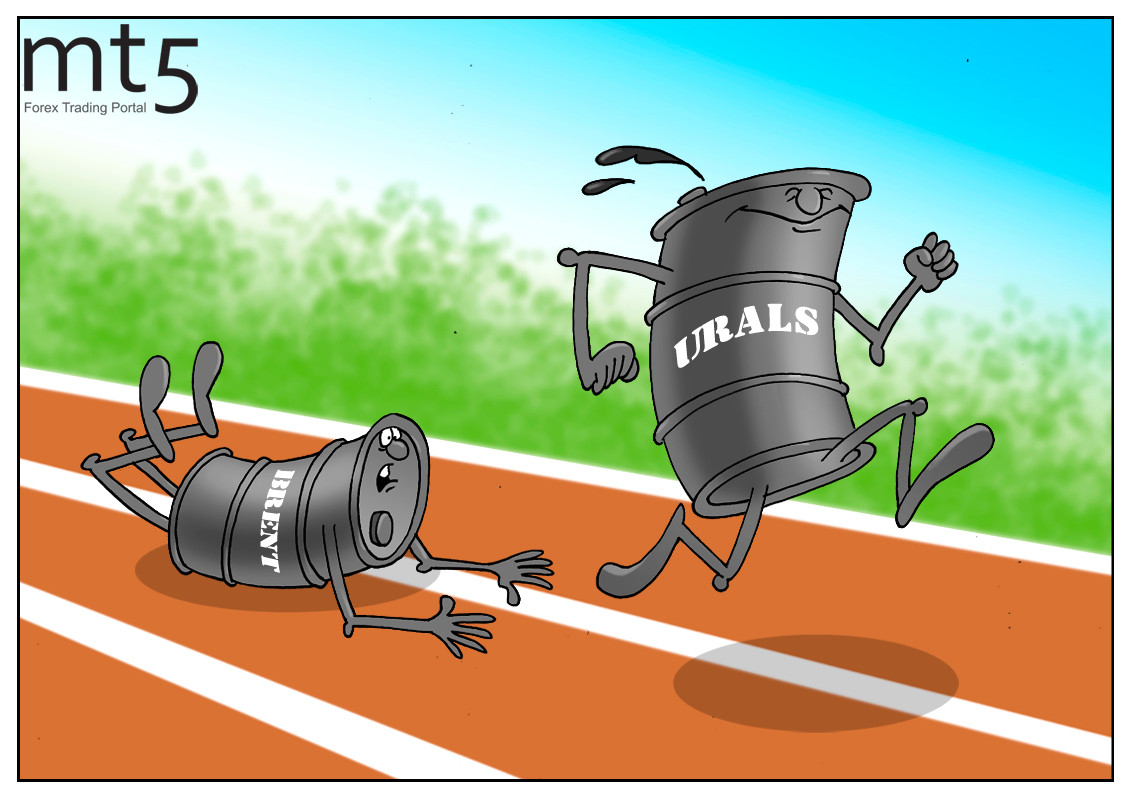

Russia losing competitive advantage in global oil market |

Russia’s oil exports have been badly affected by the coronavirus-driven economic crisis. Urals, Russia’s main export oil grade, surpassed the price of the world’s benchmark Brent for the first time this year. As a rule, Urals has always traded below Brent crude oil and even the North American WTI. Apart from reduced demand for energy, the Russian crude has fallen prey to an aggressive marketing strategy of Saudi Arabia. As a result, Russia had to put a higher price tag on its Urals blend. Last time, such a differential was seen in late November 2019. Experts say this is not the long-term trend. In fact, Moscow was forced to respond this way to low demand for the Russian oil grades. In other words, the Urals price just looks inflated compared to invoices issued by other oil exporters who slashed prices wooing large buyers. Oil producing countries aim to squeeze out the powerful competitor of traditional markets in Europe and Asia.

Meanwhile, Russian energy companies are not able to compete with other oil suppliers. At present, Russian drillers find it cheaper to burn the oil which has been extracted than deliver it to storage facilities. Russia trimmed the Urals delivery plan by 40% for May compared to April. So, this month Russia is going to supply the volume of less than 1 million barrels per day. Such a crater in supplies is caused by low demand for energy as well as Russia’s commitments to the OPEC+ pact on oil production cuts.

Read more: https://www.mt5.com/forex_humor/image/49832

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |