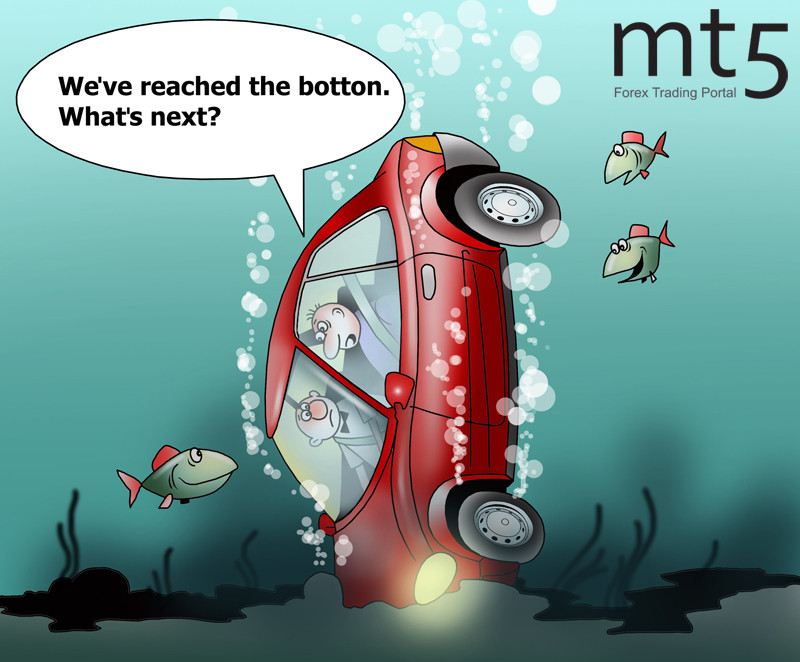

Investment banks assess risks looming over stock market |

While the coronavirus pandemic is shaking the global markets, experts have no option but stand by and watch the situation. The currency strategists of the largest investment banks are trying to figure out whether the market has bottomed out or there is still room for maneuver. Experts at JP Morgan Chase & Co and Goldman Sachs Group Inc., the two largest banking groups, have made their assessments of the current situation. JP Morgan analysts believe that the risky assets are being weighed down by the COVID-19 outbreak. The negative effects on this group of financial instruments are expected to be aggravated due to the recession gripping economies around the world. Experts at JP Morgan consider that the authorities have made every effort to stabilize and revive the economy, including different fiscal stimulus programmes. However, this did not help them turn the tide. Strategists at JP Morgan say that risky assets, excepting oil and some emerging market currencies, have hit their low points. Most of these currencies are likely to trade higher in the second quarter of 2020, so the bank recommends investors buy oversold assets. Goldman Sachs Group Inc. experts do not share the view of their colleagues from JP Morgan. The bank sees the market falling in the next few weeks. Nevertheless, the experts believe that it is too early to talk about bottoming out. According to Goldman Sachs, a sustainable stock market rally requires a number of conditions such as a slower rate of the novel coronavirus spread, a reduction in investor positions, and well-coordinated fiscal stimulus measures. Other banking experts are refraining from making projections. Some of them suggest closely monitoring current developments and not rushing to purchase any assets. Experts emphasize that the bearish market sentiment rarely leads to massive sell-off without repeated testing of the bottom.

Read more: https://www.mt5.com/forex_humor/image/48427

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |