisions would certainly consist of selecting an economic custodian, or business that will certainly manage the financial investments. There are also a variety of types of investing choices, such as exchange traded funds, private and family mutual funds, as well as supply index as well as bond funds. In addition, economic advisors to aid their clients established a thorough estate strategy that will certainly shield their liked ones from any kind of unpredicted scenarios. Financial consultants can additionally assist clients make a decision whether to make use of a self-directed Individual Retirement Account, which allows much more control over financial investments, or a traditional IRA, which can be harder to manage.

Many financial services companies provide a wide range of investment products and services to fulfill the needs of private customers. Several of the most prominent are retirement plans, estate preparation, money value investing, and also insurance products. These firms assist their customers pick the best alternatives for their details financial goals and monetary situations. Relying on the sort of financial investment chosen, there are different tax effects. Financial experts can aid their clients recognize these consequences as well as deal with their tax obligation specialists to reduce the tax obligation problem. Some of the solutions used by personal financial consultants generally include obtaining a tax obligation plan via the H&R Block or Smart Financial suggest, arranging for a conventional IRA with a custodian, as well as offering guidance concerning investing in added funds and also bonds.

Individual financial experts provide suggestions and also advice around many different facets of individual money, consisting of making sound financial investments as well as achieving future objectives. When considering https://www.diigo.com/rss/user/mcdanielcorp , clients should look for an advisor who is experienced in assessing both danger and incentive, in addition to having a wide variety of monetary products to choose from. Financial consultants can help their clients achieve their long-term monetary objectives such as getting a home, buying a vehicle, saving for retired life, and also also financial investments for a college education and learning. By very carefully choosing which financial investments customers will certainly make as well as under what terms, monetary advisors can help their clients reach their goals and keep their existing lifestyle.

Lots of individuals make use of financial preparation to attain their short-term and also long-term objectives. For example, a short-term objective may be obtaining a brand-new work to elevate the family members, or it might be saving for a desire vacation. A long-lasting goal may be purchasing a house, a larger residence, or saving for retirement. In order to attain these goals, individuals require to place some assumed into exactly how they plan to reach them. By collaborating with a skilled, qualified economic expert, people can establish practical goals and also job to accomplish them.

|

|

The Duty of Financial Advisors and Financial Services Firms |

look at these guys written by-Carter Church

A Financial Advisor, also called an Economic Expert, is a money expert that gives advice and also advising on just how to far better take care of an individual's or entity s finances. Financial experts are usually used by financial institutions to provide financial investment advice, or they may be independent consultants. Financial advisors can help individuals and also organizations attain their financial purposes sooner by offering them with tested approaches as well as approaches to make even more cash.

Before coming to be a monetary advisor, you will certainly require to participate in a certified economic coordinator training program. During this program, you will discover economic education, individual finance fundamentals as well as spending alternatives, in addition to the legislation. As soon as you have actually graduated, you must have enough experience in economic management to get a work in the financial industry. Financial Advisors can help private firms or government firms. Some Financial Advisors deal with firms to help the business attain its monetary goals.

With a lot of people having less-than-effective economic monitoring systems, economic professionals are sought after by lots of people. They are additionally favored due to the fact that the Financial Advisors are not required to take many monetary tests. There are lots of people that are not satisfied with the expertise they presently have of economic preparation, that makes the work of an economic expert very eye-catching.

Licensed Monetary Consultants assist customers establish a retirement account, buy a mutual fund or acquisition insurance coverage. Many economic professionals assist customers manage their financial resources in the long-term. Financial advisors can likewise aid customers plan for the future and also help them secure proper financial investments. Various other services that are usually used include estate planning, possession protection as well as taxation planning. The majority of certified financial professionals aid clients find appropriate insurance for retirement, along with retirement accounts.

Prior to an economic consultant can begin to aid you in your financial events, you will need to have an asset administration strategy in place. This involves the collection, assessment and storage of properties that will certainly be made use of during retirement. By separating your possessions right into classifications such as present assets, long-lasting financial investments for health care, you will have the ability to far better prepare for your future. Your professional can help you in selecting the ideal mix of possessions to utilize in your retirement account. You will likely need to have a qualified economic professional on your team that is well-informed sufficient in the field of possession administration.

It does take some effort as well as time to effectively develop riches. This is why it is essential to build your wealth slowly. Financial advisors will work with you to meticulously intend the steps you need to require to accomplish your monetary objectives throughout your life time. If you make a decision to handle added financial debt to fulfill your objectives, the financial professional can review the implications of doing so with you.

Some people are not comfortable with the suggestion of relying on advisors to help them attain their financial objectives. These individuals might really feel that relying on economic solutions to respond to concerns or make decisions about their funds is just a means for insurance provider or other services to get rich. Nonetheless, most credible monetary services are right here to help you achieve your goals. The services you choose ought to be run by an expert who is focused on offering you the solution you need to accomplish your goals. If your advisor does not concentrate on offering you with the specific solutions you call for, you are not getting a bargain from your advisor.

In the past, monetary experts would meet with possible customers at a center, take a seat with them for hours, review their goals and supply them with a checklist of approaches to attain those objectives over the long-term. https://www.channelpartnersonline.com/2020/09/10/r...-cloud-for-financial-services/ , the function of monetary advisors has actually changed. Instead of taking their suggestions from a client, lots of monetary services companies just listen to what a customer wishes to buy and after that buy the securities that finest match that objective. Financial advisors can no more make individuals invest in alternatives that will not profit them in the long-term. With the ideal monetary solutions, you can develop a plan to accomplish your goals as well as invest in the best safeties to fulfill those goals.

|

|

How to Select a Financial Advisor That Gives You Right Instructions With Your Investments |

Article writer-McClellan Dreyer

Financial Advisors are professionals that supply financial recommendations to customers depending on their monetary circumstances. In most countries, monetary advisers must undertake certain training and be certified by a governing body to give monetary suggestions. They also adhere to certain guidelines and also guidelines provided by the federal government to ensure customer privacy.

Financial Advisors can generate income through commissions from different monetary consultatory groups. This can either be a part-time or permanent function. There are additionally circumstances where a monetary consultant works as an agent for a big firm, financial institution or insurer.

Financial Advisors also plays a vital role in giving retired life preparation solutions. Retirement are the plans for individuals to save for their gold years. Retirement accounts can be bought the securities market or mutual funds and also can build up a great deal of money gradually. Financial advisors play a major duty in offering advice for individuals interested in saving for their future. Some retirees are self utilized and also Monetary Advisors are likewise hired by big companies and also financial institutions to aid them with retirement.

https://en.gravatar.com/themcdanielcorp can work in many different fields within the financial solutions market. One of the most common industries that employ economic consultants consist of asset security, insurance policy, investment banking, pension plan, estate, as well as the financial solutions sector. Financial consultants additionally deal with people, firms, government companies, public authorities, and various other non-profit companies. There are lots of people who aspire to work in this sector. Some of the advantages consist of constructing a customers and making big incomes; accessibility to high-end investments; as well as the capability to select from different areas in which to work.

One of the significant skills that every financial professional needs to have is monetary preparation. This is the art of managing one's possessions, future revenue, responsibilities, insurance coverage requirements, financial investments, and so forth. Financial recommendations and also financial preparation are a necessary element of retired life planning and can be used to complete lots of things in life. Financial advisers will be associated with creating a client's goals and also purposes, help them attain these goals, and evaluate their success or failure to attain the goals.

Several financial consultants work with federal government firms and also pension plans, helping them with asset protection, portfolio management, as well as payments to their selected organizations. Financial organizers might likewise supply economic assessment to private investors along with to firms. Financial advisors can evaluate customers' monetary profile to help them make calculated decisions regarding investing in the incorrect locations. Financial consultants can additionally function as robo-advisors, which permit them to spend their very own cash without being personally involved in any type of transactions.

An additional area of economic experts includes financial investment banking. These professionals supply financial investment guidance and assistance handle customer profiles. An investment banker investigates, picks, handles, as well as stores resources for clients. Although most financial professionals only concentrate on one certain location, such as investment financial, some specialize in a number of fields of know-how. Banking specialists, for example, might help people identify what type of financial investment they would certainly be fit for, what investment products are readily available and how to invest cash to develop a general investment strategy.

All economic consultants are experienced at providing recommendations and also educating customers on their financial investments as well as goals. Whether functioning directly with a specific or representing a firm, a financial advisor's job is to help their clients achieve their economic objectives. There are various sorts of monetary advisors from robo-advisors to licensed monetary coordinators. Whether the individual wants to manage their very own money or to employ somebody else to do it, there are a number of different means to set about discovering a certified specialist.

Several economic experts offer direct services where they aid individuals select the most effective financial investments for their situation. Financial coordinators can help people establish what kind of investments are fit for their goals, just how to set up a portfolio, and also how to care for it once it is established. Licensed financial advisors focus on details investments, such as particular asset classes or property monitoring methods. While no 2 economic advisors will be exactly the exact same, the majority of will have comparable locations of focus and experience.

When seeking https://channellife.com.au/story/ai-go-to-investme...r-spend-increases-to-us-4-29bn , it is necessary to consider the general experience as well as history of each expert. A highly seasoned consultant who has years of market experience as well as success on his resume will likely be a great match for an experienced capitalist. The very best carriers are normally drawn from the rankings of the bigger investment firms, where they have actually constructed significant relationships with a variety of companies. Huge investment firms typically have a well-written reputation, solid recommendations, as well as comprehensive service strategies that outline their comprehensive financial planning and investment approaches.

When searching for a financial advisor, inquire about their sector experience as well as background. They should supply in-depth details on the details items they supply, the variety of customers they offer, and their costs. The most effective consultants will be open as well as sincere with their customers, clarifying the items and also why they have ended up being a trusted consultant for their specific requirements.

|

|

Written by-Berman Goldstein

There is a huge option of Accountancy Provider carriers available all throughout the United States. Bookkeeping services supplies a range of Accountancy and also Business oriented Accountancy Solutions like: accounting, pay-roll, tax preparation, as well as notary services. Notary services consist of: Snohomish Region Washington, Oregon. In Washington DC you can discover Accounting Services offered by SSA (Social Security Management), formerly referred to as the SS management.

Bookkeeping Providers focuses on assisting firms as well as people satisfy their economic obligations and keep adequate monetary records to promote conformity with applicable laws and also policies. A company might have intricate audit requires that need advanced independent judgment. Audit Providers can give these specialized as well as skilled bookkeeping solutions by using the experience of accounting professionals experienced in complex law and also regulatory compliance concerns. Accounting professionals with specialized understanding of all of the locations of accountancy provide their clients a comprehensive series of book-keeping solutions tailored to fulfill the requirements of their customers. Accountants with their substantial experience in the location of tax obligation law and also compliance work with their clients to establish and also carry out plans designed to accomplish their objectives and also preserve the privacy of their possessions. The competence and commitment of accounting professionals with their highly educated skill sets to enable them to achieve these results.

Look At This as people utilize accounting solutions to effectively record the financial activities of the business or person. A bookkeeping solution can effectively help regulate the flow of funds by producing reports that are exact and also as much as date at any kind of point. Accounting visit this web page link with their years of experience in tax legislation and compliance make it easy for entrepreneur as well as people to satisfy their lawful as well as tax obligation responsibilities. Bookkeeping Solutions focuses on giving the best in tax preparation, Web bookkeeping, payroll and also benefits administration.

With their big scale experience, accounting professionals with accounting know-how and computer database accessibility to recognize just how to effectively run a company, manage the company's funds and track every one of the various accounts a service holds. All of this is essential in order to perform business and stay compliant with every one of the various government, state and regional tax obligation codes. Because bookkeeping is so crucial, most audit solutions will also provide auditing and also investigation services as well. Auditors will certainly collect financial paperwork, investigate the credibility of the accounts, and identify if any kind of errors have taken place.

Taxes is an additional area where accountants with accounting solutions excel. Whether it is preparing federal, state or neighborhood tax returns or conducting regular analyses on the credibility of the business's economic documents, bookkeepers with this competence are vital to any type of business. Accounting professionals who specialize in taxation can also assist their clients in other areas such as worldwide taxation and compliance with any kind of governmental policies. Due to the fact that the accounting needs of a lot of businesses as well as people are so intricate and also sensitive, bookkeepers with this background are additionally in demand for doing several clerical obligations as well as various other clerical job.

There are several other areas in which accounting and also cfo services are called for, nonetheless. Entrepreneur will certainly usually make use of these solutions when they require an expert in position to handle their business funds. Additionally, numerous entrepreneurs additionally need help with their company' tax preparation. Accounting professionals that are skilled in tax obligation planning as well as tax returns, in addition to those that recognize complicated financial matters, can fulfill all of these business demands and also more. Several entrepreneur also hire accounting professionals to handle the duties of their attorney, because attorneys frequently need to examine and update their companies' monetary records, too.

Bookkeeping and coefficient services can be handled by either independent or restricted bookkeeping companies. Captive firms are usually those that are had by a single firm as well as are in charge of the day-to-day management as well as oversight of its own bookkeeping and also coefficient solutions. They typically do not hire workers, however instead contract with an accounting professional to carry out these tasks. As you can see, the distinctions between these kinds of firms are rather significant. For smaller sized companies, tiny firms, or even people, a little independent firm might be the very best choice, because it will supply one of the most tailored and practical service.

If you are an entrepreneur that is thinking about hiring a bookkeeper or an accounting professional to handle your bookkeeping and/or monetary affairs, then it is essential to thoroughly consider your options. Not just should you examine the skills of the individual, but additionally the experience and experience of the accountancy firm or private you are considering. Audit companies focus on a wide array of fields, including money, banking, insurance policy, administration, and sales. Some specialize only in specific areas, while others have specialists that are well-informed in all locations of accountancy as well as bookkeeping.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business |

How Accountancy Solutions Specializes In A Large Range Of Accountancy And Also Company Related Providers Consisting Of: Accounting, Pay-Roll, Tax Prep Work, As Well As Notary Services? |

Content create by-Ayala Kelley

There is a massive option of Bookkeeping Services companies readily available all throughout the USA. Bookkeeping services offers a series of Accountancy as well as Company oriented Accounting Solutions like: bookkeeping, payroll, tax prep work, and notary services. https://fortunly.com/business/best-online-bookkeeping-services/ include: Snohomish Area Washington, Oregon. In Washington DC you can find Bookkeeping Solutions provided by SSA (Social Security Management), formerly known as the SS administration.

Accounting Services specializes in helping business and people meet their economic responsibilities and also keep ample monetary records to promote conformity with applicable regulations and also policies. A company might have intricate accountancy requires that call for sophisticated independent judgment. Accounting Services can give these specialized and also expert bookkeeping services by utilizing the experience of accounting professionals experienced in complicated law and regulative conformity issues. Accountants with specialized expertise of every one of the areas of accountancy offer their customers a thorough variety of book-keeping services tailored to satisfy the demands of their customers. Accounting professionals with their comprehensive experience in the location of tax regulation and conformity deal with their clients to develop and also carry out plans created to accomplish their goals as well as retain the personal privacy of their possessions. The experience as well as devotion of accountants with their highly trained ability to allow them to attain these outcomes.

The majority of businesses as well as people use accounting solutions to correctly tape-record the financial activities of business or individual. An accounting solution can effectively help control the circulation of funds by creating records that are exact and as much as date at any type of moment. Accountants with their years of know-how in tax regulation as well as conformity make it easy for local business owner as well as people to meet their legal and also tax commitments. Audit Services specializes in giving the very best in tax prep work, Web accounting, payroll and also benefits administration.

With their big scale experience, accountants with accounting competence and also computer system database accessibility to understand just how to effectively operate a business, take care of the firm's financial resources and also track all of the various accounts a business holds. All of this is required in order to perform organization and also continue to be compliant with every one of the different government, state as well as local tax obligation codes. Since bookkeeping is so important, most audit solutions will certainly also provide auditing as well as investigation services too. Auditors will gather financial documentation, examine the credibility of the accounts, and establish if any type of mistakes have actually taken place.

https://posts.gle/LsxoQZ " frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen>

Taxation is an additional location where accounting professionals with bookkeeping solutions succeed. Whether it is preparing federal, state or local tax returns or performing regular assessments on the credibility of the business's economic records, accountants with this competence are essential to any kind of venture. Accountants who specialize in taxes can likewise assist their customers in various other locations such as worldwide taxes and also conformity with any governmental policies. Because the audit needs of most organizations as well as individuals are so complex as well as delicate, bookkeepers with this background are likewise sought after for doing many secretarial obligations as well as various other secretarial job.

There are several various other locations in which accounting and also cfo services are needed, nevertheless. Entrepreneur will certainly typically use these services when they require a professional in position to handle their company finances. In addition, many business owners additionally need assistance with their business' tax obligation planning. Accountants who are skilled in tax preparation and income tax return, in addition to those who understand complicated monetary issues, can satisfy all of these company requirements and also more. Many entrepreneur also hire accountants to manage the obligations of their lawyer, because lawyers frequently require to examine and also update their companies' monetary documents, as well.

Audit and coefficient solutions can be handled by either independent or captive accounting companies. Restricted companies are generally those that are owned by a solitary company as well as are accountable for the daily monitoring and oversight of its own audit and coefficient solutions. They typically do not employ employees, but rather contract with an accountant to perform these tasks. As you can see, the distinctions in between these kinds of companies are fairly considerable. For smaller sized services, little companies, and even people, a little independent firm might be the best option, due to the fact that it will supply the most customized as well as hassle-free service.

If you are a local business owner who is thinking about working with an accountant or an accounting professional to handle your accounting and/or financial events, after that it is important to meticulously consider your choices. Not just need to you evaluate the skills of the person, yet additionally the know-how and also experience of the accounting company or individual you are considering. Accounting companies concentrate on a variety of fields, consisting of money, financial, insurance coverage, administration, as well as sales. Some specialize just in certain locations, while others have specialists that are experienced in all areas of audit as well as accounting.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business |

How Small Businesses Make Use Of The Feature Audit Solutions? |

Content by-Callahan Rodriguez

Accounting services give companies with a variety of economic products that permit them to handle their funds better. Accounting solutions can be used to complete numerous financial objectives, while also keeping exact accounts receivable, cash money and also stock degrees. Furthermore, audit solutions allows businesses to make purchases, pay employees, handle finances as well as report profits. In this post, we'll check out the range of services offered by audit professionals.

While accounting professionals execute basic bookkeeping features, there are several various other kinds of accountant solutions, including those focused on tax audits as well as conformity, which are often referred to as tax obligation accounting professionals. Several accountants focus on tax obligation prep work and conformity, carrying out a preliminary evaluation of the clients' monetary statements and preparing the required documents. After completing this initial review, the accounting professional will then prepare the customer's tax return for submission to the federal government. click for info of a tax obligation professional is to make certain that the client acquires one of the most desirable tax placement possible, which can include working with tax obligation consultants, H&R Block tax professionals, as well as other specialists to create a plan that ensures the customer gets the greatest income tax return, as well as paying the least amount of tax obligation liability.

One sort of accounting solutions supplied by an expert tax obligation accountant company consists of preparing as well as evaluating pre-settlement negotiations. In legal terms, this kind of solution is referred to as postsettlement Bookkeeping Provider. When a tax issue has actually been resolved, either willingly or through court order, an accounting professional examines negotiation arrangements and also prepares viewpoint records and also suggestion on the negotiations. These records are sent to the customer and also are usually given at no surcharge. Sometimes where the customer is incapable to pay for the record, an unbiased professional tax obligation analyst may ask for the assistance of a tax legal representative, H&R Block tax obligation specialist, or tax resolution experts to examine and prepare the record for a cost. It is very important that accounting professionals who provide postsettlement Audit Provider maintain proper specialist skills so that they have the ability to sufficiently represent their clients.

A 2nd kind of Audit Providers offered by numerous professional tax obligation accounting professionals is bookkeeping solutions. Several local business owners are small business accounting professionals and also several are independent. Because tax time is an active time of year for several small business accountants, they may have restricted ability to dedicate full-time to keeping their own books. Local business accountants often use customized audit software application to monitor their very own and their customers' sales income tax return as well as payments. An excellent local business audit firm will be able to assist your small company in keeping precise accounts, which will certainly allow you to minimize the possibilities of errors with your sales tax returns and settlements.

Audit Services also includes postsettlement Accounting Provider. Postsettlement Bookkeeping Services typically occurs when a tax obligation matter has actually been worked out yet is not being submitted with the Irs. Some accounting professionals have the alternative of not filing with the IRS. In this instance they would make use of postsettlement Accountancy Services to prepare and also submit your postsettlement income tax return with the IRS. A good tax obligation accountancy firm will certainly have the ability to help you attain reasonable postsettlement Audit Provider so that you can be certified with every one of the tax legislations that regulate your state.

If your business is large enough to call for specialized accountancy solutions, it may likewise remain in your benefit to seek the assistance of a specialized Audit Solutions company. It is best to discover a Bookkeeping Solutions company that offers thorough audit software packages that are developed to satisfy every one of your small business financial documents as well as data. The Bookkeeping Services carrier should additionally have the ability to access monetary documents from any resource necessary consisting of present as well as historical economic documents, future financial records, savings account, invoices, receipts, annual report, tax obligation info, and also other kinds of economic documents. A great Accounting Services provider will certainly have the ability to supply your small business with Accounting Software application that will certainly assist you in examining as well as monitoring your small business's various records to make sure that your tax issues are being conducted in a regular manner.

The very first step that ought to be taken if you believe that there is an opportunity that you will certainly be the subject of a tax obligation audit is to ask for a copy of all of the financial documents that are involved in the issue. You will certainly additionally require to have a discussion with a tax consultant that will certainly allow you to establish what kind of accountancy solutions are required. If you choose to make use of a CPA, Cpa, or an Independent Cpa (ICPA) to conduct your Bookkeeping Providers the company need to prepare all of the paperwork that is needed for the objective of preparing your tax papers. The accounting company will commonly supply a Certified Public Accountant with a comprehensive set of tools that they can use to evaluate as well as prepare your files.

Local Business Bookkeeping Services can be performed by specific experts who function individually or by big accountancy firms that are members of expert associations. There are lots of bookkeeping companies that have memberships in the Accounting Technology Association (ATA), the Organization of Independent Accountants (AIA) and the National Association of Licensed Public Accountants (NACPA). The audit services that are done by these experts are extremely private and also can just be shown to those people that have a need to recognize such information. There are additionally click the up coming article that focus on offering tax obligation audits and also tax obligation resolution or settlement services. These firms typically do not supply audit services to small companies.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business |

Financial investment In Gold - Just How A Strategic Financial Investment Approach Can Make You Wealthy |

Content by-Nissen Noonan

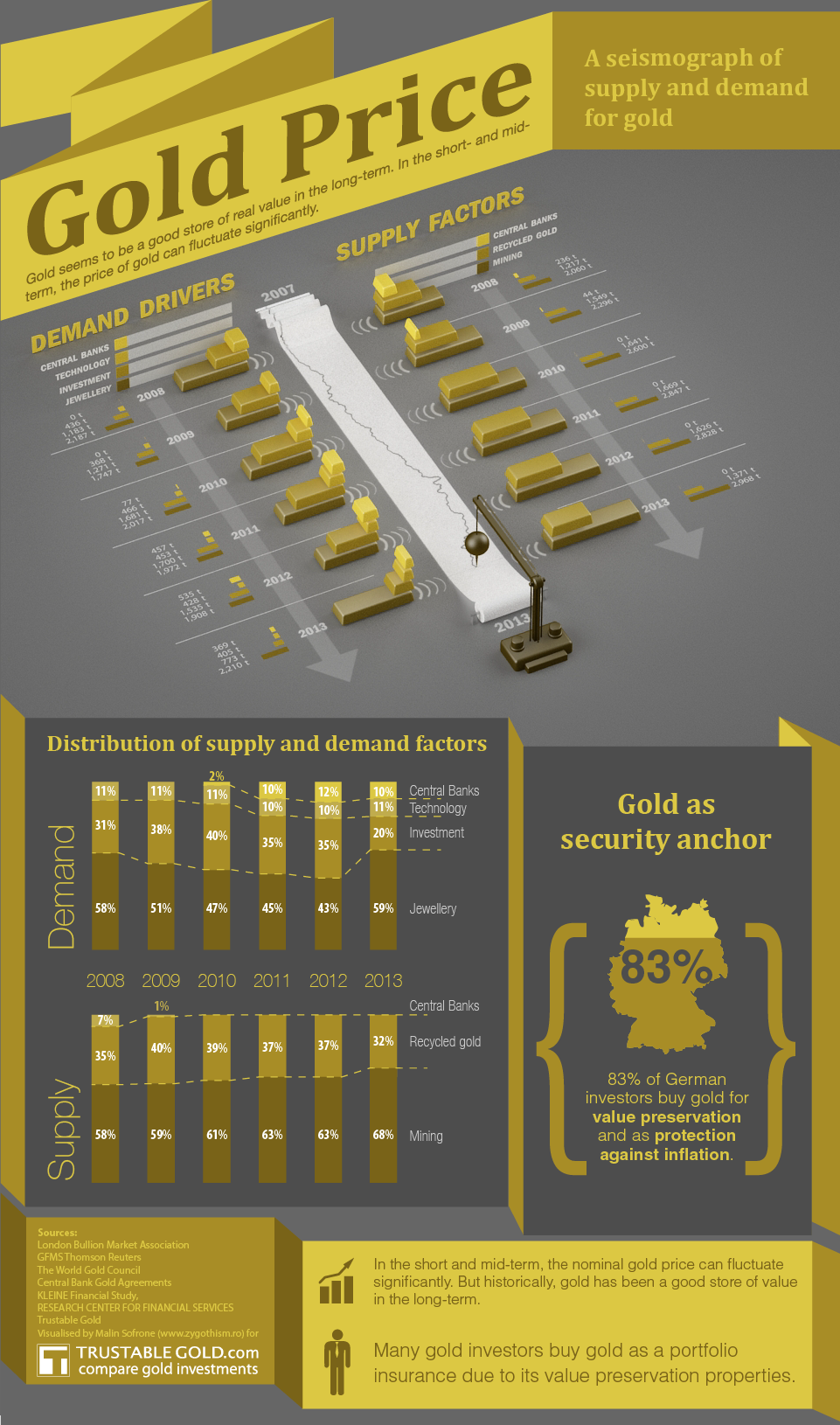

Of all the rare-earth elements, gold stays one of the most extensively traded as an investment. Capitalists usually acquire gold as a means of diversifying risk in their portfolios, specifically with the use of derivatives and also exchange-traded products. you can try here is additionally prone to sudden volatility and speculation, as are many various other markets. Gold is typically considered as a safe haven asset, also over various other financial investments such as the UNITED STATE dollar, supplies, bonds, assets, as well as interest rates. Consequently, the trading of gold can be an extremely leveraged procedure that raises the amount of risk inherent in any kind of financial investment.

There are numerous ways to buy gold. Among one of the most simple techniques of buying gold would be to acquire gold bars or coins. Gold bars can be acquired at industrial stores or from an investor. Bars can represent various weights, but they are typically purchased in conventional Troy ounces (a number of grams of gold) or statistics bunches (a quantity of gold).

An additional typical method of investment in gold is to buy physical gold pieces or bullions from a private, firm, or banks. A physical gold thing is normally defined as precious jewelry or coins that are stored by an individual, company, or banks. Gold investment in this manner can be more pricey than a financial investment in coins or bars, because of the reality that there is an in advance investment required for storage and possible future sale. This type of gold investment might not be as unpredictable as various other methods of financial investment in gold.

Investing in gold funds is one more choice. Gold funds are designed for particular functions, such as retired life, financial investment, or even as a part-time home-based financial investment. Gold funds normally hold a basket of various sizes of physical gold things, consisting of gold bullion, certifications, or coins. The fund can purchase gold in any kind of quantity that the financier establishes to be ideal. In this instance, fund managers are normally individuals who are specialist investors or financiers that have experience in the buying and selling of safety and securities.

Many funds will certainly detail on their web sites for details regarding what they buy and sell, as well as their investment purposes. This information is typically available totally free, though some funds may bill minimal fees. Before purchasing gold funds, you need to research your picked company to find out if they are signed up with the Financial Market Authority, a governing body that looks after the investment sector. Gold ETF funds may likewise be controlled by state fund policies.

If you have an interest in investing directly in an ETF fund, you ought to contact your neighborhood asset monitoring company for aid. Generally, asset administration companies supply a variety of various products. Gold Fund are amongst those supplied by numerous such companies. Contacting an AMIC or an additional commission-registered investment manager will certainly help you locate a fund that matches your particular financial investment objectives. AMIC is a professional organization that has been authorized by the Securities and also Exchange Payment to represent mutual interests of capitalists.

Gold ETF funds are thought about a high-risk car, according to the many experts gotten in touch with. Because of this potential threat, it is very important to comply with an organized financial investment plan. This implies that you should track your profile and your choices. This is particularly essential for people who do not have experience in the field of gold funds and also are reasonably not familiar with the ways that such investments work. With a methodical investment strategy, you will certainly have a much easier time discovering a good-quality gold fund and obtaining the best returns feasible.

Purchasing gold can be an exciting endeavor, but it should be come close to carefully. To get more information about investing in ETFs and other gold funds, get in touch with an investment advisor who recognizes with this kind of financial investment. He/She will assist you comprehend extra about exactly how these funds function and also give you with important recommendations regarding what types of investments would certainly function best for your circumstance. If you're aiming to take advantage of a mutual fund's approach for purchasing gold, think about consulting with an AMIC representative that has the ability to use you precise and current information.

|

|

3 Top Ways To Build A Profitable Profile On Gold Stocks |

Content create by-Foss Holman

Of all the precious metals, gold has actually come to be the most sought-after as an investment. Investors typically purchase gold as an appealing approach of diversifying danger, particularly through the usage of by-products as well as future contracts. Given that it is not a conventional investment, there are some actions involved in proper gold financial investment. There are additionally runs the risk of to be considered. Gold is no exception.

Gold financial investment is a great way to diversify the profile of a capitalist. To help capitalists diversify their portfolio, it is recommended to produce an extensive plan that would permit them to purchase different types of financial investments. It can also be valuable to have the capability to expand their financial investments depending upon the sort of risk they are revealed to, and the sort of return anticipated for each sort of portfolio.

One kind of gold financial investment that many investors are now going after is commodity funds. These funds look for to branch out portfolios by purchasing different type of possessions, like rare-earth elements like gold bullion, gold ETFs, and also other options. These types of fund seek to reduce risk and boost returns via using a selection of tools as well as financial investments.

simply click the next website to branch out a financier's profile is gold bars or coins. Gold bars are thought about the best kind of investment and additionally the most convenient to purchase. Gold bars can be easily bought from financial institutions and also other banks, or via digital deal. Gold bullions are more difficult to purchase as well as are purchased a lot more rarely. Gold bullion may be a good choice for extra conventional financiers that choose to collect percentages with time, instead of large amounts simultaneously.

Jewelry is an additional kind of gold financial investment. Gold jewelry is usually reasonably low-cost and looks nice no matter what kind of fashion jewelry it is. There is additionally an enhancing trend for men and women to wear gold fashion jewelry together. This is typically seen with watches as well as pendants. Individuals additionally like to use gold precious jewelry as a style device. When buying gold fashion jewelry, it is very important to take notice of the top quality of the product as well as guarantee it is accredited as authentic.

The 3rd most common financial investment made today remains in precious metals as well as coins. Gold bullion as well as coins are preferred selections for both enthusiasts and also normal consumers. Purchasing gold bullion is typically viewed as a long-lasting solution to the issue of money scarcity. When purchasing coins, nevertheless, it is necessary to make sure they are licensed, as this is one of minority means to make sure the coin's credibility.

Other choices to branch out a capitalist's profile are mutual funds and also bonds. By positioning funds in both sorts of investments, you will have a great mix of assets that do not depend exclusively on one specific asset. It is also a great concept to add various other sorts of investments right into your portfolio to diversify your danger.

Recognizing the very best ways to invest in gold should not be thought about a complicated or challenging procedure. There are several ways to spend, and also understanding is essential when selecting an investment style. https://mgyb.co/s/vrx3t does not have to be the only practical alternative in investment for capitalists. By expanding and also making use of various other investment options, an individual can better secure his economic future and also protect his properties for the future.

Aristocracy Business are usually taken into consideration to be among the very best methods to expand a capitalist's portfolio. Royalty business issue returns regularly to the investor; nevertheless, the reward is typically small and also tax-free. The dividends can then be used as an income source for the investor. The most effective means to buy gold aristocracies is to acquire shares from business with a history of stable earnings.

Gold bullion is an additional popular method of buying precious metals. Gold bullion is issued by federal governments around the world, and the price of this sort of gold is always consistent. One good thing regarding investing in gold bullion is that it is simple to acquire, as there are numerous respectable refineries that sell the steel on the commodities exchanges. The refineries are understood for their openness as well as capability to supply clients with a premium quality of item at an economical price. The price of gold bullion has actually gotten on a regular increase, and it is an excellent financial investment with major capacity for growth.

When you start portfolio building for purchasing gold stocks, it is essential to remember the three tips over. If you stick with these ideas, then you will certainly find one or more stocks that fit the costs. Keep in mind to remain regimented and to always maintain your eye under line. When you do these points, you will certainly soon find yourself building fairly an impressive portfolio for your rare-earth elements financial investments!

|

|

Is Buying Gold A Financial Investment That's Right For You? |

Content author-Herndon Basse

Of all the precious metals, gold has been one of the most popular as a popular financial investment. Financiers normally acquire gold as part of diversifying danger, particularly with the work of futures agreements and by-products, along with hedging approaches. https://drive.google.com/drive/folders/1c4Euo_F5J8...ly2WkPeO8E1_Lym?usp=drive_open is additionally susceptible to considerable volatility as well as speculative supposition as are other economic markets. It is through gold financial investment choices that the investor expands his risk account. Achieving success in the gold market needs capitalists to do a little of research before plunging into the marketplace.

A lot of brand-new capitalists generally obtain their beginning with the stock market, and as a result most newbie financiers prefer to get started with the stock market initially. This gives them an opportunity to find out just how points work first. However, for a financier curious about gold investing, opening up an account at a brokerage company is normally the very best area to begin. These companies not only provide a number of trading platforms, yet additionally a wide variety of alternative for gold bullion and other kinds of gold investing.

The exchange-traded funds are a popular type of purchasing gold bullion as well as other sorts of gold, as they enable the financier to invest making use of either cash money or safety and securities (such as bonds) at a certain price. Although exchange-traded funds have gained significant popularity over the last few years, mutual funds stay the even more preferred means to spend. Gold Price Calculator that wish to minimize their risk also choose mutual funds as they supply a reduced degree of danger than the exchange-traded funds. Gold mutual funds nevertheless likewise give financiers with a way to diversify their portfolios.

An additional popular kind of purchasing gold is gold mining supplies and also gold bars. Gold mining stocks are a fantastic method to invest in gold bullion, but only if you are familiar with exactly how to monitor the marketplace and also select high quality supplies. Gold mining supplies can be bought from firms like Gold Core, Gold Star, Gold Mass, Goldshield, Gold Sky, Goldmine, etc. Gold mining stocks are best bought according to the futures market or the spot market.

One of the least explored yet potentially lucrative techniques of direct investment in gold bullion as well as gold coins is straight acquiring gold coins from dealerships and collection agencies. Purchasing from a person is often high-risk because there is no guarantee that you will certainly get what you pay for, even if you are sure of the high quality of the coin. Nonetheless, there are a variety of websites that offer a service to contrast gold bullion, gold coins of different dimensions and weights from various suppliers, enabling you to make educated choices concerning what you want to get.

Direct investment in gold can additionally can be found in the form of exchange-traded funds (ETFs). ETFs are an example of an ETF that tracks the activity of the rate of gold over a time period. This allows financiers to have a less complicated time locating a financial investment option suited to their portfolio. If you get ETFs, you will certainly not require to rely on your stockbroker to advice you on which stocks or ETFs are right for your portfolio. For added safety, ETFs might additionally be acquired using a self-directed Individual Retirement Account.

If you intend to invest in physical gold bars as well as coins, you may be far better off starting with ETFs. ETFs will track the activities of the cost of gold, however they deal your gold as you accompany. This permits you to enter the function of a day-trader as opposed to depending on the spot market to make your decisions. When you start with ETFs, you might have accessibility to physical gold bars along with coins. Nevertheless, with an ETF, you will be restricted to just one sort of rare-earth element along with the ETF itself. It is necessary to recognize that an ETF won't give you with the liquidity of physical gold bars - for instance, if your stock declines, you will certainly still have funds in the ETF rather than waiting to see if the rates on the exchanges move in your support.

If you're looking to expand your profile and also raise the overall worth of your portfolio, consider getting ETFs. The tax benefits of gold coins are also appealing. Nevertheless, it is essential to recognize that these investments come at a cost. Before you determine to invest in gold coins or bars, make certain to recognize the prices of these types of financial investment possibilities to make sure that your financial investment has the ability to hold up against the volatility connected with these types of instruments.

|

|

Is Buying Gold A Financial Investment That's Right For You? |

Posted by-Baker Holman

Of all the rare-earth elements, gold has been the most prominent as a prominent financial investment. Capitalists normally acquire gold as part of expanding danger, especially through the employment of futures agreements and also derivatives, along with hedging techniques. Gold market is additionally susceptible to significant volatility as well as speculative conjecture as are other monetary markets. It is through gold financial investment decisions that the capitalist expands his danger profile. Achieving success in the gold market needs financiers to do a bit of homework before plunging into the market.

The majority of brand-new capitalists typically get their begin with the stock market, and consequently most amateur investors favor to start with the securities market initially. This provides a possibility to learn exactly how points function first. Nevertheless, for an investor curious about gold investing, opening up an account at a brokerage firm is usually the best place to begin. These companies not only use a number of trading platforms, yet additionally a wide variety of alternative for gold bullion and also various other types of gold investing.

The exchange-traded funds are a popular kind of buying gold bullion as well as other types of gold, as they permit the investor to invest making use of either cash money or securities (such as bonds) at a certain rate. Although exchange-traded funds have acquired substantial popularity over the last couple of years, mutual funds stay the even more recommended method to spend. Capitalists who intend to lessen their risk additionally favor mutual funds as they supply a reduced level of threat than the exchange-traded funds. Gold mutual funds nevertheless likewise supply investors with a means to diversify their portfolios.

One more preferred kind of investing in gold is gold mining supplies and also gold bars. Gold mining supplies are an excellent way to invest in gold bullion, however just if you recognize with just how to monitor the marketplace and also choose high quality supplies. Gold mining stocks can be bought from companies like Gold Core, Gold Star, Gold Mass, Goldshield, Gold Skies, Found diamond, and so on. Gold mining supplies are best bought according to the futures market or the spot market.