Photography Tax Deduction - Know Your Deduction Legal Rights |

Article created by-Dominguez Shaffer

As a self-employed professional photographer, the frightening reality is that you have actually an included tax liability due to the business expenses you have to incur in conducting your organization. Nonetheless, the fantastic news is that, you are additionally qualified to subtracting company photography expenses from your income tax return. As with pop over to this web-site that are incurred by a firm, you will need to pay some tax obligation on the reduction amount as well as this write-up is right here to aid you out.

For those of you who might be unfamiliar with the term, expenses are subtracted in order to reduce taxable income. The reduction may either be personal or service in nature. For https://photographytalk.tumblr.com/post/6272412708...e-photography-composition-tips , if you have taken pictures for your very own usage, you can deduct your costs. In addition, if you have actually taken these pictures as part of a project you might have the ability to declare a deduction on the expense of the images, along with for the equipment utilized.

Along with the tax obligation regulation mentioned above, there are likewise some additional reductions that are offered to you. If you get a new electronic camera or acquisition one that is more than 2 years old, you can subtract the expense of it from your income. You may additionally have the ability to assert a tax obligation credit rating on your invoices for purchases made in the past year if you do not declare your tax deductions for the year prior to.

When filing your tax returns, you have to make certain you recognize with every one of the tax regulations relevant in your state and also local area. These tax obligations, including government tax obligation, are usually greater than the routine revenue tax obligation that relates to your state.

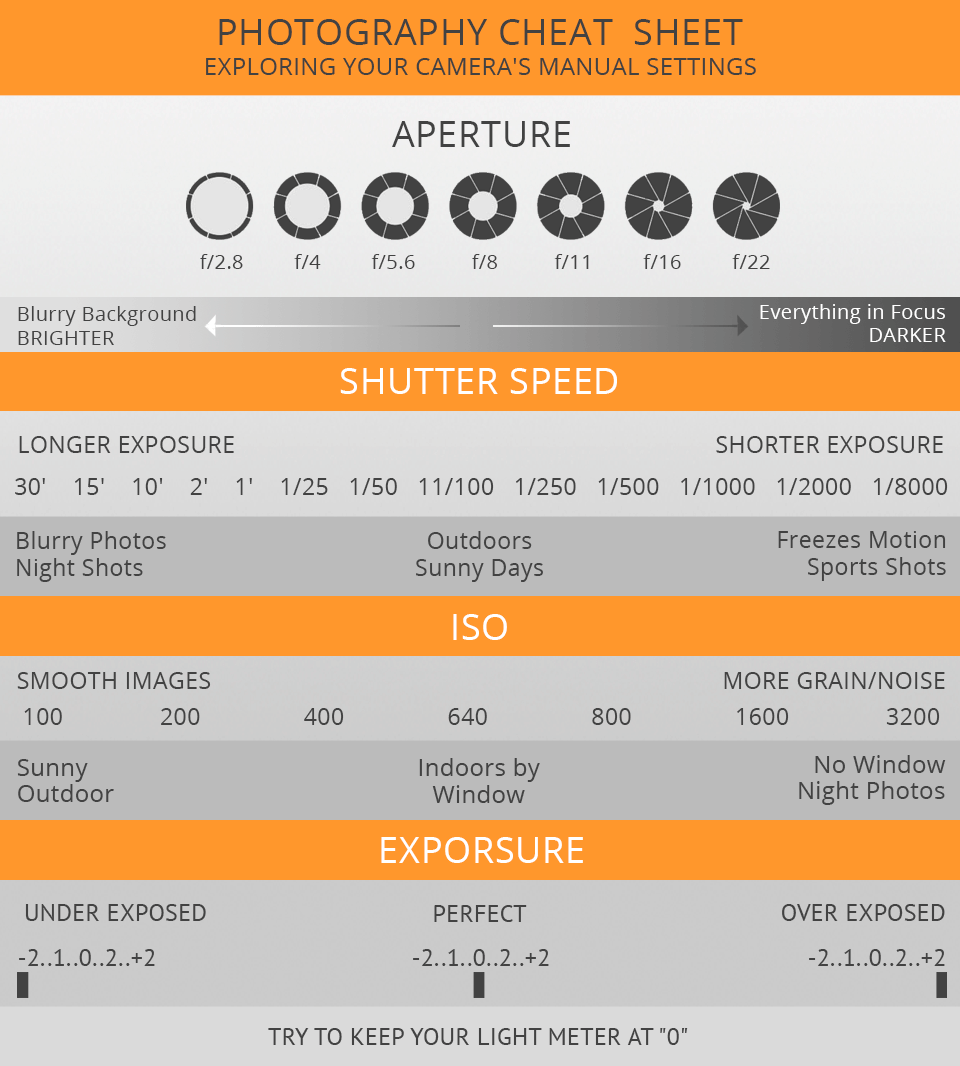

What Is Aperture In Photography

If you do not have any type of employees or service companions, then you might have the ability to case costs for the expense of materials as well as equipment as overhead. Nonetheless, you have to have these supplies and also equipment as part of your typical operations in order to be qualified to claim a cost reduction. If you do not have enough service assets to cover the cost of your materials as well as devices, you may be able to obtain a tax credit rating for that as well.

As a local business owner, you must always understand what deductions you are entitled to receive on your tax return. A competent accountant or tax expert can assist you effectively assess your earnings tax obligation situation. With the help of an accountant, you can establish if you qualify for any state or government tax obligation credit ratings and also various other reductions that might be offered to you. and also may be able to apply for deductions in your local area as well.

What Is Exposure Photography

While several professional photographers think that the only way they can conserve cash on their tax obligations is to be smart at tax obligation time, others recognize that there is a simple method to increase their deductions by being straightforward and prompt with their state as well as city governments. Being an entrepreneur, you have to keep in mind that each time you send an income tax return or pay your tax, you will need to pay tax obligations to the government.

Among the most effective means to save cash on expenses is to constantly be prepared and also accurate concerning all expenses associated with your organization. A qualified accounting professional will be able to make sure that your expenditures are properly estimated and also reported. In addition, they will help you with preparing your tax returns and also suggest reductions for your company that may be much more beneficial to you.

Which Lens Is Best For Night Sky Photography

It is very important to note that there are a number of types of reductions that can be asserted by you, consisting of education expenditures, business expenses such as the expense of digital photography devices, as well as depreciation on your photography tools. It is also feasible to claim some of these as an individual product, if you do not hold it as your major company.

If you choose that being a specialist photographer is your job, you might have the ability to case costs for employing an aide to aid with your income tax return or for paying for extra insurance coverage for your devices. The trick is to recognize what deductions and credit histories you can make the most of to help you with your taxes.

A good accounting professional or tax obligation professional in this company is an indispensable property when preparing your personal as well as organization tax return. You can use a tax expert to guide you with your declaring needs as well as suggest you on deductions you personal circumstance.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |