Unlocking The Secrets To Closing Offers As An Insurance Agent |

Article writer-Hejlesen Skaarup

Insurance coverage agents are qualified professionals that sell life, home mortgage security and disability insurance. They have to be able to locate, draw in and also keep clients. They need to additionally have a mutual understanding of policy coverage as well as terms, as well as the capability to discuss.

Some salesmen usage classic closing methods, which are scripts planned to convince potential customers to acquire. These strategies can irritate some customers, nevertheless.

1. Know Your Product

As an insurance agent, you have a special selling suggestion. You can help customers type through made complex info and choose that will certainly protect their families in the event of an emergency situation or misfortune.

To do this, you need to recognize your items well and also understand how they interact. This will certainly aid you build depend on with your customers as well as resolve their arguments.

There are many shutting methods that you can make use of to close life insurance sales. One is the assumptive close, where you think that your possibility intends to acquire. This can be efficient with a customer that is ready to dedicate, yet it can be repulsive for those that are still choosing.

2. Know Your Possibility

Offering value to your customers and also demonstrating that you recognize their needs is the most effective means to close a deal. Consumers are more likely to rely on representatives that make the effort to discover their issues and also use a solution that addresses them.

It's likewise important to know your leads' existing policies. With Cover Attach, insurance verification is simply a click away and also you can rapidly resource your client's statement pages, insurance claim records and car details. This can aid you certify leads much faster, shorten sales cycles as well as strengthen customer partnerships. Try it today!

3. Know Yourself

Insurance policy representatives have 2 methods to market themselves: their insurance provider or themselves. One of the most effective means to market on your own is to be yourself.

Informing stories of just how you've assisted clients is an excellent means to develop count on and keep potential customers mentally involved. It additionally helps to set you apart from the stereotyped sales representative that individuals hate.

Developing find out here now of close friends and also colleagues to turn to for advice can enhance your insurance coverage service as well as supply references for new clients. This will certainly give you the opportunity to flaunt your industry understanding as well as experience while constructing an ever-expanding book of company. http://dwayne205kenyatta.xtgem.com/__xt_blog/__xtb...nt?__xtblog_block_id=1#xt_blog can cause an uncapped earning capacity.

4. Know Your Competition

When you understand your competitors, it ends up being much easier to find ways to distinguish yourself as well as win company. This could be a particular insurance policy product, a distinct service that you supply, or perhaps your personality.

Asking clients why they selected to work with you over your rival can help you figure out what sets you apart. Their answers may surprise you-- as well as they could not have anything to do with prices.

Developing relationships with your leads and clients is a big part of insurance coverage advertising. This can be done with social networks, e-mail, and even a public presentation at an occasion. This will certainly develop trust and also set you up for more opportunities, like cross-selling or up-selling.

5. Know Yourself as a Professional

As an insurance policy representative, you'll work carefully with customers to determine their threat as well as build a defense strategy that fulfills their needs. Informing stories, defining the value of a policy, as well as asking concerns are all methods to aid your clients locate their best insurance coverage.

Many insurance coverage agents choose to benefit a solitary company (called restricted agents) while others partner with numerous business (referred to as independent representatives). Despite your choice, you'll take advantage of networking with other insurance policy specialists. Their understanding and experience can give indispensable insight and also assistance for your career. Additionally, getting in https://blogfreely.net/orval344bernadette/the-func...rance-representative-practices with fellow representatives can boost your consumer base and referrals.

6. Know Yourself as a Person

If you know on your own as a person, you can interact your competence and also value to customers in manner ins which feel authentic. A client who believes in you is more likely to trust you as well as end up being a repeat client.

Closing a deal in the insurance policy company is far more than just a transaction. You are offering safety and also comfort to people who have distinct needs.

Spend some time to think about what makes you distinct as a person. You can utilize journaling or meaningful contacting discover your rate of interests, character, and also worths.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Just How To Conserve Money On Insurance Policy Costs With The Right Insurer |

Written by-Sauer Groth

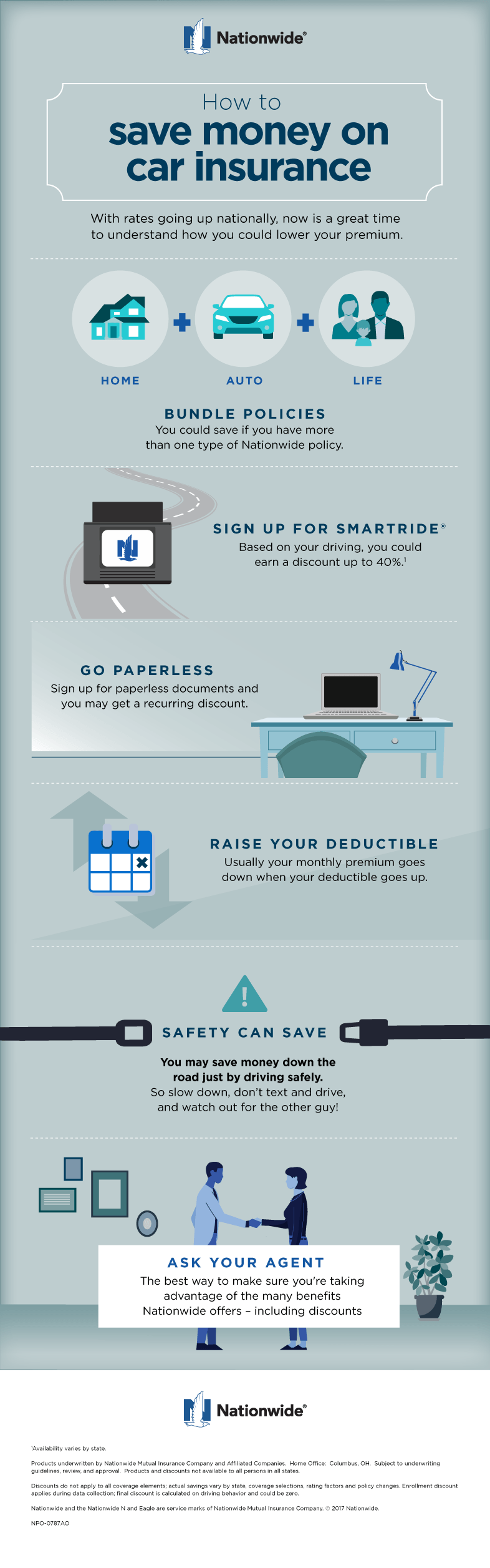

You might assume that there's nothing you can do to decrease your cars and truck insurance coverage premium, yet WalletHub has located a few ways to conserve. Enhancing your insurance deductible (but not so high that you can not pay for to pay it) might conserve you money, as can taking a driver safety and security program or installing an anti-theft tool.

1. Search

Whether you're buying health, vehicle or life insurance, it pays to look around. Some insurers supply on-line quote tools that can save you effort and time by revealing numerous prices for the policy you're taking into consideration.

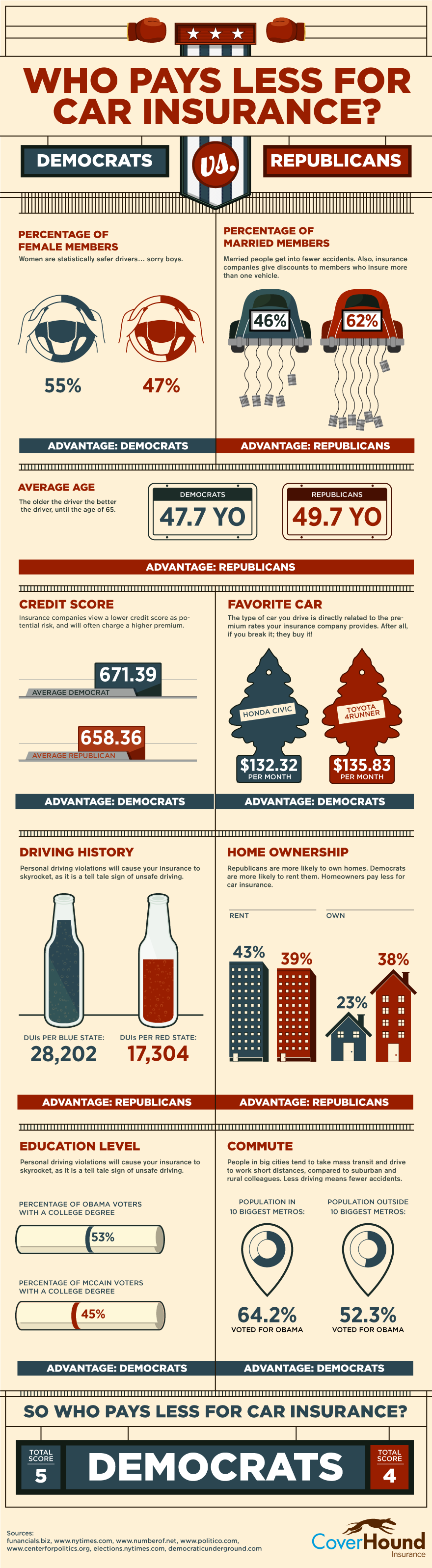

Various other elements like credit history, a safe driving record and packing plans (like auto and home) can additionally reduce your rates. You ought to also frequently evaluate your protection demands as well as reassess your premium costs. This is especially important if you strike life milestones, such as a new kid or obtaining married. Likewise, you ought to occasionally consider your vehicle's worth and take into consideration switching to a usage-based insurance program, like telematics.

2. Know Your Protection

Using these techniques will call for time and initiative, however your job will certainly be compensated with lower yearly premiums for many years to come.

Other methods to save include paying your plan six or a year at a time, which costs insurance provider less than monthly settlements. Likewise, getting rid of coverage you do not require, like roadside aid or rental cars and truck repayment, can conserve you money.

Your credit rating, age and also place additionally influence your prices, in addition to the automobile you drive. Business Owners Insurance , like SUVs and also pickup, cost more to insure than smaller automobiles. Choosing a much more fuel-efficient automobile can reduce your premiums, as will certainly opting for usage-based insurance policy.

3. Drive Securely

There are several things you can regulate when it involves decreasing your car insurance coverage rates. Some techniques consist of taking a defensive driving program, boosting your deductible (the amount you need to pay prior to your insurance policy begins paying on a claim) and changing to a safer vehicle.

Some insurance providers likewise supply usage-based discount rates as well as telematics tools such as Progressive Snapshot, StateFarm Drive Safe & Save and also Geico DriveEasy. These can reduce your rate, yet they may likewise increase it if your driving practices come to be less risk-free with time. Think about utilizing public transportation or carpooling, or lowering your gas mileage to get these programs.

4. Get a Telematics Tool

A telematics gadget-- or usage-based insurance (UBI)-- can save you money on your vehicle insurance policy. Primarily, you connect the gadget into your car and also it tracks your driving actions.

click now after that utilize that information to find out just how high-risk you are. And also they set your costs based on that. Commonly, that can suggest https://zenwriting.net/paris021jimmy/leading-7-met...s-as-an-insurance-policy-agent .

However be careful. One negative choice, such as racing to defeat a yellow light, can turn your telematics device right into the tattletale of your life. That's due to the fact that insurance companies can utilize telematics data to decrease or refute claims. And they might also revoke discount rates. That's why it is very important to weigh the compromises prior to enrolling in a UBI program.

5. Obtain a Multi-Policy Discount

Getting vehicle and house insurance coverage from the exact same carrier is often a terrific method to conserve cash, as numerous credible insurance companies supply discount rates for those that acquire numerous plans with the exact same carrier. Additionally, some insurance coverage carriers offer telematics programs where you can earn deep price cuts by tracking your driving practices.

Other means to conserve consist of downsizing your vehicle (preferably), car pool, and making use of public transportation for job and also recreation. Also, maintaining your driving record tidy can save you money as a lot of insurer provide accident-free as well as great motorist price cut plans. Numerous providers also give consumer loyalty price cuts to long-term clients. These can be significant discount rates on your costs.

6. Obtain an Excellent Price

Raising your deductible can reduce the quantity you pay in case of a mishap. Nevertheless, it is very important to make certain you can pay for the greater out-of-pocket cost before committing to a greater deductible.

If you possess a bigger lorry, take into consideration scaling down to a smaller auto that will set you back much less to guarantee. Likewise, take into consideration changing to a much more fuel efficient automobile to save money on gas expenses.

Check out other discount rates, such as multi-vehicle, multi-policy, excellent driver, secure driving and also army price cuts. In addition, some insurer supply usage-based or telematics insurance policy programs that can conserve you money by checking just how much you drive. Ask your carrier for more details on these programs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Exactly How To Conserve Cash On Insurance Costs With The Right Insurer |

Article by-Horowitz Mckee

You may think that there's nothing you can do to decrease your vehicle insurance policy premium, but WalletHub has discovered a couple of ways to save. Enhancing your insurance deductible (however not so high that you can't pay for to pay it) can save you money, as can taking a chauffeur safety and security training course or setting up an anti-theft gadget.

1. Look around

Whether you're looking for wellness, car or life insurance policy, it pays to shop around. Some insurance firms provide on-line quote tools that can save you effort and time by showing numerous costs for the policy you're thinking about.

Various other elements like credit scores, a secure driving document as well as bundling plans (like cars and truck and house) can additionally reduce your rates. You ought to also regularly examine your protection requirements and reassess your premium expenses. This is especially important if you hit life landmarks, such as a brand-new youngster or getting married. In a similar way, you must occasionally consider your automobile's worth as well as consider switching to a usage-based insurance coverage program, like telematics.

2. Know Your Coverage

Utilizing these techniques will certainly call for time as well as initiative, however your work will certainly be awarded with reduced yearly premiums for years ahead.

Other means to conserve include paying your policy 6 or a year at a time, which costs insurance provider less than monthly repayments. Likewise, getting rid of protection you don't require, like roadside assistance or rental cars and truck repayment, can save you cash.

Your credit rating, age and area also influence your prices, along with the automobile you drive. mouse click the following web site , like SUVs and pickup trucks, expense even more to insure than smaller cars and trucks. Choosing an extra fuel-efficient lorry can minimize your costs, as will going with usage-based insurance.

3. Drive Securely

There are several things you can control when it pertains to decreasing your vehicle insurance policy prices. Some approaches consist of taking a protective driving course, increasing your insurance deductible (the amount you have to pay prior to your insurance starts paying on an insurance claim) and also switching over to a more secure lorry.

Some insurers additionally supply usage-based discount rates and also telematics tools such as Progressive Picture, StateFarm Drive Safe & Save as well as Geico DriveEasy. These can reduce your rate, but they might likewise raise it if your driving habits become much less risk-free in time. Consider making use of public transportation or carpooling, or decreasing your gas mileage to receive these programs.

4. Obtain a Telematics Tool

A telematics gadget-- or usage-based insurance (UBI)-- can save you cash on your automobile insurance coverage. Basically, you plug the tool right into your automobile as well as it tracks your driving behavior.

Insurer after that make use of that data to determine exactly how dangerous you are. And they set your costs based on that. Typically, that can indicate substantial financial savings.

However take care. One negative choice, such as competing to beat a yellow light, could turn your telematics tool right into the tattletale of your life. That's due to the fact that insurance companies can use telematics data to decrease or deny cases. As well as they may even revoke price cuts. That's why it's important to consider the trade-offs prior to signing up in a UBI program.

5. Get a Multi-Policy Discount

Obtaining car as well as residence insurance coverage from the very same provider is often an excellent way to save money, as many trusted insurance companies offer discount rates for those that purchase numerous policies with the same service provider. In addition, some insurance coverage providers provide telematics programs where you can make deep price cuts by tracking your driving routines.

Other ways to conserve consist of downsizing your vehicle (ideally), car pool, as well as using public transport for work and recreation. Additionally, keeping your driving record tidy can save you money as many insurer supply accident-free as well as good motorist discount plans. Many service providers also offer consumer commitment price cuts to lasting customers. These can be substantial price cuts on your premium.

6. Get an Excellent Rate

Enhancing your insurance deductible can decrease the quantity you pay in case of an accident. Nevertheless, it is necessary to ensure you can afford the greater out-of-pocket expense prior to devoting to a higher insurance deductible.

If you have a bigger vehicle, take into consideration scaling down to a smaller sized auto that will certainly cost less to insure. Furthermore, take into consideration switching to a more fuel effective lorry to save money on gas expenses.

Check into other discount rates, such as multi-vehicle, multi-policy, good vehicle driver, safe driving and military price cuts. Furthermore, http://dara54vanna.xtgem.com/__xt_blog/__xtblog_en...ve?__xtblog_block_id=1#xt_blog use usage-based or telematics insurance programs that can conserve you cash by keeping an eye on just how much you drive. Ask http://glen2claudio.xtgem.com/__xt_blog/__xtblog_e...er?__xtblog_block_id=1#xt_blog for more information on these programs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Understanding The Different Types Of Insurance Plan As An Agent |

Content author-Healy Schmitt

Insurance policy is a vital investment that protects you as well as your possessions from financial loss. Insurance coverage representatives as well as firms can aid you understand the various sorts of insurance policies available to meet your needs.

Agents define the numerous alternatives of insurance provider and also can finish insurance sales (bind coverage) in your place. Independent representatives can collaborate with several insurance coverage carriers, while slave or special insurance representatives represent a single company.

Restricted Representatives

If you're seeking to acquire a details kind of insurance policy, you can connect with restricted representatives that work with one specific supplier. These representatives sell only the policies offered by their employer, that makes them professionals in the sorts of insurance coverage as well as price cuts offered.

They also have a strong partnership with their business and also are usually needed to satisfy sales allocations, which can affect their capability to help customers fairly. They can use a wide array of plans that fit your demands, but they will not have the ability to present you with quotes from various other insurance companies.

Captive representatives normally collaborate with big-name insurance companies such as GEICO, State Farm and also Allstate. They can be a terrific source for clients who intend to support regional businesses and also establish a long-lasting relationship with an agent that understands their location's distinct dangers.

Independent Professionals

Independent agents usually work with numerous insurer to sell their customers' plans. This allows them to offer a more tailored as well as personalized experience for their customers. They can also help them re-evaluate their insurance coverage over time and advise new plans based on their demands.

https://blogfreely.net/faustino67carli/5-necessary...representative-ought-to-master can provide their clients a selection of policy choices from numerous insurance policy providers, which implies they can provide side-by-side comparisons of rates and insurance coverage for them to select from. They do this with no hidden agenda and also can help them discover the plan that really fits their special demands.

The most effective independent agents know all the ins and outs of their different line of product as well as are able to address any type of inquiries that show up for their clients. Flood Insurance Coverage is an invaluable solution and can conserve their clients time by taking care of all the information for them.

Life insurance policy

Life insurance policies commonly pay cash to assigned beneficiaries when the insured dies. The beneficiaries can be an individual or organization. Individuals can buy life insurance policy plans straight from a personal insurer or with group life insurance supplied by companies.

A lot of life insurance policy policies need a medical examination as part of the application procedure. Streamlined issue and guaranteed issues are offered for those with illness that would otherwise prevent them from getting a typical policy. Irreversible policies, such as whole life, consist of a financial savings element that collects tax-deferred and might have higher premiums than term life plans.

Whether offering a pure defense plan or a much more complex life insurance policy, it's important for a representative to fully understand the functions of each product and also how they connect to the client's particular scenario. This helps them make educated referrals and also prevent overselling.

Health Insurance

Medical insurance is a system for funding medical costs. It is commonly financed with contributions or tax obligations and also supplied via personal insurance firms. Private medical insurance can be bought individually or through group policies, such as those supplied with companies or expert, public or spiritual groups. Some types of health protection consist of indemnity strategies, which repay policyholders for specific costs as much as an established limitation, took care of care plans, such as HMOs and also PPOs, as well as self-insured strategies.

As an agent, it is necessary to recognize the various types of insurance policies in order to help your clients find the very best alternatives for their demands and also spending plans. Nonetheless, blunders can occur, as well as if an error on your component creates a customer to lose cash, errors as well as omissions insurance coverage can cover the cost of the suit.

Long-Term Treatment Insurance Coverage

Long-term treatment insurance aids people pay for residence health and wellness aide services and also retirement home care. It can also cover a portion of the expense for assisted living as well as various other residential care. https://www.bankrate.com/insurance/car/independent-insurance-agents/ cap just how much they'll pay per day as well as over a person's lifetime. Some plans are standalone, while others combine insurance coverage with various other insurance products, such as life insurance or annuities, and are referred to as hybrid plans.

Many individual lasting treatment insurance policies need clinical underwriting, which implies the insurance firm requests for personal info as well as may request documents from a doctor. A preexisting condition may omit you from getting advantages or may create the plan to be canceled, experts alert. Some plans offer an inflation biker, which raises the daily advantage quantity on an easy or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Importance Of Building As Well As Maintaining Relationships As An Insurance Representative |

How Much Does It Cost To Insure An RV by-Colon Joyce

Insurance policy representatives are associated with people's lives during turning point occasions and difficulties. Communicating with them and constructing connections should be top of mind.

Solid customer relationships profit both the representative as well as the customer. Completely satisfied customers come to be advocates, resulting in more policy renewals and raised sales possibilities. Client connections also foster loyalty, which brings about far better consumer retention prices.

Customer support

Offering excellent client service is vital to building as well as preserving relationships as an insurance policy agent. This consists of the way in which agents communicate with potential customers prior to they become customers. If the preliminary interaction feels too sales-oriented, it might turn off possible clients. It also includes exactly how they deal with existing customers.

When insurance customers need support, such as when they have a claim to file, they want an agent that recognizes as well as empathizes with their circumstance. Empathy can soothe demanding scenarios and also make customers feel like their requirements are necessary to the business.

In addition, insurance agents ought to interact with present customers on a regular basis to guarantee they're meeting their expectations and staying up to date with any modifications in their lives that might affect their coverage. This can include birthday or holiday cards, emails to review any kind of future landmarks and conferences to examine renewals.

Referrals

Obtaining references is just one of the very best ways to expand your company as an insurance policy representative. By concentrating on connecting with people in details markets, you can establish yourself as the best professional and bring in a steady stream of customers.

When a customer trust funds their insurance coverage agent, they're most likely to stay dedicated. In addition, faithful customers will certainly come to be supporters and also refer new organization to the representative. These references can offset the cost of acquiring brand-new consumers via traditional approaches.

By offering Read Alot more during the prospecting phase, agents can develop connections that will certainly last a long time, even when various other insurance firms use lower rates. This needs producing a defined approach for customer communication management, placing custom-made supplies right into transactional messages, as well as providing personalized experiences. Customers today expect this kind of interaction. Insurance providers who don't satisfy assumptions run the risk of falling back. The bright side is that forward-thinking insurance agents understand this and have a competitive advantage.

Networking

Whether you're a social butterfly or a little bit extra shy, networking is just one of the most effective methods for insurance coverage agents to expand their organizations. Even if your clients do not turn into a network of their very own, they're likely to discuss you to friends and family who may need some protection.

Having https://zenwriting.net/risa960enrique/the-duty-of-...surance-policy-agent-practices of prospective customers can make all the distinction in your insurance sales success. If you have a steady stream of real-time insurance leads, you can concentrate on structure connections with your current clients as well as quickening the process of obtaining them brand-new organization.

Look for networking opportunities at insurance policy market events and even at various other sorts of regional events. As an example, attending a meeting of your regional Chamber of Commerce or Merchants Association can be a fantastic area to fulfill fellow business owners and form connections that can help you expand your insurance policy company. The same opts for social media sites groups that are tailored towards experts in the business neighborhood.

Talking

The insurance market is competitive, and also it takes a lot of job to remain top of mind with customers. Creating a fantastic customer experience initially will make your clients more likely to stick with you, even if another agent uses reduced costs.

Being an insurance coverage representative isn't just about marketing, it's about helping people browse an intricate area and also safeguard themselves against unanticipated economic loss. Helping them with their economic decisions can additionally make them trust your suggestions, which equates right into repeat business as well as references.

A customer's partnership with an agent is put to the test when they have a claim. That's when an agent can show they care, which can reinforce their partnership. Utilizing personalized advertising to keep in touch is important due to the fact that not all clients value the very same communications channel. Some could like e-mail newsletters, while others could wish to meet in-person or accessibility details online. It is necessary for representatives to understand their customers' choices so they can be offered when the time comes.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Future Of Insurance Coverage Professionals: Adjusting To Changing Customer Needs |

Content by-Cline Bland

The insurance coverage market is going through a major technical overhaul. But will it make insurance representatives obsolete?

Local business owner as well as customers consistently place comfort as the most vital consider their plan acquiring decisions. Agents can satisfy customer demands for electronic, smooth, as well as hybrid support by embracing innovation that encourages them to drive new company.

1. Personalization

A personalized experience can make clients seem like they are being heard and also understood. This is a critical step toward structure loyalty, recommendations and retention.

Insurance policy industry leaders have begun to reorient their companies around clients, as opposed to items. This technique can aid insurance companies create tailored digital experiences and also deliver more value to consumers.

For instance, insurance providers have the ability to determine low-risk customers and also give them with cheaper premiums by using information gathered through telematics, IoT and also machine learning. Read This method are likewise able to instantly adjust quotes based on lifestyle changes.

Raising the performance of digital self-service can further boost the consumer experience. While a human representative will certainly still be needed for even more complicated transactions, the capability to connect rapidly and also efficiently throughout digital channels can help expand service in 2023 and also past. This will require a durable modern technology facilities to support customer communications and also enable even more proactive risk-prevention solutions. It will also be important to guarantee the consistency of the customer experience throughout various communication channels.

2. Comfort

The COVID-19 pandemic accelerated this pattern, yet digital-savvy customers were already driving it. To flourish in this environment, insurance coverage representatives have to adjust to satisfy their clients where they are.

Innovation can help them do this. Automated devices quote plans, complete applications and also evaluate risks. But human judgment continues to be critical when it concerns distinct scenarios such as possibility clinical conditions, organizations with complicated policy types or startups that need aid searching for insurance firms happy to cover their threat profile.

To maximize these possibilities, insurers can furnish their networks with electronic customer communication tools like immediate messaging as well as video chat for more comprehensive reach. They can likewise supply convenient, digitized procedures that boost ease and also lower processing hold-ups for both events. These include online appointment organizing for assessment meetings with potential customers and also customers, electronic signatures for brand-new company and also consultatory video clips for products that can be shown on tablet computer systems. https://zenwriting.net/kenya51rory/the-ultimate-gu...nsurance-policy-representative can significantly enhance conversion prices.

3. Wheelchair

Like keying, insurance representatives might soon be replaced by computer systems that price quote prices, fill out applications and analyze risks. But the bright side is that brand-new innovation can likewise aid agents stay appropriate and profitable.

As an example, chatbots can provide info swiftly, and also automation as well as anticipating modeling take intestine instinct out of underwriting choices. And also company insurance policy industries eliminate the requirement to meet with a representative, enabling consumers to get immediate or near-instant decisions.

Consumer expectations for a smooth, customized and also appealing experience like the ones they obtain from leading stores as well as ridesharing firms are pushing insurance companies to revamp their front-end experiences. Installing simply click the up coming site into customers' ecological community journeys, integrating telematics information from noncarrier partners and also vehicle OEMs right into underwriting engines and also giving versatile usage-based insurance coverage are some of the methods to do it. These modifications require providers to change their existing sales networks, but those that do will reap the benefits of a more personalized and involved client base.

4. Comfort

Guaranteeing today's generation of customers implies meeting them where they are, not trying to compel them into an old system. In the future, insurance agents will certainly come to be process facilitators as well as item instructors. Their work will be helped by AI tools, remote interactions and other technologies that help them serve a broader client base.

This change in workflow will also enable insurance companies to use customers a seamless electronic as well as hybrid sales journey. This includes remote guidance, electronic self-serve systems as well as in-person meetings when practical for the client.

This adaptability is key to attracting and also maintaining more youthful clients, which will certainly drive future growth for the sector. In addition to interacting with younger consumers via the networks they prefer (message, chat, e-mail and also video clip), insurance policy agents must also have the ability to identify and also nurture leads utilizing technology-backed data. This can boost conversion prices, increase sales chances and help stay clear of pricey mistakes like a missed sale. This will certainly be specifically essential as insurers upgrade tradition systems.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

How To Efficiently Connect With Customers As An Insurance Coverage Representative |

Content create by-Green Thrane

Insurance coverage representatives must be able to properly connect with clients, whether they are sending out emails, providing phone calls or perhaps sending out transcribed notes. These approaches can aid construct depend on as well as foster customer commitment.

Improving client communication with a customer website can likewise make it less complicated for customers to handle their plans as well as reduce disappointments throughout difficult scenarios.

1. Listening Skills

When talking with customers, an insurance agent need to have the ability to pay attention attentively in order to recognize the client's demands. In addition, insurance representatives have to have the ability to reply to the customer with spoken as well as non-verbal signs.

Practicing https://theconversation.com/why-insurance-companie...the-underlying-problems-207172 can assist an insurance policy representative end up being a much better communicator. Several of one of the most important listening skills include maintaining eye call, avoiding diversions and also concentrating on the speaker.

Inefficient communication can have an adverse influence on a customer's experience with an insurance policy firm, particularly if the representative falls short to provide clear explanations of plans. Insurance policy agencies can improve their customer care by motivating workers to be vital audiences during staff conferences and also by offering training on just how to successfully communicate with clients. Having the right interaction skills can aid an insurance policy agent close more sales and also raise client retention.

2. Verbal Skills

Verbal abilities involve the capability to convey ideas or info with spoken words. This can include in person discussions, phone calls, videotaped messages, e-mails and also letters. Having solid verbal communication skills can help an insurance agent express their suggestions plainly, engage with clients as well as create genuine connections with their customers.

Insurance plan can be intricate, and misconceptions can cause costly errors that lead to client frustration as well as bad evaluations. Having actually strong written communication skills is crucial for an insurance agent to successfully interact with their clients as well as build depend on.

This includes composing e-mails, messages, letters as well as mailers that are clear as well as concise without using lingo or acronyms. Additionally, it is essential to proofread all interactions prior to sending them out to ensure they are free from punctuation as well as grammatic mistakes.

3. Listening Skills

Paying attention abilities entail taking in as well as understanding words of one more individual. It calls for perseverance, the capacity to evaluate out distractions as well as an open mind. Energetic paying attention strategies consist of paraphrasing, clarifying and summing up. These are strategies that can help an insurance coverage representative get the information they require from their customer and connect with them effectively.

Reliable listening likewise includes supplying comments to the speaker. https://www.insurancejournal.com/news/west/2022/12/09/698733.htm can be verbal or nonverbal and allows the audio speaker to understand that their message was recognized and also appreciated. When a customer obtains positive responses, they are most likely to stay devoted to the firm as well as suggest it to others. This can bring about future company as well as brand-new leads. This is why great communication is essential to a company's success. It additionally helps to avoid misunderstandings as well as construct count on.

4. Verbal Abilities

Verbal skills entail the ability to convey details clearly and also briefly. This is an important facet of insurance agents' professions as they need to have the ability to describe complex plans to customers in a manner that they can comprehend.

When representatives talk in a manner that's complicated, clients may come to be aggravated and lose trust. They'll additionally likely search for another agent who can much better describe things to them.

To improve your verbal interaction abilities, technique proactively paying attention as well as staying clear of distractions during conversations. Additionally, attempt to increase your vocabulary and also utilize new words to help you share on your own extra precisely. Ultimately, read books on public speaking and also contacting further develop these skills. These suggestions can aid you develop solid, enduring partnerships with your clients. In turn, this will enhance your business as well as make the job more gratifying.

5. Listening Abilities

As an insurance agent, you must be able to listen to your clients' needs, top priorities as well as issues in order to provide them with the right services for their individual scenarios. Great listening skills can assist you build, keep as well as increase client loyalty.

Reliable paying attention includes understanding and also approving the audio speaker's concepts, sensations as well as perspectives without judgement. It additionally involves keeping eye call, focusing on the speaker and not being sidetracked by history noise or other aesthetic interruptions.

When talking with your customers, it is essential to wait until they are done sharing their story before using a remedy. Entering prematurely may cause them to really feel that you are not interested in what they have to state. You should likewise avoid disrupting, completing their sentences for them or making remarks that demonstrate boredom or rashness.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Leading 7 Strategies To Produce Leads As An Insurance Coverage Agent |

Created by-Salinas Dahlgaard

Insurance representatives require a stable circulation of leads to expand their company. However generating quality leads isn't very easy. Below are some smart techniques that can assist.

https://www.usnews.com/insurance/renters-insurance...st-renters-insurance-companies specialized link with a digital insurance application that's house to real, bindable quotes is an easy way to generate leads. Utilize it in an e-mail, on social media sites or in advertising.

1. Build a solid on-line presence

As an insurance agent, you need a strong sales pipe. You should fill it with high quality leads that develop into customers.

Online marketing strategies give a selection of options for brand-new organization generation. They can help you create leads at a fraction of the first investment expense contrasted to typical methods.

Developing content that supplies worth to your audience can be an efficient means to bring in new consumers to your website. Nevertheless, you must make certain that this web content pertains to your target market's demands.

Providing your firm on online service directories can boost regional presence. It can likewise enhance your SEO efforts by magnifying brand understanding.

2. Get detailed on credible testimonial websites

Obtaining leads is an integral part of developing your insurance policy service. But brand-new insurance representatives, in particular, can locate it difficult to create adequate top quality leads.

Concentrating on content advertising is one method to generate extra insurance coverage leads. Create relevant and valuable material that assists your audience solve their problems and also build a bond with your brand name.

You can additionally utilize social media to enhance your lead generation. Posting posts on your LinkedIn and also Quora web pages can help you connect with more competent prospects. You can also organize educational webinars to attract possible customers and increase your reliability.

3. Use clear calls to activity

Insurance is a solution sector that flourishes or perishes on the high quality of its lead generation approaches. Using clear, straight contact us to activity is one means to produce high-quality leads.

For example, a web site that is maximized for appropriate search phrases will draw in consumers that are already searching for a representative. Obtaining noted on credible review websites can additionally boost your client base as well as generate referrals.

Remember, though, that it takes time to get arise from these initiatives. Monitor your pipe carefully, as well as make use of performance metrics to fine-tune your advertising method.

4. Buy leads from a lead solution

The insurance biz can be a hard one, even for the most skilled representatives. That's why it pays to make use of practical advertising techniques that are proven to create leads and convert them right into sales.

For example, making use of an interesting site with fresh, relatable content that positions you as a local specialist can attract on-line traffic. Obtaining detailed on trusted Read the Full Guide can assist as well. And having a chatbot is an essential for insurance digital marketing to help customers reach you 24x7, also when you run out the office.

5. Nurture leads on LinkedIn

Numerous insurance policy agents are in a race against time to get in touch with potential customers prior to the leads weary and take their organization in other places. This procedure is typically referred to as "working your leads."

Insurance coverage companies can generate leads on their very own, or they can acquire leads from a lead service. Purchasing leads conserves time and money, however it is important to comprehend that not all lead services are developed equivalent.

To get the most out of your lead generation initiatives, you need a lead solution that focuses on insurance.

6. Request for customer endorsements

Insurance coverage representatives prosper or wither based upon their capacity to connect with potential customers. Obtaining and supporting top quality leads is vital, particularly for brand-new representatives.

On-line web content advertising, a powerful and affordable technique, is a reliable way to generate leads for your insurance company. Consider what your target market is looking for and produce practical, interesting web content that reverberates with them.

Testimonials, in message or sound layout, are an outstanding tool for establishing count on with prospective clients. These can be uploaded on your web site or utilized in your email newsletter as well as social media sites.

7. Outsource your list building

Maintaining a consistent pipeline of qualified leads can be testing for insurance representatives, specifically when they are busy servicing existing clients. Outsourcing your lead generation can free up your time to concentrate on expanding your company as well as acquiring new customers.

Your website is one of the very best tools for producing insurance policy leads. It should be easy to navigate as well as provide clear contact us to action. In addition, it's important to get noted on reputable evaluation sites as well as utilize testimonials.

An additional fantastic way to produce insurance coverage leads is with web content advertising. By sharing appropriate, insightful write-ups with your audience, you can build count on and develop yourself as a thought leader in the industry.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Ultimate Guide To Coming To Be A Successful Insurance Coverage Representative |

Content create by-James McCulloch

New insurance representatives frequently have unrealistic assumptions. They see skilled representatives making "X" quantity of cash yearly and expect to make that today, yet attaining success requires time and also commitment.

Staying on top of brand-new sector techniques as well as broadening your expertise outside of the insurance policy area will certainly assist you supply tailored suggestions to your insureds.

1. Develop a Strong Brand

A solid brand name is crucial when it concerns bring in brand-new clients and keeping existing ones. Establishing an online existence is one method to do this. This can consist of publishing interesting blog sites, developing video material, and also sending out normal e-mails with valuable threat management techniques.

Click That Link %3A0x60507b29d5ebb813!2sLuxe%20Insurance%20Brokers!5e0!3m2!1sen!2sph!4v1688812113899!5m2!1sen!2sph" width="600" height="450" style="border:0;" allowfullscreen="" loading="lazy" referrerpolicy="no-referrer-when-downgrade">

Insurance policy representatives likewise need to have excellent customer care abilities. Customers value timely responses to their inquiries, emails, as well as call.

Developing a strong client base takes time and initiative. Investing in marketing strategies can assist you achieve your goals faster.

2. Create a Sales Funnel

Sales funnels are marketing tools designed to capture the biggest swimming pool of potential customers and afterwards slim them down right into a smaller group of devoted customers. They function best when they are built with details objectives for specified target audiences and are executed utilizing engaging advertising web content.

The sales funnel is generally broken down right into 4 stages-- Awareness, Passion, Choice and also Action. Each phase represents a various way of thinking that calls for a distinctive messaging technique. In the final stage, your possibility becomes a consumer by purchasing or selecting not to acquire.

3. Target Your Ideal Clients

Often, prospective insurance coverage customers will run a search prior to they contact a representative. It is essential for representatives to be leading of mind for these prospects, which can be done by composing informative blog sites or executing email marketing.

Insurance policy is a challenging industry, as well as possible customers will need an attentive representative that can discuss products in a clear and concise fashion. Additionally, representatives who exceed as well as beyond for their clients will obtain recommendations and also build a network of relied on connections.

Ending up being a successful insurance representative calls for hard work and willpower. Nonetheless, by staying existing on insurance coverage advertising fads and also concentrating on client service, agents can begin to see success in their service.

4. Develop a Structured Insurance Sales Cycle

Insurance coverage is a complex company as well as you must have a solid work ethic, great customer care and an ability to discover quickly. Furthermore, you need to have a strong understanding on your insurance policy items and also providers. Taking sales training programs such as Sandler, Opposition or Craig Wiggins is a superb method to acquire the essential expertise.

Honesty is additionally key in insurance coverage, as misleading representatives do not generally last long in the industry. It's additionally crucial to nurture your leads, so make certain that you reply to enquiries and also calls without delay.

5. Support Your Leads

Discovering clients can be hard, especially for a brand-new insurance policy representative. Nevertheless, there are a couple of approaches that can help you nurture your leads as well as grow your organization.

One technique is to concentrate on a niche within the insurance sector. For instance, you might choose to offer life or business insurance coverage. After that, become a specialist in these certain locations to attract more customers.

One more way to produce leads is by networking with various other professionals. This can include lending institutions and mortgage brokers, that typically have links with possible clients.

Cold-calling may have a poor track record, yet it can still be a reliable list building tool for many representatives. By utilizing effective scripts as well as chatting points, you can have a productive discussion with possible leads.

6. Develop a Solid Network

Insurance policy representatives should have the ability to connect with people on a personal level as well as create partnerships that last. A solid network assists insurance coverage agents obtain company when times are difficult, as well as it additionally allows them to provide a greater level of service to their clients.

Establishing a durable portfolio of insurance coverage products can assist a representative expand their earnings and serve the requirements of several insureds. On top of that, using financial solutions like budgeting or tax obligation preparation can provide customers one more reason to choose an agent rather than their competitors.

7. Be Always Learning

Insurance policy representatives should continually learn about the products as well as providers they offer. This calls for a significant amount of inspiration and grit to be effective.

https://www.stltoday.com/news/local/insurance-agen...d6-5a78-9ed3-c2440d9788b5.html 's additionally vital to stay up to day on the insurance coverage sector, sales strategies and also state-specific standards. Taking proceeding education programs and also going to workshops are excellent means to hone your skills and keep up with the latest developments.

Ultimately, client service is critical for insurance coverage agents. Being timely in replying to e-mails, telephone call or text messages is a great way to build depend on and loyalty with clients.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Vital Vehicle Insurance Coverage Info You Can Use |

Article created by-Edmondson Slaughter

The cost of auto insurance can vary depending on the insurance company, your age, driving record and other factors. By knowing about insurance and shopping around, you can get the most coverage for the least amount of money. This article can impart important and useful information to help you be an informed consumer.

Contact your auto insurance agency if you have a change in your work situation. Retiring, cutting back your hours, or switching to telecommuting all mean that you will be driving considerably fewer miles each week. The number of miles you drive can have a significant impact on your auto insurance rates.

To save money on auto insurance, be sure to take your children off of your policy once they've moved out on their own. If they are still at college, you may be able to get a discount through a distant student credit. These can apply when your child is attending school a certain distance from home.

Do not pick the first insurance company you come across. Even though insurance companies all have access to the same information in your driving record, they use it differently to decide what to charge as an insurance premium. By checking competitors, you will be able to locate the best deal in which you can save a lot of cash.

Keeping up with the times is a great way to save money on your auto insurance. Most insurance companies have electronic payment plans set up via their websites. If you use these and make your payments on time, you will be able to save some money. There's nothing wrong with the old-fashioned way, but you can save some cash by making e-payments.

There are insurance plans beyond what is legally required that offer better protection. Even though these options will increase your premium, they are usually worth the additional expense. If you get in a hit-and-run accident or one where the other party has no insurance, you will be out of luck unless you have uninsured motorist coverage.

If you are looking to save money with auto insurance, you should think about going down to one car. Ask yourself if you really need two cars. Can you could check here share with your husband or wife? Can best auto insurance companies for high risk drivers walk places you normally drive? You can save a lot of money this way.

Part of the cost of your auto insurance is based on where you live. In particular, people who live in urban areas, generally pay a significant amount more for their auto insurance than people who live in rural areas. If you live and work in a city, you might want to consider trying to find a place in a rural area, from where you can feasibly commute to work.

Drivers who do not file insurance claims are entitled to big discounts. Make sure you broach this no-claims topic after you have been with the same insurance carrier for a few years. Drivers with five years of filing no claims can be rewarded with up to 75% off of their premium payments. Now that's some big-time savings.

You should decide wisely how much coverage you want. You will need basic coverage, but you can save money by paying less every month and saving up some money in case you get in an accident and need to pay for repairs yourself. If you do this, make sure you always have enough money available to pay for repairs.

The more claims you file, the more your premium will increase. If you do not need to declare a major accident and can afford the repairs, perhaps it is best if you do not file claim. Do some research before filing a claim about how it will impact your premium.

When you are reading about the different types of car insurance, you will probably come across the idea of collision coverage and lots of words like premiums and deductibles. In order to understand this more basically, your should be covered for damage up to the official blue book value of your car according to your insurance. Damage beyond this is considered "totaled."

You should know when it comes to auto insurance that your age, gender, and driving history affect your premiums. Amongst these the only one you can control is your driving history, so you should aim to keep your driving history as pristine as possible in order to keep your premiums as low as possible.

Take advantage of multi-car discounts! If there is more than one car in your household, consider purchasing all of the auto insurance policies under one insurance provider. Insurance companies typically offer large discounts on annual premiums, when you take out more than one policy with them.

If your auto insurance policy comes with a number of minor extras, see if you can drop any that you won't need to save some money. Talk to your insurance agent and go over each of these extras to see which you really want to keep and which are just costing you money each month.

Think about becoming a member of an automobile club. If your car is a considered to be a classic or if there is another automobile club that would fit your unique circumstances, find out more information about joining. Most clubs offer their member's insurance coverage that is less expensive than what they are currently paying.

Reducing your auto insurance rate is just one more way that men can celebrate a new marriage. Because single men are statistically far more prone to accidents than married men, they have a significantly higher auto insurance rate. In other words, your auto insurance company should be one of the first bill collectors that you inform of your new married status.

Make sure you know what kind of coverage you have in your policy. Be aware of what your auto insurance is actually insuring. Many things affect the final cost of the policy. There is bodily injury liability, property damage liability, medical payments, uninsured motorist protection, collision coverage, and comprehensive coverage.

When you carefully consider these tips, you will find that your navigation and understanding of auto insurance is now greater. Knowledge is the most important part of your experience with auto insurance. You have to have it, so it is worth learning about. Now you have tools you need for insurance success.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

Winning Out In The Auto Insurance Policy Manage The Right Info |

Content written by-Sauer Shah

Every driver needs to make sure they have the proper amount of insurance coverage, but it can be hard sometimes to know exactly how much you need. You want to make sure you're getting the best deal. The advice in this article can help you avoid wasting your money on coverage you don't need.

Knowing what coverage you have with car insurance can help you to understand what exactly you're paying for. Things like collision coverage can cover damages to your car but only up to its book value. This kind of insurance carries a deductible. Your premium will be higher if you choose a low deductible.

Opt out of unnecessary coverage with your auto insurance. Collision insurance might be an unneeded extra if you drive an older vehicle, for instance. You can save a considerable amount of money by removing collision coverage. Comprehensive and liability coverage are some other things you may want to consider cutting.

As a money-wise step when car shopping, take the cost of insurance coverage into account. Your insurance agent should know which cars have low premiums. Knowing https://rallysportrayn210.blogspot.com/2021/08/burlington-car-insurance-brokers.html of insurance you will need to pay ahead of time can help in your choice of a new or used car. You'll save a good amount of money if you buy an automobile that carries an excellent safety rating.

Check and see if your car insurance provider offers any low-mileage breaks. If you do not drive your car often, this could end up saving you a fair amount of money. There is no harm in asking your provider whether they offer something like this and whether or not you qualify.

To keep your insurance claim going smoothly, you should start a notebook with details as soon as you make the claim. The first thing you will get is a claim number and everyone involved will be asking for that. Documenting every contact, conversation and promise will help you negotiate your settlement later.

Once you have a teenage driver in your house, your insurance premiums will go up. To save money, buy a less expensive and safer car for your teen to drive. Don't give in if they beg you for a fancier, sportier car. The safer the car, the cheaper the insurance.

Having more vehicles than one needs is a way to pay more than one needs to be paying for insurance. By selling or storing cars or anything else that one does not use often they will no longer have to pay insurance on that vehicle. It will save them money off their insurance.

One of the absolute greatest factors in the price of your auto insurance remains, unfortunately, completely outside of your control, this is your age. The majority of companies consider people under 25 to be a higher risk and due to this you will end up paying more. Remember, especially when you are younger, to check constantly with your agency for discounts based on age year by year.

Some insurance providers will not provide the senior-driver discount unless you complete a mature driver safety course. It is a class that is a lot like the defensive driver course but focuses on the many driving issues that an older driver may face each day. It will save you money and maybe even save your life.

You can save money on car insurance if your car is an older car, a sedate car (like a 4-door-sedan or hatchback) or has lots of miles on it. When this is the case, you can simply buy liability insurance to satisfy the requirements of your state and not bother with comprehensive insurance.

Know what factors affect your car insurance rates. The three key considerations in determining your car insurance rates are age, sex, and actual driving record. Higher rates are given to less-experienced drivers, and males in general. Any ticket that takes points off of your license will also result in an increase rate.

Get between 3-5 car insurance quotes before deciding on a company. This will allow you to see what the acceptable range is for the type of policy that you want. You can easily identify if one company is charging too much for their services and also if another is offering you a good deal.

Consider switching your current insurance to a lower coverage policy to save a few more dollars. Depending on your state's insurance requirements and if you are leasing or renting to own a vehicle, you may be able to lower your insurance coverage to save a little extra money each month.

To reduce your insurance premium, choose a higher deductible. When it comes to the cost of your insurance, the amount of your deductible makes the biggest difference in how much you pay. Understand however, that this is the amount you will pay in the event of an accident. A good practice it to have an emergency account for this reason.

You may get a discount with some companies if you are over 55 and have taken a refresher course. In some cases, this could mean saving a cool 10% in insurance premiums.

Before you rent a car and accept car rental insurance, check out what kind of coverage you have with your regular insurance. This is a great way to save money and you may actually end up with better coverage.

If you want to get cheap auto insurance rates as a brand new driver, one of the things that you can do is to take a pass plus. Some insurance companies can give up to 25% on discount if they know that you passed your test without any claims. please click the following internet page could greatly lower your insurance coverage.

As with any contractual agreement, read the fine print. There are different details provided in the fine print that you may want to be aware of, as knowing what it says could be the difference between your accepting or denying the policy. You could discover that you really aren't getting the coverage that you think you are getting.

The tips listed here are able to help most people. Use these tips when you are considering purchasing auto insurance. You want to be sure to find auto insurance that fits your needs but does not cost an arm and a leg. The information presented here should serve as a guide.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

Public Insurer - What Does a Public Insurance adjuster Does? |

Content writer-Tarp Geertsen

An Insurance Insurer or Public Adjuster is a qualified expert who gives insurance coverage claims processing solutions for an Insurance provider. They are accountable for all issues associated with insurance claims processing, including: Insurance policy Agent Education and also Training, maintaining customer files, underwriting policies and also renewals, recommending customers on post-policy maintenance arrangements, resolving insurance claims, as well as dealing with all case data as well as correspondence. The role they play is necessary to Insurer because they make certain that every one of the needed treatments and guidelines related to insurance coverage claims are followed, are done appropriately, and all parties associated with the claims process are fully educated of their legal rights and duties. Most significantly, they make certain that each of the involved parties is made up for their loss. Insurance Insurance adjusters need to have outstanding interaction skills, interpersonal skills, superb logical skills, exceptional creating skills, substantial experience, as well as expertise of the legislations that relate to their location of proficiency. Some of the many locations they need to take care of consist of:

Cases Insurance adjusters are usually perplexed with Cases Supervisors, which are usually thought of as the very same job. In reality, however, the duties as well as tasks of an insurance claims insurer and also a supervisor do very various things. Cases Insurers normally provide every one of the details necessary for the customer or insurance policy holder to acquire the insurance policy advantages they are entitled to with their insurance plan. Cases Adjusters do not manage the day to day claims procedure, however instead record to the Insurer's Claims Division or to the customer's Supervisor. Likewise, asserts insurers are not paid by the client straight, however rather pay the Insurance provider straight for their services.

The role of a public insurance adjuster differs according to state law. In some states, insurance policy holders have the obligation of speaking to and consulting with public insurance adjusters; however, in various other states insurance holders are required to file claims with the Insurance policy Service provider, not the Public Insurer. Oftentimes, the general public insurer will follow up with the customer, make an assessment of the insurance claim and then notify the insurance provider of the insurance claim. Some state public insurers additionally assign staff to work with claims at the client's house or place of work.

Each state has its very own guidelines concerning that can make a claim versus the property insurance provider. https://www.scoop.it/u/jf-public-adjusters ought to know that if they pick not to comply with the recommendations of the general public insurance adjuster that they might be dealing with a public obligation insurance claim. If they are determined to be "liable" for a residential or commercial property insurance coverage case, they may deal with penalties, loss of current advantages, and also even jail time. The very best time to call a public insurer is well prior to a case is filed. There are many things that a policyholder can do to aid stay clear of being the following sufferer.

Initially, policyholders should never sign any documents or agree to pay for repairs or substitutes prior to talking with the insurer. Lots of insurance provider call for a letter of permission from the homeowner for any kind of type of property insurance claims. Policyholders ought to likewise be aware that in some states the legislations concerning when insurance claims can be submitted have actually altered. It is an excellent idea for policyholders to talk to their state insurance policy representatives. They can additionally check online for current info regarding claims submitting needs. State insurance agents can be exceptionally valuable in identifying who can make a residential or commercial property insurance case and that can not.

Insurance holders can likewise use the web to learn more about typical mistakes that accompany insurance contracts. They can discover the kinds of damages that may be covered by their insurance policy as well as about exactly how to record all damage. Several insurance policies supply additional protection for mental and emotional suffering. Often ny public adjuster will certainly be provided separately from the agreement. Insurance policy holders should review their insurance policy contracts very carefully and also always describe their insurance coverage paperwork for these particular details.

Insurance coverage agents often have an economic incentive to function quickly. If they think that a consumer is overemphasizing or lying about physical damages, they can make quick insurance claims in order to work out the case before the adjuster has a possibility to investigate it better. Insurer are not required to examine all prospective disagreements between clients and adjusters. Oftentimes they will pick the alternative that uses them the most cash without performing any type of investigation whatsoever. Insurance policy holders that have actually experienced this from their insurance coverage agents must make certain that they do not allow this practice for their very own assurance.

If a public insurer is selected to examine your insurance coverage agreement, you need to guarantee that you remain in full agreement with every one of the conditions detailed within the document. The insurance adjuster will almost certainly need you to authorize a master plan type that will detail all of your civil liberties as well as duties when making insurance coverage cases. This form is typically provided to the insurer absolutely free and you should make sure to complete it in its totality. You must likewise make certain to maintain every one of your records pertaining to your case in a refuge, as well as beware to conserve a copy of the master policy kind for your records. When selecting an insurance representative to work on your situation, you must make certain that they have actually gotten all of the ideal expert license required for the location in which they are working.

What Does A Public Insurance adjuster Does And Just How Can He Work To You? |

Content author-Vest Dyhr

An insurance coverage sales representative can be quite an important expert to numerous insurance customers and also belongs to the team that is called the public adjuster. Many are not aware of specifically what the work of the adjuster in fact entails. Basically, asserts insurers are there to ensure that the customer's insurance policy requirements are met. Insurance policy representatives call them insurance adjusters or brokers. Below's a more detailed consider what these individuals do in a day in the office:

- Look at the validity - The entire procedure begins with a claim being filed with the firm that issues the plan. Now, Independent Adjuster in New York will certainly review the claim and also verify if it is a valid one. If go to this site is valid, the insurance holder will certainly be provided a letter from the insurance adjuster to send to the various other party to compensate or obtain re-checked within a specific time period. Subsequently, the other event will certainly return a letter saying if the insurance claim is valid or otherwise.

- Measuring the problems - After the business gets the insurance claim, the Public Adjuster will certainly assess it and also will certainly start gathering proof. In some cases, an insured person will certainly need to find in as well as in fact see the damage in order to get a determination. Once every one of the evidence has actually been gathered by the agent, they will ask for a temporary price quote of the total amount of cash needed to repay the case. At this moment, the insured might hire the services of a public insurance adjuster or he may determine to sue with the Insurance Department of the State or National Insurance Policy Stats.

- Guidance from insured - When all of the proof is in order, the general public Insurance adjuster will take it to the next action as well as will give advice to the guaranteed. Public Adjusters has the ability to inform the insured how much the insurance needs to pay. If the insurer feels that the instance stands, he might recommend that the situation be checked out by an adjuster who will be independent from the Insurance Department. Now, if the instance needs more examination, the general public Insurer will certainly aid the insurer by obtaining additional info as well as information.

The insurance adjusters have the power to examine just how the insurance company has actually fixed past claims. They can consider points like the variety of rejections and the nature of those beings rejected. This is utilized by the insurers to establish whether or not a business's insurance coverage are really valid or otherwise. The general public Adjuster will likewise take into consideration the kinds of losses that happened and also will certainly use this info to identify how to manage future cases.

As part of the function of the public insurance adjuster, he/she should likewise keep a connection with national and state supervisors of insurer. They have to be able to make suggestions to these directors concerning any type of grievances submitted versus them. The general public Insurance adjuster must additionally maintain documents on all correspondence that he/she gets from the business. By doing this, the Public Insurer can ensure that all communication is exact. The records that he/she need to keep consist of the business's address, phone number, fax number, and also insurance company's address. He/she needs to be really thorough in his/her records because if there is ever before a trouble with a record, it will certainly be simple for him/her to correct it since it's in the public record.

The General Public Adjuster is an essential part of the Insurance Department. Insurance coverage representatives no longer need to worry about the general public Adjuster. If there ever before comes to be a demand to review an insurance policy claim, insurance representatives can get in touch with the Public Insurance adjuster to manage it. Public Insurers has several responsibilities and duties, as well as he/she is well worth the job.

In order to ensure that the Insurance Division is doing their work, there has been a requirement for insurance coverage representatives to fill in a Public Insurer Form every year. This form is readily available at their office or can conveniently be gotten on-line. To see to it that this does not happen once more, insurance representatives must adhere to every one of the laws stated in The Insurance policy Procedure Act.

What Is A Public Insurance adjuster As Well As Just How Do I Work with One? |

Content by-Udsen Lerche

Do you understand what an insurance adjuster is? Have you ever before came across an insurance policy adjuster prior to? What can they do for you? Exactly how do they help you? These are simply a few of the concerns you might have while you are reading this post concerning Public Insurance adjusters, Insurance Coverage Insurers as well as Claims Adjusters.

Initially, it is essential to understand just what are Public Adjusters? If smoke damage have actually been making insurance cases in the past, the insurance claims insurer you have actually had working for you is a Public Adjuster. If you are seeking to make use of the services of an insurance policy case insurance adjuster, they are generally referred to as Public Insurance adjusters and also are experienced in aiding customers who have actually remained in mishaps. You will certainly locate that there are many people who refer to Public Insurers as Insurance policy Adjusters too.

Cases Adjusters readjust cases that have been sent by the customer or by one more individual pertaining to the insurance claim. As an example, if you have been making insurance cases, you may intend to obtain a claims insurance adjuster to aid you. When you call the claims adjuster you may talk to them on the phone or meet them face to face. It is necessary to bear in mind that declares insurers are independent service providers, not to be connected with any one particular insurance company or agent.

What does Public Insurers do for you? They make modifications to the negotiation total up to see to it the customer's insurance claim is received in a reasonable as well as simply manner. Along with this, insurers are in charge of accumulating every one of the settlement amounts for you or your insurance adjuster, unless the case is resolved outside of their workplace. Cases adjustors have to file a report with the Insurer within 45 days of getting your claim. This will make certain that they know what your settlement quantity is as well as if they are in charge of gathering it.

Public Adjusters is necessary when it concerns water damage cases due to the fact that occasionally you don't have time to prepare a reasonable insurance claim negotiation. Public Insurance adjusters can aid you figure out the proper amount of water damage to examine the problems to your house, building, as well as individual items. Furthermore, public insurers are in charge of gathering every one of the settlement amounts for you or your adjuster, unless the instance is settled beyond their workplace.