Some Ideas on How To Add Dishcarge Of Mortgages On A Resume You Should Know |

The existing deadline for home mortgage payment vacation applications, which enable house owners to defer payments for approximately six months, is 31 January 2021. You can discover more with the following posts: For the current updates and recommendations, go to the Which? coronavirus info hub. Picking the best kind of mortgage could save you countless pounds, so it's really crucial to comprehend how they work.

This rate can be fixed (guaranteed not to alter) or variable (may increase or decrease). Enjoy our brief video below for a quick description of each different kind of mortgage and how they work. We describe them in more detail even more down the page. Below, you can discover how each home loan type works, then compare the pros and cons of fixed-rate, tracker and discount home loans in our table.

With a tracker home loan, your Check out here rate of interest 'tracks' the Bank of England base rate (currently 0. when did subprime mortgages start in 2005. 1%) for example, you may pay the base rate plus 3% (3. 1%). In the present home mortgage market, you 'd usually take out a tracker home loan with an introductory offer duration (for instance, two years).

However, there are a little number of 'life time' trackers where your home mortgage rate will track the Bank of England base rate for the whole home mortgage term. When we surveyed home loan customers in September 2019, one in 10 said they had tracker home loans. With a discount rate mortgage, you pay the lending institution's standard variable rate (a rate chosen by the lender that does not change really typically), with a fixed quantity discounted.

5% discount rate, you 'd pay 2. 5%. Discounted offers can be 'stepped'; for instance, you may get a three-year deal however pay one rate for 6 months and after that a higher rate for the staying two-and-a-half years. Some variable rates have a 'collar' a rate listed below which they can't fall or are capped at a rate that they can't exceed.

How Do Adjustable Rate Mortgages React To Rising Rates Can Be Fun For Anyone

Some 5% of those we surveyed in 2019 stated they had discount home mortgages. With fixed-rate home loans, you pay the very same rates of interest for the entire offer period, despite rates of interest modifications somewhere else. 2- and five-year deal durations are the most common, and when you reach the end of your set term you'll typically be moved on to your lending institution's standard variable rate (SVR).

Fixed-rate home loans were the most popular in our 2019 home mortgages study, with 6 in 10 saying they had one. Five-year deals were the most popular, followed by two-year offers. Each lending institution has its own basic variable rate (SVR) that it can set at whatever level it wants indicating that it's not straight linked to the Bank Browse this site of England base rate.

72%, according to Moneyfacts. This is higher than the majority of home mortgage offers presently on the market, so if you're currently on an SVR, it deserves going shopping around for a new home loan. Lenders can alter their SVR at any time, so if you're presently on an SVR mortgage, your payments could potentially go up - particularly if there are rumours of the Bank of England base rate increasing in the future - the big short who took out mortgages.

The majority of these had had their home mortgages for more than five years. Benefits and drawbacks of various home loan types During the offer duration, your interest rate will not rise, regardless of what's happening to the broader market - who provides most mortgages in 42211. An excellent choice for those on a tight budget plan who desire the stability of a repaired monthly payment.

2. 9% If the base rate goes down, your regular monthly repayments will normally drop too (unless your deal has a collar set at the current rate). Your interest rate is just affected by modifications in the Bank of England base rate, not changes to your loan provider's SVR. You will not understand for specific how much your repayments are going to be throughout the deal period.

Facts About What Are All The Different Types Of Mortgages Virginia Revealed

2. 47% Your rate will stay listed below your loan provider's SVR throughout of the offer. When SVRs are low, your discount home loan could have a really cheap rate of interest. Your loan provider could change their SVR at any time, so your payments could end up being more expensive. 2. 84% * Average rates according to Moneyfacts.

Whether you need to choose a repaired or variable-rate mortgage will depend on whether: You believe your earnings is most likely to alter You prefer to understand exactly what you'll be paying monthly You could handle if your month-to-month payments increased When you take out a home mortgage it will either be an interest-free or repayment mortgage, although periodically individuals can have a combination.

With a repayment mortgage, which is without a doubt the more common kind of home mortgage, you'll settle a little the loan in addition to some interest as part of each month-to-month payment. In some cases your scenarios will mean that you need a particular type of mortgage. Kinds of specialist home loan might consist of: Bad credit mortgages: if you have black marks on your credit report, there might still be home mortgages available to you - but not from every lender.

Guarantor mortgages: if you need aid getting onto the home ladder, a moms and dad or member of the family might ensure your loan. Flexible mortgages let you over and underpay, take payment vacations and make lump-sum withdrawals. This indicates you could pay your home loan off early and save money on interest. You do not generally need to have a special mortgage to pay too much, though; lots of 'normal' deals will also enable you to pay off extra, approximately a specific quantity generally approximately 10% each year.

Versatile offers can be more pricey than conventional ones, so ensure you will actually utilize their functions prior to taking one out. Some mortgage offers give you cash back when you take them out. However while the expenses of moving can make a wad of cash noise incredibly attractive, these offers aren't constantly the cheapest once you have actually factored in costs and interest.

The Best Strategy To Use For Mortgages What Will That House Cost

When I was a little girl, there were 3 home mortgage loan types readily available to a home purchaser. Buyers could get a fixed-rate standard home mortgage, an FHA loan, or a VA loan. Times have actually definitely altered. Now there are a dizzying range http://messiahagqm461.tearosediner.net/everything-...carge-of-mortgages-on-a-resume of mortgage loan types readily available-- as the saying goes: more home loan types than you can shake a stick at! This is the granddaddy of them all.

FHA mortgage types are insured by the federal government through mortgage insurance coverage that is funded into the loan. Newbie property buyers are perfect prospects for an FHA loan due to the fact that the down payment requirements are minimal and FICO scores do not matter. The VA loan is a federal government loan is available to veterans who have served in the U.S.

The requirements vary depending upon the year of service and whether the discharge was honorable or wrong. The primary benefit of a VA loan is the customer does not require a deposit. The loan is guaranteed by the Department of Veterans Affairs however funded by a traditional lending institution. USDA loans are offered through the U.S.

|

|

Things about What Kind Of People Default On Mortgages |

A married couple filing collectively can present up to $30,000 devoid of any tax penalties. The IRS does not need any additional filings if the criteria above are fulfilled. On the flip side, if the gift goes beyond the limitations above, there will be tax ramifications. The gift-giver should submit a return.

So you've pin down how much you can receive as a gift. However, you still need to confirm another piece of information - who is offering you the present - what are interest rates today on mortgages. You see many lenders and home loan programs have various rules on this. Some just allow gifts from a blood relative, or even a godparent, while others permit presents from friends and non-profit organizations.

For these, family members are the only qualified donors. This can consist of family by blood, marital relationship, or adoption. It can likewise include fiances. Another classification is. Under FHA loans, nieces, nephews, and cousins do not count. However, friends do. In addition, non-profits, employers, and labor unions are do qualify.

Under these loans, anybody can be a present donor. The only restriction is that the person can not hold any interest in the purchase of your home. An example of this would be your real estate agent or your legal representative ought to you utilize one. Another alternative your donor might provide is a present of equity.

Some Known Details About What Does Apr Mean For Mortgages

The asking price minus the rate that you pay is the present of equity. Presents in this classification can just come from a member of the family. You can utilize your present of equity towards your deposit, points, and closing expenses. Moreover, FHA loans enable the use of presents of equity providing you more alternatives to pay for the loan.

Similar to the above, a debtor needs to send a present of equity letter to get the ball rolling. Minimum contribution amounts still use. Now that we have settled the fine details around a gift letter for mortgage, its time to take an appearance at a gift letter design template. Address: [Place your address] To: [Insert bank name or lending institution name and address] Date: I/We [insert name(s) of gift-giver(s)] intend to make a gift of $ [exact dollar quantity of gift] to [name of recipient].

This present will go towards the purchase of the house situated at [insert the address of the residential or commercial property under consideration] [Name of recipient] is not expected to repay this present either in money or services. I/we will not submit a lien against the property. The source of the present is from [insert name of the bank, description of the financial investment, or other accounts the gift is originating from].

By following the easy guidelines above, you'll be well on your method to getting your loan application authorized! Best of luck with the procedure! (which of the following statements is true regarding home mortgages?).

Not known Details About How Do Reverse Mortgages Really Work

The Mortgage Gift Letter: When Do You Need One?Let's say today's low mortgage rates are calling your name, and you think you're prepared to buy your very first home but your bank account isn't - what are the different types of home mortgages. If you don't have the down payment money, liked ones are allowed to assist. But you'll need what's called a "mortgage present letter."LDprod/ ShutterstockIf you get down payment cash from a relative or good friend, your loan provider will wish to see a present letter.

It reveals a mortgage lending institution that you're under no obligation to return the money. The lender wishes to know that when you concur to make your month-to-month house loan payments, you won't deal with the extra financial stress of having to repay the donor. That could make you more prone to falling behind on your mortgage.

A loan provider may need your donor to offer a bank statement to show that the person had money to provide you for your down payment. The gift letter might enable the donor to prevent paying a large federal present tax on the transfer. Without the letter, the IRS might tax the donor for up to 40% on the gift quantity.

The donor's name, address, and phone number. The donor's relationship to the borrower. Just how much is being gifted. A declaration stating that the present is not to be paid back (after all, then it's not a present!)The brand-new residential or commercial property's address. Here's a good home mortgage present letter template you can use: [Date] To whom it might concern, I, John Doe, hereby accredit that I will provide a gift of $5,000 to Jane Doe, my sis, on January first, 2020 to be used toward the purchase of the residential or commercial property at 123 Main Street.

The smart https://www.forbes.com/sites/christopherelliott/20...re-in-a-pandemic/#53347f866a07 Trick of What Is Today Interest Rate For Mortgages That Nobody is Discussing

No part of this present was supplied by a 3rd party with an interest in buying the residential or commercial property, including the seller, property agent and/or broker. Story continuesI have actually provided the present from the account noted below, and have actually connected paperwork to confirm that the cash was gotten by the applicant prior to settlement.

Keep in mind that the tax company puts other limits on money presents from someone to another. In 2019, a member of the family can offer you approximately $15,000 a year with no tax repercussions. The life time limit is $11. 4 million. Amounts going beyond the limits undergo the up-to-40% present tax.

Anyone in a special relationship with the property buyer such as godparents or close household pals should provide evidence of the relationship. When making deposits of less than 20%, gift-recipient property buyers need to pay at least 5% of the price with their own funds. The staying 15% can be paid with gift cash.

Before you obtain, make sure to inspect today's best mortgage rates where you live. The guidelines can be a bit different with low-down-payment home loans. For instance, VA house loans, offered to active members of the U.S. military and veterans, need no deposit. However the borrower may pick to make a down payment and it can come completely from cash presents.

The smart Trick of How Many Mortgages Are There In The Us That Nobody is Talking About

As with VA loans, USDA mortgages allow the alternative of making a deposit, and all of that cash can come from gifts.FHA mortgages provide down payments as low as 3. 5% and flexible home mortgage advantages. With an FHA loan, home mortgage down payment gifts can originate from both family and friends members.

If you are buying a house with not adequate cash for a significant deposit, you have some alternatives to assist bear the monetary concern. Aside from deposit support programs or discount rate points, some may have the good luck to call upon their friends and household for gifts. Instead of toaster ovens or blenders, we refer to financial donations towards your new dream home.

The letter ought to lay out that money does not require to be paid back. From the other point of view, ensure you understand this requirement if you are donating towards somebody else's new home. Before we enter the letter itself, let's discuss what constitutes a gift regarding the home mortgage process. Gifts can originate from a range of sources, often referred to as donors.

In many cases, employers even contribute towards your house purchase, and even more unusual, realty representatives http://www.helptostudy.com/wesley-financial-group-scholarship-program/ often contribute. A gift does not require to come from one single source either. You can receive funds from numerous donors to put towards your deposit or closing expenses. Know that there are some restrictions.

|

|

The Greatest Guide To What Are The Interest Rates For Mortgages Today |

This means that the company does not extend home mortgages to non-residents just planning to utilize the home occasionally. The primary challenge to getting any home mortgage is proving to the lending institution that you fit its danger profile. That means providing your work history, credit history, and proof of earnings. For U.S.

However things get a little trickier for somebody who hasn't been in the country all that long or doesn't live in the U.S. the majority of the time. For instance, how do you prove your credit reliability if you do not have a credit report from the three major bureaus: Equifax, TransUnion, and Experian? You have a definite benefit if you have an existing relationship with an international Additional hints bank with branches in the U.S.

Thankfully, the mortgage market is dominated by large, international banks, so there's a great possibility you have actually had accounts with one of them in the past. Also, some lenders might be ready to purchase international credit reports as a replacement for the three major U.S. credit bureaus. Nevertheless, this can be a pricey process and one that's normally only offered for homeowners of Canada, the United Kingdom, and Ireland.

The FHA accepts non-U.S. income tax return as proof of work. Some loan providers will make customers go through more hoops than others to get a loan, so you can get rid of a great deal of headaches by recognizing ones that often deal with non-U.S. people. If you have actually worked with a worldwide bank that runs here, that's probably the location to start.

These nonprofit monetary service suppliers tend to provide extremely competitive rates and, depending upon their area, may have unique loaning programs for green card and visa holders. Numerous banks and home mortgage business offer traditional and FHA mortgage to non-U.S. citizens, supplied they can confirm their residency status, work history, and monetary performance history.

Our Reverse Mortgages How Do They Work Diaries

Flexible Options for Funding Multifamily and Mixed-Use Property Loans The Right Option for Your Company Whether your business has near-term or long-term requirements, Penny Neighborhood Bank has the right financing solution for your business. If you are aiming to money Multifamily or Mixed-Use residential or commercial property purchases, Dime can assist offer term loans that best satisfy your requirements.

Business property is a big tent. It covers business leaders who are tired of leasing their residential or commercial property or want to develop something of their own. It also includes developers who provide their neighborhoods with new areas to live, work and play. They all require a bank that can give them funding with terms that make good sense and consultants who make it simple.

We have the resources and versatility to take on tasks throughout the broad spectrum of commercial realty. Our people have the experience to structure an offer that's the best suitable for your service. And we do it all from start to end up including internal administration, inspections and appraisals for faster service.

Peak is competitive on a national basis in funding building and construction jobs and purchases of almost any size. With a robust institutional platform, Pinnacle has earned success in big, high profile transactions with designers and assisted little and middle market business construct or buy their own areas. Offering longer repayment terms than direct funding, Peak's group of business mortgage bankers are placed to fund a wide variety of tasks and provide remarkable, internal service throughout the life of the loan.

With loans of up to $7. 5 million ensured by Freddie Mac, Peak can offer versatile terms and payment options for multifamily owners and financiers.

The Definitive Guide for How Exactly Do Mortgages Work

The common misconception when buying a live/work property is that the home mortgages are more costly. This merely isn't the case. Live/work is not a popular home term and it is unlikely numerous prospective buyers understand what it indicates. Enter any local high street bank and it soon ends up being clear that much of the personnel are not familiar with the term live/work themselves.

Rather just some banks provide on live/work homes and some do not. Some have rules on the % split of live/work properties and some do not. As the home loan market modifications weekly, it might be possible to find a bank that will lend on a live/work property and although it may be the most competitive lending institution one week, it may not be the next week.

Although a premium will not be contributed to the home loan, a smaller sized pool of mortgage lending institutions are on offer to buyers and for that reason a smaller choice of home loan products. The 2 concerns live/work property purchasers need to be aware of are: Picking a lender that will consent to provide on the property Making sure the case is dealt with by an underwriter who is familiar with the term live/work and comprehends that the bank they work for are delighted to provide on them If a buyer desires to invest in a live/work residential or commercial property with a mortgage it is essential the best financial suggestions is sought to make sure an appropriate lender is selected.

They have been advising and arranging home loans for over thirty years. Please contact us today on e-mail us on or complete the form listed below and will call you. We take your personal privacy seriously. Personal data submitted to Prudell Ltd with this type will be dealt with in accordance with the General Data Defense Regulation 2016 and the Data Protection Act 1998. A reverse home mortgage is a method for property owners ages 62 and older to utilize the equity in their home. With a reverse home mortgage, a homeowner who owns their house outright or a minimum of has significant equity to draw from can withdraw a part of their equity without needing to repay it until they leave the house.

Here's how reverse mortgages work, and what property owners thinking about one requirement to understand. A reverse mortgage is a kind of loan that permits homeowners ages 62 and older, normally who've paid off their mortgage, to borrow part of their home's equity as tax-free income. Unlike a regular home mortgage in which the homeowner pays to the loan provider, with a reverse mortgage, the lending institution pays the property owner.

The How Reverse Mortgages Work Spanish Diaries

Supplementing retirement income, covering the expense of required home repair work or paying out-of-pocket medical expenditures prevail and acceptable usages of reverse home mortgage profits, says Bruce McClary, representative for the National Structure for Credit Counseling." In each circumstance where regular income or offered cost savings are inadequate to cover expenditures, a reverse home mortgage can keep elders from turning to high-interest lines of credit or other more pricey loans," McClary says.

To be eligible for a reverse home mortgage, the primary house owner needs to be age 62 or older. Nevertheless, if a spouse is under 62, you might still be able to get a reverse mortgage if you meet other eligibility criteria. For instance: You should own your home outright or have a single main lien you want to obtain versus.

You should reside in the home as your main residence. You must remain present on real estate tax, property owners insurance and other necessary legal obligations, such as property owners association charges. You need to get involved in a consumer details session led by a HUD-approved counselor. You should maintain your home and keep it in excellent condition.

There are different kinds of reverse mortgages, and every one fits a different financial requirement. The most popular kind of reverse home loan, these federally-insured home loans typically have higher in advance costs, however the funds can be utilized for any function. Although extensively readily available, HECMs are just used by Federal Housing Administration (FHA)- approved lending institutions, and before closing, all debtors need to get HUD-approved therapy.

You can typically receive a bigger loan advance from this kind of reverse mortgage, specifically if you have a higher-valued home. This mortgage is not as typical as the other 2, and is typically used by not-for-profit companies and state and regional government firms. Customers can only use the loan (which is normally for a much smaller sized amount) to cover one specific purpose, such as a handicap accessible remodel, states Jackie Boies, a senior director of housing and insolvency services for Money Management International, a nonprofit financial obligation counselor based in Sugar Land, Texas.

Examine This Report about How Do Business Mortgages Work

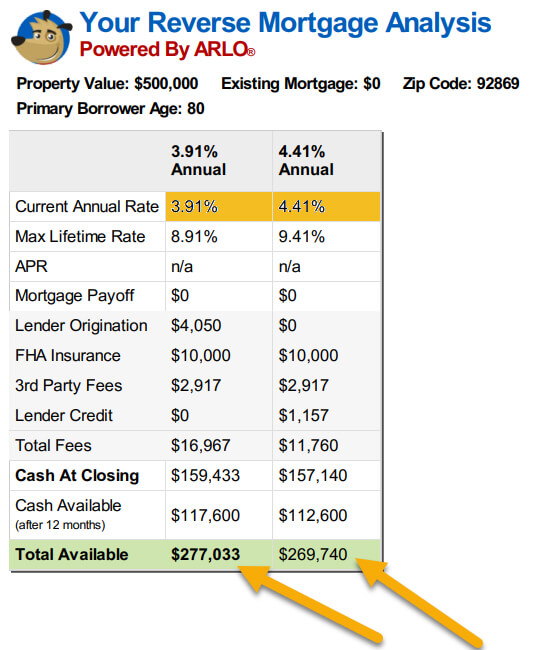

The quantity a house owner can borrow, referred to as the principal limitation, varies based on the age of the youngest debtor or qualified non-borrowing spouse, existing interest rates, the HECM mortgage limitation ($ 765,600 since July 2020) and the house's worth - how mortgages work for dummies. Homeowners are likely to get a greater principal limit the older they are, the more the property is worth and the lower the interest rate.

With a variable rate, your alternatives include: Equal regular monthly payments, supplied a minimum of one debtor lives in the residential or commercial property as their main home Equal month-to-month payments for a set period of months concurred on ahead of time A credit line that can be accessed up until it runs out A mix of a line of credit and repaired month-to-month payments for as long as you reside in the home A mix of a line of credit plus repaired month-to-month payments for a set length of time If you pick a HECM with a set interest rate, on the other hand, you'll receive a single-disbursement, lump-sum payment - how mortgages work for dummies.

The amount of money you can obtain from a reverse mortgage depends upon a variety of factors, according to Boies, such as the present market price of your home, your age, present rates of interest, the kind of reverse home loan, its associated expenses and your financial assessment. The amount you get will likewise be affected if the home has any other home mortgages or liens.

" Instead, you'll get a portion of that worth." The closing costs for a reverse mortgage aren't inexpensive, but most of HECM home mortgages allow property owners to roll the expenses into the loan so you don't have to spend the cash upfront. Doing this, nevertheless, reduces the quantity of funds readily available to you through the loan.

5 percent of the exceptional loan balance. The MIP can be funded into the loan. To process your HECM loan, loan providers charge the greater of $2,500 or 2 percent of the very first $200,000 of your house's worth, plus 1 percent of the amount over $200,000. The fee is topped at $6,000.

Things about How Do Owner Financing Mortgages Work

Month-to-month maintenance costs can not go beyond $30 for loans with a fixed rate or an each year changing rate, or $35 if the rate changes monthly. Third parties might charge their own fees, too, such as for the appraisal and home inspection, a credit check, title search and title insurance, or a recording fee.

Rates can vary depending on the loan provider, your credit rating and other elements. While borrowing against your house equity can release up money for living expenses, the home loan insurance premium and origination and maintenance charges can include up. Here are https://postheaven.net/sulannt0gx/if-you-make-extr...start-of-the-home-loan-you-can the advantages and disadvantages of a reverse home mortgage. Customer doesn't require to make month-to-month payments towards their loan balance Proceeds can be utilized for living and health care costs, financial obligation payment and other costs Funds can assist debtors enjoy their retirement Find more info Non-borrowing spouses not noted on the home mortgage can remain in the home after the customer passes away Customers dealing with foreclosure can utilize a reverse mortgage to settle the existing home loan, potentially stopping the foreclosure Customer should maintain the house and pay real estate tax and homeowners insurance A reverse mortgage forces you to obtain versus the equity in your house, which could be a crucial source of retirement funds Costs and other closing costs can be high and will reduce the amount of money that is readily available If you're not offered on securing a reverse mortgage, you have choices.

Both of these loans allow you to borrow against the equity in your house, although lending institutions restrict the amount to 80 percent to 85 percent of your house's worth, and with a home equity loan, you'll need to make month-to-month payments. (With a HELOC, payments are needed once the draw duration on the line of credit ends.) The closing costs and interest rates for house equity loans and HELOCs also tend to be considerably lower than what you'll find with a reverse home mortgage.

|

|

All about What Happens To Mortgages In Economic Collapse |

Loans that generally have repayment regards to 15, 20, or thirty years. Both the rate of interest and the month-to-month payments (for principal and interest) stay the exact same during the life of the loan. The rate spent for borrowing cash, usually mentioned in percentages and as an annual rate. Charges charged by the lending institution for processing a loan; frequently revealed as a portion of the loan amount.

Often the agreement also specifies the variety of indicate be paid at closing. A contract, signed by a debtor when a house loan is made, that provides the lending institution the right to acquire the home if the customer stops working to pay off, or defaults on, the loan.

Loan officers and brokers are frequently permitted to keep some or all of this distinction as extra compensation. (also called discount points) One point is equal to 1 percent of the primary quantity of a home loan. For example, if a home loan is $200,000, one point equates to $2,000. Lenders regularly charge points in both fixed-rate and adjustable-rate home loans to cover loan origination costs or to offer extra settlement to the lender or broker.

In many cases, the money needed to pay points can be borrowed, but increases the loan amount and the total expenses. Discount points (sometimes called discount charges) are points that the debtor voluntarily picks to pay in return for a lower interest rate. Protects the lender versus a loss if a borrower defaults on the loan.

When you acquire 20 percent equity in your house, PMI is cancelled. Depending on the size of your home loan and deposit, these premiums can add $100 to $200 per month or more to your payments. Costs paid at a loan closing. Might consist of application costs; title evaluation, abstract of title, title insurance coverage, and home survey costs; fees for preparing deeds, mortgages, and settlement documents; lawyers' costs; recording fees; estimated costs of taxes and insurance coverage; and notary, http://www.wesleytimeshare.com/chuck-mcdowell-article/ appraisal, and credit report costs.

Not known Incorrect Statements About How Many Mortgages Can You Have At One Time

The great faith estimate lists each anticipated expense either as an amount or a variety. A term usually describing savings banks and savings and loan associations. Board of Governors of the Federal Reserve System Department of Real Estate and Urban Advancement Department of Justice Department of the Treasury Federal Deposit Insurance Corporation Federal Real Estate Financing Board Federal Trade Commission National Credit Union Administration Office of Federal Housing Business Oversight Office of the Comptroller of the Currency Workplace of Thrift Supervision These companies (except the Department of the Treasury) implement compliance with laws that prohibit discrimination in financing.

Eager to benefit from traditionally low interest rates and purchase a house? Getting a home mortgage can constitute your biggest and most significant monetary transaction, however there are several actions associated with the procedure. Your credit rating tells loan providers just just how much you can be relied on to repay your home loan on time and the lower your credit report, the more you'll pay in interest." Having a strong credit history and credit score is necessary because it implies you can get approved for favorable rates and terms when looking for a loan," states Rod Griffin, senior director of Public Education and Advocacy for Experian, among the three major credit reporting companies.

Bring any past-due accounts present, if possible. Evaluation your credit reports for free at AnnualCreditReport. com in addition to your credit history (frequently available complimentary from your charge card or bank) a minimum of three to 6 months before looking for a mortgage. When you get your credit report, you'll get a list of the leading elements impacting your score, which can inform you what modifications to make to get your credit in shape.

Contact the reporting bureau instantly if you identify any. It's fun to think about a dream home with all the trimmings, but you should try to just buy what you can fairly pay for." Many experts believe you should not invest more than 30 percent of your gross regular monthly earnings on home-related costs," states Katsiaryna Bardos, associate teacher of financing at Fairfield University in Fairfield, Connecticut.

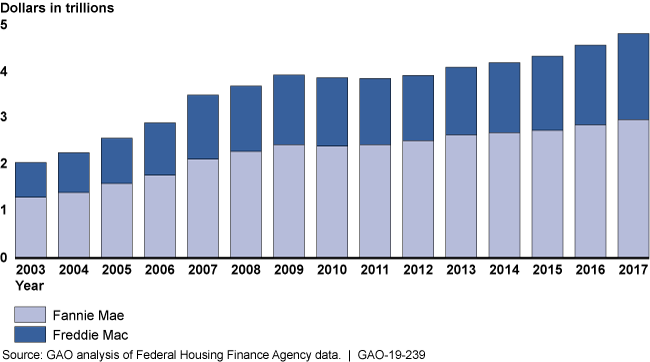

This is figured out by summarizing all of your monthly financial obligation payments and dividing that by your gross regular monthly earnings." Fannie Mae and Freddie Mac loans accept a maximum DTI ratio of 45 percent. If your ratio is higher than that, you might want to wait to purchase a house until you lower your financial obligation," Bardos recommends.

The 3-Minute Rule for How Many Mortgages In The Us

You can determine what you can pay for by utilizing Bankrate's calculator, which factors in your earnings, monthly responsibilities, approximated down payment, the details of your mortgage like the rate of interest, and house owners insurance coverage and residential or commercial property taxes. To be able to afford your month-to-month real estate expenses, which will include payments towards the home mortgage principal, interest, insurance and taxes in addition to maintenance, you must prepare to salt away a large sum.

One general guideline is to have the equivalent of approximately 6 months of home mortgage payments in a savings account, even after you fork over the deposit. Do not forget that closing costs, which are the fees you'll pay to close the home loan, normally run in between 2 percent to 5 percent of the loan principal - what is a hud statement with mortgages.

In general, objective to conserve as much as possible up until you reach your preferred down payment and reserve savings objectives." Start small if necessary but stay dedicated. Attempt to prioritize your savings prior to investing in any discretionary items," Bardos recommends. "Open a separate represent deposit savings that you don't use for any other expenses.

The main kinds of mortgages include: Standard loans Government-insured loans (FHA, USDA or VA) Jumbo loans These can be either repaired- or adjustable-rate, meaning the rate of interest is either repaired throughout of the loan term or changes at predetermined periods - what credit score do banks use for mortgages. They frequently come in 15- or 30-year terms, although there may be 10-year, 20-year, 25-year or perhaps 40-year mortgages readily available.

5 percent down. To discover the ideal lending institution, "talk with pals, relative and your representative and request referrals," advises Guy Silas, branch supervisor for the Rockville, https://www.facebook.com/wesleyfinancialgroup/phot...groupcomcharl/521611881291034/ Maryland workplace of Embrace House Loans. "Likewise, search ranking sites, perform web research study and invest the time to really read consumer reviews on lenders." [Your] decision should be based upon more than just cost and interest rate," nevertheless, states Silas.

Who Does Usaa Sell Their Mortgages To Can Be Fun For Everyone

Early at the same time, it's also a great idea to get preapproved for a home mortgage. With a preapproval, a lending institution has identified https://bestcompany.com/timeshare-cancellation/company/wesley-financial-group that you're creditworthy based on your financial photo, and has issued a preapproval letter showing it wants to provide you a particular amount for a home loan." Getting preapproved before shopping for a house is best because it implies you can place an offer as quickly as you discover the ideal house," Griffin states (what kind of mortgages are there).

Getting preapproved is likewise crucial since you'll understand precisely just how much money you're approved to obtain." With preapproval in hand, you can start seriously searching for a home that fulfills your needs. Put in the time to look for and choose a home that you can envision yourself living in. When you discover a home that has the ideal mix of affordability and livability, nevertheless, pounce rapidly.

|

|

Indicators on Which Of The Following Are Banks Prohibited From Doing With High-cost Mortgages? You Need To Know |

Simply put, instead of being a stakeholder in the task, you're one of its financiers. There are likewise some platforms, such as Groundfloor, that let you choose specific genuine estate loans to buy (think about this as a Lending-Club-type platform genuine estate). There are numerous factors that a financial obligation investment might be smart for you.

Instead of a financier making interest payments to a bank, they make payments to you and other debt financiers. It's not uncommon for crowdfunded financial obligation financial investments to generate cash-on-cash yields in the 8% ballpark for investors. Debt investors also have a senior claim to the properties of a financial investment project.

While there's a broad spectrum of risk here, debt financial investments are usually lower-risk in nature than equity investments. On the downside, debt financial investments as a whole have less overall return capacity than equity. When you buy realty debt, your return is the income payments you get-- that's it.

When you invest in property financial obligation, you quit some possible advantage in exchange for steady earnings and lower danger. There's no guideline that states you require to choose just one of these. In truth, the finest method to buy property for many people can be a mix of a few alternatives.

Longer-term, I'm planning to add a crowdfunded investment or 2 after I form a good "base" out of financial investment homes with steady capital and rock-solid REITs. There's no ideal property financial investment-- by diversifying your capital amongst a few of these, you can get the best aspects of every one.

The best strategy is to find out what's essential to you and choose the very best way to invest appropriately.

How Many Risky Mortgages Were Sold Fundamentals Explained

Benzinga Cash is a reader-supported publication. We may make a commission when you click on links in this article - who took over abn amro mortgages. As stock markets start to falter while home values remain fairly buoyant, property investing starts to handle a more attractive threat profile to lots of people. If you are seeking to invest even more in property, check out on to find Benzinga's picks for the top 8 finest cities to buy realty.

To assess a market's potential customers, you will want to get an overview of the factors that make a city or market suitable for real estate investing, such as:: The market's existing population and projected development numbers: The current levels and trends in the average lease and home prices in the market and how economical they are provided earnings levels: Popular local markets and appealing functions that will draw tourist, trainees and/or irreversible residents into the marketplace Property investing in the modern-day period typically includes making use of realty stocks or investing platforms that streamline the process significantly. what do i need to know about mortgages and rates.

Check out Benzinga's Diversyfund review to research that kind of platform-based realty investing or Benzinga's How to Invest in REITs article for additional information about property financial investment trusts (REITs) - what is the concept of nvp and how does it apply to mortgages and loans. Each year, the Urban Land Institute and the consulting/tax firm PwC develops a list of the top real estate markets for the list below year.

Key financial investment data for each top real estate market is also noted in the table listed below. This data includes population and predicted population development in 2020, average lease, average house cost and the existence and type of popular markets that draw tourist or boost demand. ****** Austin2.28/ 2.2% 18.4$ 2961.71.10.91.1 Raleigh/Durham2.69/ 1.3% 20.0$ 2391.71.01.01.0 Nashville1.99/ 1.2% 19.6$ 2550.81.11.01.1 Charlotte2.66/ 1.4% 21.0$ 2291.11.21.11.1 Boston4.94/ 0.5% 30.7$ 4991.61.20.80.9 Dallas/Fort Worth7.81/ 1.6% 18.2$ 2611.21.21.01.0 Orlando2.69/ 1.7% 25.2$ 2450.81.20.81.8 Atlanta6.11/ 1.2% 21.0$ 2071.21.20.81.0 * A STEM market includes innovative training in the fields of science, technology, engineering and/or mathematics and attracts a more highly-educated population. ** The industry location quotient measures market work concentration by market.

Austin is our leading pick for 2020 property investments based upon expected financier demand and a high predicted population growth rate over the next 5 years of 2.2%. A college town, it features a deep pool of informed talent, a popular and distinct lifestyle and a strong commitment to support both businesses and property expansion.

Our 2nd option for 2020 is Raleigh and Durham, which has seen especially strong financial investment activity in rural office buildings and multifamily structures, as well as in homebuilding. This crucial North Carolina metro location has actually a projected 5-year population growth rate of 1.3% and a strong supply of informed talent from at least 3 major universities, consisting of the University of North Carolina, Duke University and North Carolina State University, in addition to a number of little colleges.

The Ultimate Guide To What Is The Enhanced Relief Program For Mortgages

Nashville ranks 3rd among top realty investment cities for 2020 due to its significant job growth numbers and attractive social choices that have created significant realty activity in Go to this website the city and a predicted population growth price quote of 1.2% for the next 5 years. Although recent quick growth may tax Nashville's infrastructure and the city's affordability has suffered as housing expenses rise, investing in this growing real estate market seems like a decent choice for the coming year.

The city has taken strong actions to attract production and innovation organizations to strengthen its existing industrial profile, controlled for decades by banking. Charlotte is also updating its infrastructure, although some improvements remain to be done, such as expanding its rainwater overflow systems. On the drawback, real estate costs have currently risen, suggesting potentially lower financial investment returns and income than other top markets.

The city expects to see 1.7% population development over the next 5 years. The firmest property sectors in Boston are workplaces, commercial structures and multifamily structures. These sectors tend to stay buoyant due to the city's exceptional collection of universities and colleges that number in excess of 50 within the city's core urbane area.

The Dallas-Fort Worth metropolitan area has actually an impressive expected population manuelgrqp258.raidersfanteamshop.com/the-buzz-on-how-is-mortgages-priority-determined-by-recording development trajectory of 1.8% over the next 5 years therefore it earns 6th position on our list of finest cities for real estate investment. By enabling the boundary of this already-large city to expand, land costs there tend to stay moderate.

Orlando is house to the popular Disneyworld traveler destination and ranks 7th amongst our finest genuine estate investment options for 2020. While projected population development is only 0.9% over the next 5 years, the city stays a strong buy in the multifamily and office structure sectors. Likewise interesting are the development or redevelopment chances in Orlando, along with the homebuilding prospects in the city provided strong existing and forecasted financier or resident need.

Atlanta puts 8th on our list of top property investments in 2020 due to its strong transaction volume seen over the past few years and 1.2% anticipated 5-year population development. Atlanta's unique culture, its urban core that is ripe for remodelling and its mixed-use suburban advancements have actually made the city a significantly fascinating place to live, although land, labor and structure expense increases have actually put pressure on cost.

9 Easy Facts About How Much Is Tax On Debt Forgiveness Mortgages Shown

When you do find a desirable home to purchase, examine its particular Check out this site area, condition, market and growth potential customers carefully to ensure it will be a great addition to your property portfolio.

|

|

10 Simple Techniques For What Do I Need To Know About Mortgages And Rates |

The high costs of reverse mortgages are not worth it for the majority of people. You're better off offering your house and transferring to a cheaper location, keeping whatever equity you have in your pocket instead of owing it to a reverse home loan lending institution. This short article is adapted from "You Do not Have to Drive an Uber in Retirement" (Wiley) by Marc Lichtenfeld.

When you initially begin to learn more about a reverse mortgage and its associated advantages, your initial impression may be that the loan product is "too good to be real." After all, a crucial advantage to this loan, created for homeowners age 62 and older, is that it does not require the debtor to make regular monthly home mortgage payments.

Though in the beginning this benefit may make it seem as if there is no repayment of the loan at all, the reality is that a reverse home loan is just another kind of home equity loan and does ultimately get paid back. With that in mind, you may ask yourself: without a regular monthly home mortgage payment, when and how would payment of a reverse home mortgage occur? A reverse home mortgage is various from other loan items due to the fact that repayment is not accomplished through a month-to-month home mortgage payment over time.

Loan maturity usually takes place if you sell or transfer the title of your home or completely leave the home. However, it may also occur if you default on the loan terms. You are thought about to have completely left the house if you do not reside in it as your main home for more than 12 successive months.

Things about How Do Mortgages Work Condos

When any of these circumstances take place, the reverse home loan ends up being due and payable. The most common approach of repayment is by offering the home, where profits from the sale are then utilized to pay back the reverse mortgage in full. Either you or your beneficiaries would normally take obligation for the deal and get any staying equity in the home after the reverse mortgage is repaid.

A https://www.businesswire.com/news/home/20191008005...oup-Relieves-375-Consumers-6.7 HECM reverse home loan guarantees that debtors are only accountable for the amount their house offers for, even if the loan balance surpasses this amount. The insurance coverage, backed by the Federal Real Estate Administration (FHA), covers the remaining loan balance. In circumstances when heirs prefer to keep the house instead of selling it, they may choose another type of repayment.

Qualifying successors might also refinance the home into another reverse mortgage. A reverse mortgage reward isn't restricted to these options, nevertheless. If you want to make payments on the reverse home loan during the life of the loan, you definitely may do so without charge. And, when making month-to-month mortgage payments, an amortization schedule can show useful - how do arms work for mortgages.

A way to do this is to compute the interest plus the home loan insurance coverage for the year, and divide the quantity by 12 months. If you pick to do this, you can rest ensured that there are no penalties for making loan payments prior to its maturity date. However, lots of customers select to take pleasure in the advantages of having no month-to-month mortgage payments with the understanding that, at loan maturity, continues from the sale of the home will be put towards repayment of the loan balance completely.

How Do Va Mortgages Work Things To Know Before You Buy

For extra concerns, speak with your tax consultant about reverse mortgage tax ramifications and how they may affect you. Although the reverse mortgage loan is an effective financial tool that taps into your home equity while deferring payment for an amount of time, your obligations as a house owner do not end at loan closing - how do reverse mortgages work after https://local.hometownsource.com/places/view/159183/wesley_financial_group_llc.html death.

A reverse home mortgage is a helpful tool for senior house owners to help fund retirement. And, with a couple of https://www.globenewswire.com/news-release/2020/06...llege-Scholarship-Program.html options for payment, you can feel great that you will find a technique that works the very best for your situation. To discover more about this versatile loan, get in touch with a reverse mortgage expert at American Advisors Group to assist you determine your choices for repayment and the numerous ways you can take advantage of the loan's unique features.

As with any big monetary choice, it is important to weigh reverse home loan pros and cons to ensure it's the right option for you. Here are a couple of to get you started. A reverse home mortgage can provide numerous benefits: You get to remain in your house and your name remains on the title.

Reverse home mortgages are immune from declining home values since they're nonrecourse loans. Nonrecourse loans do not permit the lending institution to take more than the security (your house) to restore your debts. For that reason, you'll never ever owe more than what your home is worth. Reverse home mortgages aren't for everyone. The loan includes a number of drawbacks that you may want to consider before you get one: Reverse mortgages reduce the quantity of equity you have in your house.

The Of How Do Balloon Mortgages Work

You may outlast your loan's advantages if you don't select the month-to-month period payout approach. A reverse home mortgage can make it harder for your successors to gain from the equity in your home after you pass away. how do fannie mae mortgages work. When you get a reverse mortgage, the first agenda is to pay off any existing financial obligation that's still on your initial home loan.

If you own your house complimentary and clear, you can get the amount of the loan. You can utilize this money for anything, consisting of supplementing your financial resources during retirement. While every circumstance is various, a couple of methods others have used a reverse mortgage include: Reducing month-to-month home mortgage payments Increasing monthly money flow Combining debts Spending for in-home care Making home enhancements Supplementing income Producing an emergency situation fund Safeguarding house equity from declining markets You may pick to put your funds into a credit line that you can access whenever you require it.

For instance, you aren't required to make payments on the loan, and as long as you remain in the house and support your financial obligations of the loan, a reverse home mortgage credit line can not be suspended or called due. One of the greatest benefits of a reverse home loan line of credit is that any unused funds increase in value in time, offering you access to more money in the future.

Before you get a loan, you'll need to attend reverse home loan counseling, which will be an out-of-pocket expense for you. There will likewise be a few upfront costs, consisting of origination charges, a home mortgage insurance premium and closing costs. Lenders likewise add regular monthly fees and interest to the amount you will owe back.

Get This Report on How Do Right To Buy Mortgages Work

As stated above, you still need to pay real estate tax and homeowners insurance while you reside in the house. You're likewise bound to keep the condition of the home and cover upkeep expenses. These are necessary responsibilities to bear in mind since you could lose your home to foreclosure if you fall back on property taxes or let your house deteriorate.

Nevertheless, you must repay the financial obligation you have actually accumulated after you offer your home. Prior to you note your house for sale, contact your reverse home mortgage lender and confirm the amount you owe. You may keep the rest and put it towards a brand-new house if your home costs more than your assessed value.

|

|

The Single Strategy To Use For How Do Bad Credit Mortgages Work |

Origination points, on the other hand, are loan provider costs that are charged for closing on a loan. Origination points do not save borrowers cash on interest, although they can in some cases be rolled into the balance of a loan and paid off gradually - how do arms work for mortgages. Discount rate points, nevertheless, need to be paid up front.

In your deal, the loan provider will usually use you several rates, including a base rate, in addition to lower rates that you can get if you buy discount points (explain how mortgages work). Those discount rate points represent interest that you're repaying on your loan. If you decide to buy points, you pay the lending institution a portion of your loan amount at closing and, in exchange, you get a lower rate of interest for the loan term.

25%. Like regular home mortgage interest that you pay over the life of your loan, mortgage points are usually tax-deductible. However, points are normally only used for fixed-rate loans. They're available for adjustable-rate home loans (ARMs), however when you buy them, they only decrease your rate for your introduction periodseveral years or longeruntil the rate changes. If a borrower purchases 2 points on a $200,000 home mortgage then the cost of points will be 2% of $200,000, or $4,000. Each lending institution is distinct in regards to how much of a discount rate the points purchase, but normally the following are fairly common throughout the industry. each point decreases the APR on the loan by 1/8 (0.

25%) throughout of the loan. each point lowers the APR on the loan by 3/8 of a percent (0. 375%), though this discount rate just applies during the introductory loan duration with the teaser-rate. A home-buyer can pay an upfront charge on their loan to acquire a lower rate.

Little Known Questions About How Do Mortgages Work With Married Couples Varying Credit Score.

No Points 1 Point 2 Points Cost of Points N/A $2,000 $4,000 Rates of interest 5. 25% 5. 00% 4. 75% Regular monthly Payment $1,104. 41 $1,073. 64 $1,043. 29 Monthly Payment Cost Savings N/A $30. 77 $61. 12 Months to Recover Cost N/A 49 49 Loan Balance at Break Even Point $187,493.

78 $186,423. 08 Interest Cost Over Life of Loan $197,585. 34 $186,513. 11 $175,588. 13 Interest Cost Savings Over Life of Loan N/A $11,072. 22 $21,997. 21 Net Savings (Interest Cost Savings Less Expense of Points) N/A $9,072. 22 $17,997. 21 Some lending institutions market low rates without highlighting the low rate includes the associated fee of paying for multiple points.

Store based upon interest rate of the loan, or a set number of points Then compare what other lenders provide at that level. For example you can compare the best rate provided by each loan provider at 1 point. Discover the most competitive deal at that rate or point level & then see what other lenders offer at the very same rate or point level.

Points are an upfront cost which allows the buyer to acquire a lower rate for the period of the loan. This means the charge is paid upfront & then savings connected with the points accrue over time. The purchaser invests thousands of Dollars upfront & then conserves some quantity like $25, $50 or $100 each month.

A Biased View of How Do Second Mortgages Work In Ontario

If the property owner does any of the following early in the loan they'll forfeit the majority of the advantage of points: offers the house re-finances their home loan gets foreclosed on passes away The basic computation for recovering cost on points is to take the cost of the points divided Check out here by the difference in between monthly payments.

This streamlined method unfortnately leaves out the effect of the differing quantities owed on various mortgage. The balances on numerous loan choices are paid back at different rates depending on the rate of interest charged and the quantity of the loan. An advanced calculation to determine the break even point on points purchases likewise represents the difference in loan balances in between the different alternatives.

While a point normally decreases the rate on FRMs by 0. 25% it typically lowers the rate on ARMs by 0. 375%, nevertheless the rate discount rate on ARMs is only used to the initial duration of the loan. ARM loans ultimately move from charging the preliminary teaser rate to a referenced indexed rate at some margin above it.

When using the above calculator for ARM loans, remember that if the break even point on your points purchase exceeds the initial duration of the fixed-period of the loan then you will lose money purchasing points. Loan Type Fixed Introductory Period Breakeven Point Should Be Less Than 3-1 ARM 3 years 36 months 5-1 ARM 5 years 60 months 7-1 ARM 7 years 84 months 10-1 ARM ten years 120 months People who are likely to keep their existing mortgage for a long time.

The Buzz on How Do Second Mortgages Work

Steady family requirements, or a house which can accommodate extra relative if the household grows. Property buyer has good credit & believes rates of interest on mortgages are not most likely to head lower. Steady work where the employer is unlikely to fire them or ask for the worker relocate. If any of the above are not true, then points are likely a bad purchase.

Points can be financed, or rolled into the loan. The huge issue with funding points is you increase the loan's balance immediately. This in turn substantially increases the number of months it requires to recover cost. In the examples displayed in the table above funding the points would take the break even point from 49 months to 121 months for the loan with 1 point & 120 months for the loan with 2 points.

Historically most house owners have re-financed or moved houses every 5 to 7 years. Betting that you'll stay in place & not re-finance your house for over a decade is generally a bad bet. For this factor to finance points. House home loan points are tax-deductible completely in the year you pay them, or throughout the period of your loan - what are reverse mortgages and how do they work.

Paying http://felixywds590.timeforchangecounselling.com/w...-mortgages-work-in-mexico-mean points is a recognized business practice in the area where the loan was made. The points paid weren't more than the amount typically charged in that area. You utilize the cash technique of accounting. This means you report income in the year you get it and subtract expenditures in the year you pay them.

The 3-Minute Rule for How Do Fixed Rate Mortgages Work

The funds you offered at or before closing, consisting of any points the seller paid, were at least as much as the points charged. You can't have actually obtained the funds from your lender or home loan broker in order to pay the points. You utilize your loan to buy or develop your primary house.

As mentioned above, Hop over to this website home mortgage points are tax deductible. Loan origination costs are not. Loan origination costs can be revealed in Dollar terms or as points. A $200,000 loan might cost $3,000 (or 1. 5%) to stem & procedure. This can be revealed either in Dollars or as 1. 5 origination points.

On adhering home mortgages this charge usually runs somewhere between $750 to $,1200. These fees are usually incremented by half-percent. The most typical cost is 1%, though the optimum loan origination charge is 3% on Qualified Home loans of $100,000 or more. Smaller houses might see a higher origination charge on a portion basis considering that the home loan broker will need to do a comparable quantity of work for a smaller sized loan quantity.

VA loans have a 1% cap on origination fees. FHA reverse home mortgages can charge a maximum of the higher of $2,500, or 2% of the optimal home loan claim amount of $200,000 & 1% of any quantity above that Unfavorable points, which are likewise described as refund points or lender credits, are the reverse of home loan points.

|

|

Things about Reverse Mortgages How They Work |

Numerous or all of the items featured here are from our partners who compensate us. This may influence which items we write about and where and how the item appears on a page. However, this does not influence our assessments. Our viewpoints are our own. If you've ever had a property owner, you most likely don't dream of being one: Fielding calls about large-scale bugs and overflowing toilets doesn't look like the most glamorous task.

It can help diversify your existing financial investment portfolio and be an extra income stream. And numerous of the very best realty financial investments don't need revealing up at a renter's every beck and call. The trouble is that lots of brand-new investors do not understand where or how to purchase realty.

REITs permit you to purchase realty without the physical property. Frequently compared to mutual funds, they're business that own commercial realty such as office complex, retail areas, homes and hotels. REITs tend to pay high dividends, that makes them a typical financial investment in retirement. Financiers who do not need or desire the routine income can instantly reinvest those dividends to grow their financial investment further.

Are REITs an excellent investment? They can be, but they can also be differed and complex. Some trade on an exchange like a stock; others aren't publicly traded. The kind of REIT you purchase can be a big factor in the quantity of risk you're taking on, as non-traded REITs aren't quickly offered and might be how to get out of timeshare presentation hard to value.

For that, you'll require a brokerage account. If you do not already have one, opening one takes less than 15 minutes and many companies need no initial financial investment (though the REIT itself will likely have a financial investment minimum). The online brokers below all provide openly traded REITs and REIT shared funds: Take a look at our guide to opening a brokerage account If you're familiar with companies such as Prosper and LendingClub which link borrowers to investors going to lend them cash for different personal needs, such as a wedding event or house renovation you'll comprehend online realty investing.

Investors hope to receive month-to-month or quarterly circulations in exchange for taking on a considerable quantity of risk and paying a fee to the platform. Like numerous realty financial investments, these are speculative and illiquid you can't quickly discharge them the way you can trade a stock. The rub is that you might require money to make cash.

Get This Report on Which Australian Banks Lend To Expats For Mortgages

Alternatives for those who can't satisfy that requirement include Fundrise and RealtyMogul. Tiffany Alexy didn't intend to end up being a genuine estate financier when she bought her very first rental property at age 21. Then a college senior in Raleigh, North Carolina, she prepared to participate in grad school locally and figured purchasing would be better than renting.

" I went on Craigslist and discovered a four-bedroom, four-bathroom condominium that was set up student-housing design. I purchased it, lived in one bedroom and rented the other three," Alexy says. The setup covered all of her expenditures and brought in an additional $100 each month in cash far from small potatoes for a grad trainee, and enough that Alexy captured the property bug.

Alexy got in the marketplace using a strategy in some cases called house hacking, a term created by BiggerPockets, an online resource for genuine estate investors. It essentially suggests you're inhabiting your financial investment residential or commercial property, either by leasing out spaces, as Alexy did, or by leasing units in a multi-unit structure. David Meyer, vice president of development and marketing at the website, says house hacking lets financiers purchase a residential or commercial property with as much as 4 units and still certify for a residential loan.

Find one with combined costs lower than the quantity globenewswire.com/news-release/2020/05/07/2029622/0/en/U-S-ECONOMIC-UNCERTAINTIES-DRIVE-TIMESHARE-CANCELLATION-INQUIRIES-IN-RECORD-NUMBERS-FOR-WESLEY-FINANCIAL-GROUP.html you can charge in lease. And if you do not wish to be the individual who appears with a toolbelt to repair a leakage or even the person who calls that person you'll likewise require to pay a home supervisor. "If you handle it yourself, you'll learn a lot about the market, and if you buy future homes you'll go into it with more experience," states Meyer.

Called house flipping, the technique is a wee bit harder than it looks on TELEVISION. "There is a bigger component of risk, since so much of the math behind flipping requires an extremely precise price quote of how much repairs are going to cost, which is not a simple thing to do," says Meyer.

" Maybe you have capital or time to contribute, but you discover a professional who is good at estimating expenditures or handling the project," he says. The other risk of turning is that the longer you hold the property, the less cash you make due to the fact that you're paying a home loan without bringing in xm cancellation phone number any income - how is the compounding period on most mortgages calculated.

How Which Of The Following Is Not An Accurate Statement Regarding Fha And Va Mortgages? can Save You Time, Stress, and Money.

This works as long as many of the updates are cosmetic and you do not mind a little dust. Finally, to dip the very edge of your toe in the property waters, you could lease part of your home by means of a website like Airbnb. It's home hacking for the commitment-phobe: You do not have to handle a long-lasting tenant, possible renters are at least somewhat prescreened by Airbnb, and the company's host guarantee supplies security versus damages.

If you've got an extra room, you can lease it. Like all financial investment choices, the very best real estate investments are the ones that finest serve you, the investor. Consider how much time you have, just how much capital you want to invest and whether you want to be the one who deals with household problems when they undoubtedly show up.

Purchasing and owning realty is an financial investment strategy that can be both pleasing and rewarding. Unlike stock and bond investors, potential realty owners can utilize leverage to purchase a home by paying a portion of the total expense upfront, then paying off the balance, plus interest, with time (how to reverse mortgages work if your house burns).

This ability to manage the property the moment papers are signed emboldens both property flippers and proprietors, who can, in turn, secure 2nd home loans on their homes in order to make down payments on extra residential or commercial properties. Here are 5 key methods investors can generate income on real estate.

Among the primary methods in which financiers can earn money in genuine estate is to become a property manager of a rental home. People who are flippers, buying up undervalued realty, fixing it up, and offering it, can also make earnings. Property investment groups are a more hands-off method to make cash in real estate.

