Oil Market Outlook - An Overview |

If manufacturing does fall sharply, some oil goes into strategic shares, and demand begins to get well, the second half of 2020 will see demand exceed supply. This will allow the market to start out lowering the huge stock overhang that's build up within the first half of the 12 months bitumen prices today. Indeed, our present demand and supply estimates imply a stock draw of 4.7 mb/d within the second half. Global oil provide is ready to plunge by a record 12 mb/d in May, after OPEC+ cast a historic output deal to chop production by 9.7 mb/d from an agreed baseline level.

New oil demand falling isn't as much as a structural change as it is a byproduct of a slowing international economic system. For comparison, since 2000, new yearly global oil demand has been at 1.25 million b/d, though it has been a lot greater at 1.fifty six million b/d since 2010. trade sulphur powder price per kg row, anticipated new oil demand has been the main target for the market. In July, OPEC and allied major oil producers led by Russia agreed to extend 1.2 million b/d of crude output cuts for nine months, and they're going to most likely have to transcend that.

Is oil constantly regenerating?

This statistic exhibits the distribution of oil demand within the OECD as of 2017, broken down by sector. In 2017, approximately 50 % of the OECD's demand for oil was attributable to the highway transportation sector. If we step up manufacturing to make up for depleted oil and gas reserves, our known coal deposits might bitumen cost per ton be gone in one hundred fifty years. Although it’s typically claimed that we have enough coal to last hundreds of years, this doesn’t take into account the need for increased manufacturing if we run out of oil and gas.

Lubricating Oil Refining Market – Global Industry Outlook, Share, Growth Analysis, Trends and top manufacture like Exxon Mobil, Sinopec, Royal Dutch Shell, Eni SPA, Sasol, etc - Latest Herald https://t.co/9lZMrW0kSG

— Oil & Gas Malaysia (@OilGasMalaysia) May 3, 2020

From weakening economic progress and intensifying commerce tensions to international political dangers, our 2020 oil and gas trade outlook takes inventory of the primary factors to observe in 2020. "OPEC Shift to Maintain Market Share Will Cause Global Inventory Increases and Lower Prices," Accessed April 21, 2020. The OECD mentioned diesel price per litre that top oil prices lead to "demand destruction." If sulphur lump price enough, individuals change their buying habits. They lastly collapsed when demand declined, and supply caught up.

/https://www.thestar.com/content/dam/thestar/business/2020/05/05/stock-markets-oil-price-rebound-as-countries-ease-lockdowns/wall_st.jpg)

Top Energy Stocks for April 2020

Commodity outlook: Crude oil futures rally; here's how others may fare #CommodityNews #Outlook https://t.co/fg1CGq0DdA

— ETMarkets (@ETMarkets) May 4, 2020

- The hydraulically fractured wells are likely to have a shorter production life, so there is always new drilling exercise to seek out the subsequent deposit.

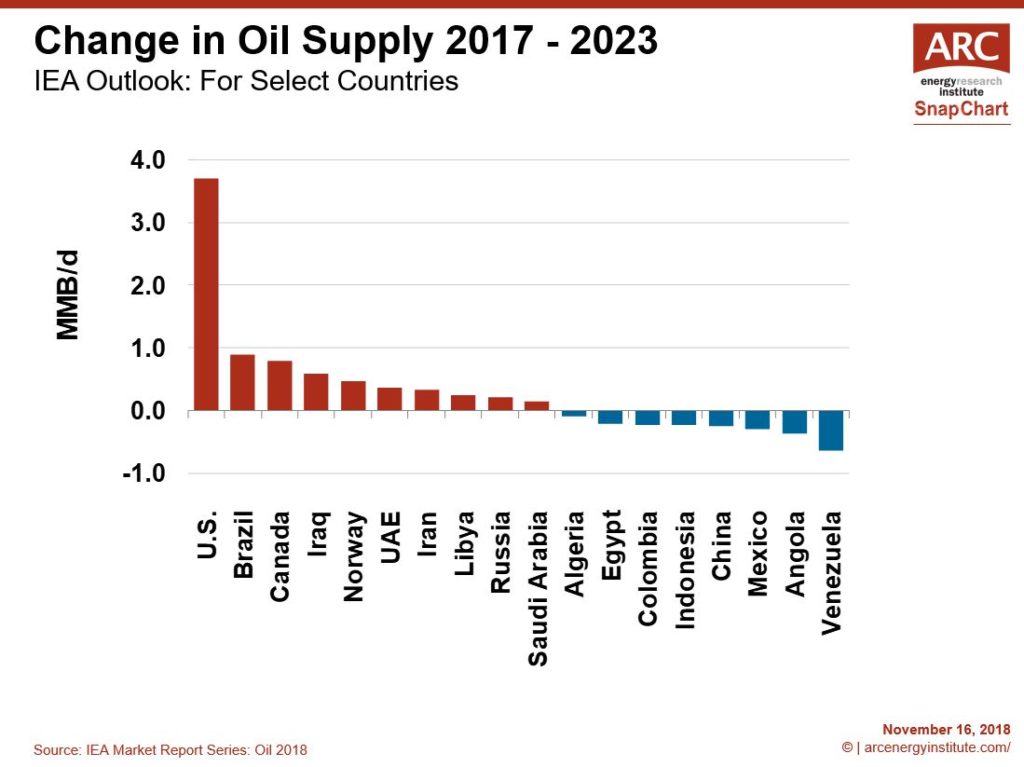

Total non-OPEC oil provide rises by four.5 mb/d to succeed in 69.5 mb/d by 2025. As for OPEC, despite the fact that sanctions and financial misery sulphur powder price have wiped out 2.5 mb/d of manufacturing from Iran and Venezuela since 2017, effective crude oil capability rises by 1.2 mb/d to 34.1 mb/d.

Rising earnings show that an organization’s business is growing and is generating extra money than it could possibly reinvest or return to shareholders. These are the oil & gas stocks with the lowest 12-month trailing price-to-earnings (P/E) ratio. Because income sulphur 90 wdg price may be returned to shareholders in the type of dividends and buybacks, a low P/E ratio reveals you’re paying much less for every dollar of profit generated.

If we enhance gas manufacturing to fill the power gap left by oil, our identified gas reserves only give us just fifty two years left. Vast amounts of land are decimated to offer space for drilling wells, pipelines, and processing facilities used today bitumen rate in oil and gas drilling operations. Habitat disruption and noise from drilling are some of the biggest threats to wildlife populations across the globe. Between 1965 and 2005, humanity has seen an increase in demand for crude oil by about two and a half times.

The EIA forecast oil prices of $214/ b in 2050 if the cost to produce oil drops and it crowds out competing energy sources. U.S. shale producers have become extra influential, but cost of sulphur per kg they don’t function as a cartel as OPEC does. To keep market share, OPEC has not reduce output sufficient to put a flooring beneath prices.

How Oil Prices Impact the U.S. sulfur market price 2019

When in comparison with the daily oil demand of 86.4 million barrels in 2010, the growing demand trajectory that occurred prior to now decade is nonetheless still clear. As we, as soon as again, move from one year to the following, how can we assess the oil and gas and chemical sectors’ performance in 2019 and its prospects for 2020? Neither excessive fuel price august 2020 seems in the playing cards for an imminent return because the business has discovered priceless lessons from both episodes, however uncertainties are clearly still a challenge to performance and funding. Is https://www.oilsandsmagazine.com/energy-statistics/oil-and-gas-prices for the uncertainties, risks, and alternatives forward?

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |