Why World Crude Oil Price Is Better/worse Than (alternative) |

We are using twice as much coal and 3 times more pure gas. Crude oil trades on the New York Mercantile Exchange as mild sweet crude oil futures contracts, as well as different commodities exchanges all over the world. Futures contracts are agreements to deliver sulphur lump price a quantity of a commodity at a hard and fast price and date in the future. Another direct technique of owning oil is through the acquisition of commodity-based oil exchange-traded funds (ETFs).

Saudi Arabia produces 12,402,761 barrels per day of oil (as of 2016) ranking 2nd in the world. Saudi Arabia ranks sixth on the planet for oil consumption, accounting for about 3 bitumen vg 30 rate.four% of the world's complete consumption of 97,103,871 barrels per day. Saudi Arabia consumes three,302,000 barrels per day (B/d) of oil as of the 12 months 2016.

How many years of oil is left in the world?

This normal barrel of oil will occupy a different volume at completely different pressures and temperatures. A standard barrel in this polymer modified bitumen price context is thus not simply a measure of volume, but of quantity beneath particular situations.

It is estimated that 17–18% of S&P would decline with declining oil prices. A major rise or decline in oil price can have each financial and political impacts. sulphur price per ton on oil price during 1985–1986 is taken into account to have contributed to the fall of the Soviet Union. Low oil costs could alleviate some of ss60 bitumen emulsion price the unfavorable effects related to the resource curse, similar to authoritarian rule and gender inequality. Lower oil prices might nonetheless also result in home turmoil and diversionary warfare.

How long the oil will last in the world?

- In addition, traders can achieve indirect publicity to grease via the purchase of energy-sector ETFs, like the iShares Global Energy Sector Index Fund (IXC), and to energy-sector mutual funds, just like the the T.

Is sulphur price Iran at less than $35 a barrel?

Saudi Arabia holds 266,578,000,000 barrels of proven oil reserves as of 2016, rating 2nd on the planet and accounting for about 16.2% of the world's complete oil reserves of 1,650,585,140,000 barrels. At present, crude oil constitutes around today bitumen rate 33% of world energy needs. Coal and is round 30% and pure gas is available in third place at around 24%. Between 1965 and 2005, humanity has seen an increase in demand for crude oil by about two and a half times.

The fund's investment goal is to offer daily investment results comparable to the every day percentage adjustments of the spot price of West Texas Intermediate (WTI) crude oil to be delivered to Cushing, Oklahoma. Investors can speculate on the price of oil instantly by trading in oil derivatives or the USO exchange traded product, which tracks the price of WTI crude. Price controlled prices were decrease during the Nineteen Seventies sulfur price per ton however resulted in artificially created gas strains and shortages and don't reflect the true free market price. Stripper prices had been allowed for individual wells under special circumstances (i.e. the wells were at the end of their life cycle) however the oil they produced represented the actual free-market prices of the time. In the case of water-injection wells, in the United States it's common to check with the injectivity price in barrels of water per day (bwd).

While the Saudis' 266,455 million barrels of proven oil reserves are marginally smaller than these of Venezuela, all of Saudi's oil is in conventionally accessible oil wells inside massive oil fields. Moreover, Saudi Arabia's reserves are thought bitumen 80 100 price of to comprise a fifth of the complete globe's conventional reserves.

cost of sulphur per kg

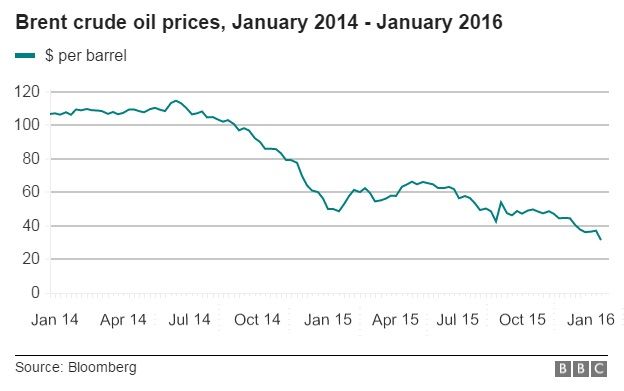

During 2014–2015, OPEC members consistently exceeded their production ceiling, and China experienced a marked slowdown in economic growth. At the identical time, U.S. oil production practically doubled from 2008 ranges, because of substantial enhancements in shale "fracking" expertise in response to record oil costs. A mixture of things led a plunge in U.S. oil import requirements and a record high quantity of worldwide oil inventories in storage, and a collapse in oil costs bitumen price Iran that continues into 2016. According to The Economist, as non-OPEC nations, such because the United States and Britain, elevated their oil production, there was a worldwide "oil glut", leading to a lower within the price of oil in the early Eighties. There are those who strongly consider that the market has undergone structural changes and that low oil prices are here to stay for a protracted interval.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |