Exactly How Software Application Can Help With Bookkeeping As Well As Insurance Coverage Audits |

Content create by-Cobb Bolton

Accounting is among the few necessary services given by organizations today. A bookkeeper's primary function is to release expenses to clients, document receipts, as well as verify invoices from distributors. Various other responsibilities of a bookkeeper include checking accounts, producing monetary records, and also fixing accounting mistakes. There are 2 main sorts of bookkeeping systems: solitary access as well as double entry. Both techniques use journal entrances to tape-record purchases. A solitary entry system records a deal only once, while dual entry documents multiple purchases in various columns.

In the past, accounting included numerous Excel or Exel files. This can be troublesome and taxing, as well as storage space can become an issue. With the advancement of technology, companies began transferring to computer-based systems. These systems were slow-moving as well as expensive, yet eventually made accounting much easier and faster. The good news is, continued advancement has made it feasible to make use of 100% online applications that support data to the cloud and deal limitless storage. This sort of accounting software has streamlined the process of recording purchases as well as has actually improved the accuracy of financial statements.

Another popular approach of bookkeeping is the double access method. This method calls for transactions to influence 2 various accounts. It is likewise error-detection, which implies that every entrance is made up twice. The benefits of this approach include the capacity to scan papers into the system. Besides being more time-efficient, it additionally provides the benefit of staying clear of the risks connected with hand-operated entry. This approach also conserves money on paper. However it is not the only kind of software that can assist businesses boost their bookkeeping procedures.

Utilizing a computer-based system is a terrific means to monitor transactions. A good software program application can automate the process and also eliminate the need for tiresome manual labor. Regardless of https://trenton-jayleandro.technetbloggers.de/by-e...their-attention-to-information choose, you need to always back up your data to guarantee its accuracy. https://www.nerdwallet.com/article/small-business/best-hotel-accounting-software -up is a practical method to protect your papers. This technique can be really helpful in the case of audits. Along with conserving time, making use of a software application permits you to store and arrange your documents online.

How To Start Bookkeeping Business

A bookkeeper must have the ability to manage several types of accounts. The most common jobs include cash, investments, equipment, and also land. Along with these, a bookkeeper should be able to manage payroll and also other workplace management tasks. This software will certainly allow for easy navigating, as well as will assist you keep track of your monetary records. Additionally, a good bookkeeping software application ought to have the ability to deal with various sorts of accounts. QuickBooks is one of the most preferred electronic accounting software application on the market.

The function of bookkeeping is to keep an eye on service transactions. It supplies a clear image of the business's economic health. With bookkeeping, you will certainly have a much more thorough understanding of your company's financial resources. A graph of accounts is a listing of groups, that make it much easier for you to manage all of your monetary information. It will certainly also help you prevent scams by making sure that every transaction is precisely recorded. If you intend to be an exceptional bookkeeper, it will certainly not just offer you more control over your business's bookkeeping.

How Do You Spell Bookkeeping

The procedure of bookkeeping is vital for any type of business. It entails the day-to-day economic tasks of an organization. The key feature of bookkeeping is to maintain account books. These books are utilized to tape all company monetary purchases. When a purchase is entered into a bookkeeping system, it becomes a record of that purchase. The precision of this information identifies the precision of bookkeeping. Nonetheless, not all companies have the ability to perform their very own audit.

Besides generating financial statements, an accountant also creates records for management. They gather info from cashiers, check receipts, and also send out payments to the bank. They additionally handle payroll. They can prepare billings and also track overdue accounts. Normally, accounting professionals are part of a larger business. The role of bookkeeping is important to the success of any company. In this field, every aspect of a firm's financial purchases requires to be precisely recorded.

How To Do Payroll On Quickbooks

A bookkeeper's work summary can differ, relying on the nature of the job. Normally, us treasury tax payment is accountable for keeping the books of an organization. They keep documents for an organization as well as prepare financial declarations for supervisors. They can additionally deal with payroll, prepare invoices, and also track overdue accounts. In some cases, an accountant is an assistant or an executive. They have several responsibilities, including overseeing accounts.

|

|

Just How Software Program Can Aid With Bookkeeping As Well As Insurance Audits |

Content by-Josefsen Lyng

Bookkeeping is just one of the few necessary services provided by organizations today. A bookkeeper's major duty is to provide costs to clients, record invoices, as well as validate invoices from distributors. Various other duties of an accountant consist of keeping track of accounts, producing financial records, and correcting accounting mistakes. There are two primary kinds of bookkeeping systems: solitary access and also double entrance. Both methods use journal entrances to tape-record deals. A single entrance system videotapes a purchase just as soon as, while double entry documents numerous transactions in various columns.

In the past, accounting involved several Excel or Exel data. This can be inconvenient as well as time-consuming, and storage space can end up being an issue. With the improvement of innovation, firms began moving to computer-based systems. These systems were sluggish as well as costly, however at some point made accounting simpler and faster. Luckily, continued https://innova-bluffton-sc.tumblr.com/post/6680181...sional-bookkeeping-services-in has made it feasible to use 100% online applications that support data to the cloud and offer unrestricted storage. This kind of accounting software application has structured the process of taping deals and has enhanced the accuracy of economic statements.

One more popular technique of bookkeeping is the dual entry technique. This technique needs transactions to impact 2 different accounts. It is likewise error-detection, which means that every access is made up twice. The benefits of this technique include the capacity to check files right into the system. Besides being much more time-efficient, it also offers the advantage of avoiding the risks associated with hands-on entry. This approach additionally saves money on paper. But it is not the only sort of software that can assist companies enhance their bookkeeping processes.

Using a computer-based system is a wonderful means to track deals. A great software application can automate the process and also get rid of the demand for tedious manual labor. Regardless of the method you select, you need to always support your data to guarantee its precision. The cloud back-up is a practical method to protect your files. This approach can be really useful in the case of audits. In addition to saving time, making use of a software program permits you to save and sort your records online.

How Do I Calculate Employer Payroll Taxes

A bookkeeper needs to have the ability to manage lots of sorts of accounts. One of the most typical jobs consist of cash money, investments, devices, and also land. In addition to these, a bookkeeper needs to have the ability to take care of payroll as well as other office administration tasks. This software program will allow for simple navigation, and also will certainly help you keep an eye on your economic records. Furthermore, a good bookkeeping software ought to have the ability to take care of many different kinds of accounts. QuickBooks is the most popular electronic bookkeeping software program on the market.

The purpose of accounting is to keep track of organization transactions. It gives a clear image of business's monetary health and wellness. With accounting, you will have a more in-depth understanding of your business's funds. A graph of accounts is a listing of groups, that make it much easier for you to handle every one of your monetary details. It will likewise aid you stay clear of fraud by making certain that every transaction is precisely recorded. If you wish to be an outstanding accountant, it will certainly not only give you extra control over your company's accountancy.

How Do You Spell Bookkeeping

The process of accounting is crucial for any type of company. It involves the daily economic tasks of a service. The key function of accounting is to maintain books of accounts. These books are made use of to tape all company economic transactions. When a purchase is entered into an accounting system, it ends up being a document of that transaction. The precision of this information identifies the precision of accountancy. Nonetheless, not all companies are able to do their very own audit.

Besides producing monetary declarations, a bookkeeper likewise develops records for management. They accumulate details from cashiers, check receipts, and also send repayments to the financial institution. They also take care of payroll. They can prepare invoices and track past due accounts. Generally, business legal consulting are part of a bigger company. The duty of bookkeeping is crucial to the success of any company. In this area, every facet of a business's financial transactions requires to be accurately videotaped.

How To Tax Gift Cards In Payroll

A bookkeeper's task summary can differ, depending upon the nature of the work. Generally, a bookkeeper is in charge of maintaining the books of a company. They keep records for a service and also prepare economic declarations for supervisors. They can additionally take care of pay-roll, prepare billings, and track overdue accounts. Sometimes, an accountant is an assistant or an executive. They have lots of obligations, consisting of supervising accounts.

|

|

Just How Software Program Can Help With Bookkeeping And Insurance Coverage Audits |

Article created by-Barefoot Rosendal

Accounting is one of minority crucial solutions supplied by businesses today. A bookkeeper's main function is to release bills to customers, document invoices, and also validate billings from providers. Other obligations of a bookkeeper consist of keeping track of accounts, creating financial reports, and also rectifying accounting errors. There are 2 main types of accounting systems: solitary access and also double entrance. Both techniques make use of journal entries to videotape purchases. A solitary access system records a purchase only as soon as, while double access records several purchases in different columns.

In the past, accounting involved numerous Excel or Exel data. how to start a consulting business while working full time can be inconvenient and taxing, as well as storage can come to be a concern. With the innovation of modern technology, business started moving to computer-based systems. These systems were slow-moving and expensive, however eventually made bookkeeping less complicated and also faster. The good news is, proceeded advancement has actually made it feasible to use 100% online applications that back up information to the cloud as well as offer limitless storage. This kind of accounting software program has streamlined the procedure of videotaping deals and has actually improved the accuracy of monetary declarations.

One more prominent approach of accounting is the double access technique. This method needs deals to affect 2 various accounts. It is also error-detection, which implies that every entrance is accounted for two times. The advantages of this method consist of the ability to check files into the system. Besides being a lot more time-efficient, it additionally supplies the benefit of staying clear of the threats connected with hand-operated access. This approach also saves money theoretically. But it is not the only kind of software that can help services boost their accounting procedures.

Using a computer-based system is a terrific method to keep track of deals. An excellent software application can automate the procedure and remove the need for tedious manual work. Despite the approach you pick, you must always support your data to guarantee its accuracy. The cloud back-up is a convenient way to safeguard your documents. This technique can be really handy in the case of audits. Along with conserving time, using a software application allows you to store and also arrange your papers online.

How To Learn Bookkeeping At Home

A bookkeeper should have the ability to manage several types of accounts. One of the most common jobs consist of money, investments, devices, and land. Along with these, an accountant needs to be able to manage pay-roll as well as other office monitoring tasks. This software will enable easy navigating, and will help you keep track of your economic documents. In addition, an excellent bookkeeping software program ought to have the ability to handle various sorts of accounts. QuickBooks is one of the most popular electronic accounting software on the marketplace.

The objective of bookkeeping is to track service purchases. It provides a clear picture of business's monetary health. With accounting, you will certainly have an extra comprehensive understanding of your service's finances. A graph of accounts is a listing of categories, that make it easier for you to manage every one of your financial info. It will also aid you avoid scams by ensuring that every purchase is precisely recorded. If you want to be an exceptional bookkeeper, it will not only give you extra control over your business's bookkeeping.

How Much Is Payroll Tax

The procedure of accounting is critical for any kind of company. It includes the daily economic tasks of a service. The main feature of bookkeeping is to preserve account books. These books are made use of to videotape all business economic deals. When a deal is become part of an accounting system, it ends up being a record of that purchase. https://mgyb.co/s/4N8BF of this information figures out the precision of bookkeeping. Nonetheless, not all organizations are able to perform their own bookkeeping.

Besides generating monetary declarations, a bookkeeper likewise creates records for management. They accumulate info from cashiers, check receipts, as well as send payments to the bank. They also manage pay-roll. They can prepare invoices and also track overdue accounts. Typically, accounting professionals become part of a bigger service. The duty of bookkeeping is important to the success of any company. In this field, every facet of a business's monetary purchases needs to be precisely videotaped.

What Is Bookkeeping Job

An accountant's work description can vary, depending on the nature of the work. Normally, an accountant is accountable for maintaining the books of a business. They maintain documents for a company and also prepare economic statements for managers. They can also handle payroll, prepare billings, as well as track past due accounts. In some cases, an accountant is a secretary or an executive. They have many duties, consisting of overseeing accounts.

|

|

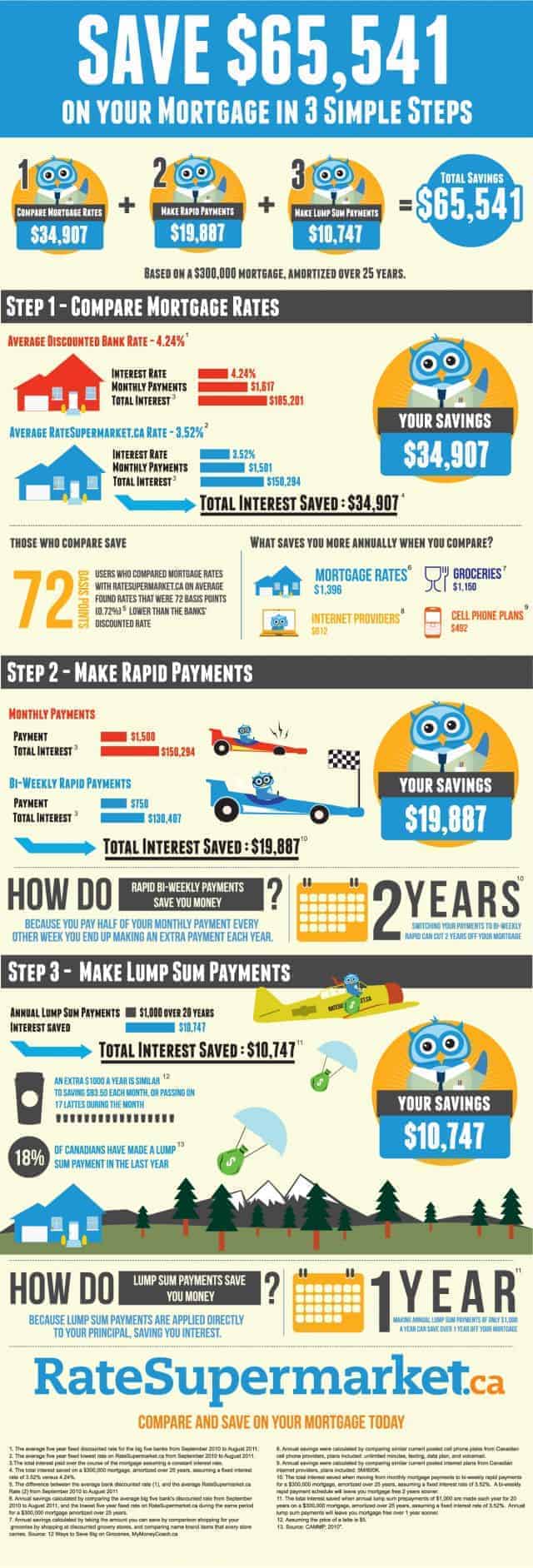

Why The Gold Investment Is One Of The Best Ways To Protect Your Monetary Future? |

Article created by-Blalock Burnett

It is a safe and secure, lasting investment. Unlike supplies and bonds, which can decline in time, gold can preserve its worth also in the worst financial downturns. In addition to its lasting value, gold is likewise tax-exempt, making it a safe house for your riches. Acquiring gold is an ideal way to diversify your portfolio, however there are lots of threats to consider.

Buying https://getpocket.com/@goldtrends isn't a fantastic suggestion, as precious jewelry as well as other types of gold financial investments commonly carry a heavy markup. In addition, jewelry isn't a sound investment technique. It is very important for capitalists to be aware of the spot rate of gold when they search the bullion market. Financing web sites typically show the area cost of the rare-earth element each day. Nonetheless, it can be risky if you purchase mining companies in unpredictable nations.

If you don't mind receiving the physical metal, you can buy stocks and also shares. visit website can shield your resources from funding gains tax obligation, as the fund costs are largely countered by the charges. An additional option is to invest in mining business. While this technique is riskier, it can yield high returns in the long term. If you choose this path, you should see to it that you know what you're doing. Or else, you'll only wind up with losses.

While gold has a reduced relationship with other properties, you must buy a small portion of your portfolio in it. You'll get a lower volatility in gold than you 'd obtain from other investments. You'll also have a hedge in case of devaluation or collapse of the economic system. Simply make certain you don't base your appropriation based upon the cost of gold, which may go up and down. The threat variable is the price you paid for the gold. For that reason, you must spend based upon the price of the metal you choose.

If you are unsure of the threats of purchasing gold, you can start with supplies and also shares in an Isa. By buying gold stocks, you'll be shielded from capital gains tax obligation when the prices of other investments drop. While stocks as well as shares have a low risk, investing in gold is a risk-free, long-lasting alternative. When you're trying to find a safe, stable investment, search for a gold financial investment that's even more steady.

The price of gold is not always correlated to various other investments. It can raise or reduce in price. This is why you require to investigate your financial investments thoroughly. It's a good idea to understand what you're investing in. Then, you ought to choose a portfolio that will supply a high return on your financial investment. And if you don't have a great deal of money, you might buy a top notch gold fund.

Along with buying gold coins and also bars, you can likewise get gold ETFs. Unlike routine Individual retirement accounts, the premium on a gold ETF is a lot lower than the rate of a 100-gram bar of the very same metal. A greater premium is a great indicator of a good quality financial investment. A high-grade ETF can make you huge earnings in the long run. So, while you can not just purchase a solitary gold bar, you can still get the right type of ETF.

A gold investment portfolio must be branched out. A small percent of your profile ought to be assigned to gold. A tiny percent of your profile must be diversified in the various possession courses. While a top notch ETF is an exceptional way to buy the precious metal, it doesn't assure a high return. And also, there's no assurance that it will certainly keep its value in time. You need to be planned for a significant drop in the cost of gold in order to shield your money.

There are lots of factors to purchase gold. Some of these consist of the truth that gold is a hedge versus inflation, while others are a bush against international money or ETFs. The financial steel's worth changes, so the cost of gold can be unstable. The cost of the physical metal is a major factor to invest in it. The inverted connection in between the price of gold and various other properties is additionally among its benefits.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

Just How To Make A Gold Investment |

Article by-Frederick Doyle

If you want to buy gold, there are a number of choices readily available. You can buy physical gold or you can buy ETFs that hold this precious metal. Both choices have their very own advantages as well as drawbacks. An ETF is frequently much more expensive than a physical bar, and also it also calls for an annual administration charge. The costs, nonetheless, are commonly worth the safety and security, as they protect your financial investment against theft. Buying physical gold is a fantastic way to begin investing in the precious metal, as well as both choices have their very own pros and cons.

When investing in gold, make certain to deal with a trusted firm. Be sure to examine the credentials of the firm you're thinking of taking care of. Request proof of licenses, insurance, and also bonding. You ought to additionally inquire about the quantity of money you'll be needed to pay to the vendor. Keep in mind, however, that there's a market value for gold, as well as you will be anticipated to pay a markup. Regardless of the kind of gold, you must know the fees related to offering it.

If you have an interest in purchasing physical gold, you must consider buying a gold ETF. Using this sort of ETF can assist you shield your capital gains when you market your supply. The disadvantage of purchasing physical gold is the danger connected with it. If you're new to investing in gold, it can be challenging to establish the precise worth of your investment. Besides, you'll have to spend for insurance policy as well as storage expenses, which are both costly.

Purchasing gold can be tough, however it can be done. You can purchase gold shares from mining companies. You can maintain your profits from marketing them as well as avoid paying tax on the gain. However if you're not comfortable doing this, there are several various other alternatives for you to consider. Among one of the most preferred choices is to buy shares of a mining business. While the price of these shares may not match the price of gold, you can profit of acquiring them when costs are reduced.

Aside from physical gold, you can also invest in gold ETFs. An ETF is an exchange-traded fund, which is a sort of mutual fund. These funds track the activity of gold and can be less costly than possessing physical gold. If you're seeking a more fluid choice, you can seek gold ETFs. These are a good way to obtain direct exposure to the rare-earth element. You can likewise get specific pieces of gold.

Another alternative is to buy shares of mining companies. This is a fantastic means to acquire gold because you can spend via an Isa, which is tax-free. This way, you can spend without needing to worry about marketing your gold at a reduced rate. To put it simply, there are numerous means to buy gold, as well as they all depend on your personal scenario and also objectives. If you don't have a certain investment goal in mind, you can always purchase the gold you require.

In addition to investing in physical gold, there are additionally Isas and a few other methods of investing. The most effective method to buy gold is by getting sovereign gold bonds. Sovereign gold bonds are not physical gold, but they are backed by the Federal government of India, which guarantees 2.5% passion on the bonds. You can buy them at a lower rate, but you have to pay tax obligations on any kind of profits you make from them.

A great technique for purchasing gold is to buy supplies as well as shares. If you have the money to purchase gold, you can get Isas to protect your capital. Along with isas, there are several various other techniques of investing in this precious metal. roth ira gold money can buy mutual funds, exchange-traded funds, as well as physical products. Each of these financial investment approaches has its own qualities and also dangers. Choosing a suitable method depends upon your objectives and your economic status.

If you wish to invest in gold, you must buy it from trusted producers. The Perth Mint, Credit Scores Suisse, and the Royal Canadian Mint are respectable sources. The price of gold will certainly depend on the pureness of the metal. Visit Web Page is important to purchase a gold investment that contends the very least 91% purity. The purity of the gold will enhance the worth of your investment. Purchasing shares in mining business is a terrific way to purchase the precious metal.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

Why The Gold Investment Is One Of The Best Methods To Safeguard Your Financial Future? |

Authored by- https://en.gravatar.com/goldtrendsnet is a protected, long-lasting financial investment. Unlike supplies and bonds, which can decline gradually, gold can maintain its worth also in the most awful financial downturns. In addition to its lasting worth, gold is additionally tax-exempt, making it a safe house for your wide range. Buying gold is a suitable method to diversify your profile, yet there are lots of risks to think about.

Buying physical gold isn't a great idea, as fashion jewelry and various other kinds of gold financial investments generally carry a hefty markup. Moreover, jewelry isn't an audio investment method. It is necessary for capitalists to be aware of the spot rate of gold when they browse the bullion market. Financing internet sites typically show the area price of the rare-earth element on a daily basis. Nevertheless, it can be high-risk if you invest in mining business in unpredictable nations.

If you do not mind receiving the physical metal, you can invest in supplies and also shares. These financial investments can protect your capital from resources gains tax obligation, as the fund fees are mainly balanced out by the costs. Another option is to invest in mining business. While this method is riskier, it can generate high returns in the long term. If you choose this course, you ought to ensure that you recognize what you're doing. Or else, you'll just end up with losses.

While gold has a reduced connection with other properties, you must buy a small portion of your portfolio in it. You'll obtain a lower volatility in gold than you would certainly obtain from other investments. You'll likewise have a hedge in situation of run-away inflation or collapse of the economic system. Just make https://www.timesnownews.com/business-economy/pers...nds-this-akshay-tritiya/756834 don't base your allocation based upon the rate of gold, which may go up and down. The threat variable is the rate you spent for the gold. Consequently, you should spend based upon the price of the steel you choose.

If you are unsure of the risks of buying gold, you can start with stocks and shares in an Isa. By buying gold stocks, you'll be shielded from resources gains tax when the costs of other investments drop. While stocks and also shares have a low risk, buying gold is a secure, long-term choice. When you're searching for a safe, steady financial investment, seek a gold financial investment that's even more stable.

The rate of gold is not constantly associated to various other investments. It can raise or decrease in price. This is why you need to research your financial investments thoroughly. It's a good idea to comprehend what you're buying. Then, you should pick a profile that will supply a high return on your investment. And if you do not have a great deal of money, you might buy a top quality gold fund.

Along with purchasing gold coins as well as bars, you can also buy gold ETFs. Unlike regular IRAs, the premium on a gold ETF is much less than the rate of a 100-gram bar of the same metal. A greater costs is a great indication of a top quality financial investment. A top quality ETF can gain you huge profits in the long run. So, while you can not simply get a solitary gold bar, you can still buy the appropriate sort of ETF.

A gold investment portfolio should be branched out. A small portion of your portfolio need to be alloted to gold. A tiny percent of your portfolio must be branched out in the different possession classes. While a premium ETF is a superb method to purchase the rare-earth element, it does not guarantee a high return. And also, there's no warranty that it will maintain its value gradually. You have to be prepared for a substantial drop in the price of gold in order to safeguard your cash.

There are several factors to invest in gold. A few of these include the truth that gold is a bush against rising cost of living, while others are a hedge against international currency or ETFs. The financial metal's value fluctuates, so the price of gold can be unstable. The price of the physical steel is a significant factor to purchase it. The inverse partnership in between the rate of gold as well as various other possessions is additionally among its advantages.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

While It Is Very Important To Comprehend The Difference In Between Personal And Business Financial? |

Content create by-Korsgaard Richardson

Personal banking is an area of banking that provides services and products that are customized to an individual's demands. These product or services typically vary from those developed for organizations and are focused on satisfying the key financial demands of individuals. They can consist of deposits, fundings, bank card, debit/ATM cards, as well as much more. For instance, a consumer might have a different demand for a charge card than an organization does. An individual banker can assist the consumer choose which kind of account would certainly be best for their requirements.

Individual financial services are supplied by various kinds of banks. They include examining accounts, mortgages, and also interest-bearing accounts. In addition, much of these establishments provide electronic banking centers, debit cards, as well as accessibility to international money. Some even supply solutions that enable clients to transfer cash money online. Whether you favor the convenience of using on-line services or checking out a branch area, personal banking services are a wonderful alternative. why not check here of individual financial is that you can handle and access your account with a few clicks.

just click the following website !2d-98.26229018460788!3d40.29094447937994!2m3!1f0!2f0!3f0!3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x0%3A0xbce140d2ba5269f1!2sFarmers%20and%20Merchants%20Bank!5e0!3m2!1sen!2sus!4v1645731350944!5m2!1sen!2sus" width="600" height="450" style="border:0;" allowfullscreen="" loading="lazy">

Individual banking involves a selection of services given by financial institutions. Some of the most prominent alternatives consist of inspecting and also savings accounts, money market accounts, deposit slips, home mortgages, and car fundings. Furthermore, you can make use of individual banks to make deposits, pay, as well as even handle your cash. Along with standard financial, you can find personal financial online centers. This is among the easiest and fastest means to transfer money. The procedure is basic as well as hassle-free, as well as online solutions are coming to be much more popular.

Along with conventional banks, lots of smaller sized organizations are starting to offer individual banking solutions. In addition to traditional organizations, insurer are additionally signing up with the battle royal and offering cost savings, home loan, as well as individual loaning services. Some countries even permit not-for-profit collectives to access deposited funds and offer individual banking solutions. Although they are ruled out financial institutions, these are still examples of personal banking. Nevertheless, they must not be puzzled with financial institution branches. However, they provide several of the most practical ways to transfer cash money.

The term "individual financial" is generally utilized to describe the services that financial institutions supply to individuals. These solutions range from standard savings accounts to bank card, and also are sometimes referred to as retail financial. While the term is not strictly specified, it does define a particular type of banking. It consists of small-dollar car loans, retirement plans, insurance policy, and mobile banking. Unlike standard bank branches, individual financial institutions don't need to offer these items.

As the term suggests, individual banking prolongs past standard financial services. A few of the major types of services that individual banks use consist of small loans and consumer savings. While most of these solutions are intended for people, some kinds are created for services. Therefore, personal financial services differ commonly. Generally, however, most banks have the ability to offer much of these type of products to the general public. Depending on the service, personal banking can consist of a variety of products.

In addition to small financings, individual banking services can also consist of investment advising, insurance policy, as well as retirement plans. While the term "individual financial" has actually ended up being a buzzword for the sector, many types of services are readily available in the context of individual banking. Whether you are seeking a savings account or a financing, individual financial solutions can be a wonderful means to enhance your life. It can additionally assist you protect your assets and minimize the threat of fraud.

An individual banking account is a method to handle all of your economic accounts. It can also help you save for the unforeseen. A savings account can aid you make it through a disaster, and also can supply assurance when making economic choices. Some financial institutions provide benefit checking and also interest-bearing account along with money market accounts. The last are an excellent option for saving for an emergency fund, deposit for a home, and also more. When picking an individual banking account, make certain you comprehend exactly how the numerous items work, as well as select a product that finest fits your requirements.

An individual banking account is a should for those that value their money. These accounts are created to be easy to manage as well as can aid you save for future objectives. Along with maintaining your cash protected, they can also assist you earn rate of interest. For those that are seeking even more earnings, a personal savings account can be an excellent means to prosper financially. These accounts provide you the freedom to pick the items that match your needs and also budget plan.

|

Метки: Personal Banking Agriculture Banking Business Banking Commercial Banking Personal Loan Personal Finance Personal Savings Banking |

Exactly How To Obtain An Individual Finance |

Created by-Schwartz Chavez

Individual Fundings are a wonderful method to pay for a range of points. In many cases, they are fast as well as simple to apply for. In order to be qualified for an individual funding, you must have a steady income. If you don't make adequate money each month, you can fall back on your payments as well as lose accessibility to the cash you require. Luckily, there are lots of choices readily available to you. Here are a few of the most typical means to obtain an individual lending:

Initially, comprehend just how individual loans influence your credit rating. While making on-time settlements on your car loan is good for building your credit report, late repayments can harm your score. However, when applying for a personal finance, you're still influencing your score. Some loan providers allow you to apply with a "soft pull" to aid you determine your qualification. This will not injure your credit history, and it will certainly show up on your record for 2 years.

Another way to make your payments on time is to settle your funding in a timely manner. An individual car loan can be used for any kind of objective you desire. If you need cash right now, you can make use of a personal financing for practically any reason. As a matter of fact, it is just one of the easiest methods to elevate your credit score. You can request a personal-loan for practically any type of purpose, and a lot of loan providers will certainly approve you as long as you can make your repayments promptly.

When requesting https://www.cnbc.com/2021/10/25/wells-fargo-has-a-...works-and-its-named-fargo.html , lenders will inspect your credit rating for numerous factors. High queries as well as numerous financial debt accounts opened up in a brief quantity of time can indicate a high risk for a loan provider. You'll need to make routine payments on your personal finance to avoid ending up being deeper in the red. Most individual financings are for single purposes, such as combining multiple bank card debt. Most of the times, they come with reduced rates of interest and also shorter terms.

An individual financing can be the excellent solution for unanticipated expenses. For instance, if you've lately lost an enjoyed one, a personal financing can aid you pay for the funeral. Besides, unexpected clinical expenses can be covered with a personal car loan. Regardless of the low cost of a personal-loan, there are lots of advantages. They can help you spend for an emergency situation. Besides its price, a personal funding can help you settle financial debt.

If you're not comfortable applying for an unsafe lending, you can look for a co-signed or safe finance instead. A guaranteed lending is backed by a property, such as a house, and if you back-pedal the settlements, the lending institution may take your home. If you're searching for a personal-loan, a co-signer's debt profile is likewise vital. A co-signed finance needs a co-signer that has a great credit rating. He or she is in charge of late or missed settlements on the car loan, which will negatively impact your credit history.

The most usual personal financing is a financial debt consolidation loan. This sort of lending is made use of to repay multiple charge card. Since it has a reduced rate of interest than an unsecured financing, it can be used for virtually any type of purpose. While it can be hard to pay off, it can be very useful in stopping you from falling much deeper into financial debt. In addition to being flexible, an individual finance can likewise aid you settle other financial debts.

A personal loan can be used to begin a small company, fund a getaway, or pay off other debts. The repayment term varies relying on the lender, however is usually between a year and also seven years. There are numerous choices for individual financings, and each one uses different advantages. The most usual reason for using is to cover a demand that you might have. This sort of finance is really flexible as well as can be used for any objective, consisting of a small house repair work or refinancing student debt.

Individual loans can aid consumers fulfill a variety of demands. As get more info , debt consolidation finances are unsafe personal car loans that are provided by several lenders. The benefit of these loans is that they are normally reduced passion, which can assist customers conserve cash as well as make their payments extra economical. Additionally, a personal finance can load a budget plan void and use a fixed rate of interest and also monthly repayment. Whether you require a funding for a cars and truck or a wedding celebration, an individual financing can aid you.

|

Метки: Personal Banking Agriculture Banking Business Banking Commercial Banking Personal Loan Personal Finance Personal Savings Banking |

Is Personal Banking Right For You? |

Created by-Kirk Harrington

If you're thinking about opening a bank account, you might be wondering whether the concept of Personal Financial is a great selection for you. Nevertheless, this kind of account isn't limited to interest-bearing accounts. Lots of financial institutions currently provide products that satisfy consumers, consisting of insurance and investment real estate financings. This selection of items helps consumers handle their economic lives and accomplish economic goals, such as purchasing a brand-new home or traveling the globe. As well as with the advantages of an account, the alternatives are nearly limitless.

Individual banking is the procedure of giving bank products and services to people. These product or services range from inspecting and also interest-bearing accounts to home mortgages, certificates of deposit, debit and credit cards, and also car funding. The primary purpose of personal financial is to develop connections with clients and also guarantee that their economic requirements are fulfilled. Today, online banking makes personal financial easier than ever. You can deposit cash money anywhere in the united state with a couple of clicks of your mouse.

Amongst the different sorts of accounts, interest-bearing accounts, and certificates of deposit are one of the most common types of individual financial. These accounts are readily available for people, such as pupils, retired people, and also businesses. You can also use a personal banking account to down payment cash as well as acquire traveler's checks. There are many advantages to individual financial, including its convenience and also affordability. As well as many financial institutions provide online banking as a practical method to handle your cash.

The primary advantage of Personal Financial is that the threat associated with it is very little. Its advantages surpass the risks. A savings account will aid you build a much better credit history, which will assist you save money in the long run. While it's still crucial to stay clear of using a financial institution that fees expensive interest rates, individual banking is a far better alternative. If you're looking to open a new account, there are numerous choices offered. As well as if you need to deposit cash online, you can do it in simply a few clicks.

There are many benefits to using an individual banking solution. Several of one of the most popular are ease, charges, and rates of interest. Besides being convenient, these solutions can also aid you secure your properties. So, if you're thinking of opening a brand-new account, have a look at the advantages of Personal Financial. If you want a financial institution that accommodates your needs, take into consideration the very best one for your needs. So, you can now obtain a financial institution that provides the ideal products for you.

While Personal Banking is an excellent option for customers, it isn't ideal for everybody. An industrial banking solution will focus more on the corporate field and also provide more concern to your requirements. A personal banking solution need to aid you manage your financial resources and stay clear of wasting cash. It must be easy to do and also secure. It ought to also come to many people. As a matter of fact, you'll have to choose which kind of financial institution is best for you. One of the most vital point is to see to it that you're getting what you require.

A personal financial account is a should for every customer. Not just will it help you keep an eye on your financial resources, it will certainly additionally make the procedure of handling your cash much easier. https://www.ft.com/content/e17654a5-3edb-4361-ba10-b7a590bc28a2 's not just useful for you in times of crisis, yet it can also aid you obtain the best out of your cash. Maintaining your money in an interest-bearing account is an excellent way to get ready for emergencies. It likewise provides you with the self-confidence you need to make decisions concerning your funds.

Besides personal banking, you can additionally invest. This sort of item helps you save for a future goal. A money market account is a type of interest-bearing account that grows with rate of interest. You can also borrow against your money with an individual bank account. While individual financial is a fantastic choice for individual consumers, it's not the very best choice for everyone. A service must focus on the needs of its customers. A commercial bank must concentrate on investments as well as their long-lasting monetary health.

Personal financial concentrates on both retail and organization financial. In retail financial, it concentrates on the needs of tiny retail consumers, while business financial concentrates on the rate of interests of huge companies. In https://www.bloomberg.com/news/articles/2021-05-18...oss-investment-bank-and-wealth , the primary emphasis of both kinds of accounts is the same: making profits for the financial institution. These accounts are designed to assist individuals with their everyday financial demands. The most typical products for personal banking are examining accounts and savings accounts. Other solutions that are readily available include over-limit credit lines, home mortgages, auto finances, and also insurance coverage.

|

Метки: Personal Banking Agriculture Banking Business Banking Commercial Banking Personal Loan Personal Finance Personal Savings Banking |

Read On To Find Out About The Various Kinds Of Individual Financial Available And Also How To Find The Appropriate One For You |

Article writer-Elgaard Cook

The term personal banking can seem obscure and generic. This is because it incorporates a selection of financial institution products and services that attend to main economic worries of private consumers. These services can be utilized to meet any kind of need an individual has. These services can consist of checking account and also loans as well as credit and debit/ATM cards. Thankfully, there are a lot of choices to pick from.

Personal financial incorporates a range of products offered by banks to individual customers. Some of the more prominent products are inspecting and savings accounts, certificates of deposit, as well as money orders and bank drafts. The series of solutions offered by these organizations is ever-growing and also frequently evolving. If https://www.forbes.com/sites/forbesbusinesscouncil...mprove-digital-transformation/ have an individual financing concern, talk with an economic expert. There are numerous means to apply online for individual financings as well as obtain a quick, practical loan.

A personal lending is one of the most usual kind of individual lending. It enables individuals to settle financial debt and also settle significant expenses. These fundings provide fixed regular monthly repayments and rates of interest. These finances are perfect for those that require funding for a single-time project and know specifically what the expense will be up front. In addition, these fundings are best for those who need a large sum of money simultaneously as well as want to know specifically just how much they will certainly have to pay ahead of time.

No matter exactly how you make a decision to utilize personal car loans, you should constantly contact your bank to talk about the terms of the lending. Whether you're looking for an one-time financing remedy, or you're searching for an ongoing credit line, there are several alternatives available to you. And also with the expanding need for these products, you should find a personal bank that fulfills your demands. The right bank can aid you make the right financial decisions for you.

If you're seeking a financial institution that provides individual financial solutions, consider all of the functions as well as convenience of these services. Along with interest rates, charges, and comfort, personal financial solutions can offer you with satisfaction and also ease. There are lots of factors to register for a personal financial solution. For instance, you'll never ever need to manage a bank once again if you're dissatisfied with the service. There are likewise a range of methods to access the funds you require.

As the name suggests, individual financial is a sort of financial that concentrates on aiding individual consumers. Simply put, it's created to satisfy the demands of individuals and also their family members. Several of the most typical types of personal banking are inspecting accounts, credit lines, as well as personal fundings. Choosing mouse click the up coming website page for you relies on the elements you value most. The comfort of individual financial is important to you. Ensure you are getting the very best service possible.

There are several advantages to personal banking. It is convenient for consumers to have accessibility to their funds. They can additionally gain passion while they are utilizing the funds. While commercial banking is a lot more focused on organizations, individual financial is still the more convenient choice for the typical customer. The ease of this service is just one of the primary advantages of personal financial. In addition, it can provide you assurance. This kind of solution can be made use of by individuals that desire to maintain their accounts in your home.

Individual financial can be split right into two primary categories: retail financial and business banking. The previous is focused on tiny retail consumers while the latter focuses on big revenues with investments. Both kinds are necessary for an individual's financial well-being. In addition to these, personal financial gives guidance on just how to make smart choices based upon the situation of their financial resources. However, there are specific differences between both sorts of individual financial. It is essential to keep in mind that both kinds of financial services can be utilized to meet the demands of individuals.

One of the most basic solution that personal financial provides is a checking account. This is a crucial tool for daily financial transactions. A savings account will earn you passion over time, however it will certainly be far more difficult to make use of than a checking account. Both kinds of personal banking serve for people, and also both can be beneficial in different ways. An individual checking account is an excellent way to protect money for your future. When you open an account, ensure you recognize your choices and the rates of interest of the bank.

|

Метки: Personal Banking Agriculture Banking Business Banking Commercial Banking Personal Loan Personal Finance Personal Savings Banking |

Using Commercial Banking Services Is An Extra Reliable Way To Handle Your Money |

Content author-Boykin Kaplan

The term "individual banking" is made use of to describe a collection of economic products supplied by banks to satisfy the monetary requirements of individual customers. These products differ from those used to business clients. Some instances of personal banking products include deposit accounts and car loans, while others might give access to charge card or debit/ATM cards. Some financial institutions might call their services "personal financial," while others may refer to them as "retail banking." Despite what the name of an item is, it is necessary to take into consideration exactly how it matches your demands.

Individual financial is the technique of giving financial institution products and services to people, such as examining and also savings accounts. It includes many sorts of economic items, consisting of deposit slips, debit as well as charge card, mortgage, as well as tourist's checks. The goal of personal banking is to offer personalized monetary suggestions as well as service to clients. As an example, First Structure Financial institution offers an Online Interest-bearing accounts to its clients from any place in the U.S., at a competitive interest rate.

Individual financial products and services are an important part of financial health and wellness. Providing financial institution products to people is essential to an individual's economic safety and security. The key goal of personal financial is to create lasting relationships with customers as well as to help them choose one of the most beneficial economic items. Typically, these products include a checking as well as interest-bearing accounts, a deposit slip, a debit card, and also debt centers. A personal banking solution should be able to fulfill the needs of the person in question.

An individual lender will give their consumers with a variety of monetary services to make their lives easier. From small-to-large-scale finances and mortgages, individual banks supply a wide range of info to customers. These products are tailored to the individual customer. These services and products assist customers handle their funds more successfully and successfully. With individual banking, a customer can get the very best service for their needs while preserving a professional partnership with their bank.

Personal banking services consist of bank account, fundings to individuals, and also financial investment preparation. It focuses on the demands of the private client, as opposed to organizations. One of the most usual products supplied by personal financial institutions are checking as well as interest-bearing accounts, money market accounts, as well as deposit slip. Additionally, individual financial services may include home loans and also vehicle loans. However, both sorts of economic solutions vary. A personal financial institution can serve the demands of an individual, while commercial banking is targeted to the business sector.

Personal financial services can be divided into two wide categories: business banking and also retail financial. In check this link right here now , the bank will certainly focus on the needs of individuals while business financial will certainly focus on the needs of organizations. A personal bank is a bank that concentrates on the needs of individual consumers. A personal financial institution is more probable to provide competitive prices. An individual bank will certainly also supply a higher rate of interest, which is a plus in the case of personal loans.

Another kind of individual banking solution is business banking. These firms give services for services and people. A personal financial institution concentrates on the requirements of tiny retail consumers. In the last, the focus gets on significant profits through financial investments. https://www.fitchratings.com/research/non-bank-fin...table-affirms-at-aa-01-07-2021 must use commercial financial services for both their financial and also retail demands. In a commercial bank, you can choose the appropriate sort of services for your demands. The benefits of using an industrial bank are clear. Its staff members will be a lot more receptive to clients' demands.

For commercial financial, the financial institution concentrates on the needs of company. While personal financial is worried about private needs, commercial banking concentrates on investment and also consumption. The previous covers the demands of customers and also bills a reduced interest rate to support the economic situation. In a consumer financial institution, an interest-bearing account provides a safe means to save for future objectives. In a personal bank, a customer will be able to select the very best kind of personal financial for their needs.

It can also work for children. As an example, they can make use of individual checking accounts to conduct standard economic transactions. On the other hand, money market accounts can be an excellent method to save for future objectives. As long as you have an interest-bearing account, it's a fantastic way to shield your financial resources. A money market account can also be a great place for a reserve.

|

Метки: Personal Banking Agriculture Banking Business Banking Commercial Banking Personal Loan Personal Finance Personal Savings Banking |

Just How To Obtain Commercial Funding |

Content author-Walton Kronborg

The initial step to getting commercial financing is deciding how to structure your company. You may want to have the property in your name or as an entity. There are several kinds of entities you can select from. healthcare financial credit union long wharf , restricted partnership, or limited obligation collaboration is one of the most usual. Various other options include a "subchapter C" or "S" corporation, a realty investment company, or a company depend on.

There are https://mgyb.co/s/ksn93 of industrial finances: unsafe and also safeguarded. Guaranteed lendings bring a higher rate of interest due to the protection provided, while unsecured car loans are cheaper due to the absence of collateral. There are numerous resources of commercial car loans. Mainstream financial institutions, challenger financial institutions, expert independent lenders, and peer-to-peer borrowing systems all offer business financing financing. The amount of financing and rates of interest that you will be billed will certainly vary from lending institution to lender.

While credit rating is a factor in industrial lending, it is additionally essential to remember that your service credit report is a crucial factor to consider. You should go for a minimum of a 700 rating, however a greater score will certainly get you much better terms and reduced rates of interest. If you're a brand-new service, your individual credit score might not be as high as you would such as, so your organization's credit score will certainly have even more weight. Yet if your credit report goes over as well as you are prepared to strive to prove your organization worthiness, you must be great.

The kind of organization credit score you have will certainly establish your eligibility for business financings. If you're looking to obtain a lending for your organization, you need to consider your individual credit rating and the overall credit history of business. If your individual credit rating is high, you will have far better opportunities of obtaining much better terms as well as reduced interest rates. Along with your service credit score, your personal monetary situation will contribute in establishing the type of business lending you will get.

How Long Are Most Business Loans

As soon as you've established the firm's credit reliability, you can start requesting an industrial loan. The most common sorts of business fundings are term car loans, lines of credit, as well as asset-based lending. A business's credit report is a crucial determining factor in whether a lending institution will certainly approve your application. If it's reduced, a bank will possibly deny it, so see to it to check the number. As a whole, a company's credit history ought to be at least 700, so you have to maintain that in mind.

While there are several kinds of industrial lendings, most of them will certainly have repaired regular monthly settlements. The payment terms of these types of lendings vary from a year to 25 years. Other sorts of commercial funding items might consist of billing factoring, seller cash loan, as well as business lines of credit score. A lot of small businesses can protect an industrial finance via a financial institution or credit union. The sort of finance will depend upon the kind of business, the quantity of funding needed, as well as the business's financial objectives.

What To Know About Business Loans

The kind of funding you apply for will establish the terms and also rates of interest. One of the most common type of industrial loan is secured by property or devices. Those with a great credit rating can get much better terms and also lower rate of interest. Nevertheless, there are various other aspects that can influence your eligibility. Make certain that you have a strong organization plan and also a viable organization model. This will certainly help the lender assess your organization and also supply you with a strong proposition.

Generally, the criteria for business car loans include your company credit history and your personal credit report. It's finest to have a great credit rating to receive a far better financing. The lender will certainly likewise take a look at your personal credit report and also your organization's monetary position. This is the most essential element of an industrial finance and can make or break your application. There are numerous factors to take into consideration when obtaining a commercial car loan, and a strong credit score can help you obtain the most effective offer.

What Qualifies As A Small Business For Sba Loans

If you're trying to find a commercial lending, you must initially consider your personal and also company credit report. Your personal credit history is important for your business's eligibility as well as will help you obtain the most effective terms for your lending. You need to likewise see to it your business's credit report goes to least 700 to guarantee that it is approved. It will assist you get the most effective commercial car loan feasible. It will additionally boost the possibilities of your success. There are many variables to think about when obtaining an industrial financing, however bear in mind to have your very own service plan ready prior to you apply.

|

Метки: Commercial Financing Small Business Loans Commercial Real Estate Financing Accounts Receivable Fix And Flip Loans Business Line Of Credit Healthcare Finance |

Just How To Get Accepted For Business Financing |

Content create by-Luna Niebuhr

When you're searching for Commercial Funding, your personal credit history as well as service credit rating are of paramount importance. While a high credit report is more suitable, even a low rating can get you better terms and rate of interest. While your service might not have actually developed a strong track record yet, you can still take advantage of a high credit history, which will boost your possibilities of being approved. The following tips can aid you protect business funding.

Guarantee you have a solid capital and also high credit history. If you have a service strategy, you can additionally detail your purposes and also methods to achieve success. It is necessary that your organization strategy clearly explains why you require the funds and how you will take care of a worst-case scenario. Make certain you're organized as well as have all of your paperwork prepared prior to meeting with a lending institution. Testimonial your company plan and also various other appropriate records before making an application for a lending.

accounts receivable jobs near me of kinds of commercial loans call for collateral. These assets can include property, tools, and even future balance due. These financings are usually short-term in nature as well as are designed to provide one of the most moneying over a collection amount of time. A lot of business loans are protected by a home mortgage on business property. They are a wonderful option for companies with an excellent credit history. You can choose a business loan to fulfill your needs.

Some kinds of business lendings have different repayment terms. Some are one-year or five-year repayments, while others call for a 20% or even more deposit. A minimum down payment can range from 0% to 20% of the lending. The lending institution's risk analysis might also play a role in establishing whether you'll be able to settle the finance. In addition to a deposit, some loan providers will certainly require that you installed collateral or various other individual possessions as collateral.

What Can Business Loans Be Used For

A great industrial finance needs to be structured as a legal entity. A single proprietorship, as an example, would be an individual car loan to the owner. visit this web page link is most likely to be authorized than a personal lending, so it is essential to consider this in the process of obtaining a business lending. A firm's credit rating can influence the regards to a business finance. It is necessary to keep in mind that the loan provider will likewise check out the proprietor's individual credit score in order to establish whether business owner can afford the financing.

If you're searching for a small-business finance, you may have the ability to discover one in a network of over 75 industrial lenders. These networks can help you locate a funding that matches your demands and also will aid you begin or expand your company. A wonderful way to get a small business loan is to find a real estate financial investment lender. If you're searching for a larger financing, you can seek a broker or utilize an online market.

Who Does Commercial Power Equipment Go Through For Financing

It is crucial to remember that industrial loans can be expensive. It is very important to be knowledgeable about the threats related to them. Besides blunders, there are likewise other elements that can delay a lending as well as hurt your opportunities of being approved for one. For instance, you should not be making an application for a number of loans at the same time. If your organization has a superb credit score ranking, you need to think about using commercial finance for your organization. An effective company lending can raise profits by up to 300%.

A commercial lending is typically secured by building or cash flow from future balance dues. A commercial loan is a funding that needs collateral. In many cases, you might need to utilize security. Depending on the sort of financing, you may need to offer a home for security. For instance, if you have a land lease, you need to make sure the lender can conveniently recover the money from the sale of the property.

How To Get Financing For Commercial Property

You can make an application for unprotected lines of credit from banks as well as loan provider. These financings are offered in a lot of states as well as can be gotten for startup or existing organizations. They normally have reduced rate of interest and also can be accepted in 5 to thirty days. For those that require added financing, you must look for an industrial loan provider that supplies a competitive interest rate. A bad credit rating will certainly not impede your organization's capacity to obtain a funding, and also it will inevitably increase the quantity of collateral it requires.

|

Метки: Commercial Financing Small Business Loans Commercial Real Estate Financing Accounts Receivable Fix And Flip Loans Business Line Of Credit Healthcare Finance |

If You Want Getting A Lending For Your Company, You Ought To Keep Reading To Get More Information Concerning The Various Kinds Of Fundings Available |

are accounts receivable on the income statement -Munk Daly

If you're looking to fund a company or growth, business loans can be the best solution. This kind of funding assists companies purchase materials, update innovation, or pay added workers without making use of security. Many financial institutions supply a selection of various commercial funding programs to help companies of all sizes. These can be valuable for companies that are simply beginning or need a little bit of added financing to broaden.

Bank lending institutions are your ideal option for business financing. Tiny and big banks, cooperative credit union, and neighborhood financial institutions all offer these products. The very best kind of small business loan is a term funding, which will certainly amortize over a longer period of time. It's usually used genuine estate purchases as well as mortgages, devices acquisitions, as well as debt loan consolidation as well as refinancing. It's additionally excellent for entrepreneur seeking to get a line of credit for their needs.

Unsecured credit lines can aid you expand your company by providing resources for a start-up or an existing business. You can obtain a line of credit and receive funding in 5 to thirty days, depending on the loan provider. The advantages of unsafe credit lines are low rates of interest, and also in many cases 0% interest for the first year. These sorts of financings can be a great choice for a tiny or brand-new business.

Generally, commercial term lendings are an excellent option for small or new services because they enable entrepreneur to preserve their service' earnings as well as maintain control over their procedures. Given that they provide a lasting solution to a business's funding demands, this type of funding is excellent for bigger firms. Yet since it's a long-lasting solution, company owner need to reapply for a brand-new financing after utilizing the cash they obtained from it. The loan provider will certainly consider numerous elements, including the length of time the business has actually been in operation, revenues, ratios, and security, prior to approving a car loan, so it's constantly best to get advice from a specialist.

Usually, a local business requires to broaden its operations as well as grow. It may not have the necessary funding to satisfy the demand in the marketplace. A credit line from a commercial lender can help. A credit line for a local business is one of the most typical type of industrial finance. A loan can be up to seventy percent of the overall expense of the property. It might be worth looking for a specialty loan to fulfill the requirements of your business.

What Kind Of Business Loans Are There

Channel lendings are a common resource of business financing for small companies. Most of these car loans are secured by assets such as realty, receivable, as well as invoices. These lines of credit are readily available in the majority of states of the USA. Most individuals who need to fund a service requiring a large amount can make use of a credit line to fund their growth. For short-term swing loan, crowdlending systems are an alternative for a local business.

https://sites.google.com/view/overfund-capital/franchise-financing-calendar of credit report can assist a service with capital issues. A business line of credit can aid cover expenditures connected to day-to-day procedures. A line of credit can be made use of to make large payments to consumers. If your company needs small amounts of cash for working capital, a business credit card can assist you satisfy this need. Despite the different sorts of business finances, it is necessary to remember the importance of the connection with your financing specialist.

How Does Commercial Equipment Financing Work

A commercial credit line is a form of unprotected financing that's readily available to startup as well as existing organizations. It can be offered for a selection of uses, from acquiring new tools to buying a service. Generally, a business line of credit history will certainly be used to fund these types of requirements. An unsafe credit line is one of the most convenient means to get an organization car loan for your start-up or development. The terms and conditions of the funding vary from loan provider to loan provider, however it's important to look around for the best bargain.

What Are Business Loans Interest Rates

A business lending is a form of temporary financing for local business. These funds are normally unprotected finances, and can be acquired with online lending institutions, financial institutions, and also credit unions. While conventional small business loan are available for big amounts, only 20% of local business owner are approved. Different lenders, referred to as industrial money firms, are a terrific option for small companies that do not meet their needs. But before you get a company car loan, ensure you comprehend the different kinds of these kinds of loans.

|

Метки: Commercial Financing Small Business Loans Commercial Real Estate Financing Accounts Receivable Fix And Flip Loans Business Line Of Credit Healthcare Finance |

If You'Re Interested In Getting A Lending For Your Business, You Should Read On To Get More Information About The Different Kinds Of Finances Readily Available |

Content written by-Carpenter Skytte

If you're aiming to fund a company or expansion, commercial financings can be the ideal service. This sort of funding aids companies acquire materials, upgrade modern technology, or pay added staff members without using collateral. Lots of banks use a selection of various business financing programs to assist services of all sizes. These can be valuable for organizations that are just starting out or require a bit of additional funding to broaden.

Bank lending institutions are your finest choice for organization funding. Small as well as large banks, lending institution, and neighborhood financial institutions all provide these products. The very best type of small business loan is a term car loan, which will certainly amortize over a longer period of time. It's most often utilized genuine estate purchases and home mortgages, equipment acquisitions, and also financial obligation consolidation and also refinancing. It's likewise terrific for company owner wanting to take out a line of credit for their demands.

Unsafe credit lines can help you broaden your organization by providing resources for a startup or an existing business. You can look for a credit line and obtain financing in five to thirty days, depending on the lending institution. The advantages of unsafe lines of credits are reduced rates of interest, and also in some cases 0% interest for the very first year. These sorts of lendings can be a great choice for a little or new organization.

Generally, business term fundings are an excellent selection for little or brand-new services because they permit company owner to keep their service' revenues and also keep control over their operations. Since they offer a long-term remedy to a business's capital demands, this sort of financing is excellent for larger business. However since https://www.evernote.com/pub/view/overfundcapitaln...de-411e-46d6-af45-478faf449726 's a long-lasting remedy, company owner should reapply for a new car loan after using the cash they obtained from it. The lending institution will take a look at numerous variables, including the size of time business has been in operation, earnings, proportions, and also collateral, before granting a funding, so it's constantly best to get suggestions from a specialist.

Frequently, a local business needs to broaden its procedures and also expand. It may not have the essential capital to satisfy the need in the market. A line of credit from an industrial lending institution can aid. A credit line for a local business is one of the most common sort of commercial financing. A car loan can be approximately seventy percent of the total expense of the residential property. It may be worth applying for a specialized car loan to fulfill the requirements of your company.

How Business Loans Work

Avenue financings are an usual resource of commercial financing for small companies. Most of these loans are secured by properties such as realty, balance due, and also billings. mouse click the next site of credit are offered in many states of the United States. The majority of people that need to fund a company requiring a big quantity can make use of a credit line to money their development. For short-term bridge loans, crowdlending platforms are an alternative for a local business.

A business line of credit scores can aid an organization with cash flow issues. A business line of credit history can assist cover expenditures related to everyday procedures. A line of credit can be utilized to make big repayments to consumers. If your company requires small amounts of money for working capital, a commercial charge card can assist you fulfill this need. Despite the different kinds of business loans, it is necessary to keep in mind the value of the partnership with your borrowing expert.

How To Start Commercial Financing And Leasing Company

A business line of credit is a type of unsecured funding that's available to start-up and existing organizations. It can be offered for a variety of uses, from getting new devices to acquiring a service. Normally, a business line of credit report will be used to money these types of needs. An unsafe line of credit is among the easiest methods to obtain a business loan for your startup or growth. The terms and conditions of the financing vary from loan provider to lender, but it is very important to search for the very best bargain.

How Much Do Business Loans Cost

An industrial lending is a kind of temporary funding for local business. These funds are generally unprotected car loans, and also can be obtained through online loan providers, financial institutions, and also cooperative credit union. While traditional bank loans are offered for big amounts, only 20% of company owner are approved. Different lenders, described as industrial financing companies, are a great option for local business that do not meet their demands. Yet prior to you get a company funding, make certain you comprehend the different types of these kinds of finances.

|

Метки: Commercial Financing Small Business Loans Commercial Real Estate Financing Accounts Receivable Fix And Flip Loans Business Line Of Credit Healthcare Finance |

How To Get Approved For Commercial Funding |

Content by-Sanders Joyce

When you're trying to find Industrial Financing, your personal credit history as well as business credit report are of vital importance. While a high credit report is more suitable, also a low score can get you much better terms and rates of interest. While your company may not have actually developed a solid record yet, you can still gain from a high credit rating, which will certainly enhance your opportunities of being authorized. The complying with tips can help you protect business financing.