Investing Recommendation You'll be able to Put Into Follow Now |

Enthusiastic about Investing In Actual Property? Read This

Most people consider inventory markets when they consider investments. However, real estate is a superb place to make an funding, too. Learn how to make income by proudly owning some property by reading the nice suggestions in this text. There may be nothing stopping from you from succeeding.

Get to know others in the true property market. Getting recommendation from these already in the enterprise will assist loads. When you have pals who put money into actual property, that's even higher. Search out like-minded individuals on-line. Examine the potential of going to meetups and joining forums.

Consider building up a real estate rental portfolio that may continue to give you consistent profit for retirement functions. While purchasing houses to sell for revenue remains to be attainable, it is much less of a reality in immediately's world than it has been prior to now. Constructing up rental earnings by buying the appropriate properties is trending vs flipping homes as a consequence of the current housing market.

All the time remember that it is best to call all utility and cable corporations to mark their traces that lay underground before you start any landscaping or digging on the property. In sure areas, it is considered unlawful to dig, and you don't need to trigger any property damage.

Insure your entire properties, even if they're currently vacant. Whereas What You'll want to Know Concerning the World Of Investing can get expensive, it would in the end protect your funding. If one thing had been to go unsuitable on the land or in a constructing you own, you may be lined. Also, have a general safety inspection performed now and again too, just to be on the protected aspect.

You are not going to find huge monetary success in a single day. Due to this fact, it is crucial to interrupt down your goals into smaller, short-time period goals. Make sure that you've got a to-do checklist to perform each day. Before you know it, you can be nicely in your strategy to achieving your larger goals.

Don't make investments greater than you possibly can afford. The property you choose could have intervals of vacancies that it's essential account for whenever you make your mortgage cost. Your prospected rental revenue ought to actually exceed your mortgage.

You want to contemplate the worst case scenario when you were unable to promote a property you had been invested in. May you rent it or re-goal it, or would it's a drain on your funds? Do you've options for that property to be able to have a back up plan if you can't promote it?

Don't neglect that tax advantages of actual estate investment. Arrange your actual estate investments in acceptable LLC or S-corp authorized entities. Accomplish that very early in getting involved in actual estate investing. You do this early to maximise your long-term advantages and because the longer you wait the extra complicated it will get to do so.

Be very careful when you want to spend money on a piece of property together with a companion. It could also be high quality if both of you may have the same funding objectives about this piece of property. Nonetheless, if one in all you needs to promote out, the opposite may not have the money to purchase him out. You might find yourself selling the property before despite your desire to maintain it.

You are taking on an enormous accountability if you decide to put money into actual property. You probably wish to get going as young as you'll be able to to maximize your potential, but you should be on stable ground first, too. It can save you a lot of money by doing all of your homework. This can be an excellent option to get established within the enterprise.

There are two things to recollect when you're investing in actual estate. First, it is better to spend more of your time listening than speaking. Additionally remember, the seller can assume for themselves. You wish to get yourself something that benefits you and that may develop your money.

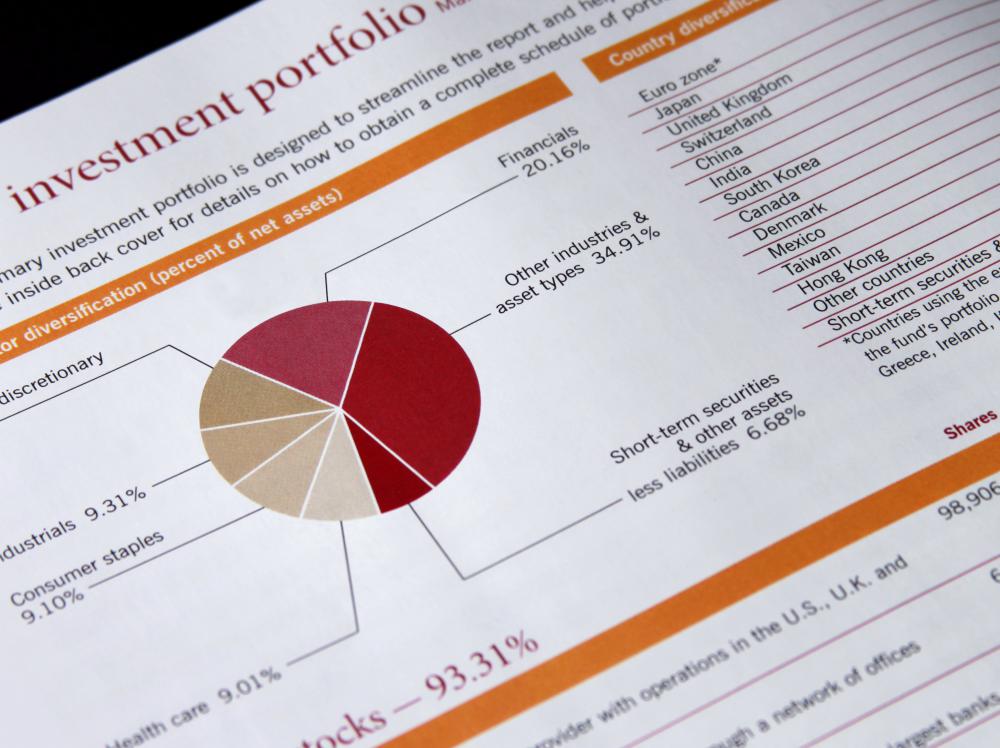

Diversify your investments. Relying on the situation, some may do better than others. One instance is that the prices of bonds usually lower when interest rates enhance. One other level to think about is that some industries prosper while others wrestle. What You will get To Find out about Investing can cut back your danger by investing in numerous sorts of funding choices.

Decide your anticipated earnings and the way you will receive them. Determine what form your earnings will likely be in. There are some ways to get them again. Investing? Use These Tips to Avoid Shedding All your Income! include rent, dividends, and curiosity. Some varieties like real property and stocks can earn and grow in value. Determine what the potential of your funding is over time.

The investment methods you pursue should have much to do along with your age. If you are closer to retirement, you definitely need to be more conservative. Making Confused By Investing? Help Is true Right here! as to add extremely risky investments to your portfolio in your later years can find yourself becoming a monetary catastrophe for you ultimately.

Set real looking expectations. Do not count on that each investment will dwell up to the hype or the perfect case situation. Do not expect that you'll have the identical good points as the one that made it large of their first yr of investing. Set practical objectives and expectations for the investments and you will not be disillusioned.

As you're constructing a stock portfolio, be sure to recollect one of many golden guidelines of investing which is to diversify. Not only must you diversify with totally different corporations, but in addition across different industries. This will assure a safety net when certain stocks or industries underperform, which can very properly happen.

Investing in precious metals can provide you with some safety in uncertain economic instances. Consultants advocate that 10 % of your portfolio be comprised of precious metals. You may purchase metals in physical kind or spend money on mining companies through ETFs, stocks and mutual funds. Many specialists advocate that you're taking supply of bodily treasured metals for maximum safety and security.

Do not permit others to discourage you out of your investing goals. Discover what you can do to take care of yourself and your loved ones. You can do well within the investing world, so don't be concerned!

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |