Understanding Personal Insurance: A Comprehensive Overview To Guarding Your Assets |

Uploaded By-Snedker Butt

Understanding individual insurance is critical for securing your monetary future. It's not practically having protection; it has to do with choosing the ideal policies that fit your specific requirements. Whether it's health and wellness, vehicle, or life insurance, each kind plays a distinct function in securing your possessions. But exactly how do you determine which insurance coverage is best for you? Let's explore the vital facets of personal insurance that can assist safeguard your wealth and comfort.

Kinds Of Personal Insurance Policy

When it involves shielding yourself and your properties, comprehending the various types of personal insurance is critical. You've obtained several choices, each developed to cover specific dangers.

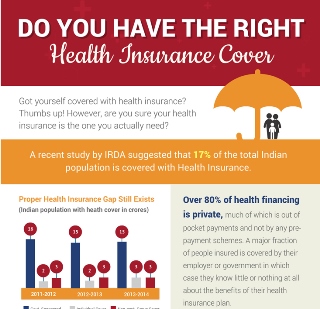

Health insurance protects against clinical expenses, guaranteeing you obtain the treatment you need without breaking the financial institution. Car insurance covers damages and obligations related to your lorry. Home owners or renters insurance coverage safeguards your building and items from burglary or damage.

mouse click the following internet site provides financial backing to your loved ones in case of your unforeseen death. Disability insurance provides revenue defense if you can not function because of disease or injury.

Benefits of Personal Insurance Policy

Comprehending the sorts of personal insurance coverage is simply the begin; the advantages they provide can considerably impact your life. With individual insurance, you gain satisfaction recognizing your assets are shielded against unforeseen occasions.

Whether it's home, vehicle, or health insurance, these policies supply monetary security and mitigate dangers. If an accident takes place, you will not face overwhelming expenditures alone; your coverage helps cover repair work, medical costs, or obligation claims.

Furthermore, personal insurance can enhance your creditworthiness, making it much easier to secure car loans or mortgages. Bear in mind, having the ideal coverage can secure your economic future, enabling you to focus on what absolutely matters without the consistent worry of potential losses.

Purchase your defense today!

Exactly how to Choose the Right Protection

Exactly how can you guarantee you choose the best protection for your needs? Begin by evaluating your possessions and responsibilities. Recognize what you need to protect-- your home, auto, or personal items.

Next, consider your way of life and any kind of potential dangers. For example, if you have a pet dog or host gatherings, you might desire liability protection.

Research different types of policies readily available and compare them. Look for visit the following website page , deductibles, and exclusions that might impact your security.

Don't be reluctant to ask concerns or inquire from insurance agents.

Lastly, evaluate your protection regularly, especially after significant life changes, to ensure it still fulfills your requirements. By taking these steps, you'll feel more certain in your insurance selections.

Conclusion

In conclusion, recognizing personal insurance coverage is essential to securing your assets and making sure financial protection. By checking out different kinds of insurance coverage and evaluating your special needs, you can make educated selections that protect your future. Routinely assessing your policies maintains them appropriate and effective. Don't wait on unexpected events to capture you off-guard-- organize your monetary wellness today, and concentrate on what truly matters in your life and career.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Exactly How To Boost Your Sales As An Insurance Policy Agent |

Write-Up By-Goode Bradshaw

As an insurance coverage agent, your success rests on developing strong partnerships with your clients. By proactively listening to their needs and tailoring your solutions, you can foster count on and contentment. Additionally, leveraging technology can simplify your processes and boost your outreach. Yet there's even more to it than simply these fundamentals. What other techniques can raise your sales and set you apart in a competitive market?

Build Solid Relationships With Clients

Building solid connections with clients is essential for long-term success in the insurance coverage industry. When you put in the time to recognize your clients' requirements and problems, you show them that you truly care.

Listen proactively during discussions, and ask inquiries that expose their goals. This aids you tailor your services to fulfill their particular requirements.

Follow up on a regular basis, whether with a fast telephone call or individualized email. These tiny motions make a huge distinction in building count on and loyalty.

Bear in mind to be transparent about policies, premiums, and insurance coverages. This sincerity promotes a sense of security.

Utilize Innovation and Social Network

To properly enhance your sales as an insurance representative, leveraging technology and social media can be a game changer.

Begin by developing a solid on-line existence with a specialist site and energetic social media profiles. Use systems like Facebook, LinkedIn, and Instagram to display client reviews and share important material concerning insurance coverage topics.

Engage with your target market by replying to remarks and messages without delay. Think about utilizing email advertising to keep customers educated concerning new services and products.

Devices like CRM software can assist you manage leads and track communications efficiently.

Continuously Improve Your Skills and Knowledge

Buy your expert development to remain ahead in the competitive insurance coverage market. Constantly enhancing your abilities and knowledge keeps you pertinent and efficient.

Go to workshops, webinars, and conferences to learn more about market trends and ideal techniques. Consider acquiring added accreditations to display your know-how.

Reading publications and posts for sale techniques and customer support can likewise improve your approach. Connecting with various other specialists can give fresh insights and techniques.

Don't forget to look for feedback from clients and peers to recognize locations for growth. Establish individual learning goals to remain motivated and track your progression.

Final thought

In conclusion, improving your sales as an insurance policy agent depends upon developing strong client relationships, embracing technology, and continuously improving your abilities. By actively listening to Flood Zone Insurance , using CRM devices, and remaining updated via workshops, you'll produce a solid foundation for success. just click the up coming website neglect the importance of openness and supplying important web content to involve your audience. With these methods, you'll not just increase your sales but additionally foster depend on and satisfaction amongst your customers.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Browsing Personal Insurance: Key Aspects To Take Into Consideration For Optimum Protection |

Post Created By-Breen Doyle

When it comes to individual insurance policy, browsing the alternatives can feel frustrating. You require to assess your monetary circumstance, recognize the types of coverage offered, and consider your future demands. have a peek at this website 's a mindful harmonizing act that calls for continuous focus to guarantee you're properly safeguarded. As life situations shift, your insurance coverage strategy need to evolve too. So, what aspects should you focus on to achieve optimal defense?

Assessing Your Current Financial Circumstance

Just how well do you really understand your monetary landscape? Taking a close take a look at your current monetary scenario is essential for efficient insurance planning.

Begin by tracking your income, expenditures, and financial savings. You need to know where your cash goes each month.

Next, examine your debts-- credit cards, car loans, and home loans can weigh heavily on your monetary health. Compute your net worth by subtracting responsibilities from assets; this provides you a clearer photo of your financial standing.

Do not forget to factor in your reserve, which can give a safeguard during unanticipated events.

Understanding Various Types of Personal Insurance Coverage

With a clear understanding of your economic circumstance, you can now discover the numerous kinds of individual insurance coverage available to secure your properties and well-being.

Begin with health insurance, which covers medical expenses and guarantees you obtain needed care.

Next off, think about car insurance policy, required in most areas, shielding you versus liabilities from vehicle-related events.

Home owners or occupants insurance policy is vital for safeguarding your building and items from theft or damages.

Don't ignore life insurance, which offers financial backing to your beneficiaries in case of your unfortunate death.

Lastly, think about disability insurance, offering earnings substitute if you can not function due to disease or injury.

Each type offers a special function, helping you accomplish assurance and security.

Evaluating Your Future Requirements and Goals

What do you imagine for your future? As you consider your personal and monetary goals, take into consideration how they'll affect your insurance coverage requires.

Are you planning to acquire a home, start a household, or seek a new job? Each of these milestones can change your insurance policy needs.

Examine your current policies and figure out if they line up with your aspirations. For instance, if you're broadening your family members, you may require more life insurance to secure their future.

Furthermore, think of potential dangers-- will your way of living changes cause enhanced responsibilities?

Frequently revisiting your objectives guarantees your coverage develops with you. By examining your future needs, you're not just securing yourself today; you're likewise planning for a protected tomorrow.

Final thought

In conclusion, navigating personal insurance is essential for protecting your economic future. By on a regular basis evaluating your monetary circumstance, understanding the various sorts of insurance coverage offered, and examining your evolving needs and objectives, you can make sure that your insurance policy aligns with your life's aspirations. Do not wait on unanticipated https://www.nytimes.com/2025/05/15/climate/climate-change-home-insurance-costs.html to capture you unsuspecting; take positive steps currently to achieve comprehensive defense and enjoy the comfort that includes it.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

At What Point Should You Connect To An Insurance Policy Agent For Recommendations? |

Article Produced By-Taylor Eriksen

When it involves securing your properties, knowing when to get in touch with an insurance agent is crucial. Whether you're purchasing a new building, beginning or expanding a company, or merely upgrading your existing insurance coverage, an agent can pinpoint the risks specific to your circumstance. But just how do you understand if your current plans are still ample? Recognizing the indicators can make all the distinction in protecting what matters most to you.

Getting a New Property

When you're buying a new home, just how do you ensure you're making the appropriate selections? Beginning by researching the location thoroughly. Explore neighborhood patterns, institutions, and amenities that matter to you.

Next, review the building itself; check its condition, format, and possibility for recognition. Don't avoid a specialist evaluation-- this can conserve you from pricey shocks later on.

Consider your budget, consisting of not just the purchase price yet ongoing costs like tax obligations and maintenance.

Lastly, seek advice from an insurance policy representative to recognize coverage options. https://www.cnbc.com/select/best-home-auto-insurance-bundles/ 'll help you recognize threats specific to the home and guide you on sufficient protection.

Making informed choices at every action will lead you to a purchase that feels right for you.

Starting or Broadening an Organization

Starting or expanding an organization can be both interesting and complicated, especially when you're browsing the complexities of the market. One important facet you can not overlook is insurance.

Bear in mind, your service deals with numerous threats-- home damage, obligation claims, and employee injuries, to name a few. Consulting an insurance coverage agent can help you determine prospective protection spaces and guarantee you're shielded from unforeseen events.

An agent can customize a policy that fits your business demands, whether it's basic responsibility, home protection, or specialized insurance. see page 'll also maintain you notified concerning legal demands and industry standards.

Upgrading Your Existing Coverage

As your service evolves, it's important to upgrade your existing coverage to reflect new dangers and changes in operations.

Whether you're launching a brand-new item, broadening your team, or moving to a larger area, these changes can impact your insurance needs. You might need greater responsibility limits or added coverage kinds to safeguard versus emerging dangers.

Do not forget adjustments in your market or regulations that can impact your policies. Consistently evaluating your insurance coverage with an insurance representative ensures you're adequately safeguarded and compliant.

Schedule annual check-ins to discuss your organization's development and any type of new obstacles you face. By staying aggressive, you can avoid gaps in insurance coverage that might cause significant monetary problems down the line.

Verdict

In conclusion, consulting an insurance policy agent is important whenever you face considerable modifications, like buying a new building, starting or expanding your company, or updating your existing insurance coverage. They assist identify threats and guarantee your insurance policy satisfies your certain requirements. Normal check-ins, particularly during significant life events or shifts in laws, can shield your investments and supply satisfaction. Don't wait-- connect to a representative today to protect your future.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

When It Comes To Personal Insurance Coverage, Figure Out Just How The Right Policies Can Secure Your Wealth, Yet Are You Completely Familiar With Your Needs? |

Created By-Rask Dueholm

Recognizing personal insurance policy is important for safeguarding your financial future. It's not almost having protection; it has to do with picking the appropriate policies that fit your particular demands. Whether it's health, automobile, or life insurance, each type plays a distinct function in safeguarding your properties. But just how do you identify which insurance coverage is best for you? Allow's explore the vital aspects of personal insurance coverage that can help guard your riches and assurance.

Kinds Of Personal Insurance

When it comes to shielding on your own and your properties, recognizing the different sorts of individual insurance policy is essential. web page got numerous options, each designed to cover specific dangers.

Health insurance safeguards versus clinical expenses, guaranteeing you get the care you need without breaking the financial institution. Auto insurance policy covers problems and responsibilities related to your vehicle. Home owners or tenants insurance coverage safeguards your residential property and belongings from burglary or damages.

Life insurance policy provides financial support to your liked ones in case of your unexpected death. Disability insurance provides income security if you can not function because of disease or injury.

Conveniences of Personal Insurance Coverage

Comprehending the kinds of individual insurance coverage is simply the beginning; the advantages they provide can substantially affect your life. With individual insurance coverage, you obtain peace of mind understanding your assets are safeguarded against unexpected events.

Whether it's home, auto, or health insurance, these plans give monetary safety and security and mitigate dangers. If a mishap occurs, you will not encounter frustrating costs alone; your insurance coverage assists cover fixings, clinical expenses, or obligation cases.

Additionally, personal insurance policy can boost your creditworthiness, making it easier to secure financings or mortgages. Bear in mind, having the best coverage can guard your monetary future, allowing you to concentrate on what really matters without the constant worry of potential losses.

Invest in your protection today!

Exactly how to Pick the Right Coverage

Just how can you guarantee you choose the right coverage for your requirements? Start by examining your assets and responsibilities. Identify what you require to safeguard-- your home, automobile, or individual items.

Next off, consider your way of life and any kind of prospective threats. For example, if you have a family pet or host events, you may desire obligation coverage.

Research study various sorts of policies offered and compare them. Seek insurance coverage limits, deductibles, and exclusions that may affect your security.

Do not wait to ask inquiries or inquire from insurance policy agents.

Finally, examine your protection regularly, particularly after major life adjustments, to ensure it still fulfills your requirements. By taking these actions, you'll feel much more certain in your insurance policy selections.

Final thought

To conclude, comprehending personal insurance is crucial to safeguarding your assets and making sure financial security. By exploring different sorts of protection and assessing your distinct demands, you can make educated choices that protect your future. What Does Flood Insurance Cover evaluating your policies keeps them pertinent and reliable. Do not wait for unforeseen occasions to catch you off-guard-- organize your financial well-being today, and concentrate on what absolutely matters in your life and profession.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Going Across The Challenges Of Insurance Policy Brokers Is Essential; Discover The Essential Facets That Guarantee Ideal Insurance Coverage Made For Your Needs |

Created By-Mcpherson Hvid

When it pertains to securing the right insurance protection, selecting the best broker is vital. You need someone who recognizes your distinct needs and can browse the complexities of numerous policies. By concentrating on essential elements like qualifications, market experience, and interaction style, you can make an extra educated option. However exactly how do you make certain that your broker will adjust to your changing requirements over time? Let's explore what to try to find in a broker.

Understanding Your Insurance Coverage Requirements

Just how well do you comprehend your insurance coverage requires? Before choosing an insurance policy broker, it's crucial to identify what protection you require.

Start by analyzing your possessions, way of living, and potential dangers. Consider whether you need property owners, car, or health insurance, and think about the specific insurance coverage restrictions that match your situation.

It's also smart to reflect on your monetary goals and any type of existing policies you may have. Comprehending your demands assists in interacting properly with your broker, guaranteeing they tailor their referrals to your certain conditions.

Do not hesitate to ask inquiries or look for information on plan information. By comprehending your insurance coverage needs, you'll equip yourself to make informed choices and find the very best broker to support you.

Reviewing Broker Credentials and Experience

When you have actually pinpointed your insurance coverage requires, the next step is evaluating possible brokers to ensure they've the ideal qualifications and experience.

Begin by examining their qualifications, such as licenses and certifications, which suggest their experience in the field. Try to find brokers with a solid record in your particular market or kind of insurance coverage; this experience can make a substantial difference in comprehending your special threats.

Don't wait to inquire about their years in the business and the variety of customers they've offered. Furthermore, consider their specialist affiliations, which can show commitment to recurring education and learning and market criteria.

Examining these aspects will certainly aid you find a broker who's well-appointed to satisfy your insurance coverage requires efficiently.

Assessing Interaction and Assistance Solutions

When reviewing an insurance broker, have you considered just how well they connect with you? Reliable communication is essential for an effective partnership. https://ruben-barbara.blogbright.net/the-clear-cut...ure-insurance-coverage-brokers ought to really feel comfortable asking concerns and anticipate prompt, clear reactions.

Take note of their availability-- do they provide support during company hours, or are they obtainable after hours?

Furthermore, assess their willingness to explain policy details in a way you can easily comprehend. A broker who prioritizes your demands will supply recurring assistance, not just during the first sale.

Try to find reviews or testimonials that highlight their responsiveness and customer service. By selecting Cheap Auto Insurance Near Me who values communication, you'll feel more certain in your insurance coverage choices and overall insurance policy experience.

Final thought

Finally, choosing the right insurance broker is important for securing the coverage you need. By recognizing your very own insurance coverage needs and reviewing a broker's qualifications, experience, and interaction skills, you can make an educated decision. Do not ignore the relevance of constructing a solid relationship with your broker, as it can cause ongoing assistance and customized services. Inevitably, this partnership will assist secure your properties and adapt to your transforming needs with time.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Approaches For Insurance Coverage Representatives To Strengthen Client Relationships |

Short Article By-Gravesen Beatty

As an insurance policy agent, you know that developing solid client partnerships is critical for success. It starts with understanding your customers' distinct requirements and preferences. By fostering open interaction, you can create an environment where customers feel valued and recognized. Yet exactly how do https://www.investopedia.com/how-other-natural-dis...al-with-home-insurance-8780085 ensure your service not only satisfies their assumptions yet additionally adapts to their evolving requirements? Let's explore some efficient techniques that can enhance those vital connections.

Understanding Customer Needs and Preferences

To construct a strong client relationship, you need to comprehend their special needs and choices. Beginning by asking flexible questions during your first conferences. This technique helps expose what matters most to them-- be it budget plan restraints, certain coverage kinds, or long-lasting goals.

Pay close attention to their reactions; it's important to listen actively. Make note to remember key information that could affect your referrals later. Do not be reluctant to follow up with clarifying inquiries if you're unclear concerning something. By showing real interest in their situations, you'll promote depend on and connection.

Regularly review these needs as situations transform, guaranteeing you adapt your services accordingly. This continuous understanding is important to maintaining a strong, enduring customer connection.

Reliable Communication Techniques

Understanding your customers' needs develops the foundation, but effective interaction takes that relationship further. To connect with clients, pay attention actively and show genuine rate of interest in their issues.

Usage clear, simple language; stay clear of lingo that might perplex them. Regularly check in through phone calls or emails, ensuring they really feel valued and notified. Dressmaker your interaction design to match their preferences-- some could favor comprehensive descriptions, while others value brevity.

Do not underestimate the power of non-verbal cues; keep eye contact and make use of open body language during in person meetings. Last but not least, be transparent concerning plans and treatments.

Structure Count On Through Exceptional Service

While delivering exceptional service might feel like a standard expectation, it's the vital to building depend on with your clients. When you go above and beyond, you reveal that you truly care about their needs. Reacting promptly to inquiries and giving clear, precise details assists clients really feel valued and comprehended.

In Cheapest Renter's Insurance , customize your solution by bearing in mind crucial information about their lives and choices. This shows that you see them as more than just an insurance holder.

Constantly follow up after an insurance claim or an assessment to guarantee their contentment. relevant internet page enhances trust fund however additionally maintains the lines of communication open.

Conclusion

In conclusion, constructing strong customer relationships as an insurance representative depends upon understanding their demands and choices. By connecting properly and offering extraordinary solution, you promote trust and commitment. Keep in mind to maintain your language clear and avoid lingo to make sure customers really feel educated and valued. Normal check-ins and tailored communications show that you really respect their objectives. By adjusting your services and motivating responses, you'll create long-term links that profit both you and your clients.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Open The Secrets To Streamlining Your Insurance Policy Trip-- Uncover Exactly How Partnering With An Agency Can Redefine Your Experience And Guide Your Options |

Full Coverage Motorcycle Insurance By-Purcell Dempsey

Browsing insurance coverage choices can feel challenging, but it doesn't have to be. When you partner with a firm, you access to professional assistance tailored to your certain demands. Instead of learning https://www.realtor.com/news/trends/texas-home-insurance-crisis/ , you'll obtain customized support that helps clarify your options. However what exactly can an agency provide for you? Let's check out just how this collaboration can change your insurance coverage experience.

The Proficiency of Insurance Policy Experts

When it pertains to selecting the appropriate insurance coverage, tapping into the proficiency of insurance coverage specialists can make all the distinction.

These experts comprehend the complexities of different plans and can help you navigate the frequently complex landscape of insurance options. They'll examine your distinct situation, recognizing your particular requirements and threats.

With their knowledge of the market, they can advise appropriate protection that you mightn't also understand exists. Plus, they remain upgraded on industry trends and adjustments, guaranteeing you're constantly notified.

Custom-made Solutions for Your Demands

How can you ensure your insurance coverage absolutely fits your distinct situation? By partnering with a company, you get to personalized solutions customized to your certain needs.

Insurance policy isn't one-size-fits-all; your way of living, possessions, and also future objectives play a critical role in figuring out the appropriate coverage for you. A knowledgeable agent will certainly put in the time to recognize your specific scenarios, allowing them to advise plans that use the best protection.

They can likewise assist determine gaps in your coverage that you may forget. With their competence, you can feel great that your insurance straightens with your individual and financial objectives, providing you peace of mind.

Custom-made options mean you're not simply one more policyholder-- you're a valued customer with unique demands.

Simplifying the Claims Process

Navigating the complexities of insurance policy does not quit at picking the ideal insurance coverage; it encompasses making the cases process as straightforward as feasible. When you partner with an agency, you get to expert advice throughout this usually overwhelming procedure.

Your agent can assist you understand the essential actions and documentation needed, ensuring you don't miss anything vital. They'll help you in submitting your case, addressing your inquiries, and supporting in your place to expedite resolution.

This support can considerably reduce stress and confusion, allowing you to concentrate on what issues most-- getting back on the right track. Ultimately, having an agency by your side simplifies the insurance claims procedure, boosting your total insurance experience.

Conclusion

Partnering with an insurance firm not just simplifies your options but likewise guarantees you get the insurance coverage that fits your special demands. With professionals guiding you via the intricacies, you can feel great in your choices. Best RV Insurance Reviews 'll help you browse insurance claims and remain updated on fads, providing you satisfaction. By working together, you're not just protecting insurance policy; you're protecting your future and straightening your insurance coverage with your financial objectives.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

The Value Of Engaging With Insurance Brokers: Educated Insights For Consumers |

Material Author-Timmermann Bengtsen

When navigating the insurance coverage landscape, you may find it frustrating to look through numerous policies and providers. Collaborating with an insurance broker can streamline this process significantly. Brokers use expert insights tailored to your certain requirements, helping you prevent usual mistakes. Yet exactly how do you pick the ideal broker for your distinct scenario? Understanding their function and advantages can make all the distinction in securing the best protection for you.

Understanding the Role of Insurance Coverage Brokers

Insurance coverage brokers play an important function in the insurance policy industry, serving as middlemans between you and insurer. They help you browse the intricate world of insurance by examining your needs and discovering policies that fit those demands.

With their knowledge, brokers can describe various insurance coverage choices and terms, ensuring you comprehend what you're acquiring. They likewise collect quotes from multiple insurance companies, offering you a range of selections to take into consideration.

Instead of investing hours looking into on your own, you can rely upon brokers to offer customized suggestions and beneficial insights. And also, their expertise of the industry permits them to recognize possible challenges, assisting you stay clear of costly mistakes.

Eventually, https://www.cnbc.com/2022/02/22/picking-best-health-insurance-plan.html to simplify the insurance coverage process for you.

Secret Benefits of Using an Insurance Broker

When you select to collaborate with an insurance policy broker, you gain access to a wealth of competence and individualized solution that can considerably improve your insurance experience.

Brokers are proficient at browsing the complicated insurance market, assisting you discover policies that fit your certain requirements. They save you time by contrasting options from multiple insurance firms, ensuring you get the most effective coverage at affordable prices.

Furthermore, When Is Flood Insurance Required use important advice and understandings, aiding you understand plan nuances and insurance coverage details that may or else go undetected. With their assistance, you can make educated decisions and feel confident in your choices.

Eventually, partnering with a broker enhances the insurance policy procedure, enabling you to concentrate on what absolutely matters in your life.

Just how to Select the Right Insurance Policy Broker for Your Needs

Just how do you find the appropriate insurance broker tailored to your details needs? Beginning by analyzing your needs. Are you seeking individual, business, or specialized insurance coverage?

After that, look for brokers with knowledge in that area. Seek suggestions from buddies or online testimonials to assess their credibility.

Next, check their qualifications. An accredited broker with market experience and accreditations can give satisfaction.

Schedule consultations to review your requirements and examine their interaction design. You want a person who pays attention and comprehends your issues.

Ultimately, consider their compensation framework. Openness is crucial; guarantee you understand how they're compensated.

Conclusion

To conclude, dealing with an insurance coverage broker can genuinely boost your insurance experience. They provide professional insights, customized recommendations, and a streamlined procedure that conserves you time and assists you make educated choices. By understanding Excess Liability Insurance Cost and comparing alternatives, brokers equip you to stay clear of costly errors. So, if you wish to browse the insurance policy market with self-confidence, partnering with an insurance coverage broker is a clever option that can result in much better coverage and peace of mind.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Choosing The Appropriate Insurance Coverage Broker: Essential Elements To Review For Optimum Insurance Coverage |

Created By- https://squareblogs.net/pablo79gladys/exactly-how-...d-in-saving-you-time-and-money

When it involves securing the right insurance policy protection, picking the ideal broker is important. https://www.expatica.com/nl/healthcare/healthcare-...nce-in-the-netherlands-109293/ need someone who understands your one-of-a-kind requirements and can browse the intricacies of numerous plans. By focusing on essential aspects like qualifications, sector experience, and interaction design, you can make an extra educated option. Yet just how do Condo Insurance Requirements For Mortgage ensure that your broker will adjust to your transforming requirements in time? Allow's discover what to try to find in a broker.

Comprehending Your Insurance Coverage Needs

Just how well do you recognize your insurance needs? Prior to choosing an insurance coverage broker, it's crucial to determine what coverage you call for.

Start by evaluating your properties, lifestyle, and potential risks. Take into consideration whether you need home owners, car, or medical insurance, and think of the details protection limitations that suit your scenario.

It's additionally smart to review your economic objectives and any kind of existing policies you could have. Understanding your demands helps in interacting effectively with your broker, guaranteeing they customize their recommendations to your particular scenarios.

Do not wait to ask inquiries or seek clarification on plan details. By grasping your insurance coverage needs, you'll encourage on your own to make educated choices and find the best broker to support you.

Examining Broker Accreditations and Experience

When you have actually determined your insurance coverage requires, the following step is examining prospective brokers to guarantee they've the appropriate qualifications and experience.

Beginning by examining their qualifications, such as licenses and accreditations, which suggest their know-how in the field. Look for brokers with a strong track record in your specific market or type of coverage; this experience can make a significant distinction in comprehending your one-of-a-kind dangers.

Do not wait to inquire about their years in business and the range of customers they've offered. Furthermore, consider their professional affiliations, which can reflect dedication to recurring education and industry criteria.

Analyzing these variables will help you discover a broker that's well-equipped to meet your insurance policy needs successfully.

Assessing Interaction and Assistance Providers

When examining an insurance coverage broker, have you thought about just how well they interact with you? Effective interaction is essential for a successful partnership. You ought to feel comfortable asking inquiries and expect timely, clear feedbacks.

Pay attention to their accessibility-- do they use support during company hours, or are they accessible after hours?

Furthermore, analyze their willingness to clarify plan information in a way you can quickly comprehend. A broker who prioritizes your demands will supply recurring support, not simply during the preliminary sale.

Seek evaluations or testimonies that highlight their responsiveness and customer care. By choosing a broker that values communication, you'll really feel extra positive in your coverage decisions and overall insurance experience.

Conclusion

Finally, selecting the appropriate insurance coverage broker is essential for securing the protection you require. By recognizing your own insurance requirements and examining a broker's certifications, experience, and communication abilities, you can make an informed decision. Do not ignore the significance of constructing a strong connection with your broker, as it can cause recurring support and tailored remedies. Inevitably, this partnership will certainly assist secure your assets and adjust to your transforming needs gradually.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Navigating The Intricacies Of Insurance Policy Brokers Is Crucial; Uncover The Key Aspects That Ensure Ideal Protection Customized To Your Requirements |

Authored By-Watkins Hvid

When it pertains to securing the ideal insurance policy protection, choosing the ideal broker is important. You require a person that recognizes your one-of-a-kind needs and can navigate the complexities of numerous plans. By concentrating on essential variables like qualifications, industry experience, and communication style, you can make a much more enlightened option. But exactly how do you make sure that your broker will adjust to your altering requirements over time? Allow's discover what to look for in a broker.

Recognizing Your Insurance Policy Requirements

How well do you recognize your insurance coverage needs? Before picking an insurance coverage broker, it's critical to recognize what protection you need.

Start by assessing visit our website , way of life, and potential threats. Think about whether How Much Is Motorcycle Insurance For A 18 Year Old need home owners, auto, or health insurance, and think about the details protection restrictions that suit your circumstance.

It's likewise smart to assess your financial objectives and any kind of existing plans you may have. Recognizing your demands assists in connecting effectively with your broker, ensuring they customize their referrals to your particular conditions.

Don't hesitate to ask questions or seek clarification on plan information. By grasping your insurance requirements, you'll encourage yourself to make educated choices and find the very best broker to support you.

Assessing Broker Certifications and Experience

When you have actually identified your insurance policy needs, the following step is reviewing possible brokers to guarantee they've the ideal credentials and experience.

