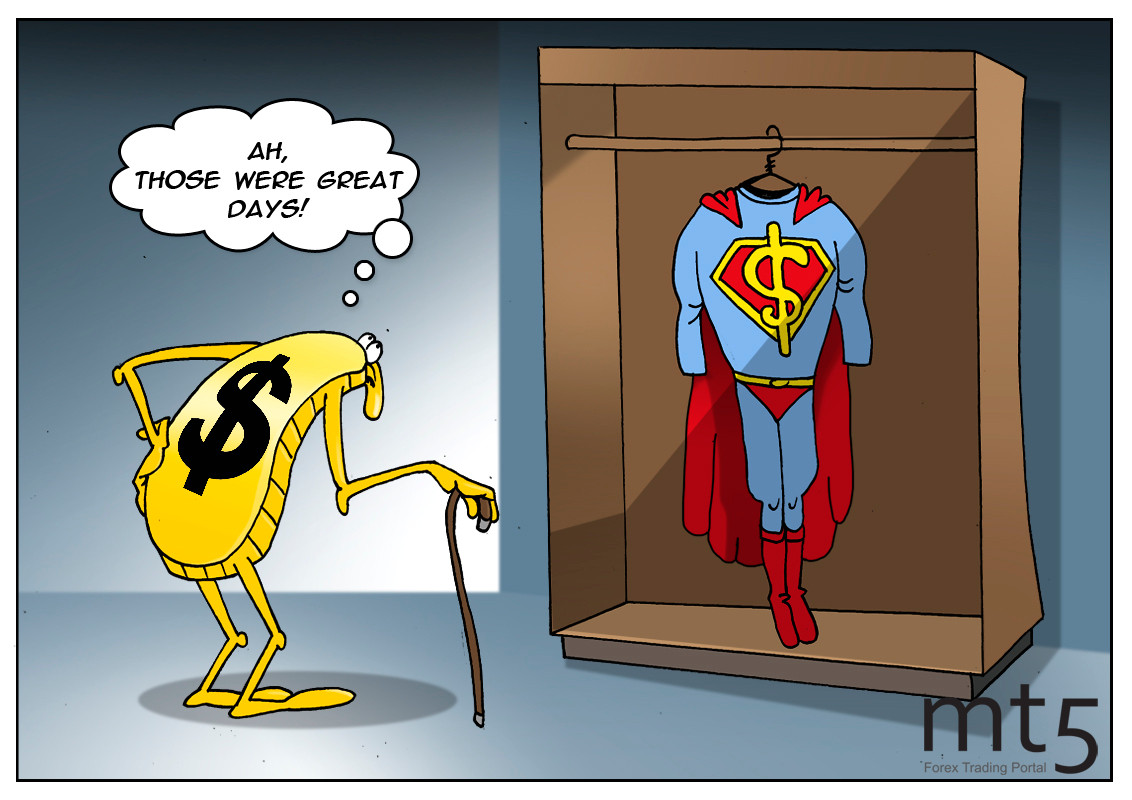

US debt losing favor with investors |

The largest lending institutions are selling off the US debt. Oddly enough, the sell-off is going on amid buoyant demand for most US assets. In fact, financial markets go through cycles of buying and selling. Nevertheless, global investors are still unwilling to include US bonds in portfolios. Interestingly, non-residents have bought US assets worth $49.47 billion more than they have sold. Investment firms and global central banks have been trimming their holdings of US Treasuries. They have sold off Treasury securities at the net value of $34.32 billion. Japan used to be the largest foreign owner of the US debt, but it has dumped US bonds at a whopping $20 billion. China ventured into an aggressive reduction of its Treasury holdings two years ago aiming to assert its leadership in the standoff with the US. More sell-offs are to follow. Russia has never been a record holder of the US debt. However, it also revised its investment portfolio having sold the whole pool of Treasuries last year. At present, Moscow is again taking an interest in the US Treasury market cautiously buying bonds since September. Nowadays, Israel is acknowledged as the main investor in the US debt. Amid massive selling in other countries, Israel has amassed its holdings of US Treasuries to a record high. As a rule, investors are poised to use a free margin for buying gold as a safe haven asset.

Read more: https://www.mt5.com/forex_humor/image/44500

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |