How To Diversify Your Profile With These 5 Choice Investments |

Article writer-Fallon Carson

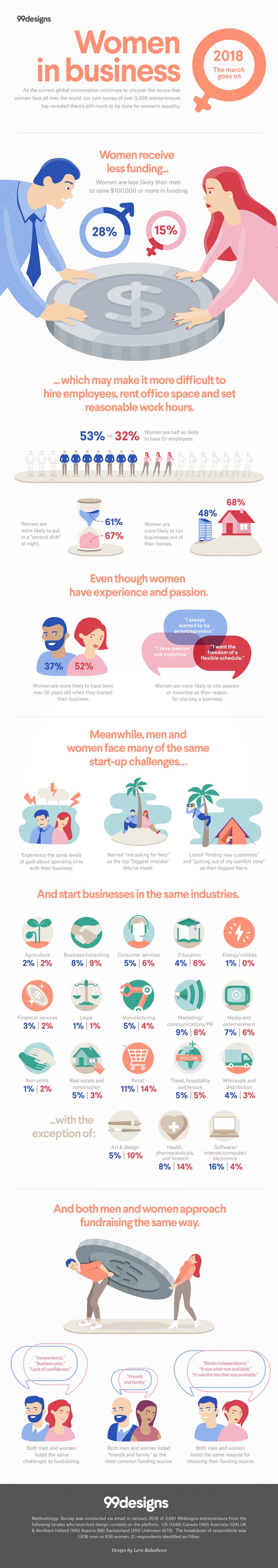

Whether you are seeking to expand your profile or just intend to try your hand at different investments, you can find a variety of financial investments that are suitable for you. These include assets, art, exclusive equity and also cryptocurrecy.

Exclusive equity

Buying private equity as an alternate financial investment can be a lucrative option. It supplies higher returns than traditional financial investments such as stocks or bonds. Nonetheless, it likewise features greater danger. You should be gotten ready for big losses if you don't expand the worth of your financial investment.

The asset course has actually been around for years. It began with private financiers as well as corporations. Nonetheless, public pension plan schemes and also insurance firms came to be significant capitalists in the 1990s. After that came the emergence of hedge funds, which specialized in particular types of transactions.

Private equity managers are typically employed to reorganize a firm. They will certainly often try to market the company at a greater value. This can also cause major expense cuts. In some cases, private equity managers will certainly take over the firm's previous management group.

Fundraising is a vital component of the private equity sector. https://writeablog.net/sara25amberly/below-are-the...r-to-you-invest-in-hedge-funds spend varying quantities of time raising resources, relying on the rate of interest of their capitalists. A company's strategy may include restructuring, cost cuts, and also brand-new modern technology.

Art

Buying art can be an interesting and also rewarding way to diversify your portfolio. Yet it is necessary to understand what you are getting into. Here are visit my web page to make sure you do not get scammed.

One of the most effective ways to invest in art is through a respectable public auction house. As an example, Christie's is one of one of the most renowned public auction houses on the planet.

An additional alternative is to purchase shares of leading auction houses. There are https://writeablog.net/tad30gillian/right-here-is-...what-are-alternate-investments providing this solution. However, it is necessary to make sure that you confirm the authenticity of any kind of bonds you purchase.

Among the simplest ways to invest in fine art is through an online art public auction. Saatchi Art, for instance, markets art work online.

A more advanced form of purchasing art is with making use of an art fund. The art fund sector has actually grown in recent times, with numerous companies supplying a series of options.

Purchasing the art market is a little bit various than purchasing supplies or realty. Unlike these even more traditional assets, art tends to be volatile and illiquid.

Cryptocurrency

Investing in cryptocurrencies has actually been an expanding pattern over the last few years. These digital assets are used for whatever from online acquisitions to hiring individuals without needing to check out a bank. Despite its growing popularity, some capitalists are unconvinced of this new financial investment option.

Purchasing cryptocurrency can be risky. This is specifically true if you are purchasing unusual antiques that can take a long time to sell. An even more prudent course of action is to expand your profile. This will help to guarantee that your profile is shielded in case of an economic dilemma.

Although it is a little bit challenging, buying cryptocurrencies can supply an excellent return in the long-term. This is because they often tend to exceed various other possession courses. Yet, it is important to take into consideration that cryptocurrencies are also very volatile.

In the past five years, cryptocurrencies have come to be more popular as an alternative financial investment. This is due to the fact that they provide some of the very same benefits of various other financial investment alternatives. On top of that, they are additionally extra easily accessible to a larger audience.

Assets

Buying commodities is a smart means to hedge against inflation. Rates of assets increase when inflation rises and they are considered safe houses in turbulent market problems. Assets can likewise assist to spread out danger in a portfolio.

Assets are a type of investment that offers investors the possibility to earn equity-like returns when markets are unpredictable. Nonetheless, investing in commodities is risky. This is because rates are highly unstable and assets have low relationship to equities. A product futures contract is one means to invest in products.

Assets are categorized into hard as well as soft commodities. Hard assets include things that require to be removed, such as steels. Soft products consist of things that are grown, such as coffee, cocoa, and also fruit. Soft products tend to be extra unstable. However, they respond well to extreme events, such as quakes, and also can provide financiers with a higher return.

Commodities are a vital part of a balanced profile. They are not always associated with equities, and they have reduced relationship to bonds. Commodities can also provide capitalists with inflation security and also portfolio diversity.![]()

Expand Your Profile With Alternative Investments |

Content by-Matthiesen Barefoot

Purchasing different investments is an option for those interested in expanding their portfolios. These investments can be located in hedge funds, fine art, handled futures, assets, and also farmland and also forests. These investments permit investors to diversify their profiles while still retaining a degree of control.

Commodities

Buying alternate investments in assets can help expand your profile. They are often liquid as well as use high returns. Nonetheless, there are several threats related to investing in assets. So prior to choosing, it is necessary to recognize the advantages and disadvantages of buying commodities.

For instance, the S&P GSCI Commodity Index has skyrocketed over 30 percent until now this year. The iPath Bloomberg Commodity Index Total Amount Return ETN is a strong option for long-term asset investing.

An asset ETF offers a low-cost and also transparent means to buy products futures. It also supplies direct exposure to a vast array of product manufacturers.

Assets have actually been shown to add genuine worth to a portfolio, along with offering inflation defense. They are additionally a safe house in volatile markets, in addition to an insurance coverage against equity market losses.

Farmland as well as forests

Agricultural land and also woodlands supply an one-of-a-kind financial investment chance. They offer investors a selection of benefits consisting of secure money income, high returns per unit of risk, and diversity advantages. Nonetheless, they additionally include dangers.

Agricultural land as well as forests give essential ecological community solutions, consisting of food manufacturing, fresh water, and provisioning services. These solutions aid protect the atmosphere, promote human health, and also preserve biodiversity. Loss of these solutions can have negative influence on biodiversity as well as family efficiency.

Furthermore, farming financial investments supply reduced correlations to various other property courses. They likewise supply a bush versus rising cost of living. Nonetheless, they are much less developed than conventional asset courses. This creates a challenge for private financiers. They must develop investment products that work and also monetarily appealing. They must also have robust compliance and oversight capabilities. They must also have solid relationships with neighborhood partners.

Managed futures

Typically marketed to high total assets people, managed futures is a specialist possession class supplied by broker-dealers. The investment course supplies lots of useful characteristics as well as qualities.

Besides offering diversity advantages, took care of futures might additionally help in reducing overall portfolio threat. These advantages can be attained by using various active financial investment strategies. https://zenwriting.net/tony44devin/buying-gold-is-...r-financial-investment-profile consist of active long and also short placements, based on technical or fundamental inputs. https://alvera4darin.bravejournal.net/post/2022/12...Prior-To-You-Buy-Bush-Finances may likewise utilize utilize to boost returns.

Managed futures approaches have been used by specialist portfolio supervisors for over three decades. These approaches have actually confirmed to be efficient in assisting to decrease profile risks and boost total profile efficiency. Historically, took care of futures have actually provided appealing outright returns.

The key advantages of handled futures consist of the ability to utilize danger without sustaining additional prices. Read More Here can be made use of along with standard asset classes to improve returns.

Art

Buying art can be a fun as well as gratifying experience. However, you need to put in the time to research the market and discover which works deserve purchasing.

In order to figure out which items deserve investing in, you'll need to consult a dependable art dealer. You'll also wish to see your regional galleries and also talk with curators. You can additionally attempt web searches to find smaller online galleries.

One of one of the most intriguing methods to invest in art is via fractional shares. This enables ordinary capitalists to get a piece of the excellent art market without investing countless dollars.

An additional method to purchase art is through crowdfunding. This entails raising money from a group of capitalists to money a project that will certainly boost the worth of an art work.

Hedge funds

Traditionally, hedge funds have actually been taken dangerous investment cars. Nevertheless, the fund of funds framework, which enables financiers to spread their investment into a variety of hedge funds, has emerged as a feasible means for a bigger team of financiers to gain access to alternative financial investment items.

In the past years, the fund of funds organization has expanded considerably. In addition to being a fairly low-priced, highly liquid choice, these products permit capitalists to take part in the returns of alternate asset classes. They may also decrease general profile volatility due to the fact that different assets often tend to have lower relationship with traditional investment profiles.

The alternative financial investment market encounters minimal guideline. Nonetheless, these financial investments are often extra high-risk than conventional financial investments. They might likewise have greater minimal investment demands. Some of these financial investments may also have limited ballot rights or various other attributes that restrict financiers' capacity to take part in the fund's activities.

Expand Your Portfolio With Option Investments |

Article written by-Bossen Kjeldgaard

Investing in alternative investments is an alternative for those thinking about diversifying their portfolios. These investments can be found in hedge funds, art, handled futures, commodities, and also farmland and also woodlands. These investments allow investors to diversify their profiles while still preserving a level of control.

Stock Market Investing

Purchasing alternate investments in products can aid diversify your profile. They are frequently fluid as well as provide high returns. However, there are many threats connected with purchasing assets. So prior to choosing, it is very important to understand the benefits and drawbacks of buying products.

As an example, the S&P GSCI Commodity Index has soared over 30 percent so far this year. The iPath Bloomberg Asset Index Total Amount Return ETN is a strong option for long-term product investing.

A product ETF gives a cost-effective as well as transparent means to purchase commodities futures. It additionally provides exposure to a wide range of commodity manufacturers.

Assets have actually been shown to include genuine value to a portfolio, along with using inflation security. They are likewise a safe house in unstable markets, as well as an insurance coverage versus equity market losses.

Farmland and also forests

Agricultural land as well as woodlands offer an one-of-a-kind financial investment opportunity. They use investors a selection of advantages including stable cash income, high returns per unit of threat, and also diversification benefits. Nevertheless, they likewise come with risks.

Agricultural land and forests provide essential community solutions, including food production, fresh water, as well as provisioning services. These services assist shield the environment, advertise human health, as well as preserve biodiversity. Loss of these services can have adverse effect on biodiversity as well as household productivity.

Furthermore, agricultural investments use lower connections to other property courses. https://economictimes.indiatimes.com/wealth/invest...in-gold/videoshow/91837695.cms use a bush versus inflation. Nonetheless, they are less industrialized than typical possession classes. This develops a challenge for personal financiers. They have to create financial investment products that work as well as economically appealing. They have to additionally have robust conformity and also oversight capacities. They should likewise have solid relationships with neighborhood partners.

Managed futures

Normally marketed to high net worth individuals, took care of futures is a professional asset class used by broker-dealers. https://zenwriting.net/marianojarvis/investing-in-...expand-your-investment-profile supplies numerous helpful attributes and also characteristics.

In addition to supplying diversity advantages, took care of futures may also help reduce total portfolio risk. These benefits can be achieved by using different active financial investment methods. These approaches consist of active lengthy and also brief positions, based upon technological or basic inputs. Some techniques might additionally make use of utilize to improve returns.

Managed futures techniques have been utilized by expert portfolio supervisors for over three decades. These strategies have actually shown to be efficient in aiding to minimize profile risks as well as improve overall profile efficiency. Historically, managed futures have actually given appealing absolute returns.

The vital benefits of managed futures include the capacity to utilize threat without incurring extra expenses. The strategy can be utilized in conjunction with standard property courses to enhance returns.

Art

Purchasing art can be an enjoyable and rewarding experience. Nonetheless, you require to make the effort to research the market and learn which works are worth purchasing.

In order to learn which items deserve purchasing, you'll require to consult a reliable art dealer. You'll additionally intend to see your regional galleries as well as speak with managers. You can likewise attempt web searches to find smaller sized on-line galleries.

Among the most fascinating methods to invest in art is with fractional shares. This allows ordinary capitalists to obtain a piece of the blue-chip art market without investing millions of dollars.

An additional means to invest in art is with crowdfunding. This involves raising money from a team of capitalists to fund a task that will boost the worth of an artwork.

Hedge funds

Traditionally, hedge funds have been thought of as dangerous investment vehicles. However, the fund of funds framework, which enables capitalists to spread their financial investment right into a number of hedge funds, has become a practical means for a larger team of capitalists to access different financial investment items.

In the past decade, the fund of funds company has actually grown significantly. In addition to being a fairly low-cost, very fluid choice, these items permit financiers to join the returns of alternative asset classes. They might additionally decrease overall portfolio volatility since alternative assets often tend to have lower connection with traditional investment portfolios.

The different investment market encounters marginal policy. Nonetheless, these financial investments are commonly much more risky than standard financial investments. They might additionally have higher minimum financial investment requirements. Several of these financial investments may also have actually restricted ballot legal rights or various other functions that limit capitalists' ability to participate in the fund's activities.

Choice Investments - What You Need To Know |

Content written by-Walker Banks

Throughout the last years, Choice Investments have actually come to be a significantly integral part of the economic landscape. This consists of hedge funds, exclusive equity, and unusual collectibles.

Private equity

Purchasing private equity as a different financial investment can be a lucrative selection for those looking for a high return. Yet Suggested Webpage comes with some dangers. The investment might need a lengthy holding period as well as is relatively illiquid.

Private equity investment firms have various financial investment methods, and they might make use of various techniques for each and every investment. For example, a personal equity fund might purchase all the shares of an underperforming company, streamline it, and then change elderly monitoring. After that, it could attempt to market it at a higher value. This raises the worth of the investment and additionally improves the return accurate invested.

Private equity investment company can additionally utilize debt to obtain a company. This enables the firm to obtain even more capital, but the financial obligation comes with additional danger.

Hedge funds

Unlike mutual funds, hedge funds purchase a range of various properties. https://schiffgold.com/interviews/peter-schiff-its...n-or-the-pandemic-its-the-fed/ consist of supplies, money, real estate, and assets. The goal of hedge funds is to lower volatility and make best use of financier returns.

Different Investments are typically much less correlated with supply as well as bond markets, and they may provide much better liquidity and lower minimum investment demands. These are excellent enhancements to a long-term profile. Nevertheless, investors need to carefully consider their options.

Different investments can be riskier than standard investments, and also might impose substantial charges. However, continued item technology might raise access and also broaden the capitalist base.

In addition to conventional asset courses, alternate financial investments are likewise much less prone to rate of interest modifications and also rising cost of living. Asset prices can be an essential diversifier, as they are tied to supply as well as require as well as federal government policy.

Art

Purchasing art as an alternative investment is becoming more and more preferred. It is a wonderful method to diversify your portfolio. Investing In Reits is likewise a method to add character and enjoyable to your home or office.

It has been recognized to outmatch standard financial investments such as equities and bonds, however it is likewise based on the same threats as other asset courses. In order to take advantage of art as a financial investment, you need to have an excellent strategy.

Investing in art has become preferred for lots of factors. It is low-cost and can give diversity to a portfolio. Unlike other possession courses, art has a tendency to keep its worth with time. It is also an optimal investment in good times as well as negative.

However, it is essential to keep in mind that purchasing art as an alternative investment is not without its risks. It calls for a certain quantity of devotion and also a high threat tolerance. It is also very illiquid, which makes it tough to trade. Additionally, the cost of art can be dropped gradually.

Rare antiques

Buying uncommon antiques is an alternate financial investment that can be amazing as well as satisfying. Yet prior to you start spending, make certain that you understand the risks entailed.

Antiques are illiquid, suggesting that they don't trade on a public market. As a result of this, there's no assurance that you'll have the ability to market them at a greater rate than they cost you. This suggests that your revenue is mosting likely to depend on the charm of the item you're collecting, the number of potential purchasers, and also the marketplace's capacity to create need.

Some collectibles can become pricey and illiquid if you don't understand how to purchase reduced as well as sell high. This is why it's a great suggestion to have an expert evaluate the thing prior to you acquire it.

Antiques are a good hedge against rising cost of living, given that they are normally valued higher than they are when they are first acquired. Purchasing antiques can additionally diversify your portfolio.

Cryptocurrency

Investing in cryptocurrencies has actually been an intriguing choice for numerous. It has the possible to help you gain a good return while lowering your overall profile danger. Nevertheless, before you can make the decision to buy this new craze, you require to understand even more regarding it.

Cryptocurrency is an electronic money that is protected by cryptography as well as a distributed journal. These technologies allow you to shop as well as exchange digital assets without a middleman. Additionally, crypto units can not be counterfeited.

It holds true that cryptocurrencies are expanding in appeal, yet they aren't yet an universally accepted financial investment. In fact, the governing environment for these electronic assets is most likely to get even more stringent over the years.

Cryptocurrency is an excellent financial investment, however you need to beware. Actually, some capitalists are shedding money. The best way to ensure that you won't get swindled is to just buy what you can pay for to shed.

Exactly How To Expand Your Profile With These 5 Choice Investments |

Content author-Madden Vedel

Whether you are looking to diversify your profile or merely intend to attempt your hand at alternative financial investments, you can locate a series of investments that appropriate for you. These consist of assets, art, private equity and also cryptocurrecy.

Exclusive equity

Buying private equity as an alternate investment can be a lucrative choice. It supplies higher returns than typical financial investments such as supplies or bonds. Nevertheless, it additionally comes with higher risk. You need to be prepared for large losses if you do not expand the value of your financial investment.

The possession course has been around for decades. It began with private financiers and companies. Nevertheless, public pension systems as well as insurance companies came to be major financiers in the 1990s. Then came https://www.investing.com/news/cryptocurrency-news...d-to-other-investments-2819069 of hedge funds, which specialized in specific kinds of transactions.

Personal equity supervisors are usually employed to reorganize a company. They will certainly typically attempt to re-sell the company at a higher value. This can additionally result in major cost cuts. In some cases, personal equity supervisors will take over the company's previous administration group.

Fundraising is a crucial element of the personal equity industry. Companies spend varying amounts of time increasing capital, depending upon the passion of their financiers. A company's strategy might include restructuring, cost cuts, as well as new technology.

Art

Purchasing fine art can be an exciting as well as fulfilling way to expand your profile. But it's important to understand what you are getting involved in. Below are some pointers to make certain you do not get scammed.

Among the very best means to invest in art is through a reliable public auction residence. For instance, Christie's is among the most popular public auction houses in the world.

An additional option is to invest in shares of leading auction homes. There are several firms offering this service. Nonetheless, it is very important to make certain that you verify the credibility of any bonds you acquire.

One of the most basic ways to invest in art is with an on the internet art auction. Saatchi Art, as an example, offers artwork online.

An advanced form of purchasing art is via making use of an art fund. The art fund sector has actually expanded in recent times, with a number of companies supplying a variety of options.

Investing in the art market is a little bit different than investing in stocks or realty. Unlike these even more conventional possessions, art often tends to be unpredictable and also illiquid.

Cryptocurrency

Buying cryptocurrencies has been a growing fad over the last few years. These electronic assets are utilized for every little thing from on-line purchases to hiring people without having to check out a bank. Regardless of its expanding popularity, some financiers are hesitant of this new financial investment alternative.

Investing in cryptocurrency can be dangerous. This is specifically true if you are purchasing unusual collectibles that can take a long time to market. An even more prudent course of action is to diversify your portfolio. https://blogfreely.net/blair2dewitt/choice-investments-what-you-need-to-know will certainly help to guarantee that your profile is safeguarded in case of a financial crisis.

Although https://writeablog.net/edward21miquel/just-how-to-...gas-as-well-as-commodity-funds is a bit difficult, purchasing cryptocurrencies can provide a good return in the long-term. This is due to the fact that they have a tendency to exceed various other asset courses. Yet, it is important to take into consideration that cryptocurrencies are likewise highly unstable.

In the past 5 years, cryptocurrencies have actually ended up being more preferred as a different investment. This is due to the truth that they offer some of the exact same advantages of other financial investment options. Furthermore, they are also much more accessible to a bigger audience.

Products

Buying commodities is a clever way to hedge versus rising cost of living. Rates of commodities boost when rising cost of living rises and they are thought about safe houses in turbulent market problems. Commodities can likewise assist to spread threat in a profile.

Products are a type of investment that provides financiers the chance to make equity-like returns when markets are unpredictable. However, purchasing products is dangerous. This is because rates are extremely unpredictable and also assets have low connection to equities. An asset futures contract is one way to buy products.

Assets are categorized right into tough as well as soft commodities. Difficult products include things that need to be drawn out, such as steels. Soft commodities include points that are grown, such as coffee, cocoa, and also fruit. Soft products have a tendency to be a lot more unpredictable. However, they respond well to severe occasions, such as quakes, as well as can give capitalists with a higher return.

Products are a vital part of a balanced profile. They are not always correlated with equities, and they have reduced relationship to bonds. Products can also give investors with rising cost of living security and profile diversification.

Buying Property Is A Wonderful Way To Develop Wealth |

Article written by-Holst McClure

You can invest in real estate by acquiring a building and after that leasing it out. You can also buy a home and hold on to it, which is called buy and hold investing.

Buy-and-hold

Investing in buy-and-hold real estate can be a wonderful method to construct wealth. Nevertheless, there are a couple of points you must understand before you begin. It's important to have an organization plan and study in place before you begin. It's also a good idea to collaborate with a home manager. This will help you prevent tenant nightmares.

Aside from creating riches, a buy-and-hold real estate investment can also provide easy earnings. You can also acquire tax benefits, consisting of reductions for rental revenue.

Purchasing buy-and-hold residential or commercial properties is a superb way to protect your wealth from inflation. This method relies on the projecting of neighborhood instructions, which can assist increase home value over time. Nevertheless, it is essential to have a plan in place to prevent a decline in the realty market.

Utilize

Using leverage in realty investing is an exceptional tool to boost your return on investment. By utilizing a mortgage, charge card or business line of credit report, you can buy a pricey property without having to invest a lot of your very own money. It is also a method to expand your portfolio as well as decrease tax obligations on your property investment.

Most individuals make use of a home mortgage when acquiring a home. Home mortgages feature rates of interest that vary from lender to loan provider. You need to satisfy the lender's needs for getting approved for financing. Lots of people will pay back the car loan over years. If you are unable to pay the loan, the lender can confiscate on the home. This can injure your credit report as well as restrict your ability to obtain future fundings.

https://melba07deon.bravejournal.net/post/2022/12/...-Oil-And-Gas-And-Product-Funds in property is a lasting venture, and location is among the most crucial factors that will certainly determine the worth of your residence. Getting a home in a great place will make certain that you have a residence that keeps worth gradually, as well as a place that you will be happy with for years to find.

Place is essential since it determines every little thing else that goes into the realty purchase. This includes the worth of your residence, your joy, as well as your family's monetary future.

When it pertains to location, there are two primary kinds: "Macro" and "Micro". "Macro" refers to the geographical area all at once. The "Micro" describes the micro-location, which is an area within "Macro".

Buying a home in an excellent neighborhood will certainly enhance the worth of your home. Locations that are close to vital areas and transport hubs are excellent. This is since these areas have a high demand for homes and also will likely enhance in worth with time.

Residential property devaluation

Buying real estate features lots of advantages, including the capacity to depreciate the worth of residential or commercial property over time. Depreciation is a way for property owners to recover expenses and also gather income. It is additionally an effective tax shelter. An excellent tax obligation expert can assist you establish just how much devaluation your investment residential property will certainly create.

To qualify for depreciation, the property needs to be owner-occupied as well as in an income-producing task. The useful life of the home have to be more than a year.

In the very first year of possession, you can drop partial quantities of the property. However, you can not drop the sum total of the residential or commercial property in the same year. visit site sets stringent policies regarding devaluation.

Residential property depreciation is determined as a portion of the worth of the home. It is based on the initial financial investment as well as the enhancements to the home. If related webpage is diminished over a number of years, the devaluation portion can be multiplied by the initial acquisition price.

Below Are The Few Things You Should Know Prior To You Invest In Bush Funds |

Written by-Niemann Snider

Investing in hedge funds is an excellent means to grow your riches.

Approved capitalists

Purchasing hedge funds calls for knowledge and a significant quantity of cash. As with any type of financial investment, this can be dangerous. Fund managers make use of advanced trading methods and also utilize to create a positive return. They also look for to create great returns, no matter market conditions.

The Securities and Exchange Payment (SEC) views hedge funds differently from other safeties. They check out these as an extra adaptable investment choice, allowing qualified financiers to capitalize on investments that are unavailable to the general public.

To be an accredited financier, you should have a net worth of a minimum of one million bucks. You likewise require to have an expert financial history. This consists of having a wage of at least $200,000 per year for the past 2 years, or a consolidated earnings of at least $300,000 if you are wed and also have a spouse.

Possessions under monitoring

Investing in hedge funds supplies a strong return capacity. Nevertheless, large quantities of cash can be difficult to handle successfully. Hedge fund supervisors charge big charges for the management of these funds. Hedge fund capitalists are generally incredibly well-off individuals.

Assets under monitoring (AUM) is the total market value of all financial investments held by an individual or establishment. It can differ from institution to organization. Some establishments also consist of bank down payments in the calculation.

Assets under administration is likewise made use of as an efficiency indicator. AUM rises and fall daily based upon market efficiency and also capitalist flows. If a fund has a secure capitalist base, the volatility of AUM will certainly be reduced. Nonetheless, if a fund has regular inflows and discharges, the estimation of AUM will certainly be much more unpredictable.

AUM is likewise used to compute monitoring costs. A fund supervisor's fee is generally determined as a percent of AUM.

Cost structure

Unlike a mutual fund, hedge fund fees are based upon 2 main resources. The initial is the administration charge, which is generally 2% of the overall properties under management. The second resource is the performance fee.

A performance fee is only billed when the hedge fund makes revenues that go beyond a pre-determined threshold. For instance, if the fund's possessions expand to $200,000 and afterwards raise to $800,000, a 20% performance charge would be charged. The fund would not be billed if the property worth fell to $100,000.

One of the most vital attribute of the efficiency charge is that it is just paid when the fund gets to a pre-determined earnings threshold. This means that a hedge fund supervisor needs to recover any losses initially prior to charging a performance cost.

A high water mark stipulation is an additional feature of the efficiency cost. This ensures that a hedge fund manager can only charge a performance fee if the fund's earnings increase to a particular degree.

Market instructions nonpartisanship

Investopedia explains market instructions nonpartisanship for hedge funds as "an investment method that intends to create positive returns regardless of market direction." Nevertheless, https://www.click4r.com/posts/g/7320268/below-is-a...what-are-alternate-investments does not eliminate all danger from the marketplace. Rather, it is a financial investment technique that minimizes threat better than other investment methods.

Market direction nonpartisanship for hedge funds is a means to reduce threat from severe equity market decreases. The strategy also intends to attain reduced total volatility. Additionally, it can likewise offer income in having markets.

A market-neutral fund strategy involves an equilibrium in between lengthy as well as short settings in the same hidden asset. The long placements are matched by brief positions, which are well balanced consistently to preserve market nonpartisanship. This technique allows better precision in forecasting future returns.

Market-neutral methods can additionally give diversity from conventional possession classes. Unlike typical benchmark-centric strategies, which often tend to have high levels of market exposure, market-neutral funds have no beta. Beta is the organized risk associated with a specific property. https://blogfreely.net/kymberly39irving/buying-gol...expand-your-investment-profile defines beta as "the level to which a stock is associated with various other supplies in the marketplace."

Market-neutral approaches have been around for decades. They are an usual investment technique amongst hedge funds. They are likewise made use of by exclusive trading companies.

Regulation

Regulatory procedures are essential to protect capitalists as well as ensure the stability of the economic market. They may be made to discourage extreme threat taking and protect against deceitful and also criminal conduct. They additionally affect the bigger economic system.

The Dodd-Frank Act laid out sweeping governing changes for the financial markets. A few of these procedures were targeted at protecting capitalists while others were designed to reinforce the regulative system.

The Dodd-Frank act required the Securities and also Exchange Compensation to modify its regulations to call for hedge fund managers to register. The guideline called for a lot more reporting from hedge fund managers as well as additionally prolonged the size of audits from 120 to 180 days. It additionally got rid of the private consultant exception.

Tim Geithner, the United States Treasury Assistant, supported the production of a new systemic threat regulator. learn here argued that hedge funds depend on utilize and also short-term funding, which placed them in danger of systemic failing.

Here Is A Better Consider What Is A 1031 Exchange?And Exactly How It Works? |

Article writer-Kristensen Abrams

Primarily, a 1031 exchange is an internal revenue service program that permits a taxpayer to defer government earnings tax responsibility and also capital gains tax. It is also described as an Area 1031 exchange.

https://money.usnews.com/investing/investing-101/a...ow-to-invest-in-lithium-stocks -to-suit exchanges

Unlike a routine deferred exchange, a build-to-suit exchange calls for a capitalist to obtain cash to buy the replacement property. This lending is normally made via a qualified intermediary, or EAT. The EAT is a holding firm, normally a single-member LLC, which holds the title to the substitute property. It will make improvements on the substitute property and also hold title while the improvements are completed.

https://www.liveinternet.ru/users/egelund_perkins/post496860954 to match exchange is a special type of 1031 exchange that enables an investor to postpone tax obligations on gain from the sale of a home. In order to qualify, the substitute building have to be like-kind to the home being sold, and it has to have a fair market price higher than or equal to the price.

A build to match exchange is matched for financiers that intend to make repair work or enhancements to their building during the exchange period. It is also a good choice for capitalists that want to acquire even more value from the exchange profits.

Unlike a normal deferred exchange, build-to-suit exchanges are commonly more costly. Investors should additionally make certain they are structuring the exchange effectively. This may consist of a guarantee on the funding from the EAT. If you require help structuring the exchange, seek advice from an experienced tax obligation expert.

A construct to fit exchange can be beneficial to a capitalist, but it can likewise take time. In addition to paying taxes, investors may need to pay closing prices two times. It is likewise hard to complete a huge building and construction task within the 180-day exchange period.

Needs for a certified intermediary

Having actually a qualified intermediary is a vital action in an effective 1031 exchange A certified intermediary is a specific, or an institutional entity, who has a specific collection of certifications as well as experience to carry out an effective 1031 exchange.

Futures Market Investing have to have a track record of carrying out 1031 tax deferral services. The federal government does not need QIs to have special licenses, yet they must adhere to state and also government policies. It is best to utilize a QI with a strong online reputation in the local market.

A QI's main task is to protect your financial investment in a 1031 Exchange. A QI has to hold the funds between closings until you are ready to purchase a substitute building. The QI must also prepare all transactional records associated with the purchase.

The QI needs to additionally develop a certified escrow account. These accounts are established in FDIC insured banks. They can hold up to $250,000 in funds. The funds will be launched from the escrow just with the approval of both the QI and also the exchanger.

A QI ought to also have an audit route. They need to submit to a yearly 3rd party audit. They need to also have transaction representatives that are certified to accomplish exchanges of that type. A qualified intermediary should likewise have a great online reputation in the regional market.

Tax ramifications of a 1031 exchange.

Using a 1031 exchange enables the proprietor of realty to delay capital gains taxes on the sale of a residential or commercial property. The earnings from the sale of the building are after that reinvested in a substitute property. The outcome is a greater profile worth.

A 1031 exchange is usually performed with a qualified intermediary. A certified intermediary is a private or business that has experience and also knowledge of the tax obligation implications of a 1031 exchange. These individuals can be a lender, attorney, financial investment broker or an accountant. A certified intermediary never comes to be the proprietor of the building.

A 1031 exchange might not be utilized to get residential or commercial property that is not held for financial investment functions. It is likewise not applicable to equipment. It can only be used to postpone funding gains taxes on the sale or lease of real estate.

A 1031 exchange is a great tool genuine estate investors. Nonetheless, the process might differ for every transaction. It is necessary to comply with the rules to the t to optimize its advantages.

In order to get a 1031 exchange, a building must be held for effective usage in a trade or service. The residential or commercial property should additionally be "like-kind". Typically, this indicates that the two residential properties have to have the same nature.

The property needs to likewise have a home loan. A home loan can be on either side of the exchange.

Purchasing A Physical Gold Bar Can Be A Suitable Means To Shield Your Wealth |

Content writer-Madden Mayer

These bars are substantial, actual properties that have been made use of as a store of value for centuries. They are very easy to store and transport, and are incredibly fluid investments. They additionally use an exclusive method to preserve your riches. If you wish to acquire a gold bar for your collection, consider buying it from a respectable resource, such as Monex. They have customer support representatives readily available Monday via Friday, 5:30 am to 4:30 p.m. Pacific time, and they are open lots of Saturdays and Sundays.

Gold bars are produced in numerous shapes and sizes. They are typically accompanied by an assay card, which provides future recognition as well as liquidity. They are a great way to secure your properties from rising cost of living and also to expand your financial investment portfolio. If you don't intend to spend your money on a solitary gold bar, you can purchase smaller sized gold bars that are less than a gram.

There are numerous benefits to possessing gold bars, that include a low supplier's premium and a bigger range of sizes. A gold bar can be used to expand your portfolio, or to develop a pension. Whether you're planning to hold your gold bar for a long time or transform it into cash money, you'll locate the costs competitive.

Purchasing gold bars online can be a straightforward process. Many on the internet suppliers offer gold bars and also can be accessed online or by phone. Nonetheless, you will certainly have to recognize the delivery costs and insurance policies. On-line dealerships usually have lower prices than traditional sellers, but you'll need to study to locate a credible dealership. You can additionally pick to get gold bars online from public auction sites such as eBay. Before buying, ensure you check out feedback from past purchasers. If there are problems regarding the seller's gold bars, maybe an indication that the seller has an online reputation for poor service.

Why Invest In Gold And Silver

When purchasing gold bars, it's best to buy numerous different sizes so you'll have the ability to sell at different rates. You can additionally consider whether you want to make use of the gold bars for individual or business objectives. Remember that larger bars normally have greater rates. You can additionally limit the choice by setting a cost array. If you're buying a lot of gold bars, suppliers might want to provide a price cut.

When purchasing a physical gold bar, make certain the producer is LBMA-approved. These requirements are extensive and business that fail to satisfy these requirements can be delisted. In addition to that, a gold bar made by a LBMA-approved producer is IRA-eligible. You can buy these bars with a self-directed IRA or solo 401k.

You can also inspect the purity of your gold bar by checking out its assay card. It will certainly show you the number of grams it is, in addition to its weight and also excellence. Along with its weight, it will certainly additionally have its serial number and mint certification, which can assist you map its possession. There are some bars that are too big to have an assay card as well as will certainly come with a separate assay certificate.

How Liquid Is A Precious Metals IRA

Gold bars are an excellent addition to your investment profile. hop over to here , also called gold bullion, can be more cost effective per gram than gold coins. please click the next website are more convenient to use when you are making large purchases. Furthermore, they are more affordable to produce compared to gold bullion coins. So, if you're seeking a lasting means to shield your investment, it is smart to purchase gold bars as opposed to purchasing coins.

How To Get Started With A Gold IRA

One thing to note is that a physical gold bar is much more safe and secure than an electronic version. The physical value of a gold bar is much more secure, which means that it is not prone to damages, burglary, or degeneration. Furthermore, unlike on the internet financial investments, a gold bar does not fall apart in a collision.

The physical type of a gold bar can be kept in a secure in your home or at a financial institution. Unlike coins, bars are easy to store as well as need less room. You can select a safe-deposit box or gold storage space center that specializes in secure storage space of precious metals.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

This Post Aims To Supply An Introduction To This Crucial Subject Concerning Retired Life Planning Guides As Well As A Gold Individual Retirement Account |

Written by-Holgersen Bradshaw

A Gold IRA can help you save for retirement. This investment choice enables you to roll over certain financial investments from competent retirement plans. A great location to begin purchasing gold is a site that uses an audio or published overview. You can also contact a company that gives gold individual retirement account solutions to learn more concerning the options readily available.

You ought to take into consideration the minimum investment needed for a gold IRA prior to you open one. Some companies require a first financial investment of $50,000 or more. Various other business do not disclose the minimal financial investment called for. The annual contribution limits are covered at 6 thousand dollars in 2020, 7 thousand bucks if you're 50 or older. Make sure you select a company that has your best interests in mind. It's likewise crucial to consider whether the business can buy as well as provide your gold swiftly.

You must stay clear of purchasing scandal sheet coins, which typically include a considerable markup. Additionally, attempt to avoid buying mining supplies, given that their costs are not established by the price of the metal. If you're looking to lessen prices, take into consideration investing in COMEX-standardized bullion bars. You can likewise acquire precious metals with trust companies.

How To Open A Gold IRA Account

Several firms offer Individual retirement accounts in gold, silver, as well as platinum. When buying https://reporter.am/2022/07/21/macroview-investmen...es-gold-trust-nysearcaiau.html , make sure to pick a business that has rigorous criteria regarding purity. Gold that meets IRS requirements is taken into consideration investment quality. If it's listed below this purity, it is not eligible for a gold IRA. A gold individual retirement account is best for investors that are wanting to diversify their investments and build a strong structure for retired life.

There are numerous advantages to having a Gold IRA. You will be able to expand your portfolio and decrease the risk of your retirement profile. It additionally adds the store of value of concrete metals to your retired life profile. On top of that, it is really hassle-free and also flexible. If you have an interest in investing in a Gold IRA, make certain to get in touch with a business that can offer the details you need. It is highly advised that you contact a business that provides superb client service.

Where To Purchase Gold Bars

Gold IRA resembles a typical individual retirement account, with one trick difference: as opposed to paper possessions, gold individual retirement account possessions are physical gold bars, coins, and other items of rare-earth element. The benefits of a Gold individual retirement account are that it will never decrease or lose value, unlike paper assets in a standard individual retirement account. It has a lengthy service life and will always preserve a steady rate.

While a Gold IRA is not readily available for every single capitalist, you can select from a number of sorts of Individual retirement accounts. Initially, you can invest in an ETF. An ETF is an index fund. This means that you do not pay tax obligations up until you take out the money. linked here is valuable for investors who wish to expand their financial investments without running the risk of way too much.

How Much Do Gold Bars Weigh

Another advantage of having a Gold individual retirement account is its tax-deferred benefit. The cost of gold is anticipated to raise incrementally. In addition to tax benefits, you'll benefit from stability versus rising cost of living. As long as you have a respectable custodian, you can rest assured that your money is safe and also protected.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

An Exclusive Storage Space Individual Retirement Account Supplies Several Benefits Over Typical Retirement Savings Accounts |

Created by-Thomson Aarup

Initially, it supplies diversification. Securities market can vary substantially daily. By expanding to a private storage residential or commercial property, an IRA holder can purchase tangible assets with constant appreciation and also capital. Another advantage of exclusive storage is that it can be lent out to non-disqualified people. Furthermore, the owner can keep the tax benefits associated with an IRA account.

Second, an exclusive storage individual retirement account can be kept in a secure place that is not noticeable to the public. The IRS and also Uncle Sam will not have the ability to view your private storage space account. Third, self-directed IRAs can be kept in metals aside from standard paper currency. These are often taken care of by a certified custodian.

mouse click the following internet site can be helpful for retirement savers due to the fact that they don't need to stress over monitoring their account. Most savers do not have the time or disposition to manage their IRA account, and their house storage space isn't almost as safe as a reliable vault. If Rosland Gold Los Angeles, Ca are fretted about losing your precious metals, exclusive storage might be a sensible option. It's secure, safe, and allows you to access your retirement savings any time.

An additional advantage of exclusive storage Individual retirement accounts is that you can have physical control over your rare-earth elements without fretting about governing threats. IRA holders with physical silver or gold can opt to keep their metals in a protected insured vault. Nonetheless, exclusive storage IRAs include extra risks as well as problems. As an example, you may be exposed to governing danger if you store your steels in an ignored storage space center.

An exclusive storage individual retirement account can also be costly for the individual retirement account owner. Along with the threats of losing tax benefits, a private storage individual retirement account may also be an offense of forbidden deals laws. If the internal revenue service discovers that the funds in an exclusive storage space account are used for investing, it might disqualify the account and also need you to disperse the properties promptly. If you stop working to comply with these guidelines, you could be responsible for substantial charges and tax obligations.

Why To Invest In Gold

If you want to have your gold individual retirement account kept in an exclusive storage company, you should initially register a minimal obligation company. Gold And Silver Investment Companies Los Angeles, Ca should have a specially-written operating contract. In addition, all of its employees must publish a $250,000 fidelity bond. You have to also make sure that the trustee corporation is owned by a team of people with good monetary histories as well as experience. The firm will have to provide you with in-depth information regarding the process and charges.

How To Invest In Gold Commodity

While a house storage Gold IRA seems like a fantastic suggestion, it could be extra pricey than the benefits it offers. It's likewise vital to note that a private storage Gold individual retirement account needs you to save the precious metals at a financial institution or various other IRS-approved center. Thus, it is necessary to work with a controlled specialist to avoid any kind of prospective tax obligation ramifications. For instance, saving your gold under a mattress or residence safe would constitute a very early withdrawal, and the IRS would evaluate a 10% penalty.

One more concern with exclusive storage Individual retirement accounts is that it may be prohibited. The internal revenue service has broad discretion when it comes to establishing legal investing methods, as well as you could deal with charges, charges, or tax obligations. If you fail to adhere to these regulations, your individual retirement account will likely be disqualified from tax benefits. If you're not sure of whether your private storage space IRA will be qualified, talk to a gold individual retirement account expert.

How To Have A Gold IRA

It's critical to recognize all rules concerning home storage rare-earth element Individual retirement accounts prior to choosing a location. The internal revenue service has extensive details concerning the regulations pertaining to precious metals and also residence storage space. If you're not sure, it's much better to obtain aid from an attorney than to run the risk of penalties. In spite of these worries, the advantages of private storage space gold IRAs are well worth it. In fact, it's easier than you believe.

Another major benefit of personal storage Individual retirement accounts is the level of service that they give. The Patriot Gold Team, as an example, provides affordable rates as well as transparent pricing. It likewise doesn't bill purchase fees, which is terrific for capitalists. They also provide a range of perks, including free storage for the initial 3 years.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

This Article Aims To Provide An Intro To This Vital Subject Regarding Residence Storage Space Gold IRA |

Content written by-McAllister Stensgaard

A home storage space gold individual retirement account is a wonderful method to hedge against rising cost of living as well as expand your retirement portfolio. Nevertheless, there are a few dangers included, which is why you should carry out comprehensive research as well as speak to a financial advisor prior to investing. Gold is a volatile financial investment, and also house storage might not be the very best choice for everyone. Therefore, it is recommended to store your gold in a safe and secure place.

https://postheaven.net/wilheminacarissa/a-gold-ind...ic-way-to-protect-your-pension supplies tax benefits as well as the safety and security of storing precious metals in your own residence. While this approach has numerous advantages, it can likewise be pricey as well as require a great deal of documentation and management expenses. Also, there are click the up coming post should fulfill, as well as the IRS is specifically conscientious to House Storage space IRAs.

Although the internal revenue service has not explicitly ruled against House Storage space Gold IRAs, the tax company has actually mentioned in various other areas of the code that physical individual retirement account possessions must not be kept in a home. This is a criminal offense, and also in many cases, you could deal with jail time if you are captured devoting such a violation. For these reasons, discernment is key.

Home Storage Gold IRA business will usually set up a minimal obligation company that functions as the IRA's proprietor and also select you as trustee. After that, they will certainly open a checking account for the LLC. You'll have to pay an arrangement charge and annual fee to Home Storage Gold individual retirement account business. There are also charges that are related to individual retirement account custodial solutions and will require to be paid.

How Invest In Gold

There are a variety of dangers entailed with keeping your gold in an individual retirement account. As a result of the vast discretion of the internal revenue service in the world of lawful investing, it is possible that you could end up paying taxes on your gold as well as also deal with penalties and charges if your account is investigated by the IRS. In addition, the internal revenue service has actually know the presence of these storage techniques for rather some time. It is consequently important that you choose a trustworthy place to store your gold.

How To Do A Gold IRA

While home storage gold IRAs are except everyone, they are suitable for those that are seeking a safe place to keep their properties. By doing Learn Alot more Here , you can be certain that your money is not going to drop with time or the economic environment. While house storage space gold IRAs are extra made complex to establish than their traditional counterparts, they can offer you satisfaction by ensuring they are secured.

House storage space gold IRAs are a prominent method to hold your gold, and also there are numerous benefits to choosing it as your retired life financial investment. Home storage space gold Individual retirement accounts allow you to hold pure gold bullion, as well as bullion constructed from various other precious metals. Nonetheless, you have to be sure to choose a credible supplier to aid you establish your account and also purchase your gold.

How To Invest In Gold Futures

A home storage gold individual retirement account will need you to discover a custodian for your rare-earth elements. Utilizing a custodian will certainly ensure the safety of your rare-earth elements. An individual retirement account custodian can keep your gold in a safe deposit box as well as make it safe and also protected. These custodians are approved by the internal revenue service and will certainly safeguard your rare-earth elements in the best method possible.

House storage space gold IRAs are not entirely legal, and lots of guidelines govern the storage space of your gold in your home. Nonetheless, they are a sensible as well as lawful choice for those who wish to invest in precious metals without taking the chance of internal revenue service tax obligation penalties. You ought to constantly speak with a financial expert to decide whether residence storage space gold Individual retirement accounts are a good alternative for you.

Residence storage space gold IRAs can likewise assist safeguard your precious metals from burglary as well as damage. The internal revenue service recommends that you keep the precious metals in a safe place and also utilize a storage space company that is IRS-approved. The only exemption to this policy is if you currently have gold in your house as well as are aiming to save it at home. If so, you should ensure that the storage firm you are making use of is authorized by the IRS.

While it may be appealing to save your gold in your home, you ought to always call your banks and also schedule it to be kept by a qualified custodian. You can additionally use a third-party custodian, however be aware that this is not the same as having a physical custodian. Additionally, your gold should be kept in a safe safe.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

House Storage Gold IRAs Are One Of The More Prominent Means To Purchase Gold |

Content create by-Pham Drew

If you are taking into consideration investing in precious metals with your IRA, you ought to understand that there are several important needs you need to meet before you can begin spending. These demands include high management expenses, paperwork, as well as time. Residence Storage IRAs additionally require special attention from the internal revenue service. You ought to speak to a specialist to comprehend your options.

Home storage space for Individual retirement accounts is not yet accepted by the internal revenue service, yet there are lots of kinds of physical rare-earth elements you can place in your IRA. The internal revenue service has actually particularly denied house storage space, but that isn't necessarily completion of the tale. This is a misleading statement. Be https://squareblogs.net/rosana4valentin/a-personal...of-advantages-over-traditional of firms that tell you otherwise. If you believe they are tricking you, walk away immediately.

How Much Is Gold IRA Transaction Fee

Residence storage space gold Individual retirement accounts are except everybody, but it is a good option for those who like to keep their gold close at hand. Unlike http://laci13jeromy.jigsy.com/entries/general/An-E...al-Retirement-Savings-Accounts of financial investments, gold doesn't depreciate over time, so it is the best means to maintain your wide range. While it may call for additional initiative to meet policies, house storage space gold IRAs offer a choice that deserves considering.

How To Buy And Invest In Gold

There are a few things you should learn about Home Storage space Gold IRAs before setting up an account. Initially, it is essential to recognize that it is only lawful to save precious metals in an approved storage facility. In fact, the IRS specifies that you have to save the steels in a financial institution or an IRS-qualified IRA custodian.

When you open a Residence Storage Gold IRA, you must select a custodian to hold your gold. The custodian will certainly hold the LLC in tax-deferred status for you. The custodian will maintain your gold in an insured as well as safe and secure place. The internal revenue service has actually published a list of regulated custodians that supply this solution.

How Much Are Gold Bars Worth

Although they are not without their risks, they are a terrific alternative for many investors. Buying physical silver and gold has a number of advantages. It is a limited resource as well as is exempt to the same volatility as the securities market.

Residence Storage Gold IRAs are a great way to save your rare-earth elements in a safe place. They are also less expensive than various other kinds of IRAs. read page offer boosted privacy, and also the capability to store your gold privately. Just be sure to collaborate with a respectable dealer for your house storage space gold IRA. The internal revenue service website has an extensive checklist of standards on house storage gold Individual retirement accounts.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

Making Use Of A Gold Individual Retirement Account Is A Great Means To Expand Your Profile |

Content writer-Schneider Pace

Before making a decision to invest in a GOLD IRA, you require to do some research study. The Internet is a terrific area to do this. You can go to review sites like Facebook, Google Service, as well as the Better Business Bureau to see what other individuals need to claim about a business. There are also certification sites like business Customer Alliance as well as Trustpilot to see just how well the company runs.

The IRS has approved a number of vault centers that manage rare-earth elements, consisting of silver and gold. Nevertheless, not all rare-earth elements are allowable for an individual retirement account. It is important to examine the rules and regulations before buying precious metals. Furthermore, the income from the sale of rare-earth elements goes into the individual retirement account on a tax-sheltered basis. IRA owners may take circulations prior to retired life, but early withdrawals are taxed at a greater price.

How Do I Invest In Gold

A gold IRA is straightforward to develop. You can transfer your existing retirement account to a gold individual retirement account. If Birch Gold Complaints Los Angeles, Ca do not want to market any one of your properties to money your gold individual retirement account, you can roll the funds over from one more retirement account. If you're over 59.5, you might qualify for a partial rollover into a gold IRA.

Some gold IRA firms might charge account set-up as well as vendor fees. You ought to check whether these charges are included in the preliminary arrangement cost or if they vary depending upon the kind of possession. Some companies also charge an upkeep charge. Rosland Gold Complaints Los Angeles, Ca differ according to the dimension of your account. Nevertheless, they are usually lower than the cost you paid for your gold.

How Can I Invest In Gold Stocks

The value of gold varies everyday and often tends to trend upwards, especially during times of economic unpredictability. https://schiffgold.com/key-gold-news/the-air-is-coming-out-of-the-housing-bubble/ can additionally obtain peace of mind recognizing that your cash is safe and steady. If you have an interest in purchasing gold, you can sign up for Insider. By submitting your info, you agree to obtain advertising emails as well as approve Insider's Regards to Service as well as Personal Privacy Policy.

The initial step in opening a gold IRA is selecting a custodian. You'll need to choose one that is IRS-approved. Normally, gold individual retirement account custodians are financial institutions or brokerage companies. They are accountable for handling your account and guaranteeing that your money is risk-free.

How To Invest In Gold And Silver Stocks

There are several business that supply gold IRAs. Several of them are little as well as have an extremely low minimum financial investment. Others need a bigger amount. Regal Properties, for instance, has a $10,000 minimum for its IRA. A gold IRA business can use a selection of gold, silver, platinum, or palladium Individual retirement accounts.

Gold IRAs are a wonderful method to diversify your retired life portfolio. They are likewise an excellent bush versus high inflation and also stock exchange volatility. Nevertheless, you must do your study to guarantee that a gold individual retirement account is the best financial investment for you. Prior to you begin investing, seek advice from a monetary advisor to see to it you comprehend the risks included as well as the advantages and drawbacks of gold Individual retirement accounts.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

House Storage Gold IRAs Are One Of The More Preferred Ways To Invest In Gold |

Article created by-Hanley Katz

If you are taking into consideration investing in rare-earth elements with your IRA, you should know that there are numerous vital needs you need to satisfy prior to you can start investing. These demands include high management prices, documents, as well as time. House Storage space IRAs also require unique focus from the IRS. You need to speak to an expert to understand your choices.

Residence storage space for Individual retirement accounts is not yet approved by the IRS, but there are several kinds of physical precious metals you can position in your IRA. The IRS has actually especially denied house storage space, however that isn't always completion of the tale. This is a misleading statement. Be Gold And Silver Backed Ira Companies California of firms that inform you or else. If you think they are deceiving you, leave immediately.

How To Invest In Gold Stocks

Residence storage space gold Individual retirement accounts are except everyone, however it is an excellent alternative for those that prefer to maintain their gold nearby. Unlike many investments, gold doesn't diminish gradually, so it is the perfect method to maintain your wide range. While it may require extra initiative to satisfy regulations, residence storage space gold Individual retirement accounts offer an option that is worth taking into consideration.

How To Create A Precious Metals IRA

There are a few things you must understand about House Storage space Gold IRAs prior to establishing an account. First, it is important to comprehend that it is only lawful to keep rare-earth elements in an accepted storage facility. Actually, the IRS states that you have to save the metals in a financial institution or an IRS-qualified IRA custodian.

When you open a Home Storage space Gold individual retirement account, you have to pick a custodian to hold your gold. https://postheaven.net/arnoldo4doug/is-a-personal-...ent-account-right-for-you-6tt5 will certainly hold the LLC in tax-deferred condition for you. The custodian will keep your gold in an insured and also secure area. The internal revenue service has actually published a list of controlled custodians that offer this solution.

How To Gold IRA Work

Although they are not without their challenges, they are a wonderful option for many financiers. Purchasing physical silver and gold has a number of benefits. It is a limited source and also is not subject to the same volatility as the stock exchange.

House Storage Gold IRAs are a fantastic way to store your rare-earth elements in a safe place. They are also cheaper than various other sorts of IRAs. They also provide increased privacy, and the capacity to store your gold independently. Simply make certain to deal with a trusted supplier for your home storage space gold IRA. The internal revenue service site has a detailed listing of standards on house storage gold Individual retirement accounts.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

The Following Resources Will Certainly Give You An Overview Of The Most Typical Sorts Of Residence Storage Gold IRA |

Posted by-Zhang Carlson

While the IRS has not especially banned residence storage space of Gold individual retirement account accounts, this sort of account is not a financial investment that you should consider. This type of account does not appreciate in worth over the long-term as well as is very unstable. There are many other investments with greater mean returns and less volatility. On top of that, gold is not an efficient frontier and is not a safe house. Consequently, Best Precious Metals Ira to gold must be absolutely no.

If you wish to invest in gold, silver, as well as other rare-earth elements, you ought to save them safely. The internal revenue service has released a checklist of accepted vault centers that offer this kind of solution. You can also consider buying your gold from a gold dealer. While this approach of storage space may be a little bit a lot more pricey, it is an effective way to maintain your financial investment secure. However, you should still be aware of the risks included.

Setting up a house storage gold IRA isn't difficult. The initial step is to establish a limited obligation firm. This firm will serve as the owner and also trustee of your account. The 2nd action is to open up a bank account for the LLC. This account will certainly be used for purchasing gold and also other rare-earth elements.

House storage space gold Individual retirement accounts are except everybody, however they are a superb option for those that want to keep control of their wealth. Unlike various other investments, gold will not depreciate with time. It is a great alternative for retirement capitalists who favor not to have their wealth purchased a foreign country. Nevertheless, it does call for a little added effort on your part to see to it that regulations are being adhered to.

How To Set Up Gold IRA

A home storage precious metals individual retirement account is additionally taken into consideration semi-legal. The Home Storage space Gold IRA firm has a captive target market, which suggests that it is not called for to be affordable in the market. The business may charge you a configuration fee, yearly charge, and also custodial fee.

A home storage gold IRA offers investors tax obligation benefits from the acquisition of rare-earth elements. Nonetheless, it is very important to bear in mind that these accounts are costly as well as require time and also paperwork. https://douglass08prince.bravejournal.net/post/202...old-IRAs-May-Be-A-Great-Choice is best to speak with a specialist prior to setting up a residence storage gold individual retirement account. In spite of its benefits, residence storage gold Individual retirement accounts are not appropriate for risk-averse investors.

Where To Buy Silver And Gold Bars

A gold individual retirement account custodian need to be an IRA custodian certified by the internal revenue service. In this instance, the firm will certainly utilize a corporate attorney on staff and also will carry out annual audits by a state-licensed accountant. In linked web-site , gold individual retirement account firms will advise a safe that is IRS-approved and uses top-to-bottom safety and an insurance plan. Nonetheless, many of these business will certainly draw consumers with "illegal" insurance claims.

How Do Gold IRA Plans Work

A house storage space gold IRA can be a fantastic method to keep silver and gold. Regrettably, this method is not legal as well as can be pricey if you do not select a credible partner. If you are considering this alternative, be sure to investigate the firm before choosing. It may seem easy, however there are lots of disadvantages.

Among the negative aspects of home storage space gold Individual retirement accounts are that they are not insured by the government. There are many firms around that advertise the suggestion of home storage space gold IRAs, including one that includes making use of an LLC to handle your gold holdings. Nevertheless, this method is still not suggested. Along with the downsides pointed out above, there are no assurances that your rare-earth elements will be risk-free while in residence storage.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

A Gold IRA Is A Terrific Means To Safeguard Your Pension |

Written by-Winkler McCurdy

Before you choose a gold individual retirement account business, it is essential to do some research. Browse testimonials on web sites such as Facebook, Google Service, and also Yelp. The Bbb and Service Customer Partnership are also excellent areas to inspect. In https://www.fool.com/investing/2021/09/15/2-gold-s...-buy-and-hold-for-the-next-de/ , inspect whether the firm has been certified by among the organizations.

In order to open up a GOLD INDIVIDUAL RETIREMENT ACCOUNT, you need to initially choose an IRS-approved depository. This is the establishment where the gold and its items will certainly be saved. The depository will only accept investments in steels that fulfill certain criteria of pureness and weight. If https://postheaven.net/tiny83elton/advantages-and-...g-a-private-storage-individual have on hand are not approved by the IRS, they will certainly be denied.