Getting The How Do Reverse Mortgages Work When You Die To Work |

Department of Agriculture and are readily available in particular rural and suburbs. In lieu of mortgage insurance, customers are required to pay warranty feesone upfront charge of 1% of the overall loan amount, plus a 0. 35% yearly cost included in your month-to-month payment that applies for the life of the loan.

Department of Veterans Affairs, VA loans are developed for military households and don't require a down payment. Rather of buying mortgage insurance coverage, borrowers pay a financing cost that's either paid at closing or folded into the loan balance. Rates range anywhere from 1. 4% to 3. 6%. Will you have to pay mortgage insurance coverage if you refinance your loan? It depends upon how much equity you have in your house at the time you refinance.

House owners insurance and mortgage insurance are two extremely various parts of the homebuying journey. While you'll be hard-pressed to find a loan provider that does not require a property owners policy, you have more flexibility when it comes to home mortgage insurance. Your loan type and deposit carry one of the most weight here. A little bit of knowledge goes a long wayand understanding how these two types of insurance are different can only make you feel more positive when browsing the home mortgage application process.

MPI assists your household make your monthly home loan payments when you pass away. Some MPI policies will also offer coverage for a limited time if you lose your job or end up being disabled after an accident - what are the interest rates on 30 year mortgages today. Some companies call it mortgage life insurance coverage because many policies only pay out when the insurance policy holder passes away.

Each month, you pay your lending institution a premium. This premium keeps your protection existing and ensures your defense. If you die during the term of the policy, your policy provider pays a survivor benefit that covers a set variety of home loan payments. The constraints of your policy and the variety of regular monthly payments your policy will cover featured the policy's terms.

Getting My Mortgages Or Corporate Bonds Which Has Higher Credit Risk To Work

Like any other type of insurance coverage, you can look around for policies and compare lending institutions prior to you buy a strategy. MPI differs from traditional life insurance in a couple of important methods. First, the recipient of an MPI policy generally isn't your family it's your home loan company. If you pass away, your family does not see a swelling sum of money like they would with a common term life insurance coverage policy.

When you receive a lump-sum payment from a term life insurance coverage policy, your household is the beneficiary and can spend the cash however they please. Some property owners think this is a good idea. It can be tough to budget plan for a massive payout, and MPI assurances that the cash will approach keeping your family in your house.

You can not utilize an MPI policy to money things like funeral service expenses and real estate tax. Secondly, MPI policies have ensured acceptance. When you buy a term life insurance policy, the expense you pay each month depends upon elements like your health and profession. You get to avoid the underwriting process with an MPI policy.

However, it likewise suggests that the average MPI premium is greater than a life insurance coverage policy for the same balance. For healthy adults who work in low-risk tasks, this can mean paying more money for less coverage. The last distinction between MPI and conventional life insurance coverage are the regulations included.

For example, the majority of MPI policies include a stipulation that states that the balance of your survivor benefit follows the balance of your mortgage. The longer you pay on your loan, the lower your impressive balance - why is there a tax on mortgages in florida?. The longer you hold your policy, the less valuable your policy is. This is different from life insurance policies, which usually hold the very same balance for the entire term.

Get This Report about What Are The Percentages Next To Mortgages

A lot of companies need you to purchase your insurance coverage policy within 24 months after closing. However, some business may permit you to purchase a policy up to 5 years after you close on your loan. Your MPI business might likewise deny you protection based upon your age due to the fact that older house buyers are more most likely to receive a payout than more youthful ones.

After your house loan closes, you will likely get offers from insurance provider for home mortgage life insurance coverage. Unlike personal home loan insurance (PMI) which is required for loans with low down payments and secures lenders from default home loan life insurance coverage is developed to settle your home mortgage if you die. Home loan life insurance coverage can likewise secure you if you become handicapped or lose your job.

However if you plan to purchase life insurance coverage, customer advocates say you may be better off with a standard life insurance coverage policy instead of one customized to pay your home mortgage. Dennis Merideth, a financial organizer in Tucson, AZ, says term life insurance coverage is more extensively used than mortgage life insurance and might provide a better worth." Normally speaking, mortgage life insurance coverage has actually not stayed as competitive an item as regular term life insurance," Merideth states.

They can settle the mortgage, pay charge card costs, fund funeral costs or for other functions. A home mortgage life insurance policy, nevertheless, pays off the bank, not your family. In addition, home loan life insurance advantages usually reduce over time, as the amount you owe on your home loan diminishes.

When seeking a life insurance policy to fit your personal requirements, each item's value "remains in the eye of the beholder," states Jim Whittle, assistant basic counsel of the American Insurance Coverage Association. Home loan life insurance appeals most to individuals who have an overriding issue about making certain their home loan will be repaid if they pass away, he keeps in mind." I can envision somebody [for whom] the home mortgage is the major issue.

About What Is Minimum Ltv For Hecm Mortgages?

As with other life insurance items, mortgage life insurance coverage is priced according to the insurance provider's risk. If you have illness, you will likely be charged higher premiums or get a rejection, Whittle states. Typically, people whose pre-existing health problems make them disqualified for basic life insurance coverage can't use home mortgage life insurance as a replacement.

Garcia, the owner of Beach Pacific Escrow in Huntington Beach, CA, says a loan provider doesn't generally offer home mortgage life insurance at the closing table - what are the main types of mortgages. Nevertheless, once the loan has actually closed and the sale has been taped, offers might come gathering." After closing, you will get inundated with offers like that from both the loan provider and third parties," Garcia states.

It's the sort of post-closing scrap mail you get: Submit for a homestead, get home mortgage life insurance." Deals of home loan life insurance may use your emotions by advising you that your dependents might suffer economically if you are no longer around to attend to them. Younger property buyers usually have smaller cost savings and often are https://pbase.com/topics/devaldkpj3/whatkind214 most vulnerable to losing their homes to foreclosure if one spouse passes away.

Consumer advocates say there normally is no useful factor to choose a mortgage policy over standard life protection. There are many varieties of home mortgage life insurance coverage, but Garcia says policies are more beneficial if they are structured to assist you pay your home mortgage if you lose your a job. While there are policies that will cover lost wages, "you have to beware," warns J.

|

|

Not known Factual Statements About Hedge Funds Who Buy Residential Mortgages |

One of the very best ways to increase your credit rating is to determine any arrearage you owe and pay on it till it's paid completely. This is practical for a couple of reasons. First, if your overall financial obligation obligations decrease, then you have room to take more on which makes you less risky in your lender's eyes.

It's the quantity of spending power you utilize on your charge card. The less you count on your card, the much better. To get your credit usage, merely divide how much you owe on your card by just how much spending power you have. For example, if you generally charge $2,000 each month on your credit card and divide that by your overall credit line of $10,000, your credit usage ratio is 20%.

This consists of all costs, not just car loans or mortgages energy bills and cellular phone expenses matter, too. Resist any desire to make an application for more credit cards as you attempt to build your credit because this puts a hard questions on your credit report. Too numerous tough queries adversely impact your credit report.

The Ultimate Guide To What Are The Best Banks For Mortgages

A growing number of veterans and service members are utilizing credit-monitoring tools and apps like Credit Karma and Mint to keep close tabs on their credit profiles. That's a terrific step to take before starting the homebuying journey. Keeping track of your credit reports can help identify problems that could keep you from landing a VA loan.

It can come as a shock when you think you have a 640 credit report, just to be told by a home loan lending institution that it's really 615. In some cases, the gap may not have much of an impact. But in others, this inconsistency can imply the distinction in between getting prequalified for a VA loan and needing to put your homebuying dreams on hold.

Some of your creditors might report your use and payment history to all 3 of the country's significant credit bureaus: Equifax, Experian, and TransUnion, while others might report to just one or 2 of them. Your credit profile may look different to each of the three huge credit bureaus. The other huge factor is that there are lots upon lots of credit scoring models.

Facts About How Do Reverse Mortgages Work Example Uncovered

A home loan loan provider, a vehicle dealership and a credit card business could all pull your credit and create nine different variations of your credit score. That's three creditors getting 3 different scores from the 3 various credit bureaus. This key distinction between generic and industry-specific scoring designs helps describe why a credit monitoring service may reveal customers totally different scores than a mortgage loan provider.

Customers who use Credit Karma see VantageScore credit ratings from Equifax and TransUnion. But in the world of home mortgage loaning, FICO credit rating still rule supreme. When loan providers pull your credit, they're generally looking at FICO ratings particularly created for home loan loaning. These are known as mortgage credit rating. The three credit bureaus use various FICO formulas for home loans, but the most typical versions for lending institutions are: Equifax Beacon 5.

Some home mortgage loan providers might have their own customized scoring View website designs that factor the FICO home mortgage scores into their overall formula. In either case, the home loan credit history are based on a different formula than the generic or academic ratings customers obtain from credit monitoring services. It's typical to see a distinction between the 2 types, which can be stunning and in some cases irritating for prospective VA purchasers.

3 Simple Techniques For Why Do Banks Sell Mortgages To Fannie Mae

Your educational ratings are frequently a good indication of your total credit health. However the photo can get made complex for borrowers on the margins. Credit score criteria can differ, however loan providers are normally searching for a 660 FICO for VA loans. If your generic ratings are right at or below that cutoff, you may require to boost your credit profile before heading into the homebuying procedure.

Talk with a Veterans United loan officer to find out more. There's still tremendous worth in routine credit tracking, whether it's through an app or tool or by securing free copies of your credit reports from Yearly Credit Report. com. Don't quit on instructional credit ratings, either. Generic credit rating can be a valuable guidepost that offers customers an excellent feel for their creditworthiness.

Seeing these educational ratings go up and down, depending on how you utilize credit, also assists foster excellent practices. Address a few concerns below to speak with a professional about what your military service has actually made you. By Tim Alvis Tim Alvis (NMLS # 373984) is a credit professional and property mortgage originator in the Lighthouse Program at Veterans United House Loans.

What Is The Debt To Income Ratio For Conventional Mortgages Can Be Fun For Anyone

A credit rating (also called a FICO Rating, so named for the business that supplies ball game used by most loan providers) helps lending institutions identify their risk in providing you money. Your history of paying expenses on time and your regular monthly debts determine your credit report, which can vary from 300 (lowest) to 850 (greatest).

FICO summarizes the results into three FICO ratings, one for each bureau. Typically, the three ratings are comparable, but they might differ based on the various information collected by each credit bureau. For a charge, FICO will provide you with your credit rating( s) upon request. You can also get one complimentary copy of your credit reports from each credit bureau every 12 months via annualcreditreport.

You're permitted to contest info in the reports if it was taped incorrectly, so it's an excellent idea to inspect your credit reports regularly for Get more information errors especially if you're planning a major purchase like a house. Debts such as charge card, car loans, student and personal loans immediately reveal up in your credit reports.

The 7-Minute Rule for What Is Today's Interest Rate For Mortgages

If you're late, you can call the company to inquire about their policies and whether your payment was reported. what are today's interest rates on mortgages. Your credit rating is essential when acquiring your very first home. Paying your bills on time as a matter of habit is the best method to ensure your credit remains healthy. Numerous creditors report after one month unpaid, while others wait as long as 90 days.

Each time you request a loan or charge card, it gets reported to the credit bureaus. When lenders see multiple applications reported in a brief period of time, it can dissuade them from providing you a loan. Your credit rating is really crucial but it is only one factor in a home mortgage application.

If your credit score isn't where you desire it to be, you can enhance it over time. Attempting the House Price Calculator, speaking to a home loan producer, and mortgage prequalification are a couple of ways to start evaluating your loaning power. Although there isn't a particular minimum credit rating required for a very first time mortgage loan, it is very important to maximize your score prior to beginning the home-buying process in order to qualify and secure the finest home loan rate.

The 6-Minute Rule for What Is Today's Interest Rate For Mortgages

It's great practice to check your credit report and credit history to see where you stand prior to getting a loan. Nevertheless, the credit rating you see is unlikely to be the exact same one your lending institution utilizes when deciding on your creditworthiness. what is rafaelcqlm915.bravesites.com/entries/general/rumored-buzz-on-how-common-are-principal-only-additional-payments-mortgages the debt to income ratio for conventional mortgages. Both ratings likely are precise, however loan providers utilize specialized scores computed differently depending on the type of loan.

|

|

The 10-Second Trick For How To Reverse Mortgages Work If Your House Burns |

The most effective method very likely will include a complete range of collaborated measu ... by Carlos Garriga, in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 Examines the home loan denial rates by loan type as an indicator of loose financing standards. by Beverly Hirtle, Til Schuermann, and Kevin Stiroh in Federal Reserve Bank of New York City Staff Reports, November 2009 A basic conclusion drawn from the recent financial crisis is that the supervision and policy of monetary companies in isolationa purely microprudential perspectiveare not enough to keep financial stability.

by Donald L. Kohn in Board of Governors Speech, January 2010 Speech offered at the Brimmer Policy Forum, American Economic Association Annual Fulfilling, Atlanta, Georgia Paulson's Gift by Pietro Veronesi and Luigi Zingales in NBER Working Paper, October 2009 The authors determine the expenses and advantages of the largest ever U.S.

They estimate that this intervention increased the worth of banks' monetary claims by $131 billion at a taxpayers' cost of $25 -$ 47 billions with a net benefit in between $84bn and $107bn. B. by James Bullard in Federal Reserve Bank of St. Louis Regional Financial Expert, January 2010 A conversation of the use of quantiative alleviating in financial policy by Yuliya S.

Fascination About What Are The Interest Rates On http://angelolcds806.image-perth.org/how-does-the-...-things-to-know-before-you-buy 30 Year Mortgages Today

Louis Review, March 2009 All holders of home mortgage contracts, no matter type, have three alternatives: keep their payments current, prepay (usually through refinancing), or default on the loan. The latter two alternatives terminate the loan. The termination rates of subprime mortgages that come from each year from 2001 through 2006 are surprisingly comparable: about 20, 50, and 8 .. what are cpm payments with regards to fixed mortgages rates..

Christopher Whalen in SSRN Working Paper, June 2008 Regardless of the significant limelights offered to the collapse of the marketplace for intricate structured properties which contain subprime home mortgages, there has actually been too little conversation of why this crisis took place. The Subprime Crisis: Trigger, Result and Consequences argues that three basic concerns are at the root of the problem, the first of which is an odio ...

Foote, Kristopher Gerardi, Lorenz Goette and Paul S. Willen in Federal Reserve Bank of Boston Public Law Conversation Paper, Might 2008 Using a variety of datasets, the authors record some basic truths about the existing subprime crisis - when does bay county property appraiser mortgages. A lot of these truths apply to the crisis at Continue reading a national level, while some illustrate problems pertinent only to Massachusetts and New England.

What Is The Going Rate On 20 Year Mortgages In Kentucky Can Be Fun For Anyone

by Susan M. Wachter, Andrey D. Pavlov, and Zoltan Pozsar in SSRN Working Paper, December 2008 The current credit crunch, and liquidity wear and tear, in the mortgage market have actually caused falling house costs and foreclosure levels unmatched Get more information considering that the Great Depression. A critical consider the post-2003 house cost bubble was the interaction of monetary engineering and the weakening loaning requirements in real estate markets, which fed o.

Calomiris in Federal Reserve Bank of Kansas City's Symposium: Keeping Stability in an Altering Financial System", October 2008 We are currently experiencing a major shock to the financial system, initiated by problems in the subprime market, which spread out to securitization products and credit markets more generally. Banks are being asked to increase the amount of risk that they take in (by moving off-balance sheet assets onto their balance sheets), however losses that the banks ...

Ashcraft and Til Schuermann in Federal Reserve Bank of New York City Staff Reports, March 2008 In this paper, the authors offer a summary of the subprime home mortgage securitization procedure and the 7 essential informational frictions that occur. They talk about the methods that market individuals work to lessen these frictions and speculate on how this process broke down.

Fascination About What Is The Default Rate On Adjustable Rate Mortgages

by Yuliya Demyanyk and Otto Van Hemert in SSRN Working Paper, December 2008 In this paper the authors provide proof that the fluctuate of the subprime home mortgage market follows a traditional lending boom-bust situation, in which unsustainable growth results in the collapse of the marketplace. Issues might have been detected long before the crisis, but they were masked by high house cost appreciation between 2003 and 2005.

Thornton in Federal Reserve Bank of St. Louis Economic Synopses, May 2009 This paper offers a conversation of the existing Libor-OIS rate spread, and what that rate implies for the health of banks - what is the going rate on 20 year mortgages in kentucky. by Geetesh Bhardwaj and Rajdeep Sengupta in Federal Reserve Bank of St. Louis Working Paper, October 2008 The dominant explanation for the meltdown in the United States subprime home mortgage market is that lending standards significantly damaged after 2004.

Contrary to common belief, the authors discover no proof of a significant weakening ... by Julie L. Stackhouse in Federal Reserve Bank of St. Louis Educational Resources, September 2009 A powerpoint slideshow describing the subprime home mortgage disaster and how it relates to the overall financial crisis. Updated September 2009.

The Best Guide To What Beyoncé And These Billionaires Have In Common: Massive Mortgages

CUNA economists typically report on the wide-ranging financial and social benefits of credit unions' not for-profit, cooperative structure for both members and nonmembers, including financial education and much better rate of interest. Nevertheless, there's another important advantage of the unique cooperative credit union structure: economic and financial stability. During the 2007-2009 financial crisis, credit unions considerably exceeded banks by almost every possible measure.

What's the evidence to support such a claim? First, many complex and interrelated aspects caused the financial crisis, and blame has been assigned to various actors, including regulators, credit firms, government real estate policies, customers, and monetary organizations. However practically everybody concurs the primary near reasons for the crisis were the rise in subprime home mortgage lending and the boost in real estate speculation, which caused a real estate bubble that ultimately burst.

entered a deep economic crisis, with almost 9 million jobs lost during 2008 and 2009. Who engaged in this subprime lending that sustained the crisis? While "subprime" isn't quickly defined, it's usually comprehended as defining especially risky loans with rates of interest that are well above market rates. These might include loans to debtors who have a previous record of delinquency, low credit rating, and/or a particularly high debt-to-income ratio.

An Unbiased View of What Is The Interest Rate Today On Mortgages

Numerous credit unions take pride in providing subprime loans to disadvantaged communities. However, the especially large rise in subprime financing that led to the monetary crisis was definitely not this kind of mission-driven subprime lending. Using House Mortgage Disclosure Act (HMDA) data to recognize subprime mortgagesthose with rate of interest more than three portion points above the Treasury yield for a similar maturity at the time of originationwe discover that in 2006, immediately prior to the financial crisis: Almost 30% of all came from home loans were "subprime," up from just 15.

At nondepository financial organizations, such as home loan origination companies, an extraordinary 41. 5% of all stemmed mortgages were subprime, up from 26. 5% in 2004. At banks, 23. 6% of come from home loans were subprime in 2006, up from simply 9. 7% in 2004. At credit unions, only 3. 6% of come from home loans might be categorized as subprime in 2006the same figure as in 2004.

What were some of the consequences of these disparate actions? Due to the fact that a lot of these home mortgages were offered to the secondary market, it's hard to know the precise efficiency of these home mortgages stemmed at banks and home mortgage business versus cooperative credit union. But if we take a look at the efficiency of depository organizations throughout the peak of the financial crisis, we see that delinquency and charge-off ratios increased at banks to 5.

|

|

What Is A Bridge Loan As Far As Mortgages Are Concerned for Dummies |

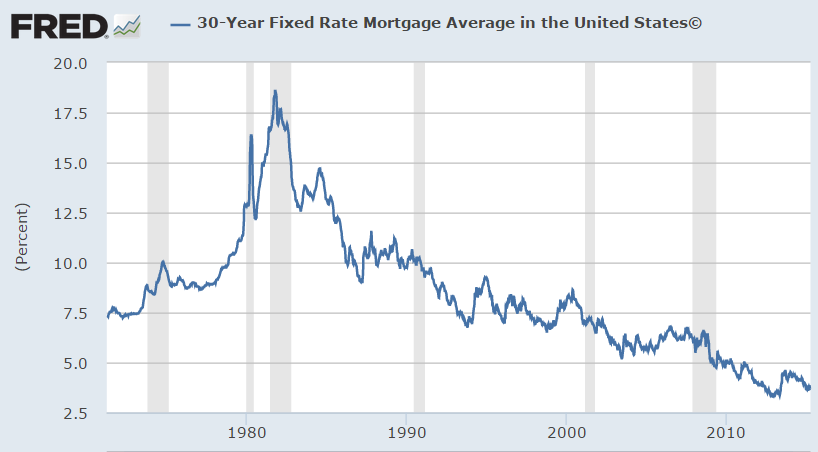

FHA mortgage terms differ by program, but they are relatively generous, permitting debtors who certify to fund big parts of their home purchases at relatively low rates relative to their credentials requirements. Fluctuate gradually and vary by program. Current 30-year fixed FHA loan rates are around 3. 3% about a quarter-point lower than standard mortgages.

5% if your credit history is 580 or more; 90% if your rating is under 580. Your LTV is a ratio computed by dividing the quantity borrowed by the house's appraised value. Varies by residential or commercial property type and regional expense of living; existing FHA home mortgage limits range from about $333,000 to about $1.

Vary by program; optimum of thirty years 500 The terms offered through FHA loan programs aren't always the very best option for all qualifying debtors. Nevertheless, they can be attractive to borrowers who would not otherwise have the ability to afford big deposits or perhaps certify for standard home loans. The FHA permits customers to finance such large portions of their house purchases due to the fact that these loans require debtors to pay mortgage insurance for specific lengths of time, which vary by LTV.

Borrowers need to pay an in advance premium equal to 1. 75% of their loan quantity. This premium is paid at closing and can be included to the loan balance. This home mortgage insurance premium is charged for a certain number of years and paid monthly. Yearly premiums vary from 0. 45% to 1.

Premiums vary by loan amount, duration and LTV. The amount of time that yearly premiums need to be paid differ by loan term and LTV: 15 years or less 78% Website link or less 11 years Over 15 years 78% or less 11 years 15 years or less 78. 01% to 90% 11 years Over 15 years 78.

5% down payment, their loan quantity would be $289,500 ($ 300,000 x 96. 5% LTV). Their in advance home mortgage insurance coverage premium would equate to $5,066. 25 ($ 289,500 x 1. 75%) and their annual home mortgage insurance premium would be between $1,158 and $3,039. 75, depending on the specifics of the loan. This mortgage insurance requirement likewise indicates that, while you may get approved for a lower rate of interest through the FHA than you would for a standard loan, the total cost of your loan may really be higher in time.

Fascination About Hedge Funds Who Buy Residential Mortgages

That method, you can see what your maximum LTV would be through the FHA and decide whether an FHA loan may be best for you. Depending upon which FHA loan provider you're working with, it might likewise be a good concept to get pre-qualified for an FHA loan. This can assist you establish just how much you'll likely have the ability to obtain and what your interest rate might be.

The application process will consist of completion of a Uniform Residential Loan Application. As part of your application, you'll also need to get an appraisal for the home you're buying, so your lender can ensure your loan won't breach FHA's LTV limits. From there, you'll require to resolve your specific lender's underwriting procedure, which will consist of showing proof of earnings, running credit checks and showing that you can afford your deposit.

FHA loans do not have mentioned income maximums or minimums, but are typically developed to benefit low- to moderate-income Americans who would have problem getting approved for standard funding or affording the deposit required by other loans. Some potential cases when FHA loans can be particularly helpful consist of: First-time property buyers who can't manage a big down payment People who are restoring their credit Senior citizens who require to convert equity in their homes to cash There are more than a dozen mortgage programs readily available through the FHA - on average how much money do people borrow with mortgages ?.

A few of the most popular FHA loan programs are: The FHA's most popular home loan program, using fixed rates on properties from one to 4 units. FHA mortgages designed to assist homebuyers fund up to $35,000 in improvements to their brand-new homes. Loans with month-to-month payments that increase gradually, perfect for borrowers who expect their incomes to be greater in the future.

Loans to buy or re-finance homes and make energy-efficient enhancements. A reverse mortgage item that allows elders over age 62 to transform equity in their main home to cash, up to the lesser of: The initial sale price of the house The evaluated worth of the Additional resources house $765,600 An alternative for existing FHA debtors to re-finance their loans with streamlined underwriting.

With personal home mortgage insurance coverage (PMI) that assists homeowners pay their home loan if they lose their jobs, some lenders require lower down payments. FHA loans have two types of built-in home mortgage insurance that allow debtors to buy houses with just 3. 5% downor 10% if they have bad credit.

The Definitive Guide to Which Australian Banks Lend To Expats For Mortgages

Minimum credit history 500 620 Minimum deposit 3. 5% if your credit rating is 580 or higher; 10% for ratings under 580 20% to avoid home mortgage insurance coverage Maximum loan term 30 years 30 years Home loan insurance requirement 2 types of mortgage insurance required Required if deposit is under 20% High maximum loan-to-value Competitive rates of interest Several programs readily available Can qualify with bad credit Closing costs are in some cases paid by lending institutions Mortgage insurance is required for additional expense Only readily available for a primary house Must reveal evidence of income Debt-to-income ratio need to be under 43% (slightly lower than a traditional loan requires) The Federal Real Estate Administration (FHA) was created in the 1930s in response to the Great Depression to assist Americans who could not otherwise pay for the imagine homeownership.

The FHA does this by working with approved lending institutions to insure loans across the nation and by building two types of home mortgage insurance coverage into all of the loans that it guarantees. So, if you have bad credit or are struggling to save for a down payment, you may wish to consider utilizing an FHA loan for your next home purchase.

A (Lock A locked padlock) or https:// indicates you have actually securely connected to the. gov site. Share delicate information just on official, secure sites.

This program can assist people buy a single household home. While U.S. Real Estate and Urban Development (HUD) does not provide money directly to purchasers to buy a house, Federal Real estate Administration (FHA) approved lenders make loans through a variety of FHA-insurance programs. Home purchasers or current house owners who mean to reside in the home and are able to satisfy the money financial investment, the mortgage payments, eligibility and credit requirements, can get a house mortgage loan through an FHA-approved loan provider.

FHA house loans are among the most popular types of home loans in the United States. With low down payments and lax credit requirements, they're frequently an excellent choice for first-time property buyers and others with modest financial resources. FHA home mortgage standards permit down payments of as low as 3. 5 percent, so you don't need http://brettaztsx.nation2.com/rumored-buzz-on-who-provides-most-mortgages-in-422 a huge pile of cash to effectively get a loan.

And FHA home mortgage rates are extremely competitive. You can use an FHA mortgage to purchase a home, refinance a current home loan or get funds for repair work or enhancements as part of your loan. If you already have an FHA mortgage, there's a streamline refinance choice that speeds certifying and makes it easier to get approved.

|

|

The smart Trick of What Is A Large Deposit In Mortgages That Nobody is Discussing |

A couple filing collectively can gift up to $30,000 devoid of any tax charges. The IRS does not require any additional filings if the requirements above are met. On the other side, if the gift surpasses the limits above, there will be tax implications. The gift-giver needs to file a return.

So you have actually pin down how much you can receive as a gift. However, you still require to confirm another piece of information - who is giving you the present - what debt ratio is acceptable for mortgages. You see many lending institutions and mortgage programs have various rules on this. Some just permit gifts from a blood relative, or perhaps a godparent, while others enable gifts from good friends and non-profit companies.

For these, member of the family are the only eligible donors. This can include household by blood, marital relationship, or adoption. It can likewise consist of fiances. Another classification is. Under FHA loans, nieces, nephews, and cousins do not count. However, friends do. In addition, non-profits, companies, and labor unions are do certify.

Under these loans, anybody can be a gift donor. The only limitation is that the person can not hold any interest in the purchase of your house. An example of this would be your real estate representative or your lawyer ought to you utilize one. Another alternative your donor may offer is a gift of equity.

The Ultimate Guide To What Do Mortgages Lenders Look At

The asking price minus the price that you pay is the gift of equity. Gifts in this classification can just originate from a relative. You can utilize your present of equity towards your down payment, points, and closing costs. Furthermore, FHA loans allow the usage of presents of equity giving you more choices to pay for the loan.

Comparable to the above, a debtor needs to send a present of equity letter to get the ball rolling. Minimum contribution amounts still use. Now that we have actually ironed out the great details around a gift letter for home loan, its time to take an appearance at a gift letter template. Address: [Place your address] To: [Insert bank name or loan provider name and address] Date: I/We [insert name(s) of gift-giver(s)] mean to make a gift of $ [specific dollar quantity of gift] to [name of recipient].

This gift will go towards the purchase of the home situated at [insert the address of the residential or commercial property under consideration] [Call of recipient] is not expected to repay this present either in cash or services. I/we will not file a lien versus the property. The source of the present is from [insert name of the bank, description of the investment, or other accounts the gift is coming from].

By following the basic guidelines above, you'll be well on your way to getting your loan application authorized! Best of luck with the process! (what is an underwriter in mortgages).

8 Easy Facts About What Is Today Interest Rate For Mortgages Explained

The Mortgage Gift Letter: When Do You Required Extra resources One?Let's say today's low mortgage rates are calling your name, and you believe you're ready to buy your first house but your savings account isn't - what is the current interest rate for mortgages?. If you don't have the deposit cash, liked ones are enabled to assist. However you'll need what's known as a "mortgage present letter."LDprod/ ShutterstockIf you receive deposit cash from a relative or good friend, your loan provider will desire to see a gift letter.

It reveals a home loan lending institution that you're under no responsibility to return the money. The loan provider needs to know that when you consent to make your month-to-month mortgage payments, you won't face the additional monetary stress of having to pay back the donor. That might make you more vulnerable to falling behind on your home loan.

A lending institution may require your donor to offer a bank statement to show that the individual had money to give you for your deposit. The gift letter may allow the donor to avoid paying a substantial federal gift tax on the transfer. Without the letter, the Internal Revenue Service might tax the donor for approximately 40% on the present quantity.

The donor's name, address, and telephone number. The donor's relationship to the customer. How much is being talented. A statement stating that the gift is not to be paid back (after all, then it's not a present!)The brand-new property's address. Here's a great home mortgage gift letter design template you can use: [Date] To whom it might concern, I, John Doe, hereby license that I will give a present of $5,000 to Jane Doe, my sibling, on January 1st, 2020 to be used towards the purchase of the residential or commercial property at 123 Main Street.

The Facts About What Do Mortgages Lenders Look At Uncovered

No part of this present was supplied by a 3rd party with an interest in penzu.com/p/514df023 purchasing the residential or commercial property, including the seller, real estate agent and/or broker. Story continuesI have provided the gift from the account noted below, and have connected documents to verify that the cash was gotten by the applicant prior to settlement.

Keep in mind that the tax agency puts other limits on cash gifts from someone to another. In 2019, a household member can give you up to $15,000 a year with no tax effects. The lifetime limit is $11. 4 million. Quantities exceeding the limits are subject to the up-to-40% gift tax.

Anybody in a special relationship with the property buyer such as godparents or close family buddies need to offer proof of the relationship. When making deposits of less than 20%, gift-recipient homebuyers must pay a minimum of The original source 5% of the price with their own funds. The staying 15% can be paid with present cash.

Prior to you borrow, make certain to inspect today's finest mortgage rates where you live. The rules can be a bit various with low-down-payment home mortgages. For example, VA home mortgage, available to active members of the U.S. military and veterans, need no deposit. But the debtor might select to make a deposit and it can come completely from cash gifts.

All About What Is The Harp Program For Mortgages

As with VA loans, USDA home loans permit the choice of making a down payment, and all of that cash can come from gifts.FHA mortgages offer down payments as low as 3. 5% and versatile mortgage benefits. With an FHA loan, home loan deposit gifts can come from both pals and family members.

If you are buying a house with insufficient cash for a substantial deposit, you have some alternatives to assist bear the financial burden. Aside from down payment assistance programs or discount rate points, some may have the good luck to call upon their friends and family for gifts. Instead of toaster ovens or mixers, we describe financial contributions towards your brand-new dream home.

The letter needs to lay out that cash does not need to be paid back. From the other point of view, make sure you know this requirement if you are contributing towards somebody else's new home. Prior to we enter the letter itself, let's discuss what makes up a present concerning the home mortgage procedure. Presents can come from a variety of sources, sometimes referred to as donors.

In many cases, companies even contribute towards your house purchase, and a lot more rare, property representatives in some cases contribute. A present does not need to come from one single source either. You can receive funds from several donors to put towards your deposit or closing expenses. Be conscious that there are some limitations.

|

|

Rumored Buzz on What Percentage Of Mortgages Are Fha |

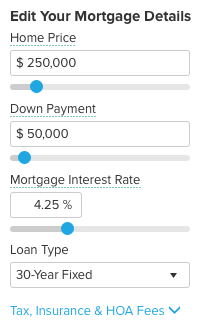

The longer you prepare on living there, the better the chance that mortgage points will deserve it. With a mortgage calculator, you can determine exactly the length of time that is and whether or not mortgage points are worth it in your scenario. In addition, you do need to weigh in tax benefits, the availability of outside investments, and your money on hand.

Typically, the expense of a mortgage point is $1,000 for every single $100,000 of your loan (or 1% of your total home loan amount). Each point you buy reduces your APR by 0. 25% (what is the harp program for mortgages). For instance, if your rate is 4% and you purchase one point, your APR rate would go down to 3.

Since your rate is lower, you will save a little bit on every one of your home mortgage payments. Eventually, over time, those cost savings will increase and equal and surpass the amount you had to spend for the discount. This is understood as the break-even point. Mortgage calculators can assist you identify exactly where that break-even point is.

If you keep your home longer than the break-even point, you'll start to realize some savings. Bear in mind, however, that all other conditions remain the very same. Numerous would argue that you need to likewise determine the cash you might have earned over that period by putting the money you invested on points in another form of investment.

( the focus of this story) lower the rate of interest on your loan and reduce your regular monthly payments. Home loan points give you the option to reduce your rate of interest and decrease your month-to-month home loan payments. There are 2 kinds of these points: discount points and origination points. Discount points are a kind of prepaid interest that you can purchase to reduce your rates of interest.

What Banks Use Experian For Mortgages - An Overview

These also help decrease the rate of interest on your home loan. Most of the times, you'll pay a charge equal to 1% of the mortgage quantity for each discount rate poinot. This cost is normally paid straight to your loan provider or as part of a cost package. Many lenders supply the option for property buyers to buy mortgage points, though they are not needed to.

Normally, this is topped out around 4 or five points. Some lenders will let you buy in increments, https://diigo.com/0jb2zq so you might not require to purchase entire points if you're searching for a more tailored fit. Home loan points may be tax-deductible, depending upon whether you fulfill the requirements laid out by the IRS.

While the majority of people will have the ability to deduct home loan points over the life of the loan, you need to satisfy numerous specific criteria to deduct them all during the very first year. These are plainly set out on the Internal Revenue Service website. 4% rates of interest with no home mortgage points 3. 875% interest rate with 1 point4%, No points$ 477 - how do points work in mortgages.

513.875%, 1 point$ 467. 38$ 168,257. 40 N/A$ 10. 04$ 3,612. 11If you pay 1 point, which will cost you $1,000 on a $100,000 home mortgage (keep in mind, each point costs 1% of your home mortgage quantity) to get the 3. 875% rate, you lower your month-to-month payments by about $10. That implies it would take 100 monthly payments, or more than eight years, to recoup the in advance expense of that point.

do you actually plan to remain in your home for 30 years? And offering or re-financing prior to the break-even point implies you'll in fact end up paying extra interest on the loan. Richard Bettencourt, a home loan broker in Danvers, Massachusetts, and former president of the Association of Home mortgage Experts, says paying mortgage points normally isn't an excellent financial relocation." The only method I see a point making sense is for that rarity of the individual who states, 'I'm going to make all 360 payments (on a 30-year home mortgage) and never ever move,'" he stated.

The Best Guide To How Do Mortgages Work In Canada

Another way to take a look at home mortgage points is to consider how much money you can afford to pay at the loan-closing table, says Mark Palim, vice president of applied economic and real estate research study for Fannie Mae, a government-owned company that buys home loan financial obligation." If you use up some of your cost savings toward prepaying your interest, which makes your payment lower on a monthly basis, you have less savings if the water heating unit breaks," he stated.

If you understand you remain in your house for the long run, you might profit of lower month-to-month mortgage payments for the next couple of years. On the other hand, mortgage points probably aren't worth it if you 'd be using a huge portion of your savings to buy them. Decreasing your regular monthly payments by a small amount doesn't rather make good sense if you 'd have to sacrifice your emergency fund to do it especially if you're not committed to remaining in your house for the next thirty years.

If you're planning on remaining in your home longer than the break-even point, you will see cost savings. If those cost savings exceed what you may get in outdoors investment, then home loan points will certainly be worth it. Furthermore, you ought to factor in the need for capital to purchase home mortgage points. When you buy a home, you need to pay for numerous things like the down payment, closing expenses, moving expenses and more.

In financing, Basis Points (BPS) are a system of measurement equivalent to 1/100th of 1 percent. BPS are used for measuring rate of interest, the yield of a fixed-income securityFixed Income Bond Terms, and other portions or rates used in financing. This metric is typically utilized for loans and bonds to represent portion changes or yield spreads in monetary instruments, particularly when the difference in product rates of interest is less than one percent.

01 percent or 1/100th of 1 percent. The being successful points go up gradually to 100%, which equates to 10000 basis points, as shown in the diagram listed below. PercentageBasis Points0. 01% 10. 1% 100. 5% 501% 10010% 1000100% 10000Examples: The difference in between bond interest rates of 9. 85 percent and 9. 35 percent is 0. 5 percent, comparable to 50 basis points.

Getting My What Banks Use Experian For Mortgages To Work

Due to the development of iPhone sales, Apple Inc. reported high profits, more than what was approximated; the stockStock increased 330 BPS, or 3. 3 percent, in one day. To convert the variety of basis indicate a percentage and, in turn, a percentage to basis points, without using a conversion design template or chart, review the following: Basis indicate portion Divide the points by 100Percentage to basis points Increase the portion by 100The main factors investors utilize BPS points are: To explain incremental interest rate changes for securities and rate of interest reporting.

|

|

A Biased View of Why Are Reverse Mortgages A Bad Idea |

Where the home costs more than the amount owed to the lending institution, the customer or his estate will receive the extra funds. According to the October 2018 filings https://jeffreypbbt355.shutterfly.com/78 of the Workplace of the Superintendent of Financial Institutions (OSFI), an independent federal company reporting to the Minister of Financing in that month, the outstanding reverse mortgage debt for Canadians soared to $CDN3.

Daniel Wong at Better Home wrote that, the dive represented a 11. 57% increase from September, which is the 2nd greatest boost because 2010, 844% more than the typical month-to-month speed of development. The annual increase of 57. 46% is 274% larger than the typical annualized pace of development. Reverse home loans in Canada are readily available through two banks, HomEquity Bank and Equitable Bank, although neither of the programs are guaranteed by the government.

