The Way To Grow And Run An Excellent Bookkeeping Provider Organisation Entity |

Article writer-Sumner Mclean

Wise bookkeeping consulting company owner are constantly planned for the worst as the economic climate could be unstable in some cases. The most effective in business are those that are passionate regarding being the very best at doing what they like. Take a look at this publication if you want to create a reliable strategy to your service model.

You can guarantee your bookkeeping speaking with service is not hurt by lawful issues by submitting all government types and also having a basic understanding of company legislation before opening your doors to the public. Unless you're experienced concerning business regulation, you may intend to speak with a legal representative that specializes in it. You would certainly succeed to remember that a variety of effective firms were torn down to the ground thanks to an expensive lawsuit. It's a wise suggestion to develop a connection with a popular service lawyer you might get in touch with when required.

It's smart to make it feasible for consumers to post responses and also item evaluations on your website. Considering that you desire customers to really feel great regarding what you do, offering them a possibility to comment will aid develop you a positive credibility in your on-line community. Services that ask their consumers for their viewpoint excite them and are most likely to respond. Using unique promotions readily available just to those that leave comments on your site is a tried and tested means to motivate clients to take part.

A huge part of an effective strategy of accounting consulting business operation is objectives. Your bookkeeping workplace will become more rewarding if you produce a collection of details objectives intended towards accomplishing development. The function of having details, measurable goals is to be able to see just how much your company has come and also maintain it on track to where you want it to go. It is essential to have a collection of objectives that are reasonable and obtainable as opposed to one overarching goal that can appear so hard to achieve that people get disappointed as well as inhibited.

Sharing suggestions with your employees can be an excellent way to place a finger on what bookkeeping consulting company choices should be made. If http://www.wrcbtv.com/Global/story.asp?S=41198748 prefer to approach the choice by yourself, try the proven technique of writing out a list of the benefits and drawbacks of each possible option. related internet page that making a list such as this will certainly make identifying the best options for your company a lot easier. It may aid to speak to professionals on progressing organisations whenever you find yourself perplexed over what the next move for your organisation ought to be.

Clients will return to business where they obtain outstanding solution. Customers will not remain around if they are not seeing solution that is continuously sufficient. When you set and stay with high standards, your consumers will certainly stick to you when you introduce new services. The companies that are probably bring you problem are those that have quality product or services.

|

Метки: Small Business Accountant Small Business Bookkeeping Finance Services Tax Preparation CPA Services Accountant Bookkeeping Investigative Accounting |

Necessary Principles For Effective Financing Business Marketing |

Content written by-Lee Udsen

There's a great deal of cash to be made by business owners, yet they've to understand when and just how to take mindful threats. It's a need to that you implement as much research as you can in the past your financing services business is formally begun. You require to understand what needs one of the most concentrate as well as just how to plan these things out with care if you're mosting likely to operate a rewarding organisation. You need to truly think about the info that we have actually assembled below regarding how you can help your company expand.

Consumers always make added purchases at companies where they received exceptional solution. However, if your client service is uneven and also occasionally shoddy, customers will most likely be reluctant to shop with you once more. When introducing brand-new services, set and abide by high standards customer care as well as your consumers will stay. The only firms that could create an issue are the ones that have quality solution and top quality items.

The time it will take to expand a financing services service must never ever be ignored. If you are to turn your organisation right into a profitable one, it'll use up a good amount of your personal time. Do not expect to be https://zenwriting.net/lucretia84antonia/just-how-...ve-funding-company-advertising to multitask initially. Smart business owners recognize when they are really feeling overwhelmed, and will turn some responsibilities on to others.

The greatest means to get brand-new abilities in the financing solutions company globe is by discovering on duty. best designations wealth management suggest getting as much hands-on experience about your desired market as possible. If you require to run your very own business, you need to experience things yourself. Funding company publications may consist of much wisdom, however nothing like the abilities as well as expertise you have actually gotten with employment.

The way the proprietor or the staff member of a financing company connects with the public ought to develop an excellent financing solutions business image. Each and every single person who gets in the properties ought to be made to feel valued and also valued. https://citywire.co.uk/wealth-manager/news/barclay...ss-in-new-wealth-role/a1264025 training is an important for employees that communicate with customers. The top quality of customer communications with your firm can make or damage your organisation.

Success in funding solutions service is normally evasive, since you never ever require to rest on your laurels. Businesses die if they quit growing, so make certain that you're always setting brand-new goals. Among the very best methods to boost your earnings is to stay up to date with the latest in industry trends. Furthermore, you could comply with market patterns to discover brand-new strategies whereby you could develop your organisation.

Whether you have been in the future many times prior to or you are starting your extremely first financing services business developing a brand-new financing firm is always challenging. The necessary first step is to do a great deal of market and also market research. With the understanding acquired from looking into, you can create a prosperous service. Don't ignore the number of sources used free of cost on the web.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Vital Concepts For Efficient Financing Organisation Marketing |

Authored by-Hagan Davenport

There's a great deal of cash to be made by business owners, yet they need to recognize when and how to take mindful risks. https://www.minds.com/blog/view/1045705338845175808 's a have to that you execute as much study as you can before your funding solutions organisation is formally started. You require to understand what needs one of the most concentrate and exactly how to plan these things out with care if you're going to run a rewarding service. https://www.minds.com/blog/view/1045673014138056704 require to really consider the info that we've compiled below concerning just how you can help your business grow.

Consumers constantly make additional purchases at firms where they obtained exceptional service. Nevertheless, if your customer service is uneven and occasionally substandard, clients will most likely hesitate to shop with you once again. When introducing new services, established as well as abide by high requirements customer support as well as your consumers will stay. The only firms that may trigger a problem are the ones that have high quality service and quality items.

The time it will certainly require to grow a financing services company need to never be ignored. If you are to turn your business right into a lucrative one, it'll use up a great quantity of your individual time. Do not anticipate to be able to multitask in the beginning. Smart company owner recognize when they are feeling bewildered, as well as will certainly transform some responsibilities on to others.

The very best method to get brand-new skills in the funding solutions organisation globe is by learning on duty. Experts recommend acquiring as much hands-on experience about your wanted sector as feasible. If you need to run your very own service, you need to experience points on your own. Financing service publications might include much wisdom, however absolutely nothing like the skills and also understanding you have actually acquired with work.

The method the owner or the worker of a financing firm associates with the public should produce an excellent funding solutions business picture. Every individual that enters the properties should be made to feel valued and valued. Individual abilities training is a necessary for workers who engage with consumers. The top quality of consumer communications with your firm can make or break your company.

Success in funding services service is normally evasive, because you never require to hinge on your laurels. Services pass away if they stop expanding, so make certain that you're constantly establishing new goals. One of the very best strategies to raise your revenues is to stay on par with the most recent in industry patterns. Furthermore, you could adhere to market fads to discover new techniques where you can develop your company.

Whether you have been down the road often times prior to or you are starting your extremely first financing services organisation building a new funding company is always challenging. The crucial first step is to do a lot of sector and also marketing research. With https://www.forbes.com/sites/nizangpackin/2018/12/...st-robots-to-invest-our-money/ gained from looking into, you can produce a prosperous business. Do not ignore the number of sources used for free on the world wide web.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Shift Your Financing Organisation For Favorable Capital |

Content by-Tolstrup Lundqvist

If you want to efficiently manage your funding solutions organisation, having a clear vision of what you desire serves. Maintaining your eyes on the reward will allow you to surmount any kind of barriers on your way to success. If you consider these ideas laid out below, they will help a landmark in organisation success and growth.

Whether you're experienced or not, building a brand-new financing solutions service is challenging. Your market research and the understanding of your competitor's strengths and weak points ought to come before any kind of step you take towards developing your funding firm. With https://penzu.com/p/9d46e6b4 acquired from researching, you can produce a profitable company. The substantial bulk of the research that's required to develop an audio service plan can be done online.

Make best high net worth wealth management has a place where consumers can leave their point of view concerning your goods and also services. Every favorable evaluation of your services and products reinforces your funding company's online credibility. Lots of consumers will react with enjoyment if you request their input as well as comments. To encourage them to share their point of views, providing promotions that are offered to only consumers who leave testimonials is a reliable method.

Bear in mind that building a successful financing company requires time. Success of your funding solutions company hinges on just how much time, energy, and also sources you are willing to take into your business at the beginning. While you remain in the initial stages of building your business, you must hold your horses and also imagine what your company will complete in the long run. If you are not tracking your organisation's development and also expansion, you might spend beyond your means or stop working.

Keep away from the temptation to hinge on your laurels when you get to a funding solutions company goal. Never rest on https://www.forbes.com/sites/jackkelly/2019/03/26/...ow-to-intelligently-answer-it/ with your organisation; instead, keep establishing brand-new, greater benchmarks to satisfy. If you stay educated with your industry's newest trends, you'll maintain discovering ways you can expand your company. Continuous improvement and the evolution of your funding firm based on patterns in the market can help make your business prosper.

When you get to a few objectives with your financing services business, don't simply commemorate as well as stop trying, continue promoting far better success. Regular planning and trial and error with growing methods are key to successful organisations. As you pursue success, make absolutely certain to stay concentrated as well as dedicated to your funding firm. It will be a lot easier to make it through difficult times if your organisation has the ability to adjust swiftly.

The most successful funding services organisation plans have versatile goals created to adapt to a financing firm's development. Having a service strategy that outlines certain, quantifiable objectives to aim for establishes a route to success for your business. Developing a strategy for success in an organisation venture depends upon establishing unique purposes. It's vital to have a collection of objectives that are sensible and also achievable instead of one overarching objective that can appear so tricky to achieve that individuals get prevented and inhibited.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Change Your Funding Service For Favorable Cash Flow |

Article writer-Dejesus Thomasen

If you wish to successfully handle your financing services business, having a clear vision of what you desire serves. Keeping your eyes on the prize will allow you to surmount any type of obstacles on your way to success. If https://citywireamericas.com/news/afore-sura-appoi...ts-investment-manager/a1297642 take into consideration these suggestions described below, they will assist a landmark in service success and development.

Whether you're seasoned or otherwise, building a brand-new financing services business is challenging. Your market research and the understanding of your competitor's staminas and weak points must come before any type of action you take in the direction of establishing your financing company. With the expertise gained from investigating, you can produce a profitable organisation. The large majority of the research study that's required to develop an audio company strategy can be done online.

Make certain your internet site has a place where customers can leave their opinion about your items and services. Every favorable review of your services and products reinforces your financing business's on the internet track record. Many clients will certainly react with enjoyment if you ask for their input and comments. To convince them to share their point of views, using promos that are readily available to just clients who leave reviews is an efficient means.

Bear in mind that building an effective financing company requires time. Success of your financing solutions organisation is dependent on how much time, power, as well as resources you are willing to put into your business at the start. While you are in the preliminary stages of constructing your service, you need to hold your horses as well as imagine what your company will certainly complete in the long run. If you are not tracking your business's growth and also development, you may spend too much or fall short.

Stay away from the lure to hinge on your laurels when you reach a funding solutions company objective. Never ever rest on your laurels with your company; instead, keep establishing brand-new, higher benchmarks to fulfill. If you remain notified with your sector's newest trends, you'll keep discovering ways you might grow your business. Constant enhancement and also the development of your funding company based on trends in the industry can aid make your business grow.

When you get to a couple of objectives with your financing services business, don't simply commemorate as well as stop attempting, continue promoting far better success. Regular preparation and also experimentation with growing approaches are essential to effective services. As you pursue success, make definitely certain to remain concentrated as well as devoted to your funding business. It will certainly be much easier to make it through bumpy rides if your business is able to adjust promptly.

One of the most successful funding solutions organisation strategies include flexible objectives made to adjust to a financing company's development. Having an organisation strategy that lays out certain, quantifiable objectives to go for develops a path to success for your service. Developing a strategy for success in a company endeavor relies on establishing unique objectives. It's crucial to have a series of goals that are sensible and also possible rather than one overarching objective that can appear so challenging to accomplish that individuals obtain dissuaded and also dissuaded.

|

Метки: Finance Services Wealth Manager Benefits of wealth management Wealth management Wealth advisor Personal finance Finance Advisor Corporate Finance |

Ingenious Tips On Just How To Construct And Handle A Successful Accountancy Provider Service |

Content writer-Svenstrup Carter

It needs a solid accounting consulting business plan to direct an organisation to lasting success as well as productivity. The lack of a comprehensive business plan has actually been the failure of several young firms. Regarding these pointers can aid you grow your business as well as achieve success.

To avoid exposing your accountancy office to financial calamity, it is essential to conduct a comprehensive and in-depth threat evaluation before making any type of major decisions. Even the most well-managed accounting consulting business can be seriously damaged by huge risks. https://www.a-zbusinessfinder.com/business-directo...Sun-City-Arizona-USA/32626473/ are more likely to injure your company, so minimize them whenever possible. Extensive risk evaluation is the only method to determine and also minimize business risks and keep earnings levels.

Your audit consulting organisation needs to always be functioning towards brand-new objectives. As an entrepreneur, you have to think that your business will certainly prosper in order for it to ever have an opportunity at it. In that exact same way, it is essential to constantly be elevating the bar on your own, setting each brand-new challenge a little bit more than the last. People who're happy with satisfying just the most mediocre milestones shouldn't manage a company.

Effective organisations do not experience overnight success. With adequate effort as well as time bought your accounting seeking advice from company, success will adhere to. It's vital to place in patience and also attentiveness to your organisation. When https://inc42.com/features/10-business-loans-for-s...smes-by-the-indian-government/ comes to be sidetracked and stops proactively looking for development for his/her accountancy workplace, the business is likely to experience severe problems.

Committing adequate hours of your life to really running a bookkeeping consulting service is imperative and also constantly takes more time than you originally anticipated. If you are to transform your organisation right into a rewarding one, it'll take up a good amount of your individual time. Don't anticipate to be in a placement to multitask at first. A clever local business owner knows when he becomes overwhelmed and will entrust a few of his responsibilities.

Consumer study shows that customers care a large amount regarding the favorable and negative reviews a certain bookkeeping consulting company has. When attempting to boost your on-line existence, often offering unique offers for client that leave evaluations for your company can have a big impact. You must experience all of the evaluations that individuals leave and also bear in mind of the ones that are likely to help you out one of the most. Your customers leaving a comment are doing you an excellent favor therefore you ought to value them by supplying discounts or promotions.

Launching a new accounting office can be an obstacle despite what variety of times you have actually done so in the past. But you can prepare yourself by investigating your market and also best bookkeeping consulting service techniques prior to in fact spending anything. Constructing a successful as well as lucrative bookkeeping office starts with the right groundwork. Do not ignore the variety of resources used free of charge online.

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Growing Your Accounting Provider Service Via Effective Advertising |

Content written by-Oneal Padilla

The key objective of introducing an accounting workplace is to generate income. Ensure you are checking the essentials of your bookkeeping speaking with organisation design. https://cpaglendaleaz.business.blog/2019/07/12/imp...business-bookkeeping-services/ don't require an advanced organisation level to have and also operate your very own company, however you do require to understand standard company concepts. Complying with, you will find some info to aid you begin.

Hands-on technique is truly the best means to build your abilities when it includes running a bookkeeping consulting organisation well. If you want to recognize more concerning exactly how the business globe functions, the most effective in business claim it is often vital to enter as well as experience it yourself. The expertise as well as skills found out while doing so aid one to run an effective organisation. With look at here now to developing bookkeeping consulting business abilities, your everyday work will serve you much better than anything that you could learn from a composed web page.

Before visiting an audit consulting company, the majority of customers browse through the comments as well as rankings of great review websites. Approach numerous of your star customers as well as ask to provide responses on your organisation. Prominently display reviews that promote your best items and reveal your accountancy workplace's strengths. Constantly give thanks to those customers that do take the time to leave an evaluation, also if they suggest points that you can enhance.

If you are having trouble making an essential bookkeeping consulting business conversation, consider brainstorming with workers to obtain some quality. A wonderful location to begin with simplifying your planning procedure is making a pros and cons list. Both of they actually are tried and true techniques that may assist you evaluate all of your selections and make the absolute best decision. Having a conference with a company development expert is an excellent behavior whenever you feel unsure about the complying with step for your organisation.

Do not think the buzz; an effective bookkeeping consulting company won't grow overnight. Your success will likely be identified by how much of your time, power as well as sources you want to spend when very first beginning. Perseverance is additionally a virtue; it permits you to concentrate on your lasting goals instead of always remaining in the moment. If you do not take notice of how your business is growing, you will certainly stop working.

At every degree of a bookkeeping workplace, all communications with the general public ought to be identified by a positive mindset. It's part of the job to make every potential and also real consumer feel valued. When you have staff members, make certain you supply them detailed customer abilities training. Customers that feel positively about your accounting seeking advice from organisation are more likely to inform others as well as assist the bookkeeping office expand.

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Elevating Your Tax Consulting Organisation Advertising Beyond A Catchy Slogan |

Authored by-Thorhauge Paaske

Think about beginning your own tax obligation consulting services service if you want to support yourself as well as do something that you love. Small business accountant goodyear of interests, hobbies as well as skills can provide you a way forward to your new occupation. The first thing to do before speaking to consumers as well as looking for customers is having a service strategy. To get started in your organisation, have a look at these helpful pointers.

When you're bringing in new individuals to your tax obligation seeking advice from solutions service, be extremely careful. Prior to adding anyone, you should be confident that the candidate recognizes in the anticipated duties and also is especially present with any type of certificates they may require. However, every new employee requirements and also should have thorough training to give them the abilities and also expertise called for by their new position. All effective services have actually motivated and also well-trained personnel.

To absorb the important capabilities to prosper in the tax obligation consulting solutions company world, we suggest discovering at the workplace with genuine experience. To obtain some understanding on exactly how to run a service, specialists advise one to find out via individual experience. Whatever employment experience and also learning you assemble from this present fact ought to help you in keeping your very own certain worthwhile organisation. Perusing a book regarding company comes up short in contrast with what you can survive work experience.

Before starting a business, tax obligation consulting services business owners require to have a basic understanding of the legislations that govern companies and they should also keep an eye on all the state as well as federal kinds that they require to file in order to avoid of legal problems. Without having https://troymedia.com/2019/06/05/cfib-puts-federal-election-issues-on-the-table/ of business regulation, you can still talk to a lawyer that focuses on the topic. Constantly want that a court case can be very pricey and also can cause the downfall of your business. A terrific relationship with a clever service attorney is a fantastic advantage to anybody facing legal obstacle.

When operating a successful tax consulting services service, you must set objectives. By building up an apparent, complete approach for success that incorporates a progression of certain, sensible goals, you will have the capacity to make and also take care of a rewarding consulting firm. By determining and laying out precisely what you want to accomplish, you can develop a structure for the future success of your tax obligation consulting consulting company. Maintaining goals little and convenient is essential to your success; marking your development with each objective met motivates you, while the irritation and stress you deal with when attempting to satisfy an extremely ambitious goal can halt your progress.

You need to constantly have brand-new goals to accomplish when running a tax obligation consulting solutions organisation. As a business owner, you will need to believe that your tax obligation consulting consulting company will be successful in order for it to ever have an opportunity at it. As you reach each brand-new objective, it must be celebrated however likewise changed with a new even more difficult one. Those who do not desire to invest their own money and time on their service ought to not be in business on their own.![]()

|

Метки: Small Business Finance Accounting services Tax Consultant Financial accounting Loan Application Assistance Investigative Accounting Finance accountant |

Right Here Are Some Other No Charge Advertising Methods For Your Financial Provider Organisation |

Written by- click now takes a strong financial consulting service strategy to assist a monetary services seeking advice from firm toward long-lasting success. You won't prosper in producing a booming business if you do not have a business strategy. Regarding these recommendations can help you expand your company as well as achieve success.

Top 10 Questions You Should Ask Your Retirement Financial Advisor

Top 10 Questions You Should Ask Your Retirement Financial Advisor There are several financial transitions throughout life. One of the most significant financial transitions is retirement. The shift from pre-retirement when you are earning, saving, and growing assets to retirement when you are withdrawing assets is monumental. A successful retirement transition can make or break retirement. It’s important your retirement financial advisor is able to make this journey with you. If you’ve never worked with a financial advisor or if you already have a financial advisor but are not sure if they can help you make the retirement financial transition, the following ten questions will help you better understand their capabilities, experience, and philosophy when it comes to helping their clients create a successful retirement.

You do not need to seek a financial consulting company degree to acquire the skills and expertise needed to excel in business. Experts recommend gaining as much hands-on experience about your preferred industry as feasible. The even more you obtain real-world experience and knowledge, the much more successful you will possibly be if you pick to open your very own company. There is something to be claimed regarding reviewing a service book, but there is far more to be said regarding real life experience.

Even if it's a start-up or you have actually been in the economic consulting company game for years, developing a new organisation is really difficult. click this over here now concerning the competition should always be performed before the start of any new service. Developing an effective and rewarding financial services getting in touch with business starts with the appropriate foundation. The large majority of the research that's needed to create a sound company strategy can be done online.

Brainstorm with your staff members to remove your ideas as well as ideas when making economic consulting business decisions ends up being tough. Lots of thriving business owners choose by noting the advantages and disadvantages of every alternative. Background tells us that making a list of benefits and drawbacks really assists to bring the very best choices for your organisation right into the light. Some execs count on advice from a service advancement consultant when making vital decisions.

Your financial consulting business ought to constantly be functioning in the direction of brand-new objectives. If you genuinely believe that your economic services getting in touch with business will certainly prosper, absolutely nothing will certainly stand in your means. If you constantly elevate your brand-new goals a bit higher after each success, you'll achieve your dreams. Financial Advisor Tysons that enjoy with meeting just one of the most average landmarks should not run a service.

Both economic solutions consulting business management as well as workers alike need to engage in a positive manner with the public. You need to make every consumer that sees you really feel comfy as well as valued. The staff member ought to be trained on the ways of taking care of and also associating with the consumers as well as the general public. When your company gets an excellent picture in terms of client relationships, the details will certainly spread around and also your economic consulting organisation will certainly grow.

When you are generating brand-new people to your monetary consulting service, be extremely mindful. Prior to bringing new individuals in, you'll require to effectively guarantee that they've the necessary experience and also accreditations. Although you deal with well-qualified individuals, they'll still need complete training in the specific tasks their brand-new placements entail. Successful businesses have pleased workers that accomplish job possibilities as well as their goals.

|

Метки: Finance Financial Advisors Wealth Management Insurance Planning Physician Wealth Management Physician Financial Planning Wealth Advisors |

Here Are A Few Other No Cost Marketing Methods For Your Financial Solutions Organisation |

Article written by-Wilder McGraw

It takes a solid financial consulting organisation strategy to direct a financial solutions speaking with company towards long-term success. click here to read will not be successful in producing a flourishing business if you don't have an organisation technique. Regarding these suggestions can aid you expand your organisation and also achieve success.

How To Become A Financial Advisor: To Ace Their First Year, Advisors Prepare With Care

How To Become A Financial Advisor: To Ace Their First Year, Advisors Prepare With CareThe run-up to getting married or buying a home can prove a hectic whirlwind of activity. Preparing to launch your own financial planning practice can prove equally stressful. But there are ways to ease the path in learning how to become a financial advisor.

http://mgyb.co/s/VLE1M do not require to seek a financial consulting business degree to acquire the skills and knowledge required to excel in organisation. linked internet site recommend gaining as much hands-on experience about your wanted market as possible. The more you acquire real-world experience and knowledge, the more effective you will possibly be if you select to open your very own organisation. There is something to be stated about reading a service book, but there is far more to be said about real world experience.

Even if it's a start-up or you have actually remained in the financial consulting service game for years, building a new business is extremely challenging. Quality study about the competitors must constantly be done before the beginning of any new service. visit my webpage and also rewarding economic solutions getting in touch with firm starts with the proper foundation. The vast majority of the research study that's required to create an audio business technique can be done online.

Brainstorm with your staff members to remove your thoughts and also suggestions when making economic consulting business decisions ends up being hard. Many thriving company owner make decisions by noting the pros and cons of every alternative. History informs us that making a checklist of pros and cons really helps to bring the best choices for your service right into the light. Some executives depend on recommendations from an organisation growth specialist when making crucial choices.

Your monetary consulting business need to constantly be functioning towards brand-new objectives. If you absolutely think that your financial services getting in touch with business will certainly prosper, absolutely nothing will certainly stand in your way. If you always raise your brand-new goals a little bit greater after each success, you'll achieve your desires. Individuals that more than happy with fulfilling just the most average turning points should not run a business.

Both financial solutions seeking advice from company management and also workers alike need to communicate in a positive manner with the public. You must make every client that sees you feel comfortable and also appreciated. The staff member needs to be educated en routes of dealing with as well as connecting to the clients and the general public. When your company obtains a great image in regards to customer relations, the details will certainly spread around as well as your economic consulting business will certainly expand.

When you are bringing in brand-new people to your monetary consulting service, be really careful. Prior to bringing brand-new people in, you'll need to successfully guarantee that they have actually the essential experience and accreditations. Despite the fact that you collaborate with well-qualified individuals, they'll still need complete training in the specific jobs their new positions involve. Successful businesses have happy workers that achieve job possibilities as well as their objectives.

|

Метки: Finance Financial Advisors Wealth Management Insurance Planning Physician Wealth Management Physician Financial Planning Wealth Advisors |

Some Insurer Will Certainly Give Multi-Policy Discounts |

Authored by-Sander Rafferty

Auto insurance can be very intimidating to someone who has never dealt with it before. It can easily lead to an overwhelming feeling because of all of the information available. Below are some tips to assist you in getting all of this information organized to the point where you can start looking for a good auto policy.

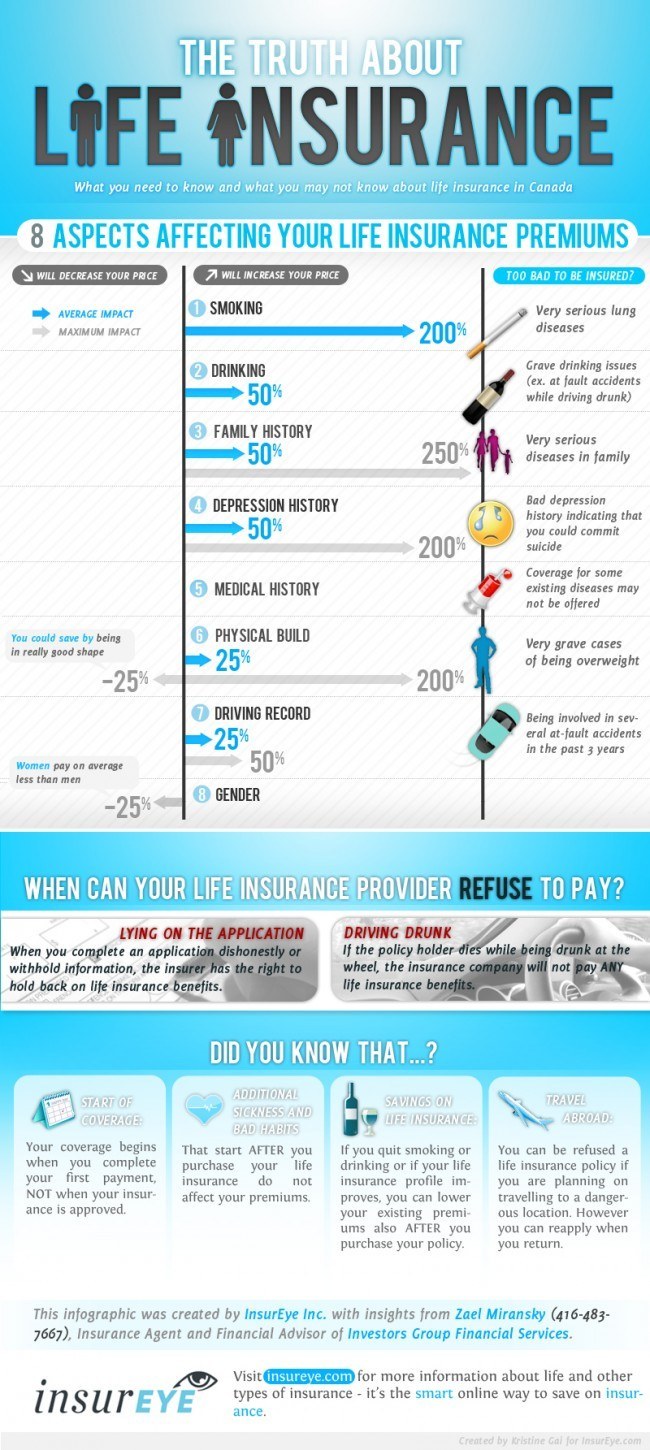

Why the future of life insurance may depend on your online presence

Why the future of life insurance may depend on your online presence Life insurance companies want to update their methods and make their businesses more efficient. Consumers fear their public information being misused in discriminatory ways. The nature of the industry doesn’t do anything to alleviate those fears, either, because life insurance inherently differentiates between people; different factors cause people to pay different premiums. Government regulators want to balance the interests of both customers and businesses, but it’s not going to be simple.

When considering auto insurance for a young driver, be sure to check with multiple insurance agencies to not only compare rates, but also any perks that they might include. It also cannot hurt to shop around once a year to see if any new perks or discounts have opened up with other companies. If you do find a better deal, let your current provider know about it to see if they will match.

Be sure to keep your car secure. Keeping your car garaged, having a security alarm system, using a locking device on your steering wheel, having a professionally installed tracking system and living in a safe neighborhood are just a few of the ways you can save some money on your car insurance. Be sure to ask your agent how you can get discounts on your insurance rates with good security measures.

When getting car insurance is not a wise idea to only get your state's minimum coverage. Most states only require that you cover the other person's car in case of an accident. If you get that type of insurance and your car is damaged you will end up paying many times more than if you had the proper coverage.

When shopping for an auto insurance policy, most companies are going to offer extras like towing, road-side assistance, GPS services, and other add-ons. These may come in handy if you're ever in a pinch, but they can be really expensive. Say no to these extras in order to save money on your insurance.

Never drive your car without liability insurance. This insurance type can save you a lot of money as the insurance company pays the damages you caused to someone. Without this insurance type, you would be liable for all the costs. Choose the coverage that is right for you and your unique situation.

Senior citizens can benefit from the discounts that are available from their car insurance company. These discounts typically kick in at age 55 or 60. You have to request that your insurer add these discounts onto your insurance, as they will not do it automatically. It could save you as much as ten percent on your premium.

When on the hunt for car insurance, cut out the middle man to save money. Shopping online, directly through the company website, is likely to save you the most money. Insurance companies that allow you to buy online are fairly reputable and it is cheaper because you are not using an agent.

Before choosing the auto insurance policy that you think is right for you, compare rates. Comparing rates has been made easy with so many online insurance companies. Many of these companies will compare rates for you. Go to a couple of these sites and get many quotes from each before making your decision.

Keep car insurance in mind when buying a new car. Different cars have different premiums. You might have your heart set on an SUV, but you might want to check just how much it is going to cost to insure before you spend money on it. Always do your insurance research before buying a new vehicle.

Everyone knows that a Ferrari is an expensive car, but what you may not know is that the insurance will be vastly more expensive as well. If you have your heart set on a car like this, make sure that you consider the increased prices of the insurance as well. At times it can be as much as 3 times the price of a normal car.

https://www.wsj.com/articles/its-open-enrollment-t...-plan-should-i-pick-1507899601 iframe src="https://docs.google.com/spreadsheets/d/e/2PACX-1vQcwkqmyxckgWSP-93GdV7ETmfimS7enJMJ3PuBM6ZGK94KP3SKXKXShXv-q0msYRem0czwwsCJzSVJ/pubhtml?widget=true&headers=false">

Work with an insurance broker or aggregator online. Sites like Esurance.com or Insureme.com can help you get quotes from several insurance companies at once for no charge so you can get a feel for how your current rates stack up, and whether you need to switch to a new insurance company.

If you believe that an insurance company is not offering you proper settlement for an accident, do a search online for similar cases in your state. This can empower you with useful information that you can negotiate with the agency, and if you still are not happy with the results, you can seek assistance from an attorney.

If you are in an accident, report it. Even if there aren't any injuries that are obvious at the time. It doesn't mean you are necessarily filing a claim, just letting your insurance company know what happened in case a claim is filed by the other party at a later time.

Even your age can play a large factor in the price you can expect to pay for auto insurance. Statistically speaking, drivers over the age of 55 and under the age of 25 are considerably more prone to vehicle accidents compared with adults in mid-life. While this cannot be changed, you may wish to compare coverage options across companies; some place less emphasis on the age of the insured party.

linked internet page of growing old is pain: Once you reach 50, you are entitled to a discount on your car insurance. Insurance companies are well-aware that senior drivers are, statistically, the safest on the road. Almost every insurer offers discounts for drivers between the ages of 50 and 70. If you are in this bracket, make sure you get the discount due to you.

You should take your driving record into account when trying to figure out how much coverage you need to get. If you are known to be that unlucky one to get into fender benders or if you drive a lot for work, it might be a good idea to get as much coverage that you can afford.

Review all additional services and coverage details of your current plan and look for items which could be dropped from your plan without jeopardizing your safety or legality. In many cases, people will initially agree to all insurance products and services available at the suggestion of their insurance agent. Many people will have little use for these add-ons.

Remember these tips, and you should be able to find a very affordable insurance that will actually cover your expenses when you run into trouble. Do not neglect auto insurance. You could get in trouble if you do not have it, and you could pay too much if you do not choose carefully.

|

|

Advice For Choosing The Very Best Life Insurance Policy |

Content author-Hodges Kudsk

When you have made the important decision to buy life insurance, you will notice that there are a lot of options to choose from. Before making a decision, you want to make sure you are knowledable about every type of life insurance there is, and what they all mean to you. This article will give you information about life insurance to help you decide which is best for you.

When purchasing life insurance, you will want to weight the company you choose very carefully. Since it is not likely that you will need to use their services for many many years, you will want to make sure that they will be around when it's needed. A strong reputable company who has been in the business for a long time is the safest choice.

Certain insurers could offer premiums approximately 40% lower than other ones. Use an online service to compare quotes from different insurers, and be sure you choose a website that will adjust your quotes for your medical history.

Find the right type of life insurance policy for your needs. The three basic types are, whole life, term life and variable life. Whole life policies will be the most expensive, but they operate much like a savings account, meaning that you can use it as an asset in the future, if it hasn't been used.

Before shopping for life insurance, put together a budget to project the amount of financial coverage you might need. Include your mortgage payoff, college costs for the kids, money to pay any other large debt obligations, funds to cover funeral and medical expenses and enough money to supplement your remaining spouse's retirement funds.

Try to buy your life insurance policy as soon as you need it. It is definitely best to do this when you are young and healthy because the policy's premiums tend to be much cheaper. If you wait till later when you are older or when you are in poor health, the premiums can be very expensive.

Your insurance agent may try to sell you additional riders to add to your life insurance policy. However, these are often unnecessary, so make sure you fully understand the purpose of each one before deciding if it would benefit you. For example, a family benefit rider allows for your death benefit to be paid in monthly increments rather than one lump sum, so your family receives a steady source of income.

When you want to get life insurance you should do some research, as well as speak to a professional. Sometimes agents will have information that you don't get on your own, and will also be able to assist with needs as they arise.

If https://www.azcentral.com/story/news/politics/legi...ans-gov-doug-ducey/3131533002/ want to have some control and decision-making power over the money you invest in your life insurance, consider a variable, universal life insurance policy. With these policies, you have the ability to invest part of your premium in the stock market. Depending on how wisely you invest this portion of your money, your death benefit can increase over time. You should have some knowledge of the stock market if purchasing this type of policy or enlist the aid of a financial professional.

Try opting for a decreasing life insurance plan. This kind of plan is used to supplement a policy holder's investments as if something caused them to die before reaching a certain amount with their investments. The more these grow, the less the monthly premiums are. That's why these make a great option for those who are looking to save over the life of their plan.

Hire an independent broker to help you select the best policy rather than going directly to an insurance company. hail insurance for cars can give you many options to choose from, whereas a company will just give you options through their company. As life insurance will be a policy you want to retain for some time, do some shopping around before you make your choice.

If you have minor children, purchase enough life insurance to offset their expenses until adulthood. The loss of your income could have a significant impact on your children's lives, and life insurance can help close the financial gap. This affects not only day-to-day expenses, but also those larger ones like college costs.

The last thing your life insurance has to be is complicated. Make sure that you're always keeping things as simple as possible. If and when you pass on, your family should be able to get the money quickly without anything there to hold the payments back. The simpler things are, the easier the money comes in.

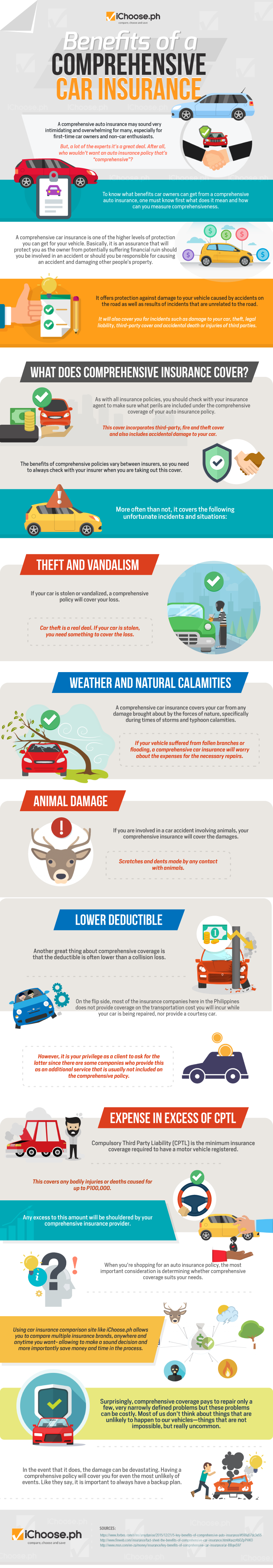

Paying Too Much in Car Insurance? 7 Expert Tips to Help You Save

Paying Too Much in Car Insurance? 7 Expert Tips to Help You Save Here are seven tips to save you money on your car insurance. Not every tip will work with every provider, but you should be able to save a few hundred dollars every year following these tips.

If meeting with a live broker, always watch to see if they're recommending a policy to you after only one meeting. If so, you can bet that they're only in this to make money and aren't accurately addressing your particular needs. You should just walk away and choose another broker instead.

One important piece of advice when purchasing life insurance is to buy when you are healthy. If you have some type of medical issue or a pre-existing condition, in many cases life insurance will be very expensive or not you will not be able to purchase it at all.

Buy the right term for your term life insurance. Your agent might suggest that you buy a 10-year term policy, even if you need 20 years of coverage, so your rates will be cheaper. They suggest that you just sign up for a new 10-year policy upon expiration of the original policy. what they don't tell you is that the rates will be higher because you are older; you might have contracted an illness or disease in those ten years and can't pass the medical exam which you have to re-take, and the agent will get a new commission. Just buy the 20-year term insurance up front, if that is the amount of coverage you need.

When purchasing life insurance, understand how much coverage you may need. A good rule of thumb commonly recommended is coverage for between 5 and 10 year's worth of your income. Go closer to 5 if you have few dependents and little debt, and more toward 10 if you have many dependents and lots of debt.

As mentioned at the beginning of this article, life insurance is not just for the rich with money to spare. Life insurance can be a life saver for a family who depends on one income and finds that family breadwinner suddenly taken away. By implementing the sage advice in this article, you can help your family make it through an untimely death and not be stuck in debt.

|

|

Life Insurance Information You Did Not Know |

Authored by-Mohamad Martinussen

It may seem like it is you against the world sometimes when it comes to dealing with life insurance. With the vast amount of information available online, it can be nearly overwhelming at first. This article will provide helpful information for you to get started on the right path

When setting up a life insurance policy, be aware of the holder of responsiblity for the funds. The "adult payee" determination has no legal standing. Simply naming someone as the "adult payee" on behalf of someone else on a policy does not require the payee to spend those funds in care of the intended recipient.

When you're choosing a policy, you need to make sure to calculate the coverage for both ongoing and fixed expenses. Keep in mind that life insurance funds can be used for pricey one-time expenses as well, like estate taxes or funeral costs which can add up.

Avoid the whole life policy and go with the term life policy instead. Whole life policies combine an investment with the standard term policy. The term life policy will pay out the amount of coverage that you have selected either in a lump sum or over the course of 20 to 30 years.

Click On this site &headers=false">

Buy the right amount of life insurance to cover all of your needs. Skimping on life insurance is not a good idea. Term insurance, especially, is very affordable, so make sure you get as much insurance as you need. For a rule of thumb, consider buying insurance that equals approximately 6 to 10 times your income.

Life insurance is an important item to have in place, especially if you have a family that will need to be provided for after you have died. Do not leave this important issue until it is too late. Investigate a life insurance policy as soon as you are able and ensure that it is backed up with a current will.

Before purchasing life insurance, make yourself aware of what you need from your policy. There are online calculators that can help you figure out what it would take to cover your expenses associated with that of your surviving spouse or children, when they either finish college or reach adulthood, whichever comes first.

Annual premiums are better than monthly ones, if it is possible for you to pay that way. A good way to save money is paying the annual premium.

When buying term life insurance, make sure the duration of your policy matches the amount of time you need it. For example, buy term insurance that stays in force long enough until the kids become independent and also, that the remaining spouse has coverage until he or she, becomes eligible for retirement income.

When getting life insurance, you will need to find out how much the premiums are. All insurance policies have different premiums and you need to be certain that you will be able to afford the coverage. If https://www.npr.org/sections/health-shots/2019/02/...who-sell-employer-health-plans lapse on payment for the policy and someone passes away, you could find that the coverage you were counting on is not available because of the lapse.

Some smaller life insurance policies out there, like those that are less than $10,000, might not require you to have a physical, but these are also usually costly for their size. The companies offering these policies are assuming that unhealthy people are opting for this option so they can be insured, so the prices are steeper per month.

If you have a spouse, try to get a two-in-one policy. Instead of having two separate policies, a two-in-one policy is a joint life policy that protects couples. Many times the insurance premium will be less on a joint policy as compared to two separate policies. You'll get the same coverage for less.

In order for the people you love to be cared for even when you aren't around to physically handle things yourself, life insurance is an important investment. The cost of funeral services are very expensive and can leave a large burden on your loved ones. Don't make the mistake of thinking you are invincible!

Discontinuing your insurance policy? Here are some tips

Discontinuing your insurance policy? Here are some tips Discontinuing endowment policyYou can abandon your insurance in two ways. Either convert your policy into a paid-up policy by not paying the premium after the mandatory period; or, surrender the policy and get the surrender value from the insurer. In both cases, you must pay the premium until the end of the mandatory period. It can be two to three years depending on the policy’s terms and conditions. If you close the plan before the mandatory period, you will lose all value.

Life insurance rates have dropped considerably, over the last few years. If you subscribed to a life insurance more than ten years ago, you are probably paying too much. Make sure that your insurance company has upgraded your policy to current rates. If not, switch to a different insurance company.

To insure that you choose the best life insurance policy, stay away from advisers who claim to be more knowledgeable about insurance companies than rating companies or who dismiss ratings as inaccurate or trivial. To file a complaint about such an agent, contact your local state insurance department or attorney general's office.

Buying mortgage life insurance is a good way to provide protection for your loved ones. Mortgage life insurance can give you peace of mind knowing that your family will be able to live in their home if something happened to you. This type of life insurance will pay your mortgage if you die before it is fully paid off.

If you are applying for life insurance that will be effective for a certain number of years, look for a return of premium rider feature. This means that you will get everything you paid in premiums back if you do not die during the period of time covered by your insurance.

In conclusion, the more you learn about a topic, the better your results will be in the end. As with weight loss, it's not as challenging as some think if you apply everything you learn about it. With all the tips discussed in the article, losing weight will be much easier and more successful.

|

|

Reduced Your Automobile Insurance Policy Premium With These Tips |

Content written by-Garrison Henson

You cannot go anywhere without somebody giving you their advice about auto insurance. You do not know if they are telling you good information or just what they might have picked up on from unknown sources. If you want the real information and want to be your own expert on the subject, this article is for you.

New Driver's Tips For Cutting Car Running Costs

New Driver's Tips For Cutting Car Running Costs The bigger the engine in a vehicle means the more difficult it can be to handle and maneuver. With larger engines, speed generally comes with it. Lastly more weight the car has; because of the engine, more damage you potentially can cause in an accident. Smaller cars mean smaller premiums and a lower risk of being involved in an accident because of the limitations of speed and weight. With a large engine comes more carbon emissions too so expect an increased or greater car road tax bill.

If someone causes an accident that involves you and or your vehicle, and their insurance only covers a portion of the cost, or expenses you have incurred, having under-insured coverage on your policy will make up the difference so you don't have any out of pocket expenses, or aren't left with a large deficit.

When shopping for a new car, be sure to check with your insurance company for any unexpected rate changes. You may be surprised at how cheap or expensive some cars may be due to unforeseen criteria. Certain safety features may bring the cost of one car down, while certain other cars with safety risks may bring the cost up.

Before you add your teenage driver to your auto insurance policy, take a look at your own credit history. If your credit is good, it's usually cheaper to add a teen to your own policy. But if you have had credit problems, it would be better not to hand that on to your child; start them off with a policy in their own name.

Only allow repair companies to use quality parts on your vehicle. Some repair shops will attempt to charge your insurance company for high-priced parts while actually giving you lower quality ones. Double check to make sure you are getting the highest quality parts that go with your vehicle, because that is what the insurance company will be charged for anyway.

Add your spouse to your insurance policy. Insurance companies are notorious for wanting stable and responsible customers. Adding your spouse to your policy signifies that you have become more stable and reliable, and many companies will lower your rates just for that reason. If your spouse has a clean driving record, that can help lower your rates as well.

https://www.azcentral.com/story/news/politics/legi...ans-gov-doug-ducey/3131533002/ ! To ensure you get the absolute best deal on car insurance, do most or all of your research online - and then buy online. https://www.medicalnewstoday.com/articles/323858.php allows fast comparison of so many companies and features; it greatly simplifies the task of finding the right company with the right rates and the right coverage to fit your needs and budget.

Having an expensive car or car that is considered a sports car will often increase the price one pays for auto insurance. If one does not like the sound of that then they should consider getting a different type of car. It will not only save them insurance money but often money off the car itself.

When choosing an auto insurance policy, look into the quality of the company. The company that holds your policy should be able to back it up. It is good to know if the company that holds your policy will be around to take care of any claims you may have.

Finding cheaper auto insurance is as easy as requesting insurance quotes. Requesting just one quote may not do the trick, but if you request several quotes online, you will probably find a substantial variance in the rates quoted by different providers. Even with exactly the same information about you and your driving history, every insurer looks at you a little differently. Certain insurers place more weight on factors such as your age or the car you drive. You could be just a few quotes away from saving a lot of money on your car insurance.

In order to protect yourself and your car with the best insurance must understand the difference between the types of liabilities and which policies cover them. This is because there are major differences between coverage for basic bodily injuries, damage to the car, and in the worst case, major medical problems to you or the other driver. If you aren't properly covered in these cases it could be a major problem.

Not only is auto insurance mandatory, but valuable. Purchasing insurance for your vehicle is a daunting task, as there are lots of options to explore. You want to shop around, perhaps by calling around using the listings in your phone book or by using the internet. Once you find a comfortable price and coverage plan for your automobile then you can be sure if you are in an accident or pulled over by the police you're protected.

Hybrid vehicles are really underrated in terms of insurance prices. So if you want to save money on insurance, you might want to look at purchasing some type of hybrid vehicle. Apart from the great tax savings, you will also stand out as a low-risk driver in a hybrid, and thus your insurance premiums will ultimately drop.

Do not allow your auto insurance policy to terminate for non-payment or terminate before you switch to a new insurer. If you do, this may cause your insurance rates to increase for quite some time.

If you are a younger driver who is being hit with extra insurance charges because of your age, don't worry too much. Many agencies work with a "good student" discount. This means if you have above a certain GPA and bring in your transcripts you can receive a discount, sometimes a quite substantial one. Make sure not to overlook this opportunity.

If you become seriously injured in an auto accident, consider hiring a lawyer to deal with the other party's insurance company. Many parts of the process, such as determining the facts of the accident and liability, are more easily completed with the help of a law firm. In addition, a lawyer may be more pushy with the insurance company about getting things done.

Although you may not want to switch your vehicle you ought to know that the vehicle you drive highly impacts your premiums. If you are driving a flashy sports car versus a simple entry model Chevy, the sports car will cost more to cover. So if you want to keep premiums down, keep the flashiness down.

Ask your insurance provider for a list of all of their available discounts. Most companies will offer breaks to someone who drives 7,500 miles or less each year. In addition, using the bus or public transit to commute to work will usually lower your premiums. If you do not take the bus, you may get a discount if you carpool instead.

Remember these tips, and you should be able to find a very affordable insurance that will actually cover your expenses when you run into trouble. Do not neglect auto insurance. You could get in trouble if you do not have it, and you could pay too much if you do not choose carefully.

|

|

Life Insurance- What You Need To Know |

Content author-Brandstrup Kudsk

If you have a spouse and children and are the main income earner of the family, you do not want to leave them in a position of hardship should anything happen to you. Yet without considering the purchase of a life insurance policy, this is a situation that could become a reality. Here are some things you need to know.

Understand the types of life insurance available before making a decision on which to purchase. Most insurance policies focus on Term Life or Whole Life and knowing the difference is key. Bear in mind that with both of these types of policy, they can be tailored to your specific needs and situations. Do your homework.

Certain insurers could offer premiums approximately 40% lower than other ones. Use an online service to compare quotes from different insurers, and be sure you choose a website that will adjust your quotes for your medical history.

Although term life insurance covers you for only a specified period of time, it does have some benefits that may make it the right choice for you. Term life insurance is vastly cheaper than whole life insurance, costing hundreds of dollars a year rather than thousands. It is flexible in that you can choose to be covered for as few as 5 or as many as 30 years with coverage ranging from $100,000 to millions. For short term needs, such as children graduating from college or a mortgage being paid off, term life insurance is ideal, especially if whole life insurance is not in your budget.

Don't ever lie on a life insurance policy application. While it may seem like a tempting idea to say, for example, that you don't smoke when you do, lying on your application is grounds for your insurance coverage to cancel your policy when the deception is eventually uncovered. Tell the truth and shop around for the best price instead.

Before investing in a life insurance policy, learn the pros and cons of each of the four types. simply click the following web site are term life insurance, whole life insurance, universal life insurance, and variable life insurance. In order to help you understand the differences, you may want to hire a financial professional. Not only can a financial professional explain each type of life insurance to you, but he or she can suggest which one best suits your needs.

If you are looking to purchase a life insurance policy and you are a smoker, try to quit. This is because most life insurance companies will not provide insurance to a smoker, as they are more at risk to getting lung cancer and other smoking-related conditions. Companies that will provide insurance to a smoker will usually charge higher premium rates.

To get a good life insurance rate, purchase life insurance while you're still young. Rates are lower the younger you are, and you can keep paying the same rate as time goes on. You may not need life insurance now, but you'll need it in the future. Being proactive about your life insurance will help you get a great policy for a low cost.

Purchasing your funeral plot in advance of your death will help your family save money once you're gone. Unfortunately, spur-of-the-moment plot purchases bring out the unscrupulous nature of some in the funeral industry, and a plot after death can cost a lot more than a plot purchased well in advance.

You should beware of an advisor who claims to know everything before purchasing life insurance. An advisor who answers every single one of your questions without researching anything, then it's likely that he or she is incorrect about certain details. Because insurance policies are very complicated, even top-notch insurance advisors do not know everything without research.

You need to know what your debts are before getting life insurance. In order to find out home much life insurance coverage you need you first have to know the amount of your debts and how much your funeral will cost. Your life insurance policy needs to be higher than that amount.

Sometimes people with life insurance (whole-life, not term) feel like updating or changing their policies after a few years, especially when a company introduces a better policy. This is why it's important to think first before getting into a commitment, because changing now could cost you your premium payments and policy. So you should avoid this.

Make sure you pay your life insurance premium payments on time. While most companies allow a grace period for late payments, consistent late payments can reduce your available cash value or result in policy cancellation. Depending on your age and health, getting a policy reinstated or finding a new one could be much more expensive than your original policy.

9 financial tips for young mothers to manage their money

9 financial tips for young mothers to manage their money At the beginning of each month, with enough organisational skills to govern a small country, mom would allot a fixed amount to innumerable expenses – school fees, salaries, groceries, holidays, pocket money…you name it. Budgeting doesn’t just help simply click the next internet page plan our expenses, but also our savings.

If you're a smoker who was addicted and smoking cigarettes at the time of your life insurance policy, you can actually quit smoking and save money. Most companies will let you reapply for a policy as a non-smoker after a certain amount of time has passed. So there's some incentive in it if you can quit.

When shopping for life insurance, be sure to shop around. Check a number of different policies online and investigate each company you are considering to be sure you are choosing an honest, reliable company. Fly-by-night life insurance is surely not a desirable commodity. You want to be sure your policy will be there and will pay out as promised in the event it is needed!

Being young is no excuse not to get life insurance. Firstly, accidents can happen, and secondly, if you keep the same life insurance for a long time, your insurance company should treat you as a valuable customer. Your premiums might go down and your coverage expand over the years.

When purchasing life insurance, understand how much coverage you may need. A good rule of thumb commonly recommended is coverage for between 5 and 10 year's worth of your income. Go closer to 5 if you have few dependents and little debt, and more toward 10 if you have many dependents and lots of debt.

In conclusion, it is definitely difficult to stay on top of all of the latest tips and tricks coming out about life insurance. To make matters worse, information is constantly changing - making it nearly impossible to be an expert unless you make it a point to keep yourself up to date. Hopefully you found this article interesting, informative, and were able to learn a couple of new things.

|

|

Auto Insurance Advice That Anyone Can Adhere To |

Article written by-Stout Kessler

Auto insurance is a crucial way to maximize your safety and savings as a car owner. Before purchasing insurance, it is important to carefully research all of your options so that you select the plan best suited to your automotive needs. This article will help you better understand what is involved in choosing and implementing auto insurance.

When considering auto insurance for a young driver, be sure to consider building up his or her credit, prior to shopping for insurance. This will not only assist with the new driver being able to get a possible better rate, but will also help when the young person may need other large purchases or loans in the future.

When you rent a car, you will likely be asked if you want to purchase coverage for the vehicle. Before you answer, you should know whether or not your personal automobile insurance covers rental cars. If it does, how much is covered? Ask your agent, or read your policy to be clear.

When considering extras for your auto insurance, you can most likely do without the car rental insurance. You will pay nearly $50 a year for rental insurance, when that is the same cost for renting a car for one to two days. Also, your rental car is most likely already covered under your policy, anyhow.

Taking the towing option off of your policy will save you money on your premiums. In the case of an accident, towing is generally covered even if you are not paying for the towing option. If https://indianexpress.com/article/business/banking...r-term-life-insurance-5706926/ take care of your car and understand how to fix small problems like a flat tire, you will never need to use the towing option and can save yourself up to 30 dollars a year.

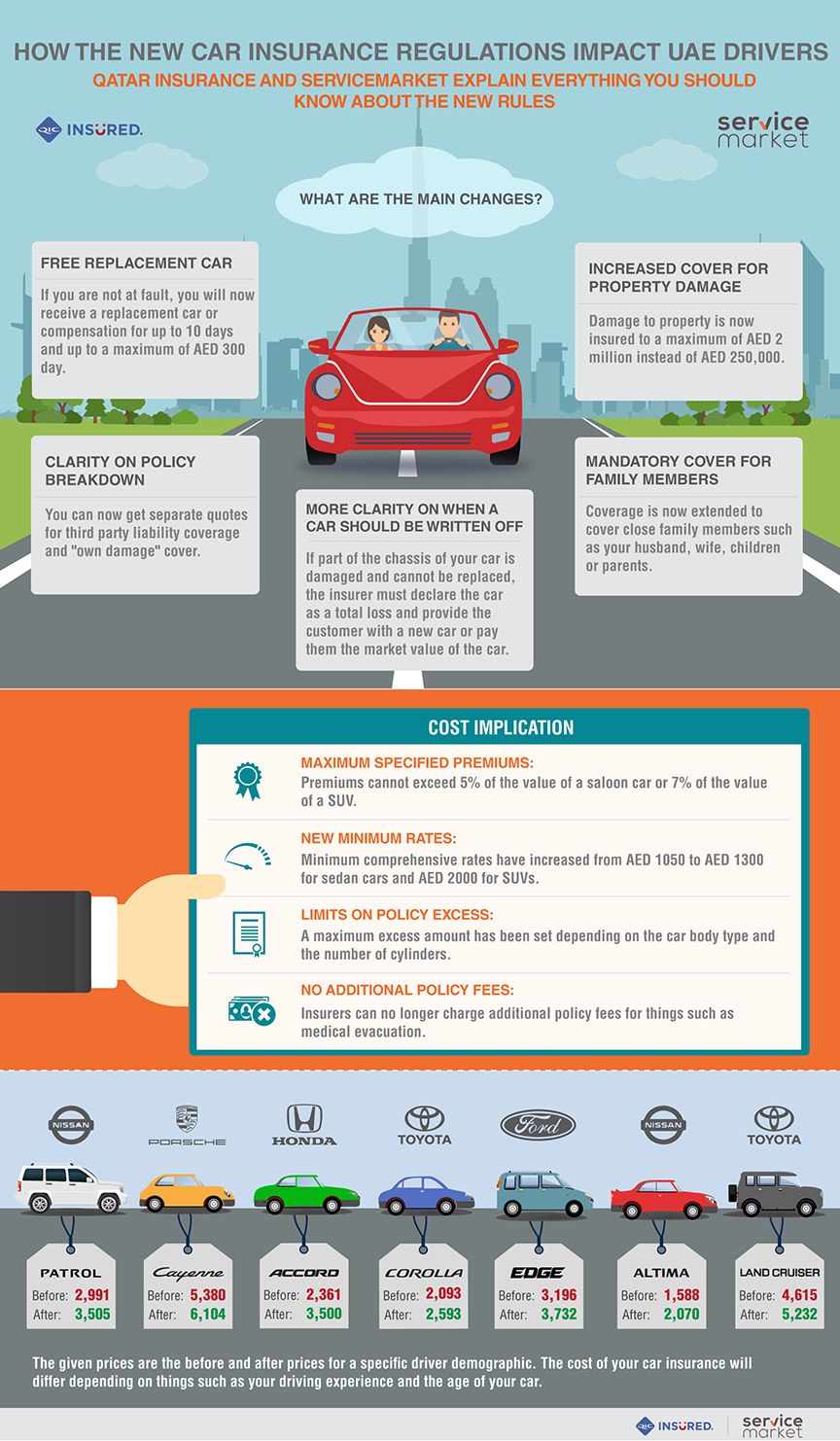

How much life insurance you need at every income level

How much life insurance you need at every income level Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. mouse click the following webpage may receive a small commission from our partners, but our reporting and recommendations are always independent and objective.

It's not easy to put a price on your life. There's a lot to consider to find out how much life insurance you need, including whether or not you have kids, a working spouse, a mortgage or other debt, and savings or investments.

If you have a shiny new car, you won't want to drive around with the evidence of a fender bender. So your auto insurance on a new car should include collision insurance as well. That way, your car will stay looking good longer. However, do you really care about that fender bender if you're driving an old beater? Since states only require liability insurance, and since collision is expensive, once your car gets to the "I don't care that much how it looks, just how it drives" stage, drop the collision and your auto insurance payment will go down dramatically.

If you are buying a brand new car, you should be aware that the car's warranty probably provides services such as towing or pays for a rental car while yours needs repairs. If you warranty covers these features, you should drop them on your insurance. When you warranty expires, do not forget to upgrade your insurance again.

In many states it is now illegal not to have car insurance. If you do get into a bad accident, your auto insurance will pay a percentage of any damages found to be your fault. Not having auto insurance could not only get you a ticket, it could also mean that you are left with huge bills.

You should always pay your car insurance on time. You will have to pay back your insurance company, perhaps with interest. If you cancel your policy without paying back your insurance company, this will show up on your credit score. When you apply for a new insurance, your bad history will show up.

In certain states your auto insurance premium will go down if you take a course to improve your driving skills. Find out more about this at your local secretary of state or department of motor vehicle. You should not trust any other resources to find an approved driving course.

Senior citizens can benefit from the discounts that are available from their car insurance company. These discounts typically kick in at age 55 or 60. You have to request that your insurer add these discounts onto your insurance, as they will not do it automatically. It could save you as much as ten percent on your premium.

Avoid auto insurance extremes. You can definitely be hurt by a lack of adequate insurance. Even more costly is being over-insured. Many people pay for coverage they can not ever possibly need. The result can be a huge drain on your budget. Evaluate your car insurance coverage and rates annually.

When shopping around for car insurance, ask the company if they give a discount for insuring multiple cars with them. If your spouse has insured their car with a different company, or if you have multiple vehicles yourself, it typically makes sense to have all household cars insured by the same company if it will cost less.

Review your insurance policy to make sure you are not being overcharged. Check for accurate annual mileage, verify your car's make, model and year. Double-check that the policy reflects your proper work commute, especially if it is very short. All of your policy's information is found on the Declaration page. Also verify that no additional coverage was added without your agreement, and that all promised discounts were applied.

If you are currently paying for comprehensive auto coverage, you may be able to drop it entirely to save additional money on your bill. This type of coverage includes non-accidental damages to the vehicle, such as flood damage or theft. If your vehicle has a very low book value, it is not likely to be stolen.

Be aware of different kinds of coverage that can be included in an auto insurance policy. Another type of coverage is property damage liability. This type of coverage covers any claims for property that is damaged by your car in an accident. Since this liability coverage protects the other party too, it is required in 47 states.

Purchase other insurance policies through one insurer to get your auto insurance cheaper. The more policies you have with one company, the cheaper all of your insurance premiums will be. Buying your home owner's insurance along with at least one other insurance policy will often land you a discount that is usually 10 percent lower on both policies.

Before you rent a car and accept car rental insurance, check out what kind of coverage you have with your regular insurance. This is a great way to save money and you may actually end up with better coverage.

Insurance coverage can be tricky. Learning who to go with and understanding what they offer is a challenge. Hopefully, the tips that have been offered here will help you in finding the coverage that works for you and learning how to deal with the issues that can come up after you sign on the dotted line.

|

|

What Everybody Demands To Find Out About Life Insurance Policy |

Content author-Conway Lomholt