A Two-Step Guide on How to Buy fuel energy shares |

How do I know what stock I should invest in?

One of the most important tasks, when we want to build an investment portfolio, is to choose the stocks that will make up this portfolio. The key question is always going to be how do I know what action I should invest in?

The first thing to keep in mind is that to know that we have chosen a "good" stock, in my opinion, is whether it is yielded or showed higher yield than the market index in which it trades.

FCEL STOCK

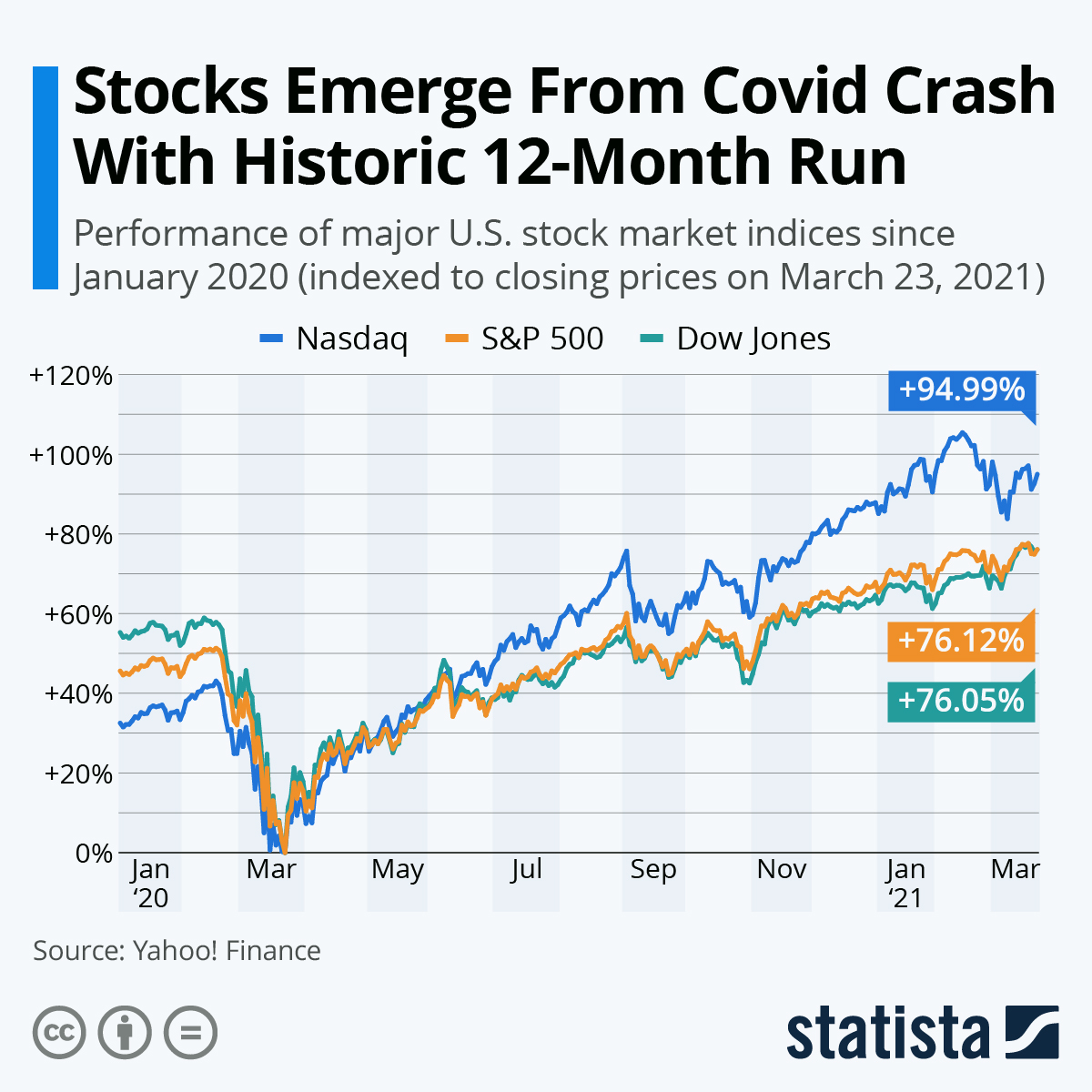

For example, if after applying any of my investment strategies (or all or a mix of all), I end up choosing to invest in Netflix stock and these in a year yield me 20% I might seem to have chosen well. But if the market index in which this company trades, in this case the NASDAQ, yielded 40%, this actually makes us think that perhaps the choice was not quite the best. In fact, this criterion also depends on each investor. For those looking for higher returns and willing to accept a higher level of risk exposure, this scenario might seem like one where the company's stock to invest was miselected. But if my profile were more conservative, 20% profitability is not bad knowing that I was able to get a negative return that year.

But in this article I will assume that we are investors who choose our investment strategies under the paradigm of always wanting to maximize profitability, always minimizing, as far as possible, portfolio risk. To do this, we return to the key question: and how do I know what action I should invest in?

To know what action we need to invest in, there are various analysis methodologies. In this and in the next articles, I will explain the 9 that I consider the most used.

In fact, there can be many more methodologies, their use will already depend on each particular analyst or each particular investor. Because these methodologies do not represent an exact science. And I say this because many times the performance of companies always depends on an emotional and human component of those who are sitting running them.

This definitely has an impact on the listing of your shares. Because it is almost impossible to anticipate or predict: one the human factor in the management or management of publicly traded and companies; two, the same investors who sometimes speculate on the price of stocks or perform buying or selling shares based more on emotions than on analysis of the company in which they are investing, is that we say that the analysis and application of these methodologies without an exact science, is an art that is fine-tuned over time.

The art of analyzing actions

Because I consider that the application of these 9 methodologies, are closer to being an art that will be refined over time, instead of being an exact science that will make us millionaires if we follow the recipe to the letter (There is not really an exact science that allows us to create instant wealth).

First, as I mentioned, we should consider that there are many variables that affect a company's performance. It is impossible to put together a financial model that allows us to predict all the quantitative and qualitative variables that affect a company's performance.

In addition, consider that of all those variables that determine a company's performance, some are measurable and some others are intangible.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |