Which Kinds Of Gold Financial Investment Are Right For You? |

Content by-Andreasen Noble

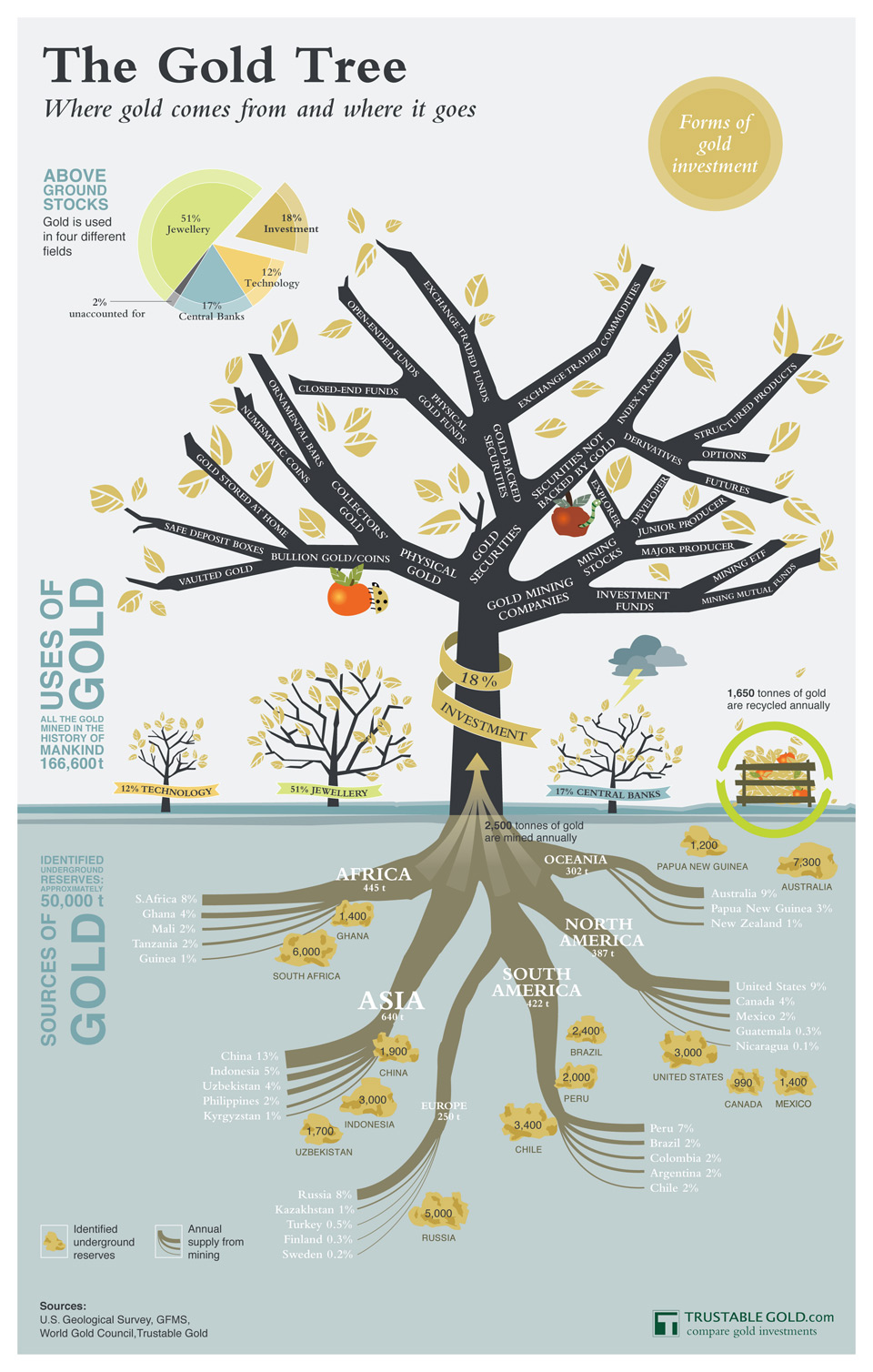

Of all the rare-earth elements available, gold is possibly the most extensively called a financial investment. Most investors typically purchase gold as part of a diversified portfolio as a way of decreasing danger, especially through the employment of by-products as well as futures contracts. just click the next article is likewise subject to substantial volatility and also supposition as are many other markets. The cost of gold is influenced by a variety of variables, including federal government plans as well as financial growths around the world. Gold rates have a tendency to increase when globe occasions threaten the security of the dollar, while decreasing when the economy of a country enhances.

For the majority of people thinking about acquiring physical gold, there are 2 major avenues for doing so. Initially, there are numerous firms that market fashion jewelry, watches, coins, and also bullion bars containing gold. Second, there are numerous brokers that offer gold financial investment products such as certifications, shares, and mutual funds. If you are thinking of purchasing gold, it is wise to speak with both professionals and knowledgeable pals before making an actual financial investment.

Buying gold can be a very prudent monetary move for those with a strong understanding of its history, business economics, and future possibility. If you are thinking about getting jewellery as an addition to your collection, it may make good sense to think about an individual retirement account, or gold financial investment in a retirement account. By purchasing gold you can benefit from tax benefits, as well as have a safe area for your assets to grow tax-deferred. If you're wanting to diversify your portfolio of possessions and funds, think about purchasing gold individual retirement account's. Particularly, if you have a considerable amount of jewelry, it might be important to consider acquiring gold bars, necklaces, and coins.

A gold individual retirement account includes a certification or "deposit slip", which is a kind of investment product provided by some banks. The advantage of a certificate of deposit is that it imitates a safety interest. This means that if you were to suffer a loss on any type of gold financial investment, the bank will certainly compensate you for the loss. If you are interested in acquiring a financial investment product that provides comparable benefits, try a gold bar or bullion.

Gold bars and bullion can make excellent additions to any kind of investor's portfolio. If you are an investor who is seeking a fast as well as secure way to include gold to your profile, think about investing in small amounts of gold in your portfolio. Gold individual retirement account's can be purchased from many on-line financial institutions, along with brick and mortar financial institutions. To shield your portfolio, it is wise to acquire percentages of gold with your IRA every month.

One more kind of gold investment is a gold futures contract. Gold futures contracts enable you to purchase and also sell future contracts based upon the price of gold at any type of given time. These kinds of financial investments are an excellent addition to a standard capitalist's investment portfolio. Financiers who acquire gold futures contracts to complement their gold financial investments should be aware that the cost of gold varies each day. Therefore, you should establish when the price of gold is likely to optimal as well as start a decrease to ensure that you have the ability to market your gold contracts early at a profit.

One last sort of gold investment to consider is purchasing gold bars. You can acquire gold bars at banks like HSBC or Bank of America. There are numerous business that concentrate on selling gold bars including PAMP, Goldwell, Freedom X, as well as Gold Star. Gold Based IRA can purchase one gold bar at once from these firms, or you might choose to invest in a gold cost savings scheme. A gold cost savings scheme is like a mutual fund other than that as opposed to receiving fixed rate of interest settlements, you get regular returns in the form of bonus factors. If Best IRA Company are thinking about purchasing gold bars as part of your overall financial investment portfolio, you need to remember that the rate of gold per ounce has a tendency to fluctuate daily.

Many individuals who have an interest in gold financial investments make the mistake of assuming they can start spending today and have their cash helping them tomorrow. It holds true that there are some exceptional gold investment possibilities available today, yet it is not smart to obtain involved in something that will fluctuate without a great amount of notice. If you make a decision to buy physical gold coins, jewellery, or other kinds of physical gold financial investments, you should aim to see if the market is mosting likely to move in your selected direction before you make your purchase. Many individuals never think about all of this, yet by keeping these facets in mind you can be sure that you are making a notified choice when you determine exactly how to proceed with your gold financial investments.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

There Are A Number Of Benefits To Purchasing Gold Etfs Instead Of Holding Physical Gold |

Content create by-Bager Agerskov

Of all the rare-earth elements readily available, gold is certainly the most popular as a prospective gold investment. Several capitalists normally invest in gold as part of diversification, especially via the employment of by-products and also future agreements. The gold exchange market is very unstable and also subject to substantial supposition. Gold IRA firms also deal in gold coins. The latter can be utilized as financial instruments or as physical items.

There are a number of methods which you can purchase gold. You can spend by acquiring physical gold in bars, coins, rounds, or bars. You can likewise spend by purchasing futures contracts for gold coins or bars. It is best to study initially prior to investing your cash in any type of gold investment so that you will certainly be able to pick the very best item for your certain demands and goals. Although you can market physical gold at a profit in the future, there are many dangers when spending via futures agreements.

Gold IRA funds are designed especially to hold physical gold. They give all capitalists with the possibility to take part in the rising gold costs. The fund allows financiers to spend both in bullion as well as ETFs.

Purchasing Gold And Silver IRA (exchange traded funds) differs from gold investment in a couple of methods. Initially, ETFs are not suggested to be holding a real possession like physical gold. Rather, they are an automobile for capitalists to acquire direct exposure to the rising rates of gold. Second, ETFs are usually traded on significant exchanges and have their own pricing system. Typically, these rates are readjusted relying on supply and also demand. If the price of gold rises, then so does the price of an ETF.

There are a number of benefits to investing in gold etfs instead of holding physical gold. Capitalists that trade these types of securities have the ability to deal them whenever the market sees fit. Find Out More gives them the ability to remain on top of the marketplace for any type of changes in rate.

It is necessary to know that purchasing ETFs is not the like standard gold investment methods. There are certain guidelines that need to be complied with. Initially, the trading process is really various from purchasing physical gold. Gold ETFs need to initially be sold the non-prescription market. After that, the buyers have to buy the shares at the present rate and also market them to the vendors for an earnings. This process commonly occurs in either the USA or in London.

When looking at purchasing ETFs, it is additionally important to bear in mind that they are not traded in the exact same fashion as holding physical gold. As a result, it is important to keep an eye on the numerous costs and exchanges in order to remain as notified as possible. When a capitalist is searching for gold investment possibilities, he will certainly want to make sure he gets in and out of the market promptly as well as easily. Several investors prefer to trade on their computer systems to ensure that they can continue to be as active as feasible out there.

One final benefit to buying gold ETFs is that they do not have the added fees related to purchasing gold coins. As gold is extremely unpredictable, numerous brokerage firm companies bill additional fees for acquiring and also offering the coins. This makes it tough to acquire maximum returns. When investing by means of an ETF, the financier doesn't need to pay broker agent costs. This makes it feasible for investors to get the highest possible return on his/her financial investment.

When seeking to get gold, it is essential to check out the overall investment climate. Gold is a really safe property to purchase, yet there are plenty of broker agent firms readily available that supply ETF services. Therefore, it may be simpler for a financier to purchase ETFs than it would certainly be by investing directly in gold bullion.

For those who are just beginning with gold financial investment, it is always a good suggestion to research the numerous alternatives available. Specifically, the most effective way to spend is by expanding across various products. While some investors stick with gold bullion, there are other ways to spend, such as purchasing ETFs and gold mining stocks.

The bottom line is that capitalists have countless financial investment choices, so they require to maintain their alternatives open. This is specifically vital when financiers intend to branch out throughout multiple markets. https://blogfreely.net/lavern09bryan/what-are-the-...k-about-before-gold-investment has been confirmed to be a strong investment with time, so there are plenty of factors to place money right into this precious metal. Whether a capitalist determines to go long or short, gold rates are most likely to proceed climbing in the coming years.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

Gold Futures Is A Good Option For Making Long Term Investments When Individuals Want To Gain From The Potential Rate Increase Of Gold |

Article written by-Boel Lancaster

Of all the rare-earth elements, gold ranks high as an investment. Capitalists generally buy gold as a way of diversity threat, especially via the employment of by-products and futures agreements. As are other markets, the gold market is vulnerable to extreme volatility as well as conjecture. It is very much like the stock exchange. Gold is additionally a type of defense for riches. Therefore, gold IRA firms can be practical for those that have a rate of interest in purchasing precious metal.

There are a variety of elements that impact gold prices. Gold investment companies function to shield financiers against changes in the gold price with the purchase of physical gold. When https://blogfreely.net/emelia72agustin/gold-future...for-making-long-term-financial holding gold investments problem supply, the holders of such supply are protected with a security contract. This agreement usually provides the business the right to sell gold stocks to capitalists must the gold financial investments fail to deliver the promised returns over a specific time period.

Gold IRA companies are firms that provide gold financial investments as part of their property monitoring solutions. These firms buy and also handle gold ETFs, gold mutual funds, as well as golden goose shares. Gold IRA business supply a number of kinds of alternatives for those interested in protecting their gold financial investment with the purchase of gold as part of their profile.

Gold individual retirement account firms can also deal with gold mining business to shield the value of gold deposits located all over the world. Best IRA Accounts of these gold deposits boosts if the mines are diminished. Gold mining firms buy gold from the gold mining market and after that offer it to refiners worldwide. Gold that is marketed in this way is referred to as unprocessed gold. The gold investment companies take an ownership rate of interest in these golden goose, which subsequently ensures the refiner that they will get settlements for the gold offered to them.

An additional kind of gold investment is via buying and selling gold coins. When individuals begin to check into investing in gold, they frequently find that it is an excellent way to expand their possessions. Gold investment can be handled by a person or a company with the acquisition as well as sale of gold coins. Gold Investment Companies in coins is particularly prominent amongst individuals who are looking for a long-term investment and also don't intend to handle storing and safeguarding the gold themselves. Gold individual retirement account companies can use financiers this opportunity to invest without having to stress over storing the gold and handling it by themselves.

Acquiring gold entails more than simply getting the steel itself. Prior to a financier can begin with buying gold, there are a few things that need to be comprehended. One of these is how gold financial investment functions to ensure that the investor knows what it is they are getting into. Comprehending gold investment also helps people to figure out if this is a solid financial investment that they should be making.

One manner in which capitalists can acquire gold investment is via ETFs or mutual funds. Gold mutual funds can help investors track the price of gold in real time as well as additionally make some make money from the revenues made by the investments. Gold mutual funds can be bought through financial institutions or online brokerage houses. People that have an interest in making some money off of their investment might want to consider buying ETFs.

Investing straight in gold ETFs is an excellent way for financiers to capitalize on the steel's increased value with time. When people are looking to make long term financial investments, they ought to think of putting a few of their cash right into gold investments. Gold futures provides capitalists the opportunity to sell gold supplies when the marketplace deviates against it. When this occurs, the cost of gold mines out and also the investors will make money from the place cost distinction in between when the market shows up as well as when it turns down.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

Which Types Of Gold Investment Are Right For You? |

Authored by-Svendsen Whitley

Of all the precious metals offered, gold is most likely the most commonly known as an investment. Many capitalists normally buy gold as part of a diversified portfolio as a way of reducing threat, particularly with the work of derivatives and also futures contracts. The gold market is additionally subject to substantial volatility as well as conjecture as are numerous various other markets. The price of gold is impacted by a number of aspects, including federal government policies as well as economic advancements around the world. Gold rates have a tendency to increase when world events intimidate the security of the buck, while decreasing when the economy of a nation improves.

For most people interested in purchasing physical gold, there are two main opportunities for doing so. Initially, there are numerous business that sell precious jewelry, watches, coins, and also bullion bars having gold. Second, there are several brokers that use gold financial investment items such as certificates, shares, and mutual funds. If you are thinking about purchasing gold, it is important to chat with both experts and also seasoned friends before making a real financial investment.

Purchasing gold can be a very sensible monetary move for those with a solid understanding of its background, business economics, and future potential. If you are thinking about getting jewelry as an addition to your collection, it might make sense to take into consideration an IRA, or gold financial investment in a retirement account. By investing in gold you can gain from tax advantages, along with have a safe area for your possessions to expand tax-deferred. If you're aiming to expand your profile of properties as well as funds, take into consideration investing in gold IRA's. Specifically, if you have a significant quantity of jewelry, it could be important to consider purchasing gold bars, pendants, and also coins.

A gold IRA consists of a certificate or "deposit slip", which is a type of investment product used by some financial institutions. The benefit of a certificate of deposit is that it imitates a safety passion. read full article indicates that if you were to experience a loss on any type of gold financial investment, the bank will certainly compensate you for the loss. If you want getting a financial investment item that offers comparable benefits, try a gold bar or bullion.

Gold bars and also bullion can make wonderful additions to any kind of investor's profile. If you are a capitalist that is searching for a quick as well as protected means to add gold to your portfolio, take into consideration purchasing small amounts of gold in your profile. Gold IRA's can be purchased from most online financial institutions, in addition to traditional banks. To secure your profile, it is important to acquire small amounts of gold with your individual retirement account every month.

An additional kind of gold financial investment is a gold futures contract. Gold futures agreements permit you to buy and also sell future agreements based on the rate of gold at any kind of given time. https://zenwriting.net/angeline12houston/gold-fina...s-readily-available-in-markets of investments are a fantastic enhancement to a common capitalist's financial investment portfolio. Capitalists that acquire gold futures agreements to complement their gold investments need to be aware that the cost of gold fluctuates each day. Therefore, you should identify when the rate of gold is likely to peak as well as begin a decrease so that you are able to market your gold contracts early at a profit.

One last kind of gold investment to take into consideration is buying gold bars. You can purchase gold bars at banks like HSBC or Bank of America. There are several companies that specialize in selling gold bars consisting of PAMP, Goldwell, Liberty X, and also Gold Star. You can buy one gold bar at a time from these business, or you may make a decision to invest in a gold savings system. A gold financial savings scheme resembles a mutual fund except that rather than obtaining set rate of interest repayments, you get normal returns in the form of benefit points. If you are taking into consideration purchasing gold bars as part of your overall financial investment profile, you should bear in mind that the price of gold per ounce tends to change daily.

Many people who have an interest in gold investments make the mistake of assuming they can start investing today and also have their money benefiting them tomorrow. It holds true that there are some exceptional gold investment possibilities available today, however it is not a good idea to get involved in something that will fluctuate without a fantastic amount of notification. If you decide to acquire physical gold coins, jewelry, or other forms of physical gold investments, you must want to see if the market is mosting likely to move in your chosen instructions before you make your acquisition. Read Home consider all of this, but by keeping these elements in mind you can be sure that you are making a notified choice when you determine how to wage your gold financial investments.

|

Метки: Gold Investment Gold Based IRA Gold Investment Companies Gold IRA Gold IRA Investing Gold And Silver IRA Gold 401k Rollover Precious Metals IRA |

How Bookkeeping Services Focuses On A Vast Array Of Accounting And Service Related Providers Including: Bookkeeping, Pay-Roll, Tax Prep Work, As Well As Notary Solutions? |

Article by-David Kelley

There is a massive choice of Audit Services carriers offered all across the United States. Bookkeeping solutions gives a range of Audit and also Company oriented Bookkeeping Solutions like: accounting, payroll, tax obligation preparation, and also notary solutions. Notary services include: Snohomish Area Washington, Oregon. In Washington DC you can find Audit Services offered by SSA (Social Security Management), previously called the SS administration.

Bookkeeping Services focuses on helping companies and people fulfill their monetary obligations and also keep ample monetary documents to facilitate conformity with relevant regulations as well as policies. A firm might have complex audit requires that need sophisticated independent judgment. Audit Services can provide these specialized and also experienced audit services by making use of the experience of accounting professionals experienced in complex law and regulatory conformity concerns. http://tyler4kari.xtgem.com/__xt_blog/__xtblog_ent...es?__xtblog_block_id=1#xt_blog with specialized understanding of all of the locations of accountancy supply their clients a detailed variety of accountancy solutions tailored to satisfy the requirements of their customers. Accountants with their extensive experience in the area of tax law as well as compliance collaborate with their clients to develop and execute plans made to complete their objectives and maintain the personal privacy of their assets. The know-how and commitment of accountants with their very trained ability to enable them to achieve these results.

Richard steiman of companies and also individuals use accounting solutions to properly tape the financial activities of business or individual. A bookkeeping service can efficiently assist manage the flow of funds by creating records that are precise as well as as much as date at any kind of moment. Accountants with their years of knowledge in tax obligation regulation as well as conformity make it easy for company owner and people to satisfy their lawful as well as tax obligation responsibilities. Audit Providers specializes in offering the very best in tax preparation, Net accounting, pay-roll and also benefits management.

With their big range experience, accounting professionals with bookkeeping competence as well as computer system database access to comprehend how to efficiently run a company, take care of the company's financial resources as well as track all of the various accounts a business holds. Every one of this is essential in order to carry out business as well as continue to be certified with every one of the different government, state and neighborhood tax obligation codes. Due to the fact that accounting is so essential, the majority of accountancy solutions will additionally offer bookkeeping as well as investigation solutions also. Auditors will certainly accumulate financial documentation, check out the credibility of the accounts, as well as identify if any type of mistakes have actually occurred.

Taxes is one more location where accounting professionals with bookkeeping solutions succeed. Whether it is preparing federal, state or local tax returns or carrying out regular evaluations on the credibility of the firm's monetary records, bookkeepers with this proficiency are indispensable to any kind of business. Accounting professionals that focus on taxes can likewise assist their customers in various other locations such as global tax and also conformity with any governmental guidelines. Due to the fact that the bookkeeping needs of a lot of companies as well as individuals are so intricate and delicate, accountants with this history are also in demand for doing lots of secretarial responsibilities and also other secretarial job.

There are numerous various other areas in which accounting and also cfo services are called for, nonetheless. Entrepreneur will certainly often make use of these solutions when they require an expert in place to manage their organization funds. Furthermore, several business owners likewise need help with their service' tax obligation planning. Accounting professionals who are experienced in tax planning and tax returns, in addition to those that recognize complex monetary issues, can meet every one of these service demands and even more. Several local business owner also work with accounting professionals to manage the duties of their attorney, because attorneys often require to review and also upgrade their organizations' financial documents, too.

Accounting and also coefficient services can be handled by either independent or captive accountancy companies. Restricted companies are normally those that are had by a solitary firm and are in charge of the daily monitoring and oversight of its own bookkeeping and also coefficient services. They typically do not hire employees, yet instead agreement with an accountant to perform these jobs. As https://postheaven.net/linwood89dirk/accounting-so...s-is-it-right-for-your-company can see, the distinctions in between these types of companies are rather considerable. For smaller sized organizations, small companies, or even people, a little independent firm may be the very best option, since it will certainly supply the most customized as well as practical solution.

If you are a local business owner that is taking into consideration hiring a bookkeeper or an accountant to manage your audit and/or financial events, then it is important to very carefully consider your alternatives. Not only need to you evaluate the abilities of the person, but additionally the proficiency as well as experience of the bookkeeping company or specific you are considering. Bookkeeping companies focus on a variety of areas, consisting of finance, banking, insurance coverage, monitoring, and also sales. Some specialize only in certain areas, while others have specialists that are well-informed in all areas of accountancy as well as bookkeeping.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Small Business Bookkeeper Bookkeeping Services |

What Is The Important Of Audit Solutions? |

Article by-Morgan Levine

Audit solutions focus on assisting dining establishment proprietors and also supervisors with their bookkeeping requires. Actually, these solutions have progressed with the dining establishment market to consist of such diverse offerings as order handling, food selection preparation, special orders, and also analytics software application. Their success has been enabled through substantial market research as well as regular improvements in software, technology, and also functional techniques. If you have an interest in leveraging the accountancy solutions of a firm focusing on restaurant bookkeeping and monitoring, right here are some of the best actions to take.

Services can considerably benefit from the recommendations of a Bookkeeping Solutions specialized firm. Since they focus on helping local business owner, restaurants have accessibility to one of the most skilled bookkeeping specialists in the sector. Compared to standard internal accounts, they're likewise a lot more inexpensive. And, considering that they're staffed by permanent staff, they can provide a vast variety of services to satisfy every need of the business.

https://writeablog.net/winfred4brandy/what-is-the-essential-of-bookkeeping-services can require to companion with an Audit Solutions firm is to develop a long term connection. You want to make certain you're mosting likely to function well together. One of the simplest means to establish this is with monetary preparation. Audit services with a concentrate on financing and accountancy supply a range of monetary preparation services including monetary planning, budgeting, and possession security, among others.

The second step, a service can require to partner with a Bookkeeping Solutions company is to have an accountant on board. This will provide an important source to your company by making certain that every one of your monetary demands are met. An excellent accountancy group focuses on all areas of accounting consisting of pay-roll, vendor accounts payable, and tax preparation. They also collaborate with your lawful group to produce a comprehensive set of audit plans to aid secure your possessions. A good service's capacity to keep current information on a firm's finances assists it remain certified with the various laws that govern the numerous aspects of the financial globe.

Bookkeeping solutions are available to most public firms as well as services. One of the most usual accounting services available to businesses include: payroll, employee benefits, tax preparation, and monetary statements. There are many accountancy companies that focus on various areas of these solutions and also can assist your business handle its funds in the very best method feasible. The majority of accountancy firms are developed to meet the requirements of other well established services and also do not cater to start up services or smaller sized companies.

The following step to partner with Bookkeeping Services is to choose a trusted public audit firm that has years of experience. Experience is what matters, as well as many bookkeeping firms hold a number of years of experience in the field. This experience gives them a large range of skills that they can make use of to help your service attain the greatest degree of success. In addition, experienced accountants proficiency helps them guarantee your audits are extensive and complete. Accountants with public accounting background have the abilities and expertise necessary to deal with any kind of audit problems that may develop.

If you are seeking a more particular kind of Bookkeeping Providers then you may want to look for a much more customized company. Read More In this article concentrate on a specific area of bookkeeping and assist small businesses and also individuals accomplish their goals. Instances of specific companies include:

Some services additionally work with in-house bookkeepers. Nevertheless, hiring an internal accountant is not always affordable. Contracting out the responsibility of tracking your books to one more professional solution can save you money over the long term. https://lana106ressie.werite.net/post/2021/08/03/W...Vital-Of-Bookkeeping-Solutions offer accounting and also audit services for small businesses as well as larger corporations. They are always ready to discuss on prices, so it is essential to do some study and also window shopping prior to deciding on which audit company to get your business involved with.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Small Business Bookkeeper Bookkeeping Services |

Just How Audit Services Specializes In A Variety Of Accounting As Well As Organization Related Solutions Including: Accounting, Pay-Roll, Tax Obligation Prep Work, As Well As Notary Services? |

Content create by-Ayala Parker

There is a huge option of Accounting Provider providers offered all across the United States. Accounting services offers a variety of Audit and Business oriented Accounting Solutions like: accounting, payroll, tax obligation preparation, and notary solutions. Notary services consist of: Snohomish County Washington, Oregon. In https://zenwriting.net/kelley867margret/what-is-the-important-of-audit-providers can find Accounting Services given by SSA (Social Security Management), formerly known as the SS administration.

Audit Solutions specializes in assisting companies as well as individuals fulfill their financial obligations and preserve adequate financial records to help with conformity with applicable regulations as well as guidelines. A company may have complex accounting needs that need advanced independent judgment. Accountancy Solutions can provide these specialized and also skilled accounting solutions by using the experience of accounting professionals experienced in complex law as well as regulative conformity problems. Accounting professionals with specialized knowledge of every one of the locations of accountancy use their clients a detailed range of accountancy solutions tailored to satisfy the needs of their customers. Accounting professionals with their comprehensive experience in the area of tax obligation law and also conformity deal with their customers to develop and also carry out strategies created to accomplish their goals as well as maintain the personal privacy of their possessions. The expertise and commitment of accounting professionals with their extremely educated ability to enable them to attain these outcomes.

Most organizations and also individuals make use of bookkeeping solutions to appropriately videotape the economic tasks of the business or person. An accounting solution can properly assist control the circulation of funds by developing reports that are exact and as much as date at any kind of moment. Accountants with their years of proficiency in tax regulation as well as compliance make it very easy for local business owner and people to meet their legal as well as tax obligations. Accountancy Solutions specializes in providing the very best in tax prep work, Web bookkeeping, payroll and benefits management.

With their huge scale experience, accounting professionals with bookkeeping knowledge and computer database accessibility to recognize exactly how to efficiently operate an organization, handle the firm's funds as well as track all of the various accounts a company holds. All of this is required in order to conduct business and also stay compliant with every one of the numerous government, state as well as local tax obligation codes. Since accounting is so vital, most bookkeeping services will certainly also use bookkeeping and investigation services as well. Auditors will certainly accumulate monetary documentation, explore the validity of the accounts, and also figure out if any type of mistakes have actually taken place.

Taxes is an additional location where accountants with accounting services succeed. Whether it is preparing federal, state or regional income tax return or conducting routine analyses on the credibility of the business's monetary documents, accountants with this know-how are vital to any business. Accounting professionals that specialize in taxes can also assist their customers in various other areas such as worldwide taxes and also conformity with any kind of governmental guidelines. Since the bookkeeping demands of most organizations as well as individuals are so intricate as well as sensitive, bookkeepers with this background are likewise sought after for carrying out lots of clerical tasks and also various other clerical job.

There are lots of various other locations in which accounting and cfo services are required, nevertheless. Company owner will certainly commonly make use of these services when they need an expert in place to handle their company finances. Additionally, many entrepreneurs also require aid with their company' tax preparation. Accounting Small business cpa in anthem az who are experienced in tax obligation preparation and also income tax return, as well as those that understand intricate economic matters, can fulfill all of these business demands as well as even more. Many company owner even hire accountants to deal with the duties of their attorney, because attorneys frequently require to assess and update their organizations' financial records, also.

Accounting as well as coefficient services can be handled by either independent or restricted accounting companies. Captive companies are typically those that are owned by a single company as well as are accountable for the everyday management and oversight of its very own accounting and also coefficient solutions. They normally do not work with workers, but rather contract with an accounting professional to carry out these jobs. As you can see, the distinctions in between these types of companies are fairly considerable. For smaller sized services, small companies, or perhaps individuals, a little independent company might be the best choice, because it will certainly offer the most individualized as well as practical solution.

If you are a business owner who is considering hiring a bookkeeper or an accounting professional to manage your audit and/or financial events, after that it is essential to carefully consider your choices. Not just need to you review the abilities of the individual, but likewise the experience as well as experience of the accounting company or private you are considering. click the up coming site focus on a wide variety of fields, consisting of finance, banking, insurance, management, and sales. Some specialize just in particular areas, while others have experts that are well-informed in all locations of bookkeeping and also bookkeeping.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Small Business Bookkeeper Bookkeeping Services |

What Is The Vital Of Accounting Providers? |

Recommended Browsing create by-Bork Barnes

Accounting services concentrate on assisting restaurant proprietors as well as managers with their bookkeeping requires. As a matter of fact, these services have evolved with the restaurant market to consist of such varied offerings as order processing, menu preparation, special orders, and also analytics software application. Their success has actually been enabled through extensive market research and regular improvements in software application, innovation, and also operational methods. If you want leveraging the accountancy solutions of a firm specializing in dining establishment accountancy and management, below are a few of the very best steps to take.

Companies can greatly benefit from the guidance of an Accounting Services specialized company. Due to the fact that they specialize in helping entrepreneur, restaurants have accessibility to the most skilled audit experts in the market. Contrasted to conventional interior accounts, they're also more cost effective. And, considering that please click the next post staffed by full time team, they can provide a vast variety of services to meet every need of the business.

The very best step an organization can take to partner with an Audit Providers business is to establish a long term partnership. You want to make sure you're going to work well with each other. One of the most convenient ways to develop this is through monetary planning. Audit services with a focus on finance and accountancy supply a range of monetary preparation services consisting of monetary planning, budgeting, as well as asset protection, to name a few.

The 2nd action, an organization can require to partner with an Audit Providers business is to have an accounting professional on board. This will supply a very useful resource to your firm by making certain that every one of your monetary requirements are satisfied. A great accountancy team focuses on all areas of bookkeeping including pay-roll, vendor accounts payable, and also tax prep work. They also collaborate with your lawful group to produce a substantial set of accountancy plans to aid safeguard your properties. An excellent service's capacity to maintain current details on a business's funds helps it remain compliant with the different regulations that control the various elements of the economic globe.

Bookkeeping solutions are offered to most public companies as well as organizations. The most usual accountancy solutions readily available to companies include: payroll, fringe benefit, tax preparation, and financial declarations. There are lots of audit firms that focus on various locations of these solutions as well as can aid your organization handle its funds in the most effective way possible. Many accountancy firms are established to satisfy the requirements of other recognized services and also do not deal with start up companies or smaller sized companies.

The next action to companion with Accounting Solutions is to select a reliable public audit firm that has years of experience. Experience is what counts, as well as a lot of accountancy firms hold several years of experience in the field. This experience provides a variety of skills that they can draw on to assist your business attain the greatest level of success. Additionally, experienced public accountants proficiency helps them guarantee your audits are extensive and also thorough. Accountants with public accounting history have the abilities and understanding necessary to take on any type of audit problems that may arise.

If you are seeking a more specific sort of Accountancy Services then you might wish to seek a much more specific firm. These companies concentrate on a specific field of accounting as well as aid small companies and people attain their goals. Examples of specific firms include:

Some services likewise work with in-house accountants. Nonetheless, hiring an internal accountant is not always budget-friendly. Contracting out the obligation of keeping an eye on your publications to another professional solution can save you money over the long term. Lots of bookkeeping firms supply accounting as well as audit services for small companies as well as larger firms. They are constantly going to work out on rates, so it is necessary to do some study and also window shopping before selecting which audit firm to get your organization involved with.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business Small Business Bookkeeper Bookkeeping Services |

How to Select a Financial Advisor That Provides You Right Direction With Your Investments |

Article by-Hanson Dreyer

Financial Advisors are experts that use economic recommendations to customers depending on their monetary conditions. In a lot of countries, financial advisers must undertake specific training and be certified by a regulative body to offer monetary suggestions. They also follow specific regulations and also laws offered by the federal government to make sure client confidentiality.

Financial Advisors can generate income with compensations from various financial consultatory groups. This can either be a part-time or permanent duty. There are additionally circumstances where a financial professional functions as a representative for a large company, financial institution or insurer.

Financial Advisors additionally plays a key duty in giving retired life planning solutions. Retirement are the prepare for people to save for their golden years. Retirement accounts can be invested in the stock exchange or mutual funds and can collect a great deal of cash gradually. Financial advisors play a significant role in giving suggestions for people thinking about saving for their future. Some retired people are self utilized and also Monetary Advisors are also employed by huge business and banks to aid them with retirement.

A Financial Consultant can operate in many different areas within the financial solutions industry. The most typical sectors that utilize monetary experts include possession security, insurance, investment financial, pension plan, estate, and the economic solutions sector. Financial advisors also deal with individuals, firms, federal government firms, public authorities, and also various other non-profit companies. There are many individuals who desire work in this market. Several of the advantages consist of developing a clients as well as making big wages; access to premium financial investments; and the capacity to choose from different areas in which to work.

Among the major abilities that every monetary expert requires to have is financial planning. This is the art of handling one's possessions, future earnings, responsibilities, insurance coverage needs, investments, and more. Financial advice and also economic preparation are an important element of retired life preparation as well as can be made use of to achieve several things in life. https://simplywall.st/stocks/us/banks/nyse-pnc/pnc...-up-the-pnc-financial-services will be involved in producing a client's objectives and objectives, help them attain these objectives, as well as examine their success or failure to attain the goals.

Several financial consultants collaborate with federal government agencies and also pension, helping them with asset defense, portfolio administration, and also contributions to their chosen organizations. Financial organizers might additionally supply monetary consultation to individual financiers in addition to to firms. Financial experts can evaluate clients' financial portfolio to help them make critical decisions about purchasing the incorrect areas. Financial experts can also work as robo-advisors, which permit them to invest their own money without being personally involved in any deals.

One more field of economic experts involves investment banking. These experts provide investment recommendations and also help manage client profiles. https://docs.google.com/document/d/1qleeuXg6t6VEB1...mGRY_69eCXVeA/edit?usp=sharing , selects, handles, and shops capital for customers. Although many monetary experts just concentrate on one particular location, such as financial investment financial, some specialize in a number of areas of experience. Financial consultants, for instance, might aid individuals identify what type of investment they would certainly be fit for, what financial investment products are readily available and how to spend cash to create a general financial investment strategy.

All monetary experts are experienced at offering suggestions and informing clients on their financial investments as well as goals. Whether functioning straight with an individual or representing a company, a financial advisor's work is to help their clients attain their economic objectives. There are several kinds of financial experts from robo-advisors to accredited financial planners. Whether the person intends to manage their very own cash or to hire another person to do it, there are several different means to set about discovering a certified expert.

Several monetary experts supply direct solutions where they help individuals pick the very best financial investments for their scenario. Financial coordinators can aid individuals establish what sort of investments are fit for their goals, how to establish a portfolio, and also exactly how to care for it once it is established. Licensed financial advisors focus on certain financial investments, such as particular possession classes or asset administration approaches. While no 2 monetary consultants will certainly be precisely the very same, a lot of will certainly have similar areas of focus and experience.

When trying to find monetary consultants, it is very important to take into consideration the overall experience and history of each expert. A highly seasoned consultant who has years of sector experience and success on his resume will likely be an excellent suit for a seasoned capitalist. The most effective service providers are usually drawn from the rankings of the bigger investment firms, where they have actually developed considerable relationships with a wide variety of firms. Big investment company typically have a well-written online reputation, strong recommendations, as well as detailed business strategies that outline their comprehensive economic preparation and financial investment methods.

When looking for an economic advisor, inquire about their sector experience and history. They should supply comprehensive details on the specific products they use, the number of clients they offer, and their costs. One of the most effective consultants will certainly be open as well as sincere with their clients, describing the products as well as why they have become a relied on expert for their certain needs.

|

|

Financial Advisors As Well As Their Duty In Your Financial Future |

Written by-Carter Shields

An economic adviser or economic professional is somebody that offers monetary recommendations to customers according to their current monetary circumstances. In most nations, monetary advisers should be registered with a relevant regulatory body and complete certain training in order to provide guidance in the UK. find an investment consultant can be a mixed blessing as some take advantage of the requirement for suggestions whilst others make a killing from the commissions received. The requirement for monetary advisors arises as a result of the requirement for people to be kept educated regarding vital monetary circumstances such as interest rates, inflation as well as securities market fads. Financial consultants serve in helping people as well as families to plan as well as handle their wide range in addition to budgeting and also savings.

These days most people rely upon monetary services supplied by economic advisers. As the variety of loan providers as well as financial advisors has grown, so has the requirement for professionals who give monetary solutions. The role of an economic consultant can vary according to where they function and what sector they operate in. Nevertheless, there are some core areas that remain typical across all economic consultants.

The very first obligation of a financial advisor would certainly be to develop a property allowance strategy, or estate plan, according to the customer's goals as well as purposes. This consists of determining what are the clients' long-term goals and objectives, in addition to temporary ones. While it is constantly best to leave the decisions concerning financial investment to the clients themselves, monetary consultants are typically contacted to aid clients prepare for the future, particularly when it pertains to retired life. Financial experts can aid individuals with all sort of financial investment needs such as choosing in between a Roth and also conventional Individual Retirement Account, setting up a tailored IRA, investing in supplies or bonds, insurance and creating an economic plan.

Financial organizers additionally aid individuals determine what type of financial investments are right for them and their families. They assist people examine their specific financial investments and their risks. The primary goal of monetary experts is to direct their clients in the direction of investments that will increase the possibilities of earning a greater earnings and staying clear of expensive pitfalls such as running out of cash throughout an unforeseen emergency situation. Some common sorts of investments include: stock and mutual fund, money market funds, CDs, or certificates of deposit as well as other certificates of interest and interest-bearing accounts.

Various other important choices would certainly consist of selecting an economic custodian, or company that will deal with the financial investments. There are additionally a number of sorts of investing choices, such as exchange traded funds, specific as well as family members mutual funds, as well as supply index as well as mutual fund. On top of that, financial experts to assist their customers established a comprehensive estate plan that will secure their enjoyed ones from any kind of unanticipated scenarios. https://hbr.org/2020/06/providing-financial-services-to-employees-is-a-win-win can also assist clients make a decision whether to make use of a self-directed IRA, which allows a lot more control over investments, or a conventional Individual Retirement Account, which can be harder to handle.

Most monetary solutions firms offer a large range of financial investment product or services to satisfy the demands of specific customers. A few of the most popular are retirement, estate preparation, cash money value investing, as well as insurance items. These firms assist their customers pick the very best choices for their details monetary objectives as well as economic situations. Depending on the kind of investment selected, there are various tax effects. Financial experts can assist their customers recognize these effects as well as collaborate with their tax professionals to lessen the tax obligation problem. Several of the services supplied by personal economic advisors usually include getting a tax obligation strategy with the H&R Block or Smart Financial advise, scheduling a typical Individual Retirement Account with a custodian, as well as providing recommendations pertaining to investing in additional funds as well as bonds.

Personal monetary consultants supply suggestions as well as advice about various facets of personal finance, including making sound financial investments as well as attaining future objectives. When considering their solutions, customers should seek a consultant who is experienced in examining both risk as well as incentive, in addition to having a wide range of financial items to pick from. Financial consultants can help their clients achieve their long-term financial objectives such as buying a house, buying a car, saving for retirement, and also also investments for a college education. By very carefully choosing which financial investments customers will make as well as under what terms, economic consultants can aid their customers reach their objectives and also retain their present lifestyle.

Numerous individuals make use of financial planning to accomplish their temporary and lasting goals. For instance, a temporary objective could be getting a new work to elevate the family, or it might be saving for a desire holiday. A long-lasting goal could be acquiring a home, a larger home, or saving for retired life. In order to accomplish these objectives, individuals need to put some believed into just how they prepare to reach them. By working with a seasoned, competent monetary expert, individuals can establish reasonable objectives as well as job to attain them.

|

|

How to Select a Financial Consultant That Provides You Right Direction With Your Investments |

Written by- https://disqus.com/by/mcdanielcorp are specialists that use monetary advice to clients relying on their monetary situations. In the majority of nations, economic advisers should undergo certain training as well as be licensed by a governing body to offer economic recommendations. They additionally adhere to specific rules as well as laws offered by the government to make sure customer discretion.

Financial Advisors can earn money with commissions from different economic advising groups. This can either be a part-time or permanent duty. There are additionally instances where a monetary professional works as an agent for a large business, bank or insurance company.

Financial Advisors additionally plays an essential duty in supplying retirement preparation services. Retirement plans are the plans for individuals to save for their gold years. Pension can be purchased the stock exchange or mutual funds and also can build up a lot of money in time. Financial experts play a major duty in offering recommendations for people curious about saving for their future. Some retirees are self employed as well as Economic Advisors are also employed by big business and banks to assist them with retirement plans.

A Financial Advisor can work in many different areas within the monetary services sector. The most typical markets that use monetary consultants include asset defense, insurance policy, financial investment banking, pension plan, estate, as well as the economic solutions sector. Financial consultants also collaborate with individuals, firms, government companies, public authorities, as well as other charitable companies. There are many individuals that aspire to work in this sector. A few of the advantages include building a clients and also making large salaries; access to premium financial investments; as well as the ability to select from various areas in which to work.

One of the major abilities that every monetary professional requires to have is monetary preparation. This is the art of managing one's possessions, future earnings, liabilities, insurance policy requirements, financial investments, and more. Financial recommendations as well as monetary planning are a crucial part of retirement preparation and can be used to accomplish many points in life. Financial consultants will be involved in creating a customer's objectives and also goals, help them achieve these objectives, as well as examine their success or failing to accomplish the goals.

Many financial professionals deal with federal government companies and also pension plans, aiding them with property protection, profile administration, and contributions to their picked organizations. Financial coordinators might also provide financial assessment to private capitalists in addition to to firms. Financial consultants can examine clients' financial portfolio to help them make calculated choices concerning buying the incorrect areas. Financial consultants can likewise function as robo-advisors, which allow them to invest their very own money without being directly involved in any kind of deals.

One more area of economic consultants involves investment financial. https://www.forbes.com/sites/awsinfrastructuresolu...n-financial-services-with-aws/ supply investment recommendations as well as help manage customer portfolios. An investment lender investigates, selects, takes care of, and stores resources for clients. Although many monetary experts just focus on one particular location, such as investment banking, some concentrate on a number of areas of know-how. Financial consultants, as an example, could help people determine what sort of investment they would be suited for, what financial investment items are offered and also exactly how to spend cash to create an overall investment strategy.

All economic experts are experienced at offering recommendations and enlightening clients on their financial investments and objectives. Whether working straight with a specific or representing a firm, a monetary expert's work is to help their customers achieve their monetary objectives. There are many different kinds of economic experts from robo-advisors to licensed monetary planners. Whether the person intends to manage their very own cash or to employ someone else to do it, there are a number of various means to go about discovering a qualified specialist.

Numerous financial experts use straight services where they assist people select the best investments for their circumstance. Financial planners can assist people identify what type of financial investments are matched for their goals, just how to establish a profile, and just how to take care of it once it is established. Licensed economic consultants specialize in particular financial investments, such as certain property classes or possession administration techniques. While no two financial consultants will certainly be exactly the very same, most will certainly have comparable locations of focus as well as experience.

When searching for monetary professionals, it is very important to take into consideration the total experience as well as history of each specialist. A highly knowledgeable expert that has years of sector experience and success on his resume will likely be a great suit for a skilled capitalist. The best suppliers are usually drawn from the ranks of the larger investment firms, where they have developed significant relationships with a wide range of companies. Huge investment firms often have a well-written online reputation, strong recommendations, and also in-depth organization strategies that describe their detailed financial planning as well as investment approaches.

When looking for a financial advisor, ask about their sector experience as well as background. They should offer detailed information on the certain products they provide, the number of customers they offer, and their charges. The most effective consultants will be open and also straightforward with their clients, explaining the items as well as why they have actually ended up being a relied on advisor for their particular requirements.

|

|

Financial Advisors As Well As Their Role In Your Financial Future |

Article written by-Jamison Linnet

An economic adviser or financial expert is somebody that uses economic recommendations to clients according to their present monetary conditions. In many nations, economic consultants have to be registered with an appropriate regulatory body and also total particular training in order to supply guidance in the UK. Financial advisors can be a mixed blessing as some gain from the need for advice whilst others make a killing from the payments received. The demand for financial consultants develops because of the requirement for people to be maintained educated concerning vital economic circumstances such as rates of interest, inflation and also stock market trends. Financial advisors work in helping people and also households to intend and also manage their wealth as well as budgeting as well as savings.

Nowadays the majority of people count on monetary services given by economic consultants. As the variety of lenders as well as economic advisors has actually grown, so has the requirement for experts who offer monetary services. The function of a financial adviser can vary according to where they work and what sector they work in. However, there are some core locations that continue to be common across all financial consultants.

The very first task of a monetary expert would be to create a possession allowance strategy, or estate plan, according to the customer's objectives and also purposes. This consists of determining what are the clients' long-term objectives and also goals, along with temporary ones. While it is constantly best to leave the decisions pertaining to financial investment to the clients themselves, economic experts are frequently called upon to aid clients plan for the future, specifically when it concerns retired life. Financial consultants can aid individuals with all type of financial investment requirements such as choosing in between a Roth as well as conventional IRA, setting up a personalized Individual Retirement Account, purchasing stocks or bonds, insurance coverage and creating an economic strategy.

Financial planners also assist individuals determine what sort of financial investments are right for them and their households. https://www.prnewswire.com/news-releases/john-hanc...-of-funds-board-301132721.html assist people examine their details financial investments as well as their dangers. The main purpose of economic advisors is to lead their customers in the direction of investments that will raise the opportunities of making a greater income and also avoiding costly mistakes such as lacking cash money throughout an unexpected emergency. Some typical sorts of financial investments consist of: supply and also mutual fund, money market funds, CDs, or certificates of deposit and other certificates of rate of interest as well as savings accounts.

Various other vital decisions would include choosing a monetary custodian, or company that will certainly take care of the financial investments. There are additionally a number of sorts of investing options, such as exchange traded funds, individual as well as family mutual funds, in addition to stock index and also bond funds. On top of that, monetary experts to help their customers established a thorough estate strategy that will certainly shield their enjoyed ones from any kind of unforeseen situations. Financial consultants can additionally assist customers determine whether to utilize a self-directed IRA, which enables much more control over financial investments, or a traditional IRA, which can be harder to take care of.

Most economic solutions firms use a variety of financial investment product or services to meet the needs of individual clients. Some of one of the most preferred are retirement, estate planning, cash money worth investing, and also insurance policy items. These companies help their clients choose the most effective alternatives for their details monetary goals and also financial situations. Relying on the sort of investment selected, there are various tax repercussions. Financial experts can assist their clients recognize these consequences as well as deal with their tax obligation specialists to lessen the tax concern. Several of the services used by individual economic advisors usually consist of obtaining a tax obligation strategy with the H&R Block or Smart Financial encourage, arranging for a conventional Individual Retirement Account with a custodian, as well as giving guidance regarding investing in added funds and also bonds.

Individual monetary advisors give recommendations and also advise about several facets of personal finance, consisting of making sound financial investments and also attaining future goals. When considering their services, clients need to look for an expert that is experienced in evaluating both threat as well as incentive, in addition to having a wide series of monetary products to pick from. Financial advisors can aid their customers attain their long-term economic goals such as buying a residence, getting a cars and truck, saving for retired life, and also also investments for an university education. By meticulously choosing which financial investments clients will certainly make and also under what terms, monetary advisors can aid their customers reach their objectives and also maintain their existing lifestyle.

https://about.me/mcdanielcorp of individuals utilize financial planning to achieve their short-term as well as long-term objectives. For instance, a temporary goal might be obtaining a new task to elevate the family members, or it might be saving for a dream trip. A long-lasting goal might be purchasing a residence, a bigger home, or saving for retirement. In order to achieve these objectives, people require to put some thought right into just how they intend to reach them. By collaborating with an experienced, qualified financial advisor, individuals can set practical goals and also work to achieve them.

|

|

Financial Advisors and the Role They Play To Safeguard Your Investments |

Written by-Vang Church

What are financial advisers? A monetary adviser or economic planner is an independent expert that gives financial advice to clients according to their specific economic scenarios. In many nations, monetary consultants should first complete particular educational training as well as be registered under a regulative body to offer guidance to their customers. visit the following page are anticipated to have audio knowledge of the numerous monetary markets, risk monitoring and also financial investment techniques.

Financial consultants are used by large organisations, frequently as company wide range supervisors. Many advisers work to set and also attain financial objectives as well as monitor and improve overall efficiency. Financial experts often support Chief executive officers and other elderly management and also in many cases act as personal advisors to their CEO.

An instance of a term economic consultant would certainly be wide range managers. A wealth manager focuses on building a portfolio of assets and also distributing them to different groups in culture. The benefit of working with such a consultant is that he or she has comprehensive experience in wide range administration and can assist you in attaining your long-lasting riches objectives. The drawback is that riches supervisors are typically paid on a performance-based cost, which can make it difficult to locate one within your range of pay options. Several additionally require a long term agreement.

Other types of financial experts to think about are those who offer retired life planning solutions. You will certainly need a certified expert to manage your retirement accounts due to the fact that after retired life your income is no longer assured. Financial coordinators help you establish a detailed economic strategy that makes certain both prompt and long-term wide range development. They are usually utilized by pension funds, mutual funds and insurer, as well as they help people in addition to business satisfy their retired life as well as wide range planning demands.

Another kind of financial experts to take into consideration is financial investment monitoring. These sorts of experts supply you with advice on just how to spend your money for riches production. Some focus on supply and also bond investing while others supply you with choices in property, products, the economic markets, as well as the real estate market. In order to work in this area of finance, you require to recognize possession appropriation as well as economic preparation concepts.

financial planner career work just in the straight financial investment sector. These include property monitoring companies and riches supervisors. If you like to work individually, you will certainly require to do the same. Financial advisors can either provide straight investments in the monetary markets or supply a larger series of investment items such as pension plan funds, insurance coverage products, as well as also managed futures and also choices for customers. Whether you choose to benefit a wide range supervisor or an investment firm, you will require to be experienced in a variety of locations consisting of tax obligations, estate preparation, retired life investing and also personal financing.

Financial advisors are also concentrated on different kinds of financial investment products. These include estate planning, securities market and foreign exchange, commodities as well as supplies as well as bond and mutual fund investing. Financial advisors can choose to concentrate on one or every one of these various types of financial investment professionals. Financial coordinators work with individuals as exclusive investors, financial investment planners work as professionals for employers, and also monetary investment specialists function as generalists.

Financial Advisors will certainly also require to meet a range of needs. Prior to they can start using financial items, they need to fulfill a standard minimum payment need, need to be registered agents of their business they suggest, and also pass the required evaluations. Most notably, the economic consultants you select need to meet a selection of various other requirements such as an ideal education, specialist experience, as well as suitability to their customers. As you can see, being a Financial Consultant can be a fascinating as well as intricate duty. It's always crucial to select the appropriate economic consultants for your requirements.

|

|

What Is The Important Of Accounting Services? |

Content author-Herring Pratt

Bookkeeping solutions focus on helping dining establishment owners and also supervisors with their bookkeeping requires. In fact, these solutions have developed with the dining establishment industry to consist of such diverse offerings as order handling, menu preparation, special orders, and analytics software application. Their success has actually been implemented through extensive market research and consistent improvements in software application, technology, and operational techniques. If you want leveraging the accountancy solutions of a firm specializing in restaurant bookkeeping as well as management, here are a few of the very best steps to take.

Businesses can considerably benefit from the guidance of an Audit Services specialized firm. Since they specialize in aiding entrepreneur, dining establishments have accessibility to one of the most experienced accounting specialists in the sector. Compared to traditional inner accounts, they're additionally extra cost effective. And, given that https://posts.gle/WuUt9e staffed by full time team, they can use a vast selection of services to satisfy every requirement of the business.

The most effective action a company can take to partner with an Accountancy Solutions business is to establish a long-term partnership. You want to be sure you're mosting likely to function well together. Among the most convenient ways to develop this is via economic preparation. Bookkeeping solutions with a focus on finance and also accountancy provide a range of monetary planning solutions consisting of monetary planning, budgeting, and possession protection, to name a few.

The 2nd step, a business can require to companion with an Audit Providers business is to have an accountant aboard. This will offer an invaluable resource to your business by making sure that all of your monetary needs are satisfied. A great book-keeping group concentrates on all areas of accounting including payroll, vendor accounts payable, and tax prep work. They likewise collaborate with your legal group to produce an extensive collection of accountancy plans to aid shield your properties. A great solution's ability to preserve present info on a company's finances aids it stay compliant with the numerous legislations that control the different facets of the financial globe.

Audit solutions are offered to most public companies as well as companies. One of the most typical accounting solutions readily available to services consist of: pay-roll, fringe benefit, tax obligation prep work, and also economic declarations. There are many bookkeeping firms that focus on different areas of these solutions as well as can aid your business manage its financial resources in the very best means possible. Most audit companies are established to meet the requirements of other established services as well as do not deal with start up businesses or smaller businesses.

The following action to partner with Accounting Services is to select a trusted public accounting company that has years of experience. Experience is what matters, and also a lot of accounting firms hold numerous years of experience in the field. This experience provides a vast array of skills that they can make use of to aid your business accomplish the best degree of success. In addition, experienced accountants competence helps them insure your audits are detailed as well as extensive. Accountants with public accountancy background have the skills and also knowledge required to tackle any kind of audit issues that might occur.

If you are looking for a much more details type of Bookkeeping Providers then you might want to choose a much more customized company. These firms concentrate on a specific field of bookkeeping and also help small companies as well as individuals attain their goals. Instances of specialized firms consist of:

Some organizations additionally employ in-house bookkeepers. However, hiring an in-house accountant is not always economical. Outsourcing you can try this out of keeping an eye on your publications to one more professional solution can conserve you cash over the future. Numerous accountancy firms use accounting and also audit solutions for local business in addition to bigger corporations. They are always willing to discuss on prices, so it's important to do some study and also window shopping prior to picking which accounting firm to get your company entailed with.

|

Метки: Accounting Services Tax Accountants Advisory Accounting Taxation Services Tax Return Agents Small Business |

What Is The Crucial Of Bookkeeping Providers? |

Content writer-Due Solomon

Audit services concentrate on assisting restaurant owners as well as supervisors with their accounting needs. In fact, these solutions have progressed with the dining establishment market to consist of such diverse offerings as order processing, food selection planning, unique orders, as well as analytics software application. Their success has been enabled through considerable marketing research and continuous improvements in software, innovation, and also functional strategies. If you want leveraging the accounting services of a company focusing on dining establishment audit and also monitoring, here are several of the very best actions to take.

Companies can significantly take advantage of the guidance of an Audit Services specialized firm. Since they concentrate on helping company owner, dining establishments have access to the most seasoned accountancy specialists in the sector. Compared to traditional internal accounts, they're likewise much more budget-friendly. As well as, since they're staffed by full time personnel, they can offer a wide range of services to satisfy every requirement of the business.

The very best action a service can require to partner with a Bookkeeping Solutions firm is to establish a long term connection. You intend to be sure you're mosting likely to work well with each other. Among the most convenient ways to develop this is through financial planning. Accountancy solutions with a focus on money as well as bookkeeping offer a range of financial preparation solutions including financial planning, budgeting, and property protection, among others.

The 2nd action, a company can require to companion with an Accounting Solutions firm is to have an accountant aboard. This will certainly provide a vital resource to your business by making certain that all of your monetary demands are satisfied. A good accountancy team focuses on all locations of accounting including pay-roll, vendor accounts payable, and also tax preparation. They additionally work with your legal team to develop a substantial collection of bookkeeping policies to help shield your properties. An excellent solution's capability to maintain current information on a company's funds assists it remain certified with the numerous legislations that control the numerous elements of the financial world.