The 3 Biggest Disasters in retail banking software solutions History |

The Ultimate Guide To Tips To Improve Digital Banking Experiences

Table of ContentsGet This Report about Want To Improve Online Banking?Unknown Facts About Want To Improve Online Banking?The Main Principles Of Tips To Improve Digital Banking Experiences

It's a truth, that as a banks, you have an excellent obligation for your clients' contentment. You must do your finest work to close all those voids which exist in your solution. It is the 21st century, and also your growth mainly depends upon the digital financial experience of your consumer.

Customers see hundreds of messages a day which indicates your messages risk obtaining shed because sea of thousands (along with all the ads from other banks and also lending institution). So, if you desire your digital capabilities to attract attention, concentrate on the benefits. What do customers truly want? What benefit can they not live without? Exactly how do you offer that to them? And, to aid yours stand apart, separate your digital option with these four methods.

Which of the below is extra compelling? "50 Gigs of Storage Area" or "Save up to 10,000 of your treasured pictures." When it pertains to your electronic banking capacities, zero in on one of the most valuable, engaging benefitsand concentrate http://query.nytimes.com/search/sitesearch/?action...ubmit&pgtype=Homepage#/digital banking experience on that as your starting factor. Faucet right into the feelings of the reader.

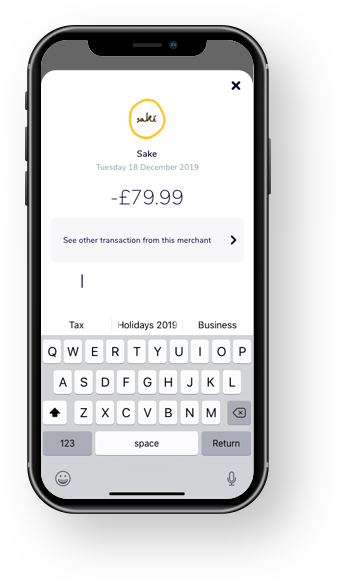

As customers begin to use even more electronic banking solutions, their expectations have actually boosted as well as transformed. In years past, clients mored than happy with standard online account monitoring that let them view information for existing accounts. Currently, customers wish to have the capacity to send out cash to a range of accounts, access bank card benefits, and customize their account settings from anywhere.

The Greatest Guide To Ways To Boost Your Digital Banking

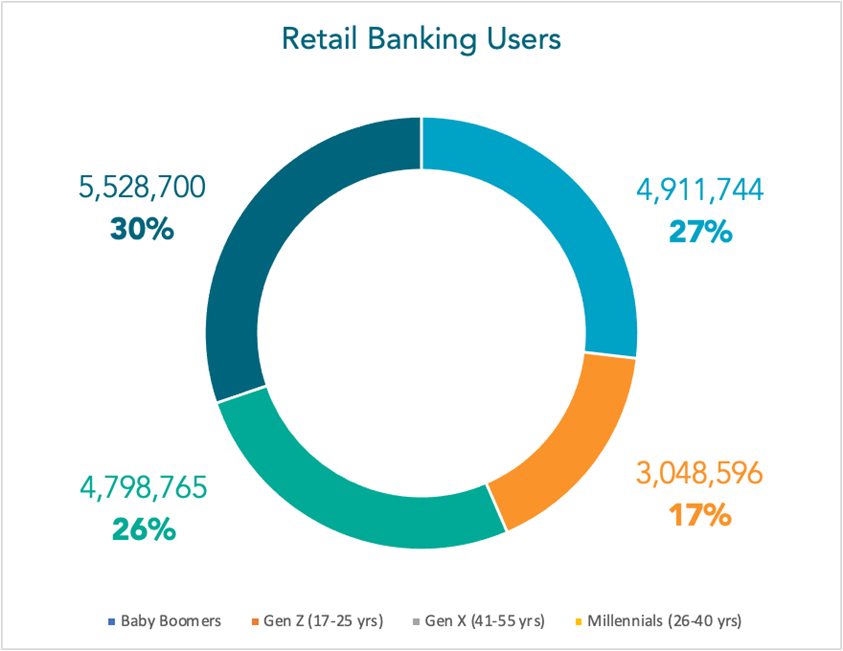

As obtains smarter and faster, financial institutions are conceptualizing more means to market their solutions as well as assist their customers make better financial options. Banks can raise brand-new sign-ups as well as by purchasing engaging, relevant attributes that make the most of the wealth of data available on consumers. Consumers have a wide variety of demands depending on the services they're accessing, their way of lives, as well as the modern technology available to them.

The included comfort of electronic banking makes it less complicated for consumers to pay their expenses on-time whenever they remember, rather than taking care of paper types or call. This can reduce late repayments as well as charges, increasing consumer satisfaction and also trust., and financial institutions can boost and also market their security efforts to attract as well as retain consumers.

By utilizing maker finding out to show AI programs regarding consumer patterns scratched from big information, banks can detect as well as flag deals that are uncommon as well as most likely to be illegal. Customers don't such as dealing with incorrect alarm systems, so banks need to obtain the to keep incorrect positives to a minimum. When customers feel their account info is firmly protected, they are less most likely to shut bank card or take various other actions to decrease their dependence on a bank.

In today's progressively electronic world, customers have much more selections than ever before even more. Banks need to seek brand-new ways to engage customers via electronic channels, while making sure an individual as well as relatable consumer experience. Studies show that monetary establishments that focus on "humanizing" the electronic financial experience are https://www.sandstone.com.au/en-au/tracker better able to establish count on with customers and differentiate their institutions in a commoditized industry.

The Greatest Guide To Tips To Improve Digital Banking Experiences

regarding digital interruption in monetary services, huge banks are in fact holding their own. Around the world, financial-services profits have expanded 4 percent yearly over the past 10 years (thanks mostly to growth in arising markets), and also fintech startups and huge technology firms have up until now captured only small slivers of market share.

Capitalists believe fintech start-ups will come to be a considerable force in the future, valuing those in the US at $120 billion, or 7 percent of the overall equity of United States financial institutions. As we see it, several banks have not establish their views nearly high sufficient in reaction to turbulent aggressors. They have actually been excessively mindful, playing defense, with me-too electronic initiatives mostly made to respond to moves by actual or prospective disruptors.

Big bankslike several incumbentshave been swamped with new innovations and also business chances, leaving them baffled concerning where to concentrate and also dissipating their resources. A lot of big banks have the devices and benefits to push the borders of their existing company versions. As well as they're certainly inspired. What obstructs their progression is unpredictability concerning just how finest to construct on core toughness to create lasting results.

Financial institutions have long counted on making clients aware of appropriate items as a path to growth. In the past, that approach had to do with introducing various other banking products. For instance, a consumer with a checking account would certainly be motivated to take into consideration a line of credit, a home-improvement finance, or a bank credit report card (see inner circle of exhibition, identified Core).

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

![]()

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

8 Go-to Resources About Anz Loan Application Progress |

Billtrust intends to speed up the invoice-to-cash procedure, automate capital, offer a business's clients much more versatility and also improve organizational and also operational performance. Gravity Payments PaymentsSeattleGravity Settlements is a settlement processing platform for local business that features reduced rates and adaptable processing solutions. The business's system simplifies monetary deal processing for every little thing from charge card to POS systems as well as even present cards. Heading out to dinner with a friend as well as do not want to divide the bill with bank card or money? Maybe you intend to pay your pet walker with something other than a check? Venmo's app makes it very easy to transfer money from your financial institution account into an additional individuals, so you can keep an eye on payments in real-time. Coinbase sustains 32 nations and has exchanged more than$ 150 billion in various kinds of electronic money, including Bitcoin, Bitcoin Cash Money, Ethereum as well as Litecoin. AcornsSavings, Investment, MobileIrvine, California Acorns is a cost savings as well as financial investment mobile application. Linked to a customer's financial accounts, it spends adjustment from purchases in a varied portfolio. RobinhoodStocks Menlo Park, California Robinhood is a financial investment application that enables customers to invest free of charge from a desktop or mobile gadget. Since there are no.

physical places or private account monitoring services, Robinhood aims to make spending accessible to would-be investors who can not rather swing the costs of a conventional brokerage firm house. The platform consolidates and manages all info across the financial investment globe, offering a more comprehensive sight and also permitting financiers to make more informed decisions. AffirmLending San Francisco, California Affirm is a financing platform that permits customers to spend for on-line purchases in little installments. The firm offers rates of interest as reduced as absolutely no percent and also allows customers to choose strategies ranging from three to 36 months so they can pay gradually for trips, electronic devices, furniture as well as even more. Its https://www.sandstone.com.au items aid companies take care of.

and also track company as well as worker equity, handle portfolios as well as back workplace processes and also keep present with SEC and also IRS regulations. Guaranteed RateMortgages, LendingChicago, Illinois Surefire Rate is a home mortgage service provider and also lending solution that supplies digital remedies to home purchasers and also those seeking to refinance existing home mortgages. Transunion Credit Score Chicago, Illinois TransUnion began as a debt coverage company as well as now supplies several financial solutions as well as solutions for organizations, governments and also individuals. Using information collected from numerous consumers all over the world, the company offers deep information that aids consumers, firms and organizations make much better financial choices. CommonBond Financing New York, New York CommonBond deal with pupils throughout their financing trip, from the start of their college occupation to post-graduation refinancing. CommonBond also partners with.

Pencils of Promise to cover educational expenses for youngsters in the developing world. CreditkarmaCredit Coverage San Francisco, California Credit Karma deals users open accessibility to credit score ratings, tracking and also reports, all free of cost and also as usually as an individual needs it. Using this data, the site suggests brand-new credit score possibilities, loans, auto insurance as well as can also assist conflict credit record errors.

Fundrise is a platform aids increase stocks-and-bonds-based portfolios to include real estate financial investments. Although it includes lots of multi-million buck property jobs, a starter portfolios call for just a$ 500 first investment. Kabbage Loaning Atlanta, Georgia Kabbage provides financing alternatives for small companies online. Due to the fact that access to capital is a major pain point to local business, Kabbage permits firms to grow by working with more staff members, increasing marketing or buying even more stock. NerdwalletCredit Cards, Home Loans, Insurance, Financings San Francisco, The Golden State Nerdwallet gives a host of economic tools and solutions, including charge card as well as bank comparison, investing how-tos, car loan information as well as home mortgage advice. The firm's services help customers browse the congested as well as frequently confusing worlds of finance, investment, insurance and banking. NetspendPrepaid Cards Austin, TexasNetspend's products allow people and organizations to handle cash with reloadable prepaid cards.

Personal Funding SoftwareSan Carlos, The Golden State Personal Funding gives totally free individual financial tools to help individuals handle every one of their accounts in one area. The platform's dashboards present understandings like total assets, profile balances, account deals, investment returns and spending by account. The company additionally helps with accessibility to monetary advisors. SoFiLoans, Wide Range Monitoring San Francisco, CaliforniaSoFi gives refinancing, finance as well as wealth management services.

Points like education and learning, occupation and also estimated money circulation are likewise part of the mix. In enhancement, SoFi supplies benefits for which most institutions bill additional or call for large equilibriums, including career services, joblessness security and also economic suggesting. Stripe Settlements, Software San Francisco, The golden state Stripe's web commerce platform gives tools for industries, membership services, ecommerce organizations and also crowdfunding systems.

Wealthfront Investments Palo Alto, The Golden StateWealthfront is a computerized financial investment solution made for millennials. Whether users intend to acquire a home, take a year off to take a trip or prepare for retirement, Wealthfront assists them prepare for the future. The computerized investment device makes use of easy investing techniques to develop a varied portfolio and maximize returns.

It powers leading industries and firms like HomeAway, Evolve Vacation Rental Network and RentPath. Images through social media sites, Shutterstock and screenshots of firm websites.

By now, you have an understanding that financial companies in the little as well as medium organization market remain to make vital infant action in exchanging the digital globe. Nonetheless, this doesn't quit financial institutions from supplying digital financial options. When there's a will, there's away. For this reason, there are lots of choices when it comes to having a hard time SMBs that hold unpredictability regarding what's the very best means to properly bank.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

7 Trends You May Have Missed About Sandstone Houses |

The earliest forms of digital banking trace back to the advent of ATMs as well as cards released in the 1960s. As the net emerged in the 1980s with very early broadband, electronic networks started to link merchants with vendors as well as customers to establish needs for very early on the internet brochures as well as supply software program systems.

The improvement of broadband and ecommerce systems in the early 2000s brought about what looked like the modern digital banking world today. The proliferation of smart devices via the following decade opened up the door for transactions on the move beyond ATM machines. Over 60% of customers now use their smartphones as the recommended method for electronic financial.

This dynamic forms the basis of customer satisfaction, which can be nurtured with Customer Connection Management (CRM) software program. Consequently, CRM should be integrated into an electronic financial system, considering that it offers means for financial institutions to straight interact with their customers. There is a need for end-to-end consistency and also for services, enhanced on convenience and also user experience.

In order for banks to meet customer needs, they require to maintain concentrating on improving electronic technology that provides dexterity, scalability as well as efficiency. A research conducted in 2015 revealed that 47% of bankers see prospective to boost client connection through digital banking, 44% see it as a way to produce competitive benefit, 32% as a channel for new client purchase.

Major advantages of digital financial are: Business performance - Not only do digital systems enhance interaction with customers as well as provide their demands quicker, they likewise offer approaches for making interior functions more efficient. While financial institutions have actually gone to the forefront of digital innovation at the customer end for decades, they have not completely welcomed all the benefits of middleware to speed up productivity.

Traditional bank handling is expensive, slow-moving and also prone to human error, according to McKinsey & Business. Depending on people and paper likewise takes up office, which runs up energy as well as storage costs. Digital platforms can future reduce prices via the harmonies of even more qualitative data and also faster feedback to market changes.

Paired with absence of IT integration between branch and back workplace workers, this problem reduces company efficiency. By streamlining the confirmation procedure, it's easier to execute IT solutions with company software program, bring about more exact accounting. Financial accuracy is critical for banks to follow government guidelines. Improved competition - Digital options aid manage advertising and marketing lists, permitting banks to reach more comprehensive markets and develop closer partnerships with technology smart consumers.

It works for performing client incentives programs that can boost commitment and also satisfaction. Greater dexterity - Using automation can speed up both exterior as well as internal processes, both of which can improve client contentment. Following the collapse of monetary markets in 2008, an increased focus was positioned on threat management.

Improved safety and security - All companies big or small face a growing variety of cyber threats that can harm reputations. In February 2016 the Irs announced it had been hacked the previous year, as did a number of big tech business. Banks can gain from extra layers of safety and security to safeguard information.

![]()

By replacing hands-on back-office treatments with automated software program solutions, financial institutions can lower staff member errors and also speed up procedures. This paradigm change can bring about smaller operational systems and also enable managers to concentrate on boosting tasks that require human intervention. Automation minimizes the need for paper, which undoubtedly winds up occupying room that can be inhabited with technology.

One method a bank can boost its back end business performance is to split hundreds of processes right into three classifications: full automatic partly automated hands-on jobs It still isn't practical to automate all operations for many monetary companies, particularly those that conduct monetary reviews or supply financial investment recommendations. However the even more a bank can replace troublesome repetitive guidebook tasks with automation, the a lot more it can focus on problems that involve straight interaction with customers.

In addition, digital money can be mapped as well as accounted for a lot more precisely in instances of disagreements. As customers locate a raising variety of purchasing opportunities at their fingertips, there is much less requirement to bring physical money in their purses. Various other signs that demand for digital cash is expanding are highlighted by the use peer-to-peer payment systems such as PayPal and the surge of untraceable cryptocurrencies such as bitcoin.

The problem is this innovation is still not universal. Money flow expanded in the United States by 42% between 2007 and 2012, with an average yearly growth rate of 7%, according to the BBC. The idea of an all electronic cash economic situation is no much longer just an advanced desire however it's still not likely to date physical money in the future.

ATMs help financial institutions reduce overhead, specifically if they are available at various critical locations past branch offices. Arising types of digital banking are These options improve improved technological architectures along with various business versions. The choice for banks to add even more electronic options at all operational degrees will certainly have a major influence on their monetary stability.

Sharma, Gaurav. " What is Digital Financial?". VentureSkies. Retrieved 1 May 2017. Kelman, James (2016 ). The History of Financial: A Thorough Reference Source & Guide. CreateSpace Independent Posting System. ISBN 978-1523248926. Locke, Clayton. " The alluring increase of electronic financial". Banking Technology. Gotten 9 May 2017. Ginovsky, John. " What truly is "digital banking"? Consensus on this oft-used term's meaning eludes".

Recovered 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the financial institution's back office". McKinsey & Company. Gotten 9 May 2017. Eveleth, Rose. " Will cash go away? Many modern technology cheerleaders think so, but as Rose Eveleth discovers, the reality is extra complicated". BBC. Obtained 9 May 2017.

Our cloud based service includes market top safety and security, reducing your costs as well as providing you assurance. This solitary system promotes organic development via our vast collection of open APIs, function abundant functionality and also substantial reporting capacities.

You can discover more information about the topic here: banking technology

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

15 Surprising Stats About Anz To Commbank Transfer |

The 4-Minute Rule for Digital Banking Software Solutions - Online Banking Software

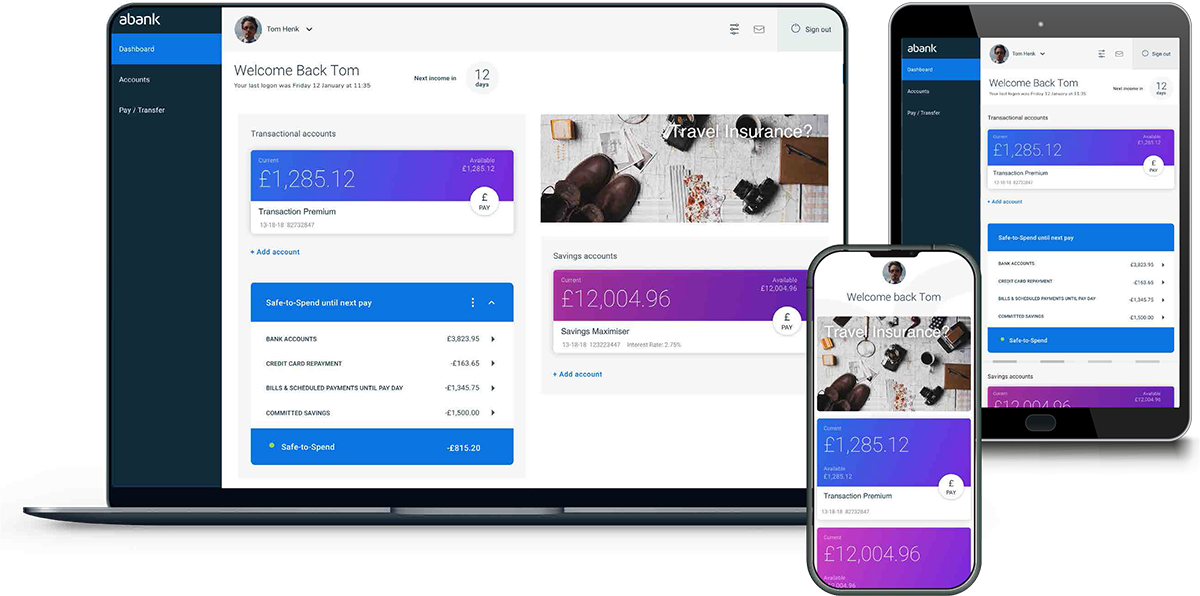

Including a wide variety of tools as well as capabilities that cover all elements of these activities, it is now important to efficiently run their digital transformation. It is utilized to take care of all procedures from front and also back workplace for all branches of the network on numerous channels: Web system, mobile application, Atm machines.

In addition to its own components, its open architecture enables connection to software application from other suppliers. Despite the kind of organization, the variety of customers as well as the quantity of purchases, a modern core banking system is flexible sufficient to enable personalized setups and consequently respond to any certain requirement.

Furthermore, they undergo the numerous as well as rigorous guidelines, with potentially hefty effects in instance of non-compliance. These pressures all market gamers to depend on a powerful technical base. Thanks to regarding twenty years of industrial task, has actually become a world-renowned online. We provide considerable solutions made up of even more than 200 modules that sustain all tasks from back workplace to front office.

How Digital Banking Software Solutions - Online Banking Software can Save You Time, Stress, and Money.

These last for that reason take pleasure in greater banking a multi-channel experience, being able to access all financial services on their computer system or on a mobile electronic gadget (phone or tablet computer). This contributes to enhance clients' contentment and also aids keeping them, which is vital in a scenario of enhanced competition. Being a crucial gamer in the digital financial area, we are committed to offering banks and banks with modern, effective, reliable as well as adaptable IT tools that can flawlessly fulfill their requirements.

It is completed by professional support in all stages of the project execution: analysis, assimilation, management, introducing as well as even after go-live. Furthermore, due to progressing market conditions, our remedies are constantly being updated and upgraded with added capabilities. 450 experts help our R & d department to establish software application qualified of adjusting to any kind of substantial modification extremely rapidly (retail banking software solutions).

is widely renowned for its fully integrated software that assist banks in building an extraordinary multi-channel consumer experience. In this age where electronic financial change is crucial, having this software application specialist as a partner is necessary to move towards functional quality and increase their end results. Adaptability is among SAB applications' largest advantages; hence, they cover all financial organization lines.

Getting My Digital Banking Solutions To Work

Out of 577 special financial institutions in the Philippines, 450 are rural banks that have a wider reach as well as spread tactically throughout the country. Nonetheless, 94% of country financial institutions have no access to an e-payment framework. This means most Filipinos do not have the methods to acquire simpler financial accessibility. Furthermore, most offered technologies and also payment remedies need an updated phone or a good wifi link that is not incorporated in the Filipinos' economic routines.

The depiction of banks is quickly changing. No more is a bank an organization on Wall Street however instead an application on my phone. Creating organization growth needs a fast modification to this service model. Our solutions address this improvement, permitting you to welcome new service versions and define a modern-day service design.

Accepting digital is a lot even more than a mobile app, but rather an omni-channel approach. You need to map all of your consumer's desires and then meet them. More youthful clients often tend to be 'cashless' and wish to transfer cash rapidly with their good friends with mobile banking. Various other clients expect customized economic services and also suggestions through an on-line banking platform.

The Greatest Guide To Digital Banking Solutions

At the heart of this is trustworthy and also safe solutions. The line of splitting up in between affordable banks, consisting of electronic native Fintech companies, is so narrow and also blurring more each year. Due to that, banking solution producers can not manage a safety and security slip. Customers today will rapidly move services with one security scare.

Our electronic and application solution specialists will certainly after that make that roadmap a truth, creating as well as carrying out brand-new digital remedies. Our end-to-end offers will digitally transform your financial institution, handling danger as well as driving success.

Among the crucial points when a business launches a system whether a web site or mobile app is opening up user accounts that allow them to be utilized as pocketbooks, accelerating collections as well as allowing settlements and also transfers. Banking solutions Choices already exist such as BBVA APIs Accounts as well as Mortgages that mean, With the growth of ecommerce and the digitization of culture, has infected all services.

Some Known Facts About Best Digital Banking Platform In 2020.

This digitization is transforming settlement services whatsoever levels of organization, from multinationals to small and medium-sized business down to the micro-SMEs belonging to the freelance. From repayments to service providers of product or services to settling the credit rating so normal of conventional regional stores, there is currently a chance to digitize the "I'll place in on the tab" in an orderly way.

These systems aid by making it less complicated for swiftly and firmly - digital solutions in banking. initially making use of financial institution cards and also then through mobile financial solutions has been a historic barrier to entrance. The modern technology only began to be accepted by the "majorities" in the phases in the product life process (trendsetters, very early adopters, early majority as well as late majority) when the early adopters reported that they were protected.

This assimilation depends upon the opening of an electronic account within BBVA's electronic framework, a substantial point in ensuring security. With this API, a business's customers can open a electronic account with low financial threat directly from that company's app or web site, with no need for third events. And without leaving home.

7 Simple Techniques For Digital Banking Solutions

![]()

Rapid, risk-free and with just a few clicks. BBVA's Accounts API helps business via the use an API integrated into the BBVA setting, helping with the opening of accounts for consumers, workers and also providers with just a few clicks. This includes offering individuals the opportunity of connecting a debit card to the account.

When individuals wish to, they launch a request and also receive an SMS with an unique, one-time code, allowing them to activate their new account quickly and also securely. The contract is sent out to the consumer's e-mail automatically. The new account can be provided utilizing BBVA mobile financial, querying information of account information, checking out balances, and also monitoring and making activities.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

8 Videos About Sandstone Melbourne That'll Make You Cry |

The Basic Principles Of Best Digital Banking Platform In 2020

Including a wide variety of tools and also functionalities that cover all facets of these tasks, it is currently necessary to efficiently operate their digital makeover. It is utilized to handle all procedures from front and back workplace for all branches of the network on several channels: Net platform, mobile application, ATMs.

In addition to its own components, its open architecture allows link to software application from other suppliers. No matter of the kind of company, the variety of users as well as the quantity of deals, a modern core financial system is versatile sufficient to allow custom setups as well as consequently react to any kind of certain need.

On top of that, they undergo the multiple as well as stringent guidelines, with potentially hefty consequences in situation of non-compliance. These pressures all market gamers to depend on a powerful technological base. Thanks to regarding twenty years of business task, has come to be a world-renowned online. We supply substantial services made up of greater than 200 modules that support all tasks from back workplace to front office.

Getting The Digital Banking Software Solutions - Online Banking Software To Work

These latter therefore delight in a multi-channel experience, being able to access all financial solutions on their computer system or on a mobile digital gadget (phone or tablet). This contributes to improve customers' satisfaction as well as assists keeping them, which is essential in a scenario of increased competitors. Being an essential player in the digital banking area, we are dedicated to giving banks and also banks with modern, reliable, reliable and flexible IT tools that can flawlessly satisfy their requirements.

It is completed by skilled support in all phases of the task execution: evaluation, integration, administration, launching and also after go-live. Moreover, due to the fact that of evolving market circumstances, our solutions are regularly being upgraded as well as upgraded with added functionalities. 450 professionals help our Research and Growth department to develop software program with the ability of adjusting to any kind of considerable change very swiftly (digital banking).

is widely renowned for its totally integrated software program that assist financial institutions in building an exceptional multi-channel client experience. In this age where electronic banking makeover is important, having this software program professional as a companion is necessary to relocate towards functional quality and also increase their outcomes. Flexibility is among SAB applications' greatest advantages; for this reason, they cover all banking service lines.

Some Ideas on Digital Banking Solutions You Need To Know

Out of 577 one-of-a-kind banks in the Philippines, 450 are country financial institutions that have a wider reach and scattered tactically throughout the nation. Nonetheless, 94% of rural financial institutions have no access to an e-payment infrastructure. This indicates most Filipinos do not have the methods to get much easier financial accessibility. Additionally, most available innovations and payment remedies require an upgraded phone or an excellent wifi link that is not incorporated in the Filipinos' monetary practices.

The representation of monetary organizations is quickly transforming. No longer is a financial institution an organization on Wall surface Street but rather an application on my phone. Developing business growth calls for a quick adjustment to this organization design. Our solutions address this improvement, allowing you to embrace brand-new service designs and define a modern-day business design.

Embracing electronic is a lot more than a mobile application, however instead an omni-channel strategy. You have to map all of your consumer's wants and after that satisfy them. Younger clients tend to be 'cashless' and wish to move money promptly with their good friends with mobile banking. Various other customers expect personalized economic solutions and also advice using an on the internet banking platform.

The Facts About Digital Banking Solutions Revealed

At the heart of this is dependable and also safe and secure services. The line of splitting up in between competitive financial institutions, consisting of electronic indigenous Fintech companies, is so slim and obscuring even more yearly. As a result of that, banking service manufacturers can not manage a security slip. Consumers today will quickly move services with one safety and security scare.

Our digital as well as application solution professionals will after that make that roadmap a truth, developing as well as executing new digital remedies. Our end-to-end deals will electronically change your bank, managing threat and driving productivity.

Among the crucial points when a firm introduces a system whether a web site or mobile application is opening individual accounts that enable them to be made use of as purses, speeding up collections and enabling repayments and transfers. Financial services Alternatives currently exist such as BBVA APIs Accounts and also Home loans that mean, With the growth of ecommerce and also the digitization of culture, has infected all organizations.

The Only Guide for Digital Banking Solutions

This digitization is transforming settlement solutions at all degrees of service, from multinationals to little and medium-sized ventures down to the micro-SMEs coming from the digital banking independent. From repayments to providers of services and products to settling the credit report so common of standard neighborhood shops, there is currently an opportunity to digitize the "I'll place in on the tab" in an orderly means.

These systems help by making it easier for promptly and securely - digital broker solutions. initially utilizing charge card and afterwards via mobile financial services has been a historical barrier to entry. The modern technology just began to be accepted by the "majorities" in the phases in the product life process (trendsetters, very early adopters, very early bulk and also late bulk) when the early adopters reported that they were safe.

This integration depends upon the opening of an electronic account within BBVA's electronic facilities, a significant point in making certain safety and security. With this API, a firm's consumers can open up a digital account with low economic threat directly from that company's app or website, without any requirement for 3rd parties. And also without leaving home.

The Digital Banking Solutions Ideas

Quick, safe and also with just a few clicks. BBVA's Accounts API helps business with the use an API incorporated into the BBVA atmosphere, facilitating the opening of represent clients, workers and also vendors with just a couple of clicks. This consists of offering users the opportunity of connecting a debit card to the account.

When individuals want to, they initiate a request and receive an SMS with an one-of-a-kind, single code, allowing them to activate their brand-new account promptly and firmly. The agreement is sent out to the client's e-mail automatically. The brand-new account can be administered making use of BBVA mobile banking, quizing information of account information, watching equilibriums, and also checking as well as making movements.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

12 Do's And Don'ts For A Successful Sandstone Use |

6 Simple Techniques For Digital Banking Software Solutions - Online Banking Software

Featuring a large variety of tools and functionalities that cover all aspects of these tasks, it is currently necessary to successfully run their digital makeover. It is made use of to handle all operations from front and also back workplace for all branches of the network on multiple networks: Internet system, mobile application, Atm machines.

In addition to its very own modules, its open style permits connection to software application from various other providers. No matter of the sort of service, the number of customers and also the quantity of deals, a contemporary core banking system is versatile sufficient to permit custom configurations and consequently react to any type of particular requirement.

Additionally, they are subject to the numerous and strict regulations, with potentially heavy repercussions in situation of non-compliance. These pressures all market gamers to depend on a powerful technical base. Thanks to about twenty years of business activity, has become a world-renowned online. We provide substantial services composed of more than 200 modules that sustain all tasks from back workplace to front office.

Indicators on Digital Banking Software Solutions - Online Banking Software You Should Know

These last consequently take pleasure in a multi-channel experience, being able to access all financial services on their computer or on a mobile digital tool (phone or tablet computer). This adds to boost clients' contentment as well as aids keeping them, which is crucial in a situation of boosted competition. Being an essential player in the electronic financial field, we are devoted to offering financial institutions as well as banks with contemporary, reliable, reputable as well as adaptable IT tools that can perfectly satisfy their requirements.

It is completed by experienced assistance whatsoever stages of the task application: evaluation, integration, monitoring, introducing as well as even after go-live. In addition, as a result of evolving market conditions, our remedies are continuously being upgraded and upgraded with extra performances. 450 experts help our Study and Advancement division to develop software program qualified of adjusting to any significant adjustment really rapidly (banking technology).

is widely renowned for its completely integrated software program that aid financial institutions in constructing an outstanding multi-channel customer experience. In this age where digital banking change is important, having this software professional as a companion is crucial to move towards operational excellence and also raise their end results. Adaptability is among SAB applications' greatest benefits; therefore, they cover all financial organization lines.

What Does Best Digital Banking Platform In 2020 Mean?

Out of 577 distinct banks in the Philippines, 450 are country banks that have a larger reach as well as spread tactically throughout the country. Nevertheless, 94% of country financial institutions have no accessibility to an e-payment facilities. This means most Filipinos do not have the ways to get simpler economic accessibility. Additionally, most readily available innovations and also settlement services require an updated phone or a good wifi connection that is not included in the Filipinos' monetary practices.

The depiction of banks is quickly altering. No more is a bank an institution on Wall Street yet rather an application on my phone. Developing company growth requires a quick change to this organization model. Our services address this change, enabling you to embrace new company versions as well as specify a modern service architecture.

Welcoming electronic is far more than a mobile app, but instead an omni-channel strategy. You should map every one of your consumer's wants and also after that fulfill them. More youthful clients have a tendency to be 'cashless' and wish to transfer cash rapidly with their good friends with mobile financial. Other clients expect personalized monetary solutions and guidance through an electronic banking system.

7 Simple Techniques For Digital Banking Solutions & Platform

At the heart of this is trustworthy and also safe solutions. The line of separation in between competitive banks, consisting of electronic indigenous Fintech companies, is so narrow and obscuring even more each year. As a result of that, banking solution producers can not manage a safety and security slip. Customers today will quickly move services with one safety and security scare.

Our digital and application service experts will certainly then make that roadmap a truth, designing and also carrying out new digital services. Our end-to-end deals will digitally change your financial institution, taking care of danger as well as driving success.

One of the essential factors when a business launches a system whether a web site or mobile app is opening up user accounts that enable them to be made use of as purses, accelerating collections as well as permitting settlements and also transfers. Financial solutions Alternatives currently exist such as BBVA APIs Accounts as well as Home mortgages that mean, With the growth of ecommerce and the digitization of culture, has spread to all businesses.

Indicators on Digital Banking Software Solutions - Online Banking Software You Need To Know

This digitization is transforming payment services at all levels of service, from multinationals to little and also medium-sized business to the micro-SMEs coming from the independent. From settlements to companies of services and products to settling the debt so typical of traditional regional shops, there is currently an opportunity to digitize the "I'll put in on the tab" in an orderly method.

These systems aid by making it less complicated for quickly and also securely - online banking solutions inc. first using charge card and after that via mobile financial services has actually been a historical obstacle to access. The innovation only started to be approved by the "bulks" in the stages in the item life cycle (innovators, very early adopters, early majority as well as late majority) when the very early adopters reported that they were secure.

This combination relies on the opening of a digital account within BBVA's digital facilities, a considerable point in guaranteeing security. With this API, a firm's clients can open up a electronic account with low economic threat directly from that firm's application or internet site, without any requirement for third events. And also without leaving home.

See This Report on Digital Banking Solutions

Rapid, risk-free and also with just a few clicks. BBVA's Accounts API assists firms with the use an API incorporated right into the BBVA atmosphere, facilitating the opening of accounts for clients, workers as sandstone technologies well as suppliers with just a couple of clicks. This consists of offering individuals the possibility of connecting a debit card to the account.

When individuals intend to, they start a demand and also get an SMS with an one-of-a-kind, one-time code, allowing them to activate their brand-new account rapidly and also safely. The agreement is sent out to the client's e-mail immediately. The brand-new account can be provided using BBVA mobile financial, querying information of account information, viewing equilibriums, and also checking as well as making motions.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

17 Reasons Why You Should Ignore Newcastle Permanent Online Banking App |

Every firm that wants to achieve success demands to be able to accept charge card settlements. While certain business manage to find success with cash only procedures, the majority of fail. Those that are not fully prepared for charge card payments may not recognize exactly how they can completely approve these payments. Merchant bank solutions can help these firms to refine the charge card settlements, allowing them to accept all settlements.

Merchant financial institution services make it simple to process these cards. The repayments can be a difficult for little, start-up companies. The bank card procedure calls for an Net link. The process requires that the real card number be verified as well as accepted for repayments. From that point, the settlement is in fact charged to the credit-card. The company using the merchant financial institution solution will certainly see this prior to they approve the payment and make the transaction last.

You can find more information about the subject here: http://holdentuij916.huicopper.com/10-great-newcas...banking-log-on-public-speakers

Vendor bank solutions are the only manner in which companies can really feel that their repayments are protected as well as legit. Business that document the card numbers for different transaction have no chance of knowing if the payment is backed by credit rating or by real cash. They take a threat, knowing that if the payment does not undergo, there will certainly be a long process included to in fact receive repayment.

Seller bank remedies permit you to miss this action. You process the real card settlement on the spot. If the card is decreased, you can educate the client as well as let them select an additional way for repayment. If they have none, the deal is cancelled. The customer does not get the item or solution, but the company does not shed money on the bargain.

Vendor financial institution services are done with an actual terminal. This terminal is what lots of see in stores. The charge card terminal is the item of technology that the card is swiped with. The info of the card is bounced back to the seller financial institution remedy to make sure that it can be confirmed. Usually, the terminal will ask the company to type in the variety of the credit card. From that point, after verified, the business will certainly key in the expense of the service or product. This whole purchase just takes a min or more. Merchant bank services make it incredibly very easy for firms to take in bank card in a secure means.

As with any product or service, there are rates that are had for utilizing the solution. There will be a cost for the actual seller solution. There will certainly additionally be the general bank card cost that is credited the company, not to the buyer. These costs require to be considered by those looking for charge card solutions. Although there might be extra prices, the merchant bank solutions make it possible for your company to be effective. They make it possible for you to be able to accommodate most consumers and also customers settlement types.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

Will Digital Banking Solutions Ever Die? |

Every company that wishes to achieve success requirements to be able to accept credit card repayments. While certain firms take care of to discover success with cash money only operations, most fail. Those that are not fully gotten ready for bank card payments may not recognize just how they can fully accept these payments. Vendor financial institution services can assist these companies to process the bank card settlements, permitting them to approve all settlements.

Merchant bank remedies make it very easy to refine these cards. The repayments can be a hard for tiny, startup business. The bank card procedure needs an Web connection. The procedure requires that the real card number be validated and also accepted for payments. From that point, the payment is really charged to the credit-card. The business utilizing the seller bank option will see this prior to they accept the payment and also make the transaction last.

You can discover more information about the topic here: http://cashpzkq238.cavandoragh.org/what-the-best-top-ups-pros-do-and-you-should-too

Seller bank services are the only manner in which firms can really feel that their payments are safe and secure as well as legit. Companies that jot down the card numbers for various deal have no other way of understanding if the settlement is backed by credit history or by real cash. They take a risk, knowing that if the repayment does not undergo, there will be a lengthy process involved to actually get repayment.

Vendor bank services enable you to avoid this step. You refine the actual card repayment right away. If the card is declined, you can notify the client as well as let them choose an additional method for repayment. If they have none, the transaction is terminated. The customer does not get the thing or solution, yet the firm does not shed cash on the deal.

Vendor bank options are done via an actual terminal. This terminal is what lots of see in stores. The bank card terminal is the item of modern technology that the card is swiped with. The info of the card is bounced back to the merchant bank solution so that it can be confirmed. Often, the terminal will ask the firm to type in the variety of the charge card. From that point, after validated, the company will enter the price of the service or product. This entire transaction only takes a minute or 2. Seller financial institution options make it incredibly very easy for business to absorb charge card in a secure method.

Just like any service or product, there are prices that are had for utilizing the service. There will certainly be a cost for the real merchant service. There will likewise be the general credit card charge that is charged to the firm, not to the purchaser. These costs need to be taken into consideration by those seeking charge card services. Although there may be added rates, the merchant financial institution solutions make it possible for your business to be successful. They make it possible for you to be able to accommodate most consumers and also consumers repayment kinds.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

The Most Innovative Things Happening With sandstone use |

5 Simple Techniques For Digital Banking - Suntrust Personal Banking - Suntrust Bank

Digital financial becomes part of the more comprehensive context for the transfer to electronic banking, where banking services are delivered online. The change from traditional to electronic banking has been progressive as well as stays continuous, and also is constituted by differing degrees of financial solution digitization. Digital financial entails high levels of process automation as well as web-based solutions and also may consist of APIs making it possible for cross-institutional service composition to provide financial items as well as give deals. .cda.

A digital financial institution represents a virtual process that consists of electronic banking as well as beyond. As an end-to-end platform, digital banking must include the front end that customers see, the backside that bankers translucent their servers as well as admin control panels as well as the middleware that connects these nodes - mobile banking. Inevitably, an electronic bank needs to assist in all useful degrees of banking on all service shipment platforms.

The reason electronic banking is greater than just a mobile or online system is that it consists of middleware remedies. Middleware is software application that bridges operating systems or data sources with various other applications. Economic industry divisions such as threat management, item advancement and also advertising must also be consisted of between and backside to truly be taken into consideration a full electronic financial institution.

Little Known Facts About Digital Banking Report: Home.

The earliest forms of electronic banking trace back to the arrival of Atm machines and also cards launched in the 1960s. As the web arised in the 1980s with early broadband, digital networks started to attach stores with distributors and consumers to develop demands for early on the internet brochures and supply software systems.

The improvement of broadband and ecommerce systems in the early 2000s led to what appeared like the modern-day digital banking world today. The proliferation of smartphones through the next decade opened the door for purchases on the go past ATM equipments. Over 60% of consumers currently use their mobile phones as the recommended method for electronic banking.

This vibrant forms the basis of client fulfillment, which can be nurtured with Client Relationship Management (CRM) software program. As a result, CRM has to be incorporated right into a digital financial system, since it provides methods for banks to straight interact with their customers. There is a demand for end-to-end uniformity and for solutions, maximized on convenience and also individual experience.

Some Known Factual Statements About Digital Banking Solutions (Security) - Thales

In order for banks to meet consumer needs, they require to keep focusing on improving digital modern technology https://www.sandstone.com.au that provides agility, scalability as well as efficiency. A research study conducted in 2015 disclosed that 47% of lenders see possible to improve customer connection with electronic financial, 44% see it as a way to produce competitive benefit, 32% as a network for brand-new consumer purchase.

Major advantages of digital banking are: Organization efficiency - Not only do electronic platforms enhance interaction with customers as well as provide their demands faster, they additionally supply methods for making interior features extra reliable. While financial institutions have actually gone to the center of electronic technology at the consumer end for years, they have not completely accepted all the advantages of middleware to increase efficiency.

Typical financial institution handling is costly, slow and susceptible to human mistake, according to McKinsey & Firm. Counting on individuals and paper also takes up office, which runs up energy as well as storage expenses. Digital systems can future reduce prices through the harmonies of even more qualitative data and also faster feedback to market modifications.

The Single Strategy To Use For Digital Banking Report: Home

Coupled with absence of IT combination in between branch and back workplace personnel, this trouble lowers organization performance. By simplifying the confirmation procedure, it's less complicated to execute IT solutions with company software program, causing even more accurate accountancy. Financial accuracy is crucial for financial institutions to follow government regulations. Enhanced competitiveness - Digital solutions assist handle advertising listings, allowing banks to get to more comprehensive markets and also construct closer connections with tech smart customers.

It's reliable for executing consumer incentives programs that can improve commitment as well as satisfaction. Greater dexterity - Making use of automation can quicken both outside and internal procedures, both of which can improve client satisfaction - mobile banking. Complying with the collapse of monetary markets in 2008, an increased focus was placed on threat management.

Enhanced security - All businesses huge or little face a growing variety of cyber threats that can damage online reputations. In February 2016 the Internal Earnings Service revealed it had actually been hacked the previous year, as did a number of huge tech business. Financial institutions can profit from extra layers of safety to safeguard information.

Some Known Facts About Digital Banking - Suntrust Personal Banking - Suntrust Bank.

By changing hand-operated back-office procedures with automated software remedies, financial institutions can minimize staff member errors and also accelerate processes. This paradigm change can result in smaller sized operational systems and also enable supervisors to focus on enhancing jobs that need human treatment. Automation minimizes the need for paper, which certainly ends up using up area that can be inhabited with modern technology.

One means a financial institution can boost its backside organization efficiency is to divide numerous processes into three classifications: full computerized partially automated hands-on tasks It still isn't useful to automate all procedures for numerous economic companies, especially those that carry out financial reviews or give investment guidance. But the even more a financial institution can replace difficult redundant handbook jobs with automation, the more it can concentrate on issues that include direct interaction with customers.

Additionally, digital cash can be mapped and accounted for more properly in cases of disagreements. As consumers discover an enhancing variety of acquiring opportunities at their fingertips, there is much less need to carry physical money in their purses. Various other signs that require for electronic cash is growing are highlighted by the use of peer-to-peer repayment systems such as PayPal as well as the surge of untraceable cryptocurrencies such as bitcoin.

Indicators on Digital Banking - Suntrust Personal Banking - Suntrust Bank You Should Know

The problem is this innovation is still not omnipresent. Money circulation expanded in the USA by 42% between 2007 and also 2012, with a typical annual growth rate of 7%, according to the BBC. The idea of an all digital cash economic situation is no longer simply an advanced dream however it's still unlikely to obsolete physical cash in the close to future.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

15 Things Your Boss Wishes You Knew About New Banking Technology |

Every business that intends to be successful needs to be able to accept bank card settlements. While certain firms take care of to find success with money just operations, most falter. Those that are not fully gotten ready for bank card payments might not understand just how they can totally approve these payments. Merchant financial institution solutions can help these companies to process the bank card repayments, allowing them to accept all payments.

Seller bank options make it simple to refine these cards. The settlements can be a difficult for little, startup firms. The bank card process requires an Net link. The procedure calls for that the real card number be validated and accepted for repayments. From that factor, the repayment is really credited the credit-card. The business making use of the merchant financial institution option will certainly see this prior to they approve the repayment and make the deal final.

You can find more information about the topic here: Learn more here

Vendor bank remedies are the only manner in which business can feel that their payments are protected and also reputable. Companies that list the card numbers for various transaction have no way of knowing if the payment is backed by credit score or by actual cash money. They take a danger, knowing that if the repayment does not undergo, there will be a long procedure entailed to really receive payment.

Seller financial institution solutions allow you to miss this action. You refine the actual card settlement on the spot. If the card is declined, you can notify the client and let them choose another method for payment. If they have none, the purchase is cancelled. The consumer does not get the item or service, but the firm does not lose money on the deal.

Vendor financial institution solutions are done with an real terminal. This terminal is what many see in stores. The credit card terminal is the piece of modern technology that the card is swiped with. The information of the card is recuperated to the merchant bank service to ensure that it can be validated. Often, the terminal will ask the company to enter the number of the charge card. From that factor, after verified, the business will certainly key in the cost of the product and services. This entire deal only takes a minute or two. Seller bank solutions make it unbelievably easy for companies to absorb charge card in a safe method.

Just like any type of product and services, there are prices that are had for making use of the solution. There will certainly be a charge for the actual vendor solution. There will certainly likewise be the general credit card fee that is charged to the company, not to the purchaser. These fees require to be considered by those seeking credit card solutions. Although there may be additional rates, the merchant financial institution services make it possible for your company to be effective. They make it feasible for you to be able to accommodate most consumers and also consumers payment types.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

The Worst Videos Of All Time About Digital Banking Solutions |

Every firm that wants to achieve success requirements to be able to approve bank card payments. While particular business manage to find success with money only procedures, most falter. Those that are not fully gotten ready for charge card settlements might not comprehend just how they can completely approve these settlements. Seller financial institution options can assist these companies to process the charge card repayments, permitting them to approve all payments.

Vendor bank services make it easy to process these cards. The settlements can be a hard for tiny, start-up firms. The credit card process needs an Web link. The procedure needs that the real card number be confirmed and also approved for payments. From that factor, the repayment is in fact charged to the credit-card. The business using the merchant financial institution solution will see this before they approve the settlement and make the transaction last.

You can discover more details about the topic here: https://www.sandstone.com.au/loan

Merchant bank remedies are the only manner in which business can really feel that their payments are protected as well as reputable. Companies that write down the card numbers for various deal have no chance of knowing if the settlement is backed by credit rating or by real cash money. They take a danger, recognizing that if the settlement does not go through, there will be a lengthy process involved to actually obtain payment.

Merchant bank options allow you to avoid this action. You process the real card repayment instantly. If the card is decreased, you can notify the customer and let them select one more way for payment. If they have none, the purchase is cancelled. The customer does not get the thing or solution, however the firm does not shed cash on the bargain.

Seller financial institution solutions are done via an real terminal. This terminal is what many see in stores. The bank card terminal is the item of innovation that the card is swiped via. The info of the card is recovered to the vendor bank service to make sure that it can be verified. Frequently, the terminal will certainly ask the business to type in the variety of the credit card. From that point, after validated, the company will certainly type in the price of the service or product. This whole transaction just takes a minute or more. Vendor bank remedies make it unbelievably easy for firms to absorb bank card in a secure way.

Similar to any kind of product and services, there are rates that are had for utilizing the service. There will be a cost for the real vendor service. There will certainly additionally be the general charge card charge that is credited the firm, not to the purchaser. These charges need to be thought about by those searching for charge card solutions. Although there might be additional prices, the vendor financial institution services make it possible for your company to be successful. They make it feasible for you to be able to accommodate most consumers and also consumers payment types.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

15 People You Oughta Know In The Sandstone Information Industry |

Every business that wants to achieve success demands to be able to approve credit card payments. While particular business manage to find success with cash money just operations, most falter. Those that are not completely gotten ready for charge card payments might not understand exactly how they can totally accept these payments. Merchant bank remedies can help these business to refine the bank card payments, permitting them to accept all payments.

Vendor financial institution solutions make it easy to refine these cards. The settlements can be a hard for tiny, start-up business. The bank card process calls for an Net connection. The procedure calls for that the real card number be verified and accepted for repayments. From that factor, the settlement is really credited the credit-card. The company utilizing the vendor financial institution remedy will see this before they accept the settlement and also make the deal last.

You can find more information about the topic here: https://www.sandstone.com.au/en-au/mobile-app

Merchant financial institution remedies are the only manner in which business can feel that their settlements are secure and also genuine. Firms that list the card numbers for numerous transaction have no chance of recognizing if the repayment is backed by credit history or by actual cash money. They take a risk, understanding that if the payment does not go through, there will certainly be a lengthy process included to in fact receive payment.

Merchant financial institution options enable you to avoid this action. You process the real card settlement on the spot. If the card is decreased, you can educate the consumer and let them choose one more method for payment. If they have none, the purchase is cancelled. The consumer does not get the item or service, however the firm does not shed money on the offer.

Seller bank solutions are done via an actual terminal. This terminal is what numerous see in stores. The credit card terminal is the piece of modern technology that the card is swiped via. The details of the card is bounced back to the vendor bank service so that it can be validated. Frequently, the terminal will certainly ask the company to enter the variety of the credit card. From that factor, after validated, the business will enter the expense of the product and services. This whole transaction only takes a minute or two. Seller bank solutions make it unbelievably very easy for companies to take in bank card in a protected way.

As with any product and services, there are prices that are had for using the solution. There will be a charge for the real seller service. There will also be the basic bank card charge that is credited the firm, not to the buyer. These charges require to be taken into consideration by those searching for credit card services. Although there might be additional rates, the merchant bank services make it possible for your firm to be effective. They make it feasible for you to be able to accommodate most customers and also consumers payment types.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

10 Meetups About Nab On Line Banking You Should Attend |

The term Open Banking began to gain prestige in 2016 as a direct outcome of the UK's Competitions Market Authority revealing plans for the leading 9 banks in the UK to deliver open source APIs for 3rd celebration usage by January 2018.

Open Banking has in fact been presented in lots of countries worldwide with differing regulative controls. As an outcome, Open Banking is now seen by great deals of in the market as a compliance task and is handling internal resistance.

However, this need not hold true. Opportunities exist for banks and banks across the globe need to they welcome Open Banking and see beyond the regulative structure.

You can find more information about the subject here: sandstone.com.au/en-au/mobile-app

This report sets out to encourage us of what Open Banking is, where it can be beneficial and go over why it hasn't been the innovative explosion everyone was anticipating.

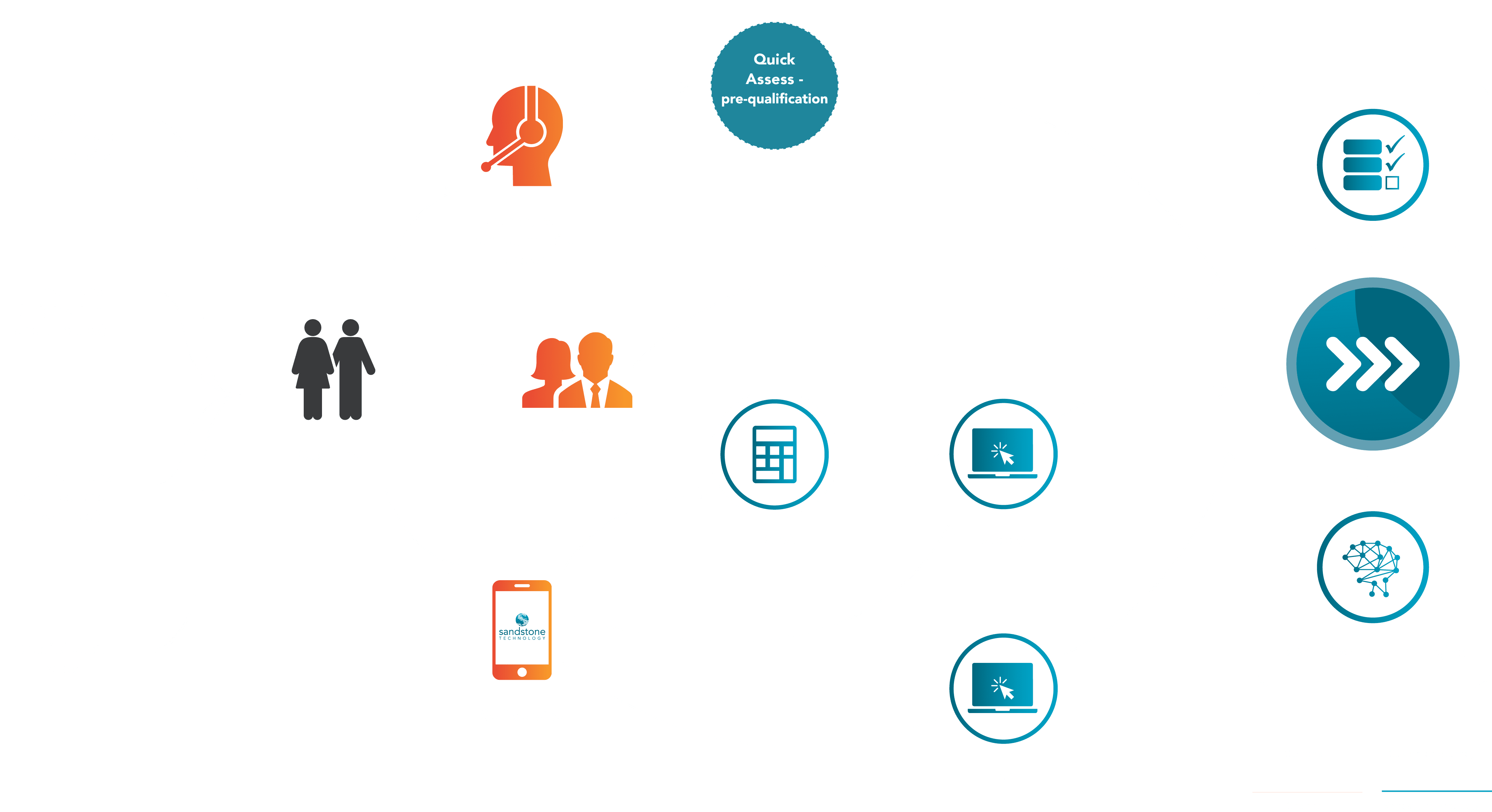

Open banking today recommends different things to various individuals all over the world. For fintechs it is the capability to deal extra service offerings to both the bank and completion customer through authorization, automation and digital experiences, such as a bank-controlled consumer portal.

For banks, it is a costly piece of policy that postures a threat to their much-valued customer relationship. For most of consumers, it is relatively extraordinary. Those that have end up being conscious of it are puzzled by the combined messages from banks concerning sharing individual data. All these descriptions have some reality to them, however Open Banking is much more. It pertains to banks digitizing their business, turning their siloed software application into available services that can be more efficiently made use of, both internally and externally.

Open Banking is basically a principle known in the technology world as" Whatever as a service" (XaaS), whichbis a design technique that enables software application to expose its functions to other software, so that a business can operate more efficiently. This software style approach generally causes Application Reveals User interfaces (APIs).

An example of XaaS may be a piece of HR software application that requirements employee's payroll information, which is currently kept in the business's payroll software application. If both the payroll and HR software application used XaaS in their styles, then HR would have the ability to straight pull the info from payroll as and when it is needed, using an API.

However, great deals of legacy systems do not support XaaS and because of that a problematic, mistake vulnerable, manual treatment remains in place to import payroll data into HR as soon as a month. A perfect example of how a company has successfully adopted XaaS within its company design is Amazon. Amazon established from providing an online retail environment to boasting a $7.7 billion cloud-based platform company today.

It is stated around 2003 Amazon CEO, Jeff Bezos, sent out a memo to https://www.washingtonpost.com/newssearch/?query=digital banking his personnel mentioning that carrying on all Amazon groups would expose their info and functionality through generic user interfaces (APIs) to be utilized by any technology-- internally or externally. Throughout the years that followed Amazon even more developed its own IT infrastructure, one that better matched their internal company needs. With the original objective in mind of sharing information to achieve company goals, Amazon had the ability to benefit from their internal systems, marketing this solution to the outdoors world.

Amazon has proven that an efficient execution and company strategy based around XaaS can favorably impact your business. When straight relating this throughout to Open Banking, the prospective advantages consist of:

-- Functional efficiencies

-- Cost cost savings

-- The advancement of digital profits streams

-- Using existing software to develop new innovative services

-- Boost the client's experience

With these offered opportunities available, it's a marvel why banks are not considering inviting Open Banking more.

Sandstone Technology Group

Level 4/123 Walker St, North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

info@sandstone.com.au

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA

|

|

The Most Influential People In The Transact-online Industry And Their Celebrity Dopplegangers |

The topic of overseas electronic banking is a warm one and also one that is progressively expanding in appeal not just within the consumer banking neighborhood, however additionally the business or corporate financial market.

The elegance of overseas electronic banking is that in addition to allowing you to conduct financial tasks allowed by standard and neighborhood brick and mortar services, it allows you more variety as well as adaptability in terms of your financial demands. As an example, if you travel commonly, overseas online banking provides you the adaptability to carry out service on to go from anywhere, while making certain that you have access to the type of currency if you require at once you require it.

Having stated that, not all banks provide online or internet banking solutions as this solution costs the banks a considerable amount of money. Setting innovative and safe systems require the effort of several full time computer system designers, complete safety and security as well as conformity departments, as well as heavy overhead to support the service on an continuous basis.

Since there are many variables involved in supplying this service, offshore electronic banking solutions differ from one banks to an additional. Some have much better systems while others have work to do. A great deal of this is based on the sources the bank has committed to this initiative, both in terms of quantity and also top quality.

Opening Up an Offshore Savings Account

Prior to diving even more right into this topic, I want to clarify that engaging in offshore electronic banking is not about evading tax obligations. It has to do with mitigating risk of capital loss as a result of no fault of your own. So when thinking about a international jurisdiction in which to establish an offshore bank account, take into consideration one that is politically stable and monetarily strong. Furthermore, it aids to pick a territory that pays an appealing rate of interest and has low to no earnings tax obligation. A few of the most favored jurisdictions throughout the years have been Switzerland, Cayman Islands, Singapore, Hong Kong and the United Arab Emirates (UAE).

Opening up a personal savings account is typically a extremely individual activity. With overseas electronic banking however, there are methods you can start remotely without needing to turn up to the bank's neighborhood workplace, saving a lots of time, cash as well as generally frustration.

One such means is by seeing a local financial institution's branch in your domicile state, or residence country. Lots of large financial institutions that supply internet banking have a multi-national presence. Opportunities are great that your selected bank has a neighborhood branch near where you live, despite being headquartered in an additional offshore territory.

In various other situations, there are international banks that may not have regional branches near where you live, yet agree as well as able to establish an offshore checking account for you via email, general delivery, fax as well as telephone. There are usually a set of files needed by financial institutions in order to implement this process. As a result you can still open up a foreign bank account with an offshore bank without needing to leave your nation, yet it may include a little much more effort, as well as often the battle associated with connecting with someone overseas.

The Advantages of Offshore Electronic Banking

Right here are some advantages of offshore electronic banking that you ought to understand about.

Defense from sovereign danger - as reference already above, parking funds in foreign checking account alleviates the risk of loss of capital resulting from freeze or confiscation of funds by Federal governments with no mistake of your very own. This danger is less of a issue in a developed economic climate with a strong financial facilities such as the USA, yet it is nevertheless an integral danger that exists.

Tax advantages - many overseas jurisdictions have low to no revenue tax implications on interest income, or income from service tasks.

Greater Rate Of Interest - since numerous offshore financial institutions operate with low costs, they can pay for to supply higher rates of interest contrasted to larger multi-national names. Actually, in developed economic climates like in Europe as well as North America, governing compliance requirements is seen by many as type of tax on financial institutions, consequently enhancing overhead costs and decreasing rates of interest.

As Needed Accessibility to Statements - offshore internet banking provides you immediate accessibility to your statements where you can view your activities on a real time basis. This includes past and pending deposits as well as withdrawals. You can for that reason access your account balance at anytime.

Finance - with overseas electronic banking you can move funds in between accounts across the globe immediately. Offshore financial institutions have supplies of numerous currencies and can aid you satisfy financial deals in numerous countries. You can arrange automated settlements to vendors to release immediately.