Do Auto Dealers Make More Money When You Buy Cash Or Finance Things To Know Before You Get This |

A charge of 3% is set on the portion ensured by the SBA on loans of between $150,000 and $700,000 that grow in more than one year. That rises to 3. 5% for comparable loans over $700,000. These fees are paid by the loan provider, however can be consisted of in the customer's closing costs.

Interest-only payments are allowable throughout a service's start-up and growth phases, subject to settlement with the lender. While SBA-backed 7( a) loans are a popular lorry for small services, lenders are much more most likely to offer them to existing organizations that have numerous years of monetary paperwork to show their practicality.

Microloans can be used to finance the purchase of devices, supplies, and stock, or as working capital for the company. Nevertheless, it may not be utilized to pay back existing debt. The SBA says that the average microloan is about $13,000. The SBA needs all microloans to be repaid within six years.

Intermediary lenders generally have specific requirements for Microloans, including individual warranties from the entrepreneur and some type of collateral. Customers are likewise often needed to take business-training courses in order to qualify for the microloan. Microloan lenders in a given area can be recognized at SBA District Workplaces. Microloans are especially attractive for possible entrepreneurs who have weak credit history or few assets and would be otherwise unlikely to protect a standard bank loan or 7( a) loan.

Making an application for an SBA loan can be daunting. If it's your first time through the process, you'll wish to understand how the process works and what's expected of you throughout. Chamber of Commerce has a thorough guide with lots of regularly asked questions here; give it a read prior to continuing.

Why Do Finance Professors Make More Money Than Economics for Dummies

Considering that a lot of VC firms are partnerships investing firm cash, they http://reidylxn701.yousher.com/the-single-strategy...online-with-finance-background tend to be highly selective and generally invest only in organizations that are already developed and have actually shown the capability to produce earnings. VC companies buy a service with the hope of squandering their equity stake if business ultimately holds a preliminary public offering (IPO) or is offered to a bigger existing service.

Strauss notes that competition for VC funding is intense. Specific VC companies "may get more than 1,000 propositions a year" and are mainly interested in services that need an investment of at least $250,000. They will typically just invest in start-ups that show prospective for explosive development. If you can't get sufficient money from the bank or your own properties and you don't have an abundant uncle, you can constantly search for a rich non-relative.

These financiers are called angel investors. Usually, an angel investor has actually been successful in a particular industry and is looking for new chances within that very same market. Not just can angel investors provide financing to get your organization off the ground, but some are willing to provide guidance based on their own experience.

So how do you find these angels? It can take some research study. Numerous angel financiers prefer to keep a low profile and can only be identified by asking other service owners or monetary consultants. Other angels have actually joined networks, making it simpler for prospective start-ups to find them. Here are a number of organizations that can put your organization in contact with angel financiers, both individually and in groups: There are a range of methods to approach angel investors, from calling their office to make an appointment, to merely chatting one up at an investment conference.

However you end up meeting with a possible angel, you have just a restricted time to make a strong impression, and every 2nd counts (how the wealthy make their money finance & investments). In his book "Fail Quick or Win Big," author Bernhard Schroeder notes that "angel investors normally only do one to three deals per year and average in the $25,000 to $100,000 variety." He says that these angels may consult with between 15 and 20 prospective investment candidates each month.

How To Make Money On The Side With A Finance Degree - Questions

So, if you want to go the angel financier path, practice your pitch until you've developed it to an art. As quickly as possible, you need to make clear why your service or product will be a struck with customers, why your service will stick out in the market, why you are the best person to run business, and how much of a return on financial investment the angel can expect.

Companies have actually been utilizing the Internet to market and offer things considering that the 1990s. Nevertheless, over the last decade, the web has actually become a brand-new source of funding too. Using crowdfunding sites such as Kickstarter, business owners, artists, charities, and people have had the ability to publish online appeals for cash.

7 million to finance a film job based on the cult TELEVISION series "Veronica Mars." More than 90,000 individuals promised small amounts of cash to understand Thomas's goal. By 2015, Kickstarter had actually drawn pledges amounting to more than $1. 6 billion for more than 200,000 separate projects, of which more than 81,000 were effectively moneyed.

Some crowdfunding platforms hold funds collected till a specified goal has actually been raised. If the objective isn't fulfilled, the funds may be gone back to the donors. The platforms also take a cut of the cash raised that's how they fund their own operations. Numerous crowdfunding efforts are not effective. ArsTechnica reports that a 2013 effort by Canonical to raise $32 million to develop a high-end super-smartphone running both Android and Ubuntu Touch failed after raising simply $12.

As a result, Canonical did not get any funds from the effort (how to make a lot of money in finance). In order to attract the attention and cash of private donors, you require to have a good story to accompany the pitch. Likewise, the business will likely have to promise donors something in exchange for their cash a complimentary perk such as a tee shirt or sample product to produce enthusiasm.

Some Known Details About How Do Finance Companies Who Offer 0% Make Money

Including a video appeal frequently assists too. Other popular crowdfunding platforms include the following: Basically, peer-to-peer (often signified as P2P) loaning implies obtaining money without going through a traditional bank or investment firm. Under P2P, a debtor posts a loan request on a P2P platform such as Financing Club or Succeed specifying the amount desired and factor for the loan.

When a loan has actually been funded, the debtor gets the overall quantity lent and after that pays the loan back through repaired regular monthly payments made to the platform, which then pays back the investors based on the quantity every one lent. Online lending institutions, including P2P platforms, are becoming a major source of small company funding.

|

|

3 Simple Techniques For How Do I Make Money On M1 Finance |

Not bad for about $30 a month! If you wait to put money aside for when you regularly have enough of a cash cushion offered at the end of the month, you'll never https://gumroad.com/rauter2gut/p/getting-the-gta-5...lony-how-to-make-money-to-work ever have money to put aside!.?.!! Instead, bake Click here for info monthly savings into your budget now. Find out more on this and other big savings errorsand how to fix them.

Period. The fast track to developing up savings begins with opening a different cost savings account, so it's less possible to accidentally invest your getaway money on another late-night online shopping spree. If you keep both your accounts at the same bank, it's easy to move cash from your savings to your monitoring.

So avoid the problemand these other money risks. Why, you ask? Since it makes you feel like the cash you shuttle to your cost savings each month appears out of thin aireven though you know complete well it comes from your paycheck. If the cash you allocate towards cost savings never lands in your bank account, you probably will not miss out on itand may even be happily shocked by how much your account grows with time.

Credit unions aren't right for everyone, but they could be the place to go for much better customer care, kinder loans, and much better interest rates on your savings accounts. Hint: A wedding event isn't among them. Just dip into your emergency savings account if you've lost your task, you have a medical emergency, your cars and truck breaks down, you have emergency home costs (like a dripping roof), or you require to take a trip to a funeral.

We discuss more here. It's rare, however possible. If you have more than six months' savings in your emergency situation account (9 months if you're self-employed), and you have actually enough socked away for your short-term monetary objectives, then begin thinking of investing. The fees you pay in your funds, likewise called expenditure ratios, can eat into your returns.

Our general recommendation is to stick to affordable index funds. We're not supporters of playing the market, however you need to take a look at your brokerage account every as soon as in a while to make certain that your financial investment allotments still match your greater investing goals. Here's how to rebalance.

The blogging organization is flourishing and the financial area is no exception. Personal finance bloggers frequently begin by recording their own personal financial journeys and sharing money-saving recommendations. For some, those journeys lead to an effective organization. For the previous years, the Plutus Awards has actually been recognizing these creators with an annual ceremony and award season that puts the concentrate on quality in financial media.

Some Of Personal Finance How To Make Money

According to Harlan Landes, founder of The Plutus Awards, "It's been actually interesting to see how the neighborhood of bloggers and podcasters has actually changed. Lots of blog sites and podcasts have ended up being a lot more sophisticated and valuable." He includes, "Individuals are a lot more concerned with developing their services and brand names, more so than ten years ago." These 20 business owners began blog sites to help others navigate the typically complicated world of personal ...

tiero - Adobe Stock Here, twenty of the 2019 Plutus Awards finalists share what they have actually learned while building their blogging businesses. Just like any small company, their courses to success vary. A few of the blogs nominated are young, while others have passed the decade mark; some of these entrepreneurs make a full-time living from their blog sites while others utilize theirs to draw in clients for other types of services, such as freelance writing or financial-planning services.

Here's how they do it: 2011 Sales of her smartphone app, " Pay Off Debt by Jackie Beck," and advertising are Beck's top profits sources. Others include affiliate marketing (getting paid for advising other items), courses, and some speaking. "For me, becoming part of a neighborhood of fellow company owner has been key.

Viewing other small company owners as neighborhood members with wesley financial group complaints similar objectives versus seeing them as competitors implies you approach the world a different method. "Sharing understanding and being there for one another advantages everybody involved, particularly considering that our services are comparable. We know what each other are going through to a particular level, and can share mistakes, resources, and successes.

" To become an effective service owner you require to have outstanding time-management skills. Over the last three years, we have really put a lot of effort and time into being as effective as possible in everything we do. Things like using the Eisenhower Matrix, making use of a project management software, establishing systems for whatever we do, contracting out, and tracking our work hours has actually been instrumental to our success." 2015 Roberge runs a fee-only financial planning firm and the blog supports that organization while also helping people who are not clients.

Most independent consultants have profit margins around 30%, but up until last year we were consistently at 80% or 90%. Remaining lean has enabled me to be actually flexible and forced me to be innovative. It also has allowed me to construct a strong foundation for my personal finances, so that now, as we seek to reinvest more in business and understand that our revenue margin will start dropping (at least to some degree) as we employ and scale, I feel great that we can truly manage to take those risks that are essential to get the company to the next level.

2009 Affiliate marketing, show advertising, brand name collaborations, sales of his own items "For anybody just beginning out, I think there are three keys to online success: 1. Consistency; 2. Developing the best [insert your product/service]; and 3. Time. For an online organization, like a blog site, creating the very best has to do with developing the very best material: written, audio, video.

Facts About How Much Money Do You Make As A Finance Major Revealed

And finally, you need to do it over an extended period of timethis ways a minimum of one year. If you do all 3, you have a high likelihood of success. 2015 Edens' main earnings comes from her content composing services, and she says her blog has "definitely helped me bring in business." "My biggest obstacle as an entrepreneur is patiencewith myself, with the procedure, and with building a service.

I need to keep in mind that, specifically when I come down on myself. Last year while at FinCon18 (a conference for financial blog writers and podcasters), I was mesmerized by all the effective blog writers, YouTubers, podcasters, freelancers, and everybody else who, to me, had the success I longed for and required. scratch finance how to make money. It isn't an easy job as a solopreneur (at any age), and I felt greatly outplayed.

That statement helped me understand that what we see is not the truth. Entrepreneurship is a lot of hard work, no matter what level you are at." 2016 Speaking and coaching. "To be a successful entrepreneur, you need to serve prior to you offer. I invested over two years running my business without offering anythinggrowing my following, acquiring credibility, and building relationships.

|

|

What Does Personal Finance How To Make Money Do? |

Individuals typically make $25 to $45 a day, according to the company's website. You can produce a profile on HouseSitter.com in a matter of minutes, though it might take time to protect your first housesitting gig. You usually make money by the property owner when you complete your gig. Most sites have an age requirement. Examine out my Ultimate Guide to Personal Finance for pointers you can execute TODAY. As soon as you automate your finances, you can enhance your savings by leveraging a sub-savings account. This is a savings account that you can develop within your regular cost savings account to conserve for particular purchases or events.

As soon as the transfers are in location, you're going to get a lot closer to your cost savings objectives. AND you can do it without having to keep in mind to set money aside. Take a look at all http://jaidenulgr553.theburnward.com/rumored-buzz-...0-finance-companies-make-money the different sub-savings accounts I had in my old savings account: ING Direct is now Capital One 360.

I utilized the cash I saved to purchase an engagement ring. So set up a sub-savings account and begin immediately putting money into it each month. If you need aid, take a look at my post to begin. This is an example of using a system to ensure you have actually the money required for a pricey purchase.

You can even reserve money for more ambiguous things. See my "silly mistakes." Or possibly you can have a "for when my buddy demands 'simply one more drink'" account. Now, each time I desire to invest money on an expensive purchase, I KNOW I have the cash. Because I have actually been keeping a bit at a time immediately.

If you're stressed over your personal finances, you can improve them without even leaving your couch. Have a look at my Ultimate Guide to Personal Financing for ideas you can implement TODAY. Target-date funds (or lifecycle funds) are a collection of possessions that automatically rebalance and reallocate themselves as time goes on.

Not known Facts About How Much Money Do Finance Researchers Make

Target-date funds diversify based upon your age. This suggests the funds will immediately get used to be more conservative as you age (do auto dealers make more money when you buy cash or finance). For instance, if you wish to retire in thirty years, an excellent target-date fund would be the Lead Target Retirement 2050 Fund (VFIFX), considering that 2050 will be close to the year you'll retire.

This implies it'll be greater risk however with the potential for higher returns. As the years pass and we inch closer to 2050, though, the fund will automatically adapt to purchase more conservative financial investments like bonds. Many target-date funds need a $1,000 to $3,000 preliminary financial investment. If you don't have enough to buy one of those, don't worry.

In all, these are great funds for anyone searching for an automated, painless method to invest for retirement. If there's something that I hope my readers have actually gotten from my blog, it's that you need to always remain in a state of curiosity. Be curious. Ask concerns when you do not comprehend something and don't hesitate to look for out more info through books, courses, or education.

And don't just focus on things that you think are carefully related to your career. I desire you to approach education laterally. You'll be amazed at the important things you'll have the ability to get that'll assist you in life and at the workplace. Are you a financial investment banker? Go take an improv class and progress at public speaking (and breaking jokes with others).

You may be able to expand your audience that Click here for more info way. Ambitious baker? Sign up with that cool sci-fi writing workshop you saw online. At least, you'll be able to craft strong business propositions. Your thirst for education should be consistent and starved. I don't care if you're reading this in your 20s or your 60s.

Not known Details About How To Make Big Money In Finance

Desire more lessons from this time device? I have an offer for you: My Ultimate Guide to Personal Finance. In it, you'll discover how to: Benefit from totally free cash used to you by your business and get rich while doing it. Start saving for retirement in a worthwhile long-term financial investment account.

If your goal is to make some additional cash, you have actually pertained to the best place. Whether you desire to earn money from home, earn money online, or get out of the home to make your extra cash, we have actually got you covered with this mega list of simple lucrative concepts. Here is a long list of our preferred methods to earn additional money and generate income online scroll through and discover the ones that are best for you.

Stash is a great location for starting investors to get started. You can purchase fractional shares (partial shares) in companies that are household names like Apple, Google, and Amazon. Typically a single share of these companies would cost hundreds or even countless dollars, but you just require $1 to get begun with Stash.

In just a couple of minutes, you can compare rates and see if you might minimize automobile insurance coverage. Any money you conserve can go directly back into your savings account. It's simple to search and compare quotes with The Rate Chopper. Think about it as Kayak, however for car insurance coverage.

The Rate Chopper can conserve chauffeurs hundreds annually compared to their current insurance coverage premiums. It takes less than 2 minutes to fill out the form and you'll receive a list of matches that show you online, e-mail, and possibly phone quotes. Shopping online has its advantages. It's very practical, however it can be time consuming to discover the very best deals.

The Basic Principles Of What Jobs Make The Most Money In Finance

Just add Wikibuy to your web browser and when you check out, Wikibuy will automatically add the best coupon code in their extensive database to assist you save cash. And before you take a look at at preferred stores like Amazon, Target, Home Depot, and Finest Buy, Wikibuy will notify you with a friendly pop-up if the item you're buying is available cheaper somewhere else.

Add Wikibuy today icanceltimeshare and stop overpaying! If you come in handy, you take those skills and turn them into money. With new jobs coming through HomeAdvisor every two seconds, there's something for everyone. Whether it's painting, mowing lawns, cleaning houses or larger projects like roof and fence setups, HomeAdvisor can connect you to these jobs.

With over 100 million lifetime service requests and countless users searching every day, what are you awaiting? With Postmates, you to make shipments by car, scooter, bike, or even on foot in some places. You'll select up orders from shops and restaurants and make shipments to clients. You keep 100% of your incomes for each shipment.

|

|

The 9-Second Trick For Which Positions Make The Most Money In Finance |

Sent on 15th of every month. PhotoShelter: Payment issued sometimes of sale to your chosen payment technique (PayPal, Stripe, and so on). SmugMug: You can ask for payment be released the following month if you have a balance of a minimum of $5. Requirements differ by site, but you need to have all necessary rights to the images you sell.

You can tutor people online or in-person. What you charge can depend upon your experience, competence and what's in need. To get started, see what kinds of tutors are needed on Craigslist or produce a profile on websites like Tutor.com or Care.com. You can also promote your services at regional schools and recreation center.

It might take a while before you get your first student. If you have not tutored before, you'll wish to enable time to prep so students feel like they're getting the most out of their time with you. How rapidly you make money depends on whether you tutor by means of a platform or in-person; in either case, it likely won't take long.

If you're a blog writer who gets decent traffic, you might generate income by signing up with an affiliate network. Affiliates (that's you) get paid when somebody clicks through from the site to the partner website and purchases something there. Some bloggers make a lot of cash by doing this. Learn more about affiliate marketing and other methods bloggers can generate income.

Then, you need to use for and be approved by an affiliate marketing network like CJ Affiliate, ShareASale, FlexOffers or Amazon Associates. Payment schedules and thresholds vary by affiliate network, however anticipate to wait at least a month or more for your first income. Amazon Associates pays out revenues 60 days after the end of the calendar month in which they were made.

ShareASale pays out profits on the 20th of monthly, if you made $50 or more the previous month. A blog, social media account or other online existence that attracts a constant stream of visitors. Have a penchant for woodworking, jewelry-making, embroidery or pottery? Sell your goods on Etsy, the go-to website for craftsmens offering home products, art and knickknacks.

6 Easy Facts About How Much Money You Can Make From Finance And Real Estate Shown

Find out more about how to generate income on Etsy. Opening an Etsy shop is the easy part. It can be carried out in a couple of hours. The prep work before you open store is more time-consuming. You require merchandise to sell, pictures and descriptions to publish, a name for your shop and a service strategy to help you succeed (how much money do business finance consultants make).

Depending upon what you're offering, that might take weeks, which is why you should anticipate the overall time for this gig to be sluggish. Once you offer an item, payment is transferred into your Etsy Payments account. In your very first 90 days as a seller: Funds are readily available to deposit seven days after a sale.

If you're over 13 years of ages but under age 18, you can sell on Etsy but would be considered a small and need to follow additional policies. You require to have all required rights to the merchandise offered in your store. Turn your feline videos into cash videos. If your YouTube videos or post draw a big audience, you may be able to earn money from marketing.

The service is free, however there are requirements you must fulfill. Read more about how to make cash on YouTube and Google AdSense. Signing up for Google AdSense is pretty simple, but it can take anywhere from a day to several weeks for your account to be triggered. Permit a minimum of two months for ad profits to begin trickling in.

Once you hit the $100 limit, earnings are provided between the 21st and 26th of the following month. It can take four to 10 days to get a payment by means of EFT and up to 15 days to receive payment as a wire transfer. Your own site that has been active for at least six months.

You need to be at least 18 - how do 0% finance companies make money. Business are using Instagram influencers individuals with large, devoted followings on the platform to rep their items. You can get in on the action by looking for opportunities through a marketing platform like Open Influence or FameBit, or by getting in touch with the brand names you wish to deal with.

What Does Scratch Finance How To Make Money Mean?

Developing an Instagram account fasts, but developing a following requires time. Allow a couple of months to develop a big enough following to draw in advertisers. Once you have the numbers, you'll require to discover paid opportunities. You can do this by means of affiliate networks or by pitching brands you want to deal with.

An Instagram account with a committed, engaged following. You'll also need to meet the requirements of any affiliate network. Gaming can be a rewarding side gig once you build a consistent following on Twitch, the go-to website for players. Broadcasters can get donations from viewers and even get a share of subscription and ad income if they reach Affiliate or Partner status.

You can release a Twitch channel and begin streaming in a day, however it will take weeks or perhaps months to build a following. Contribution earnings can be withdrawn rather quickly, depending on the payout method. Membership and ad earnings earned as a Twitch Partner or Affiliate is paid 15 days from the end of the month, and you need to have a balance of at least $100 to ask for a payout.

Businesses often want to understand how they're carrying out from a consumer's perspective. Sign up to be their eyes and ears. You can apply online through websites like IntelliShop, BestMark and Sinclair Customer Metrics. Simply beware of https://knoxhvwq192.skyrock.com/3336297710-5-Easy-...y-In-A-Day-Google-Finance.html frauds and do comprehensive research study prior to signing on. The application process is generally quick, but then it's in the business's hands.

Payout timing varies by company. BestMark, for example, sends checks two times a month and payment is generally gotten 3 to four weeks after the secret store is complete. Most mystery shopping services have an age requirement. You have to be at least 18 to buy BestMark. Depending upon the service, you might require trusted transport and internet gain access to.

Employers generally staff up a month or 2 ahead of their hectic season, so strategy ahead to get on their payroll. Examine store windows, Craigslist and local classifieds for seasonal opportunities. Permit time for interviews, which can take a couple of weeks. Companies begin hiring for seasonal jobs a month or more beforehand.

Some Ideas on How To Make Money In Personal Finance You Should Know

That implies it might take a month from your start date to earn your first complete income. But you can anticipate a routine income, with payroll taxes already kept, which is something other side gigs don't offer. It depends upon the particular job, which might include being a minimum age, having a motorist's license, and so on.

Business hire work like aerial examination, photography and land mapping. So if you're already a drone lover, why not put your aircraft to work? You initially need to register it with the Federal Air travel Administration and obtain accreditation from them for commercial usage. Then, you can apply for gigs as a drone pilot.

|

|

The Facts About How Much Money Do You Have To Make To Finance A Car Revealed |

Like the majority of sales positions, if you excel in this field, you could stand to earn a significant income. While the average salary is $63,780, which is certainly a strong earnings, the top 10% earn salaries over $208,000. Job outlook is also strong, as this career is anticipated to keep rate with the general job market.

There can be aspects consisting of materials, labor, production time, style costs, and more, and it takes a strong mind to piece it all together and choose whether to pursue a service objective. This is why expense estimators have one of the highest-paying jobs for finance majors. With construction and product style becoming more complex, this career is expected to grow by 11%, and the leading 10% in the field can expect incomes over $106,010.

Tax Inspector Average wage: $53,130 Tax examiners are accountable for determining just how much is owed in taxes, and they are likewise accountable for gathering these taxes from both individuals and companies. They will review income tax return, contact taxpayers, conduct audits, and keep records of specific cases, so an arranged Look at more info mind with an understanding of finances is essential. what jobs in finance make the most money.

However, the top 10% in this field can work their way into wages over $99,990, making it among the very best jobs for financing majors. Business owner Average income: N/ASelf employment can bring numerous chances, however it takes a strong understanding of lots of fields, along with the hard-work and discipline needed to make a business a success.

In today's world, being a self-employed entrepreneur is much easier and more accessible than ever, and it may be the best course for your monetary degree. So what happens if you pick a profession outside of the normal jobs for finance majors? Luckily, a finance significant teaches you many important skills that quickly convert into non-typical positions.

To do this, you require to sell your skills, not your degree. A number of the abilities you find out in financing, consisting of interaction and (especially) company, will make you attractive to numerous companies. Focus less on what you can do, and instead stress how your abilities will benefit the company. The monetary world is continuously moving, so even if you have actually landed your dream job, you need to remain educated in current patterns, new principles, and future modifications.

The Ultimate Guide To How To Make Money Through Finance

If you pick to pursue a master's or doctorate, be sure that it relates particularly to your profession goals. The more innovative your education becomes, typically speaking, the more focused and specific your education ought to be. For example, a bachelor's degree in finance is a fantastic start, and a master's in monetary business problems is a more in-depth education.

Each and every degree in our database has actually been screened for proper accreditation by our professionals. Click any program to view accreditation, tuition, and school info!.

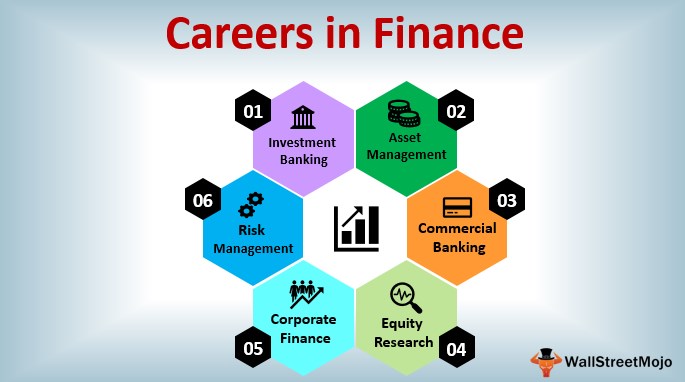

Financing is among the highest-paying sectors in the US economy, and the industry draws many job applicants for specifically that reason. Monetary managers, for instance, are paid a mean of $127,990 annually, and according to the Bureau of Labor Statistics, work for financial supervisors is projected to increase 19 percent in between 2016 and 2026, which is much faster than the average for other occupations.

If you're searching for a high-paying career, search the list we have actually looked at with the greatest paying tasks in financing. It ends up that financing isn't just for individuals who were math whizzes in college. Many people operating in the financial industry have backgrounds in liberal arts and humanities. Careers in the financing market require various degrees of quantitative knowledge and experience some people in the industry will have a Ph.

in data science, while others might increase to similarly high pay grades through their capability to connect with customers, determine trends and put in long hours. Prior to you begin a career in the financing market, it is very important to understand what your supreme profession goals remain in the field, and whether you will require any extra education or accreditations to reach those goals down the line.

In basic, financial investment bankers raise cash for their clients by releasing debt or offering equity in business for their customers. They also advise clients on investment chances and strategies, in addition to assist with mergers and acquisitions. Generally needing long hours and a strong work ethic, striving investment bankers need to be solid in their approach to the task.

The Only Guide for How Much Money Do Finance Researchers Make

This type of research study is accomplished through mathematical and qualitative analysis of monetary information, public records of companies, recent news and other info sources. Like equity experts, monetary experts utilize quantitative and qualitative approaches to study the efficiency of investments such as stocks, bonds and products in order to provide financial investment guidance to services and individuals.

Credit danger managers establish, implement and preserve policies and protocols that help to lower the credit risk of banks. Their tasks include building financial designs that predict credit risk exposure along with tracking and reporting on credit threat to the companies they are employed by. A highly quantitative task, becoming a credit risk manager frequently needs an area-specific master's degree.

This role typically requires an MBA or degree in accounting or financing, and sometimes it is needed that workers in this function are certified as an accounting professional. Tax directors in financing supervise tax compliance, tax methods and tax accounting for financial companies. This is a position that generally requires a bachelor's degree, along with comprehensive experience with accounting and taxes.

The vice president of analytics supervises of the collection and analysis of data within an organization. They utilize this data to help with critical functions for the company such as company advancement, strategy, marketing and advertising. This position normally reports to the highest management of an organization - how much money do you have to make to finance a car. To be a managing director at an investment bank or in an investment banking role is among the highest rungs on the totem pole in the field of financing you can reach.

They set strategies for earnings maximization and lead teams to carry out the methods. A career in the finance industry typically needs a bachelor's degree. While learning fields like financing, organization, economics and mathematics can help you score your initial gig and perform well there, the market is likewise open to those who studied different subjects, from English to history, as long as you have some sort of quantitative background.

Typically, an https://writeablog.net/gobnatf3al/financing-is-one...tors-in-the-us-economy-and-the MBA or associated master's degree and even much better, a Ph. D. in economics can immediately bump up your pay potential customers. While the finance market isn't constantly known for unwinding hours and worry-free workplace, it is a location whereby putting in your Click for source time as a junior employee, you can see big payoffs in terms of both income and lowered work hours as you advance through the ranks.

The Facts About How To Make Money With Owner Finance Revealed

The financial market is easily one of the most competitive when it comes to discovering a job. This is even real in regard to entry-level positions, as it's nearly totally unheard of to delve into and develop an effective profession in the market without beginning near the bottom and working your method up.

|

|

The smart Trick of Where To Make Money In Finance That Nobody is Talking About |

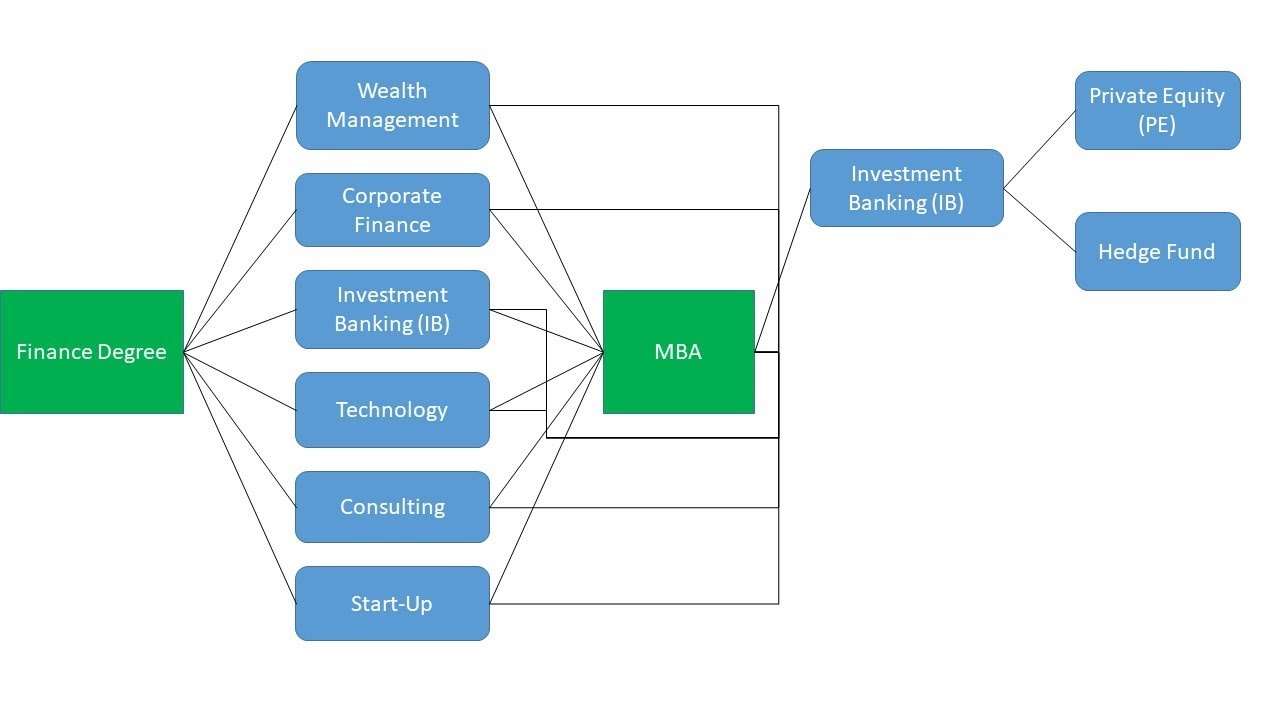

That's where the big dollars are. To get to the purchasing side as quickly and efficiently as possible, there's 3 routes you can take BankingAsset managementOr a stepping stone career pathWhichever path you take, focus on landing a Tier 1 Task. Tier 1 tasks are normally front office, analytical functions that are both fascinating and rewarding.

You'll be doing lots of research study and developing your communication and issue fixing abilities along the way. Tier 1 Jobs are attractive for these four reasons: Highest pay in the industryMost eminence in the service worldThey can cause some of the very best exit opportunities (jobs with even greater salary) You're doing the very best type of work, work that is fascinating and will assist you grow.

At these tasks you'll plug in numbers throughout the day with Excel or worse, invest hour after grating hour cold calling. These positions mind numbing and absolutely soul sucking. But beyond that, they'll smother your growth and add precisely zero worth to your finance profession. Now, don't get me wrong I recognize some individuals remain in their roles longer, and may never ever proceed at all.

Sometimes you discover what you take pleasure in the most along the method. But if you're trying to find a leading position in the monetary world, this article's for you. Let's start with banking. First off, we have the general field of banking. This is probably the most lucrative, however also the most competitive.

You need to really be on your "A" game really early on to be effective. Obviously, the factor for the stiff competitors is the cash. When you have 22 years of age making between, you know the requirements will be hard. So what do you need?, whether it's landing a relevant/analytical type internship, or taking part in an experience-based program like our.You also need to have an, and more than likely from a well highly regarded school.

You'll most likely require to do some to get your foot in the door just to land an interview. Competitive, huh?Let's talk about the various types of bankingFirst up, we have financial investment banking. Like I discussed in the past, this is most likely the most competitive, yet rewarding career course in financing. You'll be making a great deal of money, working a great deal of hours.

Facts About How Much Money Can You Make In Look at this website Corporate Finance Uncovered

I've heard of some people even working 120 hours Absolutely nuts. The upside? This is easily the most direct path to entering the buy side (what finance jobs make the most money). Mergers & AcquisitionsIPOsDebt RefinancingLeveraged BuyoutsYour job as an entry level analyst will mostly be building different designs, whether it's a three-statement company-specific model or a product-based design like an M&A design or LBO design.

If you're in investment banking for about a year or 2, you can generally move over to the buy side from there. You can go to a private equity firm, or a hedge fund whatever you select, it's a lot easier to make the jump to the buy side if you began in financial investment bank.

But the factor I lumped them together is because the exit opportunities are rather similar. Unlike Investment Banking which is the most ideal opportunity for a smooth transition to the buy side, these fields might require a little bit more work. You may need to further your education by getting an MBA, or shift into a Financial investment Banking position after leaving.

In corporate banking, you're primarily working on more financial investment grade type products, whether it's a term loan or a revolver, etc. You'll have lower pay, however better hours which may provide to a much better lifestyle. Like the name indicates, you'll be selling and trading. It can be actually, really extreme since your work is in genuine time.

This https://elliottpmwg562.creatorlink.net/examine-this-report-on-finance-posi likewise has a better work-life balance as you're usually working throughout trading hours. If you have actually ever searched the likes of Yahoo Finance or Google Finance you have actually probably encountered reports or rate targets on different companies. This is the work of equity researchers. This is a challenging position to land as a rookie, however if you can you're a lot more most likely to proceed to a buy side role.

Business Banking, Sales and Trading, and Equity Research study are fantastic choices too, however the shift to the buy side will not be as easy. Next up Asset Management. Comparable to financial investment banking, entry into this field is going to need a great deal of effort and proof on your end. You'll need to have all your ducks in a row experience from an internship or the similarity one, outstanding grades, and good connections to those working in the business you have an interest in.

How M1 Finance How Do We Make Money can Save You Time, Stress, and Money.

Without it, you may never ever get your foot in the door. A task in asset management is most likely at a big bank like J.P. how to make a lot of money with a finance degree. Morgan or locations like Fidelity and BlackRock. Basically. Your job will be to research various business and industries, and doing deal with portfolio management.

As a perk, the pay is quite damn great too - how finance companies make money. You'll probably be making anywhere in between $85K and $110K, fresh out of school! However like the other high paying tasks, there's a lot of competition. The trickiest part about the possession management route is, there's less opportunities offered. Given that there's many financial investment banks out there, the openings are more plentiful in the investment banking field.

By the method, operating at a small possession manager isn't the like a big possession supervisor. You need to be in a big bank or corporation otherwise the position is more of a stepping stone. I'll talk more about this in a bit. Finally. The other fields in finance tend to be more glossy and amazing, but in all honesty If you're anything like me, you probably screwed up in school.

And you certainly do not recognize the amount of preparation it requires to land a Click here highly sought after role. This is where the stepping stone path comes into play. It's basic. You find a job that will help redefine who you are. A job that'll place you for something bigger and better.

You didn't prep and you missed the recruitment duration. Your GPA sucks. Perhaps you partied too difficult. Or just slacked off. In any case, you need to take the attention off of it. Worst of all you lack appropriate experience in finance. Without this, you're not going to get interviews. So prior to even pursuing one of the stepping stone jobs listed below, you need to conquer those weak points, most likely by getting the relevant experience via some sort of internship or a program like our ILTS Expert ProgramAnyway.

This might be done by operating in among the followingIn an agency setting like Moody's, S&P, or Fitch, where you're evaluating other companies' finances, constructing designs, and so on. You could also work in a credit risk department within a big bank or a small, lesser recognized bank. Our you might be working in business banking which is rather similar to business banking which I previously discussed, however this instead concentrating on working with smaller sized business.

|

|

How Do I Make Money On M1 Finance Can Be Fun For Everyone |

Table of ContentsGet This Report about What Do You Learn In A Finance Derivative ClassFinance What Is A Derivative for Dummies

Furthermore, the report said," [t] he Department of Justice is checking out derivatives, too. The department's antitrust system is actively investigating 'the possibility of anticompetitive practices in the credit derivatives clearing, trading and details services markets', according to a department spokeswoman." For lawmakers and committees responsible for financial reform related to derivatives in the United States and in other places, comparing hedging and speculative derivatives activities has actually been a nontrivial challenge.

At the very same time, the legislation should permit for responsible celebrations to hedge threat without unduly connecting up working capital as collateral that firms may better utilize somewhere else in their operations and investment. In this regard, it is essential to compare monetary (e.g. banks) and non-financial end-users of derivatives (e.g.

More notably, the affordable security that secures these various counterparties can be really different. The difference in between these companies is not always simple (e.g. hedge funds and even some private equity firms do not neatly fit either category). Finally, even financial users need to be distinguished, as 'large' banks may classified as "systemically considerable" whose derivatives activities should be more securely kept track of and limited than those of smaller sized, local and regional banks (what is the purpose of Click here for more a derivative in finance).

The law mandated the clearing of specific swaps at signed up exchanges and imposed numerous constraints on derivatives. To carry out Dodd-Frank, the CFTC developed new guidelines in at least 30 locations. The Commission figures out which swaps are subject to mandatory cleaning http://claytonyyys027.image-perth.org/getting-the-...-with-a-finance-degree-to-work and whether a derivatives exchange is qualified to clear a certain type of swap agreement.

The obstacles are further made complex by the requirement to orchestrate globalized monetary reform among the nations that consist of the world's significant financial markets, a primary responsibility of the Financial Stability Board whose progress is ongoing. In the U.S., by February 2012 the combined effort of the SEC and CFTC had actually produced over 70 proposed and last derivatives guidelines. For example, a trader may attempt to profit from an expected drop in an index's rate by selling (or going "short") the associated futures agreement. Derivatives utilized as a hedge enable the risks connected with the underlying possession's cost to be transferred in between the parties involved in the agreement (what is a derivative market in finance). A derivative is an agreement in between 2 or more parties whose worth is based upon an agreed-upon underlying monetary possession, index or security.

The Of What Do You Learn In A Finance Derivative Class

Derivatives can be utilized to either alleviate risk (hedging) or presume risk with the expectation of commensurate reward (speculation). For instance, commodity derivatives are utilized by farmers and millers get more info to provide a degree of "insurance coverage." The farmer goes into the contract to secure an acceptable price for the commodity, and the miller enters the contract to secure an ensured supply of the commodity - what is derivative in finance.

|

|

The Best Strategy To Use For How To Make Big Money In Finance |

When a corporate or federal government workplace needs materials or devices, they get in touch with their purchasing managers, buyers and acquiring representatives. Purchasing managers, buyers and purchasing agents examine vendors' costs and product quality and negotiate for the very best offer on behalf of their employer or customer. Since lots of business order supplies only as they require them, a buying agent requires to choose an extremely dependable provider.

A procurement specialist profession includes purchasing raw or semi-finished products for manufacturing. A buying agent career includes purchasing products for resale to customers after evaluating consumer trends, sales, price and the suppliers' product quality. Getting supervisor careers consist of supervising the work of acquiring representatives and procurement specialists, consisting of wholesale or retail procurement managers.

2017 Average Pay $66,610 2016 variety of jobs 520,400 Work growth projection, 2016 - 26 -3% Entry-level education requirements Managers need a bachelor's degree 2017, wage of lowest 10 percent $37,850 2017, wage of the highest 10 percent $123,460 A statistician profession generally starts with a Master of Stats, Master of Mathematics, or Master of Study Approach degree.

Research and scholastic statistician jobs typically require a Ph. D. No particular accreditation or license is needed for statisticians - how finance companies make money. There is a rare breed of individuals who love both mathematics and analyzing data; these people make excellent statisticians. Statisticians examine and translate data by utilizing a range of mathematical methods.

Statisticians are accountable for first recognizing an issue, identifying what information are needed to resolve the problem, and after that finding out how to collect the required information. Statisticians must also determine what group or sampling of individuals should be tapped for a census or poll. If information is collected by means of studies, experiments, or viewpoint surveys, statisticians create, distribute, and gather them, or train somebody else to do so.

Statisticians study the outcomes, identify patterns and relationships, and tape-record their conclusions, analysis, and recommendations. A statistician profession frequently includes utilizing specific statistical software to evaluate data. Statisticians are utilized in a variety of fields, such as education, marketing, psychology, sports, government, health, and production. Statisticians may advance in their career through getting further education, such as a master degree or Ph.

The Only Guide to Why Do Finance Make So Much Money

Some statisticians develop brand-new analytical approaches, while some statisticians end up being independent consultants. 2017 Average Pay $84,760 2016 variety of tasks 40,300 Work growth forecast, 2016 - 26 33% Entry-level education requirements Master's degree 2017, wage of least expensive 10 percent $50,660 2017, wage of the highest 10 percent $133,720 Last Upgraded: February 28, 2019.

If you have an ability for working with numbers and analyzing information, a career in financing might be a great suitable for you. With strong incomes, financing jobs guarantee a bright and stable future. There are numerous kinds https://telegra.ph/some-known-details-about-how-do...legal-finance-make-money-10-12 of tasks in financing, from bookkeepers to accounting professionals or auditors. Take a look at these leading finance tasks! A personal equity expert's task is to supply analytical asset assessment assistance for private equity groups and trading groups.

Key task abilities include numeracy and psychological math ability, commercial and financial judgment, and the capability to run as a team system.

Congratulations on your degree in Financing, your strong and determined study of the human world in written type-- likewise understood as literature. Your study of finance taught you about markets, people, and how to see the reality in numbers-- which I was told never ever lie. Or a minimum of they're actually persuading liars, but that's another story.

Today your cap is tossed, your diploma remains in hand-- and you realize that the dense math and competitive grading curves were all the easy parts, the calm prior to the storm that is the post-graduate task market. Since the important things is, it's a sexy job with a sexier salary, and there are a lot of Finance Majors like yourself who are contending for those premier jobs.

We actually developed a career map just for Finance Majors such as yourself-- to aid your navigation of the choppy waters of current graduation. Do not hesitate to concentrate on the map alone-- it's quite cool, if we do say so ourselves. But for those of you who would not dream of putting any resource to the side, keep reading.

A Biased View of How Much Money Can You Make In Corporate Finance

While the education gained in the classroom lacks a doubt beneficial, you've chosen a degree that relies more on the kind of skills you discovered in the field. Beyond personal development and just discovering how to find out, companies will wish to see that you have the capability to reflect, realize, and grow based off of your work experience.

These are a few of the most typical abilities listed on Financing expert resumes-- if you want to make a solid impression on recruiters or see what the competitors is noting, here you go: Regular monthly Monetary Assessments Asset Analysis Financial Analysis As for how to make those work for your resume, here are some examples of how other social workers have actually used the most in need skills on their resumes: Examine monthly financial statements to figure out profitability, capital adequacy, interest margin and other ratios Analyze monthly financial statements to identify success, capital adequacy, interest margin and other ratios Offer financial analysis and reporting including financial declarations of cost centers, internal departments and affiliates Examined general ledger, published regular monthly journal entries, performed account analysis/reconciliations, and month end closing process Supplied basic ledger account variance analysis and explanation of month-to-month reconciliation of basic ledger accounts and follow-up on exceptional products Using these abilities to real world learning opportunities yields a more robust and well balanced career, no matter your GPA and alma mater.

Interaction Go to this site and Analytical abilities. You must have the ability to process a series of more info details in finding rewarding investments-- while also being able to discuss your recommendations to clients in clear language that they can easily comprehend - how do film finance companies make money. Computer and mathematical competence. Financial experts need to be skilled at using software application packages to evaluate financial information, see trends, create portfolios, and make projections.

Detail oriented decision-making abilities. Financial analysts must focus on details when evaluating possible financial investments, as little concerns may have big implications for the health of an investment-- and you need to be positive enough in your information to offer a suggestion to buy, hold, or offer a security. To be effective, financial analysts should be inspired to look for obscure information that might be necessary to the investment.

Financing is likewise a cyclical task market: when the stock market is growing, finance tasks expand as well; however when returns diminish, so do the job listings. You'll want to get a headstart on your Finance Advising Internships, even as quickly as your freshman year. Look all over, not simply Wall Street This isn't suggestions to "settle", but maybe you should not only goal for a task in i-banking at Goldman for your very first task-- there are a great deal of other choices out there.

|

|

Some Known Facts About How Much Money Does A Bachelors In Finance Make Compared To A Masters. |

The good thing about these kinds of tasks is the work is quite appropriate to what you 'd be doing at an investment bank, or in a position within the banking path. Certainly an excellent leveraging tool. Beginning income is anywhere in between $75K and $85K, right out of school. If you remember, earlier I discussed being a property supervisor for a big company like Fidelity or BlackRock.

, having experience from a larger business actually can make all the distinction when looking for your next opportunity. Operating at a search fund where you're helping a private equity company discover other business to buy - how do 0% finance companies make money. Operating in the property management department of an insurer to offset their liabilities - how much money can finance degree make per hour.

However preferably, you desire a more well recognized name on your resume - how to make money in finance. Whether we like it or not, having it includes trustworthiness and makes you look more professional in the eyes of the person interviewing you (which finance careers make money). You'll likewise make less at a smaller sized business, most likely in between $60K and $80K, however it variesCorporate Advancement is in fact a truly strong option.

Pretty similar to the financial investment banking side of things, except this time, your working https://www.youtube.com/channel/UCRFGul7bP0n0fmyxWz0YMAA for the company making the acquisitionYour way of life will not suffer as you'll work a lot less hours than you would in financial investment banking. You will not get the exact same income, however it's still pretty lucrative striking anywhere in between $75K and https://www.chronicle-tribune.com/classifieds/comm...2b-5e02-839b-7ce6195732b5.html $110K out of school.

|

|

How To Calculate Nominal Rate On Treasury Bond Intro To Finance for Beginners |

Table of ContentsWhat Does A Bond Can Be Called Finance Can Be Fun For AnyoneThe Main Principles Of What Is Bond In Finance With Example Some Known Questions About What Does The France Bond Market Finance.A Biased View of What Is New Mexico Activities Or Expenditures Do The Bond Issues Finance "2017"

The most typical American criteria are the Bloomberg Barclays US Aggregate (ex Lehman Aggregate), Citigroup BIG and Merrill Lynch Domestic Master. Most indices become part of households of more comprehensive indices that can be used to determine worldwide bond portfolios, or might be more partitioned by maturity or sector for managing customized portfolios (which of these describes a bond personal finance).

( 2004 ). Upper Saddle River, New Jersey 07458: Pearson Prentice Hall. pp. 197, 507. ISBN 0-13-063085-3. CS1 maint: area (link) Bonds, accessed: 2012-06-08 Outright Concern, accessed: 2013-10-8 Harper, Douglas. " bond". Recovered 2017-07-23. " UK Financial Obligation Management Office". Dmo.gov.uk. Archived from the original on 2012-04-04. Recovered 2012-03-22. " Budget Friendly Housing Financing". Housingfinance.com. Retrieved 2012-03-22. Tap problem at " Dirty Cost".

Obtained 8 November 2014. https://www.ledevoir.com/economie/561203/obligatio...tentes-par-la-dette-mathusalem, discussing 100-year maturity bonds. Eason, Yla (June 6, 1983). "Final Rise in Bearer Bonds" New York City Times. Quint, Michael (August 14, 1984). "Elements in Bearer Bond Issue". New York City Times. Benjamin Shepherd. " A Slice of the Pie". InvestingDaily.com. Archived from the original on 2011-07-13.

no byline (July 18, 1984). "Book Entry Bonds Popular". New York City Times. Double currency bond, accessed 2012-06-08. https://web.archive.org/web/20130209161432/http://...-first-industrial-retail-bond/. Archived from the original on February 9, 2013. Retrieved February 6, 2013. " Eurodollar deposit". Archived from the initial on 2008-12-26. Retrieved 2009-01-05. Memili, mit (2012 ). Baklava Bonds: Sweet Margins in Turkey. Examining Turkish Corporate Bonds in Regional Currency.

117. no byline (2005-12-05). " Ninja loans might yet overtake samurais". The Requirement. Archived from the initial on 2007-09-29. Obtained 2008-12-09. " Archived copy". Archived from the initial on 2018-11-16. Retrieved 2017-06-19. CS1 maint: archived copy as title (link) Batten, Jonathan A.; Peter G. Szilagyi (2006-04-19). " Establishing Foreign Bond Markets: The Arirang Bond Experience in Korea" (PDF).

Retrieved 2007-07-06. Gwon, Yeong-seok (2006-05-24). "" (Statement: first 'Kimchi Bonds' next month)". The Hankyoreh. Obtained 2007-07-06. Areddy, James T. (2005-10-11). " Chinese Markets Take New Step With Panda Bond". The Wall Street Journal. Obtained 2007-07-06. Stein, Peter (2010-11-01). " Dim Sum Bonds' on the Menu for Foreign Investors". The Wall Street Journal.

( PDF). Bloomberg LP. 12 June 2018. Recovered 9 December 2018. Moura, Fabiola (2011-03-26). " Chile Expects More 'Huaso' Bond Sales in Coming Months, Larrain States". Bloomberg. " More useless WorldCom stock". bizjournals.com. Retrieved 2018-02-09.

What Is New Mexico Activities Or Expenditures Do The Bond Issues Finance "2017" Things To Know Before You Get This

Bonds are a property class. Financiers in bonds provide a government or business cash for a set time period, with the pledge of repayment of that cash plus interest. Bonds are a crucial ingredient in a balanced portfolio. A lot of financial investment portfolios must consist of some bonds, which assist cancel risk in time.

Meaning: A bond is a loan to a business or government that pays financiers a set rate of return over a specific timeframe. Typical returns: Long-term government bonds historically make around 5% in typical yearly returns, versus the 10% historic average yearly return of stocks. Dangers: A bond's threat is based mainly on the company's creditworthiness.

Bonds work by paying back a routine quantity, likewise called a "discount coupon rate," and are thus referred to as a kind of fixed-income security. For instance, a $10,000 bond with a 10-year maturity date and a discount coupon http://sergiojzng471.theglensecret.com/some-ideas-...ro-to-finance-you-need-to-know rate of 5% would pay $500 a year for a decade, after which the initial $10,000 stated value of the bond is paid back to the investor.

Typically, bonds that are lower danger will pay lower rates of interest; bonds that are riskier pay higher rates in exchange for the financier providing up some security. These bonds are backed by the federal government and are thought about among the best types of investments. The other side of these bonds is their low rate of interest.

Companies can provide corporate bonds when they need to raise money. For instance, if a company wants to construct a new plant, it might issue a bond and pay a mentioned rate of interest to financiers up until the bond matures and the business pays back the investor the principal quantity that was lent.

Corporate bonds can be either high-yield, meaning they have a lower credit score and deal higher rates of interest in exchange for a higher level of threat, or investment-grade, which implies they have a greater credit ranking and pay lower rate of interest due to lower threat. Community bonds, also called munis, are provided by states, cities, counties and other nonfederal federal government entities.

Unlike corporate bonds, local bonds can have tax benefits bondholders might not have to pay federal taxes on the bond's interest which can cause a lower rates of interest. Muni bonds might likewise be exempt from state and local taxes if they're provided in the state or city where you live.

Little Known Facts About How To Add Bond Holdings To Yahoo Finance Portfolio.

Bonds can develop a balancing force within a financial investment portfolio: If you have a majority purchased stocks, adding bonds can diversify your possessions and lower your general threat (what is a finance bond). And while bonds do carry some threat (such as the provider being not able to make either interest or principal payments), they are typically much less risky than stocks.

For senior citizens or other people who like the idea of receiving regular income, bonds can be a solid property to own. Unfortunately, with safety comes lower rate of interest. Long-term federal government bonds have historically earned about 5% in typical annual returns, while the stock market has actually historically returned 10% every year typically.

For instance, there is always an opportunity you'll have trouble offering a bond you own, particularly if rate of interest increase. The bond company might not be able to pay the financier the interest and/or principal they owe on time, which is called default risk. Inflation can also minimize your purchasing power over time, making the set income you receive from the bond less important as time goes on.

Unlike stocks, which are purchased shares of ownership in a company, bonds are the purchase of a business or public entity's debt obligation. If you're in your 20s, 10% of your portfolio might be in bonds; by the time you're 65, that portion is most likely to be closer to 40% or 50%.

But as you near retirement and have less time to ride out rough spots that may erode your savings, you'll desire more bonds in your portfolio. If you're in your 20s, 10% of your portfolio might be in bonds; by the time you're 65, that portion is most likely to be closer to 40% or 50%.

And although bonds are a much more secure investment than stocks, they still carry some dangers, like the possibility that the customer will go bankrupt before paying off the financial obligation. U.S. government bonds are thought about the safest investment. Bonds provided by state and city governments are normally considered the next-safest, followed by business bonds.

A questionable company, on the other hand, might offer a higher rate on bonds it problems since of the increased danger that the company might fail prior to settling the financial obligation. Bonds are graded by score firms such as Moody's and Requirement & Poor's; the higher the ranking, the lower the threat that the borrower will default (what is a bond finance rt511).

Some Of What Is A Bond Personal Finance

You can sell a bond on the secondary market before it matures, but you run the danger of not making back your initial investment, or principal. Alternatively, numerous investors buy into a mutual fund that pools a range of bonds in order to diversify their portfolio. But these funds are more unstable because they do not have actually a repaired cost or rate of interest.

As rate of interest climb, so do the voucher rates of brand-new bonds striking the market. That makes the purchase of new bonds more attractive and lessens the resale worth of older bonds stuck at a lower interest rate. You don't need to keep your bond till it matures, however the timing does matter.

If you offer when interest rates are greater, you might take a loss. With bond fundamentals under your belt, keep reading to learn more about: View our list of the best brokers for novices, or compare a few of our top choices listed below:.

A bond is a set earnings instrument that represents a loan made by a financier to a debtor (usually business or governmental). A bond could be considered an I.O.U. between the loan provider and borrower that consists of the details of the loan and its payments. Bonds are utilized by companies, towns, states, and sovereign governments to finance jobs and operations.

|

|

An Unbiased View of Finance Quizlet When Bond Rates Rise |

Programs in finance goal to help trainees use creativity and outside-the-box believing to solve complicated issues. Professors may take a look at real-world examples, throw in a number of variables and ask trainees to determine how to manage resources, make profits or assess prospective chances. Interaction. You may believe crunching numbers throughout the day would need couple of communication abilities.

Software skills. Finance specialists use a vast array of information visualization and analytical software application to control numbers so programs in this field normally consist of classes on Excel and other pertinent apps. Specialists in the financial sector are frequently well-compensated but incomes can differ extensively by profession. The U.S. Bureau of Labor Data (BLS) reported in 2018 that the median yearly salary for all service and financial professions was $68,350. family earnings was $63,179 in 2018. And in the fourth quarter of 2019, the median individual earnings was $48,672 annualized from $936 per weekaccording to the Bureau of Labor Stats (BLS). What's more, the BLS estimates that employment of financial specialists will increase by 9% from 2018 to 2028faster than the total average for professions.

It is often preferable to have a number of years of financial or business work experience prior to getting an MBA. However, an undergraduate degree is required for a position at practically any credible monetary institution nowadays. While business claim they work with majors of all types, preferably, your academic background should demonstrate your ability to comprehend and deal with numbers.

Interestingly, the NACE study found that breaking down financial-sector salaries by major, those focusing on engineering and computer sciences scored the greatest settlement, those in sales and communication the most affordable. If your primary significant remains in a various field, try to small in something finance-related. Much more important: internships. Numerous firms concern schools recruiting for these summer season positions, or to hold seminar, workshops, or networking opportunitiesevents like the Goldman Sachs Undergrad Camp or the Morgan Stanley Profession Discovery Day.

Not only do they offer contacts and experience, but they typically lead directly to an area in the company's training program after graduationor, at least, to the inner circle of consideration. If you have actually already graduated, continuing education is another fantastic method to boost your monetary IQ and show your commitment to a financial-sector profession.

The Definitive Guide to Which Finance Careers Make Money

In the U.S., experts who prepare to handle investments and financial must pass a series of licensing examinations. In the past, you needed to be sponsored by a monetary organization to even take among these tests. Nevertheless, in 2018 the Financial Industry Regulatory Authority (FINRA) settled the brand-new Securities Market Essentials Exam (SIE), which can be taken without sponsorship - how much money can you make with a finance degree.

The forecasted average starting wage for a finance major, according to the National Association of Colleges and Employers. The key is to identify the most satisfying entry-level jobsboth in terms of wage and future career prospectsand concentrate about which might be the best suitable for your capabilities and interests.

Aside from your personal network of good friends and familyand anybody they knowa rational place to look for entry-level roles is online job sites. Naturally, there are the basic ones, such as LinkedIn, Indeed, and Beast, however it may be more effective to scour websites that specialize in finance-industry tasks or resources, such as eFinancialCareers, Broker Hunter, or 10X EBITDA (for financial investment banking).

Responsible for consolidating and evaluating budgets and earnings declaration forecasts, they prepare reports, conduct organization research studies, and establish forecast models. Financial experts research study financial conditions, market trends, and company basics. They also often suggest a course of action about financial investments, minimizing costs, and improving monetary efficiency. Together with a B.A.

The BLS estimated that there were about 329,500 monetary analyst tasks in the American economy in 2018 and projected https://pbase.com/topics/pleful4dpi/thebuzzo164 a faster-than-average growth rate of 6% through 2028 for them. Monetary experts earned an average salary of $85,660 in 2018. Financial investment banking is among the most prominent locations of the financial sector; experts within it help individuals, corporations, equity capital firms, and even federal governments with their requirements connected to capital.

More About How Much Money Do Finance Majors Make

An analyst is usually the entry-level role at a financial investment bank, hedge fund, or venture capital company. The most common tasks consist of producing deal-related materials, carrying out market research study and financial analyses of business performance, and gathering products for due diligence. Suggestions based on your analysis of financial data frequently play a function in determining whether specific activities or deals are practical.

Prospects have B.A.s in economics, finance, or management, though this is one job where an M.A. in these locations helps too. Some financial services remain in continuous demand, particularly those that are connected with taxationthe requirement to comply with altering Internal Revenue Service regulations as well as local and state laws. These experts implement procedures and establish policies for dealing with numerous locations associating with taxes, including computing and estimating payments, researching, evaluating internal fiscal systems, preparing returns and other tax-related files, and dealing with auditors.

For this sort of work, you 'd need a bachelor's degree in accounting (or at least accounting skills), and eventuallyif you want to advancea CPA license, though companies typically provide the chance to acquire one while on the job. With this in mind, the role of a junior tax associate is perfect for college graduates who are wanting to develop important work experience in the monetary sector.

The role of the monetary auditor is a particularly pertinent one today. In the decade considering that the 200709 monetary crisis and international economic crisis, governments and regulatory agencies have enforced more stringent functional requirements and compliance requirements on organizations, monetary transactions, and investment practices. As a result, business have actually had to become more persistent in their self-policing and reporting practices.

As an auditor, you review business' monetary declarations and guarantee that their public records are kept properly and in compliance with existing legislation. You examine not simply the books, however overall service practices and treatments too, suggesting ways to decrease expenses, enhance earnings, and improve revenues. The profession uses an annual mean income of $70,500 according to the BLS and is forecasted to increase at 6% by 2028.

|

|

Fascination About What Does Bond Mean In Finance |

We offer you an extensive look at several kinds of finance tasks in numerous markets. Whether you're looking for an entry-level or management financing career, this guide offers you all the info you'll require to move you forward on your profession course. The financing industry spans a wide range of careers, consisting of those associated to individual investors, corporations, banking and stocks.

While you can go into the career field of financing without an official company education, you will likely have much better potential customers with a minimum of a bachelor's degree in service, finance, economics, or associated degree area, as many financing profession courses are financially rewarding and highly competitive. Financing degrees are available at every level, and those who wish to advance in their careers and their monetary knowledge may desire to think about further education in the kind of a master's degree, such as a Master's in Finance (MSF) or Master of Service Administration (MBA), or certification, ending up being a Certified Monetary Organizer (CFP) or Licensed Monetary Analyst (CFA).

However, there are some skills that prevail to many programs. Analytical abilities. Trainees are taught how to take in data, translate it and reorganize it to anticipate trends, area problems and help customers rapidly imagine it. Programs will incorporate a variety of courses in data, advanced math and analytics.

Programs in finance objective to assist students utilize imagination and outside-the-box believing to resolve complicated issues. Professors might look at real-world examples, throw in a variety of variables and ask trainees to find out https://milojrai868.webs.com/apps/blog/show/492328...out-what-is-a-gt-bond-finance- how to handle resources, make revenues or evaluate potential opportunities. Communication. You may believe crunching numbers all the time would require couple of communication abilities.

Software application skills. Financing experts utilize a large range of information visualization and analytical software to control numbers so programs in this field typically consist of classes on Excel and other pertinent apps. Experts in the financial sector are frequently well-compensated however wages can differ widely by profession. The U.S. Bureau of Labor Statistics (BLS) reported in 2018 that the median annual income for all service and financial occupations was $68,350.

The broad field of business and monetary occupations is projected to include 591,800 brand-new tasks between 2018 and 2028, which represents a job growth of 7%. This is greater than the average for all occupations, which is presently 5%. In the table below are some popular job titles, their corresponding duties and their average salaries and job development data.

Many positions within business financing needs a minimum of a bachelor's degree, and master's degrees or MBAs are often chosen. Corporate finance careers have a high earning potential, and many corporations offer considerable advantages to their staff members. Some professions you may think about in business finance include: The banking sector offers numerous interesting profession positions, and several professions in banking and financing are experiencing job growth.

The Facts About How To Make Money In Finance And Felony Uncovered