Begin by checking their credentials, such as licenses and accreditations, which suggest their know-how in the field. Try to find brokers with a solid performance history in your details sector or type of coverage; this experience can make a considerable difference in recognizing your special threats.

Don't think twice to inquire about their years in business and the range of customers they've offered. In addition, consider their expert affiliations, which can reflect dedication to recurring education and sector standards.

Analyzing these aspects will assist you discover a broker that's well-appointed to meet your insurance requires effectively.

Assessing Communication and Support Services

When reviewing an insurance coverage broker, have you considered just how well they connect with you? Reliable interaction is crucial for a successful partnership. You need to really feel comfy asking questions and expect timely, clear reactions.

Focus on their accessibility-- do they offer support during company hours, or are they obtainable after hours?

Additionally, examine their readiness to describe plan details in such a way you can quickly recognize. A broker who prioritizes your requirements will provide continuous support, not simply during the first sale.

Try to find testimonials or endorsements that highlight their responsiveness and customer service. By choosing a broker that values interaction, you'll really feel a lot more confident in your insurance coverage choices and overall insurance coverage experience.

Verdict

Finally, picking the right insurance broker is crucial for protecting the coverage you require. By recognizing your own insurance coverage demands and evaluating a broker's credentials, experience, and interaction abilities, you can make an educated choice. Do not take https://www.insurancebusinessmag.com/us/news/risk-...ing-the-environment-48440.aspx of building a solid relationship with your broker, as it can cause ongoing assistance and tailored solutions. Ultimately, this collaboration will certainly help protect your assets and adapt to your transforming requirements with time.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |

Checking Out Insurance Policy Options: The Reasons To Work Together With A Company |

Short Article Written By-Hampton Dempsey

Browsing insurance coverage choices can really feel daunting, however it doesn't need to be. When you companion with a company, you access to specialist support customized to your particular demands. Rather than learning complex plans alone, you'll obtain customized assistance that aids clarify your selections. Yet what exactly can a firm do for you? Allow's explore exactly how this collaboration can transform your insurance policy experience.

The Experience of Insurance Policy Professionals

When it comes to selecting the appropriate insurance policy coverage, tapping into the expertise of insurance professionals can make all the difference.

These experts comprehend the intricacies of various policies and can help you navigate the frequently complex landscape of insurance alternatives. They'll examine your one-of-a-kind circumstance, recognizing your specific requirements and risks.

With their expertise of the marketplace, they can suggest suitable protection that you mightn't even recognize exists. And also, they stay upgraded on market trends and modifications, ensuring you're constantly educated.

Personalized Solutions for Your Requirements

How can you guarantee your insurance policy protection really fits your distinct circumstance? By partnering with a company, you access to personalized services tailored to your particular needs.

Insurance coverage isn't one-size-fits-all; your way of life, properties, and even future goals play a critical function in determining the right protection for you. An experienced representative will certainly make the effort to comprehend your specific situations, permitting them to advise policies that use the best security.

They can also help determine spaces in your protection that you could overlook. With their experience, you can feel great that your insurance policy lines up with your personal and financial goals, providing you peace of mind.

Personalized solutions imply you're not simply an additional insurance holder-- you're a valued client with one-of-a-kind requirements.

Streamlining the Claims Process

Browsing the complexities of insurance coverage does not quit at selecting the right protection; it includes making the claims procedure as straightforward as feasible. When you companion with an agency, you gain access to specialist assistance throughout this typically overwhelming process.

Your agent can help you recognize the essential steps and paperwork called for, ensuring you don't miss out on anything vital. They'll help you in filing your case, addressing your concerns, and advocating in your place to accelerate resolution.

This support can significantly minimize tension and confusion, enabling you to concentrate on what matters most-- coming back on course. Eventually, having an agency on your side simplifies the cases procedure, boosting your overall insurance coverage experience.

Conclusion

Partnering with an insurance company not only simplifies your choices yet likewise ensures you obtain the insurance coverage that fits your one-of-a-kind demands. With Flood Zone Insurance Cost guiding you with the intricacies, you can feel great in your decisions. They'll assist you navigate claims and stay upgraded on trends, giving you comfort. By Excess Liability Car Insurance , you're not simply securing insurance policy; you're protecting your future and straightening your coverage with your economic objectives.

|

Метки: Insurance Agent Insurance Agency Insurance Brokers Home Insurance Auto Insurance Personal Insurance Business Insurance |