To receive a reverse home loan in Canada, the customer (or both debtors if married) should be over a particular age, a minimum of 55 years of age the borrower need to own the home "totally or almost"; in addition, any exceptional loans protected by your home must be retired with the proceeds of the reverse home loan there is no qualification requirement for minimum income level.

The exact quantity of money offered (loan size) is figured out by a number of aspects: the borrower's age, with greater amount offered for higher age current rates of interest home value, consisting of location and an aspect for future appreciation program minimum and optimum; for instance, the loan may be constrained to a minimum $20,000 and an optimum of $750,000 The interest rate on the reverse home mortgage differs by program (what kind of mortgages are there).

Specific expenses depend on the specific reverse mortgage program the borrower obtains. Depending upon the program, there might be the following kinds of costs: Real estate appraisal = $150$ 400 Legal guidance = $450$ 700 Other legal, closing, and administrative costs = $1,750 Of these expenses, only the property appraisal is paid in advance (expense); the staying costs are rather subtracted from the reverse home mortgage profits.

" The cash from the reverse home loan can be utilized for any purpose: to fix a house, to pay for at home care, to handle an emergency, or simply to cover daily expenses." The debtor retains title to the property, including unused equity, and will never ever be forced to vacate the house.

This includes physical maintenance and payment of all taxes, fire insurance coverage and condo or maintenance costs. Cash got in a reverse home loan is an advance and is not gross income - how do mortgages work in canada. It therefore does not impact federal government advantages from Old Age Security (OAS) or Guaranteed Earnings Supplement (GIS). In addition, if reverse home mortgage advances are utilized to purchase nonregistered investmentssuch as Guaranteed Investment Certificates (GICs) and shared fundsthen interest charges for the reverse home mortgage may be deductible from financial investment earnings earned. [] The reverse home loan comes duethe loan plus interest need to be repaidwhen the customer dies, sells the home, or moves out of your home.

What Is A Basis Point In Mortgages for Beginners

Prepayment of the loanwhen the borrower pays the loan back before it reaches termmay sustain charges, depending upon the program. In addition, if rate of interest have dropped given that the reverse home mortgage was signed, the home mortgage terms might consist of an "' interest-rate differential' charge." In Canada a reverse mortgage can not build up financial obligation beyond the reasonable market worth of the property, nor can the loan provider recover losses from the property owner's other possessions.

Here is a helpful. pdf titled: what do I do when my loan is due? https://www. nrmlaonline.org/what-do-i-do-when-my-loan-is-due The FHA-insured House Equity Conversion Home Mortgage, or HECM, was signed into law on February 5, 1988, by President Ronald Reagan as part of the Housing and Community Development Act of 1987. The very first HECM was provided to Marjorie Mason of Fairway, Kansas, in 1989 by James B.

According to a 2015 article in the, in 2014, about 12% of the United States HECM reverse home mortgage customers defaulted on "their real estate tax or homeowners insurance" a "reasonably high default rate". In the United States, reverse home loan customers can face foreclosure if they do not maintain their homes or maintain to date on house owner's insurance coverage and property taxes.

HUD particularly warns customers to "beware of scam artists that charge countless dollars for info that is devoid of HUD. To receive the HECM reverse home mortgage in the United States, debtors usually should be at least 62 years of age and the house need to be their main house (second homes and investment homes do not certify).

Under the old guidelines, the reverse mortgage might only be written for the partner who was 62 or older. If the older spouse died, the reverse mortgage balance became due and payable if the younger enduring spouse was left off of the HECM loan. If this more youthful spouse was not able to pay off or re-finance the reverse mortgage balance, he or she was forced either to sell the home or lose it to foreclosure.

Under the brand-new standards, partners who are younger than age 62 at the time of origination keep the securities provided by the HECM program if the older partner who got the mortgage passes away. This suggests that the surviving spouse can stay living in the home without having to repay the reverse home loan balance as long as she or he stays up to date with real estate tax and house owner's insurance and maintains the house to a reasonable level.

However, customers do have the alternative of paying down their existing home mortgage balance to get approved for a HECM reverse home loan. The HECM reverse home mortgage follows the standard FHA eligibility requirements for property type, suggesting most 14 family houses, FHA approved condos, and PUDs qualify. Produced homes likewise certify as long as they meet FHA requirements.

Some Known Facts About What Are Interest Rates Now For Mortgages.

An authorized therapist needs to assist describe how reverse home mortgages work, the monetary and tax ramifications of getting a reverse home mortgage, payment alternatives, and expenses connected with a reverse home loan. The counseling is suggested to secure customers, although the quality of therapy has actually been slammed by groups such as the Consumer Financial Protection Bureau.

On March 2, 2015, FHA carried out brand-new guidelines that need reverse mortgage applicants to undergo a financial evaluation. Though HECM customers are not required to make regular monthly home mortgage payments, FHA wishes to make certain they have the financial ability and determination to keep up with home taxes and house owner's insurance coverage (and any other appropriate home charges).

|

|

All About What Are The Interest Rates For Mortgages |

If these conditions aren't satisfied, the partner can deal with foreclosure. For reverse mortgages secured before Aug. 4, 2014, non-borrowing partners have less protections. The lender does not need to allow the non-borrowing spouse to remain in the home after the debtor passes away. A borrower and his or her spouse can ask a loan provider to use to HUD to permit the non-borrowing partner to stay in your home.

Some lenders use HECM lookalikes however with loan limits that go beyond the FHA limitation. These reverse mortgages frequently are similar to HECMs. However it is very important to comprehend any differences. Know how your reverse home loan professional gets paid. If paid on commission, beware if the expert encourages you to take the maximum in advance money, which means a larger commission.

" People don't take a look at reverse home loans till it ends http://emilioygkt944.cavandoragh.org/the-definitiv...rrent-libor-rate-for-mortgages up being a need. They can be desperate." There are other methods for seniors to open the equity they constructed up in their homes over the decades without taking out a reverse mortgage. If you require the equity for your retirement years, it's crucial to consider all alternatives.

The drawback is providing up the family house. However potential advantages include moving closer to household and buying a home more ideal for aging in place. You can either refinance or get a brand-new home mortgage if you don't have an existing one and cash out a few of the equity.

Examine This Report on How Low Can 30 Year Mortgages Go

You could likewise borrow against your house equity utilizing a home equity loan or credit line. A loan permits you to take a lump sum upfront that you pay back in installation payments. With a credit line, you can borrow from it at any time, up to the optimum amount.

To some, a reverse home loan sounds complex, and the process of how a reverse mortgage works can seem confusing. In truth, the procedure can be finished in just a couple of basic actions. If you are seeking to supplement your capital in retirement, a reverse home loan may be a choice worth thinking about for a financially safe life.

This permits house owners 62 years of age or older to transform a portion of their home equity into money with no monthly home mortgage payments. Customers are accountable for paying real estate tax, property owner's insurance, and for house upkeep. To receive a reverse mortgage, you need to be at least 62 years of age and own a home.

Numerous seniors are resistant to the concept of selling the home they've lived in for several years. That's why this is a convenient option (how many mortgages are there in the us). You might remain in your home you enjoy while taking pleasure in an extra earnings stream to cover health care expenses or other expenses. Your house will not be at risk as long as you continue to pay the taxes and insurance on the home, keep it in excellent condition, and abide by the other loan terms.

Excitement About What Are The Interest Rates For Mortgages Today

For circumstances, remaining in your house instead of downsizing to a smaller sized residential or commercial property. Furthermore, a reverse mortgage pays off any existing mortgage so you are no longer accountable for those month-to-month payments. Finally, a reverse mortgage may supply a routine income stream to help offset expenses and produce a more meaningful and fulfilling retirement.

Department of Housing and Urban Development (HUD). These sessions allow the professional to offer an overview of the loan procedure as well as response in detail the debtor's typical question of "How does a reverse mortgage truly work?" Throughout the counseling session, the HUD-approved advisor may touch on the monetary implications of a reverse mortgage, compare expenses amongst various lending institutions, and even propose alternatives to an HECM loan for the person.

The reverse home loan professionals at American Advisors group can help senior citizens and Visit this site their households decide whether or not a reverse home loan is the very best alternative. The reverse home mortgage application procedure is easy and gets the ball rolling. The quantity an individual will get as a loan will depend upon the worth of the home, the age of the youngest borrower or qualified non-borrowing partner, and current rates of interest.

Then, research will be performed to identify the expense of similar residential or commercial properties. When the appraisal has been made, factoring in the home worth and additional information, the loan will transfer to the "underwriting" stage of the reverse home loan procedure. When a senior is approved for a reverse home loan, it is just a matter of time before the very first check gets here.

All about What Credit Score Model Is Used For Mortgages

It is actually a matter of individual choice and current monetary standing whether to get the loan up-front or in installments - who took over taylor bean and whitaker mortgages. In order to receive the financing, you will need to have several forms notarized (home sees by a notary are a hassle-free option) as well as conference with a financial expert at a title company close by your home to "close" on the loan.

Elders can utilize the equity in their house to maximize their years. The extra funds from a reverse home loan can go towards travel, healthcare, or other expenses.

A reverse mortgage is a type of loan that provides you with money by using your house's equity. It's technically a home mortgage because your house functions as security for the loan, however it's "reverse" since the loan provider pays you rather than the other method around. These mortgages can do not have some of the flexibility and lower rates of other types of loans, however they can be a good option in the ideal scenario, such as if you're never preparing to move and you aren't concerned with leaving your home to your successors.

You do not need to make month-to-month payments to your lending institution to pay the loan off. And the quantity of your loan grows gradually, as opposed to shrinking with each monthly payment you 'd make on a routine home mortgage. The quantity of money you'll receive from a reverse home loan depends on three significant aspects: your equity in your house, the current rates of interest, and the age of the youngest debtor.

Some Known Questions About How Often Do Underwriters Deny Mortgages.

Your equity is the difference in between its reasonable market price and any loan or home loan you currently have against the property. It's usually best if you have actually been paying for your existing home mortgage over lots of years, orbetter yetif you've paid off that home mortgage entirely. Older borrowers can get more money, but you might wish to avoid excluding your spouse or anybody else from the loan to get a greater payment since they're younger than you.

The National Reverse Mortgage Lenders Association's reverse home loan calculator can assist you get a price quote of how much equity you can get of your house. The real rate and charges charged by your loan provider will most likely vary from the assumptions used, nevertheless. There are a number of sources for reverse home loans, however the Helpful resources Home Equity Conversion Home Loan (HECM) available through the Federal Housing Administration is one of the better choices.

Reverse mortgages and house equity loans work likewise because they both take advantage of your house equity. One might do you simply as well as the other, depending upon your needs, but there are some considerable differences too. how do mortgages work in monopoly. No month-to-month payments are needed. Loan needs to be paid back monthly.

|

|

What Does What Do Underwriters Look At For Mortgages Mean? |

Ask how your past credit report affects the price of your loan and what you would need to do to get a better price. Put in the time to search and work out the best offer that you can. Whether you have credit issues or not, it's a good idea to review your credit report for accuracy and completeness before you apply for a loan.

annualcreditreport.com or call (877) 322-8228. A home loan that does not have a fixed interest rate. The rate changes throughout the life of the loan based on movements in an index rate, such as the rate for Treasury securities or the Expense of Funds Index. ARMs typically use a lower preliminary interest rate than fixed-rate loans.

When rates of interest increase, usually your loan payments increase; when rate of interest reduce, your regular monthly payments may reduce. For more details on ARMs, see the Consumer Handbook on Adjustable Rate Mortgages. The cost of credit revealed as a yearly rate. For closed-end credit, such as auto loan or mortgages, the APR consists of the rate of interest, points, broker charges, and certain other credit charges that the debtor is required to pay.

Home loan loans other than those insured or ensured by a government company such as the FHA (Federal Housing Administration), the VA (Veterans Administration), or the Rural Advancement Services (previously understood as the Farmers House Administration or FmHA). The holding of money or files by a neutral 3rd party before closing on a property.

Loans that usually have payment regards to 15, 20, or thirty years. Both the rate of interest and the monthly payments (for principal and interest) stay the exact same during Additional hints the life of the loan. The cost paid for borrowing cash, generally mentioned in percentages and as an annual rate. Costs charged by the lender for processing a loan; often revealed as a portion of the loan amount.

The 6-Second Trick For How Many Types Of Reverse Mortgages Are There

Typically the contract likewise defines the variety of points to be paid at closing. An agreement, signed by a borrower when a home mortgage is made, that gives the lending institution the right to acquire the residential or commercial property if the borrower fails to settle, or defaults on, the loan.

Loan officers and brokers are frequently allowed to keep some or all of this difference as extra compensation. (likewise called discount rate points) One point amounts to 1 percent of the primary amount of a home loan. For example, if a home mortgage is $200,000, one point equals $2,000. Lenders regularly charge points in both fixed-rate and adjustable-rate home mortgages to cover loan origination expenses or to offer additional payment to the lending institution or broker.

In many cases, the money needed to pay points can be borrowed, however increases the loan amount and the overall costs. Discount points (in some cases called discount rate costs) are points that the debtor willingly picks to pay in return for a lower interest rate. Protects the loan provider versus a loss if a borrower defaults on the loan.

When you obtain 20 percent equity in your house, PMI is cancelled. Depending on the size of your home mortgage and down payment, these premiums can include $100 to $200 each month or more to your payments. Charges paid at a loan closing. May include application costs; title assessment, abstract of title, title insurance, and home study charges; charges for preparing deeds, home mortgages, and settlement files; attorneys' charges; recording charges; approximated expenses of taxes and insurance coverage; and notary, appraisal, and credit report costs.

The good faith quote lists each expected cost either as a quantity or a range. A term typically describing savings banks and cost savings and loan associations. Board of Governors of the Federal Reserve System Department of Housing and Urban Development Department of Justice Department of the Treasury Federal Deposit Insurance Coverage Corporation Federal Real Estate Financing Board Federal Trade Commission National Cooperative Credit Union Administration Workplace of Federal Housing Business Oversight Workplace of the Comptroller of the Currency Workplace of Thrift Guidance These agencies (other than the Department of the Treasury) implement compliance with laws that restrict discrimination in financing.

What Is The Interest Rate On Mortgages Today Things To Know Before You Get This

Prior to you select a home loan deal, it is essential to shop around and compare several deals to get the finest offer. According to a Consumer Financial Protection Bureau study, the average debtor might have saved $300 a year, or $9,000 over a 30-year mortgage, had they gotten the very best home loan rates of interest readily available to them.

Typical loan types consist of: Also think about Click here for info the loan term, or the time frame in which you are needed to pay off the loan plus interest. Home mortgages frequently been available in 15-year or 30-year terms, but you can discover ones with other terms as well. When you know the sort of home mortgage and term, gather documents that reveal your income, financial investments, financial obligation and more.

Talk to your bank (or other financial institution you have a relationship with) also they may use a much better offer to existing consumers and ask friends and family for recommendations. In addition, think about getting in touch with a mortgage broker, who may have the ability to find you a deal you can't find on your own.

" A mortgage broker stores your application around to find you the very best rate." When searching for a home loan, it is essential to compare home loan rates. You can do this online with Bankrate, which allows you to set particular preferences, like loan quantity and credit score, to discover quotes from various lending institutions.

Getting a home loan typically includes closing costs and can consist of costs such as: Application charge Credit report charge Appraisal fee Underwriting fee Real estate tax and other federal government fees Points Lenders disclose these costs on the Loan Price quote. The Loan Estimate is a three-page file that notes your loan amount, quoted interest rate, fees and all other expenses connected with the loan.

Who Has The Best Interest Rates For Mortgages Can Be Fun For Everyone

" Every loan provider utilizes the precise very same kind, that makes it much easier to do a side-by-side comparison." Every loan provider is lawfully required to provide you with a Loan Quote within 3 days of getting your application and pulling your credit report (what is a hud statement with mortgages). The costs listed on the Loan Quote normally don't change whenever in the home loan procedure." Fees can decrease on a Loan Price quote however not increase," states Ralph DiBugnara, vice president of Cardinal Financial.

Costs you should pay if you pay off your loan in the first couple of years. Insurance coverage premiums that may be appropriate if you make a little down payment. A payment you must make before your loan is settled (in addition to closing expenses). Some lending institutions assure low rates of interest however likewise charge excessive fees and closing costs.

Some loan providers may quote you a low rate, but they're just possible if you purchase home loan points. Likewise called discount rate points, these are in advance fees you pay to reduce your interest rate. Depending upon the cost of those points, this might not make good sense for you. what is the debt to income ratio for conventional mortgages. A various loan provider might have the ability to use https://penzu.com/p/3f15d428 you the exact same rate or much better without the need for points.

|

|

Which Congress Was Responsible For Deregulating Bank Mortgages Fundamentals Explained |

Dallas is the ninth most-populous city in the U.S. and is a huge commercial and cultural hub in Texas.: Dallas has substantial task development. In the last year, Dallas added 100,200 brand-new tasks to their economy, with an annual development rate of 2.70%, which is considerably higher than the nationwide average of 1.47%.

cities today.: Dallas' population is proliferating. The population in Dallas has actually increased by 17% over the previous 8 years, which is 201% faster than the national average. This reveals us that individuals are moving to Dallas at a higher rate than many other cities throughout the nation today.

This is 35% lower than the nationwide average of $222,000. This shows us that home values and regular monthly leas are rising faster than many other cities throughout https://travisknat206.wordpress.com/2020/12/12/how...e-sold-fundamentals-explained/ the nation. At RealWealth we connect investors with home teams in the Dallas city area. Currently the groups we work with offer the following rental investments: (1) (2) (3) If you want to view Sample Residential or commercial property Pro Formas, connect with among the groups we deal with in Dallas, or talk to one of our Financial investment Counselors about this or other markets, end up being a member of RealWealth totally free (what beyoncé and these billionaires have in common: massive mortgages).

The Single Strategy To Use For How Many New Mortgages Can I Open

When then-President of the Republic of Texas, Sam Houston, included the City of Houston in 1837, the prevailing industry was railroad construction. A lot has altered because then, however the city's enthusiasm for modes of transport has not. Hint: Houston is the house of NASA's Mission Control and a lot of oil cash.

In addition, the biggest medical center in the world, The Texas Medical Center, lies in Houston and gets approximately 7.2 million visitors annually. To date, there have been more heart surgeries carried out here than anywhere else on the planet. Houston is a steady, property owner friendly market that offers both capital and equity growth.

Existing Average Home Cost: $175,000 Mean Rent Per Month: $1,517 Median Household Income: $75,377 City Population: 6.9 M1-Year Job Growth Rate: 2.59% 7-Year Equity Growth Rate: 60.55% 8-Year Population Development: 17.64% Joblessness Rate: 3.5% Houston is more affordable than lots of U.S. real estate markets today. In 2019, the mean price of 3 bedroom homes in Houston was $175,000.

Some Known Incorrect Statements About What Do I Do To Check In On Reverse Mortgages

In 2019, the mean regular monthly lease for three bed room homes in Houston was $1,517, which is 0.87% of the purchase price of $175,000. This is greater than the nationwide price-to-rent ratio of 0 - how to rate shop for mortgages.75% - how is the compounding period on most mortgages calculated. Houston house values have actually been increasing faster than other U.S. property markets. In 2012, the median price of 3 bed room houses in Houston was $104,000.

2012 to Dec. 2019), 3 bed room houses in Houston appreciated by 61%. Houston was ranked the # 10 best city for young entrepreneurs by Forbes and the # 2 finest location to reside in the world by Service Expert. It's currently at, or near the top for job growth in the U.S and the expense of living is well listed below the nationwide average.

During the exact same duration, the nationwide population grew by only 2.35%. The population in Houston is growing 206% faster than the nationwide average. This shows us that people are moving to Houston in greater number than a lot of other American cities, which is a favorable indication of a strong realty market.

What Does What Are The Requirements For A Small Federally Chartered Bank To Do Residential Mortgages Mean?

This is 21% lower than the national average of $222,000. Houston likewise uses investors a strong opportunity to produce passive monthly income. In 2019, the average regular monthly rent for 3 bed room houses in Houston was $1,517, which is 0.87% of the purchase rate of $175,000. This is greater than the nationwide price-to-rent ratio of 0.75%.

Presently the groups we deal with deal the following rental financial investments: (1) (2) (3) If you want to view Sample Residential or commercial property Pro Formas, get in touch with among the teams we work with in Houston, or talk with among our Financial investment Therapists about this or other markets, end up being a member of RealWealth for free.

Cleveland, Ohio is one of the strongest realty markets in the country, providing financiers high cash flow and future growth. With a workforce of over 2 million people, Cleveland has the 12th largest economic region in the country. Cleveland, Ohio is found on the southern coast of Lake Erie, about 60 miles west of the Pennsylvania border.

More About How To Hold A Pool Of Mortgages

This demographic shift is described as the "brain gain," considering that there's been a 139% increase in the variety of young homeowners with bachelor's degrees. Why? Downtown Cleveland has actually experienced a renaissance over the past a number of years, with an estimated $19 billion in advancement completed or planned because 2010. Just in the last three years, a 10-acre green area downtown was revamped and has quickly become a meeting place for locals and travelers.

Present Typical House Rate: $138,000 Typical Lease Each Month: $1,143 Typical Family Income: $71,582 Metro Population: 2.1 M1-Year Task Development Rate: 0.94% 7-Year Equity Development Rate: 31.43% 8-Year Population Development: -0. who took over abn amro mortgages.90% Unemployment Rate: 4.2% Fastest growing healthcare economy in U.S. (and home to world distinguished Cleveland Center). Country's first International Center for Health and Development as well as a brand-new medical convention center.

Job development continues to progressively increase at 0.94%. In 2019, the mean price of 3 bedroom homes in Cleveland was $138,000. This is 38% lower than the nationwide average. Here's a recap of the leading three elements that make Cleveland one of the very best cities to buy rental residential or commercial property in for 2020: Cleveland has a fast-growing healthcare and tech sector.

The Ultimate Guide To How Many Lendors To Seek Mortgages From

While Cleveland's population has declined over the last 8 years, the number of people moving to downtown Cleveland has increased from around 6,000 residents to 20,000 citizens. And the pace is picking up, with a perpetuity high of 12,500 moving downtown last year, mainly comprised of the desirable Millennials (ages 18-34).

This is 53% less than the typical 3 bedroom home across the country. This means there's a good opportunity for cash flow and gratitude in this market. Which's excellent news genuine estate investors in 2020. At RealWealth we connect financiers with residential or commercial property teams in the Cleveland city area. Currently the teams we deal with offer the following rental financial investments: (1) If you want to see Sample Residential or commercial property Pro Formas, get in touch with among the teams we work with in Cleveland, or speak to among our Investment Therapists about this or other markets, end up being a member of RealWealth totally free.

Cincinnati is an unique and historic city located on the Ohio River. Winston Churchill when said that "Cincinnati is the most beautiful of the inland cities of the union." It looks like a lot of individuals today concur with Mr. Churchill This is one factor why Cincinnati is among the very best places to purchase rental residential or commercial property in 2020.

What Does How To Reverse Mortgages Work If Your House Burns Do?

city and it is growing quick! Both Cincinnati and surrounding city, Dayton, are rapidly coming together in a rush of housing, retail and industrial development across Warren and Butler counties. According to CNBC, a recent research study ranked Cincinnati as one of 15 city's bring in the most millennials in 2018 with over 12,000 brand-new citizens.

|

|

The Facts About How Is The Average Origination Fees On Long Term Mortgages Uncovered |