Recognizing The Various Types Of Insurance Coverage As A Representative |

Get Source by-Sanders Petersen

Insurance is a vital financial investment that protects you and your assets from financial loss. Insurance policy representatives as well as companies can help you understand the various kinds of insurance plan readily available to fulfill your requirements.

https://writeablog.net/marcel9870claudio/the-ultim...nsurance-policy-representative explain the numerous choices of insurance provider as well as can finish insurance sales (bind insurance coverage) in your place. Independent representatives can work with multiple insurance carriers, while slave or special insurance representatives stand for a solitary company.

Captive Agents

If you're wanting to acquire a details type of insurance policy, you can get in touch with restricted agents that work with one particular service provider. These representatives market just the policies provided by their employer, which makes them professionals in the kinds of insurance coverage and also discount rates used.

They likewise have a solid connection with their business as well as are often required to meet sales quotas, which can impact their ability to assist customers fairly. They can supply a wide array of policies that fit your demands, yet they won't be able to provide you with quotes from other insurer.

Restricted representatives generally collaborate with big-name insurance providers such as GEICO, State Farm and Allstate. They can be a terrific source for consumers who wish to support neighborhood businesses and develop a long-lasting partnership with an agent that recognizes their area's special threats.

Independent Agents

Independent agents commonly collaborate with multiple insurance provider to offer their customers' plans. This allows them to provide a more personalized and customizable experience for their customers. They can also help them re-evaluate their protection in time and also recommend brand-new policies based upon their requirements.

https://www.scientificamerican.com/article/climate...tabilizing-insurance-industry/ can provide their customers a variety of policy options from multiple insurance providers, which means they can provide side-by-side contrasts of rates and also protection for them to pick from. They do this with no hidden agenda as well as can help them locate the policy that actually fits their distinct needs.

The best independent representatives recognize all the ins and outs of their numerous line of product and have the ability to address any type of questions that come up for their customers. This is an indispensable solution and also can conserve their customers time by taking care of all the information for them.

Life insurance policy

Life insurance plans commonly pay cash to assigned beneficiaries when the insured dies. The recipients can be a person or service. People can buy life insurance policy plans straight from an exclusive insurer or via group life insurance policy offered by employers.

Most life insurance policies call for a medical examination as part of the application process. Streamlined concern as well as ensured problems are available for those with health problems that would otherwise prevent them from getting a standard plan. Permanent plans, such as whole life, include a financial savings part that collects tax-deferred and also may have greater costs than term life plans.

Whether marketing a pure security strategy or a more complex life insurance policy, it's important for an agent to totally understand the functions of each item and also exactly how they associate with the client's particular circumstance. This helps them make educated referrals as well as prevent overselling.

Medical insurance

Medical insurance is a system for financing medical expenses. It is typically financed with payments or tax obligations and given with personal insurance companies. Private medical insurance can be bought individually or with team plans, such as those offered via employers or expert, civic or spiritual groups. Some kinds of health and wellness insurance coverage consist of indemnity strategies, which compensate policyholders for details costs as much as an established limitation, handled treatment plans, such as HMOs as well as PPOs, and self-insured plans.

As an agent, it is essential to comprehend the various types of insurance policies in order to assist your clients locate the most effective alternatives for their needs as well as spending plans. However, mistakes can occur, and if a mistake on your part creates a customer to shed cash, errors and noninclusions insurance coverage can cover the price of the fit.

Long-Term Care Insurance Policy

Long-lasting treatment insurance policy helps individuals pay for home health assistant services as well as assisted living facility treatment. It can likewise cover a section of the expense for assisted living and also other residential treatment. Policies generally top how much they'll pay daily and over a person's lifetime. Some policies are standalone, while others integrate protection with other insurance policy items, such as life insurance policy or annuities, and also are referred to as hybrid policies.

Several private lasting care insurance plan need clinical underwriting, which suggests the insurance provider requests for individual information and may request documents from a medical professional. A pre-existing condition could omit you from getting advantages or might trigger the policy to be canceled, experts caution. Some plans use a rising cost of living rider, which boosts the everyday advantage amount on an easy or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Comprehending The Different Sorts Of Insurance Coverage As An Agent |

Best Flood Insurance -Elliott Somerville

Insurance policy is a vital investment that shields you and your assets from economic loss. Insurance coverage agents and also agencies can help you recognize the different types of insurance policies offered to fulfill your needs.

Agents describe the various alternatives of insurance companies and also can finish insurance sales (bind coverage) in your place. https://blogfreely.net/sabina28maricela/the-ultima...-successful-insurance-coverage can deal with multiple insurance policy providers, while hostage or unique insurance coverage agents stand for a solitary business.

Captive Agents

If you're seeking to acquire a details sort of insurance plan, you can connect with captive agents that work with one specific service provider. These representatives sell just the plans supplied by their company, that makes them specialists in the types of coverage and discount rates supplied.

They also have a solid relationship with their company and are usually required to fulfill sales allocations, which can affect their ability to help customers fairly. They can supply a variety of plans that fit your needs, but they won't have the ability to present you with quotes from other insurer.

Restricted representatives generally deal with big-name insurers such as GEICO, State Ranch and Allstate. They can be a great resource for clients who want to support neighborhood services and also establish a long-term connection with a representative that recognizes their location's special risks.

Independent Representatives

Independent agents generally collaborate with several insurance companies to sell their clients' policies. This enables them to offer a more personalized and personalized experience for their customers. They can likewise help them re-evaluate their protection with time and also suggest new policies based on their demands.

They can provide their clients a selection of policy alternatives from several insurance providers, which means they can supply side-by-side contrasts of pricing and coverage for them to pick from. They do this without any ulterior motive as well as can help them discover the policy that really fits their one-of-a-kind needs.

The most effective independent agents recognize all the ins and outs of their numerous line of product as well as have the ability to answer any concerns that show up for their customers. This is an invaluable solution and also can conserve their customers time by dealing with all the details for them.

Life insurance policy

Life insurance policies generally pay cash to marked recipients when the insured dies. The beneficiaries can be an individual or service. People can acquire life insurance policy policies straight from an exclusive insurance provider or via team life insurance provided by employers.

Many life insurance policy policies call for a medical examination as part of the application procedure. Simplified http://dwayne109lizeth.xtgem.com/__xt_blog/__xtblo...nt?__xtblog_block_id=1#xt_blog as well as guaranteed concerns are readily available for those with illness that would certainly otherwise stop them from getting a conventional plan. Irreversible policies, such as entire life, include a financial savings element that gathers tax-deferred as well as might have higher premiums than term life policies.

Whether selling a pure defense strategy or an extra complicated life insurance plan, it is necessary for an agent to completely understand the features of each product and also how they connect to the client's details situation. This helps them make enlightened recommendations and also stay clear of overselling.

Medical insurance

Health insurance is a system for funding clinical costs. It is usually funded with contributions or taxes and supplied with personal insurance providers. Private health insurance can be acquired individually or with group plans, such as those used through employers or expert, civic or religious teams. Some sorts of health and wellness coverage consist of indemnity strategies, which repay policyholders for details expenses up to a set limitation, handled treatment strategies, such as HMOs and PPOs, and self-insured plans.

As an agent, it is very important to understand the various types of insurance coverage in order to assist your customers find the best options for their demands as well as spending plans. Nevertheless, blunders can happen, and also if a mistake on your component triggers a customer to shed money, mistakes and omissions insurance coverage can cover the price of the fit.

Long-Term Treatment Insurance

Lasting treatment insurance policy helps individuals spend for residence wellness assistant services as well as assisted living facility care. It can additionally cover a part of the price for assisted living as well as various other property care. Plans usually cap just how much they'll pay daily and also over a person's life time. Some plans are standalone, while others combine insurance coverage with other insurance coverage items, such as life insurance policy or annuities, and also are called hybrid plans.

Numerous private lasting treatment insurance plan require medical underwriting, which indicates the insurance firm requests for individual info as well as may request records from a physician. A preexisting condition might omit you from receiving advantages or may create the plan to be canceled, professionals caution. Some policies supply an inflation motorcyclist, which increases the daily advantage amount on an easy or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Essential Guide To Choosing The Right Insurer For Your Needs |

http://eliz3428gabriel.xtgem.com/__xt_blog/__xtblo...nt?__xtblog_block_id=1#xt_blog written by-Valentin Engberg

Many people focus only on cost or review on-line testimonials when picking an insurance provider. Nevertheless, there are various other important factors to think about.

As an example, if you are purchasing from a broker, look at their consumer contentment positions or ratings from agencies like AM Finest. These rankings can provide you a common sense of financial strength, claims-paying history as well as various other aspects.

Cost

Selecting insurance coverage is not only regarding price, however likewise about ensuring the insurance coverage you pick suffices to protect your economic future. As such, you should very carefully stabilize cost with insurance coverage, and it is important to examine exactly how your choices will certainly impact your lasting monetary objectives as well as requirements. If you are tempted to check out on-line reviews, take into consideration discussing them with a business rep, as they might be able to give feedback that is helpful in establishing whether the evaluation is precise or not.

Protection

Insurance coverage is a way to pool threat by spending for cases. It's a giant nest egg that spends for disasters we can not control, like hurricanes, wildfires, hurricanes, and kitchen fires, and also everyday accidents, such as minor car accident and also cars and truck crashes.

Analyzing Best RV Insurance Companies and picking appropriate coverage is a complicated process. Considerations include affordability, protection limitations, deductibles, policy terms, and the credibility and also monetary stability of insurance coverage service providers.

Make the effort to compare quotes from numerous insurance companies, taking into consideration discounts provided for bundling policies or maintaining a tidy driving document. It's likewise crucial to examine the long-term effects of your coverage options. Evaluate exactly how they will shield your assets, revenue, as well as enjoyed ones for many years. Ultimately, https://zenwriting.net/troy63kiersten/the-ultimate...e-a-successful-insurance-agent 's not nearly rate-- it has to do with securing what issues most. This Ultimate Overview will certainly aid you select the ideal insurance policy supplier for your unique requirements. The best coverage will supply you with peace of mind and guard your financial future.

Licensing

Prior to a person can start marketing insurance coverage, they require to get certified. This is a process that varies by state, yet generally consists of completing pre-license education courses as well as passing the state insurance test. It likewise requires submitting fingerprints as well as undergoing a background check.

The sort of license an individual needs relies on the kinds of insurance they plan to market. There are normally two main sorts of insurance coverage licenses: building and casualty, which focuses on insurance for vehicles and homes, and also life as well as health and wellness, which focuses on covering people as well as households in case of an accident or fatality.

Firms that provide several lines of insurance need to have a company certificate, while private representatives can obtain a private license for the lines they plan to market. The licensing process is controlled at the state level, however lots of states currently utilize third parties to aid guide and carry out license applications in order to promote efficiency.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Save Cash On Insurance Coverage Costs With The Right Insurer |

Content by-Valdez Overby

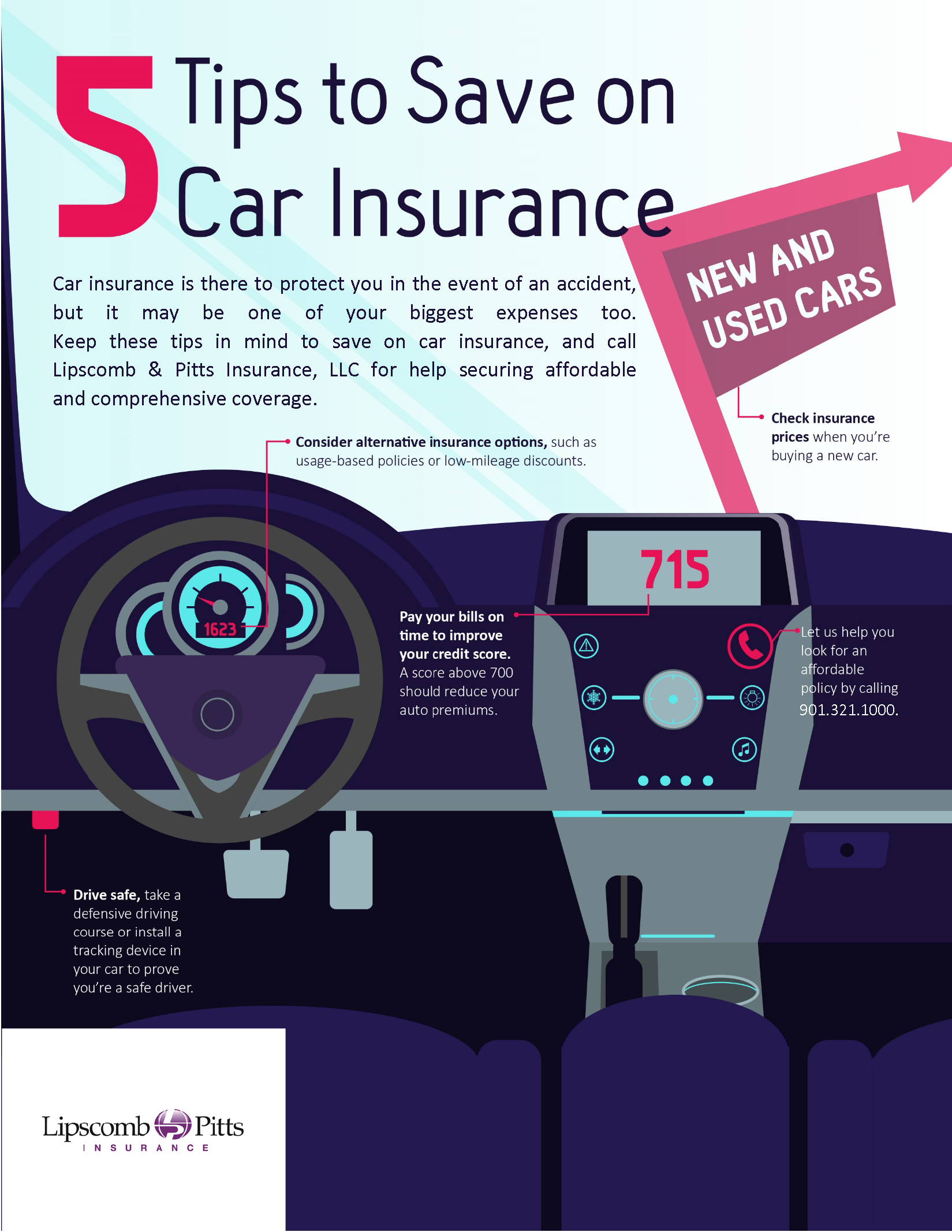

You might believe that there's nothing you can do to lower your cars and truck insurance coverage costs, yet WalletHub has found a few methods to save. Enhancing your deductible (but not so high that you can't manage to pay it) can conserve you money, as can taking a chauffeur safety and security training course or mounting an anti-theft tool.

1. Shop Around

Whether you're buying wellness, car or life insurance, it pays to search. Some insurance companies use on-line quote devices that can conserve you effort and time by showing numerous prices for the plan you're taking into consideration.

Other aspects like credit history, a risk-free driving document and also packing policies (like vehicle as well as house) can also reduce your rates. You must also on a regular basis examine your coverage needs as well as reassess your premium costs. https://zenwriting.net/beata212mitchell/top-7-stra...nsurance-policy-representative is particularly essential if you hit life landmarks, such as a brand-new youngster or getting wed. Similarly, you ought to regularly consider your lorry's worth and think about changing to a usage-based insurance policy program, like telematics.

2. Know Your Coverage

Using these methods will certainly call for time as well as initiative, however your job will be compensated with lower yearly premiums for years ahead.

Other means to conserve consist of paying your plan six or a year at a time, which sets you back insurance provider less than regular monthly payments. Additionally, eliminating protection you don't need, like roadside assistance or rental car repayment, can conserve you money.

Your credit rating, age as well as area likewise impact your rates, in addition to the automobile you drive. Bigger vehicles, like SUVs and also pickup trucks, expense even more to insure than smaller sized automobiles. Picking an extra fuel-efficient lorry can lower your premiums, as will certainly going with usage-based insurance policy.

3. Drive Securely

There are several things you can regulate when it pertains to reducing your automobile insurance policy rates. Some strategies consist of taking a protective driving course, increasing your deductible (the quantity you have to pay before your insurance policy starts paying on an insurance claim) as well as switching over to a safer car.

Some insurance providers likewise provide usage-based discount rates and also telematics gadgets such as Progressive Snapshot, StateFarm Drive Safe & Save and Geico DriveEasy. These can reduce your price, yet they might likewise increase it if your driving routines come to be much less risk-free with time. Take into consideration making use of mass transit or carpooling, or reducing your gas mileage to receive these programs.

4. Get a Telematics Gadget

A telematics device-- or usage-based insurance (UBI)-- can save you money on your vehicle insurance coverage. Generally, you plug the gadget right into your car as well as it tracks your driving habits.

Insurance provider then utilize that information to identify exactly how high-risk you are. And also they establish your premiums based upon that. Often, that can suggest substantial cost savings.

Yet be careful. One bad choice, such as competing to beat a yellow light, might transform your telematics device right into the tattletale of your life. That's because insurance companies can use telematics data to decrease or reject cases. As well as read here might even revoke discounts. That's why it is essential to evaluate the trade-offs prior to enlisting in a UBI program.

5. Obtain a Multi-Policy Discount Rate

Getting auto as well as residence insurance from the exact same provider is frequently a wonderful way to conserve money, as many trusted insurance providers use discount rates for those that acquire several plans with the very same provider. Additionally, some insurance coverage companies provide telematics programs where you can earn deep discounts by tracking your driving routines.

Various other ways to save include downsizing your lorry (when possible), car pool, and making use of public transportation for job and also leisure. Likewise, keeping your driving record clean can conserve you cash as many insurance provider provide accident-free and excellent vehicle driver discount rate plans. Lots of providers likewise offer customer loyalty discount rates to long-term consumers. These can be considerable discounts on your costs.

6. Get an Excellent Rate

Increasing your deductible can decrease the quantity you pay in case of a crash. Nevertheless, Condo Rental Insurance is very important to make certain you can afford the higher out-of-pocket expense before committing to a greater deductible.

If you possess a bigger car, take into consideration scaling down to a smaller auto that will cost much less to guarantee. Likewise, think about switching over to a much more gas efficient car to save money on gas costs.

Look into other discounts, such as multi-vehicle, multi-policy, good driver, risk-free driving and armed forces price cuts. Additionally, some insurer provide usage-based or telematics insurance coverage programs that can save you cash by checking how much you drive. Ask your carrier for even more information on these programs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

5 Secret Variables To Consider When Assessing An Insurance Company |

Article by-Kusk McCulloch

A few crucial metrics are utilized to value insurance companies, which occur to be typical to all monetary firms. These include cost to publication and return on equity.

Consider the carriers a representative advises to see which ones have strong rankings and also monetary stability. You ought to additionally examine the service provider's financial investment risk account and also concentration in high-risk investments.

1. Customer Service

It's no secret that customer care is a vital facet of an insurance company. An inadequate experience can create clients to swiftly change to rivals, while a positive communication can lead them to suggest your company to friends and family.

Evaluating local auto insurance agents near me can aid you identify means to boost your procedures. For example, you can measure for how long it considers a customer to connect with an agent or the portion of telephone calls that go unanswered. You can also review first call resolution rates, which can aid you identify how well your group has the ability to fix problems.

To provide wonderful customer service, you need to know what your consumers want and also how to meet those needs. A Voice of the Client program can provide this information as well as aid you drive consumer contentment.

2. Financial Strength

Economic strength is an essential element of any type of insurance provider. This is because it shows how much cash or assets the business has on hand to pay short-term financial obligations. https://blogfreely.net/tuan978loan/how-to-effectiv...s-as-an-insurance-policy-agent assists capitalists comprehend exactly how risky it is to purchase that particular company.

Regulators require a particular degree of funding symmetrical to an insurer's riskiness. Investors, other points equal, choose that even more equity be retained and less debt issued for an offered ranking degree yet this must stabilize with the requirement to make sure an insurance provider can fulfil its insurance holder claims obligations.

Brokers/ agents as well as insurance buyers often wish to see a high ranking prior to supplying insurance policy or reinsurance organization. This is partly because of the assumption that greater rated business are better handled, yet additionally because it can help them meet their very own internal due diligence requirements and also disclosures.

3. Claims Service

Whether the insurance company is answering inquiries concerning plan advantages, refining a claim or taking care of an issue, you want to know that they listen and receptive. Check out the hours as well as areas, as well as processes for managing issues outside of typical business hours.

Insurance companies are organized right into departments of marketing, money, underwriting and cases. Marketing as well as underwriting departments are largely concerned with saying "yes" to as several new plans as possible. Cases division senior managers are primarily focused on maintaining case expenses low.

Often, these divisions are at odds with one another. Try to find reviews that mention individuality clashes amongst department staff members, in addition to the insurance company's online reputation for dragging its feet in paying or rejecting insurance claims. Also, examine Motorcycle Insurance Agency by numerous firms.

4. Plan Options

Whether an insurance company has policies that provide one-of-a-kind coverage options is an additional vital variable to think about. For example, some insurance providers provide maternal insurance coverage while others don't. Insurers also differ in their costs fees for these insurance coverage advantages.

Make certain you review as well as comprehend your plan prior to purchasing it. It's important to know what is covered, the exclusions that get rid of coverage as well as the conditions that must be met for a claim to be accepted. It's also worth checking the company for discount rates. As an example, some firms will certainly supply a discount for buying multiple plans from them (such as house owners as well as automobile). This can help reduce your general expense. Likewise, look for functions that make it simpler to sue such as app-based claim intimation as well as tracking.

5. Firm Online reputation

In a sector where insurance holders and also prospective policyholders are buying into a guarantee of future efficiency, credibility plays a key role in an insurer's assessment. If market participants lose trust in an insurer's capability to satisfy strategic targets (like monetary objectives or incomes targets) they might shed support and this can bring about resources problems, investors moving organization somewhere else or policyholders terminating policies.

Insurance companies can improve their client experience by supplying smooth experiences with individualized choices and also understandings. As an example, using AI throughout the client trip and also making it possible for representatives to fulfill consumers at the right time on the right networks with a suitable message or web content can help transform insurance companies into trusted advisors that drive customer commitment. Business can also develop their reputation by ensuring that they have a great culture of principles as well as stability.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Comprehending The Different Types Of Insurance Coverage As A Representative |

Article by-Elliott Knox

Insurance policy is a vital investment that protects you and your assets from monetary loss. https://blogfreely.net/timmy82celesta/the-ultimate...ctive-insurance-representative and agencies can aid you recognize the various sorts of insurance plan offered to satisfy your needs.

Representatives define the different options of insurance provider as well as can complete insurance coverage sales (bind protection) in your place. Independent representatives can work with multiple insurance service providers, while captive or unique insurance coverage agents represent a single business.

Captive Representatives

If you're looking to purchase a certain kind of insurance policy, you can connect with restricted representatives that collaborate with one certain provider. These agents offer only the policies provided by their employer, that makes them experts in the kinds of coverage as well as discount rates provided.

They additionally have a solid connection with their business and are often needed to fulfill sales allocations, which can affect their capability to assist customers objectively. They can provide a variety of policies that fit your requirements, however they won't be able to present you with quotes from various other insurance companies.

Restricted representatives commonly collaborate with big-name insurance providers such as GEICO, State Farm and Allstate. They can be a great resource for consumers that want to support regional organizations and also develop a long-lasting connection with an agent that comprehends their area's one-of-a-kind threats.

Independent Brokers

Independent representatives typically collaborate with numerous insurance companies to offer their clients' plans. This allows them to offer a much more individualized as well as customizable experience for their customers. They can likewise help them re-evaluate their insurance coverage with time as well as suggest new policies based on their needs.

They can use their customers a selection of policy choices from numerous insurance service providers, which means they can supply side-by-side contrasts of pricing and protection for them to pick from. They do this without any hidden agenda and can help them find the plan that actually fits their unique demands.

RV Insurance Coverage understand all the ins and outs of their various product lines and are able to answer any concerns that show up for their clients. This is an indispensable service and can conserve their clients time by dealing with all the information for them.

Life Insurance

Life insurance policy policies normally pay money to marked beneficiaries when the insured dies. The beneficiaries can be an individual or business. People can get life insurance policies straight from a personal insurer or via team life insurance offered by employers.

moved here of life insurance plans require a medical examination as part of the application process. Streamlined concern and assured issues are available for those with health issue that would certainly or else avoid them from obtaining a traditional plan. Long-term policies, such as entire life, include a financial savings element that gathers tax-deferred as well as might have greater costs than term life policies.

Whether marketing a pure protection strategy or an extra complicated life insurance plan, it is essential for a representative to totally recognize the features of each item and also exactly how they relate to the client's details scenario. This helps them make informed referrals as well as stay clear of overselling.

Health Insurance

Health insurance is a system for financing clinical expenditures. It is normally funded with contributions or taxes and also provided via personal insurance firms. Personal medical insurance can be acquired separately or through team plans, such as those provided through companies or professional, public or religious groups. Some sorts of wellness coverage include indemnity plans, which compensate insurance holders for specific costs as much as an established limitation, handled treatment strategies, such as HMOs and PPOs, and also self-insured plans.

As a representative, it is very important to recognize the different kinds of insurance policies in order to assist your customers discover the best choices for their needs as well as budgets. Nevertheless, errors can happen, and also if a mistake on your component triggers a customer to lose money, mistakes and omissions insurance coverage can cover the price of the match.

Long-Term Care Insurance

Long-term treatment insurance aids individuals pay for house health and wellness assistant services as well as assisted living facility treatment. It can also cover a part of the expense for assisted living and also various other household care. Plans generally cover just how much they'll pay per day and over an individual's lifetime. Some policies are standalone, while others combine coverage with other insurance policy items, such as life insurance or annuities, as well as are referred to as hybrid policies.

Many individual long-lasting treatment insurance policies need medical underwriting, which suggests the insurance company asks for individual information as well as may request records from a physician. A pre-existing problem might omit you from receiving advantages or may cause the plan to be terminated, experts alert. Some plans provide a rising cost of living rider, which raises the day-to-day benefit quantity on a basic or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Introducing The Leading Insurance Companies - A Thorough Contrast |

Created by-Smart Thybo

The insurance sector is changing quickly as it embraces brand-new innovation as well as electronic innovation. As a result, business that are willing to innovate and take on a customer-centric frame of mind have an edge over their competition.

This write-up will cover the leading insurance provider for automobile, house, as well as life insurance. We will certainly likewise highlight several of the most effective life insurance firms that use lenient underwriting for those with a pre-existing health and wellness condition.

New York Life

New york city Life uses a selection of life insurance policy plans with a vast array of alternatives. Their business has actually been around for 175 years and uses professional recommendations from their insurance policy representatives. They have a wonderful online reputation as well as superb consumer satisfaction rankings. They offer a range of plan choices as well as considerable cyclists to make them one-of-a-kind from the competition.

New York life is a fantastic choice for anybody looking for a permanent life insurance policy plan. Best Auto Insurance have entire life and also universal plans that are designed to last for a person's lifetime and build cash worth. They also offer a selection of various financial investment alternatives as well as provide access to economic assistance for their customers.

They have a low grievance proportion with the National Association of Insurance Commissioners as well as have outstanding client complete satisfaction ratings. They have an extensive web site where you can begin a claim or download solution forms.

Northwestern Mutual

Founded in 1857 in Wisconsin when the state was only nine years old, Northwestern Mutual is a common company with no personal stockholders. Consequently, they have the ability to return earnings directly to policyholders in the form of dividend checks. These returns can be made use of to pay costs, enhance cash money value or purchase extra coverage.

This company is known for its monetary stamina and also high client fulfillment scores. As a matter of fact, they rank 4th in J.D. Power's 2022 Individual Life insurance policy Study, and they have extremely reduced issue prices.

They also provide a variety of economic products, including retirement and also financial investment services. The Milwaukee-based company handles assets for institutional clients, pooled financial investment vehicles as well as high-net-worth people. It supplies online solutions such as quotes as well as an on the internet consumer portal for insurance holders.

Banner Life

With a customer service rating of A+ from the Bbb, Banner Life is one of the top business for those seeking to get life insurance. They likewise have a detailed web site with a lot of information to help consumers recognize their options as well as the process.

The company provides competitive prices for term life insurance policy in a range of health classifications and also also uses some no-medical examination plans. They are additionally one of the few insurance firms to provide tables for cigarette smokers and those with significant problems like diabetes mellitus, hepatitis B or C, and coronary artery disease without including a flat extra.

In addition, their Term Life Plus plan permits the conversion to long-term insurance coverage, and also their Universal Life Step UL policy has a great interest rate. Banner operates in every state besides New york city, which is served by their sis firm William Penn

. Lincoln National

Lincoln Financial uses a variety of insurance coverage and also investment items, consisting of life insurance policy as well as workplace retirement plans. home and auto independent insurance agents near me as well as flaunts a solid credibility in the personal money press. It also succeeds in our rankings for economic stability, product and attribute variety, and the total purchasing experience.

The business is a Ton of money 250 firm and rankings among the top life insurance policy companies in terms of economic strength rankings from AM Ideal, Fitch, and also Moody's. It additionally boasts a low complaint index rating according to NerdWallet's evaluation of information from the National Organization of Insurance Coverage Commissioners.

In addition to being a solid choice permanently insurance coverage, the company supports the area through its philanthropic efforts. The Lincoln Financial Foundation contributes millions to a variety of nonprofit organizations.

Prudential

Prudential uses a wide range of life insurance policies and has good rankings from credit ranking agencies. Nevertheless, it does have a lower consumer complete satisfaction score and more grievances than anticipated for its dimension.

The business also does not provide whole life insurance, which is the most typical sort of permanent life insurance plan. This restricts the variety of options offered to consumers.

In addition to providing high quality products, Prudential has a good credibility for its area participation. https://www.marketwatch.com/guides/insurance-services/cheap-life-insurance/ volunteer as well as devote their time to assist their neighborhood areas.

Prudential is presently running a collection of ads throughout America. These advertisements are concentrating on economic health and highlighting the significance of purchasing life insurance. Several of their ads feature a daddy who is worried about his daughters in case of an unexpected death.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Expert Tips For Locating The Very Best Insurance Company For Your House |

Content written by-Jantzen Bak

Having the very best residence insurer can save you time, money as well as stress in case disaster strikes. There are several ways to find the ideal company, including on the internet reviews, specialist rankings as well as reviews.

USAA places highly in consumer complete satisfaction with its home policy and has many price cuts, consisting of loyalty breaks for those who remain claim-free. It likewise uses a special Service provider Connection data source with countless vetted service providers to aid house owners rebuild after calamity.

1. Know What You Want

Your home is among the biggest monetary investments you will certainly ever make. That is why it is essential to make the effort to find an insurance coverage supplier that supplies protection based upon your distinct demands, as well as offers a positive experience from plan purchasing, revival as well as suing.

A good place to start your search is at the website of your state's department of insurance coverage. Right here, you can find out about the business's ranking and any consumer grievances. You can also consider third-party scores like those given by J.D. Power or the National Organization of Insurance policy Commissioners to acquire a much better understanding of client complete satisfaction.

You could also think about looking for a service provider with regional representatives, or electronic policy monitoring choices. These features can help reduce prices, in addition to offer peace of mind.

2. Shop Around

If you're a homeowner who wishes to conserve cash or are buying property owners insurance policy for the first time, shopping around can aid you find the best policy. Begin by requesting quotes for the exact same coverage kind and limits from several insurance providers. You can utilize an independent representative, online market like Policygenius or contact your state insurance division to obtain quotes. Additionally consider https://blogfreely.net/huong48lino/the-duty-of-inn...rance-representative-practices , JD Power and also third-party customers when comparing prices.

It's an excellent concept to contrast quotes on a continuous basis, particularly if your residence is valued more than when it was originally guaranteed or if you're paying too much. To make the process simpler, you can ask for quotes from numerous insurance companies concurrently utilizing an on-line comparison tool such as Gabi or by speaking to an independent insurance representative.

4. Search for Discounts

In addition to contrasting prices on-line, you can additionally try to find price cuts by shopping around. Many insurance companies provide price cuts for things like having a new roofing, adding a protection system as well as other enhancements. Others will provide discount rates for having a greater insurance deductible. It is necessary to consider these options against each other, as a high insurance deductible will certainly set you back more cash up front.

Some companies might additionally offer price cuts based upon elements like your age or whether you work from home. This is since these groups often tend to be on the properties extra, which lowers some dangers such as theft.

visit my web page to consider is exactly how pleased policyholders are with the firm. This can be figured out by taking a look at consumer fulfillment reports and scores from customer web sites.

5. Get a Policy in position

House owners insurance covers damage to your home and items, as well as personal liability. A policy can cost a couple of hundred dollars a year or much less.

It's wise to get quotes prior to selecting a firm, as well as to keep shopping every few years as premium prices as well as discounts may transform. You likewise should see to it to stay on top of the condition of your property owner's plan.

Search for business that offer neighborhood agents or a mobile application for customer support. Likewise, consider http://glen2claudio.xtgem.com/__xt_blog/__xtblog_e...er?__xtblog_block_id=1#xt_blog -party rankings and testimonials, such as the JD Power residence insurance policy customer complete satisfaction score, which makes up variables like expense, representative communication and insurance claim handling. An excellent insurer will be transparent as well as sincere with customers concerning pricing and also insurance coverage. They will likewise be flexible in case of a modification in your house's situation or security features.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Unlocking The Keys To Closing Deals As An Insurance Coverage Agent |

Content create by-Seerup Bojesen

Insurance policy representatives are accredited professionals who market life, home mortgage protection and disability insurance. They have to be able to find, draw in and maintain customers. They must also have a good understanding of plan protection as well as terms, along with the capacity to work out.

Some salespeople use classic closing methods, which are scripts meant to encourage prospects to buy. These strategies can annoy some purchasers, nonetheless.

1. Know Your Item

As an insurance coverage agent, you have a special marketing recommendation. You can aid clients kind via complicated info as well as make decisions that will certainly safeguard their family members in case of an emergency situation or disaster.

To do this, you must understand your products well and comprehend how they collaborate. This will certainly aid you develop trust fund with your customers and address their objections.

There are many closing techniques that you can use to close life insurance policy sales. One is the assumptive close, where you assume that your prospect wishes to get. This can be effective with a client who is ready to devote, but it can be repulsive for those that are still making a decision.

2. Know Your Possibility

Offering value to your customers and demonstrating that you recognize their demands is the very best way to shut a deal. Customers are more likely to trust representatives that make the effort to learn about their issues as well as offer an option that fixes them.

visit the following website page 's also important to know your leads' existing policies. With Cover Link, insurance coverage verification is just a click away as well as you can rapidly resource your customer's affirmation pages, claim documents and also vehicle details. This can assist you qualify leads faster, shorten sales cycles and also enhance client relationships. Try it today!

3. Know Yourself

Insurance representatives have 2 means to market themselves: their insurance company or themselves. One of the most reliable method to market on your own is to be yourself.

Telling tales of how you've helped customers is a fantastic means to develop trust fund and keep leads psychologically engaged. It likewise assists to set you in addition to the stereotypical salesperson that people dislike.

Creating click web page of buddies and also coworkers to count on for guidance can boost your insurance company as well as provide recommendations for new clients. This will certainly offer you the chance to display your sector understanding and also experience while building an ever-expanding publication of organization. https://zenwriting.net/merrilee180cruz/just-how-to...s-as-an-insurance-policy-agent can bring about an uncapped earning capacity.

4. Know Your Competition

When you understand your competition, it ends up being much easier to locate methods to differentiate yourself and also win service. This could be a certain insurance policy item, an unique service that you supply, and even your character.

Asking clients why they picked to deal with you over your rival can aid you identify what sets you apart. Their answers might surprise you-- and also they could not have anything to do with prices.

Establishing partnerships with your potential customers and also customers is a big part of insurance advertising. This can be done through social media sites, email, or even a public discussion at an occasion. This will certainly build depend on and set you up for even more chances, like cross-selling or up-selling.

5. Know Yourself as an Expert

As an insurance policy representative, you'll function carefully with customers to determine their danger and also develop a defense plan that meets their demands. Telling stories, defining the worth of a plan, and also asking concerns are all means to help your customers find their right coverage.

Many insurance coverage agents select to help a single company (called captive representatives) while others companion with numerous business (called independent agents). No matter your choice, you'll benefit from connecting with various other insurance policy professionals. Their knowledge and also experience can supply invaluable insight as well as assistance for your job. In addition, connecting with fellow agents can raise your client base as well as recommendations.

6. Know Yourself as an Individual

If you recognize yourself as an individual, you can connect your expertise and worth to consumers in ways that really feel genuine. A consumer who relies on you is more probable to trust you as well as become a repeat client.

Closing a handle the insurance coverage service is far more than just a transaction. You are selling security and also assurance to individuals that have special needs.

Spend some time to consider what makes you unique as a person. You can make use of journaling or expressive writing to discover your rate of interests, personality, and values.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Save Cash On Insurance Policy Costs With The Right Insurance Company |

Article by-Hovgaard Erickson

You may think that there's nothing you can do to reduce your cars and truck insurance premium, yet WalletHub has actually discovered a couple of methods to save. Boosting your insurance deductible (however not so high that you can not afford to pay it) can save you cash, as can taking a vehicle driver safety course or mounting an anti-theft tool.

1. Shop Around

Whether you're shopping for health and wellness, car or life insurance policy, it pays to search. Some insurance companies offer on-line quote tools that can save you effort and time by showing several prices for the plan you're considering.

Other elements like credit history, a secure driving record and bundling policies (like cars and truck and residence) can also decrease your rates. You should additionally regularly analyze your protection requirements and reassess your premium expenses. This is especially important if you strike life turning points, such as a brand-new child or obtaining married. In a similar way, you ought to periodically consider your car's worth and also take into consideration changing to a usage-based insurance coverage program, like telematics.

2. Know Your Coverage

Using these strategies will call for some time and also initiative, but your job will be awarded with lower annual costs for years ahead.

Other means to conserve include paying your policy six or a year at once, which costs insurance provider less than month-to-month settlements. Also, getting rid of protection you don't need, like roadside aid or rental automobile reimbursement, can save you money.

Your credit report, age as well as area likewise influence your rates, along with the vehicle you drive. Larger automobiles, like SUVs and pickup trucks, price more to insure than smaller vehicles. Choosing a more fuel-efficient vehicle can minimize your premiums, as will selecting usage-based insurance coverage.

3. Drive Securely

There are numerous points you can manage when it comes to decreasing your cars and truck insurance rates. Some strategies consist of taking a protective driving training course, raising your insurance deductible (the quantity you need to pay prior to your insurance begins paying on an insurance claim) and also switching to a safer automobile.

Some insurance companies likewise use usage-based discount rates and also telematics gadgets such as Progressive Snapshot, StateFarm Drive Safe & Save and Geico DriveEasy. https://blogfreely.net/mikel2josef/5-important-ski...-insurance-agent-should-master can reduce your rate, but they may also elevate it if your driving behaviors become much less risk-free in time. Take into consideration using mass transit or car pool, or lowering your mileage to get these programs.

4. Get a Telematics Tool

A telematics gadget-- or usage-based insurance policy (UBI)-- can conserve you cash on your vehicle insurance coverage. Primarily, you connect the device right into your car as well as it tracks your driving actions.

Insurance provider after that make use of that information to figure out exactly how high-risk you are. And they establish your costs based on that. Commonly, that can suggest Recommended Internet site .

Yet take care. click here for info , such as racing to beat a yellow light, could transform your telematics tool right into the tattletale of your life. That's because insurer can make use of telematics data to lower or refute claims. And they may even withdraw price cuts. That's why it's important to consider the compromises before registering in a UBI program.

5. Get a Multi-Policy Price Cut

Getting vehicle and residence insurance policy from the same supplier is frequently a wonderful means to conserve cash, as numerous credible insurance firms supply discounts for those that buy several policies with the very same service provider. In addition, some insurance policy service providers supply telematics programs where you can make deep discount rates by tracking your driving behaviors.

Various other ways to conserve include downsizing your lorry (preferably), car pool, and also utilizing public transportation for work and recreation. Additionally, keeping your driving record tidy can save you cash as a lot of insurer use accident-free and excellent chauffeur price cut plans. Lots of providers also offer client commitment discount rates to lasting consumers. These can be significant price cuts on your premium.

6. Obtain a Good Price

Raising your insurance deductible can decrease the quantity you pay in case of a crash. Nevertheless, it's important to make certain you can manage the higher out-of-pocket expense before dedicating to a greater deductible.

If you own a bigger car, take into consideration scaling down to a smaller car that will set you back much less to guarantee. Also, think about switching over to a much more fuel efficient car to save on gas expenses.

Check out other price cuts, such as multi-vehicle, multi-policy, excellent motorist, safe driving as well as military price cuts. Furthermore, some insurance companies provide usage-based or telematics insurance programs that can conserve you cash by keeping track of just how much you drive. Ask your provider for more information on these programs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Top 7 Strategies To Produce Leads As An Insurance Coverage Agent |

Created by-Calhoun Lyons

Insurance coverage agents need a consistent circulation of cause expand their service. However creating high quality leads isn't very easy. Here are some clever techniques that can assist.

A dedicated link with a digital insurance policy application that's home to real, bindable quotes is an easy method to create leads. Utilize it in an email, on social media sites or in advertising and marketing.

1. Develop a solid online presence

As an insurance policy agent, you need a strong sales pipe. You should fill it with high quality leads that become clients.

Internet marketing strategies supply a selection of choices for new organization generation. They can help you generate leads at a portion of the first financial investment price compared to standard approaches.

Creating material that provides worth to your audience can be an efficient means to draw in brand-new customers to your web site. Nonetheless, you should make sure that this content pertains to your target market's needs.

Providing your company on online company directories can enhance neighborhood presence. It can likewise enhance your search engine optimization efforts by intensifying brand recognition.

2. Obtain provided on reputable review sites

Obtaining leads is an important part of constructing your insurance coverage organization. Yet brand-new insurance coverage representatives, specifically, can locate it difficult to produce sufficient quality leads.

Concentrating on web content advertising is one means to generate a lot more insurance policy leads. Develop relevant and also valuable web content that assists your target market address their troubles and build a bond with your brand.

You can likewise use social media to boost your lead generation. Publishing write-ups on your LinkedIn and also Quora pages can assist you connect with even more professional prospects. You can also host academic webinars to draw in prospective clients as well as enhance your integrity.

3. Use clear phone call to action

Insurance policy is a solution industry that prospers or perishes on the top quality of its lead generation techniques. Making use of clear, direct phone call to action is one method to create top quality leads.

Recommended Browsing !2d-111.9276777!3d33.6313687!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x872b7562055c8fdb%3A0x60507b29d5ebb813!2sLuxe%20Insurance%20Brokers!5e0!3m2!1sen!2sph!4v1688812113899!5m2!1sen!2sph" width="600" height="450" style="border:0;" allowfullscreen="" loading="lazy" referrerpolicy="no-referrer-when-downgrade">

As an example, a website that is enhanced for relevant keyword phrases will certainly bring in clients that are already searching for an agent. Obtaining provided on credible evaluation websites can also boost your client base and produce references.

Bear in mind, however, that it takes some time to obtain arise from these initiatives. Display your pipe closely, as well as use performance metrics to refine your advertising and marketing technique.

4. Buy leads from a lead service

The insurance coverage biz can be a hard one, even for the most knowledgeable representatives. That's why it pays to utilize useful advertising and marketing strategies that are shown to generate leads and transform them right into sales.

As an example, making use of an interesting site with fresh, relatable material that positions you as a local specialist can draw in online traffic. Obtaining provided on credible review sites can aid as well. And having a chatbot is an essential for insurance policy digital advertising and marketing to help customers reach you 24x7, also when you run out the office.

5. Support leads on LinkedIn

Lots of insurance policy representatives remain in a race against time to get in touch with possible consumers before the leads weary and also take their business in other places. This procedure is usually described as "working your leads."

Insurance coverage firms can generate leads on their own, or they can buy leads from a lead service. Purchasing leads conserves money and time, yet it is important to recognize that not all lead solutions are developed equivalent.

To get the most out of your list building initiatives, you require a lead service that specializes in insurance policy.

6. Request for consumer endorsements

Insurance agents prosper or perish based on their capacity to connect with prospects. Getting as well as nurturing quality leads is essential, particularly for brand-new agents.

On the internet material advertising, an effective and also affordable technique, is an efficient way to create leads for your insurance policy business. Think about what https://www.valuepenguin.com/best-cheap-full-coverage-auto-insurance is searching for and also create valuable, helpful content that resonates with them.

Endorsements, in text or sound style, are a superb device for establishing depend on with prospective clients. These can be published on your site or utilized in your e-mail newsletter and also social media sites.

7. Outsource your list building

Maintaining a consistent pipe of certified leads can be testing for insurance policy agents, especially when they are busy servicing existing clients. Outsourcing your list building can free up your time to concentrate on growing your organization and also acquiring brand-new clients.

Your internet site is among the very best devices for generating insurance policy leads. It needs to be very easy to navigate and also supply clear contact us to activity. In addition, it is very important to obtain listed on trustworthy evaluation websites and also make use of testimonials.

One more fantastic way to generate insurance coverage leads is with web content marketing. By sharing relevant, interesting posts with your audience, you can construct count on and develop yourself as a thought leader in the sector.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Get One Of The Most From Your Auto Insurance |

Article writer-Hoffmann Henson

If people talk their automobile insurance at all, it is most likely because the monthly premiums are just too high. Well, there are many ways you can work to bring down the cost of your insurance without allowing the quality of your coverage to suffer. You can also apply some suggestions that could keep you from inadvertently gettin into trouble. Learn about a few of them below.

If you are a young driver and pricing auto insurance, consider taking a driver's education course, even if your state does not require driver's education to earn your license. Having such a course under your belt shows your insurance company that you are serious about being a safer driver, and can earn you a substantial discount.

Buying car insurance online can help you find a great deal. Insurance companies often provide a discount for online applications, since they are easier to deal with. Much of the processing can be automated, so your application doesn't cost the company as much. You may be able to save up to 10%.

The majority of people think car insurance rates for young drivers will drastically decrease as soon as they turn twenty-five. However, the truth is that rates slowly decrease from the time a driver turns 18 years old, as long as he or she maintains a clean driving record.

There are many ways to save money on your auto insurance policies, and one of the best ways is to remove drivers from the policy if they are no longer driving. A lot of parents mistakenly leave their kids on their policies after they've gone off to school or have moved out. Don't forget to rework your policy once you lose a driver.

Don't allow inferior parts to be used to repair your car, and it will last longer. Some insurance companies may send you to a repair shop that doesn't necessarily have your car's best interests in mind. Make sure that they use parts directly from the manufacturer to ensure a perfect fit and that they meet federal safety standards.

If you have other drivers on your insurance policy, remove them to get a better deal. Most insurance companies have a "guest" clause, meaning that you can occasionally allow someone to drive your car and be covered, as long as they have your permission. If your roommate only drives your car twice a month, there's no reason they should be on there!

Before purchasing a car, check the insurance rates that come with it. The premium amount varies between different vehicles. This is because some vehicles are more accident prone than others. Also, if is is appropriate try to stay clear of purchasing trucks or SUVs. visit the up coming post are much higher on them.

Don't allow inferior parts to be used to repair your car, and it will last longer. Some insurance companies may send you to a repair shop that doesn't necessarily have your car's best interests in mind. Make sure that they use parts directly from the manufacturer to ensure a perfect fit and that they meet federal safety standards.

If your annual premium corresponds to ten percent of your car's blue book value, you should drop your collision coverage. Coverage is limited to a car's blue book value: if your car is too old, you are paying a lot of money for an insurance that will not pay you much when you file a claim.

One way to reduce the insurance premiums on a car is to ensure it is parked in a safe location. Generally speaking, parking a car on the street or in a driveway is less secure than parking it in a garage or secured lot. Most insurance companies take note of this distinction and offer discounts for safer parking arrangements.

A great tip for affordable auto insurance is to consider the possibility of increasing your deductible. If you have a higher deductible, you will not have to pay as much interest. However, you should make sure you have enough money set aside in case of emergencies before raising your deductible.

In order to save money on car insurance, it is critical that you understand what level of insurance you need. If you are driving an older car, it might not be worth paying for comprehensive or collision coverage. The most your insurance company will pay for damage to the car is its current resale value. Find the current resale value of your car and check it against how much you could save over two or three years by switching to the minimum liability insurance. You could find that simply switching your coverage from collision to liability will save you hundreds of dollars!

It's important to consider your insurance deductible and decide whether to go with a lower or higher deductible. A higher deductible will mean a lower monthly payment, but more out of pocket in the event of an accident. A lower deductible generally means a higher rate, but it might be easier to come up with the lower amount if you are at fault in an accident.

One way to reduce the insurance premiums on a car is to ensure it is parked in a safe location. Generally speaking, parking a car on the street or in a driveway is less secure than parking it in a garage or secured lot. Most insurance companies take note of this distinction and offer discounts for safer parking arrangements.

Find out whether you live in an at-fault or a no-fault state and understand the difference. If you live in a no-fault state, your insurance company is responsible for paying your medical bills and lost wages up to the amount of insurance you purchased. So if you are underinsured and become injured in an accident, there could be too little or no reimbursement to you, even if the accident was the other driver's fault.

If you are aiming to get affordable auto insurance, you should know your financing requirements. If you finance your vehicle, you may have more requirements set by the financing company that you have to maintain. This will likely affect the amount of your deductible, so you should know these requirements before raising your deductible.

If you want to get cheap auto insurance rates one of the things that you can do is to build up your reputation as a safe driver. If you had no claim in 5 five years, your insurance can be reduced by as much as 75 percent. Insurance companies will give you lower car insurance rates if they know that you can stay away from accidents.

As you can see, there's a lot of knowledge that goes in to selecting the right auto insurance for your needs. Now that insurance companies london know what needs to be done, you can make an informed decision about your insurance provider. Make sure to keep this information in mind, and good luck!

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

Read This If You Intended To Obtain The Best Automobile Insurance Coverage |

Content writer-Tilley Schwartz

Auto insurance is one of those necessities that can cost quite a bit. However, the Internet today offers great resources and tools for finding car insurance for prices well below what you would expect. In fact, these tips could save you over $100 the first year of your policy alone.

Be sure to keep your car secure. Keeping your car garaged, having a security alarm system, using a locking device on your steering wheel, having a professionally installed tracking system and living in a safe neighborhood are just a few of the ways you can save some money on your car insurance. Be sure to ask your agent how you can get discounts on your insurance rates with good security measures.

The less you use your car, the lower your insurance rates will be. If you can take the bus or train or ride your bicycle to work every day instead of driving, your insurance company may give you a low-mileage discount. This, and the fact that you will be spending so much less on gas, will save you lots of money every year.

It's important, if you're looking to get the most out of your auto insurance dollars, to continue to evaluate whether you're paying too much in terms of the number of drivers you need to cover. For example, if you're still carrying auto insurance for your children who are grown and in college who don't use your car, then take them off the policy and your rates will go down nicely.

Check out your state's minimum insurance guidelines, and follow them. Some states only require you to have liability coverage, but others require personal injury as well. Make sure you know your state's practices so that you do not fail to meet them, and end up with a ticket for not having enough coverage.

There are a lot of factors that determine the cost of your automobile insurance. Your age, sex, marital status and location all play a factor. While you can't change most of those, and few people would move or get married to save money on car insurance, you can control the type of car you drive, which also plays a role. Choose cars with lots of safety options and anti theft systems in place.

If your annual mileage driven is low, your auto insurance premium should be, too. Fewer miles on the road translates directly into fewer opportunities for you to get into accidents. Insurance companies typically provide a quote for a default annual mileage of 12,000 miles. If http://autoinsuranceinfo.info/auto-insurance-companies-for-high-risk-drivers/ drive less than this be sure your insurance company knows it.

Get a car insurance quote before you purchase a new vehicle. One of the major factors in how much your policy will cost you is the kind of car that you own. The same brand of car with a different model can change your yearly rates by a thousand dollars. Make sure you know that you can afford the insurance before you leave with the car.

When you get a quote for your auto insurance don't overvalue your vehicle. This will only cause your rates to be higher and cost you more money in the long run. In the case of an accident, you will only be paid for the market value of your car anyway.

If you have a good credit score, there is a good chance that your automobile insurance premium will be cheaper. Insurance companies are beginning to use your credit report as a part for calculating your insurance premium. If you maintain a good credit report, you will not have to worry about the increase in price.

Remember that you didn't just buy the first car that you ran across, but took time to analyze all of the good options. You should follow the same rule when looking at car insurance. Many times you will just want to accept the first deal you find, but you should be sure to look around at many options both online and in the agencies.

The cost of your auto insurance will be impacted by the number of tickets and points on your driving record. To get your best rate, you must wait until your driving record is clear and then look for a new auto insurance provider. https://thetalkingdemocrat.com/us-news/189153/auto...company-of-china-usaa-allianz/ will be significantly lower; you will save a lot on your premiums.

When you get a quote for your auto insurance don't overvalue your vehicle. This will only cause your rates to be higher and cost you more money in the long run. In the case of an accident, you will only be paid for the market value of your car anyway.

When renting a rental truck, it is likely better to purchase the rental insurance as many auto insurance policies do not cover the same damage for a commercial truck. Your credit card agreement will likely also not cover the insurance related to the renting of a commercial truck. Check your policies to be sure, but in most instances it is better to opt for the insurance when renting a truck.

Find out if you can get a discount on your car insurance rates if you have not made any claims during the last 3 years. Some insurance companies will give you a special discount because you are believed to be less of a risk, due to no recent insurance claims.

Completing a safer driving course is an easy way to reduce your annual auto insurance premiums. Most companies will give you a break on the premium if you take one of these classes. It will also teach you to become a better driver. These courses are offered by many driving schools. You can also find them online.

The cost of your auto insurance will be impacted by the number of tickets and points on your driving record. To get your best rate, you must wait until your driving record is clear and then look for a new auto insurance provider. The cost will be significantly lower; you will save a lot on your premiums.

Stay as long as you can with one auto insurance company. The longer you remain a customer, the more profitable you are to an insurance company. To try keep your business longer they will often offer you a renewal discount after three years' time. Discounts can be anywhere from one percent to ten percent. Your discount will become larger the longer you stay with them after that three year mark.

Don't hesitate to price compare when you're looking for an auto insurance policy, as prices can vary widely. The internet has made it increasingly easy to check around for the best price on a policy. Many insurers will give you instant quotes on their website, and others will e-mail you with a quote within a day or two. Make sure that you give the same information to each insurer to guarantee you're getting an accurate quote, and take into account any discounts offered, as these can vary between insurers.

As you now may be starting to understand, the auto insurance purchasing process does not need to be as painful as it once was. The important thing to remember is to explore your options. By following the tips and advice from this article, you will help to ensure that you have the best experience, while getting the best deal possible.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

What Is A Public Adjuster As Well As How Do They Function? |

Author-Vest Li

What is a Public Insurer? A public insurance adjuster, also called an independent assessor, is an independent professional acting solely in support of the insured's lawful passions. The insured pays the general public insurance adjuster, not the insurer, for his/her services. State regulations limit the authority of public insurance adjusters to the examination of building damages and losses and limit their liability to the repayment of advantages to the hurt, as well as limit their capacity to adjust injury cases.

If you are involved in an automobile crash, your insurance provider may have assigned a "public insurance adjuster" to represent your interests prior to the Insurance coverage Insurer. The insurance company's insurer will certainly investigate your claim and also assess your files. Your insurer will gather information from witnesses, photographs, authorities reports, repair estimates, and other proof to make an excellent public insurer's report. The Insurance Insurance adjuster's work is to apply all the info to establish who ought to pay you for your injuries.

When your insurance policy holder's insurance coverage claim is rejected, the insurer will often pursue the instance vigorously. The insurance adjuster's report is usually connected to the decision of the Insurance coverage Insurance adjuster to honor the insurance policy holder an insurance claim amount. Although the Insurance policy Adjuster's decision can be appealed, if the charm is refuted by the court, the general public Insurance adjuster will not be required to make a last record.

In lots of states, the charge for having a Public Insurer's record is not a needed component of your policy. Nevertheless, several public insurers charge a sensible cost for their aid. On top of that, the Insurer might request an additional fee from the general public Adjuster in the event of a rejection of an insurance claim. These fees are usually a percentage of the real loss quantity.

Insurer can locate several ways to prevent paying a public insurance adjuster's cost. Some business try to have a public insurer remove himself from the situation. If this takes place, the Insurance provider will certainly still receive all of the repayment cash that the general public insurance adjuster was spent for. Various other business try to get the Insurance Adjuster to not note any adverse aspects regarding your case.

Insurer that have public insurance adjusters typically have a separate department in charge of making decisions of the loss and settlement quantity. As part of their task, the public insurance adjuster will certainly see the real website where the mishap took place. She or he will review the website and pay attention to the claims from clients. From these gos to, the company insurer will prepare an adjusted report that will information all of the information of your insurance claim.

When the Public Adjuster makes his record, the Insurance Company will normally call for an assessment to establish an exact loss quantity. This appraisal, which is commonly carried out by an appraiser who is independent of the business that carried out the case, is extremely helpful for the Insurance Company. Great public insurers will make use of the appraisal as an overview so that they can make an accurate resolution of the loss. In Professinal Expert Public Adjusters near me to an appraisal, if the Insurance Company has a great case insurer, he or she may request that a professional (such as a land appraiser) also evaluate the loss record to guarantee that the case is being made to a precise standard.