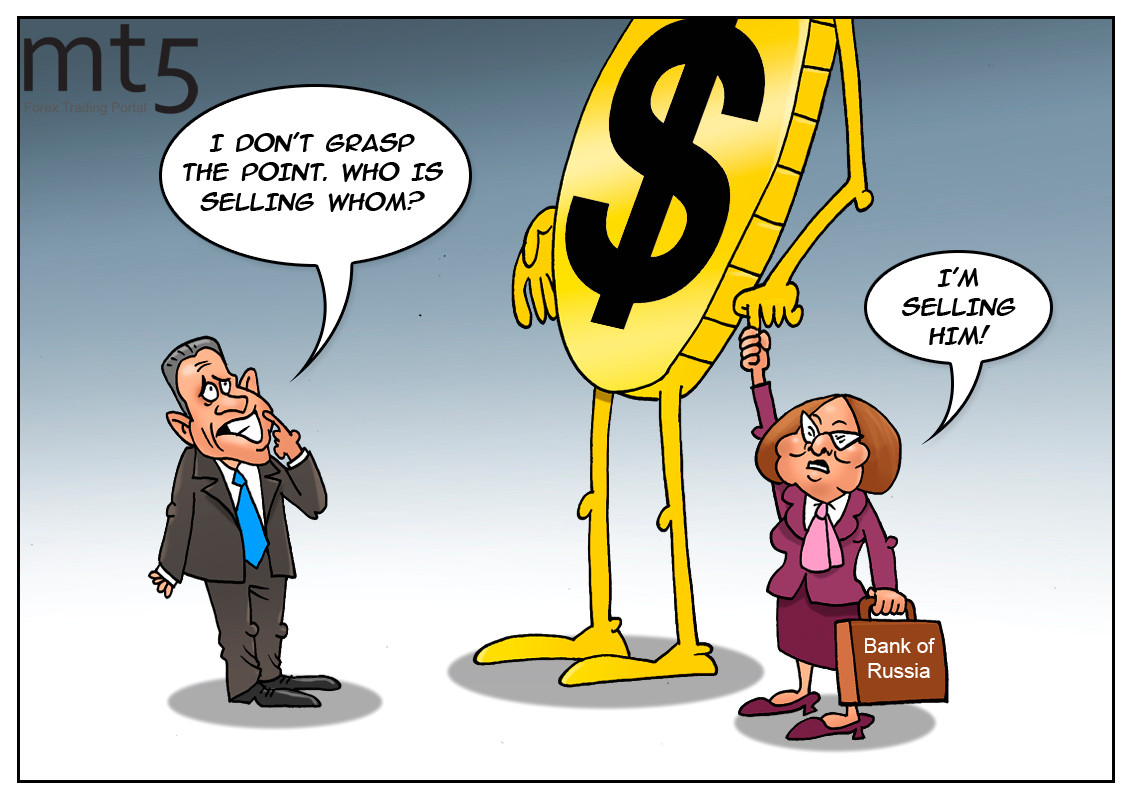

Bank of Russia eventually decides to save RUB |

Despite the Kremlin’s interest in the weak national currency, the Bank of Russia eventually decided to do something to prop up the ruble which had been trapped at historic lows against the greenback. Within a framework of forex interventions, the regulator notably increased sell-offs of US dollars in the domestic currency market. In a few days, the central bank converted $200 million to 16 billion rubles. According to the information on the Bank of Russia’s website, the amount of dollars to be sold amid forex interventions has been sharply raised by 20%. This monetary policy measure is widely used by other central banks to support a weak national currency. Indeed, thanks to the artificial buoyant demand the ruble has been able to regain some of losses. Nevertheless, full recovery of the ruble is still out of the question amid the lack of fundamentals. The currency has been weighed down by Russia’s withdrawal from the OPEC+ pact on oil production cuts. The ruble is very sensitive to any changes in oil quotes. Amid the oil price war between Saudi Arabia and Russia, the ruble is doomed to failure. There is no hope for growth of oil quotes until the rivals come to terms. Meanwhile, Urals, the domestic oil grade and the main source of Russia’s budget revenues, is trading at $13 per barrel which is cheaper than the European black mineral oil. Last time when the Urals price slumped to such a record low was in 1999. Afterwards, the price climbed over 30%. However, even that considerable rise did not help the ruble recover its previous strength.

Read more: https://www.mt5.com/forex_humor/image/48518

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |