There Are A Number Of Benefits To Investing In Gold Etfs Rather Than Holding Physical Gold |

Content writer-Hopper Broe

Of all the rare-earth elements readily available, gold is most certainly one of the most prominent as a prospective gold financial investment. Several financiers normally buy gold as part of diversity, specifically through the work of by-products as well as future contracts. The gold exchange market is really unpredictable and also based on considerable speculation. Gold individual retirement account firms also sell gold coins. The latter can be utilized as economic tools or as physical products.

There are several methods which you can purchase gold. You can spend by purchasing physical gold in bars, coins, rounds, or bars. You can likewise invest by acquiring futures contracts for gold coins or bars. It is best to research study initially prior to spending your money in any type of gold investment to make sure that you will have the ability to pick the very best item for your particular needs as well as objectives. Although you can sell physical gold at a profit in the future, there are numerous dangers when investing through futures contracts.

Gold IRA funds are created particularly to hold physical gold. Gold Based IRA give all capitalists with the opportunity to take part in the rising gold prices. The fund enables financiers to invest both in bullion as well as ETFs.

Purchasing ETFs (exchange traded funds) varies from gold investment in a few methods. Initially, ETFs are not implied to be holding an actual property like physical gold. Instead, they are a car for investors to obtain exposure to the climbing prices of gold. Second, ETFs are generally traded on significant exchanges as well as have their own pricing system. Usually, these rates are adjusted relying on supply and also need. If view it now of gold surges, then so does the rate of an ETF.

There are numerous benefits to purchasing gold etfs rather than holding physical gold. Capitalists that trade these sorts of safety and securities are able to buy and sell them whenever the market sees fit. This gives them the capability to remain on top of the marketplace for any type of changes in rate.

It is important to know that investing in ETFs is not the same as standard gold investment approaches. There are certain guidelines that should be followed. Initially, the trading process is really different from buying physical gold. Gold ETFs have to first be traded in the over the counter market. Then, the purchasers need to acquire the shares at the current rate and sell them to the sellers for an earnings. This process typically happens in either the USA or in London.

When looking at buying ETFs, it is likewise essential to remember that they are not traded in the very same manner as holding physical gold. As a result, it is essential to track the different rates and also exchanges in order to continue to be as informed as feasible. When a financier is searching for gold investment opportunities, he will want to see to it he enters and also out of the marketplace promptly and easily. Many financiers prefer to trade on their computer systems so that they can stay as energetic as possible on the market.

One last benefit to investing in gold ETFs is that they do not have the additional charges associated with purchasing gold coins. As gold is really volatile, lots of brokerage companies charge added charges for purchasing and offering the coins. This makes it tough to acquire maximum returns. When spending via an ETF, the financier does not have to pay broker agent charges. This makes it possible for investors to get the greatest possible return on his or her investment.

When seeking to purchase gold, it is necessary to look at the overall investment environment. Gold is a really risk-free possession to get, but there are plenty of brokerage firms offered that supply ETF solutions. For that reason, it may be much easier for an investor to purchase ETFs than it would certainly be by spending directly in gold bullion.

For those who are simply getting going with gold investment, it is constantly an excellent idea to look into the different alternatives available. In particular, the best way to spend is by branching out throughout various items. While some financiers stick to gold bullion, there are other methods to invest, such as investing in ETFs as well as gold mining supplies.

The bottom line is that financiers have various financial investment choices, so they require to maintain their choices open. This is especially important when financiers wish to diversify across several markets. Gold has been confirmed to be a solid financial investment over time, so there are a lot of factors to place cash right into this rare-earth element. Whether an investor chooses to go long or short, gold prices are likely to proceed rising in the coming years.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

There Are Several Benefits To Buying Gold Etfs Instead Of Holding Physical Gold |

Content by-Coley Thorsen

Of all the precious metals offered, gold is certainly the most popular as a prospective gold financial investment. Numerous investors normally purchase gold as part of diversity, specifically via the employment of by-products as well as future agreements. The gold exchange market is really unstable and also subject to substantial supposition. Gold individual retirement account business likewise sell gold coins. The latter can be used as economic tools or as physical items.

There are a number of methods which you can buy gold. You can invest by purchasing physical gold in bars, coins, rounds, or bars. linked here can additionally spend by acquiring futures contracts for gold coins or bars. It is best to research initially prior to spending your cash in any gold investment to make sure that you will certainly have the ability to pick the best item for your certain demands as well as objectives. Although you can sell physical gold at a profit in the future, there are many threats when spending with futures contracts.

Gold individual retirement account funds are designed especially to hold physical gold. They give all financiers with the possibility to partake in the increasing gold rates. The fund enables capitalists to invest both in bullion and also ETFs.

Investing in ETFs (exchange traded funds) varies from gold financial investment in a few methods. Initially, ETFs are not indicated to be holding an actual property like physical gold. Instead, they are a vehicle for investors to get exposure to the rising costs of gold. Second, ETFs are normally traded on significant exchanges and have their very own pricing system. Normally, Precious Metals Companies are changed depending on supply as well as need. If the rate of gold surges, after that so does the rate of an ETF.

There are a number of benefits to purchasing gold etfs instead of holding physical gold. Investors who trade these types of securities are able to buy and sell them whenever the marketplace sees fit. This provides the capacity to remain on top of the marketplace for any kind of adjustments in price.

It is essential to know that investing in ETFs is not the like conventional gold investment strategies. There are specific rules that should be followed. First, the trading process is very different from buying physical gold. Gold ETFs should first be sold the over-the-counter market. Then, the purchasers must purchase the shares at the current rate and offer them to the vendors for a profit. This procedure usually occurs in either the United States or in London.

When looking at buying ETFs, it is additionally essential to keep in mind that they are not sold the same manner as holding physical gold. As a result, it is necessary to keep track of the various costs as well as exchanges in order to stay as educated as feasible. When an investor is seeking gold financial investment possibilities, he will intend to make sure he enters as well as out of the marketplace promptly and easily. Numerous capitalists prefer to trade on their computer systems to ensure that they can continue to be as energetic as possible in the market.

One last benefit to purchasing gold ETFs is that they don't have the added costs connected with investing in gold coins. As gold is really unstable, lots of broker agent companies bill added charges for buying as well as selling the coins. This makes it difficult to get optimal returns. When spending through an ETF, the financier doesn't need to pay brokerage firm fees. This makes it feasible for investors to obtain the highest possible return on his/her financial investment.

When looking to get gold, it is essential to take a look at the total financial investment environment. Gold is a really safe property to get, however there are lots of brokerage companies readily available that supply ETF solutions. Consequently, it may be much easier for a capitalist to purchase ETFs than it would certainly be by spending directly in gold bullion.

For those who are just beginning with gold financial investment, it is always a good concept to research the various alternatives readily available. Particularly, the most effective means to invest is by branching out across different products. While some investors stick to gold bullion, there are other methods to invest, such as purchasing ETFs as well as gold mining supplies.

The bottom line is that financiers have many investment choices, so they need to keep their options open. This is specifically vital when investors want to branch out across several markets. Gold has been shown to be a solid investment in time, so there are plenty of factors to place money into this precious metal. Whether a capitalist makes a decision to go long or short, gold prices are likely to proceed rising in the coming years.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

An Overview To Cryptocurrency Blockchain |

Content author-Neville Agerskov

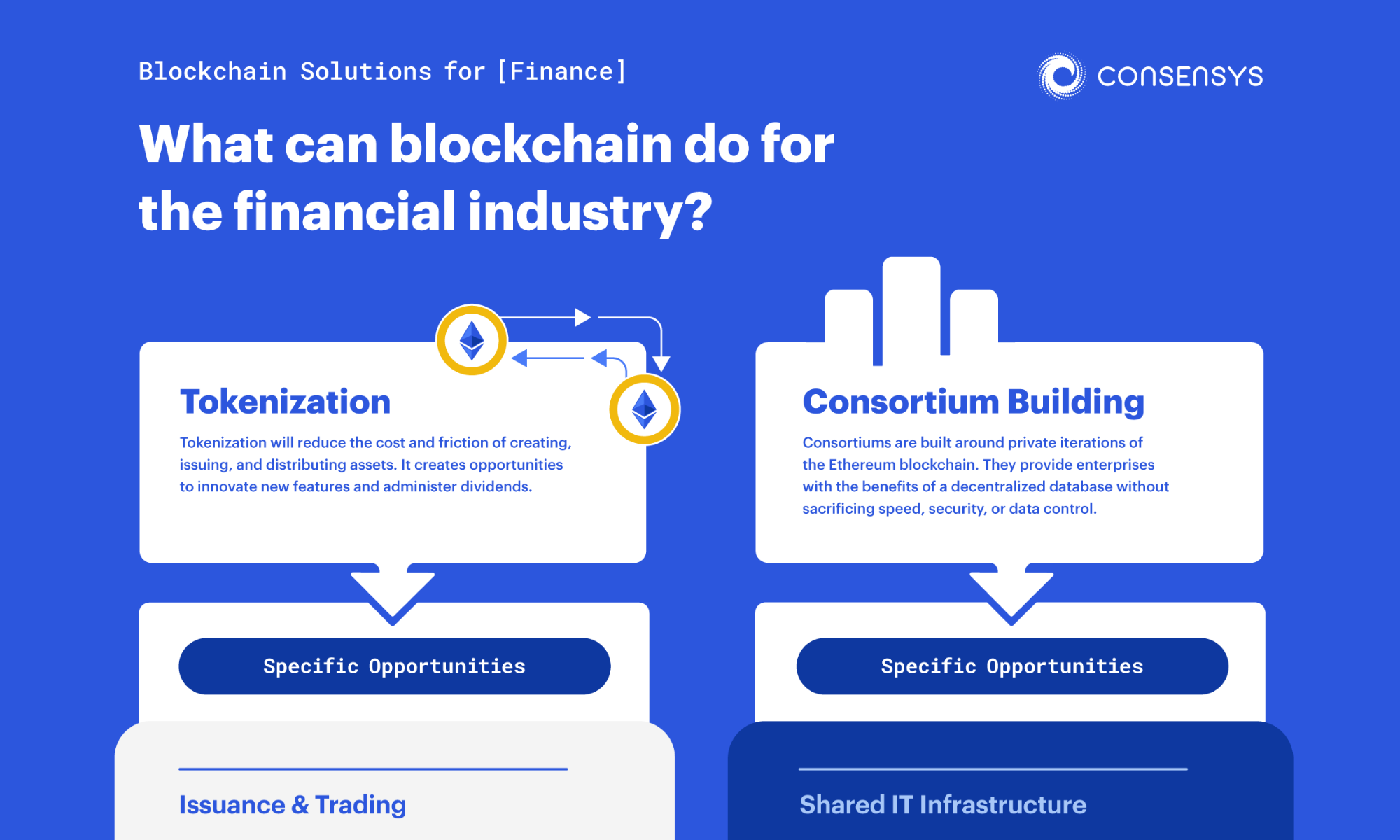

Cryptocurrency Blockchain is the new pattern in the digital currency industry. Discover More Here to take on the new innovation wasbit. bit, now recognized simply as bitBank, is presently going through huge development and has strategies to increase right into numerous money as well as business designs. bit Financial institution provides one of the most comprehensive checklist of offered electronic money to its consumers consisting of cash from Australia, Brazil, China, India, Japan, Mexico, New Zealand, the Philippines, as well as South Africa. Among these, two new digital currencies have been chosen; the cross-chain bridge as well as the absolutely no expertise networks.

An essential feature of the Cryptocurrency Blockchain is the implementation of smart agreements. Smart contract technologies give a robust and safe bridge for the transfer of digital currencies. Smart agreements are likewise referred to as "clever agreement innovations" or "blockchain wise agreements". This innovation was developed by software application designers at etherneton and also Consensys, as well as consists of attributes such as off-chain deals, rapid verifications, and also off-block chain settlement. Other attributes include resistance to hacking, high degree of personal privacy, and also instantaneous confirmation of invoice.

Another vital function of Cryptocurrency Blockchain is the application of smart contracts with the help of block explorers. According to tech blog site Technologizer, one of the project's designers states: "Smart contracts will certainly make it easy to exchange currencies without needing a broker, that makes it excellent for people who want to trade anonymously". He additionally discusses that with using block explorers, individuals can view the existing state of thechain and identify which purchases are safe or not and which are not.

Another attribute of Cryptocurrency Blockchain is the application of off-chain deals. Off-chain purchases do not depend on the main-chain because they get rid of trust. There is no longer a demand for customers to transact their money on the primary network. The programmers of the project keep that this lowers threats posed by DDoS (rejection of service) strikes, making it safer for users. The creator of one of the significant cryptosystems is quoted as stating that he is thrilled by how improbable some principles of personal privacy as well as permission-based file encryption are, and also how swiftly people are adopting these principles in their daily life.

One of the fundamental aspects of Cryptocurrency Blockchain is making use of Tor network to safeguard the network. Gray states: "The purpose of Tor is to have full anonymity. We wished to mimic that in the bitcoin network so that individuals could utilize it as a safe and secure way to negotiate without needing to disclose any kind of economic details". He better explains that they selected to implement Tor as it is free, functions well in many parts of the world, and also has a high reliability. According to him, it is the best framework for a dispersed system like the bitcoin.

There are several factors that make bitcoins interesting customers around the globe. Among them is the proof-of-work principle. The designer of the project is priced quote as stating "The proof-of-work is the only means to make certain that people are investing their cash in the right way. Otherwise, the system will certainly wear." In other words, bitcoins are just a kind of currency but unlike conventional currency, it is not based on any kind of physical property.

There are lots of means through which the owner of the bitcoins can spend his coins. One of one of the most popular is called mining. This includes the person having to care for the central database where all the purchases are tape-recorded and also processed. It also includes the person having to adhere to the policies laid down by the network, i.e. the user needs to follow the set of regulations to keep his coins protect.

The whole idea of the system and also its future is likewise explained by Gray. He states" Bitcoins are a disruptive system. When learn here have a disruption, it offers you the chance to re-invent yourself and also do something various. That is what we are making with bitcoins."

|

Метки: Cross-Chain Bridge Blockchain Bridges Cryptocurrency Defi Coins Multichain Blockchain Technology Crypto Wallet |

Just How To Choose The Company For Accountancy Solutions |

https://squareblogs.net/barney87carol/exactly-how-...he-company-for-audit-solutions by-Karstensen Walls

In this day and age, the majority of services as well as corporations can not operate without accounting solutions. To handle the everyday monetary operations of the eateries, dining establishments need accounting professional services. Consequently, Click On this website for such firms is quite high in the industry. Apparently, for small business owners, this provides good news however with it comes numerous challenges. How after that can little and also medium-sized business owners locate an appropriate partner to help them with bookkeeping?

Prior to making a final decision on which audit firm or provider to pick from, it is essential to examine your one-of-a-kind scenarios. If you are a brand-new business owner without previous experience with this area, after that you should opt for a firm that uses a thorough bundle to make sure that all your requirements are fulfilled. Several of the solutions used by a lot of accounting professionals consist of tax preparation, insurance, payroll handling, customer monitoring, audit solutions, and bookkeeping.

Little and medium-sized services typically lack the resources of big firms or corporations. This suggests that they can not pay for to work with extremely educated accounting professionals that will be essential for finishing their monetary analysis, specifically with complicated taxation systems. It is also quite pricey to hire accountants to execute the economic analysis themselves, which implies that business will certainly miss chances for conserving cash. Subsequently, only accounting solutions that provide sophisticated financial analysis and also tax preparation for small as well as medium-sized enterprises are optimal.

The next action to finding an accounting service is to evaluate the bookkeeping firms that are recommended by your good friends and relatives. Alternatively, you can use on-line organization directory sites that focus on such provider. As soon as you have actually shortlisted a couple of prospective firms, you can after that experience the list to discover the one that fulfills your accounting needs. The majority of accountants that concentrate on this sort of solution will have web sites where you will have the ability to find out more regarding their know-how and contact information. Most accountants additionally have phone number that you can call to acquire additional details.

The majority of accountancy services will certainly offer both standard solutions along with specialized solutions such as pay-roll prep work, tax obligation prep work, as well as economic evaluation. The accountancy solutions that offer basic services will certainly prepare and also submit the income tax returns. They will additionally assist with the declaring of state and also federal tax returns and also give records as well as guidance on these matters. However, they will typically not give assistance with offshore accounts or tax obligation preparation. Commonly Small business cpa sun city of solutions would certainly be supplied by an accountant or certified public accountant.

A solution providing specialized audit solutions will certainly concentrate on giving support with complicated tax obligation plans and also will just provide suggestions and advice on tax obligation matters. This type of company will not be called for to prepare as well as file the federal or state income tax returns. Nonetheless, they might be capable of assisting with offshore accounts and/or preparing for a proprietor of a company who has actually established a company or LLC. Many accounting software application provides for a company to develop a corporation or LLC in either a residential or foreign territory. This permits the firm to develop another business, called the "pass-through entity", which will work as its own legal entity for tax functions.

The majority of accountants that offer specialized accounting solutions will have details departments or personnel that take care of various areas of tax. In many cases, a client will pick a firm that has a division with participants that deal especially with problems that drop under their organization or individual fields of experience. As an example, some firms may only offer tax preparation aid. If your business includes global trade, a firm that deals solely with tax preparation will be most proper.

In order to ideal utilize the audit services provided by any type of firm, it is needed for you to understand their capabilities, and what kinds of tax obligation services are readily available. Typically, accounting professionals offering specialized public accountancy solutions will have basic daily audit skills, along with specialized expertise of tax obligation laws and also the Internal Revenue Service. These accountants will be proficient at offering assistance for clients in regard to preparing all required forms and will likewise have knowledge regarding federal and also state tax legislations. Furthermore, these accountants may be experienced at understanding as well as offering options to issues that emerge worrying conformity with lawful demands, and in numerous instances, will certainly have the ability to provide their customers with professional lawful suggestions concerning these issues.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Certified Public Accountant Bookkeeping Services Tax preparation |

What Is The Scope Of Audit Solutions? |

Article writer-Drake Boisen

Bookkeeping solutions do lots of things for businesses. Typical accounting solutions supplied include tax planning and also examination, keeping an eye on profits and expenditures, and also much more. Audit is all about keeping reliable recordkeeping methods as well as making accurate economic records to management. The term accounting is an umbrella term that consists of a variety of associated self-controls as well as areas of research study.

The scope of bookkeeping services is wide and also diverse. Some focus on consultatory capacities only while others provide seeking advice from services to a wide variety of clients. Some accounting professionals provide their solutions directly to private firms, firms, federal governments, and also nonprofit organizations. There are also accounting firms that focus on aiding corporations and other businesses satisfy their accounting and accountancy needs. The most usual type of accountant is the Cpa (Certified Public Accountant).

There are visit my homepage of accounting services. One type is called transaction processing. This consists of creating quotes, taking care of settlements as well as purchases, preparing information to be provided to capitalists, submitting records, connecting with internal auditors, processing electronically saved information, as well as examining the information to make decisions about making changes in the business's approaches as well as treatments. Other types of accounting solutions that might be carried out include economic declaration preparation, supplying general assistance to third parties entailed with bookkeeping, encouraging on tactical administration choices, recommending government firms, speaking with organizations on their tax obligation issues, preparing documents for clients, executing intricate computer system software programs for back-room operations, preparing monetary declarations, preparing different tax forms, recommending clients on investing, and also suggesting on service matters. A couple of accountants give specific audit services such as handling worldwide financial resources and insurance coverage matters.

Tax is a large problem for small businesses. Local business owners need to recognize all of the necessary laws as well as policies regarding taxation, payroll, income taxes, property taxes, sales taxes, and various other issues that impact their organizations. Accounting https://postheaven.net/suzanne47angeline/exactly-h...pany-for-bookkeeping-solutions that focus on taxes can help them understand these issues and prepare accurate tax records, which can possibly reduce their tax obligation costs. Accounting professionals likewise keep track of as well as supply assistance for federal, state, and regional tax legislation. They can aid small companies with signing up for government service programs, obtaining licenses, and gathering sales as well as utilize taxes.

Many accounting professionals have additional skill sets besides audit skills. Specialized knowledge is one example. Accounting professionals with specialized understanding in audit methods as well as computer software application applications, as an example, can do added features that accounting professionals without an audit history might not have the ability to do. Bookkeeping professionals might likewise function as legal representatives, professionals, or in other management capabilities. Several accountants have experience in money, service administration, consulting, insurance policy, financial investment, international business, or bookkeeping.

Some accounting professionals supply extra services past accounting solutions. They might supply guidance on investing, service management, estate preparation, personnels, pay-roll, marketing, advertising, federal government regulation, financial, real estate, regulation, as well as tax obligation legislation. There are numerous other locations that accounting professionals can specialize in. Lots of bookkeeping services companies have an area of specialization, such as business conformity, forensic bookkeeping, auditing from public bookkeeping, as well as tax litigation, among others.

To meet the complex demands these days's business globe, numerous small business proprietors discover that they require greater than an accounting professional's standard solutions. Company owner are significantly asking for various other specialized services. In addition to accounting demands, they are currently requesting aid with Internet marketing, handling ecommerce websites, fringe benefit preparation, health care benefits, human resource administration, supply chain monitoring, delivery, telecommunications, warehousing, tailored software program, government gives, and also on-going office support. Despite having specific bookkeeping solutions, company owner will find themselves seeking recommendations on many different topics. That's why many audit companies have professional advisers readily available who can supply a wide variety of guidance relying on the specific problems available.

For local business proprietors, particularly those who are just getting started, it is necessary to understand that using an accountant's basic business bookkeeping services is not always the most budget-friendly choice. Local business owner that want to maintain their books as well as spend much less time doing paperwork may think about outsourcing their accounting solutions. Outsourcing your accounting services is beneficial for numerous factors. https://zenwriting.net/maricruz93cleora/just-how-t...-firm-for-bookkeeping-services , you can save a great deal of cash, and 2, you can concentrate on expanding your company.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Certified Public Accountant Bookkeeping Services Tax preparation |

What Is The Extent Of Accounting Solutions? |

Created by-Gregory Martens

Bookkeeping services do lots of things for businesses. Common bookkeeping services offered include tax preparation and examination, keeping track of profits and also expenses, and much more. Accounting is all about keeping reliable recordkeeping methods as well as making accurate financial records to monitoring. The term accounting is an umbrella term that consists of a number of associated techniques and also areas of study.

The extent of accountancy solutions is large and varied. Some focus on advisory abilities just while others supply consulting solutions to a broad series of clients. Some accounting professionals supply their solutions directly to individual companies, companies, governments, and also not-for-profit organizations. There are even accounting firms that specialize in assisting corporations and also various other companies satisfy their accounting as well as bookkeeping demands. The most common sort of accounting professional is the State-licensed accountant (CPA).

There are many different facets of audit solutions. One kind is known as deal handling. This includes writing estimates, taking care of payments as well as deals, preparing details to be offered to financiers, filing records, communicating with inner auditors, refining digitally kept information, and assessing the info to choose about making changes in the business's methods and treatments. Other kinds of accounting services that may be executed include financial declaration prep work, providing basic support to third parties included with bookkeeping, recommending on critical management choices, recommending government companies, talking to organizations on their tax issues, preparing documents for customers, implementing intricate computer software programs for back-room operations, preparing financial statements, preparing various tax return, recommending clients on investing, and recommending on service matters. A couple of accounting professionals supply customized bookkeeping solutions such as handling worldwide finances as well as insurance coverage issues.

Taxes is a big problem for small companies. Small business proprietors require to know every one of the required laws as well as laws regarding taxes, pay-roll, revenue taxes, property taxes, sales tax obligations, as well as various other problems that influence their services. Accounting professionals who specialize in tax can help them recognize these issues and prepare accurate tax obligation reports, which might possibly minimize their tax obligation costs. Accounting https://blogfreely.net/magan12rosina/accounting-pr...al-for-all-sorts-of-businesses keep an eye on and offer assistance for federal, state, as well as neighborhood tax obligation law. They can help small businesses with signing up for government solution programs, obtaining permits, and also collecting sales as well as make use of tax obligations.

Several accountants have additional ability besides accounting skills. Specialized knowledge is one example. Accountants with specialized knowledge in accounting practices and computer software applications, as an example, can carry out additional functions that accountants without an accountancy background might not have the ability to do. Bookkeeping professionals might additionally work as legal representatives, consultants, or in other administrative capabilities. Lots of accounting professionals have experience in financing, business administration, consulting, insurance coverage, financial investment, global organization, or bookkeeping.

Some accounting professionals give added services past bookkeeping solutions. https://squareblogs.net/venessa55todd/what-is-the-extent-of-audit-solutions may give suggestions on investing, organization administration, estate planning, personnels, payroll, marketing, marketing, federal government policy, banking, realty, regulation, as well as tax obligation regulation. There are several various other locations that accounting professionals can specialize in. Many bookkeeping solutions firms have an area of field of expertise, such as service compliance, forensic bookkeeping, bookkeeping from public bookkeeping, and also tax obligation litigation, to name a few.

To satisfy the facility requirements these days's business world, many local business proprietors discover that they require more than an accountant's standard solutions. Entrepreneur are significantly requesting for various other specialized solutions. Along with accounting Accountant near me in el mirage , they are currently asking for assistance with Online marketing, managing ecommerce websites, employee benefit preparation, healthcare advantages, human resource administration, supply chain monitoring, delivery, telecommunications, warehousing, customized software, federal government gives, as well as on-going office support. Despite having specialized accounting services, local business owner will find themselves in need of suggestions on various subjects. That's why numerous bookkeeping firms have expert advisers offered that can supply a variety of guidance depending on the specific concerns handy.

For small business proprietors, specifically those that are simply starting, it is necessary to recognize that using an accounting professional's common service audit services is not constantly the most budget friendly choice. Local business owner who wish to keep their publications and also spend much less time doing documents could take into consideration outsourcing their accountancy services. Outsourcing your accountancy services is useful for several reasons. One, you can save a great deal of cash, and also two, you can focus on growing your company.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Certified Public Accountant Bookkeeping Services Tax preparation |

Finding A Good Financial Advisor That Can Overview You In Right Course With Your Financial investment |

Content written by-Jamison Dreyer

An economic consultant or monetary planner is an expert that offers monetary advice to customers according to their present monetary situations. In many countries, economic advisors are required to finish certain training and acquire registration with a regulatory agency in order to offer guidance to prospective consumers. This includes passing exams and a third-party certification. ira rules provide a vast array of monetary consultatory solutions, consisting of estate preparation, investment recommendations and individual finance monitoring.

There are what are wealth mangement consultants of financial solutions provided by financial consultants. They can suggest their customers on a wide array of financial products consisting of savings and also investment strategies, pension fund monitoring, financial investment techniques as well as the structure of their retirement account. They can additionally aid their customers handle their possessions and also settle high-interest financial debts. Nonetheless, monetary advisors do not offer their clients with thorough investment advice; they focus their focus on general monetary strategy.

Financial advisers need to track a variety of various things, including a person's personal finances, properties and also obligations, yearly revenue and other objectives. Because all these aspects continuously transform, it is difficult to have a full understanding of a person's monetary scenario at any type of time. Financial consultants must create a system of evaluating their customers' requirements and also goals and creating an individualized economic plan for each customer. When this has actually been done, it becomes very easy for them to suggest modifications or alterations to the original strategy.

A number of various sort of economic advisors supply different sort of advice to their customers. https://blogfreely.net/broderick35tera/how-to-sele...es-you-right-instructions-with of monetary advisor specializes in estate planning. Estate planning represents the future of a person's assets. Financial consultants who operate in this field may deal with individuals to develop specific financial investment goals or make use of basic techniques to attain those goals over a specific period of time. Various other sorts of financial advisors deal with individuals on pension or liquidating their retirement cost savings to make multiple financial investments, saving for the post-retirement years.

Financial investment advisors can likewise be found at monetary advisory firms. These firms offer a selection of financial investment alternatives for both the short-term and long-term. Several of the investment alternatives provided by a financial consultant might consist of stock market investing, bond investing, realty investing, choices trading, deposit slips investing, and even foreign money investing. While lots of people have some understanding of just how the stock market functions or a few supplies, most individuals do not have a complete understanding of how various kinds of bonds and securities job and what terms suggest.

Most of economic consultants provide a fee-only expert solution that does not call for a minimum amount of financial investment incomes. Generally, this kind of experts will certainly require their customers to pay a percent of the gains from the properties. This charge may be a portion of the complete value of the account or a flat price figured out by the company.

Financial coordinators can likewise be found by looking in the phone book, on the net, or by references. Financial planners might likewise belong to professional organizations such as the Financial Preparation Association, National Association of Personal Financial Advisors (NAPFA), or the Financial Planning and Advice Association. Lots of people have their very own hobbies or interests as well as while these people might not be proficient when it comes to investing or collaborating with other people's money, they are typically excellent professionals. This is specifically real if the financial experts want the investments the customer selects to take.

Finally, some excellent locations to search for monetary experts are your family and friends. Often times, buddies and member of the family have a wealth of expertise and experience with money management and are making certain their own finances are dealt with. If you do not have personal referrals, check out your local newspaper. Lot of times there are a number of advertisements for economic experts as well as their services. Another choice is to ask your neighborhood bar association or professional association for recommendations.

|

|

Financial Advisors As Well As Their Function In Your Financial Future |

Author-MacKenzie Stewart

A monetary adviser or monetary consultant is someone that supplies financial recommendations to clients according to their current financial scenarios. In many nations, financial advisors must be signed up with a pertinent regulatory body as well as total specific training in order to supply guidance in the UK. Financial consultants can be a mixed blessing as some benefit from the need for suggestions whilst others make a killing from the compensations received. The demand for financial advisors occurs as a result of the need for individuals to be kept educated about essential economic circumstances such as rate of interest, rising cost of living as well as securities market fads. Financial advisers are useful in aiding people and family members to prepare as well as handle their wealth along with budgeting and savings.

Nowadays many people depend on monetary services given by financial advisors. As the number of lending institutions as well as financial consultants has actually grown, so has the need for professionals who offer monetary services. The function of a financial adviser can vary according to where they function and also what market they operate in. Nonetheless, there are just click the following web page that continue to be common throughout all economic advisors.

https://maida84laverne.mystrikingly.com/blog/choos...n-secure-your-financial-future of a financial expert would certainly be to create a possession allowance strategy, or estate strategy, according to the client's goals as well as purposes. This includes identifying what are the customers' long term goals and also objectives, along with temporary ones. While https://rosalinda49greg.werite.net/post/2021/07/28...n-Your-Life-With-His-Knowledge is always best to leave the final decisions pertaining to financial investment to the clients themselves, financial advisors are often contacted to assist customers plan for the future, specifically when it pertains to retired life. Financial experts can help individuals with all kinds of investment demands such as choosing between a Roth and standard IRA, establishing a customized IRA, investing in supplies or bonds, insurance and also creating an economic strategy.

Financial planners additionally help people identify what type of investments are right for them as well as their families. They assist people analyze their details investments and their risks. The main goal of financial experts is to assist their clients towards financial investments that will raise the possibilities of gaining a greater revenue and staying clear of expensive mistakes such as running out of money throughout an unanticipated emergency. Some common types of financial investments include: supply and also mutual fund, money market funds, CDs, or deposit slips and also other certifications of interest as well as interest-bearing accounts.

Various other crucial decisions would include picking an economic custodian, or business that will certainly take care of the financial investments. There are likewise a variety of sorts of spending choices, such as exchange traded funds, specific and also family members mutual funds, in addition to supply index as well as bond funds. Furthermore, economic advisors to assist their clients set up a detailed estate plan that will certainly protect their liked ones from any type of unforeseen conditions. Financial advisers can likewise help customers make a decision whether to utilize a self-directed Individual Retirement Account, which allows a lot more control over investments, or a conventional Individual Retirement Account, which can be harder to take care of.

Many financial services firms use a large range of financial investment product or services to satisfy the requirements of specific customers. Several of the most popular are retirement, estate preparation, money value investing, and also insurance policy items. These firms help their clients pick the most effective options for their details economic goals and monetary circumstances. Depending upon the sort of investment picked, there are different tax obligation consequences. Financial consultants can help their customers comprehend these effects and deal with their tax specialists to decrease the tax obligation concern. A few of the solutions used by personal financial experts generally consist of acquiring a tax obligation plan through the H&R Block or Smart Financial recommend, scheduling a typical IRA with a custodian, as well as offering suggestions relating to investing in additional funds as well as bonds.

Personal economic consultants offer suggestions and counsel about several facets of personal financing, consisting of making sound investments as well as attaining future goals. When considering their solutions, clients ought to seek a consultant who is experienced in examining both risk and also reward, along with having a broad range of monetary items to pick from. Financial advisors can help their clients accomplish their lasting economic goals such as purchasing a home, buying a car, saving for retirement, as well as even financial investments for a college education. By meticulously selecting which financial investments customers will make as well as under what terms, monetary advisors can help their clients reach their goals and also preserve their existing way of life.

Numerous people use financial planning to attain their temporary and also long-lasting objectives. For example, a temporary objective may be getting a new task to elevate the family members, or it may be saving for a dream holiday. A long-term objective could be buying a home, a bigger home, or saving for retirement. In order to achieve these goals, people require to place some thought into just how they intend to reach them. By dealing with an experienced, certified monetary consultant, individuals can set realistic goals as well as work to accomplish them.

|

|

Financial Advisors as well as the Role They Play To Protect Your Investments |

Content author-Hanson Church

What are monetary consultants? A monetary advisor or financial organizer is an independent specialist that provides financial advice to clients according to their specific economic circumstances. In the majority of countries, financial consultants must first finish specific educational training as well as be signed up under a governing body to offer recommendations to their customers. They are expected to have sound expertise of the different monetary markets, danger monitoring and also financial investment methods.

https://www.globenewswire.com/news-release/2020/02...tions-using-SimCorp-Coric.html are used by huge organisations, usually as business wealth supervisors. Most advisors function to establish as well as attain economic objectives and also screen and also boost overall performance. Financial advisors often sustain Chief executive officers and also various other elderly management and sometimes serve as individual advisers to their Chief Executive Officer.

An example of a term economic consultant would certainly be wide range supervisors. financial advisor advice focuses on building a portfolio of possessions and distributing them to different groups in culture. The advantage of hiring such an advisor is that he or she has considerable experience in wide range monitoring and also can assist you in accomplishing your lasting riches objectives. The disadvantage is that wide range managers are typically paid on a performance-based fee, which can make it difficult to locate one within your range of pay choices. Numerous additionally require a very long term agreement.

Various other types of economic advisors to think about are those who supply retired life preparation services. You will require a qualified professional to manage your pension since after retirement your earnings is no more guaranteed. visit the up coming internet page assist you establish a detailed monetary plan that ensures both prompt and also long term wealth creation. They are commonly utilized by pension funds, mutual funds and insurance provider, as well as they assist people in addition to business fulfill their retirement as well as wide range planning requirements.

One more kind of economic advisors to take into consideration is financial investment monitoring. These sorts of consultants give you with advice on exactly how to spend your cash for wide range development. Some focus on stock and bond investing while others offer you with options in realty, commodities, the monetary markets, as well as the realty market. In order to work in this field of finance, you need to recognize asset appropriation and monetary preparation concepts.

Some monetary advisors function just in the direct financial investment arena. These include asset administration companies and wealth supervisors. If you choose to work individually, you will certainly require to do the same. Financial experts can either supply direct investments in the monetary markets or provide a bigger range of financial investment items such as pension plan funds, insurance items, and also managed futures and also options for clients. Whether you determine to work for a wide range supervisor or an investment company, you will certainly need to be well-informed in a number of locations consisting of taxes, estate preparation, retirement investing as well as personal money.

Financial advisors are additionally concentrated on different kinds of financial investment items. These include estate preparation, stock exchange and foreign exchange, products as well as stocks as well as bond and also mutual fund investing. Financial advisors can choose to specialize in one or all of these different types of investment professionals. Financial organizers collaborate with people as personal investors, investment coordinators function as consultants for employers, as well as financial investment specialists work as generalists.

Financial Advisors will likewise need to fulfill a variety of needs. Before they can begin providing financial items, they must satisfy a basic minimum payment need, need to be signed up reps of their companies they suggest, as well as pass the essential examinations. Most importantly, the monetary consultants you select should meet a range of various other needs such as a suitable education and learning, professional experience, and suitability to their customers. As you can see, being an Economic Expert can be an interesting and also intricate function. It's constantly vital to select the best financial advisors for your demands.

|

|

Searching For A Good Financial Advisor That Can Guide You In Right Course With Your Financial investment |

Author-Wu Shields

A monetary consultant or financial planner is a professional that supplies economic guidance to customers according to their existing economic situations. In most countries, financial consultants are called for to finish particular training and obtain enrollment with a regulatory agency in order to offer advice to prospective customers. This entails passing examinations as well as a third-party certification. Several financial advisers supply a vast array of financial consultatory solutions, including estate planning, financial investment advice and individual financing administration.

There are various kinds of financial solutions offered by economic consultants. They can encourage their clients on a wide variety of economic items consisting of financial savings and financial investment strategies, pension fund administration, financial investment approaches and also the framework of their pension. http://louie49colton.withtank.com/picking-the-righ...protect-your-financial-future/ can also aid their customers manage their possessions and also repay high-interest financial obligations. However, monetary consultants do not provide their customers with detailed investment suggestions; they focus their interest on total monetary strategy.

Financial consultants have to keep track of a variety of different things, including an individual's individual finances, assets and also responsibilities, yearly income and also various other objectives. Due to the fact that all these elements frequently change, it is impossible to have a complete understanding of an individual's economic situation at any type of time. Financial consultants need to establish a system of evaluating their customers' demands and also objectives as well as developing a tailored monetary plan for each client. As soon as this has actually been done, it comes to be easy for them to suggest modifications or modifications to the original plan.

A number of various sort of monetary consultants supply different kinds of guidance to their clients. One kind of economic expert focuses on estate preparation. Estate preparation stands for the future of an individual's assets. Financial experts that work in this field might deal with people to create certain investment objectives or use basic approaches to attain those goals over a specified period of time. Other types of monetary experts collaborate with individuals on retirement accounts or liquidating their retired life cost savings to make multiple financial investments, saving for the post-retirement years.

Financial investment advisors can also be found at financial consultatory firms. These companies give a variety of investment alternatives for both the short-term and also lasting. A few of the investment alternatives provided by a financial consultant might consist of stock market investing, bond investing, property investing, options trading, certificates of deposit investing, and also also international money investing. While the majority of people have some expertise of how the stock exchange functions or a couple of supplies, most individuals do not have a full understanding of exactly how numerous type of bonds as well as safety and securities job and what terms mean.

Most of monetary experts offer a fee-only advisor service that does not require a minimum quantity of investment profits. Generally, this sort of consultants will certainly need their clients to pay a percentage of the gains from the properties. This cost might be a percent of the overall worth of the account or a flat rate identified by the company.

Financial coordinators can also be found by searching in the phonebook, on the Internet, or by recommendations. https://writeablog.net/brittni4milissa/picking-the...n-secure-your-financial-future might also come from specialist organizations such as the Financial Preparation Association, National Association of Personal Financial Advisors (NAPFA), or the Financial Preparation and Guidance Association. click here now have their very own leisure activities or enthusiasms as well as while these people might not be competent when it involves spending or working with other individuals's cash, they are typically good experts. This is particularly true if the monetary experts have a passion for the financial investments the client selects to take.

Lastly, some excellent areas to try to find economic advisors are your loved ones. Oftentimes, close friends and member of the family have a wealth of knowledge and experience with money management and are ensuring their very own finances are cared for. If you do not have personal suggestions, check out your local paper. Often times there are a number of ads for monetary experts and their services. Another option is to ask your regional bar organization or professional organization for referrals.

|

|

Selecting the Right Financial Consultant That Can Protect Your Financial Future |

Article created by-Wu Church

Financial Advisors is two of one of the most crucial experts on the planet today. They are additionally 2 of one of the most misinterpreted. An economic advisor or monetary planner is someone that offers economic recommendations to clients according to their financial problem. In many countries, economic advisors have to obtain special certification and also be signed up under a regulatory body to use financial advice. Financial Advisors has a vast array of duties, some of which are reviewed below.

Financial Advisors supplies suggestions and referrals to investors on various investment choices such as the acquisition of bonds, supplies, mutual funds, etc. They are usually worked with by big firms to make economic referrals to the Board of Supervisors. They are likewise involved in investment planning for the company. Financial Advisors often acts as Brokerage Customers. In this case, they do not carry out the real trading tasks but give consultatory, info celebration services on various financial investments and choices.

Financial Advisors is responsible for setting as well as achieving the company's goals. They need to have a clear image of the business's long-term objectives and also methods. Their support as well as ideas to affect the means the company makes investments and utilizes its resources. Therefore, financial advisors play a vital role in the success of firm and also personal objectives.

Another responsibility of an economic consultant is to make certain correct documentation of all financial investment tasks. This consists of property management, tax obligation preparation, estate preparation, and so on. They are additionally charged with creating investment approaches to accomplish firm objectives. have a peek here prepare documents pertaining to savings account, investing, home loans, pension, insurance policies, etc. They also draft contracts for mergers as well as purchases, commercial ventures, and also realty deals.

Besides these obligations, a certain quantity of documentation is needed for maintaining documents of the investments of a customer. On top of that, individual financial advisors consult with clients to examine development in financial investments and make suggestions for future strategies. All records connected to the business of a client are after that kept in electronic or paper layout. Such documents include revenue declarations, balance sheets, income tax return, costs, invoices, and more.

Apart from being certified and also specialized, https://kayleigh3281hannelore.wordpress.com/2021/0...ght-path-with-your-investment/ work in a selection of areas. For instance, some focus on financial investment financial and also are employed by huge banks, hedge funds, and also insurer. Others may work in the area of safety and securities and alternatives and also take care of both retail as well as institutional clients. Many additionally work in the federal government divisions taking care of taxes and also retirement concerns. Some certified economic coordinators function only for their very own accounts as well as others may work as independent professionals for other companies.

There are many manner ins which a qualified monetary consultant can measure his performance. The main efficiency sign is the ROI, which means roi. Certified Financial Advisors need to have the ability to satisfy or surpass their ROI targets on a yearly basis. They ought to likewise be able to clarify the concepts of ROI and also just how they came to their numbers. This capacity to explain their work in basic language enables clients to make better choices concerning dangers as well as their goals, therefore accomplishing their economic objectives.

An additional important consider a Qualified Financial Consultant's work is setting the proper fee structure for his clients. The majority of suggest a three-pronged method for cost structure. A fee-only monetary consultant is one who has no additional costs apart from the straight purchase costs and also the financial investment administration costs. A fee-based financial consultant charges a level rate irrespective of the assets owned.

Some economic experts select crossbreed models of robo-advisors and also fee-only consultants. These hybrid designs incorporate facets of both robo advisors as well as fee-only advisors. In the robo-advisor scenario, an economic coordinator or expert reads the daily supply quotes and also make trades based on particular assumptions about what the marketplace will certainly do. He eagerly anticipates attain high trading returns with low danger. In fee-only scenario, an advisor does not take any other action apart from dealing the supplies that have been chosen by him. Thus he concentrates on earning the optimum possible return with the least threat.

While selecting a registered economic consultant, it is essential to guarantee that he recognizes your goals and objectives plainly. He needs to be able to go over financial investment purposes detailed and offer you a clear image of your net worth, income as well as retirement. He needs to additionally be able to talk about financial investment alternatives with you plainly. Prior to working with https://squareblogs.net/britney50noel/financial-ad...-duty-in-your-financial-future , make sure that he has a clear understanding of your goals as well as financial scenario.

Financial consultants usually obtain themselves entangled into a variety of investment products, and it is essential that they concentrate only on those products which they are qualified to advise. Therefore the most vital point to look for in a financial consultant is his experience in individual investment products, as opposed to in recommending a portfolio of items. There are a variety of monetary consultants that advertise their services online as well as deal to offer all sorts of items such as insurance policy, bonds, business real estate and alternatives. Make sure that the expert you pick concentrates on the type of financial investment product you intend to sell, to ensure that he can lead you via the process of selecting the ideal products for your profile.

|

|

What Sort of Responsibilities A Financial Advisors Can Play In Your Life With His Proficiency |

Written by-Mendoza Noble

A monetary professional or financial advisor is a person that provides economic advice to clients according to their individual monetary circumstances. In the majority of countries, economic advisors are needed to complete certain training as well as obtain registration with a governing body to use professional recommendations. Many advisors have an MBA as well as usually are experts in among 3 areas - pension plans, financial investment, or financing.

Although some financial advisors work individually, numerous find that helping a bigger organisation adds class to their function as well as also provides them with the possibilities to promote new products as well as check out brand-new markets. The variety of international capitalists has actually boosted drastically over the last few years, particularly given that the Global Financial Economic downturn started in 2021. This has created a massive need for financial consultants to help individuals understand the numerous choices available as well as help them make the right decisions for their specific profiles. In addition, the duty of monetary advisors likewise progressively needs making use of complex computer programs to compute the best techniques for investing and also advise clients on where to invest.

There are different kinds of economic advisors including: Private Financial Advisors, Public Financial Advisors, and also International Financial Advisors. They all have slightly various duties yet all play an essential duty in aiding individuals with their financial investments. For example, a personal financial consultant works on the client's behalf as well as helps them develop long-term financial savings as well as financial investment plans. They additionally help people manage their finances on an everyday basis and also advise them on just how ideal to get ready for the future. Public financial consultants are required to meet a demand by the UK Financial Services Authority and have to pass a collection of examinations. They are called for to encourage people regarding just how to get the best offer on credit report, obtain from as well as lend to them.

The function of a global monetary adviser differs somewhat from that of a UK monetary advisor. A worldwide consultant operates in a different time zone as well as calls for a bit much more expertise and experience. Most financial advisors will certainly function just within the UK, but there are some that work around the world as well as can assist people with global investments. This makes sure that they have an extensive expertise of international investments and schemes.

The work of a wealth manager varies slightly from a monetary advisor. A wide range supervisor handles an individual's money as well as spends it in various locations and sectors. While the monetary advisor only handles the client's financial investments on a daily basis. It is usually the riches manager that makes the financial investment choices as well as supplies advice on which investment options might be a good option for the client.

There are differences between personal and public wealth managers. Public monetary advisors are generally registered with the Financial Solutions Authority as well as operate in an industry-specific field. Exclusive wealth supervisors often tend to be independent and therefore do not require to sign up with the FSA. Financial advisors can provide suggestions on anything to do with the monetary industry, along with being able to aid set up brand-new financial investments and handle existing financial investments.

Financial guidance can be available in the kind of books, magazine short articles, trading ideas and also on the internet info. Some economic solutions advisors are additionally educated brokers and also can provide recommendations on anything to do with creating investment portfolios. https://hbr.org/2020/06/providing-financial-services-to-employees-is-a-win-win can encourage on pension plan and also cost savings plans, invest in shares and mutual funds and assist people discover the very best retirement homes. best rated financial planners provide financial advice for estate planning and also property defense.

The duty of an economic advisor as well as financial solutions adviser typically overlaps, depending upon what kind of guidance is being provided. Some advisors function solely as economic services experts while others might also use home loans, pension plans, annuities, savings and loans and various other financial items to people. In general, an advisor supplies financial investment recommendations and also financial planning services. Whether https://blogfreely.net/cesar07kirk/financial-advis...-duty-in-your-financial-future buying or offering shares or discovering the very best insurance cover, an economic expert can help you accomplish your financial objectives.

|

|

What Sort of Roles A Financial Advisors Can Play In Your Life With His Knowledge |

Content written by-Mendoza Linnet

An economic professional or economic advisor is somebody who offers monetary recommendations to customers according to their individual economic circumstances. In most countries, monetary advisors are required to finish particular training as well as obtain registration with a regulatory body to use specialist suggestions. A lot of advisors have an MBA and also normally are experts in one of 3 areas - pension plans, financial investment, or finance.

Although some economic advisors work individually, many locate that benefiting a larger organisation includes sophistication to their role and additionally provides them with the chances to advertise brand-new items as well as discover brand-new markets. The variety of global investors has actually enhanced substantially in the last few years, specifically given that the Global Financial Economic downturn started in 2021. This has actually created an enormous requirement for economic advisors to assist individuals comprehend the various choices available as well as help them make the right choices for their individual profiles. Furthermore, the function of monetary consultants likewise significantly requires the use of complicated computer programs to calculate the most effective methods for investing and encourage customers on where to invest.

There are different kinds of economic experts consisting of: Private Financial Advisors, Public Financial Advisors, as well as International Financial Advisors. They all have somewhat various duties yet all play a crucial role in helping people with their financial investments. As an example, an exclusive financial expert deals with the client's behalf and helps them establish lasting savings and financial investment plans. They also assist people manage their financial resources on an everyday basis as well as recommend them on exactly how ideal to prepare for the future. Public economic consultants are required to fulfil a requirement by the UK Financial Provider Authority as well as have to pass a series of examinations. They are needed to advise individuals regarding exactly how to get the very best bargain on credit, borrow from as well as offer to them.

The function of an international financial advisor varies somewhat from that of a UK economic consultant. A global expert works in a various time zone as well as requires a little bit much more understanding as well as experience. https://zona0987trey.bravejournal.net/post/2021/07...-Your-Life-With-His-Experience will certainly work just within the UK, however there are some that function around the world and can help people with global investments. This ensures that they have a thorough expertise of worldwide investments as well as schemes.

The task of a wide range supervisor varies slightly from a financial consultant. A riches manager manages an individual's cash and invests it in various areas as well as industries. While the monetary expert only takes care of the client's financial investments on an everyday basis. It is frequently the riches supervisor who makes the financial investment choices as well as offers recommendations on which investment alternatives could be an excellent selection for the customer.

There are distinctions between private and also public wide range supervisors. Public monetary experts are usually signed up with the Financial Solutions Authority as well as work in an industry-specific area. Exclusive wide range managers have a tendency to be independent as well as therefore do not need to sign up with the FSA. Financial consultants can supply recommendations on anything to do with the economic sector, as well as being able to help establish brand-new financial investments and manage existing investments.

Financial guidance can can be found in the kind of publications, publication posts, trading suggestions and on the internet details. Some economic solutions advisers are likewise educated brokers as well as can provide recommendations on anything to do with creating financial investment portfolios. Financial planners can advise on pension plan and financial savings strategies, buy shares and also mutual funds and also aid people find the very best retirement homes. independent certified financial planner supply monetary advice for estate planning and also asset security.

The duty of a monetary advisor as well as economic services consultant commonly overlaps, relying on what kind of suggestions is being provided. Some consultants work solely as economic solutions consultants while others might likewise supply home loans, pension, annuities, savings and loans and also various other economic products to people. Generally, investment consultant gives financial investment recommendations and also financial preparation solutions. Whether it's acquiring or marketing shares or discovering the best insurance cover, a monetary expert can help you attain your financial objectives.

|

|

How To Choose The Company For Audit Solutions |

Article by-Hewitt Weber

In this day and age, many organizations as well as corporations can not work without accountancy services. To handle the day-to-day financial procedures of the restaurants, restaurants require accounting professional services. As a result, the requirement for such companies is rather high in the market. Obviously, for small business proprietors, this offers great news yet with it comes several difficulties. Just how then can small and also medium-sized local business owner discover a suitable companion to help them with accountancy?

Prior to making a final decision on which accounting company or provider to choose from, it is necessary to assess your distinct circumstances. If you are a new business owner with no previous experience with this field, then you must select a company that supplies a comprehensive bundle to make sure that all your demands are fulfilled. A few of the solutions supplied by many accounting professionals include tax preparation, insurance, payroll handling, customer management, bookkeeping services, and also accounting.

Little and also medium-sized businesses usually lack the resources of large business or companies. This suggests that they can not afford to employ extremely educated accounting professionals who will certainly be essential for finishing their monetary evaluation, particularly with intricate tax systems. It is likewise quite expensive to hire accounting professionals to execute the financial evaluation themselves, which implies that the business will certainly miss out on possibilities for conserving cash. Consequently, just accounting services that give advanced financial evaluation as well as tax preparation for little and also medium-sized business are optimal.

https://www.investopedia.com/best-accounting-firms-5094262 following action to locating an audit solution is to examine the accountancy companies that are advised by your friends and family members. Additionally, you can make use of on the internet service directory sites that focus on such company. Once you have shortlisted a few possible companies, you can after that experience the checklist to discover the one that meets your accountancy needs. Most accountants that specialize in this sort of solution will have web sites where you will be able to find out more concerning their proficiency and contact details. Many accountants likewise have phone number that you can contact us to get additional information.

A lot of audit services will provide both basic services as well as specialty services such as payroll preparation, tax prep work, and also monetary evaluation. The bookkeeping services that offer basic solutions will prepare as well as file the income tax returns. They will likewise help with the declaring of state and federal tax returns and supply records as well as recommendations on these issues. Nonetheless, they will normally not offer help with offshore accounts or tax planning. Commonly these sorts of solutions would certainly be supplied by an accounting professional or cpa.

A service giving customized bookkeeping services will certainly concentrate on providing aid with complicated tax plans and will just use advice and support on tax issues. This sort of firm will not be required to prepare as well as file the government or state income tax returns. However, https://www.accountingtoday.com/news/accountants-rush-to-wrap-up-end-of-year-issues may can helping with offshore accounts and/or planning for an owner of an organization who has actually set up a corporation or LLC. Most accountancy software application attends to a company to establish a company or LLC in either a domestic or international territory. This allows the firm to establish one more business, called the "pass-through entity", which will certainly act as its very own legal entity for tax purposes.

The majority of accountants that provide specialized accountancy solutions will have certain divisions or staff members that take care of various locations of taxation. In many cases, a client will select a company that has a department with members that deal especially with issues that drop under their organization or specific fields of knowledge. As an example, some companies may just use tax preparation assistance. If your company entails global profession, a company that deals only with tax obligation preparation will certainly be most appropriate.

In order to finest utilize the accountancy services offered by any company, it is essential for you to comprehend their capacities, and what sorts of tax solutions are readily available. Usually, accountants using specialized public bookkeeping solutions will have basic everyday bookkeeping abilities, along with specialized expertise of tax regulations and also the Internal Revenue Service. These accountants will certainly be proficient at giving assistance for customers in regard to preparing all needed types and also will additionally have expertise regarding federal as well as state taxation legislations. Furthermore, these accountants might be adept at recognizing as well as offering services to problems that occur worrying conformity with legal demands, as well as in many circumstances, will certainly have the ability to give their customers with professional legal recommendations pertaining to these problems.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Certified Public Accountant Bookkeeping Services Tax preparation |

What Kind of Responsibilities A Financial Advisors Can Play In Your Life With His Proficiency |

Staff Writer-Jamison Noble

A financial professional or monetary adviser is somebody that offers financial recommendations to clients according to their private monetary conditions. In most countries, monetary advisors are called for to complete specific training and get registration with a regulative body to use specialist advice. The majority of advisers have an MBA and normally specialise in one of three locations - pension plans, investment, or financing.

Although investment consultant search , several locate that benefiting a bigger organisation includes sophistication to their duty and additionally supplies them with the possibilities to advertise new items and check out brand-new markets. The number of worldwide financiers has actually enhanced considerably in the last few years, specifically given that the Global Financial Recession started in 2021. This has created a huge requirement for monetary consultants to aid people understand the various options available and help them make the right choices for their individual portfolios. In addition, the duty of economic advisors additionally increasingly needs the use of intricate computer programs to compute the most effective strategies for investing and also recommend clients on where to spend.

There are different sorts of financial advisors including: Private Financial Advisors, Public Financial Advisors, and International Financial Advisors. They all have a little various roles however all play a crucial duty in aiding individuals with their investments. For https://writeablog.net/fallon67demetrius/choosing-...afeguard-your-financial-future , an exclusive monetary advisor works on the client's part and also helps them develop long-lasting financial savings as well as investment plans. They additionally assist individuals manage their funds on a daily basis as well as recommend them on how finest to prepare for the future. Public monetary consultants are called for to meet a demand by the UK Financial Services Authority and need to pass a series of examinations. They are required to suggest people about how to obtain the very best offer on credit rating, obtain from as well as provide to them.

The role of a worldwide economic adviser differs slightly from that of a UK financial advisor. A worldwide advisor works in a different time zone and requires a bit more understanding as well as experience. The majority of economic advisers will certainly function just within the UK, but there are some that function worldwide and also can aid people with global investments. This ensures that they have an in-depth understanding of worldwide investments as well as plans.

The job of a wealth manager differs somewhat from a monetary consultant. A riches manager takes care of an individual's money and invests it in different areas and also markets. While the financial expert just handles the client's financial investments on an everyday basis. It is often the wide range supervisor that makes the financial investment choices as well as offers advice on which financial investment alternatives might be an excellent selection for the customer.

There are differences in between personal and public wide range supervisors. Public monetary consultants are normally registered with the Financial Provider Authority and also work in an industry-specific area. Exclusive riches managers have a tendency to be freelance and also therefore do not need to sign up with the FSA. Financial advisors can offer suggestions on anything to do with the monetary market, in addition to being able to help set up brand-new investments and handle existing financial investments.

Financial recommendations can can be found in the type of books, magazine posts, trading ideas as well as on the internet info. Some financial solutions advisers are additionally trained brokers and can provide recommendations on anything to do with putting together financial investment portfolios. Financial coordinators can suggest on pension and financial savings strategies, buy shares as well as mutual funds as well as assist people locate the best retirement community. Some additionally give monetary advice for estate preparation and also asset protection.