The Value Of Structure As Well As Keeping Relationships As An Insurance Coverage Representative |

Content author-Daniels Geisler

Insurance coverage agents are associated with people's lives during milestone occasions as well as obstacles. Staying connected with them as well as developing connections need to be leading of mind.

Solid customer connections benefit both the representative and the customer. Completely satisfied clients come to be advocates, resulting in more plan revivals as well as increased sales chances. Web Site promote loyalty, which brings about much better client retention prices.

Customer support

Supplying outstanding customer support is important to building and keeping relationships as an insurance coverage agent. Compare Motorcycle Insurance Quotes consists of the way in which representatives connect with prospects prior to they end up being clients. If the initial communication feels too sales-oriented, it can switch off possible customers. It also consists of exactly how they deal with existing clients.

When insurance policy clients require assistance, such as when they have a claim to file, they want an agent that recognizes and also empathizes with their scenario. Empathy can restrain difficult circumstances and also make consumers seem like their needs are necessary to the business.

On top of that, insurance policy agents need to interact with present clients regularly to guarantee they're meeting their expectations as well as staying on top of any changes in their lives that may influence their insurance coverage. This can include birthday or holiday cards, e-mails to talk about any type of future turning points and also conferences to evaluate revivals.

Referrals

Obtaining recommendations is just one of the most effective ways to grow your organization as an insurance agent. By focusing on connecting with individuals in details industries, you can develop yourself as the go-to specialist as well as draw in a constant stream of clients.

When a client depends on their insurance coverage agent, they're more probable to stay faithful. Additionally, devoted customers will come to be supporters as well as refer new business to the representative. These recommendations can offset the price of acquiring new customers via traditional methods.

By providing a favorable consumer experience during the prospecting stage, agents can develop connections that will last a long time, also when various other insurers supply lower prices. This calls for developing a specified strategy for consumer interaction monitoring, putting custom offers right into transactional messages, and supplying customized experiences. Clients today expect this kind of interaction. Insurers who don't fulfill assumptions risk falling back. The bright side is that forward-thinking insurance coverage agents understand this and also have a competitive advantage.

Networking

Whether you're a social butterfly or a bit much more shy, networking is among the most effective means for insurance agents to grow their services. Even if your customers don't turn into a network of their very own, they're likely to mention you to loved ones that may need some insurance coverage.

Having a strong network of possible customers can make all the difference in your insurance coverage sales success. If you have a steady stream of real-time insurance leads, you can focus on structure partnerships with your existing customers and speeding up the process of getting them brand-new service.

Seek networking possibilities at insurance industry events or even at other sorts of local celebrations. As an example, attending a conference of your neighborhood Chamber of Business or Merchants Association can be a great location to fulfill fellow company owner and form connections that can assist you grow your insurance firm. The same goes with social media teams that are tailored towards specialists in business area.

Talking

The insurance coverage industry is competitive, and it takes a great deal of work to stay top of mind with customers. Creating a great customer experience from the get go will make your customers most likely to stick to you, even if another agent provides lower prices.

Being an insurance representative isn't almost marketing, it has to do with assisting people navigate a complex location and safeguard themselves against unforeseen financial loss. Helping them with their economic choices can likewise make them trust your advice, which converts right into repeat company and references.

A customer's relationship with an agent is tested when they have a claim. Average RV Insurance Cost 's when an agent can show they care, which can strengthen their partnership. Making use of personalized advertising to keep in touch is important since not all clients value the very same communications channel. Some could prefer e-mail e-newsletters, while others could wish to satisfy in-person or accessibility info online. It is very important for representatives to know their clients' choices so they can be readily available when the moment comes.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Comprehending The Various Kinds Of Insurance Plan As A Representative |

Article by-McLamb Schmitt

Insurance policy is an important investment that shields you as well as your possessions from monetary loss. Insurance policy agents as well as firms can help you understand the different sorts of insurance policies available to satisfy your requirements.

Agents define the numerous alternatives of insurer and also can finish insurance policy sales (bind protection) on your behalf. Independent representatives can deal with several insurance coverage providers, while hostage or exclusive insurance representatives stand for a solitary firm.

Captive Agents

If you're seeking to purchase a details sort of insurance policy, you can connect with captive agents that deal with one particular company. These representatives market just the policies provided by their employer, which makes them specialists in the kinds of coverage and discount rates offered.

They additionally have a strong partnership with their firm and are frequently required to fulfill sales allocations, which can impact their capability to help clients fairly. They can provide a variety of policies that fit your needs, however they will not be able to provide you with quotes from other insurer.

Captive agents commonly work with big-name insurers such as GEICO, State Farm and also Allstate. They can be a terrific resource for customers who want to support regional organizations as well as develop a long-lasting relationship with an agent that understands their area's distinct threats.

Independent Professionals

Independent representatives normally deal with several insurance companies to market their clients' plans. This allows them to supply a more tailored and customizable experience for their clients. They can also help them re-evaluate their coverage gradually and also suggest new policies based upon their requirements.

They can provide their clients a selection of policy options from several insurance service providers, which indicates they can offer side-by-side comparisons of pricing as well as coverage for them to choose from. They do this without any ulterior motive as well as can help them find the plan that actually fits their special needs.

The very best independent representatives know all the ins and outs of their numerous line of product as well as have the ability to address any concerns that come up for their clients. This is an invaluable solution and can conserve their clients time by managing all the information for them.

Life insurance policy

Life insurance plans normally pay money to marked recipients when the insured passes away. The recipients can be an individual or business. Individuals can purchase life insurance policies straight from a personal insurance company or with group life insurance provided by companies.

https://blogfreely.net/brain48love/the-ultimate-gu...e-a-successful-insurance-agent require a medical examination as part of the application procedure. Streamlined issue and also assured problems are available for those with illness that would certainly otherwise avoid them from obtaining a typical plan. Irreversible policies, such as whole life, include a cost savings part that collects tax-deferred as well as might have higher costs than term life policies.

Whether offering a pure defense plan or an extra intricate life insurance policy, it is essential for an agent to totally comprehend the attributes of each product and also just how they connect to the client's certain scenario. This helps them make educated suggestions and stay clear of overselling.

Medical insurance

Medical insurance is a system for funding medical expenses. It is normally financed with contributions or taxes as well as provided via private insurance providers. Highly recommended Reading can be purchased independently or through group plans, such as those provided via employers or expert, civic or religious teams. Some types of wellness coverage consist of indemnity plans, which repay insurance holders for specific expenses as much as a set limit, took care of treatment plans, such as HMOs and also PPOs, and also self-insured plans.

As an agent, it is essential to comprehend the different kinds of insurance policies in order to help your clients discover the best alternatives for their demands and spending plans. Nonetheless, mistakes can take place, and if a blunder on your component causes a client to lose money, mistakes and also noninclusions insurance can cover the cost of the match.

Long-Term Treatment Insurance Coverage

Long-lasting treatment insurance coverage aids individuals spend for house health aide services and nursing home treatment. It can also cover a part of the price for assisted living as well as other property treatment. Plans normally top just how much they'll pay per day and also over a person's life time. Some policies are standalone, while others combine coverage with various other insurance products, such as life insurance policy or annuities, and also are referred to as hybrid policies.

independent home insurance agents near me -lasting care insurance policies need clinical underwriting, which means the insurer asks for individual details as well as may request documents from a physician. A pre-existing condition could omit you from obtaining benefits or could trigger the plan to be terminated, professionals alert. Some plans provide a rising cost of living cyclist, which raises the day-to-day advantage quantity on a basic or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Recognizing The Claims Process |

Content by-Dalton Hejlesen

When an accident happens, it's natural to feel urged to seek payment from your insurance coverage supplier. However, sending a case can be challenging and tiresome, involving massive quantities of documentation.

Whether you're submitting an automobile, residence or responsibility case, the procedure complies with similar standards and also is broken down into 4 phases. Understanding these stages can help you file your insurance claim successfully.

1. You'll Get a Notification of Claim

As you collaborate with your insurance provider to file a claim, they will send you papers needing you to offer evidence of loss, consisting of buck quantities. They may also inquire from your medical professional or employer. This is an usual part of the insurance claims process, and it is usually done to validate your insurance policy covers what you are claiming for.

As soon as the evidence of loss is obtained, they will certainly verify it against your insurance coverage plan and also deductibles to ensure they are right. They will certainly after that send you a description of benefits that will detail the solutions got, amount paid by insurance policy and also staying debt.

Insurance companies can make the claims process a lot easier if they maintain their customers and workers satisfied by keeping a clear and constant experience. One method they can do this is by seeing to it their employees are able to without delay answer any questions or problems you have. You can also get in touch with your state insurance policy division to see if they have any issues against a certain firm or agent.

2. You'll Receive a Notice of Rejection

When an insurance claim is refuted, it can create tremendous aggravation, confusion and expenditure. It's important to keep up to day on your insurance provider's adjudication and also appeal procedures. This information should be available on their sites, as well as they must also supply it in paper copy when you register for new protection with them.

When you get a notice of rejection, request for the particular factor in composing. This will certainly permit you to contrast it to your understanding of the insurance policy terms.

Constantly document your follow-up calls as well as meetings with your insurance provider. This can aid you in future actions such as taking an interest a greater degree or submitting a claim. Videotape the day, time and also name of the rep with whom you talk. This will certainly save you important time when you require to reference those documents in the future. Additionally, RV Insurance will allow you to track who has been communicating with you throughout this process.

3. You'll Receive a Notice of Repayment

Once the insurer has actually validated your case, they will send settlement to the doctor for solutions made. This can take a few days to a number of weeks. Once the insurance provider releases a settlement, you will certainly get an Explanation of Benefits (EOB) statement that information just how much the service provider billed and also how much insurance coverage covers. The service provider will certainly after that bill patients and companies for the rest, minus coinsurance.

If you have any type of concerns with your claim, make certain to record every interaction with the insurer. Keeping a document of everything that happens with your claim can help quicken the process.

It's additionally smart to keep invoices for extra expenditures that you may be repaid for, particularly if your house was harmed in a storm or fire. Having a clear and documented claims process can additionally help insurer boost client retention by offering a far better experience. It can additionally help them identify locations of their procedure that could be boosted.

4. You'll Get a Notice of Last Negotiation

Insurance companies manage numerous claims daily, so they have systems in position to track each action of the process for all the policyholders. https://www.taipeitimes.com/News/biz/archives/2023/07/18/2003803333 allows them to maintain your initial case and also any kind of charms you could make organized in a way that is very easy for them to handle. visit website for you to mirror their procedure by maintaining every one of your paperwork in one location that is easy to gain access to as well as testimonial.

If you determine to submit an insurance provider allure, collect the evidence that supports your instance. This can consist of authorities reports, eyewitness information, pictures as well as medical reports.

Remember that your insurance provider is a for-profit business and their objective is to decrease the amount they award you or pay in a settlement. This is since any awards they make lower their earnings stream from the costs you pay. They could also see this as a reason to elevate your future rates.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Unlocking The Keys To Closing Offers As An Insurance Representative |

Article created by-Welsh Bojesen

Insurance coverage agents are certified experts that sell life, home mortgage protection and disability insurance. They need to be able to locate, attract and preserve clients. They must additionally have a mutual understanding of policy insurance coverage and terms, in addition to the ability to work out.

Some salesmen use timeless closing techniques, which are manuscripts meant to encourage potential customers to get. These strategies can irritate some buyers, nevertheless.

1. Know Your Product

As an insurance agent, you have an unique selling proposition. You can aid clients kind through complicated details as well as make decisions that will safeguard their households in the event of an emergency or catastrophe.

To do this, you need to know your items well and also understand just how they collaborate. This will certainly help you develop depend on with your customers and also resolve their objections.

There are many shutting techniques that you can use to close life insurance policy sales. One is the assumptive close, where you think that your possibility intends to buy. This can be effective with a client that prepares to dedicate, however it can be repulsive for those that are still making a decision.

2. Know Your Possibility

Providing value to your customers and demonstrating that you comprehend their needs is the very best means to close a bargain. Consumers are most likely to trust agents that make the initiative to find out about their concerns as well as use a remedy that fixes them.

It's additionally essential to recognize your leads' existing plans. With Cover Link, insurance verification is just a click away and also you can swiftly resource your client's declaration pages, claim records and also vehicle info. https://zenwriting.net/christin9598silvana/the-fun...nsurance-policy-representative can assist you certify leads quicker, reduce sales cycles as well as enhance customer partnerships. Try it today!

3. Know Yourself

Insurance representatives have 2 ways to market themselves: their insurance provider or themselves. One of the most efficient way to market yourself is to be yourself.

Telling tales of just how you've helped clients is a terrific way to build count on and keep prospects psychologically involved. It likewise aids to set you besides the stereotypical sales representative that people despise.

Developing a network of buddies and also associates to resort to for guidance can improve your insurance organization and also provide references for new clients. This will certainly offer you the possibility to flaunt your sector knowledge and experience while constructing an ever-expanding publication of business. independent home insurance agents near me can lead to an uncapped earning capacity.

4. Know Your Competition

When you understand your competitors, it ends up being much easier to locate means to differentiate yourself as well as win company. This could be a certain insurance coverage item, an unique service that you supply, or perhaps your individuality.

Asking clients why they chose to work with you over your rival can assist you figure out what sets you apart. Their answers may surprise you-- as well as they might not have anything to do with pricing.

Establishing connections with your leads and also clients is a substantial part of insurance advertising. This can be done through social media, e-mail, and even a public presentation at an event. This will certainly develop count on and also establish you up for more chances, like cross-selling or up-selling.

5. Know Yourself as an Expert

As an insurance policy agent, you'll work very closely with clients to determine their threat as well as construct a defense strategy that meets their demands. Telling stories, explaining the value of a plan, as well as asking concerns are all means to aid your customers locate their best protection.

http://jarrod0853freddie.xtgem.com/__xt_blog/__xtb...es?__xtblog_block_id=1#xt_blog pick to work for a solitary company (called captive agents) while others companion with numerous companies (known as independent representatives). No matter your preference, you'll take advantage of connecting with other insurance coverage professionals. Their understanding and experience can offer indispensable understanding and also assistance for your profession. Additionally, getting in touch with fellow agents can enhance your customer base as well as referrals.

6. Know Yourself as an Individual

If you recognize yourself as an individual, you can communicate your expertise and value to consumers in manner ins which really feel authentic. A customer who believes in you is most likely to trust you and also end up being a repeat client.

Closing a handle the insurance coverage organization is far more than simply a purchase. You are selling safety and peace of mind to people that have one-of-a-kind requirements.

Spend some time to think about what makes you special as a person. You can make use of journaling or meaningful contacting explore your rate of interests, temperament, and worths.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Comprehending The Different Kinds Of Insurance Plan As An Agent |

Content by-Kearney Dorsey

Insurance is an important investment that secures you and your possessions from financial loss. Insurance coverage agents as well as agencies can help you understand the different types of insurance policies readily available to satisfy your needs.

Agents define the different choices of insurance provider and also can complete insurance coverage sales (bind insurance coverage) in your place. Independent representatives can collaborate with several insurance policy carriers, while hostage or special insurance coverage agents represent a solitary company.

Restricted Agents

If you're looking to acquire a particular type of insurance coverage, you can connect with restricted representatives that collaborate with one certain carrier. These representatives sell just the plans offered by their employer, that makes them experts in the types of protection as well as discount rates provided.

They additionally have a solid partnership with their business and are usually needed to fulfill sales allocations, which can affect their capacity to assist clients objectively. https://www.detroitnews.com/story/opinion/2023/07/...e-more-protection/70419622007/ can provide a wide variety of plans that fit your requirements, however they will not have the ability to present you with quotes from other insurance provider.

Captive representatives generally collaborate with prominent insurance firms such as GEICO, State Farm and also Allstate. They can be a terrific source for consumers who wish to sustain local organizations as well as develop a long-lasting connection with an agent that understands their area's distinct risks.

Independent Agents

Independent representatives normally deal with several insurance provider to sell their clients' policies. https://blogfreely.net/jonathon6derrick/5-necessar...representative-ought-to-master enables them to supply a more personalized as well as customizable experience for their clients. They can likewise help them re-evaluate their insurance coverage over time and also suggest new policies based on their requirements.

They can offer their clients a selection of policy alternatives from multiple insurance service providers, which means they can offer side-by-side contrasts of prices and also coverage for them to pick from. They do this with no ulterior motive as well as can help them find the policy that truly fits their distinct requirements.

The best independent agents recognize all the ins and outs of their various line of product as well as are able to respond to any inquiries that show up for their clients. This is a very useful service and can save their clients time by dealing with all the details for them.

Life Insurance

Life insurance plans commonly pay cash to assigned beneficiaries when the insured passes away. The beneficiaries can be an individual or service. People can acquire life insurance policies straight from a private insurance company or with group life insurance offered by employers.

Many life insurance policies need a medical examination as part of the application process. Streamlined problem and guaranteed concerns are offered for those with health problems that would or else avoid them from obtaining a traditional plan. Long-term policies, such as entire life, include a savings component that collects tax-deferred and may have higher costs than term life plans.

Whether offering a pure protection strategy or an extra complicated life insurance policy plan, it is very important for an agent to completely understand the attributes of each item and also how they relate to the customer's certain situation. This helps them make enlightened suggestions and also prevent overselling.

Medical insurance

Medical insurance is a system for funding medical expenditures. https://writeablog.net/kirk782gwenn/5-essential-sk...nsurance-agent-ought-to-master is typically funded with payments or taxes and provided through personal insurers. Personal medical insurance can be acquired independently or via team policies, such as those used through employers or specialist, public or spiritual groups. Some types of wellness coverage include indemnity plans, which repay policyholders for certain prices up to an established restriction, took care of care plans, such as HMOs and PPOs, and also self-insured plans.

As an agent, it is very important to understand the various types of insurance policies in order to aid your clients discover the very best choices for their requirements and budget plans. Nonetheless, mistakes can take place, and if an error on your component causes a client to lose cash, errors and omissions insurance policy can cover the cost of the match.

Long-Term Care Insurance Coverage

Long-term care insurance aids people spend for home wellness aide services as well as retirement home treatment. It can additionally cover a part of the expense for assisted living and also various other property care. Policies typically cover how much they'll pay daily and also over an individual's life time. Some policies are standalone, while others integrate coverage with various other insurance products, such as life insurance policy or annuities, and also are known as hybrid plans.

Several individual lasting care insurance coverage need medical underwriting, which indicates the insurance company requests personal information and might request records from a medical professional. A pre-existing condition could exclude you from getting advantages or might cause the plan to be terminated, experts advise. Some plans provide a rising cost of living cyclist, which raises the daily benefit quantity on a simple or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Value Of Structure As Well As Keeping Relationships As An Insurance Coverage Agent |

Authored by-Daniels Simonsen

Insurance representatives are associated with individuals's lives throughout landmark events as well as challenges. Talking with them and constructing partnerships must be top of mind.

Solid client connections profit both the agent and the consumer. Completely satisfied clients come to be advocates, resulting in more policy renewals and also boosted sales opportunities. Client partnerships also promote loyalty, which brings about much better customer retention rates.

Customer care

Giving superb client service is important to building and keeping connections as an insurance coverage agent. This consists of the method which representatives communicate with potential customers before they come to be clients. If the first communication really feels as well sales-oriented, it can switch off prospective consumers. It additionally consists of exactly how they treat existing customers.

When insurance coverage clients need support, such as when they have a claim to file, they want a rep that comprehends as well as feels sorry for their scenario. Empathy can pacify demanding situations and also make consumers seem like their requirements are necessary to the company.

On top of that, insurance policy agents need to stay connected with existing customers regularly to guarantee they're meeting their assumptions and staying on top of any changes in their lives that may influence their protection. https://writeablog.net/rene37leonardo/the-duty-of-...rance-representative-practices can include birthday or vacation cards, emails to go over any kind of upcoming turning points and also conferences to assess revivals.

References

Getting referrals is among the very best methods to expand your organization as an insurance policy representative. By focusing on connecting with individuals in certain sectors, you can establish yourself as the go-to specialist and also attract a stable stream of customers.

When a client trust funds their insurance coverage representative, they're more probable to stay loyal. Additionally, faithful customers will certainly come to be advocates and refer new service to the representative. These recommendations can offset the expense of getting brand-new clients with typical techniques.

By offering a favorable consumer experience throughout the prospecting phase, representatives can construct partnerships that will last a long period of time, even when various other insurance providers offer reduced costs. This calls for producing a specified approach for customer communication management, putting custom-made uses into transactional messages, and also supplying tailored experiences. Consumers today anticipate this sort of interaction. link web page who don't meet assumptions take the chance of falling behind. Fortunately is that forward-thinking insurance policy representatives recognize this as well as have a competitive advantage.

Networking

Whether you're a social butterfly or a little bit much more shy, networking is just one of the best methods for insurance policy representatives to grow their companies. Even if your customers do not develop into a network of their very own, they're likely to mention you to family and friends that may need some insurance coverage.

Having a strong network of possible customers can make all the distinction in your insurance sales success. If you have a consistent stream of real-time insurance coverage leads, you can concentrate on structure partnerships with your present customers and quickening the procedure of getting them new company.

Search for networking opportunities at insurance coverage market occasions or even at various other types of neighborhood gatherings. For example, going to a conference of your neighborhood Chamber of Business or Merchants Association can be a great area to meet fellow local business owner and form connections that can assist you grow your insurance policy agency. Learn Additional Here goes for social media teams that are tailored towards specialists in the business community.

Corresponding

The insurance sector is competitive, as well as it takes a great deal of work to remain top of mind with consumers. Producing a fantastic consumer experience initially will make your customers more probable to stick with you, even if an additional representative provides lower prices.

Being an insurance coverage agent isn't just about selling, it's about helping individuals navigate an intricate area and safeguard themselves against unforeseen financial loss. Helping them with their monetary decisions can additionally make them trust your guidance, and that converts into repeat business as well as references.

A client's partnership with a representative is tested when they have a claim. That's when a representative can reveal they care, which can reinforce their connection. Utilizing individualized advertising and marketing to correspond is necessary since not all clients value the very same communications channel. Some might choose e-mail newsletters, while others could want to meet in-person or accessibility details online. It is necessary for representatives to understand their clients' preferences so they can be readily available when the time comes.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Crucial Guide To Selecting The Right Insurance Provider For Your Needs |

Article created by-Slater Stern

Many individuals focus solely on price or read on-line evaluations when picking an insurance provider. Nevertheless, there are other essential elements to take into consideration.

For instance, if you are buying from a broker, take a look at their client contentment positions or scores from agencies like AM Ideal. These scores can give you a common sense of monetary strength, claims-paying background and other variables.

Cost

Picking insurance coverage is not just regarding affordability, but also regarding ensuring the insurance coverage you select suffices to safeguard your economic future. Therefore, you should very carefully balance price with protection, and also it is important to review exactly how your choices will influence your long-term monetary objectives and demands. If you are tempted to read on the internet reviews, take into consideration reviewing them with a company associate, as they may be able to give responses that is helpful in figuring out whether the testimonial is precise or not.

Insurance coverage

Insurance policy is a way to swimming pool threat by paying for cases. https://zenwriting.net/estrella868curt/exactly-how...stomers-as-an-insurance-policy 's a gigantic nest egg that pays for catastrophes we can't manage, like hurricanes, wildfires, storms, as well as kitchen area fires, and day-to-day incidents, such as fender benders as well as cars and truck accidents.

Assessing your insurance needs as well as picking proper protection is a complicated procedure. Factors to consider consist of price, coverage limits, deductibles, policy conditions, as well as the reputation as well as financial stability of insurance coverage service providers.

Put in the time to compare quotes from several insurance companies, thinking about discounts supplied for bundling policies or maintaining a clean driving record. please click the following article 's also important to assess the lasting implications of your coverage choices. Evaluate just how they will certainly protect your properties, income, and also enjoyed ones throughout the years. Ultimately, it's not nearly cost-- it has to do with safeguarding what issues most. This Ultimate Overview will assist you choose the best insurance policy carrier for your one-of-a-kind demands. The very best coverage will provide you with satisfaction and guard your monetary future.

Licensing

Prior to a person can begin selling insurance coverage, they require to get certified. This is a procedure that varies by state, yet typically consists of finishing pre-license education and learning training courses as well as passing the state insurance policy exam. It also calls for submitting fingerprints and also undertaking a background check.

The sort of license a person needs depends on the kinds of insurance coverage they prepare to sell. There are typically https://money.com/best-motorcycle-insurance/ of insurance licenses: property and casualty, which focuses on insurance for automobiles and homes, as well as life and also health and wellness, which focuses on covering people and also families in the event of a mishap or fatality.

Firms that supply several lines of insurance must have a company license, while individual agents can acquire an individual permit for the lines they plan to sell. The licensing procedure is managed at the state level, however many states now utilize 3rd parties to aid overview and administer certificate applications in order to advertise effectiveness.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Value Of Structure And Also Preserving Relationships As An Insurance Policy Agent |

Content writer-Munk Ellison

Insurance agents are involved in people's lives throughout turning point events as well as challenges. Communicating with them as well as constructing relationships ought to be top of mind.

Strong client partnerships benefit both the agent as well as the client. Completely satisfied customers become advocates, causing even more plan revivals and also raised sales opportunities. Client partnerships additionally promote commitment, which results in far better client retention rates.

Client service

Offering excellent customer service is crucial to structure and also maintaining partnerships as an insurance agent. This includes the way in which representatives interact with leads before they end up being clients. If the preliminary interaction feels also sales-oriented, it might shut off possible customers. It likewise includes just how they deal with existing customers.

When insurance coverage clients need support, such as when they have a claim to submit, they want an agent that comprehends as well as feels sorry for their situation. Compassion can restrain demanding circumstances and make clients seem like their requirements are important to the firm.

On top of that, insurance coverage representatives must keep in touch with current customers regularly to guarantee they're meeting their assumptions and also keeping up with any type of changes in their lives that may impact their protection. This can include birthday celebration or vacation cards, emails to go over any kind of future milestones and meetings to assess renewals.

Referrals

Obtaining references is one of the best ways to grow your company as an insurance coverage representative. By focusing on connecting with people in particular sectors, you can establish yourself as the go-to professional and draw in a constant stream of customers.

When a client trusts their insurance policy representative, they're more probable to continue to be loyal. On top of that, faithful customers will come to be advocates as well as refer new business to the agent. These referrals can balance out the price of acquiring brand-new consumers via standard methods.

By supplying a positive customer experience throughout the prospecting stage, agents can build connections that will certainly last a long period of time, even when various other insurance companies supply reduced prices. This needs developing a specified method for customer interaction monitoring, putting customized provides into transactional messages, and also delivering individualized experiences. Customers today anticipate this type of interaction. Insurance providers who don't meet assumptions risk falling back. The good news is that forward-thinking insurance representatives understand this and have a competitive advantage.

Networking

Whether you're a social butterfly or a little bit a lot more shy, networking is one of the very best methods for insurance policy agents to expand their companies. Even if your clients do not develop into a network of their own, they're likely to discuss you to friends and family that might need some coverage.

Having a strong network of possible clients can make all the distinction in your insurance sales success. If you have a stable stream of real-time insurance coverage leads, you can concentrate on building relationships with your current customers and also quickening the process of obtaining them new business.

Try to find networking opportunities at insurance coverage industry occasions or perhaps at other kinds of regional events. For example, going to a conference of your local Chamber of Commerce or Merchants Organization can be a fantastic place to fulfill fellow local business owner as well as form connections that can assist you expand your insurance coverage company. Suggested Site goes with social networks teams that are geared towards professionals in the business neighborhood.

Corresponding

The insurance coverage sector is affordable, and it takes a lot of job to stay top of mind with customers. Creating check this site out from the start will certainly make your consumers more likely to stick to you, even if an additional agent provides lower rates.

Being an insurance coverage agent isn't nearly marketing, it's about aiding people navigate a complicated area and also protect themselves versus unexpected economic loss. Helping https://blogfreely.net/leonore09damien/5-necessary...e-coverage-agent-should-master with their financial choices can additionally make them trust your guidance, which translates right into repeat organization as well as referrals.

A customer's relationship with an agent is put to the test when they have a claim. That's when a representative can reveal they care, which can strengthen their partnership. Using tailored marketing to keep in touch is very important since not all clients value the exact same communications channel. Some may favor email newsletters, while others could intend to fulfill in-person or accessibility info online. It's important for representatives to recognize their customers' preferences so they can be readily available when the moment comes.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Ultimate Overview To Ending Up Being A Successful Insurance Coverage Representative |

Content written by-Calhoun McCulloch

New insurance agents commonly have unrealistic expectations. They see experienced agents making "X" quantity of money each year as well as expect to make that today, however achieving success takes time as well as commitment.

Remaining on top of brand-new sector techniques and also broadening your expertise outside of the insurance policy area will certainly aid you offer customized suggestions to your insureds.

1. Develop a Strong Brand Name

A strong brand name is crucial when it concerns bring in brand-new customers and also preserving existing ones. Developing an online visibility is one way to do this. This might include releasing helpful blog sites, developing video clip content, and sending out regular e-mails with beneficial threat management methods.

Insurance policy representatives likewise require to have outstanding customer care skills. Customers value timely reactions to their inquiries, e-mails, and also telephone call.

Creating a strong client base requires time and also effort. Purchasing advertising and marketing strategies can assist you accomplish your objectives much faster.

2. Create a Sales Funnel

Sales funnels are marketing devices developed to record the biggest pool of prospects and after that slim them down into a smaller sized group of faithful customers. They work best when they are developed with certain goals for defined target audiences as well as are implemented utilizing engaging advertising content.

Read Home Page is generally broken down into four stages-- Awareness, Passion, Choice as well as Action. Each phase stands for a different way of thinking that calls for a distinct messaging method. In the final stage, your possibility comes to be a client by buying or picking not to get.

3. Target Your Ideal Customers

Usually, potential insurance coverage customers will run a search prior to they call an agent. It is important for agents to be top of mind for these prospects, which can be done by composing interesting blogs or applying e-mail advertising and marketing.

Insurance is a complicated sector, as well as potential consumers will need an alert representative that can clarify items in a clear as well as succinct fashion. In addition, agents that exceed and past for their clients will get referrals and develop a network of trusted links.

Coming to be a successful insurance coverage agent needs hard work and also perseverance. Nevertheless, by remaining present on insurance coverage advertising trends as well as concentrating on customer service, representatives can begin to see success in their organization.

4. Establish a Structured Insurance Coverage Sales Cycle

Insurance coverage is an intricate business as well as you should have a solid job ethic, good customer care as well as an ability to find out rapidly. On top of that, you need to have a solid understanding on your insurance policy products and also service providers. Taking sales training courses such as Sandler, Opposition or Craig Wiggins is an exceptional means to gain the essential knowledge.

Honesty is also type in insurance, as misleading representatives do not typically last lengthy in the industry. It's additionally essential to nurture your leads, so make sure that you reply to queries and also calls quickly.

5. Support Your Leads

Discovering clients can be tough, especially for a brand-new insurance policy agent. Nonetheless, there are a few methods that can aid you nurture your leads as well as expand your business.

One strategy is to focus on a particular niche within the insurance coverage sector. For instance, you may select to offer life or business insurance policy. After https://www.nytimes.com/2023/05/08/health/primary-care-doctors-consolidation.html , come to be a specialist in these details areas to attract even more consumers.

Another method to produce leads is by networking with other experts. This can include loan providers as well as mortgage brokers, who usually have links with prospective clients.

Cold-calling may have a negative track record, however it can still be an effective list building device for lots of representatives. By utilizing efficient scripts and also speaking factors, you can have an efficient discussion with possible leads.

6. Construct a Strong Network

Insurance coverage representatives should have the ability to connect with individuals on an individual degree and also create connections that last. A strong network assists insurance policy representatives obtain business when times are difficult, and also it also enables them to offer a greater degree of service to their customers.

Developing a durable profile of insurance items can help an agent expand their income and also offer the needs of many insureds. In addition, providing monetary services like budgeting or tax obligation preparation can give customers an additional factor to choose an agent as opposed to their competitors.

7. Be Always Understanding

Insurance policy agents must constantly learn about the items as well as providers they sell. This requires a significant amount of motivation and grit to be effective.

It's additionally vital to keep up to day on the insurance market, sales methods and also state-specific guidelines. Taking continuing education and learning training courses and also attending workshops are great methods to sharpen your skills and stay on top of the most up to date growths.

Ultimately, customer care is important for insurance policy agents. Being punctual in replying to emails, phone calls or text messages is a terrific method to build trust as well as loyalty with clients.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Function Of Technology In Transforming Insurance Coverage Representative Practices |

Suggested Site create by-Hinrichsen Morris

Insurer are innovating, backed by technological advancements. These cutting-edge campaigns are categorized right into 4 rationales, ranging from Adaption to Expansion, Reaction and also Aggression.

https://www.nbcbayarea.com/news/california/insuran...ifornia-wildfire-risk/3244940/ can aid to automate tasks and improve the cases experience. It can likewise enhance representative productivity by allowing them to spend even more time speaking with consumers and also determining brand-new chances.

Digital Makeover

When Achmea's representatives were taking care of extraordinary telephone call volume during the pandemic, they understood it was time to upgrade their communications remedy. They had the ability to boost their client experience and also performance by giving them with the devices to communicate over video clip as well as chat. Furthermore, they acquired valuable understandings right into their calls by immediately catching and also attaching call recordings to their consumer records. This conserved them hrs a month that they made use of to invest downloading their calls.

Insurance policy companies that wish to compete in the modern marketplace needs to accept digital makeover. This consists of not just digitizing old documents, however likewise carrying out brand-new technology that will certainly allow them to meet current and also future customers' assumptions for customization as well as performance. As an example, insurance firms should have the ability to react to customer needs in real-time over real-time conversation or virtual aide as well as give accessibility to info with APIs. They ought to also have the ability to simplify back-end procedures and also mitigate threats by using innovative data analytics.

Automation

Numerous people enroll in a multitude of insurance plan to protect their future. However, a multitude of insurance policy procedures are high-volume and also labor-intensive making them hard to manage with the minimal workforce. Making use of automation in insurance coverage, companies can present performances and lower expenses while improving client experience.

A technology-driven policy administration system (PAS) is a crucial tool to automate core insurance coverage process operations. It allows for real-time monitoring of governing conformity via inner audits as well as helps insurance firms reduce danger in a prompt manner.

In addition, intelligent insurance automation options that incorporate RPA as well as AI make it possible for organizations to connect systems without coding, process data rapidly, connect networks, standardize info, as well as enhance paperwork to fulfill customer service requirements. This eliminates the hands-on mistakes associated with repeated and recurring jobs as well as frees up employees to supply superior solution to their clientele. Moreover, it additionally helps them to deliver customized and also top-quality information profiles. This subsequently, decreases clientele loss and rise earnings for insurance provider.

Client Experience

The COVID-19 pandemic pushed insurance companies to rapidly adopt more durable electronic firm systems. Insurance providers with seamless virtual channels made a wider consumer base and also increased trust fund. Establishing these online capacities will certainly continue to be an essential insurance coverage fad and is made possible by technology.

Advanced innovations like expert system (AI) are enabling insurance companies to supply more personalized customer experiences. As an example, AI-driven chatbots can connect with customers at any time of the day or evening as well as address basic concerns. They also allow insurance provider to cross-sell and up-sell products, accelerate cases handling, and supply a series of other services.

Various other technologies like machine learning can help automate underwriting as well as pricing. These technologies can collect information from several resources, including applicant-provided information, to assess risk and also develop more affordable and tailored costs. They can additionally reduce the quantity of manual work required to process applications as well as underwriting documents. This frees up representatives to focus on suggesting clients and also establishing much deeper partnerships.

Information Analytics

Information analytics is a means of transforming insurance representatives' techniques by offering top-level data and information. It allows them to make data-driven decisions in every branch of their organization. This increases their responsiveness as well as effectiveness, while also creating new chances.

For example, by utilizing intelligent monitoring systems that provide workable insights based on data assessment, insurance companies can determine essential patterns as well as market chances to establish more personalized policy offerings for their clients. This can likewise allow self-servicing of plans for their clients and enhance customer retention.

Using anticipating analytics, insurance companies can use client behavior and exterior data such as driving habits and also neighborhood safety to identify danger and also collection costs prices for their customers. This prevents overcharging low-risk customers and also guarantees fair rates for every person. It also assists identify scams and improve underwriting outcomes. This can save insurer a great deal of cash over time.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

5 Crucial Abilities Every Insurance Policy Representative Should Master |

Article by-Boswell Nilsson

Insurance agents require to be able to interact plainly with consumers. This suggests using a professional vocabulary yet still being conversational and also approachable.

over here !5e0!3m2!1sen!2sph!4v1688812113899!5m2!1sen!2sph" width="600" height="450" style="border:0;" allowfullscreen="" loading="lazy" referrerpolicy="no-referrer-when-downgrade">

They likewise need to have a mutual understanding of the items they are offering. This is since they will require to be able to describe the benefits of each item to their customers.

1. Interaction

Having solid communication skills is important for anyone that intends to become an insurance representative. A good agent needs to be able to explain challenging policies clearly and also conveniently to clients. In addition, they must have the ability to pay attention to clients to recognize their needs and also discover the most effective plan for them.

It's likewise essential for insurance coverage representatives to be able to interact with their experts properly. They must utilize clear language and stay clear of making use of technological terms that could confuse underwriters.

Additionally, agents need to consider improving communication with their customers by utilizing a client portal. mouse click the next page can help reduce the time that agents spend printing out files, making payment suggestion calls and also rekeying data. This frees up their time to focus on building relationships and client commitment.

2. Customer Service

Customer care abilities are a must for licensed insurance policy representatives. They make certain that customers receive the prompt as well as empathetic support they should have.

These abilities allow clients to really feel listened to and also comprehended, which goes a long way in creating a favorable experience. Apart from responding to inquiries, e-mails and also hires a timely way, customers additionally expect a representative to understand their one-of-a-kind circumstance and also offer them with the best details.

Insurance coverage representatives that have excellent customer service abilities can connect with their customers on a much deeper level and also help them see the economic reality of their scenario. They are also capable of routing tickets to the ideal group as quickly as they become immediate, assisting consumers to reach a resolution quicker. This is vital, as it boosts client complete satisfaction as well as loyalty.

3. Settlement

Insurance coverage representatives work with clients to negotiate plans. This needs strong customer service skills, and a favorable technique to analytical. This is particularly essential when going over a plan as well as discussing costs, as cash stimulates emotion in many people and also logical thought has a tendency to fall apart.

Throughout the meeting procedure, show your capacity to build relationship by smiling at your job interviewer and presenting open body movement. This will certainly help you convey your self-confidence in the function.

Find out exactly how to discuss efficiently by experimenting an occupation services consultant or a good friend and role-playing a number of times. It is likewise important to have a practical sight of the area of possible arrangement, which is specified as the range where you and your negotiation partner can find common ground on a specific concern.

4. Sales

Insurance representatives need to have solid sales abilities to safeguard as well as keep a consistent flow of service. They need to additionally have the ability to take initiative and also seek out brand-new clients, such as by cold-calling local business owner or checking out business to present themselves.

Great sales skills entail the capacity to evaluate customer needs and also suggest appropriate insurance policies. It is necessary for insurance policy representatives to put the client's demands ahead of their very own, not treat them like a cash machine.

This requires a level of compassion with customers, which can be difficult in some scenarios. Ultimately, great sales skills involve a willingness to learn more about new items and also various other aspects of the market on an ongoing basis. Keeping existing with the most up to date insurance coverage news as well as trends is important to maintaining competitiveness out there.

5. Company

Insurance coverage agents need to be well-organized in their job. This is because they need to have the ability to handle quantities of info and make quick computations. They ought to likewise have the ability to track their clients as well as stay in touch with them.

Insurance professionals should always make every effort to be experienced in their area as well as also beyond it. This will help them recognize potential customers better as well as advise the ideal policies for their demands.

Soft skills training is a fantastic way for insurance policy agents to build their customer-facing abilities. In fact, a recent research study discovered that business that purchase soft skills training see an average ROI of 256%. This is more than dual what they would certainly obtain from buying technology or product training.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Vehicle Insurance Guidance That Is Proven Useful |

Article writer-Hoffmann English

Having an automobile and taking proper care of it is a part of becoming a responsible adult. So whether you're a teenager who's just starting to drive or an old pro behind the wheel, the one thing you need more than anything is a great insurance package. Here are some good insurance tips you can use.

Look around on the web for the best deal in auto insurance. Most companies now offer a quote system online so that you don't have to spend valuable time on the phone or in an office, just to find out how much money it will cost you. Get a few new quotes each year to make sure you are getting the best possible price.

When considering what options you want to include with your auto insurance, be sure to see if towing insurance is something that you really need. Oftentimes towing is already included in certain types of accidents. If course of construction insurance belong to certain auto assistance agencies, they may already provide this coverage to you. Most often, it is not financially beneficial to include this extra.

Never inflate your vehicle's value when you sign up for insurance. Doing this only costs you more money, in the form of higher premiums. In the case that you would need a replacement vehicle, the insurance company would only use their value for your original car, not what you initially quoted them.

Having multiple drivers on one insurance policy is a good way to save money, but having multiple drivers of one car is an even better way. Instead of opting for multiple automobiles, have your family make do with one car. Over the life of your policy, you can save hundreds of dollars by driving the same vehicle.

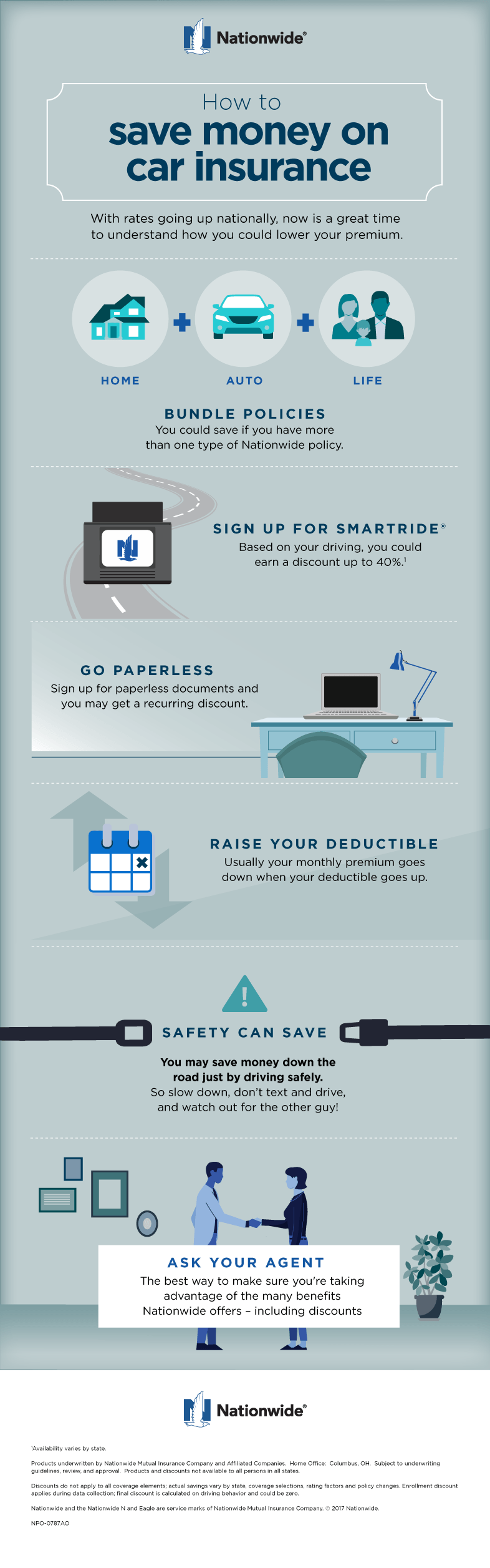

To save money on car insurance, consider setting a higher deductible of what you would pay out of pocket, in the event of an accident. The insurance company prices policies based on what they expect to pay out if you make a claim and reducing that amount, translates to lower premiums for you.

Consider purchasing your auto insurance policy online. Many companies offer a discount for online purchases. The companies do this because it costs them less to use an automated system to begin your policy. In most cases, you will see a five to 10 percent reduction in your quote for the policy.

Have an alarm, immobilizer or tracker installed in your car. Reducing the risk of theft saves money for everyone. Having an alarm, immobilizer, or tracker installed in your car can save you some grief and a bit of money on your car insurance policy. Check to make sure that your provider offers discounts for having it installed first.

In order to get the very best price on your auto insurance policy, avoid making monthly payments on the policy. Instead request to divide your premium into two payments, six months apart. In this way, you will be able to avoid monthly processing fees assessed by numerous companies. Even if your insurer requires monthly installments, try to set up automatic payments in order to avoid any additional mailing or billing charges that may otherwise accrue.

If your annual premium corresponds to ten percent of your car's blue book value, you should drop your collision coverage. Coverage is limited to a car's blue book value: if your car is too old, you are paying a lot of money for an insurance that will not pay you much when you file a claim.

When looking into auto insurance, you need to think about how much insurance you will need. Each state has a minimum amount of coverage each driver needs to maintain, so be sure to use that as a starting point. If your car is worth more, then you need more insurance. Similarly, if your car is a beater, chances are your insurance costs will be significantly lower.

Use the internet to get your car insurance plan. The internet is incredibly useful. Not only will you not have to deal with the hassle of going to the insurance provider yourself, you will also get a better deal if you shop for it online. Shopping online saves the provider money. Consequently, you save money as well.

Bundle all of your insurance needs to save money. When you are looking for cheaper auto insurance, consider asking the company that carries your home-owner policy, or renter's insurance, if they also have car insurance policies. You will often save quite a bit of money by having all of your insurance in one place.

If you are a person who has had car insurance for years but never had an accident then an insurance company who offers vanishing deductibles may be perfect for you. If you are not getting in accidents then you should be rewarded, and this kind of program offers you a reward.

A great tip to getting affordable auto insurance is to make sure that you have an accurate policy. You should make sure your current policy matches your situation because if it does not, you could be paying more when you do not have to. This includes your vehicle information and yearly estimated mileage.

Consider combining several different types of insurance into one bundled policy. This could save you up to 25 percent on the cost of your insurance, and many insurance companies have diversified into many different insurance areas. Ask your agent how much you could save by combining homeowners insurance with your auto insurance policy.

When talking with your agent about auto insurance coverage be sure to ask about discounts. Many insurance companies offer discounts for various things that could bring down the cost of your coverage. Some of the things that insurance companies offer discounts for are student discounts, anti-theft devices installed on the vehicle, low mileage, and good driving records.

If you want to get cheap auto insurance rates one of the things that you can do is to build up your reputation as a safe driver. If you had no claim in 5 five years, your insurance can be reduced by as much as 75 percent. Insurance companies will give you lower car insurance rates if they know that you can stay away from accidents.

Though simple, the tips listed above could save hundreds and thousands of dollars per year on expensive auto insurance payments. https://www.wsj.com/articles/inflation-is-everywhe...u-might-not-expect-11644748202 is, take your time and calculate your costs carefully. Get ahead of the curve and be prepared for what you will need to pay before you even go to get your vehicle. Knowledge and research is the key to saving.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

Ways On Exactly How To Get Low-Cost Car Insurance Coverage |

Content by-Mohamad Schwartz

Auto insurance is one of those necessities that can cost quite a bit. However, the Internet today offers great resources and tools for finding car insurance for prices well below what you would expect. In fact, these tips could save you over $100 the first year of your policy alone.

Most people today are purchasing their auto insurance via the Internet, but you should remember not to be sucked in by a good-looking website. Having the best website in the business does not mean a company has the best insurance in the business. Compare travel trailer insurance average cost ontario and white, the details. Do not be fooled by fancy design features and bright colors.

When shopping for the best price on auto insurance, do not inflate the worth of your vehicle. Claiming your vehicle to be worth more than it is will only increase the cost of your premiums. In the case of a total loss accident, you will only be paid the amount your vehicle was actually worth at the time of the damage.

Most states require that you pay for liability insurance. You need to be aware of the regulations regarding minimum insurance coverage in your state. If your vehicle is not insured when you are in an accident, there will not only be serious financial consequences, but there will also be consequences from your local authorities.

Raising your deductibles will help you save money on your car insurance. The higher the deductible, the lower your monthly costs will be. The rate of savings will drop pretty low if you are driving an older car since the replacement cost is not as high as if you were driving a newer car.

Join an appropriate car owners' club if you are looking for cheaper insurance on a high-value auto. Drivers with exotic, rare or antique cars know how painfully expensive they can be to insure. If you join a club for enthusiasts in the same situation, you may gain access to group insurance offers that give you significant discounts.

If you live in a city, own a car and you are getting car insurance, it may be wise to think about moving to the suburbs. By making this move, you could be saving thousands each year on your car insurance, as it is always more costly in the city.

Insurance has many factors, and the cost is just one of the ones you should think about when doing research. You need to read all the language in the contract, to be aware of the deductible amounts, the coverage levels and the benefit limits.

You can save money on car insurance if your car is an older car, a sedate car (like a 4-door-sedan or hatchback) or has lots of miles on it. When this is the case, you can simply buy liability insurance to satisfy the requirements of your state and not bother with comprehensive insurance.

Get knowledgeable about the coverage you have on your vehicle, versus the coverage you have available to you. You may find that you could have a significantly higher coverage available to you than you are taking advantage of. Sometimes the better packages only cost dollars more than your basic policy.

Learn about different insurance policies and what kind of coverage they offer. Liability is needed both to cover any injury you cause to someone else or damage you do to their property, as well as to cover any damage to your own vehicle or injuries you may suffer. Other types of coverage that you need include protection from uninsured drivers and damage from fire or other disasters.

When purchasing car insurance, do not get unnecessary add-ons. Things like Motor Club, Travel Club, and Accidental Death Insurance are rarely used and just end up costing you more money each year. Instead, stick with things you will use, such as collision coverage, liability and property damage, and bodily injury coverage.

If you live in a city, own a car and you are getting car insurance, it may be wise to think about moving to the suburbs. By making this move, you could be saving thousands each year on your car insurance, as it is always more costly in the city.

If you recently got married call your insurance agency up and have them combine the policies. Most companies offer a multi-car discount, so you might as well take advantage of it. If you use different insurance companies, you may want to crunch some numbers to see if you can save more by switching.

Compare rates before you buy. Different companies can charge vastly different rates for the same coverage, depending on how heavily they weigh such factors as your age, driving history, and credit history. Checking prices at a comparison site can help you save hundreds of dollars per year on auto insurance.

When applying for auto insurance be sure to be honest in every way to the best of your knowledge. If you are to be in an accident and your insurance company finds that you were untruthful in anyway they can deny you and anyone affected by the incident from claiming anything against them.

Determine how much coverage is really appropriate for your needs. The lowest possible coverage accepted by your state could differ from other states, but does offer the lowest rates possible for auto insurance in your state. However, make sure that this is adequate coverage, otherwise you will require a higher rate for appropriate coverage.

Stay as long as you can with one auto insurance company. The longer you remain a customer, the more profitable you are to an insurance company. To try keep your business longer they will often offer you a renewal discount after three years' time. Discounts can be anywhere from one percent to ten percent. Your discount will become larger the longer you stay with them after that three year mark.

Don't hesitate to price compare when you're looking for an auto insurance policy, as prices can vary widely. The internet has made it increasingly easy to check around for the best price on a policy. Many insurers will give you instant quotes on their website, and others will e-mail you with a quote within a day or two. Make sure that you give the same information to each insurer to guarantee you're getting an accurate quote, and take into account any discounts offered, as these can vary between insurers.

With https://youngsinsuranceburlington.blogspot.com/ are now armed with, you should have a greater insight about auto insurance. What's essential about auto insurance is to always gain more knowledge about the subject, that way you can make well informed decisions. So use these tips and you should be making the right decisions on the type of auto insurance coverage you need.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

What Is A Public Insurer And Also Exactly How Do They Work? |

Content create by-Holgersen Kok

What is a Public Insurance adjuster? A public insurance adjuster, also called an independent assessor, is an independent specialist acting exclusively in behalf of the insured's legal passions. The insured pays the general public insurance adjuster, not the insurance company, for his/her services. State regulations limit the authority of public adjusters to the examination of residential property damage and also losses as well as limit their obligation to the payment of benefits to the hurt, and also restrict their capability to change personal injury cases.

If you are involved in a vehicle mishap, your insurance provider may have designated a "public insurance adjuster" to represent your rate of interests prior to the Insurance coverage Insurer. The insurance company's adjuster will certainly investigate your case and evaluate your records. Your adjuster will collect details from witnesses, photos, cops reports, repair service quotes, as well as various other evidence to make a good public adjuster's report. mold after flood adjuster's job is to use all the details to establish that must pay you for your injuries.

When your insurance policy holder's insurance coverage case is refuted, the insurer will often seek the situation intensely. The insurer's record is normally connected to the decision of the Insurance policy Insurer to honor the policyholder a claim quantity. Although the Insurance policy Insurer's decision can be appealed, if the charm is rejected by the court, the Public Insurer will not be required to make a last record.

In many states, the fee for having a Public Insurer's record is not a needed component of your policy. Nonetheless, vinyl siding hail damage charge a reasonable fee for their support. In addition, the Insurer might request an added charge from the Public Insurance adjuster in case of a rejection of a claim. These costs are usually a percent of the actual loss amount.

Insurance companies can locate a number of means to prevent paying a public insurance adjuster's fee. Some firms try to have a public insurance adjuster eliminate himself from the instance. If this happens, the Insurance Company will certainly still get every one of the compensation cash that the public insurance adjuster was spent for. Various other companies attempt to get the Insurance coverage Insurer to not provide any kind of adverse elements about your case.

Insurance companies that have public insurance adjusters frequently have a different division in charge of making decisions of the loss and repayment amount. As part of their task, the public adjuster will certainly check out the actual website where the mishap occurred. He or she will certainly examine the website and also listen to the claims from consumers. From these sees, the company adjuster will certainly prepare an adjusted record that will information every one of the details of your insurance claim.

When the Public Insurance adjuster makes his record, the Insurer will usually call for an appraisal to identify a precise loss quantity. This appraisal, which is usually performed by an appraiser who is independent of the firm that executed the insurance claim, is very handy for the Insurance provider. Great public insurance adjusters will certainly use the appraisal as a guide so that they can make a precise resolution of the loss. Along with an assessment, if the Insurer has a good insurance claim adjuster, he or she may ask for that an expert (such as a land appraiser) likewise examine the loss report to ensure that the claim is being made to an exact requirement.

There are two primary reasons why the Insurance coverage Public Insurer bills a cost. Initially, he or she must investigate the claim as well as prepare an accurate account. Second, she or he should accumulate the proper amount of the fee from the insurance holder. If the insurance holder challenges the precision of the record, the general public insurance coverage insurer have to justify his or her billing the fee in creating. In some states, insurance holders are allowed to make their very own ask for fixing errors and also omissions; if this holds true, the policyholder needs to be offered written notification of the right to make such a demand.

What Is A Public Insurance adjuster And Just How Do They Function? |

Created by-Zamora Gregersen

What is a Public Adjuster? A public insurer, likewise known as an independent assessor, is an independent specialist acting exclusively on behalf of the insured's legal rate of interests. The insured pays the public adjuster, not the insurance company, for his/her services. State legislations limit the authority of public insurers to the examination of building damages and also losses and restrict their obligation to the settlement of benefits to the wounded, and also restrict their capability to change injury cases.