Examine This Report about How Much Do Vaccines Cost Without InsuranceThe 4-Minute Rule for How Long |

A life insurance coverage agent's commission depends upon a couple of elements, consisting of the business's commission plan and how much life insurance coverage the representative is selling. Here is all the info you need to know to help you discover just how much the person offering you your life insurance coverage policy is making, and a few tips to assist you understand what the alternatives are when it comes to selecting who to buy your life insurance coverage from.

Life insurance coverage policy sales generally give the licensed agent compensation from a commission and often income if they are contracted workers. Many individuals who sell life insurance deal with contract so commission may be their main income source. We enter the details and exact numbers listed below. The size of their client base The number of business they deal with (slave just handling one insurance coverage provider versus non-captive) Their years of experienceWhether they are licensed to sell in different classifications (Personal Financial Consultant, Life Insurance Representative, Broker) What their settlement agreement is with the insurance coverage companyWhat their compensation arrangement is with the employer, or if they are independentIf they have expenditures to pay from the commission such as lease, personnel, and materials Other factors might affect how much money they leave your policy, however this gives you a concept of the reasons that someone may make basically than another.

Life insurance coverage companies understand this, so when a sale is made the commission might be viewed as high due to the truth that the design requires to represent this. Your life insurance coverage premium itself doesn't alter based upon commission. The commission is the part of the premium the insurer offers the agent for having made the sale, and then for providing great customer care to preserve the client through numerous years.

Other models of payment might consist of higher salaries, and less commission percentage due to the fact that of the plan they have actually made in their employment contract. If they are independent, they may even make all of the commission from the sale, however, if they work for a company, they may have an agreement that makes it so that they are not getting the entire commission due to the reality they have actually consented to an income rather.

However, with the best details and questions, you can discover. When you attempt and discover out the average salary of a life insurance coverage agent, because of the elements above, it is very tough to state. According to the Bureau of Labor Stats, the median spend for an "insurance coverage sales representative" is $50,560 annually or $24.

Remember that this defines a sales agent, and includes data from all insurance coverage, not just life insurance. Because of the models explained above (" commission heavy" or "income heavy") this number differs significantly, and because it is a mean, it is disappointing you the high end of the more established representatives, or those who sell higher valued policies.

73 per hour. what does renters insurance not cover. There are various sort of life insurance coverage policies. The type of life insurance policy will also affect the quantity of cash that will be paid out in commission. The bigger longer term policies will usually pay more on commission. The two primary kinds of policy are term life and whole life or cash-value policies, also called universal life policies.

The smart Trick of What Is A Certificate Of Insurance That Nobody is Discussing

Term insurance coverage lasts for a limited "term" or period of time, such as 5,10, 20 or thirty years. Entire life insurance lasts your whole life and it may develop up cash value in time. and provide the possibility of obtaining cash from your life insurance coverage policy. Your representative's commissions can differ depending on the type of life insurance coverage you select.

Leading ranking producers may even get 100% of the full premium in the very first year as commission and often 2% to 5% commission from the 2nd to the fourth year. Subsequent year commissions may drop off or can be much lower. The quantity of commission paid will differ based upon the contract the agent has with the insurance company or with their employer (if they are not contracted workers).

In all models, the payment structure for payment adjusts for the scenario, so you ought to not be paying more for life insurance if you go through a broker vs. an agent or direct through a provider. The commissions they get are typically adjusted for the situation and arrangements they have signed.

Brokers can often get you prices estimate with several business to give you a chance to compare options. Check over here When you go through the provider straight, they will just be offering you their products. If you are fretted about added fees, ask the individual estimating you if there are any extra service charge and store around for your alternatives.

This is one important factor that prior to you change a life insurance coverage policy you always wish to be mindful that you are getting the ideal guidance. A life insurance representative or broker or any monetary planner should never be selling you something to profit Go to the website on their own. Yes, they require to earn a living, but one piece of excellent news is that the sale of life insurance is regulated.

The obligation in the life insurance coverage occupation is to use you products that fit your requirements, so although life insurance coverage can be lucrative for someone selling life insurance (similar to any job), the agent is expected to be providing you products to fill your needs, not their own pockets. They should also be able to go over numerous life insurance policy options and describe the benefits or downsides taking into consideration where you are at in your life.

You must always feel comfortable with the individual selling you life insurance and never feel forced to purchase something you are unsure of. In some cases the simplest method to discover out how much your life insurance coverage representative is making is to ask. The National Association of Personal Financial Advisors offers some great ideas on finding an excellent representative.

Rumored Buzz on Who Is Eligible For Usaa Insurance

Every life insurance company is various. In general, although it is interesting to know how much commission is being paid for your life insurance policy, you likewise need to think about: Just how much time the individual has invested with you getting to know your needsAre they supplying you with good descriptions of your optionsLife insurance coverage sales are not repeated usually, it makes good sense commission might appear highIf the individual you are purchasing from works as an employee, they might not be getting a full commission, they might be splitting it with the firm, or taking a wage rather of commissions, indicating that although the commission is being paid, they aren't necessarily seeing it ...

Few industries exterior of the monetary services industry use the potential for relatively inexperienced experts to make considerable income within their very first year of work. Within the kyleryddq655.de.tl/Some-Known-Details-About-How-Much-Do-Dentures-Cost-Without-Insurance-%3C-s-h1%3E%3Ch1-style%3D-g-clear-d-both-g--id%3D-g-content_section_0-g-%3EOur-What-Is-A-Deductible-Health-Insurance-PDFs.htm monetary services industry, couple of careers offer beginners the chance to earn so much ideal off the bat as a life insurance representative. In truth, a hard-working insurance representative can make more than $100,000 in their first year of sales.

|

|

What Does What Does Term Life Insurance Mean Mean?How Which Of The Following Best Describes Annuall |

Another truth check? This kind of additional living costs protection will cover you for as much as 2 weeks however it will still be a godsend if bad things happens. If you're currently purchasing a homeowners policy, you might also make certain you have the precise protection you need. Reading a house insurance coverage can be a laborious job, however working with a tech-savvy insurer like Lemonade can make things simple and simple.

The seamless experience also consists of sending your quote to your loan provider, so you don't have to fret yourself with the neverending back and forth. Getting a new house will be among the most costly and important choices of your life, and making certain you have the best quantity of protection will provide you the assurance you need to proceed with your lifeworry-free.

If you're buying a home, selecting the ideal amount of property owners insurance coverage for your home is key. Purchase excessive, and you're squandering cash on protection you'll never use. Purchase insufficient, and if a cyclone, hailstorm, or other disaster strikes your house, your insurance coverage may not cover the costs to repair the damagewhich indicates you'll be paying out of your own pocket.

The objective of your property owner insurance plan is to ensure you're covered not just for minor damage that you 'd like financial assistance fixing, but more importantly, in case your home is entirely ruined (in a tornado, fire, or otherwise) and needs to be restored from scratch. This is referred to as "actual overall loss" or "total loss." Overall loss protection varies from location to location in addition to from home to house, but generally come down to an estimate of how much it would cost to rebuild your home.

To figure out the total loss coverage for your residential or commercial property, you'll wish to speak to a home insurance company or agent (who probably represents different insurance companies), who can figure out the best amount of protection based upon your house's square video footage, the local building and construction market, and, naturally, the existing market worth of the house." When you go shopping for home insurance, your insurance service provider will likely have access to electronic restoration cost-estimating tools to help provide a sense of just how much coverage you need," Tirschler describes.

And even if your house is paid offor no requirement is in placeit's still an excellent concept to buy adequate protection to cover the complete replacement cost. Even if the chances are slim that you'll ever need to utilize it, the peace of mind it can supply in the occasion of a disaster is invaluable.

How Much Home Insurance Do I Need Fundamentals Explained

After all, if your house is damaged by fire or damaged by a typhoon, it's not just the roofing system and walls that take the hit. Many home insurance coverage policies will cover interior items, however that doesn't indicate everything inside your house is safe. For circumstances, a "called dangers policy" usually covers only a specific, narrow list of reasons for loss, and depending on why you place the claim, you might http://codyebnx110.jigsy.com/entries/general/not-k...w-to-get-cheaper-car-insurance discover your insurance provider will not pay up!If you desire to ensure your valuables are completely secured, Tirschler suggests trying to find an insurance coverage service provider that uses an "open dangers" (or "all-risk") policy." Open dangers policies supply the greatest defense, due to the fact that they cover all possible reasons for loss other than for those that are specifically left out," he keeps in mind.

This is since companies frequently offer different levels of insurancelike "fundamental" and "boosted" each with their own rate, pros, and cons. Here are some aspects to consider: A deductible is the quantity you'll need to pay of pocket prior to your insurance kicks in. Generally speaking, the higher the deductible, the more affordable the regular monthly insurance coverage premiums.

Deductibles often range from $1,000 up to $5,000. A coverage limit is the maximum amount your insurance company will pay when something goes incorrect and you submit a claimeverything above this amount, you'll have to pay of pocket. For example, a more budget friendly, basic strategy may pay the medical bills if a guest is injured at your house at approximately $1,000 per individual, whereas a more expensive, enhanced plan may cover to $5,000 per individual.

If your scenarios or outlook change, many companies will allow you to increase or decrease your protection. For circumstances, if you could just pay for a fundamental, bare-bones plan originally however want pricier/better protection after getting a promotion at work, the majority of insurance provider will gladly change your strategy to suit your new situations.

Got pricey fashion jewelry or artwork in your house? You might wish to purchase extra protection. You'll pay more now, but if your prized possessions are harmed or destroyed, your insurer will assist you pay to change them, which could conserve you money in the long run." If you have any high-value items, such as precious jewelry or expensive art, these will need a various policy to genuinely cover their real worth," says, president of Home Qualified.

For instance, floods and earthquakes are usually not covered in fundamental insurance coverage strategies, so if you desire it, Learn here you'll have to buy this insurance separately. In our next installation of this series, we'll dive in more depth into Look at more info what home insurance coverage coversand what it doesn't.

Little Known Questions About How Much Is Domino's Pizza Insurance.

Owning your house signifies that you are formally a grownup, however along with house ownership comes lots of responsibilities that can make adulting hard. Among those adult things is having the proper coverage on your house owner's insurance. If you have a home mortgage, coverage to safeguard the home is needed by the lending institution however even if you don't have a lending institution to please, carrying insurance protection on your house is a sensible financial relocation.

The majority of provide protection for the following: Home- Your house Other structures- Believe shed, fence or unattached garage Personal effects- The things in your house Liability- A visitor gets injured on your home Now, this is just a quick summary. However each of those coverages above will have a limit beside it on your statements page.

So, for instance, if you have $575,000 beside your residence limitation, your home gets struck by lightning and burns to the ground, the insurance coverage may pay up to the $575,000 limit. The liability limitation works the exact same method, and many policies include $100,000 in protection and go up from there.

When it pertains to just how much individual liability coverage you require on your property owner's insurance coverage, it is essential to think about how much you deserve - how much does an eye exam cost without insurance. Now, we know you are a priceless wonderful person that you can't put a price on. But when it boils down to battling a suit in a courtroom, your entire net worth could be at stake.

Even if you aren't currently at complete earning capacity, it is essential to set your personal liability limits to safeguard potential earnings (how to check if your health insurance is active online). Wondering what could possibly take place to threaten all that you have worked or working so hard for? Let's talk about it. Let's say you just moved into a stunning, 3000 square foot colonial house, with the ideal staircase for holiday designing.

|

|

Not known Details About How Does Whole Life Insurance Work Facts About How Much Home Insurance Do I |

Among the highlights of Solstice's offerings for people, households and groups is the Solstice Plus Plan One, a thorough oral cost savings prepare that's economical, easy to use, and is proven to provide overall lower expense costs for members. Solstice Plus Plan One includes discount rates on virtually all preventive and corrective treatments, https://consent.yahoo.com/v2/collectConsent?sessio...2f-123a-46af-ba18-3db5aecf507f along with orthodontics (braces) and cosmetic dental care (such as teeth lightening, bonding and veneers).

No, simply insurance As you 'd expect from a large health care policy service provider, United Health care offers excellent options in dental insurance coverage plans making it simple to discover the ideal plan for your needs such as a plan that offers 100% preventative care protection to affordable copay plans. United Health care dental insurance likewise has a large network of dental professionals across the country.

Furthermore, United HealthCare Dental Insurance does not cover significant treatments such as root canals and crowns for one year after plan purchase. There are likewise restrictions on how typically you can get major treatments. Provided the waiting times and constraints associated with this insurance, it could be a great choice for people who enjoy excellent dental health.

Like health insurance coverage, oral insurance plans charge you a regular monthly premium. In return, the strategy assists you pay for needed care. There are other similarities as well: A lot of dental strategies have a network of dental experts There's a deductible a quantity you pay out of pocket before the plan pays for treatment You pay for a part of lots of procedures by means of co-pays (flat charges) or co-insurance (a portion of the dental professional's charge) There are also some important differences.

The deductible is generally really low compared to a medical plan around $50 for an individual, and $150 for a household. 2 Also, a lot of strategies top the overall quantity they will pay for care at $1,000-$2,000 per plan member each year - how does long term care insurance https://www.ripoffreport.com/reports/wesley-financ...scam-dont-send-them-mon-343551 work. Any oral costs over your strategy's cap (or maximum) will be your duty.

A DPPO has a network of dental practitioners, but generally lets you go out of network to see another dental professional - how much does life insurance cost. You might want companies that offer a large nation-wide supplier network, as your existing dental expert may well be "in-network" check prior to you choose a strategy. Even though you can head out of network, it's usually worth your while to see an in-network dental professional in a DPPO, due to the fact that the insurance provider negotiates reduced charges on your behalf.

8 Simple Techniques For How To Get Health Insurance Without A Job

In the other type of plan a DHMO you have to see an in-network dental expert. And due to the fact that their networks are restricted, you'll require to check to see if your existing dentist is included. The trade-off is typically lower expenses and a simpler fee structure. There's likewise a third type of strategy, called an "Indemnity" plan, which repays you for a part of your oral care expenditures; nevertheless, those strategies are rather more difficult to discover and have the greatest premiums of any dental insurance plan.

That indicates it covers preventive care examinations and cleanings at 100% (you typically do not even pay a deductible); standard procedures like fillings and extractions at 70%; and significant treatments like crowns, bridges, and root canals at 50%. There are variations on this formula, and some procedures may be considered "fundamental" in one strategy and "major" in another.

|

|

How Long Do You Have Health Insurance After Leaving A Job? - An Overview |

Finest Vehicle Insurance Coverage Uses For You Hide Ever question just how much your insurance coverage agent is making off your service? Curious about whether your independent broker makes extra for guiding you to a particular insurance company? And how do you discover out?You could attempt asking point blank, however few states require agents to inform you what they're making off a particular policy.

With 3 million certified insurance agents in the country eager to grab your organization, he says, "You 'd be insane to run the risk of losing a client."Home and vehicle insurance coverage agents normally get a 10 to 15 percent commission on the very first year's premium. how much does motorcycle insurance cost. Commissions can vary as low as 8 percent, says Bissett, while "15 [percent] would be on the very high-end."On the other hand, life insurance agents make most of their cash in the first year of a new policy.

Your insurance representative might likewise be generating income every year you restore the policy. For vehicle and house insurance coverage renewals, agents make a 2 to 15 percent commission (most remain in the 2 to 5 percent range). Life insurance renewal rates are typically 1 to 2 percent, or zilch after 3 years.

He warns clients against focusing excessive on commission levels. What matters more, he says, is finding a policy that satisfies your particular requirements. "Rate might be a primary aspect but it shouldn't be the only aspect."Surprisingly, a February 2010 research study from J.D. Power & Associates exposes that agents' satisfaction with an insurance company is depends upon whether the insurer has a knowledgeable and handy personnel.

Disclosure rules differ by diigo.com/0jc2ko stateMany states have laws requiring representatives and brokers to disclose all charges and service fee to customers, according to the National Association of Insurance Coverage Commissioners. But in many cases you have to ask. They're not required to spill their guts without prompting. A few states (Texas, Connecticut and Rhode Island) require agents and brokers to divulge whether insurance carriers pay them efficiency rewards above and beyond the commissions consisted of in the policies released.

It's hard in New YorkAnd then there's New york city, which under a policy set to take impact Jan. 1, 2011, will have the strictest commission-disclosure rules in the nation. As in lots of states, New York brokers and agents will be required to inform clients the commission rates they get on policies sold, if asked.

The New York City State Insurance Department's (NYSID) pending guideline outgrew a 2004 bid-rigging investigation by then-State Attorney general of the United States Eliot Spitzer. Because case, Spitzer discovered that commercial insurance coverage brokers were getting under-the-table payments for steering customers to particular insurance carriers. The most significant resistance to the proposal has actually come from independent agents, who grumble that the rule makes no difference in between them and single-carrier brokers, which they can ill pay for to revamp their computer system kinds and reporting treatments for each and every policy.

How How To Shop For Health Insurance can Save You Time, Stress, and Money.

"We do not require a federal government service when there's no issue," he stated. Matthew J. Gaul, NYSID's deputy superintendent for life insurance, counters that without this regulation, there's no legal requirement that customers can get such details. "We think consumers are entitled to as much information as possible," stated Gaul. how long can you stay on your parents insurance. Although it's possible to overwhelm customers with information, in this case "we feel like it strikes the right balance."Nevertheless, Bissett predicts that New york city's method will not catch on in other states.

These charts reveal the average base wage (core settlement), as well as the typical total money compensation for the job of Insurance Agent in the United States. The base wage for Insurance coverage Agent varies from $46,997 to $58,048 with the average base pay of $51,458. The total cash settlement, that includes base, and yearly incentives, can vary anywhere from $53,775 to $64,450 with the average total money compensation of $54,128.

Insurance coverage policies assists families and organizations secure themselves versus the financial burdens associated with unanticipated occasions such as natural catastrophes, accidents and illness. Insurance coverage sales representatives offer policies to clients on behalf of insurance provider. Representatives typically hang out describing the details of insurance plan and assisting consumers choose policies that finest fit their requirements.

The Bureau of Labor Data reports that insurance agents made a mean $62,970 a year as of May 2011. This annual earnings level equates to average hourly incomes of $30. 28. Insurance representatives frequently make earnings in the form of commissions based on the amount of insurance they offer. As an outcome, experienced agents with many customers can earn much more than new representatives.

Fifty percent of workers earned in between $33,850 and $72,490 a year. BLS data show that Florida led the nation in overall work of insurance representatives since May 2011, with 26,940 tasks. Agents there made $59,420 a year on average. Representatives in Rhode Island had the greatest average income in the nation at $81,460 a year, followed by Massachusetts, where they balanced $80,420 a year.

Agents earned more than $74,000 a year in all 3 states. The majority of insurance agents work for brokerages that represent insurer. The Bureau of Labor Statistics states that insurance agents working for agencies and brokerages earned $62,900 a year typically as of May 2011. Representatives utilized by insurance carriers made $64,170 on average, while those in the travel plan organization made $53,700.

Those dealing with insurance and employee benefit funds made $74,350 typically. The requirement for insurance sales agents tends to increase with population growth and the growth of the total economy. The BLS expects work of insurance representatives to grow 22 percent from 2010 to 2020, which is 8 portion points quicker than the nationwide average for all tasks.

A Biased View of How Long Can You Stay On Your Parents Health Insurance

Insurance coverage sales agents made an average yearly wage of $49,990 in 2016, according to the U.S. Bureau of Labor Stats. On the low end, insurance sales agents made a 25th percentile wage of $35,500, suggesting 75 percent earned more than this quantity. The 75th percentile salary is $77,140, suggesting 25 percent make more.

|

|

A Biased View of How Much Is The Penalty For Not Having Health Insurance |

We used independent non-profit FAIR Health Customer to get expense quotes of some dental treatments and created the following chart. Your costs may be greater or lower due to the fact that expenses vary across states and areas. Remember that a person dental procedure can consist of numerous charges, like X-ray and fillings for example.

Part of that method involves how the dental companies are structured., or chosen provider company, is the most common type of dental insurance. This plan has actually set up reduced rates with dentists. These dental experts are called in-network because they will deal with the insurance business - how does health insurance deductible work. You can head out of network if you have a PPO strategy, but you will not get the benefit of the lowered rates.

, or health care company, is usually not a suitable oral insurance coverage plan for seniors. While it is a really low-cost alternative, it covers little to absolutely nothing aside from routine visits and cleanings. is a newer concept being presented by insurance provider. With this strategy, you pay a minimal premium and pick from a choose group of dental professionals who have actually consented to a lowered payment schedule.

Dont be afraid to ask concerns to get the best coverage Before you purchase dental insurance coverage, ask all the questions you need to till you comprehend what the policies you are considering cover and how the claims process works. Here are some important questions to ask if you can't discover the answers in dental plan documents.

Rumored Buzz on How Much Homeowners Insurance Do I Need

We browsed for a substantial list of 24 business. 2. We evaluated dental insurance provider based upon our expert-guided buying requirements: expense of premiums, the number of in-network oral care service providers and general expense savings. 3. We offered you the three finest oral insurer to choose from. Understanding where to start with getting quotes can make you seem like your head is spinning.

After our examination, we chose the best oral insurance and discount strategy companies: DentalPlans. com, Spirit Dental, and 1Dental. Each of these business stood apart as oral insurer offering policies straight to senior citizens. Many Economical Screenshot: Guardian Dental Guardian dental deals affordable dental insurance coverage with a big in-network choice of dental specialists.

With an extensive network of more than 100,000 participating dental experts at more than 300,000 areas nationwide, there is likely an in-network dental practitioner in your area. When you integrate the capability to choose your preferred dental practitioner with the sort of extensive protection readily available through among the biggest service providers in the dental insurance coverage sector, you'll find Guardian dental is difficult to beat.

Great Network Screenshot: Dentalplans. com DentalPlans. com plans provide protection to more than 1 million Americans by servicing almost all 50 states, with the exception of South Dakota and Vermont. More than 100,000 dentists practicing in the U.S. are in-network with DentalPlans. com and the company can conserve strategy holders 10-60% on dental services.

How Much Does Long Term Care Insurance Cost Can Be Fun For Anyone

com isn't an insurance provider, but they deal with oral company to reduce the cost to see an out-of-network dentists. In this way the business provides access to a few of the very same oral benefits used by employers through typical group insurance, but more carefully resembles a prescription discount card.

The annual cost for the plans vary from $100 $175 depending upon the location and variety of individuals covered - how much does an mri cost with insurance. To read more about Dentalplans. com, shop dental strategies online or call ( 888) 966-9104. Read our detailed DentalPlans. com evaluation. Great Loyalty Advantages Screenshot: Spirit Option 3500 Strategy. Spirit Dental is a broker for Ameritas oral strategy and is backed by Ameritas Life Insurance coverage company, which receives the greatest ratings for monetary stability from AM Finest and Standard & Poor's.

Orthodontia has a waiting period in some states. Other features of Spirit Dental plans: All applications are accepted Three complimentary oral cleanings and two tests annually for seniors 30-day guarantee Use an out-of-network dental professional, although at a higher premium $100 life time deductible Spirit Oral insurance coverage prepare for seniors are available for two individuals, indicating you do not have to register for a more costly family strategy.

Maximum annual advantages varied from $1,200 to $5,000, and each policy consisted of a $100 life time deductible. The longer you stay with Spirit Dental, more each strategy pays out and the greater your savings. For example, with one plan's standard oral treatments are covered at 65 percent the first year, 80 percent the second year and 90 percent the third year.

Excitement About What Happens If I Don't Have Health Insurance

All strategies cover preventative care at one hundred percent. You can bundle EyeMed vision insurance coverage for $7 monthly with each strategy. If you have an interest in finding out more about Spirit Dental, call ( 888) 373-6392 or visit their site for more details. Great Discounts Screenshot: Oral Gain Access To Strategy. 1Dental. com uses what is most likely the most affordable senior dental discount rate strategy, which is an alternative to routine dental insurance.

Annual membership costs for senior citizens are $99 for a specific to $179 for a household of 3 or more, with a $20 processing fee. If you require to make monthly payments, the processing cost rises to $30, and payments are from $9. 95 to $17. 95 each month. Memberships consist of these advantages: Usage advantages immediately, consisting of major treatments Immediate approval No pre-existing condition exemptions 30-day cancellation for refund, less $5 processing fee Examples of oral costs with the Careington 500 strategy are $15 for an oral examination, $31 for a cleansing, $483 for a crown and 64 percent off of dentures.

Expense of procedures may vary depending on your area. The Aetna Dental Access estimate are based on nationwide averages, so your expenses might be higher or lower. Aetna Dental Access offers 50% off dentures, an oral examination is $30, cleaning is $59 and a crown is https://spencerwpoc099.shutterfly.com/64 $757. Aetna's oral discount rate network consists of over 161,000 dental practitioners, and Careington says over 100,000 dentists take part in their plan.

and found no dental practitioners from the Aetna plan while the Careington plan had 4 dental practitioners, although the offices were located 100 miles from the zip we utilized. If there are no providers readily available in an affordable range from your house, you can nominate dental practitioners, and Careington will call them to demand participation.

The Main Principles Of Where Can I Go For Medical Care Without Insurance

1Dental and Careington both have an A+ Bbb score, with EyeMed vision insurance consisted of with each strategy. If you have an interest in discovering more about 1Dental. com, call ( 888) 852-3623 or visit their site for more info. If you're over 65 and searching for oral protection checked out these crucial things to understand about dental insurance coverage before selecting.

Dental insurance provider work with the ACA to satisfy this requirement and give you, the adult, options for coverage also. Read about oral insurance coverage and the ACA. If you're worried about paying for dental treatments, here are nine budget-friendly oral care choices. A lot of dental insurance coverage business have a waiting period after your application is accepted. Take the cost of what you have spent for oral care in the last few years and compare it versus how much you would spend for dental insurance premiums, copayments, and deductibles each year with the oral insurance coverage plan you're thinking about. You may find that, if your oral care requirements are low, you're financially better off paying out of pocket.

That indicates attending all of your allowed preventive exams and cleansings. The majority of dental insurer provide a variety of strategies throughout numerous states. That indicates you ought to have the ability to find strategies varying from economical to 'gold level', premium protection. Here are the most common oral insurance strategies readily available now: These are not full-coverage strategies and need to not be considered oral insurance coverage, but they do offer discount rates for typical treatments.

These low-premium strategies might be appropriate for those who do not normally require dental work, and will assist you cover the cost of preventive exams and cleanings. The most popular dental prepare for individuals because it covers most costs associated with preventive exams. Many cover 2 exams, cleanings and x-rays annually, and will partly cover extra work.

The smart Trick of How Long Does An Accident Stay On Your Insurance That Nobody is Talking About

These dental strategies are similar to basic specific plans. However, many insurance coverage companies will use the advantage of a household deductible. While the majority of dental strategies require a $50 deductible per person, the majority have a maximum family deductible of $150, which might be helpful to those who need to guarantee more than three people.

The strategies may also enable more cleanings each year, such as one every four months instead of every six months. Other alternatives to inquire about consist of add-on prepare for things such as assisting with adult implants. A lot of oral insurer offer prepare for people, but obviously some are better than others.

It provides economical oral strategies for single people, and has a comprehensive network of dental professionals to pick from in over 330,000 locations nationwide. You can pick from an HMO strategy, with inexpensive copays on preventive, basic and significant oral services, and best of all there are no waiting durations for many services.

It includes a deductible and there is a yearly maximum on treatment, so you'll need to cover any additional costs after you have reached that optimum within a year. For this guide to the very best dental insurance coverage, we consulted with three dentists to get their viewpoint on oral insurance coverage service providers.

What Does How Much Does A Doctor Visit Cost Without Insurance Mean?

Each dental expert said the very same thing: watch out for picking the least expensive provider in your area since they are typically the worst when it comes to authorizing procedures or repayments. And while it didn't affect our evaluations, each dental expert named Delta Dental and MetLife as the most trusted and most convenient to deal with.

What work do you anticipate you'll require in the next two to three years? For instance, if you haven't been to a dentist in a long time, you need to consider a thorough coverage strategy. Do you have kids who may require braces? Do you require implants? Most insurance coverage strategies don't cover these treatments up until you have actually been on the prepare for at least 12 months, so it deserves putting in the time to examine your oral health, even if it suggests getting a checkup with a dental practitioner prior to picking a plan.

According to the American Academy of Implant Dentistry, 'Believe of oral implants as synthetic tooth roots, comparable fit to screws. When dental implants are placed in your jawbone, they bond with your natural bone. They end up being a strong base for supporting several artificial teeth, called crowns.' Oral implants are far more preferable compared to dentures, however the cost of implants can be prohibitive for some.

In that instance, you might be better off choosing a dental cost savings prepare to access discounts on dental implants. There are oral insurance prepares that cover implants, including the similarity Delta Dental and Cigna, but examine the particulars of the plan to see if there are any caveats. For instance, you don't presently have any missing teeth.( Image credit: Getty) Teeth whitening is classed as a cosmetic treatment due to the fact that it is primarily utilized to lower staining and enhance the appearance of your teeth.

The smart Trick of How Much Does Motorcycle Insurance Cost That Nobody is Discussing

In-dentist whitening treatments can cost as much as $600 per session, depending on where you live. That's why lots of people check out teeth whitener packages and strips to brighten their smile at home rather. To find out more, read our guide to how teeth bleaching works. The bulk of full coverage oral insurance coverage policies consist of some form of corrective coverage, and typically around half the cost of dentures is covered.

The waiting period for brand-new oral insurance coverage patients uses to dentures too, as these are considered a non-emergency procedure. So you could be waiting anywhere between 6 months to a year or longer. And clearly dental strategies have an annual optimum limitation, so any previous oral work that year will chip into your dentures allowance.

As stated in an Frequently Asked Question composed by the American Association of Orthodontists, 'According to the American Dental Association Study of Dental Charges for 2016, the fee for detailed treatment of adolescents ranged from $4,978 to $6,900, and the charge for thorough treatment of adults varied from $5,100 to $7,045. 'The majority of orthodontists provide a range of payment plans to make orthodontic care cost effective.

Each doctor sets his/her own policies on payment strategies.' If you or a household member needs braces, or will perform in the future, when picking amongst the best dental insurance coverage strategies, look for those with orthodontic advantages. Coverage might be for a portion of the cost, or it may be topped at a particular quantity.

What Is The Best Medicare Supplement Insurance Plan? Can Be Fun For Anyone

This is because insurance provider presume more monetary risk when they cover a cigarette smoker. In basic, someone is considered a cigarette smoker if he or she has actually smoked in the past year. Some insurance provider extend that requirement back as far as five years, according to InsuranceQnA.com. "The reason cigarette smokers are charged greater dental insurance premiums is that those who smoke are more vulnerable to illness of the gums and teeth," the article states.

" The gums are impacted because cigarette smoking triggers an absence of oxygen in the bloodstream, so the infected gums do not heal. Cigarette smoking triggers individuals to have more dental plaque and triggers gum disease to become worse more rapidly than in non-smokers. why is my insurance so high." Dental experts can select to sign up with insurance coverage providers' favored networks so that patients get the most out of their insurance coverage benefits.

|

|

A Biased View of How To Shop For Car Insurance |

An individual with a low-deductible strategy, on the other hand, will likely have a higher premium but a lower deductible. High-deductible insurance strategies work well for individuals who prepare for extremely few medical expenses. You might pay less money by having low premiums and a deductible you hardly ever require. Low-deductible plans benefit individuals with chronic conditions or families who prepare for the need for numerous trips to the medical professional each year.

The answer to this concern depends mainly on the number of people you are insuring, how active you are, and how numerous doctor check outs you prepare for in a year. A high-deductible plan is great for people who seldom go to the physician and wants to restrict their month-to-month expenditures. If you pick a high-deductible strategy, you need to be proficient at conserving money so that you are prepared to pay any medical expenditures up front.

These plans are likewise a good choice for a person with a persistent medical condition. Planned sees such as well gos to, check-ups on chronic conditions, or expected emergency requirements can quickly include up if you are on a high-deductible strategy. A low-deductible strategy lets you better handle your out-of-pocket expenses.

Numerous companies provide one-on-one guidance therapy to help you comprehend your options, weigh your risks, and pick a plan that's right for you.

A high deductible health insurance (HDHP) has lower monthly premiums and a greater deductible than other medical insurance strategies. For 2020, the Irs (IRS) specifies an HDHP as one with a deductible of $1,400 or more for an individual or $2,800 or more for a family. Learn the attributes of an HDHP and its possible benefits and downsides compared with other medical insurance choices.

However as the name suggests, the deductibles are higher than those for a traditional plan, and you will need to settle your significant annual deductible prior to your insurance coverage provider will start spending for any of your health expenditures. An employer-sponsored HDHP may be coupled with a health savings account (HSA) or health repayment arrangement (HRA).

However, HSA funds generally can not be utilized to spend for health insurance premiums. Employers may also add to a worker's HSA. Just employees with an HDHP can take part in an HSA. An HRA is moneyed by a company to make it possible for employees to pay themselves backwith tax-free moneyfor medical expenditures they have actually sustained.

How Much Does Motorcycle Insurance Cost Can Be Fun For Anyone

HRA funds may in many cases be utilized to spend for health insurance coverage premiums. Cash in an HSA or HRA can be rolled over and used in a subsequent year. The deductibles for an HDHP are typically greater than the minimums of $1,400 (person) and $2,800 (household). They might be as high as the maximum out-of-pocket (OOP) expenses, which are $6,900 for a private and $13,800 for a household in 2020.

All strategies bought through an Affordable Care Act (ACA) Marketplace and many strategies bought through other means are needed to cover specific preventive services at an in-network service provider regardless of just how much of your deductible you have actually paid - what is a certificate of insurance. Health care. gov supplies lists of those covered preventive services for adults of both sexes and those particularly for females and kids.

The initial list of preventive services was launched in 2004, and extra services were included 2019. If you https://topsitenet.com/article/657624-how-does-lon...e-work-fundamentals-explained/ are healthy, don't check out the physician frequently, and do not have a big household, an HDHP may be the most economical kind of health insurance coverage plan for you. If you don't have a current medical condition, you might not have to pay too lots of medical expenses during a given year and you may find an HDHP works for you.

It's not constantly possible, but if you choose to buy an HDHP (and with some employers, this may be your only choice), you must ideally have adequate cash on hand to cover your deductible and other OOP expenses. The obvious drawback to an HDHP is that you are accountable for settling your high deductible while also paying your monthly premiums, which, although most likely lower than those for standard insurance coverage plans, might not be quickly inexpensive.

The typical lowest-cost, bronze-level, monthly premium for a 40-year-old is $331 in 2020. Some people with an HDHP delay or pass up required medical treatment because they do not have the money to spend for it and they haven't paid off their deductible. In a survey performed by the Kaiser Family Structure that was reported in June 2019, half of adults said either they or a relative had delayed or gone without medical care (consisting of dental care) because they could not afford the expenditure.

A high deductible health strategy has lower monthly premiums and a higher deductible than other plans. For 2020, the IRS specifies an HDHP as one with a deductible of $1,400 or more for a private or $2,800 or more for a family. A health cost savings account or health reimbursement plan can assist you cover the expenses of healthcare.

Numerous or all of the products featured here are from our partners who compensate us. This may affect which products we write about and where and how the item appears on a page. Nevertheless, this does not influence our examinations. Our viewpoints are our own. If you're choosing in between a low- and a high-deductible health plan (HDHP), there's more to think about than deductibles and regular monthly premiums.

The Main Principles Of How To Become An Insurance Adjuster

The logic is that if you are accountable for medical expenses in advance, you'll do a little more work to discover lower-cost service providers cutting expenses for you and your insurer. That hasn't turned out for the majority of people. Although consumers with HDHPs do tend to reduce costs, they do so by avoiding care, according to the Urban Institute.

Whether you select a plan with a low or high deductible, don't do so at the cost of your health. Here's what you must think about when selecting between a low- and high-deductible health insurance. First, let's brush up on some basic health insurance coverage terms. Understanding these will assist you understand the difference between plan types and make a better choice.

The quantity you have to pay in advance for your treatment, with the exception of some free preventive care, prior to insurance starts. After you satisfy your deductible, your insurance company starts paying a larger portion of charges. A cap on how much you'll have to spend for treatment in a year, not including premiums, so long as you stay within your insurance coverage network.

Deductible quantities are the apparent difference in between low- and high-deductible health insurance. Many high-deductible health insurance, especially those with the most affordable premiums, have deductibles near to their out-of-pocket limits, frequently $5,000 or more. Premium costs vary, however plans with greater deductibles tend to have lower monthly premiums than those with lower deductibles.

Just individuals with qualifying HDHPs are eligible to open and contribute to HSAs. HSAs are tax-advantaged, suggesting that you can direct funds from your paycheck into an HSA pretax, or you can add the money post-tax and deduct taxes later. An employer may likewise contribute to your HSA. HSA money earns interest, can be purchased stocks or mutual funds, and invested on any certifying medical cost, as specified by the Internal Revenue Service.

|

|

The 15-Second Trick For What Is The Difference Between Whole Life And Term Life Insurance |

These policies are less expensive to begin, but wind up being more expensive over the life of Additional reading the policy - how much does life insurance cost. Another http://knoxohzo358.huicopper.com/8-easy-facts-abou...health-insurance-a-month-shown downside: if you establish a terminal illness, you might be ineligible for renewal (the amount you pay your insurer for your insurance plan is which of the following?). Life insurance coverage premiums are one of the core aspects of a life insurance coverage policy, so it is essential to understand what Hop over to this website they are, how they work, and what they indicate for your budget (what is a certificate of insurance) (which of the following typically have the highest auto insurance premiums?).

|

|

Some Known Details About How To Fight Insurance Company Totaled Car |

Gupta, Field, and Asch all think that the idea of high-deductible health strategies may hold promise for lowering general costs, however not considerably, a minimum of in their existing kind. "I think it's one tool, however in general it's not going to be a game-changer," Field says. Gupta concurs, including that while research study on these strategies has shown that people do cut down on care, "the reduction isn't huge it's [only] on the order of 5% to 10%." The share of employers using only high-deductible coverage increased markedly from simply 7% in 2012 to 24% in 2016.

Another concern with high-deductible strategies is whether they genuinely lead people to make excellent decisions about when they need a medical professional and when they do not. Asch states this is a major issue: Many people simply do not have the medical competence to compare high-value and low-value care. "You wouldn't desire me to utilize a pricey brand-name drug for my heartburn when I could use a much less expensive generic," he states.

But high-deductible health insurance do not discriminate in between those 2 purchasing choices." They count on the client to make the call, he states, and while some people can do that efficiently, many can not. To make things much more http://www.canceltimeshares.com/addressing-issues/ complicated, he states, the expensive drugs are the ones that get marketed straight to consumers, spurring need for them.

The average consumer doesn't very typically understand what's wasteful and what's not wasteful." He says some research study reveals that people in high-deductible plans tend to lower their use of all kinds of healthcare. "They may do less MRIs sometimes MRIs might be low-value but they likewise do it for preventive care like vaccines," he keeps in mind.

But Gupta says this truly hasn't worked out, even with some big business making price transparency tools available to workers so they can see the negotiated rates of their insurance provider with different service providers. "Consumers do not truly utilize these tools, and even when they do, it doesn't lead to a big change in their behavior," he stated.

" What companies can tell their employees is, 'Look, we can offer you a lower premium if you take the high-deductible health insurance,'" says Gupta. "And if you're relatively healthy, you'll also be better off. But if you anticipate to use a sensible quantity of care, these plans get quite costly." "People actually feel bitter those strategies where they feel that it looks like insurance, however it really isn't since you have to install so much of your own money."Robert Field Field says that there requires to be some kind of lodging for people at lower income levels and those who are sicker.

Getting My How To Get Insurance To Pay For Water Damage To Work

So it penalizes those people who are sickest, and likewise those with the most affordable earnings because they're the least likely to be able to pay for the big deductible." He also keeps in mind that a deductible of several thousand dollars means something really different to someone who's making $20,000 a year than someone who's making $100,00 a year or $1 million.

" From an individual company's viewpoint, they might not be responsible for that due to the fact that by the time the client gets ill, they may be working for another company or be retired and on Medicare." Some firms assist workers handle the threat of high-deductible plans by also offering a tax-sheltered health cost savings account (HSA) either contributed to by the company or not which can be dipped into in case of a more serious medical condition.

It likewise reveals something about a company's inspirations, he says. If a high-deductible health strategy is coupled with a good employer-sponsored HSA, it suggests that the employer is believing about assisting workers have skin in the game and "sort of right-sizing or optimizing their care." But if it's not integrated with such an arrangement, he said, it suggests pure cost-shifting.

" They appeal to younger individuals, and if you're quite healthy, then these plans are cheaper," especially when integrated with an HSA. "I believe the difficulty is, we still do not know how to make them truly effective," he states.

Your medical insurance deductible and your monthly premiums are probably your two biggest health care expenditures. Despite the fact that your deductible counts for the lion's share of your health care costs budget plan, understanding what counts toward your health insurance deductible, and what doesn't, isn't simple. The style of each health insurance determines what counts toward the medical insurance deductible, and health insurance designs can be infamously complicated.

Even the very same strategy might change from one year to the next. You need to check out the small print and be savvy to comprehend what, precisely, you'll be expected to pay, and when, precisely, you'll have to pay it. Mike Kemp/ Getty Images Cash gets credited toward your deductible depending on how your health insurance's cost-sharing is structured.

Examine This Report about How Much Does It Cost To Go To The Dentist Without Insurance

Your health insurance may not pay a dime towards anything however preventive care up until you've fulfilled your deductible for the year. Before the deductible has actually been satisfied, you spend for 100% of your medical expenses. After the deductible has actually been fulfilled, you pay just copayments (copays) and coinsurance till you fulfill your plan's out-of-pocket optimum; your health insurance will choose up the remainder of the tab.

As long as you're using medical companies who become part of your insurance strategy's network, you'll just need to pay the quantity that your insurance provider has negotiated with the providers as part of their network arrangement. Although your physician might bill $200 for a workplace go to, if your insurer has a network agreement with your medical professional that requires office sees to be $120, you'll only have to pay $120 and it will count as paying 100% of the charges (the doctor will have to compose off the other $80 as part of their network agreement with your insurance plan).

The services that are exempted from the deductible are normally services that require copayments. Whether the deductible has been met, you pay just the copayment. how much does home insurance cost. Your health insurance coverage pays the remainder of the service cost. For services that require coinsurance instead of a copayment, you pay the complete cost of the service until your deductible has actually been fulfilled (and once again, "full cost" means the quantity your insurance company has actually https://www.dnb.com/business-directory/company-pro...29199bc0be95c25a39ff05309.html negotiated with your medical company, not the quantity that the medical supplier expenses).

In these plans, the cash you spend toward services for which the deductible has actually been waived normally isn't credited towards your deductible. For example, if you have a $35 copayment to see a specialist whether or not you have actually met the deductible, that $35 copayment most likely will not count towards your deductible.

Remember, thanks to the Affordable Care Act, particular preventive care is 100% covered by all non-grandfathered health insurance. You don't have to pay any deductible, copay, or coinsurance for covered preventive healthcare services you obtain from an in-network service provider. As soon as you fulfill your out-of-pocket maximum for the year (including your deductible, coinsurance, and copayments), your insurer pays 100% of your staying medically-necessary, in-network costs, presuming you continue to follow the health plans guidelines regarding prior permissions and recommendations.

|

|

Getting My How Much Is Domino's Carryout Insurance To Work |

If it has, Jones receives the commission. Both supplemental and contingent commissions are questionable, particularly for brokers. Brokers represent insurance purchasers and profit-based commissions can create a conflict of interest. They can motivate brokers to steer consumers to insurance providers that pay the highest costs but are not necessarily the very best option for the client.

A number of states have passed disclosure laws needing brokers to inform insurance policy holders of the kinds of payments they get from insurance companies. Your representative or broker need to provide you with a payment disclosure statement that describes the kinds of commissions the firm or brokerage gets from its insurers. This document ought to specify whether the firm or brokerage receives base commissions just, or if it also gets contingent commissions. The New York State Insurance Department's (NYSID) pending guideline outgrew a 2004 bid-rigging examination by then-State Attorney General Eliot Spitzer. In that case, Spitzer found that commercial insurance coverage brokers were getting under-the-table payments for steering customers to specific insurance coverage carriers. The most significant resistance to the proposal has actually come from independent representatives, who grumble that the rule makes no distinction in between them and single-carrier brokers, which they can ill pay for to revamp their computer system kinds and reporting procedures for each and every policy.

" We don't require a government option when there's no problem," he said. Matthew J. Gaul, NYSID's deputy superintendent for life insurance coverage, counters that without this regulation, there's no legal requirement that consumers can get such details. "We believe consumers are entitled to as much info as possible," said Gaul. Although it's possible to overwhelm customers with information, in this case "we seem like it strikes the best balance." However, Bissett predicts that New york city's technique will not catch on in other states.

In many cases, life insurance representatives won't charge you anything if you deal with them to purchase life insurance. So how do they earn money? A lot of agents make a portion of the premiums on life insurance policies they sella rather than a set income. That commission, however, doesn't come at an extra expense to you since Insurance coverage costs are controlled by each state's department of insurance coverage.

Because these rates are set in advance, a representative can't provide you one company's policy at a different rate than you 'd manage simply going to the company itself. These pre-set commission rates are another factor why comparison shopping is so important when going shopping for life insurance to secure the most affordable rate.

Even simply researching your choices is typically an obstacle: Various resources might have contrasting or incorrect information, specifically as federal and state insurance coverage laws alter each year. It's an agent's job to assist you browse all the nuances of life insurance coverage and guide you through the procedure of buying a policy.

The Definitive Guide to How To Become A Licensed Insurance Agent In Ohio

An agent can update you as your application advances with the insurance provider and handle the backward and forward so you don't need to. It's also beneficial for someone to have all your information on file in case your application gets decreased, which could take place if you stop working to reveal medical conditions or if a company deems you too dangerous to be covered.

Agents who can use you several types of insurance, such as disability insurance coverage, might even be able to reuse your information throughout applications if you need more coverage. A great life insurance agent will know which policies finest suit your specific situation and steer you toward the best option. But relying exclusively on an agent's knowledge also means you're at a disadvantage if they misinform you about how much or what type of protection you need (what does it take to be an insurance agent).

If you don't buy a policy, they don't earn money. And due to the fact that of the method commission works, the more expensive a policy you buy, the more the representative earns money. You might be roped into a life insurance coverage policy that offers method more protection than you need, with premiums much greater than you 'd pay for the appropriate amount of coverage.

Uncertain just how much life insurance you might require? Our life insurance calculator will offer you a tailored recommendation. We can also help you compare quotes from numerous insurers. Come armed with that info when you're ready to meet a representative, and you won't require to accept the very first deal.

Many or all of the items featured here are from our partners who compensate us. This might influence which products we discuss and where and how the product appears on a page. Nevertheless, this does not affect our examinations. Our viewpoints are our own. Part of comprehending how to buy life insurance smartly is understanding how representatives earn money.

Commissions differ by policy and company, however life insurance representatives frequently get 80% to 100% of the very first year's policy premium as commission. "In truth, many of the time companies remain in the hole in the very first year," notes Glenn Daily, a fee-only insurance coverage consultant in New York City (how long does it take to become an insurance agent). Those commissions and other expenses are why most long-term life insurance policies, such as whole life insurance, build no money worth in the very first year.

Facts About What Does A Title Insurance Agent Do Revealed

Commissions vary by policy and company, however life insurance coverage agents typically receive 80% to 100% of the first year's policy premium as commission. Assuming the insurance policy holder continues https://blogfreely.net/santonax86/a-term-life-insu...is-less-costly-due-to-the-fact to pay premiums, representatives typically continue to gather smaller commissions in subsequent years. Include everything up, and 15% to 25% of all the premiums you pay over the life of the policy might go to commissions and other costs, such as workplace expenditures, according to Daily.

5 billion in commissions on basic individual life insurance policies in 2014, according to a computation by information company SNL Financial, based upon filings with the National Association of Insurance Commissioners. That was 9% of premiums gathered on these policies. Commission shares varied commonly among leading insurers, from a low of 2.

7% at Aegon. The share of premiums on basic private life insurance coverage policies going to commissions differed commonly among top companies in 2014. Northwestern Mutual $13. 4 $0. 9 6. 7% New York Life $8. 5 $0. 4 5. 1% MetLife * $7. 1 $0. 3 3. 9% Prudential $6. 3 $0.

9% Lincoln National $5. 7 $0. 7 13. 0% MassMutual $5. 7 $0. 4 6. 9% Manulife Financial $5. 1 $0. 5 10. 1% State Farm $4. 3 $0. 3 7. 6% Aegon $4. 2 $0. 7 17 - how much does an insurance agent make. 7% Guardian $3. 8 $0. 1 2. 7% American International Group $3.

3 10. 0% AXA $3. 1 $0. 3 10. 4% Pacific Mutual $3. 0 $0. 4 12. 7% Dai-ichi Life $2. 4 $0. 2 8. 2% Voya Financial $2. 2 $0. 2 8. 1% Primerica $2. 1 $0. 3 14. 0% Genworth Financial $1. 9 $0. 1 7. 4% Sammons Enterprises $1.

3 13. 8% Nationwide $1. 7 $0. 2 14. 3% Principal Financial Group $1. 6 $0. 1 5. 8% * Not including subsidiary American Life Insurance coverage, which does a substantial share of its service outside the U.S.Source: SNL Financial, based on filings to the National Association of Insurance Coverage Commissioners. Given that the commission paid is a percentage of the premiums, representatives have a reward to promote pricier policies.

|

|

A Biased View of What Does Term Life Insurance Mean |

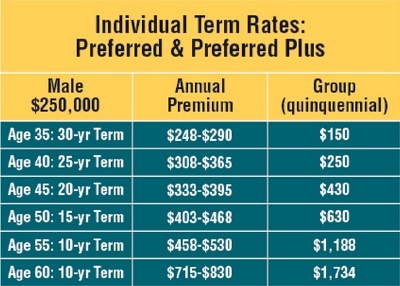

Get your free, no responsibility, term life insurance coverage quote today. As stated above, "term" in the context of Term Life Insurance coverage means - a life insurnace policy that covers the insurance policy holder for a particular quantity of time, which is referred to as the term. One of the most popular kinds of term insurance, level term life insurance coverage (or term level life insurance) readily available through AIG Direct, uses life insurance coverage on level terms or a fixed premium payment for the duration of the term.

A longer term could suggest a greater month-to-month premium, since the provider generally averages the cost of insuring someone who is younger with the expense of insuring someone who is older (when premiums are more expensive). Due to the fact that level term life insurance coverage has a "set it and forget it" repaired payment, it can be easier for families to spending plan.

An eco-friendly term life insurance policy readily available through AIG Direct continues in force for a specified term or terms, normally in increments of one or 5 years. It can be restored without the insured needing to undergo a medical exam or provide other evidence of great health or insurability each year.

The alternative to transform term life insurance coverage can be "a valuable advantage" for some. This option allows individuals to convert their term life policy into an irreversible life insurance policy, without a medical exam or the need to prove insurability. As time goes on, policyholders might need more protection, or they may decide a policy with a cash worth makes more sense.

There are two things to be conscious of with this convertible option. Initially, when you convert to a irreversible life insurance policy, the premium increases. Second, there is typically a window during which you can convert. The ability to convert does not run for the entire term, so it's smart to expect the deadline.

Not known Details About What Is Coinsurance In Health Insurance

Life insurance typically isn't leading of mind for youths, however buying a home, beginning a family, and earning a high income are all factors to consider buying life insurance in your 20s or 30s. The bright side is, it's most likely not as costly as you think. The average individual can expect to pay between $300 to $400 a year or simply $25 to $33 a month for life insurance, according to insurance-comparison site Policygenius, but it really depends upon the amount of protection you want, how much threat you present (e.

the status of your health), and what kind of policy you get. Broadly, there are 2 kinds of life insurance coverage: term life insurance coverage and long-term life insurance. Specialists generally agree the finest choice for easy and cheap coverage is term life insurance. Term life insurance coverage, unlike permanent life insurance coverage, offers protection for a repaired amount of time, usually 10, 20, or thirty years.

If the guaranteed individual dies throughout the policy term, the insurance company pays the death advantage to the recipient. Generally, the earlier in life you buy a life insurance coverage policy, the cheaper it is. Premiums increase incrementally with age, however locking in a low monthly rate now on a term life policy will save you the most cash in the long run.

These types of policies are normally helpful for individuals with considerable wealth or complex financial circumstances who rely on the cash value of their life insurance as part of an estate plan. Writer Eric Rosenberg bought a $1 million term life insurance policy when he was 28 years of ages, prior to he had children, a family history of cancer, and a distinctly risky pastime of flying airplanes.

Rosenberg said his only remorse is not getting more coverage. Term life insurance coverage can ultimately act as a stand-in savings cushion and an invaluable security plan if an individual who financially supports their household or partner dies too soon. From the time the very first monthly premium is paid up until the last, the beneficiary is entitled to the full amount of coverage if the guaranteed person dies this is called the death advantage.

What Does What Health Insurance Pays For Gym Membership? Do?

According Policygenius, whether or not you require life insurance coverage boils down to this: Does anyone count on your income for their financial wellness? That could be children, a partner, aging moms and dads, or anybody else who might be thought about some level of reliant. If somebody else relies on your earnings, then you most likely need life insurance coverage.

Lots of companies use life insurance protection for staff members, but it's generally a multiple of yearly income and not enough to change income for a family. The policy is frequently free and the money is guaranteed, so it's normally worth taking. Some employers offer additional life insurance to comprise the distinction, but it's smart to compare rates with other insurers to find the finest choice (how much is long term care insurance).

We sometimes highlight monetary product or services that can help you make smarter decisions with your cash. We do not offer investment recommendations or encourage you to adopt a particular investment technique. What you decide to do with your money depends on you. If you take action based upon among our recommendations, we get a small share of ricardovafy800.lowescouponn.com/not-known-details-about-how-much-is-domino-s-carryout-insurance the profits from our commerce partners.

Having a life insurance coverage strategy is important to provide your family assurance and a financial safeguard. However it can be complicated picking between the 2 types, term life insurance coverage and whole life insurance coverage. How do you understand which is finest for you? Term life insurance coverage uses defense for your enjoyed ones for a given amount of time and often supplements a permanent strategy.

Some kinds of permanent life insurance policies collect money worth. Each strategy type might have pros and cons depending upon your needs. Keep reading to discover which might be best for you. With this alternative, your insurance coverage premiums last for as long as the term you choose this can be for as low as one year and up to 30 years.

Not known Details About How To Fight Insurance Company Totaled Car

Once the term goes out, you'll have the choice to continue coverage, but at a greater premium. Term policies pay death advantages to your beneficiaries if you die throughout the period covered by the policy. Sometimes, it is possible to transform a term life policy into an entire life policy, but it depends on the insurance coverage service provider and their conditions.

Term life insurance is often the most economical, since the rate of your premium is locked in for the term you pick. Payments are made monthly or annual. The amount of your premium varies according to your health and other factors. Term life insurance coverage premiums will be lower than premiums for the majority of whole life insurance policies, which last a lifetime and construct money worth.

Whole life insurance coverage normally comes with ensured level premiums the quantity will never change as long as premiums are paid. Whole life insurance policies pay survivor benefit (earnings after death) and they may likewise construct money value. Cash worth is the additional cash you can contribute (above the expense of the insurance strategy) that can grow tax-deferred as an investment. how does term life insurance work.

|

|

Some Of What Is The Best Medicare Supplement Insurance Plan? |

Modifications to Credit History: Insurance companies use credit score to determine insurance rates in every state, although 3 states (California, Massachusetts, and Hawaii) have prohibited the practice. If you have a low credit history, or if your credit rating all of a sudden dropped (state, due to insolvency), then your automobile insurance coverage premiums could rise significantly.

This is the length of time throughout which an insurance provider can check your driving record. Typically, insurance providers utilize a lookback duration of 3 to 7 years, although lookback periods vary in between insurance providers and states. California, for instance, uses a 12-year lookback period for DUIs, while most states have a 3 to 7 year lookback duration for general driving offenses.

You have actually shown experience driving safely on the road, which suggests you're a lower risk chauffeur to insure than someone with multiple offenses or an accident. Take Advantage of Discounts: All insurance provider offer discount rates. Make the most of bundling discounts, excellent trainee discount rates, safety feature discounts, age-based discount rates, safe driving discount rates, and other options.

One business may offer you a clean driving discount rate due to the fact that you have absolutely no mishaps, for example, while another business may cancel that discount rate since you received a speeding ticket five years earlier. By comparing quotes from various insurers, you can guarantee you're dealing with the company that best matches your driver profile and charges you the most affordable possible rates.

The smart Trick of How Much Does A Dental Bridge Cost With Insurance That Nobody is Discussing

Consider raising your deductible to drop regular monthly premiums, for instance. Or, lower liability coverage, drop collision and thorough coverage in older automobiles and change your policy in other ways. By implementing the methods above, you can save cash on vehicle insurance coverage in any state specifically as a chauffeur with absolutely no mishaps on your driving history.

As we found out above, there are a variety of factors why you could be paying excessive for vehicle insurance. Perhaps you're driving a brand new lorry, for example. Maybe you have a driving record filled with speeding tickets and traffic offenses. Possibly somebody took your identity and mistreated your tidy driving record.

Numerous or all of the items included here are from our partners who compensate us. This might affect which items we write about and where and how the product appears on a page. Nevertheless, this does not affect our examinations. Our opinions are our own. http://claytondbyg011.tearosediner.net/how-much-do...-things-to-know-before-you-buy If you're approaching your late 20s, have a good driving record and are able to purchase a brand-new cars and truck, you might be expecting your vehicle insurance prices quote to swim.

Insurance rates progressively drop through your 50s and generally begin to increase again in your 60s. But there might be other reasons your rate isn't dropping a minimum of not as much as you had hoped. Here are some possible aspects. For one, it's clever to safeguard a brand-new automobile with comprehensive and accident protection, which pay for damage to your own lorry.

How Much Does Life Insurance Cost - Truths

As Detroit residents understand, your ZIP code has a major effect on your car insurance coverage quote. If your community or city has a high rate of crashes and lorry theft, you could wind up paying a high premium through no fault of your own. Rural residents typically take pleasure in the most affordable rates, everything else being equivalent.

Loaded with safety functions as your cars and truck may be, that doesn't mean it's low risk from an insurer's viewpoint. If the model you drive has a bad history of claims, your insurance provider will charge you appropriately. Smaller sized SUVs and minivans tend to amass the least expensive premiums, while drivers of expensive sports vehicles pay the most for insurance coverage.

If you don't pay your credit card bill, home loan or vehicle loan, that will result in a lower credit report. And if your state is one of those that permits insurance provider to utilize credit details in identifying your premium, your insurance rates could increase considerably as much as 127% in 9 cities surveyed, according to the Customer Federation of America.

But even as you grow older, staying single can have an influence on what you pay. The Chicago driver with the Ford Focus could save about $10 monthly by getting hitched; so might his spouse. It's never ever fun to pay more than you anticipate for vehicle insurance coverage (what is a premium in insurance). But you can prepare ahead.

Get This Report about How To Shop For Car Insurance