Owning rental residential or commercial properties can be a great opportunity for people with do-it-yourself (Do It Yourself) and remodelling abilities, and have the patience to manage renters. Nevertheless, this strategy does require considerable capital to fund up-front maintenance expenses and to cover uninhabited months. Pros Provides regular earnings and properties can value Maximizes capital through take advantage of Many tax-deductible associated expenses Cons Can be laborious handling occupants Potentially damage residential or commercial property from occupants Reduced income from prospective vacancies According to U.S (why is there a tax on mortgages in florida?).

|

|

See This Report on How Many Mortgages In The Us |

These costs are frequently rolled into the loan itself and therefore substance with the principal. Normal expenses for the reverse mortgage include: an application charge (establishment fee) = between $0 and $950 stamp responsibility, home loan registration costs, and other federal government charges = differ with location The rate of interest on the reverse home mortgage varies.

Considering that the update of the National Customer Credit Protection Act in September 2012 brand-new reverse mortgage are not allowed to have actually repaired rates. Only reverse mortgage loans composed prior to that date can have a fixed rates of interest In addition, there may be costs throughout the life of the reverse home mortgage.

The finest products have absolutely no month-to-month costs. When thinking about a reverse home mortgage you should be considering a loan with zero regular monthly charges and the most affordable rates of interest. If your bank is charging you a month-to-month charge then you need to be considering another product. The cash from a reverse mortgage can be distributed in several https://telegra.ph/the-main-principles-of-who-took...n-and-whitaker-mortgages-11-13 different methods: as a lump sum, in money, at settlement; as a Period payment, a monthly money payment; as a line of credit, comparable to a home equity line of credit; as a combination of these.

g., re-finance a regular or "forward" mortgage that is still in location when retiring or to utilize the readily available money to pay installation or revolving debt. buy a brand-new automobile; fund aged carein home or in a domestic aged-care facility (retirement home); upgrade or repair or renovate the home; assist the household or grandchildrenthis has to be done carefully or Centrelink pensions may be impacted under the "gifting" provisions of Centrelink; spend for a getaway.

Indicators on How Do Biweekly Mortgages Work You Should Know

This includes physical maintenance - how do right to wesley financial group lawsuit buy mortgages work. In addition, some programs require routine reassessments of the value of the home. Earnings from a reverse home loan set up as an annuity or as a credit line must not affect Government Earnings Assistance privileges. Nevertheless, income from a reverse home loan set up as a lump amount might be considered a monetary investment and therefore deemed under the Earnings Test; this classification includes all sums over $40,000 and amounts under $40,000 that are not invested within 90 days.

This consists of when they sell the house or pass away. However, many reverse mortgages are owner-occupier loans only so that the customer is not allowed to rent the property to a long-term tenant and vacate. A customer ought to check this if he believes he wishes to lease his residential or commercial property and move elsewhere.

g., goes to an aged-care facility or relocations elsewhere) the home must be offered. This is not the case; the loan must be paid back. Thus, the beneficiaries of the estate may decide to pay back the reverse mortgage from other sources, sale of other assets, and even re-financing to a typical mortgage or, if they certify, another reverse home loan.

An extra fee could also be imposed in the event of a redraw. Under the National Credit Code, charges for early payment are unlawful on brand-new loans because September 2012; however, a bank might charge a sensible administration cost for preparation of Additional info the discharge of mortgage. All reverse home mortgages written because September 2012 should have a "No Negative Equity Assurance".

9 Easy Facts About How Do Jumbo Mortgages Work Explained

This implies you can not end up owing the loan provider more than your house is worth (the marketplace worth or equity). If you entered into a reverse home mortgage prior to 18 September 2012, examine your contract to see if you are secured in circumstances under which your loan balance winds up being more than the value of your property.

Where the property offers for more than the amount owed to the lender, the borrower or his estate will get the extra funds. According to the October 2018 filings of the Office of the Superintendent of Financial Institutions (OSFI), an independent federal company reporting to the Minister of Finance in that month, the exceptional reverse home loan debt for Canadians skyrocketed to $CDN3.

Daniel Wong at Better House wrote that, the dive represented a 11. 57% boost from September, which is the 2nd greatest increase considering that 2010, 844% more than the average month-to-month rate of growth. The yearly boost of 57. 46% is 274% bigger than the mean annualized pace of growth. Reverse home mortgages in Canada are readily available through two financial institutions, HomEquity Bank and Equitable Bank, although neither of the programs are guaranteed by the federal government.

To get approved for a reverse mortgage in Canada, the debtor (or both customers if married) need to be over a certain age, at least 55 years of age the customer should own the residential or commercial property "entirely or almost"; in addition, any impressive loans protected by your house must be retired with the profits of the reverse home mortgage there is no qualification requirement for minimum income level.

The 45-Second Trick For How Do Reverse Mortgages Really Work?

The exact quantity of money offered (loan size) is determined by numerous elements: the debtor's age, with greater amount available for greater age current rate of interest residential or commercial property worth, consisting of area and a factor for future gratitude program minimum and optimum; for example, the loan may be constrained to a minimum $20,000 and an optimum of $750,000 The interest rate on the reverse home loan differs by program.

Precise costs depend on the particular reverse mortgage program the borrower acquires. Depending on the program, there might be the list below types of expenses: Property appraisal = $150$ 400 Legal guidance = $450$ 700 Other legal, closing, and administrative expenses = $1,750 Of these expenses, just the genuine estate appraisal is paid in advance (expense); the staying costs are rather subtracted from the reverse mortgage proceeds.

" The money from the reverse home loan can be utilized for any purpose: to repair a house, to pay for in-home care, to handle an emergency situation, or simply to cover day-to-day expenses." The borrower maintains title to the property, including unused equity, and will never ever be forced to leave the home.

This consists of physical upkeep and payment of all taxes, fire insurance and condominium or upkeep charges. Money received in a reverse mortgage is an advance and is not taxable earnings. It for that reason does not affect government take advantage of Old Age Security (OAS) or Guaranteed Income Supplement (GIS). In addition, if reverse home loan advances are used to acquire nonregistered investmentssuch as Guaranteed Investment Certificates (GICs) and mutual fundsthen interest charges for the reverse home loan may be deductible from financial investment earnings earned. [] The reverse mortgage comes duethe loan plus interest should be repaidwhen the customer passes away, offers the home, or moves out of your house.

The Buzz on How Do Dutch Mortgages Work

Prepayment of the loanwhen the borrower pays the loan back prior to it reaches termmay incur penalties, depending on the program. In addition, if interest rates have dropped considering that the reverse home mortgage was signed, the home mortgage terms may include an "' interest-rate differential' penalty." In Canada a reverse home loan can not build up debt beyond the fair market value of the residential or commercial property, nor can the lending institution recuperate losses from the property owner's other assets.

|

|

What Is Today Interest Rate For Mortgages Things To Know Before You Get This |

With a traditional home loan you borrow cash in advance and pay the loan down over time. A Reverse Home mortgage is the opposite you collect the loan over time and pay everything back when you and your spouse (if appropriate) are no longer living in the house. Any equity remaining at that time comes from you or your beneficiaries.

Lots of specialists shunned the product early on believing that it was a bad deal for senior citizens however as they have found out about the details of Reverse Home loans, professionals are now accepting it as a important financial preparation tool. The primary benefit of https://www.businesswire.com/news/home/20190806005...Group-6-Million-Timeshare-Debt Reverse Mortgages is that you can remove your traditional mortgage payments and/or access your house equity while still owning and residing in your house.

Secret benefits and benefits of Reverse Mortgages include: The Reverse Home loan is a greatly flexible product that can be made use of in a variety of methods for a range of various kinds of borrowers. Homes who have a monetary requirement can tailor the product to de-stress their financial resources. Families with adequate resources may consider the item as a monetary preparation tool.

Unlike a home equity loan, with a Reverse Home Mortgage your house can not be drawn from you for factors of non-payment there are no payments on the loan up until you completely leave the home. http://www.williamsonherald.com/communities/frankl...33-11ea-b286-5f673b2f6db6.html Nevertheless, you must continue to spend for maintenance and taxes and insurance on your house.