Business Tax Credits And Motivations: Exactly How To Remove Maximum Worth |

Post By-Kock Welch

Navigating corporate tax credit ratings and motivations can seem complicated, but it's necessary for your organization's monetary wellness. By understanding https://azcapitoltimes.com/news/2025/10/09/state-b...head-of-federal-h-r-1-changes/ offered and just how they put on your industry, you can open considerable savings. However, it's not practically recognizing what's around; efficient approaches for determining and obtaining these credit histories are similarly crucial. Let's discover how you can maximize your technique and guarantee you're not leaving money on the table.

Recognizing the Types of Corporate tax Credit Histories and Motivations

When you study the globe of company tax debts and incentives, you'll rapidly find that they come in various forms, each made to motivate particular organization actions.

As an example, investment tax credit reports award you for acquiring tools or property that increases your firm's operations. Work creation tax debts incentivize hiring new employees, while research and development credit scores promote innovation by balancing out expenses connected to creating brand-new items or procedures.

Energy effectiveness credit reports encourage organizations to embrace greener methods by using economic advantages for minimizing energy usage. Comprehending these kinds allows you to align your company objectives with readily available incentives, ultimately optimizing your possible savings and encouraging growth.

Strategies for Recognizing and Making An Application For tax Debts

Recognizing and looking for corporate tax credits can dramatically influence your bottom line, and knowing where to start makes all the difference.

Begin by investigating offered credits certain to your market and area. Make use of online databases and federal government internet sites to discover pertinent programs. Connecting with other company owner can supply beneficial understandings and recommendations.

Once you've determined potential credits, collect required documents, such as financial records and project summaries, to support your application.

Keep https://blogfreely.net/kenneth24perry/secret-compa...-to-lower-your-tax-commitments on target dates and ensure you fulfill all qualification criteria. Think about seeking advice from a tax obligation specialist that focuses on credit scores to maximize your opportunities of authorization.

Resources for Maximizing Your tax Motivation Advantages

Maximizing your tax incentive advantages requires leveraging the appropriate sources and devices.

Begin by speaking with a tax specialist who can assist you via the complexities of readily available credit ratings. Make use of on the internet data sources like the IRS site to stay upgraded on new motivations and qualification requirements.

Connecting with sector peers can likewise expose useful understandings and shared experiences concerning effective approaches. Don't neglect local financial advancement organizations; they typically offer resources and support for services seeking tax benefits.

Additionally, take into consideration investing in tax software program designed to identify prospective credits specific to your organization.

Final thought

Incorporating business tax credit scores and incentives into your company technique can result in substantial cost savings and development. By understanding the numerous kinds available and actively seeking them out, you can place your company for financial success. Don't hesitate to team up with tax professionals and take part in networks that can assist you. Stay informed, file whatever, and guarantee you satisfy qualification requirements. With the ideal approach, you'll not only reduce your tax obligations however additionally improve your overall business procedures.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Important Company Earnings Tax Methods For Lowering Your Tax Lots |

Write-Up By-Holcomb Mark

Browsing corporate earnings tax can really feel overwhelming, yet it doesn't have to be. By understanding your responsibilities and implementing tactical techniques, you can considerably reduce your tax concern. From optimizing go to this web-site to exploring tax-efficient organization structures, there are numerous opportunities to take into consideration. Want to uncover the most reliable approaches that could cause substantial cost savings? Let's explore these choices better.

Recognizing Your tax Commitments

Recognizing your tax responsibilities is crucial for maintaining compliance and enhancing your financial technique. You need to acquaint yourself with federal, state, and local tax demands that apply to your service.

This implies keeping track of deadlines for filing and paying taxes, guaranteeing you know various tax rates, and recognizing exactly how various types of earnings are exhausted. Don't forget about pay-roll taxes if you have workers; they come with their own collection of duties.

Think about consulting a tax expert to browse complicated laws and guarantee you're satisfying all commitments. By remaining educated and positive, you can prevent charges and make informed choices that benefit your profits.

Being compliant today collections you up for financial success tomorrow.

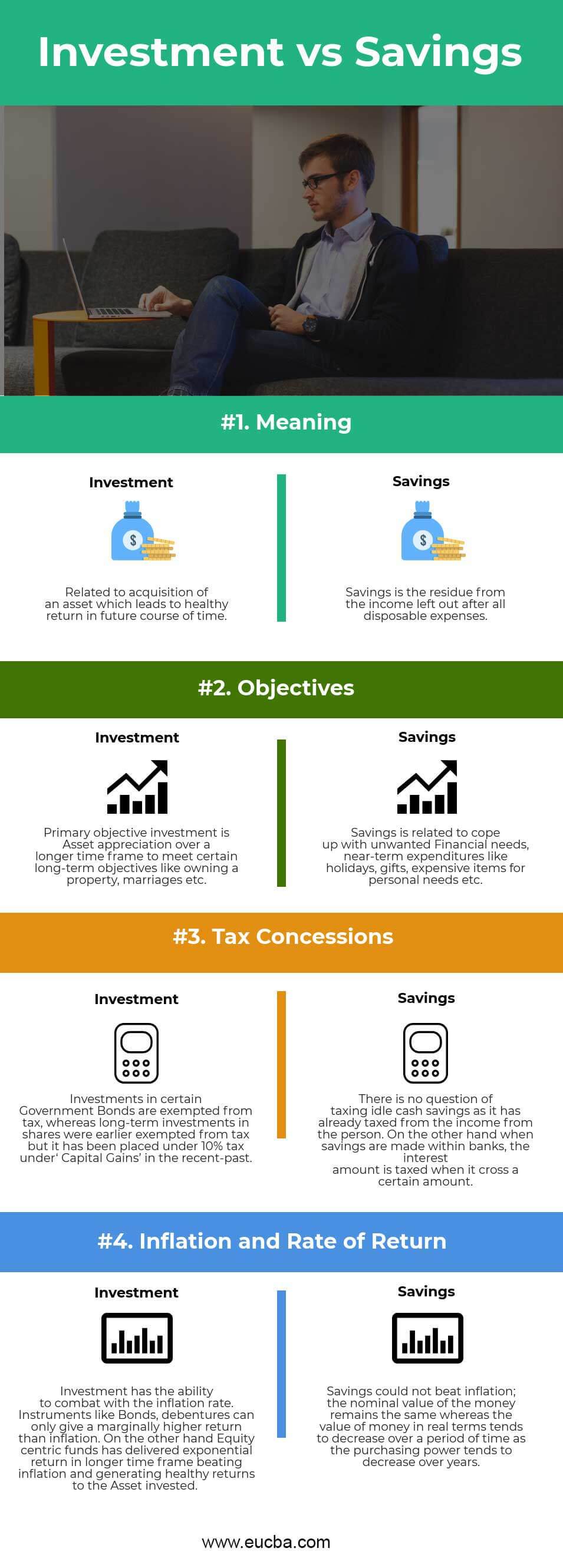

Using tax Credit Ratings Effectively

When you've grasped your tax obligations, it's time to check out just how tax credits can enhance your monetary technique. tax credit reports directly minimize the amount of tax you owe, so utilizing them efficiently can dramatically decrease your tax problem.

Start by identifying readily available credit scores pertinent to your organization, such as those for r & d, renewable energy, or employee training. See to it to keep precise records and documentation to support your claims.

Do not overlook state and neighborhood credit scores, which can likewise provide considerable savings. By remaining educated about qualification needs and deadlines, you can maximize your advantages.

Get in touch with a tax specialist to ensure you're taking full advantage of all debts readily available to you, inevitably boosting your bottom line.

Taking Full Advantage Of Deductions for Business Expenses

While you concentrate on growing your organization, don't overlook the significance of taking full advantage of reductions for your overhead. Every dollar you invest in essential expenditures can possibly minimize your taxable income.

Maintain precise documents of all business-related prices-- like office supplies, travel, and energies. Don't forget to consist of expenses for advertising and marketing, as they're important for development.

If you utilize your lorry for business, track your gas mileage and associated costs to declare those reductions. Likewise, take into consideration the benefits of office deductions if you work from home.

Implementing Tax-Deferred Retirement Plans

Carrying out tax-deferred retirement plans can be a game-changer for your business and personal finances, specifically when you want to protect your future while minimizing your existing tax obligation.

By providing plans like a 401( k) or a Basic IRA, you not just bring in and preserve top skill but additionally reduce your gross income. Contributions you make on behalf of your workers are tax-deductible, decreasing your overall tax concern.

And also, employees benefit from tax-deferred growth on their financial investments until retired life. You'll discover that these strategies can also promote a positive office society, as employees appreciate the lasting advantages.

Inevitably, it's a win-win method that boosts your monetary standing while offering beneficial retired life options for your workforce.

Discovering Tax-Efficient Company Structures

Selecting the best organization framework can considerably influence your tax effectiveness and total monetary wellness. When you're determining in between alternatives like sole proprietorships, partnerships, LLCs, or corporations, consider just how each structure impacts your tax obligations.

For example, LLCs typically offer versatility and pass-through taxes, permitting profits to be strained at your personal price as opposed to a business degree. Corporations, on the other hand, may encounter double tax yet can offer advantages like retained revenues and potential reductions for fringe benefit.

Each option has its advantages and disadvantages, so examine your company objectives, possible development, and individual economic situation. By selecting a tax-efficient structure, you can reduce your tax problem and maximize your sources for reinvestment and expansion.

Capitalizing On Loss Carryforwards

When structuring your organization for tax effectiveness, it's likewise crucial to think about exactly how to take advantage of any losses your firm may incur.

Loss carryforwards allow you to counter future gross income with previous years' losses, effectively lowering your tax problem. This implies that if your organization experiences a slump, you can apply those losses versus earnings in future years.

It's critical to track your losses carefully and comprehend the details guidelines controling carryforwards in your jurisdiction. By doing this, you'll maximize your tax benefits and boost cash flow.

Always talk to a tax expert to guarantee you're utilizing this method efficiently, as they can assist you navigate any kind of complexities and optimize your tax placement.

Participating In Strategic Charitable Payments

While you might think of philanthropic payments as a way to return, they can likewise be a powerful device for lowering your company tax responsibility. By strategically contributing to certified nonprofits, you can appreciate tax deductions that reduced your gross income.

It's vital to keep an eye on your contributions, guaranteeing they line up with your business's worths and objectives. Think about establishing a company providing program that motivates staff member involvement, which can boost morale while improving your tax benefits.

Additionally, discover donations of goods or services, as these can provide added deductions. Bear in mind, the extra intentional you're about your philanthropic providing, the much more you can take full advantage of both your effect on the neighborhood and your tax financial savings.

Thinking About International tax Approaches

As you expand your service around the world, taking into consideration worldwide tax approaches comes to be crucial for enhancing your total tax setting.

You'll want to check out tax treaties, which can aid you decrease withholding taxes and stay clear of dual taxation. Developing subsidiaries or branches in nations with beneficial tax regimes may also supply substantial financial savings.

In addition, capitalize on transfer pricing regulations to allot revenues tactically among your global entities. This enables you to manage tax obligations effectively throughout territories.

Watch on neighborhood compliance demands, as failure to adhere can bring about penalties.

Leveraging Research and Development (R&D) tax Incentives

Exactly how can your business benefit from Research and Development (R&D) tax rewards? By leveraging these rewards, you can significantly decrease your tax concern while cultivating technology.

If you're developing brand-new items, processes, or enhancing existing ones, you might get important tax credit ratings. This not only decreases your taxable income but also increases capital, enabling you to reinvest in additional R&D or various other business campaigns.

To take full benefit, maintain in-depth records of your R&D activities and expenses. Recording your projects clearly can help you confirm your cases and optimize your benefits.

Do not overlook sales tax consultant of staying up to day with changing guidelines, as this ensures you're catching all available chances in R&D tax credit histories.

Teaming Up With tax Specialists for Compliance and Strategy

Making the most of R&D tax motivations can be a video game changer for your business, yet browsing the intricate tax landscape requires expertise.

Teaming up with tax professionals is important for guaranteeing conformity and optimizing your advantages. They recognize the ins and outs of tax laws and can assist you determine qualified tasks and costs.

By working together, you can establish reliable techniques that line up with your organization goals while lessening risks. tax specialists can additionally maintain you upgraded on changes in regulation, ensuring you never ever miss a possibility.

Normal appointments can boost your tax preparation, helping you make notified decisions. Ultimately, buying specialist guidance can lead to substantial financial savings and a much more durable monetary placement for your business.

Conclusion

By applying these top corporate earnings tax techniques, you can considerably minimize your tax worry and keep even more funds in your organization. Focus on maximizing deductions, using tax debts, and discovering efficient business frameworks. Do not neglect to buy tax-deferred retirement and think about charitable contributions for included advantages. Regularly consult with tax specialists to ensure conformity and reveal new financial savings chances. With the ideal technique, you'll enhance your tax technique and improve your firm's financial wellness.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Intending To Enhance Your C-Corporation's Tax Effectiveness? Figure Out Vital Approaches That Might Alter Your Financial Framework |

Write-Up Author-Lange Graves

When it comes to tax planning for C-Corporations, you need to focus on making the most of deductions and credit ratings while ensuring conformity with tax regulations. By determining insurance deductible expenditures and leveraging available tax motivations, you can dramatically lower your liabilities. However that's simply the beginning. Navigating the complexities of earnings circulation and maintained incomes can better enhance your tax effectiveness. So, what https://blogfreely.net/louetta57laurene/corporate-...a-detailed-guide-for-companies can you implement to genuinely enhance your economic position?

Making The Most Of Deductions and Credit Histories

To take full advantage of reductions and credits for your C-Corporation, it's important to recognize the various expenditures that certify.

Beginning by recognizing operating costs like wages, rental fee, and utilities. These are normally insurance deductible, so keep precise records.

Do not forget business-related travel expenses, which can likewise minimize your gross income.

In addition, think about the benefits of depreciation on possessions, as it enables you to spread out the expense of a property over its beneficial life.

Study offered tax credit scores, like those for research and development or working with specific employees, as they can considerably reduce your tax burden.

Navigating tax Conformity and Reporting

While managing your C-Corporation's finances, you can't ignore the relevance of tax compliance and reporting. Remaining compliant with federal, state, and local tax legislations is vital to avoid charges and audits. Make certain you're staying on par with due dates for filing income tax return and making projected payments.

Organizing your financial records is necessary; preserve accurate publications and sustaining documentation for all deals. Utilize tax prep work software application or consult a tax obligation specialist to guarantee you're correctly reporting revenue, reductions, and credit ratings.

Consistently evaluate your tax strategy to adjust to any kind of adjustments in tax regulations. Remember, positive conformity not just reduces threats however likewise improves your company's integrity with stakeholders. Keeping whatever in order will certainly save you time and stress over time.

Strategic Revenue Distribution and Preserved Earnings

After ensuring compliance with tax legislations, it's time to focus on how you disperse income and take care of kept earnings within your C-Corporation.

A strategic strategy to earnings circulation can help minimize your general tax liability. Consider paying dividends to investors, however keep in mind that this will certainly set off double taxes.

Alternatively, you could preserve profits to reinvest in the business, which can foster growth and postpone tax obligations. Stabilizing these alternatives is critical; excess maintained earnings might bring in scrutiny from the internal revenue service, while excessive circulation might prevent your business's expansion.

Consistently evaluate your economic goals and speak with a tax obligation expert to optimize your technique, ensuring you're efficiently handling both distributions and maintained profits for lasting success.

Final thought

Finally, reliable tax preparation for your C-Corporation is essential for optimizing reductions and credit reports while guaranteeing compliance. By tactically handling https://taxfoundation.org/research/all/state/big-beautiful-bill-state-tax-impact/ and preserving profits, you can enhance tax performance and sustain your business goals. Frequently seeking advice from tax experts keeps you educated concerning transforming guidelines and assists you adjust your methods accordingly. Stay positive and make informed choices to reduce your tax liabilities and encourage development in your firm.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Tax Preparation Approaches For C-Corporations |

Developed By-Munkholm Gross

When it comes to tax preparation for C-Corporations, you need to focus on optimizing reductions and credits while ensuring compliance with tax regulations. By identifying deductible costs and leveraging offered tax rewards, you can significantly minimize your obligations. However that's simply the start. Navigating the intricacies of revenue distribution and maintained incomes can better boost your tax performance. So, what strategies can you implement to genuinely enhance your financial position?

Making The Most Of Deductions and Credits

To maximize deductions and debts for your C-Corporation, it's essential to comprehend the numerous costs that certify.

Begin by identifying operating costs like salaries, rent, and utilities. These are typically insurance deductible, so keep precise documents.

Do not forget about business-related travel costs, which can likewise minimize your taxable income.

In addition, consider the benefits of devaluation on assets, as it permits you to spread the price of an asset over its helpful life.

Recommended Studying , like those for research and development or hiring certain workers, as they can dramatically decrease your tax worry.

Navigating tax Compliance and Reporting

While managing your C-Corporation's financial resources, you can not ignore the relevance of tax compliance and reporting. Remaining certified with government, state, and local tax legislations is critical to prevent penalties and audits. Make certain you're staying on top of deadlines for filing tax returns and making estimated payments.

Organizing your financial documents is essential; keep exact books and sustaining documentation for all purchases. Make use of tax preparation software application or consult a tax obligation professional to guarantee you're correctly reporting earnings, reductions, and credit scores.

Consistently assess your tax method to adjust to any modifications in tax legislations. Remember, proactive conformity not just decreases threats yet also enhances your corporation's trustworthiness with stakeholders. Keeping whatever in order will certainly conserve you time and anxiety over time.

Strategic Income Circulation and Kept Revenues

After guaranteeing conformity with tax legislations, it's time to focus on how you disperse revenue and take care of retained incomes within your C-Corporation.

A calculated method to revenue circulation can help reduce your general tax obligation. Consider paying http://rayford8811elfriede.xtgem.com/__xt_blog/__x...ty?__xtblog_block_id=1#xt_blog to investors, however bear in mind that this will trigger double taxes.

Additionally, you could retain incomes to reinvest in business, which can promote development and delay tax obligations. Balancing these alternatives is essential; excess kept profits could attract examination from the IRS, while too much distribution could impede your business's development.

On a regular basis analyze your monetary goals and talk to a tax obligation consultant to optimize your method, ensuring you're effectively handling both distributions and preserved incomes for long-lasting success.

Final thought

In conclusion, effective tax preparation for your C-Corporation is vital for making best use of reductions and credit ratings while ensuring compliance. By purposefully handling income circulation and retaining earnings, you can maximize tax efficiency and support your service objectives. Regularly seeking advice from tax professionals maintains you notified about changing policies and aids you adjust your strategies as necessary. Remain proactive and make informed choices to decrease your tax responsibilities and urge development in your company.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Differences In Between Federal And State Corporate Tax Obligations |

Team Writer-McNulty Paaske

When it comes to business taxes, understanding the distinctions between federal and state regulations is crucial for any organization. simply click the next internet site might believe it's straightforward, yet varying rates and special compliance demands can make complex matters. Federal tax obligations are evaluated a level rate, while state taxes can fluctuate substantially. This can influence your service techniques greater than you recognize. So, what do you need to understand to navigate these complexities efficiently?

Summary of Federal Corporate Tax Obligations

When it pertains to corporate tax, comprehending federal corporate tax obligations is crucial for local business owner and stakeholders.

The federal business tax price presently stands at 21%, a flat price that relates to your gross income. You'll require to determine your revenue by deducting allowed deductions from your overall revenue.

Various deductions can considerably impact your taxable income, including expenses connected to organization procedures, staff member wages, and devaluation of assets.

It's essential to stay certified with the IRS laws, as falling short to do so can cause fines.

In addition, firms can pick between C-corporation and S-corporation standings, affecting tax therapy.

Understanding https://www.rossmartin.co.uk/sme-tax-news/8497-sma...ccount-for-60-of-missing-taxes will certainly aid you make informed choices about your company's financial techniques and responsibilities.

Recognizing State Business Tax Obligations

While federal business taxes are consistent across the nation, state corporate tax obligations differ significantly from one state to another, impacting your organization's overall tax obligation.

Each state has its own tax rate, which can influence where you decide to incorporate or run. Some states may offer lower rates or specific motivations to attract businesses, while others could impose greater tax obligations.

Additionally, the tax base can differ, with some states tiring just revenues and others taxing earnings. https://squareblogs.net/lucretia61arthur/preparing-for-a-federal-corporate-tax-audit 'll likewise require to think about aspects like apportionment formulas and neighborhood taxes, which can even more complicate your estimations.

Remaining informed regarding these variations is essential for effective tax preparation and making certain compliance with state policies.

Key Distinctions Between Federal and State Taxes

Although both federal and state company taxes aim to generate revenue, they vary considerably in structure, rates, and policies.

Federal business tax rates are typically consistent throughout the country, while state rates can differ commonly from one state to an additional, typically varying from 3% to 12%.

You'll additionally locate that federal taxes follow the Internal Revenue Code, while each state has its own tax regulations, resulting in special reductions and debts.

Conformity can be extra complicated at the state level due to varying filing requirements and due dates.

Furthermore, some states impose additional tax obligations, like franchise business taxes, which government tax obligations do not have.

Recognizing these differences is vital for efficient tax preparation and decreasing liabilities.

Final thought

In conclusion, understanding the distinctions in between government and state business tax obligations is vital for your business method. While the federal price is evaluated 21%, state prices can rise and fall significantly, affecting your bottom line. Each state has unique regulations, reductions, and potential additional tax obligations, like franchise taxes, that make complex compliance. By remaining educated and adjusting to these distinctions, you can optimize your tax technique and ensure your service flourishes in a complicated tax landscape.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Strategies For Tax Preparation In C-Corporations |

check this link right here now Develop By-Wall Ohlsen

When it comes to tax preparation for C-Corporations, you require to focus on optimizing reductions and credit scores while ensuring conformity with tax laws. By identifying insurance deductible expenses and leveraging offered tax incentives, you can significantly minimize your responsibilities. Yet that's simply the start. Navigating the intricacies of income distribution and retained profits can further boost your tax performance. So, what methods can you carry out to truly enhance your financial position?

Taking Full Advantage Of Deductions and Credit Histories

To make the most of reductions and credits for your C-Corporation, it's essential to recognize the various costs that qualify.

Start by identifying operating costs like salaries, rent, and utilities. retirement savings contribution credit are usually deductible, so keep exact records.

Don't forget business-related travel expenses, which can likewise minimize your taxable income.

Additionally, take into consideration the benefits of depreciation on possessions, as it permits you to spread the cost of a possession over its valuable life.

Research offered tax credit scores, like those for r & d or employing certain workers, as they can considerably decrease your tax burden.

Navigating tax Compliance and Coverage

While handling your C-Corporation's financial resources, you can not overlook the significance of tax compliance and coverage. Staying certified with federal, state, and local tax regulations is important to prevent fines and audits. Make sure you're staying up to date with due dates for filing tax returns and making projected payments.

Organizing tax amnesty is crucial; maintain accurate publications and supporting documentation for all transactions. Utilize tax prep work software or consult a tax specialist to ensure you're properly reporting earnings, reductions, and credit histories.

Routinely assess your tax strategy to adapt to any modifications in tax legislations. Bear in mind, positive conformity not only reduces risks however additionally improves your firm's reputation with stakeholders. Keeping whatever in order will conserve you time and stress in the long run.

Strategic Earnings Distribution and Retained Earnings

After making sure conformity with tax regulations, it's time to concentrate on exactly how you distribute earnings and manage maintained incomes within your C-Corporation.

A strategic strategy to earnings circulation can assist reduce your overall tax liability. Take into consideration paying dividends to shareholders, however keep in mind that this will activate dual taxation.

Conversely, you may preserve incomes to reinvest in business, which can cultivate development and delay tax obligations. Balancing these alternatives is vital; excess maintained incomes could attract examination from the IRS, while excessive distribution might hinder your business's development.

On a regular basis examine your monetary objectives and speak with a tax advisor to enhance your strategy, guaranteeing you're effectively handling both circulations and kept profits for long-term success.

Conclusion

In conclusion, reliable tax planning for your C-Corporation is essential for making best use of deductions and credit ratings while ensuring compliance. By tactically handling revenue distribution and keeping incomes, you can maximize tax performance and support your service objectives. On a regular basis consulting with tax specialists maintains you educated regarding changing policies and helps you adjust your approaches accordingly. Remain positive and make notified decisions to decrease your tax liabilities and motivate development in your firm.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Business Tax Credit Ratings And Incentives: Just How To Utilize Them |

Author-Dobson McMahan

Browsing business tax credit scores and rewards can appear daunting, yet it's important for your business's economic health. By recognizing the different kinds offered and just how they apply to your industry, you can open significant financial savings. Nevertheless, it's not nearly understanding what's out there; efficient approaches for determining and requesting these debts are equally essential. Let's check out just how you can optimize your strategy and ensure you're not leaving money on the table.

Recognizing the Sorts Of Corporate tax Credit Reports and Rewards

When you dive into the globe of corporate tax debts and rewards, you'll promptly locate that they are available in numerous kinds, each made to encourage specific organization habits.

For instance, investment tax credit reports reward you for buying equipment or property that boosts your firm's procedures. Work development tax credit scores incentivize employing new workers, while r & d credit scores promote technology by countering costs associated with developing new products or processes.

Power efficiency credit reports motivate services to embrace greener techniques by offering monetary advantages for decreasing energy usage. Recognizing these kinds allows you to straighten your company objectives with readily available rewards, ultimately optimizing your prospective cost savings and motivating development.

Methods for Determining and Making An Application For tax Credits

Determining and looking for company tax credit reports can substantially impact your profits, and knowing where to start makes all the difference.

Begin by investigating available credit scores specific to your market and place. Make use of online databases and federal government web sites to discover relevant programs. Connecting with various other entrepreneur can supply beneficial insights and referrals.

Once you have actually identified potential credit scores, gather required documentation, such as monetary records and task descriptions, to support your application.

https://www.marketwatch.com/story/the-irs-just-rel...-out-where-you-fit-in-ddbc3842 and ensure you meet all eligibility standards. Take into consideration talking to a tax professional that concentrates on credit scores to optimize your chances of authorization.

Resources for Optimizing Your tax Reward Benefits

Maximizing your tax motivation benefits calls for leveraging the best resources and devices.

Beginning by speaking with a tax professional that can guide you with the complexities of offered debts. Make use of on the internet databases like the IRS internet site to stay updated on brand-new motivations and qualification needs.

Connecting with sector peers can also expose valuable insights and shared experiences concerning effective strategies. Don't ignore regional financial growth companies; they commonly supply resources and assistance for organizations seeking tax benefits.

Furthermore, consider buying tax software application made to determine possible credit ratings particular to your service.

Final thought

Including business tax credit scores and rewards right into your business technique can result in considerable cost savings and growth. By understanding the numerous kinds offered and proactively seeking them out, you can place your company for economic success. Don't be reluctant to collaborate with tax specialists and participate in networks that can guide you. Remain educated, record accounting software , and guarantee you satisfy qualification criteria. With the ideal approach, you'll not just lower your tax liabilities however additionally improve your overall company procedures.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Just How Does Business Income Tax Contribute In Company Earnings And Economic Trends? |

Produced By-Guy Parker

Business income tax is an essential facet of how organizations operate and make monetary choices. https://www.liveinternet.ru/users/skou_sauer/post513605990 influences the earnings you see in a business's financial records. To recognize its implications, you require to recognize just how it's computed and the reductions that can be taken. These elements can dramatically influence not just business techniques yet also broader financial trends. So, what exactly goes into identifying this tax, and why should it matter to you?

Comprehending Company Revenue tax

When you consider company earnings tax, it's essential to understand how it impacts companies and the economy. This tax is levied on a firm's earnings, affecting how business run and spend. A higher tax rate may dissuade investment or lead companies to look for tax loopholes, while a lower rate can boost development and work development.

Comprehending business earnings tax assists you recognize its role in funding civil services, framework, and social programs. In addition, it influences decisions like mergers, growths, and prices approaches.

As you browse the corporate landscape, being aware of these dynamics will certainly educate your understanding of company health and economic trends. Eventually, company revenue tax plays a critical duty in shaping both organization techniques and the economic climate at large.

Exactly How Business Earnings tax Is Calculated

Determining business income tax involves establishing a business's gross income and using the proper tax price.

Initially, you'll require to determine your gross earnings, which includes all profits generated by your organization. Next, subtract permitted deductions-- like general expenses, incomes, and depreciation-- to discover your gross income.

When you have that number, you use the business tax rate, which varies based on the jurisdiction and the income bracket your organization falls under.

As an example, if your taxable income is $100,000 and the tax rate is 21%, you 'd owe $21,000 in business income tax.

The Effect of Business Earnings tax on Organizations and the Economic situation

Corporate income tax significantly influences both organizations and the wider economic climate, as it impacts choices on investment, employing, and pricing.

When tax rates enhance, you may wait to purchase brand-new tasks or broaden your labor force. This reluctance can lead to slower economic development and fewer work chances.

Conversely, reduced tax rates can motivate businesses to reinvest profits, work with even more workers, and introduce. Additionally, the way you cost items can be influenced by tax responsibilities, impacting your competition on the market.

On the whole, business income tax shapes the economic landscape, impacting not simply individual services, yet also the economy overall, eventually affecting consumers, job candidates, and capitalists alike.

Recognizing tax return preparation can help you browse your business approach better.

Final thought

Finally, business income tax is a critical element of business landscape. It directly influences your company's profits and investment decisions. By recognizing how it's determined and its broader influence on the economic climate, you can make enlightened choices that align with your financial objectives. Remember, handling your tax commitments effectively can assist you optimize revenues and add favorably to public services and economic growth. Remain positive to browse this important element of running an organization.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

An Exhaustive List For Corporate Tax Compliance |

Authored By-Irwin Hanley

Navigating company tax compliance can feel frustrating, yet having a complete list streamlines the procedure. https://zenwriting.net/nohemi05issac/tax-preparation-techniques-for-c-corporations 'll need to comprehend your tax commitments and keep vital paperwork organized. Key deadlines can creep up on you, so being positive is important. As you collect your materials and due dates, consider exactly how staying upgraded on tax legislations can make a substantial distinction in your compliance efforts. Let's explore what you require to guarantee you stay on track.

Comprehending Corporate tax Responsibilities

Understanding your business tax commitments is critical for maintaining conformity and avoiding fines. You need to stay informed about the numerous tax obligations your organization might be subject to, including revenue tax, payroll tax, and sales tax. Each type has its own regulations and due dates, so it's important to recognize what puts on your details situation.

Ensure you know local, state, and federal laws that affect your service. This knowledge assists you accurately calculate your tax liabilities.

Additionally, recognizing tax credit reports and reductions can significantly reduce your tax concern. Routinely examining your obligations ensures you're planned for submitting deadlines.

Essential Documents and Record-Keeping

To keep conformity with your company tax commitments, having the ideal paperwork and efficient record-keeping techniques is important.

Begin by arranging financial records, including earnings statements, balance sheets, and cash flow statements. Maintain all receipts, billings, and bank statements related to overhead. Record any communication with tax authorities, and preserve payroll documents for employees.

It's additionally necessary to track your business's tax returns and any type of supporting records you submitted. Frequently upgrade your records to make sure accuracy and efficiency.

Take into consideration making use of accountancy software program to simplify this procedure. By keeping thorough documents, you'll not only streamline your tax preparation but additionally be better prepared in case of an audit or inquiry from tax authorities.

Keep arranged and positive!

Secret Target Dates and Filing Needs

Staying on top of essential deadlines and filing requirements is crucial for keeping business tax conformity. Annually, you'll require to file your company income tax return by the due date, commonly March 15 for C firms and April 15 for S corporations.

If you're incapable to fulfill these due dates, take into consideration applying for an extension. Remember to pay approximated https://arnoldo-laurice53glady.technetbloggers.de/...-federal-corporate-revenue-tax to stay clear of fines.

In addition, stay educated regarding state-specific deadlines, as they can vary. Don't neglect to keep track of pay-roll tax filings, which are generally due every three months.

Reviewing these days regularly can aid you avoid expensive errors. Mark your calendar and set suggestions to guarantee you're always prepared and certified.

Conclusion

Finally, staying on top of your corporate tax compliance is important for your service's success. By comprehending your tax commitments, keeping organized documents, and sticking to vital target dates, you can prevent fines and guarantee smooth operations. Make it a top priority to consistently upgrade your understanding on tax regulations and use audit software program to streamline your procedures. With this list, you're fully equipped to browse the complexities of corporate taxes and keep conformity year-round.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Properly Taking Care Of Federal Company Tax Credit Scores Can Enhance Your Economic Technique, Yet Do You Understand The Important Steps To Completely Leverage Your Insurance Claims? |

Short Article Developed By-Rouse Bynum

Declaring federal service tax credit scores can be a clever move for your economic method, but understanding the process is vital. You need to understand which credits put on your company and what documentation is called for to show your eligibility. As you gather your financials and intend your projects, you'll locate there are several ways to maximize your possibilities. Let's discover the necessary actions you ought to take to guarantee you're on the right course.

Comprehending Qualification Requirements

Before you study declaring service tax credit ratings, it's vital to understand the eligibility demands that relate to your particular situation. Various credit reports satisfy various companies, so you'll require to evaluate which ones align with your procedures.

For instance, some debts target local business, while others may focus on specific industries or activities, such as renewable resource or r & d. https://writeablog.net/jimmie0tillie/comprehensive...e-tax-an-organization-overview ought to additionally consider your company structure-- whether you're a sole owner, collaboration, or corporation-- as this can impact your qualification.

In addition, your earnings level might play a role in getting specific credit histories. By carefully assessing these aspects, you'll position on your own to make the most of the tax debts readily available to you, maximizing your prospective cost savings.

Celebration Necessary Documentation

Gathering the needed documentation is important for efficiently asserting organization tax credit reports. Beginning by accumulating documents that verify your eligibility, such as economic statements, pay-roll documents, and income tax return.

Keep penalty abatement of all costs related to the debts you're seeking, consisting of invoices and invoices. It's additionally crucial to record any kind of tasks or tasks that certify, like research and development efforts.

Organize these papers systematically, as this will streamline the process when it's time to file. Don't forget to confirm that all info is exact and current; inconsistencies can delay your claims.

Last but not least, consider maintaining digital duplicates for simple access and back-up. With thorough preparation, you'll be much better furnished to optimize your tax credit cases.

Maximizing Your tax Credit Report Opportunities

Just how can you ensure you're making the most of offered service tax credits? Beginning by remaining educated about the credits suitable to your market. Frequently examine the internal revenue service internet site and regional resources for updates.

Do not neglect credit scores for research and development or power performance renovations-- they can considerably lower your tax costs.

Next off, job closely with a tax professional that comprehends these debts. They can help identify possibilities you might miss.

Keep thorough documents of your expenditures and activities that get approved for credit reports to simplify the asserting procedure.

Ultimately, strategy your projects around these credit reports when possible, maximizing your possible financial savings. By being aggressive and organized, you can properly enhance your tax credit history opportunities and boost your bottom line.

Final thought

Finally, declaring government company tax credit histories effectively requires you to stay informed and organized. By recognizing qualification needs, collecting the necessary paperwork, and purposefully preparing your tasks, you can optimize your savings. Don't think twice to seek advice from a tax obligation professional to navigate the intricacies of credits specific to your sector. By doing so, you'll not just enhance your monetary health and wellness yet additionally ensure you're making the most of the opportunities offered to your service.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Comprehending The Tax Differences Of C-Corps And S-Corps |

Post Developed By-Hardison Henningsen

When considering the most effective framework for your service, recognizing the differences between C-Corps and S-Corps is essential. Each has distinctive taxes ramifications that can considerably impact your profits. C-Corps face double taxation on revenues, while S-Corps offer an even more structured strategy through pass-through tax. However that's just https://zenwriting.net/kirby464dalila/intending-to...tax-setting-discover-essential . There are a lot more nuances to explore that could influence your choice. Are you all set to discover the details?

Overview of C-Corp Tax

C-Corporation taxes can seem facility, however comprehending the fundamentals can simplify your decision-making. A C-Corp is strained independently from its proprietors, meaning the company pays tax obligations on its earnings at the corporate tax price. This can result in double taxes, where income obtains tired at both the company degree and once more when dispersed as rewards to shareholders.

Nevertheless, C-Corps can deduct business expenses, which minimizes taxable income. Furthermore, they can keep profits without prompt tax effects, permitting reinvestment in business. This structure is useful for growth-oriented business looking for to draw in investors.

Introduction of S-Corp Taxes

While navigating the world of service taxation, comprehending S-Corp taxation is necessary for making notified choices.

An S-Corp, or S Corporation, allows revenues and losses to travel through straight to investors, staying clear of double taxes at the corporate degree. This suggests you report the earnings on your individual tax return, which can bring about potential tax cost savings.

To certify as an S-Corp, your business needs to fulfill details requirements, consisting of running out than 100 shareholders and being a domestic firm.

In addition, S-Corps must stick to specific functional procedures, like holding normal conferences and keeping detailed documents.

Key Differences In Between C-Corp and S-Corp Taxation

When comparing C-Corp and S-Corp tax, it's important to acknowledge exactly how their structures impact your tax commitments. C-Corps face double taxes, meaning revenues are strained at the business degree and once again when distributed as dividends to investors.

On the other hand, S-Corps enjoy pass-through taxes, allowing revenues and losses to be reported on your personal tax return, preventing double taxes.

In addition, C-Corps can have unlimited shareholders and various courses of supply, while S-Corps are limited to 100 investors and just one class of supply.

This affects your capacity to increase capital and framework ownership. Comprehending these distinctions assists you make educated decisions concerning your organization's tax approach and overall structure.

Verdict

In summary, comprehending the taxes distinctions in between C-Corps and S-Corps is critical for your company decisions. If shell companies favor pass-through tax to avoid dual taxes, an S-Corp may be the ideal selection for you. However, if taxable deduction desire flexibility in ownership and supply choices, a C-Corp could be much better. Ultimately, consider your long-term objectives and consult a tax professional to establish which framework lines up best with your company requirements.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

All Set Your Service For Tax Period With A Complete Checklist For Company Tax Compliance |

Author-McCormick Hanley

Navigating business tax conformity can feel frustrating, but having a total checklist streamlines the procedure. You'll need to understand your tax responsibilities and keep important documents organized. Key target dates can slip up on you, so being positive is vital. As you collect your materials and target dates, consider exactly how staying upgraded on tax legislations can make a substantial difference in your conformity initiatives. Allow's discover what you require to guarantee you stay on track.

Recognizing Corporate tax Obligations

Recognizing your corporate tax obligations is critical for preserving compliance and avoiding charges. You need to stay informed concerning the various taxes your organization might be subject to, consisting of revenue tax, payroll tax, and sales tax. Each kind has its very own regulations and deadlines, so it's essential to know what puts on your specific scenario.

Ensure you're aware of regional, state, and federal guidelines that influence your organization. This understanding aids you accurately determine your tax responsibilities.

In addition, understanding tax credit scores and deductions can significantly minimize your tax worry. Consistently reviewing your commitments ensures you're planned for filing due dates.

Necessary Documents and Record-Keeping

To maintain compliance with your corporate tax responsibilities, having the appropriate paperwork and efficient record-keeping methods is important.

Start by organizing economic records, consisting of earnings declarations, balance sheets, and capital statements. Keep all invoices, billings, and financial institution statements connected to overhead. Record any type of communication with tax authorities, and keep payroll records for staff members.

It's also necessary to track your company's income tax return and any supporting records you filed. Regularly update https://squareblogs.net/porsha77miriam/looking-to-...x-circumstance-check-out-vital to make sure precision and completeness.

Take into consideration using bookkeeping software program to streamline this process. By maintaining meticulous documents, you'll not only simplify your tax preparation but also be better prepared in case of an audit or query from tax authorities.

Stay organized and check over herea !

Secret Deadlines and Declaring Demands

Remaining on top of key due dates and filing requirements is vital for maintaining corporate tax compliance. Every year, you'll require to submit your company income tax return by the due day, normally March 15 for C companies and April 15 for S companies.

If you're not able to meet these target dates, consider applying for an extension. Keep in mind to pay projected taxes quarterly to avoid fines.

In addition, remain educated concerning state-specific deadlines, as they can vary. Do not fail to remember to keep track of pay-roll tax filings, which are generally due quarterly.

Assessing these dates consistently can assist you avoid expensive mistakes. Mark your calendar and established tips to guarantee you're constantly prepared and compliant.

Verdict

In conclusion, remaining on top of your company tax compliance is vital for your company's success. By understanding your tax obligations, keeping arranged documents, and adhering to essential target dates, you can stay clear of charges and ensure smooth procedures. Make it a priority to routinely update your understanding on tax legislations and make use of accounting software application to simplify your processes. With this checklist, you're well-appointed to navigate the complexities of corporate tax obligations and keep conformity year-round.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Raise Your Company Tax Savings Via These 10 Essential Approaches-- Find Out The Tricks That Could Change Your Monetary Future Today! |

Short Article Created By-Juul Beyer

When it involves corporate tax preparation, understanding and executing efficient techniques can significantly influence your profits. You could be shocked at how much you can conserve by leveraging tax credit scores and making best use of deductions. But that's simply the start. There are a lot of various other methods to check out that might improve your tax efficiency. Interested concerning the leading techniques that can aid you achieve maximum savings? Let's take a closer look.

Understand and Utilize tax Credit Scores

When you comprehend and use tax credit scores properly, you can substantially reduce your business tax liability.

tax credit histories straight lower the quantity of tax you owe, unlike deductions that only reduced your taxable income. Familiarize yourself with offered credit scores such as the R & D (R&D) tax credit history, which compensates development, or the Job Chance tax Credit Rating (WOTC) for working with from certain target teams.

Track your eligibility and the documents required, as proper documents can maximize your claims. It's crucial to stay upgraded on modifications in tax legislations that may influence these credits.

Take Full Advantage Of Reductions for Business Expenses

To optimize your reductions for business expenses, it's vital to keep comprehensive records and comprehend which costs are qualified. Track all your expenses thoroughly, including supplies, utilities, and employee salaries.

Do not forget about traveling and meal expenses, which can commonly be subtracted if they're straight related to your service tasks. Make certain to different individual expenditures from company ones to stay clear of any kind of issues throughout tax time.

Likewise, https://www.mayerbrown.com/en/insights/publication.../asia-tax-bulletin-autumn-2025 for home office area if you function from home; this can substantially reduce your taxable income.

Last but not least, talk to a tax obligation specialist to guarantee you're benefiting from all readily available reductions and remaining certified with tax regulations. Your persistance in managing expenditures can result in significant cost savings.

Implement Price Partition Studies

Price segregation studies can dramatically enhance your tax preparation approach by speeding up depreciation deductions for your commercial residential property. By breaking down your residential or commercial property right into different components, you can recognize and reclassify assets to shorter depreciation timetables. This implies you'll take pleasure in raised cash flow and tax savings in the early years of ownership.

To execute a cost partition research study, you must collaborate with a qualified expert that recognizes the complexities of tax laws and design principles. They'll evaluate your residential or commercial property and provide a detailed record that sustains your deductions.

When you have actually completed the research study, remain organized and keep documents of your findings. This positive strategy can lead to substantial cost savings, providing you much more funding to reinvest in your business.

Consider Tax-Advantaged Retirement Program

While preparing for your future, taking into consideration tax-advantaged retirement can be a clever move for your economic technique.

These strategies, like 401( k) s and Individual retirement accounts, allow you to contribute pre-tax bucks, lowering your taxable income currently and growing your savings tax-deferred up until retirement. By benefiting from company matching payments, you're essentially securing free cash, increasing your retirement fund without extra price.

And also, investing in these accounts can shield your incomes from tax obligations, maximizing your compound growth gradually. Keep in mind to discover various plan options to discover one that fits your company needs and employee preferences.

Eventually, focusing on tax-advantaged retirement plans not only helps you save money on tax obligations yet likewise secures your financial future and incentivizes staff member loyalty.

Explore International tax Techniques

Exactly how can exploring worldwide tax techniques benefit your company? By strategically placing your procedures globally, you can capitalize on positive tax regimes and treaties.

Establishing subsidiaries in low-tax territories or making use of transfer rates can considerably minimize your overall tax obligation. You could additionally think about repatriating earnings in a tax-efficient manner, guaranteeing you're compliant while making best use of savings.

In addition, leveraging international tax credit ratings can aid counter taxes paid to foreign governments. This not only enhances your cash flow but likewise improves your competitiveness in the worldwide market.

It's essential to remain educated regarding changing tax legislations and policies throughout different nations, so speaking with a worldwide tax expert can guide you with the intricacies and help you make informed decisions.

Make The Most Of Loss Carryforwards

Among one of the most effective methods for managing your corporate tax obligations is capitalizing on loss carryforwards. If your business incurs a web operating loss in one year, you can use that loss to future tax years, minimizing your gross income when your earnings rise.

This implies you won't have to pay taxes on profits approximately the quantity of your previous losses. To use this technique, maintain meticulous records of your losses and guarantee you claim them in the appropriate tax years.

Framework Your Organization for tax Performance

Structuring your service for tax efficiency can have a substantial effect on your total economic health.

Select the ideal company entity-- LLC, S-Corp, or C-Corp-- based on your earnings degree and future goals. Each framework provides different tax benefits, so it's essential to analyze which straightens best with your requirements.

Take into consideration dividing your personal and company finances to streamline tax reporting and shield individual properties. Furthermore, make https://postheaven.net/gary45lindsey/what-are-the-...-c-corps-and-s-corps-and-which of tax deductions and credit reports details to your sector. This way, you can reduce your taxable income efficiently.

Maintain precise documents of expenses, as they play an essential function in making the most of deductions. Consistently review your framework with a tax consultant to adapt to any type of modifications in tax legislations or your company method.

Purchase R & D

Buying research and development (R&D) can substantially enhance your company's growth and advancement capacity, complementing your initiatives in structuring for tax effectiveness.

By allocating sources to R&D, you're not simply cultivating creativity; you're additionally opening important tax credit scores and reductions. Several federal governments supply incentives for services that purchase innovative jobs, enabling you to lower your gross income considerably. This suggests that money spent on R&D can come back to you in the form of tax financial savings.

Additionally, a strong concentrate on R&D can result in new product or services that set you apart in the marketplace, driving profits growth. Over time, prioritizing R&D could be one of the smartest monetary decisions you make.

Maximize Inventory Monitoring

Efficient stock monitoring is vital for optimizing your organization's earnings and decreasing tax liabilities. By maintaining a close eye on your inventory levels, you can reduce bring expenses and avoid overstock situations that tie up your resources.

Carry out just-in-time stock strategies to guarantee you have the right amount of supply available, minimizing waste and improving capital. Use stock monitoring software program to track sales fads and readjust your getting accordingly. This not just aids in preserving optimal stock degrees yet also permits you to capitalize on tax reductions related to inventory write-offs.

Routinely assess your supply procedures and make changes to align with your business objectives, ensuring you're not leaving any kind of prospective savings on the table.

Stay Informed on tax Law Changes

Maintaining optimum stock degrees isn't practically handling stock; it additionally establishes the stage for staying on par with tax ramifications. Staying informed on tax legislation modifications is essential for your company's financial wellness.

tax guidelines can shift all of a sudden, affecting reductions, credit scores, and conformity demands. Regularly evaluation updates from the IRS or seek advice from a tax obligation expert to guarantee you're not missing out on any opportunities for financial savings.

Participate in workshops or subscribe to e-newsletters focused on tax law adjustments. This aggressive method not just aids you stay clear of charges yet likewise permits you to purposefully intend your funds.

Final thought

Integrating these top company tax preparation approaches can significantly boost your savings and enhance your capital. By recognizing tax debts, maximizing deductions, and considering your company framework, you're setting yourself up for success. Do not neglect to stay educated regarding tax legislation adjustments and speak with experts frequently. By remaining positive and strategic, you can browse the complexities of corporate tax obligations and maintain more of your hard-earned cash where it belongs-- within your company.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Should Your Company Convert To A C-Corporation For Tax Benefits? |

Web Content Writer-Voigt Gustafson

If you're taking into consideration transforming your organization to a C-Corporation, it is necessary to evaluate the prospective tax benefits against the challenges. A C-Corporation can provide lower tax prices on retained revenues and restricted liability protection. Nevertheless, you may likewise deal with double taxation and enhanced management burdens. So, exactly how do you recognize if the trade-offs are worth it for your specific situation? Let's check out the vital aspects that might influence your decision.

Comprehending C-Corporation tax Structure

Recognizing the C-Corporation tax framework is important if you're considering this company model. In a C-Corporation, business itself pays taxes on its revenues at the company tax price, which can differ from personal tax rates. This implies that any kind of income gained is taxed prior to it's distributed to investors.

When returns are paid out, investors face additional tax obligations on that revenue, bring about what's called "dual taxation." Nevertheless, state revenue -Corporations can preserve revenues to reinvest in business without immediate tax implications for investors.

This structure likewise enables different tax reductions and debts that can decrease taxable income. Acquainting yourself with these components will certainly assist you make educated choices regarding your organization's monetary future.

Advantages of Converting to a C-Corporation

Converting to a C-Corporation can provide considerable advantages for your service. One significant advantage is the potential for lower tax rates on retained incomes. This framework permits earnings to be reinvested back into the company, which can promote growth without dealing with instant tax repercussions.

In addition, C-Corporations offer minimal liability security, safeguarding your personal properties from business financial debts and obligations. You'll also find it much easier to attract financiers, as C-Corporations can provide numerous courses of stock. This versatility can boost your capital-raising efforts.

Furthermore, you might appreciate a lot more tax-deductible advantages, such as staff member incomes and benefits, which can aid you handle costs better. On the whole, transforming can develop a solid foundation for your organization's future success.

Downsides and Factors To Consider of C-Corporation Conversion

While the benefits of transforming to a C-Corporation can be attractive, there are additionally substantial downsides and considerations to remember.

First, C-Corporations encounter double taxation-- once at the company degree and once more on returns you disperse to shareholders. This can decrease your total revenues.

Second, the administrative demands and compliance prices are usually greater, needing even more time and resources.

Furthermore, you may lose some adaptability in revenue distribution, as revenues need to be retained or distributed according to business framework.

Finally, if you're a small company, the complexity of a C-Corporation might surpass potential advantages.

Evaluate tax incentive before making your decision, as they can considerably affect your service's economic health and wellness and operational efficiency.

Verdict

Making a decision to transform your company to a C-Corporation can offer considerable tax benefits, however it's not a choice to take lightly. Evaluate the benefits, like reduced tax prices on kept profits, versus the downsides, consisting of dual taxes and greater conformity prices. Take a tough look at your firm's dimension, development potential, and financial health. Eventually, it's crucial to assess whether the advantages really align with your organization goals prior to making the jump.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Prep Work For A Federal Corporate Tax Audit |

Developed By-Bradley Higgins

Preparing for a government corporate tax audit can feel challenging, however with the right method, you can browse the process efficiently. Beginning by recognizing the audit procedure itself, as this understanding lays the structure for your prep work. Organizing your economic records is vital, however there are specific techniques to make sure every little thing is in order. And also, reliable interaction with the internal revenue service can make a considerable difference in the result. Let's discover these crucial steps.

Understanding the Audit Refine

When you receive notification of a government business tax audit, it's all-natural to really feel anxious, but recognizing the audit process can relieve your fears.

Initially, Suggested Webpage picks companies for audits based upon various factors, such as discrepancies in tax returns. You'll receive a letter outlining the audit's extent, including the records and documents required.

The audit might take place at your business or a designated IRS office. During the procedure, auditors will certainly assess your monetary declarations and tax returns, asking concerns to clarify any issues.

It's critical to continue to be participating and supply precise information. Remember, the audit's goal isn't necessarily to penalize you however to make certain compliance and clarify any issues.

Being educated helps you browse this procedure with confidence.

Organizing Your Financial Records

After comprehending the audit process, it's time to concentrate on organizing your monetary documents. Beginning by gathering all relevant records, consisting of income tax return, financial statements, receipts, and invoices.

Produce an organized filing system-- take into consideration making use of folders or electronic devices to classify these records by year and type. Guarantee everything is full and accurate; missing out on information can raise red flags.

Regularly update innocent spouse relief to mirror continuous purchases, making it less complicated to retrieve information throughout the audit. In addition, preserve a log of any type of communication related to your funds.

This organization not only prepares you for the audit yet additionally enhances your economic monitoring in the future. Bear in mind, being organized can help reduce stress and foster transparency throughout the audit process.

Interacting Efficiently With the internal revenue service

Efficient communication with the internal revenue service is vital, as it can significantly influence the end result of your audit.

Beginning by being clear and concise in your correspondence. When you receive a notice, read it thoroughly and react immediately. Make sure to resolve all the points raised by the internal revenue service, giving any requested documentation or descriptions.

Use expert language, and prevent psychological actions. If you're uncertain regarding something, do not be reluctant to request information-- it's far better to recognize than to guess.

Maintain a record of all communications, including dates, names, and information.

Finally, if see post feel overloaded, consider looking for assistance from a tax obligation professional. Their knowledge can boost your interaction and boost your possibilities of a positive resolution.

Conclusion

To conclude, getting ready for a federal corporate tax audit needs cautious company and clear interaction. By maintaining your financial records in order and responding without delay to internal revenue service inquiries, you can browse the procedure extra smoothly. Do not wait to enlist the assistance of a tax expert if required. By taking these steps, you'll not just boost your compliance but likewise lower stress during the audit, establishing your business up for success.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Keep Your Company Revenue Tax Filing Smooth By Learning Typical Errors To Stay Clear Of-- Uncover The Key Methods That Can Conserve Your Business From Expensive Errors |

Content Author-Dissing Lorentzen

Declaring corporate income taxes can be a difficult job, and it's easy to make blunders that might cost you. You might overestimate reductions, miss vital due dates, or wrongly report your revenue. These errors can lead to charges or audits that no person wishes to encounter. Recognizing just how to sidestep these common pitfalls is vital for your business's economic health and wellness. Let's discover some methods to keep your tax declaring on the right track.

Miscalculating Deductions

When you prepare your corporate tax return, overlooking deductions can lead to costly mistakes. It's necessary to track all insurance deductible expenditures precisely, consisting of business-related travel, meals, and supplies. Losing out on qualified tax strategist can inflate your tax costs unnecessarily.

On the other hand, overestimating or misclassifying deductions can cause audits and charges. Maintain detailed documents and invoices to sustain your cases. Usage accountancy software program or speak with a tax obligation professional to ensure you're capturing every little thing appropriately.

Staying organized throughout the year helps you prevent last-minute shuffles when tax period gets here. Remember, accurate deductions not only conserve you money yet additionally maintain you certified, lowering the threat of future complications with the IRS.

Missing out on Target dates

Missing target dates can have severe consequences for your business income tax filings, so it's vital to stay on top of key dates. Late filings can result in substantial fines, rate of interest charges, and even an increased risk of audits.

To prevent these issues, create a schedule that highlights vital tax deadlines, such as approximated tax settlements and filing days. Set reminders well beforehand to guarantee you have adequate time to prepare your files.

If you find yourself not able to fulfill a due date, think about applying for an extension. Nevertheless, bear in mind that extensions do not postpone your repayment commitments, so be prepared to pay any kind of estimated tax obligations due.

Staying arranged and aggressive is vital for smooth corporate tax declaring.

Inaccurate Reporting of Income

Imprecise reporting of income can result in considerable issues for your corporate tax filings. When you misreport your income, whether it's overstating or underestimating, you take the chance of charges and audits that can drain your sources.

To avoid this error, ensure you maintain careful records of all financial purchases, consisting of sales and income sources. Routinely resolve your accounts to capture inconsistencies at an early stage.

Make use of accountancy software application that can enhance this process and decrease human error. When unsure, seek advice from a tax professional who can offer assistance customized to your circumstance.

Exact earnings reporting not just aids you stay compliant but likewise allows far better financial planning and decision-making for your business. Keep persistent and positive to safeguard your company financial resources.

Verdict

To avoid usual corporate earnings tax filing blunders, stay arranged and proactive. Keep meticulous records of your expenses, set suggestions for due dates, and routinely reconcile your accounts. Making use of accountancy software can simplify your reporting procedure, and speaking with a tax obligation expert can assist you navigate intricacies and optimize your reductions. By preparing ahead of check out here and keeping interest to information, you'll dramatically lower the danger of mistakes and prospective audits, making sure a smoother tax experience for your business.

|

Метки: federal tax tax law tax advisor tax consultant tax attorney tax lawyer tax resolution specialist tax resolution services business tax corporation tax tax law consultant |

Raise Your Corporate Tax Financial Savings Through These 10 Vital Techniques-- Find Out The Tricks That Could Alter Your Economic Future Today! |

Material By-Jernigan Rafferty

When it pertains to business tax planning, understanding and implementing effective strategies can considerably affect your profits. You might be amazed at just how much you can conserve by leveraging tax credit scores and maximizing reductions. However that's just the beginning. There are a lot of other avenues to check out that might enhance your tax performance. Curious concerning the top methods that can help you attain optimum savings? Allow's take a closer look.

Understand and Make Use Of tax Credit Reports

When you understand and utilize tax credit scores successfully, you can dramatically reduce your company tax liability.

tax credits directly decrease the quantity of tax you owe, unlike deductions that only reduced your taxable income. https://writeablog.net/mathildelatoria/are-you-fam...s-between-government-and-state with available credit scores such as the R & D (R&D) tax credit history, which compensates development, or the Job Possibility tax Debt (WOTC) for employing from specific target groups.

Track your eligibility and the documents called for, as appropriate documents can optimize your claims. It's vital to remain updated on adjustments in tax laws that may affect these credits.

Optimize Deductions for Business Expenses

To maximize your deductions for overhead, it's necessary to maintain detailed records and comprehend which expenditures are eligible. Track all your costs diligently, consisting of materials, utilities, and worker earnings.

Don't forget about travel and meal expenses, which can frequently be subtracted if they're straight related to your company activities. Be sure to separate personal expenditures from service ones to avoid any kind of issues throughout tax time.

Additionally, leverage deductions for home office area if you work from home; this can dramatically reduce your gross income.