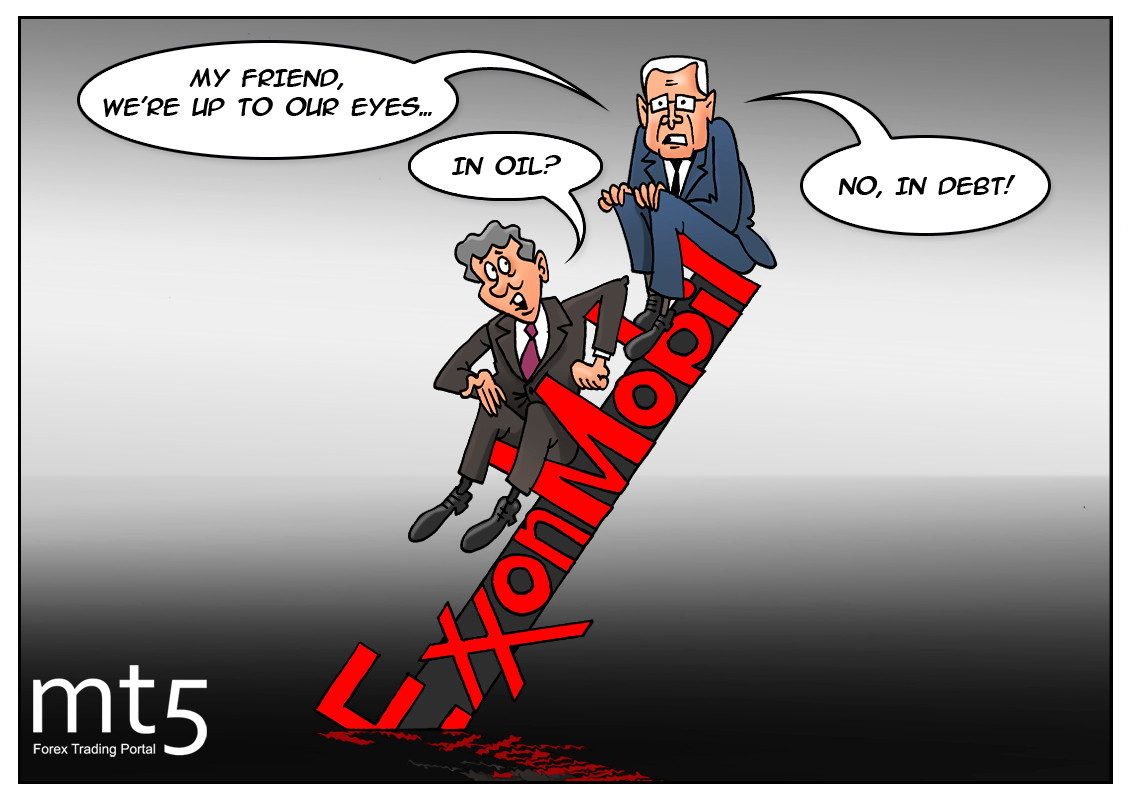

Moody’s downgrades ExxonMobil credit outlook after virus hits energy market |

A collapse in the oil market has weighed heavily on major oil companies, and ExxonMobil is no exception. America’s largest oil company is in a steady decline now. The company has been operating since 1866 and got its actual name after the merger of two oil companies in 1999. ExxonMobil is considered an industry titan and has a long history of ups and downs. According to some media reports, the oil giant was on the verge of bankruptcy several times, it almost stopped its operation once, and was occasionally posting huge losses. Recently, the oil giant’s profit has plunged to a record low and its once-perfect credit rating has been downgraded. For instance, Moody’s Investors Service has lowered the company’s debt rating from Aaa to Aa1. However, Moody’s explained this decision mainly by a number of negative external factors that the company has faced. According to Moody’s, “the company’s very high growth capital investment combined with muted oil and gas prices and low earnings in its downstream and chemicals segments resulted in substantial negative free cash flow and rising debt in 2019. ” What is more, analysts at Moody’s noted that “the large drop in oil prices and continued weakness in downstream and chemicals performance leaves the company poised to incur sizable negative free cash flow funded with debt.”

Read more: https://www.mt5.com/forex_humor/image/48766

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |