What Everyone Does What You Ought To Do Different And As It Pertains To Gasoline Market Trends |

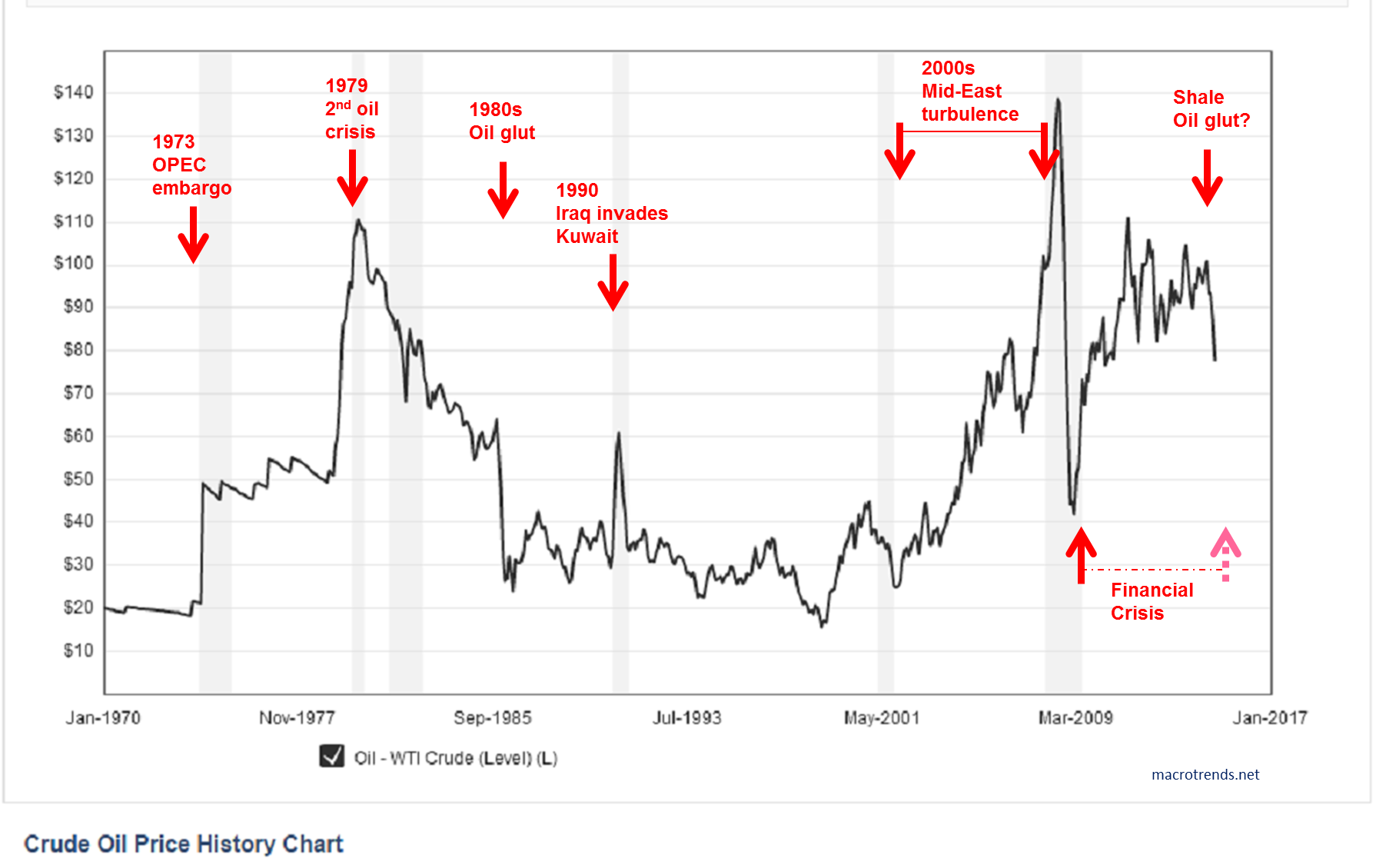

Although oil and gas manufacturing has been one driver of recent growth, it is far from the most important sector of the financial system. It is, after all, linked to different sectors and dropping growth diesel price today in a single can weaken others, but sectors like manufacturing achieve more than they lose. Higher costs per barrel of oil additionally helped to justify the price of a hydraulically fractured nicely (also called fracking).

Today in Energy

Is oil and gas a dying industry?

sulphur cost is not dying, but it is changing, and it must continue to do so. While progress has been made, oil and gas companies must do more. With increasing pressure to limit carbon emissions, oil and gas companies are investing into technologies to counter their own carbon footprints.

Not only has the Saudi-Russian oil price war depressed prices, but the falling oil demand with coronavirus-caused country lockdowns is closely weighing on the outlook for this yr’s international oil demand. Analysts see 10 million barrels of oil (bpd) or extra of misplaced demand and proper now no one expects oil demand to grow this yr compared diesel price now to last yr’s muted progress. sulfur price in oil costs dragged down the overall development of the US financial system in 2015 and 2016, that means Barack Obama’s presidency ended with the slowest yr of financial development because the end of the monetary crisis.

However, as an oil-producing country (and never just an oil client), the United States now additionally feels an disagreeable pinch when oil prices drop. However, long-term investments in oil and gas corporations cost of sulphur per kg can be highly profitable as well. Investors should understand the dangers totally before making investments within the sector.

The main threat for investing in the oil and gas sector is the volatility of the prices for the commodities. The industry has encountered quite a sulfur fertilizer prices lot of volatility in 2014 and 2015 due to a supply glut of crude oil and pure gas.

In a new sector outlook update, Audun Martinsen, head of oilfield providers analysis at Rystad Energy, forecasts a four% decline in world oilfield service revenue if oil prices keep flat next 12 months. The consultancyIHS Markit now sees total U.S. manufacturing progress dropping to 440,000 barrels a day in 2020before essentially flattening out in 2021 at a price of $50 a barrel. But some impartial observers imagine EIA’s projections are too bullish contemplating thesharp drop in drilling activityand capital discipline diesel price list seen within the U.S. oil industry this 12 months. Many shale producers continue to have a tough time breaking even beneath today’s oil costs, and traders are fed up with capital destruction within the sector and aren’t offering the hefty credit lines of previous increase years. In simply two weeks, the state of affairs on the oil market has changed dramatically and costs for the U.S. benchmark are within the low $20s.

- The price of oil influences the prices of different manufacturing and manufacturing throughout the United States.

That’s why the US financial system didn’t go into boomtime when oil prices last crashed in 2015 and 2016, falling from greater than $100 a barrel to lower than $forty. Gas costs dropped beneath $2 a gallon, and people celebrated by shopping for new cars in document bitumen prices today numbers and spending more on vacation buying. But by the tip of 2015, there had been 60,000 jobs lost within the oil and gas industry in Texas alone and the booming oil cities of North Dakota had been seeing an exodus of jobs and other people.

The price of oil influences the costs of other production and manufacturing across the United States. For example, there is the direct correlation between the cost cost of bitumen per kg of gasoline or airplane fuel to the price of transporting items and other people.

Then prices fell much more dramatically, when OPEC failed to succeed in a production deal with Russia. One of these was Jay R. Young, President and CEO of King Operating Corporation, an impartial oil and gas operator in Texas, who argued in a post on Forbes that U.S. shale shouldn’t panic as a result sulphur market outlook 2020 of costs would bounce again. Even with the loss of growth, the U.S. economy isn’t almost as tied to the price of oil as some of the other top production nations.

U.S. Energy Information Administration - EIA - Independent Statistics and Analysis

Like with home heating oil, trucking fleets often negotiate a diesel contract with one provider. Unlike gasoline, the demand for residence heating oil is seasonal, and the product is usually bought beneath contract from a supplier for a complete season, at costs that tend to be constant. However, there could today petrol and diesel rate be a delay of as much as two months earlier than decreases or will increase in crude oil costs are handed along to shoppers. sulfur powder price that have an effect on the global or native gasoline supply also result in price changes.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |