Web Content Writer-Herbert Cameron

Custom coins use an unique way to honor and keep in mind crucial moments in a tangible fashion. These personalized symbols lug a feeling of importance and recognition that exceeds simple words. From commemorating achievements to celebrating turning points, custom coins envelop sentiments that words alone can not share. The detailed styles and customizable attributes of these coins make them a thoughtful and long-lasting memento. Discover exactly how custom-made coins can include a touch of individuality and nostalgia to your unique events.

## Advantages of Custom-made Coins

Customized coins provide an one-of-a-kind means to celebrate unique events and achievements. By developing custom coins for celebrations like graduations, business milestones, or military accomplishments, you can provide a concrete symbol of recognition. These coins not only serve as keepsakes yet likewise lug a sense of pride and accomplishment. When recipients get custom-made coins, they really feel appreciated and valued for their effort and commitment.

One of the major benefits of custom coins is their convenience. You can personalize the style, shape, and product to fit the occasion perfectly. Whether you like a classic round coin or a personalized form that represents your company, the options are endless. In addition, customized coins are durable and lasting, guaranteeing that the recipients can cherish them for many years to come. Furthermore, customized coins can likewise work as reliable marketing tools, spreading understanding of your brand name or cause in an unique and remarkable means.

## Design Options for Custom Coins

When designing personalized coins, you have a wide variety of choices to select from to make them truly special and significant for your unique occasion. One prominent design option is to integrate detailed details such as logo designs, dates, and unique messages that hold value to the occasion being memorialized.

Additionally, you can opt for 3D styles that include deepness and appearance to the coin, making it aesthetically appealing and responsive. Another creative option is to make use of various coatings like antique, brightened, or colored enamel to boost the overall appearance of the coin.

Custom shapes, such as hearts, stars, or even puzzle items, can additionally be made use of to make the coin attract attention. Additionally, the edge of the coin can be tailored with reeded, wave-cut, or diamond-cut patterns to add a touch of sophistication.

## Ways to Make Use Of Custom-made Coins

Think about integrating custom-made coins right into your unique event to include an one-of-a-kind touch and develop enduring memories. discover this -made coins can be utilized in various ways to boost the experience for you and your visitors.

One innovative method to utilize custom-made coins is as distinct event invites. As opposed to conventional paper welcomes, stun your visitors with individualized coins that they can maintain as a keepsake.

One more great way to utilize custom coins is as event prefers. Offer https://fb.watch/rltX_7YEbQ/ of recognition that they can value long after the occasion is over.

Personalized coins likewise make outstanding awards or acknowledgment tokens. Whether you're hosting a company event or an institution ceremony, custom-made coins add status and significance to the event.

Additionally, custom coins can work as collectibles for hobbyists or fanatics attending your event, making them even more memorable.

## Verdict

To conclude, customized coins are like radiating celebrities overhead, every one special and special, memorializing significant moments with grace and elegance.

From honoring staff member to celebrating achievements, these tokens act as timeless reminders of the pride and joy really felt during these unique events.

With their intricate styles and personalized messages, custom coins really catch the essence of the occasion, creating long lasting memories that will certainly be treasured for several years to find.

Discover The Tailored Allure And Historic Importance Of Personalized Coins In Boosting Your Collection With A Touch Of Personalization And Unique Tales That Set Them Apart |

Write-Up Created By-Stentoft Abbott

When it comes to broadening your collection, couple of additions offer the blend of individual touch and historic allure that personalized coins do. The ability to craft coins to your preferences and interests is simply the beginning of their charm. The innate worth and tales behind these coins produce a sense of connection to the past that is hard to resist. However there's even more to custom coins than satisfies the eye-- keep reviewing to discover just how they can elevate your collection to brand-new elevations.

## Special Customization

When tailoring coins for your collection, you can choose distinct personalization alternatives that reflect your uniqueness and style. Individualizing your coins allows you to develop an one-of-a-kind collection that speaks with your preferences and interests. From adding your initials or a substantial day to integrating particular layouts or signs, the possibilities are limitless.

One means to personalize your coins is by etching them with unique messages or quotes that hold indicating to you. Whether it's an inspirational expression or a suggestion of a special memory, these inscriptions can make your coins truly one-of-a-kind. Additionally, you can choose various surfaces, such as antique, polished, or tinted, to give your coins a distinctive appearance.

An additional choice for personalization is picking the shape and size of your coins. Custom forms like stars, hearts, and even custom lays out can add an imaginative touch to your collection. Additionally, picking one-of-a-kind materials like silver, gold, or copper can better boost the visual appeal of your coins. By discovering these personalization alternatives, you can curate a collection that's both meaningful and visually striking.

## Historical Value

To recognize the historic significance of custom coins in your collection, take into consideration the tales and context behind each coin's layout and manufacturing. Custom coins typically birth symbols, insignias, or dates that hold particular historic relevance. They can memorialize significant occasions, honor noteworthy numbers, or signify a particular era. By delving right into the history of these coins, you discover a rich tapestry of stories that connect you to the past.

https://www.providencejournal.com/story/news/2020/...sell-challenge-coin/114223934/ personalized coin is a substantial item of history that envelops the values, ideas, and milestones of its time. Whether it's a coin celebrating an army accomplishment, marking a national wedding anniversary, or standing for a cultural practice, these coins function as mini time capsules that move you to different periods and contexts.

Possessing custom-made coins with historical relevance enables you to protect and value the heritage they embody. As you include these coins to your collection, you not just acquire unique and lovely items however also come to be a custodian of history, continuing the tales and heritages they represent for future generations to value.

## Investment Prospective

Consider the potential for monetary development and stability that personalized coins offer as an investment possibility. Custom coins can be more than just a collector's thing; they've the possible to increase in worth with time, making them a wise investment choice. Right here are 4 reasons purchasing custom-made coins can be a financially rewarding endeavor:

1. ** Restricted Supply **: Custom-made coins are commonly produced in minimal amounts, making them unusual and extremely searched for by collectors. This shortage can drive up their worth considerably.

2. ** Historic Significance **: Several custom coins are created to memorialize vital events or figures, including in their historic value. This historical significance can draw in a large range of enthusiasts, better raising the demand for these coins.

3. ** Artistic Worth **: Custom-made coins are typically diligently created and crafted, making them not just a piece of currency, but a masterpiece. The creative worth of these coins can value with time, especially if they're created by distinguished musicians.

4. ** Diversity **: Purchasing custom-made coins can supply diversity to your investment portfolio. Unlike typical stocks or bonds, customized coins provide a tangible possession that can help spread threat and possibly improve returns.

## Verdict

So, why not add some customized coins to your collection? With unit coins , historical significance, and financial investment capacity, they're the best addition for any kind of collector.

That recognized that something so small could hold a lot worth and significance?

Do not lose out on the opportunity to own a piece of history that can also possibly grow in value over time.

Personalized coins genuinely are a surprise gem on the planet of collecting.

Check Out The Mysteries Of Challenge Coins-- Learn More About How These Little Tokens Are Linked To A Practice |

military coins online Developed By-Burris Morris

Challenge coins hold an extensive background that goes beyond time, embodying a tradition steeped in honor and unity. As you contemplate the importance of these coins, you'll locate they serve as more than simply symbols-- they are signs of shared experiences and friendship. But what makes these coins truly classic? Remain tuned as we check out the elaborate information that make Challenge coins an enduring practice of commemoration and unity.

## Historical Beginnings of Challenge Coins

Exploring the historic origins of Challenge coins discloses their intriguing advancement within armed forces society. These coins trace back to ancient Rome, where soldiers were compensated with unique coins for their achievements. The tradition proceeded via the centuries, with a remarkable spike throughout World war when American volunteers created flying armadas in support of France. One well-off lieutenant had bronze medallions produced his device as an icon of friendship.

The concept of Challenge coins as we understand them today solidified throughout World War II. American soldiers embraced the method, making use of coins to verify subscription in a specific system or to honor considerable occasions. These coins weren't only icons of satisfaction however also served functional functions, such as confirming identity in covert procedures.

With time, Challenge coins evolved beyond the army, ending up being popular amongst numerous companies and also as collectibles. https://www.fox23.com/news/tulsa-police-create-uni...db-5db8-b4d7-333253c624cd.html of Challenge coins showcases their enduring value and the worths of honor, loyalty, and unity they represent.

## Meaning and Significance

As Challenge coins got popularity amongst different organizations, their symbolism and significance strengthened, showing worths of honor, commitment, and unity. These coins work as substantial representations of shared experiences, achievements, and subscription in a certain group or system. The styles etched on Challenge coins often include icons that hold unique definition to the company, such as emblems, adages, or important days. Each coin narrates and lugs with it a feeling of satisfaction and belonging.

The act of offering a difficulty coin is a gesture of respect, gratitude, and friendship. It symbolizes acknowledgment for exemplary solution, outstanding accomplishments, or a bond forged via shared obstacles. Getting a difficulty coin is a moment of honor and validation, promoting a feeling of unity and uniformity among employee. Lugging a difficulty coin isn't just a tradition yet a commitment to uphold the values it stands for, promoting a culture of common support and commitment within the organization.

## Effect on Unity and Belonging

The presence of Challenge coins within a group fosters a feeling of unity and belonging among members. These coins hold greater than just financial worth; they symbolize common experiences and a common bond that joins people.

Here are four ways in which Challenge coins effect unity and belonging:

- ** Advertises Friendship **: Exchanging Challenge coins develops a sensation of camaraderie among participants, fostering stronger relationships and a feeling of togetherness.

- ** Motivates Inclusivity **: The practice of Challenge coins promotes inclusivity by offering each member a tangible icon of their membership within the team.

- ** Enhances Team **: Displaying and trading Challenge coins instills a sense of esprit de corps, motivating participants to work together in the direction of usual objectives.

- ** Fosters Pride **: Owning a challenge coin imparts pride in people, creating a common sense of success and satisfaction in belonging to the team.

## Verdict

So, following time you're feeling down, just whip out your Challenge coin and advise on your own of all the honor, loyalty, and unity you embody.

It's like a little piece of recognition in your pocket, improving your spirits and making you feel like a real badass.

Challenge coins may be tiny, however they load a type promoting friendship and celebrating shared experiences.

Maintain that coin close, and keep beaming, you epic hero, you.

Personalized Coins: An Original Approach To Bear In Mind Essential Occasions |

Write-Up By-Harris Hartvigsen

Personalized coins provide a distinct way to recognize and bear in mind crucial moments in a concrete manner. These tailored tokens carry a feeling of value and appreciation that surpasses mere words. From honoring success to celebrating milestones, customized coins encapsulate views that words alone can not share. The elaborate styles and adjustable features of these coins make them a thoughtful and enduring memento. Discover how custom coins can add a touch of uniqueness and sentimentality to your unique events.

## Benefits of Custom-made Coins

Custom coins provide an unique means to honor special events and achievements. By producing personalized https://www.santaclaraca.gov/Home/Components/News/News/42485/ for events like college graduations, company turning points, or military achievements, you can give a substantial icon of acknowledgment. These coins not just serve as mementos yet additionally carry a feeling of satisfaction and achievement. When recipients get customized coins, they feel valued and valued for their effort and commitment.

Among the primary benefits of custom coins is their convenience. You can personalize the style, form, and product to fit the event flawlessly. Whether https://fb.watch/rlu1plhvuq/ favor a classic round coin or a personalized shape that represents your company, the choices are endless. In addition, customized coins are durable and resilient, ensuring that the receivers can value them for many years to find. Moreover, personalized coins can likewise work as efficient advertising tools, spreading understanding of your brand name or create in a distinct and memorable way.

## Design Options for Custom-made Coins

When creating custom-made coins, you have a variety of options to select from to make them really special and purposeful for your unique celebration. One prominent layout alternative is to integrate detailed information such as logos, days, and special messages that hold importance to the event being commemorated.

Furthermore, you can opt for 3D designs that add depth and texture to the coin, making it visually appealing and responsive. An additional imaginative choice is to use various surfaces like vintage, polished, or colored enamel to improve the overall appearance of the coin.

Personalized shapes, such as hearts, celebrities, and even puzzle items, can also be utilized to make the coin attract attention. In addition, the edge of the coin can be personalized with reeded, wave-cut, or diamond-cut patterns to include a touch of elegance.

## Ways to Utilize Custom-made Coins

Take into consideration including custom-made coins right into your unique occasion to add an unique touch and develop lasting memories. Customized coins can be made use of in numerous methods to improve the experience for you and your visitors.

One creative means to make use of personalized coins is as one-of-a-kind occasion invitations. Instead of typical paper invites, shock your visitors with customized coins that they can keep as a token.

An additional fantastic way to make use of custom-made coins is as party favors. Offer your guests a token of appreciation that they can value long after the event mores than.

Personalized coins also make excellent honors or recognition tokens. Whether you're hosting a company occasion or a school event, custom coins add prestige and significance to the celebration.

Moreover, custom coins can serve as antiques for enthusiasts or enthusiasts attending your event, making them much more remarkable.

## Final thought

To conclude, custom-made coins resemble radiating celebrities in the sky, each one unique and unique, honoring substantial minutes with grace and style.

From recognizing staff member to celebrating success, these symbols serve as classic reminders of the pride and joy felt during these unique celebrations.

With their elaborate styles and customized messages, custom-made coins absolutely record the significance of the occasion, developing long-term memories that will certainly be valued for several years to find.

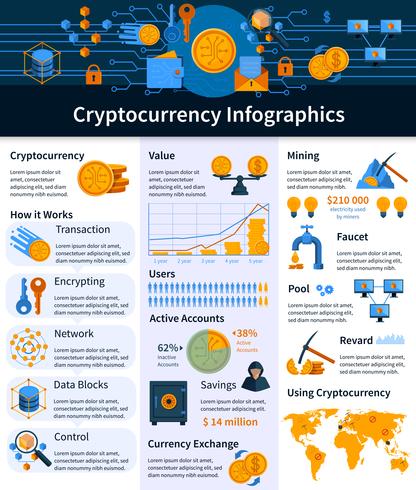

Blockchain Explained: A Newbie'S Overview |

what are blockchain bridges By-Wright Barton

Picture a globe where you can track every component in your morning mug of coffee back to the specific farm it was expanded on, with no area for adjustment or mistake. This is where blockchain technology steps in.

But how can a decentralized system that assures transparency and protection achieve such accuracy and trust fund? By comprehending the fundamental concepts behind blockchain, you'll open a new world of opportunities that could revolutionize sectors beyond just financing.

What Is Blockchain?

Blockchain is a decentralized electronic journal that tapes deals across multiple computers in a safe and clear manner. It runs without a central authority, making it resistant to fraud and tampering.

When you make a transaction, it obtains verified by a network of computers, referred to as nodes, guaranteeing its credibility. This verification process includes a new block of data to the chain, creating an unalterable record. Each block has an unique cryptographic hash that connects it to the previous block, developing a secure chain of information.

This openness and security make blockchain perfect for various applications past cryptocurrencies, such as supply chain monitoring, electing systems, and healthcare records.

How Does Blockchain Work?

To recognize how blockchain works, consider it as an electronic ledger that operates with a decentralized network of computers, guaranteeing safe and secure and clear purchases. When https://squareblogs.net/graig55blair/the-duty-of-blockchain-fit-the-web-of-things is started, it obtains bundled with other purchases in a block. This block is after that verified by several computer systems in the network prior to being included in the chain. This process ensures that the purchase is legitimate and can not be modified retroactively.

Welcome the power of blockchain modern technology via its essential attributes:

- ** Immutability **: When a block is added to the chain, it can't be modified.

- ** Openness **: All participants have accessibility to the very same details, advertising trust.

- ** Decentralization **: No single entity has control, fostering a much more autonomous system.

## Perks of Blockchain Technology

Unlock numerous benefits by accepting blockchain innovation in your procedures. One crucial advantage is raised transparency. With blockchain, all purchases are videotaped on a decentralized ledger, noticeable to all events involved. This openness enhances trust and lowers the threat of fraudulence.

Additionally, blockchain gives enhanced protection with its cryptographic algorithms, making it exceptionally tough for hackers to damage the information. Another benefit is efficiency. Smart agreements automate processes, lowering the demand for middlemans and simplifying operations.

Cost-effectiveness is likewise a significant perk, as blockchain gets rid of the need for third-party confirmation, saving both money and time. By leveraging blockchain technology, you can transform your company procedures and stay in advance in today's electronic landscape.

Final thought

Much like the elaborate dance of a beehive, blockchain technology is an unified network of interconnected nodes collaborating flawlessly.

Each deal is a fragile blossom, thoroughly kept and secured by the diligent bees.

With this decentralized system, count on is constructed and maintained, making sure the sweetness of safety and security and transparency for all that partake in the digital yard of blockchain.

|

Метки: Blockchain Technology Ethereum Virtual Machine Zero-Knowledge Technology Interlocked Pipeline Stages Zero-Knowledge Ethereum Virtual Machine Ethereum Blockchain |

Discover The Transformative Power Of Clever Contracts In Blockchain Modern Technology, And How They Are Improving Industries With Their Self-Executing Capabilities |

Created By-Voss Holck

Picture a world where contracts implement themselves - say goodbye to hold-ups or disagreements. Smart contracts, with their self-executing abilities, are transforming the method transactions are conducted in the blockchain realm. From https://blogfreely.net/candelaria26andre/unlocking...ation-a-comprehensive-overview to improving protection, their influence is indisputable.

Yet just how specifically are these electronic agreements reshaping the landscape of blockchain technology and what effects could they hold for the future of various markets? The capacity is substantial, but so are the challenges.

## Benefits of Smart Contracts

Smart agreements supply numerous benefits in regards to performance and safety and security in blockchain modern technology. By simply click the up coming site of arrangements and getting rid of the requirement for middlemans, wise agreements streamline processes and lower the capacity for mistakes or scams.

With self-executing code embedded in the blockchain, deals are permanent, making sure a high degree of safety. Additionally, wise agreements allow faster purchase rates by eliminating the time-consuming hand-operated procedures commonly associated with agreement execution. This efficiency not only saves time yet additionally reduces expenses related to third-party intermediaries.

## Application in Numerous Industries

When taking into consideration the application of clever agreements in numerous sectors, their capacity for changing typical service procedures ends up being noticeable. https://coingeek.com/revolutionizing-football-thro...e-zetly-io-and-bsv-blockchain/ are being applied in markets like real estate, where they enhance residential or commercial property transactions, decrease documents, and decrease the demand for middlemans.

In the medical care market, clever contracts are enhancing person information safety and security, ensuring openness in medical records, and automating insurance cases processes.

Supply chain administration take advantage of smart contracts by allowing seamless tracking of products, enhancing stock administration, and minimizing deceitful tasks.

In addition, in the lawful area, wise agreements are transforming the implementation of agreements, guaranteeing their stability, and automating conformity procedures.

The implementation of clever agreements across varied markets is paving the way for boosted efficiency and security in company operations.

## Future Ramifications and Challenges

Looking ahead, the evolution of blockchain innovation through wise contracts offers both interesting possibilities and substantial difficulties for sectors worldwide. As this modern technology continues to advance, you can anticipate the adhering to effects and challenges:

1. ** Boosted Effectiveness: ** Smart contracts have the possible to simplify processes, reduce intermediaries, and boost functional effectiveness throughout various industries.

2. ** Security Issues: ** With the increase of smart contracts, making sure robust protection procedures to safeguard delicate data and stop susceptabilities comes to be vital.

3. ** Regulatory Conformity: ** As wise agreements gain grip, browsing the complex regulatory landscape to guarantee conformity with existing regulations and requirements will be an important challenge for services incorporating this innovation.

## Final thought

As clever agreements remain to change blockchain innovation, they act as the trick that opens limitless opportunities for development.

Like a well-oiled equipment, these agreements streamline procedures, enhance protection, and pave the way for an extra effective and clear future.

Welcome the power of clever contracts, and watch as they paint a brighter tomorrow for the world of blockchain.

|

Метки: Blockchain Technology Ethereum Virtual Machine Zero-Knowledge Technology Interlocked Pipeline Stages Zero-Knowledge Ethereum Virtual Machine Ethereum Blockchain |

Tantalizing Insights Into How Blockchain Technology Is Reshaping Sectors Await In This Novice'S Guide |

Write-Up By-Lockhart Braswell

Picture a world where you can track every component in your morning cup of coffee back to the specific ranch it was expanded on, with no room for control or mistake. This is where blockchain modern technology steps in.

But just how can a decentralized system that assures openness and protection attain such precision and trust fund? By comprehending the essential concepts behind blockchain, you'll unlock a brand-new realm of possibilities that could revolutionize markets beyond just financing.

What Is Blockchain?

Blockchain is a decentralized digital ledger that tapes transactions throughout multiple computers in a secure and clear fashion. your domain name operates without a central authority, making it resilient to fraud and meddling.

When you make a purchase, it obtains verified by a network of computer systems, called nodes, ensuring its validity. This confirmation process adds a new block of information to the chain, developing an unalterable document. Each block includes a special cryptographic hash that connects it to the previous block, developing a safe chain of info.

This transparency and security make blockchain suitable for different applications beyond cryptocurrencies, such as supply chain administration, voting systems, and medical care records.

Exactly How Does Blockchain Job?

To comprehend how blockchain functions, consider it as a digital journal that runs through a decentralized network of computer systems, making sure safe and clear transactions. When a purchase is launched, it gets packed with other purchases in a block. This block is after that confirmed by multiple computer systems in the network prior to being added to the chain. This procedure makes sure that the transaction is legitimate and can not be modified retroactively.

Embrace the power of blockchain technology with its key functions:

- ** Immutability **: Once a block is included in the chain, it can not be changed.

- ** Openness **: All individuals have accessibility to the very same information, advertising count on.

- ** Decentralization **: No single entity has control, fostering an extra democratic system.

## Advantages of Blockchain Modern Technology

Unlock various benefits by welcoming blockchain modern technology in your operations. One crucial advantage is raised transparency. With blockchain, all purchases are taped on a decentralized ledger, visible to all events included. This openness boosts trust and lowers the threat of fraudulence.

In addition, blockchain supplies enhanced security via its cryptographic algorithms, making it incredibly difficult for hackers to tamper with the information. Another benefit is performance. Smart contracts automate procedures, minimizing the requirement for middlemans and enhancing procedures.

Cost-effectiveness is likewise a considerable perk, as blockchain gets rid of the need for third-party confirmation, saving both money and time. By leveraging https://www.techtarget.com/searchcio/feature/7-must-know-blockchain-trends , you can reinvent your service procedures and remain ahead in today's digital landscape.

Conclusion

Just like the complex dancing of a beehive, blockchain technology is an unified network of interconnected nodes collaborating effortlessly.

Each purchase is a fragile blossom, thoroughly stored and shielded by the thorough .

Via this decentralized system, trust fund is built and kept, guaranteeing the sweetness of security and openness for all that partake in the electronic yard of blockchain.

|

Метки: Blockchain Technology Ethereum Virtual Machine Zero-Knowledge Technology Interlocked Pipeline Stages Zero-Knowledge Ethereum Virtual Machine Ethereum Blockchain |

The Impact Of Blockchain Innovation On The Atmosphere |

mouse click the up coming webpage By-Donovan Byers

Think of blockchain modern technology as a double-edged sword, puncturing conventional systems with precision yet leaving a path of ecological consequences.

As you discover the influence of blockchain on our world, take into consideration the enormous power consumption and carbon impact related to its operations.

Nevertheless, there is hope coming up as ingenious options emerge to pave the way for even more lasting blockchain methods.

Discover just how this disruptive modern technology is reshaping our globe, and what steps can be required to reduce its environmental results.

## Energy Intake of Blockchain Technology

If you're curious regarding the environmental influence of blockchain modern technology, take into consideration how its energy intake has actually increased problems among sustainability advocates worldwide. The procedure of confirming transactions and developing new blocks on the blockchain calls for considerable computational power, leading to high electricity use. https://writeablog.net/darin05dominga/blockchains-...velopment-of-the-net-of-things -intensive nature originates from the agreement mechanisms utilized, such as Evidence of Job (PoW), which relies upon miners solving complex mathematical problems.

As a result, the carbon impact of blockchain innovation is substantial, adding to problems regarding its sustainability. To deal with these concerns, numerous options like Proof of Stake (PoS) are being checked out to reduce energy consumption. Understanding the energy characteristics of blockchain is crucial for establishing extra environmentally friendly remedies in the future.

## Carbon Footprint of Blockchain Innovation

The carbon footprint of blockchain innovation significantly impacts ecological sustainability because of its high power intake. The procedure of validating deals and developing new blocks in a blockchain network requires tremendous computational power, bring about a considerable carbon footprint.

The energy-intensive consensus devices like Evidence of Work (PoW) utilized in several blockchain networks add to this environmental effect. The power usage associated with mining cryptocurrencies and keeping blockchain networks results in a considerable release of carbon exhausts right into the atmosphere.

As the appeal and usage of blockchain technology grow, so does its carbon impact, increasing problems regarding its lasting ecological consequences. Attending to the carbon impact of blockchain modern technology is vital for achieving an extra lasting electronic future.

## Solutions for Lasting Blockchain Operations

To reduce the ecological impact of blockchain innovation's high power consumption, implementing lasting services for blockchain procedures is crucial. Here are some ways to make blockchain procedures much more eco-friendly:

1. ** Change to Proof of Stake **: Making use of a consensus system that does not count on intensive mining can dramatically lower energy intake.

2. ** Renewable Energy Usage **: Powering blockchain procedures with renewable energy sources like solar or wind can reduce carbon emissions.

3. ** Energy-Efficient Hardware **: Using energy-efficient hardware for mining and deal recognition can decrease total power usage.

4. ** Off-Peak Mining **: Arranging mining activities during off-peak hours when energy need is lower can help in reducing the ecological influence of blockchain operations.

## Final thought

To conclude, the ecological impact of blockchain technology is a pushing issue. The energy consumption and carbon impact connected with blockchain procedures are significant. Applying lasting https://squareblogs.net/serita90manda/blockchains-...velopment-of-the-web-of-things is important to alleviate these impacts.

By accepting environment-friendly practices and enhancing energy performance, blockchain can come to be a much more eco-friendly modern technology. Allow's pursue sustainable blockchain remedies to secure our planet's future.

|

Метки: Blockchain Technology Ethereum Virtual Machine Zero-Knowledge Technology Interlocked Pipeline Stages Zero-Knowledge Ethereum Virtual Machine Ethereum Blockchain |

Just How Smart Agreements Are Transforming The Video Game In Blockchain |

Authored By-Clemensen Slattery

Think of a world where agreements execute themselves - say goodbye to hold-ups or conflicts. Smart contracts, with their self-executing capabilities, are changing the way deals are carried out in the blockchain realm. From improving procedures to improving safety and security, their impact is undeniable.

But exactly how specifically are these electronic contracts reshaping the landscape of blockchain technology and what effects could they hold for the future of numerous markets? The possibility is substantial, however so are the challenges.

## Benefits of Smart Contracts

Smart agreements offer countless benefits in regards to efficiency and safety and security in blockchain innovation. By automating the execution of agreements and removing the need for intermediaries, wise agreements simplify procedures and decrease the capacity for errors or fraudulence.

With self-executing code installed in the blockchain, purchases are permanent, making sure a high degree of safety and security. Additionally, wise agreements allow quicker purchase speeds by eliminating the time-consuming hands-on processes commonly associated with contract execution. This performance not just saves time yet also lowers prices connected with third-party middlemans.

## Application in Different Industries

When considering the application of wise contracts in numerous sectors, their potential for transforming typical service processes ends up being noticeable. These contracts are being implemented in fields like real estate, where they improve home transactions, lower paperwork, and decrease the need for intermediaries.

In the healthcare market, clever contracts are improving person information safety and security, making sure transparency in medical records, and automating insurance cases processes.

Supply chain management gain from clever contracts by allowing seamless tracking of products, maximizing supply administration, and minimizing illegal activities.

Additionally, in the lawful area, clever contracts are transforming the implementation of contracts, guaranteeing their stability, and automating conformity procedures.

https://squareblogs.net/cecila8corey/the-future-of...blockchain-is-changing-banking of smart agreements across varied industries is leading the way for increased effectiveness and safety in company procedures.

## Future Ramifications and Difficulties

Looking ahead, the development of blockchain innovation with wise agreements provides both amazing opportunities and considerable challenges for industries worldwide. As this modern technology remains to breakthrough, you can expect the complying with implications and difficulties:

1. ** Enhanced Performance: ** Smart agreements have the possible to enhance procedures, minimize intermediaries, and enhance operational efficiency throughout numerous industries.

2. ** Safety Problems: ** With the increase of wise contracts, guaranteeing durable safety and security actions to secure delicate data and avoid vulnerabilities becomes extremely important.

3. ** Regulatory Conformity: ** As clever agreements gain grip, browsing the intricate governing landscape to ensure compliance with existing laws and criteria will be an essential difficulty for businesses incorporating this technology.

## Verdict

As clever contracts continue to revolutionize blockchain modern technology, they work as the key that unlocks endless possibilities for development.

Like pop over to this website -oiled maker, these contracts streamline processes, boost safety and security, and pave the way for an extra reliable and transparent future.

Accept the power of smart contracts, and watch as they paint a brighter tomorrow for the globe of blockchain.

|

Метки: Blockchain Technology Ethereum Virtual Machine Zero-Knowledge Technology Interlocked Pipeline Stages Zero-Knowledge Ethereum Virtual Machine Ethereum Blockchain |

Exactly How To Get The Employee Retention Tax Credit Score: A Step-By-Step Guide |

Article by-Norwood Fenger

Are you a company owner having a hard time to maintain your employees throughout the pandemic? Are you looking for methods to decrease your tax bill? If so, you may be qualified for the Employee Retention Tax Obligation Credit Rating (ERTC).

This tax credit scores was produced by the CARES Act to encourage businesses to keep their employees on pay-roll throughout the pandemic.

To get the ERTC, you should meet certain qualification requirements. These needs consist of experiencing a significant decline in gross receipts or being fully or partially put on hold because of a government order.

If you fulfill these demands, you can calculate your ERTC credit history and also case it on your income tax return. In this post, we will supply a step-by-step guide on exactly how to get the ERTC and also benefit from this important tax obligation credit score.

Qualification Demands for the ERTC

To qualify for the ERTC, you'll need to fulfill specific eligibility needs.

Initially, your company must have been either fully or partly put on hold due to a federal government order related to COVID-19. This can consist of orders that restrict business, travel, or team conferences.

Additionally, https://www.accountingtoday.com/podcast/10-top-tips-for-employee-retention may certify if it experienced a considerable decline in gross receipts. This suggests that your company's gross invoices for a quarter in 2020 were less than 50% of its gross receipts for the same quarter in 2019.

In addition to fulfilling one of these 2 needs, your business must also have had less than 500 workers during the calendar year 2019. This consists of permanent as well as part-time employees, in addition to those that were furloughed or laid off during the year.

If your business satisfies these qualification needs, you may be able to assert the ERTC and also get a credit report of up to $5,000 per employee for incomes paid from March 13, 2020, to December 31, 2020.

Determining Your ERTC Credit Scores

Prepared to discover how much money you can save with the ERTC? Let's study computing your credit history.

The first step in computing your credit rating is identifying your certified salaries. This consists of any type of earnings paid to staff members during the eligible period, which is either the initial or second quarter of 2021. The optimum amount of qualified incomes per worker is $10,000 per quarter, and also the credit history is 70% of those salaries, as much as $7,000 per employee per quarter.

When you've determined your qualified salaries, you can determine your credit scores. For instance, if you had 10 workers that each gained $10,000 in qualified wages throughout the eligible duration, your overall qualified incomes would be $100,000.

The debt for each and every worker would be 70% of their qualified incomes, which would be $7,000. Consequently, your total credit would be $70,000.

Remember that there are extra rules as well as limitations to think about, so it is essential to seek advice from a tax professional to ensure you're calculating your credit score correctly.

Asserting the ERTC on Your Income Tax Return

Asserting the ERTC on your tax return is an uncomplicated process, however it is necessary to guarantee that you satisfy all the eligibility requirements.

For example, a small company proprietor with 20 workers who experienced a decline in gross receipts of 50% or even more in Q2 2021 contrasted to Q2 2019 can claim up to $140,000 in tax credit histories on their Form 941 for the eligible quarter.

To declare the ERTC, you'll need to fill in Kind 941, which is the employer's quarterly tax return form. On this kind, you'll require to report the quantity of earnings paid to eligible staff members throughout the eligible quarter as well as the amount of the ERTC that you're claiming.

https://writeablog.net/timmy813my/discovering-the-...port-secret-truths-you-need-to can after that lower your pay-roll tax deposits by the amount of the credit rating or demand a reimbursement of any type of excess credit score by submitting Kind 941-X. It is very important to maintain precise documents and also paperwork to sustain your insurance claim, as the IRS may request to evaluate them throughout an audit.

Final thought

Congratulations! You've made it to the end of our step-by-step guide on exactly how to qualify for the Staff member Retention Tax Obligation Credit History (ERTC). By following the qualification requirements, computing your credit score, and declaring it on your income tax return, you can possibly get a significant tax benefit for keeping your staff members on pay-roll.

Envision the alleviation you'll really feel when you see the debt related to your tax obligation expense, like a weight took off your shoulders. You can utilize the cash saved to reinvest in your organization, employ brand-new workers, or merely commemorate a work well done.

So do not think twice to capitalize on this valuable tax obligation credit and maintain your business prospering!

|

Метки: Employee Retention Credit Employee Retention Tax Credit ERTC Tax Credits Paycheck Protection Program PPP Loan |

The Worker Retention Tax Debt: A Comprehensive Overview For Entrepreneur |

Article by-Webster Lauritsen

Picture you're a captain of a ship, navigating through harsh waters. Your staff is your lifeline, as well as you require them to keep the ship afloat. But what takes place when some of your team participants start leaping ship? You're left with a skeletal system team, battling to maintain the ship progressing.

This is the fact for numerous company owner during the COVID-19 pandemic. The Staff Member Retention Tax Debt (ERTC) is a lifeline for organizations struggling to keep their team intact.

The ERTC is a tax credit report program developed to aid services maintain their staff members throughout the pandemic. https://blogfreely.net/eldridge66chan/exactly-how-...igation-credit-history-can-aid 's a lifeline for organizations that are struggling to keep their doors open and their staff members on the payroll.

As a local business owner, you need to recognize the basics of the ERTC, consisting of qualification requirements and just how to determine and also declare the credit report on your income tax return. In this extensive guide, we'll stroll you through everything you require to learn about the ERTC, so you can maintain your team intact and your business afloat.

The Essentials of the Employee Retention Tax Obligation Credit Scores Program

So, you're a business owner looking for a way to preserve your workers and also save cash? Well, let me tell you concerning the basics of the Worker Retention Tax obligation Debt program âEUR" it may just be the response you have actually been looking for.

The Employee Retention Tax Credit score is a refundable tax obligation credit report that was presented as part of the CARES Respond to the COVID-19 pandemic. This credit report is developed to aid eligible employers maintain their staff members on payroll, even throughout durations of economic hardship.

To be qualified for the Employee Retention Tax Obligation Credit score, your company should satisfy specific requirements. First, your service should have experienced a significant decrease in gross invoices, either due to a government order or because your organization was straight affected by the pandemic.

In visit my web site , if your service has more than 100 employees, you can just declare the credit report for salaries paid to workers that are not giving solutions. For companies with 100 or fewer workers, you can assert the credit history for salaries paid to all staff members, no matter whether they are providing solutions or otherwise.

By capitalizing on the Staff member Retention Tax Obligation Credit scores, you can conserve cash on your payroll tax obligations and also help keep your employees on payroll throughout these unclear times.

Eligibility Requirements for the ERTC

To receive the ERTC, your company should fulfill specific criteria that make it qualified for this valuable opportunity to conserve money and also boost your bottom line. Think about the ERTC as a golden ticket for qualified companies, supplying them with a possibility to open significant cost savings and also benefits.

To be eligible, your business has to have experienced a substantial decrease in gross invoices or been fully or partially put on hold because of government orders connected to COVID-19. Additionally, your business has to have 500 or fewer staff members, as well as if you have more than 100 workers, you need to demonstrate that those employees are being paid for time not functioned as a result of COVID-19.

please click the following internet site is very important to note that the ERTC is readily available to both for-profit as well as not-for-profit companies, making it an accessible option for a variety of entities. By meeting these qualification needs, your service can make the most of the ERTC and profit of this important tax credit program.

How to Determine and also Claim the ERTC on Your Income Tax Return

You're in good luck because determining and also claiming the ERTC on your income tax return is an uncomplicated procedure that can aid you save money as well as improve your profits. Here are the steps you need to take to declare the credit score:

1. Establish your eligibility: Prior to you can determine the credit scores, you require to see to it that you fulfill the qualification needs. See our previous subtopic to find out more on this.

2. Calculate the credit report amount: The amount of the credit history is equal to 70% of the certified earnings paid to employees, approximately an optimum of $10,000 per employee per quarter. To determine the debt, increase the competent earnings paid in the quarter by 70%.

3. Declare the credit score on your tax return: The credit rating is claimed on internal revenue service Form 941, Company's Quarterly Federal Tax Return. You will certainly require to total Component III of the type to claim the credit rating. If the credit scores exceeds your payroll tax obligation, you can request a reimbursement or apply the excess to future payroll tax liabilities.

By adhering to these actions, you can take advantage of the ERTC and conserve money on your tax obligations. Make sure to consult with a tax obligation professional or make use of IRS resources for further guidance on claiming the credit score.

Final thought

So there you have it - a complete overview to the Employee Retention Tax Credit score program for local business owner. Now, you should have a respectable understanding of what the program is, that's eligible for it, and exactly how to determine as well as claim the credit report on your income tax return.

One intriguing fact to note: as of April 2021, the IRS reported that over 100,000 businesses had asserted more than $10 billion in ERTC credit ratings. This goes to reveal simply exactly how helpful this program can be for companies impacted by the COVID-19 pandemic.

If you have not currently, it's definitely worth looking into whether you get approved for the ERTC and also capitalizing on this financial backing to aid maintain your business afloat during these difficult times.

|

Метки: Employee Retention Credit Employee Retention Tax Credit ERTC Tax Credits Paycheck Protection Program PPP Loan |

The Employee Retention Tax Obligation Debt Vs. Various Other Covid-Relief Programs: Which Is Right For Your Business? |

Article writer-Marshall Mckenzie

You're a business owner who's been struck hard by the COVID-19 pandemic. You've had to lay off staff members, close your doors for months, as well as struggle to make ends meet. And now, there are federal government programs offered to help you survive.

Among the most prominent is the Worker Retention Tax Credit History (ERTC), yet there are other choices too. In this post, we'll explore the ERTC as well as various other COVID-relief programs offered to businesses.

We'll break down the advantages, demands, as well as limitations of each program so you can determine which one is right for your service. With a lot unpredictability in the present financial climate, it's vital to recognize your choices and also make notified choices that will assist your company make it through and flourish.

So, let's dive in as well as find the very best program for you.

Understanding the Worker Retention Tax Credit Rating (ERTC)

Trying to find a method to save money and preserve your workers? Check out the Staff Member Retention Tax Obligation Credit Score (ERTC) and how it can benefit your business!

The ERTC is a tax obligation credit score that was introduced as part of the CARES Act in March 2020. It's created to aid businesses that have actually been impacted by the COVID-19 pandemic to keep their employees on pay-roll by using a tax obligation credit for incomes paid during the pandemic.

The ERTC is readily available to businesses with less than 500 employees that have either fully or partly suspended procedures due to the pandemic or have actually seen a substantial decrease in gross invoices.

The tax credit is equal to 50% of certified salaries paid to workers, as much as an optimum of $5,000 per worker. To get approved for the credit, businesses must continue to pay wages to staff members, even if they're not currently working, and must meet other qualification demands set by the IRS.

By benefiting from the ERTC, your company can conserve money on payroll while also preserving your staff members via these challenging times.

Exploring Other COVID-Relief Programs Available to Companies

One choice businesses might consider is benefiting from extra types of economic assistance offered by the federal government. In addition to the Staff member Retention Tax Credit History (ERTC), there are various other COVID-relief programs readily available to companies.

For instance, the Income Defense Program (PPP) gives forgivable lendings to small businesses to help cover payroll and also other expenditures. The Economic Injury Catastrophe Car Loan (EIDL) offers low-interest fundings to small companies impacted by COVID-19. As Well As the Shuttered Venue Operators Grant (SVOG) provides grants to live venue operators, marketers, and ability reps influenced by COVID-19.

Each program has its own eligibility requirements as well as application procedure, so it's important to research study and comprehend which program( s) may be right for your service. Furthermore, some companies may be eligible for numerous programs, which can supply a lot more economic assistance.

By exploring all available options, businesses can make enlightened decisions on how to best use entitlement program to sustain their operations during the ongoing pandemic.

Identifying Which Program is Right for Your Service

Identifying one of the most ideal relief program for your service can be a game-changer in these tough times. Understanding the distinctions in the relief programs available is crucial to identifying which one is best for your organization.

The Employee Retention Tax Credit (ERTC) may be the ideal selection if you're aiming to keep employees on pay-roll. https://postheaven.net/marc6118casimira/recognizin...ation-credit-score-a-guide-for supplies a tax obligation credit rating of approximately $28,000 per worker for organizations that have actually experienced a decline in profits because of the pandemic.

On the other hand, if your company requires more immediate economic help, the Paycheck Protection Program (PPP) may be a much better fit. https://www.knoxnews.com/story/money/business/2021...rforming-employees/8523735002/ provides excusable fundings to cover pay-roll costs as well as various other expenditures.

Furthermore, the Economic Injury Disaster Lending (EIDL) program gives low-interest car loans for businesses that have actually suffered considerable economic injury as a result of the pandemic.

Ultimately, https://postheaven.net/alexa01trinidad/5-ways-to-o...n-tax-obligation-credit-rating for your business depends on its special requirements and also circumstances. It's important to very carefully consider your alternatives and also seek guidance from an economic expert to determine which program is right for you.

Verdict

So, which program is right for your business? Inevitably, the answer relies on your unique circumstance.

If you're qualified for the Staff member Retention Tax Credit History, it could be a valuable choice to think about. Nonetheless, if your company has actually been struck hard by the pandemic as well as you need a lot more instant relief, other programs like the Income Security Program or Economic Injury Disaster Car loan might be better.

In the end, choosing the right COVID-relief program for your service is like choosing the perfect wine for a meal. Equally as you would certainly consider the flavors and aromas of the white wine to enhance the recipe, you must think about the particular requirements and also goals of your business when selecting a relief program.

With mindful factor to consider as well as advice from an economic specialist, you can discover the program that'll best sustain your organization during these tough times.

|

Метки: Employee Retention Credit Employee Retention Tax Credit ERTC Tax Credits Paycheck Protection Program PPP Loan |

Just How The Worker Retention Tax Obligation Credit Can Help Your Business Cut Expenses |

Article writer-Melendez Kvist

Hey there, company owner! Are you wanting to cut costs and save your organization some cash money? Well, have you heard of the Worker Retention Tax Obligation Credit History?

https://postheaven.net/britney7octavio/5-ways-to-o...n-tax-obligation-credit-rating -known tax credit scores could be just what your organization needs to maintain your employees aboard and also your finances in check. The Employee Retention Tax Debt (ERTC) was presented by the government as part of the CARES Act in 2020, and it's been extended via 2021.

The ERTC is a refundable tax credit score that enables eligible employers to declare approximately $5,000 per employee for earnings paid between March 13, 2020, as well as December 31, 2021. In short, it's a way for businesses to decrease their payroll tax obligations while keeping their staff members on the payroll.

But how do you know if you're qualified for the ERTC? Let's figure out.

Understanding the Worker Retention Tax Credit Rating

You'll wish to recognize the Employee Retention Tax Credit rating to see if it can profit your company and also save you cash. The debt was established as part of the Coronavirus Help, Alleviation, and Economic Security (CARES) Act to supply monetary alleviation to organizations influenced by the pandemic.

To be eligible for the credit report, your organization needs to have been totally or partly put on hold as a result of a government order related to COVID-19 or have experienced a considerable decline in gross invoices. The credit scores is equal to 50% of qualified earnings paid to every staff member, as much as a maximum of $5,000 per worker.

This means that if you paid a qualified staff member $10,000 in certified wages, you could get a credit of $5,000. Comprehending the Employee Retention Tax Credit history can assist you identify if it's a practical option for your organization and potentially save you cash on your taxes.

Getting the Employee Retention Tax Credit Rating

Prior to diving into the details of qualification standards, let's take a moment to comprehend what this credit history entails. The Employee Retention Tax Obligation Debt (ERTC) is a tax credit history supplied to businesses that have been affected by the COVID-19 pandemic. It's designed to encourage employers to keep their workers on payroll by providing a financial incentive.

ERTC can aid companies cut costs by balancing out the cost of worker earnings and healthcare benefits. This credit history is available to businesses of all sizes, consisting of non-profit companies.

To get approved for the ERTC, there are specific eligibility requirements that services have to meet. First of all, business needs to have been affected by the COVID-19 pandemic either via a partial or full suspension of operations or a decrease in gross receipts. Second of https://www.bizjournals.com/bizjournals/news/2022/...employee-retention-credit.html , the business must have less than 500 staff members. Services with more than 500 workers can still get the credit if they satisfy certain standards.

Lastly, the business needs to have paid incomes and healthcare advantages throughout the duration it was affected by the pandemic. Understanding the qualification requirements is essential for organizations as it can help them determine if they receive the debt and how much they can declare.

Optimizing Your Benefit from the Staff Member Retention Tax Obligation Debt

Since you understand the eligibility criteria, let's study how to obtain the most out of the Employee Retention Tax Credit as well as take full advantage of the financial advantages for your business. Here are four means to help you do simply that:

1. Determine your eligible incomes properly: Ensure you're computing the debt based on the salaries you paid throughout the qualified duration. This includes any health insurance expenditures you paid in behalf of your employees.

2. Think about modifying prior payroll tax filings: If you really did not make the most of the tax credit history in the past, you can modify previous pay-roll tax filings to declare the credit score and also get a reimbursement.

3. Use the pay-roll tax deferral stipulation: If you're eligible for the credit history however would still such as to preserve cash money, take into consideration delaying the deposit and also payment of the employer's share of Social Security taxes.

4. Keep comprehensive records: It's important to maintain comprehensive records of the salaries as well as qualified health insurance plan expenditures you paid throughout the eligible duration to support your credit insurance claim. By doing so, you can guarantee that you receive the optimum advantage feasible from the Worker Retention Tax Credit.

Verdict

Congratulations! You have actually simply learned about the Staff member Retention Tax Credit Score as well as exactly how it can aid cut costs for your company.

By understanding the qualification requirements as well as maximizing your benefit, you can minimize tax obligations as well as maintain staff members on payroll.

Yet wait, still unsure concerning exactly how to apply? Don't stress, look for help from a tax obligation professional or HR consultant to guide you through the process.

Keep in mind, every buck saved is a buck made. The Worker Retention Tax Credit is a terrific chance to save money while keeping useful workers.

So what are you waiting on? Act currently and take advantage of this tax credit scores to sustain your company and also workers.

Your efforts will not just profit your bottom line but additionally contribute to the growth of the economic situation.

|

Метки: Employee Retention Credit Employee Retention Tax Credit ERTC Tax Credits Paycheck Protection Program PPP Loan |

The Worker Retention Tax Obligation Credit Scores: A Necessary Tool For Building A Stronger Group |

Posted by-Mahoney Austin

Are you battling to keep your best workers on board? The employee retention tax credit score (ERTC) could be the solution you've been looking for.

This tax credit history is made to incentivize services to maintain their staff members on pay-roll during challenging times, and it can be an important tool for building a more powerful team.

By making https://writeablog.net/nikita67orville/top-blunder...ation-for-the-worker-retention of the ERTC, you can not just save money on your taxes however also reveal your group that you value their payments to your organization.

With the ERTC, you can offer your workers with the stability as well as security they need to stick with your business for the long run.

Keep checking out to get more information about how the ERTC functions, how you can get approved for it, as well as exactly how you can optimize its benefits for your team.

Recognizing the Worker Retention Tax Obligation Credit

You'll wish to comprehend the Staff member Retention Tax Credit Scores, as it can supply an useful tool for reinforcing your team and optimizing your business's economic possibility.

The Employee Retention Tax Credit History (ERTC) is a refundable tax debt readily available to qualified employers who have been detrimentally impacted by the COVID-19 pandemic. The credit score is designed to urge entrepreneur to maintain staff members during this tough time by supplying a financial incentive for doing so.

https://writeablog.net/shanelle19barbar/leading-mi...-the-worker-retention-tax-debt permits eligible companies to declare a debt of approximately 50% of certified incomes paid per employee, as much as a maximum credit history of $5,000 per employee. Qualified earnings include salaries paid in between March 13, 2020, and also December 31, 2021, and are based on the variety of permanent workers the employer had in 2019.

To be qualified for Read More Here , the employer should have experienced a substantial decrease in gross receipts or undergone a government closure order as a result of the pandemic.

Comprehending the ERTC and also capitalizing on it can help you keep your team intact as well as make the most of your business's funds.

Receiving the ERTC

To be eligible for the ERTC, organizations have to satisfy particular criteria. Right here are the needs that you require to accomplish in order to get the tax credit rating:

- Your service must have been totally or partly suspended because of a government order related to COVID-19, or have experienced a considerable decline in gross receipts.

- The debt is readily available to organizations with 500 or fewer employees, as well as for salaries paid after March 12, 2020, and also prior to January 1, 2022.

- The ERTC is a refundable tax obligation credit that can be claimed on eligible incomes paid during the quarter, approximately an optimum of $7,000 per worker per quarter.

If your service meets these standards, you may be eligible for the ERTC. The credit report can be an important device to assist you maintain your employees throughout the pandemic as well as reinforce your group for the future.

See to it to speak with a tax obligation professional to ensure you're declaring the credit history correctly and making the most of all available advantages.

Optimizing the Advantages of the ERTC for Your Team

As you browse the challenges of the pandemic, the ERTC can function as a beacon of wish for boosting your workforce and also moving your organization towards success. By optimizing the benefits of the ERTC, you can ensure that your employee get the assistance they need to stick with your firm and add to its development.

One way to optimize the benefits of the ERTC is to stay current on the latest guidelines and also policies. This will aid you determine which workers are qualified for the credit rating as well as just how much you can declare for each and every staff member.

Additionally, you should interact with your staff member concerning the ERTC as well as just how it can benefit them. This will help them comprehend the value of their contributions and also motivate them to remain with your company for the lasting. By taking these steps, you can develop a solid, devoted group that's committed to your organization's success.

Final thought

Congratulations! You've discovered the Employee Retention Tax Obligation Credit Score and also just how it can aid you develop a more powerful team. By capitalizing on this debt, you'll not only save money yet also foster a more faithful and also involved workforce.

Think about it like developing a sporting activities team. The ERTC is like having a superstar player on your group. When you have a superb player, it not only brings success on the area however also brings in various other gifted gamers to join the team.

Similarly, by utilizing the ERTC, you're producing a setting that values and buys your workers, which will certainly bring in as well as preserve leading ability. So, make the most of this crucial tool as well as enjoy your team expand more powerful!

|

Метки: Employee Retention Credit Employee Retention Tax Credit ERTC Tax Credits Paycheck Protection Program PPP Loan |

Navigating The Staff Member Retention Tax Obligation Credit History: Tips For Local Business Owners |

Content by-Tilley Watson

Are you a small business owner battling to maintain your employees throughout the pandemic? The Staff Member Retention Tax Obligation Credit (ERTC) could be the option for you.

Take for example Jane, the owner of a small restaurant in downtown Seattle. Visit Homepage to the COVID-19 dilemma, her business endured a considerable loss in earnings, which made it challenging to keep her employees. The good news is, Jane learnt about the ERTC and had the ability to declare it on her income tax return, offering her service the financial boost it required to maintain her staff utilized.

Browsing the ERTC can be complicated, yet with the right support, small business proprietors like Jane can take advantage of this credit rating. In this write-up, we will provide you with tips on how to determine if you are eligible for the ERTC, just how to calculate the credit scores, and exactly how to claim it on your income tax return.

By the end of this short article, you will certainly have a better understanding of the ERTC and just how it can profit your small business throughout these challenging times.

Eligibility Demands for the ERTC

You'll be alleviated to understand that you can qualify for the ERTC if you've experienced a decrease in profits or were forced to totally or partially shut down because of the pandemic.

Especially, if your business experienced a decrease in gross receipts by more than 50% in any type of quarter of 2020 compared to the exact same quarter in 2019, you might be qualified for the ERTC.

Furthermore, if your service was totally or partly suspended as a result of a government order pertaining to COVID-19 during any type of quarter of 2020, you may likewise certify.

It is essential to keep in mind that if your organization obtained a PPP finance in 2020, you can still get approved for the ERTC. Nevertheless, you can not utilize the same incomes for both the PPP loan mercy as well as the ERTC.

Also, if you received a PPP funding in 2021, you might still be eligible for the ERTC for earnings paid after the PPP loan was gotten.

Overall, it is very important to thoroughly examine the eligibility needs and consult with a tax obligation professional to figure out if your organization gets approved for the ERTC.

Computing the Worker Retention Tax Obligation Credit Rating

Congratulations, you reach do some mathematics to identify how much cash you can come back with the Staff member Retention Tax Debt! The bright side is that the estimation is fairly straightforward.

To begin, you'll need to establish the variety of full time workers you had throughout the eligible quarters. For 2021, eligible quarters are Q3 as well as Q4 of 2020 and Q1 and also Q2 of 2021.

Next off, you'll need to compute the qualified earnings you paid to those employees throughout those eligible quarters. This consists of not just their routine incomes however additionally any health and wellness benefits, retirement advantages, as well as state and local taxes you paid on their part. The optimum amount of qualified earnings you can make use of per employee per quarter is $10,000, so maintain that in mind as you do your computations.

Once you have all of this details, you can make use of the internal revenue service's formula to compute your credit amount. It is very important to keep in mind that the credit history is refundable, so even if you do not owe any kind of taxes, you can still receive the debt as a refund.

Overall, while computing the Employee Retention Tax obligation Credit scores might call for some mathematics, it's a beneficial effort that might cause significant savings for your small company. By making the most of this credit, you can keep your staff members and maintain your company running smoothly during these challenging times.

Claiming the ERTC on Your Income Tax Return

Now it's time to assert your ERTC on your income tax return and also take pleasure in the advantages of the credit scores.

The initial step is to complete Form 941, which is the company's quarterly income tax return. On this type, you'll report the amount of the credit score you're asserting for each quarter.

If the amount of the credit scores is more than the payroll tax obligations you owe for that quarter, you can ask for a reimbursement or use the excess to your following quarter's payroll tax obligations.

Make https://writeablog.net/booker832narcisa/understand...tax-debt-a-guide-for-employers to maintain detailed records of your ERTC calculations as well as documentation to support your insurance claim. The IRS may request additional info to verify your qualification for the credit score, so it's important to have everything in order.

As soon as you have actually submitted your Form 941 with the ERTC details, the IRS will evaluate it and also establish the amount of credit you're eligible for. If there are any type of errors or disparities, they may call you for more clarification.

Generally, claiming the ERTC on your income tax return can provide useful cost savings for your local business, so see to it to take advantage of this opportunity.

Conclusion

Congratulations! You have actually made it throughout of this short article on navigating the staff member retention tax obligation credit scores. Now, you ought to have a good understanding of the eligibility demands for the ERTC, just how to determine the credit rating, and also how to assert it on your tax return.

However prior to you go, below's an interesting statistic for you: according to a recent study by the National Federation of Independent Company, just 20% of small company owners were aware of the ERTC. This suggests that there are likely numerous local business available losing out on this useful tax obligation credit rating.

Don't allow your organization be among them! Make the most of the ERTC and maintain your important staff members aboard. As always, consult with a tax obligation professional to guarantee you're capitalizing on all readily available tax credit scores as well as deductions. Best of luck!

|

Метки: Employee Retention Credit Employee Retention Tax Credit ERTC Tax Credits Paycheck Protection Program PPP Loan |

The Employee Retention Tax Obligation Debt Vs. Other Covid-Relief Programs: Which Is Right For Your Business? |

Content written by-Marshall Olson

You're an entrepreneur who's been struck hard by the COVID-19 pandemic. You've needed to lay off workers, shut your doors for months, and struggle to make ends satisfy. Now, there are federal government programs offered to help you survive.

Among the most popular is the Worker Retention Tax Credit History (ERTC), however there are various other alternatives as well. In this article, we'll check out the ERTC as well as various other COVID-relief programs offered to services.

We'll break down the advantages, needs, and also limitations of each program so you can identify which one is right for your service. With a lot unpredictability in the existing economic climate, it's critical to recognize your alternatives and make notified choices that will aid your company make it through and also thrive.

So, allow's dive in and also discover the very best program for you.

Comprehending the Employee Retention Tax Credit Rating (ERTC)

Trying to find a means to save cash and also maintain your staff members? Look into the Staff Member Retention Tax Credit Report (ERTC) and also just how it can profit your business!

The ERTC is a tax obligation credit that was introduced as part of the CARES Act in March 2020. It's designed to help businesses that have been impacted by the COVID-19 pandemic to maintain their staff members on payroll by providing a tax obligation credit scores for earnings paid throughout the pandemic.

The ERTC is readily available to organizations with fewer than 500 employees that have either completely or partially suspended procedures because of the pandemic or have actually seen a significant decrease in gross invoices.

The tax obligation credit amounts to 50% of qualified incomes paid to staff members, approximately an optimum of $5,000 per worker. To get approved for the credit report, businesses need to continue to pay salaries to employees, even if they're not presently functioning, and need to meet other qualification demands set by the internal revenue service.

By making use of the ERTC, your company can save cash on pay-roll while likewise maintaining your workers via these tough times.

Exploring Other COVID-Relief Programs Available to Companies

One alternative businesses might consider is capitalizing on added types of economic assistance offered by the government. Along with the Staff member Retention Tax Obligation Credit Report (ERTC), there are various other COVID-relief programs offered to services.

For example, the Income Security Program (PPP) supplies excusable fundings to small companies to help cover pay-roll as well as other costs. The Economic Injury Calamity Car Loan (EIDL) offers low-interest financings to local business affected by COVID-19. And simply click the up coming internet site Shuttered Venue Operators Grant (SVOG) offers grants to live place operators, marketers, and also ability agents influenced by COVID-19.

Each program has its very own qualification demands and also application process, so it is necessary to research and comprehend which program( s) may be right for your service. In https://zenwriting.net/dorsey79jesus/5-ways-to-max...e-retention-tax-credit-history , some services may be eligible for multiple programs, which can provide even more economic assistance.

By exploring all available options, businesses can make educated decisions on how to finest make use of entitlement program to support their operations during the continuous pandemic.

Identifying Which Program is Right for Your Company

Determining one of the most appropriate relief program for your business can be a game-changer in these difficult times. Understanding view it now in the relief programs readily available is vital to determining which one is ideal for your business.

The Employee Retention Tax Credit Scores (ERTC) may be the appropriate selection if you're looking to keep workers on pay-roll. This program gives a tax credit score of approximately $28,000 per employee for services that have experienced a decline in profits due to the pandemic.

On the other hand, if your business is in need of more immediate monetary aid, the Income Security Program (PPP) might be a better fit. This program gives forgivable lendings to cover pay-roll prices as well as other expenses.

In addition, the Economic Injury Catastrophe Funding (EIDL) program provides low-interest loans for businesses that have endured substantial economic injury as a result of the pandemic.

Ultimately, the very best relief program for your organization depends on its distinct needs and situations. It is very important to carefully consider your choices and also seek support from a financial professional to establish which program is right for you.

Verdict

So, which program is right for your organization? Eventually, the solution relies on your special situation.