Just How To Pay For Home Improvements |

You can call your loan provider as well as demand that they terminate your PMI strategy as soon as you reach 20% equity in your house. Many people believe that if they want to get a standard financing, they need a 20% deposit. Relying on your lender, you can get a financing with as low as 3% down.

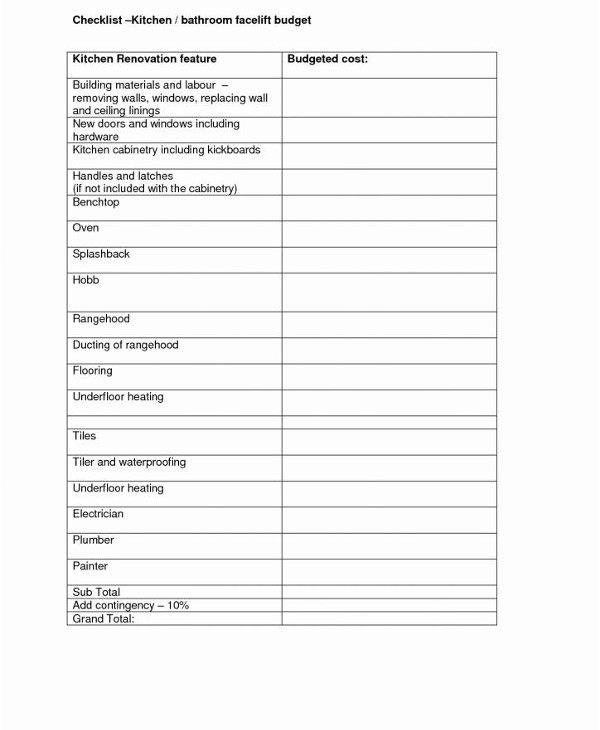

Consider your house remodelling plan as a company strategy or as your unique job you are starting from scratch. While adverse equity car loans are few and far between, the Federal Real estate Management insures co-called fixer-upper finances. You can utilize among the FHA's 203k financings to fund the kitchen remodel mount prospect purchase of a one- to four- device solitary family residence that needs repair services. The FHA defines required repair services as getting rid of ecological threats, paint, changing the roof covering, making energy efficient upgrades as well as similar actions. You can not qualify for an FHA 203k financing if you prepare to use it just to mount high-end upgrades such as a hot tub or granite cooking area counters.

How much does it cost to gut a 1200 sq ft house?

Whole House Renovation CostSquare FeetTypical RangeAverage Cost1,200$18,000 – $72,000$24,0001,500$20,000 – $85,000$30,0001,800$25,000 – $100,000$45,0002,000$28,000 – $115,000$50,0005 more rows

FHA-insured rehabilitation home mortgages covering any needed architectural repair work are available via numerous accepted loan providers, as well. There are unforeseen issues as well as prices that can leave you clambering if you're not prepared. Although you can't forecast the future, you can still take preventative measures so you are as prepared as possible if something fails, whether that be additional costs, time constraints, and so on

Consider yourdebt-to-income ratio when choosing if a fixer-upper residence will certainly make you house bad. Your DTI is all of your monthly debt payments divided by your gross month-to-month income. If you don't have the ability to do a big portion of the work on your own, think about staying away from a fixer-upper home. Working with a person to do a lot of the work for you will likely cost greater than the restorations deserve in worth. You will pay less in property taxes because they are calculated based upon your home's price.

Obtaining House Remodelling Estimates.

What credit score is needed for a home improvement loan?

The credit score needed for a home improvement loan depends on the loan type. With an FHA 203(k) rehab loan, you likely need a 620 credit score or higher. Cash-out refinancing typically requires at least 620. If you use a HELOC or home equity loan for home improvements, you'll need a FICO score of 660-700 or higher.

- Bear in mind that if you cancel the re-finance, you will certainly probably have to pay the appraisal fee.

- There are 2 various other methods for evaluators to value residential property-- the replacement expense and the earnings strategy.

- Bear in mind that home mortgage loan providers make use of the appraiser-determined value to input the "value" component of your home loan's loan-to-value calculation.

- This additionally applies if you utilize a 203 re-finance to add some home renovations when you re-finance your residential or commercial property.

- If the reduced assessment is the contractor's fault-- claim, the high quality of construction or products were not as https://www.scribd.com/document/477508297/247755Is-Your-Restoration-Actually-Worth-It described in the funding application papers, you might have the ability to sue your home builder.

Sweeten suits house restoration jobs with vetted general service providers, offering support as well as economic protection-- at no charge to the home owner. We educate our customers on cost, range and procedure-- and also introductions to customers are cost-free.

What is the easiest loan to get with bad credit?

Short-Term Personal Loans for Bad Credit with Easy ApprovalMoneyMutual. 4.8 /5.0 Stars. START NOW » Short-term loans up to $2,500. Online marketplace of lenders. Funds available in as few as 24 hours.

CashAdvance.com. 3.9 /5.0 Stars. START NOW » Short-term loan of $100 to $1,000. Bad credit is no problem.

The confusion originates from the exclusive mortgage insurance coverage requirement. Allow's have a look at just how you can obtain a USDA loan or a VA finance, both financings that permit you to acquire a house without a deposit. You might wish to get a government-backed FHA lending or a standard home mortgage if you figure out you don't meet the qualifications for a USDA funding or a VA car loan.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |