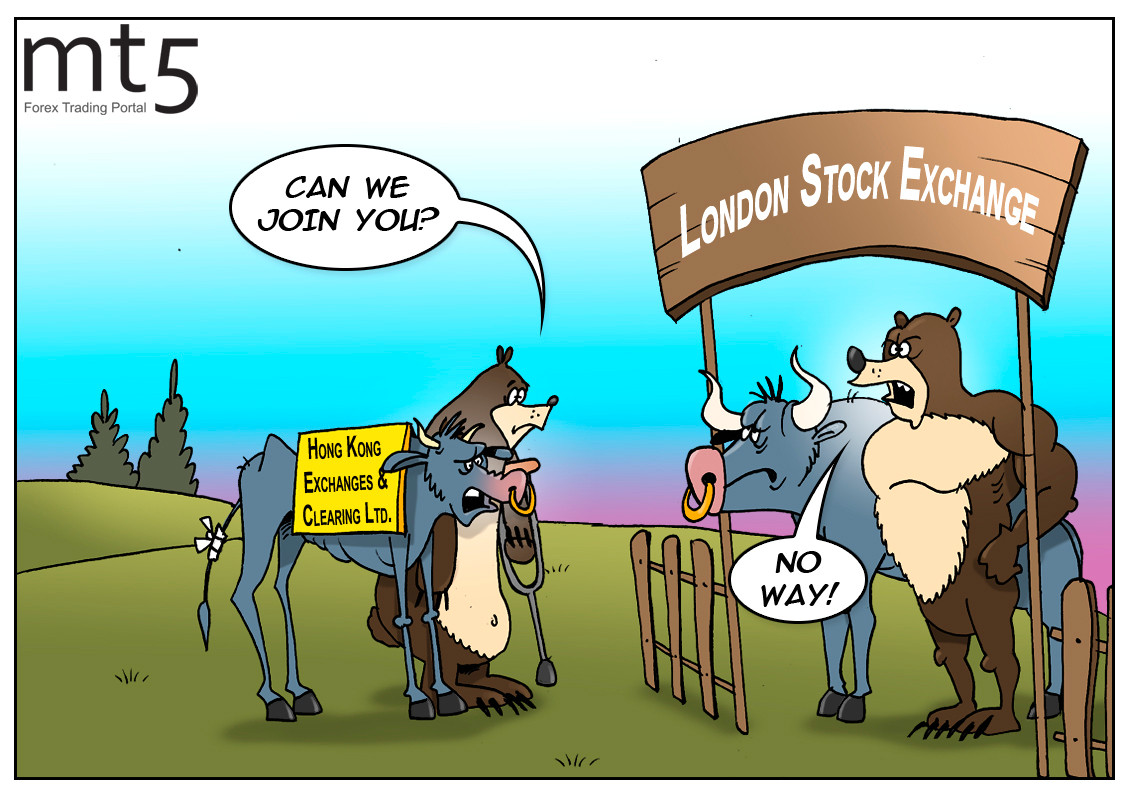

LSE flatly rejects takeover bid |

Roiled by violent clashes, Hong Kong is making every effort to tackle the social and political jitters. Even the most optimistic analysts admit that the enclave will eventually lose its governing and economic independence from mainland China. This is only a matter of time. Nevertheless, the special administrative region aims to assert itself. Earlier in September, Hong Kong Exchange and Clearing (HKEX) made a merger offer for the London Stock Exchange (LSE). This move came as a surprise to the financial world. However, the LSE rejected it instantly. The LSE's board said in a statement that it had "fundamental concerns about the key aspects of the conditional proposal: strategy, deliverability, form of consideration and value." "Accordingly, the board unanimously rejects the conditional proposal and, given its fundamental flaws, sees no merit in further engagement," the LSE management summed it up. In fact, HKEX proposed buying the LSE for $36.56 billion. With this takeover bid, Hong Kong’s government aimed to revive its financial sector. At present, the enclave’s economy is losing momentum amid the nonstop social unrest and the trade war between the US and China. The hypothetical merger between the two large stock exchanges would cushion the fallout from the looming slowdown in Hong Kong’s economy. From the LSE’s viewpoint, accepting this proposal would ruin well-established relations with Shanghai’s stock exchange. No wonder, the LSE board decided unanimously against the merger.

Read more: https://www.mt5.com/forex_humor/image/43192

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |