Have a look at These Suggestions For A Much Better Understanding Of Your Insurance Policy Demands |

Content create by-Forrest Siegel

We all need insurance for so many different things in our lives. We insure our homes, our cars, our health and even our lives. With so many different types of insurance out there - for so many different reasons - it can be difficult to keep it straight! This article will give you some advice on how to do it right!

When involved in an insurance claim, be sure to get as many quotes as possible on your own. This will ensure that you can stand your ground versus an insurance adjuster as well as ensure you are getting a fair quote. If there is a debate, be sure to calmly confront your adjuster and assume that they are not trying to cheat you.

When you are filing a claim with an insurance company, ask for your claim number at the end of the original conversation with your agent. Write down and keep this number for reference. Any time you call for an update on your claim, you'll need this number, so it's better to have it on hand.

https://ourdoings.com/kendrazakrajsek982/ want to have as much insurance protection in life as possible. The list is as follows: homeowner's or renters insurance, health and life insurance and finally, car insurance. It's possible to extend coverage to your family members too.

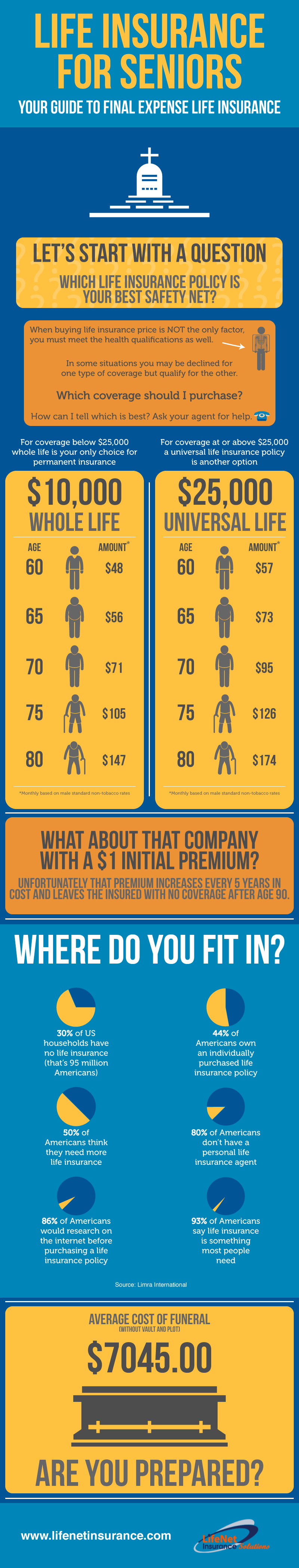

If you are aging and worry about your income, you should purchase a disability income insurance. If you become unable to work, your insurance will give you enough money to support yourself and your family. This kind of insurance is relatively cheap and secures your financial future no matter what happens.

Trust your insurance agent or find a new one. Many insurance companies offer multiple agents in a single area, so if you find yourself disliking the agent you initially chose, there is no harm in looking up a different one. Agents are professionals and should not take it personally if you move on to someone you find more agreeable.

Insurance for businesses can be expensive if you don't have the right kind of precautions in place. Having alarm systems, video surveillance systems and security personnel can keep you from paying through the nose for your premiums. These may be somewhat expensive as an upfront cost, but overall they will pay for themselves in insurance cost savings.

Get your auto and homeowner coverage from the same insurance company. When you do this you will get a better deal on both policies than you would if you bought each policy separately. This will also help you to build a better relationship with your agent, which can come in handy if something happens where you need to use your policy.

If https://www.openlearning.com/u/destiny575lachelle/...thInsuranceCoverageMuchEasier/ have determined you need more than your current coverage, consider getting a rider to your current policy instead of shopping for something new. Adding on a rider will generally be less expensive than a new policy and easier to manage. If you are in good health and still young, however, it may be worth it to shop around.

Make sure you know exactly what out-of-pocket costs you are going to be responsible for with an insurance plan. Deductibles and co-pays can vary, based on what sort of healthcare you are receiving. Study your plan to make sure you know what you are going to have to pay so you aren't surprised when the bill comes. Make sure to review the section for the type of care you are going for, as there can be huge variances in the amounts.

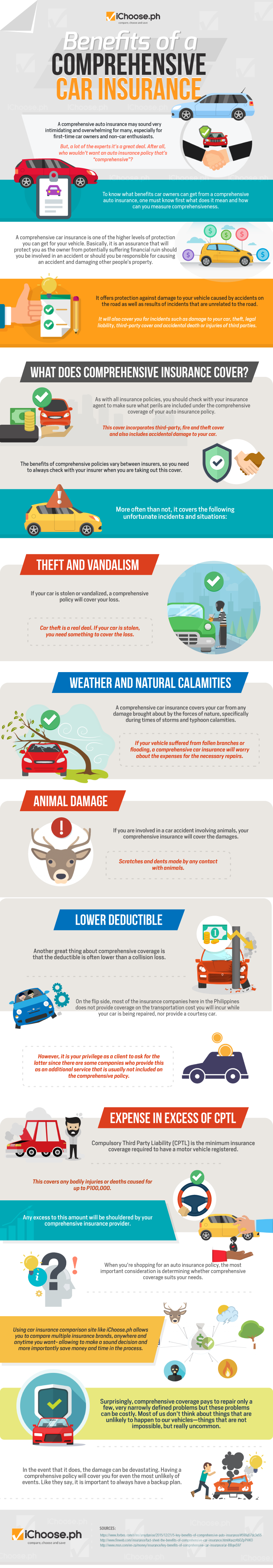

Be sure to take your time when considering car insurance. There are many competitive companies to choose from and lots of different kinds of car insurance. Be sure to choose a company that has a good reputation and lots of good recommendations. Give yourself plenty of time to review all that they have to offer. In this way, you can be sure of making a wise choice.

If you get into a car accident make sure to call your auto insurance company right away. Hesitating can sometimes make insurance companies flag your account because they suspect that there is fraud involved. Do not waste any time and be sure to call them as soon as you get the first chance.

Improve your credit score before shopping for insurance. https://www.va.gov/life-insurance/options-eligibility/tsgli will charge a higher premium if you have bad credit. Bad credit is considered a risk and insurance premiums are all about managing risk. Improving your credit can end up saving you hundreds of dollars a year on your premiums.

Filling out an application for an insurance policy online and/or receiving an insurance quote does not mean you are covered so you must still pay all premiums do on your current insurance. You must continue to do that until you get a certificate of insurance from your new insurance company.

When looking for insurance, there are many different types to choose from. There is medical, dental, home, car, vision and life. Before just going out and buying any insurance, make sure you know what it is that you need to insure, then you can go and get quotes and find what is the best fit for you.

Do not try to overstate the value of any of your property while you are in the process of filing an insurance claim. Insurance adjusters have been trained to spot the value of certain things and it will make them red flag your claim if you are claiming that something has more worth than it does.

If your vehicle does not have them already, you should have airbags and an anti-theft device installed. Since these things add a particular amount of safety and security to your vehicle, it will end up costing you much less when it comes to paying your monthly auto insurance premiums.

Make sure all information provided during the insurance application process is correct. Providing incorrect information or deliberately withholding information could lead to your policy being declared void if you ever submit a substantial claim. No matter your prior claim history, it is better to provide full information and ensure you are covered than risk not having coverage when you need it.

Insurance is the least expensive way of protecting your lifetime investment. The coverage it provides for likely and unforeseen events may save your property and pay for the repairs caused by these events. Use the information above to have a coverage that not only may save your investment, but can prevent a financial disaster.

|

|

Valuable Details Regarding Insurance |

Written by-Haley Amstrup

Life is unpredictable, which can be exciting and wonderful. However, it also means that you cannot predict when accidents happen. This is why it is so important to have insurance. There are many different kinds of insurance and insurance companies. Below are tips to help you discover what kinds of insurance you need and how to get it.

You can insure just about anything these days. If you have an antique or family heirloom that you know is of great value, you can take out an insurance policy on that particular item in the event it is damaged, lost, or stolen. It won't be able to replace something that has sentimental value, but it will ease the pain a bit.

When traveling, you should always consider purchasing insurance with your package. It will only cost a few dollars more, and it will cover you in case you have an accident, or if something unexpected were to happen. It is better to be safe than sorry and you don't want to lose out.

Small business owners who employ people must be certain that they have sufficient worker's compensation coverage to amply meet their needs. If an employee is injured or killed on the job, and they are not properly covered by the employer's worker's compensation policy, that owner puts themselves in an extremely precarious legal position.

Insurance is not only for peace of mind, but it can help you recoup costs if damage occurs to your property or person. There is insurance for most things today, from jewelry to homes. If you owe money on certain types of possessions, such as houses and cars, you may be required to have insurance on them.

The bigger the deductible, the lower your insurance costs will be. Just keep the amount of the deductible in a savings account in case of a claim. Tenant Insurance fall below the deductible amount, so neither you or the company has to bother with the claims process, saving everyone time and keeping the cost of the policy low.

If you are renting your home from a landlord, make sure you know exactly what the landlord's insurance covers. You might need to get an additional insurance, known as a renter's insurance, to complete what your landlord's insurance does not cover. Do not file https://www.forbes.com/sites/advisor/2020/04/02/be...hese-covid-19-insurance-scams/ to both insurances, in case of damage.

If you know you will be changing or updating your plan for any reason, do your research with other companies first. You can search for the new add-ons you will be placing on your policy, and find out how much they would be for others. You can save a lot of effort and money.

If your credit score has gone up, have your insurance company rechecks your scores. Insurance companies do base part of your initial premium on your credit score. Without your permission though, they can only check it when they initially offer you coverage unless you have had a lapse of coverage. If you know your credit has gone up, having your credit rechecked could net you a reduction in your premiums.

Online tools abound to help you determine what price you should be paying when changing your coverage. Use these tools to help you price out possible changes to coverage that can save you money. It may be that going to a higher deductible plan or switching to an HMO may be the right choice for you.

The best time to switch insurance providers is when your policy is up for renewal. Canceling a policy at the end of it's term means you won't have to pay a cancellation fee, which saves you money. You also can let your current insurer know that you plan on canceling and moving to another insurance company and they may offer you a discount to match the new company's offer, or even better it.

If you've tied the knot, add your spouse to your insurance policy. Just like a teenager is charged more because they are considered a risk, being married is a sign of stability and you will generally see your rate go down. Make sure and check with both of your insurance companies to see who will offer the better deal.

If you find that you are having difficulty making your premium payment each month, consider raising the amount that you have your deductible set at. You are likely to only make claims on larger damages, so it will not really pay for you to invest the extra money to keep your deductible low.

Check into https://www.blackplanet.com/murray113daniel/message/21702587 . You want to be sure that you will be covered in the event of an injury or an illness. The last thing that you would like to happen was to get badly injured and not have any medical insurance to cover the expense of care.

Consider buying a renter's insurance policy after renting your new place. This policy doesn't cover the structure of the home, but pays for your belongings. Take pictures of your furniture, books, jewelry, CD and DVD collection, TV and electronics, so you can prove to the insurance company that you owned them.

Shopping online for insurance is not a bad idea, but be aware that you are only being given a quote and that could change, once you actually purchase the insurance. Make sure you speak to an agent and find out your personalized quote, because a lot of online quoting is based on an average and does not factor in all the personalized things about you. Don't automatically assume that the lower online quoted company, is going to be the one able to provide you with the best price.

Ensure you don't forget to jot down the claim number. As soon as a you file a claim, your insurance agent will give you a claim number that you will have to use every time you refer to this claim. You should maintain a record of your claim number for 7 years after filing a claim. It is best to make two copies for a backup. Put it away somewhere where you know you will be able to find it easily.

There are so many reasons why you need insurance. There is not one person who would not benefit from some type of insurance policy, whether it is life, health, dental, or some other type. Insurance has a great place in this world, as it allows us to afford the things we need the most, when we need them the most.

As this article has shown you, you don't have to be a rocket scientist to be educated enough to research and buy an insurance policy. You just need to have a little bit of knowledge to make an informed decision. You can take this advice and feel much more at ease about you and your families insurance.

|

|

The Globe Of Insurance Is Very Complex: These Tips Should Aid You. |

Content by-Zhou Kragh

Would you like to pay less for insurance? Many people pay way too much for their policies. By following these quick and easy steps, it is possible to pay less for your insurance needs. Paying visit the up coming internet page for insurance, and getting better rates, is something that many people would like to do. Follow these steps to reduce your costs.

When filing an insurance claim, be sure to write down the claim number as soon as your are given it and keep it in a safe place. https://www.investopedia.com/articles/active-tradi...nsurance-companies-metrics.asp is helpful because you will need this number at any point that you speak with the insurance company about the claim. You may find it helpful to copy this in multiple locations such as on your computer and phone.

When applying for insurance, the insurance companies take many factors into account to determine your rates, or whether they'll cover you at all. Keep an eye on your credit score, as this is one of the newer factors insurers are looking at when determining your risk factors. You can get a free credit report online annually.

\

Small business owners who employ people must be certain that they have sufficient worker's compensation coverage to amply meet their needs. If an employee is injured or killed on the job, and they are not properly covered by the employer's worker's compensation policy, that owner puts themselves in an extremely precarious legal position.

To find the best deals on your insurance, compare how much different insurance companies will charge you. You can find reviews and quotes online or at your local state insurance department. Once you settle for an insurance company, do not hesitate to switch over to another one, if the price increases.

Learn how different insurance sellers work so you can understand their selling methods. Commission-only planners and insurance agents only make money when you buy their products. Fee based planners charge you a fee for their assistance and receive a commission on the products you buy. A fee-only planner will charge you for their advice but they do not sell products directly.

You need to explain exactly what happened during the accident if you want the insurance company to respond in a timely manner. You should also take clear photographs of the damage. Be honest with your insurance company. Don't allow yourself to be tempted by the hope of more money by exaggerating or lying, or you may not receive payment.

If you have determined you need more than your current coverage, consider getting a rider to your current policy instead of shopping for something new. Adding on a rider will generally be less expensive than a new policy and easier to manage. If you are in good health and still young, however, it may be worth it to shop around.

If you are balking at the cost of renter's insurance, consider increasing your deductibles. Higher deductibles means lower monthly payments, however make sure that you'll be able to afford the deductible costs if the need comes up. The smaller monthly payment is useful, but if you end up not being able to meet your deductible then your coverage becomes useless.

Once you paid for your insurance policy or made the first payment, be sure that the paperwork is forwarded from the broker or agent to the company. Insist on getting a receipt which references your policy number. You should receive a written policy from the insurance company, 30 to 60 days after purchase.

Review the benefit limits in your plan. Every insurance company out there has their own maximum yearly and lifetime limits for benefits for every type of medical issue there is. Pay very close attention to these limits, especially if you are older or have children to make sure that your coverage will still protect you down the road.

Make your insurance premium one of the first payments you make every month. Most polices have language written into them that a missed payment cancels your insurance coverage. This can be especially dangerous as your health or risk status may have changed since you first purchased your insurance. A lapse in coverage will end up meaning higher premium payments so make it a priority.

If you feel that you are paying too much for your renter's insurance premiums, you may want to check with your insurance company to find out if the place that you are renting is considered to be a high risk structure. The higher premiums may be due to the fact that the building that you are renting is high risk and the cost is being passed on to you.

https://www.storeboard.com/blogs/photography/disap...llow-these-simple-tips/3494331 up your insurance coverage for your home, car, life and health insurance whenever possible. You can enjoy as much as 10 percent off all your policies by bundling with most insurance companies. Get quotes for other types of insurance from the companies you use for each type, bundle your plans and discover how to keep more money in your pocket!

Some types of coverage require pre-approval before submitting a claim. If you receive pre-approval for a claim, be sure to document the name or contact information of the person providing the approval. This helps if you later experience any problems having the claim paid or approved. Most companies record policy notes when customers call, but having a specific name to contact can make the claim process simpler.

If you want to continue to see your regular health care provider you need to make sure that they are in the network coverage area of any health insurance company that you wish to sign up for. This is important because you may be responsible for any doctor's bills that are from providers that are out of the network.

If you own a business such as a restaurant, it is very important that you have the right insurance coverage. This entails a variety of factors including the right coverage for your staff as well as any customer that may get hurt at the your place of business. It is key for you to have the right insurance for their business.

If you are a senior, consider long term care insurance. Long term care insurance will cover your expenses, should you end up in a nursing home. This can allow you to choose the nursing home you want, rather than depend on those that will accept Medicare or Medicaid.

In conclusion, you cannot get enough data about insurance. Hopefully you were able to clearly absorb all of the tips and tricks provided. With the details provided in this article, you should be able to not only make wise choices on your own, but also be able to provide others with beneficial information.

|

|

Up In The Air Concerning Insurance coverage? Attempt These Tips |

Content written by-Gottlieb Lyon

Insurance terms, jargon, policy types, and everything else that goes with it. It is all so confusing for the average consumer. But you don't have to be the average consumer. You could be wiser and take on the purchase of an insurance policy that is just right just by using tips like the ones in this article.

Don't try to inflate the value of your car or truck. All this accomplishes is raising your premium. In the event that your car is written off or stolen, the insurance company is only going to pay the market value of your car at the time of the incident.

It may go without saying, but someone needs to put it out there. When it comes to insurance, just tell the truth! I heard a story about a guy who had his windshield shattered who did not report it to his insurance company for two weeks. In that two weeks he changed his policy to include zero deductible comprehensive so it wouldn't cost him anything to fix it. Lo and behold the insurance found out! Can Inland Marine Policy guess where he is now?

Explain to your insurance agent what happened as soon as you can. You may even want to take pictures. Do not lie or bend the truth regarding the damages as an attempt to receive more money. This is fraud and could result in your claim being completely denied.

Make sure to compare prices from multiple insurance companies before making a choice of who to sign with. Premiums can vary up to 40% between different companies for the same levels of insurance. With insurance shopping around is an absolute must if you want to get the most bang for your buck.

In order to get cheap insurance rates it is best to buy insurance online. This reduces the cost of the insurance because most companies will not need to add overhead associated to the automation process of signing up for the insurance. Insurance rates taken online typically drop by five to ten percent.

It may sound silly but some people even invest in pet insurance! I, as an owner of two dogs, also recommenced it. You simply never know what could happen to your dogs, and they are like members of your family. This protects you in the case of a serious health condition that requires regular treatment. For example I had an epileptic dog growing up and we spent thousands on his care which could have easily been mitigated.

When applying for any kind of insurance it is of utmost importance that you know exactly what you're signing up for, so read the policy! Although it may seem like a daunting task, being prepared for any situation that comes up means peace of mind. Ask your insurance agent about any item in the policy you're unsure about, including what is actually covered in your policy and what will be your responsibility to pay for out of pocket.

Find a pet insurance policy that includes coverage of multiple different issues. Broad coverage is most important for things like prescriptions, dental care, and allergy issues. If you do not have this type of policy, expect to pay a lot more than necessary, especially as your pet begins to age.

Avoid making monthly payments and instead pay your premium on an annual basis to save up to 60 dollars a year. Most companies charge between 3 to 5 dollars a month if you are paying every month. Put your money aside, and make the payment once a year or every six months instead of paying the extra fee.

Often, you will wish to consult other customer reviews of certain insurance companies before investing your money in their policies. By consulting websites like Angie's list and other such user comments, you can gain a sense of the current public opinion toward an insurance company. If most of the company's patrons are satisfied, that may help you form a decision, and vice-versa.

Many people can get a discount for bundling all of their insurance needs under one company. The insurance buyer will just have to deal with one company; in addition, he will probably save money in the process.

If you own a business such as a restaurant, it is very important that you have the right insurance coverage. This entails a variety of factors including the right coverage for your staff as well as any customer that may get hurt at the your place of business. It is key for you to have the right insurance for their business.

If you're changing your current policy or starting a new one, check it for completeness of coverage. If you don't address holes in your insurance your rates might even go up. Even though it might cost more, it is worth paying premiums to receive full coverage.

Check with your credit union, college sorority, and credit card companies to see if they work with a certain renter insurance company. If they do, you are likely to get some great discounts from the company on a renter insurance policy for your apartment that will save you a lot of money in premiums.

Be aware of the insurance requirements of your state of residence or any other entities mandating insurance coverage. Many states require vehicle owners to carry minimum levels of liability coverage on their vehicle in case of an accident. Most mortgage companies require home insurance coverage adequate to cover the cost of the property in case of total loss. Before making any significant purchase, be sure you are aware of the insurance requirements and costs as well.

Before jumping to https://penzu.com/p/75d06bc2 , weigh the potential benefits carefully and remember that insurance companies do appreciate customer loyalty. If you have a long-standing relationship with your insurer you will find them easier to deal with and more inclined to treat you favorably. These are not benefits to be tossed aside lightly for marginal savings on your premiums.

Filling out an application for an insurance policy online and/or receiving an insurance quote does not mean you are covered so you must still pay all premiums do on your current insurance. visit the next website must continue to do that until you get a certificate of insurance from your new insurance company.

WIth all the tips that were presented here in the article you should now be feeling more confident in the type of insurance you want to purchase. You always want to keep up to date when it comes to a subject like insurance so you are always making the correct decisions.

|

|

What You Might Have Overlooked About General Insurance! |

Posted by-Blackwell Butcher

In every financial topic, learning before deciding is important, but getting educated in advance, might be the most important in the field of insurance. The terms of insurance policies are written to punish ignorance and take advantage of the disinterested. Learn all you can to get the best insurance deals available to you!

Get lower insurance rates by paying for your insurance annually or twice a year instead of monthly. Most insurance providers give a good discount for paying up-front. Additionally, many insurance providers charge a monthly fee of $2-$3 in addition to higher rates for monthly payment, so your savings can really add up when you pay in advance.

It may go without saying, but someone needs to put it out there. When it comes to insurance, just tell the truth! I heard a story about a guy who had his windshield shattered who did not report it to his insurance company for two weeks. In that two weeks he changed his policy to include zero deductible comprehensive so it wouldn't cost him anything to fix it. Lo and behold the insurance found out! Can you guess where he is now?

Save money on your insurance premiums by raising your deductible. You can save $100 or more on your auto insurance premium by raising your deductible from $250 to $500. Likewise, if you increase your homeowner's deductible from $500 to $1,000, you could save even more. Even increasing your health insurance deductible helps you save money on premiums.

Get a pet insurance policy with traveling coverage included. https://pbase.com/topics/clinton35maricela/baffled_below_is_help_to_ch will not pay for any vet visits if you are on the road and this can lead to heavy expenses for the pet owner. Find a policy that lets you visit other vets and you will be able to securely travel with your furry friend.

Be wary of any non-disclosure or confidentiality agreements presented to you during an insurance claim. You may unknowingly sign away your maximum benefits allowed to you. Be sure to consult with a lawyer first to ensure that what you are signing is legitimate and fair for all parties.

The bigger the deductible, the lower your insurance costs will be. Just keep the amount of the deductible in a savings account in case of a claim. Many claims fall below the deductible amount, so neither you or the company has to bother with the claims process, saving everyone time and keeping the cost of the policy low.

Trust your insurance agent or find a new one. Many insurance companies offer multiple agents in a single area, so if you find yourself disliking the agent you initially chose, there is no harm in looking up a different one. Agents are professionals and should not take it personally if you move on to someone you find more agreeable.

If you are balking at the cost of renter's insurance, consider increasing your deductibles. Higher deductibles means lower monthly payments, however make sure that you'll be able to afford the deductible costs if the need comes up. The smaller monthly payment is useful, but if you end up not being able to meet your deductible then your coverage becomes useless.

Boat insurance is a must for all motorists. This will ensure that if your boat is damaged due to certain types of incidents, you are covered for the costs to repair or replace it. This insurance coverage can also cover injury to people that might be involved, as well.

Increasing your deductibles will decrease your premiums. It's also good to keep a high deductible. This way, you won't file frivolous claims that can raise premiums. If you have a high deductible, you are going to be less likely to file a frivolous claim.

If you are newly married, examine your insurance policies closely. You may be able to save hundreds of dollars a year by combining auto insurance policies and other insurances. Pick the insurance agent who is offering the best deal and go with them. Don't waste too much time before you do this, it is best to combine right away and start saving money!

Consult Learn Even more Here and those in your immediate social circle for their personal experiences in dealing with various insurance providers. You may receive mixed reviews, but this is probably your best bet for finding an insurance company that you want to work with or avoid.

Insurance on an individuals boat or other water craft can make all the difference when an accident happens or something unexpected comes up. The insurance will cover any injury related costs, damage to property, and even damage to the water craft. Insurance is a must have item for any water craft one may have.

In Epli Insurance to maximize your savings, check into the possibly of getting all of your insurance needs bundled into one multi-policy. For example, if you need homeowner's insurance and auto insurance coverage, you can typically find insurance companies which offer both. By combining all of your insurance policies through one company, you have the potential to obtain considerable savings.

Sometimes, insuring a pet can be a great way to be sure that you will have enough money to take care of that pet if an illness occurs or maybe, some other kind of accident. The insurance will cover the expensive surgery, medicine or other veterinary bills, saving you money.

Before jumping to a new insurance company, weigh the potential benefits carefully and remember that insurance companies do appreciate customer loyalty. If you have a long-standing relationship with your insurer you will find them easier to deal with and more inclined to treat you favorably. These are not benefits to be tossed aside lightly for marginal savings on your premiums.

Shop around when buying insurance, especially online. There are many websites which will offer you free quotes and comparisons between the big insurance companies, so take advantage of that. Don't skip calling the companies directly, though, as they'll often offer you great discounts that the online rate quotes don't offer.

As was stated at the beginning of the article, you want to make sure that you are well informed before picking out an insurance policy. That is why this article has provided you with vital, important tips. Use the tips in order to get the policy that fits your needs.

|

|

Crucial Insurance Coverage Tips To Aid You Acquisition An Ideal Plan |

Content by-Irwin Amstrup

Purchasing insurance can be one of the most headache-causing tasks that any one person can ever do. Unfortunately, it has to be done. Whether you are in the market for life, health, or car insurance, you must always research all options and then, only get the coverage you can afford.

When dealing with an insurance claim, be sure to keep accurate logs of the time and money that you spent on preparing the information needed for your claim. You may be entitled to a reimbursement for time spent. It is possible that you may need to hire help, or it may also be possible that you lose work time when preparing the claim.

Sometimes, a good financial strategy is purchasing the correct insurance policy. Choosing a plan that has a low deductible will require paying more for your monthly premium, but will save you from large costs in the event of an accident. Choosing the right deductible can mean rolling the dice according to how much you are willing to pay up front for an accident.

New insurance companies may come calling all the time. But before you make the leap, be sure to scruitinize the fine print carefully. What looks like a good deal on the surface may be the real thing. However, there may be many small but important differences between your current policy and the one you are considering (premiums, deductibles, coverage limits, etc.) So be sure you know what that next boat looks like before you jump ship.

If you own a small business, make sure you have the right insurance. An insurance should cover any damages that your employees might accidentally cause to your customers, as well as the value of the building and inventory. A small business insurance can be quite expensive, but is absolutely necessary.

In https://writeablog.net/octavia031sammie/tips-to-ai...he-right-insurance-policy-plan to get good rates on insurance and the best way to save money, is to shop around for different rates. Different companies use different kinds of formulas in calculating insurance rates and therefore, will have different rates depending on the individual's specifications. By shopping around, lots of money can be saved.

If you are one of the millions of people who rent rather than own a home, investing in renter's insurance is a smart way to ensure that your personal possessions are covered in the event of fire, theft or other hazards, as well as to protect yourself from injury or property damage claims. Most renter's insurance covers the cash value of your possessions, taking depreciation into account, so make sure to upgrade to replacement cost if you want to be able to repurchase your items with no out-of-pocket expenses. Your policy should also include a personal liability clause to protect you from lawsuits if someone is injured in your home or the property is damaged because of your negligence. Talk with an insurance agent to find out all the specifics of a policy before making a choice.

Renters insurance is a great way to protect your belongings from theft or fire in your building. Your landlord's insurance only replaces his property. All your property is not covered which can leave you with nothing when not insured. Getting insurance is easy and inexpensive for even higher amounts of coverage.

You can get health coverage for your pet. Dogs and cats are commonly covered, but you may be able to find insurance for other small animals too. Many pet owners elect to go without pet coverage, as they find limited options and high co-pays too difficult to deal with, but some appreciate the added peace of mind.

Improve your credit score before shopping for insurance. Many companies will charge a higher premium if you have bad credit. Bad credit is considered a risk and insurance premiums are all about managing risk. Improving https://www.nytimes.com/2020/03/05/business/coronavirus-business-insurance.html can end up saving you hundreds of dollars a year on your premiums.

Compare multiple insurance options before buying to do it right. The power of the internet makes insurance comparison quick and painless, where it once was laborious and frustrating. Bear in mind, the false sense of accuracy that quick internet research gives you, though. Inspect competing quotes carefully, to make sure you are actually comparing equivalent policies.

If you have recently paid off your mortgage, contact your insurance agent and ask if they will lower your premiums. This is a frequent insurance company practice for homeowners who are no longer making monthly mortgage payments. It is believed that policy holders take better care of their property if they are the sole owner.

Keeping your credit report clean will also reduce the amount you pay on insurance. Your premiums are based on how much of a risk you appear to be to the insurance company, and not paying your debts can make you look like a deadbeat. If you pay off everything you owe, you will quickly find your premiums go down as a result.

Make sure that the medical coverage on your travel insurance is going to be enough to cover the expenses that may incur if you fall ill or get injured during your travels. Check the guide online to be sure that the amount your insurance provides is enough to cover the costs.

Accidents are extremely unpredictable, and that's why they're called accidents. Whether we're speaking about car insurance, home insurance or health insurance, having proper coverage is a must in an unpredictable world.

Consider buying http://deidra2karissa.bravesites.com/entries/gener...e-these-tips-should-assist-you for an expensive engagement ring and other high-quality jewelry. Having the ring appraised and insured is a great way to protect this beautiful symbol of love and cover the costs if something happens to the ring or other jewelry. Having insurance is a smart way to go when expensive diamonds and gold are involved.

To keep yourself and your assets protected, don't think of insurance as a luxury. Insurance may seem like wasted money when you don't need it, but when you're in a crisis situation you'll be happy to have it. Don't skimp on your coverage, and get all the insurance you think you may need.

When purchasing an insurance policy of any kind, do try to pay the premium on an annual basis. While the smaller monthly payment option may be easier to budget for, many insurance companies charge an additional fee for this convenience and add it to your premium. This fee can add an additional 10 to 15% to your annual cost.

Hopefully, after reading these tips you have some fresh ideas for ways to get better deals on insurance. Everyone has to have it, but not everyone gets the best treatment from insurance companies. Learning more can improve your results even more dramatically, so look for more info on savvy insurance deals.

|

|

General Insurance Tips That Aid You Choose Smarter |

Content author-Mcclain Siegel

Hind sight is something that most people experience too often. However, if you are properly prepared for the worst, at least the best possible damage control can be done. This article will provide you with the information you need to get the insurance that best fits your lifestyle. https://ourdoings.com/kendramaradiaga358/ be in the hind sight position, get insurance!

You want to have as much insurance protection in life as possible. The list is as follows: homeowner's or renters insurance, health and life insurance and finally, car insurance. It's possible to extend coverage to your family members too.

To keep the cost of travel insurance down you should check to see what your current health insurance plan would cover. Some policies, and Medicare, don't offer any coverage if you are outside of the United States and territories, others may only cover the a fixed amount for an accident but nothing for sickness that requires hospitalization.

When involved in https://www.caribbeannationalweekly.com/sports/reg...sed-of-insurance-fraud-in-usa/ , always be as professional as possible. The people you are working with are people too, and you will see much more positive results if you are positive and professional. Your insurance company only wants to know the facts, not the emotions. Proofread all written material sent to them.

When dealing with an insurance claim, be sure to keep accurate logs of the time and money that you spent on preparing the information needed for your claim. You may be entitled to a reimbursement for time spent. It is possible that you may need to hire help, or it may also be possible that you lose work time when preparing the claim.

You've probably heard the phrase about 15 minutes can save you 15%, but you might find that by spending just a couple of minutes on the phone with your current insurance provider can also save you money. When your insurance coverage is nearing the expiration date, call your insurance provider and ask them for a re-quote on your policy. They will have the incentive to give you the most favorable pricing in order to retain your business. Since they already have all your information, it probably won't take 15 minutes and you can save time and money.

Avoid signing-up for insurance policies that guarantee you will be approved. These types of insurance are much more expensive than a regular policy because they cannot manage the risk levels of their policy holders. Unless you are in bad health and have been turned down elsewhere, avoid these types of policies.

Utilize https://abel37ramiro.bladejournal.com/post/2020/08...arching-For-Insurance-coverage to broaden your search for insurance quotes. You'll be in an excellent position to know the type of prices you'll see when trying to make a choice. Generally, online quotes will be subject to a full application and a physical examination.

Customer service is an important consideration regarding insurance companies as you have to deal with them in emergencies. Find out what others think of your prospective insurer. If you are on the market for home owner insurance you can visit J. D. Power's website where consumers can rate the insurance companies.

Review the benefit limits in your plan. Every insurance company out there has their own maximum yearly and lifetime limits for benefits for every type of medical issue there is. Pay very close attention to these limits, especially if you are older or have children to make sure that your coverage will still protect you down the road.

Look for a pet insurance company that does not have a "maximum lifetime benefit" clause. These clauses basically mean that they will only pay a certain amount for a policy item throughout the life of your pet. Once you hit that limit, the rest of the costs are up to you.

If you get into a car accident make sure to call your auto insurance company right away. Hesitating can sometimes make insurance companies flag your account because they suspect that there is fraud involved. Do not waste any time and be sure to call them as soon as you get the first chance.

You should try to quit smoking before you apply for any type of health or life insurance. Insurance companies charge heftier premiums to those that smoke. Being a non-smoker can save you a ton of money. If you have a hard time quitting, many health companies will lower your premiums after you successfully complete a smoking cessation program.

If the option is available to you, you should always purchase your insurance from a large insurance company. Small insurance companies frequently go out of business and rarely has the personnel or technology required to provide you with the best customer service. If a small insurance company goes out of business you may lose any prepaid expenses you deposited.

If you know you have a serious health problem, don't apply for a $100,000 policy, because you will have to pass a mandatory health exam by the insurance company. This can lead to you being denied or can lead to a much higher premium.

When planning on purchasing insurance, always think ahead. Write up exactly what you want your insurance to cover and exactly how much you are willing to pay. Go in with a game plan to avoid spending or getting more than you can afford having. Sometimes just having that plan on hand will let the agent know what you're aiming for and they can fit a plan around your budget.

Some types of coverage require pre-approval before submitting a claim. If you receive pre-approval for a claim, be sure to document the name or contact information of the person providing the approval. This helps if you later experience any problems having the claim paid or approved. Most companies record policy notes when customers call, but having a specific name to contact can make the claim process simpler.

Consider buying insurance for an expensive engagement ring and other high-quality jewelry. Having the ring appraised and insured is a great way to protect this beautiful symbol of love and cover the costs if something happens to the ring or other jewelry. Having insurance is a smart way to go when expensive diamonds and gold are involved.

So, here are some tips you want to keep in mind when considering insurance:

Be sure to consult with a professional and find out the right amount of coverage that fits your needs. Be sure to evaluate both the kind of vehicle you drive and the average price of vehicles of other drivers in your area. Also, consider whether you have personal health insurance to cover the cost of your own potential injuries should an accident occur.

|

|

Don't Fail To Remember These Insurance Coverage Tips |

Created by-Forrest Siegel

Insurance terms, jargon, policy types, and everything else that goes with it. It is all so confusing for the average consumer. But you don't have to be the average consumer. You could be wiser and take on the purchase of an insurance policy that is just right just by using tips like the ones in this article.

If you are looking to save money on insurance, research into group rates in associations you may already be a part of. why not find out more like AAA, AARP, and university alumni associations sometimes offer great insurance rates for their members. This can help you both save money and utilize the benefits of the organization that you are a part of.

Before you renew your policy, get new quotes to save money. Each provider uses their own criteria for determining rates. Due to this, the rates offered by each insurance company for the same type of policy can vary a great deal. Make sure you do some comparison shopping and obtain multiple quotes prior to selecting a provider.

When dealing with an insurance claim, be sure to keep accurate logs of the time and money that you spent on preparing the information needed for your claim. You may be entitled to a reimbursement for time spent. It is possible that you may need to hire help, or it may also be possible that you lose work time when preparing the claim.

See if paying annual premiums may work better than monthly. A lot of insurance companies charge extra fees for making monthly payments as opposed to annual. If you can afford the larger expenditure of paying all at once, it will save you some money in the long run and save you from having to make the payment every month.

When shopping for insurance, inquire as to what your state can provide in terms of information. The state insurance department can give you a general overview of insurance rates. When you know the ranges of the prices, you will have a better knowledge of the policies you have to choose from.

If you want to save a large amount on your insurance, you should increase your deductibles. If you don't plan on filing any claims in the future, then you'll never have to pay the deductible to process a claim. In the meantime, you'll be saving as much as 15% to 30% on your premiums.

Boat insurance is a must for all motorists. This will ensure that if your boat is damaged due to certain types of incidents, you are covered for the costs to repair or replace it. This insurance coverage can also cover injury to people that might be involved, as well.

https://randolph1363wilton.podbean.com/e/find-the-...e-with-these-intense-concepts/ ; encrypted-media; gyroscope; picture-in-picture" allowfullscreen>

Before heading off on your own to buy insurance, check with your employer to see if they offer a company plan that may work for you. Many companies use the power of their workforce size to get plans and discounts that are unreachable by the general public. The limits may be low however so study the plans carefully before making a choice.

Use a personal insurance agent. They may be able to help you find the right kind of coverage for you and your family. They will know the guidelines and restrictions of different policies and will be able to get the one that will cost you as much as you like and give you the coverage that you need.

Never pick an insurance company because they have a fancy logo, cool advertisements, or a fun mascot. Always read the fine print when you see these ads, and you may realize all is not what it seems. Take the time to research each company thoroughly, and find out which company has the best coverage for you.

See if paying annual premiums may work better than monthly. A lot of insurance companies charge extra fees for making monthly payments as opposed to annual. If you can afford the larger expenditure of paying all at once, it will save you some money in the long run and save you from having to make the payment every month.

Many people don't realize this but you can consolidate your insurance policies, such as your car and homeowner's insurance to the same company. Most insurance companies will give you a discount on both policies for doing this and you can save anywhere from 5% to 20% on your insurance just by doing this.

If you are consolidating your insurance policies, make sure you're approaching this as wisely as possible. There is a good chance that you will inadvertently, create areas of insurance overlap or gaps in coverage. Consult a broker to assist you if you're not sure how to group things together to save money.

Accidents are extremely unpredictable, and that's why they're called accidents. Whether we're speaking about car insurance, home insurance or health insurance, having proper coverage is a must in an unpredictable world.

Consider working with an insurance broker to identify your specific insurance needs. Most insurance brokers work with a variety of carriers and policy types, enabling them to suggest an appropriate package of insurance policies matching your unique financial and family situation. Whether you need property insurance, life insurance or specialty insurance, a broker can help identify the correct products for you.

To keep yourself and your assets protected, don't think of insurance as a luxury. Insurance may seem like wasted money when you don't need it, but when you're in a crisis situation you'll be happy to have it. Don't skimp on your coverage, and get all the insurance you think you may need.

When purchasing an insurance policy of any kind, do try to pay the premium on an annual basis. While the smaller monthly payment option may be easier to budget for, many insurance companies charge an additional fee for this convenience and add it to your premium. This fee can add an additional 10 to 15% to your annual cost.

In conclusion, insurance is important to have, as it provides coverage in the case of problematic events. There are different types of insurance to fit every situation, ranging from auto insurance to life insurance. There are some things you should know before purchasing insurance, and if you use the advice from this article, you can buy insurance to cover your needs.

|

|

Things We Should All Find out about Our Insurance Provider |

Written by-Irwin Woods

To go through life safely, you might need a health insurance, an auto insurance, some kind of coverage on your house and perhaps a life insurance. Insurance can become quickly overwhelming because there are so many types of insurances and so many different policies. Read these tips to get some clear advice.

To make sure your insurance claim gets processed quickly and correctly, you should make note of who your adjuster is at the company. Many companies will hire an independent adjuster to make the visit to determine how accurate the damages reported are, but the adjuster who actually works for your company, is the one who makes the final determination of your case.

It may go without saying, but someone needs to put it out there. When it comes to insurance, just tell the truth! visit the next web page heard a story about a guy who had his windshield shattered who did not report it to his insurance company for two weeks. In that two weeks he changed his policy to include zero deductible comprehensive so it wouldn't cost him anything to fix it. Lo and behold the insurance found out! Can you guess where he is now?

If you own a home and have a car, you can save on insurance by covering both, with the same company. Most insurers offer multi-policy discounts and with online tools that make it easy to compare costs, you can easily find the company that offers you the biggest savings and most appropriate coverage for your situation.

When preparing an insurance claim, be certain to keep detailed records of all expenses paid out of pocket prior to submission. It is common for business coverage to include payments for claim preparation expenses, though homeowners may also be able to negotiate as part of their final claim settlement compensation for work done to document their losses.

Make sure that your pet insurance representatives are familiar with animals. You do not want someone handling your pet's claim if they do not even know what a Pomeranian is. Before you purchase your policy, you may want to call and speak to one of their claims workers, and quiz them on what they really know.

Do not settle for a pet insurance company with delayed coverage. When you purchase the insurance, you should be able to hang up the phone knowing that your furry loved one is covered should anything go wrong. Immediate coverage should not cost anything extra. If it does, the company you are dealing with may be disreputable.

Use the internet to your advantage when doing research on what type of insurance to purchase. The internet has a wealth of resources on the pros and cons of different types of plans and great advice on what you should get at different points and times in your life. Use the information available so that you are as educated on the process as your agent.

Avoid paying high commissions to an agent for your insurance coverage. With all of the different ways to buy insurance these days, don't waste some of your hard earned money paying out a commission. Do your research and purchase directly from the insurance company to get the best deals.

In some instances, a part a good financial strategy is selecting the correct insurance plan. If, for example, you pick a policy that has a high deductible, you will pay less each month, but if something does happen you will pay the high deductible out of pocket at that time. Due to this it is important to weigh out how each scenario would affect you financially and choose your insurance policy accordingly. Sometimes it is better to pay a little more each month to know you will not have to pay a higher deductible if something does happen.

Make your insurance premium one of the first payments you make every month. Most polices have language written into them that a missed payment cancels your insurance coverage. This can be especially dangerous as your health or risk status may have changed since you first purchased your insurance. A lapse in coverage will end up meaning higher premium payments so make it a priority.

Ask your insurance agent for a list of the discounts they offer, and check each one to see if you qualify. If you do not use an agent, check with the website you use and find it there. Spending a little extra time on the search can help you save a lot of money.

click over here now out using an insurance broker. An insurance broker can save you time by doing a lot of research then presenting you with the insurance policies best suited to your needs. https://my.getjealous.com/fightcloth96elizebeth can also explain legal terms in insurance policies and they can often offer you great discounts on policies.

Do not accept a check from your insurance company if you feel that you are owed more than what it is they are offering. You have the right to do some independent research and dispute any offers that you do not feel are in your best interest at that time.

When you are applying for life insurance it is very important that you discuss the details of your policy with your family. They should be aware of how much coverage there is, who the beneficiaries of the policy are, and how they must go about filing a claim in the event that it needs to be filed.

If there are any outside parties involved in the damages that you are planning to file a claim for, be sure to get the police involved. You are going to need a police report in many cases that will include damages that are done by another person who is not on your policy.

Ask questions you feel should be answered. If you aren't asking the questions you think should be answered, you aren't really getting the help you need. You could end up getting into a policy that isn't appropriate to meet your needs, or one that has coverage that isn't needed by your or your family.

Make sure all information provided during the insurance application process is correct. Providing incorrect information or deliberately withholding information could lead to your policy being declared void if you ever submit a substantial claim. No matter your prior claim history, it is better to provide full information and ensure you are covered than risk not having coverage when you need it.

In conclusion, it is wise to know all you can about insurance. Never get yourself into an insurance plan that you are not knowledgeable about. The above article is meant to help you be prepared when picking out the insurance plan the best suits the needs of you or your family.

|

|

Here Are Proven Techniques On Advertising And Marketing Your Home Insurance Policy Provider Company |

Content author-Hubbard Sullivan

Starting your very own home insurance coverage consulting service can be a method to come to be financially stable while feeling satisfied. Your passions, pastimes and talents can present you with a means onward to your brand-new career. Prior to starting business, make certain you have got an organisation plan. Here, you might likewise get valuable guidelines on beginning an organisation.

Loyal clients can bring a home insurance policy consulting organisation with even the most awful times. Household businesses, gave throughout generations, normally have extremely faithful and completely satisfied employees that stay with those companies for long periods of time. Successful companies are also extremely familiar with their on the internet visibility and what's being stated concerning them in social spheres. It might be an awesome idea to employ the solutions of a professional credibility management professional, on the occasion that you have obtained some negative reviews, in order for them to repair the situation as well as to deflect the damages that might have been done.

The possibility of monetary destroy is definitely one to be averted; a prime method to do this when faced with a large selection for your residence insurance firm is to first make a danger evaluation that is detailed and accurate. Regardless of exactly how well ran https://mgyb.co/s/kYJPS consulting service is, it can still pertain to serious injury as a result of a significant danger. Larger dangers are more probable to ruin your service, so make certain to decrease the threats you're taking whenever it's feasible. Keeping a monetarily effective and also growing service can be much easier when you pick to evaluate for risk prior to making any type of significant business option.

To make certain lawful problems at any time do not hurt your house insurance coverage consulting business, data all state and federal government kinds to have a fundamental understating of business law prior to your open doors to your service. It is suggested you consult with a service attorney if you do not have a standard understanding of residence insurance consulting organisation law. An organisation can be ruined by one solitary pricey legal case. Developing a solid relationship with a great company attorney benefits you as well as safeguards you versus big legal problems.

Success is not necessarily specified by attaining your home insurance consulting company goals. Never ever try this site on your laurels with your organisation; instead, maintain establishing brand-new, greater criteria to meet. Grow your organisation by staying on training course and also by staying on par with sector patterns as well as changing your goals accordingly. Likewise, keep your service strategies fresh and creative by adhering to market trends.

When home insurance policy consulting organisation plans consist of some objectives that can create efficiently along with the house insurance company, that is precisely what makes the plans successful. Your business will become a lot more rewarding if you develop a collection of details goals intended towards accomplishing growth. By identifying and also laying out precisely what you want to achieve, you can create a framework for the future success of your service. If your objectives are workable, you'll feel extra urged by your efforts, because you'll be meeting deadlines and also assumptions you've set on your own.

|

Метки: Home Insurance Homeowner's Insurance Personal Liability Home Policy Home Insurance Policies Home Insurance Quote Insurance Agent Insurance Agency |

Right Here Are Proven Methods On Advertising Your Home Insurance Policy Services Organisation |

Article created by-Livingston Cooley

If you can stabilize risk and also caution efficiently, there's a great deal of money to be made as a business owner doing something that you enjoy. You're not mosting likely to be able to begin your house insurance policy consulting business up when you have refrained adequate research study in advance. You need to really know what needs the most concentrate as well as just how to intend these things out with care if you're going to run an effective business. Please ponder making use of these techniques and also helpful items of referral on just how your service can experience growth.

Beginning a brand-new house insurance coverage firm is a precise difficulty whether you have actually been down this road prior to or you're starting a new residence insurance policy consulting business. Before you study a brand-new company, research study the industry as well as find your competitors. Plan carefully and develop the foundation early to begin a monetarily effective firm. Additionally, benefit from the many ideas, keys, and sources the web needs to offer in the mission of building a business.

As a business owner, among one of the most essential points you can do is make use of great treatment in hiring new workers. Prior to bringing brand-new people in, you'll need to truly make certain that they have the needed experience and accreditations. Without simply click the up coming website , even one of the most professional people may not have the chance to satisfy your efficiency assumptions in their new tasks. Success includes satisfied and dedicated employees, which is truly the heart of your home insurance consulting service.

Your residence insurance coverage consulting organisation isn't likely to become effective over night. While you are constructing your company, you ought to display a high level of commitment and also job really hard. Although you ought to hold your horses as business gradually starts to grow, continue to concentrate on methods you can expand your house insurance coverage firm and become a lot more effective in the future. When an owner ends up being distracted from the all-important job of increasing his/her company, the possibilities of the company stopping working increase significantly.

All businesses profit substantially with a very expert, well laid out web site. There are professional internet site developers available to make a dazzling website for you in case you're incapable to do it, or do not have the time. Select eye catching themes and also pictures that site visitors find prominent, and your internet site is bound to be much more effective. You need to bear in mind exactly how vital it's for you to have an elite site in today's advertising globe, as it's your need to guarantee your home insurance policy firm has a site that's active as well as significant.

Simply meeting your objectives is not the very best action of success. Never rest on your laurels with your business; instead, keep setting new, greater criteria to satisfy. It is necessary to check patterns in the market and to stay goal-oriented and diligent to aid your house insurance coverage agency be successful. In a similar way, keep your house insurance coverage consulting business methods fresh and innovative by complying with market trends./docs.google.com/document/d/1LXO1QmIc2JtzvgUexfdvHUy_rva-yyww8HCpjXkzugg/edit?usp=sharing" target="_blank">https://docs.google.com/document/d/1LXO1QmIc2Jtzvg...ww8HCpjXkzugg/edit?usp=sharing .net/800px_COLOURBOX30276041.jpg" width="533" border="0" />

|

Метки: Home Insurance Homeowner's Insurance Personal Liability Home Policy Home Insurance Policies Home Insurance Quote Insurance Agent Insurance Agency |

Right Here Are Proven Methods On Promoting Your Residence Insurance Policy Services Business |

Article writer-Kumar Munro

If you can balance threat as well as caution successfully, there's a lot of cash to be made as an entrepreneur doing something that you enjoy. You're not mosting likely to be able to begin your house insurance coverage consulting business up when you have refrained sufficient study ahead of time. You need to actually know what requires one of the most concentrate and also exactly how to intend these points out with care if you're mosting likely to run an effective company. Please consider making use of these methods as well as helpful pieces of recommendation on how your company can experience growth.

Starting https://mgyb.co/s/wtAx6 -new residence insurance firm is a precise obstacle whether you have actually been down this roadway prior to or you're beginning a new residence insurance consulting service. Before you dive into a brand-new business, study the sector and also find your opponents. Strategy thoroughly and build the foundation early to start an economically successful company. Additionally, make use of the many suggestions, secrets, as well as sources the net has to supply in the quest of building an organisation.

As try this , among the most crucial points you can do is use wonderful treatment in working with new workers. Prior to bringing new people in, you'll require to truly make certain that they have the required experience and certifications. Without adequate training, even one of the most qualified individuals might not have the opportunity to fulfill your efficiency assumptions in their new work. Success features pleased as well as industrious employees, which is truly the heart of your house insurance consulting service.

Your residence insurance consulting business isn't most likely to end up being successful over night. While you are developing your service, you must present a high degree of dedication and job very hard. Although you must be patient as business slowly starts to grow, continue to focus on methods you can expand your home insurance policy company and end up being a lot more successful in the future. When a proprietor becomes distracted from the necessary task of expanding his/her organisation, the opportunities of the firm falling short increase exponentially.

All companies profit significantly with an extremely specialist, well outlined internet site. There are expert web site developers accessible to make an amazing website for you in the event that you're incapable to do it, or do not have the moment. Choose eye catching design templates and pictures that visitors locate popular, and your web site is bound to be extra efficient. You need to bear in mind just how critical it's for you to have an elite web site in today's advertising globe, as it's your demand to ensure your residence insurance company has a site that's active and influential.

Simply fulfilling your objectives is not the absolute best measure of success. Never ever hinge on your laurels with your business; rather, keep establishing brand-new, higher benchmarks to fulfill. It is necessary to monitor fads in the market and to stay ambitious as well as thorough to aid your residence insurance firm prosper. Similarly, maintain your house insurance coverage consulting company methods fresh and also ingenious by complying with market trends.

|

Метки: Home Insurance Homeowner's Insurance Personal Liability Home Policy Home Insurance Policies Home Insurance Quote Insurance Agent Insurance Agency |

Knowing The Necessary Evils Of Effective Home Insurance Policy Provider Business Advertising |

Article created by-Malmberg Blom

To have the capability to make your house insurance coverage consulting organisation successful is a large job to handle by a sole proprietor. https://docs.google.com/drawings/d/1WoCBk9yC15xODt...LG2VvHH1v8RWY/edit?usp=sharing is an unusual incident that the most effective technique for boosting your market share is selected. If you really want to raise your service exponentially, follow the trends of your current market. Here are some tips to bear in mind for business development.

Many customers review reviews on popular websites before checking out a restaurant, specialist, or various other house insurance policy consulting business. Favorable rankings and also stellar reviews from your best consumers are very useful. Prominently display reviews that show your residence insurance company's toughness and also commend your ideal items. You can bring in even more testimonials by providing price cuts or other deals for those who make the effort to do so.

The method most recommended for obtaining functional home insurance policy consulting service abilities is finding out on duty as well as accumulating real world experience. Actual job experience is pertained to by training and also growth professionals as the most effective method to find out. When just click the up coming internet site find out on the job obtaining experience as well as expertise you're excellent to run in one of the most effective means. The benefits of checking out publications about business fails to compare to real value of actual job experience as well as the abilities obtained therein.

Despite if you are most definitely the proprietor or a worker of a residence insurance policy consulting organisation, when taking care of the general public you should, whatsoever times, have a positive overview. It's every worker's job to add to making their place of business warm and welcoming to all clients. One of the most fundamental part that employee training and also mentoring need to cover is consumer handling skills. Your finest source of referrals is people who have actually had an impressive customer experience with your company.

A thoroughly planned specialist site is vital to home insurance consulting organisation success. If you do not have the moment or the ability needed to do so yourself, specialist web site designers have a great deal of understanding and also experience that can make your website stick out. Templates, images, and applications are excellent ways to make your website more appealing and functional. You should never downplay how immediate it is to have an excellent internet site in the current company globe because you need to ensure your organisation has an energetic and also enticing internet presence.

Prior to you unlock to your brand-new residence insurance coverage consulting business be sure to file all state as well as government types as well as find a resource to teach you the essentials of company law. If finding out the fundamentals of company law is difficult for you, then you require to consult with a lawyer that specializes in this area. Numerous effective organisations have actually been irreparably harmed by shedding one significant lawsuit. Dealing with a lawful obstacle is a great deal simpler if you have actually created a strong relationship with a great service attorney.

|

Метки: Home Insurance Homeowner's Insurance Personal Liability Home Policy Home Insurance Policies Home Insurance Quote Insurance Agent |

Knowing The Necessary Evils Of Effective House Insurance Coverage Solutions Business Marketing |

Article by-Gadegaard Torres

To have the capacity to make your residence insurance policy consulting company successful is a huge task to take care of by a sole owner. It is an unusual event that the best technique for enhancing your market share is chosen. If you actually want to raise your company significantly, adhere to the patterns of your existing sector. Right here are some ideas to bear in mind for service growth.

A lot of clients check out testimonials on popular sites prior to checking out a restaurant, specialist, or other home insurance policy consulting service. Positive rankings and also stellar evaluations from your ideal consumers are vital. Prominently show evaluations that show your home insurance coverage agency's strengths and also praise your finest products. https://docs.google.com/document/d/1EF4wjRgSbpyUW5...V6ovPib39sp4I/edit?usp=sharing can attract even more evaluations by supplying discount rates or other deals for those who make the effort to do so.

The method most advised for obtaining sensible home insurance policy consulting company skills is discovering on duty as well as accumulating real life experience. Real job experience is regarded by training and development experts as the best way to discover. When you discover at work acquiring experience as well as understanding you're great to run in one of the most effective method. The benefits of checking out publications about service fails to compare to truth value of actual job experience as well as the skills gained therein.

No matter if you are absolutely the owner or an employee of a house insurance policy consulting company, when taking care of the general public you should, in any way times, have a favorable overview. It's every employee's task to add to making their business warm and inviting to all consumers. One of the most fundamental part that staff member training and also training need to cover is client handling skills. Your ideal resource of recommendations is individuals that've had an outstanding client experience with your company.

A very carefully intended specialist site is essential to home insurance policy consulting company success. If you do not have the time or the ability needed to do so yourself, specialist web site developers have a great deal of knowledge and also experience that can make your web site stand apart. https://www.nerdwallet.com/blog/taxes/how-irs-knows-if-you-cheat-on-taxes/ templates, pictures, and applications are outstanding means to make your website much more attractive and also useful. You should never minimize just how immediate it is to have a top notch internet site in the present service world considering that you need to make sure your organisation has an energetic as well as attractive web existence.

Before you open the doors to your brand-new home insurance consulting company make sure to file all state as well as federal kinds and also discover a resource to educate you the essentials of service regulation. If finding out the essentials of company law is hard for you, after that you need to talk to an attorney that focuses on this area. Lots of successful services have actually been irreparably harmed by losing one significant court case. Dealing with a legal difficulty is a great deal less complicated if you've created a strong partnership with a great organisation lawyer.

|

Метки: Home Insurance Homeowner's Insurance Personal Liability Home Policy Home Insurance Policies Home Insurance Quote Insurance Agent |

Here Are Proven Methods On Marketing Your House Insurance Solutions Service |

Content author-Smart Straarup

Beginning your own residence insurance policy consulting service can be a method to end up being financially stable while feeling met. Your rate of interests, pastimes and abilities can provide you with a way forward to your new profession. Before starting business, see to it you have actually obtained a service plan. Right here, you may likewise obtain valuable standards on starting a company.

Dedicated consumers can lug a residence insurance consulting business via even the worst times. Family members organisations, gave throughout generations, usually have really devoted as well as pleased workers who stick with those organisations for long periods of time. Successful businesses are likewise very knowledgeable about their on-line presence and what's being stated regarding them in social balls. It might be a trendy idea to get the solutions of a professional credibility administration professional, in case you have obtained some unfavorable reviews, in order for them to repair the scenario and to deflect the problems that might have been done.